Wednesday, May 15, 2019 7:55:05 PM

Data Smooth

Good Morning Good Evening

Welcome to ~*~Mining & Metals Du Jour~*~Graveyard Shift~*~

On the show tonight: Great Data & News by Harvey Organ,the Top 10 Lowest Cost Gold Mines On The Globe,Headlines From The National Mining Association the Official Voice of U.S. Mining. and a Good story about lost treasure by Jenny Kile Lost Treasure of the Kinzua Bridge

Hello everybody I'm J:D your host tonight Thanks for being with us.

Hope Your Having a nice evening

EnJoy the show

OK...Onward to the data

MMGYS

Thank you

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

MAY 15/GOLD UP $1.50 TO $1297.05//SILVER UP 2 CENTS TO $14,81//USA DELAYS TARIFFS ON EU CARS SENDS DOW HIGHER BY 116 POINTS//WAR DRUMS BEATING LOUDER AND LOUDER AS THE USA CARRIER ENTERS THE GULF//TURKEY PUTS A TAX ON FINANCIAL TRANSACTIONS IN A MOVE TO INCREASE DOLLAR RESERVES// USA RETAIL SALES AND INDUSTRIAL PRODUCTION DOWN HARD LAST MONTH..LIKEWISE FOR CHINA//HUGE NUMBER OF SWAMP STORIES FOR YOU TONIGHT//

May 15, 2019 · by harveyorgan · in Uncategorized · Leave a comment

GOLD: $1297.05 UP $1.50 (COMEX TO COMEX CLOSING)

Silver: $14.81 UP 2 CENTS (COMEX TO COMEX CLOSING)

Closing access prices:

Gold : 1296.70

silver: $14.81

JPMorgan has been receiving gold with reckless abandon and sometimes supplying (stopping)

today RECEIVING 1/1

EXCHANGE: COMEX

CONTRACT: MAY 2019 COMEX 100 GOLD FUTURES

SETTLEMENT: 1,294.700000000 USD

INTENT DATE: 05/14/2019 DELIVERY DATE: 05/16/2019

FIRM ORG FIRM NAME ISSUED STOPPED

____________________________________________________________________________________________

661 C JP MORGAN 1

737 C ADVANTAGE 1

____________________________________________________________________________________________

TOTAL: 1 1

MONTH TO DATE: 233

NUMBER OF NOTICES FILED TODAY FOR MAY CONTRACT: 1 NOTICE(S) FOR 100 OZ (0.003215 tonnes)

TOTAL NUMBER OF NOTICES FILED SO FAR: 233 NOTICES FOR 23300 OZ (.7247 TONNES)

SILVER

FOR MAY

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

0 NOTICE(S) FILED TODAY FOR NIL OZ/

total number of notices filed so far this month: 3373 for 16,865,000 oz

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

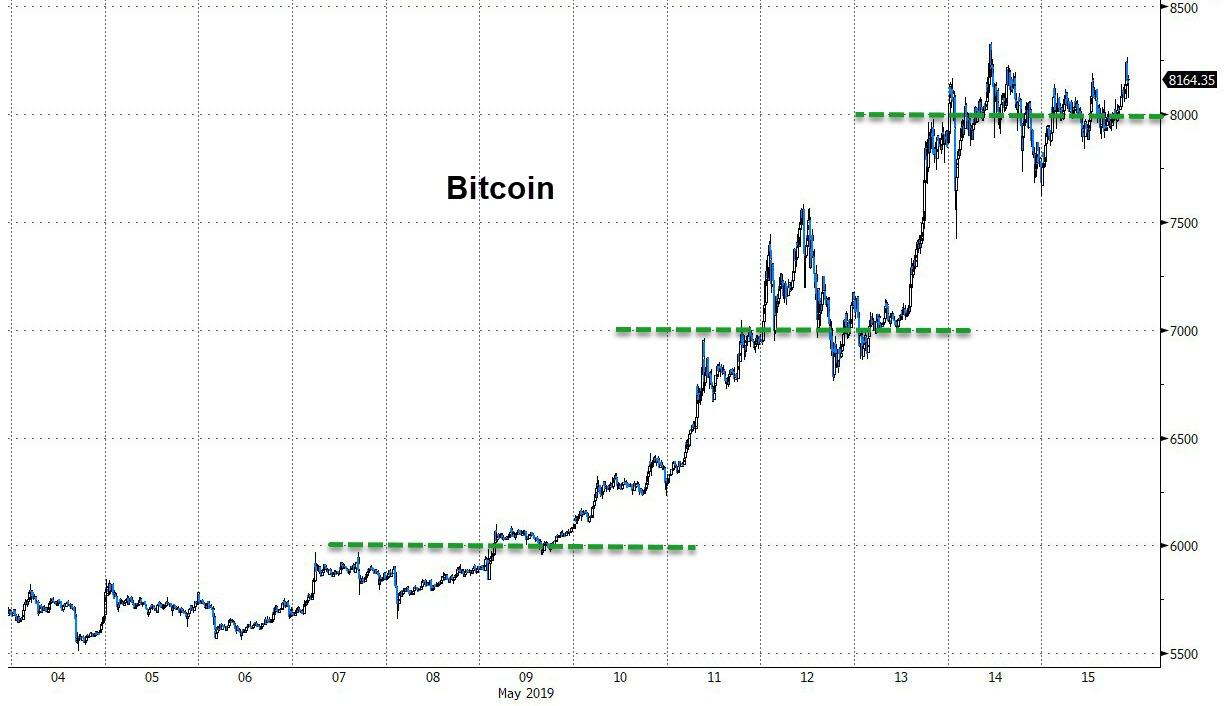

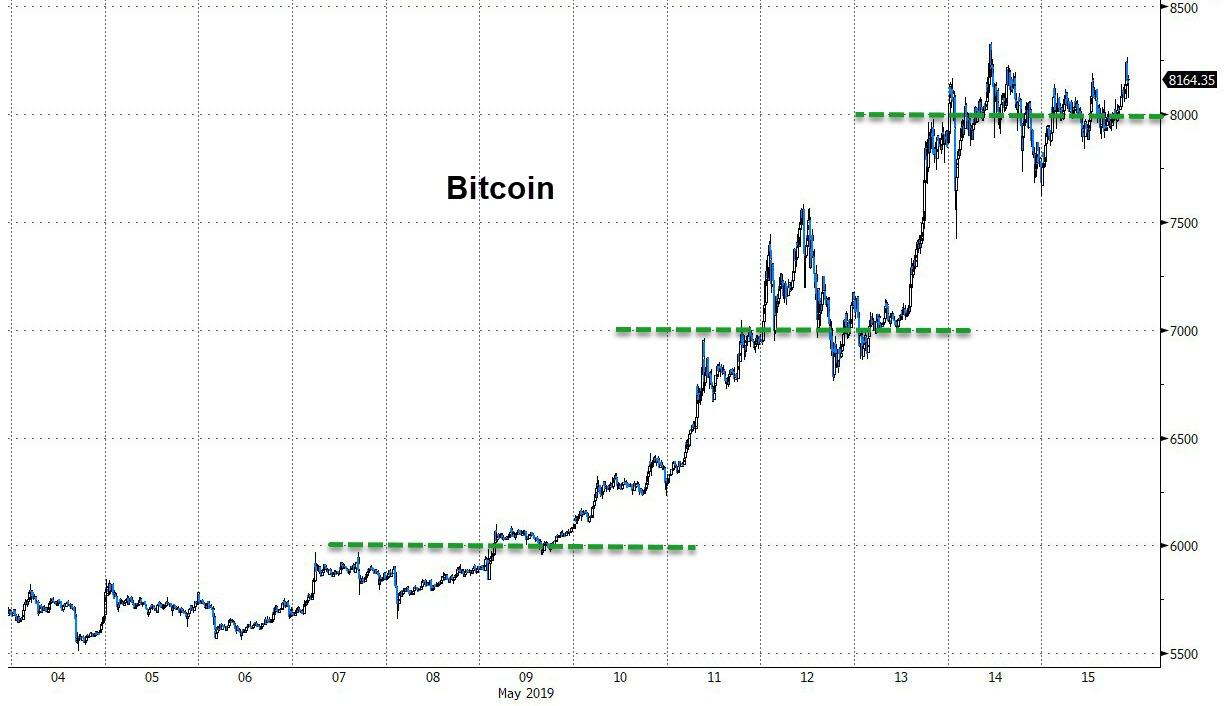

Bitcoin: OPENING MORNING TRADE :$7946 DOWN $9

Bitcoin: FINAL EVENING TRADE: $7946 UP $160.00

end

XXXX

Let us have a look at the data for today

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

IN SILVER THE COMEX OI FELL BY A TINY SIZED 102 CONTRACTS FROM 203,890 DOWN TO 203,788 WITH YESTERDAY’S 2 CENT GAIN IN SILVER PRICING AT THE COMEX. ,LIQUIDATION OF THE SPREADERS HAVE STOPPED FOR SILVER BUT IT NOW IN FULL FORCE FOR GOLD. TODAY WE ARRIVED CLOSER TO AUGUST’S 2018 RECORD SETTING OPEN INTEREST OF 244,196 CONTRACTS.

WE HAVE ALSO WITNESSED A LARGE AMOUNT OF PHYSICAL METAL STAND FOR COMEX DELIVERY AS WELL WE ARE WITNESSING CONSIDERABLE LONGS PACKING THEIR BAGS AND MIGRATING OVER TO LONDON IN GREATER NUMBERS IN THE FORM OF EFP’S. WE WERE NOTIFIED THAT WE HAD A SMALL SIZED NUMBER OF COMEX LONGS TRANSFERRING THEIR CONTRACTS TO LONDON THROUGH THE EFP:

0 FOR MAY, 0 FOR JUNE, 435 FOR JULY AND ZERO FOR ALL OTHER MONTHS AND THEREFORE TOTAL ISSUANCE 435 CONTRACTS. WITH THE TRANSFER OF 435 CONTRACTS, WHAT THE CME IS STATING IS THAT THERE IS NO SILVER (OR GOLD) TO BE DELIVERED UPON AT THE COMEX AS THEY MUST EXPORT THEIR OBLIGATION TO LONDON. ALSO KEEP IN MIND THAT THERE CAN BE A DELAY OF 24-48 HRS IN THE ISSUING OF EFP’S. THE 435 EFP CONTRACTS TRANSLATES INTO 1.665 MILLION OZ ACCOMPANYING:

1.THE 2 CENT GAIN IN SILVER PRICE AT THE COMEX AND

2. THE STRONG AMOUNT OF SILVER OUNCES WHICH STOOD FOR DELIVERY IN THE LAST NINE MONTHS:

JUNE/2018. (5.420 MILLION OZ);

FOR JULY: 30.370 MILLION OZ

FOR AUG., 6.065 MILLION OZ

FOR SEPT. 39.505 MILLION OZ S

FOR OCT.2.525 MILLION OZ.

FOR NOV: A HUGE 7.440 MILLION OZ STANDING AND

21.925 MILLION OZ FINALLY STAND FOR DECEMBER.

5.845 MILLION OZ STAND IN JANUARY.

2.955 MILLION OZ STANDING FOR FEBRUARY.:

27.120 MILLION OZ STANDING IN MARCH.

3.875 MILLION OZ STANDING FOR SILVER IN APRIL.

AND NOW 18.335 MILLION OZ STANDING FOR SILVER IN MAY.

ACCUMULATION FOR EFP’S/SILVER/J.P.MORGAN’S HOUSE OF BRIBES, / STARTING FROM FIRST DAY NOTICE/FOR MONTH OF MAY:

13,303 CONTRACTS (FOR 11 TRADING DAYS TOTAL 13,303 CONTRACTS) OR 66,51 MILLION OZ: (AVERAGE PER DAY: 1209 CONTRACTS OR 6.045 MILLION OZ/DAY)

TO GIVE YOU AN IDEA AS TO THE HUGE SUPPLY THIS MONTH IN SILVER: SO FAR THIS MONTH OF MAY: 66.51 MILLION PAPER OZ HAVE MORPHED OVER TO LONDON. THIS REPRESENTS AROUND 9.19% OF ANNUAL GLOBAL PRODUCTION (EX CHINA EX RUSSIA)* JUNE’S 345.43 MILLION OZ IS THE SECOND HIGHEST RECORDED ISSUANCE OF EFP’S AND IT FOLLOWED THE RECORD SET IN APRIL 2018 OF 385.75 MILLION OZ.

ACCUMULATION IN YEAR 2019 TO DATE SILVER EFP’S: 807.62 MILLION OZ.

JANUARY 2019 EFP TOTALS: 217.455. MILLION OZ

FEB 2019 TOTALS: 147.4 MILLION OZ/

MARCH 2019 TOTAL EFP ISSUANCE: 207.835 MILLION OZ

APRIL 2019 TOTAL EFP ISSUANCE: 182.87 MILLION OZ.

RESULT: WE HAD A TINY SIZED DECREASE IN COMEX OI SILVER COMEX CONTRACTS OF 102 WITH THE TINY 2 CENT GAIN IN SILVER PRICING AT THE COMEX /YESTERDAY... THE CME NOTIFIED US THAT WE HAD A SMALL SIZED EFP ISSUANCE OF 435 CONTRACTS WHICH EXITED OUT OF THE SILVER COMEX AND TRANSFERRED THEIR OI TO LONDON AS FORWARDS. SPECULATORS CONTINUED THEIR INTEREST IN ATTACKING THE SILVER COMEX FOR PHYSICAL SILVER (SEE COMEX DATA) . OUR BANKERS RESUMED THEIR LIQUIDATION OF THE SPREAD TRADES TODAY.

TODAY WE GAINED A SMALL SIZED: 333 TOTAL OI CONTRACTS ON THE TWO EXCHANGES:

i.e 435 OPEN INTEREST CONTRACTS HEADED FOR LONDON (EFP’s) TOGETHER WITH DECREASE OF 102 OI COMEX CONTRACTS. AND ALL OF THIS DEMAND HAPPENED WITH A 2 CENT GAIN IN PRICE OF SILVER AND A CLOSING PRICE OF $14.79 WITH RESPECT TO YESTERDAY’S TRADING. YET WE STILL HAVE A STRONG AMOUNT OF SILVER STANDING AT THE COMEX FOR DELIVERY!!

In ounces AT THE COMEX, the OI is still represented by JUST OVER 1 BILLION oz i.e. 1.020 BILLION OZ TO BE EXACT or 145% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT MARCH MONTH/ THEY FILED AT THE COMEX: 0 NOTICE(S) FOR NIL OZ OF SILVER

IN SILVER,PRIOR TO TODAY, WE SET THE NEW COMEX RECORD OF OPEN INTEREST AT 243,411 CONTRACTS ON APRIL 9.2018. AND AGAIN THIS HAS BEEN SET WITH A LOW PRICE OF $16.51.

AND NOW WE RECORD FOR POSTERITY ANOTHER ALL TIME RECORD OPEN INTEREST AT THE COMEX OF 244,196 CONTRACTS ON AUGUST 22/2018 AND AGAIN WHEN THIS RECORD WAS SET, THE PRICE OF SILVER WAS $14.78 AND LOWER IN PRICE THAN PREVIOUS RECORDS.

ON THE DEMAND SIDE WE HAVE THE FOLLOWING:

HUGE AMOUNTS OF SILVER STANDING FOR DELIVERY (MARCH/2018: 27 MILLION OZ , APRIL/2018 : 2.485 MILLION OZ MAY: 36.285 MILLION OZ ; JUNE/2018 (5.420 MILLION OZ) , JULY 2018 FINAL AMOUNT STANDING: 30.370 MILLION OZ ) FOR AUGUST 6.065 MILLION OZ. , SEPT: A HUGE 39.505 MILLION OZ./ OCTOBER: 2,520,000 oz NOV AT 7.440 MILLION OZ./ DEC. AT 21.925 MILLION OZ JANUARY AT 5.825 MILLION OZ.AND FEB 2019: 2.955 MILLION OZ/ MARCH: 27.120 MILLION OZ/ APRIL AT 3.875 MILLION OZ/ AND NOW MAY: 18.335 MILLION OZ ..

HUGE RECORD OPEN INTEREST IN SILVER 243,411 CONTRACTS (OR 1.217 BILLION OZ/ SET APRIL 9/2018) AND NOW AUGUST 22/2018: 244,196 CONTRACTS, WITH A SILVER PRICE OF $14.78.

HUGE ANNUAL EFP’S ISSUANCE EQUAL TO 2.9 BILLION OZ OR 400% OF SILVER ANNUAL PRODUCTION/2017

RECORD SETTING EFP ISSUANCE FOR ANY MONTH IN SILVER; APRIL/2018/ 385.75 MILLION OZ/ AND THE SECOND HIGHEST RECORDED EFP ISSUANCE JUNE 2018 345.43 MILLION OZ

AND YET, WITH THE EXTREMELY HIGH EFP ISSUANCE, WE HAVE A CONTINUAL LOW PRICE OF SILVER DESPITE THE ABOVE HUGE DEMAND. TO ME THE ONLY ANSWER IS THAT WE HAVE SOVEREIGN (CHINA) WHO IS ENDEAVOURING TO GOBBLE UP ALL AVAILABLE PHYSICAL SILVER NO MATTER WHERE, EXACTLY WHAT J.P.MORGAN IS DOING. AND IT IS MY BELIEF THAT J.P.MORGAN IS HOLDING ITS SILVER FOR ITS BENEFICIAL OWNER..THE USA GOVERNMENT WHO IN TURN IS HOLDING THAT SILVER FOR CHINA.(FOR A SILVER LOAN REPAYMENT).

IN GOLD, THE OPEN INTEREST FELL BY A CONSIDERABLE SIZED 2490 CONTRACTS, TO 517,995 WITH THE FALL IN THE COMEX GOLD PRICE/(AN INCREASE IN PRICE OF $5,45//YESTERDAY’S TRADING).

THE CME RELEASED THE DATA FOR EFP ISSUANCE AND IT TOTALED A GOOD SIZED 5436 CONTRACTS:

APRIL 0 CONTRACTS,JUNE: 5436 CONTRACTS DECEMBER: 0 CONTRACTS, JUNE 2020 0 CONTRACTS AND ALL OTHER MONTHS ZERO. The NEW COMEX OI for the gold complex rests at 517,995. ALSO REMEMBER THAT THERE WILL BE A DELAY IN THE ISSUANCE OF EFP’S. THE BANKERS REMOVE LONG POSITIONS OF COMEX GOLD IMMEDIATELY. THEN THEY ORCHESTRATE THEIR PRIVATE EFP DEAL WITH THE LONGS AND THAT COULD TAKE AN ADDITIONAL, 48 HRS SO WE GENERALLY DO NOT GET A MATCH WITH RESPECT TO DEPARTING COMEX LONGS AND NEW EFP LONG TRANSFERS. . EVEN THOUGH THE BANKERS ISSUED THESE MONSTROUS EFPS, THE OBLIGATION STILL RESTS WITH THE BANKERS TO SUPPLY METAL BUT IT TRANSFERS THE RISK TO A LONDON BANKER OBLIGATION AND NOT A NEW YORK COMEX OBLIGATION. LONGS RECEIVE A FIAT BONUS TOGETHER WITH A LONG LONDON FORWARD. THUS, BY THESE ACTIONS, THE BANKERS AT THE COMEX HAVE JUST STATED THAT THEY HAVE NO APPRECIABLE METAL!! THIS IS A MASSIVE FRAUD: THEY CANNOT SUPPLY ANY METAL TO OUR COMEX LONGS BUT THEY ARE QUITE WILLING TO SUPPLY MASSIVE NON BACKED GOLD (AND SILVER) PAPER KNOWING THAT THEY HAVE NO METAL TO SATISFY OUR LONGS. LONDON IS NOW SEVERELY BACKWARD IN BOTH GOLD AND SILVER AND WE ARE WITNESSING DELAYS IN ACTUAL DELIVERIES.

IN ESSENCE WE HAVE A FAIR SIZED GAIN IN TOTAL CONTRACTS ON THE TWO EXCHANGES OF 2946 CONTRACTS: 2490 OI CONTRACTS DECREASED AT THE COMEX AND 5436 EFP OI CONTRACTS WHICH NAVIGATED OVER TO LONDON. THUS TOTAL OI GAIN OF 2946 CONTRACTS OR 494,600 OZ OR 9.163 TONNES. YESTERDAY WE HAD A LOSS IN THE PRICE OF GOLD TO THE TUNE OF $5,45.…AND WITH THAT STRONG LOSS, WE HAD AN GOOD GAIN OF 9.163 TONNES!!!!!!.??????

WITH RESPECT TO SPREADING: NOT TO NOTICEABLE WITH TODAY’S FALL IN PRICE

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES:

“AS YOU WILL SEE, THE CROOKS HAVE NOW SWITCHED TO GOLD AS THEY INCREASE THE OPEN INTEREST FOR THE SPREADERS. THE TOTAL COMEX GOLD OPEN INTEREST WILL RISE FROM NOW ON UNTIL ONE WEEK PRIOR TO FIRST DAY NOTICE AND THAT IS WHEN THEY START THEIR CRIMINAL LIQUIDATION.

HERE IS HOW THE CROOKS USED SPREADING AS WE ARE NO INTO THE NON ACTIVE DELIVERY MONTH OF MAY HEADING TOWARDS THE VERY ACTIVE DELIVERY MONTH OF JUNE.

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES, HERE IS THE BANKERS MODUS OPERANDI:

YOU WILL ALSO NOTICE THAT THE COMEX OPEN INTEREST IS STARTING TO RISE IN THIS NON ACTIVE MONTH OF MAY BUT SO IS THE OPEN INTEREST OF SPREADERS. THE OPEN INTEREST IN GOLD WILL CONTINUE TO RISE UNTIL ONE WEEK BEFORE FIRST DAY NOTICE OF AN UPCOMING ACTIVE DELIVERY MONTH (JUNE), AND THAT IS WHEN THE CROOKS SELL THEIR SPREAD POSITIONS BUT NOT AT THE SAME TIME OF THE DAY. THEY WILL USE THE SELL SIDE OF THE EQUATION TO CREATE THE CASCADE (ALONG WITH THEIR COLLUSIVE FRIENDS) AND THEN COVER ON THE BUY SIDE OF THE SPREAD SITUATION AT THE END OF THE DAY. THEY DO THIS TO AVOID POSITION LIMIT DETECTION. THE LIQUIDATION OF THE SPREADING FORMATION CONTINUES FOR EXACTLY ONE WEEK AND ENDS ON FIRST DAY NOTICE.”

ACCUMULATION OF EFP’S GOLD AT J.P. MORGAN’S HOUSE OF BRIBES: (EXCHANGE FOR PHYSICAL) FOR THE MONTH OF MAY : 65,405 CONTRACTS OR 6,540,500 OR 203.43 TONNES (11 TRADING DAYS AND THUS AVERAGING: 5945 EFP CONTRACTS PER TRADING DAY

TO GIVE YOU AN IDEA AS TO THE STRONG SIZE OF THESE EFP TRANSFERS : THIS MONTH IN 11 TRADING DAYS IN TONNES: 203,43 TONNES

TOTAL ANNUAL GOLD PRODUCTION, 2018, THROUGHOUT THE WORLD EX CHINA EX RUSSIA: 3555 TONNES

THUS EFP TRANSFERS REPRESENTS 203,43/3550 x 100% TONNES =5,73% OF GLOBAL ANNUAL PRODUCTION SO FAR IN DECEMBER ALONE.***

ACCUMULATION OF GOLD EFP’S YEAR 2019 TO DATE: 2018.99 TONNES

JANUARY 2019 TOTAL EFP ISSUANCE; 531.20 TONNES

FEB 2019 TOTAL EFP ISSUANCE: 344.36 TONNES

MARCH 2019 TOTAL EFP ISSUANCE: 497.16 TONNES

APRIL 2019 TOTAL ISSUANCE: 456.10 TONNES

WHAT IS ALARMING TO ME, ACCORDING TO OUR LONDON EXPERT ANDREW MAGUIRE IS THAT THESE EFP’S ARE BEING TRANSFERRED TO WHAT ARE CALLEDRIAL FORWARD CONTRACT OBLIGATIONS AND THESE CONTRACTS ARE LESS THAN 14 DAYS. ANYTHING GREATER THAN 14 DAYS, THESE MUST BE RECORDED AND SENT TO THE COMPTROLLER, GREAT BRITAIN TO MONITOR RISK TO THE BANKING SYSTEM. IF THIS IS INDEED TRUE, THEN THIS IS A MASSIVE CONSPIRACY TO DEFRAUD AS WE NOW WITNESS A MONSTROUS TOTAL EFP’S ISSUANCE AS IT HEADS INTO THE STRATOSPHERE.

Result: A FAIR SIZED DECREASE IN OI AT THE COMEX OF 2490 WITH THE FALL IN PRICING ($5.45) THAT GOLD UNDERTOOK YESTERDAY) //.WE ALSO HAD A GOOD SIZED NUMBER OF COMEX LONG TRANSFERRING TO LONDON THROUGH THE EFP ROUTE: 5436 CONTRACTS AS THESE HAVE ALREADY BEEN NEGOTIATED AND CONFIRMED. THERE OBVIOUSLY DOES NOT SEEM TO BE MUCH PHYSICAL GOLD AT THE COMEX. I GUESS IT EXPLAINS THE HUGE ISSUANCE OF EFP’S…THERE IS HARDLY ANY GOLD PRESENT AT THE GOLD COMEX FOR DELIVERY PURPOSES. IF YOU TAKE INTO ACCOUNT THE 5436 EFP CONTRACTS ISSUED, WE HAD A FAIR SIZED GAIN OF 4566 CONTRACTS IN TOTAL OPEN INTEREST ON THE TWO EXCHANGES:

5436 CONTRACTS MOVE TO LONDON AND 2490 CONTRACTS DECREASED AT THE COMEX. (IN TONNES, THE GAIN IN TOTAL OI EQUATES TO 9.163 TONNES). ..AND THIS GOOD DEMAND OCCURRED WITH A FALL IN PRICE OF $5.45 IN YESTERDAY’S TRADING AT THE COMEX. WE NO DOUBT HAD A SMALL PRESENCE OF SPREADING TODAY.

we had: 1 notice(s) filed upon for 100 oz of gold at the comex.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

With respect to our two criminal funds, the GLD and the SLV:

GLD...

WITH GOLD UP $1.50 TODAY

INVENTORY RESTS AT 736.46 TONNES

TO ALL INVESTORS THINKING OF BUYING GOLD THROUGH THE GLD ROUTE: YOU ARE MAKING A TERRIBLE MISTAKE AS THE CROOKS ARE USING WHATEVER GOLD COMES IN TO ATTACK BY SELLING THAT GOLD. IT SURE SEEMS TO ME THAT THE GOLD OBLIGATIONS AT THE GLD EXCEED THEIR INVENTORy

SLV/

WITH SILVER UP 2 CENTS TODAY:

A BIG CHANGE IN SILVER INVENTORY AT THE SLV//

A WITHDRAWAL OF 1.031 MILLION OZ FROM THE SLV.

/INVENTORY RESTS AT 315.551 MILLION OZ.

end

First, here is an outline of what will be discussed tonight:

1. Today, we had the open interest in SILVER FELL BY A TINY SIZED 102 CONTRACTS from 201,956 UPTO 203,788 AND CLOSER TO THE NEW COMEX RECORD SET LAST IN AUG.2018 AT 244,196 WITH A SILVER PRICE OF $14.78/(AUGUST 22/2018)..THE PREVIOUS RECORD WAS SET ON APRIL 9/2018 AT 243,411 OPEN INTEREST CONTRACTS WITH THE SILVER PRICE AT THAT DAY: $16.53). AND PREVIOUS TO THAT, THE RECORD WAS ESTABLISHED AT: 234,787 CONTRACTS, SET ON APRIL 21.2017 OVER 1 1/3 YEARS AGO. THE PRICE OF SILVER ON THAT DAY: $17.89. AS YOU CAN SEE, WE HAVE RECORD HIGH OPEN INTERESTS IN SILVER ACCOMPANIED BY A CONTINUAL LOWER PRICE WHEN THAT RECORD WAS SET…..THE SPREADERS HAVE STOPPED THEIR LIQUIDATION IN SILVER BUT HAVE NOW MORPHED INTO GOLD..

EFP ISSUANCE:

OUR CUSTOMARY MIGRATION OF COMEX LONGS CONTINUE TO MORPH INTO LONDON FORWARDS AS OUR BANKERS USED THEIR EMERGENCY PROCEDURE TO ISSUE:

0 CONTRACTS FOR APRIL., 0 FOR MAY, FOR JUNE 0 CONTRACTS AND JULY: 435 CONTRACTS AND ALL OTHER MONTHS: ZERO. TOTAL EFP ISSUANCE: 435 CONTRACTS. EFP’S GIVE OUR COMEX LONGS A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. IF WE TAKE THE OI LOSS AT THE COMEX OF 102 CONTRACTS TO THE 435 OI TRANSFERRED TO LONDON THROUGH EFP’S, WE OBTAIN A SMALL GAIN OF 333 OPEN INTEREST CONTRACTS. THUS IN OUNCES, THE GAIN ON THE TWO EXCHANGES: 1.665 MILLION OZ!!! AND YET WE ALSO HAVE A STRONG DEMAND FOR PHYSICAL AS WE WITNESSED A FINAL STANDING OF GREATER THAN 30 MILLION OZ FOR JULY, A STRONG 7.475 MILLION OZ FOR AUGUST.. A HUGE 39.505 MILLION OZ STANDING FOR SILVER IN SEPTEMBER… OVER 2 million OZ STANDING FOR THE NON ACTIVE MONTH OF OCTOBER., 7.440 MILLION OZ FINALLY STANDING IN NOVEMBER. 21.925 MILLION OZ STANDING IN DECEMBER , 5.845 MILLION OZ STANDING IN JANUARY. 2.955 MILLION OZ STANDING IN FEBRUARY, 27.120 MILLION OZ FOR MARCH., 3.875 MILLION OZ FOR APRIL AND NOW 18.335 MILLION OZ FOR MAY

RESULT: A CONSIDERABLE SIZED INCREASE IN SILVER OI AT THE COMEX DESPITE THE TINY 2 CENT LOSS IN PRICING THAT SILVER UNDERTOOK IN PRICING// YESTERDAY. WE ALSO HAD A GOOD SIZED 435 EFP’S ISSUED TRANSFERRING COMEX LONGS OVER TO LONDON. TOGETHER WITH THE STRONG SIZED AMOUNT OF SILVER OUNCES STANDING FOR THIS MONTH, DEMAND FOR PHYSICAL SILVER CONTINUES TO INTENSIFY AS WE WITNESS SEVERE BACKWARDATION IN SILVER IN LONDON.

BOTH THE SILVER COMEX AND THE GOLD COMEX ARE IN STRESS AS THE BANKERS SCOUR THE BOWELS OF THE EXCHANGE FOR METAL

(report Harvey)

.

2.a) The Shanghai and London gold fix report

(Harvey)

2 b) Gold/silver trading overnight Europe, Goldcore

(Mark O’Byrne/zerohedge

and in NY: Bloomberg

3. ASIAN AFFAIRS

)WEDNESDAY MORNING/ TUESDAY NIGHT:

SHANGHAI CLOSED UP 55.07 POINTS OR 1.91% //Hang Sang CLOSED UP 146.69 POINTS OR 0.52% /The Nikkei closed UP 121.33 POINTS OR 0.58%//Australia’s all ordinaires CLOSED UP .69%

/Chinese yuan (ONSHORE) closed DOWN at 6.8830 /Oil UP to 61.64 dollars per barrel for WTI and 71.08 for Brent. Stocks in Europe OPENED GREEN// ONSHORE YUAN CLOSED DOWN // LAST AT 6.8830 AGAINST THE DOLLAR. OFFSHORE YUAN CLOSED DOWN ON THE DOLLAR AT 6.9148 TRADE TALKS STILL ON//TRUMP INITIATES A NEW 25% TARIFFS FRIDAY/MAY 10/MAJOR PROBLEMS AT HUAWEI /CFO ARRESTED : /ONSHORE YUAN TRADING ABOVE LEVEL OF OFFSHORE YUAN/ONSHORE YUAN TRADING WEAKER AGAINST USA DOLLAR/OFFSHORE YUAN TRADING WEAKER AGAINST THE DOLLAR /TRADE DEAL NOW DEAD..TRUMP THREATENS TO RAISE RATES TO 25%

3A//NORTH KOREA/ SOUTH KOREA

i)NORTH KOREA

b) REPORT ON JAPAN

3 China/Chinese affairs

i)China/

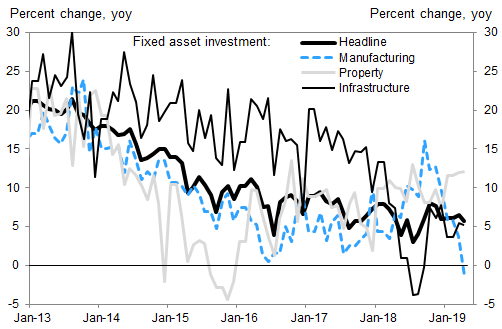

China reports today, like the USA that all green shoots are dead. China’s retail sales and Industrial production falter.

(courtesy zerohedge)

ii)Huawei offers to sign a “no spy” pact with governments as the UK is set on embark on 5 G

( zerohedge)

iii)CHINA/USA

Saxo bank discusses the latest trade war developments between China and the uSA and explains to us what to expect

( zerohedge/Saxo Bank)

iv)Trump intensifies his war against Huawei. The reason of course is that the USA is far behind Hauwei in 5 G technology

(cour zerohedge)

4/EUROPEAN AFFAIRS

i)ITALY

We brought this story to you yesterday. Salvini has had enough with the budget rules of the EU. His economy is faltering and he needs to spend more. His ultimate goal is to leave the EU and devalue the lira

( zerohedge)

ii)UK

In the words of Ron Burgundy: Boy! did that escalate fast: The new Brexit party surges to 34% while the Tories drop to 5th place. Labour has not benefited at all on the fall of the Tories. This is what happens to a party when you go against the wishes of the people.

( Mish Shedlock/Mishtalk)

iii)Brain dead Theresa May will bring back the Brexit deal for a 4th vote next month;

( zerohedge)

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

a)Turkey

Turkey again in the new today. In order to create some USA revenue it is imposing a .1% tax on foreign exchange transactions. Of course this will hurt investors who are already reeling from interest rates at 25.5%. Turkey is adamant on purchasing Russians S400 defense shield. Down goes the Lira this morning

( zerohedge)

b)IRANPerhaps the greatest sign that there is going to a military confrontation in Iran is the fact that USA allies are pulling their troops from Iraq and the Gulf

(courtesy zerohedge)

6. GLOBAL ISSUES

THE GLOBE

We have been pointing out to you since October who global trade has been collapsing. The trade war is not helping

( zerohedge)

CANADA/CHINA

This is a surprise: Canada sells a huge total of 12.5 billion of USA treasuries. Also China resumes is selling of treasuries as well, dumping 10 billion dollars worth of bonds.

( zerohedge)

7. OIL ISSUES

8 EMERGING MARKET ISSUES

VENEZUELA

9. PHYSICAL MARKETS

i)Kranzler believes that the Fed is losing control on the interest rate front..and they may lose control of the goldprice as well…

( Kranzler/IRD/GATA)

ii)Ed Steer discusses the late Bart Chilton’s revelation that JPMorgan was allowed to manipulate the silver price. He also discusses the use of derivatives by central banks to control the price of the precious metals.

