Friday, June 07, 2019 1:09:34 AM

The Canadian miner has several catalysts

June 05, 2019 | About: TPRFF +0% TSX:GCM +0% GOLD +0% GDXJ +0%

http://www.grancolombiagold.com/news-and-investors/events-and-presentations/presentations/default.aspx

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=149231566

https://www.gurufocus.com/news/889968/gran-colombia-gold-is-a-buy-

Gold Market Update - originally published

Sunday, May 19, 2019

Gold and silver dropping back again late last week had investors in the

Precious Metals sector feeling despondent, especially as their fears

were magnified by at least one analyst calling for gold to drop to the

low $900’s or even lower, which is normal when prices sink, but our

charts are instead suggesting that gold and silver are close to

completing giant bottoming patterns that started to form (in the case

of gold) as far back as 2013.

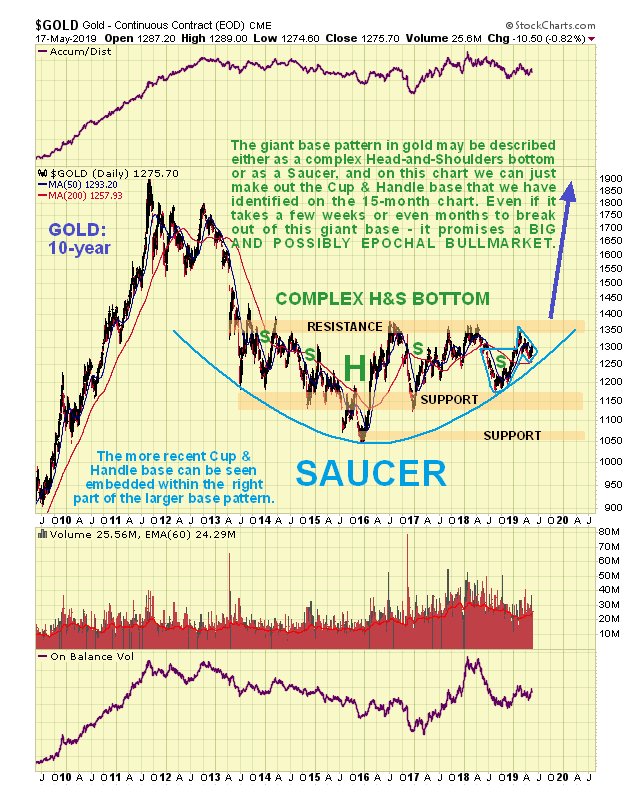

We can best see gold’s potential giant base pattern on a 10-year chart.

It can be described as a complex Head-and-Shoulders bottom or as a

Saucer, and is best considered to be both, or perhaps as a hybrid

having the characteristics of both patterns.

In any event, as we can see on this chart, it appears to be drawing

close to breaking out of it, which will be a very big deal if it

happens, because a base pattern of this magnitude can support a massive

bullmarket.

As for timing it could take several months and it is most likely to

happen during gold’s seasonally strong period from July through

September.

To maintain the bullish case it must stay above the Saucer boundary.

Embedded within the giant H&S or Saucer base pattern, a fine Cup &

Handle base has formed over the past year which we can see to advantage

on the 1-year chart.

The Handle part of this pattern may be regarded as a period of

consolidation / reaction that has allowed time both for the earlier

overbought condition arising from the rally from November through

February to unwind and also for the moving averages to slowly swing

into a much more favorable alignment, which has now happened.

On both of the above charts the drop late last week looks like “a storm

in a teacup” or given the pattern shown on the 1-year chart, a storm

just outside a teacup, and latest COTs reveal the reason for it –

the Large Specs had suddenly become too bullish, which meant that they

needed to be disciplined.

While COTs have doubtless improved as a result of the drop on Thursday

and Friday (we won’t find out until next week), the Large Specs may

require some more time in the correctional facility, especially as June

and July are not seasonally good months for the Precious Metals, so it

would not be surprising to see some more downside during the weeks

ahead before both gold and silver take a turn for the better from July

onwards.

The following seasonal chart shows that June tends to be somewhat

negative for gold on average, although it won’t be this year if Iran is

attacked.

The conclusion is that the big picture for gold and silver continues to

look strongly positive, although we may first have to contend with

weakness between now and July due to the current downtrend coupled with

negative seasonal factors until the end of June, which should present a

window of opportunity to build positions across the sector ahead of the

expected late Summer advance that promises to be very substantial if

gold succeeds in breaking above the key $1400 level.

End of update.

By Clive Maund

In GOD We Trust -

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

Recent ARMN News

- ARIS MINING TO INCREASE OWNERSHIP IN SOTO NORTE PROJECT TO 51% AND COMMENCES STUDY TO ASSESS NEW DEVELOPMENT PLAN • PR Newswire (US) • 05/23/2024 11:00:00 AM

- ARIS MINING TO INCREASE OWNERSHIP IN SOTO NORTE PROJECT TO 51% AND COMMENCES STUDY TO ASSESS NEW DEVELOPMENT PLAN • PR Newswire (Canada) • 05/23/2024 11:00:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 05/16/2024 09:00:29 PM

- ARIS MINING ANNOUNCES RESULTS OF ANNUAL GENERAL MEETING • PR Newswire (US) • 05/16/2024 09:00:00 PM

- ARIS MINING ANNOUNCES RESULTS OF ANNUAL GENERAL MEETING • PR Newswire (Canada) • 05/16/2024 09:00:00 PM

- ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW • PR Newswire (Canada) • 05/14/2024 09:47:00 PM

- ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW • PR Newswire (US) • 05/14/2024 09:47:00 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 05/14/2024 08:24:45 PM

- ARIS MINING Q1 PRODUCTION ON TRACK TO DELIVER FULL YEAR 2024 GUIDANCE WHILE EXPANSION PROJECTS ADVANCE • PR Newswire (US) • 04/15/2024 09:00:00 PM

- ARIS MINING Q1 PRODUCTION ON TRACK TO DELIVER FULL YEAR 2024 GUIDANCE WHILE EXPANSION PROJECTS ADVANCE • PR Newswire (Canada) • 04/15/2024 09:00:00 PM

- ARIS MINING ANNOUNCES APPOINTMENT OF RICHARD ORAZIETTI AS CFO AND OLIVER DACHSEL AS SVP, CAPITAL MARKETS • PR Newswire (US) • 04/08/2024 11:00:00 AM

- ARIS MINING ANNOUNCES APPOINTMENT OF RICHARD ORAZIETTI AS CFO AND OLIVER DACHSEL AS SVP, CAPITAL MARKETS • PR Newswire (Canada) • 04/08/2024 11:00:00 AM

- ARIS MINING REPORTS 2023 RESULTS WITH GUIDANCE ACHIEVED, NET EARNINGS OF $11.4M, ADJUSTED EARNINGS OF $52.2M ($0.38/SHARE), ADJUSTED EBITDA OF $159M • PR Newswire (Canada) • 03/06/2024 11:26:00 PM

- ARIS MINING REPORTS 2023 RESULTS WITH GUIDANCE ACHIEVED, NET EARNINGS OF $11.4M, ADJUSTED EARNINGS OF $52.2M ($0.38/SHARE), ADJUSTED EBITDA OF $159M • PR Newswire (US) • 03/06/2024 11:26:00 PM

- ARIS MINING TO ANNOUNCE FULL-YEAR 2023 RESULTS ON MARCH 6, 2024 • PR Newswire (Canada) • 02/22/2024 12:50:00 PM

- ARIS MINING TO ANNOUNCE FULL-YEAR 2023 RESULTS ON MARCH 6, 2024 • PR Newswire (US) • 02/22/2024 12:50:00 PM

- ARIS MINING ANNOUNCES APPOINTMENT OF TWO INDEPENDENT DIRECTORS • PR Newswire (US) • 02/14/2024 10:30:00 PM

- ARIS MINING ANNOUNCES APPOINTMENT OF TWO INDEPENDENT DIRECTORS • PR Newswire (Canada) • 02/14/2024 10:30:00 PM

- ARIS MINING ACHIEVES 2023 PRODUCTION GUIDANCE AND PROVIDES 2024 OUTLOOK • PR Newswire (US) • 01/16/2024 12:00:00 PM

- ARIS MINING ACHIEVES 2023 PRODUCTION GUIDANCE AND PROVIDES 2024 OUTLOOK • PR Newswire (Canada) • 01/16/2024 12:00:00 PM

- ARIS MINING FILES NI 43-101 TECHNICAL REPORT FOR SEGOVIA OPERATIONS • PR Newswire (US) • 12/06/2023 08:44:00 PM

- ARIS MINING FILES NI 43-101 TECHNICAL REPORT FOR SEGOVIA OPERATIONS • PR Newswire (Canada) • 12/06/2023 08:44:00 PM

- ARIS MINING INCREASES SEGOVIA GOLD MINERAL RESERVES BY +75% TO 1.3 MOZ AND ANNOUNCES PLANT EXPANSION TO INCREASE PRODUCTION RATE • PR Newswire (Canada) • 11/27/2023 12:00:00 PM

- ARIS MINING INCREASES SEGOVIA GOLD MINERAL RESERVES BY +75% TO 1.3 MOZ AND ANNOUNCES PLANT EXPANSION TO INCREASE PRODUCTION RATE • PR Newswire (US) • 11/27/2023 12:00:00 PM

- ARIS MINING INCREASES SEGOVIA OPERATIONS' MEASURED AND INDICATED MINERAL RESOURCES BY +114% TO 3.6 MOZ AT 14.34 g/t AU • PR Newswire (Canada) • 11/02/2023 10:06:00 PM

FEATURED POET Wins "Best Optical AI Solution" in 2024 AI Breakthrough Awards Program • Jun 26, 2024 10:09 AM

HealthLynked Promotes Bill Crupi to Chief Operating Officer • HLYK • Jun 26, 2024 8:00 AM

Bantec's Howco Short Term Department of Defense Contract Wins Will Exceed $1,100,000 for the current Quarter • BANT • Jun 25, 2024 10:00 AM

ECGI Holdings Targets $9.7 Billion Equestrian Apparel Market with Allon Brand Launch • ECGI • Jun 25, 2024 8:36 AM

Avant Technologies Addresses Progress on AI Supercomputer-Driven Data Centers • AVAI • Jun 25, 2024 8:00 AM

Green Leaf Innovations, Inc. Expands International Presence with New Partnership in Dubai • GRLF • Jun 24, 2024 8:30 AM