Saturday, July 27, 2019 9:41:41 AM

*** NEW in this update: 1) Updated the share structure to reflect the CEO's increased stake - he now owns nearly 30% of all COMMON shares of BMIX. 2) Re-calculated the estimated float to arrive a laughably small number of 284,155,054 for a penny stock trading in double zeroes. 3) Added the news release about the company's newest Lithium project.

TABLE OF CONTENTS

1) The Company

2) The Projects

3) The People

4) Frequently Asked Questions

1) The Company

Brazil Minerals, Inc. with its subsidiaries has two components to its business model: (1) growing a portfolio of mineral rights in a wide spectrum of strategic and sought-after minerals, from which equity holdings and/or royalty interests will develop, and (2) mining certain specific areas for gold, diamonds, and sand.

The company's progress as an exploration project generator has been steady. In early 2013 Brazil Minerals owned mineral rights for gold and diamonds. Since then the company has grown several-fold its bank of high-quality mineral properties to currently include mineral rights for gold, diamonds, cobalt, copper, lithium, manganese, nickel, precious gems (aquamarine, beryl, tourmaline) and sand.

BMIX's first equity holdings from their exploration project generation strategy is Jupiter Gold Corporation. Jupiter Gold has been a public company since December 16, 2016.

Share Structure:

O/S: 914,784,917 as of 7/26/19

https://www.otcmarkets.com/filing/html?id=13554592&guid=FYGIUFYs560sH3h

Shares held by the CEO Marc Fogassa (He is actively converting his deferred salary into COMMON shares of BMIX): 365,201,226 as of 7/26/19

Shares held by other company affiliates: 265,428,637 as of 7/26/19

Estimated float (Total outstanding count minus all affiliate shares accounted for in the official filings): 914,784,917 - 365,201,226 - 265,428,637 = 284,155,054

A/S: 1.2B as of 7/26/2019

Brazil Minerals Website: http://www.brazil-minerals.com/

Jupiter Gold Website: http://www.jupitergoldcorp.com/ (BMIX owns 47% of Jupiter Gold)

YouTube Channel: https://www.youtube.com/channel/UChcTI9t1v-E-9MJ7mMtH_tA

Facebook: https://www.facebook.com/brazilmineralsbmix

LinkedIn: https://www.linkedin.com/company/brazil-minerals-inc-

2) The Projects

I. PINDAÍBA PROJECT - FINAL MINING APPROVAL ANNOUNCED ON 06/04/2019! AURIFEROUS & DIAMONDIFEROUS GRAVEL PROCESSING TO BEGIN AFTER 6-8 WEEKS OF INITIAL EXCAVATION!

Minerals: Gold (50% of revenues belong to Brazil Minerals and 50% to Jupiter Gold) & Diamonds (100% of revenues belong to Brazil Minerals)

Location: Olhos-d'Água, state of Minas Gerais

Area: 1,310 acres

Highlights:

• Extensive drilling campaign conducted by Brazil Minerals and concluded in Q3 2018.

• 35/35 of drill holes were visually positive for gold.

• 57% of drill holes had high-probability diamond recovery; a “diamond-rich” zone was identified in the area.

• Results support open-sky mining.

• The target area studied in this drilling campaign is an alluvial plain along the Jequitinhonha River Valley, an area known for placer mining for gold and gem-quality diamonds for over two hundred years.

• Pindaíba is a storied mineral rights area which at one point had thousands of settlers along its river margin prospecting for diamond. Old settler activity is usually a strong indication of robust mineralization.

• Old settler activity does not diminish the recoverable gold and diamonds from Brazil Minerals’ Project, as settlers prospected at the river margin with rudimentary tools and, by law, regulated mining must be done at least 100 meters from the margins of this river.

• A royalty agreement with Jupiter Gold by which Brazil Minerals will use Jupiter Gold’s recovery plant for processing entails that Brazil Minerals will keep 50% of the revenues from gold and 100% of the revenue from diamond with respect to the Pindaíba Project.

In September 2018, Brazil Minerals announced the conclusion of an extensive drilling campaign of a portion of the mineral right of the Pindaíba Project. It was reported that Brazil Minerals drilled 35 holes spaced 30 to 50 meters utilizing a Banka 4-inch drill. All 35 holes were positive for fine gold as observed by our drilling team, and samples were collected for quantitative geochemical analysis. The average depth for the auriferous gravel layer was 8 meters and with a thickness between 1.5 to 9.3 meters.

Brazil Minerals also announced that this extensive drilling campaign yielded alluvial material with a high likelihood for diamonds in over 57% of the drill holes executed. Further analysis of the campaign’s results and inspection of collected samples indicated the existence of a diamond-rich zone within the drilled area. Satellite markers for diamonds, such as limonite, rutilite and tourmalinite, among others, were observed in all samples recovered within this diamond-rich zone.

II. JEQUITINHONHA PROJECT

Minerals: Gold, Diamonds, Sand (for construction)

Location: Olhos-d'Água and Diamantina, state of Minas Gerais

Area: 26,645 acres

Highlights:

• Brazil Minerals owns 9 mining concessions and 10 pre-mining concessions. A mining concession if the highest level of mineral right title in Brazil. It permits mining in perpetuity as long as environmental licensing is kept current and mining guidelines are followed.

• This collection of mineral rights covers more than 60 miles of mineral rights alongside the banks of the Jequitinhonha River, a well-known area for gold and diamonds for over 200 years.

• Gold and diamonds appear together in alluvial material; mining is open-sky, year-round.

Brazil Minerals, through subsidiaries, has 31 mineral rights for diamond, gold, and sand, on and near the margins of the Jequitinhonha River in the state of Minas Gerais in Brazil. The Jequitinhonha River valley is a well-known area for diamond and gold production; it has hosted alluvial production since the 18th century.

One of our mineral rights, covering 422 acres, is called “Duas Barras”, a mining concession for diamond, gold and sand. Our concession, awarded by the Brazilian federal government through the Brazilian mining department, is the highest level of mineral right in Brazil. It permits us to mine in perpetuity provided that environmental licenses are kept current and that mining guidelines are followed.

Mineralization

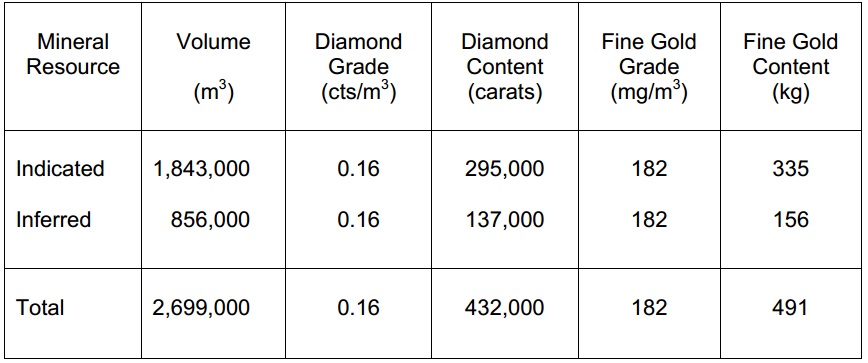

Vaaldiam, the previous owner of this mining concession, and at that time a publicly-traded Canadian company, performed detailed geological studies leading to the publication of an NI 43-101 technical report in 2007, with an update in 2008, as required by the rules of the Canadian securities administrator and filed in SEDAR. The NI 43-101 report describes the existence of mineralized materials amounting to 1,639,200 cubic meters with the following concentrations: 0.16 carats of diamonds per cubic meter and 182 milligrams of gold per cubic meter. Vaaldiam also submitted a bankable feasibility study to the Brazilian mining department in accordance with local regulations.

The link to the resultant NI 43-101 is below. Keep in mind that the official study was done for only 7% of the Duas Barras total concession area. There is still a 93% chunk of the property that has not been officially assayed.

https://xmbl.files.wordpress.com/2014/07/duas-barras-ni-43-101.pdf

What the heck is NI 43-101? Read below:

https://en.wikipedia.org/wiki/National_Instrument_43-101

Excerpt from the BMIX NI 43-101:

To fully appreciate the magnitude of the BMIX potential in just of their projects - Duas Barras - it is useful to look at the performance of the previous owner:

"Vaaldiam launched production at Duas Barras in September 2007 and produced 33,385 carats of diamonds valued at an average $165 per carat in the first 11 months of operation. Gross sales revenues from the mine to date, including 1,036 ounces of gold recovered for the period September 2007 through July 2008 reached $6.5 million."

http://www.diamonds.net/news/NewsItem.aspx?ArticleID=23120

Moreover, during February 2008 a 15.68 carat diamond was recovered at the Duas Barras mine which is the largest diamond recovered to date at this mine. This diamond was sold in the second quarter for US$78,400 or US$5,000 per carat.

http://globaldocuments.morningstar.com/documentlibrary/document/29cf493380fe9217.msdoc/original

Recovery Plants

We have two working recovery plants for diamonds and gold. Our subsidiary, Jupiter Gold owns a modular recovery plant which utilizes a large centrifuge for recovery, currently deployed in this concession area. During 2017, this plant was completed, tested and made operational. The plant uses centrifugation as the primary method of gold separation. Material identified as potentially containing diamonds is retrieved and further processed in specific high-precision equipment for detection of diamonds, located in our large plant, as described below.

See the modular gold & diamond recovery plant in action here:

Our other plant at this concession is regarded as the largest such type in Latin America and capable of processing upwards of 45 tons of gravel per hour of operation. It was acquired when we took over the concession. From the best information we have, this plant cost $2.5 million and was built by South African mining engineers. We utilize the state-of-the-art diamond recovery facilities from this large plant, following separation of concentrated diamondiferous-yielding material obtained after initial processing in our modular plant. We also utilize the gold laboratory unit of the large plant for final processing of gold obtained from our modular plant.

See the $2.5 million gold and diamond recovery plant in action here:

III. MONTES CLAROS DE GOIÁS PROJECT

Minerals: Nickel, Cobalt, Copper

Location: Montes Claros de Goiás, state of Goiás

Area: 5,011 acres (2 mineral rights)

Highlights:

• Our area has a high probability to be in a continuation of the same geological trend of nearby nickel, cobalt, copper areas.

Our Montes Claros de Goiás Project consists of two mineral rights for cobalt, copper, and nickel in the region in and surrounding Montes Claros de Goiás, where other companies have explored for these minerals, and some of the largest Brazilian reserves of nickel are located, according to publicly-available information.

We plan to conduct in-situ studies of the Montes Claros de Goiás Project in 2019.

IV. RUBELITA PROJECT

Minerals: Lithium

Location: Rubelita, state of Minas Gerais

Area: 288 acres

Highlights:

• The Rubelita Project is located within a mining district which was extensively researched by CPRM (“Companhia de Pesquisa de Recursos Minerais”), the government-funded Geological Survey of Brazil, and singled out for high levels of lithium mineralization. In this district, the identified lithium deposits are associated with pegmatite formations, and lepidolite, petalite, and spodumene mineralization.

• Our area may also have aquamarine, beryl, tourmaline, granite, and feldspar deposits.

The Rubelita project consists of a mineral right for lithium, aquamarine, beryl, tourmaline, granite, and feldspar in the Salinas district, where other companies have explored for these minerals.

We plan to conduct in-situ studies of the Rubelita Project in 2019.

THE NEWEST IRON PROJECT

On 5/31/19, Brazil Mineral announced its FIRST IRON PROJECT. The company has obtained the rights to an iron project area with 4,120 acres in the “Quadrilátero Ferrífero” (Iron Quadrangle), one of the premier iron regions in the world with multiple operating mines. Iron ore is in high demand with strong sales of Brazilian iron ore for export (mainly to China) or for use by local steelmakers.

https://www.globenewswire.com/news-release/2019/05/31/1861035/0/en/Brazil-Minerals-Inc-Announces-Its-First-Iron-Project-and-Technology-Partnership-Development.html

THE NEWEST LITHIUM PROJECT

On 7/22/19, the company announced that it has expanded its lithium footprint in Brazil over 32-fold to now 9,677 acres by adding three lithium claims totaling 9,389 acres in the state of Minas Gerais. Brazil Minerals is starting studies on these new areas immediately. Demand is evident as representatives from companies based in Australia, Bolivia, China and Russia have recently visited the Minas Gerais lithium districts in search of opportunities.

https://finance.yahoo.com/news/brazil-minerals-inc-increases-lithium-110000650.html

PHOTOS OF THE MINING SITE

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=149022856

3) The People

Brazil Minerals boasts an enviable executive team who are executing a business model which mirrors that of successful, multi-billion dollar market cap mining stocks.

http://www.brazil-minerals.com/management-board-of-directors/

http://www.brazil-minerals.com/technical-team/

Management: CEO - Dr. Marc Fogassa

https://www.linkedin.com/in/marcfogassa

DD on Dr. Fogassa by iHub veteran stervc:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=112766681

Board of Directors: Ambassador Roger Noriega

Ambassador Roger Noriega is an independent member of the Board of Directors of Brazil Minerals, Inc. Mr. Noriega was U.S. Assistant Secretary of State from July 2003 to August 2005, appointed by President George W. Bush and confirmed by the U.S Senate. In that capacity, Mr. Noriega managed a 3,000-person team of professionals in Washington and 50 diplomatic posts to design and implement political and economic strategies in Canada, Latin America, and the Caribbean.

4) Frequently Asked Questions

Q: This BMIX DD is impressive, but doesn't all of it seem too good to be true? Why is BMIX trading so low?

A: BMIX is trading so low because in 2014 the company was in urgent need of cash to seize the remaining % ownership of its key properties before they were usurped by another party. To make it possible in a timely manner, the company resorted to toxic financing which was simply the fastest option at the time. This move was essential for the LONG-TERM viability of BMIX. It takes years, if not decades, for a developmental-stage mining company to grow into revenue-generating stage. Unfortunately, this developmental stage for BMIX has been hindered by the past financing blunders. Nonetheless, the company continued to relentlessly build a solid foundation for the long-term production of diamonds and gold and was not particularly focusing on its stock price. This created a fantastic buying opportunity for some of us. Now that the production is days away and the company is expecting to be cash flow positive, I expect BMIX to start working towards strengthening their stock valuation as well.

Q: So what do you think is fair price for BMIX stock?

A: I will provide two different perspectives below:

1) Combining revenue streams from gold, diamonds, sand, and royalty-based partnerships, BMIX can reasonably make $3M net profit as early as the end of FY 2020. An average P/E ratio for mining companies is 25-30. It is often even higher for younger mining companies with many virgin claims, but let's consider the worst case scenario of 20, just to be conservative. So with a net income of $3M, the OS count of 1.2B (given the worst-case scenario of the maxed out A/S), and the P/E ratio of 20, that comes out to $0.05 per share.

$3M/1.2B = $0.0025 x 20 = $0.05

Reflecting upon the revenues obtained by the previous operator of BMIX property, $3M in net annual profit is very doable for BMIX in 2020. And the P/E of 20 is quite conservative considering how many claims with future potential BMIX owns. Add to that the upcoming hype from the penny traders who are starved for the stocks that actually have net profits, and the PPS potential here extends way beyond the $0.05 even at the maxed out A/S of 1.2B. This, obviously, represents a HUGE return from these levels.

2) In September 2014, Goldman Small Cap Research Report pinned a target market cap for BMIX at $25,380,000 (84.6M x $0.30).

http://www.brazil-minerals.com/wp-content/uploads/2018/12/Goldman-Small-Cap-Research-Report-BMIX.pdf

Given that the company's current OS is 914,784,917, the above market cap corresponds to a PPS of $0.028

Also, keep in mind that this target was established well BEFORE many of the new developments and property acquisitions. BMIX has acquired a myriad of additional property rights since then, and its subsidiary Jupiter Gold is now a publicly-traded company with its own market cap, trading at $0.90 per share. So, arguably, a reasonable market cap target should be significantly higher today.

Q: Current BMIX projects appear very impressive, Duas Barras in particular. But the natural question is WHY the previous owner failed?

A: To answer this, I will quote the CEO himself in one of the publicly available interviews:

The issue with the [previous] company was that it had 300 employees elsewhere in Brazil taking hold of ground for exploration. It had huge, huge research costs, so any semblance of profitability from diamond production was diluted by expenses elsewhere. The company also had 110 employees at the mine — we have 18 — and it had five vice presidents at the mine while we have one general manager.

https://investingnews.com/daily/resource-investing/precious-metals-investing/gold-investing/brazil-minerals-gold-diamonds-sand-otcbb-bmix/

In summary, Vaaldiam (the previous company) had 300 workers elsewhere in Brazil in various exploratory, non-revenue projects. When the 2008 financial crisis hit the markets, Vaaldiam left Brazil due to being unable to satisfy local social security payments and other demands. Initially, BMIX acquired a 55% stake in Duas Barras, and subsequent rounds of acquisitions have brought the percentage ownership to 86.88%, and then finally to 100% ownership as of today.

Q: How do we know that the company is not just using the shareholders for easy financing? Does Dr. Fogassa have any skin in the game?

A: Of course! The CEO has a lot of vested interest in BMIX succeeding. Dr. Fogassa now owns nearly 30% of all common shares of BMIX (see the share structure in the beginning of this DD post).

Dr. Fogassa graduated from MIT, then Harvard medical school, and then Harvard business school. Trust me when I say that he could be making bank out there by either practicing medicine in a nice private group in Boston, or even more so by staying at Goldman Sachs as a medical/technological financier. Instead, he dropped everything and went all-in into this baby project of his - Brazil Minerals. Moreover, instead of burning through the precious and scarce start-up capital, he was getting I.O.U's from the company for his salary and is now actively converting them into COMMON SHARES of BMIX. From my personal conversation with the CEO, he spends most of his days submerged in BMIX business -- and what does he get in return? Common BMIX shares! Dr. Fogassa's credentials are nothing short of stunning and he gave up several types of lucrative jobs where he could be making $400K+ per year from a cushy air-conditioned office in Boston or NYC to, instead, spend his days in Brazil's 100 degree heat while getting BMIX common shares in return! The man is as invested in this company as it gets, if you ask me.

Q: Are there any research reports on BMIX?

A: Sure, in September 2014, Goldman Small Cap Research issued a report in which they called Brazil Minerals “The Most Attractive Revenue-Generating Mining Stock.” Read the full report below:

http://www.brazil-minerals.com/wp-content/uploads/2018/12/Goldman-Small-Cap-Research-Report-BMIX.pdf

Q: Any interviews with the CEO that I should check out?

A: You can view the most recent interview with Marc Fogassa at the MicroCap Conference in New York in October 2018.

There is also an older interview done with Dr. Fogassa by TheStreet and it can be read below:

http://www.thestreet.com/story/12937096/1/brazil-minerals-pursuing-profitable-diamond-and-gold-mining.html

BMIX DAILY CHART

ImOnABoat

This post is my personal opinion. I do not provide investment advice.

ImOnABoat

Recent ATLX News

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/09/2024 02:30:09 AM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 03/06/2024 11:01:55 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/17/2024 02:30:41 AM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 02/14/2024 04:55:05 PM

- Form 5 - Annual statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/14/2024 03:23:59 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/12/2024 09:30:35 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/27/2024 02:30:09 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/13/2024 02:30:22 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/06/2024 02:00:24 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/06/2024 02:00:18 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/06/2024 02:00:13 AM

- Form 8-K - Current report • Edgar (US Regulatory) • 01/05/2024 10:00:31 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/05/2024 02:30:07 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/30/2023 02:25:19 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/30/2023 02:20:14 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/23/2023 02:30:35 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/19/2023 02:30:07 AM

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • BLO • Apr 25, 2024 8:52 AM

Kona Gold Beverages, Inc. Announces Name Change to NuVibe, Inc. and Initiation of Ticker Symbol Application Process • KGKG • Apr 25, 2024 8:30 AM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM