Thursday, October 24, 2019 1:57:51 AM

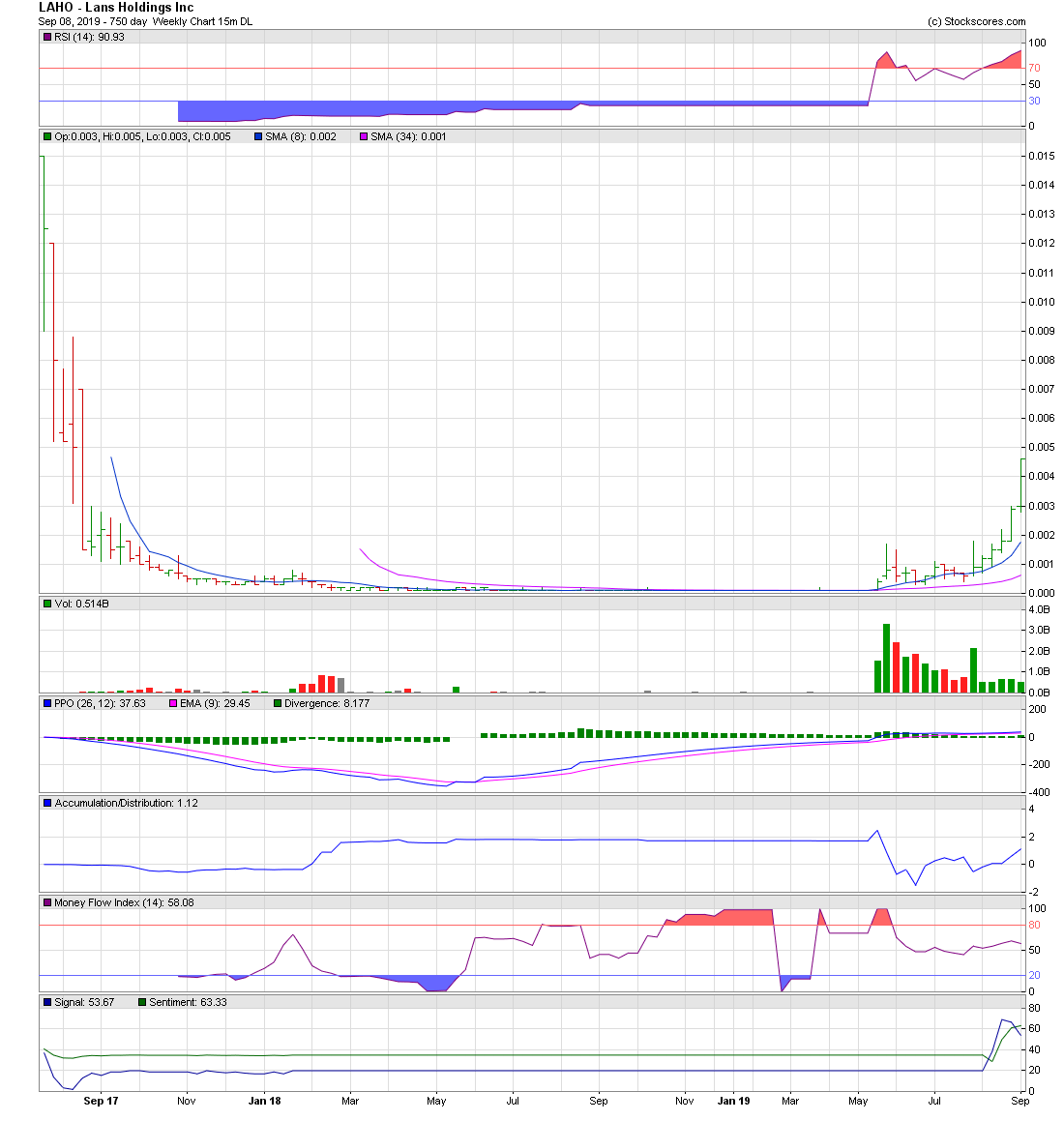

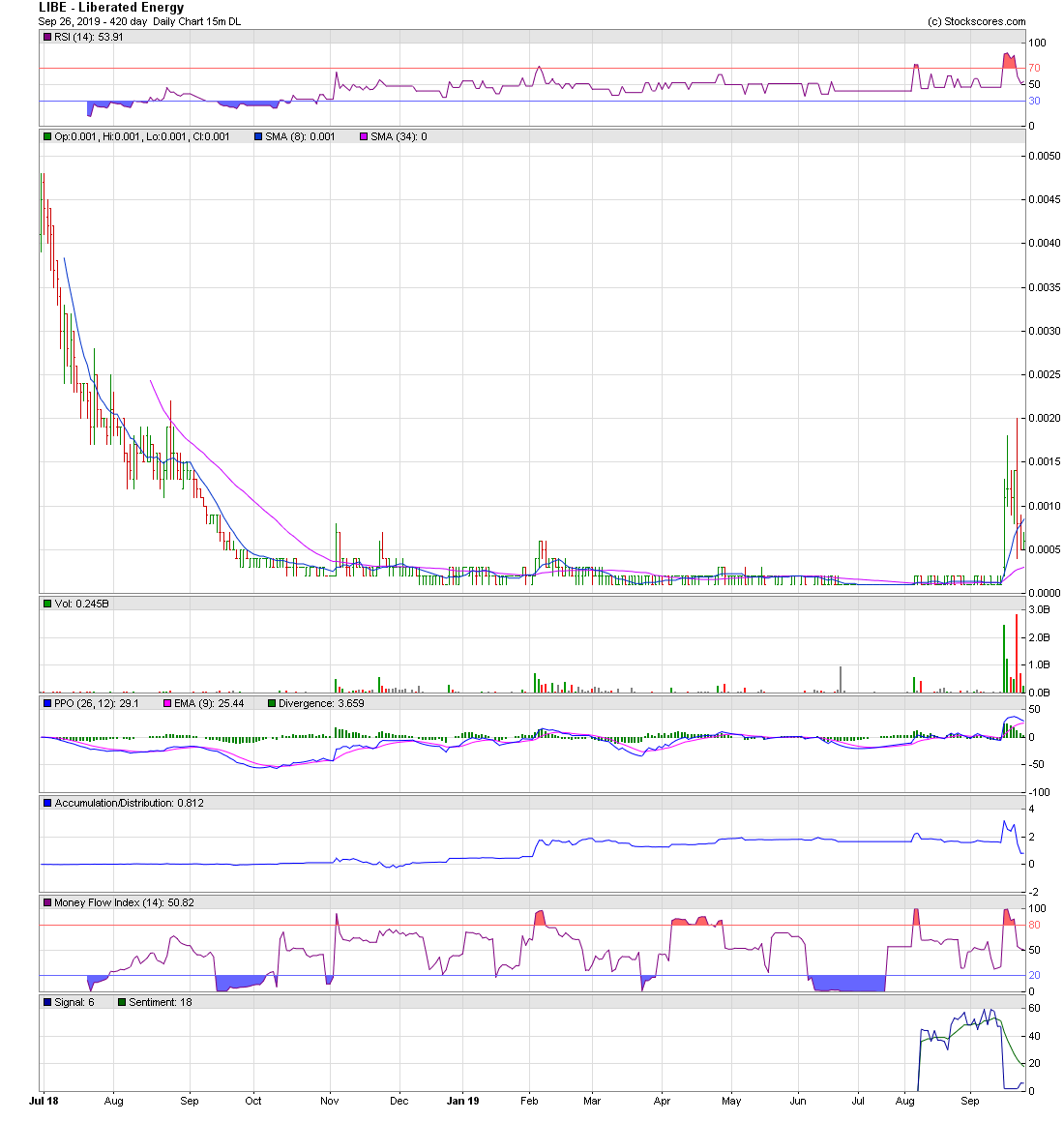

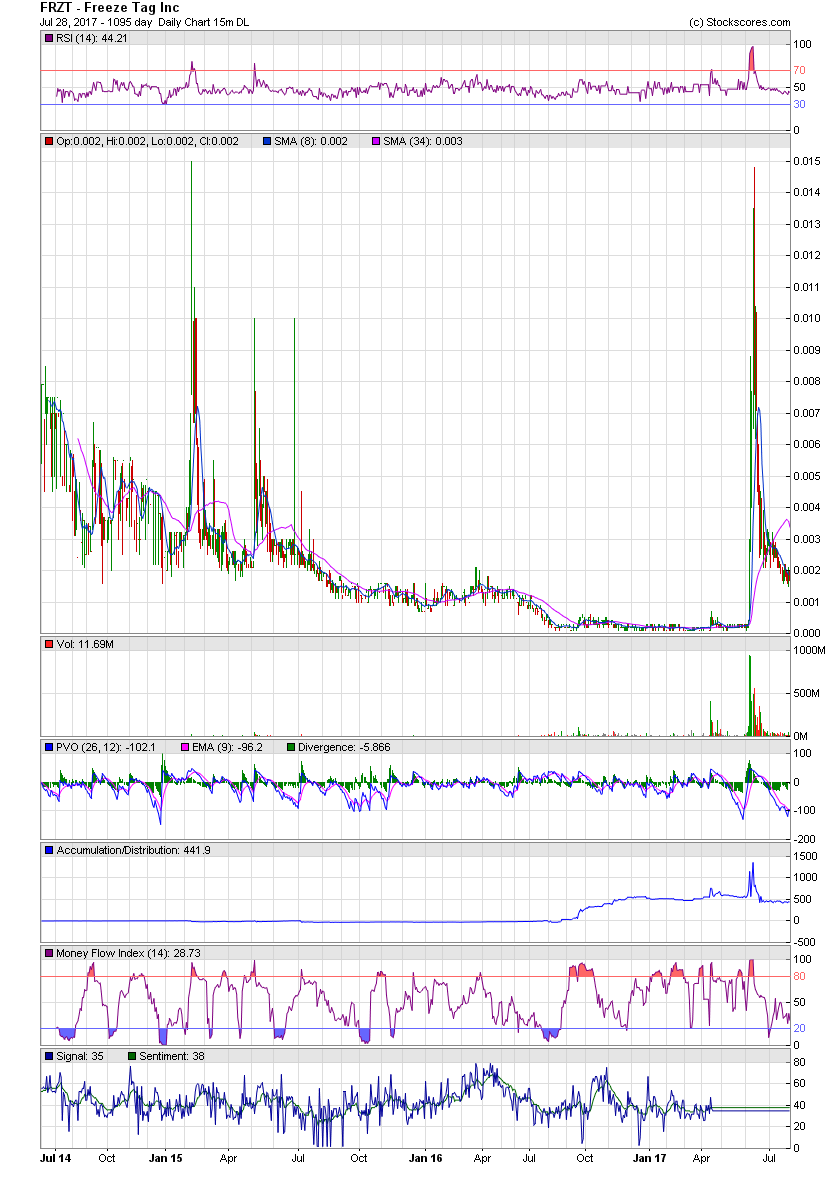

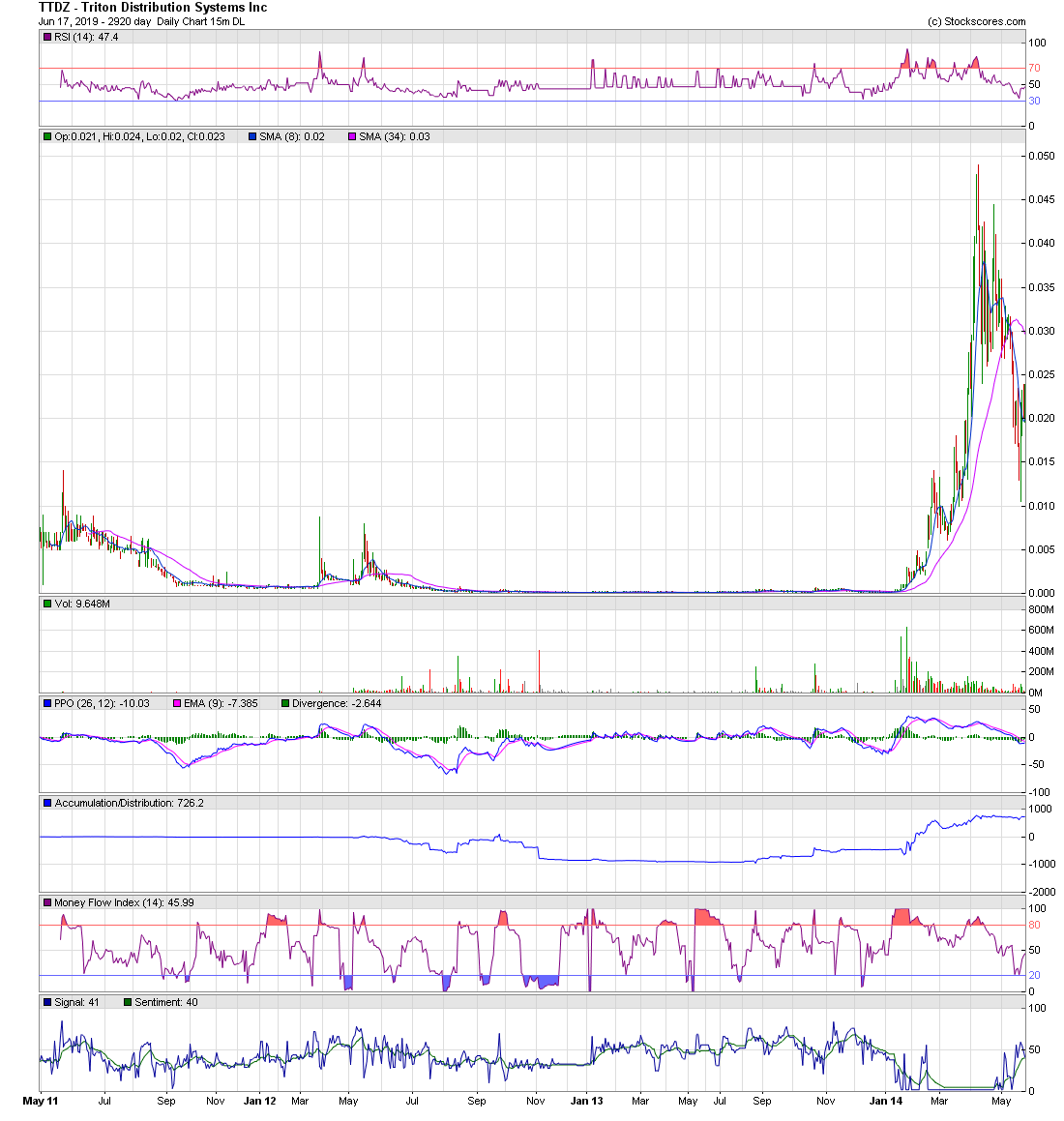

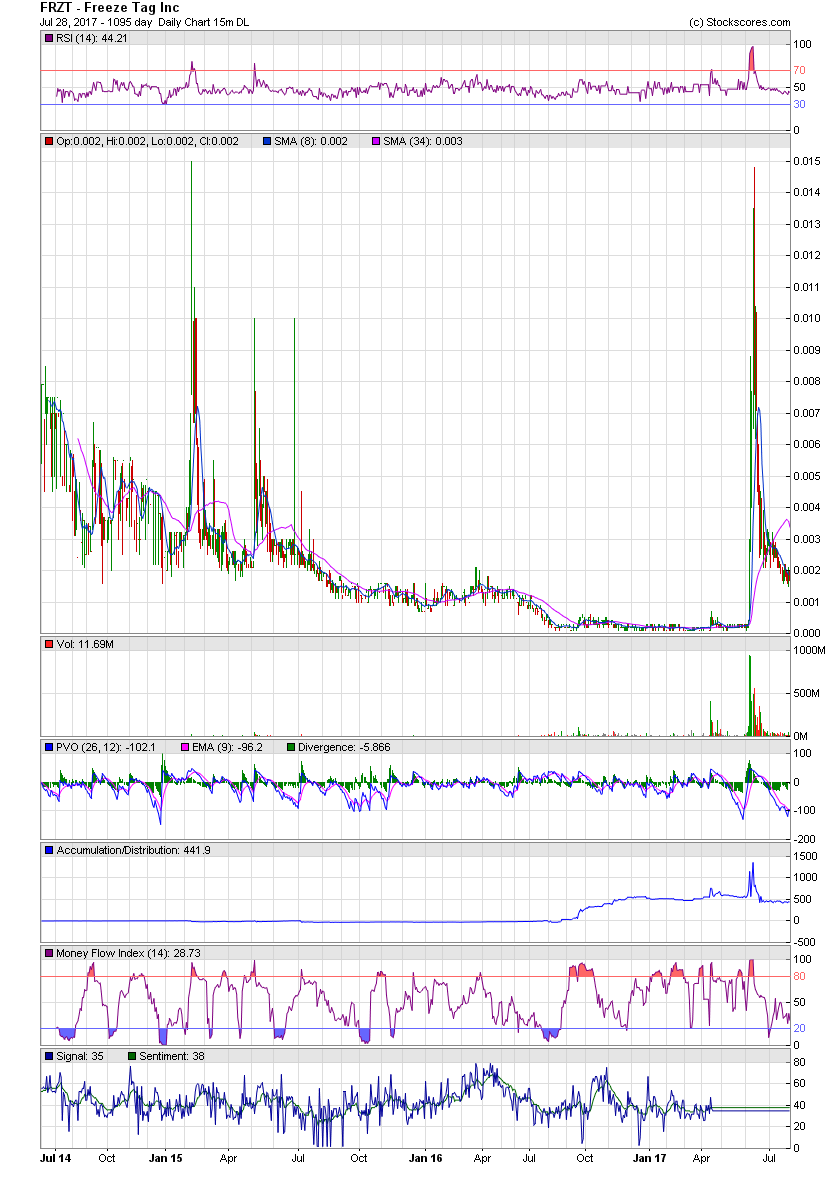

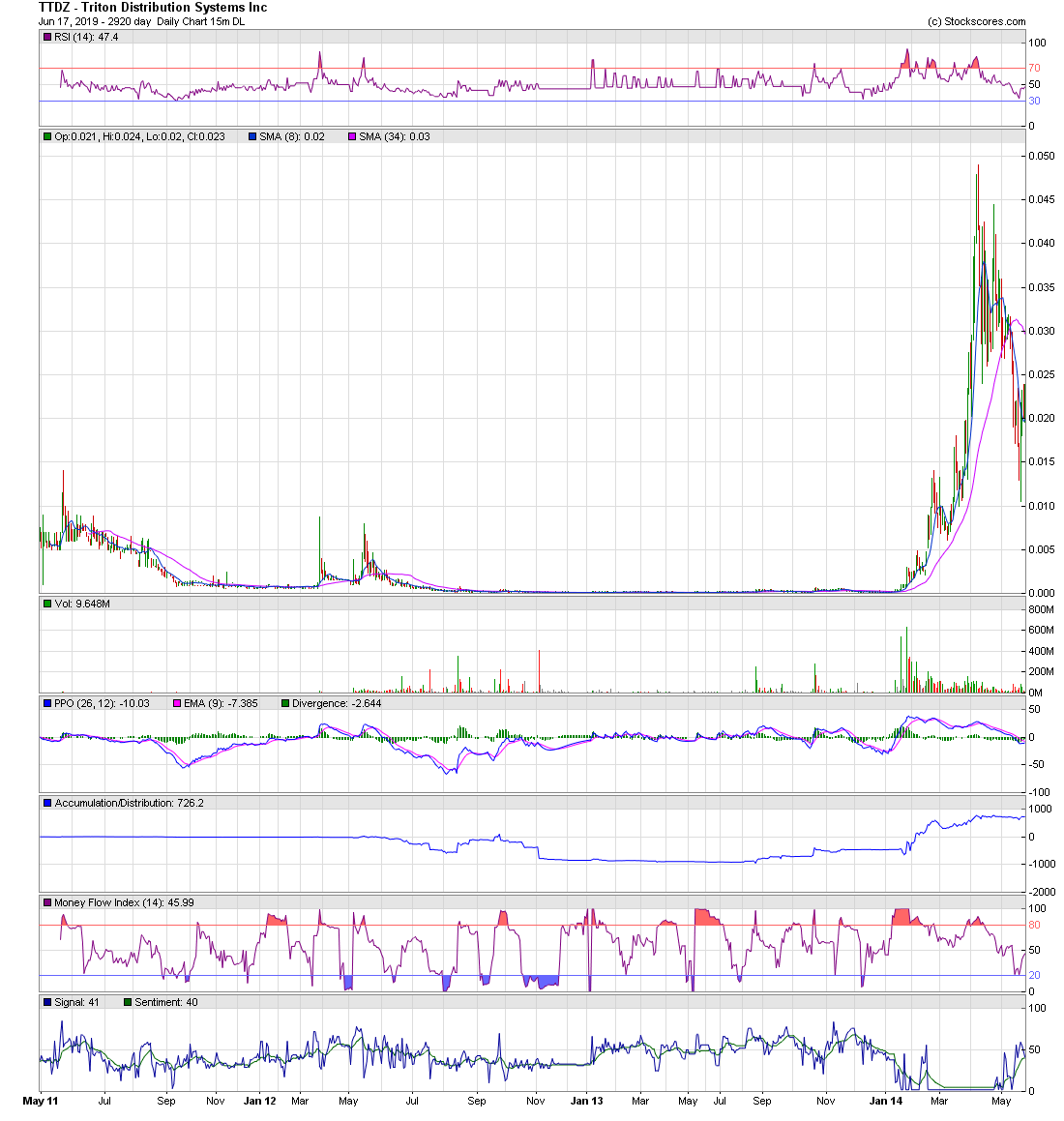

Showing Elliott Wave 5-Wave Decline Examples

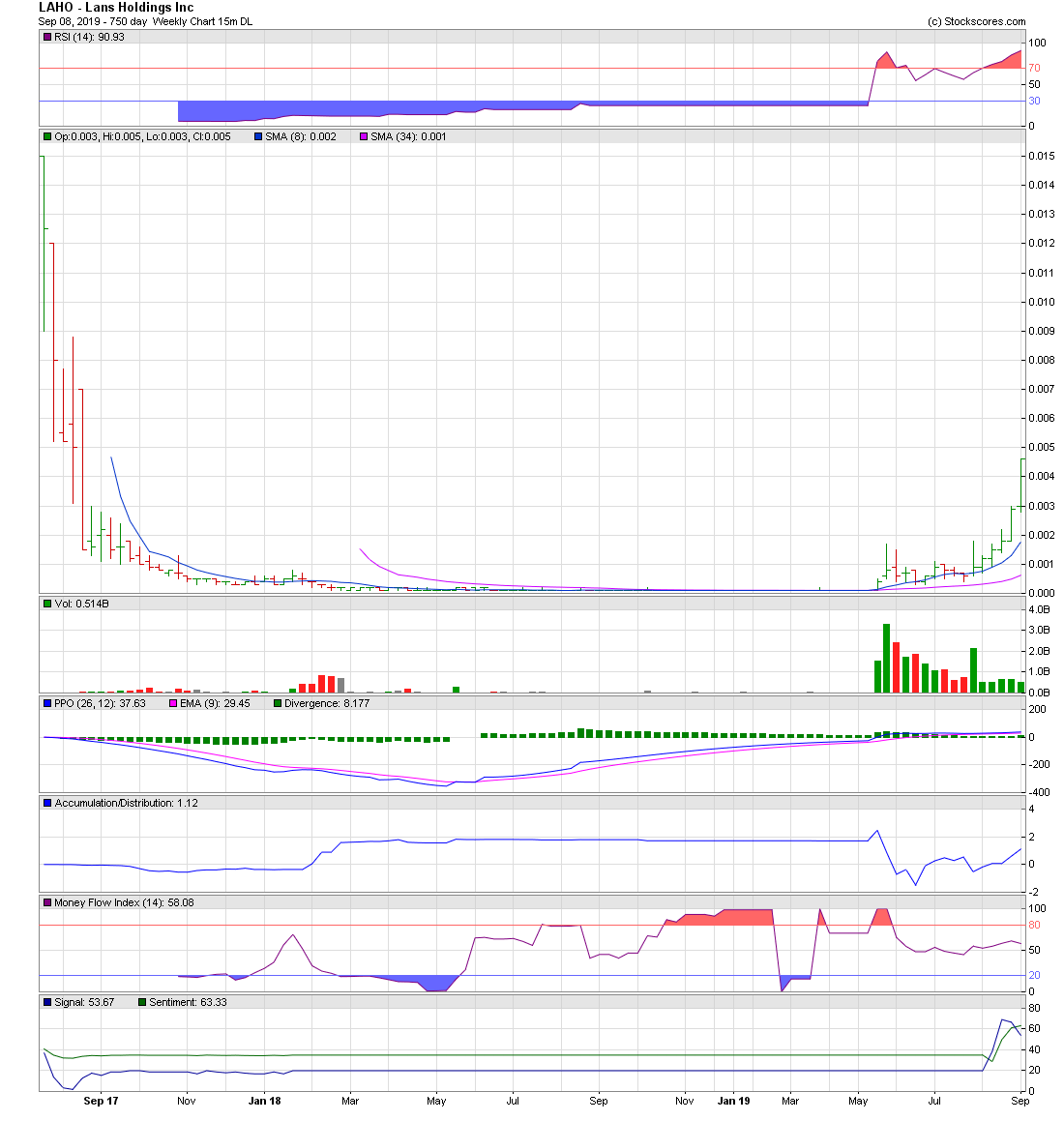

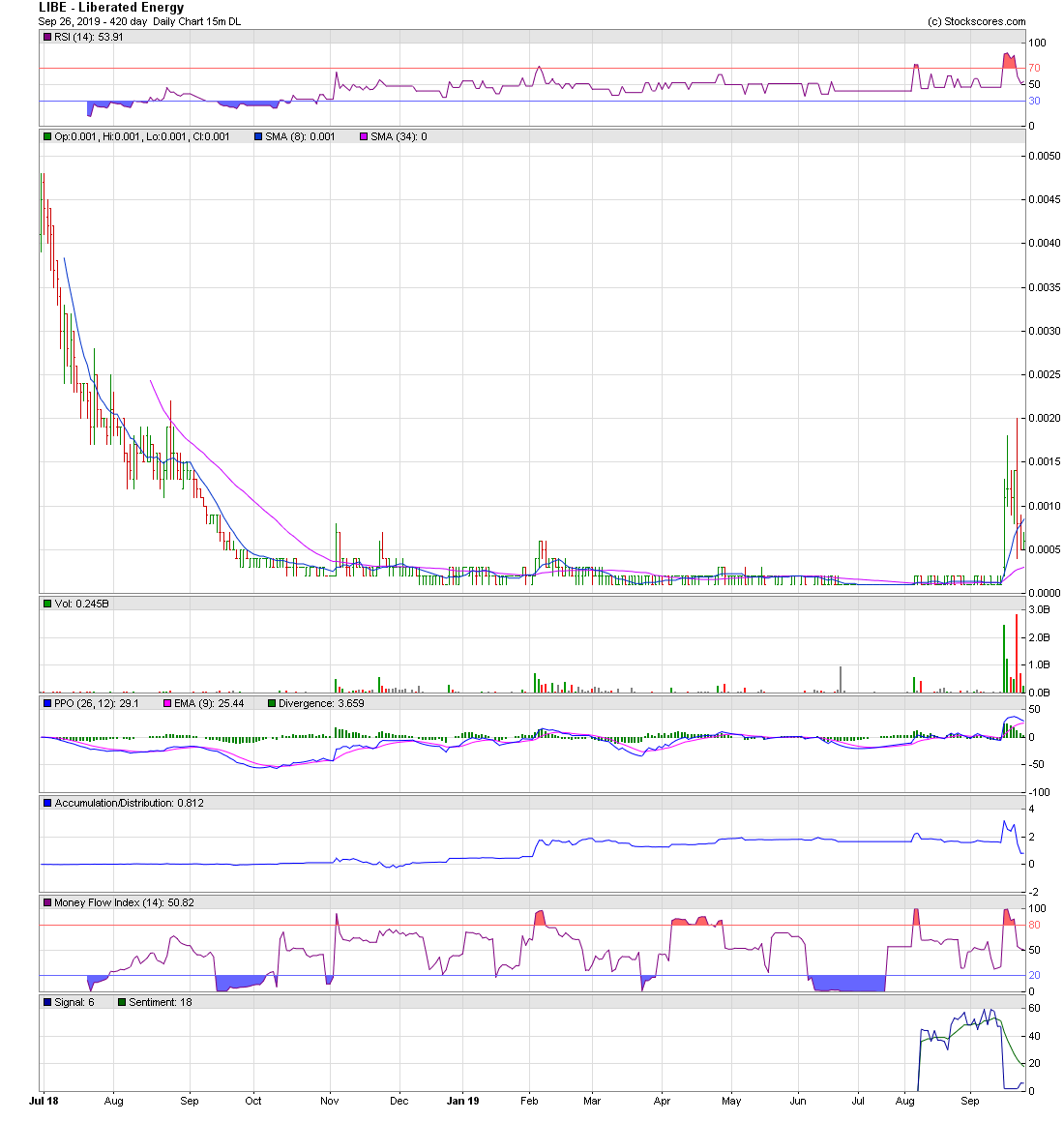

Buy after an Elliott Wave 5-Wave Decline

________________________________________________________________

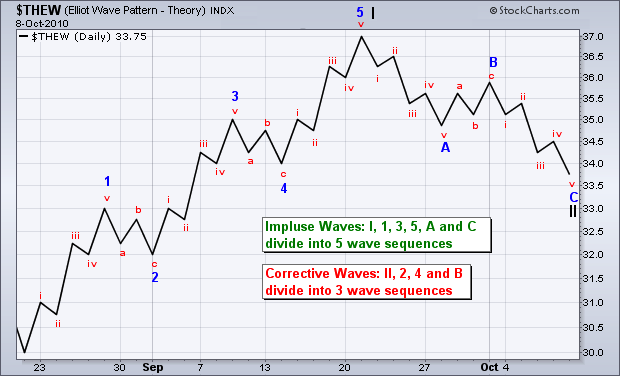

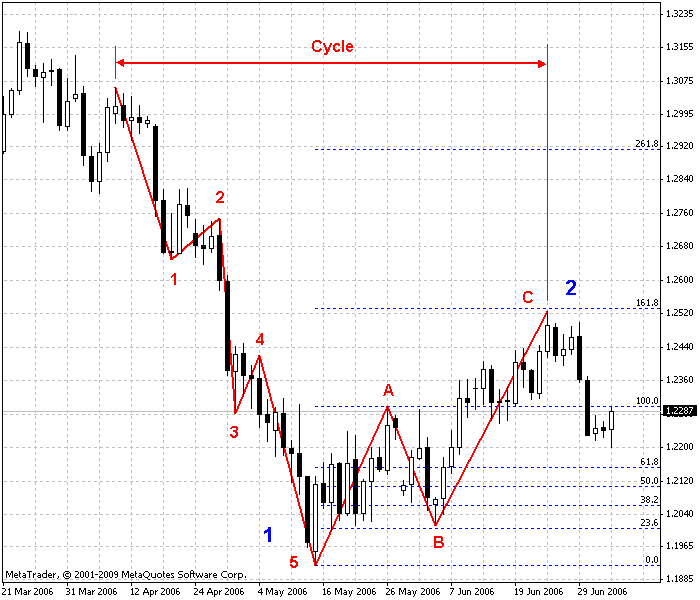

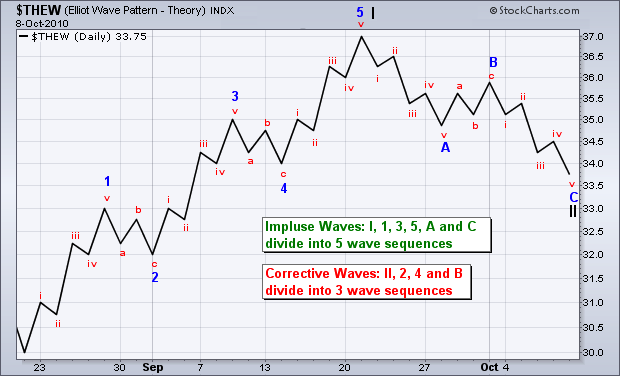

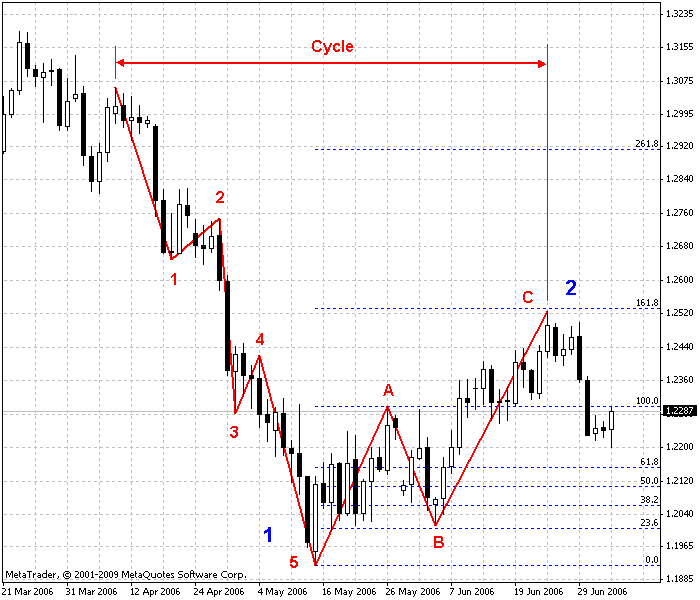

The Elliott Wave 5-Waves Sequence

A Basic "A,B,C Corrective Wave"

https://www.metatrader5.com/en/terminal/help/objects/elliott/elliott_theory

________________________________________________________________

Elliott Wave Basics

http://www.acrotec.com/ewt.htm

Elliott Wave Theory

http://ta.mql4.com/elliott_wave_theory

Buy after an Elliott Wave,

5-Wave decline sequence !

A Basic "A,B,C Corrective Wave"

Buy, ONLY when the stocks price,

is trading under the Blue 8-day M.A.

when the Blue 8-day M.A. is under the Red 34-day M.A.

_________________________________________________________________

_________________________________________________________________

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

_______________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

_______________________________________________________________

_______________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

_________________________________________________________________

________________________________________________________________

Impulse Wave 1 - The Accumulation Stage

the Wave right after a prolonged downtrend.

Wave 1

The stock makes its initial move upwards.

This is usually caused

by a relatively small number of people

that all of the sudden

(for a variety of reasons, real or imagined)

feel that the price of the stock is cheap

so it’s a perfect time to buy.

This causes the price to rise.

Wave 2 - Stock Declines

At this point,

enough people who were in the original wave

consider the stock overvalued and take profits.

This causes the stock to go down.

However, the stock will not make it to its previous lows

before the stock is considered a bargain again

Wave 3

This is usually the longest and strongest wave.

The stock has caught the attention of the mass public.

More people find out about the stock and want to buy it.

This causes the stock’s price to go higher and higher.

This wave usually exceeds the high created at the end of Wave 1.

Wave 4

Traders take profits

because the stock is considered expensive again.

This Wave tends to be weak

because there are usually more people

that are still bullish on the stock

and are waiting to “buy on the dips.”

Wave 5

This is the point that most people get in on the stock,

and is mostly driven by hysteria.

You usually start seeing the CEO of the company

on the front page of major magazines

as the Person of the Year.

Traders and investors start coming up with

ridiculous reasons to buy the stock

and try to choke you when you disagree with them.

This is when the stock becomes the most overpriced.

Contrarians start shorting the stock

which starts the ABC pattern.

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

________________________________________________________________

The Elliott Wave 5-Waves Sequence

A Basic "A,B,C Corrective Wave"

https://www.metatrader5.com/en/terminal/help/objects/elliott/elliott_theory

________________________________________________________________

Elliott Wave Basics

http://www.acrotec.com/ewt.htm

Elliott Wave Theory

http://ta.mql4.com/elliott_wave_theory

Buy after an Elliott Wave,

5-Wave decline sequence !

A Basic "A,B,C Corrective Wave"

Buy, ONLY when the stocks price,

is trading under the Blue 8-day M.A.

when the Blue 8-day M.A. is under the Red 34-day M.A.

_________________________________________________________________

_________________________________________________________________

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

_______________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

_______________________________________________________________

_______________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

_________________________________________________________________

________________________________________________________________

Impulse Wave 1 - The Accumulation Stage

the Wave right after a prolonged downtrend.

Wave 1

The stock makes its initial move upwards.

This is usually caused

by a relatively small number of people

that all of the sudden

(for a variety of reasons, real or imagined)

feel that the price of the stock is cheap

so it’s a perfect time to buy.

This causes the price to rise.

Wave 2 - Stock Declines

At this point,

enough people who were in the original wave

consider the stock overvalued and take profits.

This causes the stock to go down.

However, the stock will not make it to its previous lows

before the stock is considered a bargain again

Wave 3

This is usually the longest and strongest wave.

The stock has caught the attention of the mass public.

More people find out about the stock and want to buy it.

This causes the stock’s price to go higher and higher.

This wave usually exceeds the high created at the end of Wave 1.

Wave 4

Traders take profits

because the stock is considered expensive again.

This Wave tends to be weak

because there are usually more people

that are still bullish on the stock

and are waiting to “buy on the dips.”

Wave 5

This is the point that most people get in on the stock,

and is mostly driven by hysteria.

You usually start seeing the CEO of the company

on the front page of major magazines

as the Person of the Year.

Traders and investors start coming up with

ridiculous reasons to buy the stock

and try to choke you when you disagree with them.

This is when the stock becomes the most overpriced.

Contrarians start shorting the stock

which starts the ABC pattern.

________________________________________________________________

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.