Friday, May 17, 2019 12:04:22 AM

Friday Data Kickoff

Good Morning Good Evening

Sailing On The Waters Tonight !

Welcome to ~*~Mining & Metals Du Jour~*~Graveyard Shift~*~

On the show tonight: Great Data & News by Harvey Organ, the Latest on Gold & Silver, $Currencies Around The World are a Sinking Ship Overloaded by Government Debt and a Good Buried Treasure Story about Jean Lafitte a legendary French Privateer and Pirate who Resided in the Gulf of Mexico Did they Bury Treasure In Your Backyard

Hello everybody I'm J:D your host tonight Thanks for being with us.

Hope Your Having a Great evening and start to your weekend

EnJoy the show

OK...Let's Get It On !

MMGYS*

Thank you

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

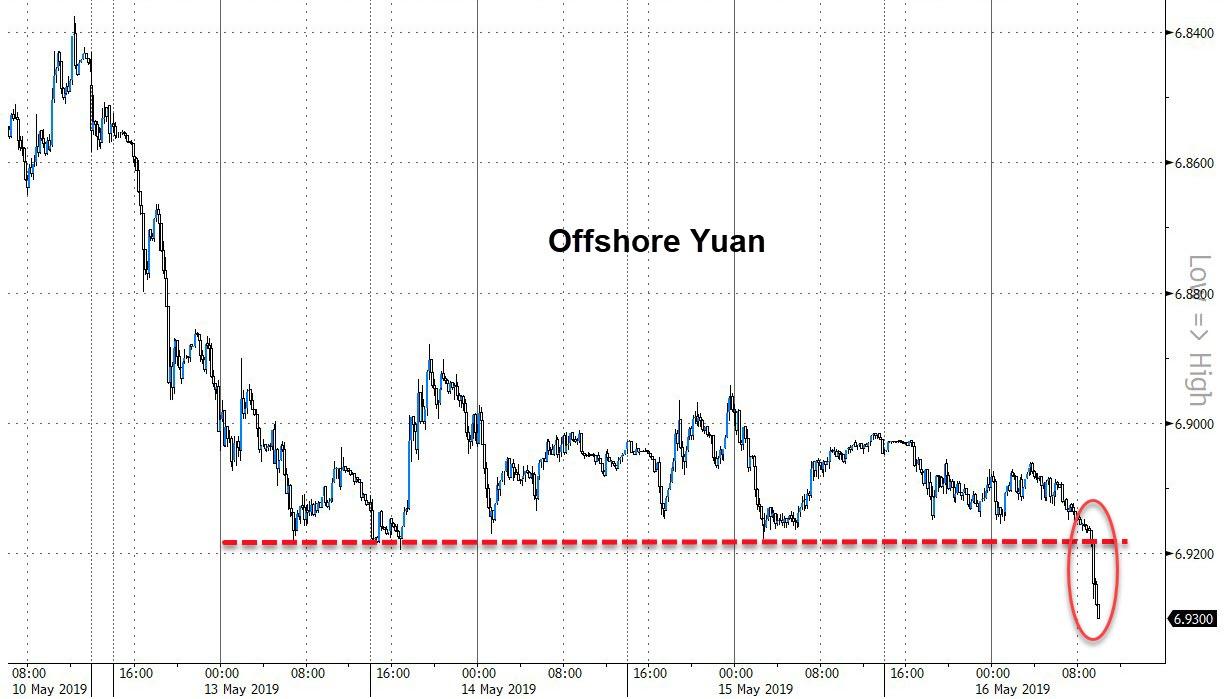

MAY 16//RAID ON THE PRECIOUS METALS: GOLD DOWN $11.10 TO $1285.95//SILVER DOWN 26 CENTS TO $14.55/TRUMP INITIATES A BAN ON CHINA’S HUAWEI//CHINESE YUAN (OFFSHORE) PLUMMETS TO 6.93 TO THE DOLLAR//THEN CHINA RESPONDS BY CHARGING TWO CANADIANS WITH ESPIONAGE//SWAMP STORIES FOR YOU TONIGHT//

May 16, 2019 · by harveyorgan · in Uncat

GOLD: $1285.95 DOWN $11.10 (COMEX TO COMEX CLOSING)

Silver: $14.55 DOWN 26 CENTS (COMEX TO COMEX CLOSING)

Closing access prices:

Gold : 1286.70

silver: $14.58

OPTIONS EXPIRY FOR THE STOCK MARKET AND GLD/SLV IS TOMORROW

COMEX EXPIRY FOR GOLD/SILVER: TUES MAY 28/2019

LBMA/OTC EXPIRY: MAY 31.2019

I do not know who said the following but it fits:

“when you have counter-intuitive trading happening all the time, you have rigged markets”

JPMorgan has been receiving gold with reckless abandon and sometimes supplying (stopping)

today RECEIVING

EXCHANGE: COMEX

CONTRACT: MAY 2019 COMEX 100 GOLD FUTURES

SETTLEMENT: 1,296.300000000 USD

INTENT DATE: 05/15/2019 DELIVERY DATE: 05/17/2019

FIRM ORG FIRM NAME ISSUED STOPPED

____________________________________________________________________________________________

657 C MORGAN STANLEY 4

661 C JP MORGAN 39 33

685 C RJ OBRIEN 1

737 C ADVANTAGE 11 17

905 C ADM 5

____________________________________________________________________________________________

TOTAL: 55 55

MONTH TO DATE: 288

NUMBER OF NOTICES FILED TODAY FOR MAY CONTRACT: 55 NOTICE(S) FOR 5500 OZ (0.1710 tonnes)

TOTAL NUMBER OF NOTICES FILED SO FAR: 288 NOTICES FOR 28800 OZ (.8958 TONNES)

SILVER

FOR MAY

4 NOTICE(S) FILED TODAY FOR 20,000 OZ/

total number of notices filed so far this month: 3377 for 16,885,000 oz

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Bitcoin: OPENING MORNING TRADE :$7946 DOWN $285

Bitcoin: FINAL EVENING TRADE: $7820 DOWN $338

end

Let us have a look at the data for today

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

IN SILVER THE COMEX OI ROSE BY A TINY SIZED 530 CONTRACTS FROM 203,788 UP TO 204,318 WITH YESTERDAY’S 2 CENT GAIN IN SILVER PRICING AT THE COMEX. ,LIQUIDATION OF THE SPREADERS HAVE STOPPED FOR SILVER BUT IT NOW IN FULL FORCE FOR GOLD. TODAY WE ARRIVED CLOSER TO AUGUST’S 2018 RECORD SETTING OPEN INTEREST OF 244,196 CONTRACTS.

WE HAVE ALSO WITNESSED A LARGE AMOUNT OF PHYSICAL METAL STAND FOR COMEX DELIVERY AS WELL WE ARE WITNESSING CONSIDERABLE LONGS PACKING THEIR BAGS AND MIGRATING OVER TO LONDON IN GREATER NUMBERS IN THE FORM OF EFP’S. WE WERE NOTIFIED THAT WE HAD A SMALL SIZED NUMBER OF COMEX LONGS TRANSFERRING THEIR CONTRACTS TO LONDON THROUGH THE EFP:

0 FOR MAY, 0 FOR JUNE, 263 FOR JULY AND ZERO FOR ALL OTHER MONTHS AND THEREFORE TOTAL ISSUANCE 263 CONTRACTS. WITH THE TRANSFER OF 435 CONTRACTS, WHAT THE CME IS STATING IS THAT THERE IS NO SILVER (OR GOLD) TO BE DELIVERED UPON AT THE COMEX AS THEY MUST EXPORT THEIR OBLIGATION TO LONDON. ALSO KEEP IN MIND THAT THERE CAN BE A DELAY OF 24-48 HRS IN THE ISSUING OF EFP’S. THE 263 EFP CONTRACTS TRANSLATES INTO 1.315 MILLION OZ ACCOMPANYING:

1.THE 2 CENT GAIN IN SILVER PRICE AT THE COMEX AND

2. THE STRONG AMOUNT OF SILVER OUNCES WHICH STOOD FOR DELIVERY IN THE LAST NINE MONTHS:

JUNE/2018. (5.420 MILLION OZ);

FOR JULY: 30.370 MILLION OZ

FOR AUG., 6.065 MILLION OZ

FOR SEPT. 39.505 MILLION OZ S

FOR OCT.2.525 MILLION OZ.

FOR NOV: A HUGE 7.440 MILLION OZ STANDING AND

21.925 MILLION OZ FINALLY STAND FOR DECEMBER.

5.845 MILLION OZ STAND IN JANUARY.

2.955 MILLION OZ STANDING FOR FEBRUARY.:

27.120 MILLION OZ STANDING IN MARCH.

3.875 MILLION OZ STANDING FOR SILVER IN APRIL.

AND NOW 18.355 MILLION OZ STANDING FOR SILVER IN MAY.

ACCUMULATION FOR EFP’S/SILVER/J.P.MORGAN’S HOUSE OF BRIBES, / STARTING FROM FIRST DAY NOTICE/FOR MONTH OF MAY:

13,566 CONTRACTS (FOR 12 TRADING DAYS TOTAL 13,566 CONTRACTS) OR 67,83 MILLION OZ: (AVERAGE PER DAY: 1131 CONTRACTS OR 5.653 MILLION OZ/DAY)

TO GIVE YOU AN IDEA AS TO THE HUGE SUPPLY THIS MONTH IN SILVER: SO FAR THIS MONTH OF MAY: 67.83 MILLION PAPER OZ HAVE MORPHED OVER TO LONDON. THIS REPRESENTS AROUND 9.69% OF ANNUAL GLOBAL PRODUCTION (EX CHINA EX RUSSIA)* JUNE’S 345.43 MILLION OZ IS THE SECOND HIGHEST RECORDED ISSUANCE OF EFP’S AND IT FOLLOWED THE RECORD SET IN APRIL 2018 OF 385.75 MILLION OZ.

ACCUMULATION IN YEAR 2019 TO DATE SILVER EFP’S: 808.93 MILLION OZ.

JANUARY 2019 EFP TOTALS: 217.455. MILLION OZ

FEB 2019 TOTALS: 147.4 MILLION OZ/

MARCH 2019 TOTAL EFP ISSUANCE: 207.835 MILLION OZ

APRIL 2019 TOTAL EFP ISSUANCE: 182.87 MILLION OZ.

RESULT: WE HAD A TINY SIZED INCREASE IN COMEX OI SILVER COMEX CONTRACTS OF 530 WITH THE TINY 2 CENT GAIN IN SILVER PRICING AT THE COMEX /YESTERDAY... THE CME NOTIFIED US THAT WE HAD A SMALL SIZED EFP ISSUANCE OF 263 CONTRACTS WHICH EXITED OUT OF THE SILVER COMEX AND TRANSFERRED THEIR OI TO LONDON AS FORWARDS. SPECULATORS CONTINUED THEIR INTEREST IN ATTACKING THE SILVER COMEX FOR PHYSICAL SILVER (SEE COMEX DATA) . OUR BANKERS RESUMED THEIR LIQUIDATION OF THE SPREAD TRADES TODAY.

TODAY WE GAINED A SMALL SIZED: 793 TOTAL OI CONTRACTS ON THE TWO EXCHANGES:

i.e 263 OPEN INTEREST CONTRACTS HEADED FOR LONDON (EFP’s) TOGETHER WITH INCREASE OF 530 OI COMEX CONTRACTS. AND ALL OF THIS DEMAND HAPPENED WITH A 2 CENT GAIN IN PRICE OF SILVER AND A CLOSING PRICE OF $14.81 WITH RESPECT TO YESTERDAY’S TRADING. YET WE STILL HAVE A STRONG AMOUNT OF SILVER STANDING AT THE COMEX FOR DELIVERY!!

In ounces AT THE COMEX, the OI is still represented by JUST OVER 1 BILLION oz i.e. 1.022 BILLION OZ TO BE EXACT or 145% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT MARCH MONTH/ THEY FILED AT THE COMEX: 4 NOTICE(S) FOR 20,000 OZ OF SILVER

IN SILVER,PRIOR TO TODAY, WE SET THE NEW COMEX RECORD OF OPEN INTEREST AT 243,411 CONTRACTS ON APRIL 9.2018. AND AGAIN THIS HAS BEEN SET WITH A LOW PRICE OF $16.51.

AND NOW WE RECORD FOR POSTERITY ANOTHER ALL TIME RECORD OPEN INTEREST AT THE COMEX OF 244,196 CONTRACTS ON AUGUST 22/2018 AND AGAIN WHEN THIS RECORD WAS SET, THE PRICE OF SILVER WAS $14.78 AND LOWER IN PRICE THAN PREVIOUS RECORDS.

ON THE DEMAND SIDE WE HAVE THE FOLLOWING:

HUGE AMOUNTS OF SILVER STANDING FOR DELIVERY (MARCH/2018: 27 MILLION OZ , APRIL/2018 : 2.485 MILLION OZ MAY: 36.285 MILLION OZ ; JUNE/2018 (5.420 MILLION OZ) , JULY 2018 FINAL AMOUNT STANDING: 30.370 MILLION OZ ) FOR AUGUST 6.065 MILLION OZ. , SEPT: A HUGE 39.505 MILLION OZ./ OCTOBER: 2,520,000 oz NOV AT 7.440 MILLION OZ./ DEC. AT 21.925 MILLION OZ JANUARY AT 5.825 MILLION OZ.AND FEB 2019: 2.955 MILLION OZ/ MARCH: 27.120 MILLION OZ/ APRIL AT 3.875 MILLION OZ/ AND NOW MAY: 18.355 MILLION OZ ..

HUGE RECORD OPEN INTEREST IN SILVER 243,411 CONTRACTS (OR 1.217 BILLION OZ/ SET APRIL 9/2018) AND NOW AUGUST 22/2018: 244,196 CONTRACTS, WITH A SILVER PRICE OF $14.78.

HUGE ANNUAL EFP’S ISSUANCE EQUAL TO 2.9 BILLION OZ OR 400% OF SILVER ANNUAL PRODUCTION/2017

RECORD SETTING EFP ISSUANCE FOR ANY MONTH IN SILVER; APRIL/2018/ 385.75 MILLION OZ/ AND THE SECOND HIGHEST RECORDED EFP ISSUANCE JUNE 2018 345.43 MILLION OZ

AND YET, WITH THE EXTREMELY HIGH EFP ISSUANCE, WE HAVE A CONTINUAL LOW PRICE OF SILVER DESPITE THE ABOVE HUGE DEMAND. TO ME THE ONLY ANSWER IS THAT WE HAVE SOVEREIGN (CHINA) WHO IS ENDEAVOURING TO GOBBLE UP ALL AVAILABLE PHYSICAL SILVER NO MATTER WHERE, EXACTLY WHAT J.P.MORGAN IS DOING. AND IT IS MY BELIEF THAT J.P.MORGAN IS HOLDING ITS SILVER FOR ITS BENEFICIAL OWNER..THE USA GOVERNMENT WHO IN TURN IS HOLDING THAT SILVER FOR CHINA.(FOR A SILVER LOAN REPAYMENT).

IN GOLD, THE OPEN INTEREST ROSE BY A STRONG SIZED 6360 CONTRACTS, TO 526,224 DESPITE THE TINY RISE IN THE COMEX GOLD PRICE/(AN INCREASE IN PRICE OF $1.50//YESTERDAY’S TRADING).

THE CME RELEASED THE DATA FOR EFP ISSUANCE AND IT TOTALED A GOOD SIZED 5454 CONTRACTS:

APRIL 0 CONTRACTS,JUNE: 5454 CONTRACTS DECEMBER: 0 CONTRACTS, JUNE 2020 0 CONTRACTS AND ALL OTHER MONTHS ZERO. The NEW COMEX OI for the gold complex rests at 524,355. ALSO REMEMBER THAT THERE WILL BE A DELAY IN THE ISSUANCE OF EFP’S. THE BANKERS REMOVE LONG POSITIONS OF COMEX GOLD IMMEDIATELY. THEN THEY ORCHESTRATE THEIR PRIVATE EFP DEAL WITH THE LONGS AND THAT COULD TAKE AN ADDITIONAL, 48 HRS SO WE GENERALLY DO NOT GET A MATCH WITH RESPECT TO DEPARTING COMEX LONGS AND NEW EFP LONG TRANSFERS. . EVEN THOUGH THE BANKERS ISSUED THESE MONSTROUS EFPS, THE OBLIGATION STILL RESTS WITH THE BANKERS TO SUPPLY METAL BUT IT TRANSFERS THE RISK TO A LONDON BANKER OBLIGATION AND NOT A NEW YORK COMEX OBLIGATION. LONGS RECEIVE A FIAT BONUS TOGETHER WITH A LONG LONDON FORWARD. THUS, BY THESE ACTIONS, THE BANKERS AT THE COMEX HAVE JUST STATED THAT THEY HAVE NO APPRECIABLE METAL!! THIS IS A MASSIVE FRAUD: THEY CANNOT SUPPLY ANY METAL TO OUR COMEX LONGS BUT THEY ARE QUITE WILLING TO SUPPLY MASSIVE NON BACKED GOLD (AND SILVER) PAPER KNOWING THAT THEY HAVE NO METAL TO SATISFY OUR LONGS. LONDON IS NOW SEVERELY BACKWARD IN BOTH GOLD AND SILVER AND WE ARE WITNESSING DELAYS IN ACTUAL DELIVERIES.

IN ESSENCE WE HAVE A VERY STRONG SIZED GAIN IN TOTAL CONTRACTS ON THE TWO EXCHANGES OF 11,814 CONTRACTS: 6330 OI CONTRACTS INCREASED AT THE COMEX AND 5454 EFP OI CONTRACTS WHICH NAVIGATED OVER TO LONDON. THUS TOTAL OI GAIN OF 11,814 CONTRACTS OR 1,181,400 OZ OR 36.75 TONNES. YESTERDAY WE HAD A TINY GAIN IN THE PRICE OF GOLD TO THE TUNE OF $1.50….AND WITH THAT TINY GAIN, WE HAD A HUGE GAIN OF 36.75 TONNES!!!!!!.??????

WITH RESPECT TO SPREADING: NOT TO NOTICEABLE WITH TODAY’S FALL IN PRICE

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES:

“AS YOU WILL SEE, THE CROOKS HAVE NOW SWITCHED TO GOLD AS THEY INCREASE THE OPEN INTEREST FOR THE SPREADERS. THE TOTAL COMEX GOLD OPEN INTEREST WILL RISE FROM NOW ON UNTIL ONE WEEK PRIOR TO FIRST DAY NOTICE AND THAT IS WHEN THEY START THEIR CRIMINAL LIQUIDATION.

HERE IS HOW THE CROOKS USED SPREADING AS WE ARE NO INTO THE NON ACTIVE DELIVERY MONTH OF MAY HEADING TOWARDS THE VERY ACTIVE DELIVERY MONTH OF JUNE.

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES, HERE IS THE BANKERS MODUS OPERANDI:

YOU WILL ALSO NOTICE THAT THE COMEX OPEN INTEREST IS STARTING TO RISE IN THIS NON ACTIVE MONTH OF MAY BUT SO IS THE OPEN INTEREST OF SPREADERS. THE OPEN INTEREST IN GOLD WILL CONTINUE TO RISE UNTIL ONE WEEK BEFORE FIRST DAY NOTICE OF AN UPCOMING ACTIVE DELIVERY MONTH (JUNE), AND THAT IS WHEN THE CROOKS SELL THEIR SPREAD POSITIONS BUT NOT AT THE SAME TIME OF THE DAY. THEY WILL USE THE SELL SIDE OF THE EQUATION TO CREATE THE CASCADE (ALONG WITH THEIR COLLUSIVE FRIENDS) AND THEN COVER ON THE BUY SIDE OF THE SPREAD SITUATION AT THE END OF THE DAY. THEY DO THIS TO AVOID POSITION LIMIT DETECTION. THE LIQUIDATION OF THE SPREADING FORMATION CONTINUES FOR EXACTLY ONE WEEK AND ENDS ON FIRST DAY NOTICE.”

ACCUMULATION OF EFP’S GOLD AT J.P. MORGAN’S HOUSE OF BRIBES: (EXCHANGE FOR PHYSICAL) FOR THE MONTH OF MAY : 70,859 CONTRACTS OR 7,085,900 OR 220.40 TONNES (12 TRADING DAYS AND THUS AVERAGING: 5904 EFP CONTRACTS PER TRADING DAY

TO GIVE YOU AN IDEA AS TO THE STRONG SIZE OF THESE EFP TRANSFERS : THIS MONTH IN 12 TRADING DAYS IN TONNES: 220.40 TONNES

TOTAL ANNUAL GOLD PRODUCTION, 2018, THROUGHOUT THE WORLD EX CHINA EX RUSSIA: 3555 TONNES

THUS EFP TRANSFERS REPRESENTS 220.40/3550 x 100% TONNES =6.20% OF GLOBAL ANNUAL PRODUCTION SO FAR IN DECEMBER ALONE.***

ACCUMULATION OF GOLD EFP’S YEAR 2019 TO DATE: 2035.95 TONNES

JANUARY 2019 TOTAL EFP ISSUANCE; 531.20 TONNES

FEB 2019 TOTAL EFP ISSUANCE: 344.36 TONNES

MARCH 2019 TOTAL EFP ISSUANCE: 497.16 TONNES

APRIL 2019 TOTAL ISSUANCE: 456.10 TONNES

WHAT IS ALARMING TO ME, ACCORDING TO OUR LONDON EXPERT ANDREW MAGUIRE IS THAT THESE EFP’S ARE BEING TRANSFERRED TO WHAT ARE CALLEDRIAL FORWARD CONTRACT OBLIGATIONS AND THESE CONTRACTS ARE LESS THAN 14 DAYS. ANYTHING GREATER THAN 14 DAYS, THESE MUST BE RECORDED AND SENT TO THE COMPTROLLER, GREAT BRITAIN TO MONITOR RISK TO THE BANKING SYSTEM. IF THIS IS INDEED TRUE, THEN THIS IS A MASSIVE CONSPIRACY TO DEFRAUD AS WE NOW WITNESS A MONSTROUS TOTAL EFP’S ISSUANCE AS IT HEADS INTO THE STRATOSPHERE.

Result: A STRONG SIZED INCREASE IN OI AT THE COMEX OF 6360 DESPITE THE TINY RISE IN PRICING ($1.50) THAT GOLD UNDERTOOK YESTERDAY) //.WE ALSO HAD A GOOD SIZED NUMBER OF COMEX LONG TRANSFERRING TO LONDON THROUGH THE EFP ROUTE: 5454 CONTRACTS AS THESE HAVE ALREADY BEEN NEGOTIATED AND CONFIRMED. THERE OBVIOUSLY DOES NOT SEEM TO BE MUCH PHYSICAL GOLD AT THE COMEX. I GUESS IT EXPLAINS THE HUGE ISSUANCE OF EFP’S…THERE IS HARDLY ANY GOLD PRESENT AT THE GOLD COMEX FOR DELIVERY PURPOSES. IF YOU TAKE INTO ACCOUNT THE 5454 EFP CONTRACTS ISSUED, WE HAD A STRONG SIZED GAIN OF 11,814 CONTRACTS IN TOTAL OPEN INTEREST ON THE TWO EXCHANGES:

5454 CONTRACTS MOVE TO LONDON AND 6360 CONTRACTS INCREASED AT THE COMEX. (IN TONNES, THE GAIN IN TOTAL OI EQUATES TO 36.75 TONNES). ..AND THIS HUMONGOUS DEMAND OCCURRED WITH A TINY RISE IN PRICE OF $1.50 IN YESTERDAY’S TRADING AT THE COMEX. WE NO DOUBT HAD A STRONG PRESENCE OF SPREADING TODAY.

we had: 55 notice(s) filed upon for 5500 oz of gold at the comex.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

With respect to our two criminal funds, the GLD and the SLV:

GLD...

WITH GOLD DOWN $11.10 TODAY

WE HAVE A HUGE WITHDRAWAL OF 3.23 TONNES OF GOLD FROM THE GLD.

STRANGE THIS IS THE EXACT DEPOSIT AMOUNT PUT INTO THE GLD ON MAY 14//.

INVENTORY RESTS AT 733.23 TONNES

TO ALL INVESTORS THINKING OF BUYING GOLD THROUGH THE GLD ROUTE: YOU ARE MAKING A TERRIBLE MISTAKE AS THE CROOKS ARE USING WHATEVER GOLD COMES IN TO ATTACK BY SELLING THAT GOLD. IT SURE SEEMS TO ME THAT THE GOLD OBLIGATIONS AT THE GLD EXCEED THEIR INVENTORy

SLV/

WITH SILVER DOWN 26 CENTS TODAY:

A BIG CHANGE IN SILVER INVENTORY AT THE SLV//

A WITHDRAWAL OF 1.031 MILLION OZ FROM THE SLV.

/INVENTORY RESTS AT 315.551 MILLION OZ.

end

First, here is an outline of what will be discussed tonight:

1. Today, we had the open interest in SILVER ROSE BY A TINY SIZED 530 CONTRACTS from 203,788 UPTO 204,318 AND CLOSER TO THE NEW COMEX RECORD SET LAST IN AUG.2018 AT 244,196 WITH A SILVER PRICE OF $14.78/(AUGUST 22/2018)..THE PREVIOUS RECORD WAS SET ON APRIL 9/2018 AT 243,411 OPEN INTEREST CONTRACTS WITH THE SILVER PRICE AT THAT DAY: $16.53). AND PREVIOUS TO THAT, THE RECORD WAS ESTABLISHED AT: 234,787 CONTRACTS, SET ON APRIL 21.2017 OVER 1 1/3 YEARS AGO. THE PRICE OF SILVER ON THAT DAY: $17.89. AS YOU CAN SEE, WE HAVE RECORD HIGH OPEN INTERESTS IN SILVER ACCOMPANIED BY A CONTINUAL LOWER PRICE WHEN THAT RECORD WAS SET…..THE SPREADERS HAVE STOPPED THEIR LIQUIDATION IN SILVER BUT HAVE NOW MORPHED INTO GOLD..

EFP ISSUANCE:

OUR CUSTOMARY MIGRATION OF COMEX LONGS CONTINUE TO MORPH INTO LONDON FORWARDS AS OUR BANKERS USED THEIR EMERGENCY PROCEDURE TO ISSUE:

0 CONTRACTS FOR APRIL., 0 FOR MAY, FOR JUNE 0 CONTRACTS AND JULY: 263 CONTRACTS AND ALL OTHER MONTHS: ZERO. TOTAL EFP ISSUANCE: 263 CONTRACTS. EFP’S GIVE OUR COMEX LONGS A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. IF WE TAKE THE OI GAIN AT THE COMEX OF 637 CONTRACTS TO THE 263 OI TRANSFERRED TO LONDON THROUGH EFP’S, WE OBTAIN A SMALL GAIN OF 793 OPEN INTEREST CONTRACTS. THUS IN OUNCES, THE GAIN ON THE TWO EXCHANGES: 4.5 MILLION OZ!!! AND YET WE ALSO HAVE A STRONG DEMAND FOR PHYSICAL AS WE WITNESSED A FINAL STANDING OF GREATER THAN 30 MILLION OZ FOR JULY, A STRONG 7.475 MILLION OZ FOR AUGUST.. A HUGE 39.505 MILLION OZ STANDING FOR SILVER IN SEPTEMBER… OVER 2 million OZ STANDING FOR THE NON ACTIVE MONTH OF OCTOBER., 7.440 MILLION OZ FINALLY STANDING IN NOVEMBER. 21.925 MILLION OZ STANDING IN DECEMBER , 5.845 MILLION OZ STANDING IN JANUARY. 2.955 MILLION OZ STANDING IN FEBRUARY, 27.120 MILLION OZ FOR MARCH., 3.875 MILLION OZ FOR APRIL AND NOW 18.355 MILLION OZ FOR MAY

RESULT: A SMALL SIZED INCREASE IN SILVER OI AT THE COMEX DESPITE THE TINY 2 CENT GAIN IN PRICING THAT SILVER UNDERTOOK IN PRICING// YESTERDAY. WE ALSO HAD A SMALL SIZED 263 EFP’S ISSUED TRANSFERRING COMEX LONGS OVER TO LONDON. TOGETHER WITH THE STRONG SIZED AMOUNT OF SILVER OUNCES STANDING FOR THIS MONTH, DEMAND FOR PHYSICAL SILVER CONTINUES TO INTENSIFY AS WE WITNESS SEVERE BACKWARDATION IN SILVER IN LONDON.

BOTH THE SILVER COMEX AND THE GOLD COMEX ARE IN STRESS AS THE BANKERS SCOUR THE BOWELS OF THE EXCHANGE FOR METAL

(report Harvey)

.

2.a) The Shanghai and London gold fix report

(Harvey)

2 b) Gold/silver trading overnight Europe, Goldcore

(Mark O’Byrne/zerohedge

and in NY: Bloomberg

3. ASIAN AFFAIRS

i)THURSDAY MORNING/ WEDNESDAY NIGHT:

SHANGHAI CLOSED UP 17,03 POINTS OR 0.58% //Hang Sang CLOSED UP 6.36 POINTS OR 0.02% /The Nikkei closed DOWN 125.58 POINTS OR 0.59%//Australia’s all ordinaires CLOSED UP .74%

/Chinese yuan (ONSHORE) closed DOWN at 6.8884 /Oil UP to 61.64 dollars per barrel for WTI and 71.08 for Brent. Stocks in Europe OPENED GREEN// ONSHORE YUAN CLOSED DOWN // LAST AT 6.8884 AGAINST THE DOLLAR. OFFSHORE YUAN CLOSED DOWN ON THE DOLLAR AT 6.9072 TRADE TALKS STILL ON//TRUMP INITIATES A NEW 25% TARIFFS FRIDAY/MAY 10/MAJOR PROBLEMS AT HUAWEI /CFO ARRESTED : /ONSHORE YUAN TRADING ABOVE LEVEL OF OFFSHORE YUAN/ONSHORE YUAN TRADING WEAKER AGAINST USA DOLLAR/OFFSHORE YUAN TRADING WEAKER AGAINST THE DOLLAR /TRADE DEAL NOW DEAD..TRUMP RAISED RATES TO 25%

3A//NORTH KOREA/ SOUTH KOREA

i)NORTH KOREA

b) REPORT ON JAPAN

3 China/Chinese affairs

i)China/Huawei

Huawei responds to the tech ban and in a concession to Trump the company states that it is willing “to engage to ensure the product safety.” It seems that Trump was right that Huawei was using its products for spying purposes.

( zerohedge)

ii)CHINA/CANADA

NOT GOOD!! Two Canadians held by Beijing in December are now facing the death penalty as they are being charged on espionage. No doubt that these are related to the Meng (CFO Huawei) arrest.

( zerohedge)

iii)Serious stuff going on in Washington with their nuclear option against Huawei. Huawei has offered to open up its devices in order for the USA to feel secure form spying. The USA counters by putting Huawei on the “Entity list” which would ban USA corporations from dealing with the company. Also, the timing for China seems odd that on the day that the USA puts Huawei on the “entity list” two Canadians were arrested for espionage and could face the death sentence. I guess travel to China is now out of the question.

(zerohedge)

4/EUROPEAN AFFAIRS

i)FRANCE

An excellent commentary on the state of affairs in France which has the highest social spending per GDP in the world at 31%. The social spending in totally non productive. France incomes are falling below even America’s poorest states. I guess this is the reason for the Yellow Vest Movement as they feel the pain inside France

( Ryan McMaken/ Mises)

ii)Now that the USA has finished issuing fines to our favourite bankers, the EU has now started as they fined 5 banks 1.2 billion dollars in a FX cartel case

(courtesy zerohedge)

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

a)SAUDI ARABIA/IRAN/YEMEN

The Saudis now claim the Iran has carried out the Aramco Pipeline attack in Saudi Arabia using drones. We now have footage and it is extensive.

The USA are not happy campers on this issue. Remember that the USA carrier Lincoln will be entering the Gulf shortly.

(courtesy zerohedge)

6. GLOBAL ISSUES

THE GLOBE

Maersk, the largest shipping company in the world sees a significant slowdown in business activity as the third largest transshipment port in the Mediterranean, located on the island of Malta.

Maersk is now going to shift operations from Malta to other African ports due to the slowdown

( zerohedge)

7. OIL ISSUES

A mystery tanker violates USA sanctions by unloading oil to China

(courtesy zerohedge)

8 EMERGING MARKET ISSUES

VENEZUELA

Officially the uSA suspends all passenger and cargo flights to Venezuela

(courtesy zerohedge)

9. PHYSICAL MARKETS

10. USA stories which will influence the price of gold/silver)

MARKET TRADING//

ii)Market data

ii)USA ECONOMIC/GENERAL STORIES

a)This is the continuing story by Brandon Smith on how the USA hegemony will end. We are witnessing the globalists in their attack on the populist movement. There is no question that the USA cannot win in their trade battle with China. You will recall Alasdair Macleod prove that unless the uSA citizens become savers, then trade deficits will continue despite the trade war. The following article is important and we must be cognizant of what might happen: China and the rest of the world will liquidate their vast USA treasuries sending the USA into a hyperinflation panic. The Globalist goal: one government, one currency..and the USA must go.

a must read…

(courtesy Brandon Smith/AltMarket.com)

b)The tariffs are killing USA farmers.

(courtesy Mac Slavo)

c)Too much rain has killed off much the corn planting

(courtesy michael Snyder)

SWAMP STORIES

What a riot: there is now a dispute as to whether it was Comey or Brennan who pushed the Steele dossier: i.e. to be included into the intelligence community assessment

( zerohedge)

E)SWAMP STORIES/MAJOR STORIES//THE KING REPORT

Let us head over to the comex:

THE TOTAL COMEX GOLD OPEN INTEREST ROSE BY A VERY STRONG SIZED 6360 CONTRACTS TO A LEVEL OF 526,224 DESPITE THE TINY RISE IN THE PRICE OF GOLD ($1.50) IN YESTERDAY’S // COMEX TRADING)

WE ARE NOW IN THE NON ACTIVE DELIVERY MONTH OF MAY.. THE CME REPORTS THAT THE BANKERS ISSUED A GOOD SIZED TRANSFER THROUGH THE EFP ROUTE AS THESE LONGS RECEIVED A DELIVERABLE LONDON FORWARD TOGETHER WITH A FIAT BONUS., THAT IS 5454 EFP CONTRACTS WERE ISSUED:

0 FOR JUNE ’19: 5454 CONTRACTS , DEC; 0 CONTRACTS: 0 AND ZERO FOR ALL OTHER MONTHS:

TOTAL EFP ISSUANCE: 5454 CONTRACTS.

THE OBLIGATION STILL RESTS WITH THE BANKERS ON THESE TRANSFERS. ALSO REMEMBER THAT THERE IS NO DOUBT A HUGE DELAY IN THE ISSUANCE OF EFP’S AND IT PROBABLY TAKES AT LEAST 48 HRS AFTER LONGS GIVE UP THEIR COMEX CONTRACTS FOR THEM TO RECEIVE THEIR EFP’S AS THEY ARE NEGOTIATING THIS CONTRACT WITH THE BANKS FOR A FIAT BONUS PLUS THEIR TRANSFER TO A LONDON BASED FORWARD.

ON A NET BASIS IN OPEN INTEREST WE GAINED THE FOLLOWING TODAY ON OUR TWO EXCHANGES: 11,814 TOTAL CONTRACTS IN THAT 5454 LONGS WERE TRANSFERRED AS FORWARDS TO LONDON AND WE GAINED A VERY STRONG SIZED 6360 COMEX CONTRACTS.

NET GAIN ON THE TWO EXCHANGES : 11,814 contracts OR 1,181,400 OZ OR 39.65 TONNES.

We are now in the NON active contract month of MAY and here the open interest stands at 123 contracts, having GAINED 2 contracts. We had 1 notices served yesterday so we gained 3 contracts or an additional 300 oz will stand as they guys refused to morph into a London based forward as well as negating a fiat bonus

The next contract month after May is June and here the open interest FELL by 1215 contracts DOWN to 279,612. July GAINED 2 contracts to stand at 70. After July the next active month is August and here the OI rose by 5241 contracts up to 159,287 contracts.

TODAY’S NOTICES FILED:

WE HAD 55 NOTICE FILED TODAY AT THE COMEX FOR 5500 OZ. (0.1710 TONNES)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for the wild silver comex results.

Total COMEX silver OI ROSE BY A SMALL SIZED 530 CONTRACTS FROM 203,788 UP TO 204,318 (AND CLOSER TO THE NEW RECORD OI FOR SILVER SET ON AUGUST 22.2018. THE PREVIOUS RECORD WAS SET APRIL 9.2018/ 243,411 CONTRACTS) AND TODAY’S TINY OI COMEX GAIN OCCURRED WITH A 2 CENT GAIN IN PRICING.//YESTERDAY.

WE ARE NOW INTO THE ACTIVE DELIVERY MONTH OF MAY. HERE WE HAVE 298 OPEN INTEREST STAND SO FAR FOR A GAIN OF 3 CONTRACTS. WE HAD 0 NOTICES SERVED UPON YESTERDAY SO IN ESSENCE WE GAINED ANOTHER 3 CONTRACT OR AN ADDITIONAL 15,000 OZ WILL STAND FOR DELIVERY AS THESE GUYS REFUSED TO MORPH INTO LONDON BASED FORWARDS AND AS WELL THEY NEGATING A FIAT BONUS. SILVER MUST BE SCARCE AT THE COMEX. QUEUE JUMPING RETURNS WITH A VENGEANCE. WE HAVE NOW SURPASSED THE INITIAL AMOUNT STANDING WHICH OCCURRED ON APRIL 30.2019

THE NEXT MONTH AFTER MAY IS THE NON ACTIVE MONTH OF JUNE. HERE THIS MONTH LOST 16 CONTRACTS DOWN TO 717. AFTER JUNE IS THE ACTIVE MONTH OF JULY, (THE SECOND LARGEST DELIVERY MONTH OF THE YEAR FOR SILVER) AND HERE THIS MONTH GAINED 103 CONTRACTS UP TO 154,050 CONTRACTS. THE NEXT ACTIVE MONTH AFTER JULY FOR SILVER IS SEPTEMBER AND HERE THE OI ROSE BY 292 DOWN TO 19,054 CONTRACTS.

TODAY’S NUMBER OF NOTICES FILED:

We, today, had 4 notice(s) filed for 20,000 OZ for the MARCH, 2019 COMEX contract for silver

Trading Volumes on the COMEX TODAY: 142,269 CONTRACTS

CONFIRMED COMEX VOL. FOR YESTERDAY: 273,292

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for silver

AND NOW THE DELIVERY MONTH OF APRIL

INITIAL standings/SILVER

IN TOTAL CONTRAST TO GOLD, HUGE ACTIVITY IN SILVER TODAY.

MAY 16 2019

Silver Ounces

Withdrawals from Dealers Inventory NIL oz

Withdrawals from Customer Inventory

1,073,733.093 oz

BRINS

CNT

BNS

Deposits to the Dealer Inventory

NIL oz

Deposits to the Customer Inventory

NIL oz

No of oz served today (contracts)

4

CONTRACT(S)

(20,000 OZ)

No of oz to be served (notices)

294 contracts

1,470,000 oz)

Total monthly oz silver served (contracts) 3377 contracts

16,885,000 oz)

Total accumulative withdrawal of silver from the Dealers inventory this month NIL oz

Total accumulative withdrawal of silver from the Customer inventory this month

**

we had 0 inventory movement at the dealer side of things

total dealer deposits: NIL oz

total dealer withdrawals: nil oz

we had 0 deposits into the customer account

into JPMorgan: nil

*** JPMorgan for most of 2017 and in 2018 has adding to its inventory almost every single day.

JPMorgan now has 149.469 million oz of total silver inventory or 48.80% of all official comex silver. (149 million/307 million)

into EVERYBODY ELSE: NIL OZ

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

News

Gold Settles With a Modest Gain, Remains Pinned Below

Gold Steadies as Stocks Retreat; Trade Uncertainty Persists

Weak U.s. Retail Sales, Industrial Output Highlight Slowing Economy

U.S., European Shares Strengthen After Trump Auto-Tariff Delay

Us Orders ‘non-emergency Government Employees’ to Leave Iraq

Commentary

3 Charts Warning Investors To Rebalance Portfolios

Global Trade Collapsing To Depression Levels

Calls For 120,000 Troops To Counter Iran

Iran’s Military “On The Cusp Of War” As US Allies Pull Troops From Iraq

Central Banks Are Buying Gold At The Fastest Pace In Six Years

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

GATA STORIES WITH RESPECT TO GOLD/PRECIOUS METALS.

PART II of Chris Powell’s important interview on gold price suppression

(courtesy Chris Powell/GATA)

If they wise up, gold investors can beat price suppression, GATA secretary says

Submitted by cpowell on Wed, 2019-05-15 20:57. Section: Daily Dispatches

5:03p ET Wednesday, May 15, 2019

Dear Friend of GATA and Gold:

In the second part of his recent interview with GoldCore’s Mark O’Byrne, your secretary/treasurer discusses:

— The counterintuitive movements in the gold price that are caused by surreptitious government interventions.

— The silly explanations for these counterintuitive movements that are contrived by market analysts.

— The ability of gold investors themselves to defeat price suppression by wising up and avoiding “paper gold” and keeping their metal outside the banking system, where derivatives turn it into imaginary supply that is used to smash gold prices down.

— The failure of the governments of developing countries to oppose the market manipulations by which the developed countries exploit them.

— GATA’s primary objectives, which are limited, transparent, and accountable government and fair dealing among nations.

The interview is 32 minutes long and can be viewed at GoldCore here:

https://news.goldcore.com/us/gold-blog/video-we-have-the-power-to-end-go…

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

END

iii) Other Physical stories

LAWRIE WILLIAMS: Are GLD withdrawals a threat to the gold price?

So far this year a total of 62 tonnes of gold – worth nearly $US2.6 billion at current prices – has been taken out of the world’s largest gold ETF, SPDR gold shares (GLD), despie a couple of months when gold was added into the ETF. Yesterday there was a withdrawal of 3.2 tonnes, but this may have been ultra short term profit taking as there was a deposit of a similar amount a couple of working days prior and the gold price jumped in between!

Gold followers will recall that a continuing outflow of metal from GLD coincided with the big gold price fall in 2012 and 2013, which could worry gold investors should gold continue to bleed out of GLD. However so far the volumes of outflows are not at that kind of level and seem to be more than being balanced by announced increases in central bank gold holdings. With demand apparently picking up in India and perhaps falling off a little in China, although still at substantial levels, the supply/demand balance seems to be holding up. Increased tensions in the Middle East – in particular with the U.S. seemingly taking an increasingly belligerent stance with Iran – and the prospects of an escalating trade war between the U.S. and China, gold could yet be set fair for a substantial boost in the second half of the year should any of these come to a head. And there are other potential flashpoints out there – particularly if President Trump continues with a policy of utilisation of American military strength, and the imposition of sanctions, against regimes to which he is opposed.

This latter policy could even be imposed on supposed staunch allies. For example the U.S. is strongly opposed to the building of a new natural gas pipeline from Russia to Germany – the disputed NordStream 2 project. German Chancellor, Angela Merkel, seems to be heavily in favour and although there is dissension within the EC over the pipeline’s construction, Merkel says the EC can’t and won’t delay the project. But this could lay European companies involved in the pipeline construction open to possible U.S. sanctions, which President Trump seems keen to use as a persuasive tactic on friend and foe alike. Trying to impose U.S. policy on an ally like Germany as to who it can buy its natural gas from is likely to stir up considerable resentment. Multiply this across other jurisdictions over which the U.S. wishes to exert economic pressure and we will see a build-up of resentment against the U.S. Arguably this is already being demonstrated in countries trying to reduce their reliance on the dollar and their turning to gold as a replacement asset in their forex reserves.

The aggressive U.S. policy on Iran is another case in point. The unilateral cessation of the Iran nuclear deal by the U.S. has not found favour amongst the U.S.’s European allies and the slapping of sanctions on any nation continuing to trade with Iran is yet another economic flashpoint. The U.S. dollar has been the world’s principal reserve currency, backed up by virtually all trade in oil being conducted in U.S. dollars. However this is beginning to be eroded and will likely accelerate as time goes on. The law of unintended consequences! All this could be beneficial to gold as a direct, or indirect substitute for the dollar’s role.

So to come back to the question posed in the title, we don’t think so. We suspect withdrawals from GLD, and from other gold ETFs, will diminish and probably reverse as the year progresses. The general consensus is that the gold price is due for a sustained rise in the second half of the year – there seem to be a plethora of geopolitical factors out there which should favour gold and past performance suggests that a rising gold price tends to be accompanied by gold ETF inputs rather than withdrawals. We still think things are aligning positively for gold through the second half of the year – but then gold often confounds. We hope that this time we are correct.

16 May 2019

-END-

India’s Gold imports spike 54% to $3.97 billion in April

MUMBAI (Scrap Register): India’s gold imports spiked by 54% to $3.97 billion in April from $2.58 billion in the same month last year, according to latest data release from the Ministry of Commerce.

The rise in imports by the world’s second-biggest consumer of the precious metal was driven by strong demand during wedding season along with fall in prices which prompted purchases.

After recording negative growth for three consecutive months – October, November and December 2018 – gold imports grew 38.16% to $2.31 billion in January 2019. It again contracted by 10.8% to $2.58 billion in February.

In March 2019, gold imports grew by 31.22 % to $3.27 billion.

India is one of the largest gold importers in the world, and the imports mainly take care of demand from the jewellery industry.

-END-

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

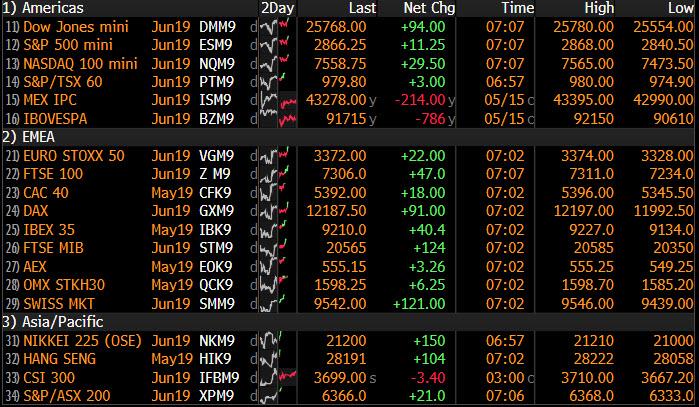

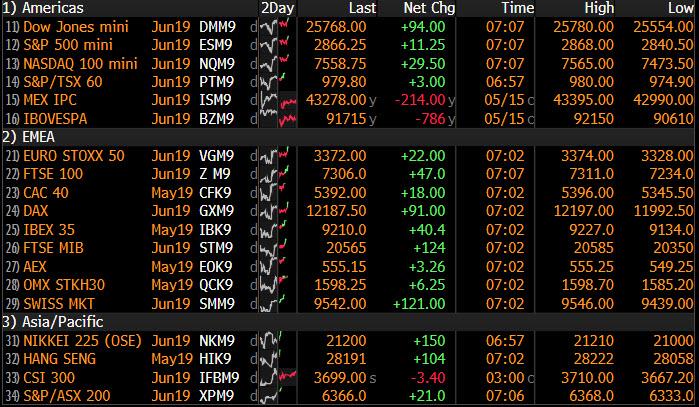

Futures Rebound Despite Trump’s Huawei Ban, Yuan Slides For Record 12th Day

It has been a session of two halves. Early on European and Asian stocks fell, government bond yields slipped and the Japanese yen firmed after the U.S. government hit Chinese telecoms giant Huawei with severe sanctions, further straining Sino-U.S. trade ties, with Beijing warning that the Huawei restrictions won’t be seen as a goodwill gesture and that China will take “all necessary measures” to defend its companies. Amid fresh trade war concerns, the European Stoxx 600 index fell as much as 0.5% in early European trading with the German DAX down 0.4%, while U.S. equity futures were initially down 0.4%.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Market Snapshot

S&P 500 futures up 0.3% to 2,864.50

STOXX Europe 600 down 0.2% to 377.45

MXAP down 0.3% to 154.86

MXAPJ down 0.2% to 508.98

Nikkei down 0.6% to 21,062.98

Topix down 0.4% to 1,537.55

Hang Seng Index up 0.02% to 28,275.07

Shanghai Composite up 0.6% to 2,955.71

Sensex up 0.3% to 37,221.67

Australia S&P/ASX 200 up 0.7% to 6,327.84

Kospi down 1.2% to 2,067.69

German 10Y yield fell 1.7 bps to -0.115%

Euro up 0.1% to $1.1215

Brent Futures up 0.8% to $72.33/bbl

Italian 10Y yield rose 1.8 bps to 2.373%

Spanish 10Y yield fell 4.5 bps to 0.91%

Brent Futures up 0.8% to $72.33/bbl

Gold spot up 0.03% to $1,296.91

U.S. Dollar Index down 0.07% to 97.50

Top Overnight News from Bloomberg

Theresa May flies back to London on Thursday morning to once again face colleagues seeking to oust her, as she struggles to find a way to pass her Brexit deal. The executive of the 1922 Committee, representing Tory members of Parliament, will use a meeting at the premier’s office at 11:30 a.m. Thursday to urge her to quit as soon as possible, according to two of its members, speaking on condition of anonymity

Donald Trump signed an order Wednesday that’s expected to restrict Huawei and fellow Chinese telecommunications company ZTE Corp. from selling their equipment in the U.S. The Department of Commerce said it had put Huawei on a blacklist that could forbid it from doing business with American companies. This campaign could disrupt 5G rollouts globally

China cut its U.S. Treasuries holdings to the lowest level since 2017 in March amid the trade dispute between the world’s two biggest economies

The U.S. ordered its non-emergency government staff to leave Iraq amid increasing Middle East tensions that American officials are blaming on Iran, as fears rise that the region may be heading toward another conflict

Trump will also give the EU and Japan 180 days to agree to a deal that would “limit or restrict” imports into the U.S. of automobiles and their parts in return for delaying new auto tariffs, according to a draft executive order seen by Bloomberg

Global funds are taking cover in defensive trades amid a widening U.S.-China rift, with yuan sovereign bonds emerging as the top pick in developing Asia

Asian equity markets were mixed as blue-chip earnings and the US blacklisting of Huawei as well as 70 of its affiliates overshadowed the positive lead from Wall St, where sentiment was underpinned by reports that President Trump plans to delay the decision on tariffs for auto imports by up to 6-months. ASX 200 (+0.7%) and Nikkei 225 (-0.6%) were mixed in which the commodity-related sectors led the intraday recovery in Australia and as a higher Unemployment Rate stoked calls for an RBA rate cut, while Tokyo trade was pressured by disappointing earnings including Japan’s megabanks Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group. Hang Seng (U/C) and Shanghai Comp. (+0.6%) were initially subdued with underperformance seen in tech and telecoms following US President Trump’s national emergency declaration on foreign companies posing threats to US telecommunications, although strength in property names after firmer Chinese House Price data helped reverse the losses. 10yr JGBs were initially supported as they tracked recent upside in T-notes and amid weakness in Tokyo stocks, although gains were capped after the 5-year JGB auction results were relatively inline with the previous albeit with a weaker b/c.

Top Asian News

Philippines Cuts Large Banks’ Reserve Ratio by 2Ppt to 16%

Moody’s Changes Outlook on Japan Banking System to Negative

China Says It Will Take Necessary Measures to Defend Its Firms

MUFG Shifts Asia Rates Trading to London From Hong Kong

European equities have been volatile [Eurostoxx 50 +0.3%] following on from a mostly positive lead in Asia. Sectors are mixed with outperformance in material names (amidst rising base metal prices) whilst consumer discretionary lags as EU auto names pare back some of yesterday’s tariff-spurred gains. In terms of individual movers, Thyssenkrupp (+6.5%) shares rose to the top of the DAX after reports that Finland’s Kone (+3.8%) are exploring the viability of a bid for Thyssenkrupp’s EUR 14bln elevator division. Meanwhile, Thomas Cook (-18.4%) shares opened lower by over 20% after posting a Q1 pre-tax loss of EUR 1.465bln which came alongside a warning that “challenging” trading over the peak summer season would impact FY earnings, although the Co. did note that they have received multiple bids for all and parts of the group airline. Finally, Ubisoft (-12.4%) rests at the foot of the Stoxx 600 despite posting record sales figures, after a delay to its open-world game “Skull & Bones” into the next FY.

Top European News

Car Stocks Retreat as Trump Seen Seeking Industry Import Curbs

Burberry Falls as China Weakness Hangs Over Tisci’s New Looks

ECB’s Weidmann Says Rate Tiering Could Be Net Negative For Banks

Italian Banks Expectations Remain Demanding, Goldman Sachs Says

In FX, the Dollar is holding above Wednesday’s post-US data lows, but stands narrowly mixed vs G10 counterparts as the US-China trade dispute continues via recriminations over the cause of the derailment in talks that has sparked another round of reciprocal tariffs. However, the DXY is stuck in a narrow band either side of the 97.500 mark that has been pivotal for a while, and very close to the 30 DMA (94.428) between 97.565-438.

NZD/EUR/CAD/JPY/AUD/CHF – All marginally firmer vs the Greenback, with the Kiwi outperforming or clawing back more losses than other so be precise from sub-0.6550 levels to circa 0.6580. Meanwhile, the single currency is holding above 1.1200 after reclaiming big figure+ status yesterday on the EU auto tax reprieve, but unable to breach the 30 DMA (1.1222) convincingly amidst increasingly dovish ECB market expectations and another potential clash between Italy and the EU on budget policy intentions. The Loonie has also rebounded from recent lows and a post-Canadian CPI dip to test resistance ahead of 1.3400 with some positive momentum coming from reports that the Canada, Mexico and the US are close to clinching a deal on steel tariffs (Peso paring losses as well as Usd/Mxn eyes 19.0000). Usd/Jpy continues to straddle 109.50 as the Yen retains a safe-haven bid, but also contends with more decent option expiry interest (1.55 bn from 109.15 to 109.25 and 2.2 bn between 109.40-55). Elsewhere, the Aussie has recovered from its latest slump in wake of more weak data on balance (labour report) and a dip through 0.6900 stops with the aid of underlying bids/short covering, and Aud/Usd has now absorbed supply said to be sitting around 0.6910 and above to trade back up around 0.6933. Lastly, funding for a proposed acquisition has been touted as a factor behind recent Franc strength, but Usd/Chf has bounced towards 1.0100 from a few pips above 1.0050 and Eur/Chf has crossed over 1.1300 again.

GBP – Brexit and related UK political uncertainty is still haunting Sterling along with other global and geopolitical risk, with Cable retreating a tad further towards 1.2800 and Eur/Gbp inching close to 0.8750 as PM May meets the 1922 group in just under an hour.

EM – The Rand is showing a degree of resilience in the face of somewhat negative reviews from Moody’s on SA’s credit outlook with Usd/Zar hovering at the lower end of 14.2650-1525 trading parameters and perhaps being drawn or attracted to an unusually large expiry at the 14.0000 strike (1.365 bn).

In commodities, a positive session thus far for WTI (+0.7%) and Brent (+0.5%) futures as tensions in the Middle East drift back into focus. The former remains above USD 62.00/bbl and in close proximity to USD 62.50/bbl whilst its Brent counterpart floats comfortably above the USD 72.00/bbl mark. On the Iranian front, ship tracking data showed that a tanker carrying Iranian oil (in violation with US sanctions) has unloaded its cargo of almost 130k tonnes of oil near Zhousan, in China. Iran will remain a focus as the JMMC convene this weekend in Jeddah, with ministers expected to discuss whether the supply gap from Iranian sanctions will need to be filled, and hence whether the output curb deal will need to be extended until the end of the year. In terms of technicals, analysts at PVM highlight resistance at 63.09 (21 DMA) in WTI and 72.60 in Brent (short-term DMA) which they believe will be tested today given the optimism emanating from Trump’s decision to delay EU auto tariffs, progress regarding the Canadian and Mexican aluminium and steel tariffs and concerns of supply disruptions from Middle Eastern tensions. Looking at metals, gold remains choppy below the 1300/oz level and flirts with its 100 DMA at 1296.82 ahead of its 50 DMA (1291.69). Elsewhere, copper prices are poised to notch a third day of gains amid a weakening buck and optimism surrounding Trump’s auto tariff delays with the red metal now back above 2.75/lb ahead of its 200 DMA at 2.7604.

US Event Calendar

8:30am: Housing Starts, est. 1.21m, prior 1.14m; Housing Starts MoM, est. 6.15%, prior -0.3%

8:30am: Building Permits, est. 1.29m, prior 1.27m; Building Permits MoM, est. 0.08%, prior -1.7%

8:30am: Philadelphia Fed Business Outlook, est. 9, prior 8.5

8:30am: Initial Jobless Claims, est. 220,000, prior 228,000; Continuing Claims, est. 1.67m, prior 1.68m

9:45am: Bloomberg Consumer Comfort, prior 59.8

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

(courtesy zerohedge)

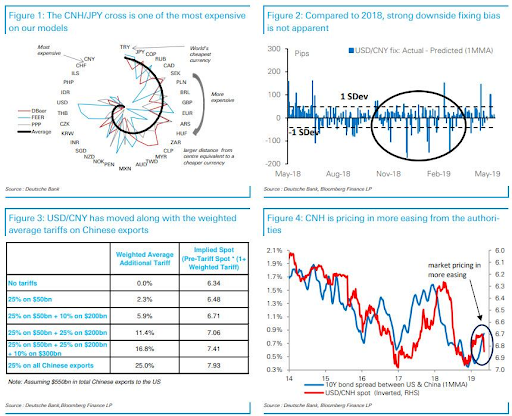

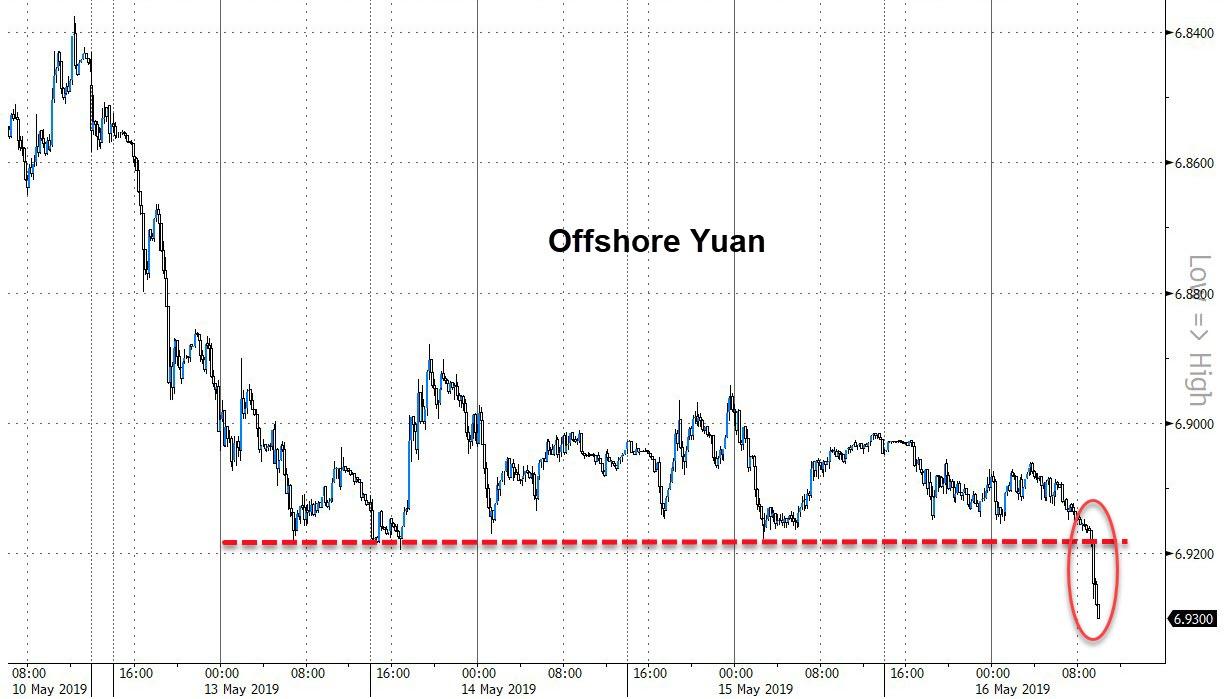

Something Just Broke In The Chinese Yuan

Having been well-managed all week, amid various headlines (and extreme hopium in US equities), something just snapped in the Chinese yuan…

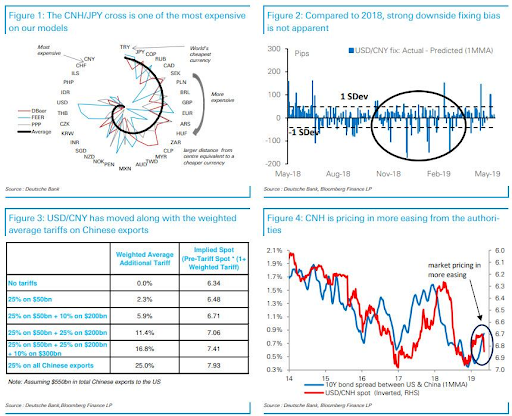

As we just detailed, from Deutsche Bank, who worry that USD/CNY will break through 7…

Asia is the region we expect to suffer most from the renewed global headwinds. We argue that policymakers in China are now going to be more accepting of USD/CNY appreciation through 7: years of regulatory measures should make outflows more manageable, easier monetary policy will add upside pressure and a weakening FX is the natural means of offsetting tariffs.

Moves so far in USD/CNY have been proportional to the weighted average tariff being borne by Chinese exporters with the measures currently imposed already consistent with USD/CNY at 7.10. Our preferred trade expression is short CNH/JPY with the yen primed to benefit from global risk aversion and resumed signs of Japanese equity repatriation in recent weeks.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

say Hey hey we're sailing over to Captain Bly's Beach Party over on Captain's Quarters Board

Big Shout Outs to all you Mates

Hey haw say hey

CQs*

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Global Markets Surge, Erase Trade-War-Escalation Losses

We had it all wrong after all – Global trade war escalation is bullish for global stocks after all!!!!

Chinese markets accelerated higher – erasing all losses post-trade-war escalation…

and European stocks extended yesterday’s gains – soaring higher on the week…

US equities extended yesterday’s gains to erase the losses from trade war escalations and fill Sunday night/Monday morning’s gap down… but as the last hour hit, stocks started to fade.

So, Chinese stocks are up on the week (record buybacks), European stocks are up on the week, but US stocks are down on the week – who’s winning the trade war?

Another short-squeeze at the open… getting “most shorted” stocks almost back to unch..

Bonds and stocks remain decoupled (even as bonds were sold as stocks rallied today)…

Treasury yields rose on the day (up 2bps at the long-end and up 4bps at the short-end)…

But 10Y Yields are still well below 2.50%

The dollar soared today after a small dip at the European open…back to pre-payrolls levels…

Yuan tumbled through key support to its weakest since Nov 2018…yuan is down 7 of the last 8 days.

Ethereum outperformed today, soaring 50% on the week as Bitcoin dipped…

Silver was slammed today as WTI surged…

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Stocks regained their 50% retracement from the recent steep decline today.

Stock market option expiration for May tomorrow.

The dollar strengthened while gold and silver declined.

A cartel of Banks led by Citi were fined $1.2 Billion for manipulating the foreign exchange market.

Over the past twenty years, a cartel of traders manipulating almost every market have been exposed, one by one.

These are serial felons, career criminals. That we tolerate their drain upon society is a remarkable testament to the corrupting power of big money.

Have a pleasant evening.

Read More Jesse Here....

https://jessescrossroadscafe.blogspot.com/

read More Harvey Here....

https://harveyorganblog.com/2019/05/16/may-16-raid-on-the-precious-metals-gold-down-11-10-to-1285-95-silver-down-26-cents-to-14-55-trump-initiates-a-ban-on-chinas-huawei-chinese-yuan-offshore-plummets-to-6-93-to-the-dollar-then/

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

*MAsOSFriniteKOS

show simo casted

.jpg)

Good Morning Good Evening

Sailing On The Waters Tonight !

Welcome to ~*~Mining & Metals Du Jour~*~Graveyard Shift~*~

On the show tonight: Great Data & News by Harvey Organ, the Latest on Gold & Silver, $Currencies Around The World are a Sinking Ship Overloaded by Government Debt and a Good Buried Treasure Story about Jean Lafitte a legendary French Privateer and Pirate who Resided in the Gulf of Mexico Did they Bury Treasure In Your Backyard

Hello everybody I'm J:D your host tonight Thanks for being with us.

Hope Your Having a Great evening and start to your weekend

EnJoy the show

OK...Let's Get It On !

MMGYS*

Friday Night Kickoff

Thank you

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

MAY 16//RAID ON THE PRECIOUS METALS: GOLD DOWN $11.10 TO $1285.95//SILVER DOWN 26 CENTS TO $14.55/TRUMP INITIATES A BAN ON CHINA’S HUAWEI//CHINESE YUAN (OFFSHORE) PLUMMETS TO 6.93 TO THE DOLLAR//THEN CHINA RESPONDS BY CHARGING TWO CANADIANS WITH ESPIONAGE//SWAMP STORIES FOR YOU TONIGHT//

May 16, 2019 · by harveyorgan · in Uncat

GOLD: $1285.95 DOWN $11.10 (COMEX TO COMEX CLOSING)

Silver: $14.55 DOWN 26 CENTS (COMEX TO COMEX CLOSING)

Closing access prices:

Gold : 1286.70

silver: $14.58

OPTIONS EXPIRY FOR THE STOCK MARKET AND GLD/SLV IS TOMORROW

COMEX EXPIRY FOR GOLD/SILVER: TUES MAY 28/2019

LBMA/OTC EXPIRY: MAY 31.2019

I do not know who said the following but it fits:

“when you have counter-intuitive trading happening all the time, you have rigged markets”

JPMorgan has been receiving gold with reckless abandon and sometimes supplying (stopping)

today RECEIVING

EXCHANGE: COMEX

CONTRACT: MAY 2019 COMEX 100 GOLD FUTURES

SETTLEMENT: 1,296.300000000 USD

INTENT DATE: 05/15/2019 DELIVERY DATE: 05/17/2019

FIRM ORG FIRM NAME ISSUED STOPPED

____________________________________________________________________________________________

657 C MORGAN STANLEY 4

661 C JP MORGAN 39 33

685 C RJ OBRIEN 1

737 C ADVANTAGE 11 17

905 C ADM 5

____________________________________________________________________________________________

TOTAL: 55 55

MONTH TO DATE: 288

NUMBER OF NOTICES FILED TODAY FOR MAY CONTRACT: 55 NOTICE(S) FOR 5500 OZ (0.1710 tonnes)

TOTAL NUMBER OF NOTICES FILED SO FAR: 288 NOTICES FOR 28800 OZ (.8958 TONNES)

SILVER

FOR MAY

4 NOTICE(S) FILED TODAY FOR 20,000 OZ/

total number of notices filed so far this month: 3377 for 16,885,000 oz

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Bitcoin: OPENING MORNING TRADE :$7946 DOWN $285

Bitcoin: FINAL EVENING TRADE: $7820 DOWN $338

end

Let us have a look at the data for today

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

IN SILVER THE COMEX OI ROSE BY A TINY SIZED 530 CONTRACTS FROM 203,788 UP TO 204,318 WITH YESTERDAY’S 2 CENT GAIN IN SILVER PRICING AT THE COMEX. ,LIQUIDATION OF THE SPREADERS HAVE STOPPED FOR SILVER BUT IT NOW IN FULL FORCE FOR GOLD. TODAY WE ARRIVED CLOSER TO AUGUST’S 2018 RECORD SETTING OPEN INTEREST OF 244,196 CONTRACTS.

WE HAVE ALSO WITNESSED A LARGE AMOUNT OF PHYSICAL METAL STAND FOR COMEX DELIVERY AS WELL WE ARE WITNESSING CONSIDERABLE LONGS PACKING THEIR BAGS AND MIGRATING OVER TO LONDON IN GREATER NUMBERS IN THE FORM OF EFP’S. WE WERE NOTIFIED THAT WE HAD A SMALL SIZED NUMBER OF COMEX LONGS TRANSFERRING THEIR CONTRACTS TO LONDON THROUGH THE EFP:

0 FOR MAY, 0 FOR JUNE, 263 FOR JULY AND ZERO FOR ALL OTHER MONTHS AND THEREFORE TOTAL ISSUANCE 263 CONTRACTS. WITH THE TRANSFER OF 435 CONTRACTS, WHAT THE CME IS STATING IS THAT THERE IS NO SILVER (OR GOLD) TO BE DELIVERED UPON AT THE COMEX AS THEY MUST EXPORT THEIR OBLIGATION TO LONDON. ALSO KEEP IN MIND THAT THERE CAN BE A DELAY OF 24-48 HRS IN THE ISSUING OF EFP’S. THE 263 EFP CONTRACTS TRANSLATES INTO 1.315 MILLION OZ ACCOMPANYING:

1.THE 2 CENT GAIN IN SILVER PRICE AT THE COMEX AND

2. THE STRONG AMOUNT OF SILVER OUNCES WHICH STOOD FOR DELIVERY IN THE LAST NINE MONTHS:

JUNE/2018. (5.420 MILLION OZ);

FOR JULY: 30.370 MILLION OZ

FOR AUG., 6.065 MILLION OZ

FOR SEPT. 39.505 MILLION OZ S

FOR OCT.2.525 MILLION OZ.

FOR NOV: A HUGE 7.440 MILLION OZ STANDING AND

21.925 MILLION OZ FINALLY STAND FOR DECEMBER.

5.845 MILLION OZ STAND IN JANUARY.

2.955 MILLION OZ STANDING FOR FEBRUARY.:

27.120 MILLION OZ STANDING IN MARCH.

3.875 MILLION OZ STANDING FOR SILVER IN APRIL.

AND NOW 18.355 MILLION OZ STANDING FOR SILVER IN MAY.

ACCUMULATION FOR EFP’S/SILVER/J.P.MORGAN’S HOUSE OF BRIBES, / STARTING FROM FIRST DAY NOTICE/FOR MONTH OF MAY:

13,566 CONTRACTS (FOR 12 TRADING DAYS TOTAL 13,566 CONTRACTS) OR 67,83 MILLION OZ: (AVERAGE PER DAY: 1131 CONTRACTS OR 5.653 MILLION OZ/DAY)

TO GIVE YOU AN IDEA AS TO THE HUGE SUPPLY THIS MONTH IN SILVER: SO FAR THIS MONTH OF MAY: 67.83 MILLION PAPER OZ HAVE MORPHED OVER TO LONDON. THIS REPRESENTS AROUND 9.69% OF ANNUAL GLOBAL PRODUCTION (EX CHINA EX RUSSIA)* JUNE’S 345.43 MILLION OZ IS THE SECOND HIGHEST RECORDED ISSUANCE OF EFP’S AND IT FOLLOWED THE RECORD SET IN APRIL 2018 OF 385.75 MILLION OZ.

ACCUMULATION IN YEAR 2019 TO DATE SILVER EFP’S: 808.93 MILLION OZ.

JANUARY 2019 EFP TOTALS: 217.455. MILLION OZ

FEB 2019 TOTALS: 147.4 MILLION OZ/

MARCH 2019 TOTAL EFP ISSUANCE: 207.835 MILLION OZ

APRIL 2019 TOTAL EFP ISSUANCE: 182.87 MILLION OZ.

RESULT: WE HAD A TINY SIZED INCREASE IN COMEX OI SILVER COMEX CONTRACTS OF 530 WITH THE TINY 2 CENT GAIN IN SILVER PRICING AT THE COMEX /YESTERDAY... THE CME NOTIFIED US THAT WE HAD A SMALL SIZED EFP ISSUANCE OF 263 CONTRACTS WHICH EXITED OUT OF THE SILVER COMEX AND TRANSFERRED THEIR OI TO LONDON AS FORWARDS. SPECULATORS CONTINUED THEIR INTEREST IN ATTACKING THE SILVER COMEX FOR PHYSICAL SILVER (SEE COMEX DATA) . OUR BANKERS RESUMED THEIR LIQUIDATION OF THE SPREAD TRADES TODAY.

TODAY WE GAINED A SMALL SIZED: 793 TOTAL OI CONTRACTS ON THE TWO EXCHANGES:

i.e 263 OPEN INTEREST CONTRACTS HEADED FOR LONDON (EFP’s) TOGETHER WITH INCREASE OF 530 OI COMEX CONTRACTS. AND ALL OF THIS DEMAND HAPPENED WITH A 2 CENT GAIN IN PRICE OF SILVER AND A CLOSING PRICE OF $14.81 WITH RESPECT TO YESTERDAY’S TRADING. YET WE STILL HAVE A STRONG AMOUNT OF SILVER STANDING AT THE COMEX FOR DELIVERY!!

In ounces AT THE COMEX, the OI is still represented by JUST OVER 1 BILLION oz i.e. 1.022 BILLION OZ TO BE EXACT or 145% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT MARCH MONTH/ THEY FILED AT THE COMEX: 4 NOTICE(S) FOR 20,000 OZ OF SILVER

IN SILVER,PRIOR TO TODAY, WE SET THE NEW COMEX RECORD OF OPEN INTEREST AT 243,411 CONTRACTS ON APRIL 9.2018. AND AGAIN THIS HAS BEEN SET WITH A LOW PRICE OF $16.51.

AND NOW WE RECORD FOR POSTERITY ANOTHER ALL TIME RECORD OPEN INTEREST AT THE COMEX OF 244,196 CONTRACTS ON AUGUST 22/2018 AND AGAIN WHEN THIS RECORD WAS SET, THE PRICE OF SILVER WAS $14.78 AND LOWER IN PRICE THAN PREVIOUS RECORDS.

ON THE DEMAND SIDE WE HAVE THE FOLLOWING:

HUGE AMOUNTS OF SILVER STANDING FOR DELIVERY (MARCH/2018: 27 MILLION OZ , APRIL/2018 : 2.485 MILLION OZ MAY: 36.285 MILLION OZ ; JUNE/2018 (5.420 MILLION OZ) , JULY 2018 FINAL AMOUNT STANDING: 30.370 MILLION OZ ) FOR AUGUST 6.065 MILLION OZ. , SEPT: A HUGE 39.505 MILLION OZ./ OCTOBER: 2,520,000 oz NOV AT 7.440 MILLION OZ./ DEC. AT 21.925 MILLION OZ JANUARY AT 5.825 MILLION OZ.AND FEB 2019: 2.955 MILLION OZ/ MARCH: 27.120 MILLION OZ/ APRIL AT 3.875 MILLION OZ/ AND NOW MAY: 18.355 MILLION OZ ..

HUGE RECORD OPEN INTEREST IN SILVER 243,411 CONTRACTS (OR 1.217 BILLION OZ/ SET APRIL 9/2018) AND NOW AUGUST 22/2018: 244,196 CONTRACTS, WITH A SILVER PRICE OF $14.78.

HUGE ANNUAL EFP’S ISSUANCE EQUAL TO 2.9 BILLION OZ OR 400% OF SILVER ANNUAL PRODUCTION/2017

RECORD SETTING EFP ISSUANCE FOR ANY MONTH IN SILVER; APRIL/2018/ 385.75 MILLION OZ/ AND THE SECOND HIGHEST RECORDED EFP ISSUANCE JUNE 2018 345.43 MILLION OZ

AND YET, WITH THE EXTREMELY HIGH EFP ISSUANCE, WE HAVE A CONTINUAL LOW PRICE OF SILVER DESPITE THE ABOVE HUGE DEMAND. TO ME THE ONLY ANSWER IS THAT WE HAVE SOVEREIGN (CHINA) WHO IS ENDEAVOURING TO GOBBLE UP ALL AVAILABLE PHYSICAL SILVER NO MATTER WHERE, EXACTLY WHAT J.P.MORGAN IS DOING. AND IT IS MY BELIEF THAT J.P.MORGAN IS HOLDING ITS SILVER FOR ITS BENEFICIAL OWNER..THE USA GOVERNMENT WHO IN TURN IS HOLDING THAT SILVER FOR CHINA.(FOR A SILVER LOAN REPAYMENT).

IN GOLD, THE OPEN INTEREST ROSE BY A STRONG SIZED 6360 CONTRACTS, TO 526,224 DESPITE THE TINY RISE IN THE COMEX GOLD PRICE/(AN INCREASE IN PRICE OF $1.50//YESTERDAY’S TRADING).

THE CME RELEASED THE DATA FOR EFP ISSUANCE AND IT TOTALED A GOOD SIZED 5454 CONTRACTS:

APRIL 0 CONTRACTS,JUNE: 5454 CONTRACTS DECEMBER: 0 CONTRACTS, JUNE 2020 0 CONTRACTS AND ALL OTHER MONTHS ZERO. The NEW COMEX OI for the gold complex rests at 524,355. ALSO REMEMBER THAT THERE WILL BE A DELAY IN THE ISSUANCE OF EFP’S. THE BANKERS REMOVE LONG POSITIONS OF COMEX GOLD IMMEDIATELY. THEN THEY ORCHESTRATE THEIR PRIVATE EFP DEAL WITH THE LONGS AND THAT COULD TAKE AN ADDITIONAL, 48 HRS SO WE GENERALLY DO NOT GET A MATCH WITH RESPECT TO DEPARTING COMEX LONGS AND NEW EFP LONG TRANSFERS. . EVEN THOUGH THE BANKERS ISSUED THESE MONSTROUS EFPS, THE OBLIGATION STILL RESTS WITH THE BANKERS TO SUPPLY METAL BUT IT TRANSFERS THE RISK TO A LONDON BANKER OBLIGATION AND NOT A NEW YORK COMEX OBLIGATION. LONGS RECEIVE A FIAT BONUS TOGETHER WITH A LONG LONDON FORWARD. THUS, BY THESE ACTIONS, THE BANKERS AT THE COMEX HAVE JUST STATED THAT THEY HAVE NO APPRECIABLE METAL!! THIS IS A MASSIVE FRAUD: THEY CANNOT SUPPLY ANY METAL TO OUR COMEX LONGS BUT THEY ARE QUITE WILLING TO SUPPLY MASSIVE NON BACKED GOLD (AND SILVER) PAPER KNOWING THAT THEY HAVE NO METAL TO SATISFY OUR LONGS. LONDON IS NOW SEVERELY BACKWARD IN BOTH GOLD AND SILVER AND WE ARE WITNESSING DELAYS IN ACTUAL DELIVERIES.

IN ESSENCE WE HAVE A VERY STRONG SIZED GAIN IN TOTAL CONTRACTS ON THE TWO EXCHANGES OF 11,814 CONTRACTS: 6330 OI CONTRACTS INCREASED AT THE COMEX AND 5454 EFP OI CONTRACTS WHICH NAVIGATED OVER TO LONDON. THUS TOTAL OI GAIN OF 11,814 CONTRACTS OR 1,181,400 OZ OR 36.75 TONNES. YESTERDAY WE HAD A TINY GAIN IN THE PRICE OF GOLD TO THE TUNE OF $1.50….AND WITH THAT TINY GAIN, WE HAD A HUGE GAIN OF 36.75 TONNES!!!!!!.??????

WITH RESPECT TO SPREADING: NOT TO NOTICEABLE WITH TODAY’S FALL IN PRICE

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES:

“AS YOU WILL SEE, THE CROOKS HAVE NOW SWITCHED TO GOLD AS THEY INCREASE THE OPEN INTEREST FOR THE SPREADERS. THE TOTAL COMEX GOLD OPEN INTEREST WILL RISE FROM NOW ON UNTIL ONE WEEK PRIOR TO FIRST DAY NOTICE AND THAT IS WHEN THEY START THEIR CRIMINAL LIQUIDATION.

HERE IS HOW THE CROOKS USED SPREADING AS WE ARE NO INTO THE NON ACTIVE DELIVERY MONTH OF MAY HEADING TOWARDS THE VERY ACTIVE DELIVERY MONTH OF JUNE.

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES, HERE IS THE BANKERS MODUS OPERANDI:

YOU WILL ALSO NOTICE THAT THE COMEX OPEN INTEREST IS STARTING TO RISE IN THIS NON ACTIVE MONTH OF MAY BUT SO IS THE OPEN INTEREST OF SPREADERS. THE OPEN INTEREST IN GOLD WILL CONTINUE TO RISE UNTIL ONE WEEK BEFORE FIRST DAY NOTICE OF AN UPCOMING ACTIVE DELIVERY MONTH (JUNE), AND THAT IS WHEN THE CROOKS SELL THEIR SPREAD POSITIONS BUT NOT AT THE SAME TIME OF THE DAY. THEY WILL USE THE SELL SIDE OF THE EQUATION TO CREATE THE CASCADE (ALONG WITH THEIR COLLUSIVE FRIENDS) AND THEN COVER ON THE BUY SIDE OF THE SPREAD SITUATION AT THE END OF THE DAY. THEY DO THIS TO AVOID POSITION LIMIT DETECTION. THE LIQUIDATION OF THE SPREADING FORMATION CONTINUES FOR EXACTLY ONE WEEK AND ENDS ON FIRST DAY NOTICE.”

ACCUMULATION OF EFP’S GOLD AT J.P. MORGAN’S HOUSE OF BRIBES: (EXCHANGE FOR PHYSICAL) FOR THE MONTH OF MAY : 70,859 CONTRACTS OR 7,085,900 OR 220.40 TONNES (12 TRADING DAYS AND THUS AVERAGING: 5904 EFP CONTRACTS PER TRADING DAY

TO GIVE YOU AN IDEA AS TO THE STRONG SIZE OF THESE EFP TRANSFERS : THIS MONTH IN 12 TRADING DAYS IN TONNES: 220.40 TONNES

TOTAL ANNUAL GOLD PRODUCTION, 2018, THROUGHOUT THE WORLD EX CHINA EX RUSSIA: 3555 TONNES

THUS EFP TRANSFERS REPRESENTS 220.40/3550 x 100% TONNES =6.20% OF GLOBAL ANNUAL PRODUCTION SO FAR IN DECEMBER ALONE.***

ACCUMULATION OF GOLD EFP’S YEAR 2019 TO DATE: 2035.95 TONNES

JANUARY 2019 TOTAL EFP ISSUANCE; 531.20 TONNES

FEB 2019 TOTAL EFP ISSUANCE: 344.36 TONNES

MARCH 2019 TOTAL EFP ISSUANCE: 497.16 TONNES

APRIL 2019 TOTAL ISSUANCE: 456.10 TONNES

WHAT IS ALARMING TO ME, ACCORDING TO OUR LONDON EXPERT ANDREW MAGUIRE IS THAT THESE EFP’S ARE BEING TRANSFERRED TO WHAT ARE CALLEDRIAL FORWARD CONTRACT OBLIGATIONS AND THESE CONTRACTS ARE LESS THAN 14 DAYS. ANYTHING GREATER THAN 14 DAYS, THESE MUST BE RECORDED AND SENT TO THE COMPTROLLER, GREAT BRITAIN TO MONITOR RISK TO THE BANKING SYSTEM. IF THIS IS INDEED TRUE, THEN THIS IS A MASSIVE CONSPIRACY TO DEFRAUD AS WE NOW WITNESS A MONSTROUS TOTAL EFP’S ISSUANCE AS IT HEADS INTO THE STRATOSPHERE.

Result: A STRONG SIZED INCREASE IN OI AT THE COMEX OF 6360 DESPITE THE TINY RISE IN PRICING ($1.50) THAT GOLD UNDERTOOK YESTERDAY) //.WE ALSO HAD A GOOD SIZED NUMBER OF COMEX LONG TRANSFERRING TO LONDON THROUGH THE EFP ROUTE: 5454 CONTRACTS AS THESE HAVE ALREADY BEEN NEGOTIATED AND CONFIRMED. THERE OBVIOUSLY DOES NOT SEEM TO BE MUCH PHYSICAL GOLD AT THE COMEX. I GUESS IT EXPLAINS THE HUGE ISSUANCE OF EFP’S…THERE IS HARDLY ANY GOLD PRESENT AT THE GOLD COMEX FOR DELIVERY PURPOSES. IF YOU TAKE INTO ACCOUNT THE 5454 EFP CONTRACTS ISSUED, WE HAD A STRONG SIZED GAIN OF 11,814 CONTRACTS IN TOTAL OPEN INTEREST ON THE TWO EXCHANGES:

5454 CONTRACTS MOVE TO LONDON AND 6360 CONTRACTS INCREASED AT THE COMEX. (IN TONNES, THE GAIN IN TOTAL OI EQUATES TO 36.75 TONNES). ..AND THIS HUMONGOUS DEMAND OCCURRED WITH A TINY RISE IN PRICE OF $1.50 IN YESTERDAY’S TRADING AT THE COMEX. WE NO DOUBT HAD A STRONG PRESENCE OF SPREADING TODAY.

we had: 55 notice(s) filed upon for 5500 oz of gold at the comex.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

With respect to our two criminal funds, the GLD and the SLV:

GLD...

WITH GOLD DOWN $11.10 TODAY

WE HAVE A HUGE WITHDRAWAL OF 3.23 TONNES OF GOLD FROM THE GLD.

STRANGE THIS IS THE EXACT DEPOSIT AMOUNT PUT INTO THE GLD ON MAY 14//.

INVENTORY RESTS AT 733.23 TONNES

TO ALL INVESTORS THINKING OF BUYING GOLD THROUGH THE GLD ROUTE: YOU ARE MAKING A TERRIBLE MISTAKE AS THE CROOKS ARE USING WHATEVER GOLD COMES IN TO ATTACK BY SELLING THAT GOLD. IT SURE SEEMS TO ME THAT THE GOLD OBLIGATIONS AT THE GLD EXCEED THEIR INVENTORy

SLV/

WITH SILVER DOWN 26 CENTS TODAY:

A BIG CHANGE IN SILVER INVENTORY AT THE SLV//

A WITHDRAWAL OF 1.031 MILLION OZ FROM THE SLV.

/INVENTORY RESTS AT 315.551 MILLION OZ.

end

First, here is an outline of what will be discussed tonight:

1. Today, we had the open interest in SILVER ROSE BY A TINY SIZED 530 CONTRACTS from 203,788 UPTO 204,318 AND CLOSER TO THE NEW COMEX RECORD SET LAST IN AUG.2018 AT 244,196 WITH A SILVER PRICE OF $14.78/(AUGUST 22/2018)..THE PREVIOUS RECORD WAS SET ON APRIL 9/2018 AT 243,411 OPEN INTEREST CONTRACTS WITH THE SILVER PRICE AT THAT DAY: $16.53). AND PREVIOUS TO THAT, THE RECORD WAS ESTABLISHED AT: 234,787 CONTRACTS, SET ON APRIL 21.2017 OVER 1 1/3 YEARS AGO. THE PRICE OF SILVER ON THAT DAY: $17.89. AS YOU CAN SEE, WE HAVE RECORD HIGH OPEN INTERESTS IN SILVER ACCOMPANIED BY A CONTINUAL LOWER PRICE WHEN THAT RECORD WAS SET…..THE SPREADERS HAVE STOPPED THEIR LIQUIDATION IN SILVER BUT HAVE NOW MORPHED INTO GOLD..

EFP ISSUANCE:

OUR CUSTOMARY MIGRATION OF COMEX LONGS CONTINUE TO MORPH INTO LONDON FORWARDS AS OUR BANKERS USED THEIR EMERGENCY PROCEDURE TO ISSUE:

0 CONTRACTS FOR APRIL., 0 FOR MAY, FOR JUNE 0 CONTRACTS AND JULY: 263 CONTRACTS AND ALL OTHER MONTHS: ZERO. TOTAL EFP ISSUANCE: 263 CONTRACTS. EFP’S GIVE OUR COMEX LONGS A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. IF WE TAKE THE OI GAIN AT THE COMEX OF 637 CONTRACTS TO THE 263 OI TRANSFERRED TO LONDON THROUGH EFP’S, WE OBTAIN A SMALL GAIN OF 793 OPEN INTEREST CONTRACTS. THUS IN OUNCES, THE GAIN ON THE TWO EXCHANGES: 4.5 MILLION OZ!!! AND YET WE ALSO HAVE A STRONG DEMAND FOR PHYSICAL AS WE WITNESSED A FINAL STANDING OF GREATER THAN 30 MILLION OZ FOR JULY, A STRONG 7.475 MILLION OZ FOR AUGUST.. A HUGE 39.505 MILLION OZ STANDING FOR SILVER IN SEPTEMBER… OVER 2 million OZ STANDING FOR THE NON ACTIVE MONTH OF OCTOBER., 7.440 MILLION OZ FINALLY STANDING IN NOVEMBER. 21.925 MILLION OZ STANDING IN DECEMBER , 5.845 MILLION OZ STANDING IN JANUARY. 2.955 MILLION OZ STANDING IN FEBRUARY, 27.120 MILLION OZ FOR MARCH., 3.875 MILLION OZ FOR APRIL AND NOW 18.355 MILLION OZ FOR MAY

RESULT: A SMALL SIZED INCREASE IN SILVER OI AT THE COMEX DESPITE THE TINY 2 CENT GAIN IN PRICING THAT SILVER UNDERTOOK IN PRICING// YESTERDAY. WE ALSO HAD A SMALL SIZED 263 EFP’S ISSUED TRANSFERRING COMEX LONGS OVER TO LONDON. TOGETHER WITH THE STRONG SIZED AMOUNT OF SILVER OUNCES STANDING FOR THIS MONTH, DEMAND FOR PHYSICAL SILVER CONTINUES TO INTENSIFY AS WE WITNESS SEVERE BACKWARDATION IN SILVER IN LONDON.

BOTH THE SILVER COMEX AND THE GOLD COMEX ARE IN STRESS AS THE BANKERS SCOUR THE BOWELS OF THE EXCHANGE FOR METAL

(report Harvey)

.

2.a) The Shanghai and London gold fix report

(Harvey)

2 b) Gold/silver trading overnight Europe, Goldcore

(Mark O’Byrne/zerohedge

and in NY: Bloomberg

3. ASIAN AFFAIRS

i)THURSDAY MORNING/ WEDNESDAY NIGHT:

SHANGHAI CLOSED UP 17,03 POINTS OR 0.58% //Hang Sang CLOSED UP 6.36 POINTS OR 0.02% /The Nikkei closed DOWN 125.58 POINTS OR 0.59%//Australia’s all ordinaires CLOSED UP .74%

/Chinese yuan (ONSHORE) closed DOWN at 6.8884 /Oil UP to 61.64 dollars per barrel for WTI and 71.08 for Brent. Stocks in Europe OPENED GREEN// ONSHORE YUAN CLOSED DOWN // LAST AT 6.8884 AGAINST THE DOLLAR. OFFSHORE YUAN CLOSED DOWN ON THE DOLLAR AT 6.9072 TRADE TALKS STILL ON//TRUMP INITIATES A NEW 25% TARIFFS FRIDAY/MAY 10/MAJOR PROBLEMS AT HUAWEI /CFO ARRESTED : /ONSHORE YUAN TRADING ABOVE LEVEL OF OFFSHORE YUAN/ONSHORE YUAN TRADING WEAKER AGAINST USA DOLLAR/OFFSHORE YUAN TRADING WEAKER AGAINST THE DOLLAR /TRADE DEAL NOW DEAD..TRUMP RAISED RATES TO 25%

3A//NORTH KOREA/ SOUTH KOREA

i)NORTH KOREA

b) REPORT ON JAPAN

3 China/Chinese affairs

i)China/Huawei

Huawei responds to the tech ban and in a concession to Trump the company states that it is willing “to engage to ensure the product safety.” It seems that Trump was right that Huawei was using its products for spying purposes.

( zerohedge)

ii)CHINA/CANADA

NOT GOOD!! Two Canadians held by Beijing in December are now facing the death penalty as they are being charged on espionage. No doubt that these are related to the Meng (CFO Huawei) arrest.

( zerohedge)

iii)Serious stuff going on in Washington with their nuclear option against Huawei. Huawei has offered to open up its devices in order for the USA to feel secure form spying. The USA counters by putting Huawei on the “Entity list” which would ban USA corporations from dealing with the company. Also, the timing for China seems odd that on the day that the USA puts Huawei on the “entity list” two Canadians were arrested for espionage and could face the death sentence. I guess travel to China is now out of the question.

(zerohedge)

4/EUROPEAN AFFAIRS

i)FRANCE

An excellent commentary on the state of affairs in France which has the highest social spending per GDP in the world at 31%. The social spending in totally non productive. France incomes are falling below even America’s poorest states. I guess this is the reason for the Yellow Vest Movement as they feel the pain inside France

( Ryan McMaken/ Mises)

ii)Now that the USA has finished issuing fines to our favourite bankers, the EU has now started as they fined 5 banks 1.2 billion dollars in a FX cartel case

(courtesy zerohedge)

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

a)SAUDI ARABIA/IRAN/YEMEN

The Saudis now claim the Iran has carried out the Aramco Pipeline attack in Saudi Arabia using drones. We now have footage and it is extensive.

The USA are not happy campers on this issue. Remember that the USA carrier Lincoln will be entering the Gulf shortly.

(courtesy zerohedge)

6. GLOBAL ISSUES

THE GLOBE

Maersk, the largest shipping company in the world sees a significant slowdown in business activity as the third largest transshipment port in the Mediterranean, located on the island of Malta.

Maersk is now going to shift operations from Malta to other African ports due to the slowdown

( zerohedge)

7. OIL ISSUES

A mystery tanker violates USA sanctions by unloading oil to China

(courtesy zerohedge)

8 EMERGING MARKET ISSUES

VENEZUELA

Officially the uSA suspends all passenger and cargo flights to Venezuela

(courtesy zerohedge)

9. PHYSICAL MARKETS

10. USA stories which will influence the price of gold/silver)

MARKET TRADING//

ii)Market data

ii)USA ECONOMIC/GENERAL STORIES

a)This is the continuing story by Brandon Smith on how the USA hegemony will end. We are witnessing the globalists in their attack on the populist movement. There is no question that the USA cannot win in their trade battle with China. You will recall Alasdair Macleod prove that unless the uSA citizens become savers, then trade deficits will continue despite the trade war. The following article is important and we must be cognizant of what might happen: China and the rest of the world will liquidate their vast USA treasuries sending the USA into a hyperinflation panic. The Globalist goal: one government, one currency..and the USA must go.

a must read…

(courtesy Brandon Smith/AltMarket.com)

b)The tariffs are killing USA farmers.

(courtesy Mac Slavo)

c)Too much rain has killed off much the corn planting

(courtesy michael Snyder)

SWAMP STORIES

What a riot: there is now a dispute as to whether it was Comey or Brennan who pushed the Steele dossier: i.e. to be included into the intelligence community assessment

( zerohedge)

E)SWAMP STORIES/MAJOR STORIES//THE KING REPORT

Let us head over to the comex:

THE TOTAL COMEX GOLD OPEN INTEREST ROSE BY A VERY STRONG SIZED 6360 CONTRACTS TO A LEVEL OF 526,224 DESPITE THE TINY RISE IN THE PRICE OF GOLD ($1.50) IN YESTERDAY’S // COMEX TRADING)

WE ARE NOW IN THE NON ACTIVE DELIVERY MONTH OF MAY.. THE CME REPORTS THAT THE BANKERS ISSUED A GOOD SIZED TRANSFER THROUGH THE EFP ROUTE AS THESE LONGS RECEIVED A DELIVERABLE LONDON FORWARD TOGETHER WITH A FIAT BONUS., THAT IS 5454 EFP CONTRACTS WERE ISSUED:

0 FOR JUNE ’19: 5454 CONTRACTS , DEC; 0 CONTRACTS: 0 AND ZERO FOR ALL OTHER MONTHS:

TOTAL EFP ISSUANCE: 5454 CONTRACTS.

THE OBLIGATION STILL RESTS WITH THE BANKERS ON THESE TRANSFERS. ALSO REMEMBER THAT THERE IS NO DOUBT A HUGE DELAY IN THE ISSUANCE OF EFP’S AND IT PROBABLY TAKES AT LEAST 48 HRS AFTER LONGS GIVE UP THEIR COMEX CONTRACTS FOR THEM TO RECEIVE THEIR EFP’S AS THEY ARE NEGOTIATING THIS CONTRACT WITH THE BANKS FOR A FIAT BONUS PLUS THEIR TRANSFER TO A LONDON BASED FORWARD.

ON A NET BASIS IN OPEN INTEREST WE GAINED THE FOLLOWING TODAY ON OUR TWO EXCHANGES: 11,814 TOTAL CONTRACTS IN THAT 5454 LONGS WERE TRANSFERRED AS FORWARDS TO LONDON AND WE GAINED A VERY STRONG SIZED 6360 COMEX CONTRACTS.

NET GAIN ON THE TWO EXCHANGES : 11,814 contracts OR 1,181,400 OZ OR 39.65 TONNES.

We are now in the NON active contract month of MAY and here the open interest stands at 123 contracts, having GAINED 2 contracts. We had 1 notices served yesterday so we gained 3 contracts or an additional 300 oz will stand as they guys refused to morph into a London based forward as well as negating a fiat bonus

The next contract month after May is June and here the open interest FELL by 1215 contracts DOWN to 279,612. July GAINED 2 contracts to stand at 70. After July the next active month is August and here the OI rose by 5241 contracts up to 159,287 contracts.

TODAY’S NOTICES FILED:

WE HAD 55 NOTICE FILED TODAY AT THE COMEX FOR 5500 OZ. (0.1710 TONNES)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for the wild silver comex results.

Total COMEX silver OI ROSE BY A SMALL SIZED 530 CONTRACTS FROM 203,788 UP TO 204,318 (AND CLOSER TO THE NEW RECORD OI FOR SILVER SET ON AUGUST 22.2018. THE PREVIOUS RECORD WAS SET APRIL 9.2018/ 243,411 CONTRACTS) AND TODAY’S TINY OI COMEX GAIN OCCURRED WITH A 2 CENT GAIN IN PRICING.//YESTERDAY.

WE ARE NOW INTO THE ACTIVE DELIVERY MONTH OF MAY. HERE WE HAVE 298 OPEN INTEREST STAND SO FAR FOR A GAIN OF 3 CONTRACTS. WE HAD 0 NOTICES SERVED UPON YESTERDAY SO IN ESSENCE WE GAINED ANOTHER 3 CONTRACT OR AN ADDITIONAL 15,000 OZ WILL STAND FOR DELIVERY AS THESE GUYS REFUSED TO MORPH INTO LONDON BASED FORWARDS AND AS WELL THEY NEGATING A FIAT BONUS. SILVER MUST BE SCARCE AT THE COMEX. QUEUE JUMPING RETURNS WITH A VENGEANCE. WE HAVE NOW SURPASSED THE INITIAL AMOUNT STANDING WHICH OCCURRED ON APRIL 30.2019

THE NEXT MONTH AFTER MAY IS THE NON ACTIVE MONTH OF JUNE. HERE THIS MONTH LOST 16 CONTRACTS DOWN TO 717. AFTER JUNE IS THE ACTIVE MONTH OF JULY, (THE SECOND LARGEST DELIVERY MONTH OF THE YEAR FOR SILVER) AND HERE THIS MONTH GAINED 103 CONTRACTS UP TO 154,050 CONTRACTS. THE NEXT ACTIVE MONTH AFTER JULY FOR SILVER IS SEPTEMBER AND HERE THE OI ROSE BY 292 DOWN TO 19,054 CONTRACTS.

TODAY’S NUMBER OF NOTICES FILED:

We, today, had 4 notice(s) filed for 20,000 OZ for the MARCH, 2019 COMEX contract for silver

Trading Volumes on the COMEX TODAY: 142,269 CONTRACTS

CONFIRMED COMEX VOL. FOR YESTERDAY: 273,292

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for silver

AND NOW THE DELIVERY MONTH OF APRIL

INITIAL standings/SILVER

IN TOTAL CONTRAST TO GOLD, HUGE ACTIVITY IN SILVER TODAY.

MAY 16 2019

Silver Ounces

Withdrawals from Dealers Inventory NIL oz

Withdrawals from Customer Inventory

1,073,733.093 oz

BRINS

CNT

BNS

Deposits to the Dealer Inventory

NIL oz

Deposits to the Customer Inventory

NIL oz

No of oz served today (contracts)

4

CONTRACT(S)

(20,000 OZ)

No of oz to be served (notices)

294 contracts

1,470,000 oz)

Total monthly oz silver served (contracts) 3377 contracts

16,885,000 oz)

Total accumulative withdrawal of silver from the Dealers inventory this month NIL oz

Total accumulative withdrawal of silver from the Customer inventory this month

**

we had 0 inventory movement at the dealer side of things

total dealer deposits: NIL oz

total dealer withdrawals: nil oz

we had 0 deposits into the customer account

into JPMorgan: nil

*** JPMorgan for most of 2017 and in 2018 has adding to its inventory almost every single day.

JPMorgan now has 149.469 million oz of total silver inventory or 48.80% of all official comex silver. (149 million/307 million)

into EVERYBODY ELSE: NIL OZ

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

News

Gold Settles With a Modest Gain, Remains Pinned Below

Gold Steadies as Stocks Retreat; Trade Uncertainty Persists

Weak U.s. Retail Sales, Industrial Output Highlight Slowing Economy

U.S., European Shares Strengthen After Trump Auto-Tariff Delay

Us Orders ‘non-emergency Government Employees’ to Leave Iraq

Commentary

3 Charts Warning Investors To Rebalance Portfolios

Global Trade Collapsing To Depression Levels

Calls For 120,000 Troops To Counter Iran

Iran’s Military “On The Cusp Of War” As US Allies Pull Troops From Iraq

Central Banks Are Buying Gold At The Fastest Pace In Six Years

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

GATA STORIES WITH RESPECT TO GOLD/PRECIOUS METALS.

PART II of Chris Powell’s important interview on gold price suppression

(courtesy Chris Powell/GATA)

If they wise up, gold investors can beat price suppression, GATA secretary says

Submitted by cpowell on Wed, 2019-05-15 20:57. Section: Daily Dispatches

5:03p ET Wednesday, May 15, 2019

Dear Friend of GATA and Gold:

In the second part of his recent interview with GoldCore’s Mark O’Byrne, your secretary/treasurer discusses:

— The counterintuitive movements in the gold price that are caused by surreptitious government interventions.

— The silly explanations for these counterintuitive movements that are contrived by market analysts.

— The ability of gold investors themselves to defeat price suppression by wising up and avoiding “paper gold” and keeping their metal outside the banking system, where derivatives turn it into imaginary supply that is used to smash gold prices down.

— The failure of the governments of developing countries to oppose the market manipulations by which the developed countries exploit them.

— GATA’s primary objectives, which are limited, transparent, and accountable government and fair dealing among nations.

The interview is 32 minutes long and can be viewed at GoldCore here:

https://news.goldcore.com/us/gold-blog/video-we-have-the-power-to-end-go…

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

END

iii) Other Physical stories

LAWRIE WILLIAMS: Are GLD withdrawals a threat to the gold price?

So far this year a total of 62 tonnes of gold – worth nearly $US2.6 billion at current prices – has been taken out of the world’s largest gold ETF, SPDR gold shares (GLD), despie a couple of months when gold was added into the ETF. Yesterday there was a withdrawal of 3.2 tonnes, but this may have been ultra short term profit taking as there was a deposit of a similar amount a couple of working days prior and the gold price jumped in between!