( Ed Steer/Silver Doctors/GATA)

iii)Craig Hemke believes that 2019 is the shakeout year for both gold and silver

(Craig Hemke/GATA)

iv)Simon Black comments that central banks are buying gold at its fastest pace in 6 years

( Simon Black/Sovereign Man)

10. USA stories which will influence the price of gold/silver)

MARKET TRADING//

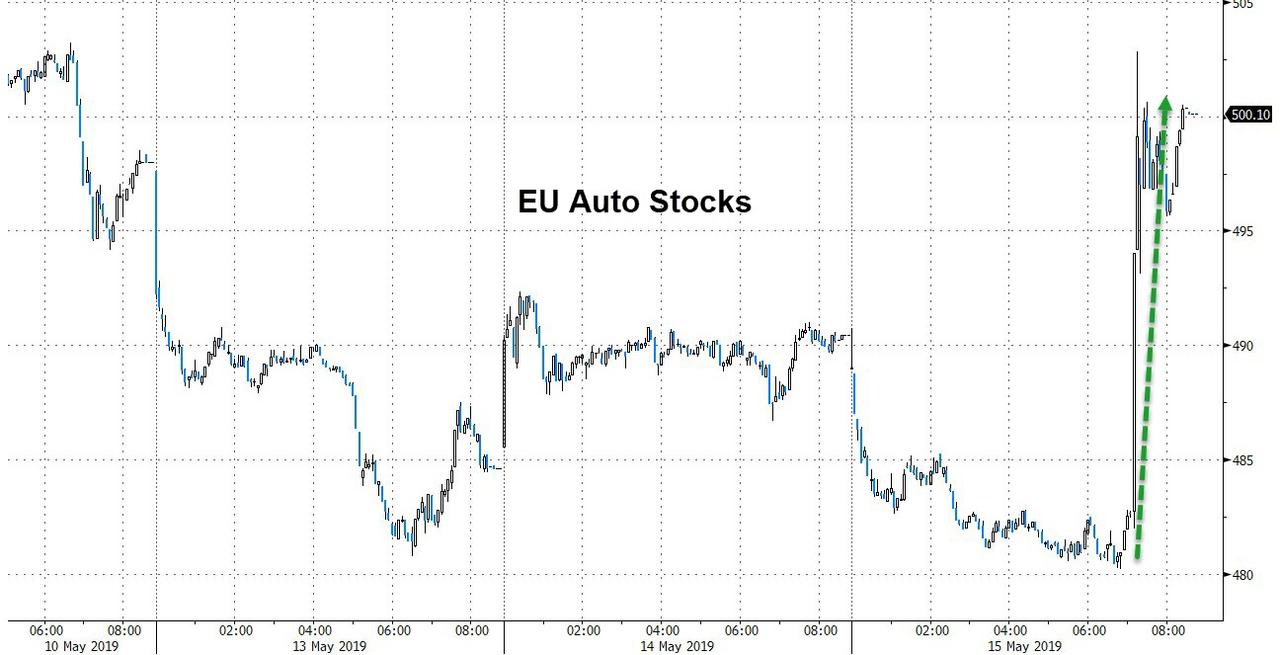

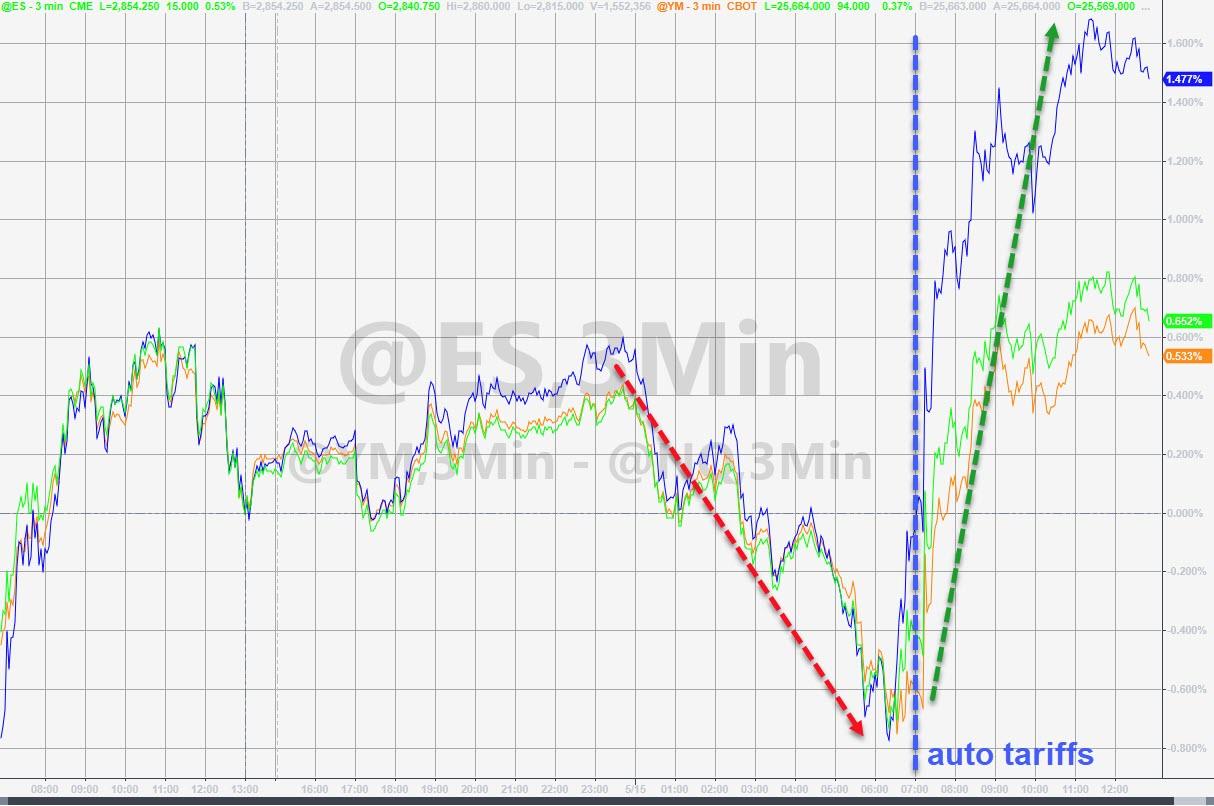

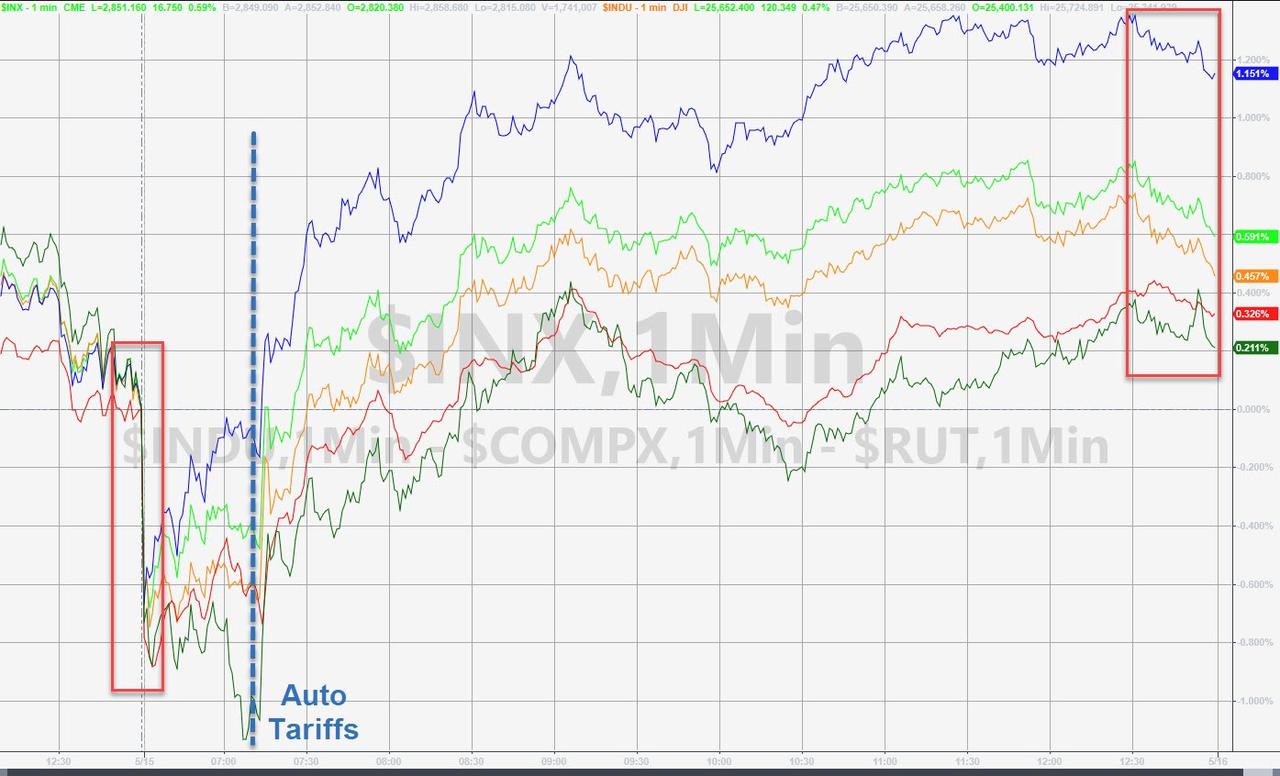

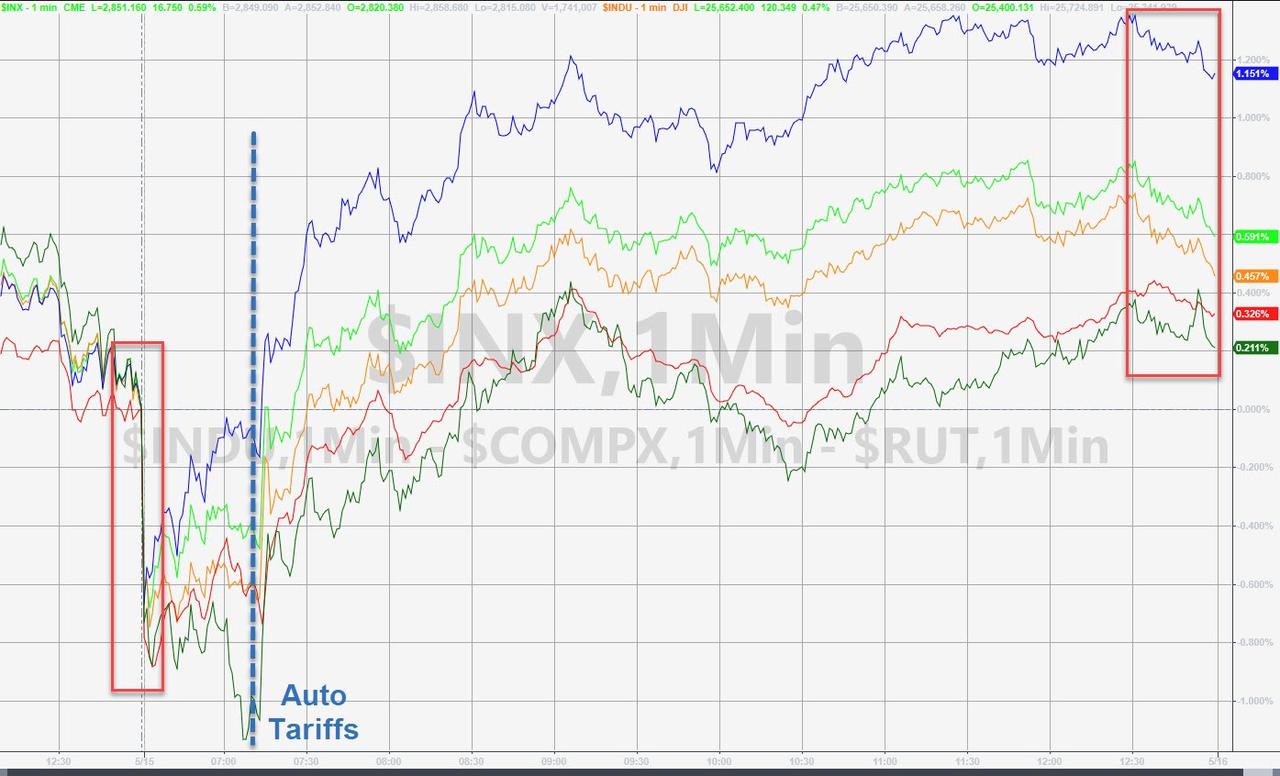

Stocks surge from the depths on Trump’s plan to delay EU auto import tariffs. Trump according to Bloomberg does not want to upset ongoing talks. However Trump may still go against advisors and initiate the tariffs this week

( zerohedge)

ii)Market data

We obtained two big hard data this morning..retail sales and industrial production:

First retail spending contracted big time with auto sales leading the way

( zerohedge)

ii)USA ECONOMIC/GENERAL STORIES

Esther George is one of the hawks at the Fed. She warns against cutting interest rates as she states that will lead to bubbles. She is correct on that point..however she states that cutting rates will lead to a recession..wrong. If the Fed raises rates a recession will surely be upon the USA

( zerohedge)

SWAMP STORIES

i)This is a big story. The Bidens are big crooks and took huge bribe money form both Ukraine and China while Joe Biden was Vice President. Schweizer wrote a book on this and demands that Hunter Biden must testify over these revelations

(Courtesy zerohedge)

ii)This is big!! USA Attorney Joe DiGenova tells Laura Ingram that John Durham has already been on the case for a couple of months now. He states that John Brennan, the orchestra leader and Comey are in big trouble. Also the issuance of those FISA applications will probably cause headaches for many in the Democratic field.

(/Ingram Angle)

iii)What a joke: He now know that Andrew Weissmann hand picked all of those “angry Democrats” to lead the witch hunt against Trump et al

( zerohedge)

iv)White HOuse tells Nadler that there is no “do over” with respect to the Russian collusion hoax. It is over…

( zerohedge)

E)SWAMP STORIES/MAJOR STORIES//THE KING REPORT

Let us head over to the comex:

THE TOTAL COMEX GOLD OPEN INTEREST FELL BY A CONSIDERABLE SIZED 2490 CONTRACTS.TO A LEVEL OF 519,615 WITH THE FALL IN THE PRICE OF GOLD ($5.45) IN YESTERDAY’S // COMEX TRADING)

WE ARE NOW IN THE NON ACTIVE DELIVERY MONTH OF MAY.. THE CME REPORTS THAT THE BANKERS ISSUED A GOOD SIZED TRANSFER THROUGH THE EFP ROUTE AS THESE LONGS RECEIVED A DELIVERABLE LONDON FORWARD TOGETHER WITH A FIAT BONUS., THAT IS 5436EFP CONTRACTS WERE ISSUED:

0 FOR JUNE ’19: 5436 CONTRACTS , DEC; 0 CONTRACTS: 0 AND ZERO FOR ALL OTHER MONTHS:

TOTAL EFP ISSUANCE: 5436 CONTRACTS.

THE OBLIGATION STILL RESTS WITH THE BANKERS ON THESE TRANSFERS. ALSO REMEMBER THAT THERE IS NO DOUBT A HUGE DELAY IN THE ISSUANCE OF EFP’S AND IT PROBABLY TAKES AT LEAST 48 HRS AFTER LONGS GIVE UP THEIR COMEX CONTRACTS FOR THEM TO RECEIVE THEIR EFP’S AS THEY ARE NEGOTIATING THIS CONTRACT WITH THE BANKS FOR A FIAT BONUS PLUS THEIR TRANSFER TO A LONDON BASED FORWARD.

ON A NET BASIS IN OPEN INTEREST WE GAINED THE FOLLOWING TODAY ON OUR TWO EXCHANGES: 2946 TOTAL CONTRACTS IN THAT 5436 LONGS WERE TRANSFERRED AS FORWARDS TO LONDON AND WE LOST A SMALL SIZED 2490 COMEX CONTRACTS.

NET GAIN ON THE TWO EXCHANGES : 2946 contracts OR 294600 OZ OR 9.163 TONNES.

We are now in the NON active contract month of MAY and here the open interest stands at 121 contracts, having LOST 38 contracts. We had 43 notices served yesterday so we gained 5 contracts or an additional 500 oz will stand as they guys refused to morph into a London based forward as well as negating a fiat bonus

The next contract month after May is June and here the open interest FELL by 9385 contracts DOWN to 280,827. July LOST 18 contracts to stand at 68. After July the next active month is August and here the OI rose by 4747 contracts up to 154,046 contracts.

TODAY’S NOTICES FILED:

WE HAD 1 NOTICE FILED TODAY AT THE COMEX FOR 100 OZ. (0.00311 TONNES)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for the wild silver comex results.

Total COMEX silver OI FELL BY A SMALL SIZED 102 CONTRACTS FROM 201,956 UP TO 203,788 (AND CLOSER TO THE NEW RECORD OI FOR SILVER SET ON AUGUST 22.2018. THE PREVIOUS RECORD WAS SET APRIL 9.2018/ 243,411 CONTRACTS) AND TODAY’S TINY OI COMEX GAIN OCCURRED WITH A 2 CENT LOSS IN PRICING.//YESTERDAY.

WE ARE NOW INTO THE ACTIVE DELIVERY MONTH OF MAY. HERE WE HAVE 295 OPEN INTEREST STAND SO FAR FOR A LOSS OF ONLY 12 CONTRACTS. WE HAD 13 NOTICES SERVED UPON YESTERDAY SO IN ESSENCE WE GAINED ANOTHER 1 CONTRACT OR AN ADDITIONAL 5,000 OZ WILL STAND FOR DELIVERY AS THESE GUYS REFUSED TO MORPH INTO LONDON BASED FORWARDS AND AS WELL THEY NEGATING A FIAT BONUS. SILVER MUST BE SCARCE AT THE COMEX. QUEUE JUMPING RETURNS WITH A VENGEANCE. WE HAVE NOW SURPASSED THE INITIAL AMOUNT STANDING WHICH OCCURRED ON APRIL 30.2019

THE NEXT MONTH AFTER MAY IS THE NON ACTIVE MONTH OF JUNE. HERE THIS MONTH LOST 8 CONTRACTS DOWN TO 733. AFTER JUNE IS THE ACTIVE MONTH OF JULY, (THE SECOND LARGEST DELIVERY MONTH OF THE YEAR FOR SILVER) AND HERE THIS MONTH LOST 1432 CONTRACTS DOWN TO 153,947 CONTRACTS. THE NEXT ACTIVE MONTH AFTER JULY FOR SILVER IS SEPTEMBER AND HERE THE OI FELL BY 229 DOWN TO 18,762 CONTRACTS.

TODAY’S NUMBER OF NOTICES FILED:

We, today, had 0 notice(s) filed for NIL OZ for the MARCH, 2019 COMEX contract for silver

Trading Volumes on the COMEX TODAY: 256,879 CONTRACTS

CONFIRMED COMEX VOL. FOR YESTERDAY: 247,064 contracts

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

GATA STORIES WITH RESPECT TO GOLD/PRECIOUS METALS.

Kranzler believes that the Fed is losing control on the interest rate front..and they may lose control of the goldprice as well…

(courtesy Kranzler/IRD/GATA)

Dave Kranzler: Fed is losing control of rates, then may lose control of gold too

Submitted by cpowell on Tue, 2019-05-14 13:05. Section: Daily Dispatches

9:05a ET Tuesday, May 14, 2019

Dear Friend of GATA and Gold:

Dave Kranzler of Investment Research Dynamics in Denver explains today why a big move up in the monetary metals may be at hand at last.

Kranzler writes: “The inverted yield curve, combined with an effective Fed funds rate that is above the interest rate used to calculate the quantity of free money given by the Fed to the banks on excess reserves, is strong evidence that the Fed is losing its ability to control the financial markets. At some point the Fed and its Western central bank collaborators, led by the Bank for International Settlements, will also lose control of the gold price.”

Kranzler’s analysis is headlined “Gold and Silver May Be Setting Up for a Big Move” and it’s posted at IRD here:

investmentresearchdynamics.com/gold-and-silver-may-be-setting-up-…

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

END

Ed Steer discusses the late Bart Chilton’s revelation that JPMorgan was allowed to manipulate the silver price. He also discusses the use of derivatives by central banks to control the price of the precious metals.

(courtesy Ed Steer/Silver Doctors/GATA)

GATA’s Ed Steer discusses Chilton’s admission, commodity price control

Submitted by cpowell on Tue, 2019-05-14 13:46. Section: Daily Dispatches

9:45a ET Tuesday, May 14, 2019

Dear Friend of GATA and Gold:

GATA Board of Directors member Ed Steer, editor of Ed Steer’s Gold & Silver Digest letter, was interviewed the other day by James Anderson for Silver Doctors. They discussed former U.S. Commodity Futures Trading Commission member Bart Chilton’s confirmation that the commission allowed JPMorganChase to manipulate the silver market. They also discussed the use of derivatives by central banks and their agents to control commodity prices.

The interview is 20 minutes long and can be heard at Silver Doctors here:

https://www.silverdoctors.com/headlines/world-news/ed-steer-gold-silver-…

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

END

Craig Hemke believes that 2019 is the shakeout year for both gold and silver

(Craig Hemke/GATA)

Craig Hemke at Sprott Money: Recalling 2010

Submitted by cpowell on Tue, 2019-05-14 20:01. Section: Daily Dispatches

4p ET Tuesday, May 14, 2019

Dear Friend of GATA and Gold:

Craig Hemke of the TF Metals Report, writing at Sprott Money today, explains why he is more persuaded that 2019 will follow 2010’s pattern of a shakeout in the monetary metals followed by a sharp rally. His analysis is headlined “Recalling 2010” and it’s posted at Sprott Money here:

https://www.sprottmoney.com/Blog/recalling-2010-craig-hemke-14-052019.ht…

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

END

iii) Other Physical stories

Simon Black comments that central banks are buying gold at its fastest pace in 6 years

(courtesy Simon Black/Sovereign Man)

Central Banks Are Buying Gold At The Fastest Pace In Six Years

Authored by Simon Black via SoveriegnMan.com,

Earlier this month the World Gold Council published its quarterly report– and it shows that central banks and foreign governments from around the world are buying up gold at their fastest pace in six years.

This is pretty big news, and it says a LOT about the future of the dollar.

Remember, central banks and foreign governments hold literally TRILLIONS of dollars of reserves… and traditionally they do this by buying US government debt.

It sounds strange, but to big institutions, banks, etc., US government debt is equivalent to cash. They use it as a form of money.

More importantly, they hold US dollars because that’s the global standard: the US dollar has been the world’s primary international reserve currency for seventy five years.

So US debt is extremely liquid. In fact, the $22 trillion US debt market is the biggest and most liquid market in the world.

But foreign governments have started breaking with the tradition of buying treasuries.

As the World Gold Council’s report showed us, foreign governments and central banks have been buying a LOT more gold than in previous years.

Net gold purchases in Q1/2019 among foreign governments and central banks was nearly 70% greater than Q1/2018… and the highest rate of first quarter purchases in six years.

The Chinese in particular, have been stockpiling gold faster than ever, while at the same time, Chinese ownership of US treasuries as a percentage of total holdings has been gradually declining over the past years.

And it’s not just China.

Russia, Turkey, Qatar, and even Colombia – a long-time ally of the US – have been diversifying and buying a lot more gold.

There are a few obvious reasons behind that.

The debt of the US federal government recently reached $22 trillion. And it isn’t getting any better– they add at least $1 trillion to the debt each year.

And the Congressional Budget Office forecasts that the Uncle Sam will NEVER again see an annual budget deficit of less than $1 trillion starting in 2021.

That has serious impact on the ability of the US government to repay its obligations to foreign creditors.

And if the Bolsheviks come to power next year and offer free goodies (paid for with more debt) to anyone with a pulse, the debt burden will explode.

Anyone who thinks owning 10-year US treasuries – or even worse, 30-year government bonds – is risk-free, is completely insane.

The dollar’s problems aren’t limited to the US government’s pitiful finances either.

Even the Federal Reserve– the central bank of the United States– is close to insolvency, according to its own financial statements.

And the Fed’s coffers are routinely plundered by Congress in order to fund pet projects in Washington.

It’s so ridiculous that, in late 2015, Congress passed a law to steal $53.3 billion from the Federal reserve, putting the central bank on the brink of insolvency.

Then of course there’s the looming prospect of escalating US trade wars… and it’s easy to see why so many foreign governments and central banks are diversifying out of the dollar and into gold.

History shows that reserve currencies come and go.

There was a time when the British pound was the dominant currency in the world. And before that, Dutch guilders, Spanish pieces of eight…

Reserve currencies go all the way back before the gold solidus coin of the Byzantine Empire.

Today, the US dollar is the dominant currency in the world.

This is unlikely to change in the near future. But it would be equally foolish to assume that the dollar’s dominance will last forever.

Gold, on the other hand, has been a constant of wealth preservation for nearly all of human history.

It was first used as money more than 3,000 years ago. And an ounce of gold continues to buy roughly the same amount of goods over time.

There are a number of reasons for that. Gold is scarce, portable, and it can stand the test of time without corroding.

Today, I own gold as an insurance policy. It’s a form of wealth with no counter party risk, and one that has global demand.

Virtually anywhere you can possibly go in the world, gold has value, and it’s definitely worth your consideration.

One interesting benefit– we’re living in a time where nearly every other asset is at an all-time high. Stocks, bonds, real estate, etc.

A single troy ounce of gold sells for nearly 50% below its record price from 2011.

Given what’s happening with central banks, foreign governments, and US debt, it’s clear that demand is rising.

But simultaneously, the supply of gold is under a lot of pressure. We’ve discussed before that large mines have been closing, and large producers haven’t invested in new discoveries.

So there could be significant potential for rising gold prices in the future.

And to continue learning how to ensure you thrive no matter what happens next in the world, I encourage you to download our free Perfect Plan B Guide.

-END-

Market Snapshot

S&P 500 futures little changed at 2,839.25

MXAP up 0.5% to 155.33

MXAPJ up 0.4% to 510.12

Nikkei up 0.6% to 21,188.56

Topix up 0.6% to 1,544.15

Hang Seng Index up 0.5% to 28,268.71

Shanghai Composite up 1.9% to 2,938.68

Sensex up 0.5% to 37,485.81

Australia S&P/ASX 200 up 0.7% to 6,284.20

Kospi up 0.5% to 2,092.78

STOXX Europe 600 down 0.1% to 375.80

German 10Y yield fell 2.4 bps to -0.094%

Euro up 0.08% to $1.1213

Italian 10Y yield rose 2.9 bps to 2.355%

Spanish 10Y yield fell 0.5 bps to 0.966%

Brent futures down 0.3% to $71.06/bbl

Gold spot up 0.1% to $1,298.37

U.S. Dollar Index down 0.1% to 97.47

Top Overnight News

Theresa May set a date for her final Brexit showdown, promising to bring her deal back to Parliament at the start of June

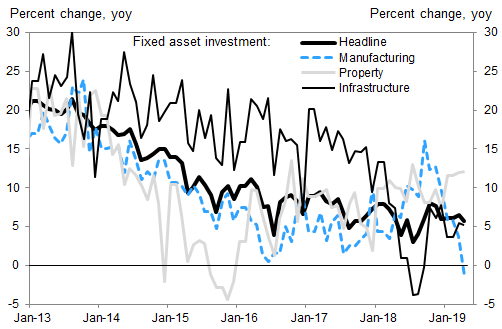

China’s economy lost steam in April, underscoring the fragility of the world’s second-largest economy as it girds for an intensified face-off with the U.S. over trade. Industrial output, retail sales and investment all slowed more than economists forecast

Trump rejected a report that his administration is planning for war with Iran, but then warned he’d send “a hell of a lot more” than 120,000 troops to the Middle East in the event of hostilities

President Donald Trump called on the Federal Reserve to “match” what he said China would do to offset economic hardship being caused by tariffs as he sought to draft the U.S. central bank into his simmering trade war

New York Fed President John Williams and his Kansas City colleague Esther George, who vote on policy this year, acknowledged that new tariffs on Chinese imports could affect the outlook for U.S. inflation and growth. But both saw no need for the central bank to react

Japanese Prime Minister Shinzo Abe said propping up domestic demand would be a priority for his government as economic data show signs of weakness ahead of a planned increase in the sales tax in October

Germany’s economy emerged from stagnation at the beginning of 2019, returning to growth despite a slump in manufacturing that continues to plague the nation.

U.K.’s Theresa May will bring her Brexit deal back to Parliament at the start of June in the hope that she can persuade MPs to support it

Asian equity markets eventually traded mostly higher following the positive lead from the US where sentiment was underpinned by President Trump’s optimism regarding a US-China trade deal, but with gains in the Asia-Pac region capped as participants digested earnings, as well as disappointing Chinese Industrial Production and Retail Sales data. ASX 200 (+0.7%) was led higher by strength in tech as the sector tracked the outperformance of its counterpart stateside, while Nikkei (+0.6%) mirrored a somewhat indecisive currency with heavy losses seen in Takeda and Nissan shares post-earnings. Hang Seng (+0.5%) and Shanghai Comp. (+1.9%) were positive after President Trump’s encouraging rhetoric and with the first phase of the PBoC’s targeted RRR adjustment taking effect today which would release around CNY 100bln of long-term funds and resulted to a decline in Chinese money market rates, although the gains across the region were somewhat capped by disappointing Chinese Industrial Production and Retail Sales data. Finally, 10yr JGBs were flat with price action hampered by the ambiguous risk tone in Japan and with today’s BoJ Rinban operation at a relatively paltry JPY 505bln concentrated in the belly.

Top Asian News

China’s Xi Calls Efforts to Reshape Other Nations ’Foolish’

Turkey Imposes 0.1% Tax for Some Foreign Exchange Transactions

Rich Asia Investors Face Rising Risk in Leveraged Bond Funds

Wanda to Plow Billions Into China After Dumping Assets Abroad

Choppy trade in European equities [Eurostoxx 50 -0.6%] following on from a positive Asia-Pac as sentiment deteriorated in early trade. Major indices are now mostly lower after opening with marginal gains, although initial downside coincided with defensive comments from China’s Foreign Minister, which seemed to have dampened the prospects of a US-China trade deal in the near term. Sectors are mostly lower with defensive stocks buoyed for the time being and broad-based losses seen across the rest. In terms of individual movers, Renault (-4.0%) fell to the foot of the CAC as shares of its alliance partner Nissan tumbled in the wake of dismal earnings. Meanwhile, Italian banks [Intesa Sanpaolo -1.7%, Unicredit -1.5%, Banco BPM -1.5%] fell in tandem with the decline in BTPs (albeit off lows), given the banks’ large holdings of the sovereign debt. Elsewhere, given the looming US auto import tariffs deadline (May 18th), analyst at Morgan Stanley believe that the German economy will be hit the hardest due to direct impact and through supply chains, adding that Germany’s exports of vehicles and auto parts to the US make up around 2% of the total goods exports, thus, “a US car tariff increase to 25% could lower growth in Germany by ~0.25pp, with any knock-on impact on sentiment on top.”

Top European News

German Economy Rebounds From Stagnation With 0.4% Expansion

Credit Agricole Revenue Misses Estimates on Key Italian Market

Italy Rocks European Bond Markets Over Its Deficit Once Again

Pound Turns Currency Laggard as Brexit Bad News Is Seen Looming

In FX, we start with CHF/JPY/EUR/GBP – The Franc is back in favour and outperforming after a temporary loss of safe-haven appeal on Tuesday as a combination of sub-forecast Chinese data (IP and retail sales) and Italian fiscal jitters offset less acute angst on the US-China trade front, although the latest barbs from Beijing have been quite inflammatory. Usd/Chf has retreated towards 1.0050 again and Eur/Chf is back down below 1.1300 even though the single currency remains relatively resilient vs a broadly firm Dollar having survived another test of 1.1200 with the aid of some firm Eurozone GDP prints. Meanwhile, Usd/Jpy has also pulled back from yesterday’s rebound highs to probe bids under 109.50 and expose Fib support at 109.23 that was breached on Monday when the headline pair got to within a whisker of 109.00. Note, however, decent option expiry interest may keep the headline pair afloat given 1.2 bn rolling off between 109.00-20 and almost 1.8 bn at 109.40-50. Elsewhere, the Pound has also defended poignant big figure levels at 1.2900 in Cable and 0.8700 vs the Euro as UK PM May prepares for Thursday’s 1922 showdown and another stab at getting the WA through the HoC in early June.

AUD/NZD/CAD – All under pressure and down vs their US counterpart, with the Aussie hit by soft wages on top of the aforementioned disappointing Chinese macro releases ahead of tomorrow’s jobs report that has been flagged by the RBA as key in terms of near term policy and whether a rate cut is required. Aud/Usd is just off fresh multi-month lows around 0.6920 and Aud/Nzd is pivoting 1.0550 as the Kiwi hovers just above 0.6550 against the Greenback. Meanwhile, the Loonie is meandering between 1.3476-56 and in a tighter range than on Tuesday awaiting some independent impetus/direction from Canadian CPI that is due alongside US retail sales and with the DXY equally contained within 97.432-578 parameters and just above the 30 DMA (97.417).

EM – The Lira remains in the spotlight and volatile after yesterday’s seemingly impressive recovery, as Usd/Try bounced back over 6.0000 despite more efforts by the CBRT to stop the rot via a return of tax

In commodities, WTI (-1.3%) and Brent (-0.9%) futures are on the backfoot with the initial decline sparked by a substantial surprise build in API crude inventories (+8.6mln vs. Exp. -1.3mln). Crude prices then recovered off lows amid positive sentiment in Asia-Pac trade before an intensifying risk-averse mood pressured the complex. Upside in the energy market is also capped by the IEA Monthly Oil Report which cut 2019 oil demand growth estimate by 90k bpd to 1.3mln bpd, in contrast to yesterday’s OPEC monthly report where the total world oil demand growth for 2019 was left unchanged at 1.21mln BPD. On a technical front, WTI Jun’19 futures reside just below its 50 DMA (61.45) ahead of its 200 DMA (60.40) whilst its Brent counterpart seems to have been recently finding support its 50 DMA (currently at 69.78). Looking ahead, traders will be keeping an eye out for the more widely followed EIA crude stocks release later today wherein ING agrees that numbers similar to the API would likely be seen as bearish in the immediate term. Elsewhere, the receding buck and soured risk tone has modestly supported gold (+0.3%) in recent trade, as the yellow metal fluctuates above its 100 DMA (1296.64) and in close proximity to the 1300/oz level. Meanwhile, Chinese steel production increased by 12.7% Y/Y to the highest level on record as stronger margins allowed steel mills to increase utilisation rates. However, ING believes that margins can come under pressure moving forwards as “the more recent strength in Chinese steel prices [are] reflecting stock building following the Chinese New Year.”

US Event Calendar

7am: MBA Mortgage Applications, prior 2.7%

8:30am: Empire Manufacturing, est. 8, prior 10.1

8:30am: Retail Sales Advance MoM, est. 0.2%, prior 1.6%; Retail Sales Ex Auto MoM, est. 0.7%, prior 1.2%; Retail Sales Control Group, est. 0.3%, prior 1.0%

9:15am: Industrial Production MoM, est. 0.0%, prior -0.1%; Manufacturing (SIC) Production, est. 0.0%, prior 0.0%

10am: NAHB Housing Market Index, est. 64, prior 63

10am: Business Inventories, est. 0.0%, prior 0.3%

4pm: Net Long-term TIC Flows, prior $51.9b; Total Net TIC Flows, prior $21.6b deficit

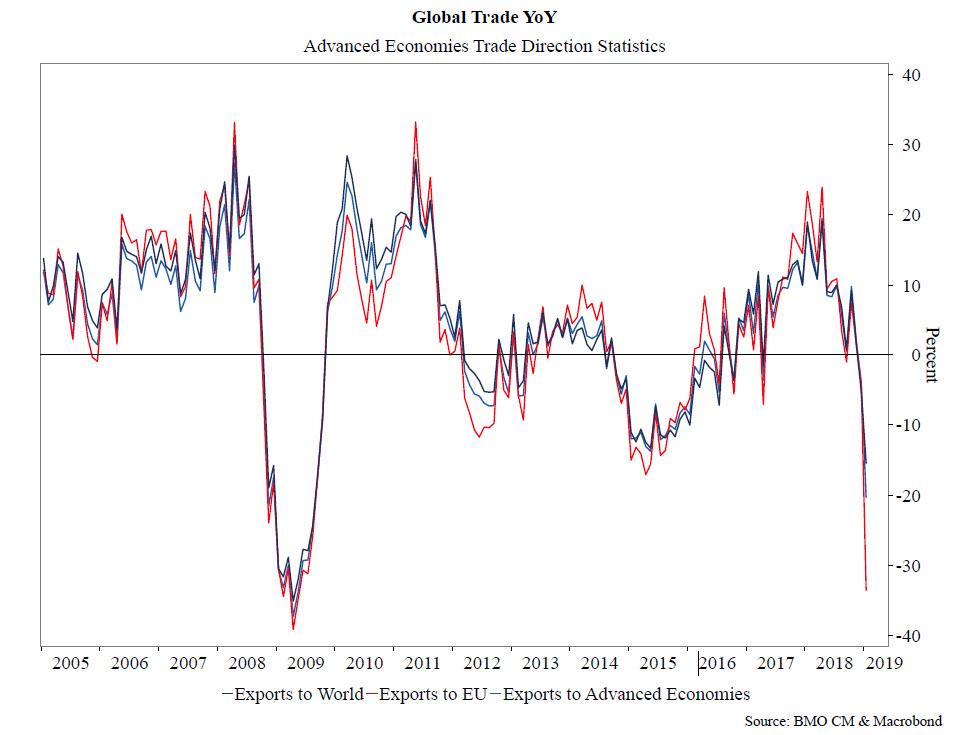

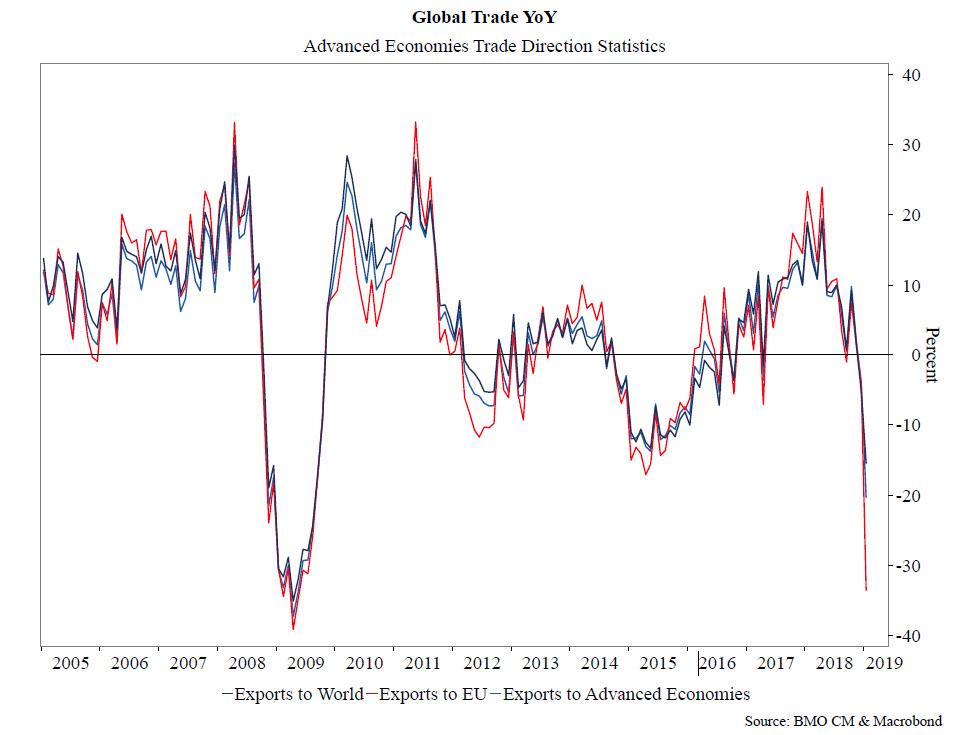

Global Trade Collapsing To Depression Levels

With the trade war between the US and China re-escalating once more, investors are again casting frightened glances at declining global trade volumes, which as Bloomberg writes today, “threaten to upend the global economy’s much-anticipated rebound and could even throw its decade-long expansion into doubt if the conflict spirals out of control.”

“Just as tentative signs appeared that a recovery is taking hold, trade tensions have re-emerged as a credible and significant threat to the business cycle,” said Morgan Stanley’s chief economist, Chetan Ahya, highlighting a “serious impact on corporate confidence” from the tariff feud.

To be sure, even before the latest trade war round, global growth and trade were already suffering, confirmed most recently by last night’s dismal China economic data, which showed industrial output, retail sales and investment all sliding in April by more than economists forecast.

A similar deterioration was observed in the US, where retail sales unexpectedly declined in April while factory production fell for the third time in four months. Meanwhile, over in Europe even though Germany’s economy emerged from stagnation to grow by 0.4% in the first quarter, “the outlook remains fragile amid a manufacturing slump that will be challenged anew by the trade war.” As a result, investor confidence in Europe’s largest economy unexpectedly weakened this month for the first time since October.

Framing the threat, a study by Bloomberg Economics calculated that about 1% of global economic activity is at stake in goods and services traded between the US and China. Almost 4% of Chinese output is exported to the U.S. and any hit to its manufacturers would reverberate through regional supply chains with Taiwan and South Korea among those at risk.

U.S. shipments to China are more limited, though 5.1% of its agricultural production heads there as does 3.3% of its manufactured goods.

The macro fears are once again trickling down to the micro level, and last week chip giant Intel tumbled after it guided to a “more cautious view of the year,” and Italian drinks maker Davide Campari-Milano SpA this month noted the “uncertain geopolitical and macro economic environment.”

“The world economy has been in a significant slowdown for a period,’’ said James Bevan, chief investment officer at CCLA Investment Management. “People just have to wake up and look at the trade data.’’

But the best way to visualize just how serious the threat to global flow of trade, and the world economy in general, below is a chart on the year-over-year changes in global trade as measured by the IMF’s Direction of Trade Statistics, courtesy of BMO’s Ian Lyngern. It shows the absolutely collapse in global exports as broken down into three categories:

Exports to the world (weakest since 2009),

Exports to advances economies (also lowest since 2009), and

Exports to the European Union (challenging 2009 lows).

In short, even before the latest round of trade escalation, global trade had tumbled to levels last seen during the financial crisis depression. One can only wonder what happens to global trade after the latest escalation in US-China trade war…

Commenting on the chart above, Lyngen writs that “as estimates of the fallout from the renewed Trade War begin to reflect the growing apprehension in a variety of markets, we’re struck by the extent of the drop in exports.”

On Wednesday, markets were clearly not struck by the drop in exports, or any other negative news for that matter, with the Dow ripping, reversing its entire morning drop, and trading over 100 points in the green at last check.

end

CANADA/CHINA

PART A: TIC REPORT

This is a surprise: Canada sells a huge total of 12.5 billion of USA treasuries. Also China resumes is selling of treasuries as well, dumping 10 billion dollars worth of bonds.

(courtesy zerohedge)

Canada Dumps Most US Treasuries In 8 Years, China Resumes Selling

Overall, U.S. total cross-border investment was an $8.1 billion outflow in March, consisting of:

Foreign net selling of Treasuries at $12.5b

Foreign net selling of equities at $23.6b

Foreign net buying of corporate debt at $1.1b

Foreign net buying of agency debt at $4.7b

The biggest seller of Treasuries was our friends to the north – Canada – who dumped $12.5 billion, the biggest drop since July 2011.

And China was the second biggest Treasury seller (which comes at an awkward moment after the proxy threats in the last week).

After 3 months of buying, China resumed its previous trend of selling US Treasuries in March, dumping over $10 billion worth taking the holdings to their lowest since May 2017.

The Cayman Islands were the month’s biggest buyers (typically proxy for hedge funds), adding $9.4bn

Along with Singapore, India, Japan, Hong Kong, and Belgium (often considered another proxy for China).

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

MMGYS

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

TRADING IN GRAPH FORM FOR THE DAY/WEEKLY SUMMARY/FOLLOWED BY TODAY

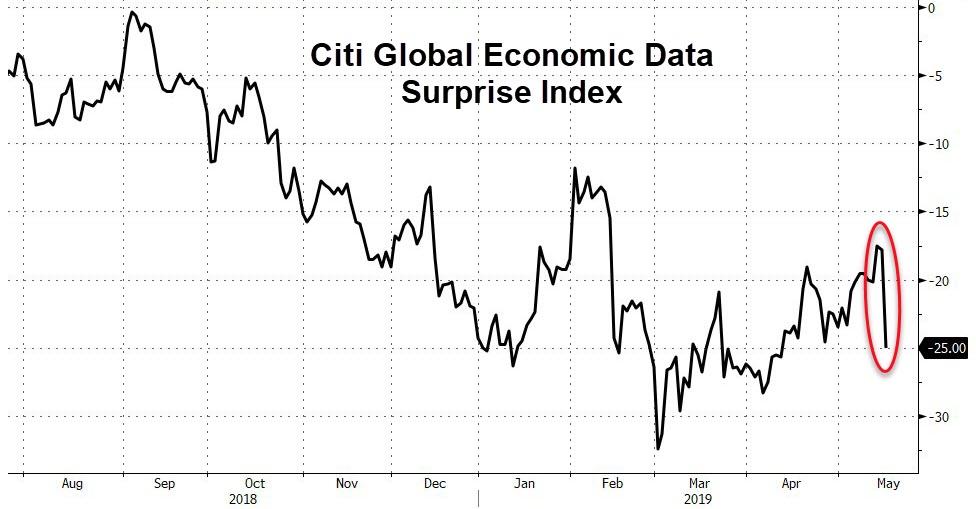

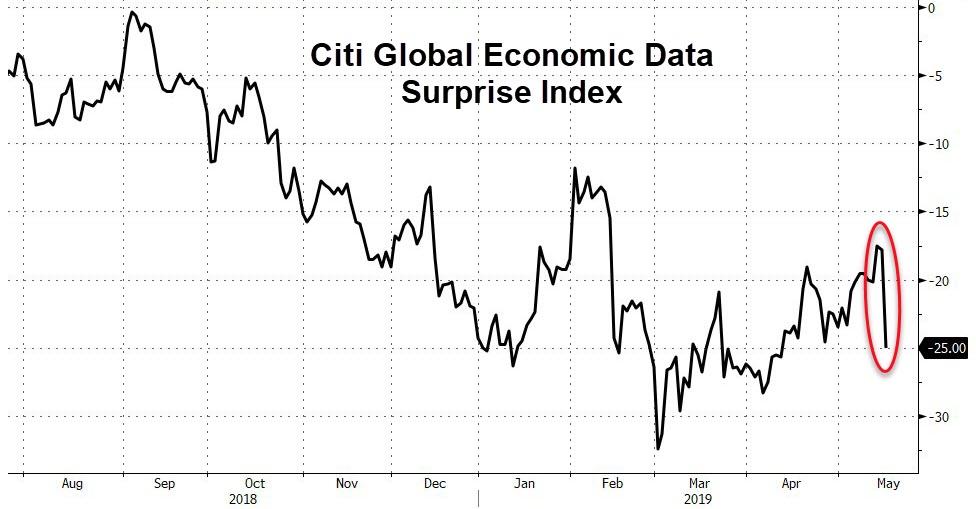

Stocks, Bonds, & Bitcoin Jump As Global Economic Data Dumps

The last 24 hours in global economic data has been the second biggest disappointment in over 5 years…

Chinese stocks rallied because bad news (dismal industrial production and retail sales) is good news for more stimulus, right? because that has worked so well before?

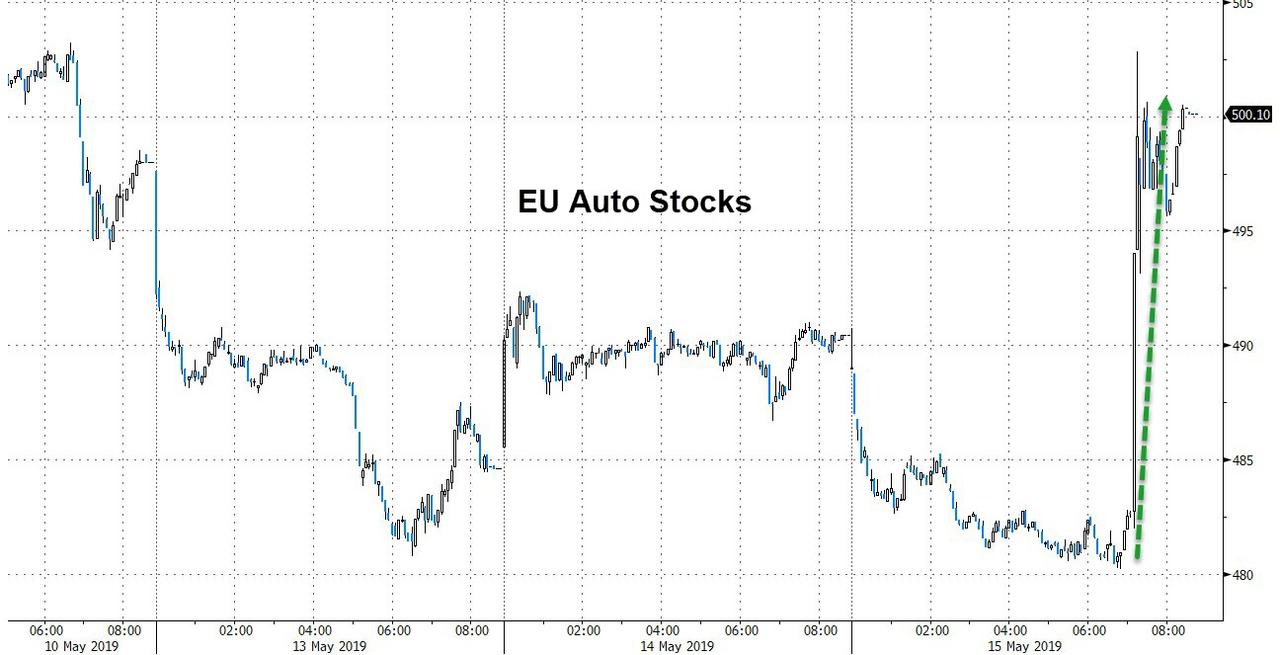

European stocks also soared after headlines reported that Trump may delay auto tariffs by six months…

EU Autos soared on the headlines…

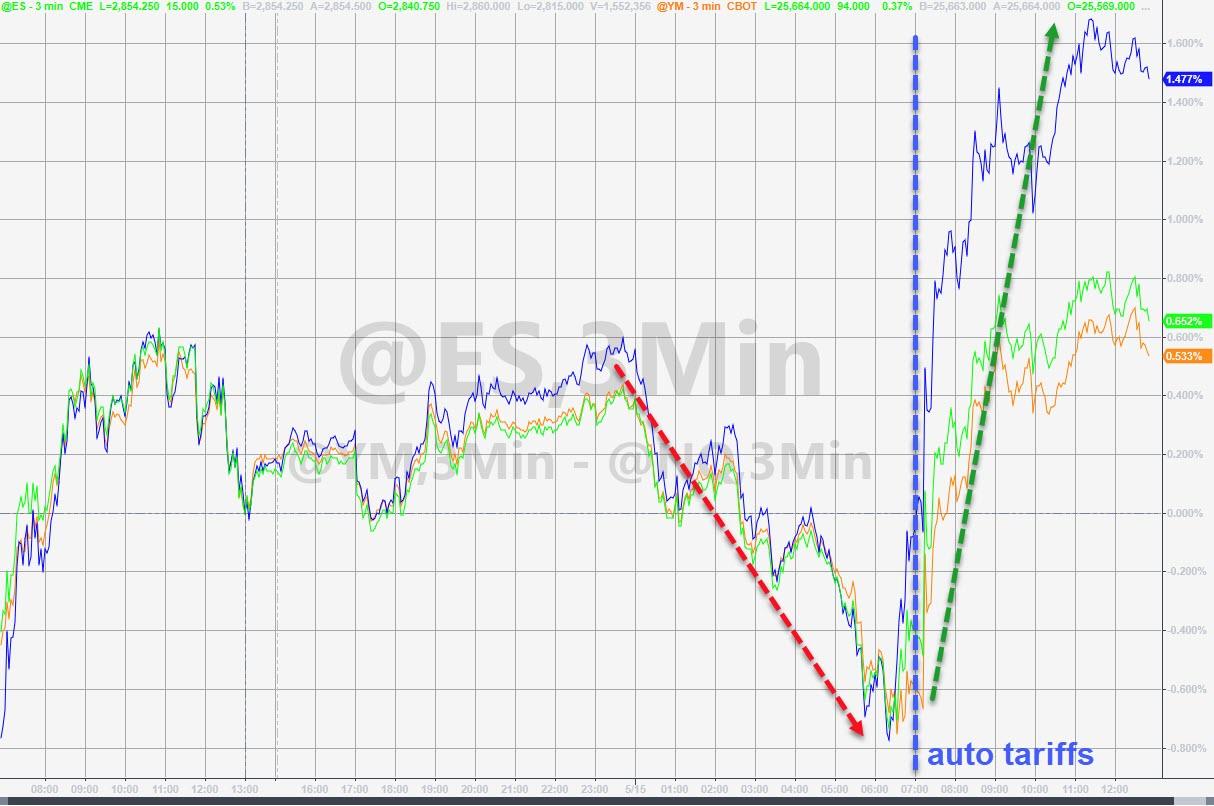

US markets were a combination of shitty data (yay easy Fed) and delayed tariffs (yay buy auto makers) that levitated stocks in a deja vu move from yesterday…

The tariff delay headline hit at 1010ET

Nasdaq led the bounce followed by S&P after a weak overnight and open…and following yesterday’s pattern of a dead cat bounce, it was an ugly close…

Lower lows and lower highs…

Big short squeeze delivered the gains today…again…

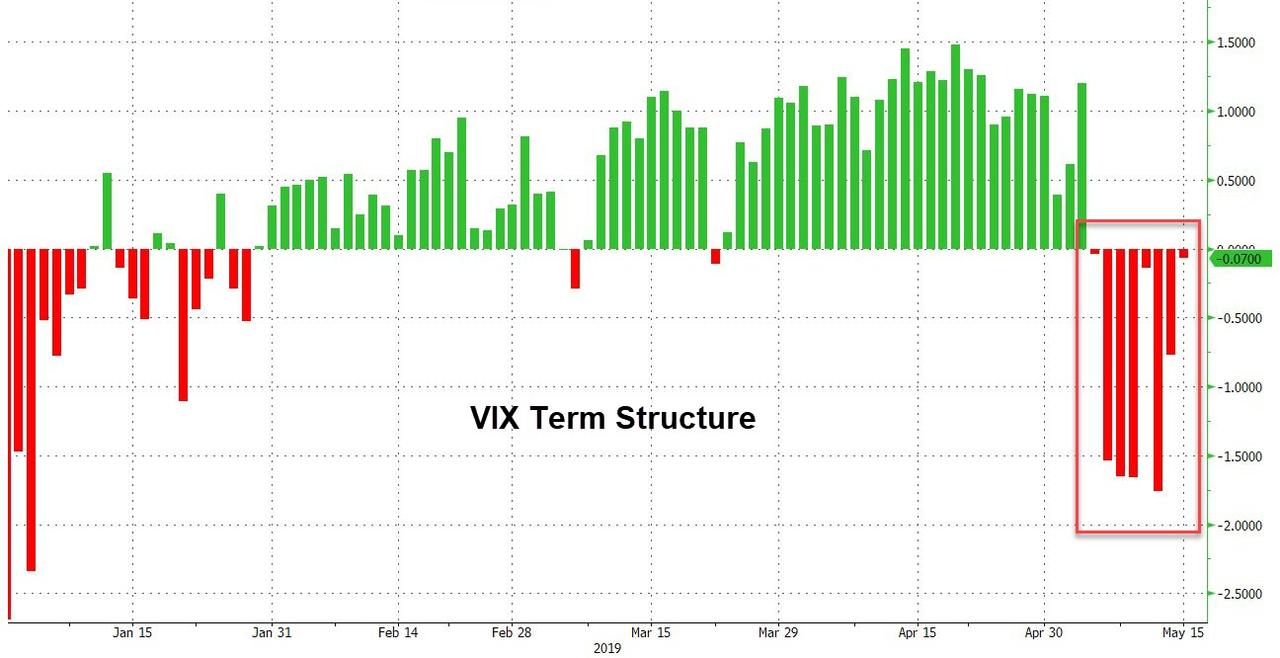

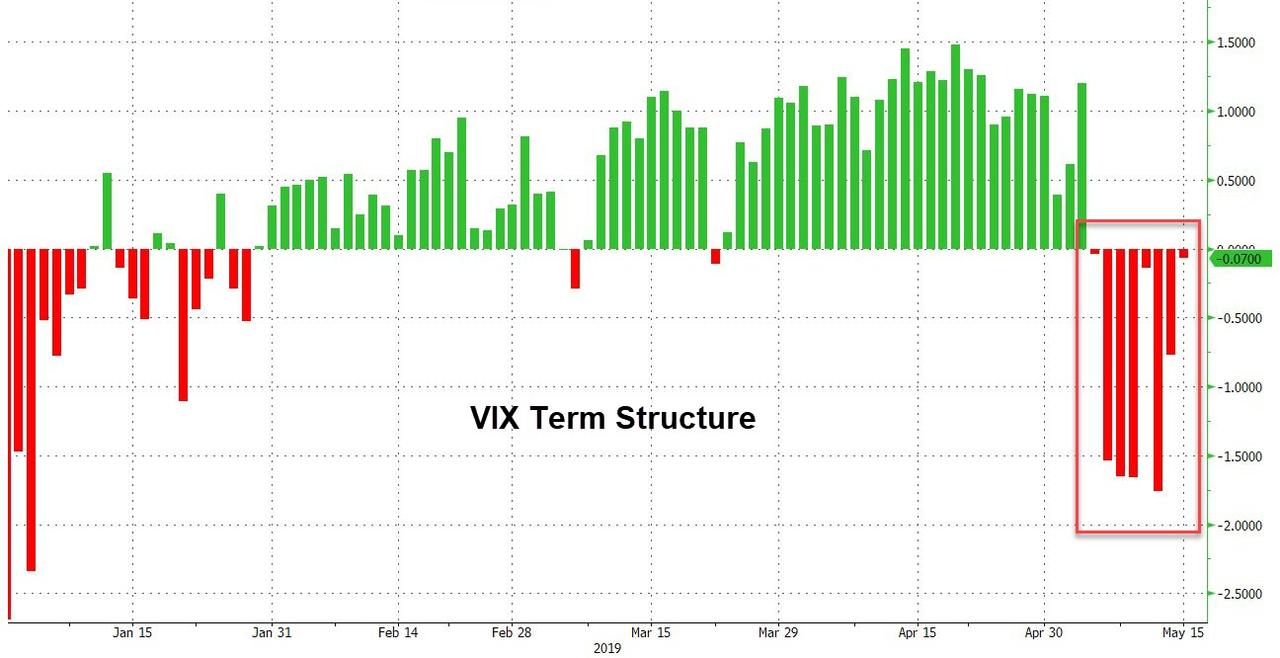

The Vix Term structure remains inverted for the 8th day in a row…

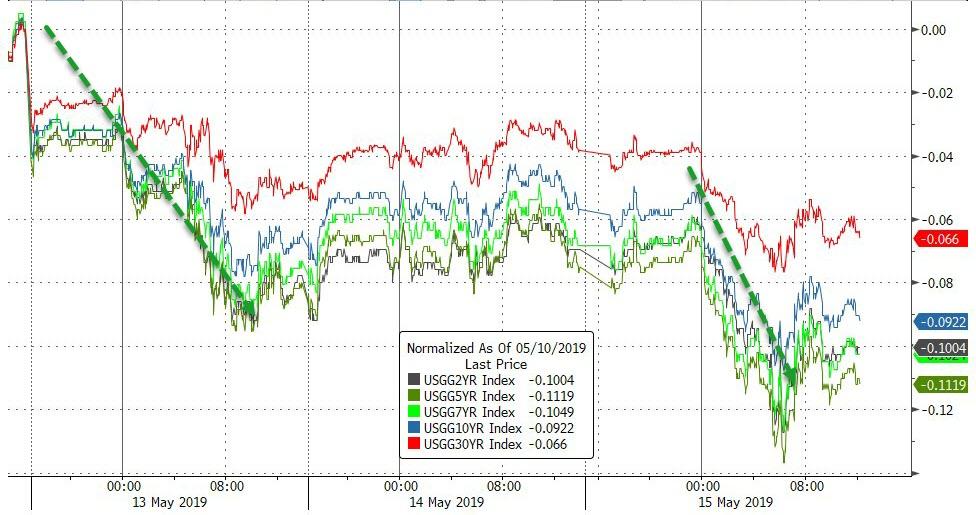

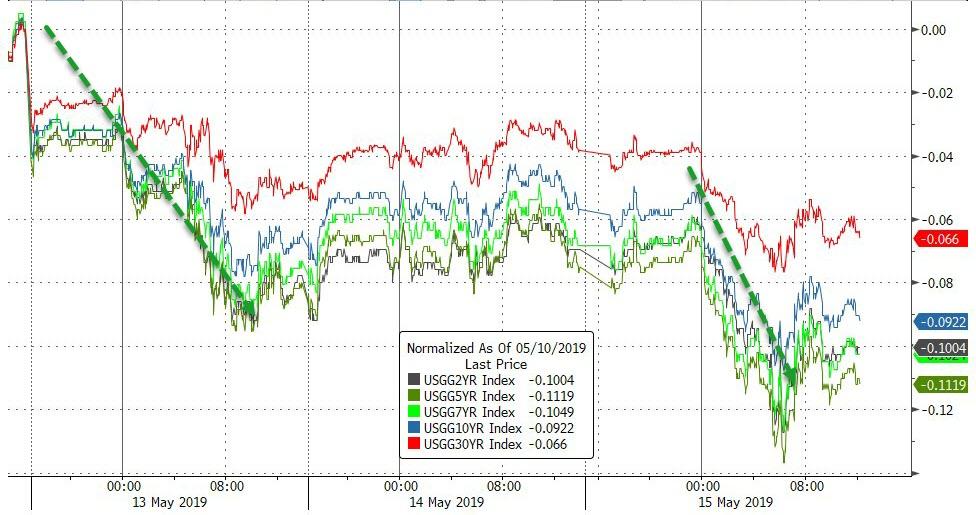

There was a notable decoupling between bonds and stocks on the day

Treasury yields were down around 3bps across the curve today, even as stocks soared

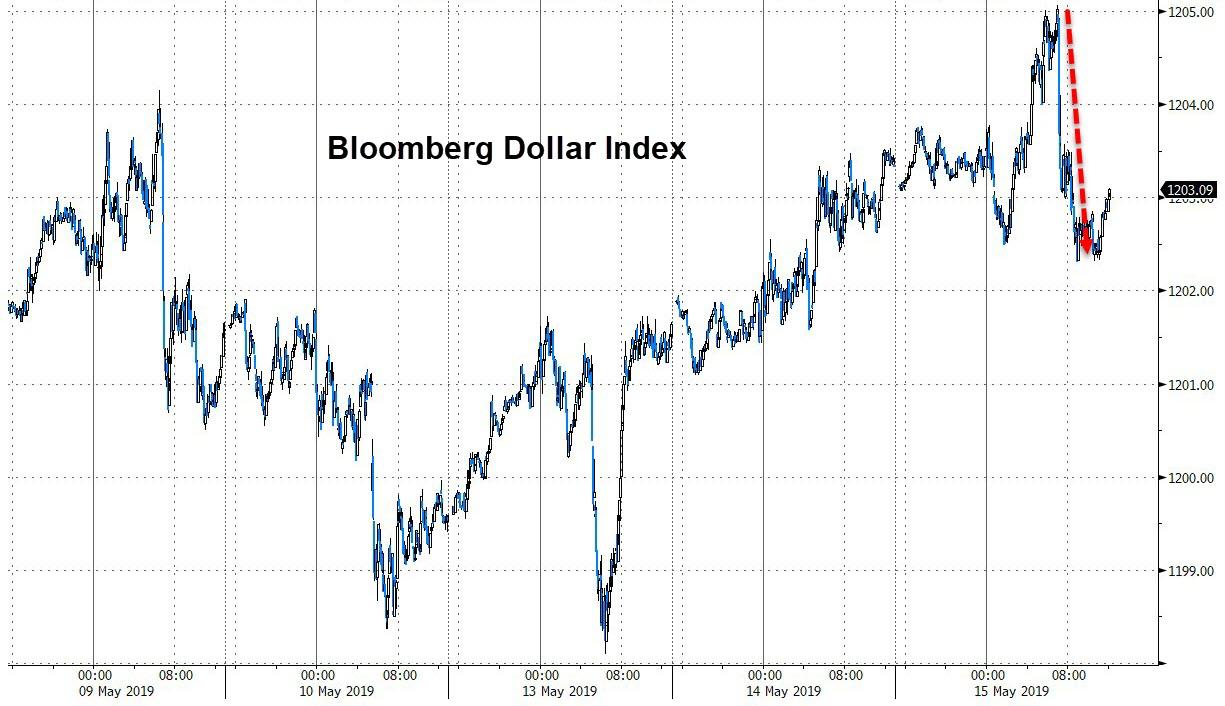

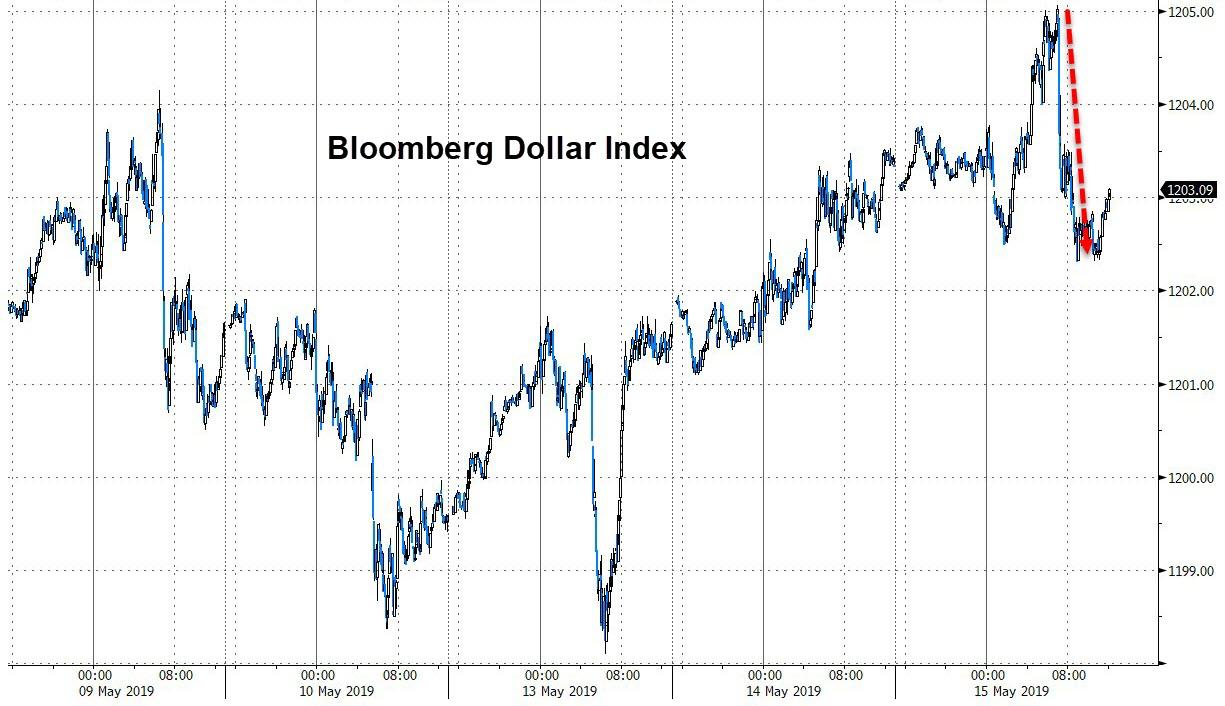

The Dollar Index extended gains overnight but plunged when the auto tariffs headlines hit sparking a big bid for Euros…

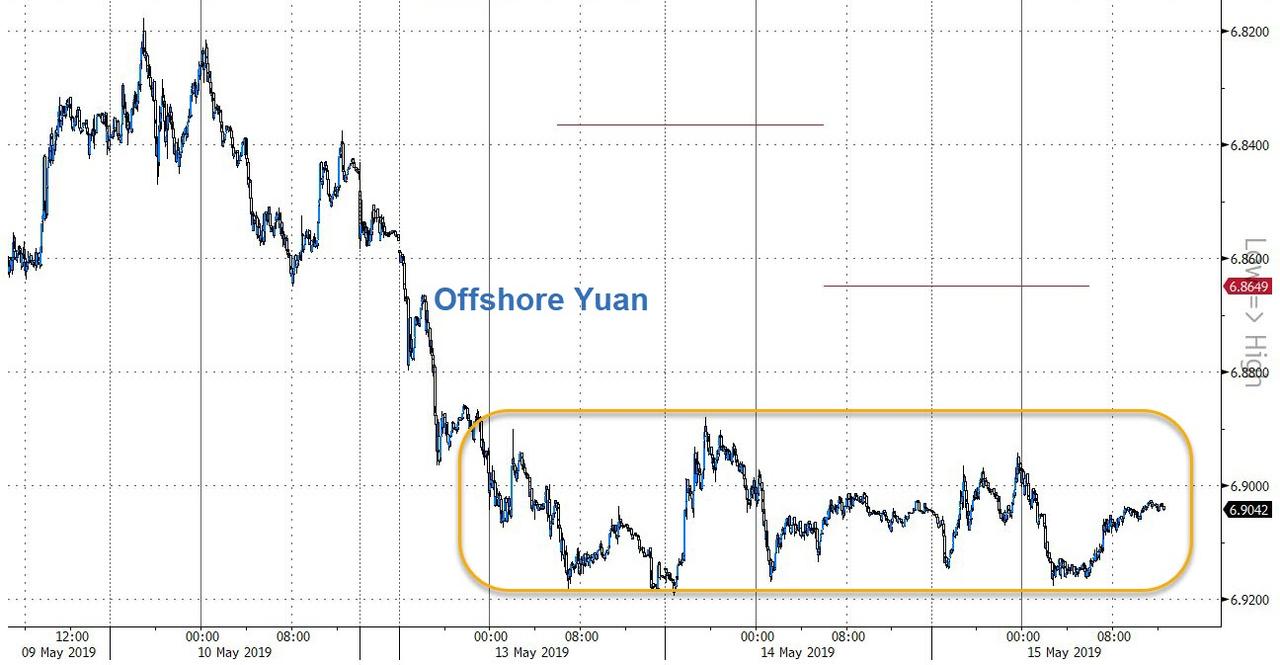

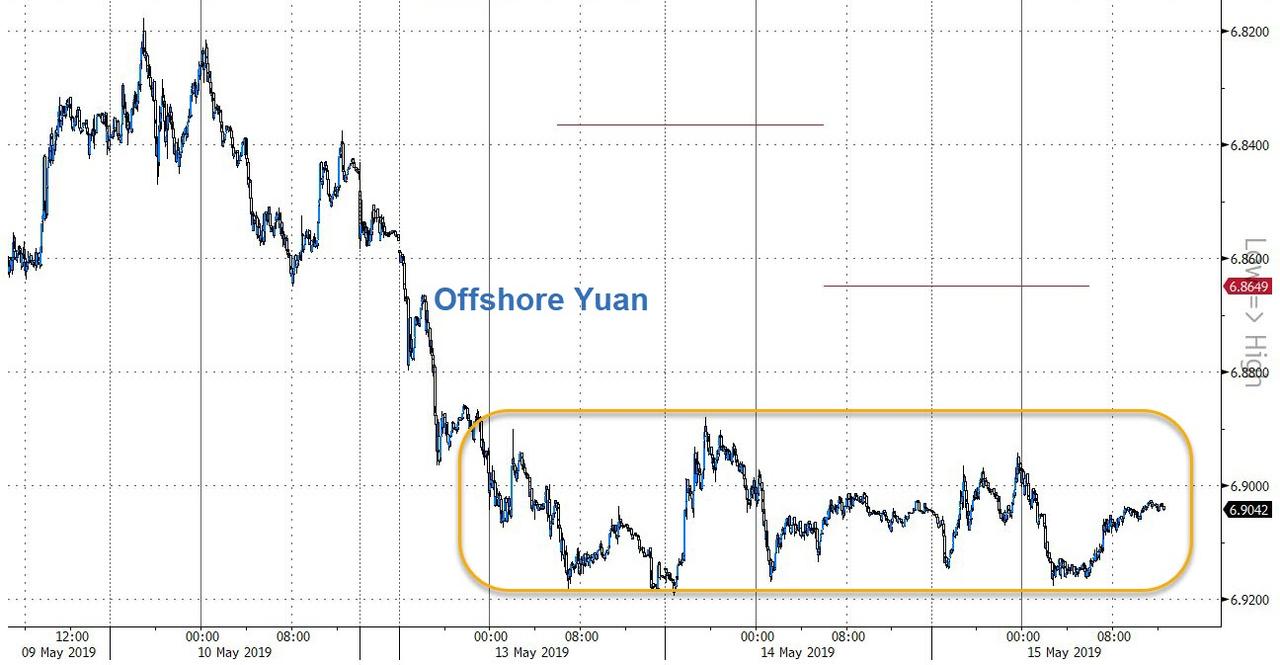

China is managing offshore yuan very well the last two days…

Cryptos continued to rally…

With Bitcoin back above $8000…

In keep with the rest of the idiocy, copper and crude rallied after the crap china data (more stimulus). PMs trod water…

Finally, global money supply and fundamentals are no longer supporting stocks…

Read more Harvey Organ here...

https://harveyorganblog.com/2019/05/15/may-15-gold-up-1-50-to-1297-05-silver-up-2-cents-to-1481-usa-delays-tariffs-on-eu-cars-sends-dow-higher-by-116-points-war-drums-beating-louder-and-louder-as-the-usa-carrier-enters-the-gulf-tur/

show simo casted

.jpg)

Good Morning Good Evening

Welcome to ~*~Mining & Metals Du Jour~*~Graveyard Shift~*~

On the show tonight: Great Data & News by Harvey Organ,the Top 10 Lowest Cost Gold Mines On The Globe,Headlines From The National Mining Association the Official Voice of U.S. Mining. and a Good story about lost treasure by Jenny Kile Lost Treasure of the Kinzua Bridge

Hello everybody I'm J:D your host tonight Thanks for being with us.

Hope Your Having a nice evening

EnJoy the show

OK...Onward to the data

MMGYS

Thank you

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

MAY 15/GOLD UP $1.50 TO $1297.05//SILVER UP 2 CENTS TO $14,81//USA DELAYS TARIFFS ON EU CARS SENDS DOW HIGHER BY 116 POINTS//WAR DRUMS BEATING LOUDER AND LOUDER AS THE USA CARRIER ENTERS THE GULF//TURKEY PUTS A TAX ON FINANCIAL TRANSACTIONS IN A MOVE TO INCREASE DOLLAR RESERVES// USA RETAIL SALES AND INDUSTRIAL PRODUCTION DOWN HARD LAST MONTH..LIKEWISE FOR CHINA//HUGE NUMBER OF SWAMP STORIES FOR YOU TONIGHT//

May 15, 2019 · by harveyorgan · in Uncategorized · Leave a comment

GOLD: $1297.05 UP $1.50 (COMEX TO COMEX CLOSING)

Silver: $14.81 UP 2 CENTS (COMEX TO COMEX CLOSING)

Closing access prices:

Gold : 1296.70

silver: $14.81

JPMorgan has been receiving gold with reckless abandon and sometimes supplying (stopping)

today RECEIVING 1/1

EXCHANGE: COMEX

CONTRACT: MAY 2019 COMEX 100 GOLD FUTURES

SETTLEMENT: 1,294.700000000 USD

INTENT DATE: 05/14/2019 DELIVERY DATE: 05/16/2019

FIRM ORG FIRM NAME ISSUED STOPPED

____________________________________________________________________________________________

661 C JP MORGAN 1

737 C ADVANTAGE 1

____________________________________________________________________________________________

TOTAL: 1 1

MONTH TO DATE: 233

NUMBER OF NOTICES FILED TODAY FOR MAY CONTRACT: 1 NOTICE(S) FOR 100 OZ (0.003215 tonnes)

TOTAL NUMBER OF NOTICES FILED SO FAR: 233 NOTICES FOR 23300 OZ (.7247 TONNES)

SILVER

FOR MAY

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

0 NOTICE(S) FILED TODAY FOR NIL OZ/

total number of notices filed so far this month: 3373 for 16,865,000 oz

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Bitcoin: OPENING MORNING TRADE :$7946 DOWN $9

Bitcoin: FINAL EVENING TRADE: $7946 UP $160.00

end

XXXX

Let us have a look at the data for today

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

IN SILVER THE COMEX OI FELL BY A TINY SIZED 102 CONTRACTS FROM 203,890 DOWN TO 203,788 WITH YESTERDAY’S 2 CENT GAIN IN SILVER PRICING AT THE COMEX. ,LIQUIDATION OF THE SPREADERS HAVE STOPPED FOR SILVER BUT IT NOW IN FULL FORCE FOR GOLD. TODAY WE ARRIVED CLOSER TO AUGUST’S 2018 RECORD SETTING OPEN INTEREST OF 244,196 CONTRACTS.

WE HAVE ALSO WITNESSED A LARGE AMOUNT OF PHYSICAL METAL STAND FOR COMEX DELIVERY AS WELL WE ARE WITNESSING CONSIDERABLE LONGS PACKING THEIR BAGS AND MIGRATING OVER TO LONDON IN GREATER NUMBERS IN THE FORM OF EFP’S. WE WERE NOTIFIED THAT WE HAD A SMALL SIZED NUMBER OF COMEX LONGS TRANSFERRING THEIR CONTRACTS TO LONDON THROUGH THE EFP:

0 FOR MAY, 0 FOR JUNE, 435 FOR JULY AND ZERO FOR ALL OTHER MONTHS AND THEREFORE TOTAL ISSUANCE 435 CONTRACTS. WITH THE TRANSFER OF 435 CONTRACTS, WHAT THE CME IS STATING IS THAT THERE IS NO SILVER (OR GOLD) TO BE DELIVERED UPON AT THE COMEX AS THEY MUST EXPORT THEIR OBLIGATION TO LONDON. ALSO KEEP IN MIND THAT THERE CAN BE A DELAY OF 24-48 HRS IN THE ISSUING OF EFP’S. THE 435 EFP CONTRACTS TRANSLATES INTO 1.665 MILLION OZ ACCOMPANYING:

1.THE 2 CENT GAIN IN SILVER PRICE AT THE COMEX AND

2. THE STRONG AMOUNT OF SILVER OUNCES WHICH STOOD FOR DELIVERY IN THE LAST NINE MONTHS:

JUNE/2018. (5.420 MILLION OZ);

FOR JULY: 30.370 MILLION OZ

FOR AUG., 6.065 MILLION OZ

FOR SEPT. 39.505 MILLION OZ S

FOR OCT.2.525 MILLION OZ.

FOR NOV: A HUGE 7.440 MILLION OZ STANDING AND

21.925 MILLION OZ FINALLY STAND FOR DECEMBER.

5.845 MILLION OZ STAND IN JANUARY.

2.955 MILLION OZ STANDING FOR FEBRUARY.:

27.120 MILLION OZ STANDING IN MARCH.

3.875 MILLION OZ STANDING FOR SILVER IN APRIL.

AND NOW 18.335 MILLION OZ STANDING FOR SILVER IN MAY.

ACCUMULATION FOR EFP’S/SILVER/J.P.MORGAN’S HOUSE OF BRIBES, / STARTING FROM FIRST DAY NOTICE/FOR MONTH OF MAY:

13,303 CONTRACTS (FOR 11 TRADING DAYS TOTAL 13,303 CONTRACTS) OR 66,51 MILLION OZ: (AVERAGE PER DAY: 1209 CONTRACTS OR 6.045 MILLION OZ/DAY)

TO GIVE YOU AN IDEA AS TO THE HUGE SUPPLY THIS MONTH IN SILVER: SO FAR THIS MONTH OF MAY: 66.51 MILLION PAPER OZ HAVE MORPHED OVER TO LONDON. THIS REPRESENTS AROUND 9.19% OF ANNUAL GLOBAL PRODUCTION (EX CHINA EX RUSSIA)* JUNE’S 345.43 MILLION OZ IS THE SECOND HIGHEST RECORDED ISSUANCE OF EFP’S AND IT FOLLOWED THE RECORD SET IN APRIL 2018 OF 385.75 MILLION OZ.

ACCUMULATION IN YEAR 2019 TO DATE SILVER EFP’S: 807.62 MILLION OZ.

JANUARY 2019 EFP TOTALS: 217.455. MILLION OZ

FEB 2019 TOTALS: 147.4 MILLION OZ/

MARCH 2019 TOTAL EFP ISSUANCE: 207.835 MILLION OZ

APRIL 2019 TOTAL EFP ISSUANCE: 182.87 MILLION OZ.

RESULT: WE HAD A TINY SIZED DECREASE IN COMEX OI SILVER COMEX CONTRACTS OF 102 WITH THE TINY 2 CENT GAIN IN SILVER PRICING AT THE COMEX /YESTERDAY... THE CME NOTIFIED US THAT WE HAD A SMALL SIZED EFP ISSUANCE OF 435 CONTRACTS WHICH EXITED OUT OF THE SILVER COMEX AND TRANSFERRED THEIR OI TO LONDON AS FORWARDS. SPECULATORS CONTINUED THEIR INTEREST IN ATTACKING THE SILVER COMEX FOR PHYSICAL SILVER (SEE COMEX DATA) . OUR BANKERS RESUMED THEIR LIQUIDATION OF THE SPREAD TRADES TODAY.

TODAY WE GAINED A SMALL SIZED: 333 TOTAL OI CONTRACTS ON THE TWO EXCHANGES:

i.e 435 OPEN INTEREST CONTRACTS HEADED FOR LONDON (EFP’s) TOGETHER WITH DECREASE OF 102 OI COMEX CONTRACTS. AND ALL OF THIS DEMAND HAPPENED WITH A 2 CENT GAIN IN PRICE OF SILVER AND A CLOSING PRICE OF $14.79 WITH RESPECT TO YESTERDAY’S TRADING. YET WE STILL HAVE A STRONG AMOUNT OF SILVER STANDING AT THE COMEX FOR DELIVERY!!

In ounces AT THE COMEX, the OI is still represented by JUST OVER 1 BILLION oz i.e. 1.020 BILLION OZ TO BE EXACT or 145% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT MARCH MONTH/ THEY FILED AT THE COMEX: 0 NOTICE(S) FOR NIL OZ OF SILVER

IN SILVER,PRIOR TO TODAY, WE SET THE NEW COMEX RECORD OF OPEN INTEREST AT 243,411 CONTRACTS ON APRIL 9.2018. AND AGAIN THIS HAS BEEN SET WITH A LOW PRICE OF $16.51.

AND NOW WE RECORD FOR POSTERITY ANOTHER ALL TIME RECORD OPEN INTEREST AT THE COMEX OF 244,196 CONTRACTS ON AUGUST 22/2018 AND AGAIN WHEN THIS RECORD WAS SET, THE PRICE OF SILVER WAS $14.78 AND LOWER IN PRICE THAN PREVIOUS RECORDS.

ON THE DEMAND SIDE WE HAVE THE FOLLOWING:

HUGE AMOUNTS OF SILVER STANDING FOR DELIVERY (MARCH/2018: 27 MILLION OZ , APRIL/2018 : 2.485 MILLION OZ MAY: 36.285 MILLION OZ ; JUNE/2018 (5.420 MILLION OZ) , JULY 2018 FINAL AMOUNT STANDING: 30.370 MILLION OZ ) FOR AUGUST 6.065 MILLION OZ. , SEPT: A HUGE 39.505 MILLION OZ./ OCTOBER: 2,520,000 oz NOV AT 7.440 MILLION OZ./ DEC. AT 21.925 MILLION OZ JANUARY AT 5.825 MILLION OZ.AND FEB 2019: 2.955 MILLION OZ/ MARCH: 27.120 MILLION OZ/ APRIL AT 3.875 MILLION OZ/ AND NOW MAY: 18.335 MILLION OZ ..

HUGE RECORD OPEN INTEREST IN SILVER 243,411 CONTRACTS (OR 1.217 BILLION OZ/ SET APRIL 9/2018) AND NOW AUGUST 22/2018: 244,196 CONTRACTS, WITH A SILVER PRICE OF $14.78.

HUGE ANNUAL EFP’S ISSUANCE EQUAL TO 2.9 BILLION OZ OR 400% OF SILVER ANNUAL PRODUCTION/2017

RECORD SETTING EFP ISSUANCE FOR ANY MONTH IN SILVER; APRIL/2018/ 385.75 MILLION OZ/ AND THE SECOND HIGHEST RECORDED EFP ISSUANCE JUNE 2018 345.43 MILLION OZ

AND YET, WITH THE EXTREMELY HIGH EFP ISSUANCE, WE HAVE A CONTINUAL LOW PRICE OF SILVER DESPITE THE ABOVE HUGE DEMAND. TO ME THE ONLY ANSWER IS THAT WE HAVE SOVEREIGN (CHINA) WHO IS ENDEAVOURING TO GOBBLE UP ALL AVAILABLE PHYSICAL SILVER NO MATTER WHERE, EXACTLY WHAT J.P.MORGAN IS DOING. AND IT IS MY BELIEF THAT J.P.MORGAN IS HOLDING ITS SILVER FOR ITS BENEFICIAL OWNER..THE USA GOVERNMENT WHO IN TURN IS HOLDING THAT SILVER FOR CHINA.(FOR A SILVER LOAN REPAYMENT).

IN GOLD, THE OPEN INTEREST FELL BY A CONSIDERABLE SIZED 2490 CONTRACTS, TO 517,995 WITH THE FALL IN THE COMEX GOLD PRICE/(AN INCREASE IN PRICE OF $5,45//YESTERDAY’S TRADING).

THE CME RELEASED THE DATA FOR EFP ISSUANCE AND IT TOTALED A GOOD SIZED 5436 CONTRACTS:

APRIL 0 CONTRACTS,JUNE: 5436 CONTRACTS DECEMBER: 0 CONTRACTS, JUNE 2020 0 CONTRACTS AND ALL OTHER MONTHS ZERO. The NEW COMEX OI for the gold complex rests at 517,995. ALSO REMEMBER THAT THERE WILL BE A DELAY IN THE ISSUANCE OF EFP’S. THE BANKERS REMOVE LONG POSITIONS OF COMEX GOLD IMMEDIATELY. THEN THEY ORCHESTRATE THEIR PRIVATE EFP DEAL WITH THE LONGS AND THAT COULD TAKE AN ADDITIONAL, 48 HRS SO WE GENERALLY DO NOT GET A MATCH WITH RESPECT TO DEPARTING COMEX LONGS AND NEW EFP LONG TRANSFERS. . EVEN THOUGH THE BANKERS ISSUED THESE MONSTROUS EFPS, THE OBLIGATION STILL RESTS WITH THE BANKERS TO SUPPLY METAL BUT IT TRANSFERS THE RISK TO A LONDON BANKER OBLIGATION AND NOT A NEW YORK COMEX OBLIGATION. LONGS RECEIVE A FIAT BONUS TOGETHER WITH A LONG LONDON FORWARD. THUS, BY THESE ACTIONS, THE BANKERS AT THE COMEX HAVE JUST STATED THAT THEY HAVE NO APPRECIABLE METAL!! THIS IS A MASSIVE FRAUD: THEY CANNOT SUPPLY ANY METAL TO OUR COMEX LONGS BUT THEY ARE QUITE WILLING TO SUPPLY MASSIVE NON BACKED GOLD (AND SILVER) PAPER KNOWING THAT THEY HAVE NO METAL TO SATISFY OUR LONGS. LONDON IS NOW SEVERELY BACKWARD IN BOTH GOLD AND SILVER AND WE ARE WITNESSING DELAYS IN ACTUAL DELIVERIES.

IN ESSENCE WE HAVE A FAIR SIZED GAIN IN TOTAL CONTRACTS ON THE TWO EXCHANGES OF 2946 CONTRACTS: 2490 OI CONTRACTS DECREASED AT THE COMEX AND 5436 EFP OI CONTRACTS WHICH NAVIGATED OVER TO LONDON. THUS TOTAL OI GAIN OF 2946 CONTRACTS OR 494,600 OZ OR 9.163 TONNES. YESTERDAY WE HAD A LOSS IN THE PRICE OF GOLD TO THE TUNE OF $5,45.…AND WITH THAT STRONG LOSS, WE HAD AN GOOD GAIN OF 9.163 TONNES!!!!!!.??????

WITH RESPECT TO SPREADING: NOT TO NOTICEABLE WITH TODAY’S FALL IN PRICE

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES:

“AS YOU WILL SEE, THE CROOKS HAVE NOW SWITCHED TO GOLD AS THEY INCREASE THE OPEN INTEREST FOR THE SPREADERS. THE TOTAL COMEX GOLD OPEN INTEREST WILL RISE FROM NOW ON UNTIL ONE WEEK PRIOR TO FIRST DAY NOTICE AND THAT IS WHEN THEY START THEIR CRIMINAL LIQUIDATION.

HERE IS HOW THE CROOKS USED SPREADING AS WE ARE NO INTO THE NON ACTIVE DELIVERY MONTH OF MAY HEADING TOWARDS THE VERY ACTIVE DELIVERY MONTH OF JUNE.

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES, HERE IS THE BANKERS MODUS OPERANDI:

YOU WILL ALSO NOTICE THAT THE COMEX OPEN INTEREST IS STARTING TO RISE IN THIS NON ACTIVE MONTH OF MAY BUT SO IS THE OPEN INTEREST OF SPREADERS. THE OPEN INTEREST IN GOLD WILL CONTINUE TO RISE UNTIL ONE WEEK BEFORE FIRST DAY NOTICE OF AN UPCOMING ACTIVE DELIVERY MONTH (JUNE), AND THAT IS WHEN THE CROOKS SELL THEIR SPREAD POSITIONS BUT NOT AT THE SAME TIME OF THE DAY. THEY WILL USE THE SELL SIDE OF THE EQUATION TO CREATE THE CASCADE (ALONG WITH THEIR COLLUSIVE FRIENDS) AND THEN COVER ON THE BUY SIDE OF THE SPREAD SITUATION AT THE END OF THE DAY. THEY DO THIS TO AVOID POSITION LIMIT DETECTION. THE LIQUIDATION OF THE SPREADING FORMATION CONTINUES FOR EXACTLY ONE WEEK AND ENDS ON FIRST DAY NOTICE.”

ACCUMULATION OF EFP’S GOLD AT J.P. MORGAN’S HOUSE OF BRIBES: (EXCHANGE FOR PHYSICAL) FOR THE MONTH OF MAY : 65,405 CONTRACTS OR 6,540,500 OR 203.43 TONNES (11 TRADING DAYS AND THUS AVERAGING: 5945 EFP CONTRACTS PER TRADING DAY

TO GIVE YOU AN IDEA AS TO THE STRONG SIZE OF THESE EFP TRANSFERS : THIS MONTH IN 11 TRADING DAYS IN TONNES: 203,43 TONNES

TOTAL ANNUAL GOLD PRODUCTION, 2018, THROUGHOUT THE WORLD EX CHINA EX RUSSIA: 3555 TONNES

THUS EFP TRANSFERS REPRESENTS 203,43/3550 x 100% TONNES =5,73% OF GLOBAL ANNUAL PRODUCTION SO FAR IN DECEMBER ALONE.***

ACCUMULATION OF GOLD EFP’S YEAR 2019 TO DATE: 2018.99 TONNES

JANUARY 2019 TOTAL EFP ISSUANCE; 531.20 TONNES

FEB 2019 TOTAL EFP ISSUANCE: 344.36 TONNES

MARCH 2019 TOTAL EFP ISSUANCE: 497.16 TONNES

APRIL 2019 TOTAL ISSUANCE: 456.10 TONNES

WHAT IS ALARMING TO ME, ACCORDING TO OUR LONDON EXPERT ANDREW MAGUIRE IS THAT THESE EFP’S ARE BEING TRANSFERRED TO WHAT ARE CALLEDRIAL FORWARD CONTRACT OBLIGATIONS AND THESE CONTRACTS ARE LESS THAN 14 DAYS. ANYTHING GREATER THAN 14 DAYS, THESE MUST BE RECORDED AND SENT TO THE COMPTROLLER, GREAT BRITAIN TO MONITOR RISK TO THE BANKING SYSTEM. IF THIS IS INDEED TRUE, THEN THIS IS A MASSIVE CONSPIRACY TO DEFRAUD AS WE NOW WITNESS A MONSTROUS TOTAL EFP’S ISSUANCE AS IT HEADS INTO THE STRATOSPHERE.

Result: A FAIR SIZED DECREASE IN OI AT THE COMEX OF 2490 WITH THE FALL IN PRICING ($5.45) THAT GOLD UNDERTOOK YESTERDAY) //.WE ALSO HAD A GOOD SIZED NUMBER OF COMEX LONG TRANSFERRING TO LONDON THROUGH THE EFP ROUTE: 5436 CONTRACTS AS THESE HAVE ALREADY BEEN NEGOTIATED AND CONFIRMED. THERE OBVIOUSLY DOES NOT SEEM TO BE MUCH PHYSICAL GOLD AT THE COMEX. I GUESS IT EXPLAINS THE HUGE ISSUANCE OF EFP’S…THERE IS HARDLY ANY GOLD PRESENT AT THE GOLD COMEX FOR DELIVERY PURPOSES. IF YOU TAKE INTO ACCOUNT THE 5436 EFP CONTRACTS ISSUED, WE HAD A FAIR SIZED GAIN OF 4566 CONTRACTS IN TOTAL OPEN INTEREST ON THE TWO EXCHANGES:

5436 CONTRACTS MOVE TO LONDON AND 2490 CONTRACTS DECREASED AT THE COMEX. (IN TONNES, THE GAIN IN TOTAL OI EQUATES TO 9.163 TONNES). ..AND THIS GOOD DEMAND OCCURRED WITH A FALL IN PRICE OF $5.45 IN YESTERDAY’S TRADING AT THE COMEX. WE NO DOUBT HAD A SMALL PRESENCE OF SPREADING TODAY.

we had: 1 notice(s) filed upon for 100 oz of gold at the comex.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

With respect to our two criminal funds, the GLD and the SLV:

GLD...

WITH GOLD UP $1.50 TODAY

INVENTORY RESTS AT 736.46 TONNES

TO ALL INVESTORS THINKING OF BUYING GOLD THROUGH THE GLD ROUTE: YOU ARE MAKING A TERRIBLE MISTAKE AS THE CROOKS ARE USING WHATEVER GOLD COMES IN TO ATTACK BY SELLING THAT GOLD. IT SURE SEEMS TO ME THAT THE GOLD OBLIGATIONS AT THE GLD EXCEED THEIR INVENTORy

SLV/

WITH SILVER UP 2 CENTS TODAY:

A BIG CHANGE IN SILVER INVENTORY AT THE SLV//

A WITHDRAWAL OF 1.031 MILLION OZ FROM THE SLV.

/INVENTORY RESTS AT 315.551 MILLION OZ.

end

First, here is an outline of what will be discussed tonight:

1. Today, we had the open interest in SILVER FELL BY A TINY SIZED 102 CONTRACTS from 201,956 UPTO 203,788 AND CLOSER TO THE NEW COMEX RECORD SET LAST IN AUG.2018 AT 244,196 WITH A SILVER PRICE OF $14.78/(AUGUST 22/2018)..THE PREVIOUS RECORD WAS SET ON APRIL 9/2018 AT 243,411 OPEN INTEREST CONTRACTS WITH THE SILVER PRICE AT THAT DAY: $16.53). AND PREVIOUS TO THAT, THE RECORD WAS ESTABLISHED AT: 234,787 CONTRACTS, SET ON APRIL 21.2017 OVER 1 1/3 YEARS AGO. THE PRICE OF SILVER ON THAT DAY: $17.89. AS YOU CAN SEE, WE HAVE RECORD HIGH OPEN INTERESTS IN SILVER ACCOMPANIED BY A CONTINUAL LOWER PRICE WHEN THAT RECORD WAS SET…..THE SPREADERS HAVE STOPPED THEIR LIQUIDATION IN SILVER BUT HAVE NOW MORPHED INTO GOLD..

EFP ISSUANCE:

OUR CUSTOMARY MIGRATION OF COMEX LONGS CONTINUE TO MORPH INTO LONDON FORWARDS AS OUR BANKERS USED THEIR EMERGENCY PROCEDURE TO ISSUE:

0 CONTRACTS FOR APRIL., 0 FOR MAY, FOR JUNE 0 CONTRACTS AND JULY: 435 CONTRACTS AND ALL OTHER MONTHS: ZERO. TOTAL EFP ISSUANCE: 435 CONTRACTS. EFP’S GIVE OUR COMEX LONGS A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. IF WE TAKE THE OI LOSS AT THE COMEX OF 102 CONTRACTS TO THE 435 OI TRANSFERRED TO LONDON THROUGH EFP’S, WE OBTAIN A SMALL GAIN OF 333 OPEN INTEREST CONTRACTS. THUS IN OUNCES, THE GAIN ON THE TWO EXCHANGES: 1.665 MILLION OZ!!! AND YET WE ALSO HAVE A STRONG DEMAND FOR PHYSICAL AS WE WITNESSED A FINAL STANDING OF GREATER THAN 30 MILLION OZ FOR JULY, A STRONG 7.475 MILLION OZ FOR AUGUST.. A HUGE 39.505 MILLION OZ STANDING FOR SILVER IN SEPTEMBER… OVER 2 million OZ STANDING FOR THE NON ACTIVE MONTH OF OCTOBER., 7.440 MILLION OZ FINALLY STANDING IN NOVEMBER. 21.925 MILLION OZ STANDING IN DECEMBER , 5.845 MILLION OZ STANDING IN JANUARY. 2.955 MILLION OZ STANDING IN FEBRUARY, 27.120 MILLION OZ FOR MARCH., 3.875 MILLION OZ FOR APRIL AND NOW 18.335 MILLION OZ FOR MAY

RESULT: A CONSIDERABLE SIZED INCREASE IN SILVER OI AT THE COMEX DESPITE THE TINY 2 CENT LOSS IN PRICING THAT SILVER UNDERTOOK IN PRICING// YESTERDAY. WE ALSO HAD A GOOD SIZED 435 EFP’S ISSUED TRANSFERRING COMEX LONGS OVER TO LONDON. TOGETHER WITH THE STRONG SIZED AMOUNT OF SILVER OUNCES STANDING FOR THIS MONTH, DEMAND FOR PHYSICAL SILVER CONTINUES TO INTENSIFY AS WE WITNESS SEVERE BACKWARDATION IN SILVER IN LONDON.

BOTH THE SILVER COMEX AND THE GOLD COMEX ARE IN STRESS AS THE BANKERS SCOUR THE BOWELS OF THE EXCHANGE FOR METAL

(report Harvey)

.

2.a) The Shanghai and London gold fix report

(Harvey)

2 b) Gold/silver trading overnight Europe, Goldcore

(Mark O’Byrne/zerohedge

and in NY: Bloomberg

3. ASIAN AFFAIRS

)WEDNESDAY MORNING/ TUESDAY NIGHT:

SHANGHAI CLOSED UP 55.07 POINTS OR 1.91% //Hang Sang CLOSED UP 146.69 POINTS OR 0.52% /The Nikkei closed UP 121.33 POINTS OR 0.58%//Australia’s all ordinaires CLOSED UP .69%

/Chinese yuan (ONSHORE) closed DOWN at 6.8830 /Oil UP to 61.64 dollars per barrel for WTI and 71.08 for Brent. Stocks in Europe OPENED GREEN// ONSHORE YUAN CLOSED DOWN // LAST AT 6.8830 AGAINST THE DOLLAR. OFFSHORE YUAN CLOSED DOWN ON THE DOLLAR AT 6.9148 TRADE TALKS STILL ON//TRUMP INITIATES A NEW 25% TARIFFS FRIDAY/MAY 10/MAJOR PROBLEMS AT HUAWEI /CFO ARRESTED : /ONSHORE YUAN TRADING ABOVE LEVEL OF OFFSHORE YUAN/ONSHORE YUAN TRADING WEAKER AGAINST USA DOLLAR/OFFSHORE YUAN TRADING WEAKER AGAINST THE DOLLAR /TRADE DEAL NOW DEAD..TRUMP THREATENS TO RAISE RATES TO 25%

3A//NORTH KOREA/ SOUTH KOREA

i)NORTH KOREA

b) REPORT ON JAPAN

3 China/Chinese affairs

i)China/

China reports today, like the USA that all green shoots are dead. China’s retail sales and Industrial production falter.

(courtesy zerohedge)

ii)Huawei offers to sign a “no spy” pact with governments as the UK is set on embark on 5 G

( zerohedge)

iii)CHINA/USA

Saxo bank discusses the latest trade war developments between China and the uSA and explains to us what to expect

( zerohedge/Saxo Bank)

iv)Trump intensifies his war against Huawei. The reason of course is that the USA is far behind Hauwei in 5 G technology

(cour zerohedge)

4/EUROPEAN AFFAIRS

i)ITALY

We brought this story to you yesterday. Salvini has had enough with the budget rules of the EU. His economy is faltering and he needs to spend more. His ultimate goal is to leave the EU and devalue the lira

( zerohedge)

ii)UK

In the words of Ron Burgundy: Boy! did that escalate fast: The new Brexit party surges to 34% while the Tories drop to 5th place. Labour has not benefited at all on the fall of the Tories. This is what happens to a party when you go against the wishes of the people.

( Mish Shedlock/Mishtalk)

iii)Brain dead Theresa May will bring back the Brexit deal for a 4th vote next month;

( zerohedge)

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

a)Turkey

Turkey again in the new today. In order to create some USA revenue it is imposing a .1% tax on foreign exchange transactions. Of course this will hurt investors who are already reeling from interest rates at 25.5%. Turkey is adamant on purchasing Russians S400 defense shield. Down goes the Lira this morning

( zerohedge)

b)IRANPerhaps the greatest sign that there is going to a military confrontation in Iran is the fact that USA allies are pulling their troops from Iraq and the Gulf

(courtesy zerohedge)

6. GLOBAL ISSUES

THE GLOBE

We have been pointing out to you since October who global trade has been collapsing. The trade war is not helping

( zerohedge)

CANADA/CHINA

This is a surprise: Canada sells a huge total of 12.5 billion of USA treasuries. Also China resumes is selling of treasuries as well, dumping 10 billion dollars worth of bonds.

( zerohedge)

7. OIL ISSUES

8 EMERGING MARKET ISSUES

VENEZUELA

9. PHYSICAL MARKETS

i)Kranzler believes that the Fed is losing control on the interest rate front..and they may lose control of the goldprice as well…

( Kranzler/IRD/GATA)

ii)Ed Steer discusses the late Bart Chilton’s revelation that JPMorgan was allowed to manipulate the silver price. He also discusses the use of derivatives by central banks to control the price of the precious metals.

( Ed Steer/Silver Doctors/GATA)

iii)Craig Hemke believes that 2019 is the shakeout year for both gold and silver

(Craig Hemke/GATA)

iv)Simon Black comments that central banks are buying gold at its fastest pace in 6 years

( Simon Black/Sovereign Man)

10. USA stories which will influence the price of gold/silver)

MARKET TRADING//

Stocks surge from the depths on Trump’s plan to delay EU auto import tariffs. Trump according to Bloomberg does not want to upset ongoing talks. However Trump may still go against advisors and initiate the tariffs this week

( zerohedge)

ii)Market data

We obtained two big hard data this morning..retail sales and industrial production:

First retail spending contracted big time with auto sales leading the way

( zerohedge)

ii)USA ECONOMIC/GENERAL STORIES

Esther George is one of the hawks at the Fed. She warns against cutting interest rates as she states that will lead to bubbles. She is correct on that point..however she states that cutting rates will lead to a recession..wrong. If the Fed raises rates a recession will surely be upon the USA

( zerohedge)

SWAMP STORIES

i)This is a big story. The Bidens are big crooks and took huge bribe money form both Ukraine and China while Joe Biden was Vice President. Schweizer wrote a book on this and demands that Hunter Biden must testify over these revelations

(Courtesy zerohedge)

ii)This is big!! USA Attorney Joe DiGenova tells Laura Ingram that John Durham has already been on the case for a couple of months now. He states that John Brennan, the orchestra leader and Comey are in big trouble. Also the issuance of those FISA applications will probably cause headaches for many in the Democratic field.

(/Ingram Angle)

iii)What a joke: He now know that Andrew Weissmann hand picked all of those “angry Democrats” to lead the witch hunt against Trump et al

( zerohedge)

iv)White HOuse tells Nadler that there is no “do over” with respect to the Russian collusion hoax. It is over…

( zerohedge)

E)SWAMP STORIES/MAJOR STORIES//THE KING REPORT

Let us head over to the comex:

THE TOTAL COMEX GOLD OPEN INTEREST FELL BY A CONSIDERABLE SIZED 2490 CONTRACTS.TO A LEVEL OF 519,615 WITH THE FALL IN THE PRICE OF GOLD ($5.45) IN YESTERDAY’S // COMEX TRADING)

WE ARE NOW IN THE NON ACTIVE DELIVERY MONTH OF MAY.. THE CME REPORTS THAT THE BANKERS ISSUED A GOOD SIZED TRANSFER THROUGH THE EFP ROUTE AS THESE LONGS RECEIVED A DELIVERABLE LONDON FORWARD TOGETHER WITH A FIAT BONUS., THAT IS 5436EFP CONTRACTS WERE ISSUED:

0 FOR JUNE ’19: 5436 CONTRACTS , DEC; 0 CONTRACTS: 0 AND ZERO FOR ALL OTHER MONTHS:

TOTAL EFP ISSUANCE: 5436 CONTRACTS.

THE OBLIGATION STILL RESTS WITH THE BANKERS ON THESE TRANSFERS. ALSO REMEMBER THAT THERE IS NO DOUBT A HUGE DELAY IN THE ISSUANCE OF EFP’S AND IT PROBABLY TAKES AT LEAST 48 HRS AFTER LONGS GIVE UP THEIR COMEX CONTRACTS FOR THEM TO RECEIVE THEIR EFP’S AS THEY ARE NEGOTIATING THIS CONTRACT WITH THE BANKS FOR A FIAT BONUS PLUS THEIR TRANSFER TO A LONDON BASED FORWARD.

ON A NET BASIS IN OPEN INTEREST WE GAINED THE FOLLOWING TODAY ON OUR TWO EXCHANGES: 2946 TOTAL CONTRACTS IN THAT 5436 LONGS WERE TRANSFERRED AS FORWARDS TO LONDON AND WE LOST A SMALL SIZED 2490 COMEX CONTRACTS.

NET GAIN ON THE TWO EXCHANGES : 2946 contracts OR 294600 OZ OR 9.163 TONNES.

We are now in the NON active contract month of MAY and here the open interest stands at 121 contracts, having LOST 38 contracts. We had 43 notices served yesterday so we gained 5 contracts or an additional 500 oz will stand as they guys refused to morph into a London based forward as well as negating a fiat bonus

The next contract month after May is June and here the open interest FELL by 9385 contracts DOWN to 280,827. July LOST 18 contracts to stand at 68. After July the next active month is August and here the OI rose by 4747 contracts up to 154,046 contracts.

TODAY’S NOTICES FILED:

WE HAD 1 NOTICE FILED TODAY AT THE COMEX FOR 100 OZ. (0.00311 TONNES)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for the wild silver comex results.

Total COMEX silver OI FELL BY A SMALL SIZED 102 CONTRACTS FROM 201,956 UP TO 203,788 (AND CLOSER TO THE NEW RECORD OI FOR SILVER SET ON AUGUST 22.2018. THE PREVIOUS RECORD WAS SET APRIL 9.2018/ 243,411 CONTRACTS) AND TODAY’S TINY OI COMEX GAIN OCCURRED WITH A 2 CENT LOSS IN PRICING.//YESTERDAY.

WE ARE NOW INTO THE ACTIVE DELIVERY MONTH OF MAY. HERE WE HAVE 295 OPEN INTEREST STAND SO FAR FOR A LOSS OF ONLY 12 CONTRACTS. WE HAD 13 NOTICES SERVED UPON YESTERDAY SO IN ESSENCE WE GAINED ANOTHER 1 CONTRACT OR AN ADDITIONAL 5,000 OZ WILL STAND FOR DELIVERY AS THESE GUYS REFUSED TO MORPH INTO LONDON BASED FORWARDS AND AS WELL THEY NEGATING A FIAT BONUS. SILVER MUST BE SCARCE AT THE COMEX. QUEUE JUMPING RETURNS WITH A VENGEANCE. WE HAVE NOW SURPASSED THE INITIAL AMOUNT STANDING WHICH OCCURRED ON APRIL 30.2019

THE NEXT MONTH AFTER MAY IS THE NON ACTIVE MONTH OF JUNE. HERE THIS MONTH LOST 8 CONTRACTS DOWN TO 733. AFTER JUNE IS THE ACTIVE MONTH OF JULY, (THE SECOND LARGEST DELIVERY MONTH OF THE YEAR FOR SILVER) AND HERE THIS MONTH LOST 1432 CONTRACTS DOWN TO 153,947 CONTRACTS. THE NEXT ACTIVE MONTH AFTER JULY FOR SILVER IS SEPTEMBER AND HERE THE OI FELL BY 229 DOWN TO 18,762 CONTRACTS.

TODAY’S NUMBER OF NOTICES FILED:

We, today, had 0 notice(s) filed for NIL OZ for the MARCH, 2019 COMEX contract for silver

Trading Volumes on the COMEX TODAY: 256,879 CONTRACTS

CONFIRMED COMEX VOL. FOR YESTERDAY: 247,064 contracts

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

GATA STORIES WITH RESPECT TO GOLD/PRECIOUS METALS.

Kranzler believes that the Fed is losing control on the interest rate front..and they may lose control of the goldprice as well…

(courtesy Kranzler/IRD/GATA)

Dave Kranzler: Fed is losing control of rates, then may lose control of gold too

Submitted by cpowell on Tue, 2019-05-14 13:05. Section: Daily Dispatches

9:05a ET Tuesday, May 14, 2019

Dear Friend of GATA and Gold: