Monday, May 06, 2019 10:00:00 PM

The New Midnight Data SiMO Flyer

Take a ride on the new midnight data SiMO flyer at the bottom of this post

Good Morning Good Evening

You Can Hear That Train Whistle a Blowing

Were Riding The Rails Tonight On Graveyard

Welcome to ~*~Mining & Metals Du Jour~*~Graveyard Shift~*~

We have lots of good stuff on the train tonight Great Data & News by Harvey Organ, a new segment by InvestorHub Videowire, JP Morgan Sentence Delayed Again,Gary Chrisenson It’s Time for an International Gold Reset

Hello everybody I'm J:D your host tonight Thanks for being with us.

Hope your having a wonderful evening EnJoy the show

OK......All Aboard !!!!!

Thank you

MMGYS

May 6, 2019 · by harveyorgan · in Uncategorized ·

I was out all day today and away from my computer

the comex data is complete including data from GLD and SLV

the morning data is accurate

the afternoon and closing Dow nasdaq data is from Friday

i will resume my normal routine tomorrow

AND SORRY FOR MY REPORT BEING INCOMPLETE..

GOLD: $1282.50 UP $2.35 (COMEX TO COMEX CLOSING)

Silver: $14.92 DOWN 3 CENTS (COMEX TO COMEX CLOSING)

Closing access prices:

Gold :

silver:

JPMorgan has been receiving gold with reckless abandon and sometimes supplying (stopping)

today RECEIVING: 9/13

EXCHANGE: COMEX

CONTRACT: MAY 2019 COMEX 100 GOLD FUTURES

SETTLEMENT: 1,279.200000000 USD

INTENT DATE: 05/03/2019 DELIVERY DATE: 05/07/2019

FIRM ORG FIRM NAME ISSUED STOPPED

____________________________________________________________________________________________

661 C JP MORGAN 9

737 C ADVANTAGE 5 4

905 C ADM 8

____________________________________________________________________________________________

TOTAL: 13 13

MONTH TO DATE: 158

NUMBER OF NOTICES FILED TODAY FOR MAY CONTRACT: 13 NOTICE(S) FOR 1300 OZ (0.0404 tonnes)

TOTAL NUMBER OF NOTICES FILED SO FAR: 158 NOTICES FOR 15800 OZ (.4914 TONNES)

SILVER

FOR MAY

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

76 NOTICE(S) FILED TODAY FOR 380,000 OZ/

total number of notices filed so far this month: 2977 for 14,885,000 oz

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Bitcoin: OPENING MORNING TRADE :$5680 DOWN 95.00

Bitcoin: FINAL EVENING TRADE: $5756 DOWN 13

end

XXXX

Let us have a look at the data for today

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

IN SILVER THE COMEX OI FELL BY A CONSIDERABLE SIZED 2193 CONTRACTS FROM 202,655 DOWN TO 200,109 DESPITE FRIDAY’S STRONG 34 CENT RISE IN SILVER PRICING AT THE COMEX. ,LIQUIDATION OF THE SPREADERS HAVE STOPPED FOR SILVER BUT IT NOW COMMENCES FOR GOLD. TODAY WE ARRIVED FURTHER FROM AUGUST’S 2018 RECORD SETTING OPEN INTEREST OF 244,196 CONTRACTS.

WE HAVE ALSO WITNESSED A LARGE AMOUNT OF PHYSICAL METAL STAND FOR COMEX DELIVERY AS WELL WE ARE WITNESSING CONSIDERABLE LONGS PACKING THEIR BAGS AND MIGRATING OVER TO LONDON IN GREATER NUMBERS IN THE FORM OF EFP’S. WE WERE NOTIFIED THAT WE HAD A FAIR SIZED NUMBER OF COMEX LONGS TRANSFERRING THEIR CONTRACTS TO LONDON THROUGH THE EFP:

0 FOR MAY, 0 FOR JUNE, 698 FOR JULY AND ZERO FOR ALL OTHER MONTHS AND THEREFORE TOTAL ISSUANCE 698 CONTRACTS. WITH THE TRANSFER OF 698 CONTRACTS, WHAT THE CME IS STATING IS THAT THERE IS NO SILVER (OR GOLD) TO BE DELIVERED UPON AT THE COMEX AS THEY MUST EXPORT THEIR OBLIGATION TO LONDON. ALSO KEEP IN MIND THAT THERE CAN BE A DELAY OF 24-48 HRS IN THE ISSUING OF EFP’S. THE 698 EFP CONTRACTS TRANSLATES INTO 3.49 MILLION OZ ACCOMPANYING:

1.THE 34 CENT RISE IN SILVER PRICE AT THE COMEX AND

2. THE STRONG AMOUNT OF SILVER OUNCES WHICH STOOD FOR DELIVERY IN THE LAST NINE MONTHS:

JUNE/2018. (5.420 MILLION OZ);

FOR JULY: 30.370 MILLION OZ

FOR AUG., 6.065 MILLION OZ

FOR SEPT. 39.505 MILLION OZ S

FOR OCT.2.525 MILLION OZ.

FOR NOV: A HUGE 7.440 MILLION OZ STANDING AND

21.925 MILLION OZ FINALLY STAND FOR DECEMBER.

5.845 MILLION OZ STAND IN JANUARY.

2.955 MILLION OZ STANDING FOR FEBRUARY.:

27.120 MILLION OZ STANDING IN MARCH.

3.875 MILLION OZ STANDING FOR SILVER IN APRIL.

AND NOW 17.860 MILLION OZ STANDING FOR SILVER IN MAY.

ACCUMULATION FOR EFP’S/SILVER/J.P.MORGAN’S HOUSE OF BRIBES, / STARTING FROM FIRST DAY NOTICE/FOR MONTH OF MAY:

7522 CONTRACTS (FOR 4 TRADING DAYS TOTAL 7522 CONTRACTS) OR 37.61 MILLION OZ: (AVERAGE PER DAY: 1880 CONTRACTS OR 9.4 MILLION OZ/DAY)

TO GIVE YOU AN IDEA AS TO THE HUGE SUPPLY THIS MONTH IN SILVER: SO FAR THIS MONTH OF MAY: 37.61 MILLION PAPER OZ HAVE MORPHED OVER TO LONDON. THIS REPRESENTS AROUND 5.37% OF ANNUAL GLOBAL PRODUCTION (EX CHINA EX RUSSIA)* JUNE’S 345.43 MILLION OZ IS THE SECOND HIGHEST RECORDED ISSUANCE OF EFP’S AND IT FOLLOWED THE RECORD SET IN APRIL 2018 OF 385.75 MILLION OZ.

ACCUMULATION IN YEAR 2019 TO DATE SILVER EFP’S: 779.46 MILLION OZ.

JANUARY 2019 EFP TOTALS: 217.455. MILLION OZ

FEB 2019 TOTALS: 147.4 MILLION OZ/

MARCH 2019 TOTAL EFP ISSUANCE: 207.835 MILLION OZ

APRIL 2019 TOTAL EFP ISSUANCE: 182.87 MILLION OZ.

RESULT: WE HAD A CONSIDERABLE SIZED DECREASE IN COMEX OI SILVER COMEX CONTRACTS OF 2193 DESPITE THE STRONG 34 CENT FALL IN SILVER PRICING AT THE COMEX /YESTERDAY... THE CME NOTIFIED US THAT WE HAD A FAIR SIZED EFP ISSUANCE OF 698 CONTRACTS WHICH EXITED OUT OF THE SILVER COMEX AND TRANSFERRED THEIR OI TO LONDON AS FORWARDS. SPECULATORS CONTINUED THEIR INTEREST IN ATTACKING THE SILVER COMEX FOR PHYSICAL SILVER (SEE COMEX DATA) . OUR BANKERS RESUMED THEIR LIQUIDATION OF THE SPREAD TRADES TODAY.

TODAY WE LOST A CONSIDERABLE SIZED: 1495 TOTAL OI CONTRACTS ON THE TWO EXCHANGES:

i.e 698 OPEN INTEREST CONTRACTS HEADED FOR LONDON (EFP’s) TOGETHER WITH DECREASE OF 698 OI COMEX CONTRACTS. AND ALL OF THIS DEMAND HAPPENED WITH A 34 CENT RISE IN PRICE OF SILVER AND A CLOSING PRICE OF $14.95 WITH RESPECT TO YESTERDAY’S TRADING. YET WE STILL HAVE A STRONG AMOUNT OF SILVER STANDING AT THE COMEX FOR DELIVERY!!

In ounces AT THE COMEX, the OI is still represented by JUST OVER 1 BILLION oz i.e. 1.008 BILLION OZ TO BE EXACT or 144% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT MARCH MONTH/ THEY FILED AT THE COMEX: 76 NOTICE(S) FOR 380,000 OZ OF SILVER

IN SILVER,PRIOR TO TODAY, WE SET THE NEW COMEX RECORD OF OPEN INTEREST AT 243,411 CONTRACTS ON APRIL 9.2018. AND AGAIN THIS HAS BEEN SET WITH A LOW PRICE OF $16.51.

AND NOW WE RECORD FOR POSTERITY ANOTHER ALL TIME RECORD OPEN INTEREST AT THE COMEX OF 244,196 CONTRACTS ON AUGUST 22/2018 AND AGAIN WHEN THIS RECORD WAS SET, THE PRICE OF SILVER WAS $14.78 AND LOWER IN PRICE THAN PREVIOUS RECORDS.

ON THE DEMAND SIDE WE HAVE THE FOLLOWING:

HUGE AMOUNTS OF SILVER STANDING FOR DELIVERY (MARCH/2018: 27 MILLION OZ , APRIL/2018 : 2.485 MILLION OZ MAY: 36.285 MILLION OZ ; JUNE/2018 (5.420 MILLION OZ) , JULY 2018 FINAL AMOUNT STANDING: 30.370 MILLION OZ ) FOR AUGUST 6.065 MILLION OZ. , SEPT: A HUGE 39.505 MILLION OZ./ OCTOBER: 2,520,000 oz NOV AT 7.440 MILLION OZ./ DEC. AT 21.925 MILLION OZ JANUARY AT 5.825 MILLION OZ.AND FEB 2019: 2.955 MILLION OZ/ MARCH: 27.120 MILLION OZ/ APRIL AT 3.875 MILLION OZ/ AND NOW MAY: 17,750,000 OZ..

HUGE RECORD OPEN INTEREST IN SILVER 243,411 CONTRACTS (OR 1.217 BILLION OZ/ SET APRIL 9/2018) AND NOW AUGUST 22/2018: 244,196 CONTRACTS, WITH A SILVER PRICE OF $14.78.

HUGE ANNUAL EFP’S ISSUANCE EQUAL TO 2.9 BILLION OZ OR 400% OF SILVER ANNUAL PRODUCTION/2017

RECORD SETTING EFP ISSUANCE FOR ANY MONTH IN SILVER; APRIL/2018/ 385.75 MILLION OZ/ AND THE SECOND HIGHEST RECORDED EFP ISSUANCE JUNE 2018 345.43 MILLION OZ

AND YET, WITH THE EXTREMELY HIGH EFP ISSUANCE, WE HAVE A CONTINUAL LOW PRICE OF SILVER DESPITE THE ABOVE HUGE DEMAND. TO ME THE ONLY ANSWER IS THAT WE HAVE SOVEREIGN (CHINA) WHO IS ENDEAVOURING TO GOBBLE UP ALL AVAILABLE PHYSICAL SILVER NO MATTER WHERE, EXACTLY WHAT J.P.MORGAN IS DOING. AND IT IS MY BELIEF THAT J.P.MORGAN IS HOLDING ITS SILVER FOR ITS BENEFICIAL OWNER..THE USA GOVERNMENT WHO IN TURN IS HOLDING THAT SILVER FOR CHINA.(FOR A SILVER LOAN REPAYMENT).

IN GOLD, THE OPEN INTEREST FELL BY A CONSIDERABLE SIZED 2775 CONTRACTS, TO 440,217 DESPITE THE STRONG RISE IN THE COMEX GOLD PRICE/(AN INCREASE IN PRICE OF $9.35//YESTERDAY’S TRADING).

THE CME RELEASED THE DATA FOR EFP ISSUANCE AND IT TOTALED A STRONG SIZED 9114 CONTRACTS:

APRIL 0 CONTRACTS,JUNE: 9114 CONTRACTS DECEMBER: 0 CONTRACTS, JUNE 2020 0 CONTRACTS AND ALL OTHER MONTHS ZERO. The NEW COMEX OI for the gold complex rests at 440,217. ALSO REMEMBER THAT THERE WILL BE A DELAY IN THE ISSUANCE OF EFP’S. THE BANKERS REMOVE LONG POSITIONS OF COMEX GOLD IMMEDIATELY. THEN THEY ORCHESTRATE THEIR PRIVATE EFP DEAL WITH THE LONGS AND THAT COULD TAKE AN ADDITIONAL, 48 HRS SO WE GENERALLY DO NOT GET A MATCH WITH RESPECT TO DEPARTING COMEX LONGS AND NEW EFP LONG TRANSFERS. . EVEN THOUGH THE BANKERS ISSUED THESE MONSTROUS EFPS, THE OBLIGATION STILL RESTS WITH THE BANKERS TO SUPPLY METAL BUT IT TRANSFERS THE RISK TO A LONDON BANKER OBLIGATION AND NOT A NEW YORK COMEX OBLIGATION. LONGS RECEIVE A FIAT BONUS TOGETHER WITH A LONG LONDON FORWARD. THUS, BY THESE ACTIONS, THE BANKERS AT THE COMEX HAVE JUST STATED THAT THEY HAVE NO APPRECIABLE METAL!! THIS IS A MASSIVE FRAUD: THEY CANNOT SUPPLY ANY METAL TO OUR COMEX LONGS BUT THEY ARE QUITE WILLING TO SUPPLY MASSIVE NON BACKED GOLD (AND SILVER) PAPER KNOWING THAT THEY HAVE NO METAL TO SATISFY OUR LONGS. LONDON IS NOW SEVERELY BACKWARD IN BOTH GOLD AND SILVER AND WE ARE WITNESSING DELAYS IN ACTUAL DELIVERIES.

IN ESSENCE WE HAVE A STRONG SIZED GAIN IN TOTAL CONTRACTS ON THE TWO EXCHANGES OF 6339 CONTRACTS: 2775 OI CONTRACTS DECREASED AT THE COMEX AND 9114 EFP OI CONTRACTS WHICH NAVIGATED OVER TO LONDON. THUS TOTAL OI GAIN OF 6339 CONTRACTS OR 633,900 OZ OR 19,716 TONNES. FRIDAY WE HAD A GAIN IN THE PRICE OF GOLD TO THE TUNE OF $9.35….AND WITH THAT RISE, WE HAD A STRONG GAIN IN TONNAGE OF 25.82 TONNES!!!!!!.??????????????????????????????????????????

AS YOU WILL SEE, THE CROOKS HAVE NOW SWITCHED TO GOLD AS THEY INCREASE THE OPEN INTEREST FOR THE SPREADERS. THE TOTAL COMEX GOLD OPEN INTEREST WILL RISE FROM NOW ON UNTIL ONE WEEK PRIOR TO FIRST DAY NOTICE AND THAT IS WHEN THEY START THEIR CRIMINAL LIQUIDATION.

HERE IS HOW THE CROOKS USED SPREADING AS WE ENTER A NON ACTIVE DELIVERY MONTH OF MAY HEADING TOWARDS THE VERY ACTIVE DELIVERY MONTH OF JUNE.

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES, HERE IS THE BANKERS MODUS OPERANDI:

“YOU WILL ALSO NOTICE THAT THE COMEX OPEN INTEREST IS STARTING TO RISE IN THIS NON ACTIVE MONTH OF MAY BUT SO IS THE OPEN INTEREST OF SPREADERS. THE OPEN INTEREST IN GOLD WILL CONTINUE TO RISE UNTIL ONE WEEK BEFORE FIRST DAY NOTICE OF AN UPCOMING ACTIVE DELIVERY MONTH (JUNE), AND THAT IS WHEN THE CROOKS SELL THEIR SPREAD POSITIONS BUT NOT AT THE SAME TIME OF THE DAY. THEY WILL USE THE SELL SIDE OF THE EQUATION TO CREATE THE CASCADE (ALONG WITH THEIR COLLUSIVE FRIENDS) AND THEN COVER ON THE BUY SIDE OF THE SPREAD SITUATION AT THE END OF THE DAY. THEY DO THIS TO AVOID POSITION LIMIT DETECTION. THE LIQUIDATION OF THE SPREADING FORMATION CONTINUES FOR EXACTLY ONE WEEK AND ENDS ON FIRST DAY NOTICE.”

ACCUMULATION OF EFP’S GOLD AT J.P. MORGAN’S HOUSE OF BRIBES: (EXCHANGE FOR PHYSICAL) FOR THE MONTH OF MAY : 27,375 CONTRACTS OR 2,727,500OR 85.15 TONNES (4 TRADING DAYS AND THUS AVERAGING: 6843 EFP CONTRACTS PER TRADING DAY

TO GIVE YOU AN IDEA AS TO THE STRONG SIZE OF THESE EFP TRANSFERS : THIS MONTH IN 4 TRADING DAYS IN TONNES: 85.15 TONNES

TOTAL ANNUAL GOLD PRODUCTION, 2018, THROUGHOUT THE WORLD EX CHINA EX RUSSIA: 3555 TONNES

THUS EFP TRANSFERS REPRESENTS 85.15/3550 x 100% TONNES =2.39% OF GLOBAL ANNUAL PRODUCTION SO FAR IN DECEMBER ALONE.***

ACCUMULATION OF GOLD EFP’S YEAR 2019 TO DATE: 1900.72 TONNES

JANUARY 2019 TOTAL EFP ISSUANCE; 531.20 TONNES

FEB 2019 TOTAL EFP ISSUANCE: 344.36 TONNES

MARCH 2019 TOTAL EFP ISSUANCE: 497.16 TONNES

APRIL 2019 TOTAL ISSUANCE: 456.10 TONNES

WHAT IS ALARMING TO ME, ACCORDING TO OUR LONDON EXPERT ANDREW MAGUIRE IS THAT THESE EFP’S ARE BEING TRANSFERRED TO WHAT ARE CALLEDRIAL FORWARD CONTRACT OBLIGATIONS AND THESE CONTRACTS ARE LESS THAN 14 DAYS. ANYTHING GREATER THAN 14 DAYS, THESE MUST BE RECORDED AND SENT TO THE COMPTROLLER, GREAT BRITAIN TO MONITOR RISK TO THE BANKING SYSTEM. IF THIS IS INDEED TRUE, THEN THIS IS A MASSIVE CONSPIRACY TO DEFRAUD AS WE NOW WITNESS A MONSTROUS TOTAL EFP’S ISSUANCE AS IT HEADS INTO THE STRATOSPHERE.

Result: A CONSIDERABLE SIZED DECREASE IN OI AT THE COMEX OF 2775 DESPITE THE RISE IN PRICING ($9.35) THAT GOLD UNDERTOOK YESTERDAY) //.WE ALSO HAD A STRONG SIZED NUMBER OF COMEX LONG TRANSFERRING TO LONDON THROUGH THE EFP ROUTE: 9114 CONTRACTS AS THESE HAVE ALREADY BEEN NEGOTIATED AND CONFIRMED. THERE OBVIOUSLY DOES NOT SEEM TO BE MUCH PHYSICAL GOLD AT THE COMEX. I GUESS IT EXPLAINS THE HUGE ISSUANCE OF EFP’S…THERE IS HARDLY ANY GOLD PRESENT AT THE GOLD COMEX FOR DELIVERY PURPOSES. IF YOU TAKE INTO ACCOUNT THE 9114 EFP CONTRACTS ISSUED, WE HAD AN GOOD GAIN OF 6339 CONTRACTS IN TOTAL OPEN INTEREST ON THE TWO EXCHANGES:

9114 CONTRACTS MOVE TO LONDON AND 2775 CONTRACTS DECREASED AT THE COMEX. (IN TONNES, THE GAIN IN TOTAL OI EQUATES TO 19.716 TONNES). ..AND THIS GOOD DEMAND OCCURRED WITH A RISE IN PRICE OF $9.35 IN YESTERDAY’S TRADING AT THE COMEX. HOWEVER A PERCENTAGE OF OI WAS DUE TO THE COMMENCEMENT OF THE SPREADING OPERATION AS I HAVE OUTLINED ABOVE.

we had: 76 notice(s) filed upon for 7600 oz of gold at the comex.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

With respect to our two criminal funds, the GLD and the SLV:

GLD...

WITH GOLD UP $2.35 TODAY

STRANGE!!

ANOTHER BIG CHANGE IN GOLD INVENTORY AT THE GLD

A HUGE WITHDRAWAL OF 5.88 TONNES

INVENTORY RESTS AT 739.64 TONNES

IT LOOKS LIKE WE HAVE REACHED THE BOTTOM OF THE BARREL FOR PHYSICAL GOLD BEING SUPPLIED TO THE CROOKS.

TO ALL INVESTORS THINKING OF BUYING GOLD THROUGH THE GLD ROUTE: YOU ARE MAKING A TERRIBLE MISTAKE AS THE CROOKS ARE USING WHATEVER GOLD COMES IN TO ATTACK BY SELLING THAT GOLD. IT SURE SEEMS TO ME THAT THE GOLD OBLIGATIONS AT THE GLD EXCEED THEIR INVENTORY

SLV/

WITH SILVER DOWN 3 CENTS TODAY:

A BIG CHANGE IN SILVER INVENTORY AT THE SLV/

A DEPOSIT OF 891,000

/INVENTORY RESTS AT 316.582 MILLION OZ.

end

First, here is an outline of what will be discussed tonight:

1. Today, we had the open interest in SILVER FELL BY A CONSIDERABLE SIZED 2193 CONTRACTS from 200,655 UP DOWN TO 200,109 AND FURTHER FROM THE NEW COMEX RECORD SET LAST IN AUG.2018 AT 244,196 WITH A SILVER PRICE OF $14.78/(AUGUST 22/2018)..THE PREVIOUS RECORD WAS SET ON APRIL 9/2018 AT 243,411 OPEN INTEREST CONTRACTS WITH THE SILVER PRICE AT THAT DAY: $16.53). AND PREVIOUS TO THAT, THE RECORD WAS ESTABLISHED AT: 234,787 CONTRACTS, SET ON APRIL 21.2017 OVER 1 1/3 YEARS AGO. THE PRICE OF SILVER ON THAT DAY: $17.89. AS YOU CAN SEE, WE HAVE RECORD HIGH OPEN INTERESTS IN SILVER ACCOMPANIED BY A CONTINUAL LOWER PRICE WHEN THAT RECORD WAS SET…..THE SPREADERS HAVE STOPPED THEIR LIQUIDATION IN SILVER BUT HAVE NOW MORPHED INTO GOLD..

EFP ISSUANCE:

OUR CUSTOMARY MIGRATION OF COMEX LONGS CONTINUE TO MORPH INTO LONDON FORWARDS AS OUR BANKERS USED THEIR EMERGENCY PROCEDURE TO ISSUE:

0 CONTRACTS FOR APRIL., 0 FOR MAY, FOR JUNE 0 CONTRACTS AND JULY: 698 CONTRACTS AND ALL OTHER MONTHS: ZERO. TOTAL EFP ISSUANCE: 698 CONTRACTS. EFP’S GIVE OUR COMEX LONGS A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. IF WE TAKE THE OI LOSS AT THE COMEX OF 2193 CONTRACTS TO THE 698 OI TRANSFERRED TO LONDON THROUGH EFP’S, WE OBTAIN A CONSIDERABLE LOSS OF 1495 OPEN INTEREST CONTRACTS. THUS IN OUNCES, THE LOSS ON THE TWO EXCHANGES: 4.7545 MILLION OZ!!! AND YET WE ALSO HAVE A STRONG DEMAND FOR PHYSICAL AS WE WITNESSED A FINAL STANDING OF GREATER THAN 30 MILLION OZ FOR JULY, A STRONG 7.475 MILLION OZ FOR AUGUST.. A HUGE 39.505 MILLION OZ STANDING FOR SILVER IN SEPTEMBER… OVER 2 million OZ STANDING FOR THE NON ACTIVE MONTH OF OCTOBER., 7.440 MILLION OZ FINALLY STANDING IN NOVEMBER. 21.925 MILLION OZ STANDING IN DECEMBER , 5.845 MILLION OZ STANDING IN JANUARY. 2.955 MILLION OZ STANDING IN FEBRUARY, 27.120 MILLION OZ FOR MARCH., 3.875 MILLION OZ FOR APRIL AND NOW 17.750 MILLION OZ FOR MAY

RESULT: A CONSIDERABLE SIZED DECREASE IN SILVER OI AT THE COMEX DESPITE THE 34 CENT GAIN IN PRICING THAT SILVER UNDERTOOK IN PRICING// FRIDAY. WE ALSO HAD A STRONG SIZED 698 EFP’S ISSUED TRANSFERRING COMEX LONGS OVER TO LONDON. TOGETHER WITH THE STRONG SIZED AMOUNT OF SILVER OUNCES STANDING FOR THIS MONTH, DEMAND FOR PHYSICAL SILVER CONTINUES TO INTENSIFY AS WE WITNESS SEVERE BACKWARDATION IN SILVER IN LONDON.

BOTH THE SILVER COMEX AND THE GOLD COMEX ARE IN STRESS AS THE BANKERS SCOUR THE BOWELS OF THE EXCHANGE FOR METAL

(report Harvey)

.

2.a) The Shanghai and London gold fix report

(Harvey)

2 b) Gold/silver trading overnight Europe, Goldcore

(Mark O’Byrne/zerohedge

and in NY: Bloomberg

3. ASIAN AFFAIRS

i)MONDAY MORNING/ SUNDAY NIGHT:

SHANGHAI CLOSED DOWN 171.88 POINTS OR 5.58% //Hang Sang CLOSED DOWN 871.73 POINTS OR 2.90% /The Nikkei closed //Australia’s all ordinaires CLOSED DOWN .89%

/Chinese yuan (ONSHORE) closed DOWN at 6.7651 AS TRUCE DECLARED FOR 3 MONTHS /Oil DOWN to 63.26 dollars per barrel for WTI and 71.38 for Brent. Stocks in Europe OPENED RED// ONSHORE YUAN CLOSED DOWN // LAST AT 6.7651 AGAINST THE DOLLAR. OFFSHORE YUAN CLOSED DOWN ON THE DOLLAR AT 6.7813 TRADE TALKS NOW ON/MAJOR PROBLEMS AT HUAWEI /CFO ARRESTED : /ONSHORE YUAN TRADING ABOVE LEVEL OF OFFSHORE YUAN/ONSHORE YUAN TRADING WEAKER AGAINST USA DOLLAR/OFFSHORE YUAN TRADING WEAKER AGAINST THE DOLLAR /TRADE DEAL NOW DEAD..TRUMP THREATENS TO RAISE RATES TO 25%

3A//NORTH KOREA/ SOUTH KOREA

NORTH KOREA

b) REPORT ON JAPAN

3 China/Chinese affairs

i)China/USA

4/EUROPEAN AFFAIRS

i)GERMANY

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

6. GLOBAL ISSUES

7. OIL ISSUES

8 EMERGING MARKET ISSUES

9. PHYSICAL MARKETS

10. USA stories which will influence the price of gold/silver)

MARKET TRADING//

ii)Market data

ii)USA ECONOMIC/GENERAL STORIES

SWAMP STORIES

E)SWAMP STORIES/MAJOR STORIES//THE KING REPORT

Let us head over to the comex:

THE TOTAL COMEX GOLD OPEN INTEREST FELL BY A CONSIDERABLE SIZED 2775 CONTRACTS.TO A LEVEL OF 440,217 DESPITE THE GAIN IN THE PRICE OF GOLD ($9.35) IN FRIDAY’S // COMEX TRADING)

WE ARE NOW IN THE NON ACTIVE DELIVERY MONTH OF MAY.. THE CME REPORTS THAT THE BANKERS ISSUED A STRONG SIZED TRANSFER THROUGH THE EFP ROUTE AS THESE LONGS RECEIVED A DELIVERABLE LONDON FORWARD TOGETHER WITH A FIAT BONUS., THAT IS 9114 EFP CONTRACTS WERE ISSUED:

0 FOR JUNE ’19: 9114 CONTRACTS , DEC; 0 CONTRACTS: 0 AND ZERO FOR ALL OTHER MONTHS:

TOTAL EFP ISSUANCE: 9114 CONTRACTS.

THE OBLIGATION STILL RESTS WITH THE BANKERS ON THESE TRANSFERS. ALSO REMEMBER THAT THERE IS NO DOUBT A HUGE DELAY IN THE ISSUANCE OF EFP’S AND IT PROBABLY TAKES AT LEAST 48 HRS AFTER LONGS GIVE UP THEIR COMEX CONTRACTS FOR THEM TO RECEIVE THEIR EFP’S AS THEY ARE NEGOTIATING THIS CONTRACT WITH THE BANKS FOR A FIAT BONUS PLUS THEIR TRANSFER TO A LONDON BASED FORWARD.

ON A NET BASIS IN OPEN INTEREST WE GAINED THE FOLLOWING TODAY ON OUR TWO EXCHANGES: 6339 TOTAL CONTRACTS IN THAT 9114 LONGS WERE TRANSFERRED AS FORWARDS TO LONDON AND WE LOST A CONSIDERABLE SIZED 2775 COMEX CONTRACTS.

NET GAIN ON THE TWO EXCHANGES : 6339 contracts OR 633900 OZ OR 19.716 TONNES.

We are now in the NON active contract month of MAY and here the open interest stands at 136 contracts, having LOST 17 contracts. We had 27 notices served yesterday so we gained 10 contracts or an additional 1000 oz will stand as they guys refused to morph into a London based forward as well as negating a fiat bonus

The next contract month after May is June and here the open interest FELL by 5687 contracts up to 291,355. July LOST 1 contract to stand at 51. After July the next active month is August and here the OI rose by 2351 contracts up to 77,625 contracts.

TODAY’S NOTICES FILED:

WE HAD 13 NOTICES FILED TODAY AT THE COMEX FOR 1300 OZ. (0.0404 TONNES)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for the wild silver comex results.

Total COMEX silver OI FELL BY A CONSIDERABLE SIZED 2193 CONTRACTS FROM 202,302 DOWN TO 200,109(AND FURTHER FROM THE NEW RECORD OI FOR SILVER SET ON AUGUST 22.2018. THE PREVIOUS RECORD WAS SET APRIL 9.2018/ 243,411 CONTRACTS) AND TODAY’S CONSIDERABLE OI COMEX LOSS OCCURRED DESPITE A STRONG 34 CENT GAIN IN PRICING.//FRIDAY.???

WE ARE NOW INTO THE ACTIVE DELIVERY MONTH OF MAY. HERE WE HAVE 671 OPEN INTEREST STAND SO FAR FOR A LOSS OF ONLY 340CONTRACTS. WE HAD 362 NOTICES SERVED UPON YESTERDAY SO IN ESSENCE WE GAINED ANOTHER 22 CONTRACTS OR AN ADDITIONAL 110,000 OZ WILL STAND FOR DELIVERY AS THESE GUYS REFUSED TO MORPH INTO LONDON BASED FORWARDS AND AS WELL THEY NEGATING A FIAT BONUS. SILVER MUST BE SCARCE AT THE COMEX. QUEUE JUMPING RETURNS WITH A VENGEANCE. WE HAVE NOW SURPASSED THE INITIAL AMOUNT STANDING WHICH OCCURED ON APRIL 30.2019

THE NEXT MONTH AFTER MAY IS THE NON ACTIVE MONTH OF JUNE. HERE THIS MONTH LOST 170 CONTRACTS DOWN TO 714. AFTER JUNE IS THE ACTIVE MONTH OF JULY, (THE SECOND LARGEST DELIVERY MONTH OF THE YEAR FOR SILVER) AND HERE THIS MONTH LOST 2129 CONTRACTS DOWN TO 152,559 CONTRACTS.

TODAY’S NUMBER OF NOTICES FILED:

We, today, had 76 notice(s) filed for 380,000 OZ for the MARCH, 2019 COMEX contract for silver

Trading Volumes on the COMEX TODAY: 254,651 CONTRACTS

CONFIRMED COMEX VOL. FOR YESTERDAY: 293,964 contracts

we had 0 dealer entries:

total dealer deposits: nil oz

total dealer withdrawals: nil oz

We had 0 kilobar entries

we had 0 deposit into the customer account

i) Into JPMorgan: nil oz

ii) Into everybody else: zero oz

total gold deposits: nil oz

very little gold arrives from outside/ again zero amount arrived today

we had 0 gold withdrawals from the customer account:

(maybe investors are taking our advice by not storing their gold at the comex.)

this will hurt our bankers as they need to replace leased gold as all gold stored at the gold comex is unallocated.

Gold withdrawals;

i) We had one withdrawal:

Out of HSBC: 11,726.248 oz

.

total gold withdrawals; 11,726.248 oz

i) we had 0 adjustments today

FOR THE MAY 2019 CONTRACT MONTH)

Today, 0 notice(s) were issued from JPMorgan dealer account and 0 notices were issued from their client or customer account. The total of all issuance by all participants equates to 13 contract(s) of which 0 notices were stopped (received) by j.P. Morgan dealer and 9 notice(s) was (were) stopped/ Received) by j.P.Morgan customer account and 0 notices by the squid (Goldman Sachs)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

To calculate the INITIAL total number of gold ounces standing for the MAY /2019. contract month, we take the total number of notices filed so far for the month (158) x 100 oz , to which we add the difference between the open interest for the front month of MAY. (136 contract) minus the number of notices served upon today (13 x 100 oz per contract) equals 28,100 OZ OR 0.8740 TONNES) the number of ounces standing in this NON active month of MAY

Thus the INITIAL standings for gold for the MAY/2019 contract month:

No of notices served (158 x 100 oz) + (136)OI for the front month minus the number of notices served upon today (13 x 100 oz )which equals 28,100 oz standing OR 0.8740 TONNES in this NON active delivery month of MAY.

We gained 10 contracts or an additional 1000 oz will stand for delivery as they refused to morph into a London based forwards. Queue jumping continues where we left off last month in gold and for that matter in silver. We now have two precious metals undergoing queue jumping as the bankers scramble to obtain physical metal.

SURPRISINGLY LITTLE GOLD HAS BEEN ENTERING THE COMEX VAULTS AND WE HAVE WITNESSED THIS FOR THE PAST YEAR!! WE HAVE ONLY 6.604 TONNES OF REGISTERED ( GOLD OFFERED FOR SALE) VS 0.8740 TONNES OF GOLD STANDING// THEY SEEM TO BE USING CONSIDERABLE GOLD VAPOUR TO SETTLE UPON UNSUSPECTING LONGS.

total registered or dealer gold: 212,322.479 oz or 6.604tonnes

total registered and eligible (customer) gold; 7,770.289.523 oz 241.68 tonnes

FOR COMPARISON FIRST DAY NOTICE FOR APRIL 2018 AND FINAL STANDING APRIL 30 2018

AT FIRST DAY NOTICE MAY 1 2018: WE HAD 1.284 TONNES OF GOLD STAND. BY MONTH’S END: 2.27 TONNES AS WE HAD ONE QUEUE JUMPING IN THE MIDDLE OF THE MONTH.

IN THE LAST 31 MONTHS 113 NET TONNES HAS LEFT THE COMEX.

THE GOLD COMEX IS NOW IN STRESS AS

1. GOLD IS LEAVING THE COMEX

2. GOLD IS LEAVING THE REGISTERED CATEGORY OF THE COMEX.

end

And now for silver

AND NOW THE DELIVERY MONTH OF APRIL

INITIAL standings/SILVER

MAY 6 2019

Silver Ounces

Withdrawals from Dealers Inventory NIL oz

Withdrawals from Customer Inventory

21,934.000 oz

Delaware

Deposits to the Dealer Inventory

nil oz

Deposits to the Customer Inventory

537,619.785oz

int. delaware

No of oz served today (contracts)

76

CONTRACT(S)

(380,000 OZ)

No of oz to be served (notices)

595 contracts

2,975,000 oz)

Total monthly oz silver served (contracts) 2977 contracts

14,885,000 oz)

Total accumulative withdrawal of silver from the Dealers inventory this month NIL oz

Total accumulative withdrawal of silver from the Customer inventory this month

**

we had 0 inventory movement at the dealer side of things

total dealer deposits: nil oz

total dealer withdrawals: nil oz

we had 1 deposits into the customer account

into JPMorgan: nil

*** JPMorgan for most of 2017 and in 2018 has adding to its inventory almost every single day.

JPMorgan now has 149.469 million oz of total silver inventory or 48.80% of all official comex silver. (149 million/305 million)

into Int. Delaware: 21,934.020 oz

total customer deposits today: 557,619.785 oz

we had 1 withdrawals out of the customer account:

i) Out of Delaware: 21,934.020 oz

total withdrawals: 21,934.020 oz

we had 1 adjustment :

out of CNT: 5238.800 oz was adjusted out of the customer account and this landed into the dealer account of CNT

total dealer silver: 95.182 million

total dealer + customer silver: 308.244 million oz

The total number of notices filed today for the MAY 2019. contract month is represented by 76 contract(s) FOR 380,000 oz

To calculate the number of silver ounces that will stand for delivery in MAY, we take the total number of notices filed for the month so far at 2977 x 5,000 oz = 14,885,000 oz to which we add the difference between the open interest for the front month of MAY. (671) and the number of notices served upon today (76 x 5000 oz) equals the number of ounces standing.

.

Thus the INITIAL standings for silver for the MAY/2019 contract month: 2977(notices served so far)x 5000 oz + OI for front month of MAY( 671) -number of notices served upon today (37)x 5000 oz equals 17,860,000 oz of silver standing for the MAY contract month.

We GAINED 22 contracts or an additional 110,000 oz will stand as these guys refused to morph into London based forwards as well as negating a fiat bonus for their efforts.

FOR COMPARISON VS LAST YEAR:

ON FIRST DAY NOTICE APRIL 30/2018 (FOR THE MAY 2018 CONTRACT MONTH) WE HAD 24.11 MILLION OZ STAND FOR DELIVERY. BY MONTH END WE HAD HUGE QUEUE JUMPING AND THUS 36.285 MILLION OZ EVENTUALLY STOOD FOR DELIVERY.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

TODAY’S ESTIMATED SILVER VOLUME: 66,559 CONTRACTS

CONFIRMED VOLUME FOR YESTERDAY: 89,841 CONTRACTS..

..

YESTERDAY’S CONFIRMED VOLUME OF 89,841 CONTRACTS EQUATES to 449 million OZ 64.1% OF ANNUAL GLOBAL PRODUCTION OF SILVER

COMMODITY LAW SUGGESTS THAT OPEN INTEREST SHOULD NOT BE MORE THAN 3% OF ANNUAL GLOBAL PRODUCTION. THE CROOKS ARE SUPPLYING MASSIVE PAPER TRYING TO KEEP SILVER IN CHECK.

The record level of silver open interest is 234,787 contracts set on April 21./2017 with the price at that day at $18.42

The previous record was 224,540 contracts with the price at that time of $20.44

end

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

NPV for Sprott

1. Sprott silver fund (PSLV): NAV FALLS TO -4.54% (MAY 6/2019)

2. Sprott gold fund (PHYS): premium to NAV FALLS TO -2.52% to NAV (MAY 6/2019 )

Note: Sprott silver trust back into NEGATIVE territory at -4.54%-/Sprott physical gold trust is back into NEGATIVE/

(courtesy Sprott/GATA)

3.SPROTT CEF.A FUND (FORMERLY CENTRAL FUND OF CANADA):

NAV 12.84 TRADING 12.26/DISCOUNT 4.49

END

And now the Gold inventory at the GLD/

MAY 6/WITH GOLD UP $2.35: ANOTHER WITHDRAWAL OF 5.88 TONNES OF GOLD FROM THE GLD/INVENTORY RESTS AT 739.64 TONNES

MAY 3/WITH GOLD UP $9.35 TODAY: A WITHDRAWAL OF 1.17 TONNES OF GOLD FROM THE GLD INVENTORY/INVENTORY RESTS AT 745.52

MAY 2/WITH GOLD DOWN $12.30 TODAY: NO CHANGE IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 746.69 TONNES

MAY 1/WITH GOLD DOWN $1.20 TODAY: NO CHANGE IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 746.69 TONNES

APRIL 30/WITH GOLD UP $4.30 TODAY: NO CHANGE IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 746.69 TONNES//

APRIL 29/WITH GOLD DOWN $7.00: NO CHANGE IN GOLD INVENTORY AT THE GLD//INVENTORY RESTS AT 746.69 TONNES

APRIL 26/WITH GOLD UP $9.2//ANOTHER BIG CHANGE IN GOLD INVENTORY AT THE GLD; A WITHDRAWAL OF 1.18 TONNES OF GOLD FROM THE GLD.//INVENTORY LOWERS TO 746.69 TONNES TONNES

APRIL 25//WITH GOLD UP $.05 TODAY (BASICALLY FLAT) NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 747.87 TONNES

APRIL 24 WITH GOLD UP $6.00 TODAY// TWO TRANSACTIONS: 1)A HUGE WITHDRAWAL OF 2.05 TONNES FROM THE GLD AND THEN II) ANOTHER WITHDRAWAL OF 1.76 TONNES//INVENTORY RESTS AT 747.87 TONNES

APRIL 23./WITH GOLD DOWN $4.45 TODAY: NO CHANGES AT THE GLD/INVENTORY RESTS AT 751.68 TONNES//

APRIL 22/WITH GOLD UP $1.75//A SMALL WITHDRAWAL OF .59 TONNES OF GOLD FROM THE GLD INVENTORY//INVENTORY RESTS AT 751.68 TONNES

APRIL 18/WITH GOLD DOWN $.45 TODAY: NO CHANGE IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT752.27 TONNES

APRIL 17/WITH GOLD DOWN $0.10 TODAY: ANOTHER HUGE WITHDRAWAL OF 1.76 TONNES AT THE GLD WHICH WAS USED IN YESTERDAY’S RAID/INVENTORY RESTS AT 752.27 TONNES

APRIL 16/WITH GOLD DOWN $13.60 TODAY: A HUGE WITHDRAWAL OF 3.82 TONNES AT THE GLD/INVENTORY RESTS AT 754.03

APRIL 15/WITH GOLD DOWN $3.70 TODAY: NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 757.85 TONNES

APRIL 12/WITH GOLD UP $2.10 TODAY:NO CHANGE IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 757..85 TONNES

APRIL 11/WITH GOLD DOWN $19.85 TODAY: NO CHANGE IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 757.85 TONNES

APRIL 10/WITH GOLD UP $5.45 AGAIN TODAY, THE CROOKS AGAIN RAIDED THE COOKE JAR BY 2.64 TONNES/INVENTORY RESTS AT 757.85 TONNES

APRIL 9/WITH GOLD UP AGAIN BY $6.40/THE CROOKS RAIDED THE COOKIE JAR AGAIN BY 1.18 TONNES/INVENTORY RESTS AT 760.49 TONNES

APRIL 8/WITH GOLD UP AGAIN BY $6.40: THE CROOKS RAIDED THE COOKIE JAR AGAIN BY .88 TONNES//INVENTORY RESTS TONIGHT AT 761.67 TONNES.

APRIL 5/WITH GOLD UP$1.35: ANOTHER WITHDRAWAL OF 1.74 TONNES OF PHYSICAL GOLD FROM THE GLD INVENTORY: INVENTORY RESTS AT 762.55 TONNES

APRIL 4/WITH GOLD DOWN 90 CENTS TODAY: NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 764.29 TONNES

APRIL 3:WITH GOLD DOWN 20 CENTS: ANOTHER WHOPPER OF A WITHDRAWAL: 3.81 TONNES FROM THE GLD//INVENTORY RESTS AT 764.29 TONNES

APRIL 2//WOW! WE LOST A WHOPPING 16.16 TONNES OF GOLD WITH A RISE IN PRICE OF $1.80//INVENTORY RESTS AT 768.10

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

MAY 6/2019/ Inventory rests tonight at 739.64 tonnes

*IN LAST 591 TRADING DAYS: 194.33 NET TONNES HAVE BEEN REMOVED FROM THE GLD

*LAST 491 TRADING DAYS: A NET 28.49 TONNES HAVE NOW BEEN LOST INTO THE GLD INVENTORY.

