Friday, May 10, 2019 9:26:11 PM

Jungle Data & News

Good Morning Good Evening

Ya Know Where You Are

You In The Jungle Babe

Welcome to ~*~Mining & Metals Du Jour~*~Graveyard Shift~*~

On the show tonight: Great Data & News by Harvey Organ,Our Miners Resource Pipeline,what Make diamonds Blue,some Good Miner Swing Plays,GATA Daily Dispatches and Egon von Greyerz says Moves in Gold & Silver Will Be 1970s on Stilts

Hello everybody I'm J:D your host tonight Thanks for being with us.

Hope Your Having a Wonderful Weekend

EnJoy the show

OK...Welcome to the Jungle ! !

MMGYS

Thank you

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

MAY 10//MARKETS ARE ONE BIG JOKE: THE DOW RISES BY 114 POINTS ON “CONSTRUCTIVE TALKS” WITH CHINA DESPITE TRUMP RAISING TARIFFS TO 25% ON 200 BILLION DOLLARS WORTH OF GOODS/ GOLD UP $2.15 TO $1286.75//SILVER UP 2 CENTS TO $14,79///QUEUE JUMPING CONTINUES IN BOTH GOLD AND SILVER COMEX//STILL NO GOLD ENTERS THE GOLD AREN/MORE SWAMP STORIES FOR YOU TONIGHT//

May 10, 2019 · by harveyorgan · in Uncat

GOLD: $1286.75 UP $2.15 (COMEX TO COMEX CLOSING)

Silver: $14.79 UP 2 CENTS (COMEX TO COMEX CLOSING)

Closing access prices:

Gold : 1286.75

silver: $14.79

JPMorgan has been receiving gold with reckless abandon and sometimes supplying (stopping)

today RECEIVING:7/11

EXCHANGE: COMEX

CONTRACT: MAY 2019 COMEX 100 GOLD FUTURES

SETTLEMENT: 1,283.500000000 USD

INTENT DATE: 05/09/2019 DELIVERY DATE: 05/13/2019

FIRM ORG FIRM NAME ISSUED STOPPED

____________________________________________________________________________________________

657 C MORGAN STANLEY 1

661 C JP MORGAN 7

690 C ABN AMRO 3

737 C ADVANTAGE 2 3

905 C ADM 6

____________________________________________________________________________________________

TOTAL: 11 11

MONTH TO DATE: 187

NUMBER OF NOTICES FILED TODAY FOR MAY CONTRACT: 11 NOTICE(S) FOR 1100 OZ (0.0342 tonnes)

TOTAL NUMBER OF NOTICES FILED SO FAR: 187 NOTICES FOR 18700 OZ (.5816 TONNES)

SILVER

FOR MAY

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

13 NOTICE(S) FILED TODAY FOR 65,000 OZ/

total number of notices filed so far this month: 3341 for 16,705,000 oz

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

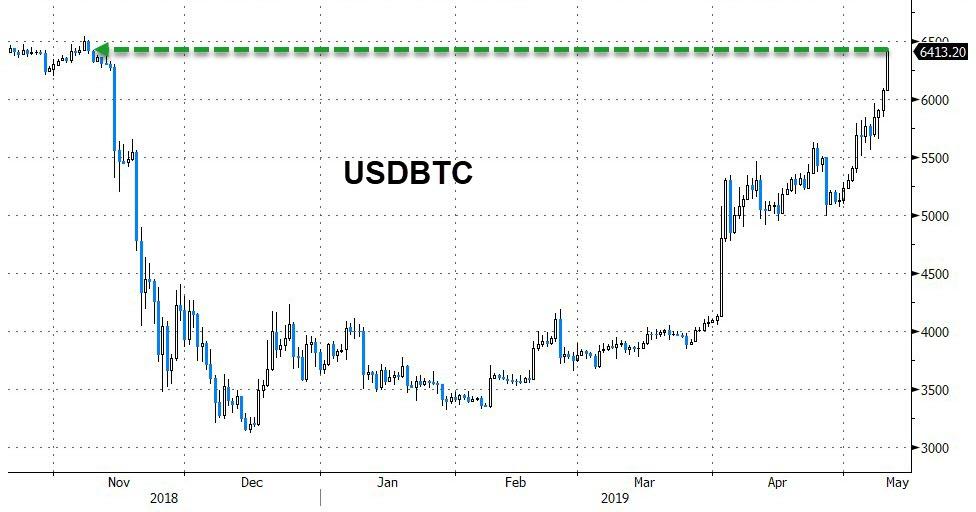

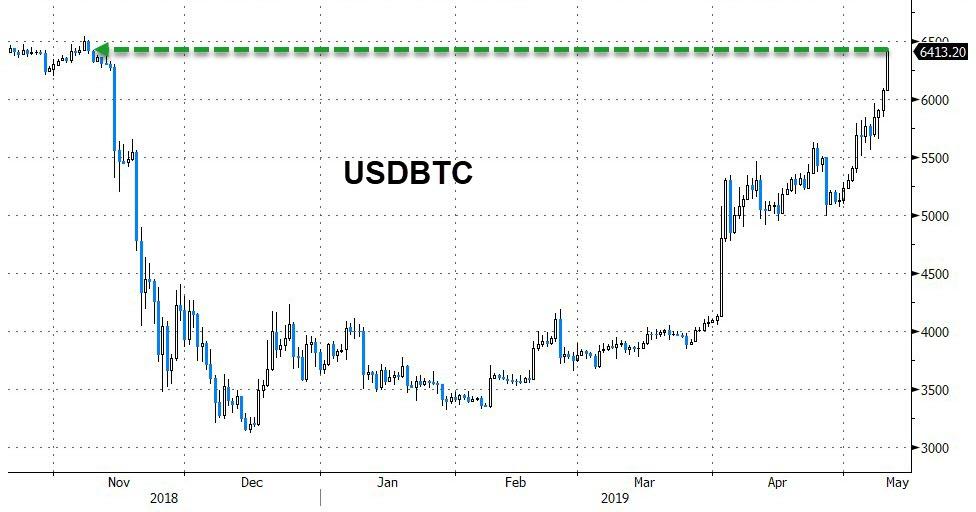

Bitcoin: OPENING MORNING TRADE :$6299 UP $118.00

Bitcoin: FINAL EVENING TRADE: $6407 UP $229

end

XXXX

Let us have a look at the data for today

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

IN SILVER THE COMEX OI ROSE BY A CONSIDERABLE SIZED 1691 CONTRACTS FROM 198,782 UP TO 200,473 DESPITE YESTERDAY’S 9 CENT FALL IN SILVER PRICING AT THE COMEX. ,LIQUIDATION OF THE SPREADERS HAVE STOPPED FOR SILVER BUT IT NOW COMMENCES FOR GOLD. TODAY WE705RRIVED FURTHER FROM AUGUST’S 2018 RECORD SETTING OPEN INTEREST OF 244,196 CONTRACTS.

WE HAVE ALSO WITNESSED A LARGE AMOUNT OF PHYSICAL METAL STAND FOR COMEX DELIVERY AS WELL WE ARE WITNESSING CONSIDERABLE LONGS PACKING THEIR BAGS AND MIGRATING OVER TO LONDON IN GREATER NUMBERS IN THE FORM OF EFP’S. WE WERE NOTIFIED THAT WE HAD A FAIR SIZED NUMBER OF COMEX LONGS TRANSFERRING THEIR CONTRACTS TO LONDON THROUGH THE EFP:

0 FOR MAY, 0 FOR JUNE, 956 FOR JULY AND ZERO FOR ALL OTHER MONTHS AND THEREFORE TOTAL ISSUANCE 956 CONTRACTS. WITH THE TRANSFER OF 956 CONTRACTS, WHAT THE CME IS STATING IS THAT THERE IS NO SILVER (OR GOLD) TO BE DELIVERED UPON AT THE COMEX AS THEY MUST EXPORT THEIR OBLIGATION TO LONDON. ALSO KEEP IN MIND THAT THERE CAN BE A DELAY OF 24-48 HRS IN THE ISSUING OF EFP’S. THE 956 EFP CONTRACTS TRANSLATES INTO 4.78 MILLION OZ ACCOMPANYING:

1.THE 9 CENT FALL IN SILVER PRICE AT THE COMEX AND

2. THE STRONG AMOUNT OF SILVER OUNCES WHICH STOOD FOR DELIVERY IN THE LAST NINE MONTHS:

JUNE/2018. (5.420 MILLION OZ);

FOR JULY: 30.370 MILLION OZ

FOR AUG., 6.065 MILLION OZ

FOR SEPT. 39.505 MILLION OZ S

FOR OCT.2.525 MILLION OZ.

FOR NOV: A HUGE 7.440 MILLION OZ STANDING AND

21.925 MILLION OZ FINALLY STAND FOR DECEMBER.

5.845 MILLION OZ STAND IN JANUARY.

2.955 MILLION OZ STANDING FOR FEBRUARY.:

27.120 MILLION OZ STANDING IN MARCH.

3.875 MILLION OZ STANDING FOR SILVER IN APRIL.

AND NOW 18.280 MILLION OZ STANDING FOR SILVER IN MAY.

ACCUMULATION FOR EFP’S/SILVER/J.P.MOAN’S HOUSE OF BRIBES, / STARTING FROM FIRST DAY NOTICE/FOR MONTH OF MAY:

10,514 CONTRACTS (FOR 8 TRADING DAYS TOTAL 10,514 CONTRACTS) OR 52.57 MILLION OZ: (AVERAGE PER DAY: 1314 CONTRACTS OR 6.57 MILLION OZ/DAY)

TO GIVE YOU AN IDEA AS TO THE HUGE SUPPLY THIS MONTH IN SILVER: SO FAR THIS MONTH OF MAY: 52.57 MILLION PAPER OZ HAVE MORPHED OVER TO LONDON. THIS REPRESENTS AROUND 7.51% OF ANNUAL GLOBAL PRODUCTION (EX CHINA EX RUSSIA)* JUNE’S 345.43 MILLION OZ IS THE SECOND HIGHEST RECORDED ISSUANCE OF EFP’S AND IT FOLLOWED THE RECORD SET IN APRIL 2018 OF 385.75 MILLION OZ.

ACCUMULATION IN YEAR 2019 TO DATE SILVER EFP’S: 793.30 MILLION OZ.

JANUARY 2019 EFP TOTALS: 217.455. MILLION OZ

FEB 2019 TOTALS: 147.4 MILLION OZ/

MARCH 2019 TOTAL EFP ISSUANCE: 207.835 MILLION OZ

APRIL 2019 TOTAL EFP ISSUANCE: 182.87 MILLION OZ.

RESULT: WE HAD A CONSIDERABLE SIZED INCREASE IN COMEX OI SILVER COMEX CONTRACTS OF 1691 DESPITE THE 9 CENT FALL IN SILVER PRICING AT THE COMEX /YESTERDAY... THE CME NOTIFIED US THAT WE HAD A GOOD SIZED EFP ISSUANCE OF 956 CONTRACTS WHICH EXITED OUT OF THE SILVER COMEX AND TRANSFERRED THEIR OI TO LONDON AS FORWARDS. SPECULATORS CONTINUED THEIR INTEREST IN ATTACKING THE SILVER COMEX FOR PHYSICAL SILVER (SEE COMEX DATA) . OUR BANKERS RESUMED THEIR LIQUIDATION OF THE SPREAD TRADES TODAY.

TODAY WE GAINED A STRONG SIZED: 2647 TOTAL OI CONTRACTS ON THE TWO EXCHANGES:

i.e 956 OPEN INTEREST CONTRACTS HEADED FOR LONDON (EFP’s) TOGETHER WITH INCREASE OF 1691 OI COMEX CONTRACTS. AND ALL OF THIS DEMAND HAPPENED WITH A 9 CENT FALL IN PRICE OF SILVER AND A CLOSING PRICE OF $14.77 WITH RESPECT TO YESTERDAY’S TRADING. YET WE STILL HAVE A STRONG AMOUNT OF SILVER STANDING AT THE COMEX FOR DELIVERY!!

In ounces AT THE COMEX, the OI is still represented by JUST OVER 1 BILLION oz i.e. 1.007 BILLION OZ TO BE EXACT or 144% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT MARCH MONTH/ THEY FILED AT THE COMEX: 13 NOTICE(S) FOR 65,000 OZ OF SILVER

IN SILVER,PRIOR TO TODAY, WE SET THE NEW COMEX RECORD OF OPEN INTEREST AT 243,411 CONTRACTS ON APRIL 9.2018. AND AGAIN THIS HAS BEEN SET WITH A LOW PRICE OF $16.51.

AND NOW WE RECORD FOR POSTERITY ANOTHER ALL TIME RECORD OPEN INTEREST AT THE COMEX OF 244,196 CONTRACTS ON AUGUST 22/2018 AND AGAIN WHEN THIS RECORD WAS SET, THE PRICE OF SILVER WAS $14.78 AND LOWER IN PRICE THAN PREVIOUS RECORDS.

ON THE DEMAND SIDE WE HAVE THE FOLLOWING:

HUGE AMOUNTS OF SILVER STANDING FOR DELIVERY (MARCH/2018: 27 MILLION OZ , APRIL/2018 : 2.485 MILLION OZ MAY: 36.285 MILLION OZ ; JUNE/2018 (5.420 MILLION OZ) , JULY 2018 FINAL AMOUNT STANDING: 30.370 MILLION OZ ) FOR AUGUST 6.065 MILLION OZ. , SEPT: A HUGE 39.505 MILLION OZ./ OCTOBER: 2,520,000 oz NOV AT 7.440 MILLION OZ./ DEC. AT 21.925 MILLION OZ JANUARY AT 5.825 MILLION OZ.AND FEB 2019: 2.955 MILLION OZ/ MARCH: 27.120 MILLION OZ/ APRIL AT 3.875 MILLION OZ/ AND NOW MAY: 18.280 MILLION OZ ..

HUGE RECORD OPEN INTEREST IN SILVER 243,411 CONTRACTS (OR 1.217 BILLION OZ/ SET APRIL 9/2018) AND NOW AUGUST 22/2018: 244,196 CONTRACTS, WITH A SILVER PRICE OF $14.78.

HUGE ANNUAL EFP’S ISSUANCE EQUAL TO 2.9 BILLION OZ OR 400% OF SILVER ANNUAL PRODUCTION/2017

RECORD SETTING EFP ISSUANCE FOR ANY MONTH IN SILVER; APRIL/2018/ 385.75 MILLION OZ/ AND THE SECOND HIGHEST RECORDED EFP ISSUANCE JUNE 2018 345.43 MILLION OZ

AND YET, WITH THE EXTREMELY HIGH EFP ISSUANCE, WE HAVE A CONTINUAL LOW PRICE OF SILVER DESPITE THE ABOVE HUGE DEMAND. TO ME THE ONLY ANSWER IS THAT WE HAVE SOVEREIGN (CHINA) WHO IS ENDEAVOURING TO GOBBLE UP ALL AVAILABLE PHYSICAL SILVER NO MATTER WHERE, EXACTLY WHAT J.P.MORGAN IS DOING. AND IT IS MY BELIEF THAT J.P.MORGAN IS HOLDING ITS SILVER FOR ITS BENEFICIAL OWNER..THE USA GOVERNMENT WHO IN TURN IS HOLDING THAT SILVER FOR CHINA.(FOR A SILVER LOAN REPAYMENT).

IN GOLD, THE OPEN INTEREST ROSE BY A VERY STRONG SIZED 11,269 CONTRACTS, TO 474,094 WITH THE RISE IN THE COMEX GOLD PRICE/(AN INCREASE IN PRICE OF $4.00//YESTERDAY’S TRADING).

THE CME RELEASED THE DATA FOR EFP ISSUANCE AND IT TOTALED A GOOD SIZED 4205 CONTRACTS:

APRIL 0 CONTRACTS,JUNE: 4205 CONTRACTS DECEMBER: 0 CONTRACTS, JUNE 2020 0 CONTRACTS AND ALL OTHER MONTHS ZERO. The NEW COMEX OI for the gold complex rests at 474,094. ALSO REMEMBER THAT THERE WILL BE A DELAY IN THE ISSUANCE OF EFP’S. THE BANKERS REMOVE LONG POSITIONS OF COMEX GOLD IMMEDIATELY. THEN THEY ORCHESTRATE THEIR PRIVATE EFP DEAL WITH THE LONGS AND THAT COULD TAKE AN ADDITIONAL, 48 HRS SO WE GENERALLY DO NOT GET A MATCH WITH RESPECT TO DEPARTING COMEX LONGS AND NEW EFP LONG TRANSFERS. . EVEN THOUGH THE BANKERS ISSUED THESE MONSTROUS EFPS, THE OBLIGATION STILL RESTS WITH THE BANKERS TO SUPPLY METAL BUT IT TRANSFERS THE RISK TO A LONDON BANKER OBLIGATION AND NOT A NEW YORK COMEX OBLIGATION. LONGS RECEIVE A FIAT BONUS TOGETHER WITH A LONG LONDON FORWARD. THUS, BY THESE ACTIONS, THE BANKERS AT THE COMEX HAVE JUST STATED THAT THEY HAVE NO APPRECIABLE METAL!! THIS IS A MASSIVE FRAUD: THEY CANNOT SUPPLY ANY METAL TO OUR COMEX LONGS BUT THEY ARE QUITE WILLING TO SUPPLY MASSIVE NON BACKED GOLD (AND SILVER) PAPER KNOWING THAT THEY HAVE NO METAL TO SATISFY OUR LONGS. LONDON IS NOW SEVERELY BACKWARD IN BOTH GOLD AND SILVER AND WE ARE WITNESSING DELAYS IN ACTUAL DELIVERIES.

IN ESSENCE WE HAVE A GIGANTIC SIZED GAIN IN TOTAL CONTRACTS ON THE TWO EXCHANGES OF 15,474 CONTRACTS: 11,269 OI CONTRACTS INCREASED AT THE COMEX AND 4205 EFP OI CONTRACTS WHICH NAVIGATED OVER TO LONDON. THUS TOTAL OI GAIN OF 15,474 CONTRACTS OR 1,547,400 OZ OR 48.13TONNES. YESTERDAY WE HAD A GAIN IN THE PRICE OF GOLD TO THE TUNE OF $4.00….AND WITH THAT RISE, WE HAD A HUMONGOUS GAIN IN TONNAGE OF 48.13 TONNES!!!!!!.??????????????????????????????????????????

AS YOU WILL SEE, THE CROOKS HAVE NOW SWITCHED TO GOLD AS THEY INCREASE THE OPEN INTEREST FOR THE SPREADERS. THE TOTAL COMEX GOLD OPEN INTEREST WILL RISE FROM NOW ON UNTIL ONE WEEK PRIOR TO FIRST DAY NOTICE AND THAT IS WHEN THEY START THEIR CRIMINAL LIQUIDATION.

HERE IS HOW THE CROOKS USED SPREADING AS WE ENTER A NON ACTIVE DELIVERY MONTH OF MAY HEADING TOWARDS THE VERY ACTIVE DELIVERY MONTH OF JUNE.

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES, HERE IS THE BANKERS MODUS OPERANDI:

“YOU WILL ALSO NOTICE THAT THE COMEX OPEN INTEREST IS STARTING TO RISE IN THIS NON ACTIVE MONTH OF MAY BUT SO IS THE OPEN INTEREST OF SPREADERS. THE OPEN INTEREST IN GOLD WILL CONTINUE TO RISE UNTIL ONE WEEK BEFORE FIRST DAY NOTICE OF AN UPCOMING ACTIVE DELIVERY MONTH (JUNE), AND THAT IS WHEN THE CROOKS SELL THEIR SPREAD POSITIONS BUT NOT AT THE SAME TIME OF THE DAY. THEY WILL USE THE SELL SIDE OF THE EQUATION TO CREATE THE CASCADE (ALONG WITH THEIR COLLUSIVE FRIENDS) AND THEN COVER ON THE BUY SIDE OF THE SPREAD SITUATION AT THE END OF THE DAY. THEY DO THIS TO AVOID POSITION LIMIT DETECTION. THE LIQUIDATION OF THE SPREADING FORMATION CONTINUES FOR EXACTLY ONE WEEK AND ENDS ON FIRST DAY NOTICE.”

AND WITH THE RELEASE OF THE COT REPORT TODAY, HERE IS THE PROOF AS TO WHAT I HAVE BEEN TELLING YOU. NOTE THE HUGE INCREASE IN SPREADING TO THE TUNE OF 16,755 CONTRACTS. THIS IS A FRAUD TO THE HIGHEST ORDER!! SILVER HAD ONLY A SMALL 1000 CONTRACT GAIN IN OI SPREADERS IN ITS COT REPORT..

Gold COT Report – Futures

Large Speculators Commercial Total

Long Short Spreading Long Short Long Short

185,801 110,390 73,060 142,078 238,437 400,939 421,887

Change from Prior Reporting Period

8,526 -666 16,755 -5,210 2,837 20,071 18,926

Traders

180 70 79 54 60 261 185

Small Speculators

Long Short Open Interest

49,100 28,152 450,039

-43 1,102 20,028

non reportable positions Change from the previous reporting period

COT Gold Report – Positions as of Tuesday, May 7, 2019

ACCUMULATION OF EFP’S GOLD AT J.P. MORGAN’S HOUSE OF BRIBES: (EXCHANGE FOR PHYSICAL) FOR THE MONTH OF MAY : 45,855 CONTRACTS OR 4,585,500 OR 142.62 TONNES (8 TRADING DAYS AND THUS AVERAGING: 5731 EFP CONTRACTS PER TRADING DAY

TO GIVE YOU AN IDEA AS TO THE STRONG SIZE OF THESE EFP TRANSFERS : THIS MONTH IN 8 TRADING DAYS IN TONNES: 142.62 TONNES

TOTAL ANNUAL GOLD PRODUCTION, 2018, THROUGHOUT THE WORLD EX CHINA EX RUSSIA: 3555 TONNES

THUS EFP TRANSFERS REPRESENTS 142.62/3550 x 100% TONNES =4,01% OF GLOBAL ANNUAL PRODUCTION SO FAR IN DECEMBER ALONE.***

ACCUMULATION OF GOLD EFP’S YEAR 2019 TO DATE: 1958.18 TONNES

JANUARY 2019 TOTAL EFP ISSUANCE; 531.20 TONNES

FEB 2019 TOTAL EFP ISSUANCE: 344.36 TONNES

MARCH 2019 TOTAL EFP ISSUANCE: 497.16 TONNES

APRIL 2019 TOTAL ISSUANCE: 456.10 TONNES

WHAT IS ALARMING TO ME, ACCORDING TO OUR LONDON EXPERT ANDREW MAGUIRE IS THAT THESE EFP’S ARE BEING TRANSFERRED TO WHAT ARE CALLEDRIAL FORWARD CONTRACT OBLIGATIONS AND THESE CONTRACTS ARE LESS THAN 14 DAYS. ANYTHING GREATER THAN 14 DAYS, THESE MUST BE RECORDED AND SENT TO THE COMPTROLLER, GREAT BRITAIN TO MONITOR RISK TO THE BANKING SYSTEM. IF THIS IS INDEED TRUE, THEN THIS IS A MASSIVE CONSPIRACY TO DEFRAUD AS WE NOW WITNESS A MONSTROUS TOTAL EFP’S ISSUANCE AS IT HEADS INTO THE STRATOSPHERE.

Result: A HUGE SIZED INCREASE IN OI AT THE COMEX OF 11,269 WITH THE RISE IN PRICING ($4.00) THAT GOLD UNDERTOOK YESTERDAY) //.WE ALSO HAD A GOOD SIZED NUMBER OF COMEX LONG TRANSFERRING TO LONDON THROUGH THE EFP ROUTE: 4205 CONTRACTS AS THESE HAVE ALREADY BEEN NEGOTIATED AND CONFIRMED. THERE OBVIOUSLY DOES NOT SEEM TO BE MUCH PHYSICAL GOLD AT THE COMEX. I GUESS IT EXPLAINS THE HUGE ISSUANCE OF EFP’S…THERE IS HARDLY ANY GOLD PRESENT AT THE GOLD COMEX FOR DELIVERY PURPOSES. IF YOU TAKE INTO ACCOUNT THE 4205 EFP CONTRACTS ISSUED, WE HAD AN ATMOSPHERIC SIZED GAIN OF 17,112 CONTRACTS IN TOTAL OPEN INTEREST ON THE TWO EXCHANGES:

4205 CONTRACTS MOVE TO LONDON AND 11,269 CONTRACTS INCREASED AT THE COMEX. (IN TONNES, THE GAIN IN TOTAL OI EQUATES TO 48.13 TONNES). ..AND THIS HUGE DEMAND OCCURRED WITH A RISE IN PRICE OF $4.00 IN YESTERDAY’S TRADING AT THE COMEX. NO DOUBT THAT A STRONG PERCENTAGE OF OI GAIN WAS DUE TO THE CONTINUING OF THE SPREADING OPERATION AS I HAVE OUTLINED ABOVE.

we had: 11 notice(s) filed upon for 1100 oz of gold at the comex.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

With respect to our two criminal funds, the GLD and the SLV:

GLD...

WITH GOLD UP $4.00 TODAY

NO CHANGE IN GOLD INVENTORY AT THE GLD//

INVENTORY RESTS AT 739.64 TONNES

IT LOOKS LIKE WE HAVE REACHED THE BOTTOM OF THE BARREL FOR PHYSICAL GOLD BEING SUPPLIED TO THE CROOKS.

TO ALL INVESTORS THINKING OF BUYING GOLD THROUGH THE GLD ROUTE: YOU ARE MAKING A TERRIBLE MISTAKE AS THE CROOKS ARE USING WHATEVER GOLD COMES IN TO ATTACK BY SELLING THAT GOLD. IT SURE SEEMS TO ME THAT THE GOLD OBLIGATIONS AT THE GLD EXCEED THEIR INVENTOR8

SLV/

WITH SILVER DOWN 9 CENTS TODAY:

NO CHANGE IN SILVER INVENTORY AT THE SLV//

/INVENTORY RESTS AT 316.582 MILLION OZ.

end

First, here is an outline of what will be discussed tonight:

1. Today, we had the open interest in SILVER ROSE BY A CONSIDERABLE SIZED 1691 CONTRACTS from 199,782 UPTO 200,473 AND CLOSER TO THE NEW COMEX RECORD SET LAST IN AUG.2018 AT 244,196 WITH A SILVER PRICE OF $14.78/(AUGUST 22/2018)..THE PREVIOUS RECORD WAS SET ON APRIL 9/2018 AT 243,411 OPEN INTEREST CONTRACTS WITH THE SILVER PRICE AT THAT DAY: $16.53). AND PREVIOUS TO THAT, THE RECORD WAS ESTABLISHED AT: 234,787 CONTRACTS, SET ON APRIL 21.2017 OVER 1 1/3 YEARS AGO. THE PRICE OF SILVER ON THAT DAY: $17.89. AS YOU CAN SEE, WE HAVE RECORD HIGH OPEN INTERESTS IN SILVER ACCOMPANIED BY A CONTINUAL LOWER PRICE WHEN THAT RECORD WAS SET…..THE SPREADERS HAVE STOPPED THEIR LIQUIDATION IN SILVER BUT HAVE NOW MORPHED INTO GOLD..

EFP ISSUANCE:

OUR CUSTOMARY MIGRATION OF COMEX LONGS CONTINUE TO MORPH INTO LONDON FORWARDS AS OUR BANKERS USED THEIR EMERGENCY PROCEDURE TO ISSUE:

0 CONTRACTS FOR APRIL., 0 FOR MAY, FOR JUNE 0 CONTRACTS AND JULY: 956 CONTRACTS AND ALL OTHER MONTHS: ZERO. TOTAL EFP ISSUANCE: 956 CONTRACTS. EFP’S GIVE OUR COMEX LONGS A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. IF WE TAKE THE OI GAIN AT THE COMEX OF 1691 CONTRACTS TO THE 956 OI TRANSFERRED TO LONDON THROUGH EFP’S, WE OBTAIN A STRONG GAIN OF 2647 OPEN INTEREST CONTRACTS. THUS IN OUNCES, THE GAIN ON THE TWO EXCHANGES: 13.24 MILLION OZ!!! AND YET WE ALSO HAVE A STRONG DEMAND FOR PHYSICAL AS WE WITNESSED A FINAL STANDING OF GREATER THAN 30 MILLION OZ FOR JULY, A STRONG 7.475 MILLION OZ FOR AUGUST.. A HUGE 39.505 MILLION OZ STANDING FOR SILVER IN SEPTEMBER… OVER 2 million OZ STANDING FOR THE NON ACTIVE MONTH OF OCTOBER., 7.440 MILLION OZ FINALLY STANDING IN NOVEMBER. 21.925 MILLION OZ STANDING IN DECEMBER , 5.845 MILLION OZ STANDING IN JANUARY. 2.955 MILLION OZ STANDING IN FEBRUARY, 27.120 MILLION OZ FOR MARCH., 3.875 MILLION OZ FOR APRIL AND NOW 18.280 MILLION OZ FOR MAY

RESULT: A CONSIDERABLE SIZED INCREASE IN SILVER OI AT THE COMEX DESPITE THE 9 CENT LOSS IN PRICING THAT SILVER UNDERTOOK IN PRICING// YESTERDAY. WE ALSO HAD A GOOD SIZED 956 EFP’S ISSUED TRANSFERRING COMEX LONGS OVER TO LONDON. TOGETHER WITH THE STRONG SIZED AMOUNT OF SILVER OUNCES STANDING FOR THIS MONTH, DEMAND FOR PHYSICAL SILVER CONTINUES TO INTENSIFY AS WE WITNESS SEVERE BACKWARDATION IN SILVER IN LONDON.

BOTH THE SILVER COMEX AND THE GOLD COMEX ARE IN STRESS AS THE BANKERS SCOUR THE BOWELS OF THE EXCHANGE FOR METAL

(report Harvey)

.

2.a) The Shanghai and London gold fix report

(Harvey)

2 b) Gold/silver trading overnight Europe, Goldcore

(Mark O’Byrne/zerohedge

and in NY: Bloomberg

3. ASIAN AFFAIRS

i)FRIDAY MORNING/ THURSDAY NIGHT:

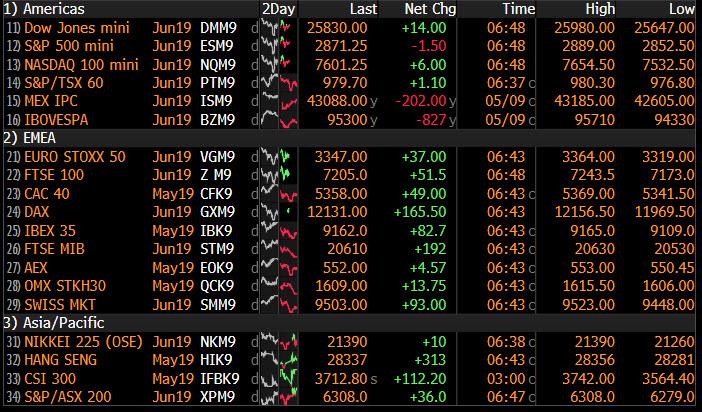

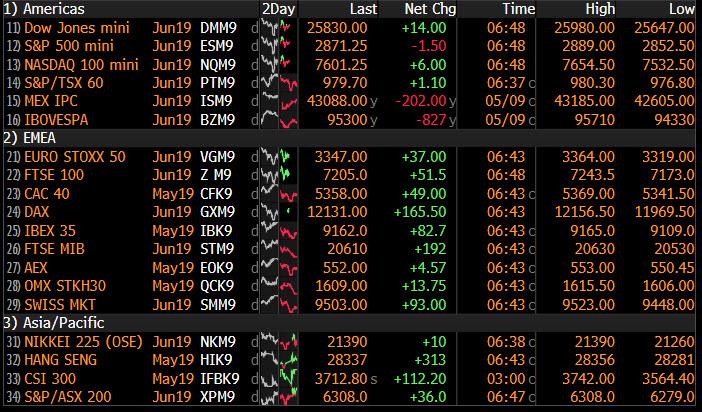

SHANGHAI CLOSED UP 88.26 POINTS OR 3.10% //Hang Sang CLOSED UP 239.17 POINTS OR 0.84% /The Nikkei closed DOWN 57.21 POINTS OR 0.27%//Australia’s all ordinaires CLOSED UP .25%

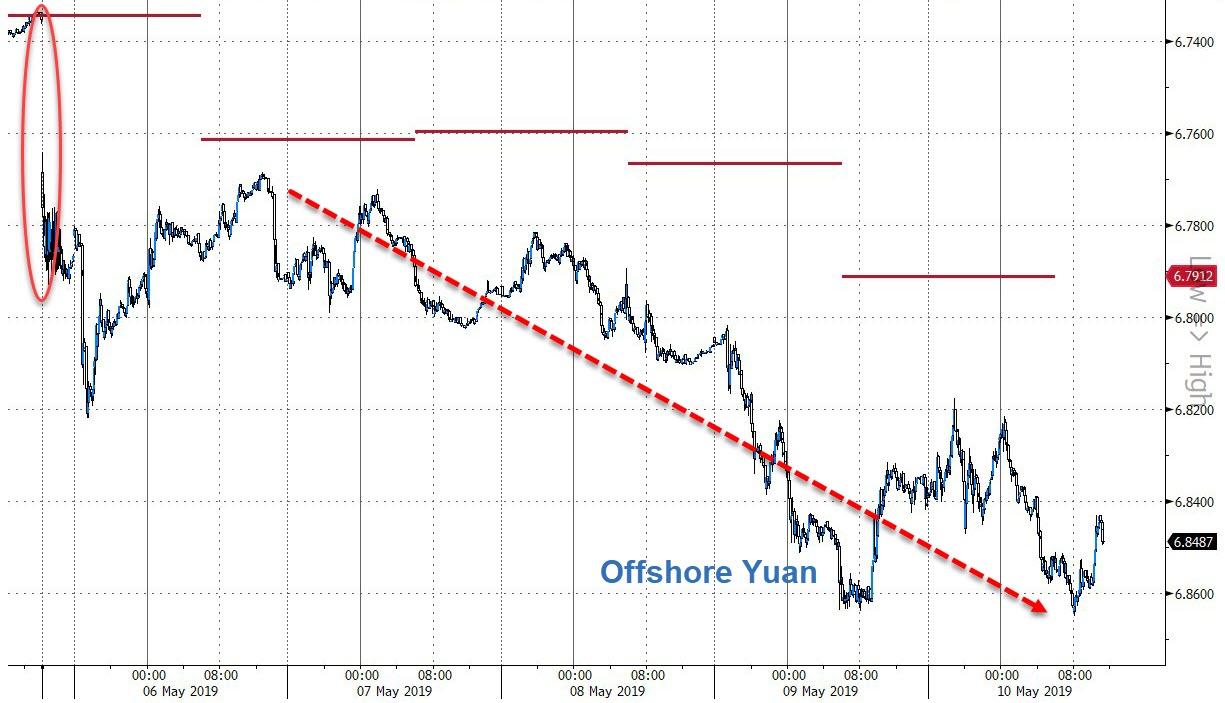

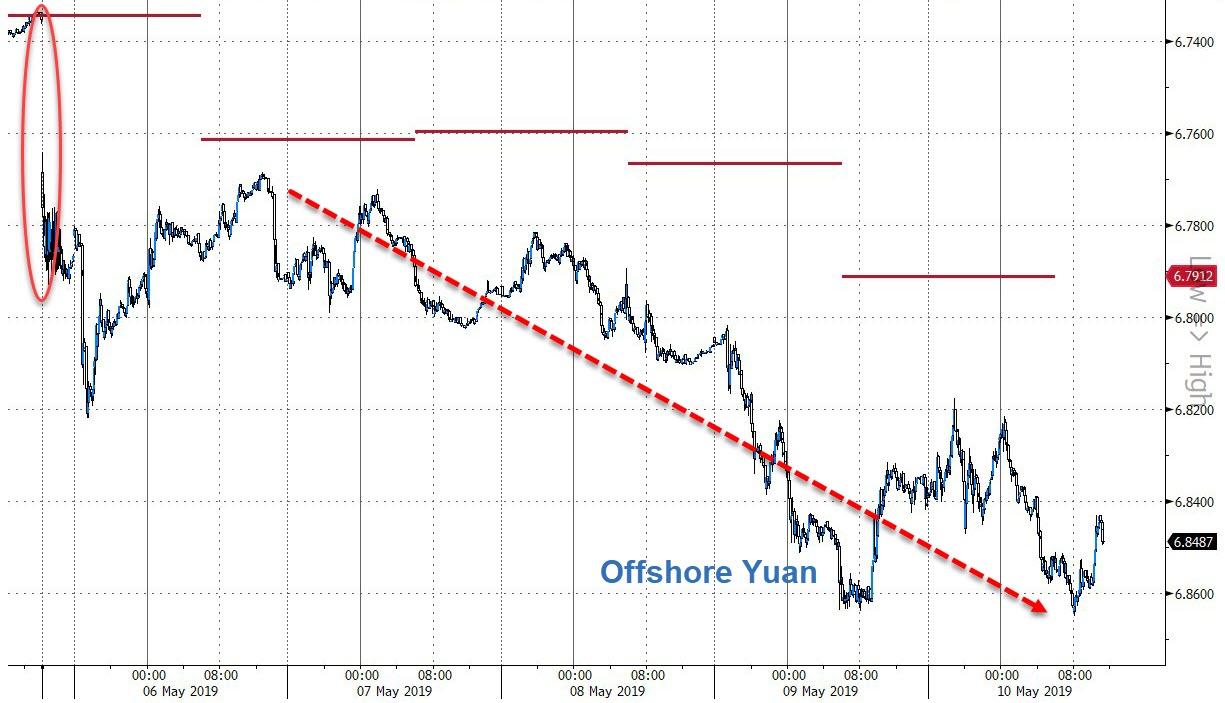

/Chinese yuan (ONSHORE) closed DOWN at 6.8246 AS TRUCE DECLARED FOR 3 MONTHS /Oil UP to 61.92 dollars per barrel for WTI and 70.47 for Brent. Stocks in Europe OPENED RED// ONSHORE YUAN CLOSED DOWN // LAST AT 6.8246 AGAINST THE DOLLAR. OFFSHORE YUAN CLOSED DOWN ON THE DOLLAR AT 6.8550 TRADE TALKS STILL ON//TRUMP INITIATES A NEW 25% TARIFFS FRIDAY/MAY 10/MAJOR PROBLEMS AT HUAWEI /CFO ARRESTED : /ONSHORE YUAN TRADING ABOVE LEVEL OF OFFSHORE YUAN/ONSHORE YUAN TRADING WEAKER AGAINST USA DOLLAR/OFFSHORE YUAN TRADING WEAKER AGAINST THE DOLLAR /TRADE DEAL NOW DEAD..TRUMP THREATENS TO RAISE RATES TO 25%

3A//NORTH KOREA/ SOUTH KOREA

i)NORTH KOREA

The USA seizes a North Korean ship suspected of violating international sanctions.

Kim not too happy

( zerohedge)

ii)NORTH KOREA

Kim states that his latest launch was a “long range strike”.

Trump not to happy with “fat man”

( zerohedge)

b) REPORT ON JAPAN

3 China/Chinese affairs

i)/China/USA/ last night 9 pm

Algos panic as the USA China trade talks end early and at midnight tariffs are to begin

( zerohedge)

ii)Midnight THURSDAY NIGHT/Friday 12:01 am

USA hikes Chinese tariffs after the talks result in no progress and China vows to retaliate

( zerohedge)

iii)China’s National team ( plunge protection team) swoops in to prop up stocks as deal hopes crumble

( zerohedge)

iv)Liu leaves empty handed after his two hour meeting//all markets remain subdued.( zerohedge)

4/EUROPEAN AFFAIRS

i)UK

Mises’s Pickering lays out what is the best outcome for Britain and that is a no deal Brexit. Britain would be able to deal with the rest of the world with cheaper costs. Also she could get rid of those bothersome high regulatory problems facing all members of the EU. The problem of course is that goods to the EU will be higher but Britain can deal with it

( Pickering//Mises)

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

i)CYPRUS/TURKEY/EUROPE/ISRAEL

This is becoming quite explosive as Cyprus slams potential Turkish oil and gas drilling in areas controlled by Greek/Cyprus. They demand EU action

( zerohedge)

ii)Bolton held an extremely rare meeting on Iran at CIA headquarters.

( zerohedge)

iii)Iran/USAIran threatens to destroy the USS Lincoln which is passing through the Suez Canal right now if it proceeds through the Straits of Hormuz

( zerohedge)

6. GLOBAL ISSUES

i)Sweden

Strange: The government at first desired a cashless Sweden and in the last few years, the amount of notes in circulation decreased. Now the Government wants its citizens to hoard cash in case of a cyber attack or war.

(courtesy zerohedge)

7. OIL ISSUES

8 EMERGING MARKET ISSUES

VENEZUELA

9. PHYSICAL MARKETS

i)We promised that this would happen: AngloGold has decided enough is enough and they are leaving South Africa.

(courtesy Seccombe/Business Day.GATA

ii)A must listen to interview on gold suppression courtesy of Chris Powell of GATA and Mark O”Byrne of Goldcore

( Goldcore/GATA//Chris Powell/

iii)More fines are going to be set against our usual crooked banks for rigging foreign exchange (and that should include gold/silver)

The Banks involved are Barclays, Citigroup, HSBC, JPMorgan and 3 others.

( Reuters/GATA)

10. USA stories which will influence the price of gold/silver)

MARKET TRADING//

ii)Market data

ii)USA ECONOMIC/GENERAL STORIES

SWAMP STORIES

a)The true store behind the Steele dossier: how claims are now debunked and how leaks were perpetrated before the FISA application had actually begun

(zerohedge)

b)Craig Murray takes on whether it was the Russians that hacked the DNC. He and others state that it was not the Russians

( Craig Murray)

E)SWAMP STORIES/MAJOR STORIES//THE KING REPORT

Let us head over to the comex:

THE TOTAL COMEX GOLD OPEN INTEREST ROSE BY A HUMONGOUS SIZED 11,269 CONTRACTS.TO A LEVEL OF 474,094 WITH THE GAIN IN THE PRICE OF GOLD ($4.00) IN YESTERDAY’S // COMEX TRADING)

WE ARE NOW IN THE NON ACTIVE DELIVERY MONTH OF MAY.. THE CME REPORTS THAT THE BANKERS ISSUED A GOOD SIZED TRANSFER THROUGH THE EFP ROUTE AS THESE LONGS RECEIVED A DELIVERABLE LONDON FORWARD TOGETHER WITH A FIAT BONUS., THAT IS 7366 EFP CONTRACTS WERE ISSUED:

0 FOR JUNE ’19: 4206 CONTRACTS , DEC; 0 CONTRACTS: 0 AND ZERO FOR ALL OTHER MONTHS:

TOTAL EFP ISSUANCE: 4206 CONTRACTS.

THE OBLIGATION STILL RESTS WITH THE BANKERS ON THESE TRANSFERS. ALSO REMEMBER THAT THERE IS NO DOUBT A HUGE DELAY IN THE ISSUANCE OF EFP’S AND IT PROBABLY TAKES AT LEAST 48 HRS AFTER LONGS GIVE UP THEIR COMEX CONTRACTS FOR THEM TO RECEIVE THEIR EFP’S AS THEY ARE NEGOTIATING THIS CONTRACT WITH THE BANKS FOR A FIAT BONUS PLUS THEIR TRANSFER TO A LONDON BASED FORWARD.

ON A NET BASIS IN OPEN INTEREST WE GAINED THE FOLLOWING TODAY ON OUR TWO EXCHANGES: 15,474 TOTAL CONTRACTS IN THAT 4205 LONGS WERE TRANSFERRED AS FORWARDS TO LONDON AND WE GAINED A VERY STRONG SIZED 11,269 COMEX CONTRACTS.

NET GAIN ON THE TWO EXCHANGES : 15,474 contracts OR 1,547,400 OZ OR 48.13 TONNES.

We are now in the NON active contract month of MAY and here the open interest stands at 128 contracts, having LOST 0 contracts. We had 5 notices served yesterday so we gained 5 contracts or an additional 500 oz will stand as they guys refused to morph into a London based forward as well as negating a fiat bonus

The next contract month after May is June and here the open interest ROSE by 1397 contracts UP to 283,635. July GAINED 15 contracts to stand at 72. After July the next active month is August and here the OI rose by 8,624 contracts up to 114,318 contracts.

TODAY’S NOTICES FILED:

WE HAD 11 NOTICES FILED TODAY AT THE COMEX FOR 1100 OZ. (0.0342 TONNES)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for the wild silver comex results.

Total COMEX silver OI ROSE BY A CONSIDERABLE SIZED 1691 CONTRACTS FROM 198,782 UP TO 200,473(AND FURTHER FROM THE NEW RECORD OI FOR SILVER SET ON AUGUST 22.2018. THE PREVIOUS RECORD WAS SET APRIL 9.2018/ 243,411 CONTRACTS) AND TODAY’S TINY OI COMEX GAIN OCCURRED DESPITE A 9 CENT LOSS IN PRICING.//YESTERDAY.

WE ARE NOW INTO THE ACTIVE DELIVERY MONTH OF MAY. HERE WE HAVE 328 OPEN INTEREST STAND SO FAR FOR A LOSS OF ONLY 38 CONTRACTS. WE HAD 49 NOTICES SERVED UPON YESTERDAY SO IN ESSENCE WE GAINED ANOTHER 11 CONTRACTS OR AN ADDITIONAL 55,000 OZ WILL STAND FOR DELIVERY AS THESE GUYS REFUSED TO MORPH INTO LONDON BASED FORWARDS AND AS WELL THEY NEGATING A FIAT BONUS. SILVER MUST BE SCARCE AT THE COMEX. QUEUE JUMPING RETURNS WITH A VENGEANCE. WE HAVE NOW SURPASSED THE INITIAL AMOUNT STANDING WHICH OCCURED ON APRIL 30.2019

THE NEXT MONTH AFTER MAY IS THE NON ACTIVE MONTH OF JUNE. HERE THIS MONTH GAINED 18 CONTRACTS UP TO 724. AFTER JUNE IS THE ACTIVE MONTH OF JULY, (THE SECOND LARGEST DELIVERY MONTH OF THE YEAR FOR SILVER) AND HERE THIS MONTH GAINED 1389 CONTRACTS UP TO 152,783 CONTRACTS. THE NEXT ACTIVE MONTH AFTER JULY FOR SILVER IS SEPTEMBER AND HERE THE OI ROSE BY 1004 UP TO 17,872 CONTRACTS.

TODAY’S NUMBER OF NOTICES FILED:

We, today, had 13 notice(s) filed for 65,000 OZ for the MARCH, 2019 COMEX contract for silver

Trading Volumes on the COMEX TODAY: 244,286 CONTRACTS

CONFIRMED COMEX VOL. FOR YESTERDAY: 339,743 contracts

INITIAL standings for MAY/GOLD

Your early FRIDAY morning currency, Asian stock market results, important USA/Asian currency crosses, gold/silver pricing overnight along with the price of oil Major stories overnight/9 AM EST

i) Chinese yuan vs USA dollar/CLOSED/ LAST AT: 6.8246/

//OFFSHORE YUAN: 6.8550 /shanghai bourse CLOSED UP 88.26 POINTS OR 3.10%

HANG SANG CLOSED UP 239.17 POINTS OR 0.84%

2. Nikkei closed DOWN 57.21 POINTS OR 0.27%

3. Europe stocks OPENED GREEN /

USA dollar index FALLS TO 97.36/Euro RISES TO 1.1232

3b Japan 10 year bond yield: FALLS TO. –.05/ !!!!(Japan buying 100% of bond issuance)/Japanese yen vs usa cross now at 109.73/ THIS IS TROUBLESOME AS BANK OF JAPAN IS RUNNING OUT OF BONDS TO BUY./JAPAN 10 YR YIELD IS NOW TARGETED AT .11%/JAPAN LOSING CONTROL OF THEIR BOND MARKET//CARRY TRADERS GETTING KILLED

3c Nikkei now JUST BELOW 17,000

3d USA/Yen rate now well below the important 120 barrier this morning

3e WTI:: 62.02 and Brent: 70.92

3f Gold UP/JAPANESE Yen UP CHINESE YUAN: ON -SHORE DOWN/OFF- SHORE: DOWN

3g Japan is to buy the equivalent of 108 billion uSA dollars worth of bond per month or $1.3 trillion. Japan’s GDP equals 5 trillion usa./“HELICOPTER MONEY” OFF THE TABLE FOR NOW /REVERSE OPERATION TWIST ON THE BONDS: PURCHASE OF LONG BONDS AND SELLING THE SHORT END

Japan to buy 100% of all new Japanese debt and by 2018 they will have 25% of all Japanese debt. Fifty percent of Japanese budget financed with debt.

3h Oil UP for WTI and UP FOR Brent this morning

3i European bond buying continues to push yields lower on all fronts in the EMU. German 10yr bund RISES TO –04%/Italian 10 yr bond yield UP to 2.67% /SPAIN 10 YR BOND YIELD DOWN TO 0.96%…ITALIAN 10 YR BOND YIELD/GERMAN BUND: 2.71: DANGEROUS FOR THE ITALIAN BANKING SYSTEM

3j Greek 10 year bond yield RISES TO : 3.50

3k Gold at $1285.50 silver at: 14.76 7 am est) SILVER NEXT RESISTANCE LEVEL AT $18.50

3l USA vs Russian rouble; (Russian rouble UP 2/100 in roubles/dollar) 65.22

3m oil into the 61 dollar handle for WTI and 70 handle for Brent/

3n Higher foreign deposits out of China sees huge risk of outflows and a currency depreciation. This can spell financial disaster for the rest of the world/

JAPAN ON JAN 29.2016 INITIATES NIRP. THIS MORNING THEY SIGNAL THEY MAY END NIRP. TODAY THE USA/YEN TRADES TO 109.73 DESTROYING JAPANESE CITIZENS WITH HIGHER FOOD INFLATION

30 SNB (Swiss National Bank) still intervening again in the markets driving down the SF. It is not working: USA/SF this morning 1.0134 as the Swiss Franc is still rising against most currencies. Euro vs SF is 1.1383 well above the floor set by the Swiss Finance Minister. Thomas Jordan, chief of the Swiss National Bank continues to purchase euros trying to lower value of the Swiss Franc.

3p BRITAIN VOTES AFFIRMATIVE BREXIT/LOWER PARLIAMENT APPROVES BREXIT COMMENCEMENT/ARTICLE 50 COMMENCES MARCH 29/2017

3r the 10 Year German bund now NEGATIVE territory with the 10 year FALLING to –0.04%

The bank withdrawals were causing massive hardship to the Greek bank. the Greek referendum voted overwhelming “NO”. Next step for Greece will be the recapitalization of the banks and that will be difficult.

4. USA 10 year treasury bond at 2.45% early this morning. Thirty year rate at 2.87%

5. Details Ransquawk, Bloomberg, Deutsche bank/Jim Reid.

6. TURKISH LIRA: UP TO 6.1302..they are toast

Stocks Rise On “Trade Deal Hopes” After US Hikes Tariffs As Trade Deal Collapses

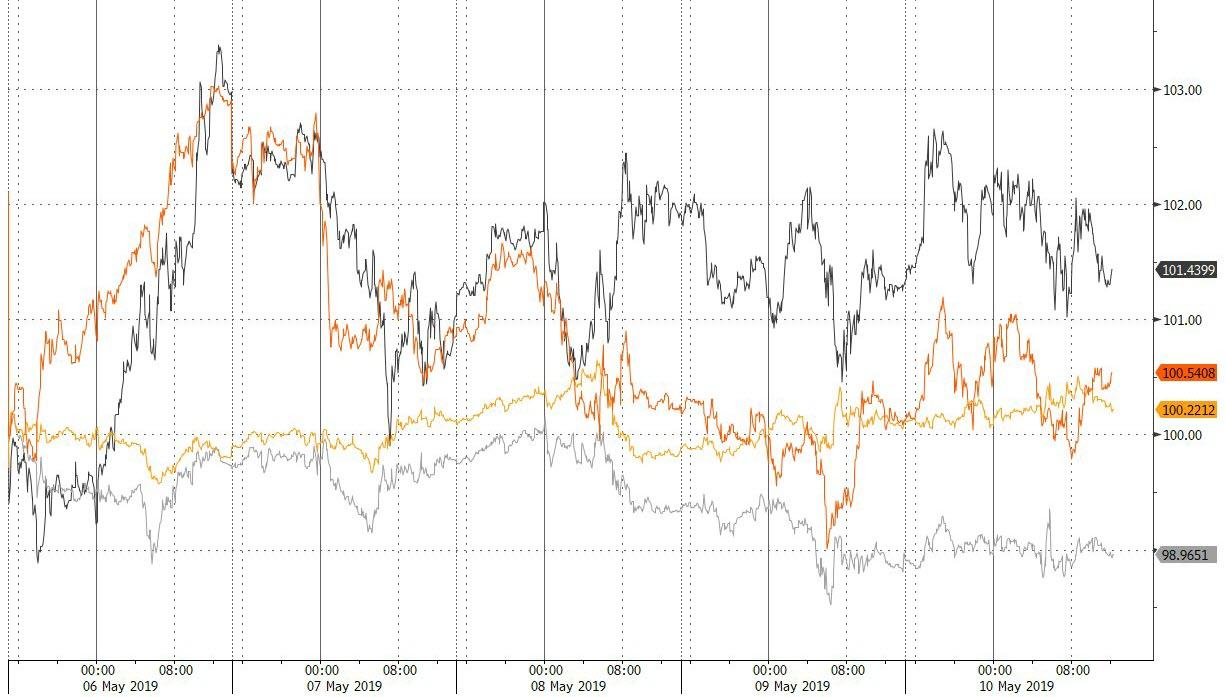

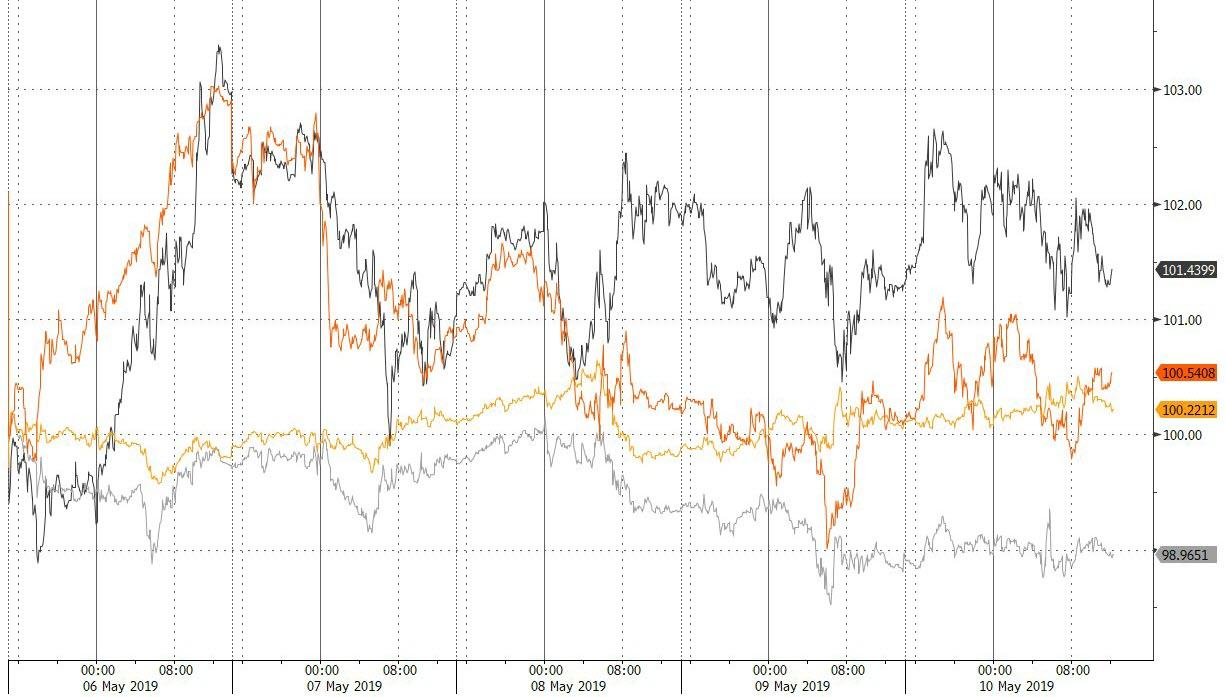

The market may have hit peak absurdity this morning because just hours after another round of US tariffs against China went into effect as some $200BN of Chinese imports saw tariffs hiked to 25% and Beijing vowed it would strike back, world stocks and US equity futures jumped after a volatile overnight session because, as the official narrative goes according to Reuters, “investors held out hopes for a trade deal between the United States and China” even as, as noted above, another round of U.S. tariffs on Chinese goods took effect.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

MMGYS

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Kim Says Latest North Korea Launch Was “Long-Range Strike” Drill

North Korean state media is reporting that what was previously reported as “two short-range missile tests” by South Korea were actually long-range tests, which came on the same day US authorities seized a North Korean ship used to sell coal in violation of international sanctions.

State media announced early Friday (local time): “At the command post, Supreme Leader Kim Jong-un learned about a plan of the strike drill of various long-range strike means and gave an order of start of the drill,” the Korean Central News Agency (KCNA) said in English, as reported by Yonhap.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

US Hikes China Tariffs After Talks Result In No Progress; China Vows To Retaliate

After much theatrics and 11th hour negotiations, the US more than doubled tariffs to 25% on more than $200 billion in good imports from China just after midnight on Friday in what has been dubbed the “most dramatic step yet” in Donald Trump’s crusade to extract trade concessions from Beijing, deepening a nearly two-year old conflict that has roiled global markets and impacted the world economy.

While the White House said in a statement that talks are set to resume Friday, setting the stage for a tense final day of negotiations between Liu He, China’s vice premier and Robert Lighthizer, the US trade rep, Bloomberg reports that according to “close observers” there is little hope for any meaningful breakthroughs, especially since Liu does not have the authority to make any meaningful commitments, while an alleged phone call between Trump and president Xi yielded no positive results. It was also unclear, Bloomberg adds, whether China had resolved the internal debates that had led to last week’s rescinding of prior commitments to enshrine reforms agreed in Chinese law.

News that the US would hike tariffs, and set off a sequence of events that would most likely result in further escalation pushed US equity futures, treasury yields and the USDJPY lower around midnight.

In response to the tariff hike, China immediately said in a statement it “deeply regrets the latest tariff hike” and that it will be forced to take countermeasures against the US actions, but didn’t specify how, even as it said that it sill hopes the two sides can resolve issues via ongoing consultations.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Pic JD Doing the show

Having a Blast ! Thanks

[/img]

[/img]

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

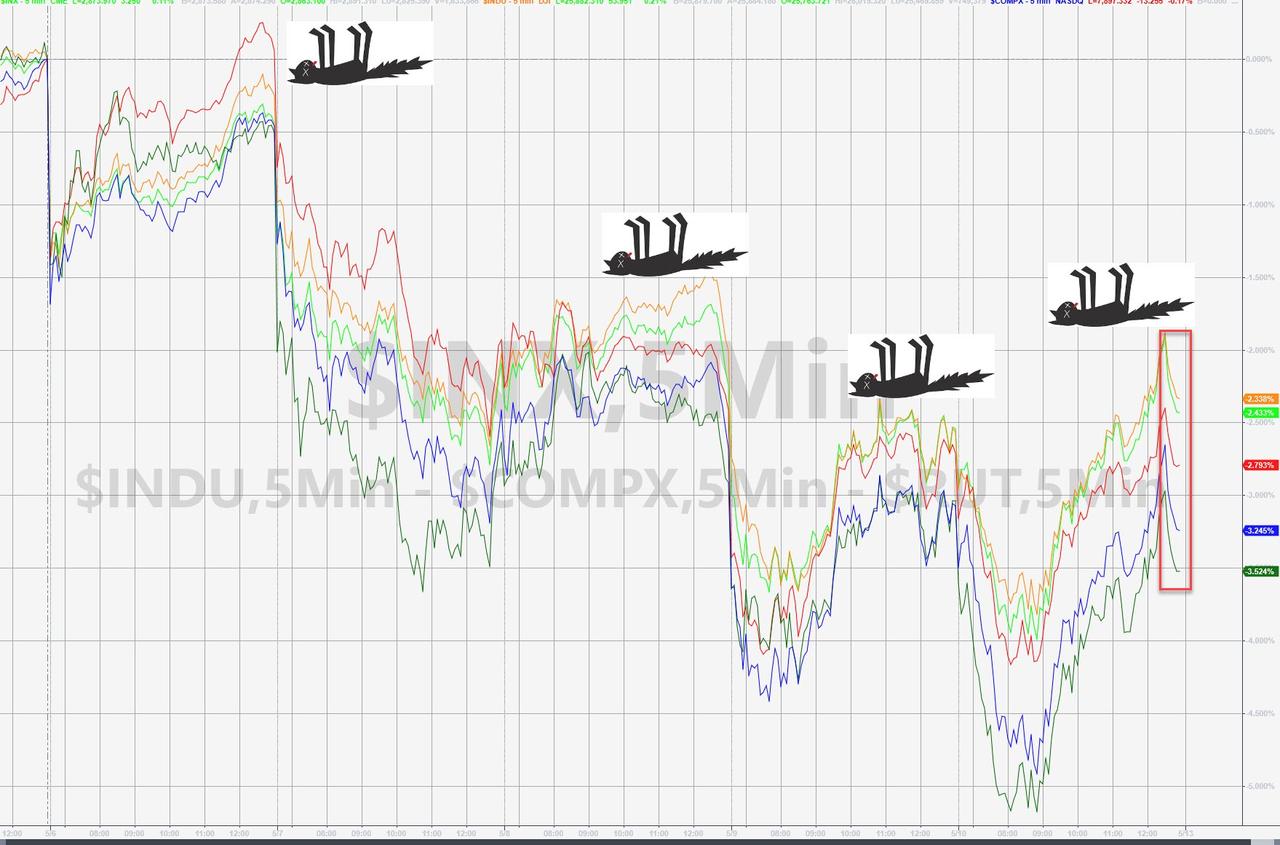

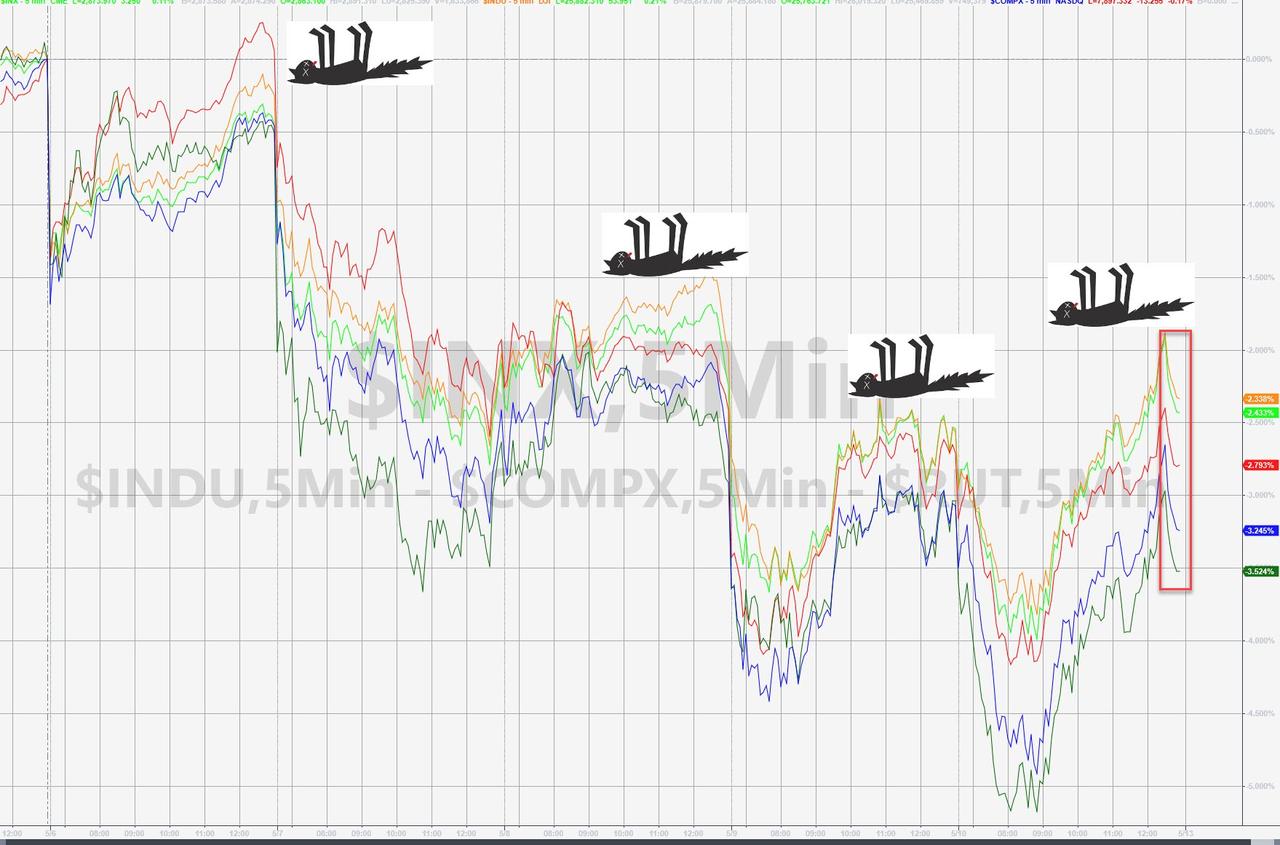

Trade Turmoil Sparks Worst Week Of 2019, Wipes Over $2 Trillion Off Global Stocks

A couple of tweets, and just like that $2.5 trillion of global equity market cap evaporates…

As stocks went from ‘everything is awesome’ to the worst week of the year in an instant…

With global money supply failing to support the illusion…

As stocks began to catch down to the far less exuberant global systemically important banks…

China’s National Team refused to let stocks fall overnight (following the tariffs) and obviously lifted the market dramatically. However, it was still the worst week of the year…

An ugly week in Europe too with France and Italy worst…

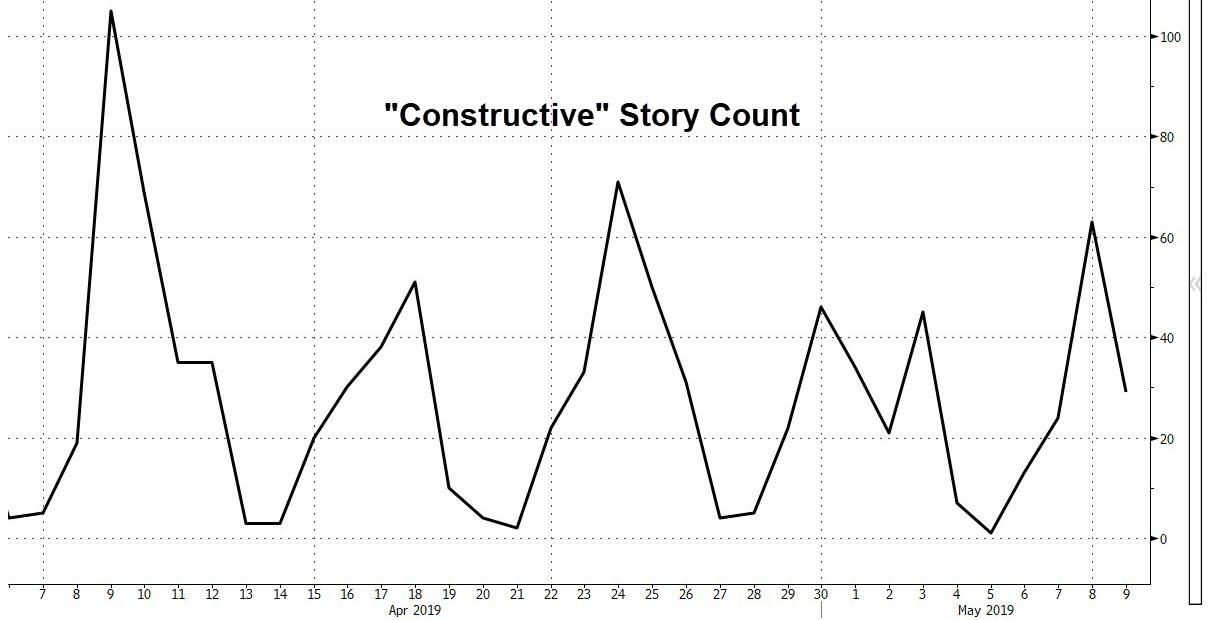

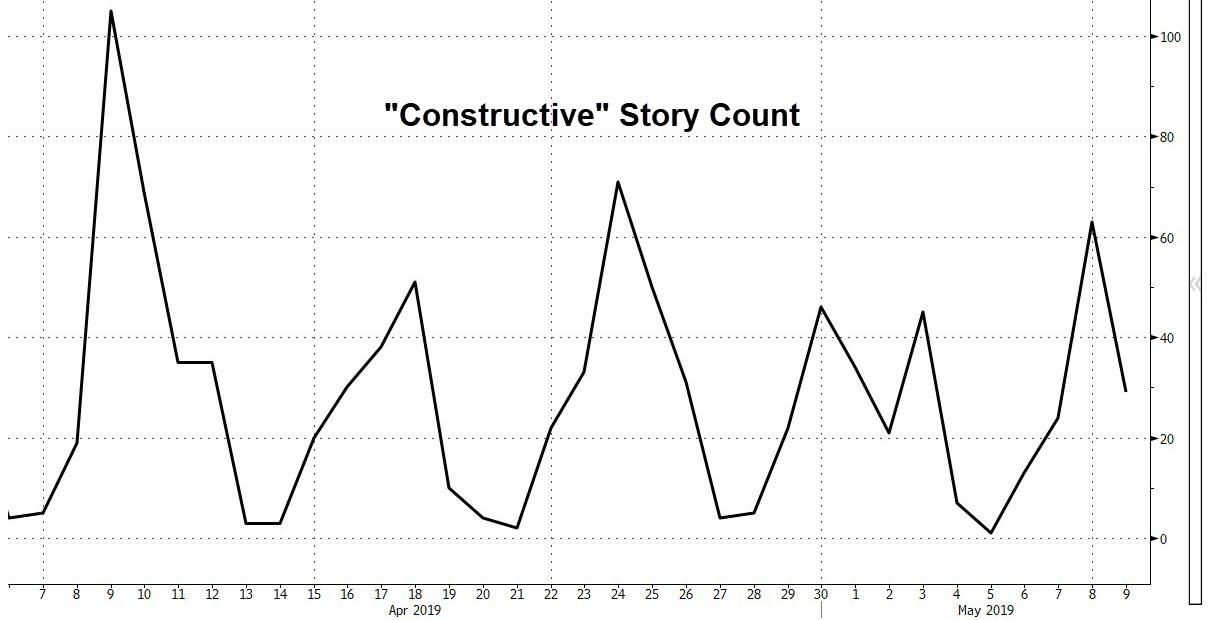

The week in US equity markets has been dominated by algos chasing headlines about trade talks with dead cat bounces giving way to reality checks…

NOTE – today’s “constructive” talks headline prompted the 4th biggest buy program of the month (PPT?).

Notice that the market turned around when the world’s biggest money-losing IPO opened…

It seems it took the algos a long time to actually read He’s and Mnuchin’s comments:

Liu He: “No talks are scheduled from here”

Steve Mnuchin: “No future talks planned as of now”

But when they did, stocks rolled over…

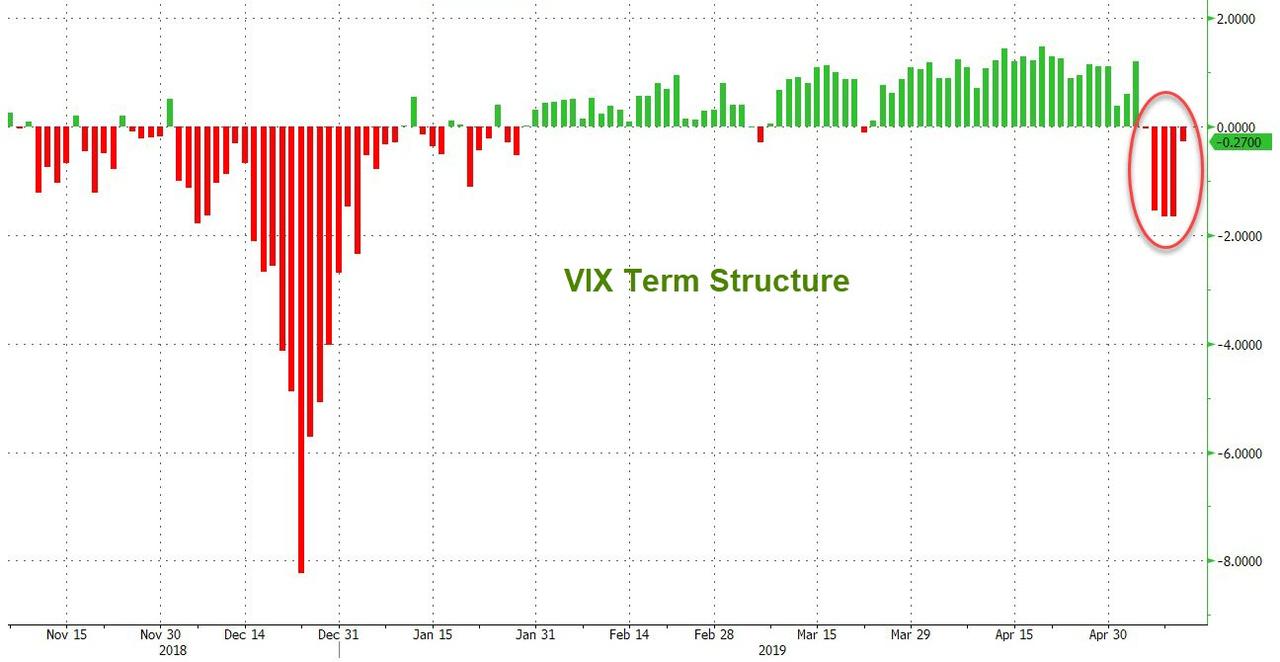

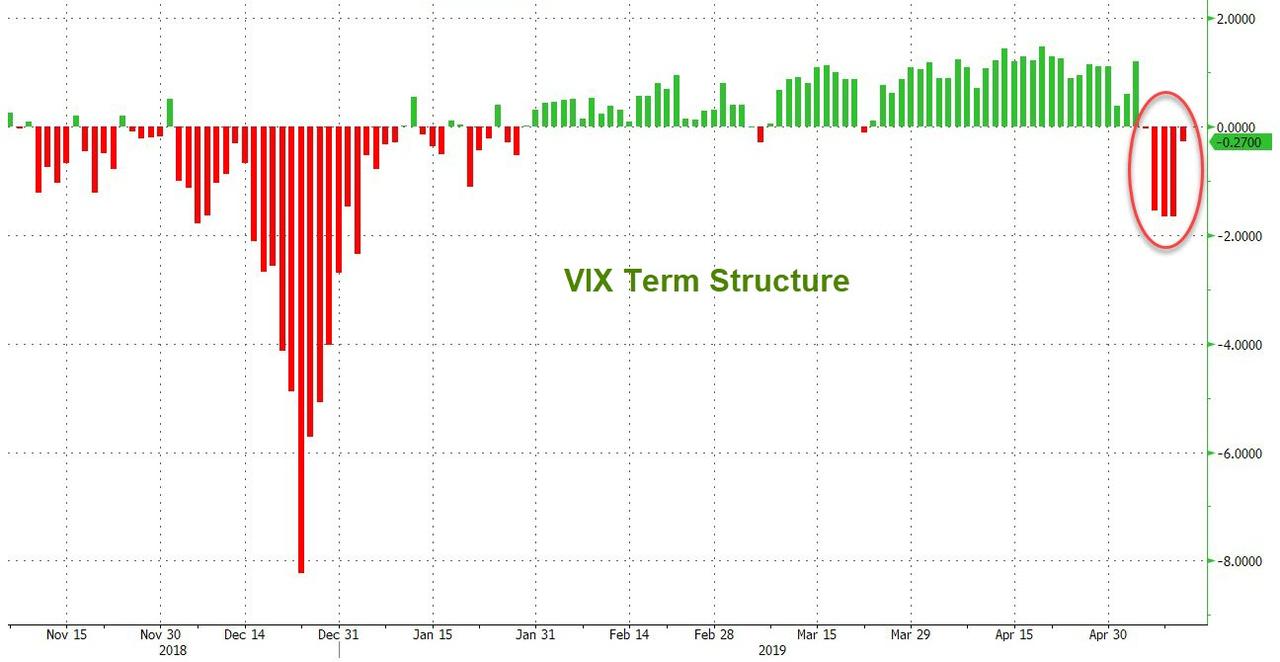

Smells like PPT turned up after Mnuchin’s comments as VIX flash-crashed (signaled) at 0830ET today then fell after Mnuchin’s comments…

VIX has been inverted all 5 days this week…

Prompting a huge short-squeeze lift. just like on Monday (fail) and Thursday (fail)…

This is the seventh Friday in a row where a sudden panic bid lifted stocks…

The Dow ended below its 50DMA for the 3rd day in a row but the rest of the majors scrambled back above the key technical level…

DMA

And then of course, there’s Uber…

Second worst week of the year for credit markets…

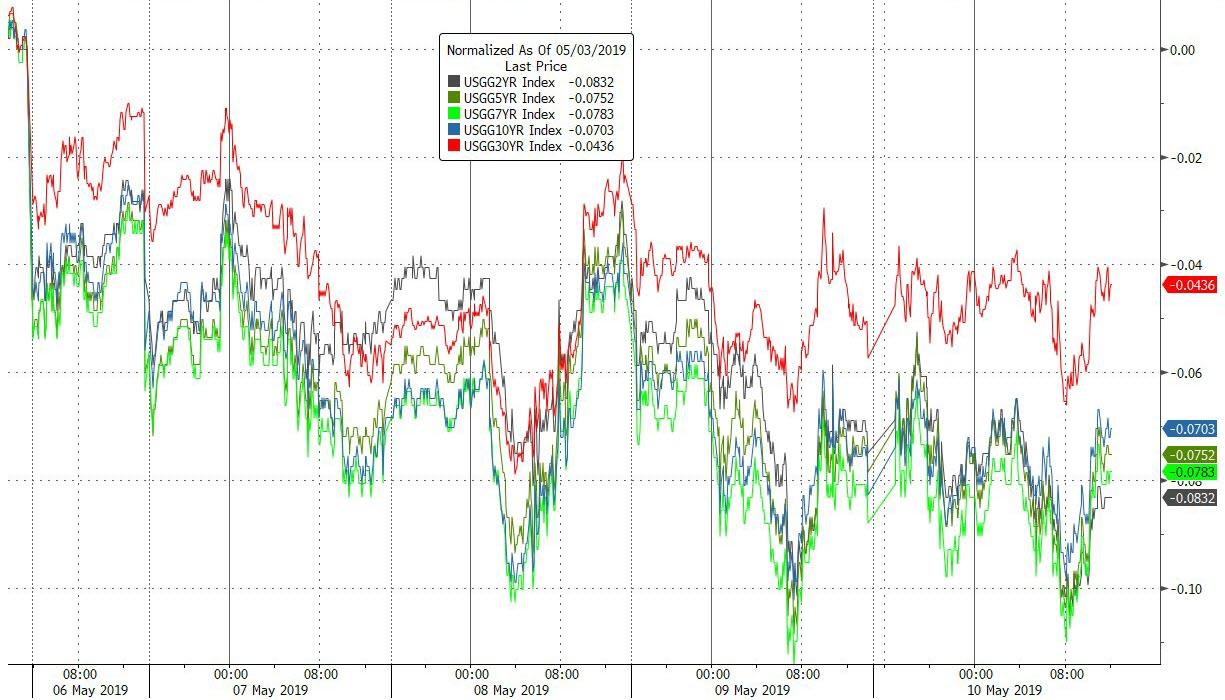

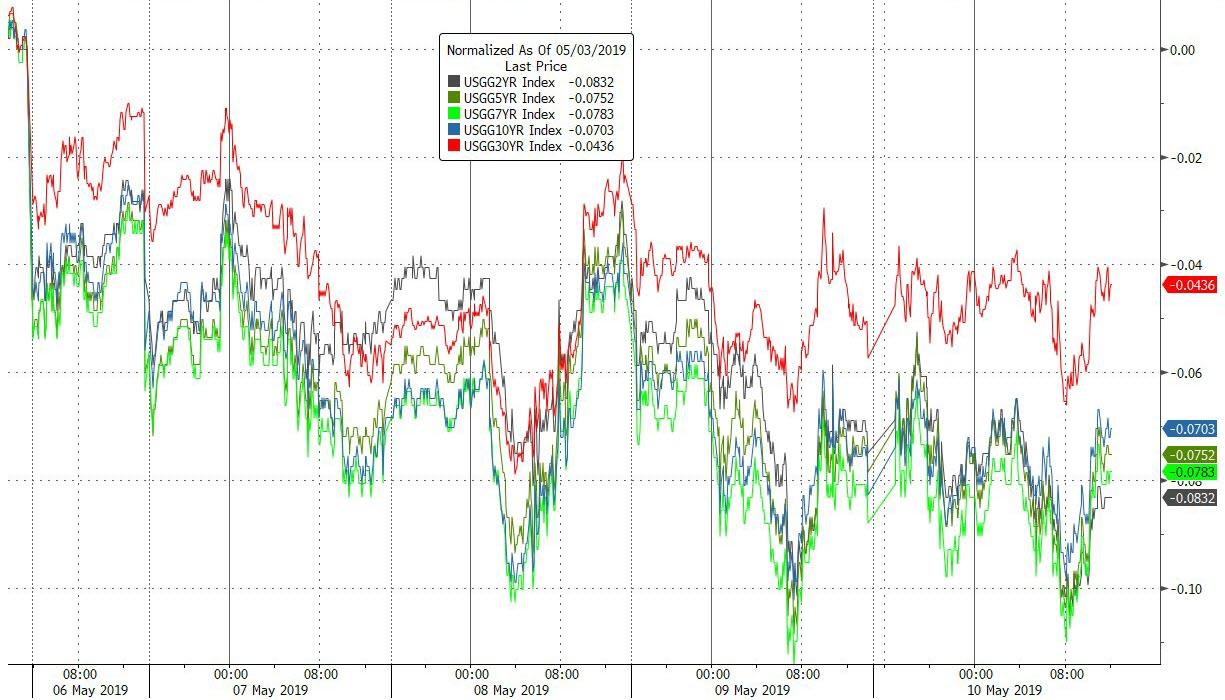

Treasury yields fell across the curve this week but the long-end notably underperformed…

The Dollar ended the week unchanged…

Yuan fell all week…biggest weekly drop in yuan against the dollar since June 2018

Bitcoin soared on the week, along with Ethereum…

Bitcoin rallied above $6400 as trade tensions escalate…

Despite the dollar’s flat week, silver slumped and crude managed gains…

And finally, it appears “constructive” is the new ‘put’…

Read More Harvey Here.....

https://harveyorganblog.com/2019/05/10/may-10-markets-are-one-big-joke-the-dow-rises-by-114-points-on/

.jpg)

Good Morning Good Evening

Ya Know Where You Are

You In The Jungle Babe

Welcome to ~*~Mining & Metals Du Jour~*~Graveyard Shift~*~

On the show tonight: Great Data & News by Harvey Organ,Our Miners Resource Pipeline,what Make diamonds Blue,some Good Miner Swing Plays,GATA Daily Dispatches and Egon von Greyerz says Moves in Gold & Silver Will Be 1970s on Stilts

Hello everybody I'm J:D your host tonight Thanks for being with us.

Hope Your Having a Wonderful Weekend

EnJoy the show

OK...Welcome to the Jungle ! !

MMGYS

Thank you

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

MAY 10//MARKETS ARE ONE BIG JOKE: THE DOW RISES BY 114 POINTS ON “CONSTRUCTIVE TALKS” WITH CHINA DESPITE TRUMP RAISING TARIFFS TO 25% ON 200 BILLION DOLLARS WORTH OF GOODS/ GOLD UP $2.15 TO $1286.75//SILVER UP 2 CENTS TO $14,79///QUEUE JUMPING CONTINUES IN BOTH GOLD AND SILVER COMEX//STILL NO GOLD ENTERS THE GOLD AREN/MORE SWAMP STORIES FOR YOU TONIGHT//

May 10, 2019 · by harveyorgan · in Uncat

GOLD: $1286.75 UP $2.15 (COMEX TO COMEX CLOSING)

Silver: $14.79 UP 2 CENTS (COMEX TO COMEX CLOSING)

Closing access prices:

Gold : 1286.75

silver: $14.79

JPMorgan has been receiving gold with reckless abandon and sometimes supplying (stopping)

today RECEIVING:7/11

EXCHANGE: COMEX

CONTRACT: MAY 2019 COMEX 100 GOLD FUTURES

SETTLEMENT: 1,283.500000000 USD

INTENT DATE: 05/09/2019 DELIVERY DATE: 05/13/2019

FIRM ORG FIRM NAME ISSUED STOPPED

____________________________________________________________________________________________

657 C MORGAN STANLEY 1

661 C JP MORGAN 7

690 C ABN AMRO 3

737 C ADVANTAGE 2 3

905 C ADM 6

____________________________________________________________________________________________

TOTAL: 11 11

MONTH TO DATE: 187

NUMBER OF NOTICES FILED TODAY FOR MAY CONTRACT: 11 NOTICE(S) FOR 1100 OZ (0.0342 tonnes)

TOTAL NUMBER OF NOTICES FILED SO FAR: 187 NOTICES FOR 18700 OZ (.5816 TONNES)

SILVER

FOR MAY

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

13 NOTICE(S) FILED TODAY FOR 65,000 OZ/

total number of notices filed so far this month: 3341 for 16,705,000 oz

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Bitcoin: OPENING MORNING TRADE :$6299 UP $118.00

Bitcoin: FINAL EVENING TRADE: $6407 UP $229

end

XXXX

Let us have a look at the data for today

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

IN SILVER THE COMEX OI ROSE BY A CONSIDERABLE SIZED 1691 CONTRACTS FROM 198,782 UP TO 200,473 DESPITE YESTERDAY’S 9 CENT FALL IN SILVER PRICING AT THE COMEX. ,LIQUIDATION OF THE SPREADERS HAVE STOPPED FOR SILVER BUT IT NOW COMMENCES FOR GOLD. TODAY WE705RRIVED FURTHER FROM AUGUST’S 2018 RECORD SETTING OPEN INTEREST OF 244,196 CONTRACTS.

WE HAVE ALSO WITNESSED A LARGE AMOUNT OF PHYSICAL METAL STAND FOR COMEX DELIVERY AS WELL WE ARE WITNESSING CONSIDERABLE LONGS PACKING THEIR BAGS AND MIGRATING OVER TO LONDON IN GREATER NUMBERS IN THE FORM OF EFP’S. WE WERE NOTIFIED THAT WE HAD A FAIR SIZED NUMBER OF COMEX LONGS TRANSFERRING THEIR CONTRACTS TO LONDON THROUGH THE EFP:

0 FOR MAY, 0 FOR JUNE, 956 FOR JULY AND ZERO FOR ALL OTHER MONTHS AND THEREFORE TOTAL ISSUANCE 956 CONTRACTS. WITH THE TRANSFER OF 956 CONTRACTS, WHAT THE CME IS STATING IS THAT THERE IS NO SILVER (OR GOLD) TO BE DELIVERED UPON AT THE COMEX AS THEY MUST EXPORT THEIR OBLIGATION TO LONDON. ALSO KEEP IN MIND THAT THERE CAN BE A DELAY OF 24-48 HRS IN THE ISSUING OF EFP’S. THE 956 EFP CONTRACTS TRANSLATES INTO 4.78 MILLION OZ ACCOMPANYING:

1.THE 9 CENT FALL IN SILVER PRICE AT THE COMEX AND

2. THE STRONG AMOUNT OF SILVER OUNCES WHICH STOOD FOR DELIVERY IN THE LAST NINE MONTHS:

JUNE/2018. (5.420 MILLION OZ);

FOR JULY: 30.370 MILLION OZ

FOR AUG., 6.065 MILLION OZ

FOR SEPT. 39.505 MILLION OZ S

FOR OCT.2.525 MILLION OZ.

FOR NOV: A HUGE 7.440 MILLION OZ STANDING AND

21.925 MILLION OZ FINALLY STAND FOR DECEMBER.

5.845 MILLION OZ STAND IN JANUARY.

2.955 MILLION OZ STANDING FOR FEBRUARY.:

27.120 MILLION OZ STANDING IN MARCH.

3.875 MILLION OZ STANDING FOR SILVER IN APRIL.

AND NOW 18.280 MILLION OZ STANDING FOR SILVER IN MAY.

ACCUMULATION FOR EFP’S/SILVER/J.P.MOAN’S HOUSE OF BRIBES, / STARTING FROM FIRST DAY NOTICE/FOR MONTH OF MAY:

10,514 CONTRACTS (FOR 8 TRADING DAYS TOTAL 10,514 CONTRACTS) OR 52.57 MILLION OZ: (AVERAGE PER DAY: 1314 CONTRACTS OR 6.57 MILLION OZ/DAY)

TO GIVE YOU AN IDEA AS TO THE HUGE SUPPLY THIS MONTH IN SILVER: SO FAR THIS MONTH OF MAY: 52.57 MILLION PAPER OZ HAVE MORPHED OVER TO LONDON. THIS REPRESENTS AROUND 7.51% OF ANNUAL GLOBAL PRODUCTION (EX CHINA EX RUSSIA)* JUNE’S 345.43 MILLION OZ IS THE SECOND HIGHEST RECORDED ISSUANCE OF EFP’S AND IT FOLLOWED THE RECORD SET IN APRIL 2018 OF 385.75 MILLION OZ.

ACCUMULATION IN YEAR 2019 TO DATE SILVER EFP’S: 793.30 MILLION OZ.

JANUARY 2019 EFP TOTALS: 217.455. MILLION OZ

FEB 2019 TOTALS: 147.4 MILLION OZ/

MARCH 2019 TOTAL EFP ISSUANCE: 207.835 MILLION OZ

APRIL 2019 TOTAL EFP ISSUANCE: 182.87 MILLION OZ.

RESULT: WE HAD A CONSIDERABLE SIZED INCREASE IN COMEX OI SILVER COMEX CONTRACTS OF 1691 DESPITE THE 9 CENT FALL IN SILVER PRICING AT THE COMEX /YESTERDAY... THE CME NOTIFIED US THAT WE HAD A GOOD SIZED EFP ISSUANCE OF 956 CONTRACTS WHICH EXITED OUT OF THE SILVER COMEX AND TRANSFERRED THEIR OI TO LONDON AS FORWARDS. SPECULATORS CONTINUED THEIR INTEREST IN ATTACKING THE SILVER COMEX FOR PHYSICAL SILVER (SEE COMEX DATA) . OUR BANKERS RESUMED THEIR LIQUIDATION OF THE SPREAD TRADES TODAY.

TODAY WE GAINED A STRONG SIZED: 2647 TOTAL OI CONTRACTS ON THE TWO EXCHANGES:

i.e 956 OPEN INTEREST CONTRACTS HEADED FOR LONDON (EFP’s) TOGETHER WITH INCREASE OF 1691 OI COMEX CONTRACTS. AND ALL OF THIS DEMAND HAPPENED WITH A 9 CENT FALL IN PRICE OF SILVER AND A CLOSING PRICE OF $14.77 WITH RESPECT TO YESTERDAY’S TRADING. YET WE STILL HAVE A STRONG AMOUNT OF SILVER STANDING AT THE COMEX FOR DELIVERY!!

In ounces AT THE COMEX, the OI is still represented by JUST OVER 1 BILLION oz i.e. 1.007 BILLION OZ TO BE EXACT or 144% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT MARCH MONTH/ THEY FILED AT THE COMEX: 13 NOTICE(S) FOR 65,000 OZ OF SILVER

IN SILVER,PRIOR TO TODAY, WE SET THE NEW COMEX RECORD OF OPEN INTEREST AT 243,411 CONTRACTS ON APRIL 9.2018. AND AGAIN THIS HAS BEEN SET WITH A LOW PRICE OF $16.51.

AND NOW WE RECORD FOR POSTERITY ANOTHER ALL TIME RECORD OPEN INTEREST AT THE COMEX OF 244,196 CONTRACTS ON AUGUST 22/2018 AND AGAIN WHEN THIS RECORD WAS SET, THE PRICE OF SILVER WAS $14.78 AND LOWER IN PRICE THAN PREVIOUS RECORDS.

ON THE DEMAND SIDE WE HAVE THE FOLLOWING:

HUGE AMOUNTS OF SILVER STANDING FOR DELIVERY (MARCH/2018: 27 MILLION OZ , APRIL/2018 : 2.485 MILLION OZ MAY: 36.285 MILLION OZ ; JUNE/2018 (5.420 MILLION OZ) , JULY 2018 FINAL AMOUNT STANDING: 30.370 MILLION OZ ) FOR AUGUST 6.065 MILLION OZ. , SEPT: A HUGE 39.505 MILLION OZ./ OCTOBER: 2,520,000 oz NOV AT 7.440 MILLION OZ./ DEC. AT 21.925 MILLION OZ JANUARY AT 5.825 MILLION OZ.AND FEB 2019: 2.955 MILLION OZ/ MARCH: 27.120 MILLION OZ/ APRIL AT 3.875 MILLION OZ/ AND NOW MAY: 18.280 MILLION OZ ..

HUGE RECORD OPEN INTEREST IN SILVER 243,411 CONTRACTS (OR 1.217 BILLION OZ/ SET APRIL 9/2018) AND NOW AUGUST 22/2018: 244,196 CONTRACTS, WITH A SILVER PRICE OF $14.78.

HUGE ANNUAL EFP’S ISSUANCE EQUAL TO 2.9 BILLION OZ OR 400% OF SILVER ANNUAL PRODUCTION/2017

RECORD SETTING EFP ISSUANCE FOR ANY MONTH IN SILVER; APRIL/2018/ 385.75 MILLION OZ/ AND THE SECOND HIGHEST RECORDED EFP ISSUANCE JUNE 2018 345.43 MILLION OZ

AND YET, WITH THE EXTREMELY HIGH EFP ISSUANCE, WE HAVE A CONTINUAL LOW PRICE OF SILVER DESPITE THE ABOVE HUGE DEMAND. TO ME THE ONLY ANSWER IS THAT WE HAVE SOVEREIGN (CHINA) WHO IS ENDEAVOURING TO GOBBLE UP ALL AVAILABLE PHYSICAL SILVER NO MATTER WHERE, EXACTLY WHAT J.P.MORGAN IS DOING. AND IT IS MY BELIEF THAT J.P.MORGAN IS HOLDING ITS SILVER FOR ITS BENEFICIAL OWNER..THE USA GOVERNMENT WHO IN TURN IS HOLDING THAT SILVER FOR CHINA.(FOR A SILVER LOAN REPAYMENT).

IN GOLD, THE OPEN INTEREST ROSE BY A VERY STRONG SIZED 11,269 CONTRACTS, TO 474,094 WITH THE RISE IN THE COMEX GOLD PRICE/(AN INCREASE IN PRICE OF $4.00//YESTERDAY’S TRADING).

THE CME RELEASED THE DATA FOR EFP ISSUANCE AND IT TOTALED A GOOD SIZED 4205 CONTRACTS:

APRIL 0 CONTRACTS,JUNE: 4205 CONTRACTS DECEMBER: 0 CONTRACTS, JUNE 2020 0 CONTRACTS AND ALL OTHER MONTHS ZERO. The NEW COMEX OI for the gold complex rests at 474,094. ALSO REMEMBER THAT THERE WILL BE A DELAY IN THE ISSUANCE OF EFP’S. THE BANKERS REMOVE LONG POSITIONS OF COMEX GOLD IMMEDIATELY. THEN THEY ORCHESTRATE THEIR PRIVATE EFP DEAL WITH THE LONGS AND THAT COULD TAKE AN ADDITIONAL, 48 HRS SO WE GENERALLY DO NOT GET A MATCH WITH RESPECT TO DEPARTING COMEX LONGS AND NEW EFP LONG TRANSFERS. . EVEN THOUGH THE BANKERS ISSUED THESE MONSTROUS EFPS, THE OBLIGATION STILL RESTS WITH THE BANKERS TO SUPPLY METAL BUT IT TRANSFERS THE RISK TO A LONDON BANKER OBLIGATION AND NOT A NEW YORK COMEX OBLIGATION. LONGS RECEIVE A FIAT BONUS TOGETHER WITH A LONG LONDON FORWARD. THUS, BY THESE ACTIONS, THE BANKERS AT THE COMEX HAVE JUST STATED THAT THEY HAVE NO APPRECIABLE METAL!! THIS IS A MASSIVE FRAUD: THEY CANNOT SUPPLY ANY METAL TO OUR COMEX LONGS BUT THEY ARE QUITE WILLING TO SUPPLY MASSIVE NON BACKED GOLD (AND SILVER) PAPER KNOWING THAT THEY HAVE NO METAL TO SATISFY OUR LONGS. LONDON IS NOW SEVERELY BACKWARD IN BOTH GOLD AND SILVER AND WE ARE WITNESSING DELAYS IN ACTUAL DELIVERIES.

IN ESSENCE WE HAVE A GIGANTIC SIZED GAIN IN TOTAL CONTRACTS ON THE TWO EXCHANGES OF 15,474 CONTRACTS: 11,269 OI CONTRACTS INCREASED AT THE COMEX AND 4205 EFP OI CONTRACTS WHICH NAVIGATED OVER TO LONDON. THUS TOTAL OI GAIN OF 15,474 CONTRACTS OR 1,547,400 OZ OR 48.13TONNES. YESTERDAY WE HAD A GAIN IN THE PRICE OF GOLD TO THE TUNE OF $4.00….AND WITH THAT RISE, WE HAD A HUMONGOUS GAIN IN TONNAGE OF 48.13 TONNES!!!!!!.??????????????????????????????????????????

AS YOU WILL SEE, THE CROOKS HAVE NOW SWITCHED TO GOLD AS THEY INCREASE THE OPEN INTEREST FOR THE SPREADERS. THE TOTAL COMEX GOLD OPEN INTEREST WILL RISE FROM NOW ON UNTIL ONE WEEK PRIOR TO FIRST DAY NOTICE AND THAT IS WHEN THEY START THEIR CRIMINAL LIQUIDATION.

HERE IS HOW THE CROOKS USED SPREADING AS WE ENTER A NON ACTIVE DELIVERY MONTH OF MAY HEADING TOWARDS THE VERY ACTIVE DELIVERY MONTH OF JUNE.

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES, HERE IS THE BANKERS MODUS OPERANDI:

“YOU WILL ALSO NOTICE THAT THE COMEX OPEN INTEREST IS STARTING TO RISE IN THIS NON ACTIVE MONTH OF MAY BUT SO IS THE OPEN INTEREST OF SPREADERS. THE OPEN INTEREST IN GOLD WILL CONTINUE TO RISE UNTIL ONE WEEK BEFORE FIRST DAY NOTICE OF AN UPCOMING ACTIVE DELIVERY MONTH (JUNE), AND THAT IS WHEN THE CROOKS SELL THEIR SPREAD POSITIONS BUT NOT AT THE SAME TIME OF THE DAY. THEY WILL USE THE SELL SIDE OF THE EQUATION TO CREATE THE CASCADE (ALONG WITH THEIR COLLUSIVE FRIENDS) AND THEN COVER ON THE BUY SIDE OF THE SPREAD SITUATION AT THE END OF THE DAY. THEY DO THIS TO AVOID POSITION LIMIT DETECTION. THE LIQUIDATION OF THE SPREADING FORMATION CONTINUES FOR EXACTLY ONE WEEK AND ENDS ON FIRST DAY NOTICE.”

AND WITH THE RELEASE OF THE COT REPORT TODAY, HERE IS THE PROOF AS TO WHAT I HAVE BEEN TELLING YOU. NOTE THE HUGE INCREASE IN SPREADING TO THE TUNE OF 16,755 CONTRACTS. THIS IS A FRAUD TO THE HIGHEST ORDER!! SILVER HAD ONLY A SMALL 1000 CONTRACT GAIN IN OI SPREADERS IN ITS COT REPORT..

Gold COT Report – Futures

Large Speculators Commercial Total

Long Short Spreading Long Short Long Short

185,801 110,390 73,060 142,078 238,437 400,939 421,887

Change from Prior Reporting Period

8,526 -666 16,755 -5,210 2,837 20,071 18,926

Traders

180 70 79 54 60 261 185

Small Speculators

Long Short Open Interest

49,100 28,152 450,039

-43 1,102 20,028

non reportable positions Change from the previous reporting period

COT Gold Report – Positions as of Tuesday, May 7, 2019

ACCUMULATION OF EFP’S GOLD AT J.P. MORGAN’S HOUSE OF BRIBES: (EXCHANGE FOR PHYSICAL) FOR THE MONTH OF MAY : 45,855 CONTRACTS OR 4,585,500 OR 142.62 TONNES (8 TRADING DAYS AND THUS AVERAGING: 5731 EFP CONTRACTS PER TRADING DAY

TO GIVE YOU AN IDEA AS TO THE STRONG SIZE OF THESE EFP TRANSFERS : THIS MONTH IN 8 TRADING DAYS IN TONNES: 142.62 TONNES

TOTAL ANNUAL GOLD PRODUCTION, 2018, THROUGHOUT THE WORLD EX CHINA EX RUSSIA: 3555 TONNES

THUS EFP TRANSFERS REPRESENTS 142.62/3550 x 100% TONNES =4,01% OF GLOBAL ANNUAL PRODUCTION SO FAR IN DECEMBER ALONE.***

ACCUMULATION OF GOLD EFP’S YEAR 2019 TO DATE: 1958.18 TONNES

JANUARY 2019 TOTAL EFP ISSUANCE; 531.20 TONNES

FEB 2019 TOTAL EFP ISSUANCE: 344.36 TONNES

MARCH 2019 TOTAL EFP ISSUANCE: 497.16 TONNES

APRIL 2019 TOTAL ISSUANCE: 456.10 TONNES

WHAT IS ALARMING TO ME, ACCORDING TO OUR LONDON EXPERT ANDREW MAGUIRE IS THAT THESE EFP’S ARE BEING TRANSFERRED TO WHAT ARE CALLEDRIAL FORWARD CONTRACT OBLIGATIONS AND THESE CONTRACTS ARE LESS THAN 14 DAYS. ANYTHING GREATER THAN 14 DAYS, THESE MUST BE RECORDED AND SENT TO THE COMPTROLLER, GREAT BRITAIN TO MONITOR RISK TO THE BANKING SYSTEM. IF THIS IS INDEED TRUE, THEN THIS IS A MASSIVE CONSPIRACY TO DEFRAUD AS WE NOW WITNESS A MONSTROUS TOTAL EFP’S ISSUANCE AS IT HEADS INTO THE STRATOSPHERE.

Result: A HUGE SIZED INCREASE IN OI AT THE COMEX OF 11,269 WITH THE RISE IN PRICING ($4.00) THAT GOLD UNDERTOOK YESTERDAY) //.WE ALSO HAD A GOOD SIZED NUMBER OF COMEX LONG TRANSFERRING TO LONDON THROUGH THE EFP ROUTE: 4205 CONTRACTS AS THESE HAVE ALREADY BEEN NEGOTIATED AND CONFIRMED. THERE OBVIOUSLY DOES NOT SEEM TO BE MUCH PHYSICAL GOLD AT THE COMEX. I GUESS IT EXPLAINS THE HUGE ISSUANCE OF EFP’S…THERE IS HARDLY ANY GOLD PRESENT AT THE GOLD COMEX FOR DELIVERY PURPOSES. IF YOU TAKE INTO ACCOUNT THE 4205 EFP CONTRACTS ISSUED, WE HAD AN ATMOSPHERIC SIZED GAIN OF 17,112 CONTRACTS IN TOTAL OPEN INTEREST ON THE TWO EXCHANGES:

4205 CONTRACTS MOVE TO LONDON AND 11,269 CONTRACTS INCREASED AT THE COMEX. (IN TONNES, THE GAIN IN TOTAL OI EQUATES TO 48.13 TONNES). ..AND THIS HUGE DEMAND OCCURRED WITH A RISE IN PRICE OF $4.00 IN YESTERDAY’S TRADING AT THE COMEX. NO DOUBT THAT A STRONG PERCENTAGE OF OI GAIN WAS DUE TO THE CONTINUING OF THE SPREADING OPERATION AS I HAVE OUTLINED ABOVE.

we had: 11 notice(s) filed upon for 1100 oz of gold at the comex.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

With respect to our two criminal funds, the GLD and the SLV:

GLD...

WITH GOLD UP $4.00 TODAY

NO CHANGE IN GOLD INVENTORY AT THE GLD//

INVENTORY RESTS AT 739.64 TONNES

IT LOOKS LIKE WE HAVE REACHED THE BOTTOM OF THE BARREL FOR PHYSICAL GOLD BEING SUPPLIED TO THE CROOKS.

TO ALL INVESTORS THINKING OF BUYING GOLD THROUGH THE GLD ROUTE: YOU ARE MAKING A TERRIBLE MISTAKE AS THE CROOKS ARE USING WHATEVER GOLD COMES IN TO ATTACK BY SELLING THAT GOLD. IT SURE SEEMS TO ME THAT THE GOLD OBLIGATIONS AT THE GLD EXCEED THEIR INVENTOR8

SLV/

WITH SILVER DOWN 9 CENTS TODAY:

NO CHANGE IN SILVER INVENTORY AT THE SLV//

/INVENTORY RESTS AT 316.582 MILLION OZ.

end

First, here is an outline of what will be discussed tonight:

1. Today, we had the open interest in SILVER ROSE BY A CONSIDERABLE SIZED 1691 CONTRACTS from 199,782 UPTO 200,473 AND CLOSER TO THE NEW COMEX RECORD SET LAST IN AUG.2018 AT 244,196 WITH A SILVER PRICE OF $14.78/(AUGUST 22/2018)..THE PREVIOUS RECORD WAS SET ON APRIL 9/2018 AT 243,411 OPEN INTEREST CONTRACTS WITH THE SILVER PRICE AT THAT DAY: $16.53). AND PREVIOUS TO THAT, THE RECORD WAS ESTABLISHED AT: 234,787 CONTRACTS, SET ON APRIL 21.2017 OVER 1 1/3 YEARS AGO. THE PRICE OF SILVER ON THAT DAY: $17.89. AS YOU CAN SEE, WE HAVE RECORD HIGH OPEN INTERESTS IN SILVER ACCOMPANIED BY A CONTINUAL LOWER PRICE WHEN THAT RECORD WAS SET…..THE SPREADERS HAVE STOPPED THEIR LIQUIDATION IN SILVER BUT HAVE NOW MORPHED INTO GOLD..

EFP ISSUANCE:

OUR CUSTOMARY MIGRATION OF COMEX LONGS CONTINUE TO MORPH INTO LONDON FORWARDS AS OUR BANKERS USED THEIR EMERGENCY PROCEDURE TO ISSUE:

0 CONTRACTS FOR APRIL., 0 FOR MAY, FOR JUNE 0 CONTRACTS AND JULY: 956 CONTRACTS AND ALL OTHER MONTHS: ZERO. TOTAL EFP ISSUANCE: 956 CONTRACTS. EFP’S GIVE OUR COMEX LONGS A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. IF WE TAKE THE OI GAIN AT THE COMEX OF 1691 CONTRACTS TO THE 956 OI TRANSFERRED TO LONDON THROUGH EFP’S, WE OBTAIN A STRONG GAIN OF 2647 OPEN INTEREST CONTRACTS. THUS IN OUNCES, THE GAIN ON THE TWO EXCHANGES: 13.24 MILLION OZ!!! AND YET WE ALSO HAVE A STRONG DEMAND FOR PHYSICAL AS WE WITNESSED A FINAL STANDING OF GREATER THAN 30 MILLION OZ FOR JULY, A STRONG 7.475 MILLION OZ FOR AUGUST.. A HUGE 39.505 MILLION OZ STANDING FOR SILVER IN SEPTEMBER… OVER 2 million OZ STANDING FOR THE NON ACTIVE MONTH OF OCTOBER., 7.440 MILLION OZ FINALLY STANDING IN NOVEMBER. 21.925 MILLION OZ STANDING IN DECEMBER , 5.845 MILLION OZ STANDING IN JANUARY. 2.955 MILLION OZ STANDING IN FEBRUARY, 27.120 MILLION OZ FOR MARCH., 3.875 MILLION OZ FOR APRIL AND NOW 18.280 MILLION OZ FOR MAY

RESULT: A CONSIDERABLE SIZED INCREASE IN SILVER OI AT THE COMEX DESPITE THE 9 CENT LOSS IN PRICING THAT SILVER UNDERTOOK IN PRICING// YESTERDAY. WE ALSO HAD A GOOD SIZED 956 EFP’S ISSUED TRANSFERRING COMEX LONGS OVER TO LONDON. TOGETHER WITH THE STRONG SIZED AMOUNT OF SILVER OUNCES STANDING FOR THIS MONTH, DEMAND FOR PHYSICAL SILVER CONTINUES TO INTENSIFY AS WE WITNESS SEVERE BACKWARDATION IN SILVER IN LONDON.

BOTH THE SILVER COMEX AND THE GOLD COMEX ARE IN STRESS AS THE BANKERS SCOUR THE BOWELS OF THE EXCHANGE FOR METAL

(report Harvey)

.

2.a) The Shanghai and London gold fix report

(Harvey)

2 b) Gold/silver trading overnight Europe, Goldcore

(Mark O’Byrne/zerohedge

and in NY: Bloomberg

3. ASIAN AFFAIRS

i)FRIDAY MORNING/ THURSDAY NIGHT:

SHANGHAI CLOSED UP 88.26 POINTS OR 3.10% //Hang Sang CLOSED UP 239.17 POINTS OR 0.84% /The Nikkei closed DOWN 57.21 POINTS OR 0.27%//Australia’s all ordinaires CLOSED UP .25%

/Chinese yuan (ONSHORE) closed DOWN at 6.8246 AS TRUCE DECLARED FOR 3 MONTHS /Oil UP to 61.92 dollars per barrel for WTI and 70.47 for Brent. Stocks in Europe OPENED RED// ONSHORE YUAN CLOSED DOWN // LAST AT 6.8246 AGAINST THE DOLLAR. OFFSHORE YUAN CLOSED DOWN ON THE DOLLAR AT 6.8550 TRADE TALKS STILL ON//TRUMP INITIATES A NEW 25% TARIFFS FRIDAY/MAY 10/MAJOR PROBLEMS AT HUAWEI /CFO ARRESTED : /ONSHORE YUAN TRADING ABOVE LEVEL OF OFFSHORE YUAN/ONSHORE YUAN TRADING WEAKER AGAINST USA DOLLAR/OFFSHORE YUAN TRADING WEAKER AGAINST THE DOLLAR /TRADE DEAL NOW DEAD..TRUMP THREATENS TO RAISE RATES TO 25%

3A//NORTH KOREA/ SOUTH KOREA

i)NORTH KOREA

The USA seizes a North Korean ship suspected of violating international sanctions.

Kim not too happy

( zerohedge)

ii)NORTH KOREA

Kim states that his latest launch was a “long range strike”.

Trump not to happy with “fat man”

( zerohedge)

b) REPORT ON JAPAN

3 China/Chinese affairs

i)/China/USA/ last night 9 pm

Algos panic as the USA China trade talks end early and at midnight tariffs are to begin

( zerohedge)

ii)Midnight THURSDAY NIGHT/Friday 12:01 am

USA hikes Chinese tariffs after the talks result in no progress and China vows to retaliate

( zerohedge)

iii)China’s National team ( plunge protection team) swoops in to prop up stocks as deal hopes crumble

( zerohedge)

iv)Liu leaves empty handed after his two hour meeting//all markets remain subdued.( zerohedge)

4/EUROPEAN AFFAIRS

i)UK

Mises’s Pickering lays out what is the best outcome for Britain and that is a no deal Brexit. Britain would be able to deal with the rest of the world with cheaper costs. Also she could get rid of those bothersome high regulatory problems facing all members of the EU. The problem of course is that goods to the EU will be higher but Britain can deal with it

( Pickering//Mises)

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

i)CYPRUS/TURKEY/EUROPE/ISRAEL

This is becoming quite explosive as Cyprus slams potential Turkish oil and gas drilling in areas controlled by Greek/Cyprus. They demand EU action

( zerohedge)

ii)Bolton held an extremely rare meeting on Iran at CIA headquarters.

( zerohedge)

iii)Iran/USAIran threatens to destroy the USS Lincoln which is passing through the Suez Canal right now if it proceeds through the Straits of Hormuz

( zerohedge)

6. GLOBAL ISSUES

i)Sweden

Strange: The government at first desired a cashless Sweden and in the last few years, the amount of notes in circulation decreased. Now the Government wants its citizens to hoard cash in case of a cyber attack or war.

(courtesy zerohedge)

7. OIL ISSUES

8 EMERGING MARKET ISSUES

VENEZUELA

9. PHYSICAL MARKETS

i)We promised that this would happen: AngloGold has decided enough is enough and they are leaving South Africa.

(courtesy Seccombe/Business Day.GATA

ii)A must listen to interview on gold suppression courtesy of Chris Powell of GATA and Mark O”Byrne of Goldcore

( Goldcore/GATA//Chris Powell/

iii)More fines are going to be set against our usual crooked banks for rigging foreign exchange (and that should include gold/silver)

The Banks involved are Barclays, Citigroup, HSBC, JPMorgan and 3 others.

( Reuters/GATA)

10. USA stories which will influence the price of gold/silver)

MARKET TRADING//

ii)Market data

ii)USA ECONOMIC/GENERAL STORIES

SWAMP STORIES

a)The true store behind the Steele dossier: how claims are now debunked and how leaks were perpetrated before the FISA application had actually begun

(zerohedge)

b)Craig Murray takes on whether it was the Russians that hacked the DNC. He and others state that it was not the Russians

( Craig Murray)

E)SWAMP STORIES/MAJOR STORIES//THE KING REPORT

Let us head over to the comex:

THE TOTAL COMEX GOLD OPEN INTEREST ROSE BY A HUMONGOUS SIZED 11,269 CONTRACTS.TO A LEVEL OF 474,094 WITH THE GAIN IN THE PRICE OF GOLD ($4.00) IN YESTERDAY’S // COMEX TRADING)

WE ARE NOW IN THE NON ACTIVE DELIVERY MONTH OF MAY.. THE CME REPORTS THAT THE BANKERS ISSUED A GOOD SIZED TRANSFER THROUGH THE EFP ROUTE AS THESE LONGS RECEIVED A DELIVERABLE LONDON FORWARD TOGETHER WITH A FIAT BONUS., THAT IS 7366 EFP CONTRACTS WERE ISSUED:

0 FOR JUNE ’19: 4206 CONTRACTS , DEC; 0 CONTRACTS: 0 AND ZERO FOR ALL OTHER MONTHS:

TOTAL EFP ISSUANCE: 4206 CONTRACTS.

THE OBLIGATION STILL RESTS WITH THE BANKERS ON THESE TRANSFERS. ALSO REMEMBER THAT THERE IS NO DOUBT A HUGE DELAY IN THE ISSUANCE OF EFP’S AND IT PROBABLY TAKES AT LEAST 48 HRS AFTER LONGS GIVE UP THEIR COMEX CONTRACTS FOR THEM TO RECEIVE THEIR EFP’S AS THEY ARE NEGOTIATING THIS CONTRACT WITH THE BANKS FOR A FIAT BONUS PLUS THEIR TRANSFER TO A LONDON BASED FORWARD.

ON A NET BASIS IN OPEN INTEREST WE GAINED THE FOLLOWING TODAY ON OUR TWO EXCHANGES: 15,474 TOTAL CONTRACTS IN THAT 4205 LONGS WERE TRANSFERRED AS FORWARDS TO LONDON AND WE GAINED A VERY STRONG SIZED 11,269 COMEX CONTRACTS.

NET GAIN ON THE TWO EXCHANGES : 15,474 contracts OR 1,547,400 OZ OR 48.13 TONNES.

We are now in the NON active contract month of MAY and here the open interest stands at 128 contracts, having LOST 0 contracts. We had 5 notices served yesterday so we gained 5 contracts or an additional 500 oz will stand as they guys refused to morph into a London based forward as well as negating a fiat bonus

The next contract month after May is June and here the open interest ROSE by 1397 contracts UP to 283,635. July GAINED 15 contracts to stand at 72. After July the next active month is August and here the OI rose by 8,624 contracts up to 114,318 contracts.

TODAY’S NOTICES FILED:

WE HAD 11 NOTICES FILED TODAY AT THE COMEX FOR 1100 OZ. (0.0342 TONNES)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for the wild silver comex results.

Total COMEX silver OI ROSE BY A CONSIDERABLE SIZED 1691 CONTRACTS FROM 198,782 UP TO 200,473(AND FURTHER FROM THE NEW RECORD OI FOR SILVER SET ON AUGUST 22.2018. THE PREVIOUS RECORD WAS SET APRIL 9.2018/ 243,411 CONTRACTS) AND TODAY’S TINY OI COMEX GAIN OCCURRED DESPITE A 9 CENT LOSS IN PRICING.//YESTERDAY.

WE ARE NOW INTO THE ACTIVE DELIVERY MONTH OF MAY. HERE WE HAVE 328 OPEN INTEREST STAND SO FAR FOR A LOSS OF ONLY 38 CONTRACTS. WE HAD 49 NOTICES SERVED UPON YESTERDAY SO IN ESSENCE WE GAINED ANOTHER 11 CONTRACTS OR AN ADDITIONAL 55,000 OZ WILL STAND FOR DELIVERY AS THESE GUYS REFUSED TO MORPH INTO LONDON BASED FORWARDS AND AS WELL THEY NEGATING A FIAT BONUS. SILVER MUST BE SCARCE AT THE COMEX. QUEUE JUMPING RETURNS WITH A VENGEANCE. WE HAVE NOW SURPASSED THE INITIAL AMOUNT STANDING WHICH OCCURED ON APRIL 30.2019

THE NEXT MONTH AFTER MAY IS THE NON ACTIVE MONTH OF JUNE. HERE THIS MONTH GAINED 18 CONTRACTS UP TO 724. AFTER JUNE IS THE ACTIVE MONTH OF JULY, (THE SECOND LARGEST DELIVERY MONTH OF THE YEAR FOR SILVER) AND HERE THIS MONTH GAINED 1389 CONTRACTS UP TO 152,783 CONTRACTS. THE NEXT ACTIVE MONTH AFTER JULY FOR SILVER IS SEPTEMBER AND HERE THE OI ROSE BY 1004 UP TO 17,872 CONTRACTS.

TODAY’S NUMBER OF NOTICES FILED:

We, today, had 13 notice(s) filed for 65,000 OZ for the MARCH, 2019 COMEX contract for silver

Trading Volumes on the COMEX TODAY: 244,286 CONTRACTS

CONFIRMED COMEX VOL. FOR YESTERDAY: 339,743 contracts

INITIAL standings for MAY/GOLD

Your early FRIDAY morning currency, Asian stock market results, important USA/Asian currency crosses, gold/silver pricing overnight along with the price of oil Major stories overnight/9 AM EST

i) Chinese yuan vs USA dollar/CLOSED/ LAST AT: 6.8246/

//OFFSHORE YUAN: 6.8550 /shanghai bourse CLOSED UP 88.26 POINTS OR 3.10%

HANG SANG CLOSED UP 239.17 POINTS OR 0.84%

2. Nikkei closed DOWN 57.21 POINTS OR 0.27%

3. Europe stocks OPENED GREEN /

USA dollar index FALLS TO 97.36/Euro RISES TO 1.1232

3b Japan 10 year bond yield: FALLS TO. –.05/ !!!!(Japan buying 100% of bond issuance)/Japanese yen vs usa cross now at 109.73/ THIS IS TROUBLESOME AS BANK OF JAPAN IS RUNNING OUT OF BONDS TO BUY./JAPAN 10 YR YIELD IS NOW TARGETED AT .11%/JAPAN LOSING CONTROL OF THEIR BOND MARKET//CARRY TRADERS GETTING KILLED

3c Nikkei now JUST BELOW 17,000

3d USA/Yen rate now well below the important 120 barrier this morning

3e WTI:: 62.02 and Brent: 70.92

3f Gold UP/JAPANESE Yen UP CHINESE YUAN: ON -SHORE DOWN/OFF- SHORE: DOWN

3g Japan is to buy the equivalent of 108 billion uSA dollars worth of bond per month or $1.3 trillion. Japan’s GDP equals 5 trillion usa./“HELICOPTER MONEY” OFF THE TABLE FOR NOW /REVERSE OPERATION TWIST ON THE BONDS: PURCHASE OF LONG BONDS AND SELLING THE SHORT END

Japan to buy 100% of all new Japanese debt and by 2018 they will have 25% of all Japanese debt. Fifty percent of Japanese budget financed with debt.

3h Oil UP for WTI and UP FOR Brent this morning

3i European bond buying continues to push yields lower on all fronts in the EMU. German 10yr bund RISES TO –04%/Italian 10 yr bond yield UP to 2.67% /SPAIN 10 YR BOND YIELD DOWN TO 0.96%…ITALIAN 10 YR BOND YIELD/GERMAN BUND: 2.71: DANGEROUS FOR THE ITALIAN BANKING SYSTEM

3j Greek 10 year bond yield RISES TO : 3.50

3k Gold at $1285.50 silver at: 14.76 7 am est) SILVER NEXT RESISTANCE LEVEL AT $18.50

3l USA vs Russian rouble; (Russian rouble UP 2/100 in roubles/dollar) 65.22

3m oil into the 61 dollar handle for WTI and 70 handle for Brent/

3n Higher foreign deposits out of China sees huge risk of outflows and a currency depreciation. This can spell financial disaster for the rest of the world/

JAPAN ON JAN 29.2016 INITIATES NIRP. THIS MORNING THEY SIGNAL THEY MAY END NIRP. TODAY THE USA/YEN TRADES TO 109.73 DESTROYING JAPANESE CITIZENS WITH HIGHER FOOD INFLATION

30 SNB (Swiss National Bank) still intervening again in the markets driving down the SF. It is not working: USA/SF this morning 1.0134 as the Swiss Franc is still rising against most currencies. Euro vs SF is 1.1383 well above the floor set by the Swiss Finance Minister. Thomas Jordan, chief of the Swiss National Bank continues to purchase euros trying to lower value of the Swiss Franc.

3p BRITAIN VOTES AFFIRMATIVE BREXIT/LOWER PARLIAMENT APPROVES BREXIT COMMENCEMENT/ARTICLE 50 COMMENCES MARCH 29/2017

3r the 10 Year German bund now NEGATIVE territory with the 10 year FALLING to –0.04%

The bank withdrawals were causing massive hardship to the Greek bank. the Greek referendum voted overwhelming “NO”. Next step for Greece will be the recapitalization of the banks and that will be difficult.

4. USA 10 year treasury bond at 2.45% early this morning. Thirty year rate at 2.87%

5. Details Ransquawk, Bloomberg, Deutsche bank/Jim Reid.

6. TURKISH LIRA: UP TO 6.1302..they are toast

Stocks Rise On “Trade Deal Hopes” After US Hikes Tariffs As Trade Deal Collapses

The market may have hit peak absurdity this morning because just hours after another round of US tariffs against China went into effect as some $200BN of Chinese imports saw tariffs hiked to 25% and Beijing vowed it would strike back, world stocks and US equity futures jumped after a volatile overnight session because, as the official narrative goes according to Reuters, “investors held out hopes for a trade deal between the United States and China” even as, as noted above, another round of U.S. tariffs on Chinese goods took effect.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

MMGYS

G&R double shot

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Kim Says Latest North Korea Launch Was “Long-Range Strike” Drill

North Korean state media is reporting that what was previously reported as “two short-range missile tests” by South Korea were actually long-range tests, which came on the same day US authorities seized a North Korean ship used to sell coal in violation of international sanctions.

State media announced early Friday (local time): “At the command post, Supreme Leader Kim Jong-un learned about a plan of the strike drill of various long-range strike means and gave an order of start of the drill,” the Korean Central News Agency (KCNA) said in English, as reported by Yonhap.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

US Hikes China Tariffs After Talks Result In No Progress; China Vows To Retaliate

After much theatrics and 11th hour negotiations, the US more than doubled tariffs to 25% on more than $200 billion in good imports from China just after midnight on Friday in what has been dubbed the “most dramatic step yet” in Donald Trump’s crusade to extract trade concessions from Beijing, deepening a nearly two-year old conflict that has roiled global markets and impacted the world economy.

While the White House said in a statement that talks are set to resume Friday, setting the stage for a tense final day of negotiations between Liu He, China’s vice premier and Robert Lighthizer, the US trade rep, Bloomberg reports that according to “close observers” there is little hope for any meaningful breakthroughs, especially since Liu does not have the authority to make any meaningful commitments, while an alleged phone call between Trump and president Xi yielded no positive results. It was also unclear, Bloomberg adds, whether China had resolved the internal debates that had led to last week’s rescinding of prior commitments to enshrine reforms agreed in Chinese law.

News that the US would hike tariffs, and set off a sequence of events that would most likely result in further escalation pushed US equity futures, treasury yields and the USDJPY lower around midnight.

In response to the tariff hike, China immediately said in a statement it “deeply regrets the latest tariff hike” and that it will be forced to take countermeasures against the US actions, but didn’t specify how, even as it said that it sill hopes the two sides can resolve issues via ongoing consultations.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Pic JD Doing the show

Having a Blast ! Thanks

[/img]

[/img] xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Trade Turmoil Sparks Worst Week Of 2019, Wipes Over $2 Trillion Off Global Stocks

A couple of tweets, and just like that $2.5 trillion of global equity market cap evaporates…

As stocks went from ‘everything is awesome’ to the worst week of the year in an instant…

With global money supply failing to support the illusion…

As stocks began to catch down to the far less exuberant global systemically important banks…

China’s National Team refused to let stocks fall overnight (following the tariffs) and obviously lifted the market dramatically. However, it was still the worst week of the year…

An ugly week in Europe too with France and Italy worst…

The week in US equity markets has been dominated by algos chasing headlines about trade talks with dead cat bounces giving way to reality checks…

NOTE – today’s “constructive” talks headline prompted the 4th biggest buy program of the month (PPT?).

Notice that the market turned around when the world’s biggest money-losing IPO opened…

It seems it took the algos a long time to actually read He’s and Mnuchin’s comments:

Liu He: “No talks are scheduled from here”

Steve Mnuchin: “No future talks planned as of now”

But when they did, stocks rolled over…

Smells like PPT turned up after Mnuchin’s comments as VIX flash-crashed (signaled) at 0830ET today then fell after Mnuchin’s comments…

VIX has been inverted all 5 days this week…

Prompting a huge short-squeeze lift. just like on Monday (fail) and Thursday (fail)…

This is the seventh Friday in a row where a sudden panic bid lifted stocks…

The Dow ended below its 50DMA for the 3rd day in a row but the rest of the majors scrambled back above the key technical level…

DMA

And then of course, there’s Uber…

Second worst week of the year for credit markets…

Treasury yields fell across the curve this week but the long-end notably underperformed…

The Dollar ended the week unchanged…

Yuan fell all week…biggest weekly drop in yuan against the dollar since June 2018

Bitcoin soared on the week, along with Ethereum…

Bitcoin rallied above $6400 as trade tensions escalate…

Despite the dollar’s flat week, silver slumped and crude managed gains…

And finally, it appears “constructive” is the new ‘put’…

Read More Harvey Here.....

https://harveyorganblog.com/2019/05/10/may-10-markets-are-one-big-joke-the-dow-rises-by-114-points-on/

.jpg)

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.