Tuesday, July 02, 2019 12:08:48 AM

Down with "Data" At The Twist And Shout

MMMGYS

Good Morning Good Evening

'Mining Investor Insights Drawn From The Wells Of Minerals,Metals & Mining'

Welcome to ~The Graveyard Shift Minerals Metals & Mining Show~

On the show tonight: ~~Great Data & News by Harvey Organ ,~~ Jim Wyckoff from Kitco gives us the Gold & Silver AM/PM Round Up, ~~ In Our Continuing Series GATA 'Gold Rush 21' Exposes The Manipulation of The Gold Market By Central Banks, ~~ Treasure Tales: "California" Desert Steamers, and maybe more....

Hello everybody I'm J:D your host tonight Thanks for being with us.

Hope Your Having a Wonderful Evening

EnJoy the show

OK...Here We go...to the Numbers

MMMGYS

Thank you

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

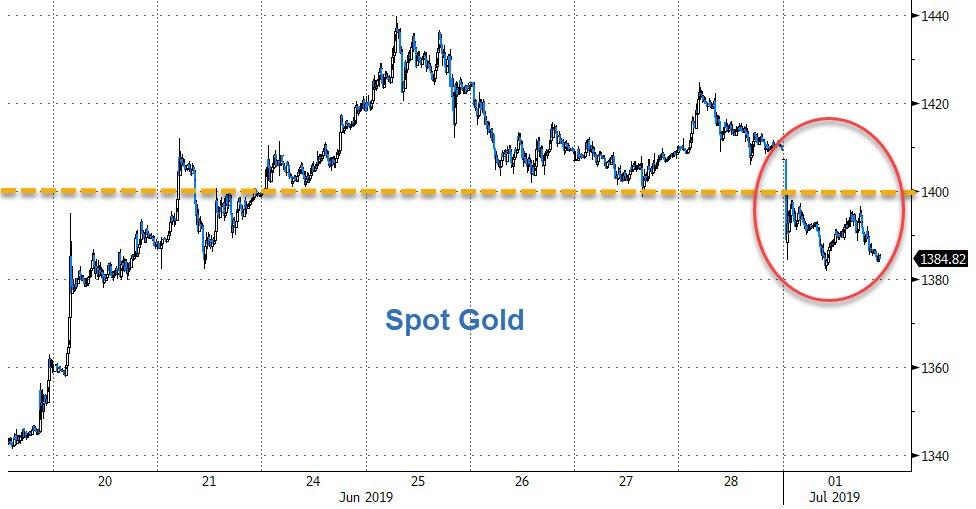

JULY 1/ANOTHER RAID COURTESY OF OUR CROOKED BANKS: GOLD DOWN $24.70 TO $1386.10//SILVER DOWN 16 CENTS TO $15.16//WE HAVE HAD HUGE OPEN INTEREST DISCREPANCIES BETWEEN PRELIMINARY GOLD OI AND FINAL OI NUMBERS ON 6 OUT OF LAST 7 TRADING DAYS//CEASE FIRE BETWEEN TRUMP AND XI WITH TRUMP GIVING ANOTHER REPRIEVE TO HUAWEI AND GET INCREASE CHINESE PURCHASES OF AMERICAN GOODS //POOR PMI NUMBERS (MFG) IN CHINA AND ALL ACROSS THE GLOBE//MORE PROTESTS IN HONG KONG YESTERDAY AND TODAY//ISRAEL STRIKES AGAIN INTO SYRIA/IRAN ANNOUNCES THAT IT HAS SURPASSED THE 300 KG LIMIT ON URANIUM ENRICHMENT//

July 1, 2019 · by harveyorgan · in Uncat

GOLD: $1386.10 DOWN $24.70 (COMEX TO COMEX CLOSING)

Silver: $15,16 DOWN 16 CENTS (COMEX TO COMEX CLOSING)//

Closing access prices:

Gold : $1383.50

silver: $15.14

This is a holiday week with many taking off as July 4 in the USA is their independence day. As always, this is an excuse for the crooks to raid as many are away. The fun will begin on Monday July 8.

YOUR DATA…

COMEX DATA

JPMorgan has been receiving gold with reckless abandon and sometimes supplying (stopping)

today RECEIVING 84/193

EXCHANGE: COMEX

CONTRACT: JULY 2019 COMEX 100 GOLD FUTURES

SETTLEMENT: 1,409.700000000 USD

INTENT DATE: 06/28/2019 DELIVERY DATE: 07/02/2019

FIRM ORG FIRM NAME ISSUED STOPPED

____________________________________________________________________________________________

167 H MAREX 6

624 C BOFA SECURITIES 3

657 C MORGAN STANLEY 14

661 C JP MORGAN 74

661 H JP MORGAN 10

690 C ABN AMRO 13 17

737 C ADVANTAGE 73 63

800 C MAREX SPEC 101

905 C ADM 12

____________________________________________________________________________________________

TOTAL: 193 193

MONTH TO DATE: 564

NUMBER OF NOTICES FILED TODAY FOR JULY CONTRACT: 193 NOTICE(S) FOR 19,300 OZ (0.2674 tonnes)

TOTAL NUMBER OF NOTICES FILED SO FAR: 564 NOTICES FOR 56,400 OZ (1.754 TONNES)

SILVER

FOR JULY

515 NOTICE(S) FILED TODAY FOR 2,575,000 OZ/

total number of notices filed so far this month: 3135 for 15,675,000 oz

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Bitcoin: OPENING MORNING TRADE : $ 10,933 DOWN 527

Bitcoin: FINAL EVENING TRADE: $ 10,157 DOWN 675

end

Let us have a look at the data for today

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

IN SILVER THE COMEX OI FELL A CONSIDERABLE SIZED 2257 CONTRACTS FROM 220,612 DOWN TO 218,355 DESPITE THE 6 CENT GAIN IN SILVER PRICING AT THE COMEX.

TODAY WE ARRIVED FURTHER FROM AUGUST’S 2018 RECORD SETTING OPEN INTEREST OF 244,196 CONTRACTS.

WE HAVE ALSO WITNESSED A LARGE AMOUNT OF PHYSICAL METAL STAND FOR COMEX DELIVERY AS WELL WE ARE WITNESSING CONSIDERABLE LONGS PACKING THEIR BAGS AND MIGRATING OVER TO LONDON IN GREATER NUMBERS IN THE FORM OF EFP’S. WE WERE NOTIFIED THAT WE HAD A STRONG SIZED NUMBER OF COMEX LONGS TRANSFERRING THEIR CONTRACTS TO LONDON THROUGH THE EFP:,

0 FOR JULY. 0 FOR AUGUST, 1816 FOR SEPT, AND ZERO FOR ALL OTHER MONTHS AND THEREFORE TOTAL ISSUANCE 1816 CONTRACTS. WITH THE TRANSFER OF 1816 CONTRACTS, WHAT THE CME IS STATING IS THAT THERE IS NO SILVER (OR GOLD) TO BE DELIVERED UPON AT THE COMEX AS THEY MUST EXPORT THEIR OBLIGATION TO LONDON. ALSO KEEP IN MIND THAT THERE CAN BE A DELAY OF 24-48 HRS IN THE ISSUING OF EFP’S. THE 1816 EFP CONTRACTS TRANSLATES INTO 9.08 MILLION OZ ACCOMPANYING:

1.THE 6 CENT GAIN IN SILVER PRICE AT THE COMEX AND

2. THE STRONG AMOUNT OF SILVER OUNCES WHICH STOOD FOR DELIVERY IN THE LAST 12 MONTHS:

JUNE/2018. (5.420 MILLION OZ);

FOR JULY: 30.370 MILLION OZ

FOR AUG., 6.065 MILLION OZ

FOR SEPT. 39.505 MILLION OZ S

FOR OCT.2.525 MILLION OZ.

FOR NOV: A HUGE 7.440 MILLION OZ STANDING AND

21.925 MILLION OZ FINALLY STAND FOR DECEMBER.

5.845 MILLION OZ STAND IN JANUARY.

2.955 MILLION OZ STANDING FOR FEBRUARY.:

27.120 MILLION OZ STANDING IN MARCH.

3.875 MILLION OZ STANDING FOR SILVER IN APRIL.

18.845 MILLION OZ STANDING FOR SILVER IN MAY.

2.660 MILLION OZ STANDING FOR SILVER IN JUNE//

20.150 MILLION OZ INITIAL STANDING FOR JULY

WE HAD CONSIDERABLE SHORT COVERING AT THE SILVER COMEX FRIDAY ..AND ZERO SPREADING ACCUMULATION SO FAR.

ACCUMULATION FOR EFP’S/SILVER/J.P.MORGAN’S HOUSE OF BRIBES, / STARTING FROM FIRST DAY NOTICE/FOR MONTH OF JULY:

1816 CONTRACTS (FOR 1 TRADING DAY TOTAL 1816 CONTRACTS) OR 9.08 MILLION OZ: (AVERAGE PER DAY: 1816 CONTRACTS OR 9.08 MILLION OZ/DAY)

TO GIVE YOU AN IDEA AS TO THE HUGE SUPPLY THIS MONTH IN SILVER: SO FAR THIS MONTH OF JULY: 9.08 MILLION PAPER OZ HAVE MORPHED OVER TO LONDON. THIS REPRESENTS AROUND 1.29% OF ANNUAL GLOBAL PRODUCTION (EX CHINA EX RUSSIA)* JUNE’S 345.43 MILLION OZ IS THE SECOND HIGHEST RECORDED ISSUANCE OF EFP’S AND IT FOLLOWED THE RECORD SET IN APRIL 2018 OF 385.75 MILLION OZ.

ACCUMULATION IN YEAR 2019 TO DATE SILVER EFP’S: 1166.57 MILLION OZ.

JANUARY 2019 EFP TOTALS: 217.455. MILLION OZ

FEB 2019 TOTALS: 147.4 MILLION OZ/

MARCH 2019 TOTAL EFP ISSUANCE: 207.835 MILLION OZ

APRIL 2019 TOTAL EFP ISSUANCE: 182.87 MILLION OZ.

MAY 2019: TOTAL EFP ISSUANCE: 136.55 MILLION OZ

JUNE 2019 , TOTAL EFP ISSUANCE: 265.38 MILLION OZ

RESULT: WE HAD A CONSIDERABLE SIZED DECREASE IN COMEX OI SILVER COMEX CONTRACTS OF 2257, DESPITE THE 6 CENT GAIN IN SILVER PRICING AT THE COMEX /YESTERDAY... THE CME NOTIFIED US THAT WE HAD A STRONG SIZED EFP ISSUANCE OF 1816 CONTRACTS WHICH EXITED OUT OF THE SILVER COMEX AND TRANSFERRED THEIR OI TO LONDON AS FORWARDS. SPECULATORS CONTINUED THEIR INTEREST IN ATTACKING THE SILVER COMEX FOR PHYSICAL SILVER (SEE COMEX DATA) .

TODAY WE LOST A SMALL SIZED: 441 TOTAL OI CONTRACTS ON THE TWO EXCHANGES:

i.e 1816 OPEN INTEREST CONTRACTS HEADED FOR LONDON (EFP’s) TOGETHER WITH DECREASE OF 2257 OI COMEX CONTRACTS. AND ALL OF THIS DEMAND HAPPENED WITH A 6 CENT GAIN IN PRICE OF SILVER AND A CLOSING PRICE OF $15.32 WITH RESPECT TO FRIDAY’S TRADING. YET WE STILL HAVE A STRONG AMOUNT OF SILVER STANDING AT THE COMEX FOR DELIVERY!!

In ounces AT THE COMEX, the OI is still represented by JUST OVER 1 BILLION oz i.e. 1.187 BILLION OZ TO BE EXACT or 169% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT MARCH MONTH/ THEY FILED AT THE COMEX: 515 NOTICE(S) FOR 2,575,000 OZ OF SILVER

IN SILVER,PRIOR TO TODAY, WE SET THE NEW COMEX RECORD OF OPEN INTEREST AT 243,411 CONTRACTS ON APRIL 9.2018. AND AGAIN THIS HAS BEEN SET WITH A LOW PRICE OF $16.51.

AND NOW WE RECORD FOR POSTERITY ANOTHER ALL TIME RECORD OPEN INTEREST AT THE COMEX OF 244,196 CONTRACTS ON AUGUST 22/2018 AND AGAIN WHEN THIS RECORD WAS SET, THE PRICE OF SILVER WAS $14.78 AND LOWER IN PRICE THAN PREVIOUS RECORDS.

ON THE DEMAND SIDE WE HAVE THE FOLLOWING:

HUGE AMOUNTS OF SILVER STANDING FOR DELIVERY (MARCH/2018: 27 MILLION OZ , APRIL/2018 : 2.485 MILLION OZ MAY: 36.285 MILLION OZ ; JUNE/2018 (5.420 MILLION OZ) , JULY 2018 FINAL AMOUNT STANDING: 30.370 MILLION OZ ) FOR AUGUST 6.065 MILLION OZ. , SEPT: A HUGE 39.505 MILLION OZ./ OCTOBER: 2,520,000 oz NOV AT 7.440 MILLION OZ./ DEC. AT 21.925 MILLION OZ JANUARY AT 5.825 MILLION OZ.AND FEB 2019: 2.955 MILLION OZ/ MARCH: 27.120 MILLION OZ/ APRIL AT 3.875 MILLION OZ/ A MAY: 18.845 MILLION OZ ..JUNE 2.660 MILLION OZ//JULY 20.150 MILLION OZ

HUGE RECORD OPEN INTEREST IN SILVER 243,411 CONTRACTS (OR 1.217 BILLION OZ/ SET APRIL 9/2018) AND NOW AUGUST 22/2018: 244,196 CONTRACTS, WITH A SILVER PRICE OF $14.78.

HUGE ANNUAL EFP’S ISSUANCE EQUAL TO 2.9 BILLION OZ OR 400% OF SILVER ANNUAL PRODUCTION/2017

RECORD SETTING EFP ISSUANCE FOR ANY MONTH IN SILVER; APRIL/2018/ 385.75 MILLION OZ/ AND THE SECOND HIGHEST RECORDED EFP ISSUANCE JUNE 2018 345.43 MILLION OZ

AND YET, WITH THE EXTREMELY HIGH EFP ISSUANCE, WE HAVE A CONTINUAL LOW PRICE OF SILVER DESPITE THE ABOVE HUGE DEMAND. TO ME THE ONLY ANSWER IS THAT WE HAVE SOVEREIGN (CHINA) WHO IS ENDEAVOURING TO GOBBLE UP ALL AVAILABLE PHYSICAL SILVER NO MATTER WHERE, EXACTLY WHAT J.P.MORGAN IS DOING. AND IT IS MY BELIEF THAT J.P.MORGAN IS HOLDING ITS SILVER FOR ITS BENEFICIAL OWNER..THE USA GOVERNMENT WHO IN TURN IS HOLDING THAT SILVER FOR CHINA.(FOR A SILVER LOAN REPAYMENT)

.

WITH RESPECT TO SPREADING: WE WILL WITNESS THE MORPHING OF OUR SPREADERS OUT OF SILVER AND INTO GOLD AS THE JULY MONTH PROCEEDS INTO THE ACTIVE DELIVERY MONTH OF AUGUST.

.

FOR NEWCOMERS, HERE IS THE MODUS OPERANDI OF THE CORRUPT BANKERS WITH RESPECT TO THEIR SPREAD/TRADING.

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES:

“AS YOU WILL SEE, THE CROOKS WILL NOW SWITCHED TO SILVER AS THEY INCREASE THE OPEN INTEREST FOR THE SPREADERS. THE TOTAL COMEX GOLD OPEN INTEREST WILL RISE FROM NOW ON UNTIL ONE WEEK PRIOR TO FIRST DAY NOTICE AND THAT IS WHEN THEY START THEIR CRIMINAL LIQUIDATION.

HERE IS HOW THE CROOKS USED SPREADING AS WE ARE NO INTO THE NON ACTIVE DELIVERY MONTH OF JULY HEADING TOWARDS THE VERY ACTIVE DELIVERY MONTH OF AUGUST.

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES, HERE IS THE BANKERS MODUS OPERANDI:

YOU WILL ALSO NOTICE THAT THE COMEX OPEN INTEREST IS STARTING TO RISE IN THIS NON ACTIVE MONTH OF JULY BUT SO IS THE OPEN INTEREST OF SPREADERS. THE OPEN INTEREST IN SILVER WILL CONTINUE TO RISE UNTIL ONE WEEK BEFORE FIRST DAY NOTICE OF AN UPCOMING ACTIVE DELIVERY MONTH (JULY), AND THAT IS WHEN THE CROOKS SELL THEIR SPREAD POSITIONS BUT NOT AT THE SAME TIME OF THE DAY. THEY WILL USE THE SELL SIDE OF THE EQUATION TO CREATE THE CASCADE (ALONG WITH THEIR COLLUSIVE FRIENDS) AND THEN COVER ON THE BUY SIDE OF THE SPREAD SITUATION AT THE END OF THE DAY. THEY DO THIS TO AVOID POSITION LIMIT DETECTION. THE LIQUIDATION OF THE SPREADING FORMATION CONTINUES FOR EXACTLY ONE WEEK AND ENDS ON FIRST DAY NOTICE.”

IN GOLD, THE OPEN INTEREST FELL BY A SMALL 1341 CONTRACTS, TO 580,855 ACCOMPANYING THE TINY $0.90 PRICING GAIN WITH RESPECT TO COMEX GOLD PRICING YESTERDAY// /THE SPREADING LIQUIDATION WILL NOW COMMENCE FOR GOLD….

FOR THE 6TH TIME IN THE LAST 7 TRADING DAYS WE HAVE WITNESSED A HUGE REDUCTION FORM THE PRELIMINARY GOLD OPEN INTEREST TO THE FINAL OI NUMBER. THE ONLY ANSWER TO THIS IS MASSIVE FRAUD TO WHICH THE CFTC REFUSED TO ANSWER…

THE CME RELEASED THE DATA FOR EFP ISSUANCE AND IT TOTALED A STRONG SIZED 5397 CONTRACTS:

APRIL 0 CONTRACTS,JUNE: 0 CONTRACTS, AUGUST 2019: 5397 CONTRACTS, DEC> 0 CONTRACTS AND ALL OTHER MONTHS ZERO. The NEW COMEX OI for the gold complex rests at 580,855. ALSO REMEMBER THAT THERE WILL BE A DELAY IN THE ISSUANCE OF EFP’S. THE BANKERS REMOVE LONG POSITIONS OF COMEX GOLD IMMEDIATELY. THEN THEY ORCHESTRATE THEIR PRIVATE EFP DEAL WITH THE LONGS AND THAT COULD TAKE AN ADDITIONAL, 48 HRS SO WE GENERALLY DO NOT GET A MATCH WITH RESPECT TO DEPARTING COMEX LONGS AND NEW EFP LONG TRANSFERS. . EVEN THOUGH THE BANKERS ISSUED THESE MONSTROUS EFPS, THE OBLIGATION STILL RESTS WITH THE BANKERS TO SUPPLY METAL BUT IT TRANSFERS THE RISK TO A LONDON BANKER OBLIGATION AND NOT A NEW YORK COMEX OBLIGATION. LONGS RECEIVE A FIAT BONUS TOGETHER WITH A LONG LONDON FORWARD. THUS, BY THESE ACTIONS, THE BANKERS AT THE COMEX HAVE JUST STATED THAT THEY HAVE NO APPRECIABLE METAL!! THIS IS A MASSIVE FRAUD: THEY CANNOT SUPPLY ANY METAL TO OUR COMEX LONGS BUT THEY ARE QUITE WILLING TO SUPPLY MASSIVE NON BACKED GOLD (AND SILVER) PAPER KNOWING THAT THEY HAVE NO METAL TO SATISFY OUR LONGS. LONDON IS NOW SEVERELY BACKWARD IN BOTH GOLD AND SILVER AND WE ARE WITNESSING DELAYS IN ACTUAL DELIVERIES.

IN ESSENCE WE HAVE A GOOD SIZED GAIN IN TOTAL CONTRACTS ON THE TWO EXCHANGES OF 6738 CONTRACTS: 1341 CONTRACTS INCREASED AT THE COMEX AND 5397 EFP OI CONTRACTS WHICH NAVIGATED OVER TO LONDON. THUS TOTAL OI GAIN OF 6738 CONTRACTS OR 673,800 OZ OR 20.95 TONNES. FRIDAY WE HAD A TINY GAIN OF $0.90 IN GOLD TRADING.…AND WITH THAT TINY GAIN IN PRICE, WE HAD A STRONG GAIN IN GOLD TONNAGE OF 20.95 TONNES!!!!!! THE BANKERS WERE SUPPLYING INFINITE SUPPLIES OF SHORT GOLD COMEX PAPER.

ACCUMULATION OF EFP’S GOLD AT J.P. MORGAN’S HOUSE OF BRIBES: (EXCHANGE FOR PHYSICAL) FOR THE MONTH OF JULY : 5397 CONTRACTS OR 539,700 oz OR 16.786 TONNES (1 TRADING DAY AND THUS AVERAGING: 5397 EFP CONTRACTS PER TRADING DAY

TO GIVE YOU AN IDEA AS TO THE STRONG SIZE OF THESE EFP TRANSFERS : THIS MONTH IN 1 TRADING DAY IN TONNES: 16.786 TONNES

TOTAL ANNUAL GOLD PRODUCTION, 2018, THROUGHOUT THE WORLD EX CHINA EX RUSSIA: 3555 TONNES

THUS EFP TRANSFERS REPRESENTS 16.786/3550 x 100% TONNES =0.47% OF GLOBAL ANNUAL PRODUCTION

ACCUMULATION OF GOLD EFP’S YEAR 2019 TO DATE: 2,936.92 TONNES

JANUARY 2019 TOTAL EFP ISSUANCE; 531.20 TONNES

FEB 2019 TOTAL EFP ISSUANCE: 344.36 TONNES

MARCH 2019 TOTAL EFP ISSUANCE: 497.16 TONNES

APRIL 2019 TOTAL ISSUANCE: 456.10 TONNES

MAY 2019 TOTAL ISSUANCE: 449.10 TONNES

JUNE 2019 TOTAL ISSUANCE: 642.22 TONNES

WHAT IS ALARMING TO ME, ACCORDING TO OUR LONDON EXPERT ANDREW MAGUIRE IS THAT THESE EFP’S ARE BEING TRANSFERRED TO WHAT ARE CALLED SERIAL FORWARD CONTRACT OBLIGATIONS AND THESE CONTRACTS ARE LESS THAN 14 DAYS. ANYTHING GREATER THAN 14 DAYS, THESE MUST BE RECORDED AND SENT TO THE COMPTROLLER, GREAT BRITAIN TO MONITOR RISK TO THE BANKING SYSTEM. IF THIS IS INDEED TRUE, THEN THIS IS A MASSIVE CONSPIRACY TO DEFRAUD AS WE NOW WITNESS A MONSTROUS TOTAL EFP’S ISSUANCE AS IT HEADS INTO THE STRATOSPHERE.

Result: A FAIR SIZED INCREASE IN OI AT THE COMEX OF 1341 WITH THE TINY PRICING GAIN THAT GOLD UNDERTOOK ON FRIDAY($0.90)) //.WE ALSO HAD A STRONG SIZED NUMBER OF COMEX LONG TRANSFERRING TO LONDON THROUGH THE EFP ROUTE: 5397 CONTRACTS AS THESE HAVE ALREADY BEEN NEGOTIATED AND CONFIRMED. THERE OBVIOUSLY DOES NOT SEEM TO BE MUCH PHYSICAL GOLD AT THE COMEX. I GUESS IT EXPLAINS THE HUGE ISSUANCE OF EFP’S…THERE IS HARDLY ANY GOLD PRESENT AT THE GOLD COMEX FOR DELIVERY PURPOSES. IF YOU TAKE INTO ACCOUNT THE 5397 EFP CONTRACTS ISSUED, WE HAD A GOOD SIZED GAIN OF 6738 CONTRACTS IN TOTAL OPEN INTEREST ON THE TWO EXCHANGES:

5397 CONTRACTS MOVE TO LONDON AND 1341 CONTRACTS INCREASED AT THE COMEX. (IN TONNES, THE GAIN IN TOTAL OI EQUATES TO 20.95 TONNES). ..AND THIS HUGE INCREASE OF DEMAND OCCURRED ACCOMPANYING THE TINY GAIN IN PRICE OF $0.90 WITH RESPECT TO FRIDAY’S TRADING AT THE COMEX. WE WILL COMMENCE WITH SPREADING ACCUMULATION IN GOLD AS THE MONTH PROCEEDS/

we had: 193 notice(s) filed upon for 19300 oz of gold at the comex.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

With respect to our two criminal funds, the GLD and the SLV:

GLD...

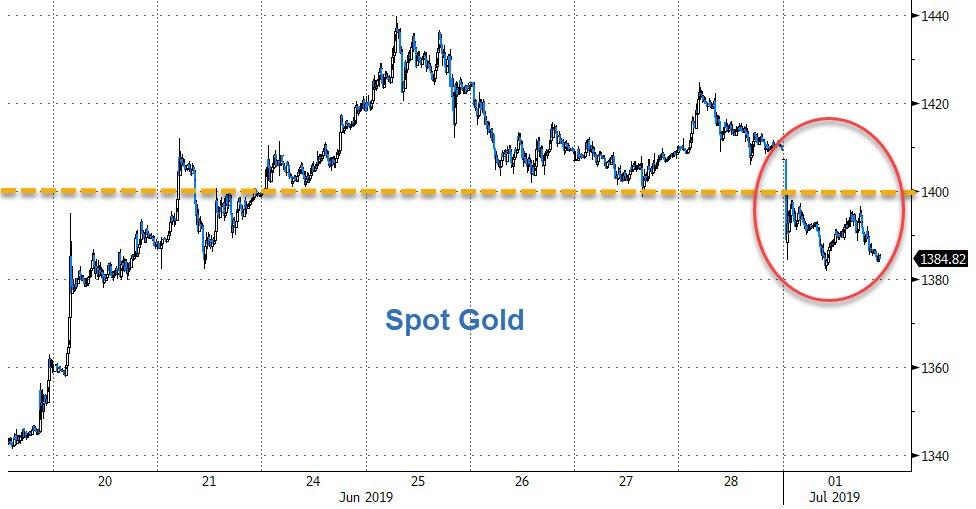

WITH GOLD DOWN $24.70 TODAY//

A HUGE CHANGE IN GOLD INVENTORY AT THE GLD: A PAPER WITHDRAWAL OF 1.76 TONNES

WHICH WAS UTILIZED IN THE RAID TODAY.

INVENTORY RESTS AT 794.04 TONNES

TO ALL INVESTORS THINKING OF BUYING GOLD THROUGH THE GLD ROUTE: YOU ARE MAKING A TERRIBLE MISTAKE AS THE CROOKS ARE USING WHATEVER GOLD COMES IN TO ATTACK BY SELLING THAT GOLD. IT SURE SEEMS TO ME THAT THE GOLD OBLIGATIONS AT THE GLD EXCEED THEIR INVENTORY

SLV/

WITH SILVER DOWN 16 CENTS TODAY:

A BIG CHANGES WITH RESPECT TO SILVER INVENTORY AT THE SILVER SLV:

A SURPRISING PAPER DEPOSIT OF 936,000 OZ

/INVENTORY RESTS AT 323.330 MILLION OZ.

end

OUTLINE OF TOPICS TONIGHT

First, here is an outline of what will be discussed tonight:

1. Today, we had the open interest in SILVER FELL BY A CONSIDERABLE SIZED 2257 CONTRACTS from 220,612 DOWN TO 218,355 AND FURTHER FROM THE NEW COMEX RECORD SET LAST IN AUG.2018 AT 244,196 WITH A SILVER PRICE OF $14.78/(AUGUST 22/2018)..THE PREVIOUS RECORD WAS SET ON APRIL 9/2018 AT 243,411 OPEN INTEREST CONTRACTS WITH THE SILVER PRICE AT THAT DAY: $16.53). AND PREVIOUS TO THAT, THE RECORD WAS ESTABLISHED AT: 234,787 CONTRACTS, SET ON APRIL 21.2017 OVER 1 1/3 YEARS AGO. THE PRICE OF SILVER ON THAT DAY: $17.89. AS YOU CAN SEE, WE HAVE RECORD HIGH OPEN INTERESTS IN SILVER ACCOMPANIED BY A CONTINUAL LOWER PRICE WHEN THAT RECORD WAS SET…..THE SPREADERS HAVE COMMENCED THEIR ACCUMULATION OF OPEN INTEREST CONTRACTS IN SILVER AND STOPPED THE LIQUIDATION OF THE SPREADERS IN GOLD

EFP ISSUANCE:

OUR CUSTOMARY MIGRATION OF COMEX LONGS CONTINUE TO MORPH INTO LONDON FORWARDS AS OUR BANKERS USED THEIR EMERGENCY PROCEDURE TO ISSUE:

FOR JULY: 0 CONTRACTS FOR AUGUST: 0, FOR SEPT. 1816 AND ALL OTHER MONTHS: ZERO. TOTAL EFP ISSUANCE: 1816 CONTRACTS. EFP’S GIVE OUR COMEX LONGS A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. IF WE TAKE THE OI LOSS AT THE COMEX OF 2025 CONTRACTS TO THE 1816 OI TRANSFERRED TO LONDON THROUGH EFP’S, WE OBTAIN A SMALL LOSS OF 441 OPEN INTEREST CONTRACTS. THUS IN OUNCES, THE LOSS ON THE TWO EXCHANGES: 1.045 MILLION OZ!!! AND YET WE ALSO HAVE A STRONG DEMAND FOR PHYSICAL AS WE WITNESSED A FINAL STANDING OF GREATER THAN 30 MILLION OZ FOR JULY, A STRONG 7.475 MILLION OZ FOR AUGUST.. A HUGE 39.505 MILLION OZ STANDING FOR SILVER IN SEPTEMBER… OVER 2 million OZ STANDING FOR THE NON ACTIVE MONTH OF OCTOBER., 7.440 MILLION OZ FINALLY STANDING IN NOVEMBER. 21.925 MILLION OZ STANDING IN DECEMBER , 5.845 MILLION OZ STANDING IN JANUARY. 2.955 MILLION OZ STANDING IN FEBRUARY, 27.120 MILLION OZ FOR MARCH., 3.875 MILLION OZ FOR APRIL 18.765 MILLION OZ FOR MAY ; 2.660 MILLION OZ FOR JUNE AND NOW JULY AT 20.150 MILLION OZ STANDING SO FAR.

RESULT: A CONSIDERABLE SIZED DECREASE IN SILVER OI AT THE COMEX DESPITE THE 6 CENT GAIN IN PRICING THAT SILVER UNDERTOOK IN PRICING// YESTERDAY. WE ALSO HAD A STRONG SIZED 1816 EFP’S ISSUED TRANSFERRING COMEX LONGS OVER TO LONDON. TOGETHER WITH THE STRONG SIZED AMOUNT OF SILVER OUNCES STANDING FOR THIS MONTH, DEMAND FOR PHYSICAL SILVER CONTINUES TO INTENSIFY AS WE WITNESS SEVERE BACKWARDATION IN SILVER IN LONDON.

BOTH THE SILVER COMEX AND THE GOLD COMEX ARE IN STRESS AS THE BANKERS SCOUR THE BOWELS OF THE EXCHANGE FOR METAL

(report Harvey)

.

2 ) Gold/silver trading overnight Europe, Goldcore

(Mark O’Byrne/zerohedge

and in NY: Bloomberg

3. ASIAN AFFAIRS

)MONDAY MORNING/ SUNDAY NIGHT:

SHANGHAI CLOSED UP 66.03 POINTS OR 2.22% //Hang Sang CLOSED DOWN 78.80 POINTS OR 0.28% /The Nikkei closed UP 454.05 POINTS OR 2.13%//Australia’s all ordinaires CLOSED UP .48%

/Chinese yuan (ONSHORE) closed UP at 6.8427 /Oil UP TO 60.02 dollars per barrel for WTI and 66.53 for Brent. Stocks in Europe OPENED GREEN// ONSHORE YUAN CLOSED UP // LAST AT 6.8427 AGAINST THE DOLLAR. OFFSHORE YUAN CLOSED UP ON THE DOLLAR AT 6.8421 TRADE TALKS RESUME//YUAN LEVELS GETTING DANGEROUSLY CLOSE TO 7:1//TRUMP INITIATES A NEW 25% TARIFFS FRIDAY/MAY 10/MAJOR PROBLEMS AT HUAWEI /CFO ARRESTED : /ONSHORE YUAN TRADING BELOW LEVEL OF OFFSHORE YUAN/ONSHORE YUAN TRADING STRONGER AGAINST USA DOLLAR/OFFSHORE YUAN TRADING STRONGER AGAINST THE DOLLAR /TRADE DEAL NOW DEAD..TRUMP RAISED RATES TO 25%

3A//NORTH KOREA/ SOUTH KOREA

b) REPORT ON JAPAN

3 China/Chinese affairs

i)China/

Early Saturday morning/Friday night: China and the USA agree to a ceasefire as their trade talks are back on. Trump concedes on Huawei and China agrees to purchase more goods. The problem is now with Powell as he will probably delay his interest rate cuts.

( zerohedge)

ii)Wall Street responds/Saturday morning

( zerohedge)

iii)This is not good for China. Last night they revealed with latest Mfg PMI and it was awful as it fell below 50 and thus contraction in their economy

( zerohedge)

iv)Hong Kong protests erupt again as thousands storm the legislature. The citizens will no way go for extradition to the Mainland.

( zerohedge)

4/EUROPEAN AFFAIRS

iItaly

A female captain of a Migrant NGO ship has been arrested after illegal docking in Italy

( zerohedge)

Bill Blain discusses his take on Osaka…nothing was solved and both the USA and China remain on a collusion course.

( Bill Blain)

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

i)Turkey

A wounded Erdogan is a dangerous person. From his purchase of Russian made S 400’s to his attack on ships trying to bring out natural gas in the Israeli-Cypriot-Greek waters.

( Hallinan//Counterpunch.org)

i b)Libya/Turkey/USA

Basically Hafter has declared war on Turkish planes flying over Libya and also boats off its shore. This proxy war is escalating fast. It certainly looks like Turkey will have to leave NATO as their policies are continuing to show their true colours as they face east.

(zerohedge)

ii)ISRAEL/SYRIA Last night: a major Israeli airstrike on Syrian positions trying to take out the Russian supplied #SAM 300. Also targeted was Iranian positions inside Syria(courtesy zerohedge)

i)IRAN

Iran enriches Uranium and the level has now surpasses 300 kg. Israel and the uSA are not happy.

( zerohedge)

6. GLOBAL ISSUES

i)Canada/Vancouver

China has long sought to get its money out of China and now Hong Kong is doing the same thing (the latest riots), Vancouver is one of the hot spots for the Chinese with Toronto coming in 2nd. It has made housing unaffordable now.

( zerohedge)

ii)Global warnings

this is something that you must pay attention to: The BIS which is the central bank to the central banks warns of a worsening and spreading global slowdown as central banks are running out of ammo

(courtesy BIS/zerohedge)

iib)The latest manufacturing surveys: Japan’s Tankan mfg survey, China’s PMI and now the uSA all witnessing market declines

(courtesy zerohedge)

7. OIL ISSUES

8 EMERGING MARKET ISSUES

9. PHYSICAL MARKETS

i)Dave is correct: the raid was well orchestrated by our crooks

(Dave Kranzler/IRD/GATA)

ii)Government debts are continually on the rise. So it is probably correct to assume that the only way to handle rising government debt is to lower all interest rates to zero or below

(Smith/Bloomberg/GATA)

iii)A must read…

James Turk states that the run up in gold has created losses of 2.2 billion dollars in gold. Who can withstand such losses other than central banks.

( Kingworldnews/James Turk/GATA)

iv)MbS has been very chummy with Trump who seems to have ignored the Khashoggi murder being orchestrated by the Prince. Now the Saudi’s are buying huge amounts of uSA treasuries.

(Bloomberg/GATA)

v)The following is continually happening in Europe as Swiss banks confiscate citizens allocated gold

( Von Greyerz/Kingworldnews)

10. USA stories which will influence the price of gold/silver)

MARKET TRADING//USA

a)Market trading/LAST NIGHT/USA

Stocks, oil yuan surge after Trump Xi deals..gold whacked again.

(zerohedge)

II)MARKET TRADING/USA

ii)Market data/USA

iii)USA ECONOMIC/GENERAL STORIES

a)A good look at how millennials are thinking of marriage..how they use high interest loans to pay for their weeddings

etc

( zerohedge)

b)Inflation is ripping apart American way of life…

now more than half of Americans are lying awake at night worrying about how they are going to pay for necessities of life

(courtesy zerohedge)

c)Quite a story…Boeing outsourced its 737 Max software to low paying engineers ( after laying off higher cost engineers)

(courtesy zerohedge)

d)How the USA pension system is on a death spiral and it is reaching crisis mode

(zerohedge)

e)It is not just the USA that has devastating crop losses. It is happening all over the globe( Michael Snyder)

SWAMP STORIES

E)SWAMP STORIES/MAJOR STORIES//THE KING REPORT

end

LET US BEGIN:

Let us head over to the comex:

THE TOTAL COMEX GOLD OPEN INTEREST ROSE BY A FAIR SIZED 1341 CONTRACTS TO A LEVEL OF 580,855 ACCOMPANYING THE SMALL GAIN OF $0.90 IN GOLD PRICING WITH RESPECT TO YESTERDAY’S // COMEX TRADING)

WE ARE NOW IN THE ACTIVE DELIVERY MONTH OF JUNE.. THE CME REPORTS THAT THE BANKERS ISSUED STRONG SIZED TRANSFER THROUGH THE EFP ROUTE AS THESE LONGS RECEIVED A DELIVERABLE LONDON FORWARD TOGETHER WITH A FIAT BONUS., THAT IS 5397 EFP CONTRACTS WERE ISSUED:

FOR AUGUST; 5397 CONTRACTS: DEC: 0 AND ZERO FOR ALL OTHER MONTHS:

TOTAL EFP ISSUANCE: 5397 CONTRACTS.

THE OBLIGATION STILL RESTS WITH THE BANKERS ON THESE TRANSFERS. ALSO REMEMBER THAT THERE IS NO DOUBT A HUGE DELAY IN THE ISSUANCE OF EFP’S AND IT PROBABLY TAKES AT LEAST 48 HRS AFTER OUR LONGS GIVE UP THEIR COMEX CONTRACTS FOR THEM TO RECEIVE THEIR EFP’S AS THEY ARE NEGOTIATING THIS CONTRACT WITH THE BANKS FOR A FIAT BONUS PLUS THEIR TRANSFER TO A LONDON BASED FORWARD.

ON A NET BASIS IN OPEN INTEREST WE GAINED THE FOLLOWING TODAY ON OUR TWO EXCHANGES: 6738 TOTAL CONTRACTS IN THAT 5397 LONGS WERE TRANSFERRED AS FORWARDS TO LONDON AND WE GAINED A FAIR SIZED 1341 COMEX CONTRACTS. THE BANKERS SUPPLIED THE NECESSARY AND INFINITE AMOUNT OF SHORT PAPER IN GOLD TO CONTAIN THE PRICE RISE.

NET GAIN ON THE TWO EXCHANGES :: 6738 CONTRACTS OR 673,800 OZ OR 20.95 TONNES.

We are now in the NON active contract month of JULY and here the open interest stands at 226 CONTRACTS as we LOST 198 contracts. We had 371 notices filed yesterday so we surprisingly gained 173 contracts or 17,300 oz of gold that will stand for delivery as there appears to be some gold at the comex as they will now try their luck on finding the fast vanishing supplies of physical gold over here. We usually witness queue jumping in silver immediately after first day notice but not gold. That changed today. The next big active month for deliverable gold is August and here the OI FELL by 1351 contracts down to 417,048. September picked up its initial 8 contracts to stand at 8 contracts and now the next active delivery month is October and here the OI rose by 108 contracts up to 10,887.

TODAY’S NOTICES FILED:

WE HAD 193 NOTICES FILED TODAY AT THE COMEX FOR 19300 OZ. (0.6003 TONNES)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for the wild silver comex results.

Total COMEX silver OI FELL BY A CONSIDERABLE SIZED 2257 CONTRACTS FROM 220,612 DOWN TO 218,355 (AND FURTHER FROM THE NEW RECORD OI FOR SILVER SET ON AUGUST 22.2018. THE PREVIOUS RECORD WAS SET APRIL 9.2018/ 243,411 CONTRACTS) AND TODAY’S CONSIDERABLE OI COMEX LOSS OCCURRED DESPITE A 6 CENT GAIN IN PRICING.//FRIDAY.

WE ARE NOW INTO THE ACTIVE DELIVERY MONTH OF JULY. HERE WE HAVE 1410 OPEN INTEREST STAND FOR DELIVERY WITH A LOSS OF 2456 CONTRACTS. WE HAD 2620 NOTICES FILED YESTERDAY SO WE GAINED 164 CONTRACTS OR AN ADDITIONAL 820,000 OZ OF SILVER WILL ATTEMPT TO STAND AT THE COMEX…. AND THESE GUYS REFUSED TO MORPH INTO A LONDON BASED FORWARD AS WELL AS NEGATING A FIAT BONUS. LET US WAIT AND SEE IF SUCCESSFUL IN OBTAINING PHYSICAL METAL ON THIS SIDE OF THE POND. AFTER JULY WE HAVE THE NON ACTIVE MONTH OF AUGUST AND HERE WE GAINED 34 CONTRACTS UP TO 1085. THE NEXT BIG ACTIVE DELIVERY MONTH AFTER AUGUST IS SEPT AND HERE THE OI ROSE BY 34 CONTRACTS UP TO 158,815 CONTRACTS.

TODAY’S NUMBER OF NOTICES FILED:

We, today, had 515 notice(s) filed for 2,575,000 OZ for the JUNE, 2019 COMEX contract for silver

Trading Volumes on the COMEX TODAY: 382,459 CONTRACTS

CONFIRMED COMEX VOL. FOR YESTERDAY: 324,546 contracts

INITIAL standings for JULY/GOLD

JULY 1/2019

Gold Ounces

Withdrawals from Dealers Inventory in oz nil oz

Withdrawals from Customer Inventory in oz

32.15 oz

BRINKS

(one kilobar)

Deposits to the Dealer Inventory in oz

nil

Deposits to the Customer Inventory, in oz

nil

No of oz served (contracts) today

193 notice(s)

19300 OZ

(0.6003 TONNES)

No of oz to be served (notices)

33 contracts

(3300 oz)

0.1026 TONNES

Total monthly oz gold served (contracts) so far this month

564 notices

56400 OZ

1.754 TONNES

Total accumulative withdrawals of gold from the Dealers inventory this month NIL oz

Total accumulative withdrawal of gold from the Customer inventory this month xxx oz

we had 0 dealer entry:

We had 1 kilobar entries

total dealer deposits: nil oz

total dealer withdrawals: nil oz

we had 0 deposit into the customer account

i) Into JPMorgan: nil oz

ii) Into Everybody else: nil oz

total gold deposits: nil oz

very little gold arrives from outside/ NO amount arrived today

we had 1 gold withdrawal from the customer account:

i ) out of Brinks: 32.15 oz

one kilobar

total gold withdrawals; 32.15 oz

i) we had 0 adjustment today

FOR THE JULY 2019 CONTRACT MONTH)Today, 0 notice(s) were issued from JPMorgan dealer account and 0 notices were issued from their client or customer account. The total of all issuance by all participants equates to 193 contract(s) of which 74 notices were stopped (received) by j.P. Morgan dealer and 10 notice(s) was (were) stopped/ Received) by j.P.Morgan customer account and 0 notices by the squid (Goldman Sachs)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

To calculate the INITIAL total number of gold ounces standing for the JULY /2019. contract month, we take the total number of notices filed so far for the month (564) x 100 oz , to which we add the difference between the open interest for the front month of JULY. (226 contract) minus the number of notices served upon today (193 x 100 oz per contract) equals 59,700 OZ OR 1.8569 TONNES) the number of ounces standing in this NON active month of JULY

Thus the INITIAL standings for gold for the JULY/2019 contract month:

No of notices served (564 x 100 oz) + (226)OI for the front month minus the number of notices served upon today (193 x 100 oz )which equals 59,700 oz standing OR 1.8569 TONNES in this active delivery month of JUNE.

We GAINED 173 contracts or an additional 17,300 oz will stand as these guys refused to morph into London based forwards as well as negating a fiat bonus. Somebody was in need of physical gold badly on this side of the pond…VERY UNUSUAL TO SEE QUEUE JUMPING THIS EARLY IN THE UP FRONT JULY CONTRACT MONTH.

SURPRISINGLY LITTLE TO NO GOLD HAS BEEN ENTERING THE COMEX VAULTS AND WE HAVE WITNESSED THIS FOR THE PAST YEAR!! WE HAVE ONLY 10.043 TONNES OF REGISTERED ( GOLD OFFERED FOR SALE) VS 1.8569 TONNES OF GOLD STANDING// THEY SEEM TO BE USING CONSIDERABLE GOLD VAPOUR TO SETTLE UPON UNSUSPECTING LONGS.

total registered or dealer gold: 322,910.634 oz or 10.0438 tonnes

total registered and eligible (customer) gold; 7,696,679.553 oz 239.39 tonnes

IN THE LAST 32 MONTHS 117 NET TONNES HAS LEFT THE COMEX.

THE GOLD COMEX IS NOW IN STRESS AS

1. GOLD IS LEAVING THE COMEX

2. GOLD IS LEAVING THE REGISTERED CATEGORY OF THE COMEX.

end

And now for silver

AND NOW THE DELIVERY MONTH OF JULY

INITIAL standings/SILVER

IN TOTAL CONTRAST TO GOLD, HUGE ACTIVITY IN SILVER TODAY.

JULY 1 2019

Silver Ounces

Withdrawals from Dealers Inventory NIL oz

Withdrawals from Customer Inventory

630,553.433 oz

Int. Delaware

Scotia

Deposits to the Dealer Inventory

NIL oz

Deposits to the Customer Inventory

6942.400 oz

Brinks

No of oz served today (contracts)

515

CONTRACT(S)

(2,575,000 OZ)

No of oz to be served (notices)

895 contracts

4 475,000 oz)

Total monthly oz silver served (contracts) 3135 contracts

15,675,000 oz)

Total accumulative withdrawal of silver from the Dealers inventory this month NIL oz

Total accumulative withdrawal of silver from the Customer inventory this month

**

we had 0 inventory movement at the dealer side of things

total dealer deposits: NIL oz

total dealer withdrawals: nil oz

we had 0 deposits into the customer account

into JPMorgan: nil oz

ii)into everybody else: 0 oz

*** JPMorgan for most of 2017 and in 2018 has adding to its inventory almost every single day.

JPMorgan now has 153.4 million oz of total silver inventory or 50.36% of all official comex silver. (153.4 million/304.6 million

total customer deposits today: nil oz

we had 2 withdrawals out of the customer account:

i) out of int.Delaware 9656.603 oz

ii) Out of Scotia: 620,896.830 oz

total 630,553.433 oz

we had 1 adjustments :

i ) Out of CNT: 1,196,659.970 oz was adjusted out of the customer account and this lands into the dealer account.

total dealer silver: 92.323 million

total dealer + customer silver: 305.683 million oz

The total number of notices filed today for the JULY 2019. contract month is represented by 515 contract(s) FOR 2,575,000 oz

To calculate the number of silver ounces that will stand for delivery in JULY, we take the total number of notices filed for the month so far at 3135 x 5,000 oz = 15,675,000 oz to which we add the difference between the open interest for the front month of JULY. (1410) and the number of notices served upon today (515 x 5000 oz) equals the number of ounces standing.

.

Thus the INITIAL standings for silver for the JULY/2019 contract month: 3135(notices served so far)x 5000 oz + OI for front month of JULY( 1410) number of notices served upon today (515)x 5000 oz equals 20,150,000 oz of silver standing for the JULY contract month.

WE GAINED 164 CONTRACTS OR AN ADDITIONAL 820,000 OZ WILL STAND AT THE COMEX AS THESE GUYS REFUSED TO MORPH INTO A LONDON BASED FORWARDS AND AS WELL THEY ALSO NEGATED A FIAT BONUS. IT SEEMS THAT SOMEBODY WAS BADLY IN NEED OF PHYSICAL SILVER ON THIS SIDE OF THE POND JOINING GOLD!.

TODAY’S NUMBER OF NOTICES FILED:

We, today, had 515 notice(s) filed for 2,575,000 OZ for the JUNE, 2019 COMEX contract for silver

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

TODAY’S ESTIMATED SILVER VOLUME: 69,221 CONTRACTS (we had considerable spreading activity..accumulation

CONFIRMED VOLUME FOR YESTERDAY: 60,949 CONTRACTS..

YESTERDAY’S CONFIRMED VOLUME OF 260,949 CONTRACTS EQUATES to 304.7 million OZ 43.5% OF ANNUAL GLOBAL PRODUCTION OF SILVER..makes sense!!

COMMODITY LAW SUGGESTS THAT OPEN INTEREST SHOULD NOT BE MORE THAN 3% OF ANNUAL GLOBAL PRODUCTION. THE CROOKS ARE SUPPLYING MASSIVE PAPER TRYING TO KEEP SILVER IN CHECK.

The record level of silver open interest is 234,787 contracts set on April 21./2017 with the price at that day at $18.42

The previous record was 224,540 contracts with the price at that time of $20.44

end

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

GATA

ii) Physical stories courtesy of GATA/Chris Powell

Dave is correct: the raid was well orchestrated by our crooks

(Dave Kranzler/IRD/GATA)

Dave Kranzler: Expect raid on gold next week

Submitted by cpowell on Sun, 2019-06-30 03:34. Section: Daily Dispatches

11:35p ET Saturday, June 29, 2019

Dear Friend of GATA and Gold:

The week ahead probably will see attacks on the gold price by bullion banks because it includes the July 4 holiday in the United States and a financial crisis seems to be developing behind the scenes, Dave Kranzler of Investment Research Dynamics writes today.

“Low-volume holiday periods are the favorite time for the bullion banks to stage a raid on gold,” Kranzler writes. “The success of this raid is crucial to maintaining the illusion that obvious systemic problems are manageable.”

Kranzler’s commentary is headlined “Gold: Boom Goes the Dynamite” and it’s posted at IRD here:

http://investmentresearchdynamics.com/gold-boom-goes-the-dynamite-2/

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

end

Government debts are continually on the rise. So it is probably correct to assume that the only way to handle rising government debt is to lower all interest rates to zero or below

(Smith/Bloomberg/GATA)

Noah Smith: Zero interest rates forever may be only way to handle rising government debt

Submitted by cpowell on Sat, 2019-06-29 14:29. Section: Daily Dispatches

U.S. Is Heading to a Future of Zero Interest Rates Forever

By Noah Smith

Bloomberg News

Thursday, June 27, 2019

The Congressional Budget Office has just released its projections for the U.S. federal budget during the next 30 years. The picture is one of steadily rising deficits. Federal government borrowing now amounts to about 4.2% of gross domestic product each year. By 2049, the CBO predicts, that will more than double, to 8.7%:

Only a small portion of these deficits will be due to tax cuts; the CBO projection expects that individual income taxes rise substantially as a share of GDP. Nor will it be due to government profligacy; CBO predicts that discretionary spending will shrink substantially relative to the size of the economy.

…

Instead, the growth in deficits is mostly about two things. First, government health care spending is projected to grow, which is partly due to population aging and partly because the CBO predicts that medical costs will keep going up. Second, and even more importantly, the CBO predicts that interest rates will rise, forcing the government to spend much more on simply paying interest on its debt. The federal government now pays an average of 2.4 % to borrow; in three decades, the CBO predicts that this will rise to 4.2%.

If true, that will cause an exponential increase in the amount the government has to pay for debt service. …

… For the remainder of the commentary:

https://www.bloomberg.com/opinion/articles/2019-06-27/u-s-s-rising-debt-…

* * *

Help keep GATA going:

GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at:

http://www.gata.org

To contribute to GATA, please visit:

http://www.gata.org/node/16

end

A must read…

James Turk states that the run up in gold has created losses of 2.2 billion dollars in gold. Who can withstand such losses other than central banks.

(courtesy Kingworldnews/James Turk/GATA)

Only central banks could handle recent losses on gold futures sales, Turk says

Submitted by cpowell on Sun, 2019-06-30 19:39. Section: Daily Dispatches

3:39p ET Sunday, June 30, 2019

Dear Friend of GATA and Gold:

At King World News this weekend, GoldMoney founder James Turk says only central banks could accommodate the sort of losses — more than $2 billion — suffered by gold futures sellers since April:

https://kingworldnews.com/central-banks-see-massive-2-2-billion-in-losse…

And Swiss gold fund manager Egon von Greyerz says another Swiss bank seems to have misplaced its client’s gold, a reminder that no gold investor should store his gold with a bank:

https://kingworldnews.com/greyerz-another-swiss-bank-cant-find-their-cli…

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

end

Please join GATA from Nov. 1-4 at the New Orleans Investment Conference

Submitted by cpowell on Mon, 2019-07-01 01:49. Section: Daily Dispatches

9:48p ET Sunday, June 30, 2019

Dear Friend of GATA and Gold:

With four months to go, it’s time to start thinking about the biggest and most comprehensive financial conference in North America, the New Orleans Investment Conference, to be held Friday through Monday, November 1-4.

The conference’s speakers again will include GATA Chairman Bill Murphy and your secretary/treasurer. Also speaking will be GATA favorites including Gold Newsletter editor Brien Lundin, commodity newsletter editor Dennis Gartman, renowned contrarian Doug Casey of Casey Research, newsletter editors Mary Anne and Pamela Aden, Peter Boockvar of Bookmark Advisers, and Thom Calandra of The Calandra Report.

…

..The conference always is oriented toward sound money, free and transparent markets, and limited and accountable government and provides many prospective investment ideas, so GATA supporters always feel both comfortable and challenged there.

The conference continues to be held at the sensational Hilton New Orleans Riverside hotel downtown, on the banks of the Mississippi River at the northern entrance of the city’s famed RiverWalk shopping mall, just a few blocks from the historic French Quarter and across the street from Harrah’s casino.

Full of history, great restaurants, great music, fun, and romance, New Orleans competes mightily with the conference itself even as it much great value to the conference, so anyone considering attending the conference is well-advised to consider spending a few extra days in the city. November in New Orleans is usually balmy as winter descends on the rest of North America.

For more information about the conference and to register to attend, please visit:

https://neworleansconference.com/

We hope to see you there.

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

end

MbS has been very chummy with Trump who seems to have ignored the Khashoggi murder being orchestrated by the Prince. Now the Saudi’s are buying huge amounts of uSA treasuries.

(Bloomberg/GATA)

Saudi buying of U.S. Treasuries has soared since Trump election

Submitted by cpowell on Mon, 2019-07-01 02:38. Section: Daily Dispatches

By Liz McCormick

Bloomberg News

Sunday, June 30, 2019

By now, President Donald Trump’s bromance with Mohammed bin Salman of Saudi Arabia is well documented. The platitudes and chummy photo-ops. The billions of dollars in U.S. arms sales. And, of course, the willingness to brush aside evidence implicating the crown prince in the murder of journalist Jamal Khashoggi.

But what’s gone largely unnoticed is just how enthusiastic the kingdom has been in snapping up America’s debt.

…

After aggressively culling its holdings of U.S. government debt for most of 2016, Saudi Arabia has amassed an even larger position since Trump’s election in November that year. Based on the latest reported figures, the nation nearly doubled its ownership of Treasuries to $177 billion. No major foreign creditor has ramped up its lending to the U.S. faster. …

… For the remainder of the report:

https://www.bloomberg.com/news/articles/2019-06-30/saudi-buying-of-u-s-d…

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

PIC OF THE DAY

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

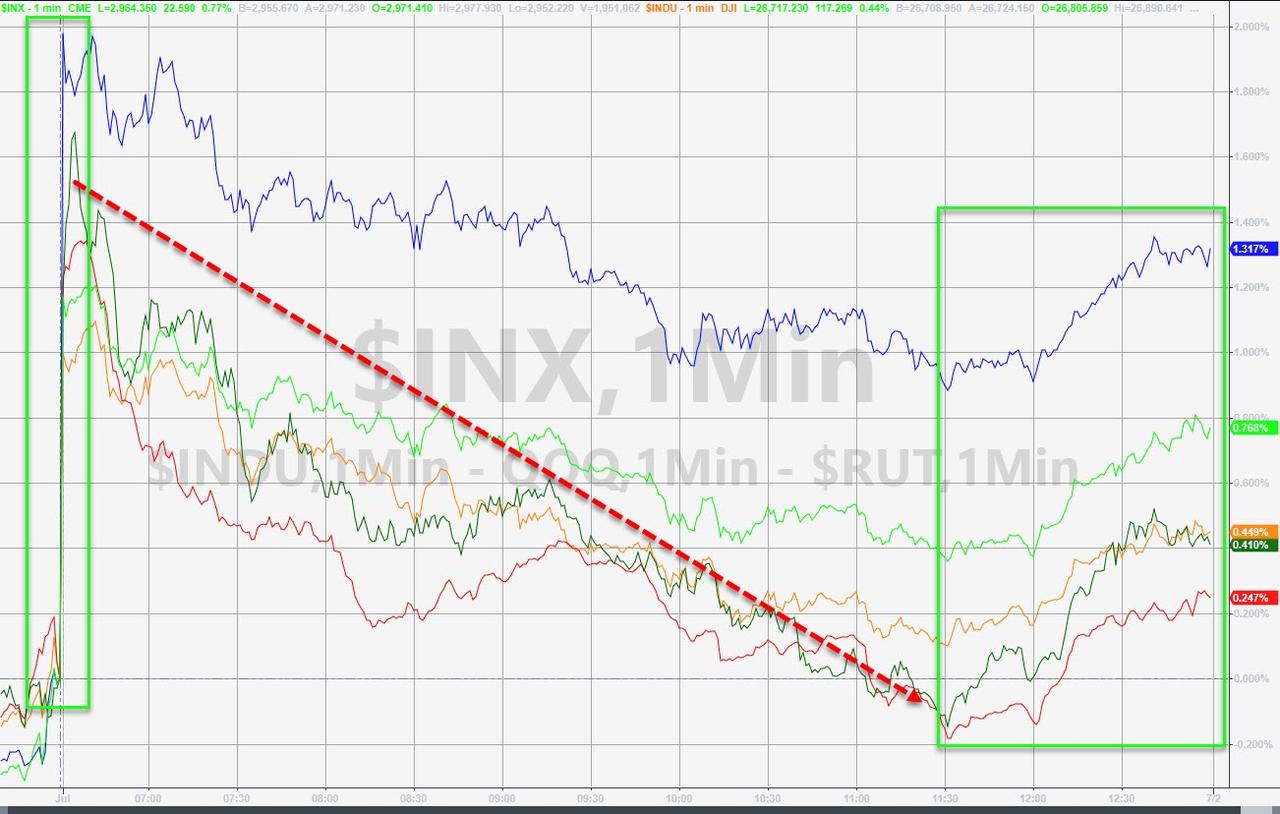

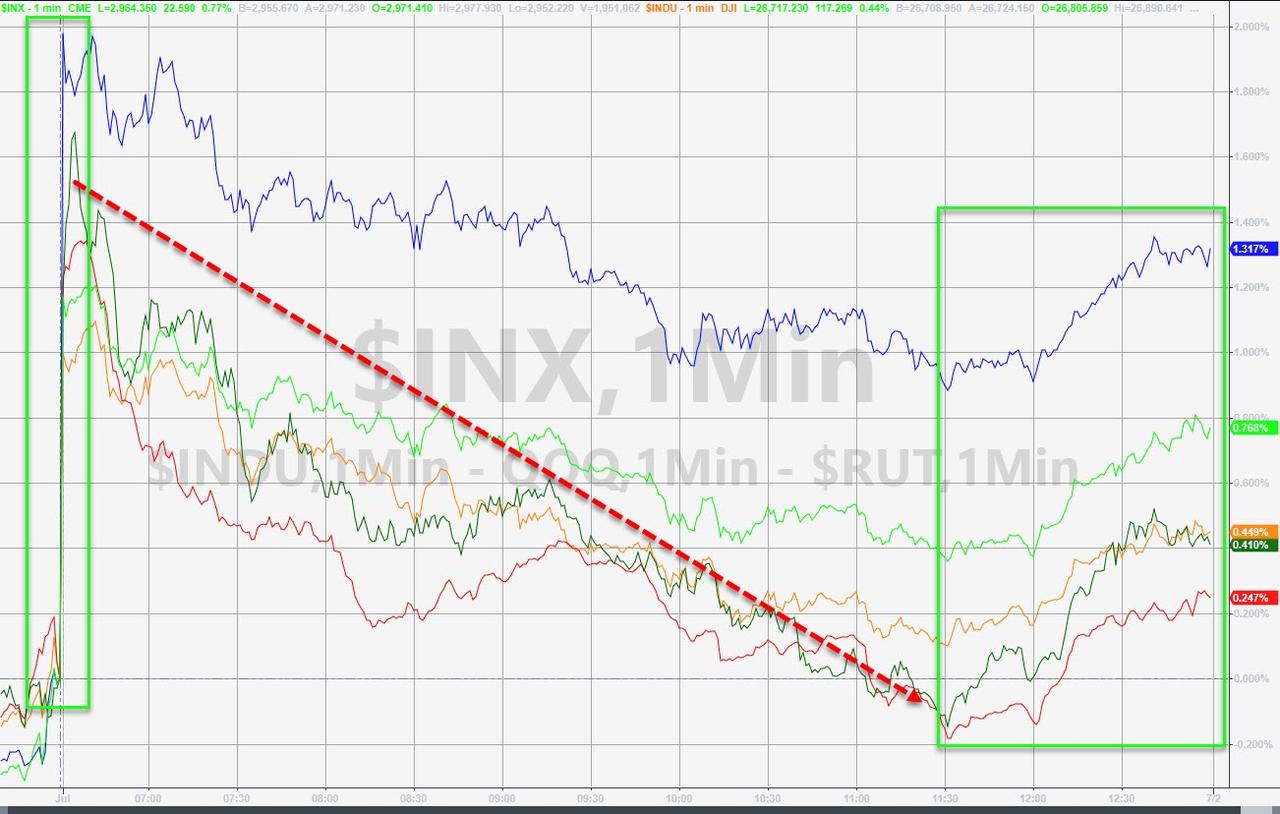

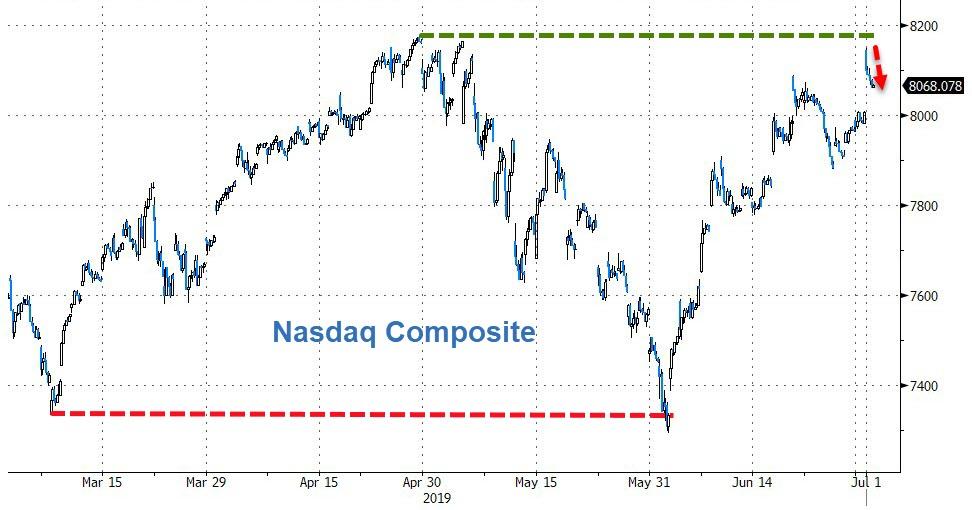

Traders Sell The Trade-Truce News But S&P Holds Record Highs

A China trade truce, surging chip stocks, and bad (economic) news that must be good ammo for The Fed to cut, BUT stocks faded all the gains – simply put, it’s never enough!!

Harvey**

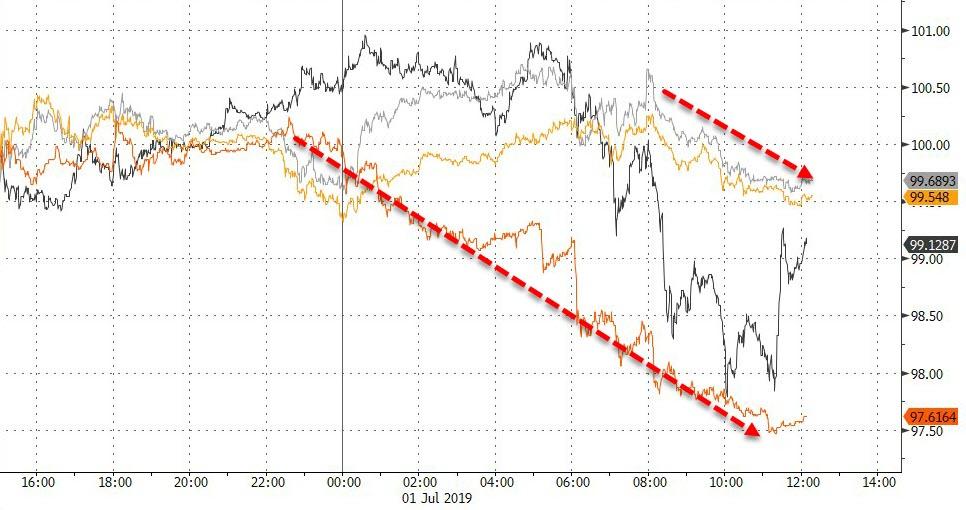

Chinese stocks surged on the trade-truce and while they maintained gains, the afternoon session saw barely any follow-through…

European stocks opened dramatically higher (on the trade truce) but faded practically non-stop from the open with Italy ending unch…

German bund yields fell to new record (negative) lows today and Italian yields dropped below 2.00% for the first time since May 2018…

Almost from the cash market open, US equities went in only one direction as “sell the news” dominated the nothing-burger truce deal…

Stocks managed a pretty good run into the close starting at 3pmET to ensure The S&P closed at a record closing high…

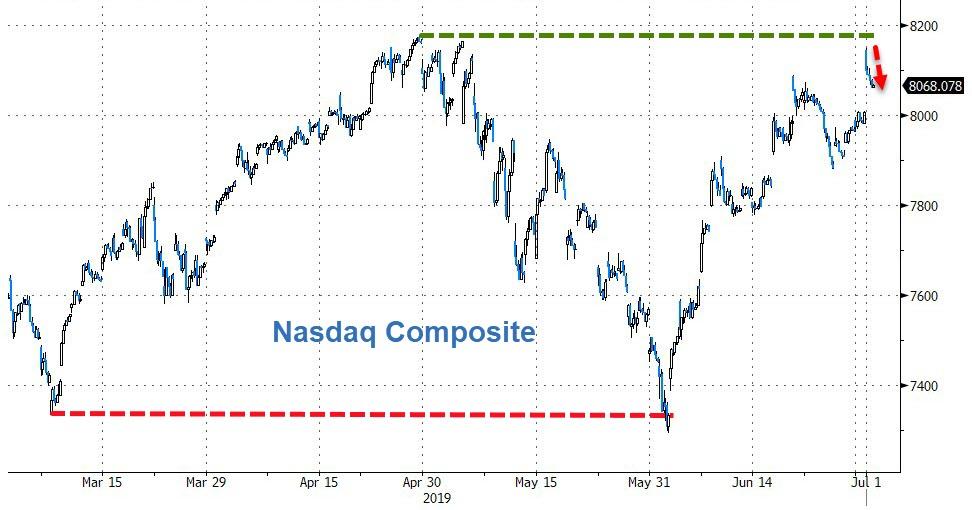

The Nasdaq outperformed however, helped by the biggest gap-up opening in SOX (Semis dramatically outperformed) in its history…

But notably, Nasdaq Composite failed to make new highs and was down by around 100 points from the highs…

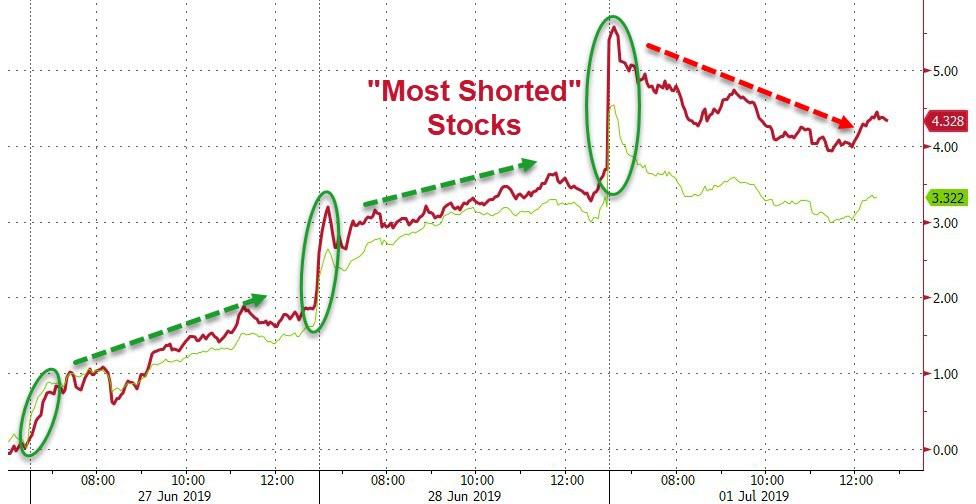

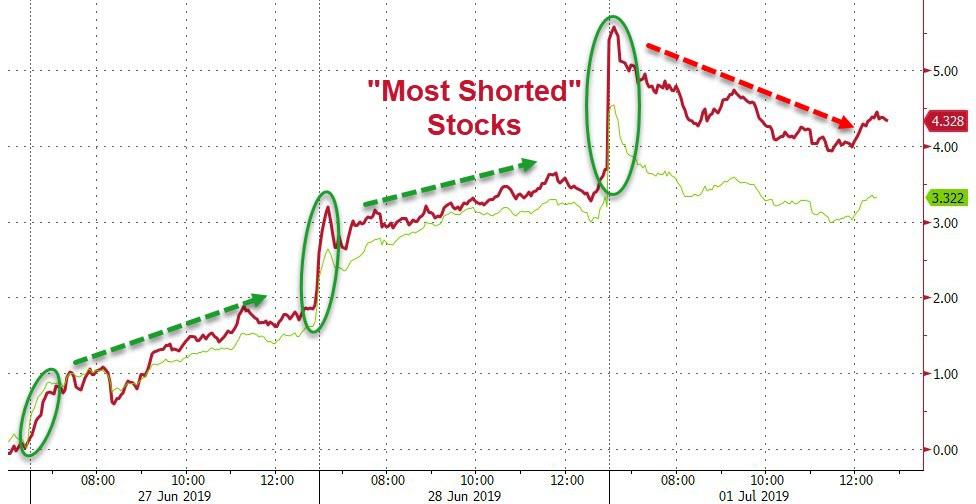

Giant short-squeeze at the US cash open – for the 3rd day in a row…

10Y Yields tested down to 2.00% once again (but bounced)…

As it seems “sell all the things hit shortly after the US open"

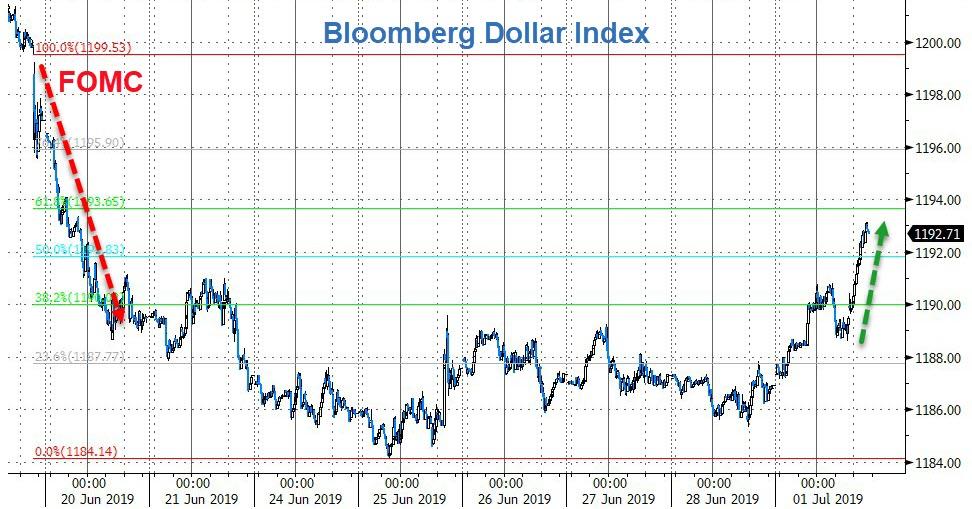

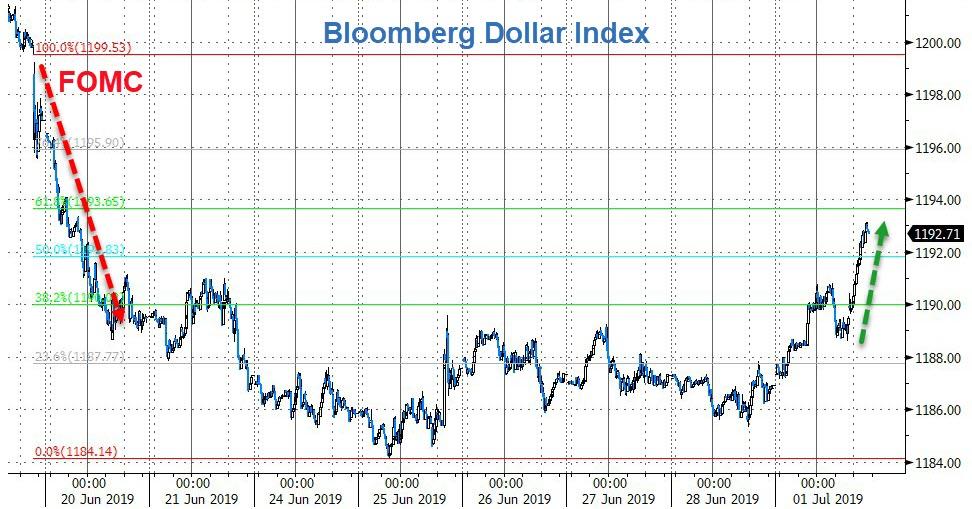

The dollar surged (retracing almost the Fib 61.8% of the post-FOMC losses)…

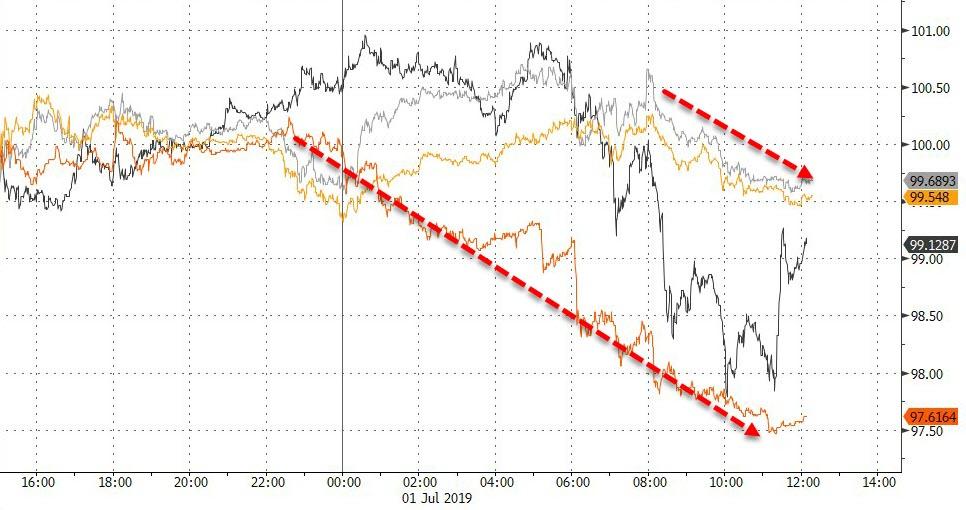

Yuan erased almost all of its trade-truce gains…

Dollar strength sent commodities broadly lower (even WTI faded despite OPEC+ deal chatter), gold and silver was least hit…

Gold fell back below $1400…

Oil price behavior was quite shocking, spiking on hype about an OPEC+ deal (Russia and Saudi agreeing a deal at G-20), then rolling over from the US equity market open, then spiking towards the NYMEX close…

And if the trade truce is so awesome, why did copper crap the bed?

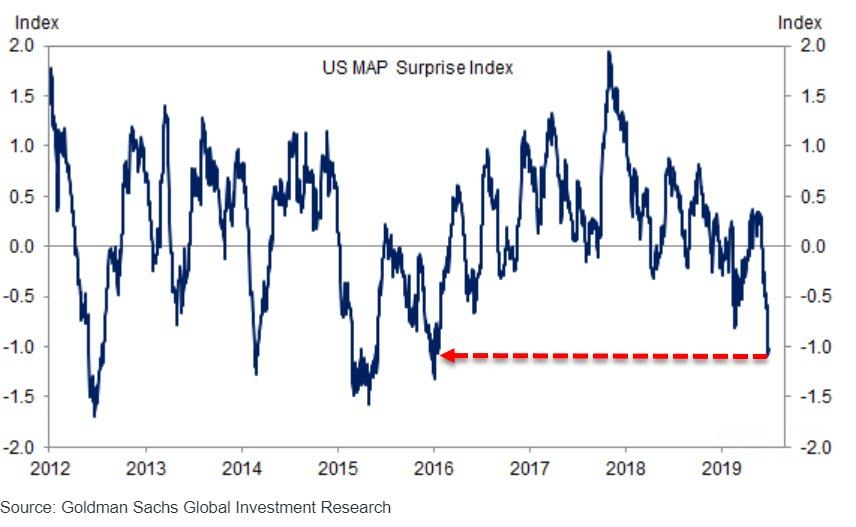

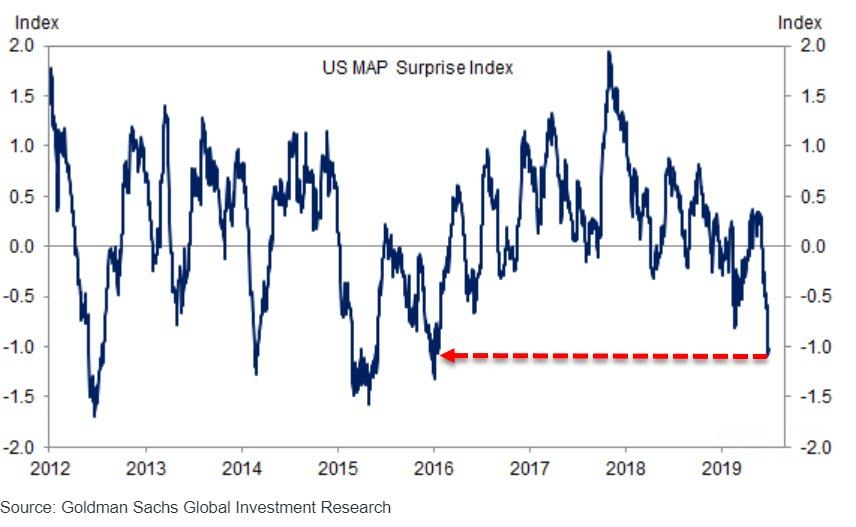

Finally, more dismal global macro data today, not helped at all by the US…

Seems to confirm bonds have it right…

So for all those buying stocks, do you really feel that lucky?

Read more Harvey here....

https://harveyorganblog.com/2019/07/01/july-1-another-raid-courtesy-of-our-crooked-banks-gold-down-24-70-to-1386-10-silver-down-16-cents-to-15-16-we-have-had-huge-open-interest-discrepancies-between-preliminary-gold-oi-and-final-oi/

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

**Harveys First Merit Awards for a Bumper-song & theme

**Special Thanks to All Helpers <3 and the ~*~Mining & Metals Du Jour~*~ Board <3

click top part of videos for links

tonight's show simo casted on Captain's Quarters board

MMMGYS**SiMO***Exclusively on IHUB educational purposes only***

.jpg)

MMMGYS

Good Morning Good Evening

'Mining Investor Insights Drawn From The Wells Of Minerals,Metals & Mining'

Welcome to ~The Graveyard Shift Minerals Metals & Mining Show~

On the show tonight: ~~Great Data & News by Harvey Organ ,~~ Jim Wyckoff from Kitco gives us the Gold & Silver AM/PM Round Up, ~~ In Our Continuing Series GATA 'Gold Rush 21' Exposes The Manipulation of The Gold Market By Central Banks, ~~ Treasure Tales: "California" Desert Steamers, and maybe more....

Hello everybody I'm J:D your host tonight Thanks for being with us.

Hope Your Having a Wonderful Evening

EnJoy the show

OK...Here We go...to the Numbers

MMMGYS

Thank you

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

JULY 1/ANOTHER RAID COURTESY OF OUR CROOKED BANKS: GOLD DOWN $24.70 TO $1386.10//SILVER DOWN 16 CENTS TO $15.16//WE HAVE HAD HUGE OPEN INTEREST DISCREPANCIES BETWEEN PRELIMINARY GOLD OI AND FINAL OI NUMBERS ON 6 OUT OF LAST 7 TRADING DAYS//CEASE FIRE BETWEEN TRUMP AND XI WITH TRUMP GIVING ANOTHER REPRIEVE TO HUAWEI AND GET INCREASE CHINESE PURCHASES OF AMERICAN GOODS //POOR PMI NUMBERS (MFG) IN CHINA AND ALL ACROSS THE GLOBE//MORE PROTESTS IN HONG KONG YESTERDAY AND TODAY//ISRAEL STRIKES AGAIN INTO SYRIA/IRAN ANNOUNCES THAT IT HAS SURPASSED THE 300 KG LIMIT ON URANIUM ENRICHMENT//

July 1, 2019 · by harveyorgan · in Uncat

GOLD: $1386.10 DOWN $24.70 (COMEX TO COMEX CLOSING)

Silver: $15,16 DOWN 16 CENTS (COMEX TO COMEX CLOSING)//

Closing access prices:

Gold : $1383.50

silver: $15.14

This is a holiday week with many taking off as July 4 in the USA is their independence day. As always, this is an excuse for the crooks to raid as many are away. The fun will begin on Monday July 8.

YOUR DATA…

COMEX DATA

JPMorgan has been receiving gold with reckless abandon and sometimes supplying (stopping)

today RECEIVING 84/193

EXCHANGE: COMEX

CONTRACT: JULY 2019 COMEX 100 GOLD FUTURES

SETTLEMENT: 1,409.700000000 USD

INTENT DATE: 06/28/2019 DELIVERY DATE: 07/02/2019

FIRM ORG FIRM NAME ISSUED STOPPED

____________________________________________________________________________________________

167 H MAREX 6

624 C BOFA SECURITIES 3

657 C MORGAN STANLEY 14

661 C JP MORGAN 74

661 H JP MORGAN 10

690 C ABN AMRO 13 17

737 C ADVANTAGE 73 63

800 C MAREX SPEC 101

905 C ADM 12

____________________________________________________________________________________________

TOTAL: 193 193

MONTH TO DATE: 564

NUMBER OF NOTICES FILED TODAY FOR JULY CONTRACT: 193 NOTICE(S) FOR 19,300 OZ (0.2674 tonnes)

TOTAL NUMBER OF NOTICES FILED SO FAR: 564 NOTICES FOR 56,400 OZ (1.754 TONNES)

SILVER

FOR JULY

515 NOTICE(S) FILED TODAY FOR 2,575,000 OZ/

total number of notices filed so far this month: 3135 for 15,675,000 oz

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Bitcoin: OPENING MORNING TRADE : $ 10,933 DOWN 527

Bitcoin: FINAL EVENING TRADE: $ 10,157 DOWN 675

end

Let us have a look at the data for today

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

IN SILVER THE COMEX OI FELL A CONSIDERABLE SIZED 2257 CONTRACTS FROM 220,612 DOWN TO 218,355 DESPITE THE 6 CENT GAIN IN SILVER PRICING AT THE COMEX.

TODAY WE ARRIVED FURTHER FROM AUGUST’S 2018 RECORD SETTING OPEN INTEREST OF 244,196 CONTRACTS.

WE HAVE ALSO WITNESSED A LARGE AMOUNT OF PHYSICAL METAL STAND FOR COMEX DELIVERY AS WELL WE ARE WITNESSING CONSIDERABLE LONGS PACKING THEIR BAGS AND MIGRATING OVER TO LONDON IN GREATER NUMBERS IN THE FORM OF EFP’S. WE WERE NOTIFIED THAT WE HAD A STRONG SIZED NUMBER OF COMEX LONGS TRANSFERRING THEIR CONTRACTS TO LONDON THROUGH THE EFP:,

0 FOR JULY. 0 FOR AUGUST, 1816 FOR SEPT, AND ZERO FOR ALL OTHER MONTHS AND THEREFORE TOTAL ISSUANCE 1816 CONTRACTS. WITH THE TRANSFER OF 1816 CONTRACTS, WHAT THE CME IS STATING IS THAT THERE IS NO SILVER (OR GOLD) TO BE DELIVERED UPON AT THE COMEX AS THEY MUST EXPORT THEIR OBLIGATION TO LONDON. ALSO KEEP IN MIND THAT THERE CAN BE A DELAY OF 24-48 HRS IN THE ISSUING OF EFP’S. THE 1816 EFP CONTRACTS TRANSLATES INTO 9.08 MILLION OZ ACCOMPANYING:

1.THE 6 CENT GAIN IN SILVER PRICE AT THE COMEX AND

2. THE STRONG AMOUNT OF SILVER OUNCES WHICH STOOD FOR DELIVERY IN THE LAST 12 MONTHS:

JUNE/2018. (5.420 MILLION OZ);

FOR JULY: 30.370 MILLION OZ

FOR AUG., 6.065 MILLION OZ

FOR SEPT. 39.505 MILLION OZ S

FOR OCT.2.525 MILLION OZ.

FOR NOV: A HUGE 7.440 MILLION OZ STANDING AND

21.925 MILLION OZ FINALLY STAND FOR DECEMBER.

5.845 MILLION OZ STAND IN JANUARY.

2.955 MILLION OZ STANDING FOR FEBRUARY.:

27.120 MILLION OZ STANDING IN MARCH.

3.875 MILLION OZ STANDING FOR SILVER IN APRIL.

18.845 MILLION OZ STANDING FOR SILVER IN MAY.

2.660 MILLION OZ STANDING FOR SILVER IN JUNE//

20.150 MILLION OZ INITIAL STANDING FOR JULY

WE HAD CONSIDERABLE SHORT COVERING AT THE SILVER COMEX FRIDAY ..AND ZERO SPREADING ACCUMULATION SO FAR.

ACCUMULATION FOR EFP’S/SILVER/J.P.MORGAN’S HOUSE OF BRIBES, / STARTING FROM FIRST DAY NOTICE/FOR MONTH OF JULY:

1816 CONTRACTS (FOR 1 TRADING DAY TOTAL 1816 CONTRACTS) OR 9.08 MILLION OZ: (AVERAGE PER DAY: 1816 CONTRACTS OR 9.08 MILLION OZ/DAY)

TO GIVE YOU AN IDEA AS TO THE HUGE SUPPLY THIS MONTH IN SILVER: SO FAR THIS MONTH OF JULY: 9.08 MILLION PAPER OZ HAVE MORPHED OVER TO LONDON. THIS REPRESENTS AROUND 1.29% OF ANNUAL GLOBAL PRODUCTION (EX CHINA EX RUSSIA)* JUNE’S 345.43 MILLION OZ IS THE SECOND HIGHEST RECORDED ISSUANCE OF EFP’S AND IT FOLLOWED THE RECORD SET IN APRIL 2018 OF 385.75 MILLION OZ.

ACCUMULATION IN YEAR 2019 TO DATE SILVER EFP’S: 1166.57 MILLION OZ.

JANUARY 2019 EFP TOTALS: 217.455. MILLION OZ

FEB 2019 TOTALS: 147.4 MILLION OZ/

MARCH 2019 TOTAL EFP ISSUANCE: 207.835 MILLION OZ

APRIL 2019 TOTAL EFP ISSUANCE: 182.87 MILLION OZ.

MAY 2019: TOTAL EFP ISSUANCE: 136.55 MILLION OZ

JUNE 2019 , TOTAL EFP ISSUANCE: 265.38 MILLION OZ

RESULT: WE HAD A CONSIDERABLE SIZED DECREASE IN COMEX OI SILVER COMEX CONTRACTS OF 2257, DESPITE THE 6 CENT GAIN IN SILVER PRICING AT THE COMEX /YESTERDAY... THE CME NOTIFIED US THAT WE HAD A STRONG SIZED EFP ISSUANCE OF 1816 CONTRACTS WHICH EXITED OUT OF THE SILVER COMEX AND TRANSFERRED THEIR OI TO LONDON AS FORWARDS. SPECULATORS CONTINUED THEIR INTEREST IN ATTACKING THE SILVER COMEX FOR PHYSICAL SILVER (SEE COMEX DATA) .

TODAY WE LOST A SMALL SIZED: 441 TOTAL OI CONTRACTS ON THE TWO EXCHANGES:

i.e 1816 OPEN INTEREST CONTRACTS HEADED FOR LONDON (EFP’s) TOGETHER WITH DECREASE OF 2257 OI COMEX CONTRACTS. AND ALL OF THIS DEMAND HAPPENED WITH A 6 CENT GAIN IN PRICE OF SILVER AND A CLOSING PRICE OF $15.32 WITH RESPECT TO FRIDAY’S TRADING. YET WE STILL HAVE A STRONG AMOUNT OF SILVER STANDING AT THE COMEX FOR DELIVERY!!

In ounces AT THE COMEX, the OI is still represented by JUST OVER 1 BILLION oz i.e. 1.187 BILLION OZ TO BE EXACT or 169% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT MARCH MONTH/ THEY FILED AT THE COMEX: 515 NOTICE(S) FOR 2,575,000 OZ OF SILVER

IN SILVER,PRIOR TO TODAY, WE SET THE NEW COMEX RECORD OF OPEN INTEREST AT 243,411 CONTRACTS ON APRIL 9.2018. AND AGAIN THIS HAS BEEN SET WITH A LOW PRICE OF $16.51.

AND NOW WE RECORD FOR POSTERITY ANOTHER ALL TIME RECORD OPEN INTEREST AT THE COMEX OF 244,196 CONTRACTS ON AUGUST 22/2018 AND AGAIN WHEN THIS RECORD WAS SET, THE PRICE OF SILVER WAS $14.78 AND LOWER IN PRICE THAN PREVIOUS RECORDS.

ON THE DEMAND SIDE WE HAVE THE FOLLOWING:

HUGE AMOUNTS OF SILVER STANDING FOR DELIVERY (MARCH/2018: 27 MILLION OZ , APRIL/2018 : 2.485 MILLION OZ MAY: 36.285 MILLION OZ ; JUNE/2018 (5.420 MILLION OZ) , JULY 2018 FINAL AMOUNT STANDING: 30.370 MILLION OZ ) FOR AUGUST 6.065 MILLION OZ. , SEPT: A HUGE 39.505 MILLION OZ./ OCTOBER: 2,520,000 oz NOV AT 7.440 MILLION OZ./ DEC. AT 21.925 MILLION OZ JANUARY AT 5.825 MILLION OZ.AND FEB 2019: 2.955 MILLION OZ/ MARCH: 27.120 MILLION OZ/ APRIL AT 3.875 MILLION OZ/ A MAY: 18.845 MILLION OZ ..JUNE 2.660 MILLION OZ//JULY 20.150 MILLION OZ

HUGE RECORD OPEN INTEREST IN SILVER 243,411 CONTRACTS (OR 1.217 BILLION OZ/ SET APRIL 9/2018) AND NOW AUGUST 22/2018: 244,196 CONTRACTS, WITH A SILVER PRICE OF $14.78.

HUGE ANNUAL EFP’S ISSUANCE EQUAL TO 2.9 BILLION OZ OR 400% OF SILVER ANNUAL PRODUCTION/2017

RECORD SETTING EFP ISSUANCE FOR ANY MONTH IN SILVER; APRIL/2018/ 385.75 MILLION OZ/ AND THE SECOND HIGHEST RECORDED EFP ISSUANCE JUNE 2018 345.43 MILLION OZ

AND YET, WITH THE EXTREMELY HIGH EFP ISSUANCE, WE HAVE A CONTINUAL LOW PRICE OF SILVER DESPITE THE ABOVE HUGE DEMAND. TO ME THE ONLY ANSWER IS THAT WE HAVE SOVEREIGN (CHINA) WHO IS ENDEAVOURING TO GOBBLE UP ALL AVAILABLE PHYSICAL SILVER NO MATTER WHERE, EXACTLY WHAT J.P.MORGAN IS DOING. AND IT IS MY BELIEF THAT J.P.MORGAN IS HOLDING ITS SILVER FOR ITS BENEFICIAL OWNER..THE USA GOVERNMENT WHO IN TURN IS HOLDING THAT SILVER FOR CHINA.(FOR A SILVER LOAN REPAYMENT)

.

WITH RESPECT TO SPREADING: WE WILL WITNESS THE MORPHING OF OUR SPREADERS OUT OF SILVER AND INTO GOLD AS THE JULY MONTH PROCEEDS INTO THE ACTIVE DELIVERY MONTH OF AUGUST.

.

FOR NEWCOMERS, HERE IS THE MODUS OPERANDI OF THE CORRUPT BANKERS WITH RESPECT TO THEIR SPREAD/TRADING.

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES:

“AS YOU WILL SEE, THE CROOKS WILL NOW SWITCHED TO SILVER AS THEY INCREASE THE OPEN INTEREST FOR THE SPREADERS. THE TOTAL COMEX GOLD OPEN INTEREST WILL RISE FROM NOW ON UNTIL ONE WEEK PRIOR TO FIRST DAY NOTICE AND THAT IS WHEN THEY START THEIR CRIMINAL LIQUIDATION.

HERE IS HOW THE CROOKS USED SPREADING AS WE ARE NO INTO THE NON ACTIVE DELIVERY MONTH OF JULY HEADING TOWARDS THE VERY ACTIVE DELIVERY MONTH OF AUGUST.

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES, HERE IS THE BANKERS MODUS OPERANDI:

YOU WILL ALSO NOTICE THAT THE COMEX OPEN INTEREST IS STARTING TO RISE IN THIS NON ACTIVE MONTH OF JULY BUT SO IS THE OPEN INTEREST OF SPREADERS. THE OPEN INTEREST IN SILVER WILL CONTINUE TO RISE UNTIL ONE WEEK BEFORE FIRST DAY NOTICE OF AN UPCOMING ACTIVE DELIVERY MONTH (JULY), AND THAT IS WHEN THE CROOKS SELL THEIR SPREAD POSITIONS BUT NOT AT THE SAME TIME OF THE DAY. THEY WILL USE THE SELL SIDE OF THE EQUATION TO CREATE THE CASCADE (ALONG WITH THEIR COLLUSIVE FRIENDS) AND THEN COVER ON THE BUY SIDE OF THE SPREAD SITUATION AT THE END OF THE DAY. THEY DO THIS TO AVOID POSITION LIMIT DETECTION. THE LIQUIDATION OF THE SPREADING FORMATION CONTINUES FOR EXACTLY ONE WEEK AND ENDS ON FIRST DAY NOTICE.”

IN GOLD, THE OPEN INTEREST FELL BY A SMALL 1341 CONTRACTS, TO 580,855 ACCOMPANYING THE TINY $0.90 PRICING GAIN WITH RESPECT TO COMEX GOLD PRICING YESTERDAY// /THE SPREADING LIQUIDATION WILL NOW COMMENCE FOR GOLD….

FOR THE 6TH TIME IN THE LAST 7 TRADING DAYS WE HAVE WITNESSED A HUGE REDUCTION FORM THE PRELIMINARY GOLD OPEN INTEREST TO THE FINAL OI NUMBER. THE ONLY ANSWER TO THIS IS MASSIVE FRAUD TO WHICH THE CFTC REFUSED TO ANSWER…

THE CME RELEASED THE DATA FOR EFP ISSUANCE AND IT TOTALED A STRONG SIZED 5397 CONTRACTS:

APRIL 0 CONTRACTS,JUNE: 0 CONTRACTS, AUGUST 2019: 5397 CONTRACTS, DEC> 0 CONTRACTS AND ALL OTHER MONTHS ZERO. The NEW COMEX OI for the gold complex rests at 580,855. ALSO REMEMBER THAT THERE WILL BE A DELAY IN THE ISSUANCE OF EFP’S. THE BANKERS REMOVE LONG POSITIONS OF COMEX GOLD IMMEDIATELY. THEN THEY ORCHESTRATE THEIR PRIVATE EFP DEAL WITH THE LONGS AND THAT COULD TAKE AN ADDITIONAL, 48 HRS SO WE GENERALLY DO NOT GET A MATCH WITH RESPECT TO DEPARTING COMEX LONGS AND NEW EFP LONG TRANSFERS. . EVEN THOUGH THE BANKERS ISSUED THESE MONSTROUS EFPS, THE OBLIGATION STILL RESTS WITH THE BANKERS TO SUPPLY METAL BUT IT TRANSFERS THE RISK TO A LONDON BANKER OBLIGATION AND NOT A NEW YORK COMEX OBLIGATION. LONGS RECEIVE A FIAT BONUS TOGETHER WITH A LONG LONDON FORWARD. THUS, BY THESE ACTIONS, THE BANKERS AT THE COMEX HAVE JUST STATED THAT THEY HAVE NO APPRECIABLE METAL!! THIS IS A MASSIVE FRAUD: THEY CANNOT SUPPLY ANY METAL TO OUR COMEX LONGS BUT THEY ARE QUITE WILLING TO SUPPLY MASSIVE NON BACKED GOLD (AND SILVER) PAPER KNOWING THAT THEY HAVE NO METAL TO SATISFY OUR LONGS. LONDON IS NOW SEVERELY BACKWARD IN BOTH GOLD AND SILVER AND WE ARE WITNESSING DELAYS IN ACTUAL DELIVERIES.

IN ESSENCE WE HAVE A GOOD SIZED GAIN IN TOTAL CONTRACTS ON THE TWO EXCHANGES OF 6738 CONTRACTS: 1341 CONTRACTS INCREASED AT THE COMEX AND 5397 EFP OI CONTRACTS WHICH NAVIGATED OVER TO LONDON. THUS TOTAL OI GAIN OF 6738 CONTRACTS OR 673,800 OZ OR 20.95 TONNES. FRIDAY WE HAD A TINY GAIN OF $0.90 IN GOLD TRADING.…AND WITH THAT TINY GAIN IN PRICE, WE HAD A STRONG GAIN IN GOLD TONNAGE OF 20.95 TONNES!!!!!! THE BANKERS WERE SUPPLYING INFINITE SUPPLIES OF SHORT GOLD COMEX PAPER.

ACCUMULATION OF EFP’S GOLD AT J.P. MORGAN’S HOUSE OF BRIBES: (EXCHANGE FOR PHYSICAL) FOR THE MONTH OF JULY : 5397 CONTRACTS OR 539,700 oz OR 16.786 TONNES (1 TRADING DAY AND THUS AVERAGING: 5397 EFP CONTRACTS PER TRADING DAY

TO GIVE YOU AN IDEA AS TO THE STRONG SIZE OF THESE EFP TRANSFERS : THIS MONTH IN 1 TRADING DAY IN TONNES: 16.786 TONNES

TOTAL ANNUAL GOLD PRODUCTION, 2018, THROUGHOUT THE WORLD EX CHINA EX RUSSIA: 3555 TONNES

THUS EFP TRANSFERS REPRESENTS 16.786/3550 x 100% TONNES =0.47% OF GLOBAL ANNUAL PRODUCTION

ACCUMULATION OF GOLD EFP’S YEAR 2019 TO DATE: 2,936.92 TONNES

JANUARY 2019 TOTAL EFP ISSUANCE; 531.20 TONNES

FEB 2019 TOTAL EFP ISSUANCE: 344.36 TONNES

MARCH 2019 TOTAL EFP ISSUANCE: 497.16 TONNES

APRIL 2019 TOTAL ISSUANCE: 456.10 TONNES

MAY 2019 TOTAL ISSUANCE: 449.10 TONNES

JUNE 2019 TOTAL ISSUANCE: 642.22 TONNES

WHAT IS ALARMING TO ME, ACCORDING TO OUR LONDON EXPERT ANDREW MAGUIRE IS THAT THESE EFP’S ARE BEING TRANSFERRED TO WHAT ARE CALLED SERIAL FORWARD CONTRACT OBLIGATIONS AND THESE CONTRACTS ARE LESS THAN 14 DAYS. ANYTHING GREATER THAN 14 DAYS, THESE MUST BE RECORDED AND SENT TO THE COMPTROLLER, GREAT BRITAIN TO MONITOR RISK TO THE BANKING SYSTEM. IF THIS IS INDEED TRUE, THEN THIS IS A MASSIVE CONSPIRACY TO DEFRAUD AS WE NOW WITNESS A MONSTROUS TOTAL EFP’S ISSUANCE AS IT HEADS INTO THE STRATOSPHERE.

Result: A FAIR SIZED INCREASE IN OI AT THE COMEX OF 1341 WITH THE TINY PRICING GAIN THAT GOLD UNDERTOOK ON FRIDAY($0.90)) //.WE ALSO HAD A STRONG SIZED NUMBER OF COMEX LONG TRANSFERRING TO LONDON THROUGH THE EFP ROUTE: 5397 CONTRACTS AS THESE HAVE ALREADY BEEN NEGOTIATED AND CONFIRMED. THERE OBVIOUSLY DOES NOT SEEM TO BE MUCH PHYSICAL GOLD AT THE COMEX. I GUESS IT EXPLAINS THE HUGE ISSUANCE OF EFP’S…THERE IS HARDLY ANY GOLD PRESENT AT THE GOLD COMEX FOR DELIVERY PURPOSES. IF YOU TAKE INTO ACCOUNT THE 5397 EFP CONTRACTS ISSUED, WE HAD A GOOD SIZED GAIN OF 6738 CONTRACTS IN TOTAL OPEN INTEREST ON THE TWO EXCHANGES:

5397 CONTRACTS MOVE TO LONDON AND 1341 CONTRACTS INCREASED AT THE COMEX. (IN TONNES, THE GAIN IN TOTAL OI EQUATES TO 20.95 TONNES). ..AND THIS HUGE INCREASE OF DEMAND OCCURRED ACCOMPANYING THE TINY GAIN IN PRICE OF $0.90 WITH RESPECT TO FRIDAY’S TRADING AT THE COMEX. WE WILL COMMENCE WITH SPREADING ACCUMULATION IN GOLD AS THE MONTH PROCEEDS/

we had: 193 notice(s) filed upon for 19300 oz of gold at the comex.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

With respect to our two criminal funds, the GLD and the SLV:

GLD...

WITH GOLD DOWN $24.70 TODAY//

A HUGE CHANGE IN GOLD INVENTORY AT THE GLD: A PAPER WITHDRAWAL OF 1.76 TONNES

WHICH WAS UTILIZED IN THE RAID TODAY.

INVENTORY RESTS AT 794.04 TONNES

TO ALL INVESTORS THINKING OF BUYING GOLD THROUGH THE GLD ROUTE: YOU ARE MAKING A TERRIBLE MISTAKE AS THE CROOKS ARE USING WHATEVER GOLD COMES IN TO ATTACK BY SELLING THAT GOLD. IT SURE SEEMS TO ME THAT THE GOLD OBLIGATIONS AT THE GLD EXCEED THEIR INVENTORY

SLV/

WITH SILVER DOWN 16 CENTS TODAY:

A BIG CHANGES WITH RESPECT TO SILVER INVENTORY AT THE SILVER SLV:

A SURPRISING PAPER DEPOSIT OF 936,000 OZ

/INVENTORY RESTS AT 323.330 MILLION OZ.

end

OUTLINE OF TOPICS TONIGHT

First, here is an outline of what will be discussed tonight:

1. Today, we had the open interest in SILVER FELL BY A CONSIDERABLE SIZED 2257 CONTRACTS from 220,612 DOWN TO 218,355 AND FURTHER FROM THE NEW COMEX RECORD SET LAST IN AUG.2018 AT 244,196 WITH A SILVER PRICE OF $14.78/(AUGUST 22/2018)..THE PREVIOUS RECORD WAS SET ON APRIL 9/2018 AT 243,411 OPEN INTEREST CONTRACTS WITH THE SILVER PRICE AT THAT DAY: $16.53). AND PREVIOUS TO THAT, THE RECORD WAS ESTABLISHED AT: 234,787 CONTRACTS, SET ON APRIL 21.2017 OVER 1 1/3 YEARS AGO. THE PRICE OF SILVER ON THAT DAY: $17.89. AS YOU CAN SEE, WE HAVE RECORD HIGH OPEN INTERESTS IN SILVER ACCOMPANIED BY A CONTINUAL LOWER PRICE WHEN THAT RECORD WAS SET…..THE SPREADERS HAVE COMMENCED THEIR ACCUMULATION OF OPEN INTEREST CONTRACTS IN SILVER AND STOPPED THE LIQUIDATION OF THE SPREADERS IN GOLD

EFP ISSUANCE:

OUR CUSTOMARY MIGRATION OF COMEX LONGS CONTINUE TO MORPH INTO LONDON FORWARDS AS OUR BANKERS USED THEIR EMERGENCY PROCEDURE TO ISSUE:

FOR JULY: 0 CONTRACTS FOR AUGUST: 0, FOR SEPT. 1816 AND ALL OTHER MONTHS: ZERO. TOTAL EFP ISSUANCE: 1816 CONTRACTS. EFP’S GIVE OUR COMEX LONGS A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. IF WE TAKE THE OI LOSS AT THE COMEX OF 2025 CONTRACTS TO THE 1816 OI TRANSFERRED TO LONDON THROUGH EFP’S, WE OBTAIN A SMALL LOSS OF 441 OPEN INTEREST CONTRACTS. THUS IN OUNCES, THE LOSS ON THE TWO EXCHANGES: 1.045 MILLION OZ!!! AND YET WE ALSO HAVE A STRONG DEMAND FOR PHYSICAL AS WE WITNESSED A FINAL STANDING OF GREATER THAN 30 MILLION OZ FOR JULY, A STRONG 7.475 MILLION OZ FOR AUGUST.. A HUGE 39.505 MILLION OZ STANDING FOR SILVER IN SEPTEMBER… OVER 2 million OZ STANDING FOR THE NON ACTIVE MONTH OF OCTOBER., 7.440 MILLION OZ FINALLY STANDING IN NOVEMBER. 21.925 MILLION OZ STANDING IN DECEMBER , 5.845 MILLION OZ STANDING IN JANUARY. 2.955 MILLION OZ STANDING IN FEBRUARY, 27.120 MILLION OZ FOR MARCH., 3.875 MILLION OZ FOR APRIL 18.765 MILLION OZ FOR MAY ; 2.660 MILLION OZ FOR JUNE AND NOW JULY AT 20.150 MILLION OZ STANDING SO FAR.

RESULT: A CONSIDERABLE SIZED DECREASE IN SILVER OI AT THE COMEX DESPITE THE 6 CENT GAIN IN PRICING THAT SILVER UNDERTOOK IN PRICING// YESTERDAY. WE ALSO HAD A STRONG SIZED 1816 EFP’S ISSUED TRANSFERRING COMEX LONGS OVER TO LONDON. TOGETHER WITH THE STRONG SIZED AMOUNT OF SILVER OUNCES STANDING FOR THIS MONTH, DEMAND FOR PHYSICAL SILVER CONTINUES TO INTENSIFY AS WE WITNESS SEVERE BACKWARDATION IN SILVER IN LONDON.

BOTH THE SILVER COMEX AND THE GOLD COMEX ARE IN STRESS AS THE BANKERS SCOUR THE BOWELS OF THE EXCHANGE FOR METAL

(report Harvey)

.

2 ) Gold/silver trading overnight Europe, Goldcore

(Mark O’Byrne/zerohedge

and in NY: Bloomberg

3. ASIAN AFFAIRS

)MONDAY MORNING/ SUNDAY NIGHT:

SHANGHAI CLOSED UP 66.03 POINTS OR 2.22% //Hang Sang CLOSED DOWN 78.80 POINTS OR 0.28% /The Nikkei closed UP 454.05 POINTS OR 2.13%//Australia’s all ordinaires CLOSED UP .48%

/Chinese yuan (ONSHORE) closed UP at 6.8427 /Oil UP TO 60.02 dollars per barrel for WTI and 66.53 for Brent. Stocks in Europe OPENED GREEN// ONSHORE YUAN CLOSED UP // LAST AT 6.8427 AGAINST THE DOLLAR. OFFSHORE YUAN CLOSED UP ON THE DOLLAR AT 6.8421 TRADE TALKS RESUME//YUAN LEVELS GETTING DANGEROUSLY CLOSE TO 7:1//TRUMP INITIATES A NEW 25% TARIFFS FRIDAY/MAY 10/MAJOR PROBLEMS AT HUAWEI /CFO ARRESTED : /ONSHORE YUAN TRADING BELOW LEVEL OF OFFSHORE YUAN/ONSHORE YUAN TRADING STRONGER AGAINST USA DOLLAR/OFFSHORE YUAN TRADING STRONGER AGAINST THE DOLLAR /TRADE DEAL NOW DEAD..TRUMP RAISED RATES TO 25%

3A//NORTH KOREA/ SOUTH KOREA

b) REPORT ON JAPAN

3 China/Chinese affairs

i)China/

Early Saturday morning/Friday night: China and the USA agree to a ceasefire as their trade talks are back on. Trump concedes on Huawei and China agrees to purchase more goods. The problem is now with Powell as he will probably delay his interest rate cuts.

( zerohedge)

ii)Wall Street responds/Saturday morning

( zerohedge)

iii)This is not good for China. Last night they revealed with latest Mfg PMI and it was awful as it fell below 50 and thus contraction in their economy

( zerohedge)

iv)Hong Kong protests erupt again as thousands storm the legislature. The citizens will no way go for extradition to the Mainland.

( zerohedge)

4/EUROPEAN AFFAIRS

iItaly

A female captain of a Migrant NGO ship has been arrested after illegal docking in Italy

( zerohedge)

Bill Blain discusses his take on Osaka…nothing was solved and both the USA and China remain on a collusion course.

( Bill Blain)

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

i)Turkey

A wounded Erdogan is a dangerous person. From his purchase of Russian made S 400’s to his attack on ships trying to bring out natural gas in the Israeli-Cypriot-Greek waters.

( Hallinan//Counterpunch.org)

i b)Libya/Turkey/USA

Basically Hafter has declared war on Turkish planes flying over Libya and also boats off its shore. This proxy war is escalating fast. It certainly looks like Turkey will have to leave NATO as their policies are continuing to show their true colours as they face east.

(zerohedge)

ii)ISRAEL/SYRIA Last night: a major Israeli airstrike on Syrian positions trying to take out the Russian supplied #SAM 300. Also targeted was Iranian positions inside Syria(courtesy zerohedge)

i)IRAN

Iran enriches Uranium and the level has now surpasses 300 kg. Israel and the uSA are not happy.

( zerohedge)

6. GLOBAL ISSUES

i)Canada/Vancouver

China has long sought to get its money out of China and now Hong Kong is doing the same thing (the latest riots), Vancouver is one of the hot spots for the Chinese with Toronto coming in 2nd. It has made housing unaffordable now.

( zerohedge)

ii)Global warnings

this is something that you must pay attention to: The BIS which is the central bank to the central banks warns of a worsening and spreading global slowdown as central banks are running out of ammo

(courtesy BIS/zerohedge)

iib)The latest manufacturing surveys: Japan’s Tankan mfg survey, China’s PMI and now the uSA all witnessing market declines

(courtesy zerohedge)

7. OIL ISSUES

8 EMERGING MARKET ISSUES

9. PHYSICAL MARKETS

i)Dave is correct: the raid was well orchestrated by our crooks

(Dave Kranzler/IRD/GATA)

ii)Government debts are continually on the rise. So it is probably correct to assume that the only way to handle rising government debt is to lower all interest rates to zero or below

(Smith/Bloomberg/GATA)

iii)A must read…

James Turk states that the run up in gold has created losses of 2.2 billion dollars in gold. Who can withstand such losses other than central banks.

( Kingworldnews/James Turk/GATA)

iv)MbS has been very chummy with Trump who seems to have ignored the Khashoggi murder being orchestrated by the Prince. Now the Saudi’s are buying huge amounts of uSA treasuries.

(Bloomberg/GATA)

v)The following is continually happening in Europe as Swiss banks confiscate citizens allocated gold

( Von Greyerz/Kingworldnews)

10. USA stories which will influence the price of gold/silver)

MARKET TRADING//USA

a)Market trading/LAST NIGHT/USA

Stocks, oil yuan surge after Trump Xi deals..gold whacked again.

(zerohedge)

II)MARKET TRADING/USA

ii)Market data/USA

iii)USA ECONOMIC/GENERAL STORIES

a)A good look at how millennials are thinking of marriage..how they use high interest loans to pay for their weeddings

etc

( zerohedge)

b)Inflation is ripping apart American way of life…

now more than half of Americans are lying awake at night worrying about how they are going to pay for necessities of life

(courtesy zerohedge)

c)Quite a story…Boeing outsourced its 737 Max software to low paying engineers ( after laying off higher cost engineers)

(courtesy zerohedge)

d)How the USA pension system is on a death spiral and it is reaching crisis mode

(zerohedge)

e)It is not just the USA that has devastating crop losses. It is happening all over the globe( Michael Snyder)

SWAMP STORIES

E)SWAMP STORIES/MAJOR STORIES//THE KING REPORT

end

LET US BEGIN:

Let us head over to the comex:

THE TOTAL COMEX GOLD OPEN INTEREST ROSE BY A FAIR SIZED 1341 CONTRACTS TO A LEVEL OF 580,855 ACCOMPANYING THE SMALL GAIN OF $0.90 IN GOLD PRICING WITH RESPECT TO YESTERDAY’S // COMEX TRADING)

WE ARE NOW IN THE ACTIVE DELIVERY MONTH OF JUNE.. THE CME REPORTS THAT THE BANKERS ISSUED STRONG SIZED TRANSFER THROUGH THE EFP ROUTE AS THESE LONGS RECEIVED A DELIVERABLE LONDON FORWARD TOGETHER WITH A FIAT BONUS., THAT IS 5397 EFP CONTRACTS WERE ISSUED:

FOR AUGUST; 5397 CONTRACTS: DEC: 0 AND ZERO FOR ALL OTHER MONTHS:

TOTAL EFP ISSUANCE: 5397 CONTRACTS.

THE OBLIGATION STILL RESTS WITH THE BANKERS ON THESE TRANSFERS. ALSO REMEMBER THAT THERE IS NO DOUBT A HUGE DELAY IN THE ISSUANCE OF EFP’S AND IT PROBABLY TAKES AT LEAST 48 HRS AFTER OUR LONGS GIVE UP THEIR COMEX CONTRACTS FOR THEM TO RECEIVE THEIR EFP’S AS THEY ARE NEGOTIATING THIS CONTRACT WITH THE BANKS FOR A FIAT BONUS PLUS THEIR TRANSFER TO A LONDON BASED FORWARD.

ON A NET BASIS IN OPEN INTEREST WE GAINED THE FOLLOWING TODAY ON OUR TWO EXCHANGES: 6738 TOTAL CONTRACTS IN THAT 5397 LONGS WERE TRANSFERRED AS FORWARDS TO LONDON AND WE GAINED A FAIR SIZED 1341 COMEX CONTRACTS. THE BANKERS SUPPLIED THE NECESSARY AND INFINITE AMOUNT OF SHORT PAPER IN GOLD TO CONTAIN THE PRICE RISE.

NET GAIN ON THE TWO EXCHANGES :: 6738 CONTRACTS OR 673,800 OZ OR 20.95 TONNES.

We are now in the NON active contract month of JULY and here the open interest stands at 226 CONTRACTS as we LOST 198 contracts. We had 371 notices filed yesterday so we surprisingly gained 173 contracts or 17,300 oz of gold that will stand for delivery as there appears to be some gold at the comex as they will now try their luck on finding the fast vanishing supplies of physical gold over here. We usually witness queue jumping in silver immediately after first day notice but not gold. That changed today. The next big active month for deliverable gold is August and here the OI FELL by 1351 contracts down to 417,048. September picked up its initial 8 contracts to stand at 8 contracts and now the next active delivery month is October and here the OI rose by 108 contracts up to 10,887.

TODAY’S NOTICES FILED:

WE HAD 193 NOTICES FILED TODAY AT THE COMEX FOR 19300 OZ. (0.6003 TONNES)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for the wild silver comex results.

Total COMEX silver OI FELL BY A CONSIDERABLE SIZED 2257 CONTRACTS FROM 220,612 DOWN TO 218,355 (AND FURTHER FROM THE NEW RECORD OI FOR SILVER SET ON AUGUST 22.2018. THE PREVIOUS RECORD WAS SET APRIL 9.2018/ 243,411 CONTRACTS) AND TODAY’S CONSIDERABLE OI COMEX LOSS OCCURRED DESPITE A 6 CENT GAIN IN PRICING.//FRIDAY.

WE ARE NOW INTO THE ACTIVE DELIVERY MONTH OF JULY. HERE WE HAVE 1410 OPEN INTEREST STAND FOR DELIVERY WITH A LOSS OF 2456 CONTRACTS. WE HAD 2620 NOTICES FILED YESTERDAY SO WE GAINED 164 CONTRACTS OR AN ADDITIONAL 820,000 OZ OF SILVER WILL ATTEMPT TO STAND AT THE COMEX…. AND THESE GUYS REFUSED TO MORPH INTO A LONDON BASED FORWARD AS WELL AS NEGATING A FIAT BONUS. LET US WAIT AND SEE IF SUCCESSFUL IN OBTAINING PHYSICAL METAL ON THIS SIDE OF THE POND. AFTER JULY WE HAVE THE NON ACTIVE MONTH OF AUGUST AND HERE WE GAINED 34 CONTRACTS UP TO 1085. THE NEXT BIG ACTIVE DELIVERY MONTH AFTER AUGUST IS SEPT AND HERE THE OI ROSE BY 34 CONTRACTS UP TO 158,815 CONTRACTS.

TODAY’S NUMBER OF NOTICES FILED:

We, today, had 515 notice(s) filed for 2,575,000 OZ for the JUNE, 2019 COMEX contract for silver

Trading Volumes on the COMEX TODAY: 382,459 CONTRACTS

CONFIRMED COMEX VOL. FOR YESTERDAY: 324,546 contracts

INITIAL standings for JULY/GOLD

JULY 1/2019

Gold Ounces

Withdrawals from Dealers Inventory in oz nil oz

Withdrawals from Customer Inventory in oz

32.15 oz

BRINKS

(one kilobar)

Deposits to the Dealer Inventory in oz

nil

Deposits to the Customer Inventory, in oz

nil

No of oz served (contracts) today

193 notice(s)

19300 OZ

(0.6003 TONNES)

No of oz to be served (notices)

33 contracts

(3300 oz)

0.1026 TONNES

Total monthly oz gold served (contracts) so far this month

564 notices

56400 OZ

1.754 TONNES

Total accumulative withdrawals of gold from the Dealers inventory this month NIL oz

Total accumulative withdrawal of gold from the Customer inventory this month xxx oz

we had 0 dealer entry:

We had 1 kilobar entries

total dealer deposits: nil oz

total dealer withdrawals: nil oz

we had 0 deposit into the customer account

i) Into JPMorgan: nil oz

ii) Into Everybody else: nil oz

total gold deposits: nil oz

very little gold arrives from outside/ NO amount arrived today

we had 1 gold withdrawal from the customer account:

i ) out of Brinks: 32.15 oz

one kilobar

total gold withdrawals; 32.15 oz

i) we had 0 adjustment today

FOR THE JULY 2019 CONTRACT MONTH)Today, 0 notice(s) were issued from JPMorgan dealer account and 0 notices were issued from their client or customer account. The total of all issuance by all participants equates to 193 contract(s) of which 74 notices were stopped (received) by j.P. Morgan dealer and 10 notice(s) was (were) stopped/ Received) by j.P.Morgan customer account and 0 notices by the squid (Goldman Sachs)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

To calculate the INITIAL total number of gold ounces standing for the JULY /2019. contract month, we take the total number of notices filed so far for the month (564) x 100 oz , to which we add the difference between the open interest for the front month of JULY. (226 contract) minus the number of notices served upon today (193 x 100 oz per contract) equals 59,700 OZ OR 1.8569 TONNES) the number of ounces standing in this NON active month of JULY

Thus the INITIAL standings for gold for the JULY/2019 contract month:

No of notices served (564 x 100 oz) + (226)OI for the front month minus the number of notices served upon today (193 x 100 oz )which equals 59,700 oz standing OR 1.8569 TONNES in this active delivery month of JUNE.

We GAINED 173 contracts or an additional 17,300 oz will stand as these guys refused to morph into London based forwards as well as negating a fiat bonus. Somebody was in need of physical gold badly on this side of the pond…VERY UNUSUAL TO SEE QUEUE JUMPING THIS EARLY IN THE UP FRONT JULY CONTRACT MONTH.

SURPRISINGLY LITTLE TO NO GOLD HAS BEEN ENTERING THE COMEX VAULTS AND WE HAVE WITNESSED THIS FOR THE PAST YEAR!! WE HAVE ONLY 10.043 TONNES OF REGISTERED ( GOLD OFFERED FOR SALE) VS 1.8569 TONNES OF GOLD STANDING// THEY SEEM TO BE USING CONSIDERABLE GOLD VAPOUR TO SETTLE UPON UNSUSPECTING LONGS.

total registered or dealer gold: 322,910.634 oz or 10.0438 tonnes

total registered and eligible (customer) gold; 7,696,679.553 oz 239.39 tonnes

IN THE LAST 32 MONTHS 117 NET TONNES HAS LEFT THE COMEX.

THE GOLD COMEX IS NOW IN STRESS AS

1. GOLD IS LEAVING THE COMEX

2. GOLD IS LEAVING THE REGISTERED CATEGORY OF THE COMEX.

end

And now for silver

AND NOW THE DELIVERY MONTH OF JULY

INITIAL standings/SILVER

IN TOTAL CONTRAST TO GOLD, HUGE ACTIVITY IN SILVER TODAY.

JULY 1 2019

Silver Ounces

Withdrawals from Dealers Inventory NIL oz

Withdrawals from Customer Inventory

630,553.433 oz

Int. Delaware

Scotia

Deposits to the Dealer Inventory

NIL oz

Deposits to the Customer Inventory

6942.400 oz

Brinks

No of oz served today (contracts)

515

CONTRACT(S)

(2,575,000 OZ)

No of oz to be served (notices)

895 contracts

4 475,000 oz)

Total monthly oz silver served (contracts) 3135 contracts

15,675,000 oz)

Total accumulative withdrawal of silver from the Dealers inventory this month NIL oz