| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Wednesday, May 08, 2019 11:18:36 AM

S&P Executes Wedge And Rotation To Defensive Sectors Accelerates

By: Julius de Kempenaer | May 8, 2019

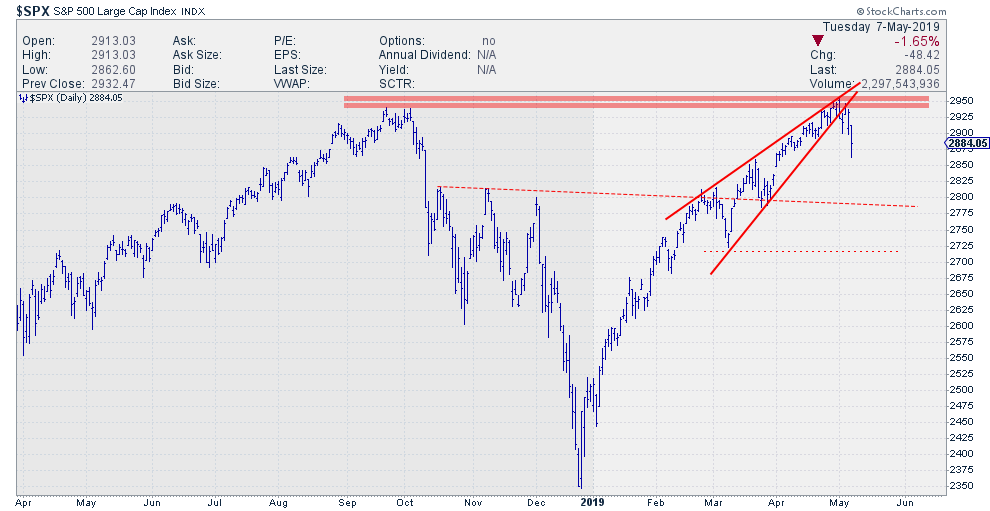

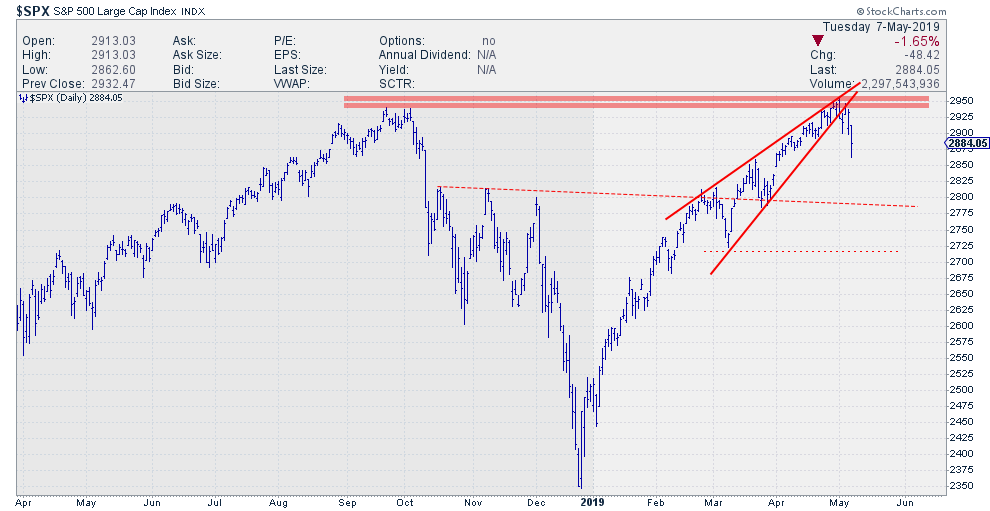

Since printing its high on 1 May, the S&P 500 struggled to keep up and make its final push through resistance. In the last three to four days the bulls capitulated and a reinforcement of the 2940-2950 resistance zone has been put into place and the rising wedge formation that was built up since March has now executed.

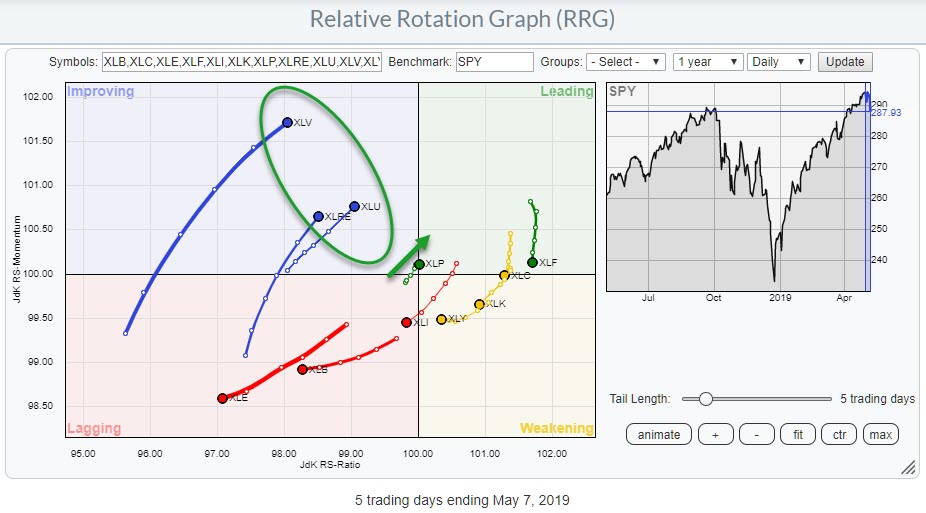

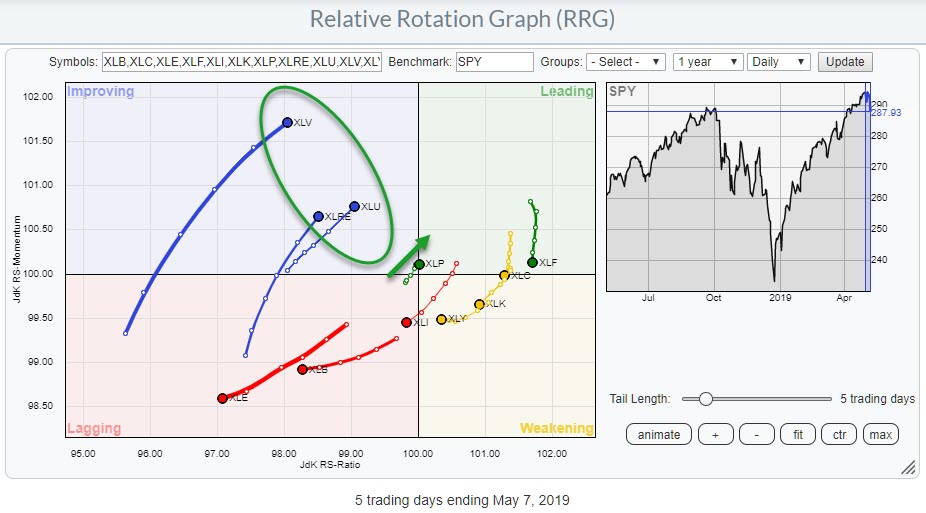

On the daily relative rotation graph for US sectors, the rotation to the more defensive sectors is now accelerating with Health Care, Utilities, and Real Estate all inside the improving quadrant and rapidly heading towards leading at a strong RRG-Heading.

That wedge in the S&P 500.

The chart above is an updated and slightly zoomed out of the chart that I used in my DITC contribution of 17 April titled "Are We Looking At A Wedge In The Making?". Now knowing last week's and especially yesterday's price action I think we can confirm that this wedge pattern has triggered a sell-signal, opening up the way for further correction.

Wedges may not be the most reliable pattern around but at least it will give us some ideas and guidance.

Reasons, why I am happy to qualify the current setup in the S&P as a completed and fairly reliable rising wedge, are:

1. The peak of the wedge before breaking down coincides with a major resistance level coming off a prior high, which is a resistance level in itself. That resistance level has now been tested and proven to be too heavy to break for now and this reinforces that level of resistance.

2. The downward break out of that wedge coincides with the completion of a small double top formation and it reverses the recent series of higher highs followed by higher lows into a new rhythm of lower highs and lower lows. Admitted that new series is still fragile but it is there and reversals are always a bit tricky at the beginning.

3. Wedge or no wedge, both observations above in themselves are negatives and suggest that we are looking for some more downside ahead in coming days. Only time will tell and the macroeconomic impact of the current political discussions will very likely add volatility to the markets. That does not make things any easier.

All in all, from a trading/investing perspective it looks as if the upside is very very limited for now and blocked by an overhead resistance barrier that just got a lot stronger while the downside is getting more and more exposed.

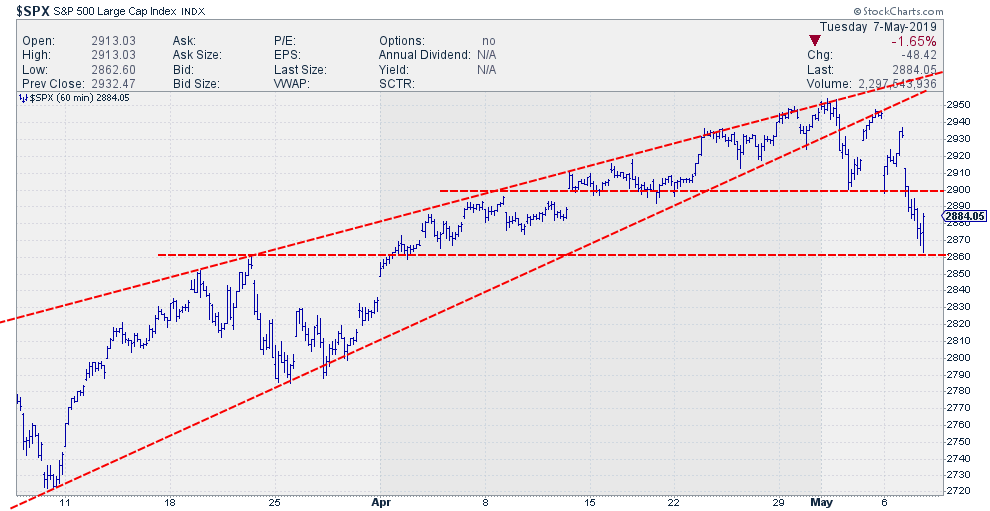

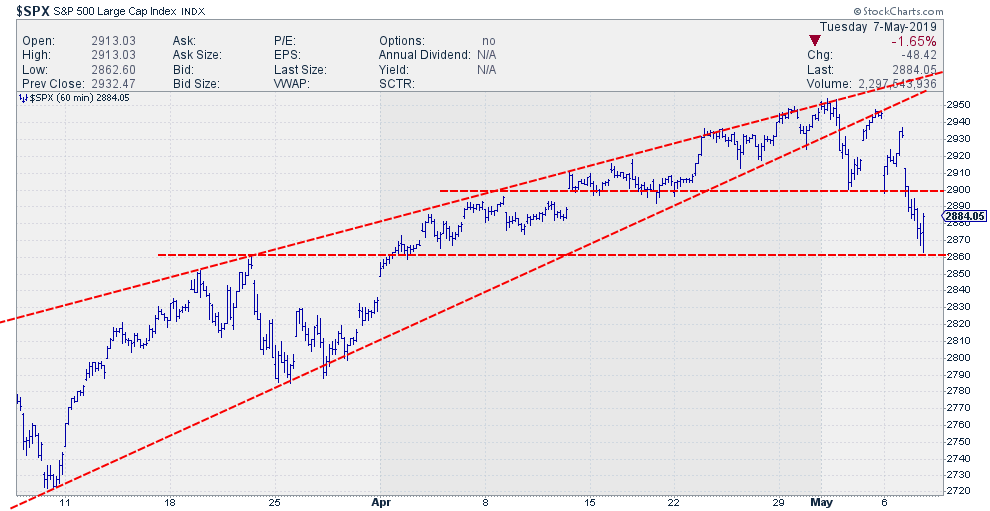

On the hourly chart below it can be seen that 2860 served as short-term support where the market bounced towards yesterday's close. 2900 Shows up as resistance while the big barrier is in the range between 2940-2955.

Accelerating Rotation towards defensive sectors

The daily RRG for US sectors is showing a rapid improvement for defensive sectors like Health care, Utilities, and Real Estate.

All three are inside the leading quadrant and traveling towards leading at strong RRG-Headings.

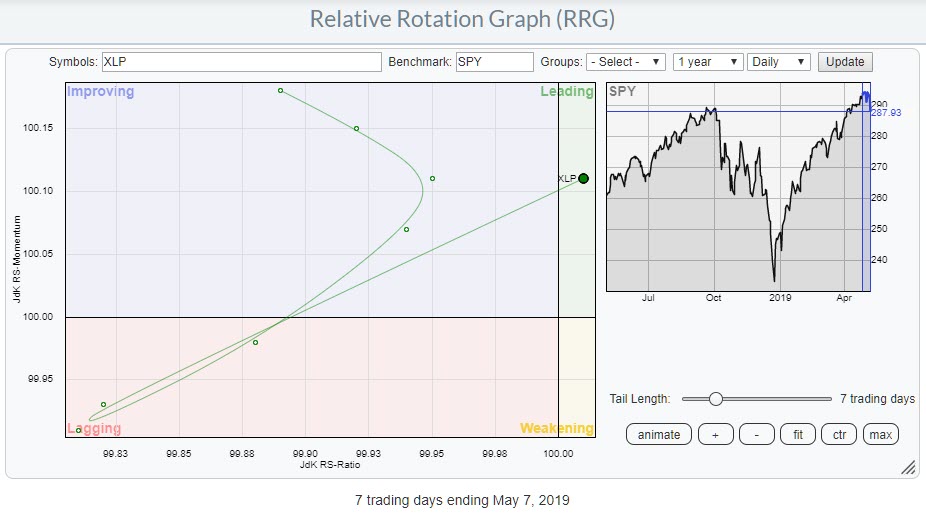

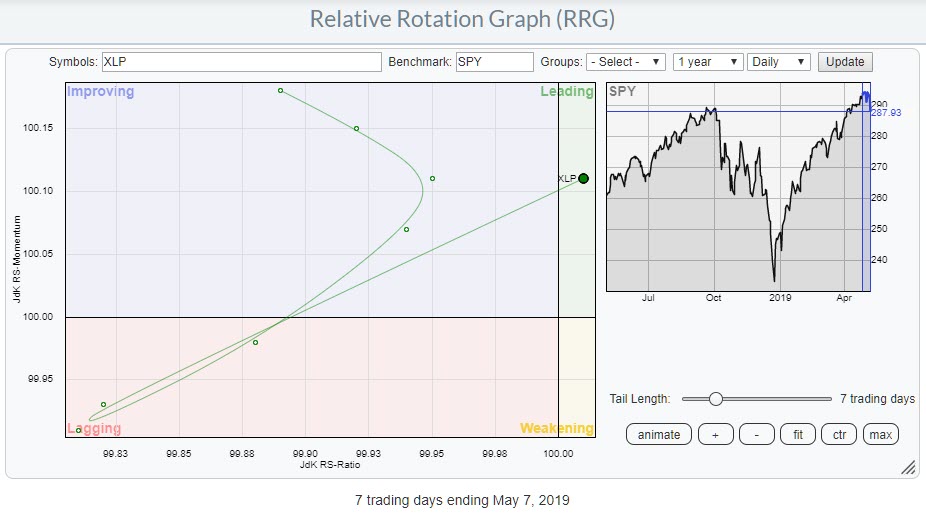

The Consumer Staples sector, also one of the classic defensive sectors is right at the center of the RRG, meaning that its relative trend against SPY has been flat recently, is now hooking up into the leading quadrant and accelerating. A strongly zoomed in RRG, as below, is needed to see that fast rotation on the XLP tail.

Out of these four sectors, the charts for Utilities and Staples look the most promising IMHO.

Health Care is pushing against resistance in price AND relative and just had a big momentum run that is at risk of rolling over.

Real Estate is in a trading range on both the price- and the relative charts and this sector should really break beyond its former relative highs in order to unlock serious relative upside.

So, for the time being, I am keeping an eye on Utilities and Staples.

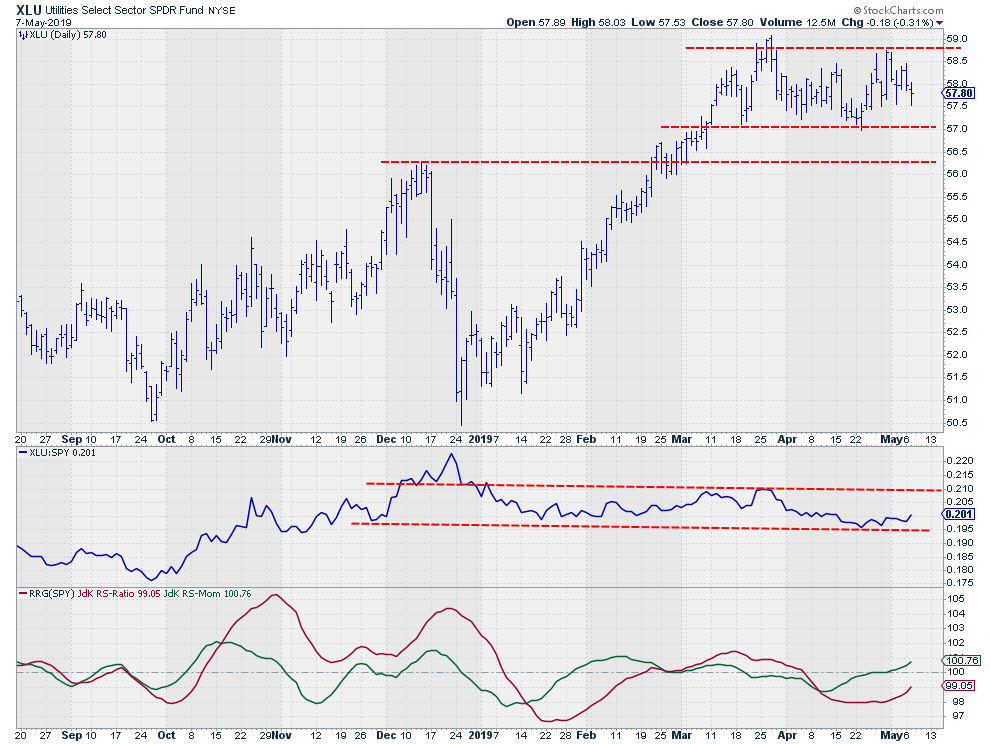

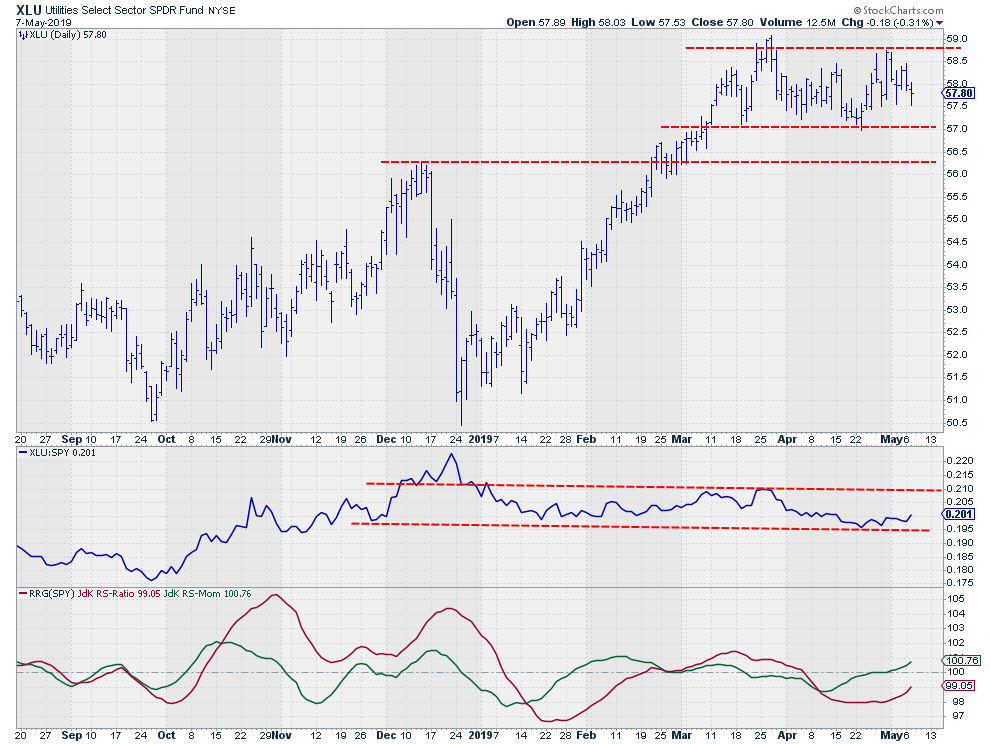

Utilities

The keen observer might say: "Hey but the Utilities sector is also in a trading range on both price- and relative charts, just like Health Care.?" And that's right, but the big difference is that Utilities broke to new all-time highs in March and are now consolidating just above that former resistance level, now support, which makes for much easier movement to the upside than the downside.

Also it is at the bottom of its range on the relative chart which creates some relative upside. When price manages to get above those recent highs around $59 I expect the relative strength to follow.

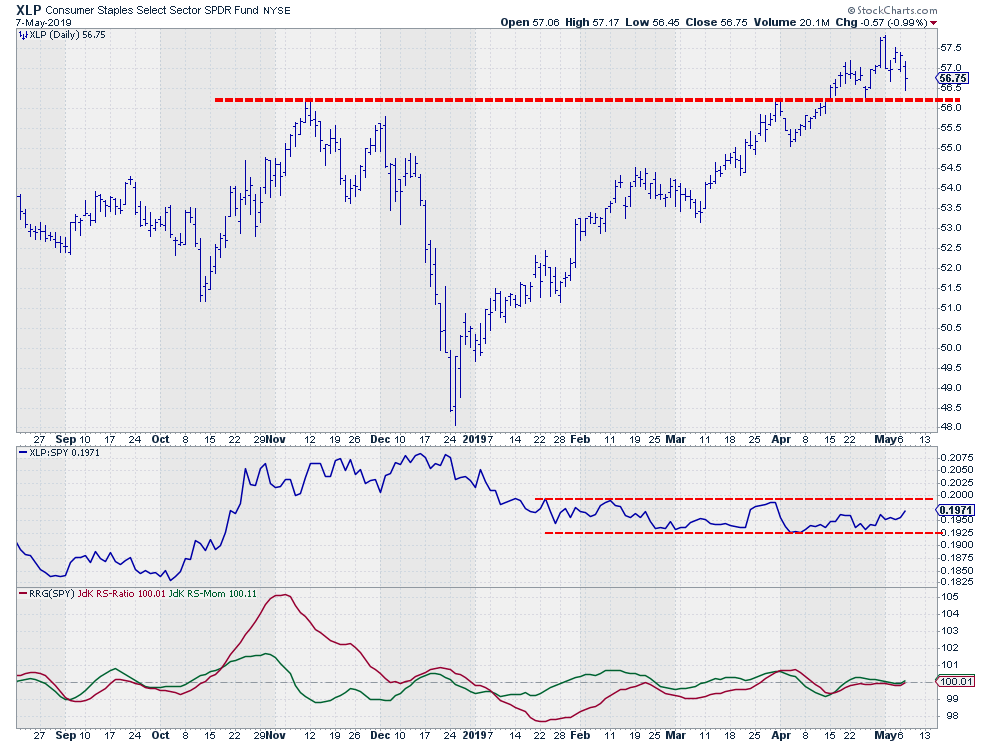

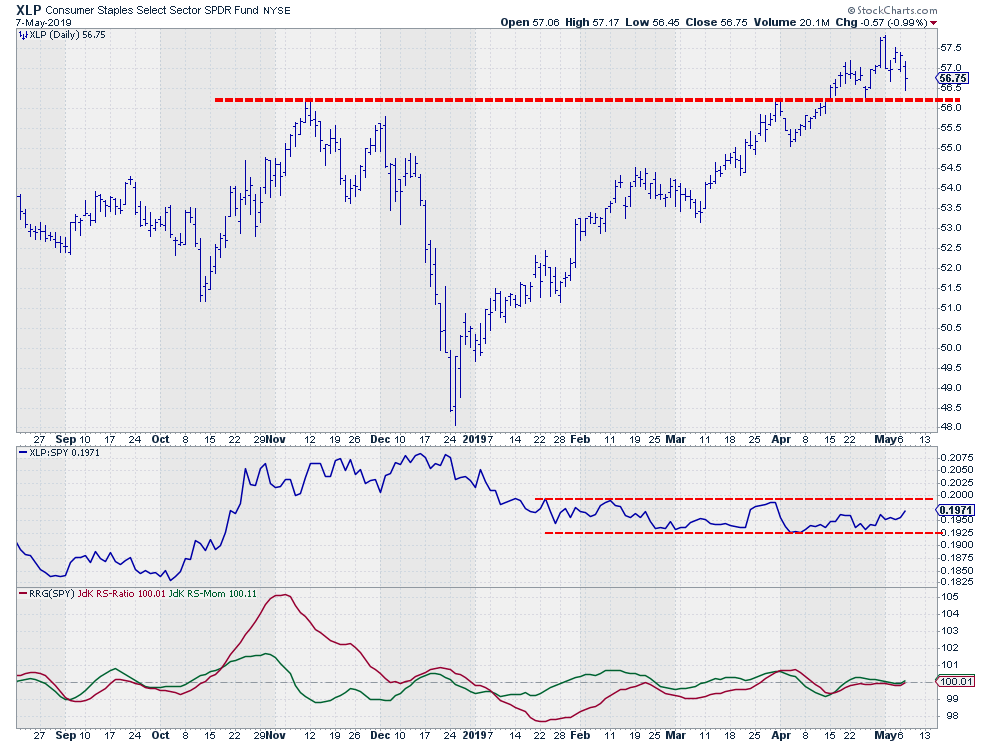

Staples

A similar situation, albeit less of a range in the price chart, goes for Staples. This sector also broke to new highs and so far has been able to keep up above that breakout level which is definitely a sign of strength when the rest of the market is moving lower.

With their tails inside the improving quadrant but still at relatively low JdK RS-Momentum levels (meaning there is plenty of room for more) I prefer Staples and Utilities as (overweight) holdings in a portfolio over Health Care and/or Real Estate.

Julius de Kempenaer

Read Full Story »»»

• DiscoverGold

By: Julius de Kempenaer | May 8, 2019

Since printing its high on 1 May, the S&P 500 struggled to keep up and make its final push through resistance. In the last three to four days the bulls capitulated and a reinforcement of the 2940-2950 resistance zone has been put into place and the rising wedge formation that was built up since March has now executed.

On the daily relative rotation graph for US sectors, the rotation to the more defensive sectors is now accelerating with Health Care, Utilities, and Real Estate all inside the improving quadrant and rapidly heading towards leading at a strong RRG-Heading.

That wedge in the S&P 500.

The chart above is an updated and slightly zoomed out of the chart that I used in my DITC contribution of 17 April titled "Are We Looking At A Wedge In The Making?". Now knowing last week's and especially yesterday's price action I think we can confirm that this wedge pattern has triggered a sell-signal, opening up the way for further correction.

Wedges may not be the most reliable pattern around but at least it will give us some ideas and guidance.

Reasons, why I am happy to qualify the current setup in the S&P as a completed and fairly reliable rising wedge, are:

1. The peak of the wedge before breaking down coincides with a major resistance level coming off a prior high, which is a resistance level in itself. That resistance level has now been tested and proven to be too heavy to break for now and this reinforces that level of resistance.

2. The downward break out of that wedge coincides with the completion of a small double top formation and it reverses the recent series of higher highs followed by higher lows into a new rhythm of lower highs and lower lows. Admitted that new series is still fragile but it is there and reversals are always a bit tricky at the beginning.

3. Wedge or no wedge, both observations above in themselves are negatives and suggest that we are looking for some more downside ahead in coming days. Only time will tell and the macroeconomic impact of the current political discussions will very likely add volatility to the markets. That does not make things any easier.

All in all, from a trading/investing perspective it looks as if the upside is very very limited for now and blocked by an overhead resistance barrier that just got a lot stronger while the downside is getting more and more exposed.

On the hourly chart below it can be seen that 2860 served as short-term support where the market bounced towards yesterday's close. 2900 Shows up as resistance while the big barrier is in the range between 2940-2955.

Accelerating Rotation towards defensive sectors

The daily RRG for US sectors is showing a rapid improvement for defensive sectors like Health care, Utilities, and Real Estate.

All three are inside the leading quadrant and traveling towards leading at strong RRG-Headings.

The Consumer Staples sector, also one of the classic defensive sectors is right at the center of the RRG, meaning that its relative trend against SPY has been flat recently, is now hooking up into the leading quadrant and accelerating. A strongly zoomed in RRG, as below, is needed to see that fast rotation on the XLP tail.

Out of these four sectors, the charts for Utilities and Staples look the most promising IMHO.

Health Care is pushing against resistance in price AND relative and just had a big momentum run that is at risk of rolling over.

Real Estate is in a trading range on both the price- and the relative charts and this sector should really break beyond its former relative highs in order to unlock serious relative upside.

So, for the time being, I am keeping an eye on Utilities and Staples.

Utilities

The keen observer might say: "Hey but the Utilities sector is also in a trading range on both price- and relative charts, just like Health Care.?" And that's right, but the big difference is that Utilities broke to new all-time highs in March and are now consolidating just above that former resistance level, now support, which makes for much easier movement to the upside than the downside.

Also it is at the bottom of its range on the relative chart which creates some relative upside. When price manages to get above those recent highs around $59 I expect the relative strength to follow.

Staples

A similar situation, albeit less of a range in the price chart, goes for Staples. This sector also broke to new highs and so far has been able to keep up above that breakout level which is definitely a sign of strength when the rest of the market is moving lower.

With their tails inside the improving quadrant but still at relatively low JdK RS-Momentum levels (meaning there is plenty of room for more) I prefer Staples and Utilities as (overweight) holdings in a portfolio over Health Care and/or Real Estate.

Julius de Kempenaer

Read Full Story »»»

• DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.