Friday, April 03, 2020 1:58:32 PM

BofA:"QE vs Unemployment" Means Soaring Inflation

BofA: "QE vs Unemployment" Means Soaring Inflation Will Crush The Dollar

by Tyler Durden ZeroHedge

Here are the key takeaways from Michael Hartnett's latest Flow Show:

* Lows on corporate bonds & stocks to hold on extreme bearishness & policy stimulus.

* Policy ended credit crunch but not yet recession...US dollar, oil, HY bonds will signals worst of recession priced-in.

* Big EPS headwinds: bias asset allocation toward growth, yield, quality alongside stagflation hedges (gold & small cap).

And before we get into the meat of Hartnett's latest weekly must read, a quick reminder that it's one of those years where gold is the top performing assets: gold 3.6%, US dollar 3.4%, government bonds 3.0%, cash 0.5%, IG bonds -5.7%, HY bonds -14.9%, global equities -24.2%, commodities -41.6% YTD.

With that in mind, here are the key themes of the current week:

* March capitulation: historic $284bn out of bonds and $658bn into cash in past 4 weeks ($64bn out of equities = sideshow).

* Bond capitulation: record month of redemptions from IG bonds ($156bn), EM debt ($47bn), Municipal bonds ($24bn), HY bonds ($23bn).

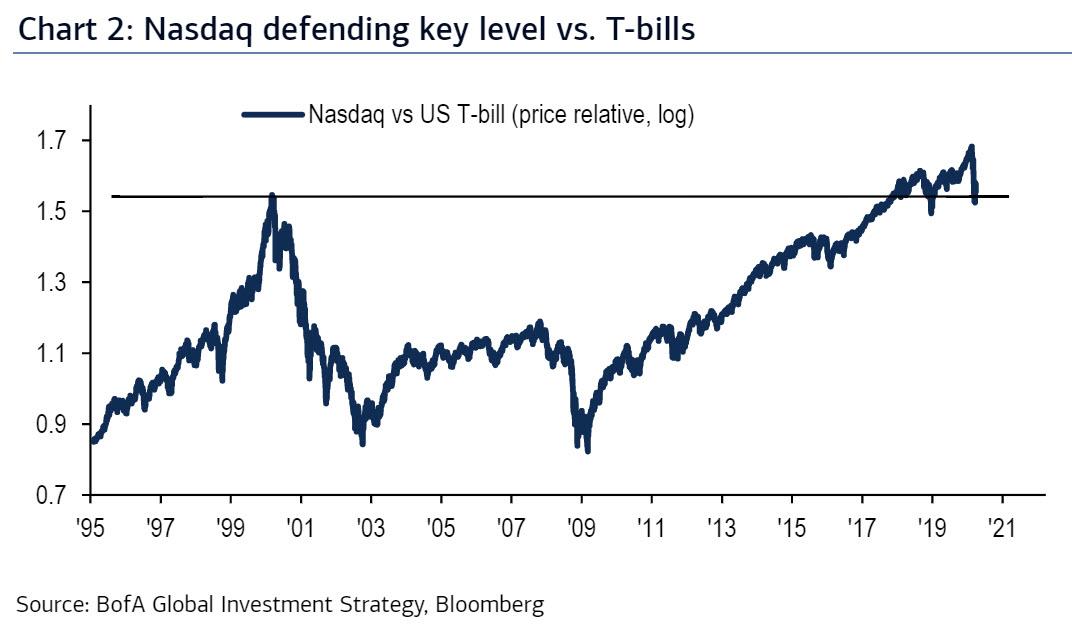

* Tech indestructible: $4bn inflows to technology funds in March & inflows throughout 2020 (Chart 3); IG bonds = "glue" holding Wall St together, but tech "glue" for stocks (Nasdaq currently defending v imp asset allocation resistance level vs. T-bills - Chart 2).

cont................

UN Expects Global Unemployment to ADD nearly 26 Million before the end of 2020 making Total Global Unemployment nearly 213 Million. The UN Number is CRAP if this Continues Global Unemployment will be in excess of 300 MILLION and 7+% of that Number will be coming from the US!!!!!!!!!!!

Still Buying...............""Made in CHINA""????????????

Could HAVE.........Fricken DID and the Virus WAS Engineered just ask Arkansas Senator Tom Cotton............

""Senator Tom Cotton Thinks Coronavirus is a Bioweapon; China Mounts Feeble Response""

Molecular Biologist Says COVID-19 Could Have Leaked From Wuhan Biolab

****Molecular Biologist Says COVID-19 Could Have Leaked From Wuhan Biolab

by Steve Watson via Summit News

A molecular biologist proclaimed Thursday that the Chinese coronavirus could have originated at the Wuhan Institute of Virology, and been leaked, leading to it’s horrific spread around the globe.

Richard H. Ebright, a professor of chemical biology at Rutgers University, told The Daily Caller that he believes it is a distinct possibility that an accident in the laboratory in China could have caused the outbreak.

Professor Ebright said that “A denial is not a refutation,” referring to China’s top virologist Shi Zhengli, who works at the lab in Wuhan, and has repeatedly denied that it was the source of the pandemic.

Zhengli, known as ‘bat-woman’, because she works with bat-borne viruses, has said that the coronavirus spread is “nature punishing the human race for keeping uncivilized living habits.”

“The novel 2019 coronavirus is nature punishing the human race for keeping uncivilized living habits. I, Shi Zhengli, swear on my life that it has nothing to do with our laboratory,” she wrote in early February, adding “I advise those who believe and spread rumors from harmful media sources … to shut their stinking mouths.”

Professor Ebright pointed to the quote, noting that it makes Zhengli’s denial more suspect.

While the professor has been cited by the likes of The Washington Post and MSNBC to dismiss theories about the virus being a bioweapon, the media has not covered his belief that the possibility of a lab accident being the source of the outbreak “cannot–and should not–be dismissed.”

cont.............

IMF:Coronavirus pandemic economic fallout ‘way worse than the global financial crisis’

Coronavirus pandemic economic fallout ‘way worse than the global financial crisis,’ IMF chief says

By Dan Mangan, Berkeley Lovelace Jr., William Feuer

The coronavirus pandemic has created a economic crisis “like no other,” the International Monetary Fund’s top official said Friday.

“Never in the history of the IMF have we witnessed the world economy come to a standstill,” said Kristalina Georgieva, managing director of the IMF.

“This is in my lifetime humanity’s darkest hour, a big threat to the whole world and it requires for us to stand united, be united,” Georgieva said during a World Health Organization press conference.

“It is way worse than the global financial crisis” of 2008-09, she said. “This is a crisis like no other.”

Georgieva said that the IMF is working with the World Bank and other international financial institutions to alleviated economic harm from the virus outbreak, which has infected more than 1 million people.

“We have a $1 trillion war chest,” she said. “We are determined to use as much of it as necessary.”

More than 90 countries so far have applied for assistance from those funds, she said.

“We have never seen ever such a growing demand for emergency financing,” Georgieva said.

She urged countries who will tap that financing to use the money they get to pay doctors, nurses and other health care workers, and otherwise support health-care needs.

Georgieva said that developing economies have been hardest hit by the outbreak and often has less resources to protect themselves from the economic fallout.

“We know that in many countries health systems are weak,” she said.

cont...............

In the jobs report paints an even gloomier picture of the coronavirus damage

Another figure in the jobs report paints an even gloomier picture of the coronavirus damage

By Jeff Cox

The government’s survey of establishments painted a grim picture of the U.S. employment situation through early March, but its poll of households was far worse.

The household survey, which asks individual residents how many people are working there, showed a stunning drop of 2,987,000 workers for the month.

That compares with the nonfarm payrolls decline of 701,000 reported in the establishment survey and gives another perspective to just how bad the situation has gotten since the economy has all but shut down to protect against the coronavirus spread.

When releasing its headline nonfarm payroll numbers, the government focuses on the establishment survey as it captures a larger sample size and is considered less volatile than the household count. The establishment survey captures about 145,000 businesses and work sites, while its counterpart focuses on 60,000 eligible households and includes agricultural workers.

Both use the week up to the 12th of the month for sampling, which in this case was before the worst of the job losses began.

The Labor Department uses the household survey to calculate the headline unemployment rate, which jumped from 3.5% to 4.4%.

In the March survey, the household survey’s numbers are stunning.

They show a decline of employment from 158,759,000 in February to 155,772,000 in March. That came amid a drop of 1.6 million in the civilian labor force and a 1.1 percentage point tumble in the employment-population ratio to 60%. The labor force participation rate contracted 0.7 percentage point to 62.7%. Those counted as not in the labor force rose nearly 1.8 million to 96.8 million.

cont.............

Fitch sees ‘deep global recession’

*****Fitch sees ‘deep global recession’ just 10 days after predicting slow economic growth

By Tomi Kilgore

Worldwide economic activity expected to decline 1.9% this year, with U.S. GDP down 3.3%

In a chilling reminder of how fast the coronavirus epidemic has spread around the world, Fitch Ratings changed its 2020 view on the global economy to “deep global recession” from slow growth in just 10 days.

“The speed with which the coronavirus pandemic is evolving has necessitated another round of huge cuts to our [gross domestic product] forecasts,” Fitch said in a research report.

The credit rating agency said it now expects world economic activity to decline by 1.9% this year. On March 22, Fitch had projected global GDP growth of 1.3%.

“A deep global recession in 2020 is now Fitch Ratings’ baseline forecast according to its latest update of its Global Economic Outlook (GEO) forecasts,” Fitch said. The new baseline forecast incorporates full-scale lockdowns across Europe, the U.S. and many other countries, something the forecast in March didn’t assume. Read MarketWatch’s coronavirus update.

“The forecast fall in global GDP for the year as a whole is on par with the global financial crisis, but the immediate hit to activity and jobs in the first half of this year will be worse,” said Brian Coulton, Fitch’s chief economist.

cont.................

Recent GORO News

- Gold Resource Corporation Announces Preliminary First Quarter Production Results • Business Wire • 04/16/2024 01:02:00 AM

- Gold Resource Corporation Reports Results of Operations for the Year Ended December 31, 2023 • Business Wire • 03/13/2024 08:59:00 PM

- Gold Resource Corporation Announces Preliminary Fourth Quarter and Year-End Results • Business Wire • 01/30/2024 05:15:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/10/2024 10:46:55 PM

- Gold Resource Corporation Reports High Grade Drill Results at the Don David Gold Mine • Business Wire • 12/11/2023 11:37:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 11/07/2023 02:42:24 AM

- Gold Resource Corporation Reports Third Quarter Operational Results and Announces the Initiation of a Review to Evaluate Strategic Alternatives • Business Wire • 11/07/2023 02:22:00 AM

- Gold Resource Corporation Will Reschedule Release of Its Third Quarter 2023 Results • Business Wire • 11/03/2023 01:48:00 AM

- Gold Resource Corporation Reports the Filing of a SK1300 Initial Assessment for the Back Forty Project • Business Wire • 10/26/2023 10:31:00 PM

- Gold Resource Corporation Announces Q3 2023 Conference Call • Business Wire • 10/23/2023 07:35:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 10/20/2023 10:01:30 AM

- Gold Resource Corporation Announces Preliminary Third Quarter Results • Business Wire • 10/16/2023 10:34:00 PM

- Gold Resource Corporation Reports Continued Positive Drill Results at Don David Gold Mine • Business Wire • 09/12/2023 10:16:00 PM

- Form 3 - Initial statement of beneficial ownership of securities • Edgar (US Regulatory) • 08/10/2023 03:15:54 PM

- Change in Chief Financial Officer and the Appointment of Chet Holyoak As Interim Chief Financial Officer • Business Wire • 08/02/2023 10:45:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 08/02/2023 09:00:11 PM

- Gold Resource Corporation Reports Mid-Year Operational Results • Business Wire • 07/26/2023 08:55:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 07/26/2023 08:49:33 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 07/26/2023 08:40:17 PM

- Gold Resource Corporation Announces Year-to-Date Production Results, Reaffirms 2023 Production Guidance • Business Wire • 07/13/2023 10:24:00 PM

- Gold Resource Corporation Addresses Unusual Market Activity • Business Wire • 07/06/2023 09:16:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 07/05/2023 07:13:24 PM

- Gold Resource Corporation Prepared for Anaem Omot Listing on the National Register of Historic Places • Business Wire • 06/28/2023 12:41:00 AM

- Gold Resource Corporation Announces the Resignation of Joe Driscoll From the Board of Directors • Business Wire • 06/16/2023 11:00:00 PM

- Gold Resource Corporation Provides an Update on Positive Year-to-Date 2023 Drill Results at the Don David Gold Mine • Business Wire • 06/14/2023 09:03:00 PM

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • BLO • Apr 25, 2024 8:52 AM

Kona Gold Beverages, Inc. Announces Name Change to NuVibe, Inc. and Initiation of Ticker Symbol Application Process • KGKG • Apr 25, 2024 8:30 AM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM