Tuesday, January 14, 2020 7:00:32 PM

***Captains Night Live*** Tuesday Night

Captains Quarters is Now Live Streaming 24/7

Still experimenting with the Live streams

Please bare with us as our Live Streams debut and develop Thanks:)

Catch "TFNN LIVE" during the day 9am to 5pm, Our "Bitcoin Stream" 24/7 and Early bird "Forex Trading Live" 24/7 in middle of the night

and Feel Free to join us evenings on """Captains Night Live""" and Share your MUSIC NEWS STOCK PICKS

Nice to see you and Thanks for being with us tonight

On the show tonight

*Day In A Chart

**Greg Mannarino

***Jesse's Cafe

EnJoy

OK Let's go >>>>>>>>>

Live from aboard the mighty Captains Quarters

Welcome Aboard

****CAPTAINS NIGHT LIVE****

Day In A Chart

Tonight's "Day In A Chart" is Brought to You by:

" Reverie "

Please Support our Anxiety Relief Sponsors

Thank You

and Now our feature Chart Presentation >>>>>>>>

Stocks Slip From Record Highs As Risk Demand Reaches “Historic Turning Point”

The market’s relationship with The Fed explained…

The US market’s price-to-sales ratio has reached a new record high (but it’s different this time)…

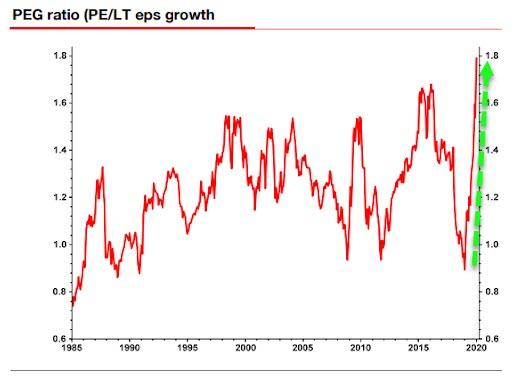

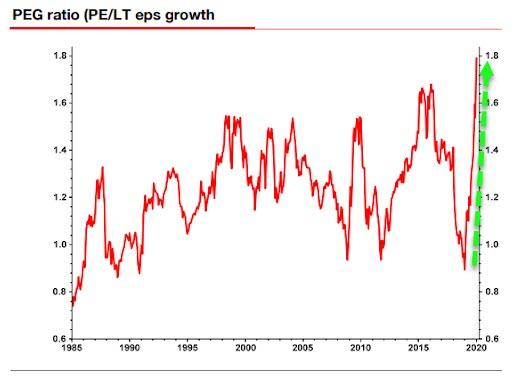

And its PEG ratio has also never been higher…

“perpetually easy” US financial conditions make this an “everything rally” environment for investors, where risk assets / spread product should be supported by “firm” USTs over the course of 2020 (as I do not see scope for a large US Rates selloff as some are expecting, nor a massive rally for that matter)

“Goldilocks” US economic backdrop with benign inflation

Fed reaction function clearly skewed asymmetrically (super-low bar to ease, almost impossible bar to hike)

My belief that the current “QE-Lite” (in that the Fed are NOT buyers of “Duration,” just short-term Bills) will transition to standard “QE” over time, moving toward towards USTs / outright “Duration” purchases in an effort to provide “ample” reserves in the banking system and offset money market stress points

Long-term view from investors that the “Three D’s” will continue to create secular disinflation which makes will keep policy “easy” and rates “low”—the overall 1) trajectory of Debt growth, 2) fading Demographic impulse and 3) tech Disruption.

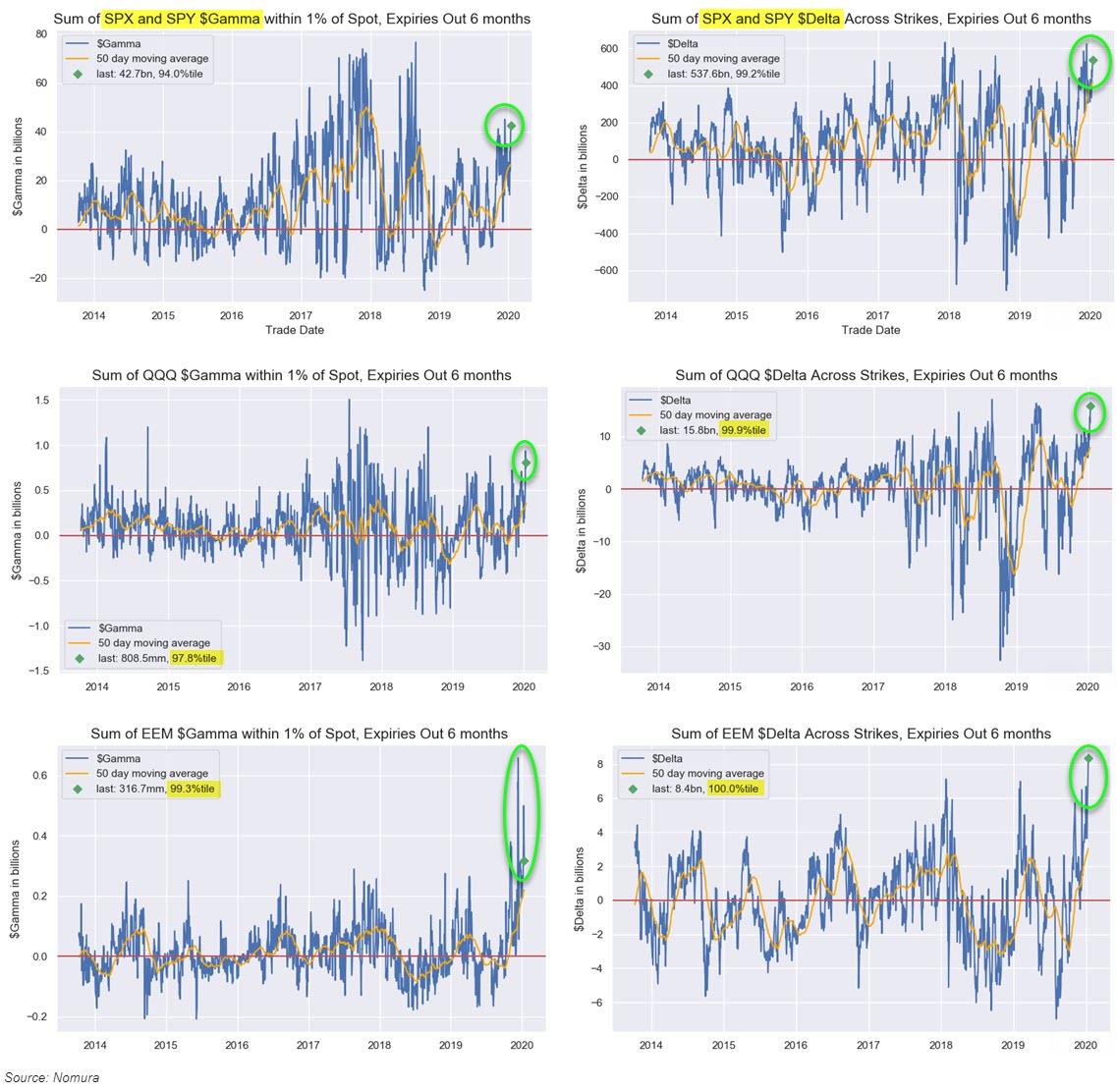

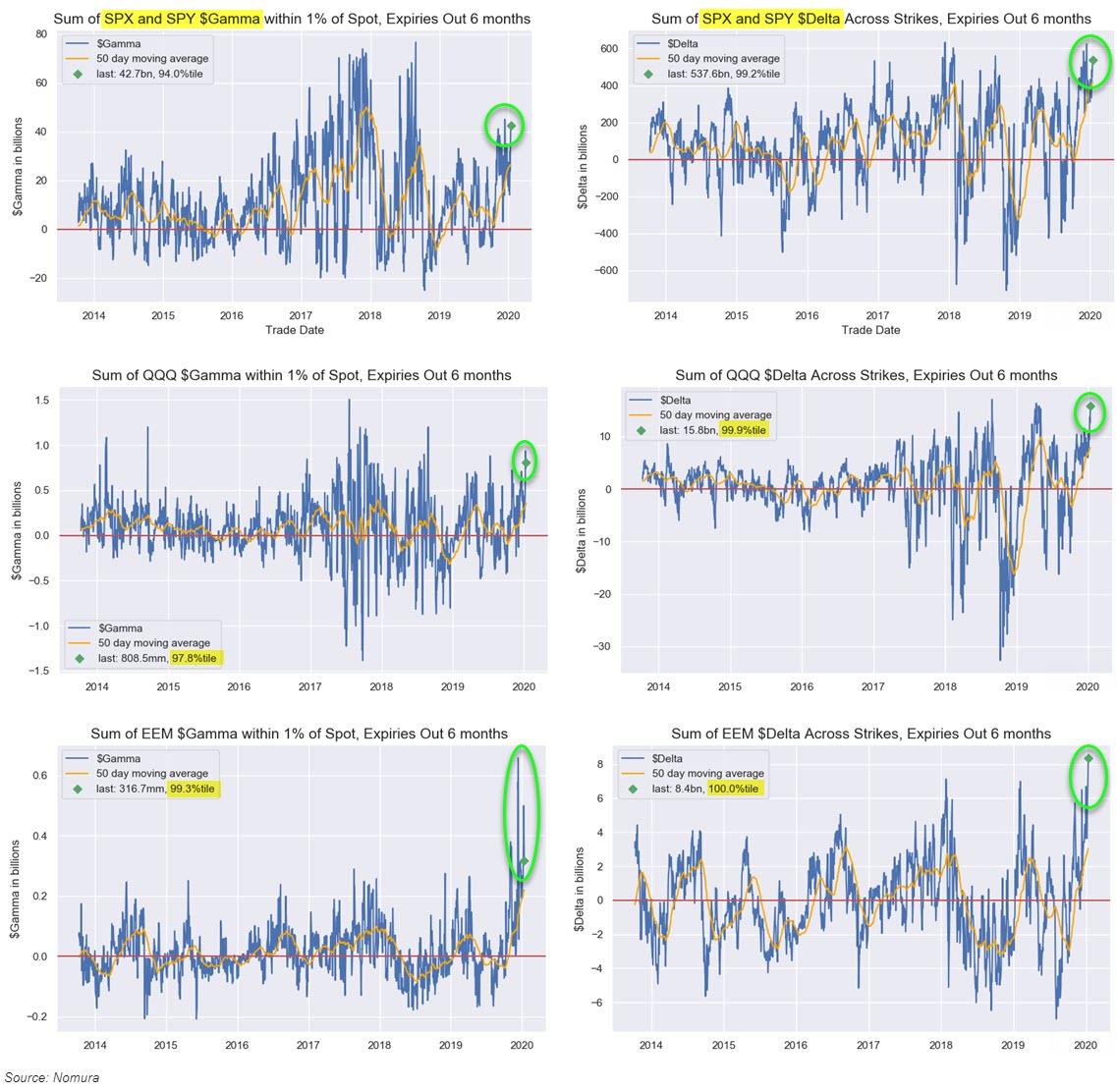

And positioning in options is extreme to say the least…

And the market keeps rising on the back of the biggest 2-day short-squeeze in 2 months…

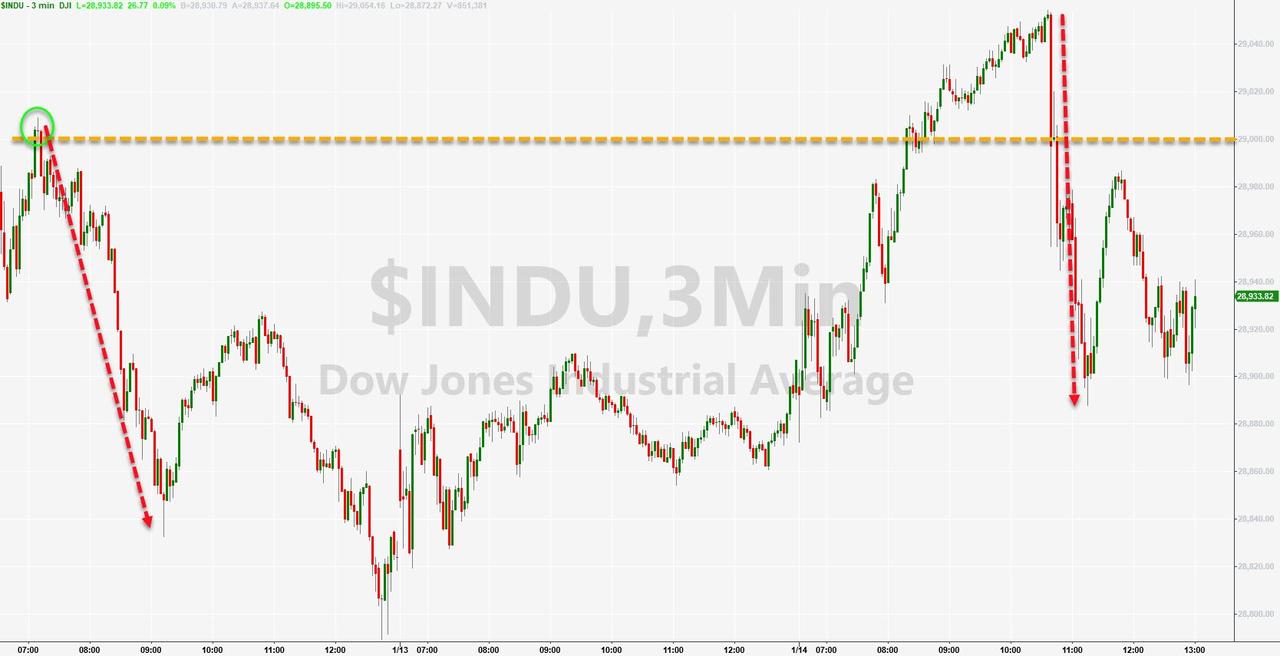

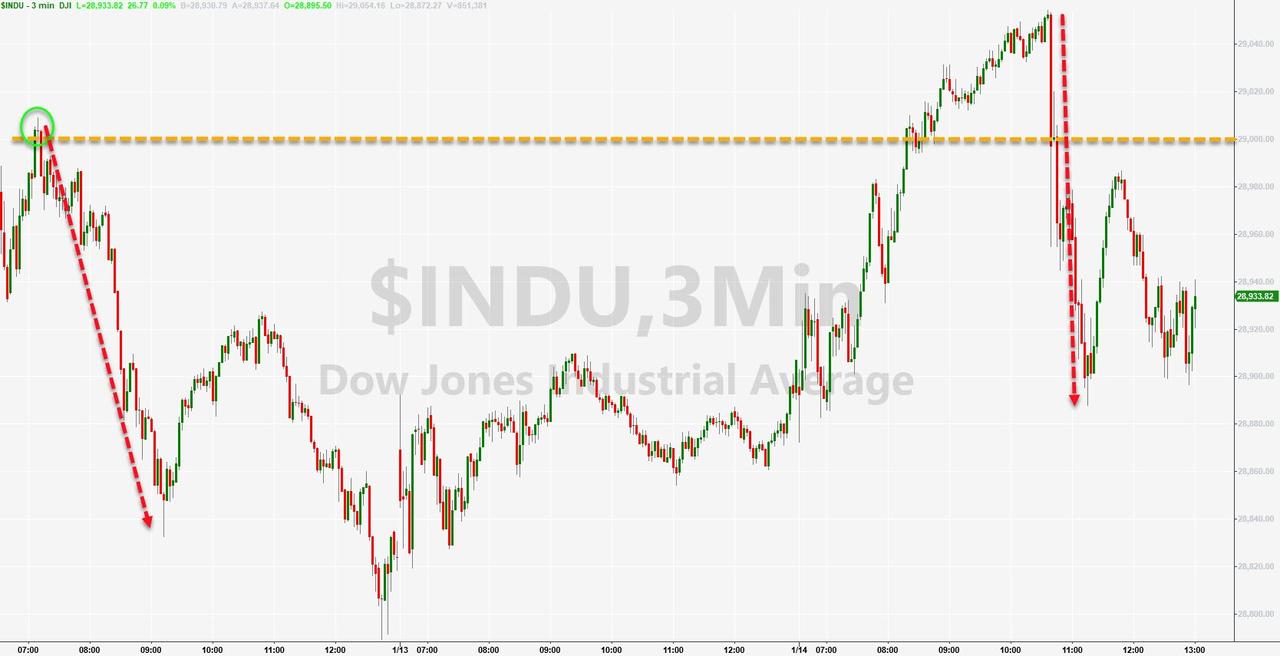

For a few brief minutes today, the machines hiccup’d on China tariff headlines… but that didn’t last… until NYFed reduced the size of its repo plans and that dipped stocks again (briefly)… S&P and Nasdaq dared to close red!

The Dow topped 29k once again, but couldn't hold it

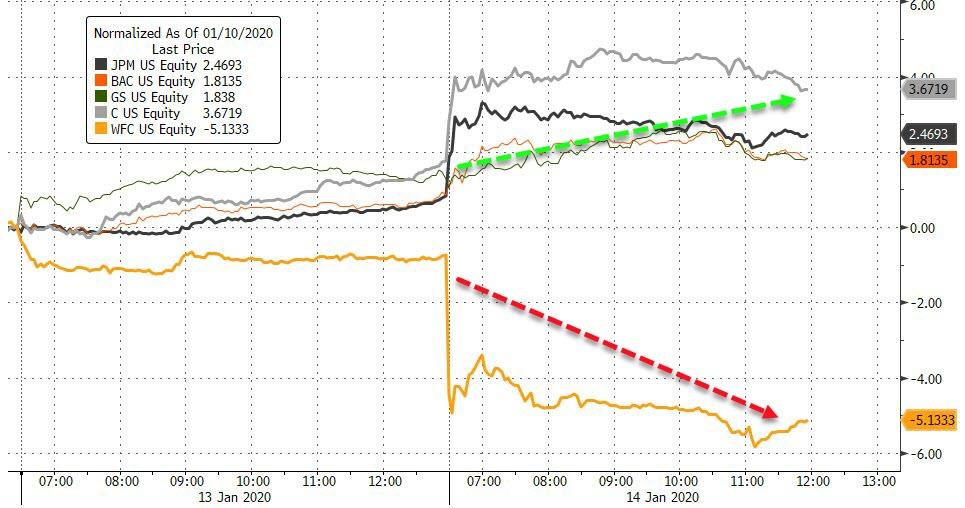

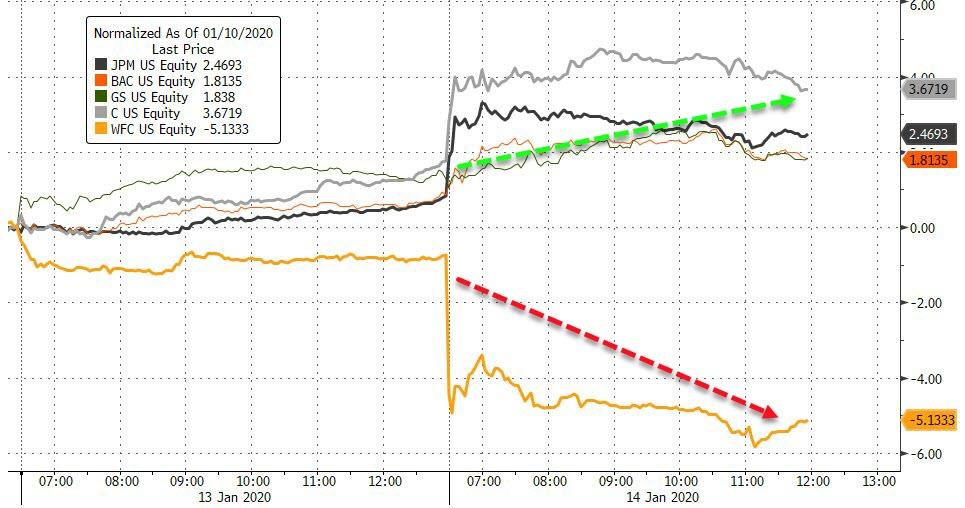

Bank stocks were mixed after earnings with C and JPM rallying as WFC tumbled

The recent gains in the broad market have been driven by a resurgence in a defensive bid…

TSLA continued its parabolic ride, almost tagging $100bn market cap…

And while BYND continued its epic squeeze, after it was halted, it did start to fade fast…

But AAPL dared to close red…

Credit markets are (for once) leading the shift in protection costs higher (even if VIX was also higher today)…

Despite the gains in stocks, bonds were also bid with Treasury yields down 2-3bps (short-end underperformed)… Today’s rally erases yesterday’s losses…

30Y Yields fell back below pre-Soleimani levels…

And the yield curve flattened to almost one-month lows…

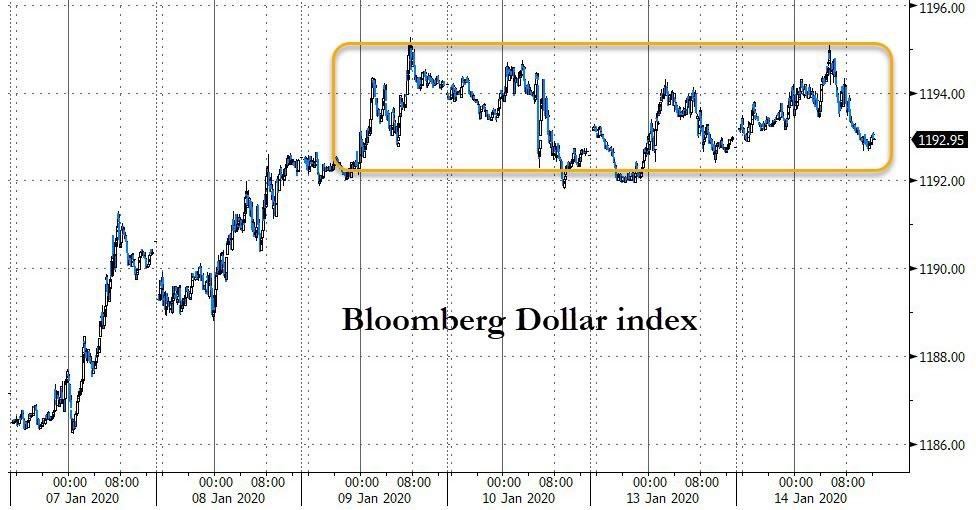

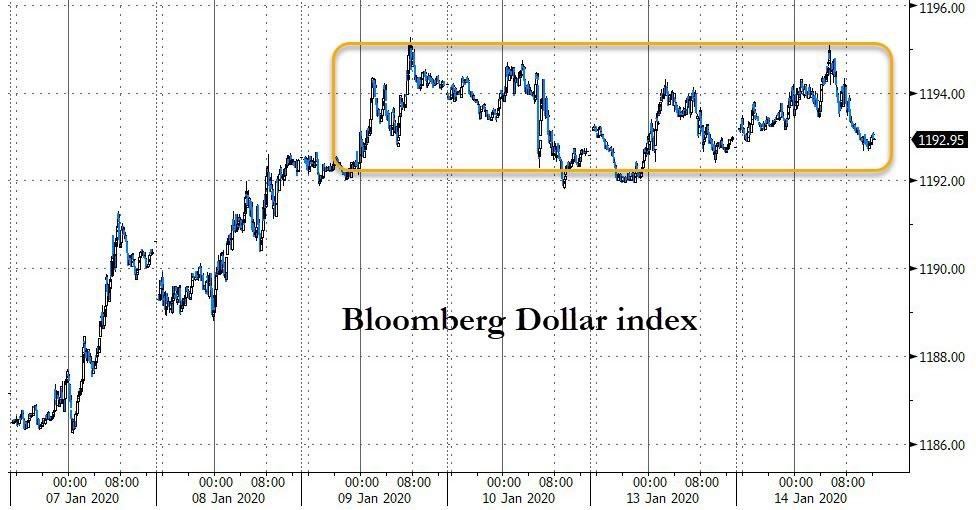

The Dollar trod water for a 4th day…

Yuan ended modestly lower after the trade headlines…

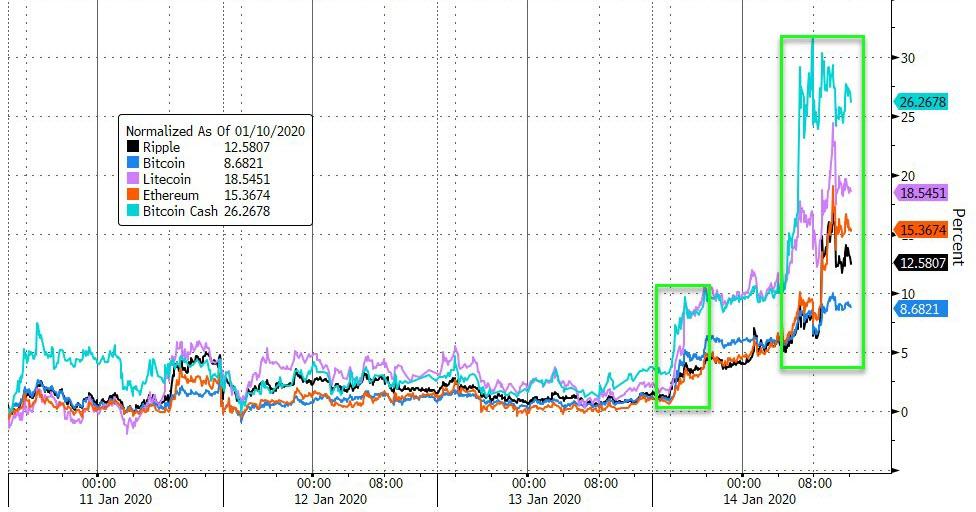

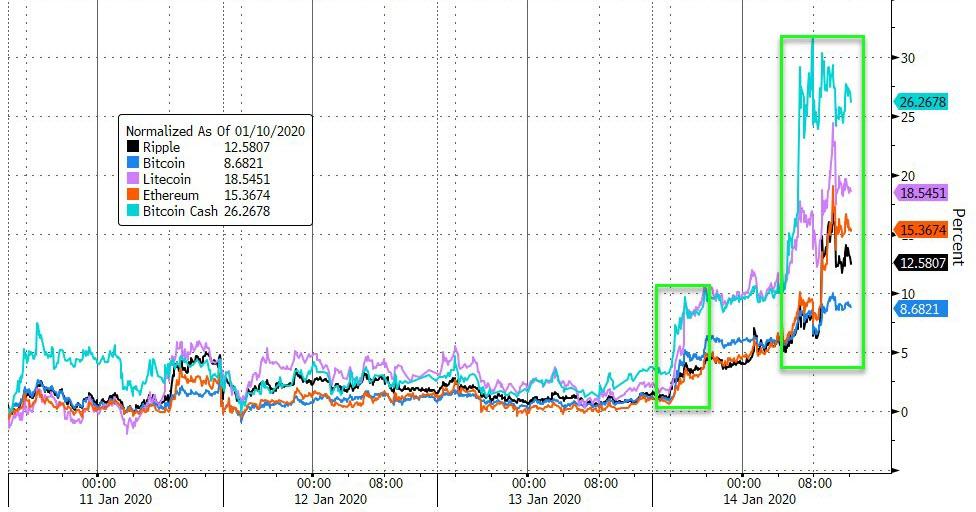

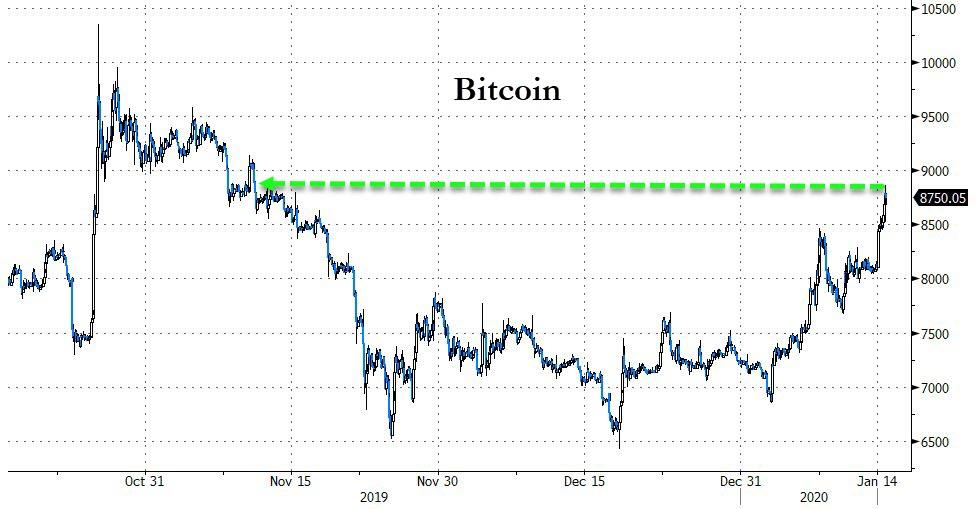

Cryptos surged today…

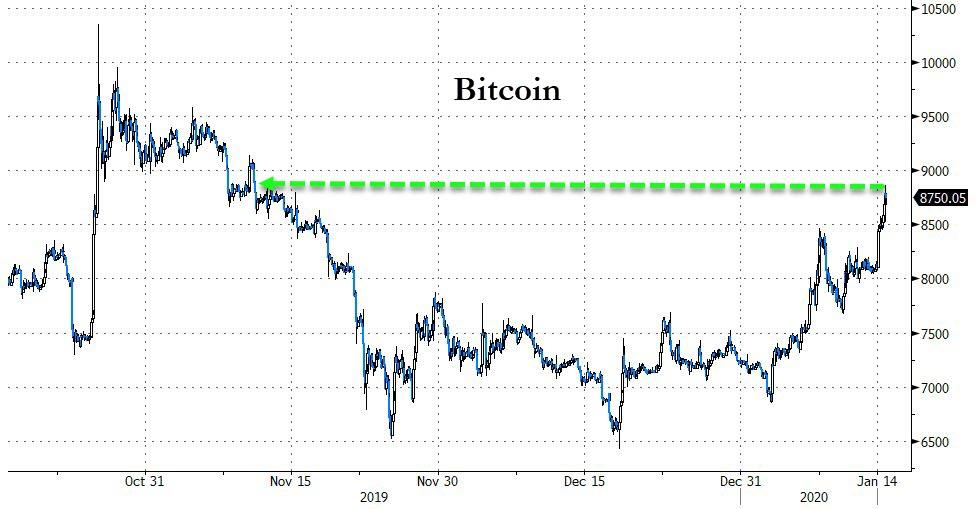

With Bitcoin jumping back above $8800 – 2-mointh highs…

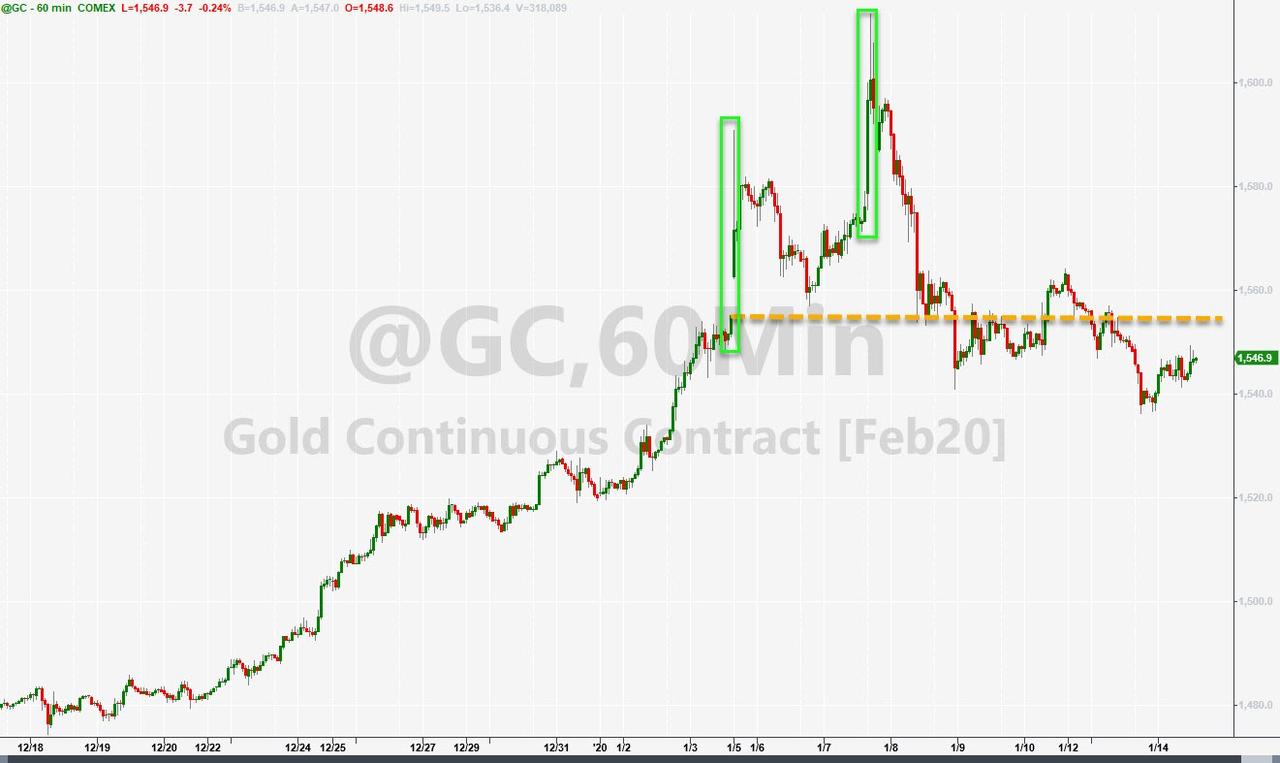

Copper extended yesterday’s gains as PMs mirrored that to the downside, oil managed a modest gain...

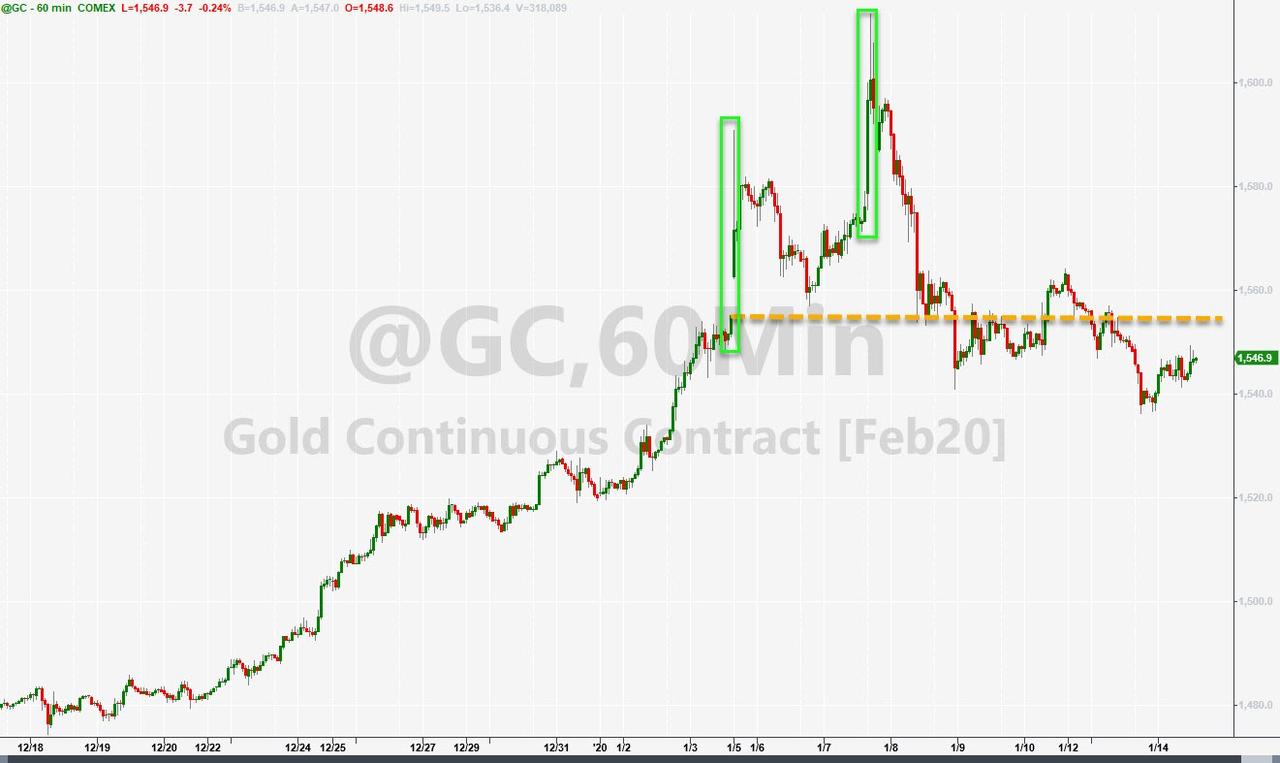

Gold is back below pre-Soleimani levels…

WTI managed a small gains, bouncing off $58-the figure…

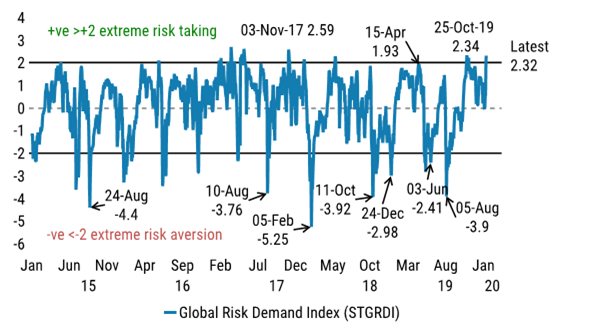

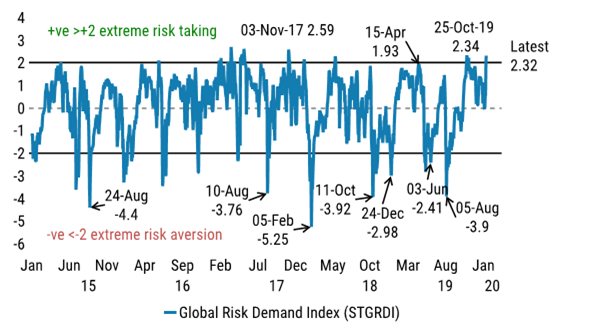

and finally, in case you wondered when this malarkey would end, Morgan Stanley’s Global Risk Demand index soared to +2.3 – above 2.00 has historically been a significant turning point for risk…

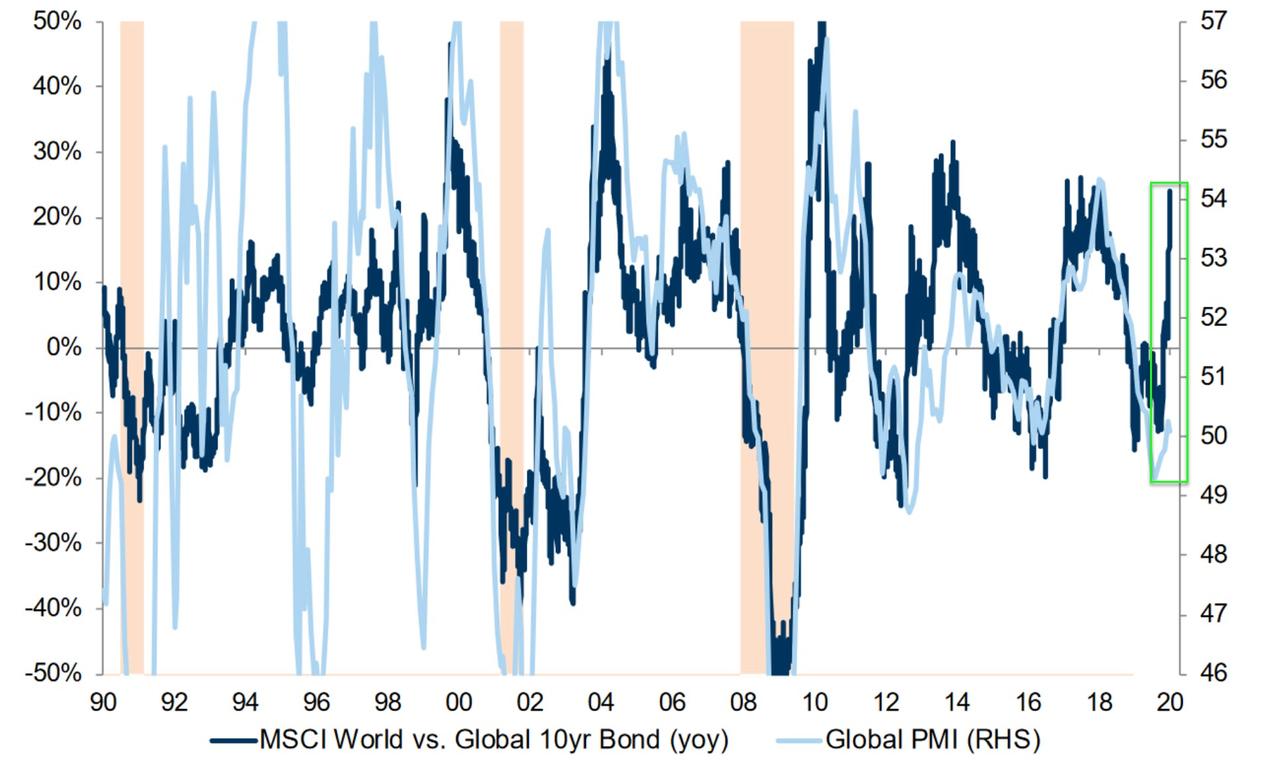

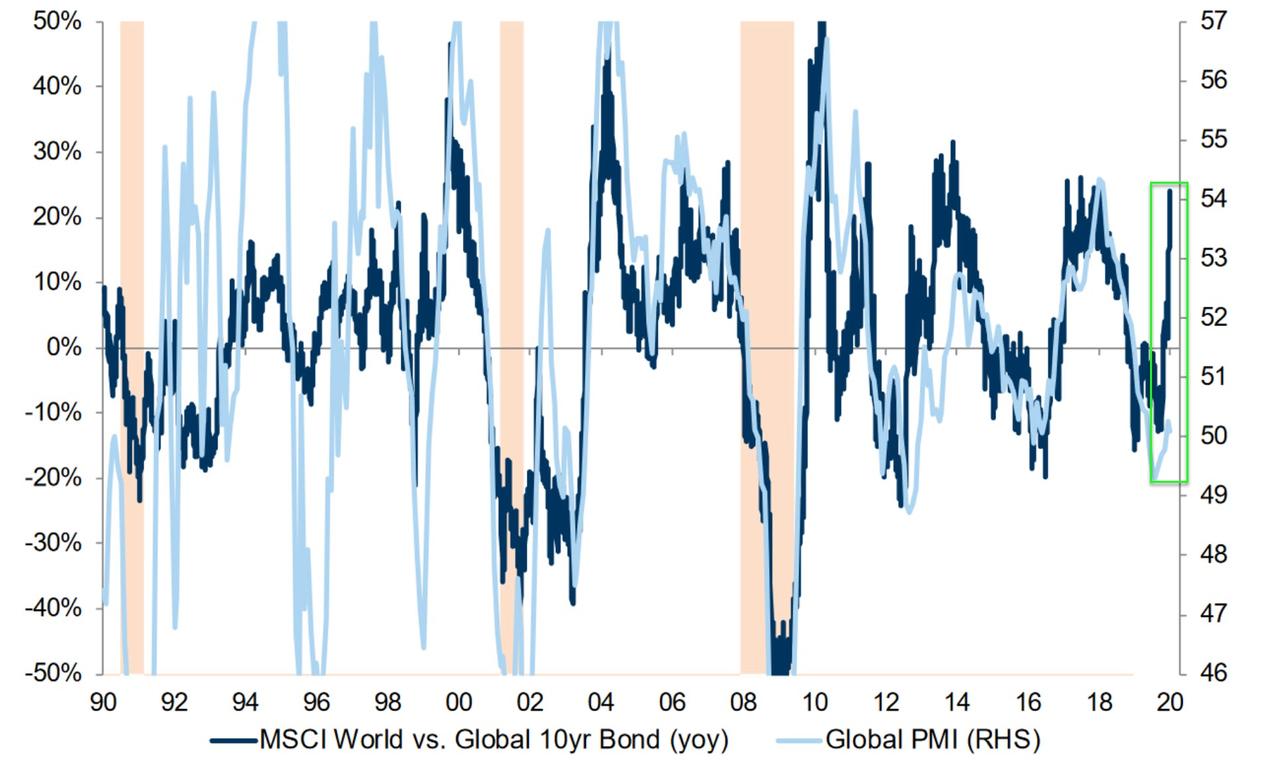

And don’t forget, stocks have priced-in a dramatic rebound in growth… that is failing to appear for now…

This won’t end well…

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

SURPRISE! The US/China Trade Deal Is Not Looking So Good... Mannarino

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Polyphony and Cacophony

Jesse

Polyphony and Cacophony

"When we talk about company culture in the context of financial services, the first thing that comes to mind is the risky, unethical, and sometimes criminal behavior in the banking industry, particularly during the financial crisis. And ten years on from the crisis, this behavior persists. [Persists? It remains their very business model] Instances of fraud, money laundering, and scandals related to foreign exchange and LIBOR continue to make the headlines.

This behavior puts a spotlight on the essential role of robust regulation and strict enforcement [which is the primary responsibility of the NY Fed]. But illicit and unethical behavior is rarely the result of an isolated 'bad apple.' [or a rogue trader] It’s more often the symptom of a rotten culture. And rotten cultures don’t appear overnight—nor for that matter do positive, inclusive ones, where people feel empowered and accountable to upholding the values of the organization.

Culture is created—intentionally or otherwise—by the structures, incentives, and behavioral norms that shape our working lives."

John C Williams, President, NY Fed, Getting to the Core of Culture, 14 January 2020, London

"Oh, yes, we shall be in chains and there will be no freedom, but then, in our great sorrow, we shall rise again to joy, without which man cannot live nor God exist, for God gives joy: it's His privilege — a grand one. Ah, man should be dissolved in prayer! What should I be underground there without God?

If they drive God from the earth, we shall shelter Him underground. One cannot exist in prison without God; it's even more impossible than out of prison. And then we men underground will sing from the bowels of the earth a glorious hymn to God, with Whom is joy. Hail to God and His joy! I love Him!"

Fyodor Dostoevsky, The Brothers Karamazov

“Each day we are becoming a creature of splendid glory, or one of unthinkable horror.”

C. S. Lewis

Stocks were mixed today and the major indices finished largely unchanged to slightly weaker.

Gold and silver were hit very hard in the quiet overnight trading by the usual suspects, but managed to take most of that back during regular hours and also finished largely unchanged along with the Dollar.

I think that we all see what has been going on. And some are slowly coming to their senses.

But lawlessness thrives, and there are few consequences. And so the love of most has grown cold.

And if they drive God from the face of the earth, we will shelter Him in our hearts.

"Such is the rule of our warfare We advance by yielding; we rise by falling; we conquer by suffering; we persuade by silence; we become rich by bountifulness ; we inherit the earth through meekness; we gain comfort through mourning; we earn glory by penitence and prayer. Heaven and earth shall sooner fall than this rule be reversed; it is the law of Christ's kingdom, and nothing can reverse it but sin."

John Henry Newman

This is the music that rises up from the clamor. This is the true and lasting resistance, hidden with God, and sustained by His love..

Have a pleasant evening.

https://jessescrossroadscafe.blogspot.com/

Jesse

Thank You for Being With Us Tonight

<3

Captains Quarters is Now Live Streaming 24/7

Still experimenting with the Live streams

Please bare with us as our Live Streams debut and develop Thanks:)

Catch "TFNN LIVE" during the day 9am to 5pm, Our "Bitcoin Stream" 24/7 and Early bird "Forex Trading Live" 24/7 in middle of the night

and Feel Free to join us evenings on """Captains Night Live""" and Share your MUSIC NEWS STOCK PICKS

Nice to see you and Thanks for being with us tonight

On the show tonight

*Day In A Chart

**Greg Mannarino

***Jesse's Cafe

EnJoy

OK Let's go >>>>>>>>>

Live from aboard the mighty Captains Quarters

Welcome Aboard

****CAPTAINS NIGHT LIVE****

Day In A Chart

Tonight's "Day In A Chart" is Brought to You by:

" Reverie "

Please Support our Anxiety Relief Sponsors

Thank You

and Now our feature Chart Presentation >>>>>>>>

Stocks Slip From Record Highs As Risk Demand Reaches “Historic Turning Point”

The market’s relationship with The Fed explained…

The US market’s price-to-sales ratio has reached a new record high (but it’s different this time)…

And its PEG ratio has also never been higher…

“perpetually easy” US financial conditions make this an “everything rally” environment for investors, where risk assets / spread product should be supported by “firm” USTs over the course of 2020 (as I do not see scope for a large US Rates selloff as some are expecting, nor a massive rally for that matter)

“Goldilocks” US economic backdrop with benign inflation

Fed reaction function clearly skewed asymmetrically (super-low bar to ease, almost impossible bar to hike)

My belief that the current “QE-Lite” (in that the Fed are NOT buyers of “Duration,” just short-term Bills) will transition to standard “QE” over time, moving toward towards USTs / outright “Duration” purchases in an effort to provide “ample” reserves in the banking system and offset money market stress points

Long-term view from investors that the “Three D’s” will continue to create secular disinflation which makes will keep policy “easy” and rates “low”—the overall 1) trajectory of Debt growth, 2) fading Demographic impulse and 3) tech Disruption.

And positioning in options is extreme to say the least…

And the market keeps rising on the back of the biggest 2-day short-squeeze in 2 months…

For a few brief minutes today, the machines hiccup’d on China tariff headlines… but that didn’t last… until NYFed reduced the size of its repo plans and that dipped stocks again (briefly)… S&P and Nasdaq dared to close red!

The Dow topped 29k once again, but couldn't hold it

Bank stocks were mixed after earnings with C and JPM rallying as WFC tumbled

The recent gains in the broad market have been driven by a resurgence in a defensive bid…

TSLA continued its parabolic ride, almost tagging $100bn market cap…

And while BYND continued its epic squeeze, after it was halted, it did start to fade fast…

But AAPL dared to close red…

Credit markets are (for once) leading the shift in protection costs higher (even if VIX was also higher today)…

Despite the gains in stocks, bonds were also bid with Treasury yields down 2-3bps (short-end underperformed)… Today’s rally erases yesterday’s losses…

30Y Yields fell back below pre-Soleimani levels…

And the yield curve flattened to almost one-month lows…

The Dollar trod water for a 4th day…

Yuan ended modestly lower after the trade headlines…

Cryptos surged today…

With Bitcoin jumping back above $8800 – 2-mointh highs…

Copper extended yesterday’s gains as PMs mirrored that to the downside, oil managed a modest gain...

Gold is back below pre-Soleimani levels…

WTI managed a small gains, bouncing off $58-the figure…

and finally, in case you wondered when this malarkey would end, Morgan Stanley’s Global Risk Demand index soared to +2.3 – above 2.00 has historically been a significant turning point for risk…

And don’t forget, stocks have priced-in a dramatic rebound in growth… that is failing to appear for now…

This won’t end well…

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

SURPRISE! The US/China Trade Deal Is Not Looking So Good... Mannarino

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Polyphony and Cacophony

Jesse

Polyphony and Cacophony

"When we talk about company culture in the context of financial services, the first thing that comes to mind is the risky, unethical, and sometimes criminal behavior in the banking industry, particularly during the financial crisis. And ten years on from the crisis, this behavior persists. [Persists? It remains their very business model] Instances of fraud, money laundering, and scandals related to foreign exchange and LIBOR continue to make the headlines.

This behavior puts a spotlight on the essential role of robust regulation and strict enforcement [which is the primary responsibility of the NY Fed]. But illicit and unethical behavior is rarely the result of an isolated 'bad apple.' [or a rogue trader] It’s more often the symptom of a rotten culture. And rotten cultures don’t appear overnight—nor for that matter do positive, inclusive ones, where people feel empowered and accountable to upholding the values of the organization.

Culture is created—intentionally or otherwise—by the structures, incentives, and behavioral norms that shape our working lives."

John C Williams, President, NY Fed, Getting to the Core of Culture, 14 January 2020, London

"Oh, yes, we shall be in chains and there will be no freedom, but then, in our great sorrow, we shall rise again to joy, without which man cannot live nor God exist, for God gives joy: it's His privilege — a grand one. Ah, man should be dissolved in prayer! What should I be underground there without God?

If they drive God from the earth, we shall shelter Him underground. One cannot exist in prison without God; it's even more impossible than out of prison. And then we men underground will sing from the bowels of the earth a glorious hymn to God, with Whom is joy. Hail to God and His joy! I love Him!"

Fyodor Dostoevsky, The Brothers Karamazov

“Each day we are becoming a creature of splendid glory, or one of unthinkable horror.”

C. S. Lewis

Stocks were mixed today and the major indices finished largely unchanged to slightly weaker.

Gold and silver were hit very hard in the quiet overnight trading by the usual suspects, but managed to take most of that back during regular hours and also finished largely unchanged along with the Dollar.

I think that we all see what has been going on. And some are slowly coming to their senses.

But lawlessness thrives, and there are few consequences. And so the love of most has grown cold.

And if they drive God from the face of the earth, we will shelter Him in our hearts.

"Such is the rule of our warfare We advance by yielding; we rise by falling; we conquer by suffering; we persuade by silence; we become rich by bountifulness ; we inherit the earth through meekness; we gain comfort through mourning; we earn glory by penitence and prayer. Heaven and earth shall sooner fall than this rule be reversed; it is the law of Christ's kingdom, and nothing can reverse it but sin."

John Henry Newman

This is the music that rises up from the clamor. This is the true and lasting resistance, hidden with God, and sustained by His love..

Have a pleasant evening.

https://jessescrossroadscafe.blogspot.com/

Jesse

Thank You for Being With Us Tonight

<3

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.