Thursday, May 30, 2019 12:11:12 AM

Data Under Pressure

Good Morning Good Evening

'Mining Investor Insights Drawn From The Wells Of Minerals,Metals & Mining'

Welcome to ~*~Mining & Metals Du Jour~*~Graveyard Shift~*~

On the show tonight: Great Data & News by Harvey Organ , Jim Wyckoffs AM/PM Gold and Silver Round Up, a Cute Math Test, China_Gears_Up_ To Weaponize Rare Earths Dominance In Trade_War, Treasure Tales:Eleven and One Colorado Lost Treasure Tales, and maybe more.....

Hello everybody I'm J:D your host tonight Thanks for being with us.

Hope Your Having a Wonderful Evening

EnJoy the show

OK...Here We Go......

MMGYS

Thank you

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

MAY 29/GOLD UP $3.90 TO $1281.70//SILVER UP 11 CENTS//DOW FALTERS AGAIN BY 220 POINTS//USA 10 YR BOND YIELD HITS 2.21% BEFORE SLIGHTLY RECOVERING TO 2.26%//PBOC PRESSES PANIC BUTTON BY RELEASING HUGE LIQUIDITY AFTER A BANKING FAILURE//GERMAN 10 YR RATE PLUMMETS TO -.18%//JAPANESE 10 YR BOND YIELD PLUMMETS TO .09%//ITALY NOW CONFIRMS THAT IT IS OF RISK TO RECEIVE A HUGE FINE FOR EXCEEDING BUDGET DEFICITS OF 2.%//HUGE NUMBER OF SWAMP STORIES FOR YOU TONIGHT//

May 29, 2019 · by harveyorgan · in Uncat

FINALIZED

GOLD: $1281.70 UP $3.90 (COMEX TO COMEX CLOSING)

Silver: $14.34 UP 11 CENTS (COMEX TO COMEX CLOSING)

Closing access prices:

Gold : 1280.20

silver: $14.43

COMEX EXPIRY FOR GOLD/SILVER: TUES MAY 28/2019

LBMA/OTC EXPIRY: MAY 31.2019

COMEX DATA

JPMorgan has been receiving gold with reckless abandon and sometimes supplying (stopping)

today RECEIVING 0/0

NUMBER OF NOTICES FILED TODAY FOR MAY CONTRACT: 0 NOTICE(S) FOR NIL OZ (0.0000 tonnes)

TOTAL NUMBER OF NOTICES FILED SO FAR: 306 NOTICES FOR 3060000 OZ (.9517 TONNES)

SILVER

FOR MAY

77 NOTICE(S) FILED TODAY FOR 385,000 OZ/

total number of notices filed so far this month: 3651 for 18,255,000 oz

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Bitcoin: OPENING MORNING TRADE : $8708 DOWN $51

Bitcoin: FINAL EVENING TRADE: $ 8653 DOWN $73

end

XXX

Let us have a look at the data for today

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

IN SILVER THE COMEX OI ROSE BY AN UNBELIEVABLE SIZED 6027 CONTRACTS FROM 211,578 UP TO 217,605 DESPITE THE 23 CENT LOSS IN SILVER PRICING AT THE COMEX. LIQUIDATION OF THE SPREADERS HAVE STOPPED FOR SILVER BUT IT NOW IN FULL FORCE FOR GOLD. TODAY WE ARRIVED CLOSER TO AUGUST’S 2018 RECORD SETTING OPEN INTEREST OF 244,196 CONTRACTS.

WE HAVE ALSO WITNESSED A LARGE AMOUNT OF PHYSICAL METAL STAND FOR COMEX DELIVERY AS WELL WE ARE WITNESSING CONSIDERABLE LONGS PACKING THEIR BAGS AND MIGRATING OVER TO LONDON IN GREATER NUMBERS IN THE FORM OF EFP’S. WE WERE NOTIFIED THAT WE HAD A FAIR SIZED NUMBER OF COMEX LONGS TRANSFERRING THEIR CONTRACTS TO LONDON THROUGH THE EFP:

0 FOR MAY, 0 FOR JUNE, 2294 FOR JULY AND ZERO FOR ALL OTHER MONTHS AND THEREFORE TOTAL ISSUANCE 2294 CONTRACTS. WITH THE TRANSFER OF 2294 CONTRACTS, WHAT THE CME IS STATING IS THAT THERE IS NO SILVER (OR GOLD) TO BE DELIVERED UPON AT THE COMEX AS THEY MUST EXPORT THEIR OBLIGATION TO LONDON. ALSO KEEP IN MIND THAT THERE CAN BE A DELAY OF 24-48 HRS IN THE ISSUING OF EFP’S. THE 2294 EFP CONTRACTS TRANSLATES INTO 11.47 MILLION OZ ACCOMPANYING:

1.THE 23 CENT LOSS IN SILVER PRICE AT THE COMEX AND

2. THE STRONG AMOUNT OF SILVER OUNCES WHICH STOOD FOR DELIVERY IN THE LAST NINE MONTHS:

JUNE/2018. (5.420 MILLION OZ);

FOR JULY: 30.370 MILLION OZ

FOR AUG., 6.065 MILLION OZ

FOR SEPT. 39.505 MILLION OZ S

FOR OCT.2.525 MILLION OZ.

FOR NOV: A HUGE 7.440 MILLION OZ STANDING AND

21.925 MILLION OZ FINALLY STAND FOR DECEMBER.

5.845 MILLION OZ STAND IN JANUARY.

2.955 MILLION OZ STANDING FOR FEBRUARY.:

27.120 MILLION OZ STANDING IN MARCH.

3.875 MILLION OZ STANDING FOR SILVER IN APRIL.

AND NOW 18.765 MILLION OZ STANDING FOR SILVER IN MAY.

ACCUMULATION FOR EFP’S/SILVER/J.P.MORGAN’S HOUSE OF BRIBES, / STARTING FROM FIRST DAY NOTICE/FOR MONTH OF MAY:

24,941 CONTRACTS (FOR 20 TRADING DAYS TOTAL 24,941 CONTRACTS) OR 124.71 MILLION OZ: (AVERAGE PER DAY: 1247 CONTRACTS OR 6.235 MILLION OZ/DAY)

TO GIVE YOU AN IDEA AS TO THE HUGE SUPPLY THIS MONTH IN SILVER: SO FAR THIS MONTH OF MAY: 124.71 MILLION PAPER OZ HAVE MORPHED OVER TO LONDON. THIS REPRESENTS AROUND 17.81% OF ANNUAL GLOBAL PRODUCTION (EX CHINA EX RUSSIA)* JUNE’S 345.43 MILLION OZ IS THE SECOND HIGHEST RECORDED ISSUANCE OF EFP’S AND IT FOLLOWED THE RECORD SET IN APRIL 2018 OF 385.75 MILLION OZ.

ACCUMULATION IN YEAR 2019 TO DATE SILVER EFP’S: 865.80 MILLION OZ.

JANUARY 2019 EFP TOTALS: 217.455. MILLION OZ

FEB 2019 TOTALS: 147.4 MILLION OZ/

MARCH 2019 TOTAL EFP ISSUANCE: 207.835 MILLION OZ

APRIL 2019 TOTAL EFP ISSUANCE: 182.87 MILLION OZ.

RESULT: WE HAD AN UNBELIEVABLE SIZED INCREASE IN COMEX OI SILVER COMEX CONTRACTS OF 6027 DESPITE THE 23 CENT LOSS IN SILVER PRICING AT THE COMEX /YESTERDAY... THE CME NOTIFIED US THAT WE HAD A VERY STRONG SIZED EFP ISSUANCE OF 2294 CONTRACTS WHICH EXITED OUT OF THE SILVER COMEX AND TRANSFERRED THEIR OI TO LONDON AS FORWARDS. SPECULATORS CONTINUED THEIR INTEREST IN ATTACKING THE SILVER COMEX FOR PHYSICAL SILVER (SEE COMEX DATA) . OUR BANKERS RESUMED THEIR LIQUIDATION OF THE SPREAD TRADES TODAY.

TODAY WE GAINED A HUMONGOUS SIZED: 8,321 TOTAL OI CONTRACTS ON THE TWO EXCHANGES:

i.e 2294 OPEN INTEREST CONTRACTS HEADED FOR LONDON (EFP’s) TOGETHER WITH INCREASE OF 6027 OI COMEX CONTRACTS. AND ALL OF THIS DEMAND HAPPENED WITH A 23 CENT LOSS IN PRICE OF SILVER AND A CLOSING PRICE OF $14.34 WITH RESPECT TO YESTERDAY’S TRADING. YET WE STILL HAVE A STRONG AMOUNT OF SILVER STANDING AT THE COMEX FOR DELIVERY!!

In ounces AT THE COMEX, the OI is still represented by JUST OVER 1 BILLION oz i.e. 1.536 BILLION OZ TO BE EXACT or 158% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT MARCH MONTH/ THEY FILED AT THE COMEX: 77 NOTICE(S) FOR 385,000, OZ OF SILVER

IN SILVER,PRIOR TO TODAY, WE SET THE NEW COMEX RECORD OF OPEN INTEREST AT 243,411 CONTRACTS ON APRIL 9.2018. AND AGAIN THIS HAS BEEN SET WITH A LOW PRICE OF $16.51.

AND NOW WE RECORD FOR POSTERITY ANOTHER ALL TIME RECORD OPEN INTEREST AT THE COMEX OF 244,196 CONTRACTS ON AUGUST 22/2018 AND AGAIN WHEN THIS RECORD WAS SET, THE PRICE OF SILVER WAS $14.78 AND LOWER IN PRICE THAN PREVIOUS RECORDS.

ON THE DEMAND SIDE WE HAVE THE FOLLOWING:

HUGE AMOUNTS OF SILVER STANDING FOR DELIVERY (MARCH/2018: 27 MILLION OZ , APRIL/2018 : 2.485 MILLION OZ MAY: 36.285 MILLION OZ ; JUNE/2018 (5.420 MILLION OZ) , JULY 2018 FINAL AMOUNT STANDING: 30.370 MILLION OZ ) FOR AUGUST 6.065 MILLION OZ. , SEPT: A HUGE 39.505 MILLION OZ./ OCTOBER: 2,520,000 oz NOV AT 7.440 MILLION OZ./ DEC. AT 21.925 MILLION OZ JANUARY AT 5.825 MILLION OZ.AND FEB 2019: 2.955 MILLION OZ/ MARCH: 27.120 MILLION OZ/ APRIL AT 3.875 MILLION OZ/ AND NOW MAY: 18.765 MILLION OZ ..

HUGE RECORD OPEN INTEREST IN SILVER 243,411 CONTRACTS (OR 1.217 BILLION OZ/ SET APRIL 9/2018) AND NOW AUGUST 22/2018: 244,196 CONTRACTS, WITH A SILVER PRICE OF $14.78.

HUGE ANNUAL EFP’S ISSUANCE EQUAL TO 2.9 BILLION OZ OR 400% OF SILVER ANNUAL PRODUCTION/2017

RECORD SETTING EFP ISSUANCE FOR ANY MONTH IN SILVER; APRIL/2018/ 385.75 MILLION OZ/ AND THE SECOND HIGHEST RECORDED EFP ISSUANCE JUNE 2018 345.43 MILLION OZ

AND YET, WITH THE EXTREMELY HIGH EFP ISSUANCE, WE HAVE A CONTINUAL LOW PRICE OF SILVER DESPITE THE ABOVE HUGE DEMAND. TO ME THE ONLY ANSWER IS THAT WE HAVE SOVEREIGN (CHINA) WHO IS ENDEAVOURING TO GOBBLE UP ALL AVAILABLE PHYSICAL SILVER NO MATTER WHERE, EXACTLY WHAT J.P.MORGAN IS DOING. AND IT IS MY BELIEF THAT J.P.MORGAN IS HOLDING ITS SILVER FOR ITS BENEFICIAL OWNER..THE USA GOVERNMENT WHO IN TURN IS HOLDING THAT SILVER FOR CHINA.(FOR A SILVER LOAN REPAYMENT).

IN GOLD, THE OPEN INTEREST FELL BY A HUGE SIZED 12,153 CONTRACTS, TO 505,126 WITH THE $6.40 PRICE FALL WITH RESPECT TO COMEX GOLD PRICING YESTERDAY/THERE WAS HUGE LIQUIDATION OF SPREADERS YESTERDAY

WE ARE NOW 2 TRADING DAYS PRIOR TO FIRST DAY NOTICE. THE SIGNAL WAS GIVEN TO START THE LIQUIDATION PROCESS OF OUR SPREADERS ON MAY 21.

THE CME RELEASED THE DATA FOR EFP ISSUANCE AND IT TOTALED A STRONG SIZED 7587 CONTRACTS:

APRIL 0 CONTRACTS,JUNE: 5411 CONTRACTS, AUGUST 2019: 2176 CONTRACTS, JUNE 2020 0 CONTRACTS AND ALL OTHER MONTHS ZERO. The NEW COMEX OI for the gold complex rests at 505,126. ALSO REMEMBER THAT THERE WILL BE A DELAY IN THE ISSUANCE OF EFP’S. THE BANKERS REMOVE LONG POSITIONS OF COMEX GOLD IMMEDIATELY. THEN THEY ORCHESTRATE THEIR PRIVATE EFP DEAL WITH THE LONGS AND THAT COULD TAKE AN ADDITIONAL, 48 HRS SO WE GENERALLY DO NOT GET A MATCH WITH RESPECT TO DEPARTING COMEX LONGS AND NEW EFP LONG TRANSFERS. . EVEN THOUGH THE BANKERS ISSUED THESE MONSTROUS EFPS, THE OBLIGATION STILL RESTS WITH THE BANKERS TO SUPPLY METAL BUT IT TRANSFERS THE RISK TO A LONDON BANKER OBLIGATION AND NOT A NEW YORK COMEX OBLIGATION. LONGS RECEIVE A FIAT BONUS TOGETHER WITH A LONG LONDON FORWARD. THUS, BY THESE ACTIONS, THE BANKERS AT THE COMEX HAVE JUST STATED THAT THEY HAVE NO APPRECIABLE METAL!! THIS IS A MASSIVE FRAUD: THEY CANNOT SUPPLY ANY METAL TO OUR COMEX LONGS BUT THEY ARE QUITE WILLING TO SUPPLY MASSIVE NON BACKED GOLD (AND SILVER) PAPER KNOWING THAT THEY HAVE NO METAL TO SATISFY OUR LONGS. LONDON IS NOW SEVERELY BACKWARD IN BOTH GOLD AND SILVER AND WE ARE WITNESSING DELAYS IN ACTUAL DELIVERIES.

IN ESSENCE WE HAVE A STRONG SIZED LOSS IN TOTAL CONTRACTS ON THE TWO EXCHANGES OF 4566 CONTRACTS: 12,153 OI CONTRACTS DECREASED AT THE COMEX AND 7387 EFP OI CONTRACTS WHICH NAVIGATED OVER TO LONDON. THUS TOTAL OI LOSS OF 4566 CONTRACTS OR 456,600 OZ OR 14.20 TONNES. YESTERDAY WE HAD A LARGE PRICE FALL OF $6.40 IN GOLD TRADING ….AND WITH THAT FALL IN PRICE, WE HAD A CONSIDERABLE LOSS OF GOLD TONNAGE OF 14.20 TONNES!!!!!!

WITH RESPECT TO SPREADING: WE HAD HUGE ACTIVITY YESTERDAY

.

FOR NEWCOMERS, HERE IS THE MODUS OPERANDI OF THE CORRUPT BANKERS WITH RESPECT TO THEIR SPREAD/TRADING.

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES:

“AS YOU WILL SEE, THE CROOKS HAVE NOW SWITCHED TO GOLD AS THEY INCREASE THE OPEN INTEREST FOR THE SPREADERS. THE TOTAL COMEX GOLD OPEN INTEREST WILL RISE FROM NOW ON UNTIL ONE WEEK PRIOR TO FIRST DAY NOTICE AND THAT IS WHEN THEY START THEIR CRIMINAL LIQUIDATION.

HERE IS HOW THE CROOKS USED SPREADING AS WE ARE NO INTO THE NON ACTIVE DELIVERY MONTH OF MAY HEADING TOWARDS THE VERY ACTIVE DELIVERY MONTH OF JUNE.

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES, HERE IS THE BANKERS MODUS OPERANDI:

YOU WILL ALSO NOTICE THAT THE COMEX OPEN INTEREST IS STARTING TO RISE IN THIS NON ACTIVE MONTH OF MAY BUT SO IS THE OPEN INTEREST OF SPREADERS. THE OPEN INTEREST IN GOLD WILL CONTINUE TO RISE UNTIL ONE WEEK BEFORE FIRST DAY NOTICE OF AN UPCOMING ACTIVE DELIVERY MONTH (JUNE), AND THAT IS WHEN THE CROOKS SELL THEIR SPREAD POSITIONS BUT NOT AT THE SAME TIME OF THE DAY. THEY WILL USE THE SELL SIDE OF THE EQUATION TO CREATE THE CASCADE (ALONG WITH THEIR COLLUSIVE FRIENDS) AND THEN COVER ON THE BUY SIDE OF THE SPREAD SITUATION AT THE END OF THE DAY. THEY DO THIS TO AVOID POSITION LIMIT DETECTION. THE LIQUIDATION OF THE SPREADING FORMATION CONTINUES FOR EXACTLY ONE WEEK AND ENDS ON FIRST DAY NOTICE.”

ACCUMULATION OF EFP’S GOLD AT J.P. MORGAN’S HOUSE OF BRIBES: (EXCHANGE FOR PHYSICAL) FOR THE MONTH OF MAY : 129,209 CONTRACTS OR 12,920,900 OR 401.89 TONNES (20 TRADING DAYS AND THUS AVERAGING: 6460 EFP CONTRACTS PER TRADING DAY

TO GIVE YOU AN IDEA AS TO THE STRONG SIZE OF THESE EFP TRANSFERS : THIS MONTH IN 20 TRADING DAYS IN TONNES: 401,89 TONNES

TOTAL ANNUAL GOLD PRODUCTION, 2018, THROUGHOUT THE WORLD EX CHINA EX RUSSIA: 3555 TONNES

THUS EFP TRANSFERS REPRESENTS 401.89/3550 x 100% TONNES =11.32% OF GLOBAL ANNUAL PRODUCTION SO FAR IN DECEMBER ALONE.***

ACCUMULATION OF GOLD EFP’S YEAR 2019 TO DATE: 2217.41 TONNES

JANUARY 2019 TOTAL EFP ISSUANCE; 531.20 TONNES

FEB 2019 TOTAL EFP ISSUANCE: 344.36 TONNES

MARCH 2019 TOTAL EFP ISSUANCE: 497.16 TONNES

APRIL 2019 TOTAL ISSUANCE: 456.10 TONNES

WHAT IS ALARMING TO ME, ACCORDING TO OUR LONDON EXPERT ANDREW MAGUIRE IS THAT THESE EFP’S ARE BEING TRANSFERRED TO WHAT ARE CALLEDRIAL FORWARD CONTRACT OBLIGATIONS AND THESE CONTRACTS ARE LESS THAN 14 DAYS. ANYTHING GREATER THAN 14 DAYS, THESE MUST BE RECORDED AND SENT TO THE COMPTROLLER, GREAT BRITAIN TO MONITOR RISK TO THE BANKING SYSTEM. IF THIS IS INDEED TRUE, THEN THIS IS A MASSIVE CONSPIRACY TO DEFRAUD AS WE NOW WITNESS A MONSTROUS TOTAL EFP’S ISSUANCE AS IT HEADS INTO THE STRATOSPHERE.

Result: A CONSIDERABLE SIZED DECREASE IN OI AT THE COMEX OF 12,153 DESPITE WITH LARGE PRICING LOSS THAT GOLD UNDERTOOK YESTERDAY(6.40)) //.WE ALSO HAD A STRONG SIZED NUMBER OF COMEX LONG TRANSFERRING TO LONDON THROUGH THE EFP ROUTE: 7587 CONTRACTS AS THESE HAVE ALREADY BEEN NEGOTIATED AND CONFIRMED. THERE OBVIOUSLY DOES NOT SEEM TO BE MUCH PHYSICAL GOLD AT THE COMEX. I GUESS IT EXPLAINS THE HUGE ISSUANCE OF EFP’S…THERE IS HARDLY ANY GOLD PRESENT AT THE GOLD COMEX FOR DELIVERY PURPOSES. IF YOU TAKE INTO ACCOUNT THE 7587 EFP CONTRACTS ISSUED, WE HAD A HUGE SIZED LOSS OF 4566 CONTRACTS IN TOTAL OPEN INTEREST ON THE TWO EXCHANGES:

7587 CONTRACTS MOVE TO LONDON AND 12,153 CONTRACTS DECREASED AT THE COMEX. (IN TONNES, THE LOSS IN TOTAL OI EQUATES TO 14.20 TONNES). ..AND THIS LOSS OF DEMAND OCCURRED WITH THE LARGE FALL IN PRICE OF $6.40 WITH RESPECT TO YESTERDAY’S TRADING AT THE COMEX. WE HAD A HUGE PRESENCE OF SPREADING LIQUIDATION YESTERDAY/

we had: 0 notice(s) filed upon for NIL oz of gold at the comex.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

With respect to our two criminal funds, the GLD and the SLV:

GLD...

WITH GOLD UP $3.90 TODAY

NO CHANGS IN GOLD INVENTORY AT THE GLD:

INVENTORY RESTS AT 737,34 TONNES

TO ALL INVESTORS THINKING OF BUYING GOLD THROUGH THE GLD ROUTE: YOU ARE MAKING A TERRIBLE MISTAKE AS THE CROOKS ARE USING WHATEVER GOLD COMES IN TO ATTACK BY SELLING THAT GOLD. IT SURE SEEMS TO ME THAT THE GOLD OBLIGATIONS AT THE GLD EXCEED THEIR INVENTORY

SLV/

WITH SILVER UP 11 CENTS TODAY:

NO CHANGES IN SILVER INVENTORY AT THE SLV:

/INVENTORY RESTS AT 311.616 MILLION OZ.

end

OUTLINE OF TOPICS TONIGHT

First, here is an outline of what will be discussed tonight:

1. Today, we had the open interest in SILVER ROSE BY AN ATMOSPHERIC SIZED 6027 CONTRACTS from 211,578 UP TO 217,605 AND CLOSER TO THE NEW COMEX RECORD SET LAST IN AUG.2018 AT 244,196 WITH A SILVER PRICE OF $14.78/(AUGUST 22/2018)..THE PREVIOUS RECORD WAS SET ON APRIL 9/2018 AT 243,411 OPEN INTEREST CONTRACTS WITH THE SILVER PRICE AT THAT DAY: $16.53). AND PREVIOUS TO THAT, THE RECORD WAS ESTABLISHED AT: 234,787 CONTRACTS, SET ON APRIL 21.2017 OVER 1 1/3 YEARS AGO. THE PRICE OF SILVER ON THAT DAY: $17.89. AS YOU CAN SEE, WE HAVE RECORD HIGH OPEN INTERESTS IN SILVER ACCOMPANIED BY A CONTINUAL LOWER PRICE WHEN THAT RECORD WAS SET…..THE SPREADERS HAVE STOPPED THEIR LIQUIDATION IN SILVER BUT HAVE NOW MORPHED INTO GOLD..

EFP ISSUANCE:

OUR CUSTOMARY MIGRATION OF COMEX LONGS CONTINUE TO MORPH INTO LONDON FORWARDS AS OUR BANKERS USED THEIR EMERGENCY PROCEDURE TO ISSUE:

0 CONTRACTS FOR APRIL., 0 FOR MAY, FOR JUNE 0 CONTRACTS AND JULY: 2294 CONTRACTS AND ALL OTHER MONTHS: ZERO. TOTAL EFP ISSUANCE: 2294 CONTRACTS. EFP’S GIVE OUR COMEX LONGS A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. IF WE TAKE THE OI GAIN AT THE COMEX OF 6027 CONTRACTS TO THE 2294 OI TRANSFERRED TO LONDON THROUGH EFP’S, WE OBTAIN A GIGANTIC GAIN OF 8,321 OPEN INTEREST CONTRACTS. THUS IN OUNCES, THE GAIN ON THE TWO EXCHANGES: 41.605 MILLION OZ!!! AND YET WE ALSO HAVE A STRONG DEMAND FOR PHYSICAL AS WE WITNESSED A FINAL STANDING OF GREATER THAN 30 MILLION OZ FOR JULY, A STRONG 7.475 MILLION OZ FOR AUGUST.. A HUGE 39.505 MILLION OZ STANDING FOR SILVER IN SEPTEMBER… OVER 2 million OZ STANDING FOR THE NON ACTIVE MONTH OF OCTOBER., 7.440 MILLION OZ FINALLY STANDING IN NOVEMBER. 21.925 MILLION OZ STANDING IN DECEMBER , 5.845 MILLION OZ STANDING IN JANUARY. 2.955 MILLION OZ STANDING IN FEBRUARY, 27.120 MILLION OZ FOR MARCH., 3.875 MILLION OZ FOR APRIL AND NOW 18.765 MILLION OZ FOR MAY

RESULT: A STRONG SIZED INCREASE IN SILVER OI AT THE COMEX DESPITE THE 23 CENT LOSS IN PRICING THAT SILVER UNDERTOOK IN PRICING// FRIDAY. WE ALSO HAD A STRONG SIZED 2294 EFP’S ISSUED TRANSFERRING COMEX LONGS OVER TO LONDON. TOGETHER WITH THE STRONG SIZED AMOUNT OF SILVER OUNCES STANDING FOR THIS MONTH, DEMAND FOR PHYSICAL SILVER CONTINUES TO INTENSIFY AS WE WITNESS SEVERE BACKWARDATION IN SILVER IN LONDON.

BOTH THE SILVER COMEX AND THE GOLD COMEX ARE IN STRESS AS THE BANKERS SCOUR THE BOWELS OF THE EXCHANGE FOR METAL

(report Harvey)

.

2 ) Gold/silver trading overnight Europe, Goldcore

(Mark O’Byrne/zerohedge

and in NY: Bloomberg

3. ASIAN AFFAIRS

)WEDNESDAY MORNING/ TUESDAY NIGHT:

SHANGHAI CLOSED DOWN 43.77 POINTS OR 0.67% //Hang Sang CLOSED DOWN 155.10 POINTS OR 0.57% /The Nikkei closed DOWN 256.77 POINTS OR 1.21%//Australia’s all ordinaires CLOSED DOWN 0.67%

/Chinese yuan (ONSHORE) closed DOWN at 6.9091 /Oil DOWN TO 57,28 dollars per barrel for WTI and 68.41 for Brent. Stocks in Europe OPENED RED// ONSHORE YUAN CLOSED DOWN // LAST AT 6.9091 AGAINST THE DOLLAR. OFFSHORE YUAN CLOSED DOWN ON THE DOLLAR AT 6.9273 TRADE TALKS STALL//YUAN LEVELS GETTING DANGEROUSLY CLOSE TO 7:1//TRUMP INITIATES A NEW 25% TARIFFS FRIDAY/MAY 10/MAJOR PROBLEMS AT HUAWEI /CFO ARRESTED : /ONSHORE YUAN TRADING ABOVE LEVEL OF OFFSHORE YUAN/ONSHORE YUAN TRADING WEAKER AGAINST USA DOLLAR/OFFSHORE YUAN TRADING WEAKER AGAINST THE DOLLAR /TRADE DEAL NOW DEAD..TRUMP RAISED RATES TO 25%

3A//NORTH KOREA/ SOUTH KOREA

b) REPORT ON JAPAN

3 China/Chinese affairs

i)China/USA

An excellent commentary on the” 3 Trump cards” that China holds on the USA, namely their rare earth supply, their huge treasury hoard and the fact that China can block USA access to the Chinese markets

( Oriental Review)

ii)Funny stuff: Huawei is to ask a USA court to declare Trump’s “national Security” ban unconstitutional even though Huawei used stolen technology. The hearing will be in September.

(zerohedge)

iii)China presses the panic button with huge liquidity as interbank funding freezes up after the Baoshang seizure(courtesy zerohedge)

4/EUROPEAN AFFAIRS

i)GERMANY

My goodness, that escalated fast…German unemployed exploded to 5.0% from 4.6% as their economy is faltering fast.

( zerohedge)

ii)Italy

The EU confirms that Italy is now risking a massive fine over its huge deficit. It sent the Euro to session lows\\(courtesy zerohedge)

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

i)IRAN/USA

Bolton says that he has no doubt that iranian naval mines were used in that UAE tanker assault last week

(courtesy zerohedge)

ii)ISRAEL/PALESTINE/RUSSIA AND CHINA

It now seems that China and Russia will be against any USA initiative. Today they are against Trump’s Middle east proposal

( zerohedge)

iii)Iran/Europe/USA

A shot across the bow against Europe as they now threaten them with a loss to the uSA financial system as Europe will begin to use their new “SWIFT” system to evade sanctions by the uSA

(courtesy zerohedge)

6. GLOBAL ISSUES

7. OIL ISSUES

8 EMERGING MARKET ISSUES

VENEZUELA/

9. PHYSICAL MARKETS

Craig Hemke discusses what the bond market is telling us:

( Sprott/Hemke/GATA)

10. USA stories which will influence the price of gold/silver)

MARKET TRADING//

MARKET TRADING/Europe Monday

ii)Market data

iii)USA ECONOMIC/GENERAL STORIES

i)Are these guys nuts: Illinois now pushes for a new “wealth tax” as highe earners will now flee the state with reckless abandon

( zerohedge)

ii)The trade battle has semi conductors as the epicentre and the UASA is on the losing end

( zerohedge)

SWAMP STORIES

i)Comey is one big nut job: here he states that there was no coup and Trump and his supporters are stating nothing but lies on him and his upper echelon of cohorts

( zerohedge)

ii)Full scale war in the intelligence community as Christopher Steel refuses to cooperate with AG Barr and Durham

( zerohedge)

iii a) We will be following this: Mueller is to make an unexpected statement on the Russian probe at 11 am

THE INTERVIEW AT 11 AM WAS A “NOTHING BURGER”

( zerohedge)

iii b)Democrats are now put into a tough spot after Mueller is goading them into the impeachment process

(courtesy zerohedge)

iii)c And then this; Pelosi and Schumer refuse to endorse impeachment procedures after the Mueller statement

( zerohedge)

E)SWAMP STORIES/MAJOR STORIES//THE KING REPORT

end

LET US BEGIN:

Let us head over to the comex:

THE TOTAL COMEX GOLD OPEN INTEREST FELL BY A CONSIDERABLE SIZED 12,153 CONTRACTS TO A LEVEL OF 505,126 WITH THE LARGE FALL OF $6.40 IN GOLD PRICING WITH RESPECT TO YESTERDAY’S // COMEX TRADING)

WE ARE NOW IN THE NON ACTIVE DELIVERY MONTH OF MAY.. THE CME REPORTS THAT THE BANKERS ISSUED A STRONG SIZED TRANSFER THROUGH THE EFP ROUTE AS THESE LONGS RECEIVED A DELIVERABLE LONDON FORWARD TOGETHER WITH A FIAT BONUS., THAT IS 7587 EFP CONTRACTS WERE ISSUED:

0 FOR JUNE ’19: 5411 CONTRACTS , AUG; 2176 CONTRACTS: 0 AND ZERO FOR ALL OTHER MONTHS:

TOTAL EFP ISSUANCE: 7587 CONTRACTS.

THE OBLIGATION STILL RESTS WITH THE BANKERS ON THESE TRANSFERS. ALSO REMEMBER THAT THERE IS NO DOUBT A HUGE DELAY IN THE ISSUANCE OF EFP’S AND IT PROBABLY TAKES AT LEAST 48 HRS AFTER OUR LONGS GIVE UP THEIR COMEX CONTRACTS FOR THEM TO RECEIVE THEIR EFP’S AS THEY ARE NEGOTIATING THIS CONTRACT WITH THE BANKS FOR A FIAT BONUS PLUS THEIR TRANSFER TO A LONDON BASED FORWARD.

ON A NET BASIS IN OPEN INTEREST WE LOST THE FOLLOWING TODAY ON OUR TWO EXCHANGES: 4566 TOTAL CONTRACTS IN THAT 7587 LONGS WERE TRANSFERRED AS FORWARDS TO LONDON AND WE LOST A CONSIDERABLE SIZED 12,153 COMEX CONTRACTS.ALMOST ALL OF THE LOSS IN OI WAS DUE TO THE LIQUIDATION OF THE SPREADERS.

NET LOSS ON THE TWO EXCHANGES :: 4566 CONTRACTS OR 456600 OZ OR 14.20 TONNES.

We are now in the NON active contract month of MAY and here the open interest stands at 49 contracts, having LOST 8 contracts. We had 8 notices served yesterday so we LOST 0 contracts or an additional NIL oz will not stand as they guys refused to morph into a London based forward as well as negating a fiat bonus

The next contract month after May is June and here the open interest FELL by 64,526 contracts DOWN to 87,463. July GAINED 249 contracts to stand at 1096. After July the next active month is August and here the OI rose by 50,782 contracts up to 308,427/ contracts. We no doubt witnessed HUGE spreading liquidation yesterday/today

We have 2 more trading days before first day notice, May .2019

TODAY’S NOTICES FILED:

WE HAD 0 NOTICES FILED TODAY AT THE COMEX FOR NIL OZ. (0.000 TONNES)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for the wild silver comex results.

Total COMEX silver OI ROSE BY A HUMONGOUS SIZED 6027 CONTRACTS FROM 211.578 DOWN TO 217,605 (AND CLOSER TO THE NEW RECORD OI FOR SILVER SET ON AUGUST 22.2018. THE PREVIOUS RECORD WAS SET APRIL 9.2018/ 243,411 CONTRACTS) AND TODAY’S HUGE OI COMEX GAIN OCCURRED DESPITE THE 23 CENT FALL IN PRICING.//YESTERDAY.

WE ARE NOW INTO THE ACTIVE DELIVERY MONTH OF MAY. HERE WE HAVE 195 OPEN INTEREST STAND SO FAR FOR A LOSS OF 24 CONTRACTS. WE HAD 40 NOTICES SERVED UPON YESTERDAY SO IN ESSENCE WE GAINED 16 CONTRACTS OR AN ADDITIONAL 80,000 OZ WILL STAND FOR DELIVERY AS THESE GUYS REFUSED TO MORPH INTO LONDON BASED FORWARDS AND AS WELL THEY NEGATED A FIAT BONUS.

THE NEXT MONTH AFTER MAY IS THE NON ACTIVE MONTH OF JUNE. HERE THIS MONTH LOST 156 CONTRACTS DOWN TO 467. AFTER JUNE IS THE ACTIVE MONTH OF JULY, (THE SECOND LARGEST DELIVERY MONTH OF THE YEAR FOR SILVER) AND HERE THIS MONTH GAINED 3828 CONTRACTS UP TO 161,226 CONTRACTS. THE NEXT ACTIVE MONTH AFTER JULY FOR SILVER IS SEPTEMBER AND HERE THE OI ROSE BY 1438 UP TO 22,357 CONTRACTS.

TODAY’S NUMBER OF NOTICES FILED:

We, today, had 77 notice(s) filed for 385,000 OZ for the MAY, 2019 COMEX contract for silver

Trading Volumes on the COMEX TODAY: 374,463 CONTRACTS (high spreading liquidation)

CONFIRMED COMEX VOL. FOR YESTERDAY: 588,146 contracts (some spreading liquidation)

INITIAL standings for MAY/GOLD

MAY 29 /2019.

Gold Ounces

Withdrawals from Dealers Inventory in oz nil oz

Withdrawals from Customer Inventory in oz

2170.88

oz

Brinks

Deposits to the Dealer Inventory in oz nil

oz

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for silver

AND NOW THE DELIVERY MONTH OF APRIL

INITIAL standings/SILVER

IN TOTAL CONTRAST TO GOLD, HUGE ACTIVITY IN SILVER TODAY.

MAY 28 2019

Silver Ounces

Withdrawals from Dealers Inventory NIL oz

Withdrawals from Customer Inventory

148,719.189 oz

CNT

Brinks

Deposits to the Dealer Inventory

NIL oz

Deposits to the Customer Inventory

nil oz

No of oz served today (contracts)

77

CONTRACT(S)

(385,000 OZ)

No of oz to be served (notices)

118 contracts

590,000 oz)

Total monthly oz silver served (contracts) 3651 contracts

18,255,000 oz)

Total accumulative withdrawal of silver from the Dealers inventory this month NIL oz

Total accumulative withdrawal of silver from the Customer inventory this month

**

we had 0 inventory movement at the dealer side of things

total dealer deposits: NIL oz

total dealer withdrawals: nil oz

we had 0 deposits into the customer account

into JPMorgan: nil

*** JPMorgan for most of 2017 and in 2018 has adding to its inventory almost every single day.

JPMorgan now has 149.469 million oz of total silver inventory or 48.80% of all official comex silver. (149 million/307 milli

into everybody else: nil

total customer deposits today: nil oz

we had 2 withdrawals out of the customer account:

i) out of CNT: 29,848.879 oz

ii) Out of Brinks: 118,870.310 oz

total withdrawals: 148,719.189 oz

we had 1 adjustment : and it was a dilly

i)Out of CNT: 1,564,601.797 oz was adjusted out of the dealer account and this landed into the customer account of CNT

and we also had an accounting error correction:

3040.280 oz of silver customer removed from JPMorgan

total dealer silver: 90.984 million

total dealer + customer silver: 305.909 million oz

The total number of notices filed today for the MAY 2019. contract month is represented by 77 contract(s) FOR 385,000 oz

To calculate the number of silver ounces that will stand for delivery in MAY, we take the total number of notices filed for the month so far at 3651 x 5,000 oz = 18,255,000 oz to which we add the difference between the open interest for the front month of MAY. (195) and the number of notices served upon today (77 x 5000 oz) equals the number of ounces standing.

.

Thus the INITIAL standings for silver for the MAY/2019 contract month: 3651(notices served so far)x 5000 oz + OI for front month of MAY( 195) -number of notices served upon today (77)x 5000 oz equals 18,845,000 oz of silver standing for the MAY contract month.

We GAINED 16 contracts or an additional 80,000 oz will stand as these guys refused to morph into London based forwards as well as negating a fiat bonus for their efforts. WE HAVE SOME SERIOUS PLAYERS GOING AFTER LARGELY DEPLETED PHYSICAL SILVER!

FOR COMPARISON VS LAST YEAR:

ON FIRST DAY NOTICE APRIL 30/2018 (FOR THE MAY 2018 CONTRACT MONTH) WE HAD 24.11 MILLION OZ STAND FOR DELIVERY. BY MONTH END WE HAD HUGE QUEUE JUMPING AND THUS 36.285 MILLION OZ EVENTUALLY STOOD FOR DELIVERY.

ON FIRST DAY NOTICE FOR THE JUNE 2018 CONTRACT WE INITIALLY HAD 3.43 MILLION OZ STAND WHICH WAS HUGE FOR A NON DELIVERY MONTH

EVENTUALLY, 5.405 MILLION OZ STOOD FOR PHYSICAL DELIVERY.

ON THE 29TH OF MAY/2018 WE HAD 731 OPEN INTEREST WITH TWO DAYS BEFORE FIRST DAY NOTICE

ON THE 29TH OF MAY/2019 WE HAD 467 OPEN INTEREST CONTRACTS STILL OUTSTANDING WITH 2 DAYS TO GO BEFORE FIRST DAY NOTICE.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

TODAY’S ESTIMATED SILVER VOLUME: 74,426 CONTRACTS

CONFIRMED VOLUME FOR YESTERDAY: 113,270 CONTRACTS..

YESTERDAY’S CONFIRMED VOLUME OF 113,270 CONTRACTS EQUATES to 566 million OZ 80.8% OF ANNUAL GLOBAL PRODUCTION OF SILVER

COMMODITY LAW SUGGESTS THAT OPEN INTEREST SHOULD NOT BE MORE THAN 3% OF ANNUAL GLOBAL PRODUCTION. THE CROOKS ARE SUPPLYING MASSIVE PAPER TRYING TO KEEP SILVER IN CHECK.

The record level of silver open interest is 234,787 contracts set on April 21./2017 with the price at that day at $18.42

The previous record was 224,540 contracts with the price at that time of $20.44

end

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

NPV for Sprott

1. Sprott silver fund (PSLV): NAV FALLS TO -4.35% (MAY 29/2019)

2. Sprott gold fund (PHYS): premium to NAV FALLS TO -1.91% to NAV (MAY 29/2019 )

Note: Sprott silver trust back into NEGATIVE territory at -4.35%-/Sprott physical gold trust is back into NEGATIVE/

(courtesy Sprott/GATA)

3.SPROTT CEF.A FUND (FORMERLY CENTRAL FUND OF CANADA):

NAV 12.76 TRADING 12.21/DISCOUNT 4.48

END

And now the Gold inventory at the GLD/

MAY 29/WITH GOLD UP $3.90 TODAY: NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 737.34 TONNES

MAY 28/WITH GOLD DOWN $6.50 TODAY: A BIG CHANGE IN GOLD INVENTORY AT THE GLD> A WITHDRAWAL OF 1.47 TONNES/INVENTORY RESTS AT 737.34 TONNES

MAY 24/WITH GOLD DOWN $1.60 TODAY: NO CHANGE IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 738.81 TONNES

MAY 23/WITH GOLD UP $11.10 TODAY: A STRANGE WITHDRAWAL OF .88 TONNES FORM THE GLD/INVENTORY RESTS AT 738,81 TONNES

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Markets Tumble, S&P Below 2,800, Bond Yields Crater As Traders Brace For Impact

It’s going from bad to worse for global equity market and US stock futures, which again are a sea of red as Sino-U.S. trade tensions continue to escalate – with a rare earth boycott by China now virtually assured – while fears of an Italy-EU confrontation are growing again, accelerating a global bond rally on Wednesday, as investors dumped shares and scurried for the safety of government debt, the dollar and gold.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Stocks Slammed As Credit Cracks, Retail Routed, Yield Curve Craters

MMGYS

MMGYS

Stocks Slammed As Credit Cracks, Retail Routed, Yield Curve Craters

The Fed trying to hit its inflation goal…

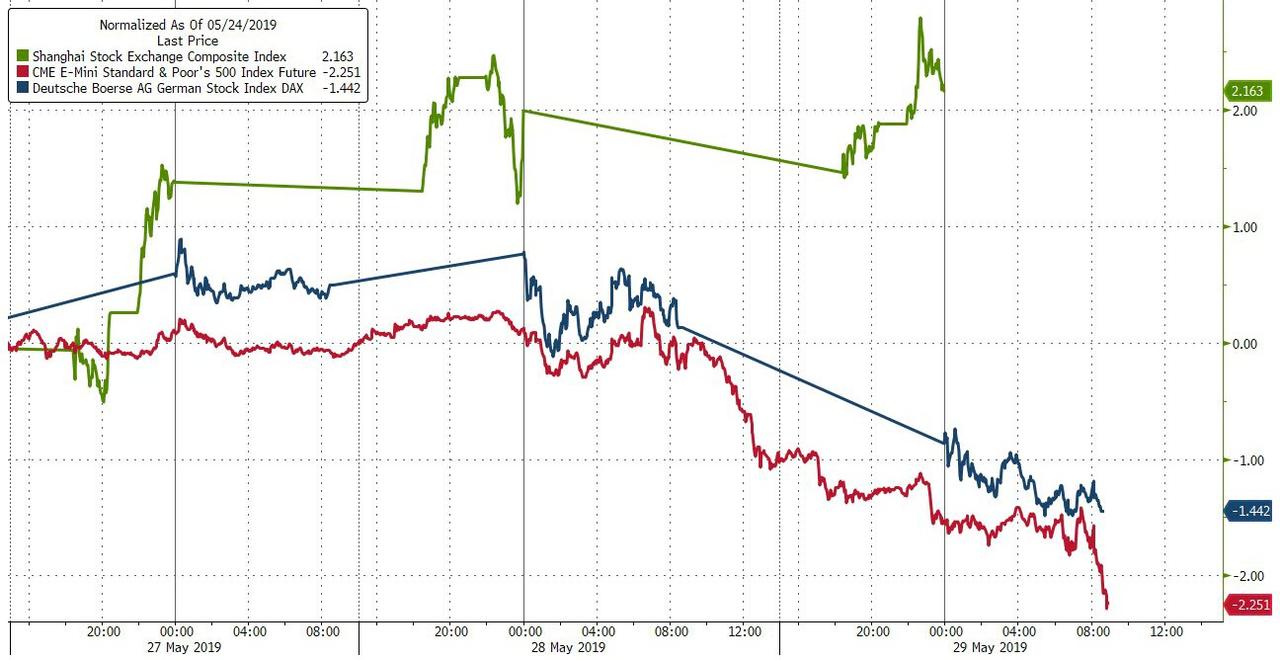

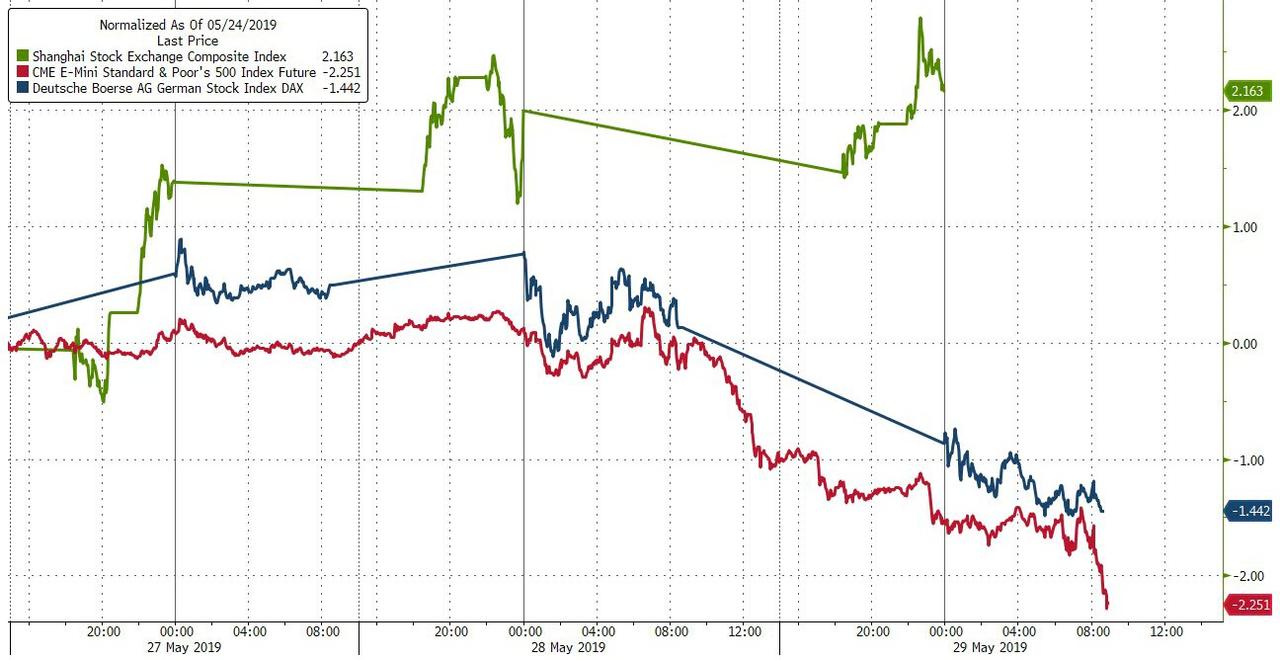

Chinese stocks are outperforming Europe and US this week (thanks to a panicking PBOC throwing liquidity at it)…

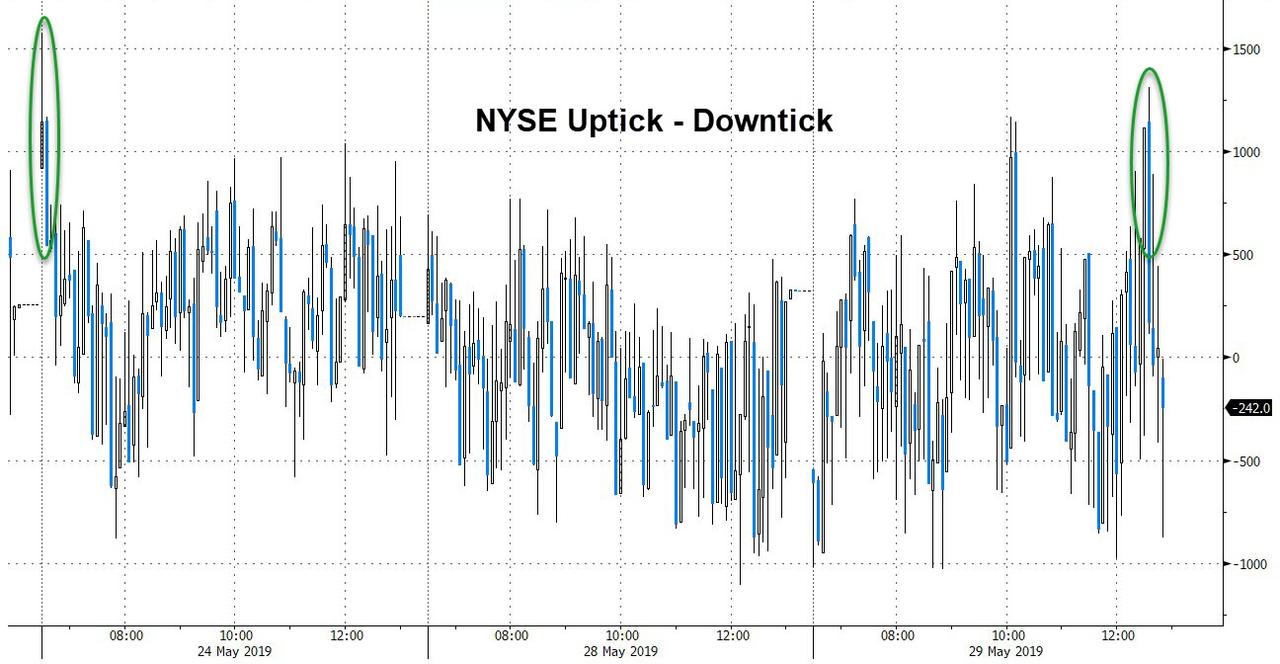

As buying-panics keep rescuing stocks…

European Stocks were uniformly ugly today…

And after a stunningly bad German unemployment print, bunds tumbled even close to record low yields…

US markets traded very much in sync today, chopping and popping together with a late-day surge that dragged us “off the lows”…

Dow briefly lost 25k intraday

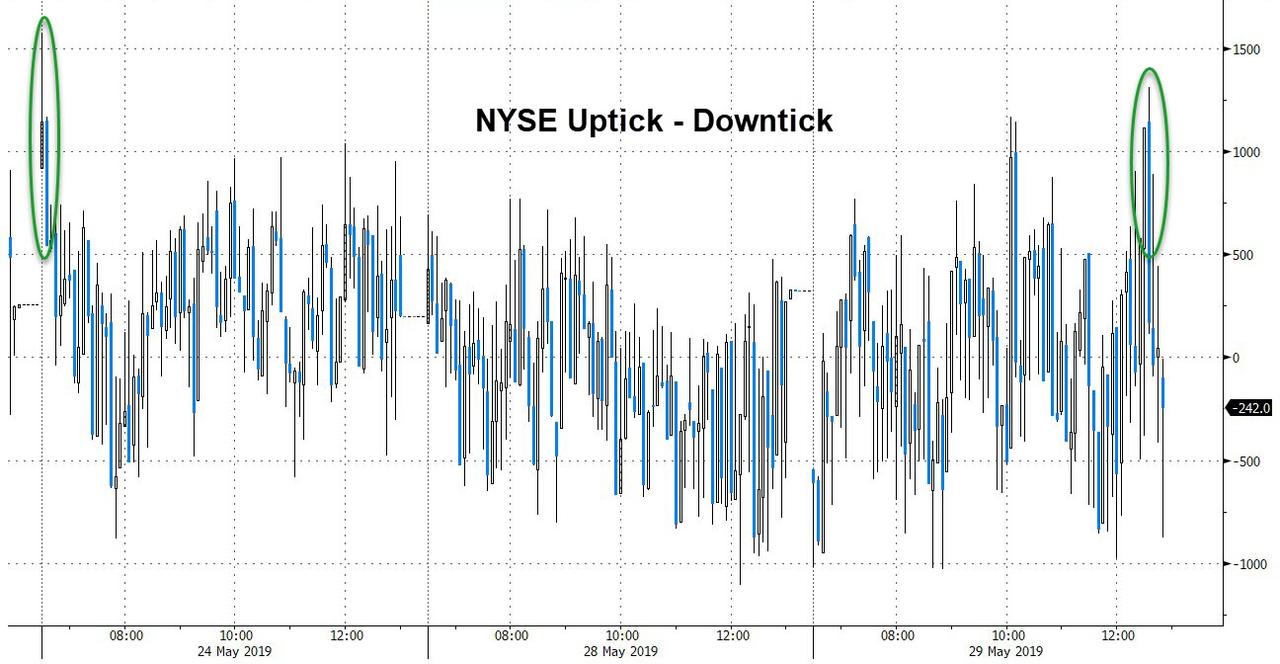

The buy program hit at around 1530ET – biggest in 3 days…

S&P and Nasdaq both broke below their 200DMA today (joining The Dow and Small Caps already well below it), but the machines did their best to get them both back above that key level…

YTD, Nasdaq remains up almost 14% and Dow up around 8%…

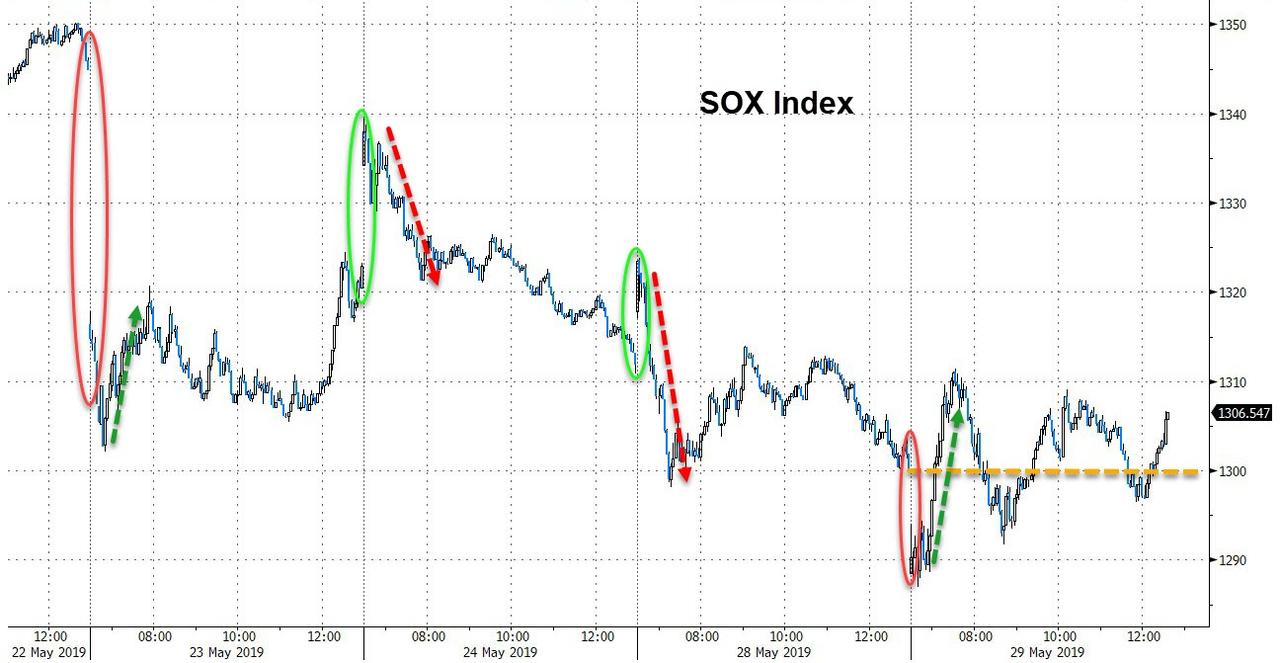

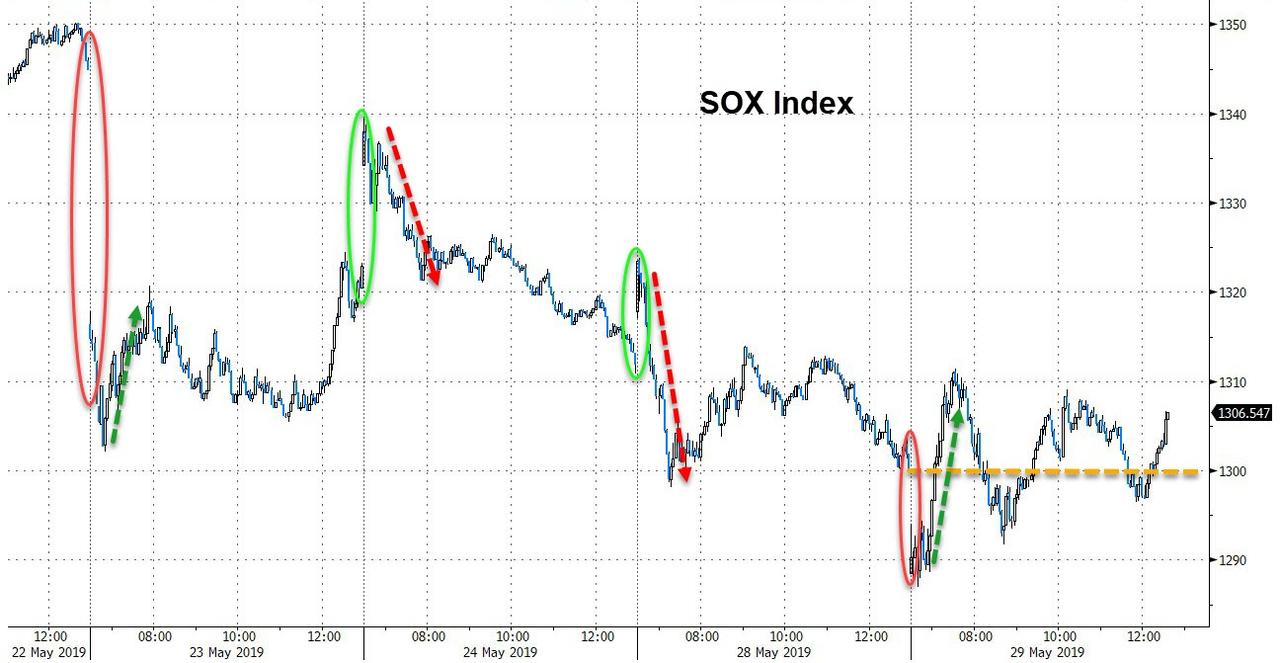

Semis ended the day marginally higher after almost tagging the bear market (-19.79%) at the open…

NOTE – the machines always ready to fade the opening

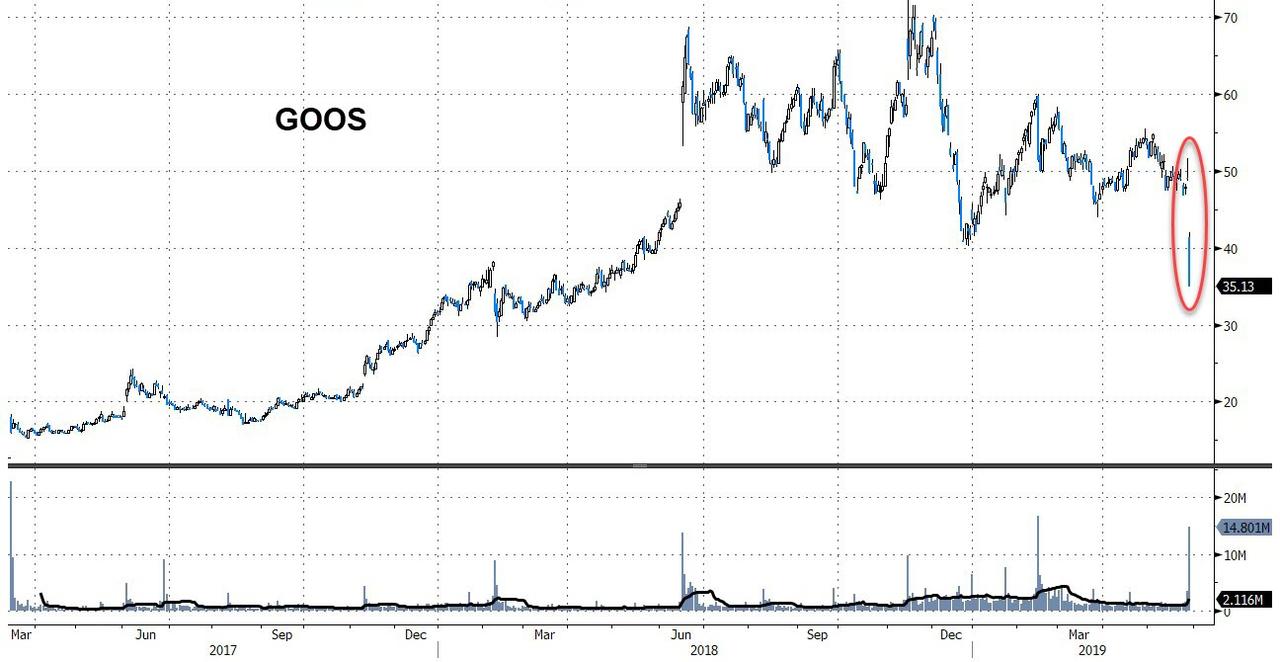

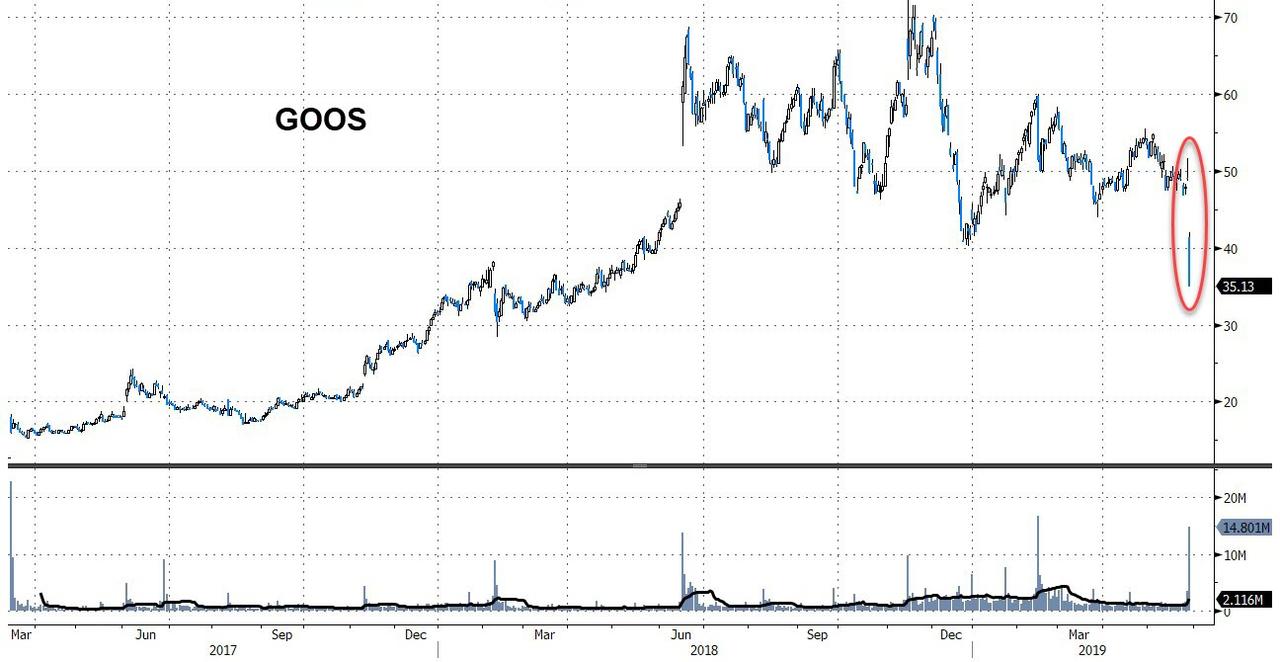

The GOOS was cooked… (down a record 28% on the day)…

But the entire retail space is getting monkey-hammered…

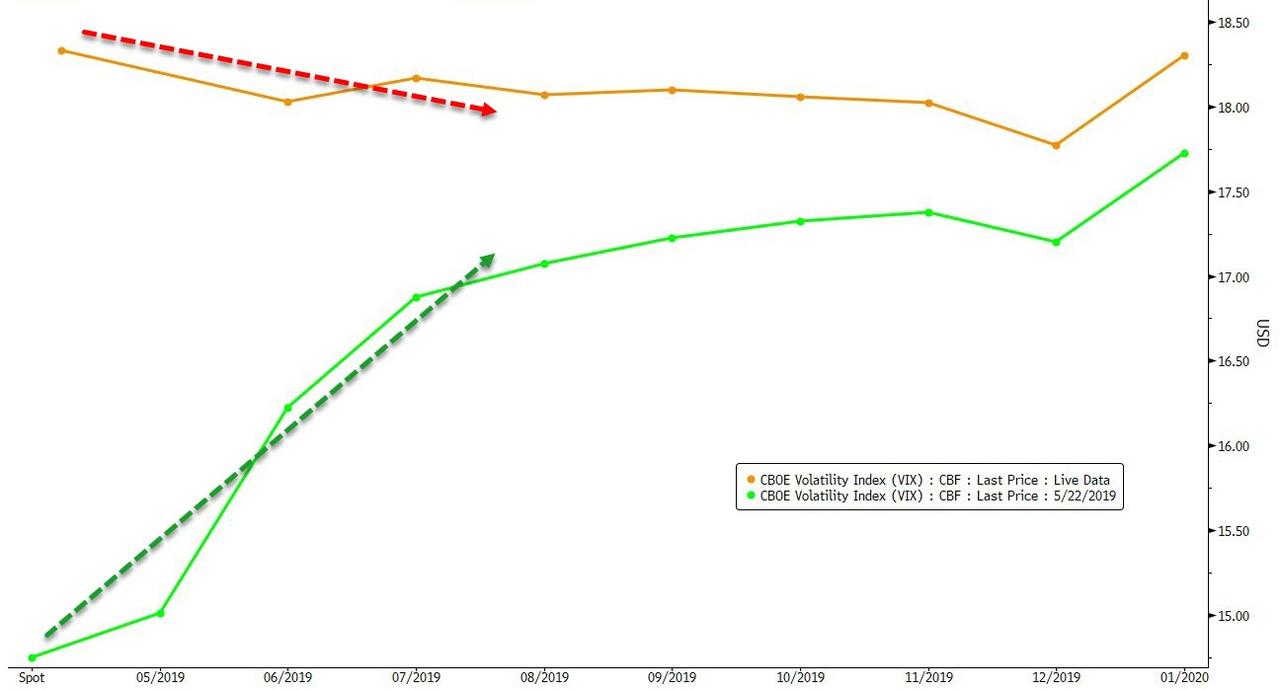

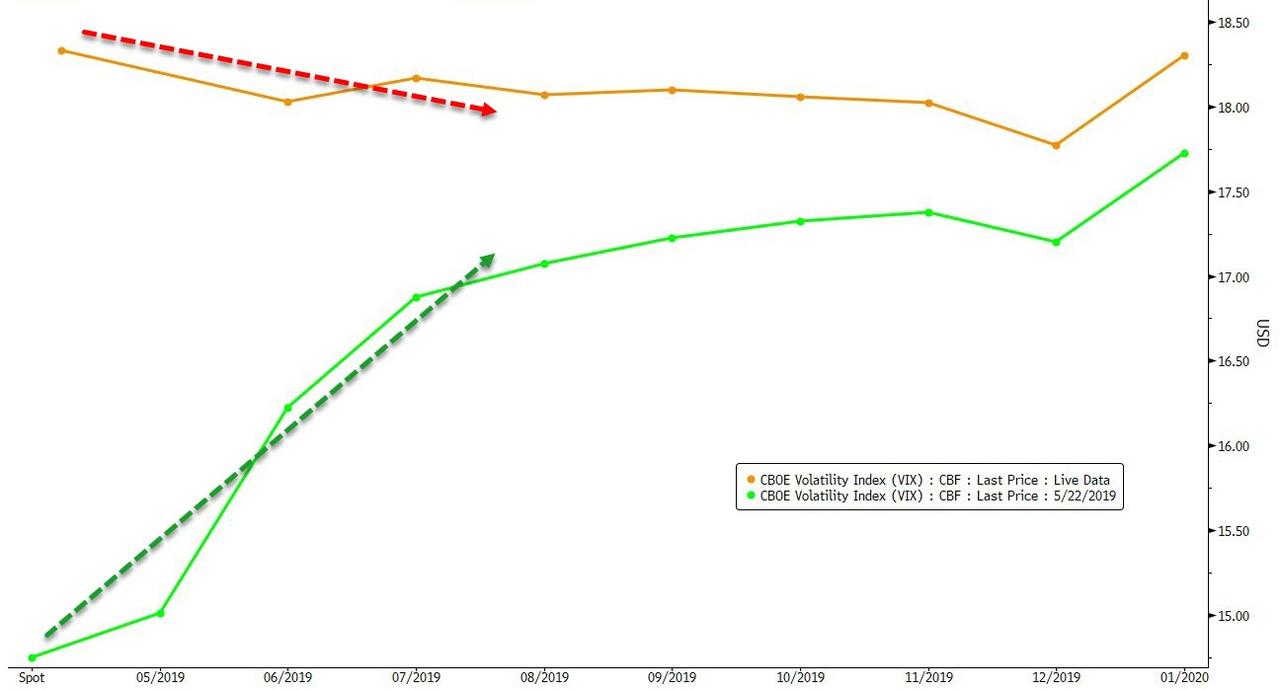

VIX term structure inverted further…

HY Credit spreads are blowing out to 4-month highs, eerily tracking last year’s collapse…

Global Stocks are starting to roll over but Global Bond Yields are collapsing…

And HY risk is leading stocks notably lower…

Treasury yields tumbled once again today but a weak 7Y auction sparked some yield give-back…

Additionally, as Bloomberg notes, rates on 10-year and 30-year securities hit an additional milestone, retracing over half of their climb from the record lows of 2016 to the multiyear highs in 2018. Having broken through those levels, the yields’ next major technical objectives include the 61.8% retracements, which for the 30-year is fewer than 5 basis points away.

For the 10-year, which rose from 1.318% in 2016 to 3.259% in 2018 and touched 2.2081% today, the 50% retracement was at 2.289%; the 61.8% is at 2.0596%

For the 30-year, which rose from 2.088% in 2016 to 3.465% in 2018 and touched 2.654% today, the 50% retracement was at 2.777%; the 61.8% is at 2.6141%

This prompted the yield curve to collapse to new cycle lows…

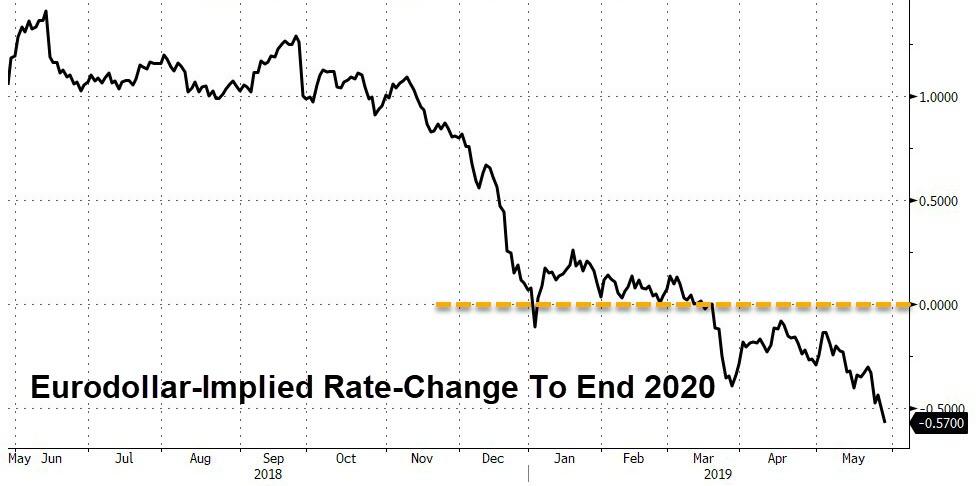

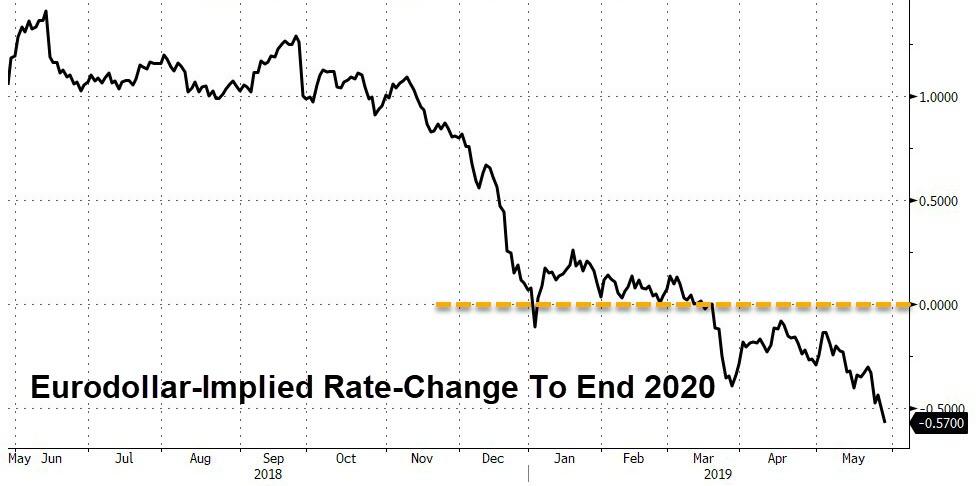

And before we leave bond-land, the ED market is implying more than 2 rate cuts by the end of 2020…

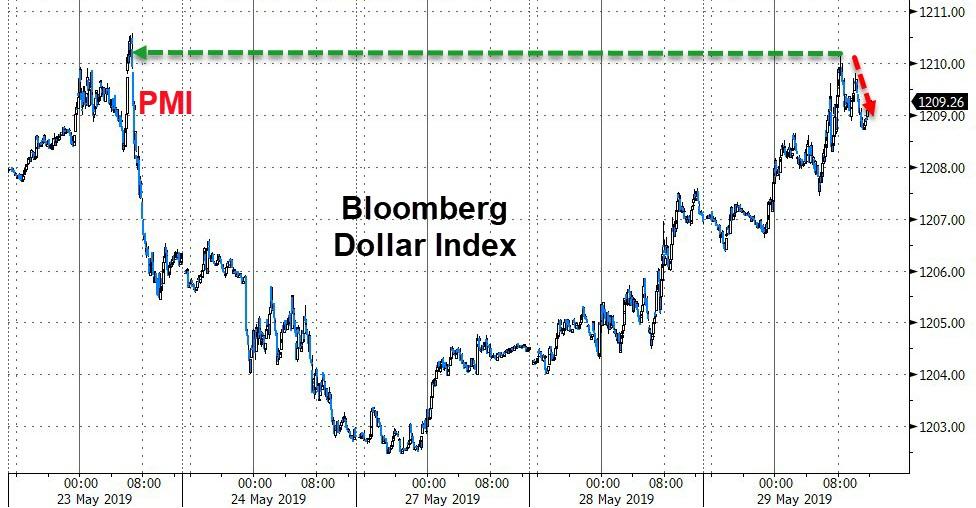

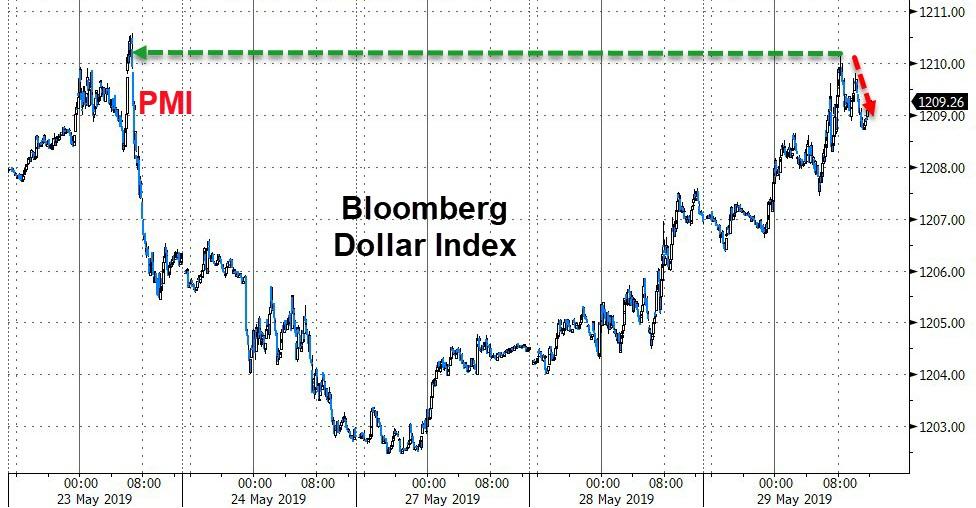

The Dollar Index extended gains, erasing losses from last Thursday’s spike and dump after ugly PMI data…

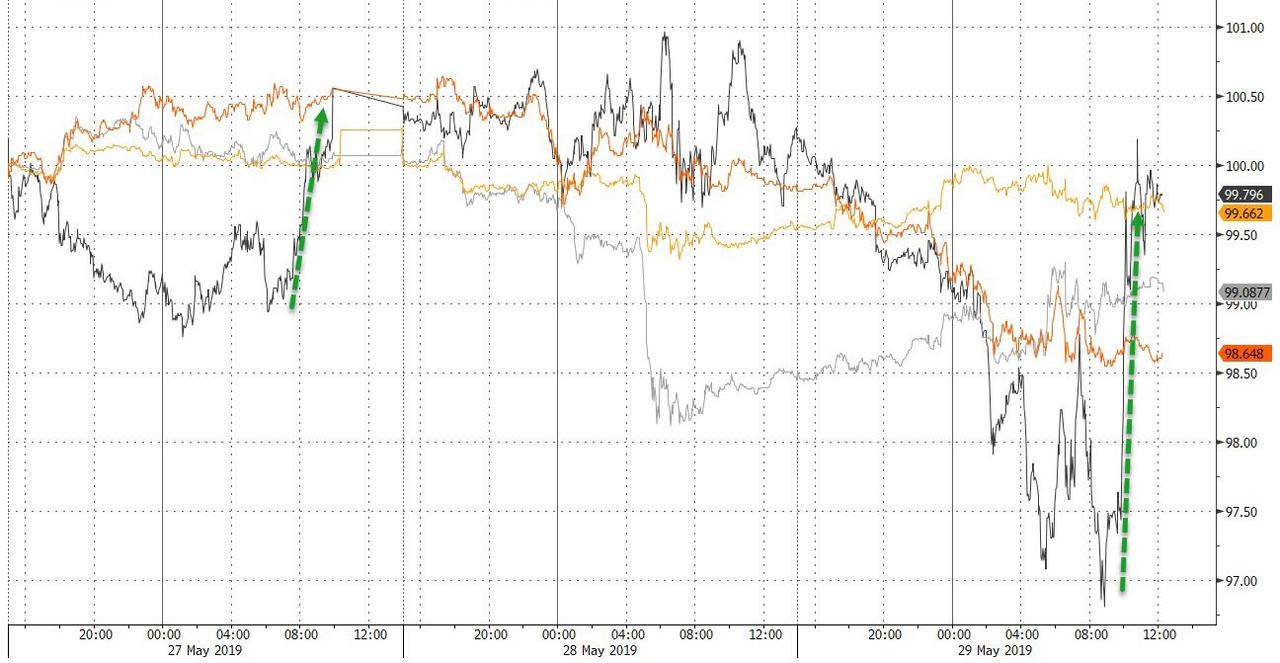

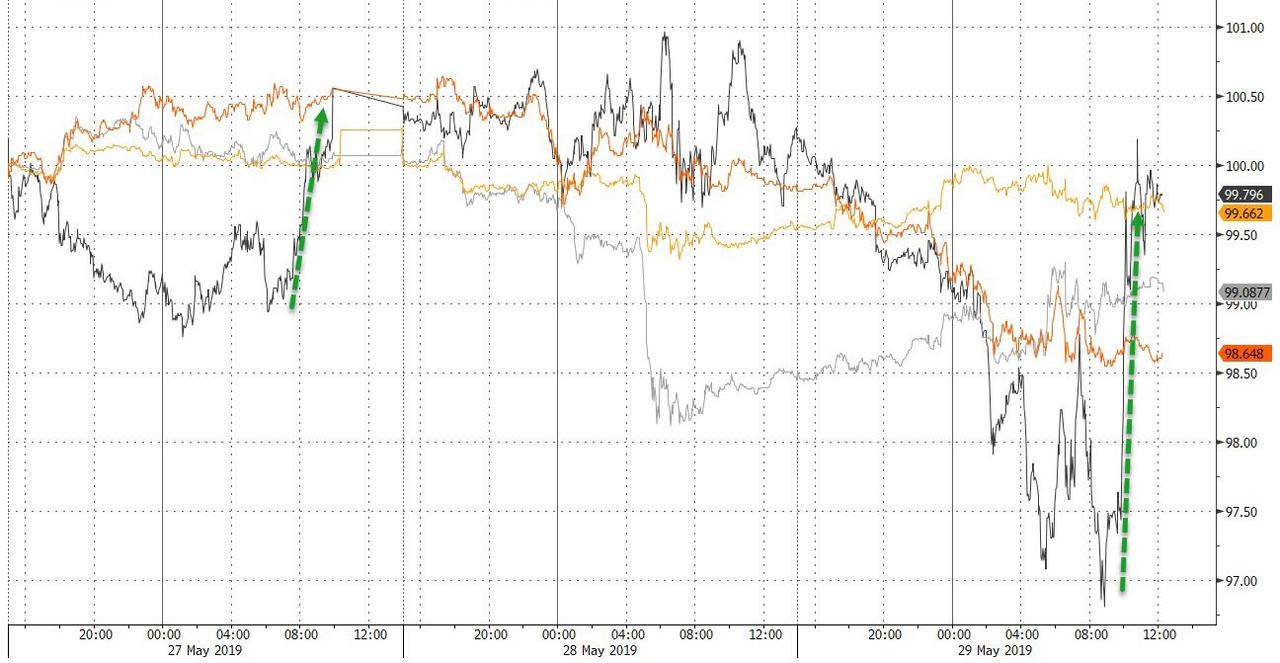

And PBOC threats to Yuan shorts keep failing…

Cryptos dropped and popped today to end marginally higher with Ripple and Litecoin leading the week…

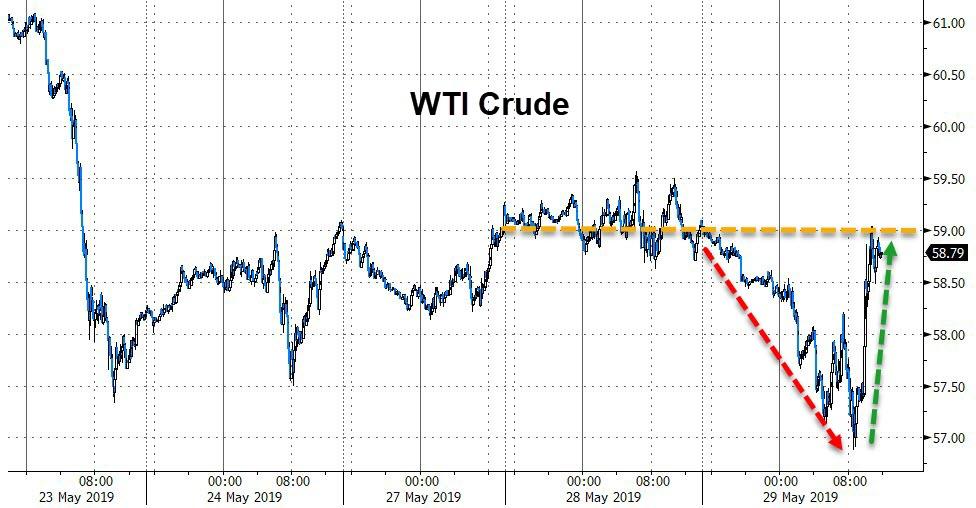

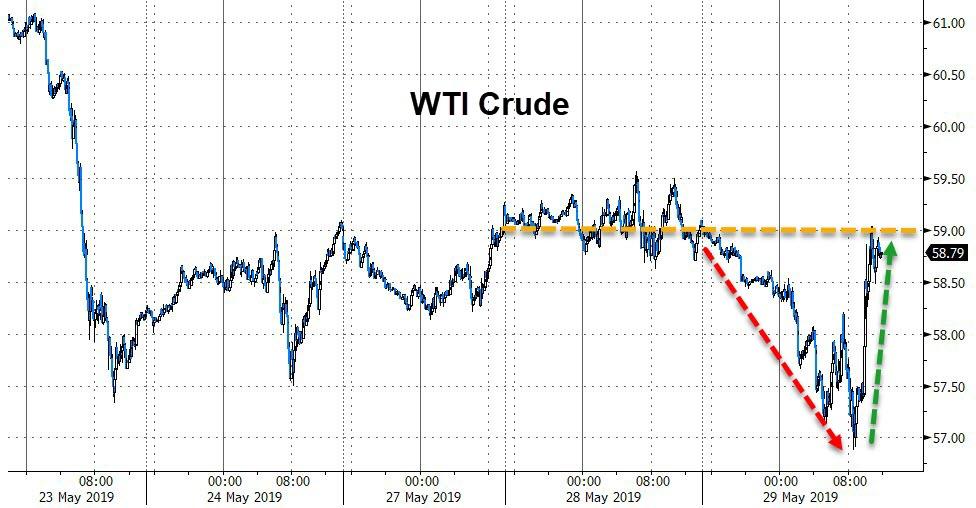

Commodities were mixed on the day with PMs modestly higher (despite USD gains), copper clobbered, and WTI doing a huge circle-jerk…

WTI Crude collapsed to a $57 handle before going vertical back to unchanged…early weakness was growth scare and rare-earth escalation fears and the spike was seemingly catalyzed by Iran chatter and rumors that MPLX’s Ozark pipeline would restart early on Thursday…

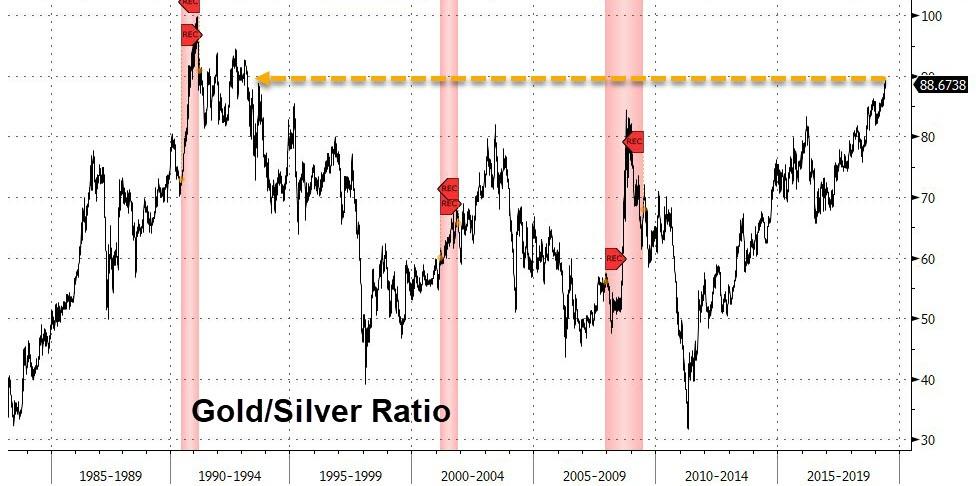

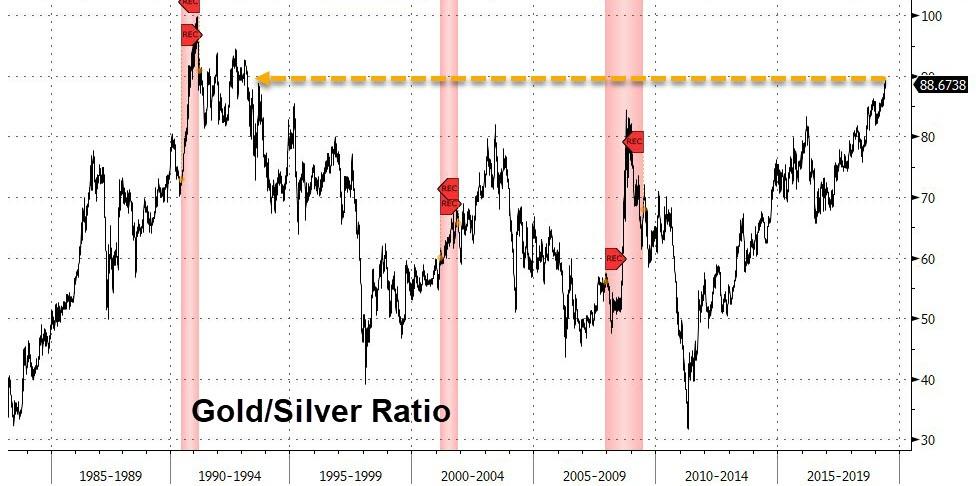

The gold-silver ratio has surged to a 26-year high…

As Bloomberg’s Marvin Perez notes, the surge in the gold-silver ratio adds to economic warning signs including the U.S. Treasury yield curve as trade tensions, a weakening Chinese expansion and sluggishness from Europe to Brazil dim global growth prospects. The ratio’s rise comes even as dollar gains have limited demand for gold, often seen as a store of value in times of market turbulence.

The ratio “has surged to generational highs on the sustained weakness in silver that has been caught in the gravity well of base metals, which have suffered on the worsening trade war,” Tai Wong, head of base and precious metals derivatives trading at BMO Capital Markets, said by email.

Finally, as Bloomberg macro strategist Mark Cudmore notes, dip-buyers beware!

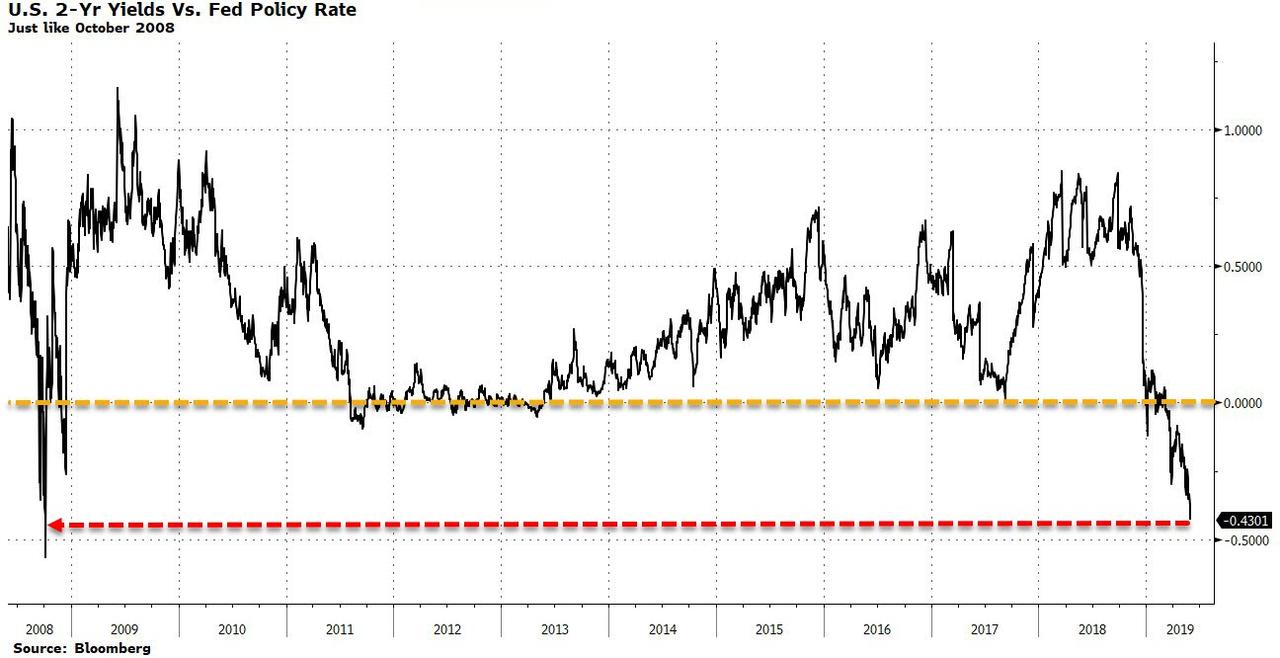

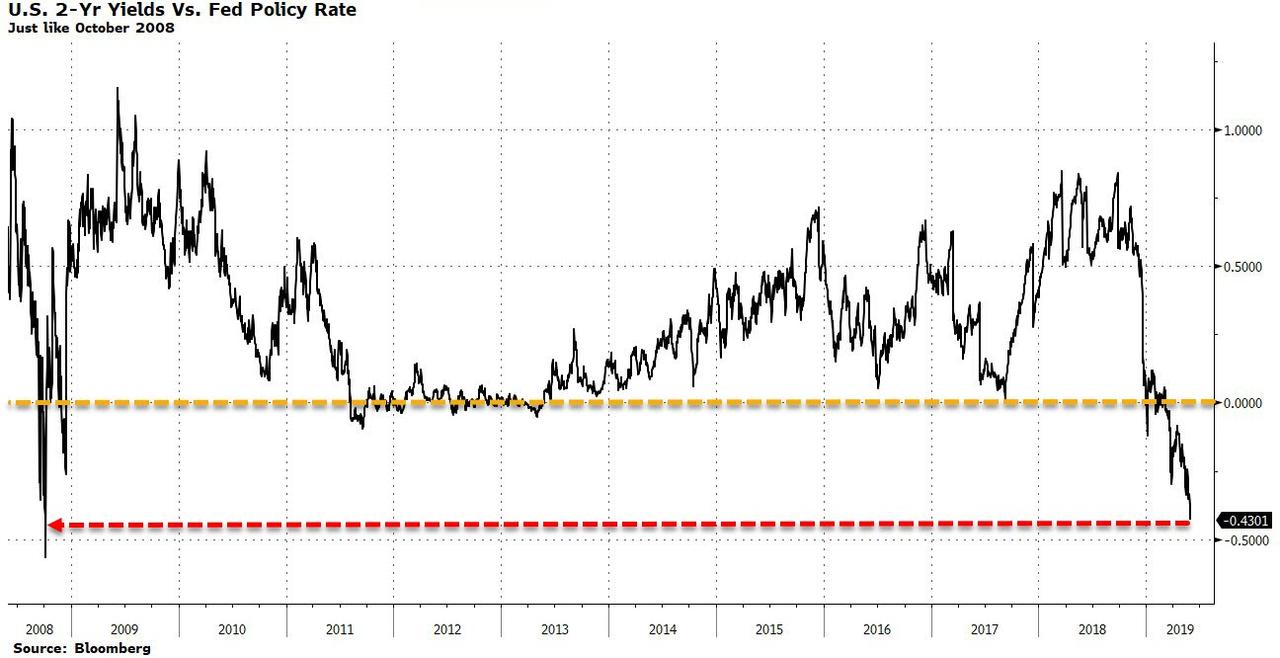

After a decade of reliable support, the Fed may find it tougher to support flailing U.S. stocks in the months ahead. Rates markets are already pricing in the steepest policy easing since October 2008, so it’ll take something extraordinary for the Fed to deliver a dovish surprise from here.

end

Read More Harvey Here......

https://harveyorganblog.com/2019/05/29/may-29-work-in-progress/

show simo casted on Captain's Quarters

.jpg)

Good Morning Good Evening

'Mining Investor Insights Drawn From The Wells Of Minerals,Metals & Mining'

Welcome to ~*~Mining & Metals Du Jour~*~Graveyard Shift~*~

On the show tonight: Great Data & News by Harvey Organ , Jim Wyckoffs AM/PM Gold and Silver Round Up, a Cute Math Test, China_Gears_Up_ To Weaponize Rare Earths Dominance In Trade_War, Treasure Tales:Eleven and One Colorado Lost Treasure Tales, and maybe more.....

Hello everybody I'm J:D your host tonight Thanks for being with us.

Hope Your Having a Wonderful Evening

EnJoy the show

OK...Here We Go......

MMGYS

Thank you

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

MAY 29/GOLD UP $3.90 TO $1281.70//SILVER UP 11 CENTS//DOW FALTERS AGAIN BY 220 POINTS//USA 10 YR BOND YIELD HITS 2.21% BEFORE SLIGHTLY RECOVERING TO 2.26%//PBOC PRESSES PANIC BUTTON BY RELEASING HUGE LIQUIDITY AFTER A BANKING FAILURE//GERMAN 10 YR RATE PLUMMETS TO -.18%//JAPANESE 10 YR BOND YIELD PLUMMETS TO .09%//ITALY NOW CONFIRMS THAT IT IS OF RISK TO RECEIVE A HUGE FINE FOR EXCEEDING BUDGET DEFICITS OF 2.%//HUGE NUMBER OF SWAMP STORIES FOR YOU TONIGHT//

May 29, 2019 · by harveyorgan · in Uncat

FINALIZED

GOLD: $1281.70 UP $3.90 (COMEX TO COMEX CLOSING)

Silver: $14.34 UP 11 CENTS (COMEX TO COMEX CLOSING)

Closing access prices:

Gold : 1280.20

silver: $14.43

COMEX EXPIRY FOR GOLD/SILVER: TUES MAY 28/2019

LBMA/OTC EXPIRY: MAY 31.2019

COMEX DATA

JPMorgan has been receiving gold with reckless abandon and sometimes supplying (stopping)

today RECEIVING 0/0

NUMBER OF NOTICES FILED TODAY FOR MAY CONTRACT: 0 NOTICE(S) FOR NIL OZ (0.0000 tonnes)

TOTAL NUMBER OF NOTICES FILED SO FAR: 306 NOTICES FOR 3060000 OZ (.9517 TONNES)

SILVER

FOR MAY

77 NOTICE(S) FILED TODAY FOR 385,000 OZ/

total number of notices filed so far this month: 3651 for 18,255,000 oz

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Bitcoin: OPENING MORNING TRADE : $8708 DOWN $51

Bitcoin: FINAL EVENING TRADE: $ 8653 DOWN $73

end

XXX

Let us have a look at the data for today

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

IN SILVER THE COMEX OI ROSE BY AN UNBELIEVABLE SIZED 6027 CONTRACTS FROM 211,578 UP TO 217,605 DESPITE THE 23 CENT LOSS IN SILVER PRICING AT THE COMEX. LIQUIDATION OF THE SPREADERS HAVE STOPPED FOR SILVER BUT IT NOW IN FULL FORCE FOR GOLD. TODAY WE ARRIVED CLOSER TO AUGUST’S 2018 RECORD SETTING OPEN INTEREST OF 244,196 CONTRACTS.

WE HAVE ALSO WITNESSED A LARGE AMOUNT OF PHYSICAL METAL STAND FOR COMEX DELIVERY AS WELL WE ARE WITNESSING CONSIDERABLE LONGS PACKING THEIR BAGS AND MIGRATING OVER TO LONDON IN GREATER NUMBERS IN THE FORM OF EFP’S. WE WERE NOTIFIED THAT WE HAD A FAIR SIZED NUMBER OF COMEX LONGS TRANSFERRING THEIR CONTRACTS TO LONDON THROUGH THE EFP:

0 FOR MAY, 0 FOR JUNE, 2294 FOR JULY AND ZERO FOR ALL OTHER MONTHS AND THEREFORE TOTAL ISSUANCE 2294 CONTRACTS. WITH THE TRANSFER OF 2294 CONTRACTS, WHAT THE CME IS STATING IS THAT THERE IS NO SILVER (OR GOLD) TO BE DELIVERED UPON AT THE COMEX AS THEY MUST EXPORT THEIR OBLIGATION TO LONDON. ALSO KEEP IN MIND THAT THERE CAN BE A DELAY OF 24-48 HRS IN THE ISSUING OF EFP’S. THE 2294 EFP CONTRACTS TRANSLATES INTO 11.47 MILLION OZ ACCOMPANYING:

1.THE 23 CENT LOSS IN SILVER PRICE AT THE COMEX AND

2. THE STRONG AMOUNT OF SILVER OUNCES WHICH STOOD FOR DELIVERY IN THE LAST NINE MONTHS:

JUNE/2018. (5.420 MILLION OZ);

FOR JULY: 30.370 MILLION OZ

FOR AUG., 6.065 MILLION OZ

FOR SEPT. 39.505 MILLION OZ S

FOR OCT.2.525 MILLION OZ.

FOR NOV: A HUGE 7.440 MILLION OZ STANDING AND

21.925 MILLION OZ FINALLY STAND FOR DECEMBER.

5.845 MILLION OZ STAND IN JANUARY.

2.955 MILLION OZ STANDING FOR FEBRUARY.:

27.120 MILLION OZ STANDING IN MARCH.

3.875 MILLION OZ STANDING FOR SILVER IN APRIL.

AND NOW 18.765 MILLION OZ STANDING FOR SILVER IN MAY.

ACCUMULATION FOR EFP’S/SILVER/J.P.MORGAN’S HOUSE OF BRIBES, / STARTING FROM FIRST DAY NOTICE/FOR MONTH OF MAY:

24,941 CONTRACTS (FOR 20 TRADING DAYS TOTAL 24,941 CONTRACTS) OR 124.71 MILLION OZ: (AVERAGE PER DAY: 1247 CONTRACTS OR 6.235 MILLION OZ/DAY)

TO GIVE YOU AN IDEA AS TO THE HUGE SUPPLY THIS MONTH IN SILVER: SO FAR THIS MONTH OF MAY: 124.71 MILLION PAPER OZ HAVE MORPHED OVER TO LONDON. THIS REPRESENTS AROUND 17.81% OF ANNUAL GLOBAL PRODUCTION (EX CHINA EX RUSSIA)* JUNE’S 345.43 MILLION OZ IS THE SECOND HIGHEST RECORDED ISSUANCE OF EFP’S AND IT FOLLOWED THE RECORD SET IN APRIL 2018 OF 385.75 MILLION OZ.

ACCUMULATION IN YEAR 2019 TO DATE SILVER EFP’S: 865.80 MILLION OZ.

JANUARY 2019 EFP TOTALS: 217.455. MILLION OZ

FEB 2019 TOTALS: 147.4 MILLION OZ/

MARCH 2019 TOTAL EFP ISSUANCE: 207.835 MILLION OZ

APRIL 2019 TOTAL EFP ISSUANCE: 182.87 MILLION OZ.

RESULT: WE HAD AN UNBELIEVABLE SIZED INCREASE IN COMEX OI SILVER COMEX CONTRACTS OF 6027 DESPITE THE 23 CENT LOSS IN SILVER PRICING AT THE COMEX /YESTERDAY... THE CME NOTIFIED US THAT WE HAD A VERY STRONG SIZED EFP ISSUANCE OF 2294 CONTRACTS WHICH EXITED OUT OF THE SILVER COMEX AND TRANSFERRED THEIR OI TO LONDON AS FORWARDS. SPECULATORS CONTINUED THEIR INTEREST IN ATTACKING THE SILVER COMEX FOR PHYSICAL SILVER (SEE COMEX DATA) . OUR BANKERS RESUMED THEIR LIQUIDATION OF THE SPREAD TRADES TODAY.

TODAY WE GAINED A HUMONGOUS SIZED: 8,321 TOTAL OI CONTRACTS ON THE TWO EXCHANGES:

i.e 2294 OPEN INTEREST CONTRACTS HEADED FOR LONDON (EFP’s) TOGETHER WITH INCREASE OF 6027 OI COMEX CONTRACTS. AND ALL OF THIS DEMAND HAPPENED WITH A 23 CENT LOSS IN PRICE OF SILVER AND A CLOSING PRICE OF $14.34 WITH RESPECT TO YESTERDAY’S TRADING. YET WE STILL HAVE A STRONG AMOUNT OF SILVER STANDING AT THE COMEX FOR DELIVERY!!

In ounces AT THE COMEX, the OI is still represented by JUST OVER 1 BILLION oz i.e. 1.536 BILLION OZ TO BE EXACT or 158% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT MARCH MONTH/ THEY FILED AT THE COMEX: 77 NOTICE(S) FOR 385,000, OZ OF SILVER

IN SILVER,PRIOR TO TODAY, WE SET THE NEW COMEX RECORD OF OPEN INTEREST AT 243,411 CONTRACTS ON APRIL 9.2018. AND AGAIN THIS HAS BEEN SET WITH A LOW PRICE OF $16.51.

AND NOW WE RECORD FOR POSTERITY ANOTHER ALL TIME RECORD OPEN INTEREST AT THE COMEX OF 244,196 CONTRACTS ON AUGUST 22/2018 AND AGAIN WHEN THIS RECORD WAS SET, THE PRICE OF SILVER WAS $14.78 AND LOWER IN PRICE THAN PREVIOUS RECORDS.

ON THE DEMAND SIDE WE HAVE THE FOLLOWING:

HUGE AMOUNTS OF SILVER STANDING FOR DELIVERY (MARCH/2018: 27 MILLION OZ , APRIL/2018 : 2.485 MILLION OZ MAY: 36.285 MILLION OZ ; JUNE/2018 (5.420 MILLION OZ) , JULY 2018 FINAL AMOUNT STANDING: 30.370 MILLION OZ ) FOR AUGUST 6.065 MILLION OZ. , SEPT: A HUGE 39.505 MILLION OZ./ OCTOBER: 2,520,000 oz NOV AT 7.440 MILLION OZ./ DEC. AT 21.925 MILLION OZ JANUARY AT 5.825 MILLION OZ.AND FEB 2019: 2.955 MILLION OZ/ MARCH: 27.120 MILLION OZ/ APRIL AT 3.875 MILLION OZ/ AND NOW MAY: 18.765 MILLION OZ ..

HUGE RECORD OPEN INTEREST IN SILVER 243,411 CONTRACTS (OR 1.217 BILLION OZ/ SET APRIL 9/2018) AND NOW AUGUST 22/2018: 244,196 CONTRACTS, WITH A SILVER PRICE OF $14.78.

HUGE ANNUAL EFP’S ISSUANCE EQUAL TO 2.9 BILLION OZ OR 400% OF SILVER ANNUAL PRODUCTION/2017

RECORD SETTING EFP ISSUANCE FOR ANY MONTH IN SILVER; APRIL/2018/ 385.75 MILLION OZ/ AND THE SECOND HIGHEST RECORDED EFP ISSUANCE JUNE 2018 345.43 MILLION OZ

AND YET, WITH THE EXTREMELY HIGH EFP ISSUANCE, WE HAVE A CONTINUAL LOW PRICE OF SILVER DESPITE THE ABOVE HUGE DEMAND. TO ME THE ONLY ANSWER IS THAT WE HAVE SOVEREIGN (CHINA) WHO IS ENDEAVOURING TO GOBBLE UP ALL AVAILABLE PHYSICAL SILVER NO MATTER WHERE, EXACTLY WHAT J.P.MORGAN IS DOING. AND IT IS MY BELIEF THAT J.P.MORGAN IS HOLDING ITS SILVER FOR ITS BENEFICIAL OWNER..THE USA GOVERNMENT WHO IN TURN IS HOLDING THAT SILVER FOR CHINA.(FOR A SILVER LOAN REPAYMENT).

IN GOLD, THE OPEN INTEREST FELL BY A HUGE SIZED 12,153 CONTRACTS, TO 505,126 WITH THE $6.40 PRICE FALL WITH RESPECT TO COMEX GOLD PRICING YESTERDAY/THERE WAS HUGE LIQUIDATION OF SPREADERS YESTERDAY

WE ARE NOW 2 TRADING DAYS PRIOR TO FIRST DAY NOTICE. THE SIGNAL WAS GIVEN TO START THE LIQUIDATION PROCESS OF OUR SPREADERS ON MAY 21.

THE CME RELEASED THE DATA FOR EFP ISSUANCE AND IT TOTALED A STRONG SIZED 7587 CONTRACTS:

APRIL 0 CONTRACTS,JUNE: 5411 CONTRACTS, AUGUST 2019: 2176 CONTRACTS, JUNE 2020 0 CONTRACTS AND ALL OTHER MONTHS ZERO. The NEW COMEX OI for the gold complex rests at 505,126. ALSO REMEMBER THAT THERE WILL BE A DELAY IN THE ISSUANCE OF EFP’S. THE BANKERS REMOVE LONG POSITIONS OF COMEX GOLD IMMEDIATELY. THEN THEY ORCHESTRATE THEIR PRIVATE EFP DEAL WITH THE LONGS AND THAT COULD TAKE AN ADDITIONAL, 48 HRS SO WE GENERALLY DO NOT GET A MATCH WITH RESPECT TO DEPARTING COMEX LONGS AND NEW EFP LONG TRANSFERS. . EVEN THOUGH THE BANKERS ISSUED THESE MONSTROUS EFPS, THE OBLIGATION STILL RESTS WITH THE BANKERS TO SUPPLY METAL BUT IT TRANSFERS THE RISK TO A LONDON BANKER OBLIGATION AND NOT A NEW YORK COMEX OBLIGATION. LONGS RECEIVE A FIAT BONUS TOGETHER WITH A LONG LONDON FORWARD. THUS, BY THESE ACTIONS, THE BANKERS AT THE COMEX HAVE JUST STATED THAT THEY HAVE NO APPRECIABLE METAL!! THIS IS A MASSIVE FRAUD: THEY CANNOT SUPPLY ANY METAL TO OUR COMEX LONGS BUT THEY ARE QUITE WILLING TO SUPPLY MASSIVE NON BACKED GOLD (AND SILVER) PAPER KNOWING THAT THEY HAVE NO METAL TO SATISFY OUR LONGS. LONDON IS NOW SEVERELY BACKWARD IN BOTH GOLD AND SILVER AND WE ARE WITNESSING DELAYS IN ACTUAL DELIVERIES.

IN ESSENCE WE HAVE A STRONG SIZED LOSS IN TOTAL CONTRACTS ON THE TWO EXCHANGES OF 4566 CONTRACTS: 12,153 OI CONTRACTS DECREASED AT THE COMEX AND 7387 EFP OI CONTRACTS WHICH NAVIGATED OVER TO LONDON. THUS TOTAL OI LOSS OF 4566 CONTRACTS OR 456,600 OZ OR 14.20 TONNES. YESTERDAY WE HAD A LARGE PRICE FALL OF $6.40 IN GOLD TRADING ….AND WITH THAT FALL IN PRICE, WE HAD A CONSIDERABLE LOSS OF GOLD TONNAGE OF 14.20 TONNES!!!!!!

WITH RESPECT TO SPREADING: WE HAD HUGE ACTIVITY YESTERDAY

.

FOR NEWCOMERS, HERE IS THE MODUS OPERANDI OF THE CORRUPT BANKERS WITH RESPECT TO THEIR SPREAD/TRADING.

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES:

“AS YOU WILL SEE, THE CROOKS HAVE NOW SWITCHED TO GOLD AS THEY INCREASE THE OPEN INTEREST FOR THE SPREADERS. THE TOTAL COMEX GOLD OPEN INTEREST WILL RISE FROM NOW ON UNTIL ONE WEEK PRIOR TO FIRST DAY NOTICE AND THAT IS WHEN THEY START THEIR CRIMINAL LIQUIDATION.

HERE IS HOW THE CROOKS USED SPREADING AS WE ARE NO INTO THE NON ACTIVE DELIVERY MONTH OF MAY HEADING TOWARDS THE VERY ACTIVE DELIVERY MONTH OF JUNE.

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES, HERE IS THE BANKERS MODUS OPERANDI:

YOU WILL ALSO NOTICE THAT THE COMEX OPEN INTEREST IS STARTING TO RISE IN THIS NON ACTIVE MONTH OF MAY BUT SO IS THE OPEN INTEREST OF SPREADERS. THE OPEN INTEREST IN GOLD WILL CONTINUE TO RISE UNTIL ONE WEEK BEFORE FIRST DAY NOTICE OF AN UPCOMING ACTIVE DELIVERY MONTH (JUNE), AND THAT IS WHEN THE CROOKS SELL THEIR SPREAD POSITIONS BUT NOT AT THE SAME TIME OF THE DAY. THEY WILL USE THE SELL SIDE OF THE EQUATION TO CREATE THE CASCADE (ALONG WITH THEIR COLLUSIVE FRIENDS) AND THEN COVER ON THE BUY SIDE OF THE SPREAD SITUATION AT THE END OF THE DAY. THEY DO THIS TO AVOID POSITION LIMIT DETECTION. THE LIQUIDATION OF THE SPREADING FORMATION CONTINUES FOR EXACTLY ONE WEEK AND ENDS ON FIRST DAY NOTICE.”

ACCUMULATION OF EFP’S GOLD AT J.P. MORGAN’S HOUSE OF BRIBES: (EXCHANGE FOR PHYSICAL) FOR THE MONTH OF MAY : 129,209 CONTRACTS OR 12,920,900 OR 401.89 TONNES (20 TRADING DAYS AND THUS AVERAGING: 6460 EFP CONTRACTS PER TRADING DAY

TO GIVE YOU AN IDEA AS TO THE STRONG SIZE OF THESE EFP TRANSFERS : THIS MONTH IN 20 TRADING DAYS IN TONNES: 401,89 TONNES

TOTAL ANNUAL GOLD PRODUCTION, 2018, THROUGHOUT THE WORLD EX CHINA EX RUSSIA: 3555 TONNES

THUS EFP TRANSFERS REPRESENTS 401.89/3550 x 100% TONNES =11.32% OF GLOBAL ANNUAL PRODUCTION SO FAR IN DECEMBER ALONE.***

ACCUMULATION OF GOLD EFP’S YEAR 2019 TO DATE: 2217.41 TONNES

JANUARY 2019 TOTAL EFP ISSUANCE; 531.20 TONNES

FEB 2019 TOTAL EFP ISSUANCE: 344.36 TONNES

MARCH 2019 TOTAL EFP ISSUANCE: 497.16 TONNES

APRIL 2019 TOTAL ISSUANCE: 456.10 TONNES

WHAT IS ALARMING TO ME, ACCORDING TO OUR LONDON EXPERT ANDREW MAGUIRE IS THAT THESE EFP’S ARE BEING TRANSFERRED TO WHAT ARE CALLEDRIAL FORWARD CONTRACT OBLIGATIONS AND THESE CONTRACTS ARE LESS THAN 14 DAYS. ANYTHING GREATER THAN 14 DAYS, THESE MUST BE RECORDED AND SENT TO THE COMPTROLLER, GREAT BRITAIN TO MONITOR RISK TO THE BANKING SYSTEM. IF THIS IS INDEED TRUE, THEN THIS IS A MASSIVE CONSPIRACY TO DEFRAUD AS WE NOW WITNESS A MONSTROUS TOTAL EFP’S ISSUANCE AS IT HEADS INTO THE STRATOSPHERE.

Result: A CONSIDERABLE SIZED DECREASE IN OI AT THE COMEX OF 12,153 DESPITE WITH LARGE PRICING LOSS THAT GOLD UNDERTOOK YESTERDAY(6.40)) //.WE ALSO HAD A STRONG SIZED NUMBER OF COMEX LONG TRANSFERRING TO LONDON THROUGH THE EFP ROUTE: 7587 CONTRACTS AS THESE HAVE ALREADY BEEN NEGOTIATED AND CONFIRMED. THERE OBVIOUSLY DOES NOT SEEM TO BE MUCH PHYSICAL GOLD AT THE COMEX. I GUESS IT EXPLAINS THE HUGE ISSUANCE OF EFP’S…THERE IS HARDLY ANY GOLD PRESENT AT THE GOLD COMEX FOR DELIVERY PURPOSES. IF YOU TAKE INTO ACCOUNT THE 7587 EFP CONTRACTS ISSUED, WE HAD A HUGE SIZED LOSS OF 4566 CONTRACTS IN TOTAL OPEN INTEREST ON THE TWO EXCHANGES:

7587 CONTRACTS MOVE TO LONDON AND 12,153 CONTRACTS DECREASED AT THE COMEX. (IN TONNES, THE LOSS IN TOTAL OI EQUATES TO 14.20 TONNES). ..AND THIS LOSS OF DEMAND OCCURRED WITH THE LARGE FALL IN PRICE OF $6.40 WITH RESPECT TO YESTERDAY’S TRADING AT THE COMEX. WE HAD A HUGE PRESENCE OF SPREADING LIQUIDATION YESTERDAY/

we had: 0 notice(s) filed upon for NIL oz of gold at the comex.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

With respect to our two criminal funds, the GLD and the SLV:

GLD...

WITH GOLD UP $3.90 TODAY

NO CHANGS IN GOLD INVENTORY AT THE GLD:

INVENTORY RESTS AT 737,34 TONNES

TO ALL INVESTORS THINKING OF BUYING GOLD THROUGH THE GLD ROUTE: YOU ARE MAKING A TERRIBLE MISTAKE AS THE CROOKS ARE USING WHATEVER GOLD COMES IN TO ATTACK BY SELLING THAT GOLD. IT SURE SEEMS TO ME THAT THE GOLD OBLIGATIONS AT THE GLD EXCEED THEIR INVENTORY

SLV/

WITH SILVER UP 11 CENTS TODAY:

NO CHANGES IN SILVER INVENTORY AT THE SLV:

/INVENTORY RESTS AT 311.616 MILLION OZ.

end

OUTLINE OF TOPICS TONIGHT

First, here is an outline of what will be discussed tonight:

1. Today, we had the open interest in SILVER ROSE BY AN ATMOSPHERIC SIZED 6027 CONTRACTS from 211,578 UP TO 217,605 AND CLOSER TO THE NEW COMEX RECORD SET LAST IN AUG.2018 AT 244,196 WITH A SILVER PRICE OF $14.78/(AUGUST 22/2018)..THE PREVIOUS RECORD WAS SET ON APRIL 9/2018 AT 243,411 OPEN INTEREST CONTRACTS WITH THE SILVER PRICE AT THAT DAY: $16.53). AND PREVIOUS TO THAT, THE RECORD WAS ESTABLISHED AT: 234,787 CONTRACTS, SET ON APRIL 21.2017 OVER 1 1/3 YEARS AGO. THE PRICE OF SILVER ON THAT DAY: $17.89. AS YOU CAN SEE, WE HAVE RECORD HIGH OPEN INTERESTS IN SILVER ACCOMPANIED BY A CONTINUAL LOWER PRICE WHEN THAT RECORD WAS SET…..THE SPREADERS HAVE STOPPED THEIR LIQUIDATION IN SILVER BUT HAVE NOW MORPHED INTO GOLD..

EFP ISSUANCE:

OUR CUSTOMARY MIGRATION OF COMEX LONGS CONTINUE TO MORPH INTO LONDON FORWARDS AS OUR BANKERS USED THEIR EMERGENCY PROCEDURE TO ISSUE:

0 CONTRACTS FOR APRIL., 0 FOR MAY, FOR JUNE 0 CONTRACTS AND JULY: 2294 CONTRACTS AND ALL OTHER MONTHS: ZERO. TOTAL EFP ISSUANCE: 2294 CONTRACTS. EFP’S GIVE OUR COMEX LONGS A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. IF WE TAKE THE OI GAIN AT THE COMEX OF 6027 CONTRACTS TO THE 2294 OI TRANSFERRED TO LONDON THROUGH EFP’S, WE OBTAIN A GIGANTIC GAIN OF 8,321 OPEN INTEREST CONTRACTS. THUS IN OUNCES, THE GAIN ON THE TWO EXCHANGES: 41.605 MILLION OZ!!! AND YET WE ALSO HAVE A STRONG DEMAND FOR PHYSICAL AS WE WITNESSED A FINAL STANDING OF GREATER THAN 30 MILLION OZ FOR JULY, A STRONG 7.475 MILLION OZ FOR AUGUST.. A HUGE 39.505 MILLION OZ STANDING FOR SILVER IN SEPTEMBER… OVER 2 million OZ STANDING FOR THE NON ACTIVE MONTH OF OCTOBER., 7.440 MILLION OZ FINALLY STANDING IN NOVEMBER. 21.925 MILLION OZ STANDING IN DECEMBER , 5.845 MILLION OZ STANDING IN JANUARY. 2.955 MILLION OZ STANDING IN FEBRUARY, 27.120 MILLION OZ FOR MARCH., 3.875 MILLION OZ FOR APRIL AND NOW 18.765 MILLION OZ FOR MAY

RESULT: A STRONG SIZED INCREASE IN SILVER OI AT THE COMEX DESPITE THE 23 CENT LOSS IN PRICING THAT SILVER UNDERTOOK IN PRICING// FRIDAY. WE ALSO HAD A STRONG SIZED 2294 EFP’S ISSUED TRANSFERRING COMEX LONGS OVER TO LONDON. TOGETHER WITH THE STRONG SIZED AMOUNT OF SILVER OUNCES STANDING FOR THIS MONTH, DEMAND FOR PHYSICAL SILVER CONTINUES TO INTENSIFY AS WE WITNESS SEVERE BACKWARDATION IN SILVER IN LONDON.

BOTH THE SILVER COMEX AND THE GOLD COMEX ARE IN STRESS AS THE BANKERS SCOUR THE BOWELS OF THE EXCHANGE FOR METAL

(report Harvey)

.

2 ) Gold/silver trading overnight Europe, Goldcore

(Mark O’Byrne/zerohedge

and in NY: Bloomberg

3. ASIAN AFFAIRS

)WEDNESDAY MORNING/ TUESDAY NIGHT:

SHANGHAI CLOSED DOWN 43.77 POINTS OR 0.67% //Hang Sang CLOSED DOWN 155.10 POINTS OR 0.57% /The Nikkei closed DOWN 256.77 POINTS OR 1.21%//Australia’s all ordinaires CLOSED DOWN 0.67%

/Chinese yuan (ONSHORE) closed DOWN at 6.9091 /Oil DOWN TO 57,28 dollars per barrel for WTI and 68.41 for Brent. Stocks in Europe OPENED RED// ONSHORE YUAN CLOSED DOWN // LAST AT 6.9091 AGAINST THE DOLLAR. OFFSHORE YUAN CLOSED DOWN ON THE DOLLAR AT 6.9273 TRADE TALKS STALL//YUAN LEVELS GETTING DANGEROUSLY CLOSE TO 7:1//TRUMP INITIATES A NEW 25% TARIFFS FRIDAY/MAY 10/MAJOR PROBLEMS AT HUAWEI /CFO ARRESTED : /ONSHORE YUAN TRADING ABOVE LEVEL OF OFFSHORE YUAN/ONSHORE YUAN TRADING WEAKER AGAINST USA DOLLAR/OFFSHORE YUAN TRADING WEAKER AGAINST THE DOLLAR /TRADE DEAL NOW DEAD..TRUMP RAISED RATES TO 25%

3A//NORTH KOREA/ SOUTH KOREA

b) REPORT ON JAPAN

3 China/Chinese affairs

i)China/USA

An excellent commentary on the” 3 Trump cards” that China holds on the USA, namely their rare earth supply, their huge treasury hoard and the fact that China can block USA access to the Chinese markets

( Oriental Review)

ii)Funny stuff: Huawei is to ask a USA court to declare Trump’s “national Security” ban unconstitutional even though Huawei used stolen technology. The hearing will be in September.

(zerohedge)

iii)China presses the panic button with huge liquidity as interbank funding freezes up after the Baoshang seizure(courtesy zerohedge)

4/EUROPEAN AFFAIRS

i)GERMANY

My goodness, that escalated fast…German unemployed exploded to 5.0% from 4.6% as their economy is faltering fast.

( zerohedge)

ii)Italy

The EU confirms that Italy is now risking a massive fine over its huge deficit. It sent the Euro to session lows\\(courtesy zerohedge)

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

i)IRAN/USA

Bolton says that he has no doubt that iranian naval mines were used in that UAE tanker assault last week

(courtesy zerohedge)

ii)ISRAEL/PALESTINE/RUSSIA AND CHINA

It now seems that China and Russia will be against any USA initiative. Today they are against Trump’s Middle east proposal

( zerohedge)

iii)Iran/Europe/USA

A shot across the bow against Europe as they now threaten them with a loss to the uSA financial system as Europe will begin to use their new “SWIFT” system to evade sanctions by the uSA

(courtesy zerohedge)

6. GLOBAL ISSUES

7. OIL ISSUES

8 EMERGING MARKET ISSUES

VENEZUELA/

9. PHYSICAL MARKETS

Craig Hemke discusses what the bond market is telling us:

( Sprott/Hemke/GATA)

10. USA stories which will influence the price of gold/silver)

MARKET TRADING//

MARKET TRADING/Europe Monday

ii)Market data

iii)USA ECONOMIC/GENERAL STORIES

i)Are these guys nuts: Illinois now pushes for a new “wealth tax” as highe earners will now flee the state with reckless abandon

( zerohedge)

ii)The trade battle has semi conductors as the epicentre and the UASA is on the losing end

( zerohedge)

SWAMP STORIES

i)Comey is one big nut job: here he states that there was no coup and Trump and his supporters are stating nothing but lies on him and his upper echelon of cohorts

( zerohedge)

ii)Full scale war in the intelligence community as Christopher Steel refuses to cooperate with AG Barr and Durham

( zerohedge)

iii a) We will be following this: Mueller is to make an unexpected statement on the Russian probe at 11 am

THE INTERVIEW AT 11 AM WAS A “NOTHING BURGER”

( zerohedge)

iii b)Democrats are now put into a tough spot after Mueller is goading them into the impeachment process

(courtesy zerohedge)

iii)c And then this; Pelosi and Schumer refuse to endorse impeachment procedures after the Mueller statement

( zerohedge)

E)SWAMP STORIES/MAJOR STORIES//THE KING REPORT

end

LET US BEGIN:

Let us head over to the comex:

THE TOTAL COMEX GOLD OPEN INTEREST FELL BY A CONSIDERABLE SIZED 12,153 CONTRACTS TO A LEVEL OF 505,126 WITH THE LARGE FALL OF $6.40 IN GOLD PRICING WITH RESPECT TO YESTERDAY’S // COMEX TRADING)

WE ARE NOW IN THE NON ACTIVE DELIVERY MONTH OF MAY.. THE CME REPORTS THAT THE BANKERS ISSUED A STRONG SIZED TRANSFER THROUGH THE EFP ROUTE AS THESE LONGS RECEIVED A DELIVERABLE LONDON FORWARD TOGETHER WITH A FIAT BONUS., THAT IS 7587 EFP CONTRACTS WERE ISSUED:

0 FOR JUNE ’19: 5411 CONTRACTS , AUG; 2176 CONTRACTS: 0 AND ZERO FOR ALL OTHER MONTHS:

TOTAL EFP ISSUANCE: 7587 CONTRACTS.

THE OBLIGATION STILL RESTS WITH THE BANKERS ON THESE TRANSFERS. ALSO REMEMBER THAT THERE IS NO DOUBT A HUGE DELAY IN THE ISSUANCE OF EFP’S AND IT PROBABLY TAKES AT LEAST 48 HRS AFTER OUR LONGS GIVE UP THEIR COMEX CONTRACTS FOR THEM TO RECEIVE THEIR EFP’S AS THEY ARE NEGOTIATING THIS CONTRACT WITH THE BANKS FOR A FIAT BONUS PLUS THEIR TRANSFER TO A LONDON BASED FORWARD.

ON A NET BASIS IN OPEN INTEREST WE LOST THE FOLLOWING TODAY ON OUR TWO EXCHANGES: 4566 TOTAL CONTRACTS IN THAT 7587 LONGS WERE TRANSFERRED AS FORWARDS TO LONDON AND WE LOST A CONSIDERABLE SIZED 12,153 COMEX CONTRACTS.ALMOST ALL OF THE LOSS IN OI WAS DUE TO THE LIQUIDATION OF THE SPREADERS.

NET LOSS ON THE TWO EXCHANGES :: 4566 CONTRACTS OR 456600 OZ OR 14.20 TONNES.

We are now in the NON active contract month of MAY and here the open interest stands at 49 contracts, having LOST 8 contracts. We had 8 notices served yesterday so we LOST 0 contracts or an additional NIL oz will not stand as they guys refused to morph into a London based forward as well as negating a fiat bonus

The next contract month after May is June and here the open interest FELL by 64,526 contracts DOWN to 87,463. July GAINED 249 contracts to stand at 1096. After July the next active month is August and here the OI rose by 50,782 contracts up to 308,427/ contracts. We no doubt witnessed HUGE spreading liquidation yesterday/today

We have 2 more trading days before first day notice, May .2019

TODAY’S NOTICES FILED:

WE HAD 0 NOTICES FILED TODAY AT THE COMEX FOR NIL OZ. (0.000 TONNES)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for the wild silver comex results.

Total COMEX silver OI ROSE BY A HUMONGOUS SIZED 6027 CONTRACTS FROM 211.578 DOWN TO 217,605 (AND CLOSER TO THE NEW RECORD OI FOR SILVER SET ON AUGUST 22.2018. THE PREVIOUS RECORD WAS SET APRIL 9.2018/ 243,411 CONTRACTS) AND TODAY’S HUGE OI COMEX GAIN OCCURRED DESPITE THE 23 CENT FALL IN PRICING.//YESTERDAY.

WE ARE NOW INTO THE ACTIVE DELIVERY MONTH OF MAY. HERE WE HAVE 195 OPEN INTEREST STAND SO FAR FOR A LOSS OF 24 CONTRACTS. WE HAD 40 NOTICES SERVED UPON YESTERDAY SO IN ESSENCE WE GAINED 16 CONTRACTS OR AN ADDITIONAL 80,000 OZ WILL STAND FOR DELIVERY AS THESE GUYS REFUSED TO MORPH INTO LONDON BASED FORWARDS AND AS WELL THEY NEGATED A FIAT BONUS.

THE NEXT MONTH AFTER MAY IS THE NON ACTIVE MONTH OF JUNE. HERE THIS MONTH LOST 156 CONTRACTS DOWN TO 467. AFTER JUNE IS THE ACTIVE MONTH OF JULY, (THE SECOND LARGEST DELIVERY MONTH OF THE YEAR FOR SILVER) AND HERE THIS MONTH GAINED 3828 CONTRACTS UP TO 161,226 CONTRACTS. THE NEXT ACTIVE MONTH AFTER JULY FOR SILVER IS SEPTEMBER AND HERE THE OI ROSE BY 1438 UP TO 22,357 CONTRACTS.

TODAY’S NUMBER OF NOTICES FILED:

We, today, had 77 notice(s) filed for 385,000 OZ for the MAY, 2019 COMEX contract for silver

Trading Volumes on the COMEX TODAY: 374,463 CONTRACTS (high spreading liquidation)

CONFIRMED COMEX VOL. FOR YESTERDAY: 588,146 contracts (some spreading liquidation)

INITIAL standings for MAY/GOLD

MAY 29 /2019.

Gold Ounces

Withdrawals from Dealers Inventory in oz nil oz

Withdrawals from Customer Inventory in oz

2170.88

oz

Brinks

Deposits to the Dealer Inventory in oz nil

oz

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for silver

AND NOW THE DELIVERY MONTH OF APRIL

INITIAL standings/SILVER

IN TOTAL CONTRAST TO GOLD, HUGE ACTIVITY IN SILVER TODAY.

MAY 28 2019

Silver Ounces

Withdrawals from Dealers Inventory NIL oz

Withdrawals from Customer Inventory

148,719.189 oz

CNT

Brinks

Deposits to the Dealer Inventory

NIL oz

Deposits to the Customer Inventory

nil oz

No of oz served today (contracts)

77

CONTRACT(S)

(385,000 OZ)

No of oz to be served (notices)

118 contracts

590,000 oz)

Total monthly oz silver served (contracts) 3651 contracts

18,255,000 oz)

Total accumulative withdrawal of silver from the Dealers inventory this month NIL oz

Total accumulative withdrawal of silver from the Customer inventory this month

**

we had 0 inventory movement at the dealer side of things

total dealer deposits: NIL oz

total dealer withdrawals: nil oz

we had 0 deposits into the customer account

into JPMorgan: nil

*** JPMorgan for most of 2017 and in 2018 has adding to its inventory almost every single day.

JPMorgan now has 149.469 million oz of total silver inventory or 48.80% of all official comex silver. (149 million/307 milli

into everybody else: nil

total customer deposits today: nil oz

we had 2 withdrawals out of the customer account:

i) out of CNT: 29,848.879 oz

ii) Out of Brinks: 118,870.310 oz

total withdrawals: 148,719.189 oz

we had 1 adjustment : and it was a dilly

i)Out of CNT: 1,564,601.797 oz was adjusted out of the dealer account and this landed into the customer account of CNT

and we also had an accounting error correction:

3040.280 oz of silver customer removed from JPMorgan

total dealer silver: 90.984 million

total dealer + customer silver: 305.909 million oz

The total number of notices filed today for the MAY 2019. contract month is represented by 77 contract(s) FOR 385,000 oz

To calculate the number of silver ounces that will stand for delivery in MAY, we take the total number of notices filed for the month so far at 3651 x 5,000 oz = 18,255,000 oz to which we add the difference between the open interest for the front month of MAY. (195) and the number of notices served upon today (77 x 5000 oz) equals the number of ounces standing.

.

Thus the INITIAL standings for silver for the MAY/2019 contract month: 3651(notices served so far)x 5000 oz + OI for front month of MAY( 195) -number of notices served upon today (77)x 5000 oz equals 18,845,000 oz of silver standing for the MAY contract month.

We GAINED 16 contracts or an additional 80,000 oz will stand as these guys refused to morph into London based forwards as well as negating a fiat bonus for their efforts. WE HAVE SOME SERIOUS PLAYERS GOING AFTER LARGELY DEPLETED PHYSICAL SILVER!

FOR COMPARISON VS LAST YEAR:

ON FIRST DAY NOTICE APRIL 30/2018 (FOR THE MAY 2018 CONTRACT MONTH) WE HAD 24.11 MILLION OZ STAND FOR DELIVERY. BY MONTH END WE HAD HUGE QUEUE JUMPING AND THUS 36.285 MILLION OZ EVENTUALLY STOOD FOR DELIVERY.

ON FIRST DAY NOTICE FOR THE JUNE 2018 CONTRACT WE INITIALLY HAD 3.43 MILLION OZ STAND WHICH WAS HUGE FOR A NON DELIVERY MONTH

EVENTUALLY, 5.405 MILLION OZ STOOD FOR PHYSICAL DELIVERY.

ON THE 29TH OF MAY/2018 WE HAD 731 OPEN INTEREST WITH TWO DAYS BEFORE FIRST DAY NOTICE

ON THE 29TH OF MAY/2019 WE HAD 467 OPEN INTEREST CONTRACTS STILL OUTSTANDING WITH 2 DAYS TO GO BEFORE FIRST DAY NOTICE.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

TODAY’S ESTIMATED SILVER VOLUME: 74,426 CONTRACTS

CONFIRMED VOLUME FOR YESTERDAY: 113,270 CONTRACTS..

YESTERDAY’S CONFIRMED VOLUME OF 113,270 CONTRACTS EQUATES to 566 million OZ 80.8% OF ANNUAL GLOBAL PRODUCTION OF SILVER

COMMODITY LAW SUGGESTS THAT OPEN INTEREST SHOULD NOT BE MORE THAN 3% OF ANNUAL GLOBAL PRODUCTION. THE CROOKS ARE SUPPLYING MASSIVE PAPER TRYING TO KEEP SILVER IN CHECK.

The record level of silver open interest is 234,787 contracts set on April 21./2017 with the price at that day at $18.42

The previous record was 224,540 contracts with the price at that time of $20.44

end

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

NPV for Sprott

1. Sprott silver fund (PSLV): NAV FALLS TO -4.35% (MAY 29/2019)

2. Sprott gold fund (PHYS): premium to NAV FALLS TO -1.91% to NAV (MAY 29/2019 )

Note: Sprott silver trust back into NEGATIVE territory at -4.35%-/Sprott physical gold trust is back into NEGATIVE/

(courtesy Sprott/GATA)

3.SPROTT CEF.A FUND (FORMERLY CENTRAL FUND OF CANADA):

NAV 12.76 TRADING 12.21/DISCOUNT 4.48

END

And now the Gold inventory at the GLD/

MAY 29/WITH GOLD UP $3.90 TODAY: NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 737.34 TONNES

MAY 28/WITH GOLD DOWN $6.50 TODAY: A BIG CHANGE IN GOLD INVENTORY AT THE GLD> A WITHDRAWAL OF 1.47 TONNES/INVENTORY RESTS AT 737.34 TONNES

MAY 24/WITH GOLD DOWN $1.60 TODAY: NO CHANGE IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 738.81 TONNES

MAY 23/WITH GOLD UP $11.10 TODAY: A STRANGE WITHDRAWAL OF .88 TONNES FORM THE GLD/INVENTORY RESTS AT 738,81 TONNES

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Markets Tumble, S&P Below 2,800, Bond Yields Crater As Traders Brace For Impact

It’s going from bad to worse for global equity market and US stock futures, which again are a sea of red as Sino-U.S. trade tensions continue to escalate – with a rare earth boycott by China now virtually assured – while fears of an Italy-EU confrontation are growing again, accelerating a global bond rally on Wednesday, as investors dumped shares and scurried for the safety of government debt, the dollar and gold.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Stocks Slammed As Credit Cracks, Retail Routed, Yield Curve Craters

MMGYS

MMGYS

Stocks Slammed As Credit Cracks, Retail Routed, Yield Curve Craters

The Fed trying to hit its inflation goal…

Chinese stocks are outperforming Europe and US this week (thanks to a panicking PBOC throwing liquidity at it)…

As buying-panics keep rescuing stocks…

European Stocks were uniformly ugly today…

And after a stunningly bad German unemployment print, bunds tumbled even close to record low yields…

US markets traded very much in sync today, chopping and popping together with a late-day surge that dragged us “off the lows”…

Dow briefly lost 25k intraday

The buy program hit at around 1530ET – biggest in 3 days…

S&P and Nasdaq both broke below their 200DMA today (joining The Dow and Small Caps already well below it), but the machines did their best to get them both back above that key level…

YTD, Nasdaq remains up almost 14% and Dow up around 8%…

Semis ended the day marginally higher after almost tagging the bear market (-19.79%) at the open…

NOTE – the machines always ready to fade the opening

The GOOS was cooked… (down a record 28% on the day)…

But the entire retail space is getting monkey-hammered…

VIX term structure inverted further…

HY Credit spreads are blowing out to 4-month highs, eerily tracking last year’s collapse…

Global Stocks are starting to roll over but Global Bond Yields are collapsing…

And HY risk is leading stocks notably lower…

Treasury yields tumbled once again today but a weak 7Y auction sparked some yield give-back…

Additionally, as Bloomberg notes, rates on 10-year and 30-year securities hit an additional milestone, retracing over half of their climb from the record lows of 2016 to the multiyear highs in 2018. Having broken through those levels, the yields’ next major technical objectives include the 61.8% retracements, which for the 30-year is fewer than 5 basis points away.

For the 10-year, which rose from 1.318% in 2016 to 3.259% in 2018 and touched 2.2081% today, the 50% retracement was at 2.289%; the 61.8% is at 2.0596%

For the 30-year, which rose from 2.088% in 2016 to 3.465% in 2018 and touched 2.654% today, the 50% retracement was at 2.777%; the 61.8% is at 2.6141%

This prompted the yield curve to collapse to new cycle lows…

And before we leave bond-land, the ED market is implying more than 2 rate cuts by the end of 2020…

The Dollar Index extended gains, erasing losses from last Thursday’s spike and dump after ugly PMI data…

And PBOC threats to Yuan shorts keep failing…

Cryptos dropped and popped today to end marginally higher with Ripple and Litecoin leading the week…

Commodities were mixed on the day with PMs modestly higher (despite USD gains), copper clobbered, and WTI doing a huge circle-jerk…

WTI Crude collapsed to a $57 handle before going vertical back to unchanged…early weakness was growth scare and rare-earth escalation fears and the spike was seemingly catalyzed by Iran chatter and rumors that MPLX’s Ozark pipeline would restart early on Thursday…

The gold-silver ratio has surged to a 26-year high…

As Bloomberg’s Marvin Perez notes, the surge in the gold-silver ratio adds to economic warning signs including the U.S. Treasury yield curve as trade tensions, a weakening Chinese expansion and sluggishness from Europe to Brazil dim global growth prospects. The ratio’s rise comes even as dollar gains have limited demand for gold, often seen as a store of value in times of market turbulence.

The ratio “has surged to generational highs on the sustained weakness in silver that has been caught in the gravity well of base metals, which have suffered on the worsening trade war,” Tai Wong, head of base and precious metals derivatives trading at BMO Capital Markets, said by email.

Finally, as Bloomberg macro strategist Mark Cudmore notes, dip-buyers beware!

After a decade of reliable support, the Fed may find it tougher to support flailing U.S. stocks in the months ahead. Rates markets are already pricing in the steepest policy easing since October 2008, so it’ll take something extraordinary for the Fed to deliver a dovish surprise from here.

end

Read More Harvey Here......

https://harveyorganblog.com/2019/05/29/may-29-work-in-progress/

show simo casted on Captain's Quarters

.jpg)

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.