Thursday, April 02, 2020 9:27:14 AM

JPowell and the rest of the Fools at the Federal Reserve have a HELLISH Problem building in Treasuries.........Like fewer people want to OWN the overpriced Toilet Paper. Last month Sovereigns were sellers of US Treasuries and Q2 refunding this week with all of the NEW Inventory is looking like Powell is going to be the only Real Buyer.

The AHOLES in DC may have stopped the Near Term ""Credit Crisis"" but they have begun something FAR Worse.............A Monetary Crisis!!!!!!!!!! GOLD is about to throw DOWN the BULLSHIT Card on this latest Ponzi SCHEME and when GOLD begins its run through $1,700 is Game OVER for All of this CRAP coming from ""BIG Government""

Gold COMEX (Jun'20)

Gold COMEX (Jun'20) (@GC.1:CEC:Commodities Exchange Centre)

1,623.30 +31.90 (+2.0045%)

10 Million Americans have lost their JOBS in just 2 Weeks. For the Month of April you are possible going to see something like 30 MILLION More Americans Unemployed. What the HELL do you think that's going to do to STATES, Counties and Fricking LIBERAL Run Cities? The Muni Market is Already signally Fricking ""CRISIS"" and that what I was doing Yesterday.........Getting Ready for ""Worst CASE""!!!!!!!!!!

America, You Don't OWN Enough GOLD......Sell YOUR Dollars NOW and BUY anything GOLD or BUY some GUNS because BOTH will be worth more than CASH this time next YEAR!!!!!!!!!!!!!!!!!!!

READ Folks!!!!!!!!!!!

Credit Crisis Averted... Monetary Crisis Initiated

Credit Crisis Averted... Monetary Crisis Initiated

GoldMoney Insights,

The Fed seems to have managed to halt the massive dollar squeeze and the associated strength in nominal yields and real-interest rate expectations. This has led to a reversal of the rather peculiar gold sell-off that started in early March. We think this short-term win for the Fed to come at the expense of sharp currency depreciation over the medium term. We expect this to be very bullish gold medium term.

Just a week ago, we published a report with the title “What is holding gold back?” (What is holding gold back, 20 March 2020). In that report, we analyzed the odd downward move in gold since early March amidst a global pandemic, crashing equities, unchecked central bank intervention and the prospect for the largest fiscal stimulus bills the world has ever seen. We conclude that the main reason for this sell-off – a sharp rise in real-interest rate expectations – was temporary and could turn on a dime. We didn’t have to wait long.

In order to get a better understanding of what was going on, in last week’s report, we took a closer look at the main drivers of gold prices, which we had identified in our gold price framework (Gold Price Framework Vol. 1: Price Model, 8 October 2015). What we found was that a sharp spike in real-interest rate expectations was mostly responsible for the move from $1700 to $1450. As we noted in our March 20 report:

cont..........

10 Million Americans Have Filed For Unemployment In Past 2 Weeks

"US Labor Market Is In Free-Fall" - 10 Million Americans Have Filed For Unemployment In Past 2 Weeks

by Tyler Durden ZeroHedge

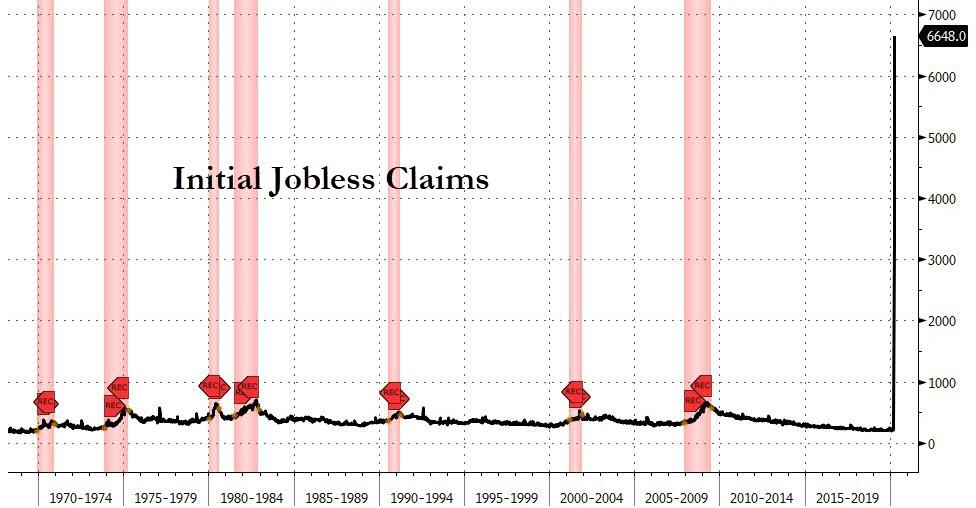

After last week's unprecedented 3.3 million surge in initial jobless claims, this week's is even more unprecedented-er, adding a stunning 6.648 million (just 100k away from our estimate of 6.5million) for a two-week sum of 10 million new Americans claiming unemployment benefits...

As @GreekFire noted, "We’ve lost 46 jobs for every confirmed case of COVID-19 in the US..."

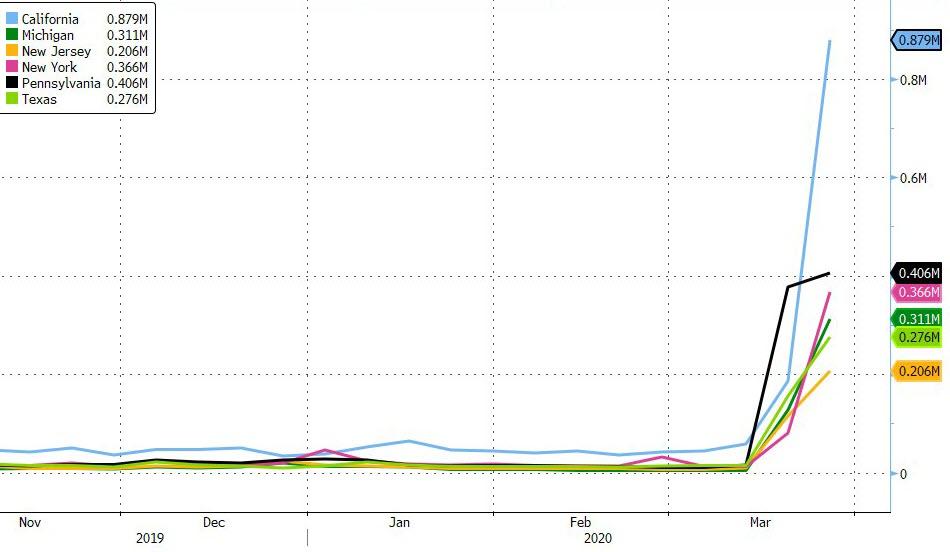

The 6.648mm print is worse than the worst of 50 estimating analysts' expectations. Breaking down by state (which is one week lagged and so represents the prior week's 3.3mm print detail), California, Pennsylvania, and New York dominate...

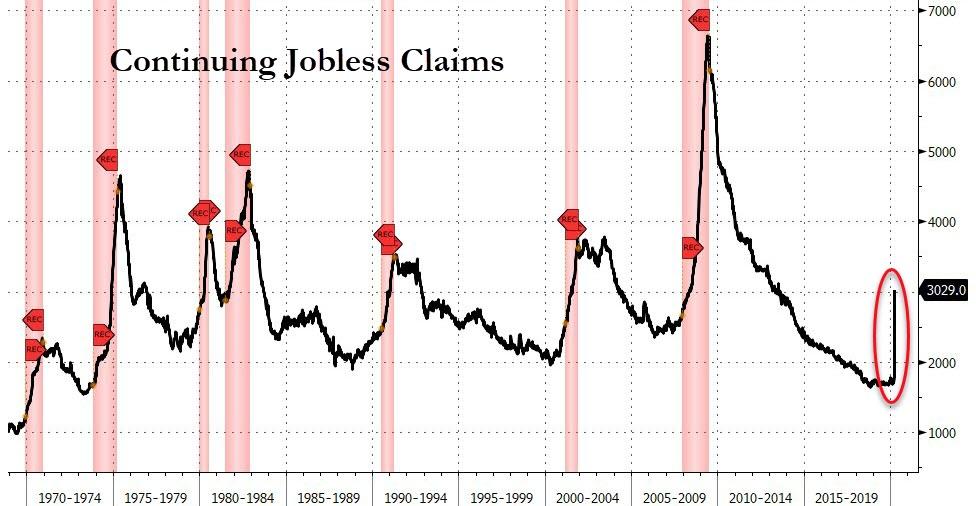

And of course, last week's "initial" claims and this week's "continuing" claims...

CONT!!!!!!!!!!!!!!!!!!!!!!

"What The Market Should Be Focusing On Is Whether There Are Still Markets"

Rabobank: "What The Market Should Be Focusing On Is Whether There Are Still Markets"

by Michael Every Head of Financial Markets Research Asia-Pacific. Based in Hong Kong

Rabobank

As COVID-19 continues to spread worldwide, economies slump, stocks of personal protective equipment and key drugs dwindle in the US, and as Americans buy record numbers of guns, the market focus today is arguably going to be on one thing:

How high is the spike in US initial jobless claims going to be this week? Last Thursday saw a staggering 3.3 million figure, far worse than what were already shocking consensus figures, and producing the kind of chart that many observers presumed must have been a mistake. It wasn’t – and this time round the expectation is 3.7 million newly jobless.

Yet there is a further claim to be made today: what the market should be focusing on is whether there are still markets.

To put it another way, how much and how rapidly are Western economies going to look like their Chinese counterpart (which is not recognized as a market economy)?

On a surface level we already see lockdowns, and state drones in the sky monitoring people to see what they are doing, virus-wise; or intelligence agencies using mobile phone monitoring to see where people have been, again to track the virus spread and infection risk. Yet those are arguably just to fight the virus itself.

Economically and financially we can also see that we are about to face fiscal deficits of 10-20% of GDP with no prospect of that debt being dealt with the ‘traditional way’ and repaid (which overlooks the fact that financial repression and de facto default is actually the traditional way and arguably more effective for economic development if the state is spending the money right).

We are already used to zero rates in the West – which are lower than in China by the way. We are used to an alphabetti spaghetti of different central bank mechanisms to try --and largely fail-- to force liquidity into the parts of the productive economy that actually need it as opposed to the bloated and/or extractive and/or low productivity zombies that really don’t.

We now have yield curve control too: sovereign bond yields are going to be where they need to be. So while any part of the curve that central banks don’t control yet can still go wild for now, that will just end up with the central banks extending their powers to it too eventually. The price will be what they want it to be.

We know that equity markets can still go down, but that authorities won’t allow this to last for long without stepping in with support of some kind. “Because markets.” That might even mean nationalisation in some cases; or slush funds and bail outs for firms who squandered all their free cash flow on dividends and executive bonuses in others.

cont..............

Virus Rips Into Middle-Class America, Where Finances Are Fragile

Virus Rips Into Middle-Class America, Where Finances Are Fragile

By Alex Tanzi

The coronavirus is set to overwhelm the precarious finances of America’s middle class, a group that’s seen its share of the national wealth decline steadily since the last financial crisis in 2008.

Economic activity has collapsed in the past few weeks as Americans stop traveling and shopping, business revenues plummet and millions are thrown out of work. The country’s middle-income group is likely ill-prepared for such a shock, according to the latest update of household-finance data from the Federal Reserve.

The following six charts examine the balance-sheet of the middle class, defined here as Americans except the richest 20% and the poorest 20%. Viewed another way, that corresponds to families with incomes between roughly $25,000 and $110,000 a year.

The cohort’s share of the U.S. national wealth has been reduced to the smallest since the Fed began keeping these kind of records in 1989 -- dropping below 25% at the end of 2019.

While the decline began earlier, it has gathered pace in the past decade or so. The real, wage-paying economy was slow to recover after the 2008 crisis. The value of financial assets, more likely to be held by the richest sliver of Americans, roared back much faster.

U.S. household debt is lower now, as a share of economic output, than it was before the last recession. And low interest rates have in the aggregate helped to keep servicing costs down.

But one trend in the composition of middle-class debt is more worrying. Among this cohort, the share of low-cost loans used to finance assets that will generally increase in value -- such as real estate -- has declined sharply. The group is now saddled with a bigger share of consumer debts, which typically come with higher interest rates.

cont....................

Recent GORO News

- Gold Resource Corporation Announces Preliminary First Quarter Production Results • Business Wire • 04/16/2024 01:02:00 AM

- Gold Resource Corporation Reports Results of Operations for the Year Ended December 31, 2023 • Business Wire • 03/13/2024 08:59:00 PM

- Gold Resource Corporation Announces Preliminary Fourth Quarter and Year-End Results • Business Wire • 01/30/2024 05:15:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/10/2024 10:46:55 PM

- Gold Resource Corporation Reports High Grade Drill Results at the Don David Gold Mine • Business Wire • 12/11/2023 11:37:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 11/07/2023 02:42:24 AM

- Gold Resource Corporation Reports Third Quarter Operational Results and Announces the Initiation of a Review to Evaluate Strategic Alternatives • Business Wire • 11/07/2023 02:22:00 AM

- Gold Resource Corporation Will Reschedule Release of Its Third Quarter 2023 Results • Business Wire • 11/03/2023 01:48:00 AM

- Gold Resource Corporation Reports the Filing of a SK1300 Initial Assessment for the Back Forty Project • Business Wire • 10/26/2023 10:31:00 PM

- Gold Resource Corporation Announces Q3 2023 Conference Call • Business Wire • 10/23/2023 07:35:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 10/20/2023 10:01:30 AM

- Gold Resource Corporation Announces Preliminary Third Quarter Results • Business Wire • 10/16/2023 10:34:00 PM

- Gold Resource Corporation Reports Continued Positive Drill Results at Don David Gold Mine • Business Wire • 09/12/2023 10:16:00 PM

- Form 3 - Initial statement of beneficial ownership of securities • Edgar (US Regulatory) • 08/10/2023 03:15:54 PM

- Change in Chief Financial Officer and the Appointment of Chet Holyoak As Interim Chief Financial Officer • Business Wire • 08/02/2023 10:45:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 08/02/2023 09:00:11 PM

- Gold Resource Corporation Reports Mid-Year Operational Results • Business Wire • 07/26/2023 08:55:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 07/26/2023 08:49:33 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 07/26/2023 08:40:17 PM

- Gold Resource Corporation Announces Year-to-Date Production Results, Reaffirms 2023 Production Guidance • Business Wire • 07/13/2023 10:24:00 PM

- Gold Resource Corporation Addresses Unusual Market Activity • Business Wire • 07/06/2023 09:16:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 07/05/2023 07:13:24 PM

- Gold Resource Corporation Prepared for Anaem Omot Listing on the National Register of Historic Places • Business Wire • 06/28/2023 12:41:00 AM

- Gold Resource Corporation Announces the Resignation of Joe Driscoll From the Board of Directors • Business Wire • 06/16/2023 11:00:00 PM

- Gold Resource Corporation Provides an Update on Positive Year-to-Date 2023 Drill Results at the Don David Gold Mine • Business Wire • 06/14/2023 09:03:00 PM

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • BLO • Apr 25, 2024 8:52 AM

Kona Gold Beverages, Inc. Announces Name Change to NuVibe, Inc. and Initiation of Ticker Symbol Application Process • KGKG • Apr 25, 2024 8:30 AM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM