| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Tuesday, September 17, 2019 11:03:48 AM

By: SentimenTrader | September 17, 2019

Shocking move

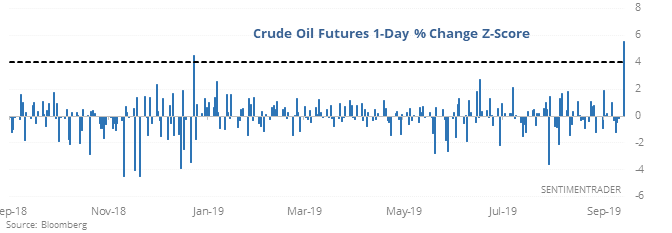

The jump in crude oil on Monday was one of the most shocking in 30 years.

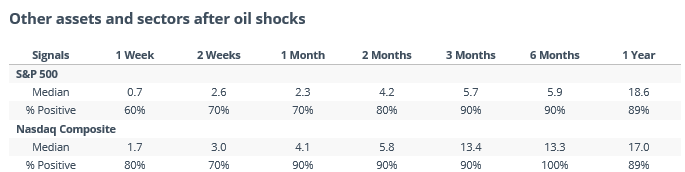

For energy stocks, a 4 standard deviation jump in oil prices tended to be a good sign going forward, with only a single loss over the next 2-3 months. Contrary to what many may believe, it was also a good sign for indexes like the Nasdaq Composite, which was positive every time 6 months later.

It came at a good time

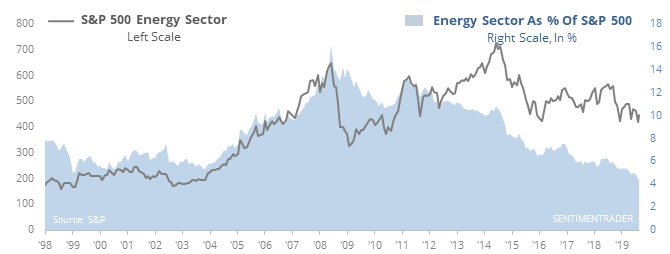

As noted last week, energy stocks were the most undervalued major sector, with a dividend yield at a record high relative to Treasuries. It also came when these stocks made up a record low percentage of the S&P 500 index.

New trend?

It faded during the day, so the S&P’s energy component didn’t quite pop enough above its 200-day average, which would end one of the longest downtrends since 1926. Other times long streaks ended, it was a decent long-term sign.

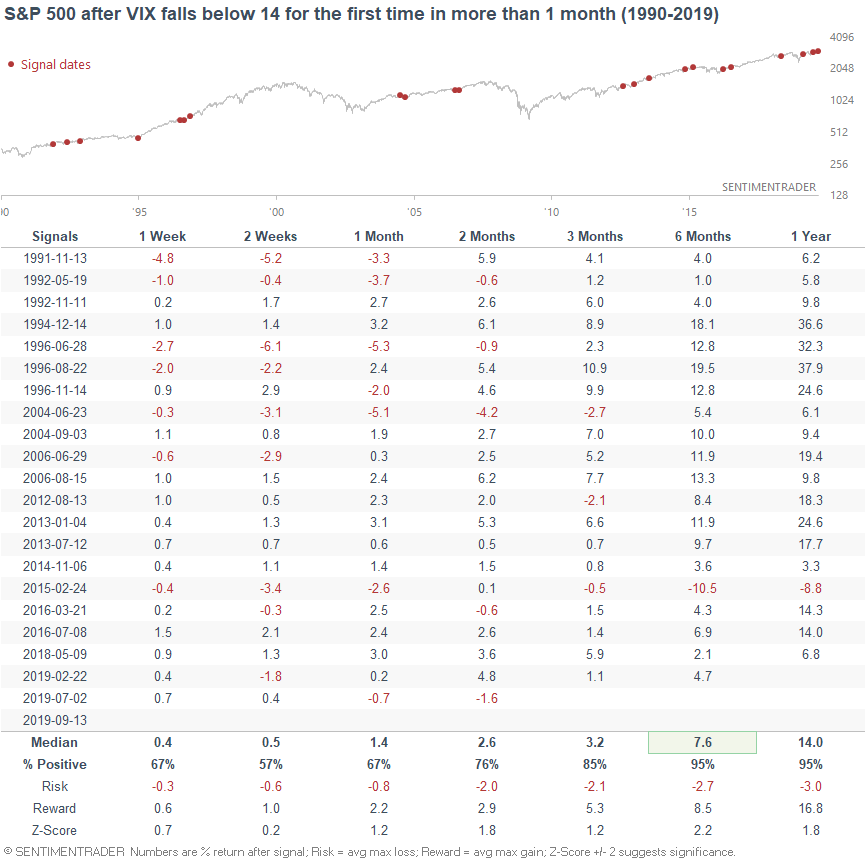

Volatility drip

Even though it rose a little bit on Monday, on Friday the VIX dropped below 14 for the first time in more than a month. As Troy noted, of the more than 20 times this has happened since 1990, all but one led to a higher return in the S&P 500 6-12 months later. The VIX itself tended to rise in the weeks ahead, but that wasn’t necessarily a consistent negative for stocks.

Broadening rally

The percentage of stocks on the NYSE above their 200-day averages hit a 1-year high. That has led to a positive return over the next 2 months all but once (a loss of -0.2%).

Read Full Story »»»

• DiscoverGold

• DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM