Friday, April 03, 2020 9:17:45 AM

Asia Gold-Demand soars in some hubs

Asia Gold-Demand soars in some hubs, lockdowns, supply woes hit others

By Arpan Varghese and Rajendra Jadhav

BENGALURU/MUMBAI, April 3 (Reuters) - Physical bullion markets in major Asian hubs saw a sharp divide this week with some regions seeing a surge in demand, while others grappled with strained supply and muted activity amid global lockdowns due to the coronavirus.

"It's just a lot of strange things happening in the market now, because in some parts of the world, you will see massive premiums on gold, while other parts have discounts - just boils down to logistics and supply chain disruptions," said Saxo Bank analyst Ole Hansen.

While high value bullion bars are available, low denominations are in short supply, he added.

The market has been plagued by supply concerns following the shutdown of major Swiss refineries and air travel lockdowns.

"The name of the game now is which dealers can supply their clients and where, and which ones have enough inventory," said Joshua Rotbart, managing partner, J. Rotbart & Co in Hong Kong.

Top consumer China saw weak demand, with gold sold at $15-$20 discounts over benchmark spot prices.

"Gold is a luxury. People would rather go to the supermarket than buy gold," said Ronald Leung, chief dealer, Lee Cheong Gold Dealers in Hong Kong.

Trading was suspended for a second straight week in India amidst a lockdown.

Retail buying could slow due to higher prices even after the lockdown, said a Mumbai-based dealer with a private bank.

Indian gold futures soared to a record 45,800 rupees per 10 grammes on Friday, tracking recent gains in global markets as gold is seen as a safe haven and helped by a weak rupee.

In Hong Kong, some retailers saw good demand.

"We continue to see strong demand across the board from both new and regular customers, both retail and wholesale," said Keanan Brackenridge, product Manager at LPM Group Ltd, adding premiums on retail gold have jumped.

Demand surged in Singapore, meanwhile, pushing premiums to $1.60-$2.00 an ounce from last week's $1.20-$1.60, with traders still seeing a sharp disconnect between spot and physical prices.

cont.............

Gold Squeeze Had Traders Looking for Bars as Far Away as Sydney

Gold Squeeze Had Traders Looking for Bars as Far Away as Sydney

By Ranjeetha Pakiam

The historic squeeze in New York that roiled the gold market last week had investors looking as far as Sydney for supply.

Logistical disruptions due to the coronavirus pandemic had led to fears there wouldn’t be enough bullion in New York to meet delivery obligations for contracts traded on the Comex. Investors scoured the globe to track down physical gold, with independent Australian refiner ABC Refinery reporting a surge in demand from North America for deliverable bars last week.

“We have received increased demand from North America, obviously with the recent Comex liquidity shortage,” said Managing Director Phillip Cochineas. Demand also picked up from Europe due to “the lack of production from refiners who have had their operations locked down,” he said.

ABC makes products including 100-ounce, 1-kilogram and 400-ounce bars, with the latter now deliverable after CME Group rushed the launch of a new futures contract to address supply issues.

While the squeeze in futures has eased -- there’s enough gold in Comex warehouses to meet delivery obligations -- prices are surging on demand for a haven amid global market turmoil. Investors are pouring into exchange-traded funds, gold sales at Australia’s Perth Mint jumped to the highest since 2013, while the U.S. Mint sold the most bullion coins in three years.

The Gold Market Is Being Tested Like Never BeforeGold Suppliers Eye Chartered Flights for Metal Stranded by VirusWhen a Hot Gold Trade Blew Up, the Rush for 100-Ounce Bars BeganThere’s Ample Gold to Go Around in Futures Markets After All

ABC, which has capacity to refine more than 400 tons of gold and over 750 tons of silver a year, has increased production as it’s seeing strong demand in Europe and Asia, in addition to North America.

“The general demand is for gold in whatever form possible in order to fulfill the huge demand that is running across the market place at the moment,” said Cochineas. The refinery has focused on making 1-ounce, 100-gram and 1-kilogram cast gold products and 1-kilogram cast silver products.

Strong demand may persist even once the virus is contained due to large amounts of government and corporate debt and low-yielding bonds, according to Cochineas.

“Equities and bonds are out and gold is in,” he said. “Investors are worried about indebtedness. There’s so much corporate leverage in the world that the worldwide economic impact of coronavirus is only going to amplify the pain that’s going to be felt by those corporate borrowers. There will be a real deterioration of government finances in the aftermath of the virus. Gold will be a natural choice for investors both large and small.”

Physical gold demand at record levels, paper gold price disconnect

Bullion Star/Ronan Manly

“Given that international gold price discovery takes place on derivatives markets which have little or no connection to the physical gold market and that the prices are merely blips on a screen (screen gold), we can therefore say that the gold price plunge last Friday was driven by trading in these markets, led by the COMEX, and also that the gold price fall last Friday was unconnected to the physical gold market.

While the mainstream financial press will never question gold price discovery or the difference between screen gold and physical gold, they do predictably try to come up with reasons to explain price movements. Unfortunately, most of these reasons are often not based on anything other than off-the-cuff the remarks of stockbrokers, trading desks, and buy side investment bank analysts. Unfortunately also, by not explicitly distinguishing between prices derived in an electronic casino and the real physical safe haven asset of tangible gold, the reasons provided by these reporters will fall into the trap of jumbling up two different things.”

USAGOLD note 1: The tail wags the dog and quite often, as the cartoon above suggests, to the surprise of the dog or, better put, to the surprise of the dog’s owners. In this piece, Manly makes a distinction between the price “taker” (physical gold) and the price “maker” (the paper gold markets). That dichotomy has been the centerpiece discussion in the gold market for the past quarter-century. Though a source of great frustration to speculators in the short run, big price drops like the one we had this past Friday create opportunities for knowledgeable, strong-handed buyers to accumulate physical metal. Asia comes to mind. So do American professional money managers who have joined them in loading up on the dips.

USAGOLD note 2: Sooner or later, demand for the physical metal translates to the paper markets, even if cause and effect do not always match-up precisely on the timeline. If that were not the case, the price of gold would still be at $35 per ounce and physical supplies would have disappeared from the face of the earth long ago.

Gold price at $2,000 is a 'distinct possibility' into 2021 - TD Securities

By Anna Golubova

(Kitco News) Another bullish gold price update comes from TD Securities, which is now projecting a move to $1,800 an ounce and then a jump to $2,000 near year-end.

Gold prices rallied along with risk assets this week. At one point, gold even neared $1,700 an ounce. At the time of writing, April Comex gold futures were trading at $1,636.40, up 0.18% on the day.

There are many drivers supporting gold at the moment and once the COVID-19 outbreak peaks, constructive price conditions will remain, said TD Securities head of global strategy Bart Melek said on Thursday.

“Normalizing liquidity conditions, negative real rates, low cost of carry and concerns surrounding fiat currency debasement, not unlike those present during the post-GFC period, likely mean gold price could move toward $1,800/oz in the not too distant future,” he wrote. “A move toward $2,000 is also a distinct possibility into 2021, as the global economy normalizes, monetary contentions remain loose while fiscal deficits surge.”

Monday’s announcement by the Federal Reserve to provide unlimited liquidity and the U.S. Senate’s decision to unanimously approve the unprecedented $2 trillion stimulus bill late Wednesday evening have really turned things around for equities as well as gold.

“After declining for some two weeks … the metal is seeing a resurgence as the pressure to grow dollar positions eases. Once the funding stresses that drove prices lower are alleviated further, as the Fed and other key central banks monetize COVID-19 related market disfunctions and major governments spend trillions of borrowed money to fortify stressed households and corporates … investors are likely to continue to pivot their focus towards gold,” Melek pointed out.

There are similarities between how gold behaved during the 2008 financial crisis and now, which means that the yellow metal could beat its previous record highs reached in the aftermath of that crisis.

“Once the COVID-19 economic crisis is well defined and health issues are mitigated, the economy should have a good base to perform well. Negative interest rates will likely be the order of the day for a long time, which make gold relatively cheap to hold. And, since and it is nobody's liability, which is quite opposite to government paper which will be issued to support all the spending needed by the trillions to fund the various stability programs throughout the G7, gold has a clear path towards $2,000/oz,” Melek noted.

In the very short-term, high volatility is not ruled out for gold prices, especially considering some of the weak macro data that the markets are bound to be digesting in the months to come, added the strategist.

“But, any selloff in the near-term should be considered as temporary, as the previously discussed macro factors and the fact that some six million oz of annualized mining gold production is shutdown due to COVID-19 measures and logistical issues making physical shipments extremely hard, will likely serve as an additional catalyst moving the price toward $1,800 before the yellow metal reaches escape velocity toward a $2-handle,” Melek explained.

How the C-Factor Could Decimate 2020 Global Gold and Silver Production

By: MoneyMetals

Item: March 16, 2020. A huge poly-metallic (gold, silver, copper) mining operation in Mongolia "has suspended operations" after authorities "restricted the movement of goods and people within the country."

Item: March 17. In Peru, one of the world's largest primary silver-gold producers has its 4 mines "temporarily suspended" following the Government's Declared State of Emergency.

Item: March 18. A Canadian mining major suspends construction of a $4.7b copper mine upgrade in Chile affecting 15,000 workers.

Item: March 20. Argentina declares a state of emergency and imposes "a nationwide mandatory quarantine starting today." Silver and gold mines across the country move to halt operations, except for "a reduced workforce to ensure appropriate safety, security and environmental systems are maintained."

Item: March 30. Peruvian authorities extend their halt of transportation until at least April 13.

This list could be much longer, but you get the idea. Miners and explorers around the world are being told to stop production, move to "care and maintenance" or "disperse the workforce" – all due to the C-Factor. Which of course refers to the rapidly – spreading global pandemic known as novel coronavirus, or COVID-19.

Being a new strain that has not been previously identified in humans, earns this virus the moniker of "novel." Enough is still unknown about how it spreads and what it takes to halt the contagion, that even the experts still search for answers.

These unknowns – along with the government and public response to it – means this is slated to become the most costly financial crisis in modern history. Asset classes crater across the board, with mining shares diving alongside S&P 500 stalwarts.

What's surprising to those who do not remember 2008 is initially both silver and gold tanked. In part it's because when funds – some of whom are leveraged 30:1 – get a margin call, they sell what they can. That includes precious metals, further depressing the price.

The Paper Price Is Not the Physical Price

Beneath the surface, recent massive demand by the public for physical silver and gold makes it apparent that the quoted "paper metals" price bears little reality to what a person pays – if they can find the "hold in your hand" product at all.

An example: Although the COMEX shows roughly a $14/ounce paper silver price, physical metal – other than 1000 oz bars – is going for 30-80% over spot. In other words, this supposed $14 silver could cost you upwards of $20 the ounce. And, at some dealers, you should expect to pay as much as $2,000 or more for that $1,650 1-oz gold piece.

The U.S. Mint has nearly run out of American Silver Eagles (ASEs) and extended back orders are the norm. Premiums have risen from about $3 to $8 or even $10 over spot.

This Situation Is Novel in More Ways Than One

At this writing, most mines remain open. But the suspension-of-production list steadily grows.

It's safe to say that operations in every country on the globe have been, or soon will be affected. Projected downtimes assume 2-3 weeks, but some places are expecting a 6-week-plus hiatus.

The reality is that no one really knows how long this state of affairs will last, let alone return to normal. Even when a mill temporarily shuts down, it's not just a matter of flipping a switch and returning to full-scale production.

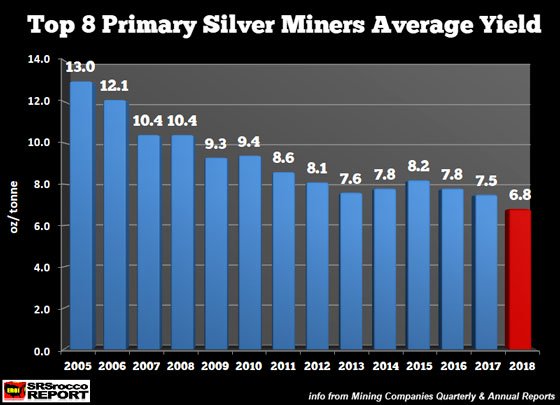

The metals, especially silver, may have seen their best production levels for some time. Yields have steadily declined for the last decade.

Fewer large discoveries, increased regulations, costly infrastructure and longer lead times, have conspired to just about double the number of years it takes from discovery to production.

Being an industrial metal, silver consumption will probably decline this year, but... as David Morgan has long noted, "Important price changes occur on the margin." He means that investment demand is the big driver for silver prices. And lately, has that demand ever been robust!

Metals' dealers report the strongest buying they've witnessed in recent years – some for as long as they've been in business. Selection is down, premiums are way up and delivery dates pushed out from days to somewhere on the horizon.

Silver Is Finding Important New Uses

Readers in this space are aware of the almost daily new uses for which silver is being employed in industry and commerce. Now there are two new ones – difficult to quantify initially, but unwise to ignore on the demand side.

An evolving silver-backed digital coin. First, is the build out of a new monetary vehicle called AGX Pay designed around a vaulted silver-backed digital coin, enabled by the blockchain.

Its ultimate level of acceptance is yet to be determined, but the coin's numerous uses, including spending it for merchandise and services, or simply holding as an investment bet on rising silver, make this an intriguing consideration.

Silver is a COVID-19 Killer. Second, it appears that more locales are using decontaminants to disinfect city streets, public buildings, and airport terminals.

One effective and non-toxic solution of which I'm aware is made up of potassium iodide, water... and silver. How much silver? Hard to say right now, but as it becomes more widely used?

The Tectonic Plate Collision of High Demand and Declining Production Means That "Houston, We Have a Problem"

Few investors have considered that, as the ripple effect of mines shutting down spreads (if only for a few weeks but possibly much longer), 2020 gold, copper, and silver production are set to fall off a cliff.

Let's say there is only a 4-week period between when most mines "go offline" and return to normal output. It's possible that 10% or more annual silver production may not take place at all!

2020 was already set to become the fourth straight year of declining silver production. Last year, the total was about 1 billion ounces.

Ask yourself what's going to happen if the demand spike runs up against say, 100 million ounces less silver than was available the year before?

I would suggest the result will include skyrocketing premiums, and an even greater disconnect between the paper quote and the actual physical sales price.

Recent GORO News

- Form 8-K - Current report • Edgar (US Regulatory) • 08/07/2024 09:00:10 PM

- Gold Resource Corporation Reports Financial Results for the Second Quarter of 2024 • Business Wire • 08/06/2024 09:42:00 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 08/06/2024 08:45:52 PM

- Gold Resource Corporation Announces Q2 2024 Conference Call • Business Wire • 07/30/2024 01:43:00 AM

- Form 8-K - Current report • Edgar (US Regulatory) • 06/20/2024 03:07:18 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/06/2024 07:21:04 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/06/2024 07:19:30 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/06/2024 07:16:38 PM

- Gold Resource Corporation Reports Financial Results for the First Quarter 2024 • Business Wire • 05/02/2024 11:00:00 PM

- Gold Resource Corporation Will Reschedule Release of Its First Quarter 2024 Results • Business Wire • 04/30/2024 12:16:00 AM

- Gold Resource Corporation Announces Preliminary First Quarter Production Results • Business Wire • 04/16/2024 01:02:00 AM

- Gold Resource Corporation Reports Results of Operations for the Year Ended December 31, 2023 • Business Wire • 03/13/2024 08:59:00 PM

- Gold Resource Corporation Announces Preliminary Fourth Quarter and Year-End Results • Business Wire • 01/30/2024 05:15:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/10/2024 10:46:55 PM

- Gold Resource Corporation Reports High Grade Drill Results at the Don David Gold Mine • Business Wire • 12/11/2023 11:37:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 11/07/2023 02:42:24 AM

- Gold Resource Corporation Reports Third Quarter Operational Results and Announces the Initiation of a Review to Evaluate Strategic Alternatives • Business Wire • 11/07/2023 02:22:00 AM

- Gold Resource Corporation Will Reschedule Release of Its Third Quarter 2023 Results • Business Wire • 11/03/2023 01:48:00 AM

- Gold Resource Corporation Reports the Filing of a SK1300 Initial Assessment for the Back Forty Project • Business Wire • 10/26/2023 10:31:00 PM

- Gold Resource Corporation Announces Q3 2023 Conference Call • Business Wire • 10/23/2023 07:35:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 10/20/2023 10:01:30 AM

- Gold Resource Corporation Announces Preliminary Third Quarter Results • Business Wire • 10/16/2023 10:34:00 PM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM