Saturday, May 18, 2019 12:16:16 AM

Data Breeze

Good Morning Good Evening

(doing the show over here for a while)

Welcome to ~*~Mining & Metals Du Jour~*~Graveyard Shift~*~

On the show tonight: Great Data & News by Harvey Organ,GATA Daily Dispatches, Peter Brandt Declares Silver Dead and More...

Hello everybody I'm J:D your host tonight Thanks for being with us.

Hope Your Having a Great Weekend

EnJoy the show

OK...here we go

MMGYS

Thank you

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

MAY 17/GOLD DOWN $9.70 TO $1276.25//SILVER DOWN ANOTHER 13 CENTS ON THIS COMEX EXPIRY DAY: MORE MANIPULATION//CHINA STATES THAT THERE ARE NO MORE TALKS WITH THE USA CONCERNING THE TRADE WAR AND THIS WAS VERIFIED BY THE USA//THE TURKISH LIRA FALTERS AGAIN WITH TRUMP REMOVING THE “DEVELOPING NATION” STATUS ON THE COUNTRY AND THEN THE USA IMPOSES A 25% TARIFF ON STEEL AND ALUMINUM ON TURKEY//BARR IS GOING AFTER THE DEMOCRATS FOR THEIR CRIMES/MAY BE TREASON//MORE SWAMP STORIES FOR YOU TONIGHT//

May 17, 2019 · by harveyorgan · in Uncategorized · Leave a comment

GOLD: $1276.25 DOWN $9.70 (COMEX TO COMEX CLOSING)

Silver: $14.41 DOWN 13 CENTS (COMEX TO COMEX CLOSING)

Closing access prices:

Gold : 1277.70

silver: $14.42

OPTIONS EXPIRY FOR THE STOCK MARKET AND GLD/SLV WAS TODAY

COMEX EXPIRY FOR GOLD/SILVER: TUES MAY 28/2019

LBMA/OTC EXPIRY: MAY 31.2019

JPMorgan has been receiving gold with reckless abandon and sometimes supplying (stopping)

today RECEIVING 2/2

EXCHANGE: COMEX

CONTRACT: MAY 2019 COMEX 100 GOLD FUTURES

SETTLEMENT: 1,285.000000000 USD

INTENT DATE: 05/16/2019 DELIVERY DATE: 05/20/2019

FIRM ORG FIRM NAME ISSUED STOPPED

____________________________________________________________________________________________

661 C JP MORGAN 2

737 C ADVANTAGE 2

____________________________________________________________________________________________

TOTAL: 2 2

MONTH TO DATE: 290

NUMBER OF NOTICES FILED TODAY FOR MAY CONTRACT: 2 NOTICE(S) FOR 200 OZ (0.0062 tonnes)

TOTAL NUMBER OF NOTICES FILED SO FAR: 290 NOTICES FOR 28000 OZ (.9020 TONNES)

SILVER

FOR MAY

15 NOTICE(S) FILED TODAY FOR 75,000 OZ/

total number of notices filed so far this month: 3392 for 16,960,000 oz

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

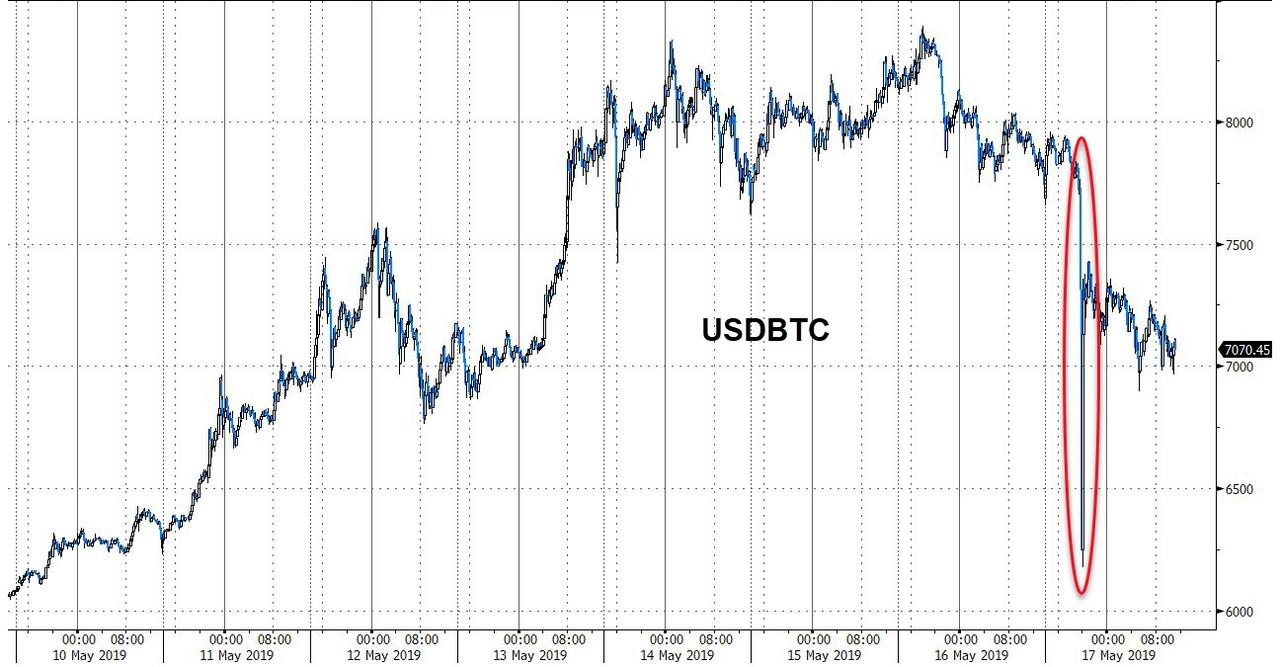

Bitcoin: OPENING MORNING TRADE :$7255 DOWN $632

Bitcoin: FINAL EVENING TRADE: $7104 DOWN $766

end

XXXX

Let us have a look at the data for today

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

IN SILVER THE COMEX OI ROSE BY A MONSTROUS SIZED 5190 CONTRACTS FROM 204,318 UP TO 209,508 DESPITE YESTERDAY’S 26 CENT LOSS IN SILVER PRICING AT THE COMEX. LIQUIDATION OF THE SPREADERS HAVE STOPPED FOR SILVER BUT IT NOW IN FULL FORCE FOR GOLD. TODAY WE ARRIVED CLOSER TO AUGUST’S 2018 RECORD SETTING OPEN INTEREST OF 244,196 CONTRACTS.

WE HAVE ALSO WITNESSED A LARGE AMOUNT OF PHYSICAL METAL STAND FOR COMEX DELIVERY AS WELL WE ARE WITNESSING CONSIDERABLE LONGS PACKING THEIR BAGS AND MIGRATING OVER TO LONDON IN GREATER NUMBERS IN THE FORM OF EFP’S. WE WERE NOTIFIED THAT WE HAD A STRONG SIZED NUMBER OF COMEX LONGS TRANSFERRING THEIR CONTRACTS TO LONDON THROUGH THE EFP:

0 FOR MAY, 0 FOR JUNE, 1368 FOR JULY AND ZERO FOR ALL OTHER MONTHS AND THEREFORE TOTAL ISSUANCE 1368 CONTRACTS. WITH THE TRANSFER OF 1368 CONTRACTS, WHAT THE CME IS STATING IS THAT THERE IS NO SILVER (OR GOLD) TO BE DELIVERED UPON AT THE COMEX AS THEY MUST EXPORT THEIR OBLIGATION TO LONDON. ALSO KEEP IN MIND THAT THERE CAN BE A DELAY OF 24-48 HRS IN THE ISSUING OF EFP’S. THE 1368 EFP CONTRACTS TRANSLATES INTO 6.84 MILLION OZ ACCOMPANYING:

1.THE 26 CENT LOSS IN SILVER PRICE AT THE COMEX AND

2. THE STRONG AMOUNT OF SILVER OUNCES WHICH STOOD FOR DELIVERY IN THE LAST NINE MONTHS:

JUNE/2018. (5.420 MILLION OZ);

FOR JULY: 30.370 MILLION OZ

FOR AUG., 6.065 MILLION OZ

FOR SEPT. 39.505 MILLION OZ S

FOR OCT.2.525 MILLION OZ.

FOR NOV: A HUGE 7.440 MILLION OZ STANDING AND

21.925 MILLION OZ FINALLY STAND FOR DECEMBER.

5.845 MILLION OZ STAND IN JANUARY.

2.955 MILLION OZ STANDING FOR FEBRUARY.:

27.120 MILLION OZ STANDING IN MARCH.

3.875 MILLION OZ STANDING FOR SILVER IN APRIL.

AND NOW 18.650 MILLION OZ STANDING FOR SILVER IN MAY.

ACCUMULATION FOR EFP’S/SILVER/J.P.MORGAN’S HOUSE OF BRIBES, / STARTING FROM FIRST DAY NOTICE/FOR MONTH OF MAY:

14,934 CONTRACTS (FOR 13 TRADING DAYS TOTAL 14,934 CONTRACTS) OR 74,67 MILLION OZ: (AVERAGE PER DAY: 1148 CONTRACTS OR 5.743 MILLION OZ/DAY)

TO GIVE YOU AN IDEA AS TO THE HUGE SUPPLY THIS MONTH IN SILVER: SO FAR THIS MONTH OF MAY: 74.67 MILLION PAPER OZ HAVE MORPHED OVER TO LONDON. THIS REPRESENTS AROUND 10.66% OF ANNUAL GLOBAL PRODUCTION (EX CHINA EX RUSSIA)* JUNE’S 345.43 MILLION OZ IS THE SECOND HIGHEST RECORDED ISSUANCE OF EFP’S AND IT FOLLOWED THE RECORD SET IN APRIL 2018 OF 385.75 MILLION OZ.

ACCUMULATION IN YEAR 2019 TO DATE SILVER EFP’S: 815,77 MILLION OZ.

JANUARY 2019 EFP TOTALS: 217.455. MILLION OZ

FEB 2019 TOTALS: 147.4 MILLION OZ/

MARCH 2019 TOTAL EFP ISSUANCE: 207.835 MILLION OZ

APRIL 2019 TOTAL EFP ISSUANCE: 182.87 MILLION OZ.

RESULT: WE HAD A HUGE SIZED INCREASE IN COMEX OI SILVER COMEX CONTRACTS OF 5190 DESPITE THE LARGE 26 CENT LOSS IN SILVER PRICING AT THE COMEX /YESTERDAY... THE CME NOTIFIED US THAT WE HAD A STRONG SIZED EFP ISSUANCE OF 1368 CONTRACTS WHICH EXITED OUT OF THE SILVER COMEX AND TRANSFERRED THEIR OI TO LONDON AS FORWARDS. SPECULATORS CONTINUED THEIR INTEREST IN ATTACKING THE SILVER COMEX FOR PHYSICAL SILVER (SEE COMEX DATA) . OUR BANKERS RESUMED THEIR LIQUIDATION OF THE SPREAD TRADES TODAY.

TODAY WE GAINED A GIGANTIC SIZED: 6558 TOTAL OI CONTRACTS ON THE TWO EXCHANGES:

i.e 1368 OPEN INTEREST CONTRACTS HEADED FOR LONDON (EFP’s) TOGETHER WITH INCREASE OF 5190 OI COMEX CONTRACTS. AND ALL OF THIS DEMAND HAPPENED WITH A 26 CENT LOSS IN PRICE OF SILVER AND A CLOSING PRICE OF $14.55 WITH RESPECT TO YESTERDAY’S TRADING. YET WE STILL HAVE A STRONG AMOUNT OF SILVER STANDING AT THE COMEX FOR DELIVERY!!

In ounces AT THE COMEX, the OI is still represented by JUST OVER 1 BILLION oz i.e. 1.022 BILLION OZ TO BE EXACT or 145% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT MARCH MONTH/ THEY FILED AT THE COMEX: 15 NOTICE(S) FOR 75,000 OZ OF SILVER

IN SILVER,PRIOR TO TODAY, WE SET THE NEW COMEX RECORD OF OPEN INTEREST AT 243,411 CONTRACTS ON APRIL 9.2018. AND AGAIN THIS HAS BEEN SET WITH A LOW PRICE OF $16.51.

AND NOW WE RECORD FOR POSTERITY ANOTHER ALL TIME RECORD OPEN INTEREST AT THE COMEX OF 244,196 CONTRACTS ON AUGUST 22/2018 AND AGAIN WHEN THIS RECORD WAS SET, THE PRICE OF SILVER WAS $14.78 AND LOWER IN PRICE THAN PREVIOUS RECORDS.

ON THE DEMAND SIDE WE HAVE THE FOLLOWING:

HUGE AMOUNTS OF SILVER STANDING FOR DELIVERY (MARCH/2018: 27 MILLION OZ , APRIL/2018 : 2.485 MILLION OZ MAY: 36.285 MILLION OZ ; JUNE/2018 (5.420 MILLION OZ) , JULY 2018 FINAL AMOUNT STANDING: 30.370 MILLION OZ ) FOR AUGUST 6.065 MILLION OZ. , SEPT: A HUGE 39.505 MILLION OZ./ OCTOBER: 2,520,000 oz NOV AT 7.440 MILLION OZ./ DEC. AT 21.925 MILLION OZ JANUARY AT 5.825 MILLION OZ.AND FEB 2019: 2.955 MILLION OZ/ MARCH: 27.120 MILLION OZ/ APRIL AT 3.875 MILLION OZ/ AND NOW MAY: 18.650 MILLION OZ ..

HUGE RECORD OPEN INTEREST IN SILVER 243,411 CONTRACTS (OR 1.217 BILLION OZ/ SET APRIL 9/2018) AND NOW AUGUST 22/2018: 244,196 CONTRACTS, WITH A SILVER PRICE OF $14.78.

HUGE ANNUAL EFP’S ISSUANCE EQUAL TO 2.9 BILLION OZ OR 400% OF SILVER ANNUAL PRODUCTION/2017

RECORD SETTING EFP ISSUANCE FOR ANY MONTH IN SILVER; APRIL/2018/ 385.75 MILLION OZ/ AND THE SECOND HIGHEST RECORDED EFP ISSUANCE JUNE 2018 345.43 MILLION OZ

AND YET, WITH THE EXTREMELY HIGH EFP ISSUANCE, WE HAVE A CONTINUAL LOW PRICE OF SILVER DESPITE THE ABOVE HUGE DEMAND. TO ME THE ONLY ANSWER IS THAT WE HAVE SOVEREIGN (CHINA) WHO IS ENDEAVOURING TO GOBBLE UP ALL AVAILABLE PHYSICAL SILVER NO MATTER WHERE, EXACTLY WHAT J.P.MORGAN IS DOING. AND IT IS MY BELIEF THAT J.P.MORGAN IS HOLDING ITS SILVER FOR ITS BENEFICIAL OWNER..THE USA GOVERNMENT WHO IN TURN IS HOLDING THAT SILVER FOR CHINA.(FOR A SILVER LOAN REPAYMENT).

IN GOLD, THE OPEN INTEREST FELL BY A CONSIDERABLE SIZED 3112 CONTRACTS, TO 521,243 DESPITE THE CONSIDERABLE FALL IN THE COMEX GOLD PRICE/(A LOSS IN PRICE OF $11.10//YESTERDAY’S TRADING).

THE CME RELEASED THE DATA FOR EFP ISSUANCE AND IT TOTALED A VERY STRONG SIZED 14,239 CONTRACTS:

APRIL 0 CONTRACTS,JUNE: 14,239 CONTRACTS DECEMBER: 0 CONTRACTS, JUNE 2020 0 CONTRACTS AND ALL OTHER MONTHS ZERO. The NEW COMEX OI for the gold complex rests at 521,243. ALSO REMEMBER THAT THERE WILL BE A DELAY IN THE ISSUANCE OF EFP’S. THE BANKERS REMOVE LONG POSITIONS OF COMEX GOLD IMMEDIATELY. THEN THEY ORCHESTRATE THEIR PRIVATE EFP DEAL WITH THE LONGS AND THAT COULD TAKE AN ADDITIONAL, 48 HRS SO WE GENERALLY DO NOT GET A MATCH WITH RESPECT TO DEPARTING COMEX LONGS AND NEW EFP LONG TRANSFERS. . EVEN THOUGH THE BANKERS ISSUED THESE MONSTROUS EFPS, THE OBLIGATION STILL RESTS WITH THE BANKERS TO SUPPLY METAL BUT IT TRANSFERS THE RISK TO A LONDON BANKER OBLIGATION AND NOT A NEW YORK COMEX OBLIGATION. LONGS RECEIVE A FIAT BONUS TOGETHER WITH A LONG LONDON FORWARD. THUS, BY THESE ACTIONS, THE BANKERS AT THE COMEX HAVE JUST STATED THAT THEY HAVE NO APPRECIABLE METAL!! THIS IS A MASSIVE FRAUD: THEY CANNOT SUPPLY ANY METAL TO OUR COMEX LONGS BUT THEY ARE QUITE WILLING TO SUPPLY MASSIVE NON BACKED GOLD (AND SILVER) PAPER KNOWING THAT THEY HAVE NO METAL TO SATISFY OUR LONGS. LONDON IS NOW SEVERELY BACKWARD IN BOTH GOLD AND SILVER AND WE ARE WITNESSING DELAYS IN ACTUAL DELIVERIES.

IN ESSENCE WE HAVE A VERY STRONG SIZED GAIN IN TOTAL CONTRACTS ON THE TWO EXCHANGES OF 11,127 CONTRACTS: 3112 OI CONTRACTS DECREASED AT THE COMEX AND 14,239 EFP OI CONTRACTS WHICH NAVIGATED OVER TO LONDON. THUS TOTAL OI GAIN OF 11,127 CONTRACTS OR 1,112,700 OZ OR 34.60 TONNES. YESTERDAY WE HAD A LOSS IN THE PRICE OF GOLD TO THE TUNE OF $11.10.…AND WITH LARGE LOSS, WE HAD A HUGE GAIN OF 34.60 TONNES!!!!!!.??????

WITH RESPECT TO SPREADING: WE MAY HAVE HAD SOME ACTIVITY WITH TODAY’S FALL IN PRICE

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES:

“AS YOU WILL SEE, THE CROOKS HAVE NOW SWITCHED TO GOLD AS THEY INCREASE THE OPEN INTEREST FOR THE SPREADERS. THE TOTAL COMEX GOLD OPEN INTEREST WILL RISE FROM NOW ON UNTIL ONE WEEK PRIOR TO FIRST DAY NOTICE AND THAT IS WHEN THEY START THEIR CRIMINAL LIQUIDATION.

HERE IS HOW THE CROOKS USED SPREADING AS WE ARE NO INTO THE NON ACTIVE DELIVERY MONTH OF MAY HEADING TOWARDS THE VERY ACTIVE DELIVERY MONTH OF JUNE.

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES, HERE IS THE BANKERS MODUS OPERANDI:

YOU WILL ALSO NOTICE THAT THE COMEX OPEN INTEREST IS STARTING TO RISE IN THIS NON ACTIVE MONTH OF MAY BUT SO IS THE OPEN INTEREST OF SPREADERS. THE OPEN INTEREST IN GOLD WILL CONTINUE TO RISE UNTIL ONE WEEK BEFORE FIRST DAY NOTICE OF AN UPCOMING ACTIVE DELIVERY MONTH (JUNE), AND THAT IS WHEN THE CROOKS SELL THEIR SPREAD POSITIONS BUT NOT AT THE SAME TIME OF THE DAY. THEY WILL USE THE SELL SIDE OF THE EQUATION TO CREATE THE CASCADE (ALONG WITH THEIR COLLUSIVE FRIENDS) AND THEN COVER ON THE BUY SIDE OF THE SPREAD SITUATION AT THE END OF THE DAY. THEY DO THIS TO AVOID POSITION LIMIT DETECTION. THE LIQUIDATION OF THE SPREADING FORMATION CONTINUES FOR EXACTLY ONE WEEK AND ENDS ON FIRST DAY NOTICE.”

ACCUMULATION OF EFP’S GOLD AT J.P. MORGAN’S HOUSE OF BRIBES: (EXCHANGE FOR PHYSICAL) FOR THE MONTH OF MAY : 85,098 CONTRACTS OR 8,509,800 OR 264.69 TONNES (13 TRADING DAYS AND THUS AVERAGING: 6546 EFP CONTRACTS PER TRADING DAY

TO GIVE YOU AN IDEA AS TO THE STRONG SIZE OF THESE EFP TRANSFERS : THIS MONTH IN 13 TRADING DAYS IN TONNES: 264.69 TONNES

TOTAL ANNUAL GOLD PRODUCTION, 2018, THROUGHOUT THE WORLD EX CHINA EX RUSSIA: 3555 TONNES

THUS EFP TRANSFERS REPRESENTS 264.69/3550 x 100% TONNES =7.43% OF GLOBAL ANNUAL PRODUCTION SO FAR IN DECEMBER ALONE.***

ACCUMULATION OF GOLD EFP’S YEAR 2019 TO DATE: 2080.23 TONNES

JANUARY 2019 TOTAL EFP ISSUANCE; 531.20 TONNES

FEB 2019 TOTAL EFP ISSUANCE: 344.36 TONNES

MARCH 2019 TOTAL EFP ISSUANCE: 497.16 TONNES

APRIL 2019 TOTAL ISSUANCE: 456.10 TONNES

WHAT IS ALARMING TO ME, ACCORDING TO OUR LONDON EXPERT ANDREW MAGUIRE IS THAT THESE EFP’S ARE BEING TRANSFERRED TO WHAT ARE CALLEDRIAL FORWARD CONTRACT OBLIGATIONS AND THESE CONTRACTS ARE LESS THAN 14 DAYS. ANYTHING GREATER THAN 14 DAYS, THESE MUST BE RECORDED AND SENT TO THE COMPTROLLER, GREAT BRITAIN TO MONITOR RISK TO THE BANKING SYSTEM. IF THIS IS INDEED TRUE, THEN THIS IS A MASSIVE CONSPIRACY TO DEFRAUD AS WE NOW WITNESS A MONSTROUS TOTAL EFP’S ISSUANCE AS IT HEADS INTO THE STRATOSPHERE.

Result: A CONSIDERABLE SIZED DECREASE IN OI AT THE COMEX OF 3112 DESPITE THE LARGE FALL IN PRICING ($11.10) THAT GOLD UNDERTOOK YESTERDAY) //.WE ALSO HAD A MONSTROUS SIZED NUMBER OF COMEX LONG TRANSFERRING TO LONDON THROUGH THE EFP ROUTE: 14,239 CONTRACTS AS THESE HAVE ALREADY BEEN NEGOTIATED AND CONFIRMED. THERE OBVIOUSLY DOES NOT SEEM TO BE MUCH PHYSICAL GOLD AT THE COMEX. I GUESS IT EXPLAINS THE HUGE ISSUANCE OF EFP’S…THERE IS HARDLY ANY GOLD PRESENT AT THE GOLD COMEX FOR DELIVERY PURPOSES. IF YOU TAKE INTO ACCOUNT THE 14,239 EFP CONTRACTS ISSUED, WE HAD A STRONG SIZED GAIN OF 11,127 CONTRACTS IN TOTAL OPEN INTEREST ON THE TWO EXCHANGES:

14,239 CONTRACTS MOVE TO LONDON AND 3112 CONTRACTS DECREASED AT THE COMEX. (IN TONNES, THE GAIN IN TOTAL OI EQUATES TO 34.60 TONNES). ..AND THIS HUMONGOUS DEMAND OCCURRED DESPITE THE FALL IN PRICE OF $11.10 IN YESTERDAY’S TRADING AT THE COMEX.WE MAY HAVE HAD A STRONG PRESENCE OF SPREADING TODAY IN THE RAID ORCHESTRATED BY THE CROOKS.

we had: 2 notice(s) filed upon for 200 oz of gold at the comex.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

With respect to our two criminal funds, the GLD and the SLV:

GLD...

WITH GOLD DOWN $9.70 TODAY

NO CHANGE IN GOLD INVENTORY AT THE GLD/

INVENTORY RESTS AT 733.23 TONNES

TO ALL INVESTORS THINKING OF BUYING GOLD THROUGH THE GLD ROUTE: YOU ARE MAKING A TERRIBLE MISTAKE AS THE CROOKS ARE USING WHATEVER GOLD COMES IN TO ATTACK BY SELLING THAT GOLD. IT SURE SEEMS TO ME THAT THE GOLD OBLIGATIONS AT THE GLD EXCEED THEIR INVENTORy

SLV/

WITH SILVER DOWN 13 CENTS TODAY:

A HUGE 3.186 MILLION OZ WITHDRAWAL OF PAPER SILVER FORM THE SLV.

THIS PAPER SILVER WAS USED IN THE ATTACK TODAY.

/INVENTORY RESTS AT 312.366 MILLION OZ.

end

First, here is an outline of what will be discussed tonight:

1. Today, we had the open interest in SILVER ROSE BY A HUMONGOUS SIZED 5284 CONTRACTS from 204,318 UPTO 209,602 AND CLOSER TO THE NEW COMEX RECORD SET LAST IN AUG.2018 AT 244,196 WITH A SILVER PRICE OF $14.78/(AUGUST 22/2018)..THE PREVIOUS RECORD WAS SET ON APRIL 9/2018 AT 243,411 OPEN INTEREST CONTRACTS WITH THE SILVER PRICE AT THAT DAY: $16.53). AND PREVIOUS TO THAT, THE RECORD WAS ESTABLISHED AT: 234,787 CONTRACTS, SET ON APRIL 21.2017 OVER 1 1/3 YEARS AGO. THE PRICE OF SILVER ON THAT DAY: $17.89. AS YOU CAN SEE, WE HAVE RECORD HIGH OPEN INTERESTS IN SILVER ACCOMPANIED BY A CONTINUAL LOWER PRICE WHEN THAT RECORD WAS SET…..THE SPREADERS HAVE STOPPED THEIR LIQUIDATION IN SILVER BUT HAVE NOW MORPHED INTO GOLD..

EFP ISSUANCE:

OUR CUSTOMARY MIGRATION OF COMEX LONGS CONTINUE TO MORPH INTO LONDON FORWARDS AS OUR BANKERS USED THEIR EMERGENCY PROCEDURE TO ISSUE:

0 CONTRACTS FOR APRIL., 0 FOR MAY, FOR JUNE 0 CONTRACTS AND JULY: 1368 CONTRACTS AND ALL OTHER MONTHS: ZERO. TOTAL EFP ISSUANCE: 1368 CONTRACTS. EFP’S GIVE OUR COMEX LONGS A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. IF WE TAKE THE OI GAIN AT THE COMEX OF 5190 CONTRACTS TO THE 1368 OI TRANSFERRED TO LONDON THROUGH EFP’S, WE OBTAIN A HUGE GAIN OF 6558 OPEN INTEREST CONTRACTS. THUS IN OUNCES, THE GAIN ON THE TWO EXCHANGES: 32.79 MILLION OZ!!! AND YET WE ALSO HAVE A STRONG DEMAND FOR PHYSICAL AS WE WITNESSED A FINAL STANDING OF GREATER THAN 30 MILLION OZ FOR JULY, A STRONG 7.475 MILLION OZ FOR AUGUST.. A HUGE 39.505 MILLION OZ STANDING FOR SILVER IN SEPTEMBER… OVER 2 million OZ STANDING FOR THE NON ACTIVE MONTH OF OCTOBER., 7.440 MILLION OZ FINALLY STANDING IN NOVEMBER. 21.925 MILLION OZ STANDING IN DECEMBER , 5.845 MILLION OZ STANDING IN JANUARY. 2.955 MILLION OZ STANDING IN FEBRUARY, 27.120 MILLION OZ FOR MARCH., 3.875 MILLION OZ FOR APRIL AND NOW 18.650 MILLION OZ FOR MAY

RESULT: A HUGE SIZED INCREASE IN SILVER OI AT THE COMEX DESPITE THE 26 CENT LOSS IN PRICING THAT SILVER UNDERTOOK IN PRICING// YESTERDAY. WE ALSO HAD A STRONG SIZED 1368 EFP’S ISSUED TRANSFERRING COMEX LONGS OVER TO LONDON. TOGETHER WITH THE STRONG SIZED AMOUNT OF SILVER OUNCES STANDING FOR THIS MONTH, DEMAND FOR PHYSICAL SILVER CONTINUES TO INTENSIFY AS WE WITNESS SEVERE BACKWARDATION IN SILVER IN LONDON.

BOTH THE SILVER COMEX AND THE GOLD COMEX ARE IN STRESS AS THE BANKERS SCOUR THE BOWELS OF THE EXCHANGE FOR METAL

(report Harvey)

.

2.a) The Shanghai and London gold fix report

(Harvey)

2 b) Gold/silver trading overnight Europe, Goldcore

(Mark O’Byrne/zerohedge

and in NY: Bloomberg

3. ASIAN AFFAIRS

)FRIDAY MORNING/ THURSDAY NIGHT:

SHANGHAI CLOSED DOWN 73.42 POINTS OR 2.48% //Hang Sang CLOSED DOWN 328.61 POINTS OR 1.16% /The Nikkei closed UP 187.11 POINTS OR 0.89%//Australia’s all ordinaires CLOSED UP .69%

/Chinese yuan (ONSHORE) closed DOWN at 6.9145 /Oil UP to 61.64 dollars per barrel for WTI and 71.08 for Brent. Stocks in Europe OPENED GREEN// ONSHORE YUAN CLOSED DOWN // LAST AT 6.9145 AGAINST THE DOLLAR. OFFSHORE YUAN CLOSED DOWN ON THE DOLLAR AT 6.9468 TRADE TALKS STALL//YUAN LEVELS GETTING DANGEROUSLY CLOSE TO 7:1//TRUMP INITIATES A NEW 25% TARIFFS FRIDAY/MAY 10/MAJOR PROBLEMS AT HUAWEI /CFO ARRESTED : /ONSHORE YUAN TRADING ABOVE LEVEL OF OFFSHORE YUAN/ONSHORE YUAN TRADING WEAKER AGAINST USA DOLLAR/OFFSHORE YUAN TRADING WEAKER AGAINST THE DOLLAR /TRADE DEAL NOW DEAD..TRUMP RAISED RATES TO 25%

3A//NORTH KOREA/ SOUTH KOREA

i)NORTH KOREA

b) REPORT ON JAPAN

3 China/Chinese affairs

i)China/

Trade optimism fizzles as China states it has no more plans for talks. Obviously they are quite concerned with the Huawei situation

(courtesy zerohedge)

ii)Huawei bonds tumble the most on record after the new prohibition of sales of components from uSA sources to it

( zerohedge)

iii)Very problematic as Beijing faces China and Russia who have their back as they both firmly oppose unilateral USA sanctions

( zerohedge)

iv)An excellent commentary from James Rickards as he discusses the problems China faces with the trade war

a must read

( James Rickards)

v)Your weekly economic lesson from Alasdair Macleod as he discusses the end game. The trade wars will not help the USA because they do not safe and as such their budget deficit will still blow out. This will lead to a hyperinflationary depression in the USA as dollars leave the globe and circulate in great quantities in the USA

(courtesy Alasdair Macleod)

4/EUROPEAN AFFAIRS

i)UK

Corbyn is a fool: the opposition leader wants to nationalize the UK national energy grid. They just handed the election to Farage as both the conservatives and labour disintegrate

( Mish Shedlock/Mishtalk)

ii)UK

The pound hits a 4 month low as stalks with labour collapse

( zerohedge)

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

a)TURKEY

Early last night, the Turkish lira tumbles to 6.0840 after Trump terminates its preferential trade agreement with Turkey stating that Turkey is no longer in need of help as a developing nation and thus all goods will have the normal tariffs assigned to those goods. However as a kind gesture, he has initiated a 25% tariff on Turkish steel instead of the 50% that everybody else pays.

( zerohedge)

b)IRAN

There is fear that Iranian operatives have moved missiles in Iraq and are planning to attack USA interests there. We do not know how many missiles have been mobilized

( zerohedge)

c)IRAN/USA

two more warships travel through the Straits of Hormuz without incident. They are joining the USS Abraham Lincoln as well as a strike force including B 52 bombers as the uSA builds up its forces in the Gulf

( zerohedge)

6. GLOBAL ISSUES

Canada/Mexico/USA

Canada and Mexico reach a deal with the USA as they both lift tariffs against each other

(courtesy zerohedge

7. OIL ISSUES

8 EMERGING MARKET ISSUES

VENEZUELA

9. PHYSICAL MARKETS

i)My goodness, I guess that there is inflation

(Bloomberg/GATA)

ii)For the first time Kitco is allowed to mention gold manipulation. The interview is with Max Keiser and the interviewer is Daniela Cambone

( Kitco/GATA)

iii)Another Cdn miner going into the dust bin: Iamgold explores its sale amid gold sector consolidation

(Bloomberg/GATA)

iv)This is going to help a little in our manipulation of the precious metals as the futures exchange are introducing a speed bump to stop front running by our HFT traders.

(zerohedge)

10. USA stories which will influence the price of gold/silver)

MARKET TRADING//

Late trading today.

ii)Market data

The generally more accurate gauge of consumer confidence is the Bank of America survey as compared to the U. of Michigan report. Yesterday the U. of Michigan was bullish on confidence. Today’s B of America report was bearish.

(courtesy zerohedge)

ii)USA ECONOMIC/GENERAL STORIES

a)Baltimore is now crippled by the cryptocurrency ransomware attack.

(courtesy zerohedge)

b)auto loan delinquencies are now spiking levels not seen since 3rd quarter of 2009

(courtesy WolfRichter)

SWAMP STORIES

a)Barr’s first interview with Bill Hammer: Government power was used to spy on American citizens states Barr.

(courtesy Fox news/Bill Hammer/Bill Barr)

b)This is good: Nellie Ohr deleted emails on Bruce Ohr’s computer while she was doing her research digging up dirt on Trump. So we have a non government employee destroy evidence on a government employee’s computer.. Sounds like obstruction of justice to me

( zerohedge)

c)Maxine Waters is one nutjob: here she calls Trump’s very immigration plan racist because it is not important for new immigrants to learn English and have a job

(zerohedge)

E)SWAMP STORIES/MAJOR STORIES//THE KING REPORT

Let us head over to the comex:

THE TOTAL COMEX GOLD OPEN INTEREST FELL BY A CONSIDERABLE SIZED 3112 CONTRACTS TO A LEVEL OF 521,243 DESPITE THE CONSIDERABLE FALL IN THE PRICE OF GOLD ($11.10) IN YESTERDAY’S // COMEX TRADING)

WE ARE NOW IN THE NON ACTIVE DELIVERY MONTH OF MAY.. THE CME REPORTS THAT THE BANKERS ISSUED A HUMONGOUS SIZED TRANSFER THROUGH THE EFP ROUTE AS THESE LONGS RECEIVED A DELIVERABLE LONDON FORWARD TOGETHER WITH A FIAT BONUS., THAT IS 14,239 EFP CONTRACTS WERE ISSUED:

0 FOR JUNE ’19: 14,239 CONTRACTS , DEC; 0 CONTRACTS: 0 AND ZERO FOR ALL OTHER MONTHS:

TOTAL EFP ISSUANCE: 14,239 CONTRACTS.

THE OBLIGATION STILL RESTS WITH THE BANKERS ON THESE TRANSFERS. ALSO REMEMBER THAT THERE IS NO DOUBT A HUGE DELAY IN THE ISSUANCE OF EFP’S AND IT PROBABLY TAKES AT LEAST 48 HRS AFTER LONGS GIVE UP THEIR COMEX CONTRACTS FOR THEM TO RECEIVE THEIR EFP’S AS THEY ARE NEGOTIATING THIS CONTRACT WITH THE BANKS FOR A FIAT BONUS PLUS THEIR TRANSFER TO A LONDON BASED FORWARD.

ON A NET BASIS IN OPEN INTEREST WE GAINED THE FOLLOWING TODAY ON OUR TWO EXCHANGES: 11,127 TOTAL CONTRACTS IN THAT 14,239 LONGS WERE TRANSFERRED AS FORWARDS TO LONDON AND WE LOST A CONSIDERABLE SIZED 3112 COMEX CONTRACTS.

NET GAIN ON THE TWO EXCHANGES : 11,127 contracts OR 1,112,700 OZ OR 34.60 TONNES.

We are now in the NON active contract month of MAY and here the open interest stands at 69 contracts, having LOST 54 contracts. We had 55 notices served yesterday so we gained 1 contracts or an additional 100 oz will stand as they guys refused to morph into a London based forward as well as negating a fiat bonus

The next contract month after May is June and here the open interest FELL by 15,934 contracts DOWN to 263,678. July LOST 300 contracts to stand at 370. After July the next active month is August and here the OI rose by 3636 contracts up to 162,923 contracts.

TODAY’S NOTICES FILED:

WE HAD 2 NOTICE FILED TODAY AT THE COMEX FOR 200 OZ. (0.0062 TONNES)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for the wild silver comex results.

Total COMEX silver OI ROSE BY A HUGE SIZED 5190 CONTRACTS FROM 204,318 UP TO 209,508 (AND CLOSER TO THE NEW RECORD OI FOR SILVER SET ON AUGUST 22.2018. THE PREVIOUS RECORD WAS SET APRIL 9.2018/ 243,411 CONTRACTS) AND TODAY’S HUGE OI COMEX GAIN OCCURRED WITH A 26 CENT LOSS IN PRICING.//YESTERDAY.

WE ARE NOW INTO THE ACTIVE DELIVERY MONTH OF MAY. HERE WE HAVE 353 OPEN INTEREST STAND SO FAR FOR A GAIN OF 55 CONTRACTS. WE HAD 4 NOTICES SERVED UPON YESTERDAY SO IN ESSENCE WE GAINED ANOTHER 59 CONTRACT OR AN ADDITIONAL 295,000 OZ WILL STAND FOR DELIVERY AS THESE GUYS REFUSED TO MORPH INTO LONDON BASED FORWARDS AND AS WELL THEY NEGATING A FIAT BONUS. SILVER MUST BE SCARCE AT THE COMEX. QUEUE JUMPING RETURNS WITH A VENGEANCE. WE HAVE NOW SURPASSED THE INITIAL AMOUNT STANDING WHICH OCCURRED ON APRIL 30.2019

THE NEXT MONTH AFTER MAY IS THE NON ACTIVE MONTH OF JUNE. HERE THIS MONTH GAINED 6 CONTRACTS DOWN TO 723. AFTER JUNE IS THE ACTIVE MONTH OF JULY, (THE SECOND LARGEST DELIVERY MONTH OF THE YEAR FOR SILVER) AND HERE THIS MONTH GAINED 4280 CONTRACTS UP TO 158,330 CONTRACTS. THE NEXT ACTIVE MONTH AFTER JULY FOR SILVER IS SEPTEMBER AND HERE THE OI ROSE BY 207 UP TO 19,323 CONTRACTS.

TODAY’S NUMBER OF NOTICES FILED:

We, today, had 15 notice(s) filed for 75,000 OZ for the MARCH, 2019 COMEX contract for silver

Trading Volumes on the COMEX TODAY: 267,386 CONTRACTS

CONFIRMED COMEX VOL. FOR YESTERDAY: 320,233 contracts

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

12 Month MM GOFO

+ 2.33%

LIBOR FOR 12 MONTH DURATION: 2.63

GOFO = LIBOR – GOLD LENDING RATE

GOLD LENDING RATE = +.30

end

PHYSICAL GOLD/SILVER STORIES

end

i) GOLDCORE BLOG/Mark O’Byrne

OFF TODAY

end

GATA STORIES WITH RESPECT TO GOLD/PRECIOUS METALS.

My goodness, I guess that there is inflation

(Bloomberg/GATA)

Koons’ silver Rabbit sets living artist record

Submitted by cpowell on Thu, 2019-05-16 13:39. Section: Daily Dispatches

Thank God there’s no inflation.

* * *

By Katya Kazakina and Allison McCartney

Bloomberg News

Thursday, May 16, 2019

It was another heady auction night in New York.

Minutes after Robert Rauschenberg’s painting Buffalo II fetched $88.8 million at Christie’s — almost five times the late artist’s previous auction record — Jeff Koons’s sculpture of an inflatable silver bunny topped that at $91.1 million, the most ever paid for a work by a living artist at auction.

The Koons led Christie’s postwar and contemporary art sale today, which totalled $539 million, up 36 percent from a year ago. The evening saw seven new artist records, with a $32.1 million spider sculpture by Louise Bourgeois joining Koons and Rauschenberg.

…

The 1986 Rabbit was bought by art dealer Bob Mnuchin, U.S. Treasury Secretary Steven Mnuchin’s father, who was in the midtown Manhattan salesroom and said he made the purchase on behalf of a client. Estimated at $50 million to $70 million, it was part of a group of works consigned by the family of late media mogul Si Newhouse. …

… For the remainder of the report:

https://www.bloomberg.com/graphics/2019-may-art-auctions/

END

For the first time Kitco is allowed to mention gold manipulation. The interview is with Max Keiser and the interviewer is Daniela Cambone

(courtesy Kitco/GATA)

Kitco lets Max Keiser mention gold market manipulation

Submitted by cpowell on Thu, 2019-05-16 15:18. Section: Daily Dispatches

11:19a ET Thursday, May 16, 2019

Dear Friend of GATA and Gold:

Gold market manipulation makes a surprising appearance at Kitco today as Daniela Cambone interviews financial market commentator Max Keiser about the monetary metal’s underperformance. The interview is 11 minutes long and can be viewed at Kitco News here:

https://www.kitco.com/news/2019-05-16/Fair-Value-For-Gold-Price-2-900-Bi…

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

END

Another Cdn miner going into the dust bin: Iamgold explores its sale amid gold sector consolidation

(Bloomberg/GATA)

Iamgold explores sale amid gold-sector consolidation

Submitted by cpowell on Fri, 2019-05-17 02:10. Section: Daily Dispatches

By Scott Deveau and Dinesh Nair

Bloomberg News

Thursday, May 16, 2019

Canadian miner Iamgold Corp. is exploring a possible sale of all or part of the company amid a wave of consolidation in the gold sector, according to people familiar with the matter.

The Toronto-based miner is working with advisers and has spoken to several potential buyers, said the people, who asked not to be identified because the matter is private.

Iamgold’s plans could still change and there’s no guarantee it would succeed in selling itself, the people said.

A representative for Iamgold declined to comment. …

… For the remainder of the report:

https://www.bloomberg.com/news/articles/2019-05-16/iamgold-is-said-to-ex…

iii) Other Physical stories

This is going to help a little in our manipulation of the precious metals as the futures exchange are introducing a speed bump to stop front running by our HFT traders.

(zerohedge)

Futures Exchange To Introduce Gold, Silver “Speed Bump” To End HFT Manipulation

No sooner had we covered the battle of high frequency traders physically moving infrastructure and microwave towers to gain nanosecond advantages, that we learned that Intercontinental Exchange (ICE) has planned on launching the first ever “speed bump” for the US futures market that would negate some of these advantages. Despite two of the CFTC’s five commissioners disagreeing with the decision, the exchange still looks set to impose a split second delay on some trades, according to the Wall Street Journal.

Those not in favor of the decision claim that the “speed bump” would unfairly punish firms that rely on their speed advantage. Those in favor, say that it’s about time someone did something to stop the HFTs from frontrunning everyone in the futures market. Which is also why some of the largest high frequency trading firms are vocally opposed to the plan.

As part of the proposed speed bump, the ICE is looking to introduce a 3 millisecond pause before executing some trades in its gold and silver futures contracts. Trading in those contracts is relatively tiny, as most gold and silver futures trades take place at the CME Group. However, traders have been watching this decision because of the precedent it could set.

The CFTC had a chance to block the proposal within 90 days, but that period ended on Tuesday. Now, ICE is free to do as it pleases. The CFTC’s Division of Market Oversight said it’s going to watch carefully to analyze the impact of the new “speed bump” saying it “does not view the certification of the ICE Rule as establishing a precedent with respect to the legal and policy merits of speed bump functionalities generally.”

Other attempts to create similar “speed bumps” at other exchanges will be assessed on individual merits, according to the Division. Both a Democratic and Republican commissioner issued objections to the decision. The Republican cited Kurt Vonnegut’s short story “Harrison Bergeron”, where the government forces handicaps on talented people to create a level playing field, in his dissent.

Republican Brian Quintenz said: “Those that invent, and invest in, faster information transmission technologies to capitalize on market dislocations reap the profits of their advantage. That process enhances market efficiency.”

ICE hasn’t given a timeline for when they are going to implement the “speed bump”. The exchange commented: “We are very pleased with the CFTC’s decision to allow our rule amendment for passive order protection—or what is commonly referred to as a speed bump—in futures markets to become effective.”

HFT giants like Citadel Securities LLC and DRW Holdings LLC, which make the bulk of their revenue from frontrunning slower retail and “dumb money whale” orders, were opposed to the idea, along with trade group Managed Funds Association, which represents hedge funds. Stephen Berger, global head of government and regulatory policy for Citadel Securities said: “We appreciate the commission’s confirmation that today’s rule change is limited in scope to two specific contracts and that any future expansion will require a new rule filing and legal analysis.”

The best hot take on the speed bump belonged to Tom McClellan, who said that “high-frequency algo traders spent all that money, locating their offices closer to ICE server farms and buying high-speed fiber connections to get an edge on trading, and now ICE is introducing a 3-millisecond delay trying to level the playing field.”

First ‘Speed Bump’ Coming to U.S. Futures Markets

The ICE futures exchange is set to blunt the advantages of ultrafast traders by imposing a split-second delay on some trades.

wsj.com

95 people are talking about this

Which also explains why they are all so furious.

Several smaller firms welcomed the idea, however, claiming it would allow greater competition. HFT firms now have to spend significant amounts of capital to shave millionths of a second off their trades. Large firms have built out microwave infrastructure and have jostled to get close to exchanges to find minuscule advantages, as we have profiled in the past.

The “bump” is set to apply to incoming orders seeking to hit unexecuted buy or sell orders already posted on ICE, while traders posting new orders to be displayed on the exchange won’t be affected. Eric Swanson, head of the Americas unit of XTX Markets said: “By negating costly HFT speed advantages at millisecond time frames, ICE’s speed bump will reduce the indirect operational tax on end users.”

Still, some critics claim that the delay could actually cause more volatility in periods of market turmoil.

DRW founder and Chief Executive Donald Wilson Jr. said: “During episodes of volatility, there would be essentially fake liquidity on the screen. I think that’s a very dangerous thing.”

Due to the criminal conviction of trader Edmonds, the USA prosecution is seeking to halt the civil lawsuit. I was misinformed: all discoveries in a civil suit are public and because of that, the prosecution gives the defendants the right to plead the 5th if their testimony incriminates them

(courtesy zerohedge/Chris Powell)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

MMGYS

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Dow Suffers Worst Streak Since 2016 Despite Best Dip-Buying In A Decade

Quite a week…

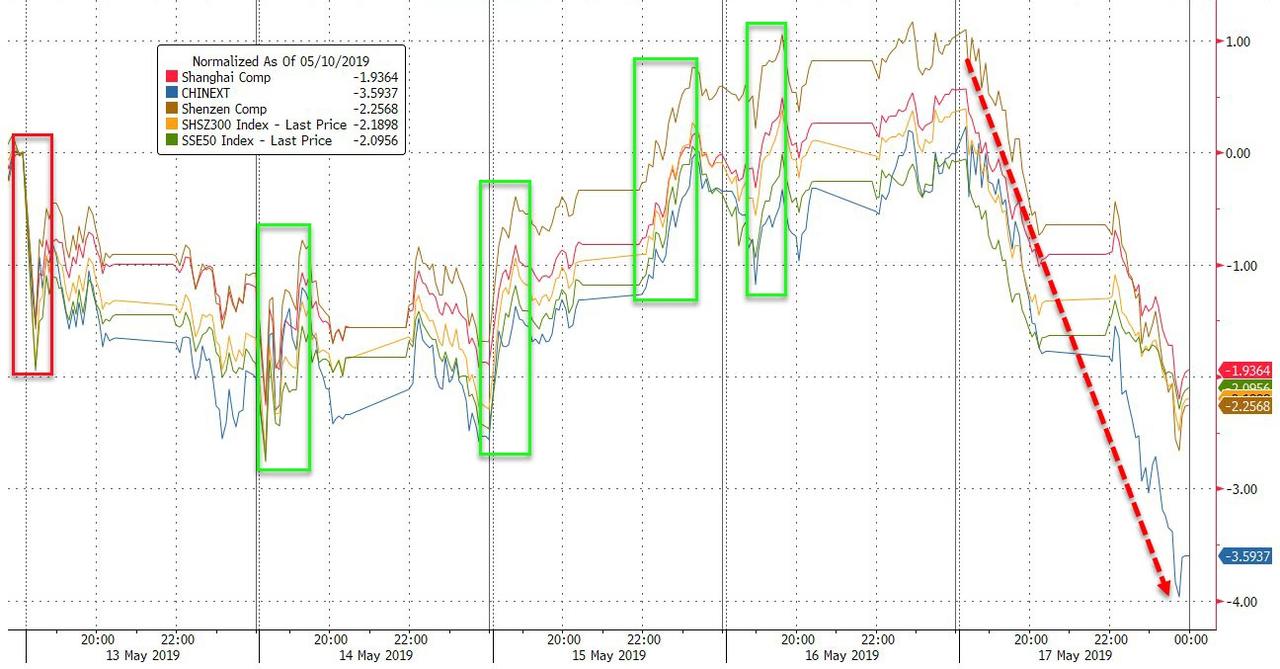

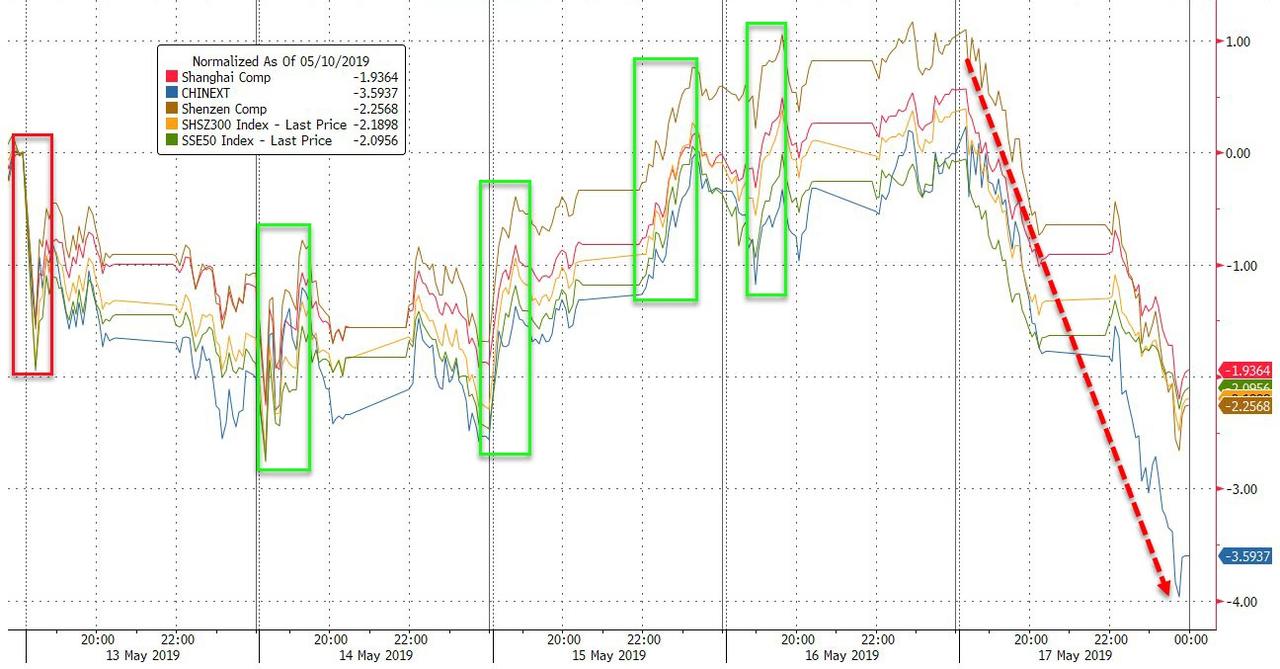

China was ugly overnight after defending any dip all week – have to make sure the stock market does not reflect weakness after the trade deal fell apart!!

But Europe soared this week as US delayed auto tariffs…

China remains the best performer YTD, barely…

The late-day headlines from CNBC that “trade talks have stalled” – merely repeating what was said overnight numerous times – triggered the algos to dump after early gains (thanks to op-ex gamma hedging and US-Canada tariff headlines)…Small Caps were the week’s biggest laggard…

The Dow is down four weeks in a row – something it has not done since May 2016!!

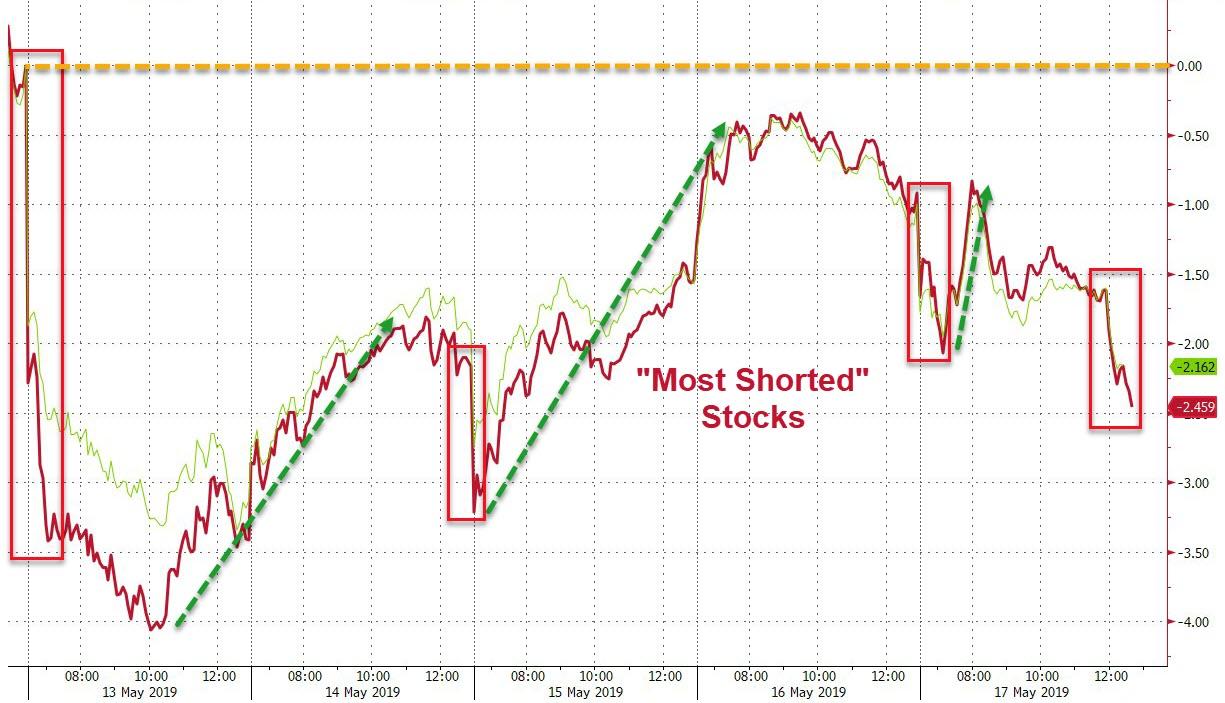

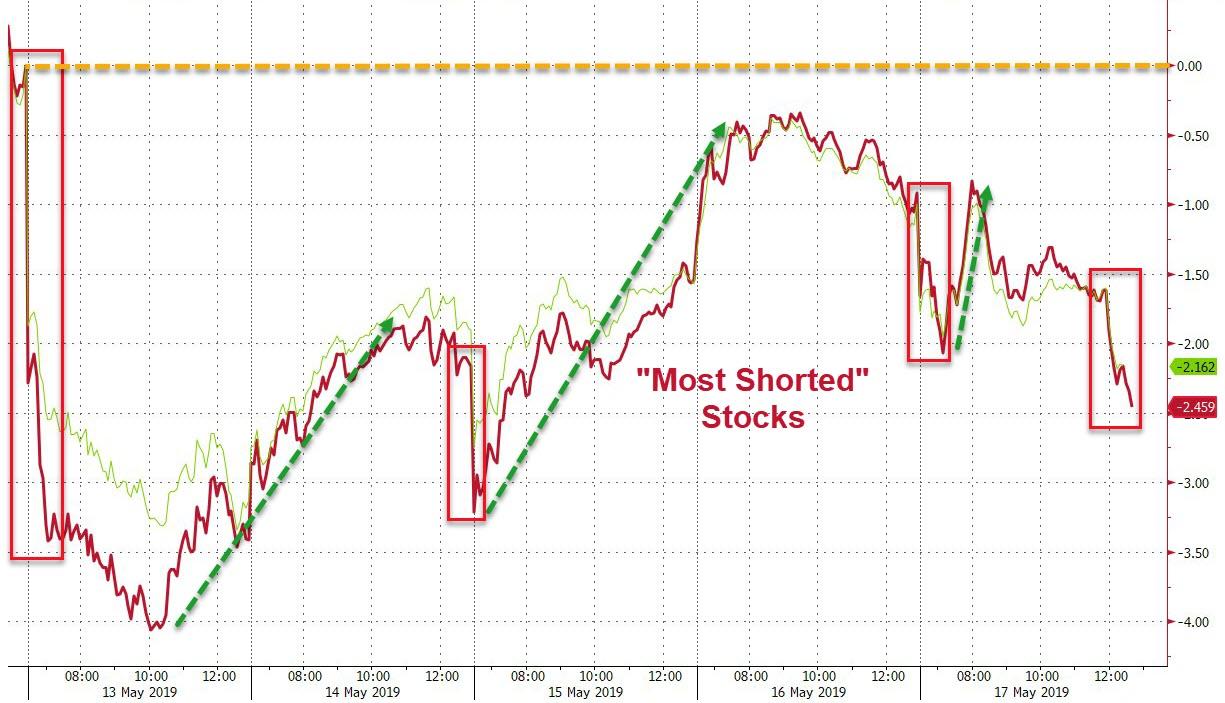

The midweek ramp was all one big short-squeeze and the machines ran out of ammo today…

Another failed IPO today…

Trade deal hope was dashed this week…

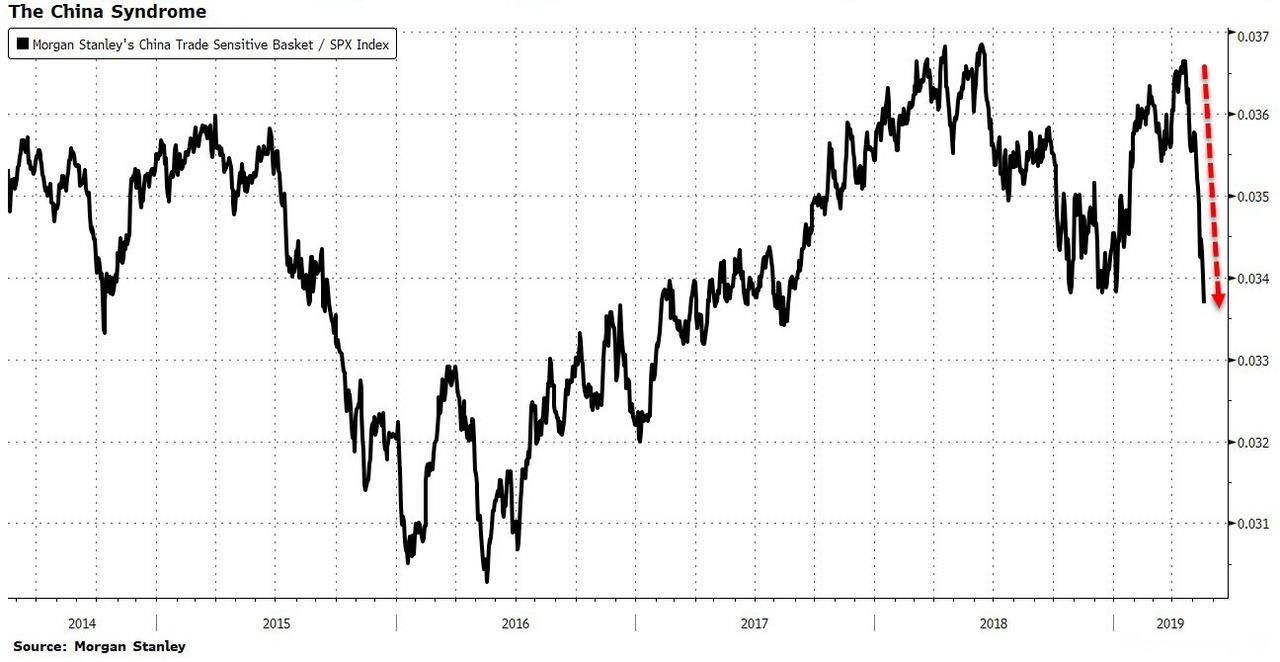

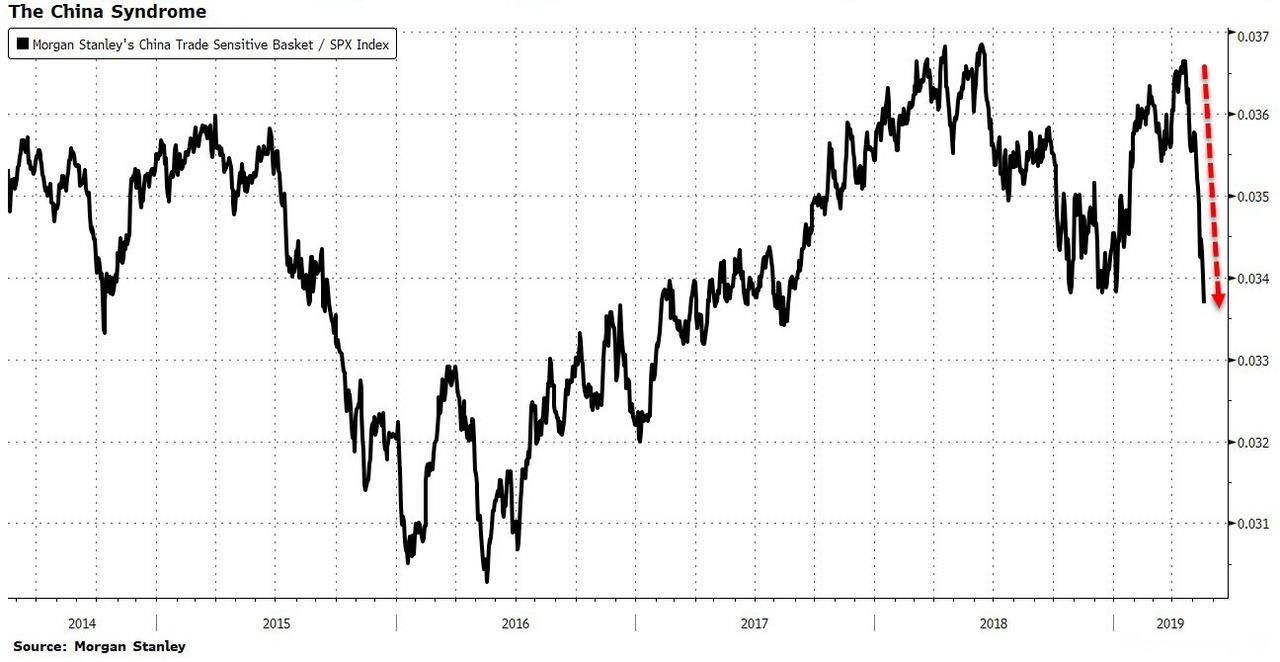

The ratio between Morgan Stanley’s China Trade Sensitive Basket and the S&P 500 has dropped to the lowest since U.S. President Trump and Chinese President Xi announced a truce at the G-20 meeting in Argentina in December.

Credit ended the week wider (despite ripping back midweek from Monday’s gap wider)…VIX was around unch…

Stocks and bonds decoupled this week (as stocks short-squeezed higher midweek)…

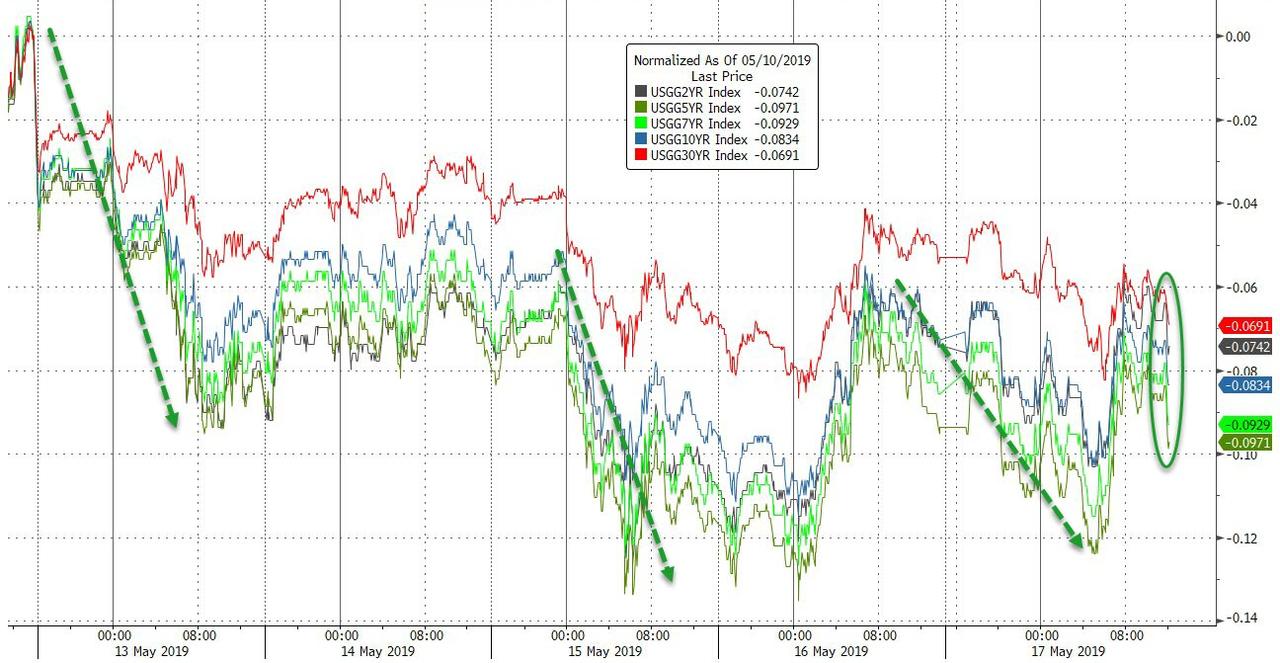

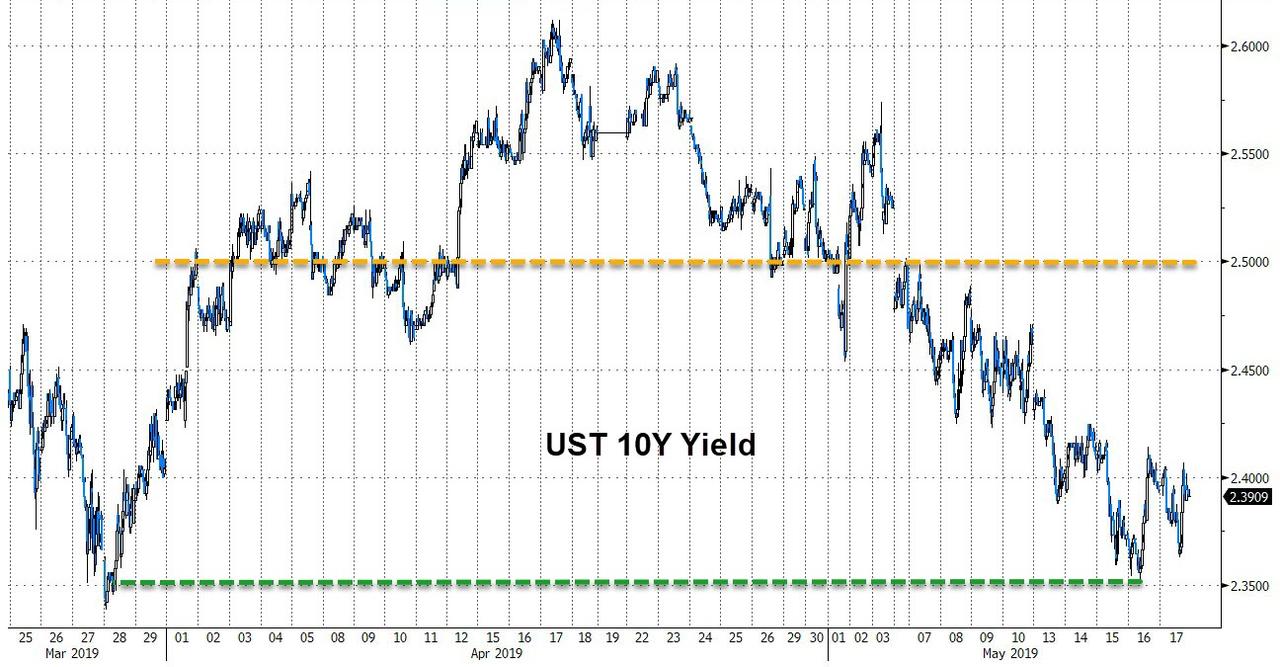

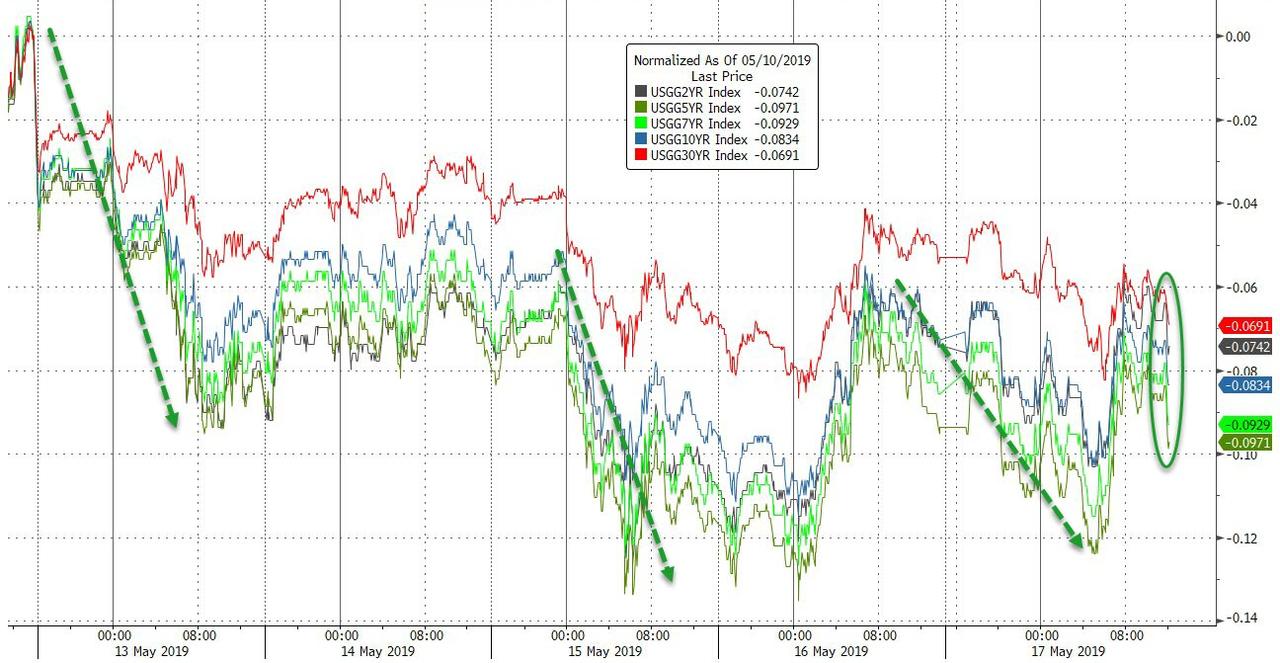

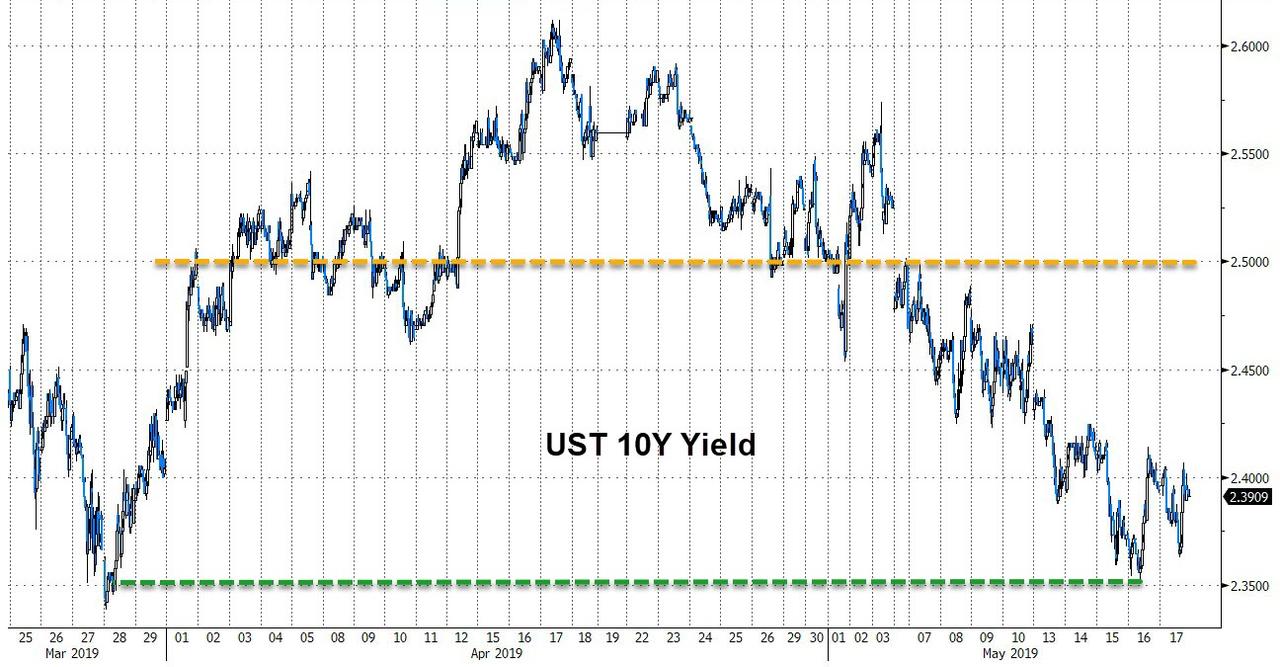

Treasury yields were bid on the week and accelerated lower in the last hour as repeated headlines of trade talks being stalled sparked more bond buying…

10Y Yields fell back close to YTD lows this week

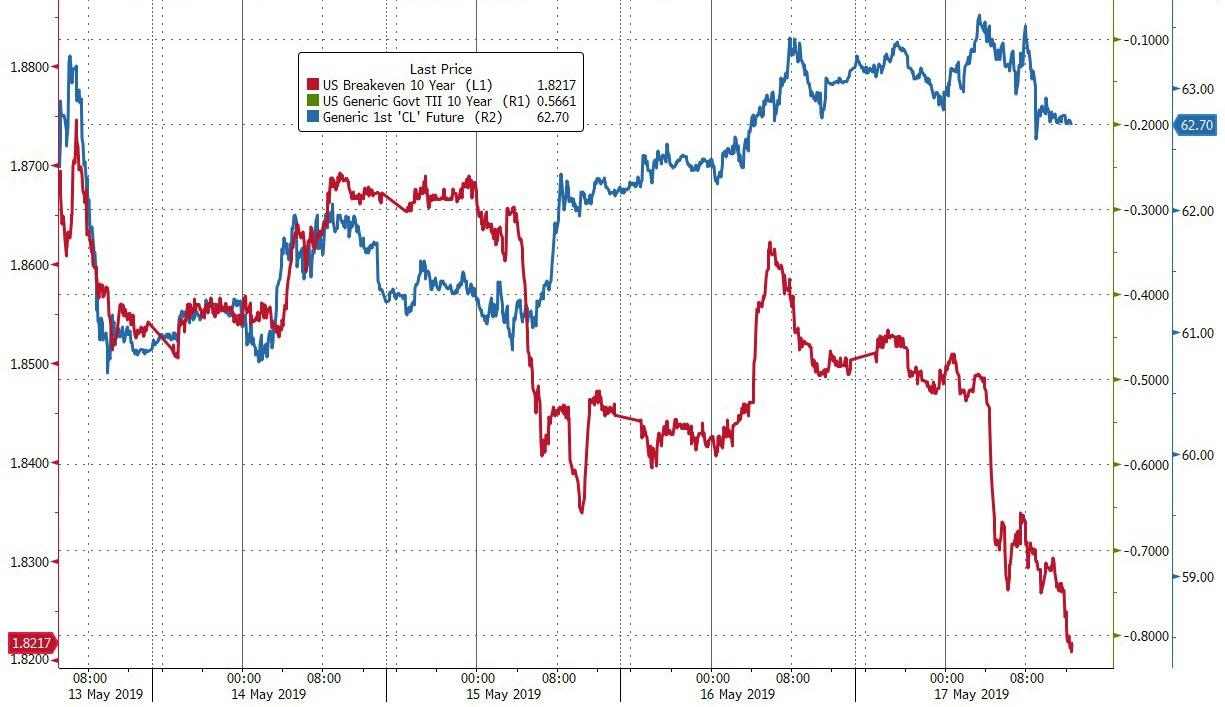

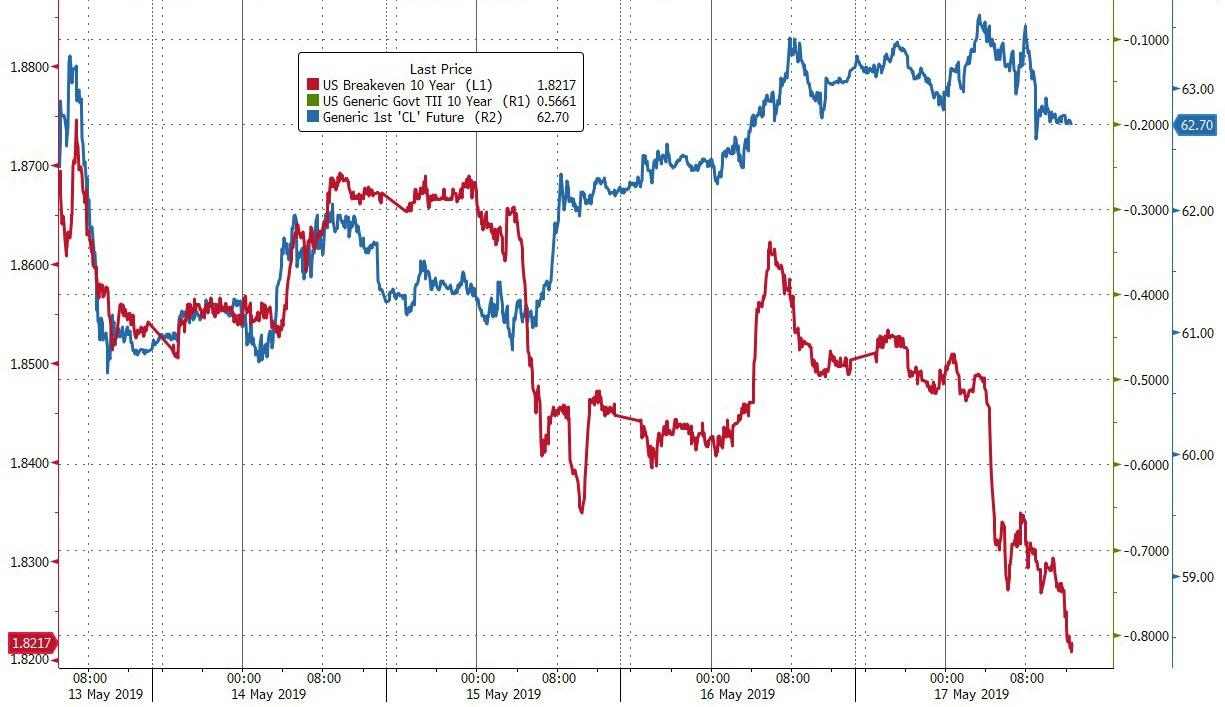

Notably crude and inflation breakevens decoupled late in the week…

The yield curve closed the week just above inversion…

But before we leave bond-land, both US and Europe priced in more dovishness from their respective central banks this week (41bps of cuts in 2019 for the Fed and 35bps of cuts for the ECB)…

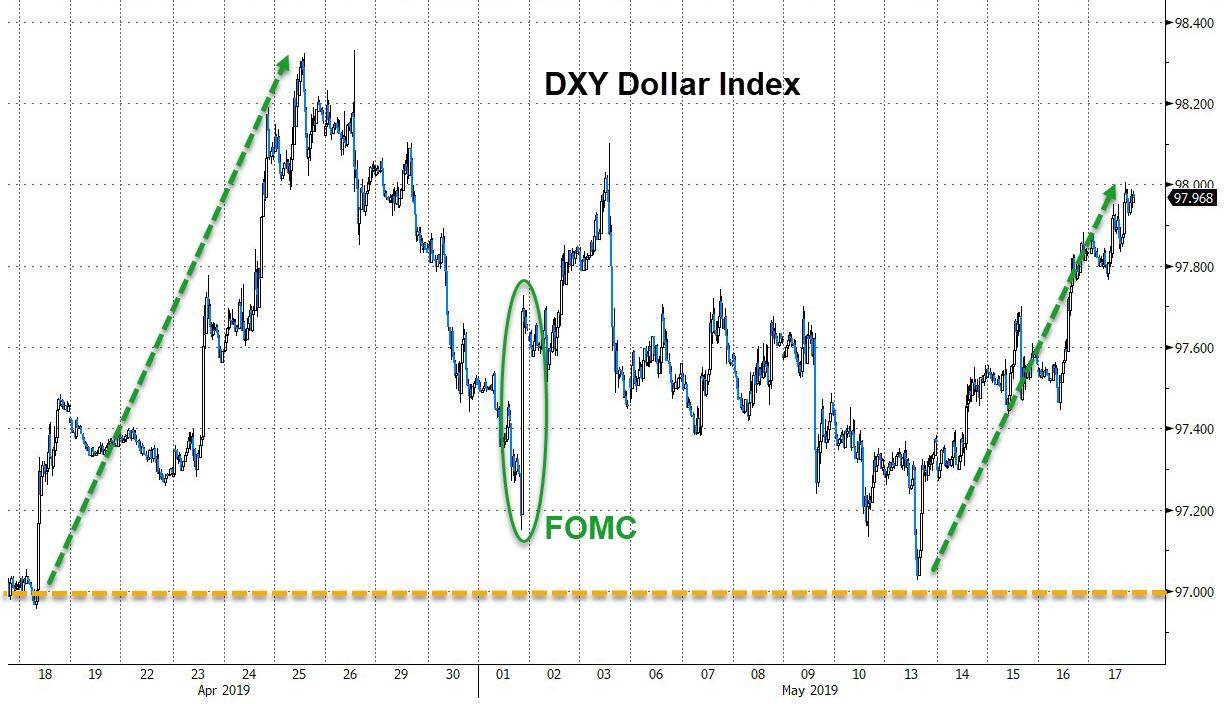

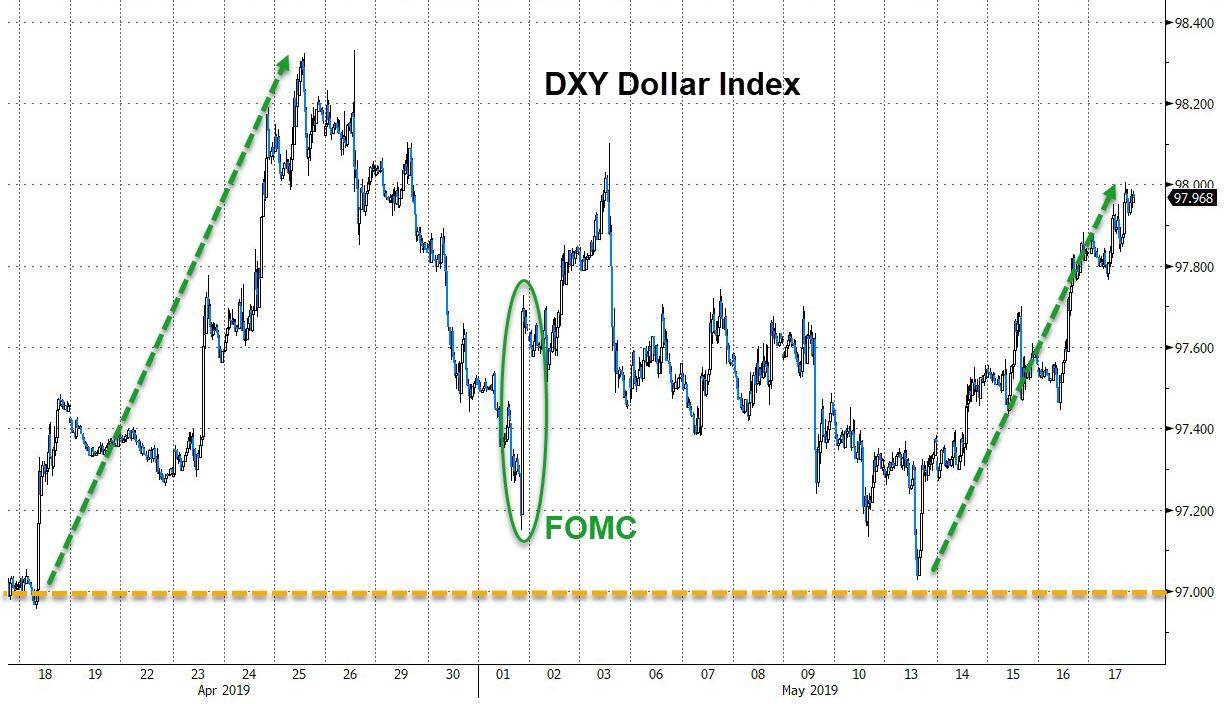

The Dollar Index rose on the week – its best week in over 2 months…

The last two weeks have seen offshore yuan collapse over 3.1% getting closer to 7.00 – the biggest 2-week plunge since Aug 2015’s devaluation

Cable was a disaster this week with GBPEUR down 10 days in a row – the longest losing streak in 19 years

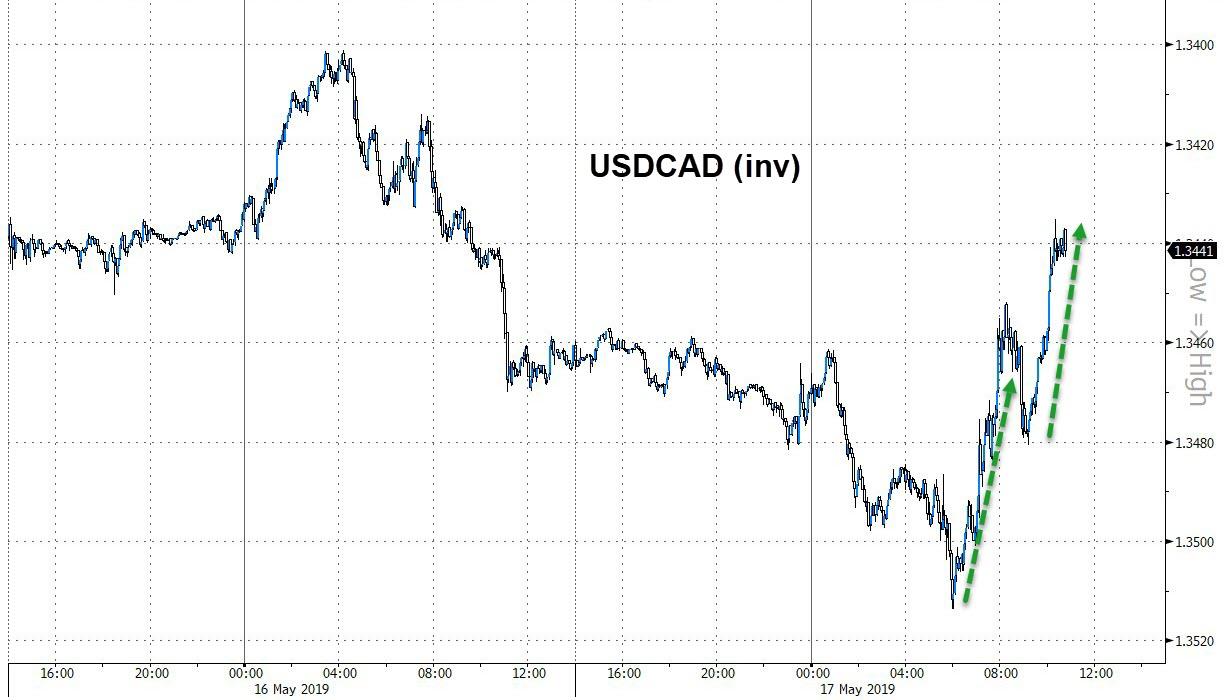

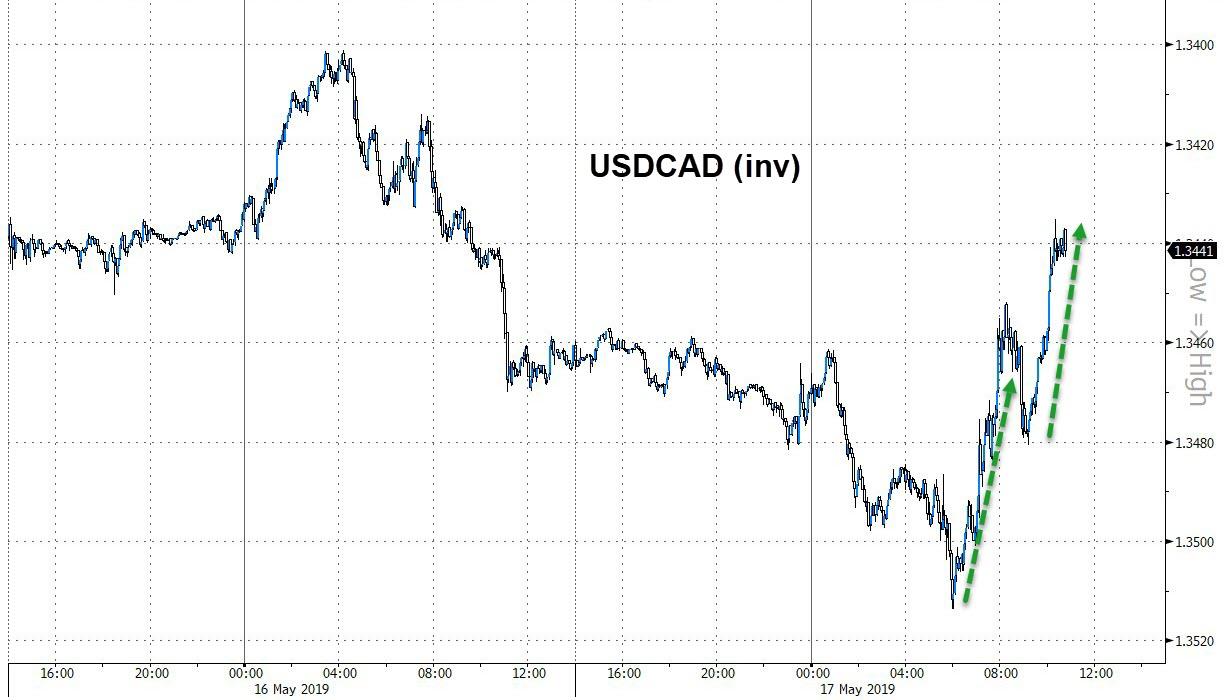

The Loonie rallied on the day after US dropped steel tariffs…

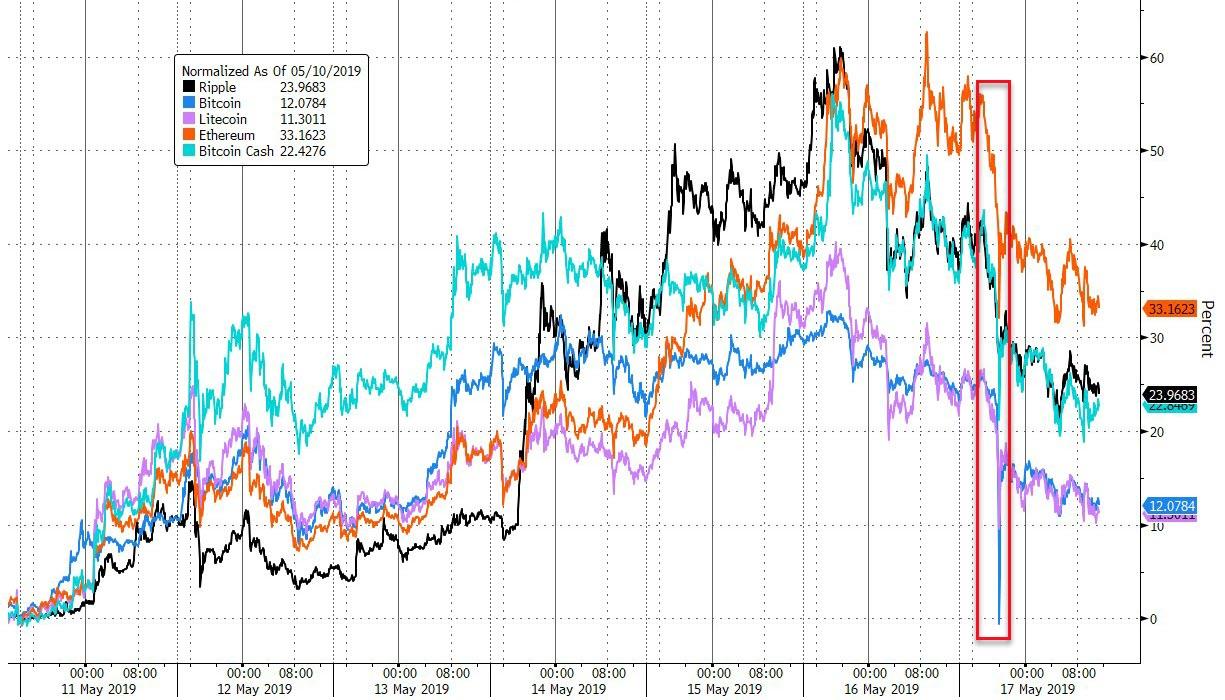

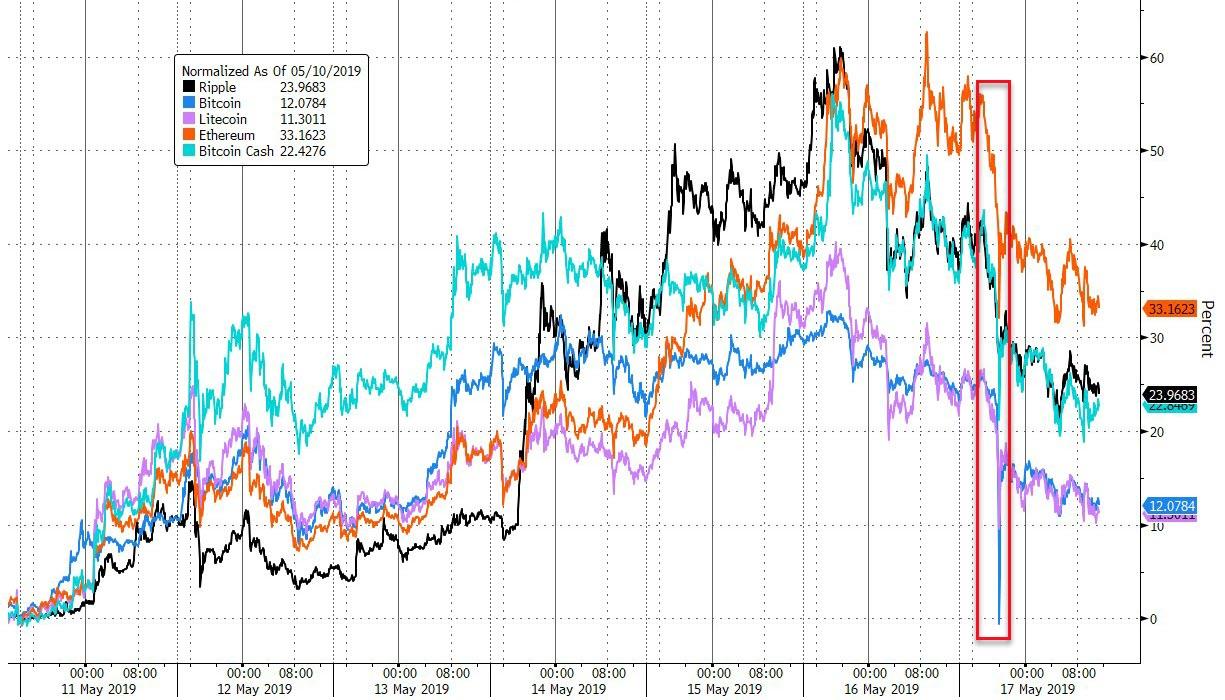

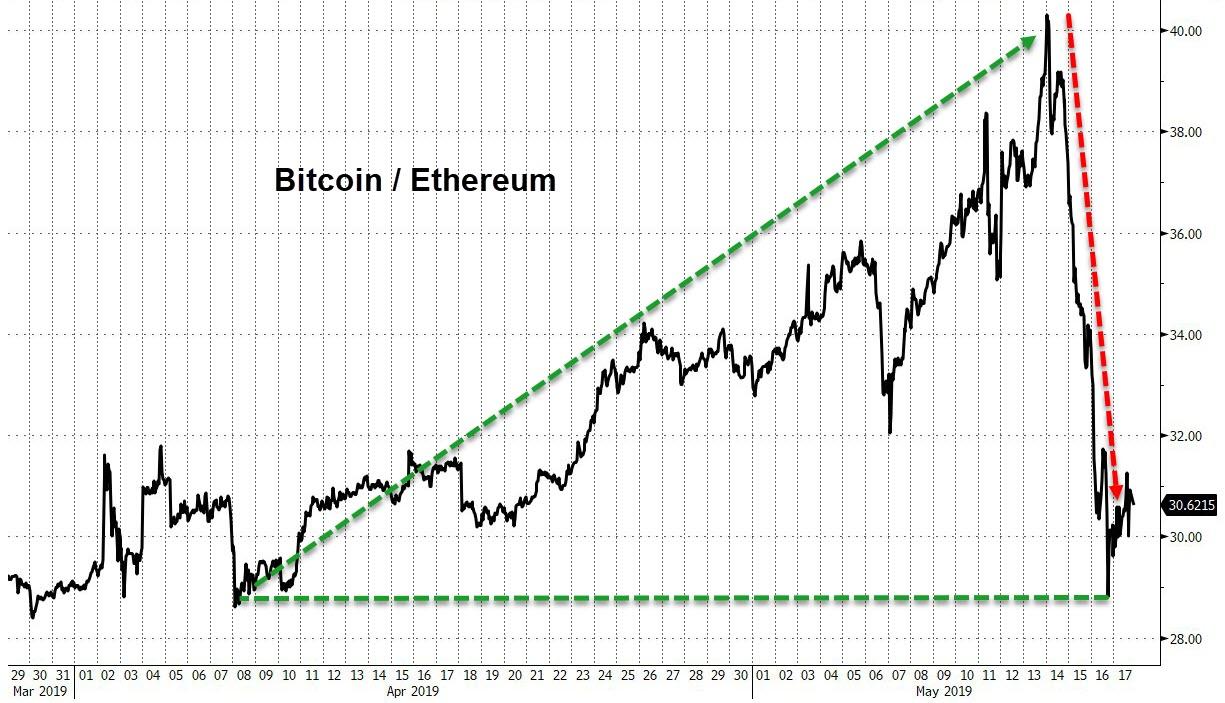

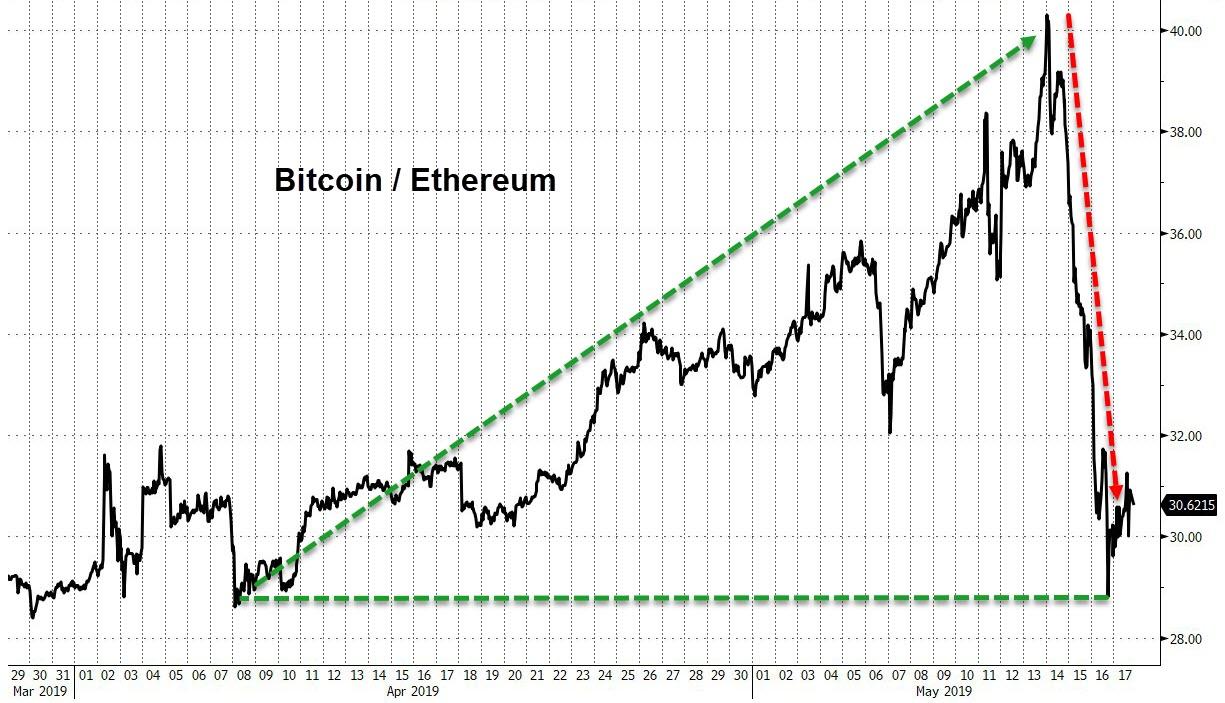

Cryptos had a violent week but ended significantly higher, led by a 33% rise in ethereum…

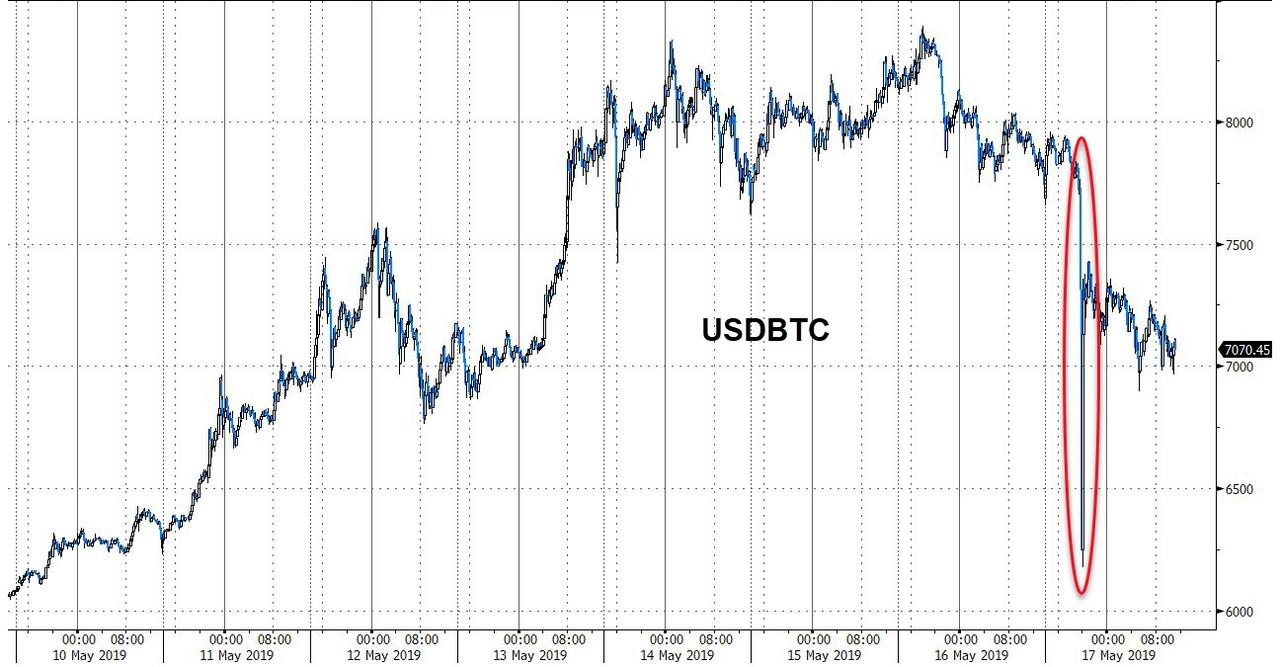

With Bitcoin reaching almost $8500 before crashing Friday…

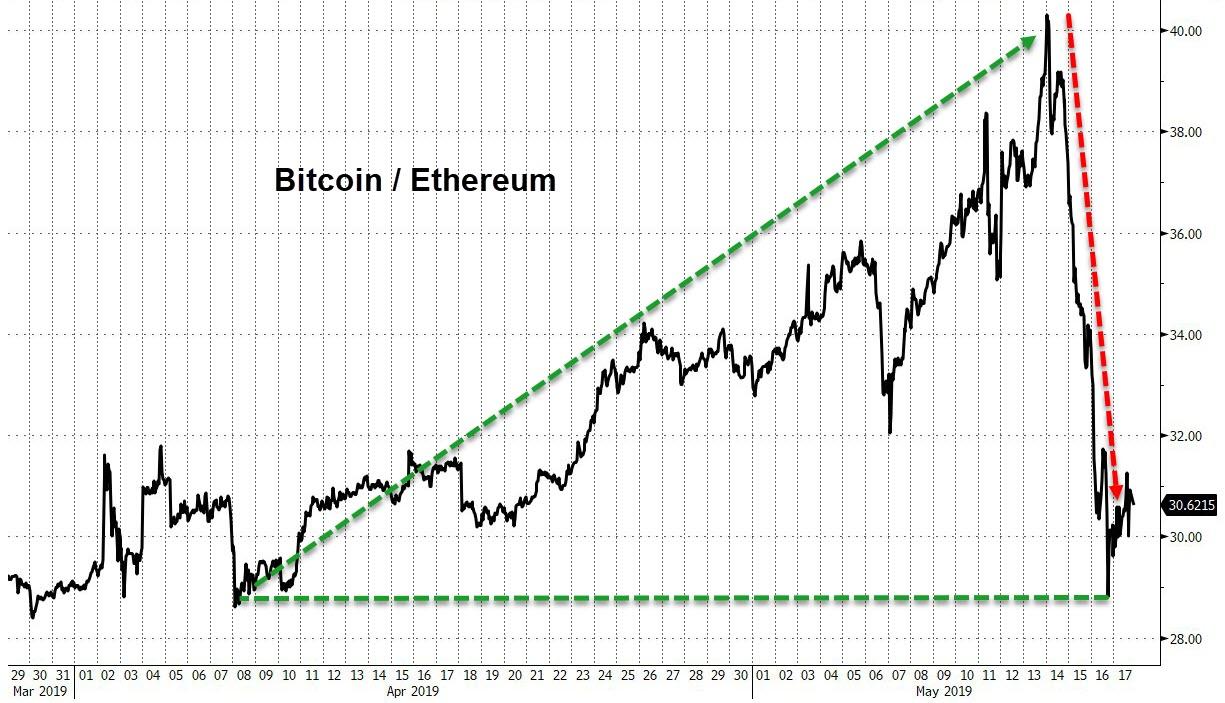

The dramatic outperformance of Ethereum in the last few days has erased all of Bitcoin’s outperformance over the last 6 weeks…

The dramatic outperformance of Ethereum in the last few days has erased all of Bitcoin’s outperformance over the last 6 weeks…

WTI rallied on the week (copper did not) despite a strong dollar and trade talks breakdown but silver was the biggest loser…

In other words, as the US-China trade deal began to collapse confidence in the markets, ‘someone’ was panic-buying US equities during the day after ‘someone else’ was dumping them overnight at historically high levels.

With global money supply now collapsing, stock markets are gonna need more dip-buying to support this debacle…

Read more Harvey here...

https://harveyorganblog.com/2019/05/17/may-17-gold-down-9-70-to-1276-25-silver-down-another-13-cents-on-this-comex-expiry-day-more-manipulation-china-states-that-there-are-no-more-talks-with-the-usa-concerning-the-trade-war-and-this-w/

show simo casted

.jpg)

Good Morning Good Evening

(doing the show over here for a while)

Welcome to ~*~Mining & Metals Du Jour~*~Graveyard Shift~*~

On the show tonight: Great Data & News by Harvey Organ,GATA Daily Dispatches, Peter Brandt Declares Silver Dead and More...

Hello everybody I'm J:D your host tonight Thanks for being with us.

Hope Your Having a Great Weekend

EnJoy the show

OK...here we go

MMGYS

Thank you

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

MAY 17/GOLD DOWN $9.70 TO $1276.25//SILVER DOWN ANOTHER 13 CENTS ON THIS COMEX EXPIRY DAY: MORE MANIPULATION//CHINA STATES THAT THERE ARE NO MORE TALKS WITH THE USA CONCERNING THE TRADE WAR AND THIS WAS VERIFIED BY THE USA//THE TURKISH LIRA FALTERS AGAIN WITH TRUMP REMOVING THE “DEVELOPING NATION” STATUS ON THE COUNTRY AND THEN THE USA IMPOSES A 25% TARIFF ON STEEL AND ALUMINUM ON TURKEY//BARR IS GOING AFTER THE DEMOCRATS FOR THEIR CRIMES/MAY BE TREASON//MORE SWAMP STORIES FOR YOU TONIGHT//

May 17, 2019 · by harveyorgan · in Uncategorized · Leave a comment

GOLD: $1276.25 DOWN $9.70 (COMEX TO COMEX CLOSING)

Silver: $14.41 DOWN 13 CENTS (COMEX TO COMEX CLOSING)

Closing access prices:

Gold : 1277.70

silver: $14.42

OPTIONS EXPIRY FOR THE STOCK MARKET AND GLD/SLV WAS TODAY

COMEX EXPIRY FOR GOLD/SILVER: TUES MAY 28/2019

LBMA/OTC EXPIRY: MAY 31.2019

JPMorgan has been receiving gold with reckless abandon and sometimes supplying (stopping)

today RECEIVING 2/2

EXCHANGE: COMEX

CONTRACT: MAY 2019 COMEX 100 GOLD FUTURES

SETTLEMENT: 1,285.000000000 USD

INTENT DATE: 05/16/2019 DELIVERY DATE: 05/20/2019

FIRM ORG FIRM NAME ISSUED STOPPED

____________________________________________________________________________________________

661 C JP MORGAN 2

737 C ADVANTAGE 2

____________________________________________________________________________________________

TOTAL: 2 2

MONTH TO DATE: 290

NUMBER OF NOTICES FILED TODAY FOR MAY CONTRACT: 2 NOTICE(S) FOR 200 OZ (0.0062 tonnes)

TOTAL NUMBER OF NOTICES FILED SO FAR: 290 NOTICES FOR 28000 OZ (.9020 TONNES)

SILVER

FOR MAY

15 NOTICE(S) FILED TODAY FOR 75,000 OZ/

total number of notices filed so far this month: 3392 for 16,960,000 oz

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Bitcoin: OPENING MORNING TRADE :$7255 DOWN $632

Bitcoin: FINAL EVENING TRADE: $7104 DOWN $766

end

XXXX

Let us have a look at the data for today

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

IN SILVER THE COMEX OI ROSE BY A MONSTROUS SIZED 5190 CONTRACTS FROM 204,318 UP TO 209,508 DESPITE YESTERDAY’S 26 CENT LOSS IN SILVER PRICING AT THE COMEX. LIQUIDATION OF THE SPREADERS HAVE STOPPED FOR SILVER BUT IT NOW IN FULL FORCE FOR GOLD. TODAY WE ARRIVED CLOSER TO AUGUST’S 2018 RECORD SETTING OPEN INTEREST OF 244,196 CONTRACTS.

WE HAVE ALSO WITNESSED A LARGE AMOUNT OF PHYSICAL METAL STAND FOR COMEX DELIVERY AS WELL WE ARE WITNESSING CONSIDERABLE LONGS PACKING THEIR BAGS AND MIGRATING OVER TO LONDON IN GREATER NUMBERS IN THE FORM OF EFP’S. WE WERE NOTIFIED THAT WE HAD A STRONG SIZED NUMBER OF COMEX LONGS TRANSFERRING THEIR CONTRACTS TO LONDON THROUGH THE EFP:

0 FOR MAY, 0 FOR JUNE, 1368 FOR JULY AND ZERO FOR ALL OTHER MONTHS AND THEREFORE TOTAL ISSUANCE 1368 CONTRACTS. WITH THE TRANSFER OF 1368 CONTRACTS, WHAT THE CME IS STATING IS THAT THERE IS NO SILVER (OR GOLD) TO BE DELIVERED UPON AT THE COMEX AS THEY MUST EXPORT THEIR OBLIGATION TO LONDON. ALSO KEEP IN MIND THAT THERE CAN BE A DELAY OF 24-48 HRS IN THE ISSUING OF EFP’S. THE 1368 EFP CONTRACTS TRANSLATES INTO 6.84 MILLION OZ ACCOMPANYING:

1.THE 26 CENT LOSS IN SILVER PRICE AT THE COMEX AND

2. THE STRONG AMOUNT OF SILVER OUNCES WHICH STOOD FOR DELIVERY IN THE LAST NINE MONTHS:

JUNE/2018. (5.420 MILLION OZ);

FOR JULY: 30.370 MILLION OZ

FOR AUG., 6.065 MILLION OZ

FOR SEPT. 39.505 MILLION OZ S

FOR OCT.2.525 MILLION OZ.

FOR NOV: A HUGE 7.440 MILLION OZ STANDING AND

21.925 MILLION OZ FINALLY STAND FOR DECEMBER.

5.845 MILLION OZ STAND IN JANUARY.

2.955 MILLION OZ STANDING FOR FEBRUARY.:

27.120 MILLION OZ STANDING IN MARCH.

3.875 MILLION OZ STANDING FOR SILVER IN APRIL.

AND NOW 18.650 MILLION OZ STANDING FOR SILVER IN MAY.

ACCUMULATION FOR EFP’S/SILVER/J.P.MORGAN’S HOUSE OF BRIBES, / STARTING FROM FIRST DAY NOTICE/FOR MONTH OF MAY:

14,934 CONTRACTS (FOR 13 TRADING DAYS TOTAL 14,934 CONTRACTS) OR 74,67 MILLION OZ: (AVERAGE PER DAY: 1148 CONTRACTS OR 5.743 MILLION OZ/DAY)

TO GIVE YOU AN IDEA AS TO THE HUGE SUPPLY THIS MONTH IN SILVER: SO FAR THIS MONTH OF MAY: 74.67 MILLION PAPER OZ HAVE MORPHED OVER TO LONDON. THIS REPRESENTS AROUND 10.66% OF ANNUAL GLOBAL PRODUCTION (EX CHINA EX RUSSIA)* JUNE’S 345.43 MILLION OZ IS THE SECOND HIGHEST RECORDED ISSUANCE OF EFP’S AND IT FOLLOWED THE RECORD SET IN APRIL 2018 OF 385.75 MILLION OZ.

ACCUMULATION IN YEAR 2019 TO DATE SILVER EFP’S: 815,77 MILLION OZ.

JANUARY 2019 EFP TOTALS: 217.455. MILLION OZ

FEB 2019 TOTALS: 147.4 MILLION OZ/

MARCH 2019 TOTAL EFP ISSUANCE: 207.835 MILLION OZ

APRIL 2019 TOTAL EFP ISSUANCE: 182.87 MILLION OZ.

RESULT: WE HAD A HUGE SIZED INCREASE IN COMEX OI SILVER COMEX CONTRACTS OF 5190 DESPITE THE LARGE 26 CENT LOSS IN SILVER PRICING AT THE COMEX /YESTERDAY... THE CME NOTIFIED US THAT WE HAD A STRONG SIZED EFP ISSUANCE OF 1368 CONTRACTS WHICH EXITED OUT OF THE SILVER COMEX AND TRANSFERRED THEIR OI TO LONDON AS FORWARDS. SPECULATORS CONTINUED THEIR INTEREST IN ATTACKING THE SILVER COMEX FOR PHYSICAL SILVER (SEE COMEX DATA) . OUR BANKERS RESUMED THEIR LIQUIDATION OF THE SPREAD TRADES TODAY.

TODAY WE GAINED A GIGANTIC SIZED: 6558 TOTAL OI CONTRACTS ON THE TWO EXCHANGES:

i.e 1368 OPEN INTEREST CONTRACTS HEADED FOR LONDON (EFP’s) TOGETHER WITH INCREASE OF 5190 OI COMEX CONTRACTS. AND ALL OF THIS DEMAND HAPPENED WITH A 26 CENT LOSS IN PRICE OF SILVER AND A CLOSING PRICE OF $14.55 WITH RESPECT TO YESTERDAY’S TRADING. YET WE STILL HAVE A STRONG AMOUNT OF SILVER STANDING AT THE COMEX FOR DELIVERY!!

In ounces AT THE COMEX, the OI is still represented by JUST OVER 1 BILLION oz i.e. 1.022 BILLION OZ TO BE EXACT or 145% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT MARCH MONTH/ THEY FILED AT THE COMEX: 15 NOTICE(S) FOR 75,000 OZ OF SILVER

IN SILVER,PRIOR TO TODAY, WE SET THE NEW COMEX RECORD OF OPEN INTEREST AT 243,411 CONTRACTS ON APRIL 9.2018. AND AGAIN THIS HAS BEEN SET WITH A LOW PRICE OF $16.51.

AND NOW WE RECORD FOR POSTERITY ANOTHER ALL TIME RECORD OPEN INTEREST AT THE COMEX OF 244,196 CONTRACTS ON AUGUST 22/2018 AND AGAIN WHEN THIS RECORD WAS SET, THE PRICE OF SILVER WAS $14.78 AND LOWER IN PRICE THAN PREVIOUS RECORDS.

ON THE DEMAND SIDE WE HAVE THE FOLLOWING:

HUGE AMOUNTS OF SILVER STANDING FOR DELIVERY (MARCH/2018: 27 MILLION OZ , APRIL/2018 : 2.485 MILLION OZ MAY: 36.285 MILLION OZ ; JUNE/2018 (5.420 MILLION OZ) , JULY 2018 FINAL AMOUNT STANDING: 30.370 MILLION OZ ) FOR AUGUST 6.065 MILLION OZ. , SEPT: A HUGE 39.505 MILLION OZ./ OCTOBER: 2,520,000 oz NOV AT 7.440 MILLION OZ./ DEC. AT 21.925 MILLION OZ JANUARY AT 5.825 MILLION OZ.AND FEB 2019: 2.955 MILLION OZ/ MARCH: 27.120 MILLION OZ/ APRIL AT 3.875 MILLION OZ/ AND NOW MAY: 18.650 MILLION OZ ..

HUGE RECORD OPEN INTEREST IN SILVER 243,411 CONTRACTS (OR 1.217 BILLION OZ/ SET APRIL 9/2018) AND NOW AUGUST 22/2018: 244,196 CONTRACTS, WITH A SILVER PRICE OF $14.78.

HUGE ANNUAL EFP’S ISSUANCE EQUAL TO 2.9 BILLION OZ OR 400% OF SILVER ANNUAL PRODUCTION/2017

RECORD SETTING EFP ISSUANCE FOR ANY MONTH IN SILVER; APRIL/2018/ 385.75 MILLION OZ/ AND THE SECOND HIGHEST RECORDED EFP ISSUANCE JUNE 2018 345.43 MILLION OZ

AND YET, WITH THE EXTREMELY HIGH EFP ISSUANCE, WE HAVE A CONTINUAL LOW PRICE OF SILVER DESPITE THE ABOVE HUGE DEMAND. TO ME THE ONLY ANSWER IS THAT WE HAVE SOVEREIGN (CHINA) WHO IS ENDEAVOURING TO GOBBLE UP ALL AVAILABLE PHYSICAL SILVER NO MATTER WHERE, EXACTLY WHAT J.P.MORGAN IS DOING. AND IT IS MY BELIEF THAT J.P.MORGAN IS HOLDING ITS SILVER FOR ITS BENEFICIAL OWNER..THE USA GOVERNMENT WHO IN TURN IS HOLDING THAT SILVER FOR CHINA.(FOR A SILVER LOAN REPAYMENT).

IN GOLD, THE OPEN INTEREST FELL BY A CONSIDERABLE SIZED 3112 CONTRACTS, TO 521,243 DESPITE THE CONSIDERABLE FALL IN THE COMEX GOLD PRICE/(A LOSS IN PRICE OF $11.10//YESTERDAY’S TRADING).

THE CME RELEASED THE DATA FOR EFP ISSUANCE AND IT TOTALED A VERY STRONG SIZED 14,239 CONTRACTS:

APRIL 0 CONTRACTS,JUNE: 14,239 CONTRACTS DECEMBER: 0 CONTRACTS, JUNE 2020 0 CONTRACTS AND ALL OTHER MONTHS ZERO. The NEW COMEX OI for the gold complex rests at 521,243. ALSO REMEMBER THAT THERE WILL BE A DELAY IN THE ISSUANCE OF EFP’S. THE BANKERS REMOVE LONG POSITIONS OF COMEX GOLD IMMEDIATELY. THEN THEY ORCHESTRATE THEIR PRIVATE EFP DEAL WITH THE LONGS AND THAT COULD TAKE AN ADDITIONAL, 48 HRS SO WE GENERALLY DO NOT GET A MATCH WITH RESPECT TO DEPARTING COMEX LONGS AND NEW EFP LONG TRANSFERS. . EVEN THOUGH THE BANKERS ISSUED THESE MONSTROUS EFPS, THE OBLIGATION STILL RESTS WITH THE BANKERS TO SUPPLY METAL BUT IT TRANSFERS THE RISK TO A LONDON BANKER OBLIGATION AND NOT A NEW YORK COMEX OBLIGATION. LONGS RECEIVE A FIAT BONUS TOGETHER WITH A LONG LONDON FORWARD. THUS, BY THESE ACTIONS, THE BANKERS AT THE COMEX HAVE JUST STATED THAT THEY HAVE NO APPRECIABLE METAL!! THIS IS A MASSIVE FRAUD: THEY CANNOT SUPPLY ANY METAL TO OUR COMEX LONGS BUT THEY ARE QUITE WILLING TO SUPPLY MASSIVE NON BACKED GOLD (AND SILVER) PAPER KNOWING THAT THEY HAVE NO METAL TO SATISFY OUR LONGS. LONDON IS NOW SEVERELY BACKWARD IN BOTH GOLD AND SILVER AND WE ARE WITNESSING DELAYS IN ACTUAL DELIVERIES.

IN ESSENCE WE HAVE A VERY STRONG SIZED GAIN IN TOTAL CONTRACTS ON THE TWO EXCHANGES OF 11,127 CONTRACTS: 3112 OI CONTRACTS DECREASED AT THE COMEX AND 14,239 EFP OI CONTRACTS WHICH NAVIGATED OVER TO LONDON. THUS TOTAL OI GAIN OF 11,127 CONTRACTS OR 1,112,700 OZ OR 34.60 TONNES. YESTERDAY WE HAD A LOSS IN THE PRICE OF GOLD TO THE TUNE OF $11.10.…AND WITH LARGE LOSS, WE HAD A HUGE GAIN OF 34.60 TONNES!!!!!!.??????

WITH RESPECT TO SPREADING: WE MAY HAVE HAD SOME ACTIVITY WITH TODAY’S FALL IN PRICE

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES:

“AS YOU WILL SEE, THE CROOKS HAVE NOW SWITCHED TO GOLD AS THEY INCREASE THE OPEN INTEREST FOR THE SPREADERS. THE TOTAL COMEX GOLD OPEN INTEREST WILL RISE FROM NOW ON UNTIL ONE WEEK PRIOR TO FIRST DAY NOTICE AND THAT IS WHEN THEY START THEIR CRIMINAL LIQUIDATION.

HERE IS HOW THE CROOKS USED SPREADING AS WE ARE NO INTO THE NON ACTIVE DELIVERY MONTH OF MAY HEADING TOWARDS THE VERY ACTIVE DELIVERY MONTH OF JUNE.

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES, HERE IS THE BANKERS MODUS OPERANDI:

YOU WILL ALSO NOTICE THAT THE COMEX OPEN INTEREST IS STARTING TO RISE IN THIS NON ACTIVE MONTH OF MAY BUT SO IS THE OPEN INTEREST OF SPREADERS. THE OPEN INTEREST IN GOLD WILL CONTINUE TO RISE UNTIL ONE WEEK BEFORE FIRST DAY NOTICE OF AN UPCOMING ACTIVE DELIVERY MONTH (JUNE), AND THAT IS WHEN THE CROOKS SELL THEIR SPREAD POSITIONS BUT NOT AT THE SAME TIME OF THE DAY. THEY WILL USE THE SELL SIDE OF THE EQUATION TO CREATE THE CASCADE (ALONG WITH THEIR COLLUSIVE FRIENDS) AND THEN COVER ON THE BUY SIDE OF THE SPREAD SITUATION AT THE END OF THE DAY. THEY DO THIS TO AVOID POSITION LIMIT DETECTION. THE LIQUIDATION OF THE SPREADING FORMATION CONTINUES FOR EXACTLY ONE WEEK AND ENDS ON FIRST DAY NOTICE.”

ACCUMULATION OF EFP’S GOLD AT J.P. MORGAN’S HOUSE OF BRIBES: (EXCHANGE FOR PHYSICAL) FOR THE MONTH OF MAY : 85,098 CONTRACTS OR 8,509,800 OR 264.69 TONNES (13 TRADING DAYS AND THUS AVERAGING: 6546 EFP CONTRACTS PER TRADING DAY

TO GIVE YOU AN IDEA AS TO THE STRONG SIZE OF THESE EFP TRANSFERS : THIS MONTH IN 13 TRADING DAYS IN TONNES: 264.69 TONNES

TOTAL ANNUAL GOLD PRODUCTION, 2018, THROUGHOUT THE WORLD EX CHINA EX RUSSIA: 3555 TONNES

THUS EFP TRANSFERS REPRESENTS 264.69/3550 x 100% TONNES =7.43% OF GLOBAL ANNUAL PRODUCTION SO FAR IN DECEMBER ALONE.***

ACCUMULATION OF GOLD EFP’S YEAR 2019 TO DATE: 2080.23 TONNES

JANUARY 2019 TOTAL EFP ISSUANCE; 531.20 TONNES

FEB 2019 TOTAL EFP ISSUANCE: 344.36 TONNES

MARCH 2019 TOTAL EFP ISSUANCE: 497.16 TONNES

APRIL 2019 TOTAL ISSUANCE: 456.10 TONNES

WHAT IS ALARMING TO ME, ACCORDING TO OUR LONDON EXPERT ANDREW MAGUIRE IS THAT THESE EFP’S ARE BEING TRANSFERRED TO WHAT ARE CALLEDRIAL FORWARD CONTRACT OBLIGATIONS AND THESE CONTRACTS ARE LESS THAN 14 DAYS. ANYTHING GREATER THAN 14 DAYS, THESE MUST BE RECORDED AND SENT TO THE COMPTROLLER, GREAT BRITAIN TO MONITOR RISK TO THE BANKING SYSTEM. IF THIS IS INDEED TRUE, THEN THIS IS A MASSIVE CONSPIRACY TO DEFRAUD AS WE NOW WITNESS A MONSTROUS TOTAL EFP’S ISSUANCE AS IT HEADS INTO THE STRATOSPHERE.

Result: A CONSIDERABLE SIZED DECREASE IN OI AT THE COMEX OF 3112 DESPITE THE LARGE FALL IN PRICING ($11.10) THAT GOLD UNDERTOOK YESTERDAY) //.WE ALSO HAD A MONSTROUS SIZED NUMBER OF COMEX LONG TRANSFERRING TO LONDON THROUGH THE EFP ROUTE: 14,239 CONTRACTS AS THESE HAVE ALREADY BEEN NEGOTIATED AND CONFIRMED. THERE OBVIOUSLY DOES NOT SEEM TO BE MUCH PHYSICAL GOLD AT THE COMEX. I GUESS IT EXPLAINS THE HUGE ISSUANCE OF EFP’S…THERE IS HARDLY ANY GOLD PRESENT AT THE GOLD COMEX FOR DELIVERY PURPOSES. IF YOU TAKE INTO ACCOUNT THE 14,239 EFP CONTRACTS ISSUED, WE HAD A STRONG SIZED GAIN OF 11,127 CONTRACTS IN TOTAL OPEN INTEREST ON THE TWO EXCHANGES:

14,239 CONTRACTS MOVE TO LONDON AND 3112 CONTRACTS DECREASED AT THE COMEX. (IN TONNES, THE GAIN IN TOTAL OI EQUATES TO 34.60 TONNES). ..AND THIS HUMONGOUS DEMAND OCCURRED DESPITE THE FALL IN PRICE OF $11.10 IN YESTERDAY’S TRADING AT THE COMEX.WE MAY HAVE HAD A STRONG PRESENCE OF SPREADING TODAY IN THE RAID ORCHESTRATED BY THE CROOKS.

we had: 2 notice(s) filed upon for 200 oz of gold at the comex.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

With respect to our two criminal funds, the GLD and the SLV:

GLD...

WITH GOLD DOWN $9.70 TODAY

NO CHANGE IN GOLD INVENTORY AT THE GLD/

INVENTORY RESTS AT 733.23 TONNES

TO ALL INVESTORS THINKING OF BUYING GOLD THROUGH THE GLD ROUTE: YOU ARE MAKING A TERRIBLE MISTAKE AS THE CROOKS ARE USING WHATEVER GOLD COMES IN TO ATTACK BY SELLING THAT GOLD. IT SURE SEEMS TO ME THAT THE GOLD OBLIGATIONS AT THE GLD EXCEED THEIR INVENTORy

SLV/

WITH SILVER DOWN 13 CENTS TODAY:

A HUGE 3.186 MILLION OZ WITHDRAWAL OF PAPER SILVER FORM THE SLV.

THIS PAPER SILVER WAS USED IN THE ATTACK TODAY.

/INVENTORY RESTS AT 312.366 MILLION OZ.

end

First, here is an outline of what will be discussed tonight:

1. Today, we had the open interest in SILVER ROSE BY A HUMONGOUS SIZED 5284 CONTRACTS from 204,318 UPTO 209,602 AND CLOSER TO THE NEW COMEX RECORD SET LAST IN AUG.2018 AT 244,196 WITH A SILVER PRICE OF $14.78/(AUGUST 22/2018)..THE PREVIOUS RECORD WAS SET ON APRIL 9/2018 AT 243,411 OPEN INTEREST CONTRACTS WITH THE SILVER PRICE AT THAT DAY: $16.53). AND PREVIOUS TO THAT, THE RECORD WAS ESTABLISHED AT: 234,787 CONTRACTS, SET ON APRIL 21.2017 OVER 1 1/3 YEARS AGO. THE PRICE OF SILVER ON THAT DAY: $17.89. AS YOU CAN SEE, WE HAVE RECORD HIGH OPEN INTERESTS IN SILVER ACCOMPANIED BY A CONTINUAL LOWER PRICE WHEN THAT RECORD WAS SET…..THE SPREADERS HAVE STOPPED THEIR LIQUIDATION IN SILVER BUT HAVE NOW MORPHED INTO GOLD..

EFP ISSUANCE:

OUR CUSTOMARY MIGRATION OF COMEX LONGS CONTINUE TO MORPH INTO LONDON FORWARDS AS OUR BANKERS USED THEIR EMERGENCY PROCEDURE TO ISSUE:

0 CONTRACTS FOR APRIL., 0 FOR MAY, FOR JUNE 0 CONTRACTS AND JULY: 1368 CONTRACTS AND ALL OTHER MONTHS: ZERO. TOTAL EFP ISSUANCE: 1368 CONTRACTS. EFP’S GIVE OUR COMEX LONGS A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. IF WE TAKE THE OI GAIN AT THE COMEX OF 5190 CONTRACTS TO THE 1368 OI TRANSFERRED TO LONDON THROUGH EFP’S, WE OBTAIN A HUGE GAIN OF 6558 OPEN INTEREST CONTRACTS. THUS IN OUNCES, THE GAIN ON THE TWO EXCHANGES: 32.79 MILLION OZ!!! AND YET WE ALSO HAVE A STRONG DEMAND FOR PHYSICAL AS WE WITNESSED A FINAL STANDING OF GREATER THAN 30 MILLION OZ FOR JULY, A STRONG 7.475 MILLION OZ FOR AUGUST.. A HUGE 39.505 MILLION OZ STANDING FOR SILVER IN SEPTEMBER… OVER 2 million OZ STANDING FOR THE NON ACTIVE MONTH OF OCTOBER., 7.440 MILLION OZ FINALLY STANDING IN NOVEMBER. 21.925 MILLION OZ STANDING IN DECEMBER , 5.845 MILLION OZ STANDING IN JANUARY. 2.955 MILLION OZ STANDING IN FEBRUARY, 27.120 MILLION OZ FOR MARCH., 3.875 MILLION OZ FOR APRIL AND NOW 18.650 MILLION OZ FOR MAY

RESULT: A HUGE SIZED INCREASE IN SILVER OI AT THE COMEX DESPITE THE 26 CENT LOSS IN PRICING THAT SILVER UNDERTOOK IN PRICING// YESTERDAY. WE ALSO HAD A STRONG SIZED 1368 EFP’S ISSUED TRANSFERRING COMEX LONGS OVER TO LONDON. TOGETHER WITH THE STRONG SIZED AMOUNT OF SILVER OUNCES STANDING FOR THIS MONTH, DEMAND FOR PHYSICAL SILVER CONTINUES TO INTENSIFY AS WE WITNESS SEVERE BACKWARDATION IN SILVER IN LONDON.

BOTH THE SILVER COMEX AND THE GOLD COMEX ARE IN STRESS AS THE BANKERS SCOUR THE BOWELS OF THE EXCHANGE FOR METAL

(report Harvey)

.

2.a) The Shanghai and London gold fix report

(Harvey)

2 b) Gold/silver trading overnight Europe, Goldcore

(Mark O’Byrne/zerohedge

and in NY: Bloomberg

3. ASIAN AFFAIRS

)FRIDAY MORNING/ THURSDAY NIGHT:

SHANGHAI CLOSED DOWN 73.42 POINTS OR 2.48% //Hang Sang CLOSED DOWN 328.61 POINTS OR 1.16% /The Nikkei closed UP 187.11 POINTS OR 0.89%//Australia’s all ordinaires CLOSED UP .69%

/Chinese yuan (ONSHORE) closed DOWN at 6.9145 /Oil UP to 61.64 dollars per barrel for WTI and 71.08 for Brent. Stocks in Europe OPENED GREEN// ONSHORE YUAN CLOSED DOWN // LAST AT 6.9145 AGAINST THE DOLLAR. OFFSHORE YUAN CLOSED DOWN ON THE DOLLAR AT 6.9468 TRADE TALKS STALL//YUAN LEVELS GETTING DANGEROUSLY CLOSE TO 7:1//TRUMP INITIATES A NEW 25% TARIFFS FRIDAY/MAY 10/MAJOR PROBLEMS AT HUAWEI /CFO ARRESTED : /ONSHORE YUAN TRADING ABOVE LEVEL OF OFFSHORE YUAN/ONSHORE YUAN TRADING WEAKER AGAINST USA DOLLAR/OFFSHORE YUAN TRADING WEAKER AGAINST THE DOLLAR /TRADE DEAL NOW DEAD..TRUMP RAISED RATES TO 25%

3A//NORTH KOREA/ SOUTH KOREA

i)NORTH KOREA

b) REPORT ON JAPAN

3 China/Chinese affairs

i)China/

Trade optimism fizzles as China states it has no more plans for talks. Obviously they are quite concerned with the Huawei situation

(courtesy zerohedge)

ii)Huawei bonds tumble the most on record after the new prohibition of sales of components from uSA sources to it

( zerohedge)

iii)Very problematic as Beijing faces China and Russia who have their back as they both firmly oppose unilateral USA sanctions

( zerohedge)

iv)An excellent commentary from James Rickards as he discusses the problems China faces with the trade war

a must read

( James Rickards)

v)Your weekly economic lesson from Alasdair Macleod as he discusses the end game. The trade wars will not help the USA because they do not safe and as such their budget deficit will still blow out. This will lead to a hyperinflationary depression in the USA as dollars leave the globe and circulate in great quantities in the USA

(courtesy Alasdair Macleod)

4/EUROPEAN AFFAIRS

i)UK

Corbyn is a fool: the opposition leader wants to nationalize the UK national energy grid. They just handed the election to Farage as both the conservatives and labour disintegrate

( Mish Shedlock/Mishtalk)

ii)UK

The pound hits a 4 month low as stalks with labour collapse

( zerohedge)

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

a)TURKEY

Early last night, the Turkish lira tumbles to 6.0840 after Trump terminates its preferential trade agreement with Turkey stating that Turkey is no longer in need of help as a developing nation and thus all goods will have the normal tariffs assigned to those goods. However as a kind gesture, he has initiated a 25% tariff on Turkish steel instead of the 50% that everybody else pays.

( zerohedge)

b)IRAN

There is fear that Iranian operatives have moved missiles in Iraq and are planning to attack USA interests there. We do not know how many missiles have been mobilized

( zerohedge)

c)IRAN/USA

two more warships travel through the Straits of Hormuz without incident. They are joining the USS Abraham Lincoln as well as a strike force including B 52 bombers as the uSA builds up its forces in the Gulf

( zerohedge)

6. GLOBAL ISSUES

Canada/Mexico/USA

Canada and Mexico reach a deal with the USA as they both lift tariffs against each other

(courtesy zerohedge

7. OIL ISSUES

8 EMERGING MARKET ISSUES

VENEZUELA

9. PHYSICAL MARKETS

i)My goodness, I guess that there is inflation

(Bloomberg/GATA)

ii)For the first time Kitco is allowed to mention gold manipulation. The interview is with Max Keiser and the interviewer is Daniela Cambone

( Kitco/GATA)

iii)Another Cdn miner going into the dust bin: Iamgold explores its sale amid gold sector consolidation

(Bloomberg/GATA)

iv)This is going to help a little in our manipulation of the precious metals as the futures exchange are introducing a speed bump to stop front running by our HFT traders.

(zerohedge)

10. USA stories which will influence the price of gold/silver)

MARKET TRADING//

Late trading today.

ii)Market data

The generally more accurate gauge of consumer confidence is the Bank of America survey as compared to the U. of Michigan report. Yesterday the U. of Michigan was bullish on confidence. Today’s B of America report was bearish.

(courtesy zerohedge)

ii)USA ECONOMIC/GENERAL STORIES

a)Baltimore is now crippled by the cryptocurrency ransomware attack.

(courtesy zerohedge)

b)auto loan delinquencies are now spiking levels not seen since 3rd quarter of 2009

(courtesy WolfRichter)

SWAMP STORIES

a)Barr’s first interview with Bill Hammer: Government power was used to spy on American citizens states Barr.

(courtesy Fox news/Bill Hammer/Bill Barr)

b)This is good: Nellie Ohr deleted emails on Bruce Ohr’s computer while she was doing her research digging up dirt on Trump. So we have a non government employee destroy evidence on a government employee’s computer.. Sounds like obstruction of justice to me

( zerohedge)

c)Maxine Waters is one nutjob: here she calls Trump’s very immigration plan racist because it is not important for new immigrants to learn English and have a job

(zerohedge)

E)SWAMP STORIES/MAJOR STORIES//THE KING REPORT

Let us head over to the comex:

THE TOTAL COMEX GOLD OPEN INTEREST FELL BY A CONSIDERABLE SIZED 3112 CONTRACTS TO A LEVEL OF 521,243 DESPITE THE CONSIDERABLE FALL IN THE PRICE OF GOLD ($11.10) IN YESTERDAY’S // COMEX TRADING)

WE ARE NOW IN THE NON ACTIVE DELIVERY MONTH OF MAY.. THE CME REPORTS THAT THE BANKERS ISSUED A HUMONGOUS SIZED TRANSFER THROUGH THE EFP ROUTE AS THESE LONGS RECEIVED A DELIVERABLE LONDON FORWARD TOGETHER WITH A FIAT BONUS., THAT IS 14,239 EFP CONTRACTS WERE ISSUED:

0 FOR JUNE ’19: 14,239 CONTRACTS , DEC; 0 CONTRACTS: 0 AND ZERO FOR ALL OTHER MONTHS:

TOTAL EFP ISSUANCE: 14,239 CONTRACTS.

THE OBLIGATION STILL RESTS WITH THE BANKERS ON THESE TRANSFERS. ALSO REMEMBER THAT THERE IS NO DOUBT A HUGE DELAY IN THE ISSUANCE OF EFP’S AND IT PROBABLY TAKES AT LEAST 48 HRS AFTER LONGS GIVE UP THEIR COMEX CONTRACTS FOR THEM TO RECEIVE THEIR EFP’S AS THEY ARE NEGOTIATING THIS CONTRACT WITH THE BANKS FOR A FIAT BONUS PLUS THEIR TRANSFER TO A LONDON BASED FORWARD.

ON A NET BASIS IN OPEN INTEREST WE GAINED THE FOLLOWING TODAY ON OUR TWO EXCHANGES: 11,127 TOTAL CONTRACTS IN THAT 14,239 LONGS WERE TRANSFERRED AS FORWARDS TO LONDON AND WE LOST A CONSIDERABLE SIZED 3112 COMEX CONTRACTS.

NET GAIN ON THE TWO EXCHANGES : 11,127 contracts OR 1,112,700 OZ OR 34.60 TONNES.

We are now in the NON active contract month of MAY and here the open interest stands at 69 contracts, having LOST 54 contracts. We had 55 notices served yesterday so we gained 1 contracts or an additional 100 oz will stand as they guys refused to morph into a London based forward as well as negating a fiat bonus

The next contract month after May is June and here the open interest FELL by 15,934 contracts DOWN to 263,678. July LOST 300 contracts to stand at 370. After July the next active month is August and here the OI rose by 3636 contracts up to 162,923 contracts.

TODAY’S NOTICES FILED:

WE HAD 2 NOTICE FILED TODAY AT THE COMEX FOR 200 OZ. (0.0062 TONNES)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for the wild silver comex results.

Total COMEX silver OI ROSE BY A HUGE SIZED 5190 CONTRACTS FROM 204,318 UP TO 209,508 (AND CLOSER TO THE NEW RECORD OI FOR SILVER SET ON AUGUST 22.2018. THE PREVIOUS RECORD WAS SET APRIL 9.2018/ 243,411 CONTRACTS) AND TODAY’S HUGE OI COMEX GAIN OCCURRED WITH A 26 CENT LOSS IN PRICING.//YESTERDAY.

WE ARE NOW INTO THE ACTIVE DELIVERY MONTH OF MAY. HERE WE HAVE 353 OPEN INTEREST STAND SO FAR FOR A GAIN OF 55 CONTRACTS. WE HAD 4 NOTICES SERVED UPON YESTERDAY SO IN ESSENCE WE GAINED ANOTHER 59 CONTRACT OR AN ADDITIONAL 295,000 OZ WILL STAND FOR DELIVERY AS THESE GUYS REFUSED TO MORPH INTO LONDON BASED FORWARDS AND AS WELL THEY NEGATING A FIAT BONUS. SILVER MUST BE SCARCE AT THE COMEX. QUEUE JUMPING RETURNS WITH A VENGEANCE. WE HAVE NOW SURPASSED THE INITIAL AMOUNT STANDING WHICH OCCURRED ON APRIL 30.2019

THE NEXT MONTH AFTER MAY IS THE NON ACTIVE MONTH OF JUNE. HERE THIS MONTH GAINED 6 CONTRACTS DOWN TO 723. AFTER JUNE IS THE ACTIVE MONTH OF JULY, (THE SECOND LARGEST DELIVERY MONTH OF THE YEAR FOR SILVER) AND HERE THIS MONTH GAINED 4280 CONTRACTS UP TO 158,330 CONTRACTS. THE NEXT ACTIVE MONTH AFTER JULY FOR SILVER IS SEPTEMBER AND HERE THE OI ROSE BY 207 UP TO 19,323 CONTRACTS.

TODAY’S NUMBER OF NOTICES FILED:

We, today, had 15 notice(s) filed for 75,000 OZ for the MARCH, 2019 COMEX contract for silver

Trading Volumes on the COMEX TODAY: 267,386 CONTRACTS

CONFIRMED COMEX VOL. FOR YESTERDAY: 320,233 contracts

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

12 Month MM GOFO

+ 2.33%

LIBOR FOR 12 MONTH DURATION: 2.63

GOFO = LIBOR – GOLD LENDING RATE

GOLD LENDING RATE = +.30

end

PHYSICAL GOLD/SILVER STORIES

end

i) GOLDCORE BLOG/Mark O’Byrne

OFF TODAY

end

GATA STORIES WITH RESPECT TO GOLD/PRECIOUS METALS.

My goodness, I guess that there is inflation

(Bloomberg/GATA)

Koons’ silver Rabbit sets living artist record

Submitted by cpowell on Thu, 2019-05-16 13:39. Section: Daily Dispatches

Thank God there’s no inflation.

* * *

By Katya Kazakina and Allison McCartney

Bloomberg News

Thursday, May 16, 2019

It was another heady auction night in New York.

Minutes after Robert Rauschenberg’s painting Buffalo II fetched $88.8 million at Christie’s — almost five times the late artist’s previous auction record — Jeff Koons’s sculpture of an inflatable silver bunny topped that at $91.1 million, the most ever paid for a work by a living artist at auction.

The Koons led Christie’s postwar and contemporary art sale today, which totalled $539 million, up 36 percent from a year ago. The evening saw seven new artist records, with a $32.1 million spider sculpture by Louise Bourgeois joining Koons and Rauschenberg.

…

The 1986 Rabbit was bought by art dealer Bob Mnuchin, U.S. Treasury Secretary Steven Mnuchin’s father, who was in the midtown Manhattan salesroom and said he made the purchase on behalf of a client. Estimated at $50 million to $70 million, it was part of a group of works consigned by the family of late media mogul Si Newhouse. …

… For the remainder of the report:

https://www.bloomberg.com/graphics/2019-may-art-auctions/

END

For the first time Kitco is allowed to mention gold manipulation. The interview is with Max Keiser and the interviewer is Daniela Cambone

(courtesy Kitco/GATA)

Kitco lets Max Keiser mention gold market manipulation

Submitted by cpowell on Thu, 2019-05-16 15:18. Section: Daily Dispatches

11:19a ET Thursday, May 16, 2019

Dear Friend of GATA and Gold:

Gold market manipulation makes a surprising appearance at Kitco today as Daniela Cambone interviews financial market commentator Max Keiser about the monetary metal’s underperformance. The interview is 11 minutes long and can be viewed at Kitco News here:

https://www.kitco.com/news/2019-05-16/Fair-Value-For-Gold-Price-2-900-Bi…

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

END

Another Cdn miner going into the dust bin: Iamgold explores its sale amid gold sector consolidation

(Bloomberg/GATA)

Iamgold explores sale amid gold-sector consolidation

Submitted by cpowell on Fri, 2019-05-17 02:10. Section: Daily Dispatches

By Scott Deveau and Dinesh Nair

Bloomberg News

Thursday, May 16, 2019

Canadian miner Iamgold Corp. is exploring a possible sale of all or part of the company amid a wave of consolidation in the gold sector, according to people familiar with the matter.

The Toronto-based miner is working with advisers and has spoken to several potential buyers, said the people, who asked not to be identified because the matter is private.

Iamgold’s plans could still change and there’s no guarantee it would succeed in selling itself, the people said.

A representative for Iamgold declined to comment. …

… For the remainder of the report:

https://www.bloomberg.com/news/articles/2019-05-16/iamgold-is-said-to-ex…

iii) Other Physical stories

This is going to help a little in our manipulation of the precious metals as the futures exchange are introducing a speed bump to stop front running by our HFT traders.

(zerohedge)

Futures Exchange To Introduce Gold, Silver “Speed Bump” To End HFT Manipulation

No sooner had we covered the battle of high frequency traders physically moving infrastructure and microwave towers to gain nanosecond advantages, that we learned that Intercontinental Exchange (ICE) has planned on launching the first ever “speed bump” for the US futures market that would negate some of these advantages. Despite two of the CFTC’s five commissioners disagreeing with the decision, the exchange still looks set to impose a split second delay on some trades, according to the Wall Street Journal.

Those not in favor of the decision claim that the “speed bump” would unfairly punish firms that rely on their speed advantage. Those in favor, say that it’s about time someone did something to stop the HFTs from frontrunning everyone in the futures market. Which is also why some of the largest high frequency trading firms are vocally opposed to the plan.

As part of the proposed speed bump, the ICE is looking to introduce a 3 millisecond pause before executing some trades in its gold and silver futures contracts. Trading in those contracts is relatively tiny, as most gold and silver futures trades take place at the CME Group. However, traders have been watching this decision because of the precedent it could set.

The CFTC had a chance to block the proposal within 90 days, but that period ended on Tuesday. Now, ICE is free to do as it pleases. The CFTC’s Division of Market Oversight said it’s going to watch carefully to analyze the impact of the new “speed bump” saying it “does not view the certification of the ICE Rule as establishing a precedent with respect to the legal and policy merits of speed bump functionalities generally.”

Other attempts to create similar “speed bumps” at other exchanges will be assessed on individual merits, according to the Division. Both a Democratic and Republican commissioner issued objections to the decision. The Republican cited Kurt Vonnegut’s short story “Harrison Bergeron”, where the government forces handicaps on talented people to create a level playing field, in his dissent.

Republican Brian Quintenz said: “Those that invent, and invest in, faster information transmission technologies to capitalize on market dislocations reap the profits of their advantage. That process enhances market efficiency.”

ICE hasn’t given a timeline for when they are going to implement the “speed bump”. The exchange commented: “We are very pleased with the CFTC’s decision to allow our rule amendment for passive order protection—or what is commonly referred to as a speed bump—in futures markets to become effective.”

HFT giants like Citadel Securities LLC and DRW Holdings LLC, which make the bulk of their revenue from frontrunning slower retail and “dumb money whale” orders, were opposed to the idea, along with trade group Managed Funds Association, which represents hedge funds. Stephen Berger, global head of government and regulatory policy for Citadel Securities said: “We appreciate the commission’s confirmation that today’s rule change is limited in scope to two specific contracts and that any future expansion will require a new rule filing and legal analysis.”

The best hot take on the speed bump belonged to Tom McClellan, who said that “high-frequency algo traders spent all that money, locating their offices closer to ICE server farms and buying high-speed fiber connections to get an edge on trading, and now ICE is introducing a 3-millisecond delay trying to level the playing field.”

First ‘Speed Bump’ Coming to U.S. Futures Markets

The ICE futures exchange is set to blunt the advantages of ultrafast traders by imposing a split-second delay on some trades.

wsj.com

95 people are talking about this

Which also explains why they are all so furious.

Several smaller firms welcomed the idea, however, claiming it would allow greater competition. HFT firms now have to spend significant amounts of capital to shave millionths of a second off their trades. Large firms have built out microwave infrastructure and have jostled to get close to exchanges to find minuscule advantages, as we have profiled in the past.

The “bump” is set to apply to incoming orders seeking to hit unexecuted buy or sell orders already posted on ICE, while traders posting new orders to be displayed on the exchange won’t be affected. Eric Swanson, head of the Americas unit of XTX Markets said: “By negating costly HFT speed advantages at millisecond time frames, ICE’s speed bump will reduce the indirect operational tax on end users.”

Still, some critics claim that the delay could actually cause more volatility in periods of market turmoil.

DRW founder and Chief Executive Donald Wilson Jr. said: “During episodes of volatility, there would be essentially fake liquidity on the screen. I think that’s a very dangerous thing.”

Due to the criminal conviction of trader Edmonds, the USA prosecution is seeking to halt the civil lawsuit. I was misinformed: all discoveries in a civil suit are public and because of that, the prosecution gives the defendants the right to plead the 5th if their testimony incriminates them

(courtesy zerohedge/Chris Powell)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

MMGYS

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Dow Suffers Worst Streak Since 2016 Despite Best Dip-Buying In A Decade

Quite a week…

China was ugly overnight after defending any dip all week – have to make sure the stock market does not reflect weakness after the trade deal fell apart!!

But Europe soared this week as US delayed auto tariffs…

China remains the best performer YTD, barely…

The late-day headlines from CNBC that “trade talks have stalled” – merely repeating what was said overnight numerous times – triggered the algos to dump after early gains (thanks to op-ex gamma hedging and US-Canada tariff headlines)…Small Caps were the week’s biggest laggard…

The Dow is down four weeks in a row – something it has not done since May 2016!!

The midweek ramp was all one big short-squeeze and the machines ran out of ammo today…

Another failed IPO today…

Trade deal hope was dashed this week…

The ratio between Morgan Stanley’s China Trade Sensitive Basket and the S&P 500 has dropped to the lowest since U.S. President Trump and Chinese President Xi announced a truce at the G-20 meeting in Argentina in December.

Credit ended the week wider (despite ripping back midweek from Monday’s gap wider)…VIX was around unch…

Stocks and bonds decoupled this week (as stocks short-squeezed higher midweek)…

Treasury yields were bid on the week and accelerated lower in the last hour as repeated headlines of trade talks being stalled sparked more bond buying…

10Y Yields fell back close to YTD lows this week

Notably crude and inflation breakevens decoupled late in the week…

The yield curve closed the week just above inversion…

But before we leave bond-land, both US and Europe priced in more dovishness from their respective central banks this week (41bps of cuts in 2019 for the Fed and 35bps of cuts for the ECB)…

The Dollar Index rose on the week – its best week in over 2 months…

The last two weeks have seen offshore yuan collapse over 3.1% getting closer to 7.00 – the biggest 2-week plunge since Aug 2015’s devaluation

Cable was a disaster this week with GBPEUR down 10 days in a row – the longest losing streak in 19 years

The Loonie rallied on the day after US dropped steel tariffs…

Cryptos had a violent week but ended significantly higher, led by a 33% rise in ethereum…

With Bitcoin reaching almost $8500 before crashing Friday…

The dramatic outperformance of Ethereum in the last few days has erased all of Bitcoin’s outperformance over the last 6 weeks…

The dramatic outperformance of Ethereum in the last few days has erased all of Bitcoin’s outperformance over the last 6 weeks…

WTI rallied on the week (copper did not) despite a strong dollar and trade talks breakdown but silver was the biggest loser…

In other words, as the US-China trade deal began to collapse confidence in the markets, ‘someone’ was panic-buying US equities during the day after ‘someone else’ was dumping them overnight at historically high levels.

With global money supply now collapsing, stock markets are gonna need more dip-buying to support this debacle…

Read more Harvey here...

https://harveyorganblog.com/2019/05/17/may-17-gold-down-9-70-to-1276-25-silver-down-another-13-cents-on-this-comex-expiry-day-more-manipulation-china-states-that-there-are-no-more-talks-with-the-usa-concerning-the-trade-war-and-this-w/

show simo casted

.jpg)

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.