Friday, February 21, 2020 9:01:13 PM

***Captains Night Live*** Friday Night

Welcome Everybody I'm Ready Willing and Able to kick off tonight's show

Captains Quarters is Now Live Streaming 24/7

Hope your enjoying our Live Streams debut and development Thanks:)

Catch "TFNN LIVE" all day long, Our "Bitcoin Stream" 24/7 and Early bird "Forex Trading Live" 24/7

and Feel Free to join us and Share your MUSIC NEWS STOCK PICKS

Nice to see you and Thanks for being with us tonight

Shout Outs & Thank Yous to tonight's outstanding contributors

*Day In A Chart

**Greg Mannarino POST MARKET WRAP UP

***Jesse's Cafe

EnJoy

OK Let's go >>>>>>>>>

Live from aboard the Mighty Captains Quarters

Welcome Aboard

****CAPTAINS NIGHT LIVE****

Day In A Chart

Tonight's "Day In A Chart" is Brought to You by:

" Cowboys Herding Cats "

Please Support our Anxiety Relief Sponsors

Thank You

and Now our feature Chart Presentation >>>>>>>>

Schizophrenic Stocks End Near Record Highs As Virus Fears Send Yields To All-Time Lows

Yeah, that just happened…

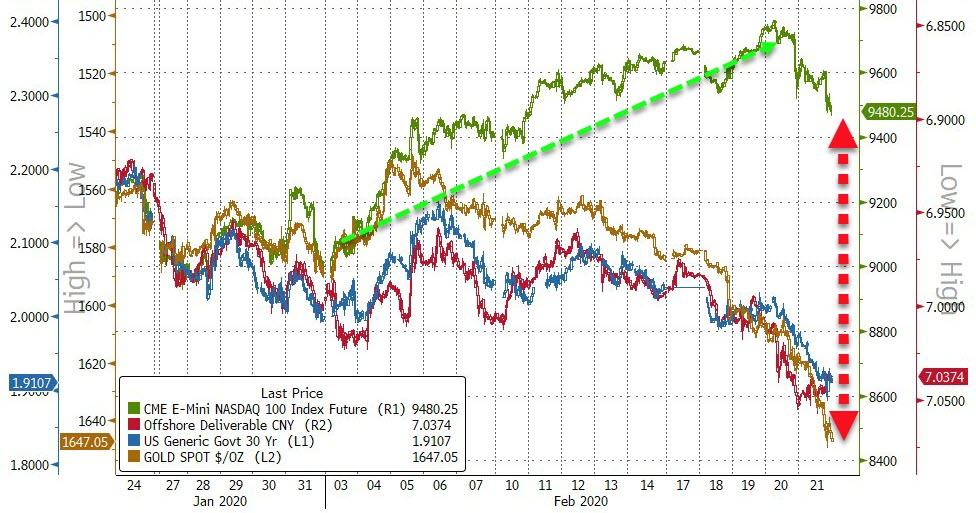

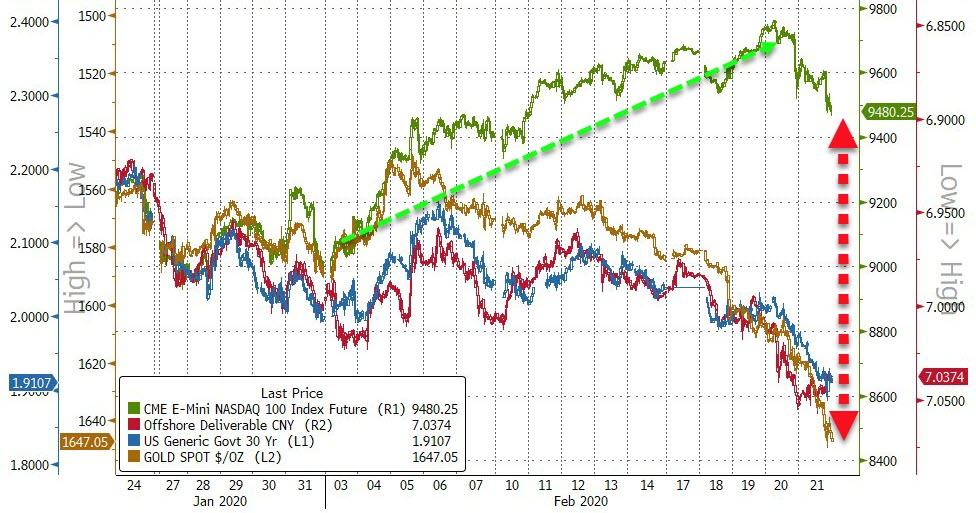

Stocks hover near record highs, bonds crash to all-time lows, and gold is exploding higher…

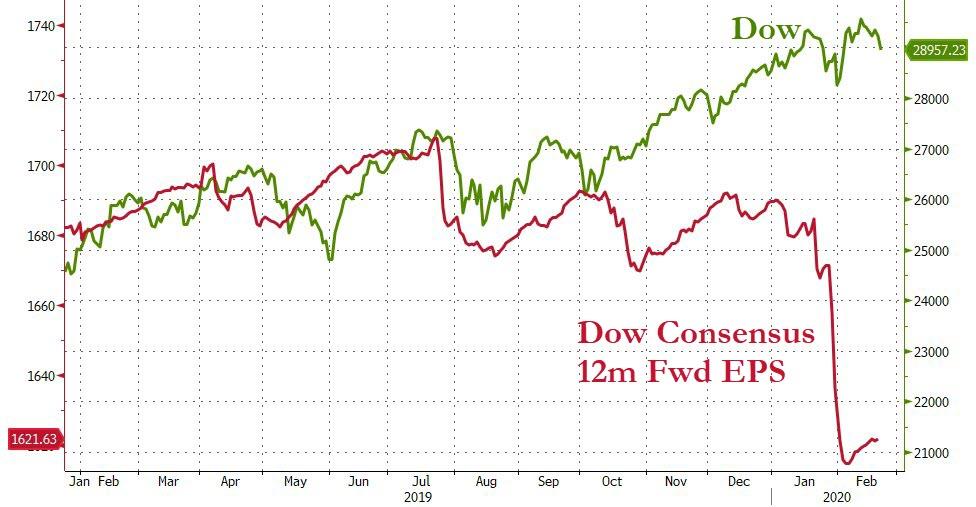

As it is becoming more and more obvious that investors in stocks have entirely lost contact with reality since the virus took hold…

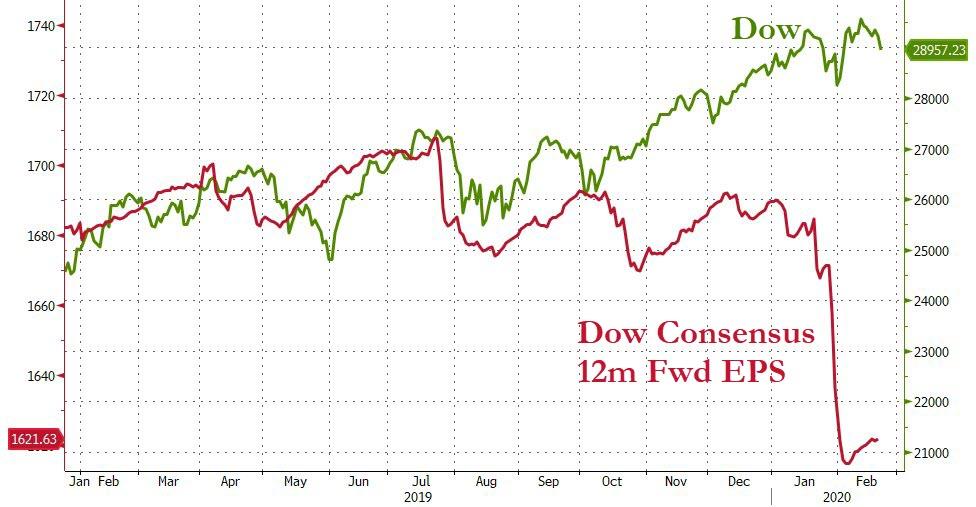

Especially the funny-mentals…

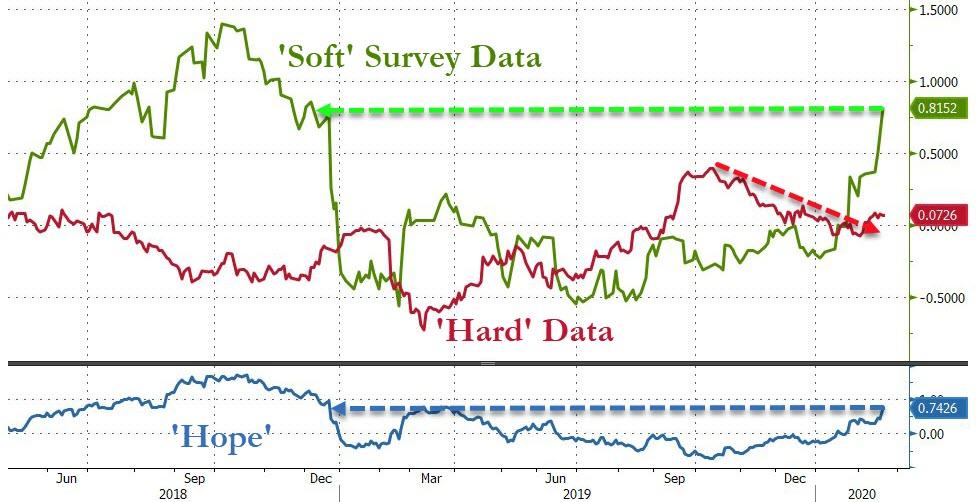

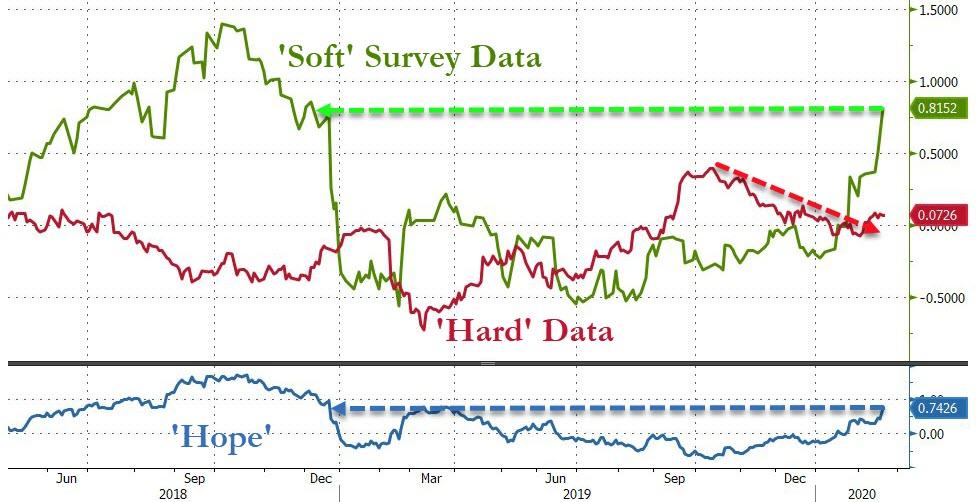

The ‘hope’-filled gap between ‘soft’ survey data rising and ‘hard’ real economic data slumping has surged to 16 month highs… until this morning’s carnage in PMIs…

Year-to-date, gold is the biggest winner…

Chinese stocks soared higher this week…

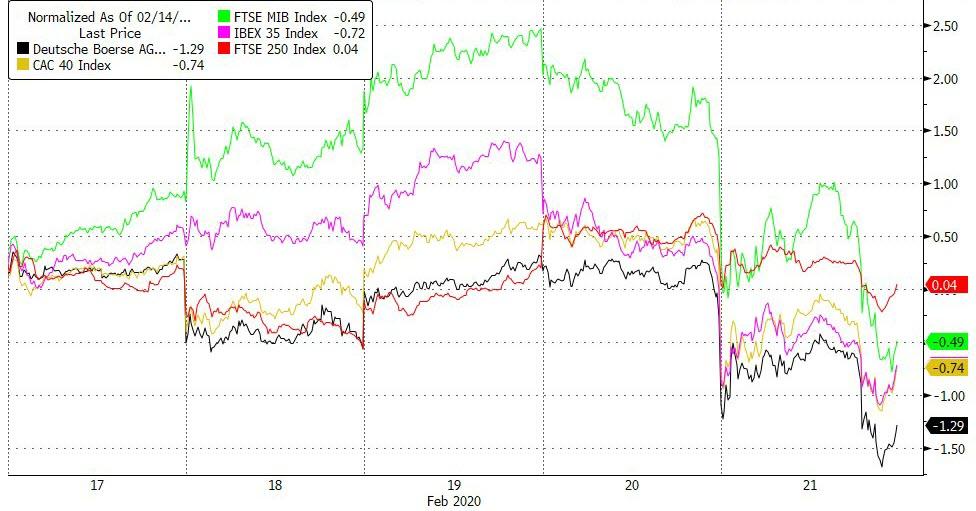

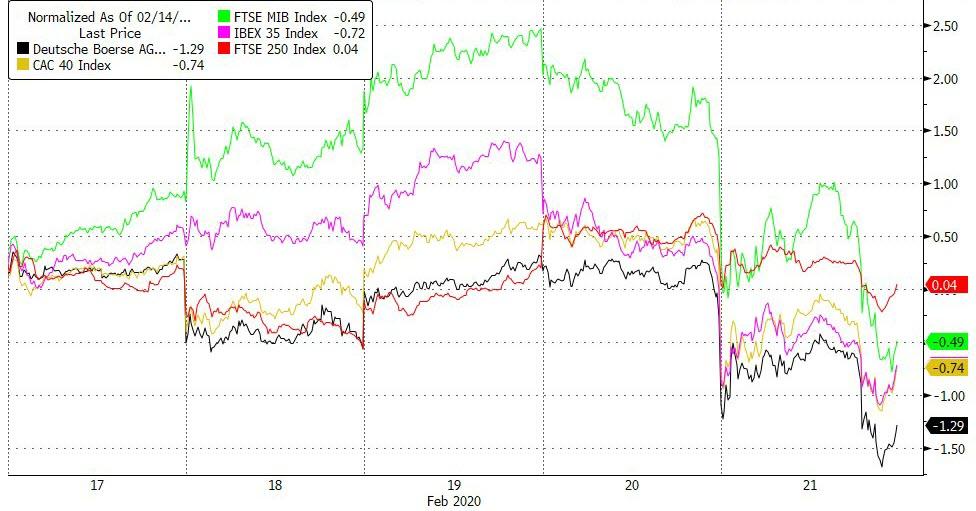

European stocks were broadly lower with UK’s FTSE managing to scramble back into the green for the week…

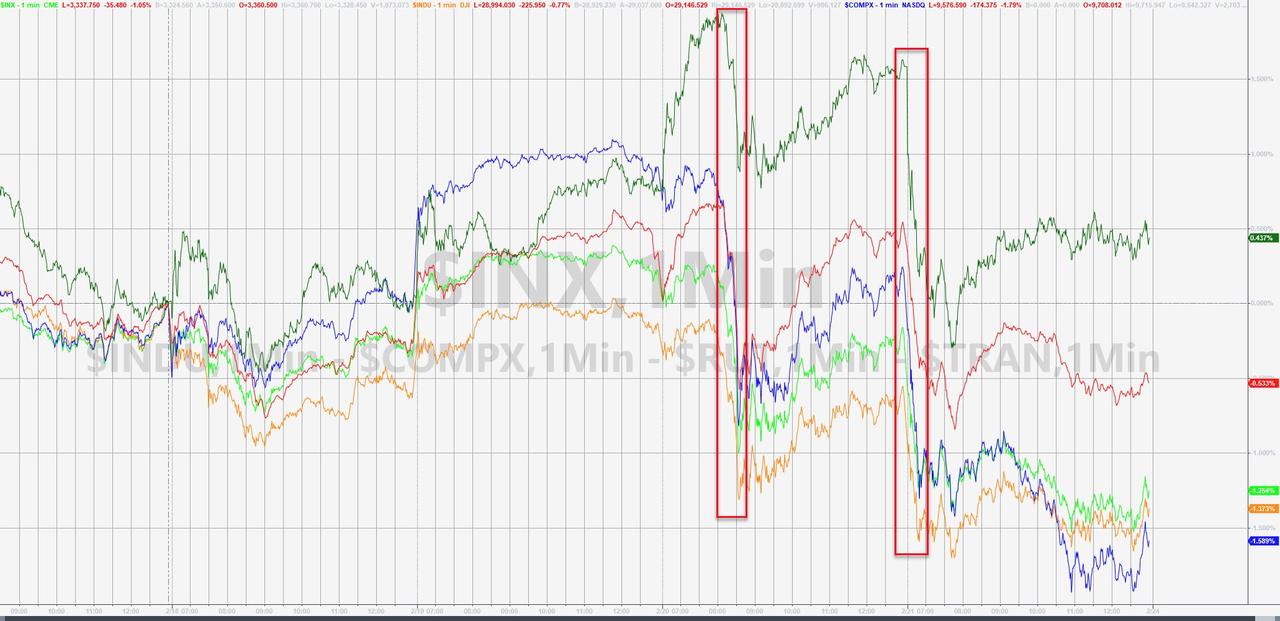

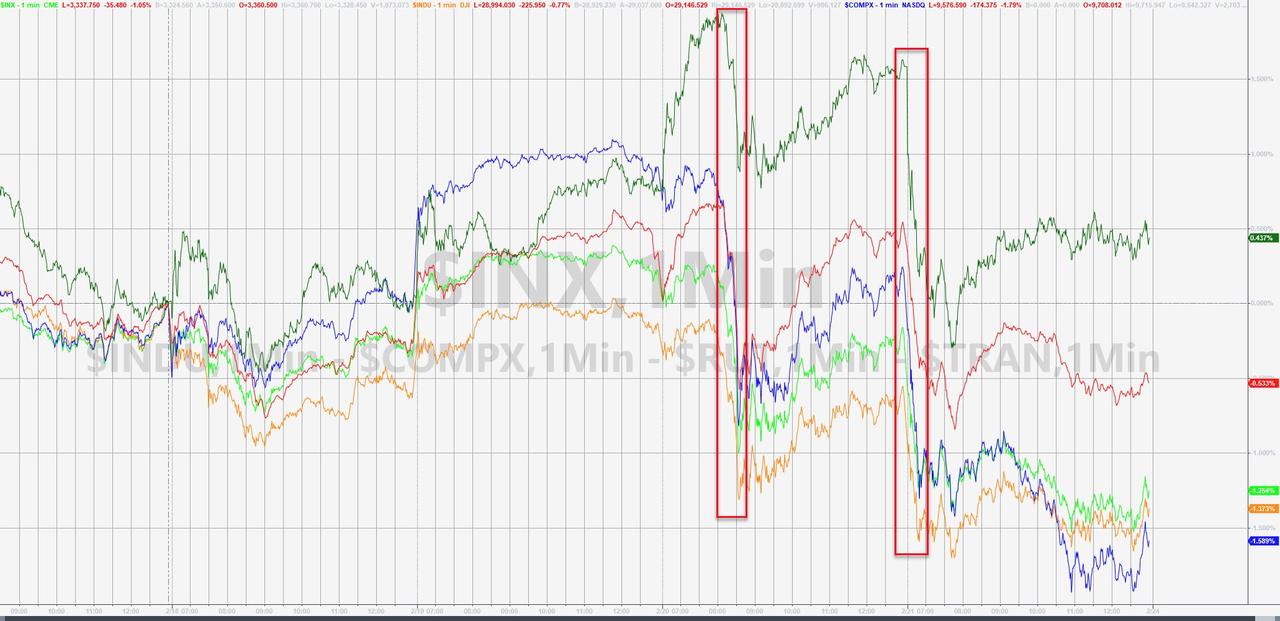

In the US, only Trannies managed to cling to gains as Nasdaq went from outperformer to biggest loser…

Dow ended the week back below 29k…

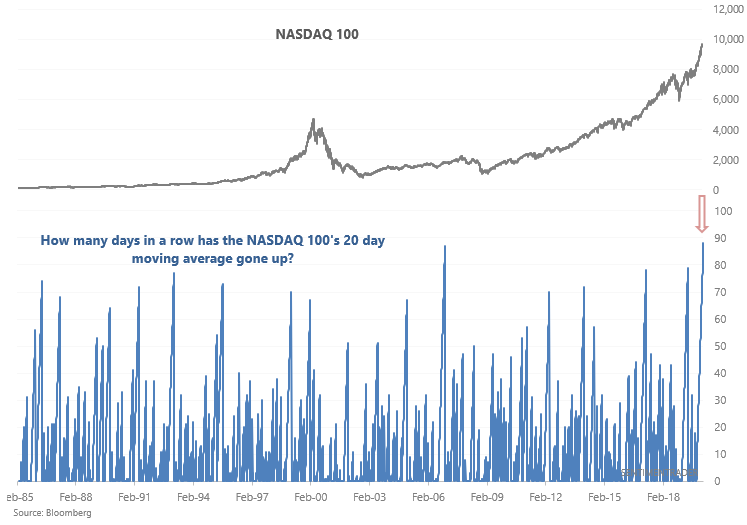

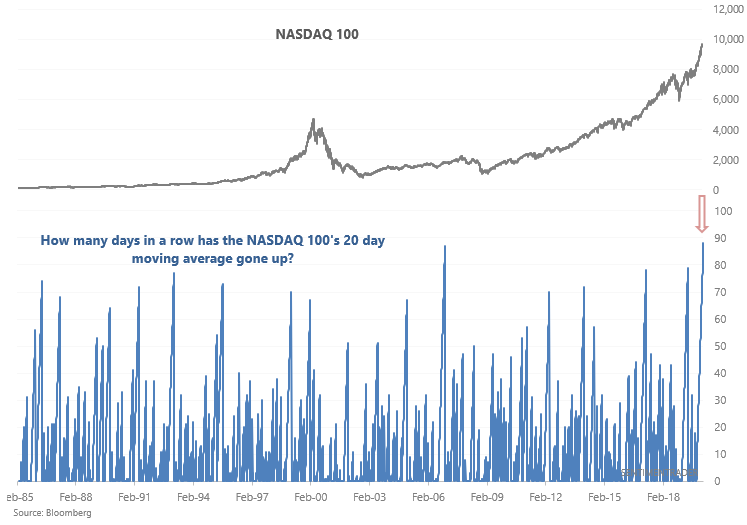

As @Sentimentrader noted, NASDAQ 100’s 20 day moving average has gone up 88 days in a row, THE MOST EXTREME IN HISTORY.

Similar streaks always ended with SHARP corrections over the next month.

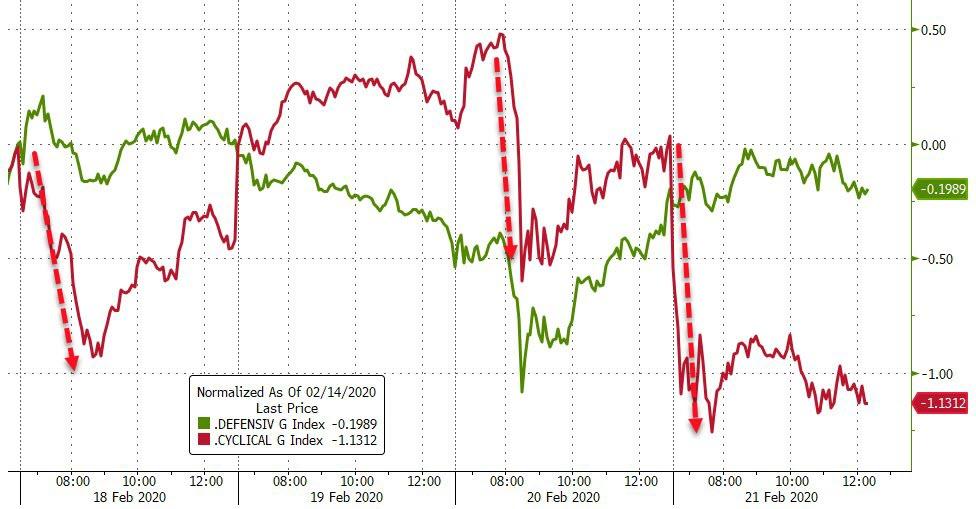

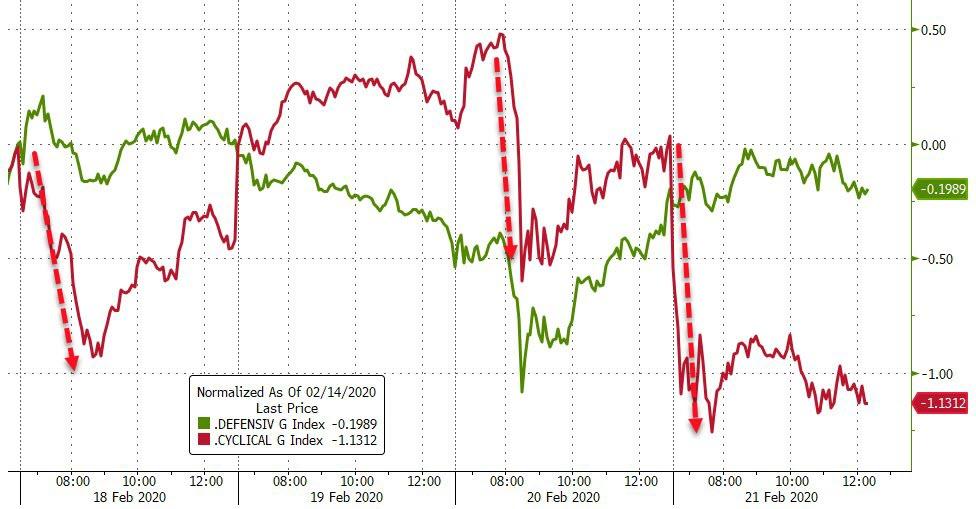

Cyclicals notably underperformed…

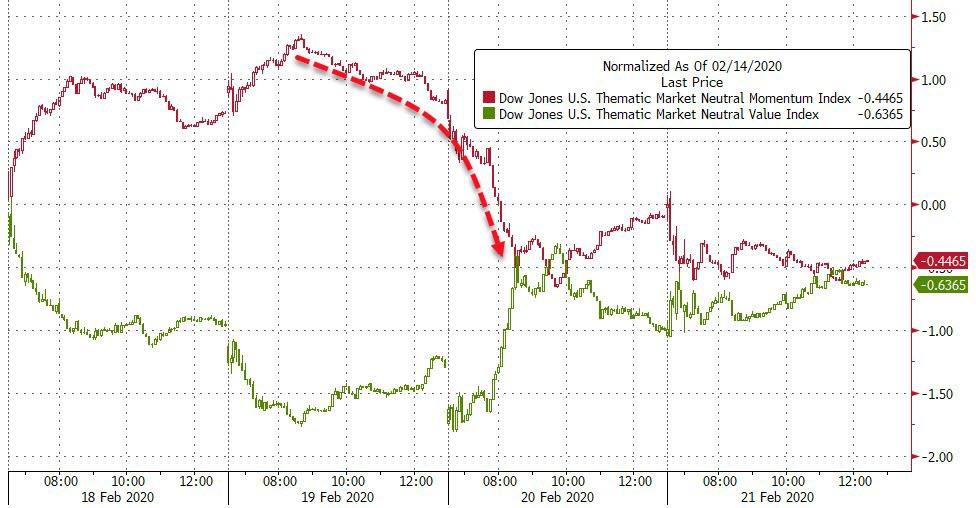

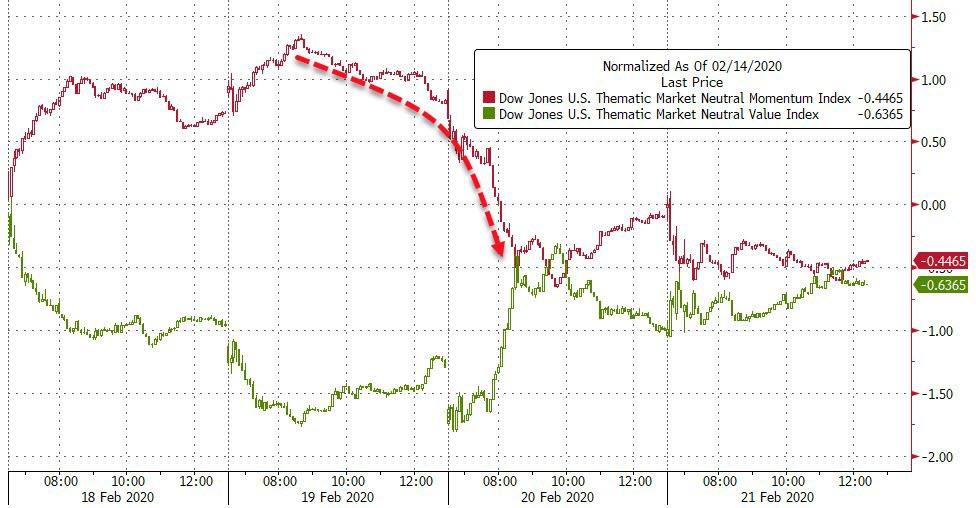

Momentum was hit hard midweek but stabilized…

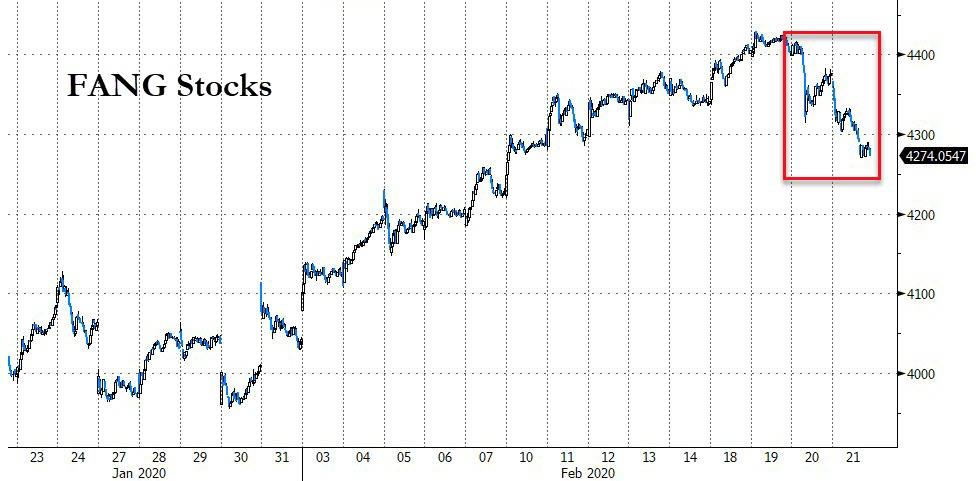

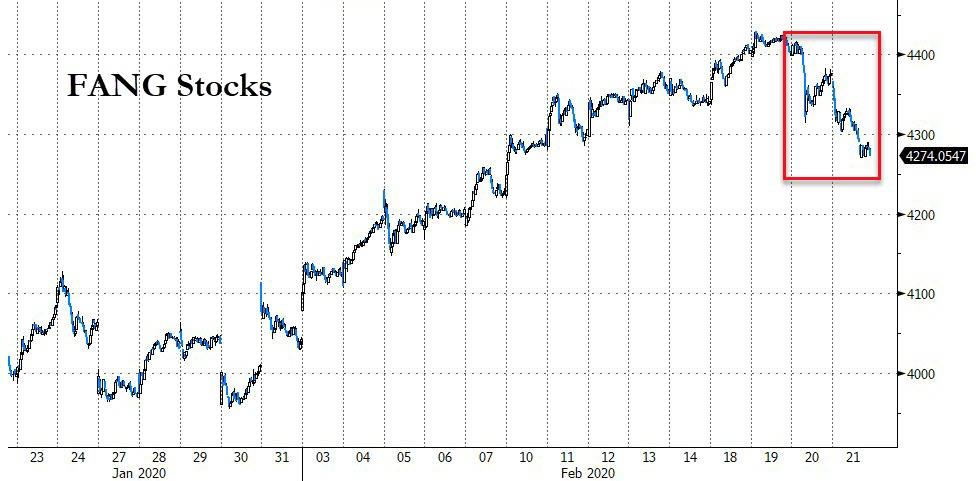

FANG stocks suffered their worst day since Mid-October…

As global liquidity has sent global stock prices to higher and higher record highs, it has also sparked more and more buying in global bonds (yields inverted in chart). Critically, as investors recognize the growth/inflation that was so hoped for is evaporating, global liquidity suggests the global average sovereign bond yield should be drastically lower… at ZERO!!

US Treasury yields extended their collapse today ending a major weekly plunge…

30Y and 5Y yields hit new record lows today, 10Y and 2Y were just shy of their record lows…

The 30Y Yield hit 1.8840% at today’s lows (the previous intraday low was 1.9039% on 8/28/19)…

The yield curve continued to collapse, falling to its most inverted since October…

The market is now demanding almost 2 full rate-cuts by end-2020… or else!

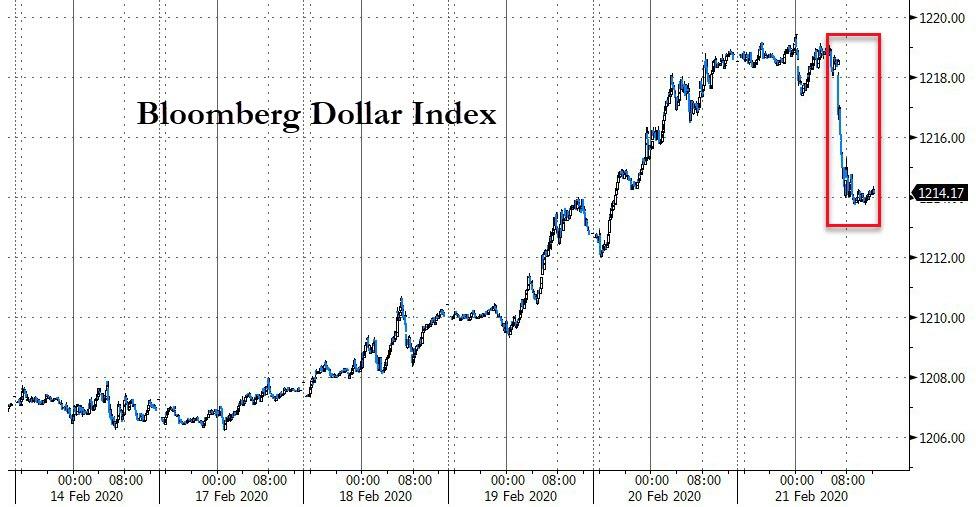

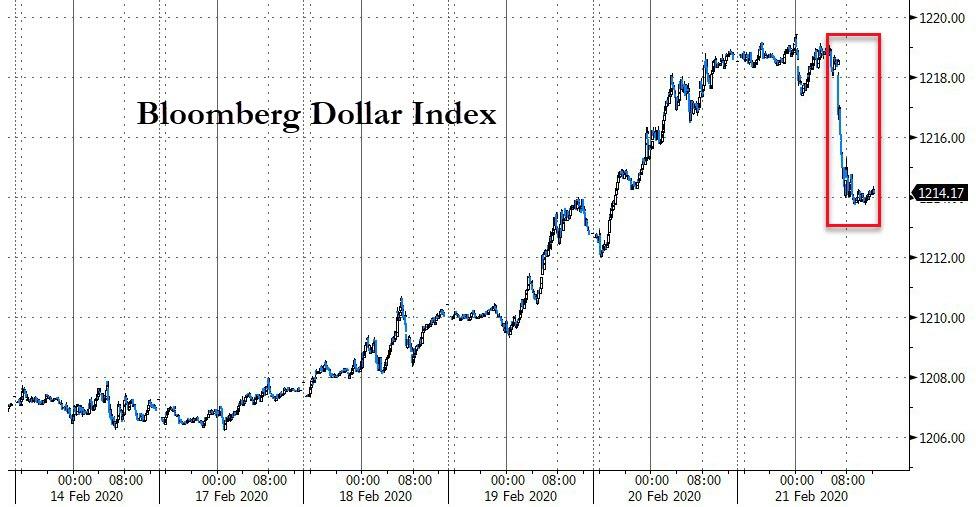

The dollar was clubbed like a baby seal today – worst day since 12/27, after 4 straight up…

Cryptos were all lower on the week…

Commodities were all higher on the week (copper barely) with PMs leading…

WTI managed to get back above $54 briefly but faded back…

This is the best start to a year for gold since 2016. Today was the best day for gold since mid-August (gold is up 10 of the last 13 days)…

Silver is also surging, back above $18.50…

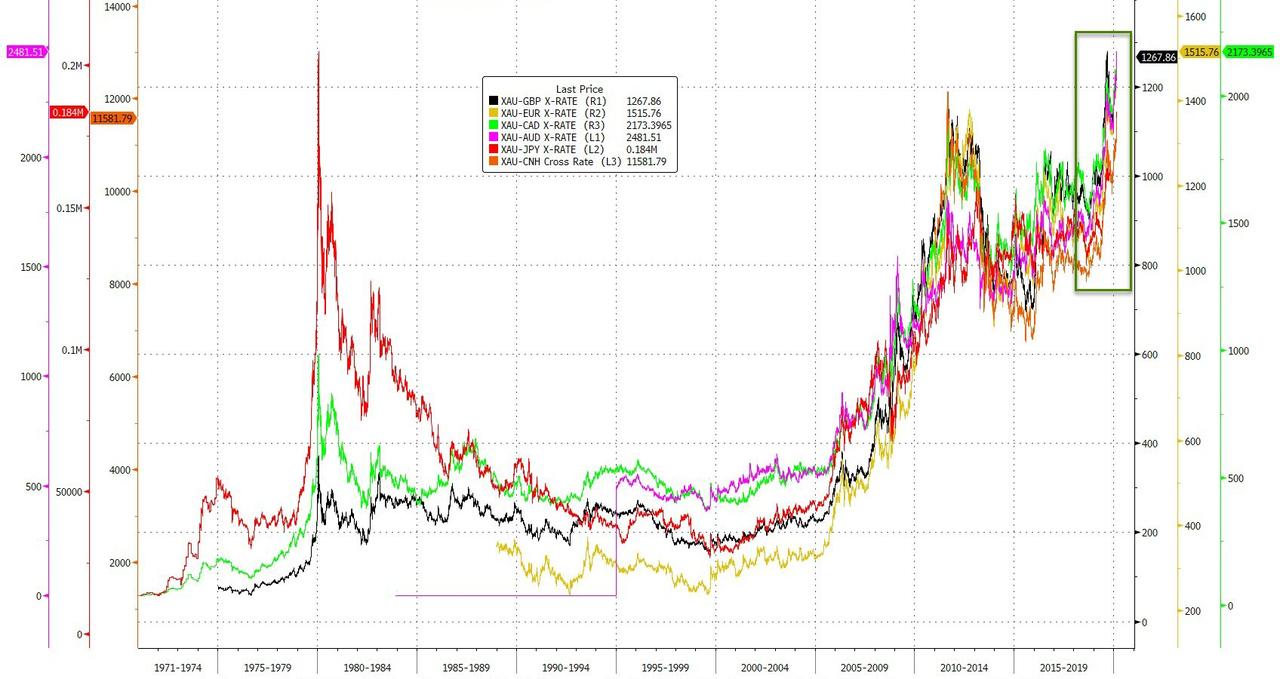

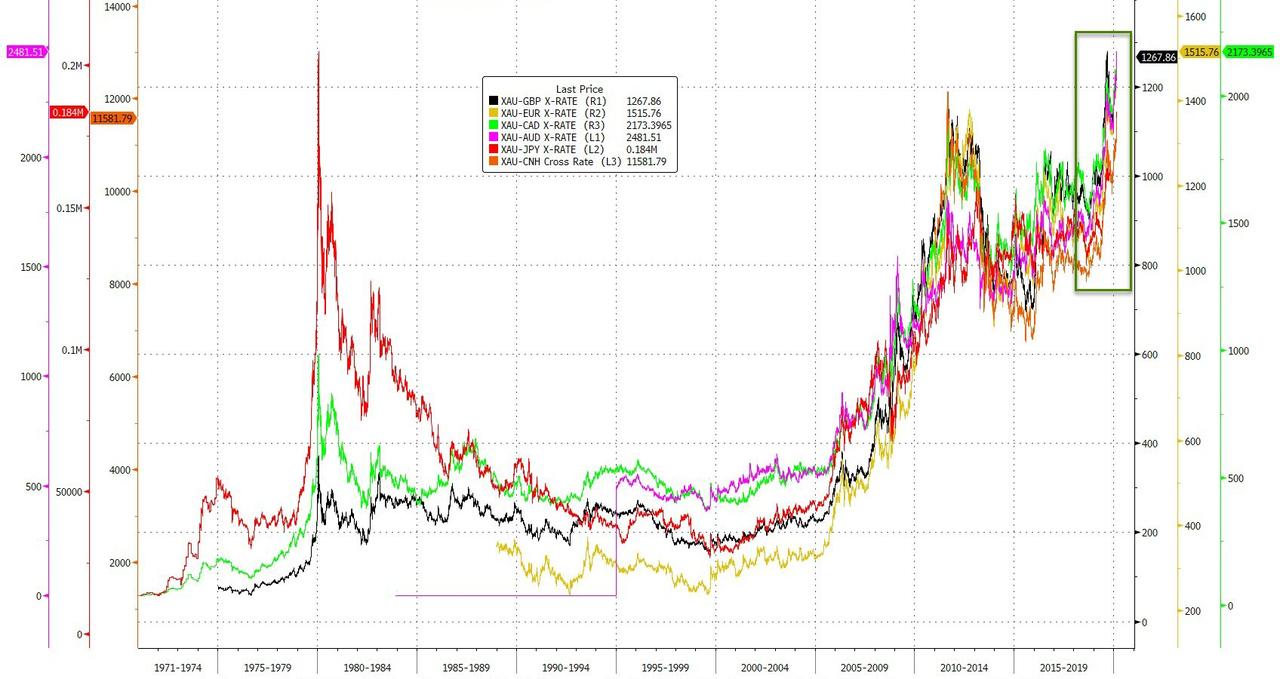

Gold is hitting record highs in many global currencies…

The dollar is holding up against the rest of global fiat but collapsing against hard assets!!

Finally, there’s this… that Nasdaq 10,000 Y2K analog is spookily accurate still…

Stock markets seem unable to grasp that the liquidity spigot may not be open forever…

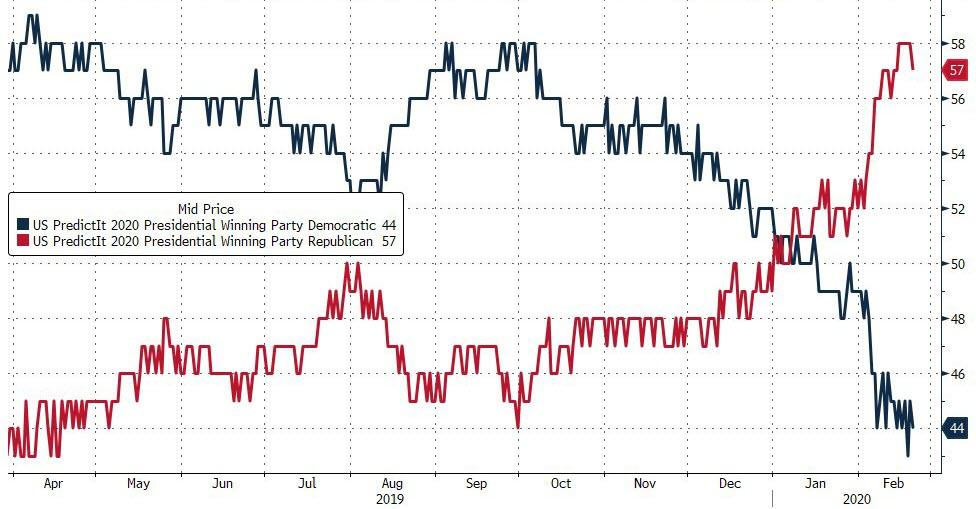

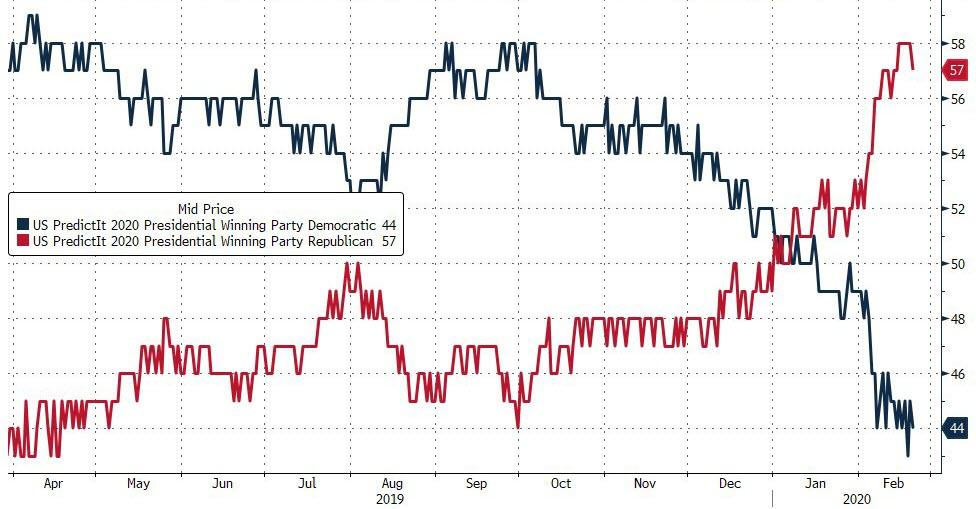

Maybe Bernie’s rise will be the breaking point for stocks?

For now the market remains convinced that Trump will win…

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

and now Ladies and Gentleman

grab some refreshments and please welcome

One of the Kings of market insights

Gregory Mannarino

Post Market Wrap Up

SECOND WARNING: Debt Market Hyper-Bubble FLASHING RED.. MUST WATCH! Mannarino

Thank You GM always good stuff !

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Risk Off For Option Expiration - Gold Breaks Out

Some weaker than expected economic news, and the reality of the coronavirus, helped to despress stock prices today.

Especially since the option expiration was today, and the wiseguys had already done half the job by jacking the markets up earlier this week.

Gold has broken out of its 'W' or double bottom formation.

We may see some retracement back to test former resistance, but for now it looks like a trip uptown for the yellow dog.

And silver is going along for the ride.

I have to run to the airport so that's all for now.

Have a great weekend.

https://jessescrossroadscafe.blogspot.com/

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

It's been a pleasure having you with us tonight

Wishing everybody a Wonderful weekend !

Thanks for the Adventure

Now go have a New One !

J:D <3

Welcome Everybody I'm Ready Willing and Able to kick off tonight's show

Captains Quarters is Now Live Streaming 24/7

Hope your enjoying our Live Streams debut and development Thanks:)

Catch "TFNN LIVE" all day long, Our "Bitcoin Stream" 24/7 and Early bird "Forex Trading Live" 24/7

and Feel Free to join us and Share your MUSIC NEWS STOCK PICKS

Nice to see you and Thanks for being with us tonight

Shout Outs & Thank Yous to tonight's outstanding contributors

*Day In A Chart

**Greg Mannarino POST MARKET WRAP UP

***Jesse's Cafe

EnJoy

OK Let's go >>>>>>>>>

Friday Night Kick Off

Live from aboard the Mighty Captains Quarters

Welcome Aboard

****CAPTAINS NIGHT LIVE****

Day In A Chart

Tonight's "Day In A Chart" is Brought to You by:

" Cowboys Herding Cats "

Please Support our Anxiety Relief Sponsors

Thank You

and Now our feature Chart Presentation >>>>>>>>

Schizophrenic Stocks End Near Record Highs As Virus Fears Send Yields To All-Time Lows

Yeah, that just happened…

Stocks hover near record highs, bonds crash to all-time lows, and gold is exploding higher…

As it is becoming more and more obvious that investors in stocks have entirely lost contact with reality since the virus took hold…

Especially the funny-mentals…

The ‘hope’-filled gap between ‘soft’ survey data rising and ‘hard’ real economic data slumping has surged to 16 month highs… until this morning’s carnage in PMIs…

Year-to-date, gold is the biggest winner…

Chinese stocks soared higher this week…

European stocks were broadly lower with UK’s FTSE managing to scramble back into the green for the week…

In the US, only Trannies managed to cling to gains as Nasdaq went from outperformer to biggest loser…

Dow ended the week back below 29k…

As @Sentimentrader noted, NASDAQ 100’s 20 day moving average has gone up 88 days in a row, THE MOST EXTREME IN HISTORY.

Similar streaks always ended with SHARP corrections over the next month.

Cyclicals notably underperformed…

Momentum was hit hard midweek but stabilized…

FANG stocks suffered their worst day since Mid-October…

As global liquidity has sent global stock prices to higher and higher record highs, it has also sparked more and more buying in global bonds (yields inverted in chart). Critically, as investors recognize the growth/inflation that was so hoped for is evaporating, global liquidity suggests the global average sovereign bond yield should be drastically lower… at ZERO!!

US Treasury yields extended their collapse today ending a major weekly plunge…

30Y and 5Y yields hit new record lows today, 10Y and 2Y were just shy of their record lows…

The 30Y Yield hit 1.8840% at today’s lows (the previous intraday low was 1.9039% on 8/28/19)…

The yield curve continued to collapse, falling to its most inverted since October…

The market is now demanding almost 2 full rate-cuts by end-2020… or else!

The dollar was clubbed like a baby seal today – worst day since 12/27, after 4 straight up…

Cryptos were all lower on the week…

Commodities were all higher on the week (copper barely) with PMs leading…

WTI managed to get back above $54 briefly but faded back…

This is the best start to a year for gold since 2016. Today was the best day for gold since mid-August (gold is up 10 of the last 13 days)…

Silver is also surging, back above $18.50…

Gold is hitting record highs in many global currencies…

The dollar is holding up against the rest of global fiat but collapsing against hard assets!!

Finally, there’s this… that Nasdaq 10,000 Y2K analog is spookily accurate still…

Stock markets seem unable to grasp that the liquidity spigot may not be open forever…

Maybe Bernie’s rise will be the breaking point for stocks?

For now the market remains convinced that Trump will win…

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

and now Ladies and Gentleman

grab some refreshments and please welcome

One of the Kings of market insights

Gregory Mannarino

Post Market Wrap Up

SECOND WARNING: Debt Market Hyper-Bubble FLASHING RED.. MUST WATCH! Mannarino

Thank You GM always good stuff !

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Risk Off For Option Expiration - Gold Breaks Out

Some weaker than expected economic news, and the reality of the coronavirus, helped to despress stock prices today.

Especially since the option expiration was today, and the wiseguys had already done half the job by jacking the markets up earlier this week.

Gold has broken out of its 'W' or double bottom formation.

We may see some retracement back to test former resistance, but for now it looks like a trip uptown for the yellow dog.

And silver is going along for the ride.

I have to run to the airport so that's all for now.

Have a great weekend.

https://jessescrossroadscafe.blogspot.com/

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

It's been a pleasure having you with us tonight

Wishing everybody a Wonderful weekend !

Thanks for the Adventure

Now go have a New One !

J:D <3

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.