IT LOOKS LIKE WE REACHED THE BOTTOM OF THE BARREL FOR PHYSICAL GOLD AT THE GLD.

end

Now the SLV Inventory/

MAY 6/WITH SILVER DOWN 3 CENTS WE HAD ANOTHER DEPOSIT OF 891,000 OZ OF SILVER INTO THE SLV/INVENTORY RESTS AT 316.582

MAY 3//WITH SILVER UP 34 CENTS TODAY: A DEPOSIT OF 843,000 OZ INTO THE SLV/TOTAL INVENTORY RESTS AT 315.691 MILLION OZ//

MAY 2/WITH SILVER DOWN ANOTHER 13 CENTS, MIRACUOUSLY THE AUTHORITIES ADD 2.869 MILLION OZ OF SILVER BACK INTO THE SLV/INVENTORY RESTS AT 314.848 MILLION OZ//

MAY 1/WITH SILVER DOWN 23 CENTS TODAY: NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 311.979 MILLION OZ////

APRIL 30/WITH SILVER UP 5 CENTS TODAY: NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 311.979 MILLION OZ/

APRIL 29/ WITH SILVER DOWN 13 CENTS TODAY: NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 311.979 MILLION OZ.

APRIL 26//WITH SILVER UP 12 CENTS TODAY: NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 311.979 MILLION OZ//

APRIL 25/WITH SILVER DOWN 4 CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 311.979 MILLION OZ///

APRIL 24/WITH SILVER UP 15 CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 311.979 MILLION OZ//

APRIL 23./WITH SILVER DOWN 21 CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 311.979 MILLION OZ///

APRIL 22/WITH SILVER UP 4 CENTS TODAY; NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 311.979 MILLION OZ///

APRIL 18/WITH SILVER FLAT TODAY: A SHOCKING 2.8122 MILLION PAPER OZ WERE ADDED INTO SLV INVENTORY: INVENTORY RESTS AT 311.979 MILLION OZ/

APRIL 17/WITH SILVER UP ONE CENT TODAY; NO CHANGES IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 309.167 MILLION OZ///

APRIL 16/WITH SILVER DOWN 3 CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 309.167 MILLION OZ//

APRIL 15: WITH SILVER DOWN ONE CENT TODAY: A SMALL CHANGE IN SILVER INVENTORY AT THE SLV: A WITHDRAWAL OF 750,000 OZ//INVENTORY RESTS AT 309.167 MILLION OZ.

APRIL 12 WITH SILVER UP 11 CENTS TODAY: NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 309.917 MILLION OZ.

APRIL 11/WITH SILVER DOWN 37 CENTS TODAY: A DEPOSIT OF 750,000 OZ INTO THE SLV/INVENTORY RESTS AT 309.917 MILLION OZ//

April 10/WITH SILVER UP 4 CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 309.167 MILLION OZ.

APRIL 9/WITH SILVER DOWN ONE CENT: NO CHANGES IN SILVER INVENTORY AT THE SLV.INVENTORY RESTS AT 309.167 MILLION OZ///

APRIL 8/WITH SILVER UP 14 CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV.INVENTORY RESTS AT 309.167 MILLION OZ///

APRIL 5/WITH SILVER DOWN 2 CENTS: NO CHANGES IN SILVER INVENTORY: THE CROOKS CANNOT RAID ANY SILVER BECAUSE THERE IS NONE: INVENTORY RETS AT 309.167 MILLION OZ//

APRIL 4/WITH SILVER FLAT TODAY; NO CHANGES IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 309.167 MILLION OZ/

APRIL 3/WITH SILVER UP TWO CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 309.167 MILLION OZ/

APRIL 2/ WITH SILVER DOWN ONE CENT TODAY: A SMALL WITHDRAWAL OF 134,000 OZ FROM THE SLV TO PAY FOR FEES/INVENTORY RESTS AT 309.167

MAY 6/2019:

Inventory 316.582 MILLION OZ

LIBOR SCHEDULE AND GOFO RATES:

THE RISE IN LIBOR IS CREATING A SCARCITY OF DOLLARS BECAUSE FOREIGN EXCHANGE SWAPS (COSTS) ARE SIMPLY PROHIBITIVE

YOUR DATA…..

6 Month MM GOFO 2.11/ and libor 6 month duration 2.64

Indicative gold forward offer rate for a 6 month duration/calculation:

G0LD LENDING RATE: + .53/

XXXXXXXX

12 Month MM GOFO

+ 2.46%

LIBOR FOR 12 MONTH DURATION: 2.74

GOFO = LIBOR – GOLD LENDING RATE

GOLD LENDING RATE = +.28

end

PHYSICAL GOLD/SILVER STORIES

end

i) GOLDCORE BLOG/Mark O’Byrne

Gold To Gain as Gl

end

GATA STORIES WITH RESPECT TO GOLD/PRECIOUS METALS.

Silver is backward by a huge 7 cents and that should propel a strong rally in silver.

(courtesy Andrew Maguire/Kingworldnews)

end

GATA STORIES WITH RESPECT TO GOLD/PRECIOUS METALS.

Silver is backward by a huge 7 cents and that should propel a strong rally in silver.

(courtesy Andrew Maguire/Kingworldnews)

Silver backwardation signals rally, Maguire tells KWN

Submitted by cpowell on Fri, 2019-05-03 20:46. Section: Daily Dispatches

4:46p ET Friday, May 3, 2019

Dear Friend of GATA and Gold:

London metals trader Andrew Maguire, interviewed today by King World News, says the cash price for silver is so far above the recent futures contract price — deep backwardation — that a rally is imminent.

“This is the time to join the commercials and ride the next silver and gold wave higher,” Maguire says. “But if you do it, do it by taking physical delivery. That way you will not only be fighting back but will also be exacerbating already tight physical gold and silver markets.”

Maguire’s comments are posted at KWN here:

https://kingworldnews.com/andrew-maguire-bullion-banks-are-about-to-torc…

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

END

India’s central bank denies moving any gold to London or the uSAin 2014

(courtesy Times of India/Mumbai)

India’s central bank denies moving gold abroad in 2014 or since

Submitted by cpowell on Sat, 2019-05-04 13:43. Section: Daily Dispatches

No Gold Shifted Outside India in 2014 or After, RBI Says

From the Press Trust of India

via The Times of India, Mumbai

Friday, May 3, 2019

https://economictimes.indiatimes.com/news/economy/finance/no-gold-shifte…

The Reserve Bank of India said Friday no gold was shifted outside the country in 2014 or thereafter. The statement comes against the backdrop of reports in certain sections of the print and social media regarding the central bank shifting abroad a part of its gold holding in 2014.

It is a normal practice for central banks world over to keep their gold reserves overseas with central banks of other countries like Bank of England for safe custody, according to the statement.

…

It is further stated that no gold was shifted by the RBI from India to other countries in 2014 or thereafter. Thus the media reports cited above are factually incorrect,” the statement said.

The Congress Party had tweeted a report regarding shifting of 200 tonne of the RBI’s gold to Switzerland in 2014.

“Did the Modi govt secretly transport 200 tonnes of RBI’s gold to Switzerland in 2014?,” the party had tweeted while tagging the report.

* * *

Help keep GATA going:

GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at:

www.gata.org

To contribute to GATA, please visit:

http://www.gata.org/node/16

end

Strange! the sentencing of former JPMorgan trader Edmonds has been delayed again for 6 months until December

The Feds continue with their criminal investigation of the manipulation of the metals while at the same time the crooks continue to manipulate

(courtesy Gile/CNBC/GATA)

Sentencing of former JPM metals trader delayed again

Submitted by cpowell on Sat, 2019-05-04 15:38. Section: Daily Dispatches

Sentencing of former JP Morgan Chase Precious Metals Trader Delayed as Federal Probe Continues

By Dawn Giel

CNBC, New York

Thursday, May 2, 2019

The criminal sentencing of former J.P. Morgan Chase precious metals trader John Edmonds has been postponed six more months, to December, as federal investigators continue to probe possible manipulation of metals markets.

Edmonds, 37, pleaded guilty in October in Connecticut federal court to working with other “unnamed co-conspirators” to manipulate the prices of gold, silver, platinum, and palladium futures contracts between 2009 and 2015 while employed at J.P. Morgan.

…

The New York City man admitted learning illegal trading tactics from senior traders — and to using those tactics with the knowledge and consent of supervisors.

His sentencing has been postponed twice, suggesting he is continuing to cooperate with prosecutors in their investigation. No one else has been charged. …

… For the remainder of the report:

https://www.cnbc.com/2019/05/02/sentencing-of-ex-jp-morgan-chase-metals-…

iii) Other Physical stories

-END-

Gold trading/

end

Due to the criminal conviction of trader Edmonds, the USA prosecution is seeking to halt the civil lawsuit. I was misinformed: all discoveries in a civil suit are public and because of that, the prosecution gives the defendants the right to plead the 5th if their testimony incriminates them

(courtesy zerohedge/Chris Powell)

US seeks halt in civil lawsuit accusing JP Morgan of manipulating metals market, citing criminal case

The U.S. wants a federal judge to halt a civil lawsuit accusing J. P. Morgan of manipulating precious metals markets. The Justice Department cited an ongoing criminal case as its reason for the request.

A former J. P. Morgan trader pleaded guilty in Connecticut last month to manipulation charges.

In the guilty plea, the trader said he had learned to make bogus trade orders from senior traders at the bank and that he used the strategy hundreds of times with the knowledge and consent of his immediate supervisors.

Amr Alfiky | Reuters

A sign of JP Morgan Chase Bank is seen in front of their headquarters tower in New York.

The Justice Department is asking a judge to put the brakes on a civil lawsuit against J. P. Morgan Chase, citing an ongoing probe into a “related criminal case” that involves alleged manipulation of precious metals markets.

The department wants a six-month postponement in the proceedings of the civil lawsuit, which was filed in 2015 by hedge fund manager Daniel Shak and two commodity traders. The government also says it could ask for a longer delay in the case, according to a court filing on Monday.

The move comes days after Shak’s lawyer, David Kovel, sought permission to reopen questioning of two former J. P. Morgan traders and the bank’s current global head of base and precious metals trading.

Kovel, in making the request with the Manhattan federal judge in the civil case, cited last month’s guilty plea by one of those former traders, John Edmonds, in federal court in Connecticut.

Edmonds admitted making bogus bids on precious metals contracts while working at the bank from 2009 to 2015.

Neither J. P. Morgan Chase nor Kovel’s clients have opposed the Justice Department’s request.

In arguing for a delay, the Justice Department said Shak’s lawsuit is “related” to Edmonds’ criminal case and that Edmonds has “pleaded guilty and acknowledged his own participation in such conduct, as well as that of other traders.”

“Edmonds awaits sentencing, but the broader investigation is ongoing,” the Justice Department said. The U.S. wants to delay the civil case “to protect the integrity of its ongoing criminal investigation,” it said.

J. P. Morgan did not respond to a request for comment by CNBC. Kovel declined to comment.

Tuesday night, after this story first was published, Judge Paul Engelmayer ordered the federal prosecutors to explain in detail by Monday why postponing proceedings in the civil lawsuit would not harm those involved, and why reopening questioning “would be detrimental to the Government’s ongoing criminal investigation.”

Englemayer also wrote that he regards Edmonds’ guilty plea “as potentially highly consequential” to the civil case.

In his guilty plea, the 36-year-old Edmonds said he had learned to make bogus trade orders from senior traders at the bank and that he used the strategy hundreds of times with the knowledge and consent of his immediate supervisors. He admitted to working with “unnamed co-conspirators” at J. P. Morgan, according to the Justice Department.

Kovel wants to question Edmonds again as well as Michael Nowak, the bank’s global head of base and precious metal trading, and former J. P. Morgan Chase Managing Director Robert Gottlieb. The three had previously answered questions under oath in the civil case.

Kovel said in court filings that Nowak was the immediate supervisor of Edmonds, while Gottlieb was Edmonds’ mentor.

In his prior deposition, Edmonds said that Gottlieb sat only a “couple feet” away from him for about five years, and that he was “somebody [he] looked up to in the business,” who helped guide and train him.

Nowak is described by Edmonds as his direct supervisor, with whom he would sometimes discuss trading strategies. Nowak was also the person responsible for overseeing the performance and risk of Edmonds’ portfolio, according to the deposition.

Edmonds also stated in his prior deposition that he would enter precious metals trades for both Nowak and Gottlieb, among others.

The civil lawsuit claims Shak and his fellow plaintiffs lost tens of millions of dollars as a result of actions by J. P. Morgan’s traders.

Dawn GielReporter

end

A federal judge tells traders that they can combine cases (with the other 6 banks) as they accused JPMorgan of rigging the precious metals market

(courtesy CNBC)

Federal judge tells traders they can combine cases accusing JP Morgan of rigging metals market

Litigation in a separate civil case has been put on hold until at least May at the behest of the Justice Department, which is investigating a “related criminal case” that involves alleged market manipulation by precious metals traders at J. P. Morgan.

Judge John Koeltl of the Southern District of New York appointed the White Plains, N.Y., law firm Lowey Dannenberg as interim lead counsel for the proposed class action.

71671201

Spencer Platt | Getty Images

A group of traders from across the U.S. who allege that J. P. Morgan Chase manipulated precious metals markets for years are one step closer to bringing a class action suit against the nation’s largest bank.

Earlier this month, a federal judge said five separate lawsuits making similar allegations against the bank could be combined, potentially including thousands of people who traded in the precious metals market from Jan. 2009 through Dec. 2015.

Litigation in a separate civil case has been put on hold until at least May at the behest of the Justice Department, which is investigating a “related criminal case” that involves alleged market manipulation by precious metals traders at J. P. Morgan.

J. P. Morgan declined to comment on this story.

Judge John Koeltl of the Southern District of New York appointed the White Plains, N.Y., law firm Lowey Dannenberg as interim lead counsel for the proposed class action.

Vincent Briganti, a partner at the firm, filed the first suit seeking class action status in November on behalf of Dominick Cognata, a trader who alleges he suffered losses due to J.P. Morgan’s illegal trading conduct in the silver and gold futures and options markets.

That was after the federal court in Connecticut unsealed a criminal plea agreement by John Edmonds, a former J.P. Morgan metals trader. In his guilty plea, Edmonds, who is 36-years old, admitted that he and other “unnamed co-conspirators” fraudulently manipulated the precious metals markets while they were employed at J. P. Morgan from 2009 to 2015.

Edmonds said he had learned the illegal trading tactics from senior traders, and then used them hundreds of times with the knowledge of and consent of his immediate supervisors.

Briganti’s lawsuit also names John Edmonds and a group of yet-to-be-identified precious metals traders and the bank as defendants.

On Wednesday, the lawyers sent a letter to Judge Koeltl saying they were having difficulty locating Edmonds to serve him legal papers and requested a 30-day extension to do so, which the judge granted on Thursday. Briganti noted that they have been in contact with Edmonds’ attorney in the criminal case. Edmonds’ attorney and Briganti could not be reached for comment.

“We are hopeful that this extension will result in completing service on Mr. Edmonds without formal motion practice and a request for alternative means of service,” Briganti said in the letter.

The next step in the civil case is for the plaintiffs to file an amended class action complaint and set a schedule for defendants to respond.

In addition to the proposed class action, J. P. Morgan also faces a separate civil suit which also accuses the bank of rigging precious metals markets.

end

March 4.2019

Parker City News

JP Morgan faces potential class action lawsuit after guilty pleas by a former metals trader

Traders from across the U.S. are banding together to accuse J. P. Morgan Chase of manipulating precious metals markets for years.

At least six lawsuits, all making similar allegations against the nation‘s largest bank, have been filed in New York federal court in the past month, since federal prosecutors in Connecticut with a former J. P. Morgan Chase metals trader.

The cases could potentially include thousands of people who traded in the precious metals market. The White Plains, N.Y., law firm Lowey Dannenberg is asking the court to combine the cases and name it as the lead.

The law firm‘s commodities group is led by Vincent Briganti, the attorney who filed the first lawsuit on behalf of Dominick Cognata, a New York resident who alleges he suffered losses due to J. P. Morgan‘s trading conduct in the silver and gold futures and options markets.

A combined case, seeking class action status, would include anyone who purchased or sold futures contracts or an option on NYMEX platinum or palladium or COMEX silver or gold between at least Jan. 1, 2009, and Dec. 31, 2015. The lawyers believe that “at least hundreds, if not thousands” of traders would be eligible to join the case.

Named as defendants in all of the lawsuits are John Edmonds, a 36-year old former metals trader at J. P. Morgan, a group of yet-to-be-identified precious metals traders and the bank.

Edmonds, a New York resident, pleaded guilty in October to one count of conspiracy to defraud the market and manipulate prices of precious metals futures contracts and one count of commodities fraud. In the criminal plea, Edmonds admitted that he and other “unnamed co- conspirators” at J. P. Morgan, fraudulently manipulated precious metals markets from 2009 to 2015, the same time frame covered in the class action suits.

Briganti filed the initial class action on Nov. 7, just one day after the Justice Department unsealed Edmonds‘ plea in the U.S. District Court of Connecticut.

Edmonds admitted in his guilty plea that he deployed the illegal trading scheme hundreds of times with the direct knowledge and consent of his immediate supervisors. Plaintiffs say they have suffered economic injury, including monetary losses, as a direct result of actions by Edmonds and the other unnamed J. P. Morgan metals traders in the futures and options contracts.

One of the suits alleges that “the number of unlawful trades that JP Morgan traders executed in precious metals futures markets is at least in the thousands.”

J. P. Morgan declined to comment. Lowey Dannenberg did not respond to a request for comment by CNBC.

The Justice Department‘s criminal investigation is still ongoing and recently caused a separate related civil case to be put on hold for at least six months while the government continues its investigation. That civil lawsuit, which also accuses J. P. Morgan of rigging the precious metals market, was filed in 2015 by hedge fund manager Daniel Shak and two commodity traders.

After reviewing the details of the plea agreement, David Kovel, the attorney for Shak‘s suit, sought to re- interview Edmonds, along with two other current and former senior traders at the bank. However, the government argued that reopening questioning would be detrimental to the ongoing criminal investigation. The federal judge overseeing the proceedings ordered a six-month stay in the civil case.

Kovel declined to comment.

Edmonds was originally scheduled to be sentenced in Hartford, Conn., on Wednesday, Dec. 19, but a court filing on Nov. 27 shows the sentencing has been postponed until June. A spokesman for the U.S. Attorney for Connecticut could not elaborate on why the sentencing was postponed since the court filing is under seal.

-END-

Your early MONDAY morning currency, Asian stock market results, important USA/Asian currency crosses, gold/silver pricing overnight along with the price of oil Major stories overnight/9 AM EST

i) Chinese yuan vs USA dollar/CLOSED/ LAST AT: 6.7651/

//OFFSHORE YUAN: 6.7813 /shanghai bourse CLOSED DOWN 171.88 POINTS OR 5.58%

HANG SANG CLOSED DOWN 871.73 POINTS OR 2.90%

2. Nikkei closed

3. Europe stocks OPENED RED EXCEPT LONDON

USA dollar index RISES TO 97.56/Euro FALLS TO 1.10.42

3b Japan 10 year bond yield: FALLS TO. –.04/ !!!!(Japan buying 100% of bond issuance)/Japanese yen vs usa cross now at 111.52/ THIS IS TROUBLESOME AS BANK OF JAPAN IS RUNNING OUT OF BONDS TO BUY./JAPAN 10 YR YIELD IS NOW TARGETED AT .11%/JAPAN LOSING CONTROL OF THEIR BOND MARKET//CARRY TRADERS GETTING KILLED

3c Nikkei now JUST BELOW 17,000

3d USA/Yen rate now well below the important 120 barrier this morning

3e WTI:: 61.36 and Brent: 70.30

3f Gold UP/JAPANESE Yen UP CHINESE YUAN: ON -SHORE DOWN/OFF- SHORE: DOWN

3g Japan is to buy the equivalent of 108 billion uSA dollars worth of bond per month or $1.3 trillion. Japan’s GDP equals 5 trillion usa./“HELICOPTER MONEY” OFF THE TABLE FOR NOW /REVERSE OPERATION TWIST ON THE BONDS: PURCHASE OF LONG BONDS AND SELLING THE SHORT END

Japan to buy 100% of all new Japanese debt and by 2018 they will have 25% of all Japanese debt. Fifty percent of Japanese budget financed with debt.

3h Oil DOWN for WTI and DOWN FOR Brent this morning

3i European bond buying continues to push yields lower on all fronts in the EMU. German 10yr bund FALLS TO +01%/Italian 10 yr bond yield UP to 2.60% /SPAIN 10 YR BOND YIELD DOWN TO 0.98%…ITALIAN 10 YR BOND YIELD/GERMAN BUND: 2.59: DANGEROUS FOR THE ITALIAN BANKING SYSTEM

3j Greek 10 year bond yield RISES TO : 3.34

3k Gold at $1281.50 silver at: 14.88 7 am est) SILVER NEXT RESISTANCE LEVEL AT $18.50

3l USA vs Russian rouble; (Russian rouble DOWN 1/100 in roubles/dollar) 65.38

3m oil into the 61 dollar handle for WTI and 70 handle for Brent/

3n Higher foreign deposits out of China sees huge risk of outflows and a currency depreciation. This can spell financial disaster for the rest of the world/

JAPAN ON JAN 29.2016 INITIATES NIRP. THIS MORNING THEY SIGNAL THEY MAY END NIRP. TODAY THE USA/YEN TRADES TO 110.82 DESTROYING JAPANESE CITIZENS WITH HIGHER FOOD INFLATION

30 SNB (Swiss National Bank) still intervening again in the markets driving down the SF. It is not working: USA/SF this morning 1.0184 as the Swiss Franc is still rising against most currencies. Euro vs SF is 1.1340 well above the floor set by the Swiss Finance Minister. Thomas Jordan, chief of the Swiss National Bank continues to purchase euros trying to lower value of the Swiss Franc.

3p BRITAIN VOTES AFFIRMATIVE BREXIT/LOWER PARLIAMENT APPROVES BREXIT COMMENCEMENT/ARTICLE 50 COMMENCES MARCH 29/2017

3r the 10 Year German bund now NEGATIVE territory with the 10 year FALLING to +0.01%

The bank withdrawals were causing massive hardship to the Greek bank. the Greek referendum voted overwhelming “NO”. Next step for Greece will be the recapitalization of the banks and that will be difficult.

4. USA 10 year treasury bond at 2.48% early this morning. Thirty year rate at 2.89%

5. Details Ransquawk, Bloomberg, Deutsche bank/Jim Reid.

6. TURKISH LIRA: UP TO 6.0141.. VERY DEADLY

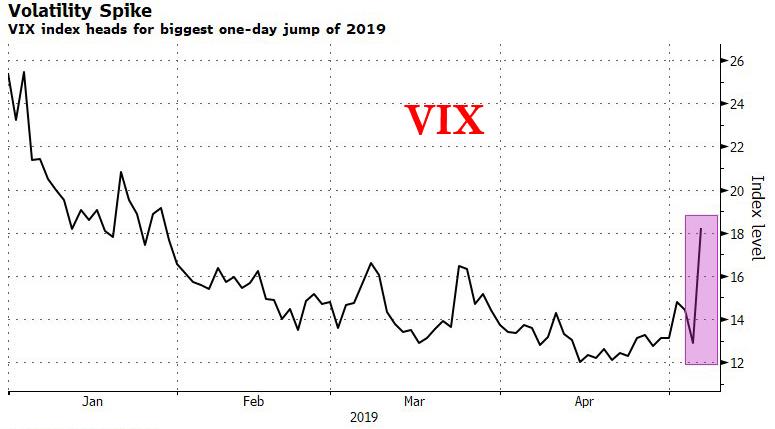

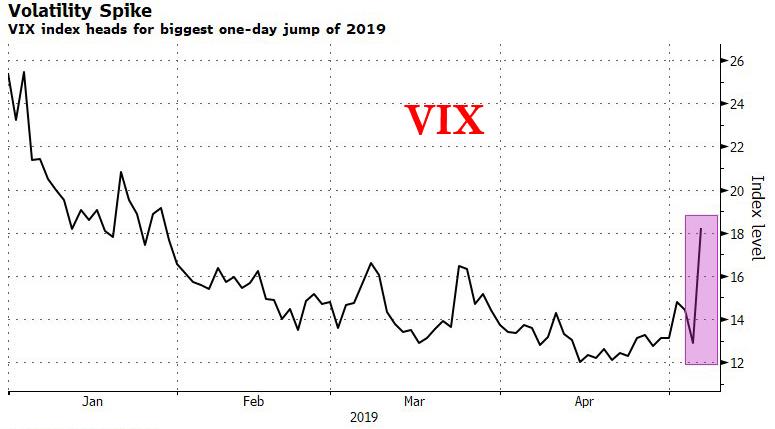

“This Was Totally Out Of The Blue”: Global Stocks Crash As Trade Talks Collapse

The S&P closed on Friday at a new all time high, with hardly a concern in the world and nothing but blue skies ahead… and then just two tweets from Donald Trump shortly after noon on Sunday afternoon shattered the market’s idyllic picture, when the US president admitted that trade talks with China are not only not going “optimistically”, but have effectively collapsed and tariffs on Chinese imports would be hiked.

The result, discussed overnight, was a “sea of red” as risk assets and currencies across the globe collapsed, offset by a flight into safe assets including Treasuries and the US dollar. The MSCI world index fell half a percent.

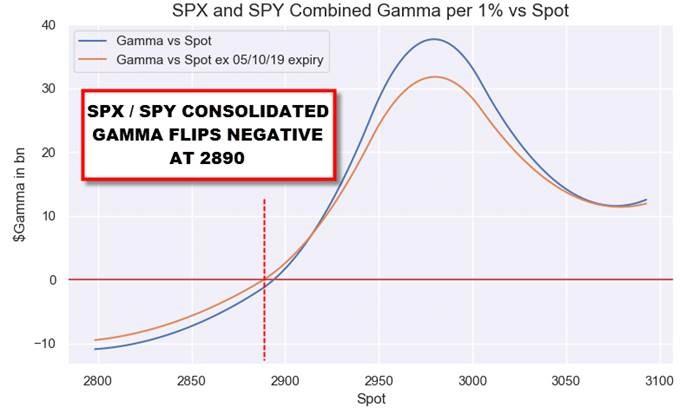

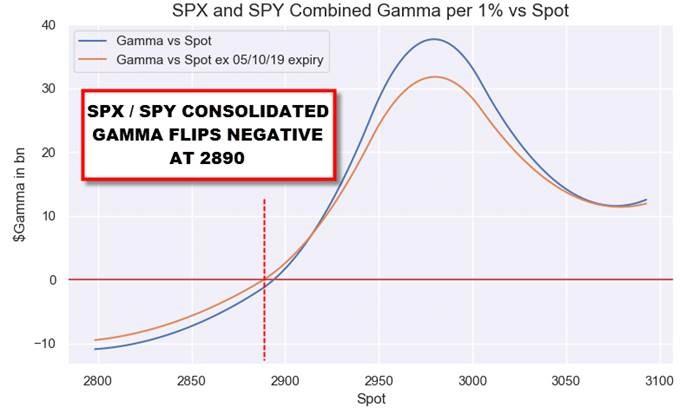

Friday

… while futures on the S&P 500 index sank as much as 2.2 percent, tumbling back below 2,900 and approaching the 2,890 level where dealer gamma turns negative, and any continued selloff will only lead to further selling.

European stocks tumbled to a one-month low, suffering their biggest drop of the year…

… as German bond yields slipped back into negative territory. Germany’s DAX was down 1.8% while the Stoxx 600 tumbled 2% to its lowest level since early April. Moves were slightly exaggerated, with Japanese markets still on holidays while London markets shut for a local holiday. Losses in equities translated into gains for bonds with benchmark government bond yields in Germany retreating to a shade below zero and not far from a 2-1/2-year low of minus 0.09 percent hit in late March.

Even as Beijing tried to salvage some clam, when China’s foreign ministry said on Monday a delegation was still preparing to go to United States for trade talks, but was unable to confirm when amid signs that a delay is now being considered, the benchmark index in Shanghai crashed 5.6%, with the Shanghai Composite suffering its worst day since February 2016 and sliding back under 3,000 even after Chinese state-backed funds were said to have been active in an effort to limit the sell-off.

John Williams Warns: “Recession Already In Place, Watch Out!”

Via Greg Hunter’s USAWatchdog.com,

You might be wondering why the Trump Administration is calling for rate cuts and money printing with all the good news about the economy.

Economist John Williams of ShadowStats.com knows why and contends,

“We have a recession in place. It’s just a matter of playing out in some of these other funny numbers. The reality is on the downside, where you have mixed pressures right now. People who are really concerned about the economy right now, and that includes President Trump looking at re-election, he’s been arguing that the Fed should lower rates, and I am with him. The Fed created this circumstance. They are pushing for the economy on the upside because they want to continue to keep raising rates. Banks make more money with higher rates, and they are still trying to liquidate the problems they created when they bailed out the banking system back in 2008.”

Williams strips out all the financial gimmicks in his work that make things look better than they really are to give a true picture of the real financial health. Take for example the recent reportedly good news of the trade deficit narrowing. Williams says,

“What we saw was the very unusual narrowing of the deficit . . . that’s generally good news . . . but if you look at why the trade deficit was narrowing, it wasn’t that we were having new surging exports . . . instead, we were having collapsing domestic consumption. People weren’t buying things. People were not buying goods. So, the imports were falling off, and that narrowed the deficit. That is not a healthy sign. The last time you saw something like that was the beginning of the Great Recession (2008–2009). . . . We still haven’t recovered from the Great Recession.”

If rate cuts don’t happen soon, is the economy going to tank? Williams says,

“The economy is tanking, and I’ll contend it already has, although we have not seen it in the GDP reporting. . . . The ultimate thing here is you have a collapse in the dollar. I am talking about a hyperinflationary collapse. Your purchasing power becomes worthless. What you have in gold or canned goods or real estate, that will be your assets – hard assets.”

In closing, Williams says, “The underlying weakness is with the consumer…”

“Until the consumer gets turned around, you are not going to get a fundamental change in the economy. The economy is going to get weaker. The Fed is going to recognize that, and they probably already do recognize that. . . . They don’t want to lower rates, but I think they are going to have to. I would look for easing by September and maybe quantitative easing (money printing) as the economy continues to deteriorate as it seems to be doing. I know the numbers are not there yet in the headlines, but watch out.”

Join Greg Hunter as he goes One-on-One with economist John Williams, founder of ShadowStats.com.

Thank You Harvey Always The Best Man !

https://harveyorganblog.com/2019/05/06/may-6/

All Aboard

MMGYS Midnight Data SiMO Flyer

Both Videos Work At The Same Time (SiMO) start as fast as you can

Start Sound track

Now Start SiMO Feature

show simo casted

.jpg)

Take a ride on the new midnight data SiMO flyer at the bottom of this post

Good Morning Good Evening

You Can Hear That Train Whistle a Blowing

Were Riding The Rails Tonight On Graveyard

Welcome to ~*~Mining & Metals Du Jour~*~Graveyard Shift~*~

We have lots of good stuff on the train tonight Great Data & News by Harvey Organ, a new segment by InvestorHub Videowire, JP Morgan Sentence Delayed Again,Gary Chrisenson It’s Time for an International Gold Reset

Hello everybody I'm J:D your host tonight Thanks for being with us.

Hope your having a wonderful evening EnJoy the show

OK......All Aboard !!!!!

Thank you

MMGYS

May 6, 2019 · by harveyorgan · in Uncategorized ·

I was out all day today and away from my computer

the comex data is complete including data from GLD and SLV

the morning data is accurate

the afternoon and closing Dow nasdaq data is from Friday

i will resume my normal routine tomorrow

AND SORRY FOR MY REPORT BEING INCOMPLETE..

GOLD: $1282.50 UP $2.35 (COMEX TO COMEX CLOSING)

Silver: $14.92 DOWN 3 CENTS (COMEX TO COMEX CLOSING)

Closing access prices:

Gold :

silver:

JPMorgan has been receiving gold with reckless abandon and sometimes supplying (stopping)

today RECEIVING: 9/13

EXCHANGE: COMEX

CONTRACT: MAY 2019 COMEX 100 GOLD FUTURES

SETTLEMENT: 1,279.200000000 USD

INTENT DATE: 05/03/2019 DELIVERY DATE: 05/07/2019

FIRM ORG FIRM NAME ISSUED STOPPED

____________________________________________________________________________________________

661 C JP MORGAN 9

737 C ADVANTAGE 5 4

905 C ADM 8

____________________________________________________________________________________________

TOTAL: 13 13

MONTH TO DATE: 158

NUMBER OF NOTICES FILED TODAY FOR MAY CONTRACT: 13 NOTICE(S) FOR 1300 OZ (0.0404 tonnes)

TOTAL NUMBER OF NOTICES FILED SO FAR: 158 NOTICES FOR 15800 OZ (.4914 TONNES)

SILVER

FOR MAY

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

76 NOTICE(S) FILED TODAY FOR 380,000 OZ/

total number of notices filed so far this month: 2977 for 14,885,000 oz

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Bitcoin: OPENING MORNING TRADE :$5680 DOWN 95.00

Bitcoin: FINAL EVENING TRADE: $5756 DOWN 13

end

XXXX

Let us have a look at the data for today

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

IN SILVER THE COMEX OI FELL BY A CONSIDERABLE SIZED 2193 CONTRACTS FROM 202,655 DOWN TO 200,109 DESPITE FRIDAY’S STRONG 34 CENT RISE IN SILVER PRICING AT THE COMEX. ,LIQUIDATION OF THE SPREADERS HAVE STOPPED FOR SILVER BUT IT NOW COMMENCES FOR GOLD. TODAY WE ARRIVED FURTHER FROM AUGUST’S 2018 RECORD SETTING OPEN INTEREST OF 244,196 CONTRACTS.

WE HAVE ALSO WITNESSED A LARGE AMOUNT OF PHYSICAL METAL STAND FOR COMEX DELIVERY AS WELL WE ARE WITNESSING CONSIDERABLE LONGS PACKING THEIR BAGS AND MIGRATING OVER TO LONDON IN GREATER NUMBERS IN THE FORM OF EFP’S. WE WERE NOTIFIED THAT WE HAD A FAIR SIZED NUMBER OF COMEX LONGS TRANSFERRING THEIR CONTRACTS TO LONDON THROUGH THE EFP:

0 FOR MAY, 0 FOR JUNE, 698 FOR JULY AND ZERO FOR ALL OTHER MONTHS AND THEREFORE TOTAL ISSUANCE 698 CONTRACTS. WITH THE TRANSFER OF 698 CONTRACTS, WHAT THE CME IS STATING IS THAT THERE IS NO SILVER (OR GOLD) TO BE DELIVERED UPON AT THE COMEX AS THEY MUST EXPORT THEIR OBLIGATION TO LONDON. ALSO KEEP IN MIND THAT THERE CAN BE A DELAY OF 24-48 HRS IN THE ISSUING OF EFP’S. THE 698 EFP CONTRACTS TRANSLATES INTO 3.49 MILLION OZ ACCOMPANYING:

1.THE 34 CENT RISE IN SILVER PRICE AT THE COMEX AND

2. THE STRONG AMOUNT OF SILVER OUNCES WHICH STOOD FOR DELIVERY IN THE LAST NINE MONTHS:

JUNE/2018. (5.420 MILLION OZ);

FOR JULY: 30.370 MILLION OZ

FOR AUG., 6.065 MILLION OZ

FOR SEPT. 39.505 MILLION OZ S

FOR OCT.2.525 MILLION OZ.

FOR NOV: A HUGE 7.440 MILLION OZ STANDING AND

21.925 MILLION OZ FINALLY STAND FOR DECEMBER.

5.845 MILLION OZ STAND IN JANUARY.

2.955 MILLION OZ STANDING FOR FEBRUARY.:

27.120 MILLION OZ STANDING IN MARCH.

3.875 MILLION OZ STANDING FOR SILVER IN APRIL.

AND NOW 17.860 MILLION OZ STANDING FOR SILVER IN MAY.

ACCUMULATION FOR EFP’S/SILVER/J.P.MORGAN’S HOUSE OF BRIBES, / STARTING FROM FIRST DAY NOTICE/FOR MONTH OF MAY:

7522 CONTRACTS (FOR 4 TRADING DAYS TOTAL 7522 CONTRACTS) OR 37.61 MILLION OZ: (AVERAGE PER DAY: 1880 CONTRACTS OR 9.4 MILLION OZ/DAY)

TO GIVE YOU AN IDEA AS TO THE HUGE SUPPLY THIS MONTH IN SILVER: SO FAR THIS MONTH OF MAY: 37.61 MILLION PAPER OZ HAVE MORPHED OVER TO LONDON. THIS REPRESENTS AROUND 5.37% OF ANNUAL GLOBAL PRODUCTION (EX CHINA EX RUSSIA)* JUNE’S 345.43 MILLION OZ IS THE SECOND HIGHEST RECORDED ISSUANCE OF EFP’S AND IT FOLLOWED THE RECORD SET IN APRIL 2018 OF 385.75 MILLION OZ.

ACCUMULATION IN YEAR 2019 TO DATE SILVER EFP’S: 779.46 MILLION OZ.

JANUARY 2019 EFP TOTALS: 217.455. MILLION OZ

FEB 2019 TOTALS: 147.4 MILLION OZ/

MARCH 2019 TOTAL EFP ISSUANCE: 207.835 MILLION OZ

APRIL 2019 TOTAL EFP ISSUANCE: 182.87 MILLION OZ.

RESULT: WE HAD A CONSIDERABLE SIZED DECREASE IN COMEX OI SILVER COMEX CONTRACTS OF 2193 DESPITE THE STRONG 34 CENT FALL IN SILVER PRICING AT THE COMEX /YESTERDAY... THE CME NOTIFIED US THAT WE HAD A FAIR SIZED EFP ISSUANCE OF 698 CONTRACTS WHICH EXITED OUT OF THE SILVER COMEX AND TRANSFERRED THEIR OI TO LONDON AS FORWARDS. SPECULATORS CONTINUED THEIR INTEREST IN ATTACKING THE SILVER COMEX FOR PHYSICAL SILVER (SEE COMEX DATA) . OUR BANKERS RESUMED THEIR LIQUIDATION OF THE SPREAD TRADES TODAY.

TODAY WE LOST A CONSIDERABLE SIZED: 1495 TOTAL OI CONTRACTS ON THE TWO EXCHANGES:

i.e 698 OPEN INTEREST CONTRACTS HEADED FOR LONDON (EFP’s) TOGETHER WITH DECREASE OF 698 OI COMEX CONTRACTS. AND ALL OF THIS DEMAND HAPPENED WITH A 34 CENT RISE IN PRICE OF SILVER AND A CLOSING PRICE OF $14.95 WITH RESPECT TO YESTERDAY’S TRADING. YET WE STILL HAVE A STRONG AMOUNT OF SILVER STANDING AT THE COMEX FOR DELIVERY!!

In ounces AT THE COMEX, the OI is still represented by JUST OVER 1 BILLION oz i.e. 1.008 BILLION OZ TO BE EXACT or 144% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT MARCH MONTH/ THEY FILED AT THE COMEX: 76 NOTICE(S) FOR 380,000 OZ OF SILVER

IN SILVER,PRIOR TO TODAY, WE SET THE NEW COMEX RECORD OF OPEN INTEREST AT 243,411 CONTRACTS ON APRIL 9.2018. AND AGAIN THIS HAS BEEN SET WITH A LOW PRICE OF $16.51.

AND NOW WE RECORD FOR POSTERITY ANOTHER ALL TIME RECORD OPEN INTEREST AT THE COMEX OF 244,196 CONTRACTS ON AUGUST 22/2018 AND AGAIN WHEN THIS RECORD WAS SET, THE PRICE OF SILVER WAS $14.78 AND LOWER IN PRICE THAN PREVIOUS RECORDS.

ON THE DEMAND SIDE WE HAVE THE FOLLOWING:

HUGE AMOUNTS OF SILVER STANDING FOR DELIVERY (MARCH/2018: 27 MILLION OZ , APRIL/2018 : 2.485 MILLION OZ MAY: 36.285 MILLION OZ ; JUNE/2018 (5.420 MILLION OZ) , JULY 2018 FINAL AMOUNT STANDING: 30.370 MILLION OZ ) FOR AUGUST 6.065 MILLION OZ. , SEPT: A HUGE 39.505 MILLION OZ./ OCTOBER: 2,520,000 oz NOV AT 7.440 MILLION OZ./ DEC. AT 21.925 MILLION OZ JANUARY AT 5.825 MILLION OZ.AND FEB 2019: 2.955 MILLION OZ/ MARCH: 27.120 MILLION OZ/ APRIL AT 3.875 MILLION OZ/ AND NOW MAY: 17,750,000 OZ..

HUGE RECORD OPEN INTEREST IN SILVER 243,411 CONTRACTS (OR 1.217 BILLION OZ/ SET APRIL 9/2018) AND NOW AUGUST 22/2018: 244,196 CONTRACTS, WITH A SILVER PRICE OF $14.78.

HUGE ANNUAL EFP’S ISSUANCE EQUAL TO 2.9 BILLION OZ OR 400% OF SILVER ANNUAL PRODUCTION/2017

RECORD SETTING EFP ISSUANCE FOR ANY MONTH IN SILVER; APRIL/2018/ 385.75 MILLION OZ/ AND THE SECOND HIGHEST RECORDED EFP ISSUANCE JUNE 2018 345.43 MILLION OZ

AND YET, WITH THE EXTREMELY HIGH EFP ISSUANCE, WE HAVE A CONTINUAL LOW PRICE OF SILVER DESPITE THE ABOVE HUGE DEMAND. TO ME THE ONLY ANSWER IS THAT WE HAVE SOVEREIGN (CHINA) WHO IS ENDEAVOURING TO GOBBLE UP ALL AVAILABLE PHYSICAL SILVER NO MATTER WHERE, EXACTLY WHAT J.P.MORGAN IS DOING. AND IT IS MY BELIEF THAT J.P.MORGAN IS HOLDING ITS SILVER FOR ITS BENEFICIAL OWNER..THE USA GOVERNMENT WHO IN TURN IS HOLDING THAT SILVER FOR CHINA.(FOR A SILVER LOAN REPAYMENT).

IN GOLD, THE OPEN INTEREST FELL BY A CONSIDERABLE SIZED 2775 CONTRACTS, TO 440,217 DESPITE THE STRONG RISE IN THE COMEX GOLD PRICE/(AN INCREASE IN PRICE OF $9.35//YESTERDAY’S TRADING).

THE CME RELEASED THE DATA FOR EFP ISSUANCE AND IT TOTALED A STRONG SIZED 9114 CONTRACTS:

APRIL 0 CONTRACTS,JUNE: 9114 CONTRACTS DECEMBER: 0 CONTRACTS, JUNE 2020 0 CONTRACTS AND ALL OTHER MONTHS ZERO. The NEW COMEX OI for the gold complex rests at 440,217. ALSO REMEMBER THAT THERE WILL BE A DELAY IN THE ISSUANCE OF EFP’S. THE BANKERS REMOVE LONG POSITIONS OF COMEX GOLD IMMEDIATELY. THEN THEY ORCHESTRATE THEIR PRIVATE EFP DEAL WITH THE LONGS AND THAT COULD TAKE AN ADDITIONAL, 48 HRS SO WE GENERALLY DO NOT GET A MATCH WITH RESPECT TO DEPARTING COMEX LONGS AND NEW EFP LONG TRANSFERS. . EVEN THOUGH THE BANKERS ISSUED THESE MONSTROUS EFPS, THE OBLIGATION STILL RESTS WITH THE BANKERS TO SUPPLY METAL BUT IT TRANSFERS THE RISK TO A LONDON BANKER OBLIGATION AND NOT A NEW YORK COMEX OBLIGATION. LONGS RECEIVE A FIAT BONUS TOGETHER WITH A LONG LONDON FORWARD. THUS, BY THESE ACTIONS, THE BANKERS AT THE COMEX HAVE JUST STATED THAT THEY HAVE NO APPRECIABLE METAL!! THIS IS A MASSIVE FRAUD: THEY CANNOT SUPPLY ANY METAL TO OUR COMEX LONGS BUT THEY ARE QUITE WILLING TO SUPPLY MASSIVE NON BACKED GOLD (AND SILVER) PAPER KNOWING THAT THEY HAVE NO METAL TO SATISFY OUR LONGS. LONDON IS NOW SEVERELY BACKWARD IN BOTH GOLD AND SILVER AND WE ARE WITNESSING DELAYS IN ACTUAL DELIVERIES.

IN ESSENCE WE HAVE A STRONG SIZED GAIN IN TOTAL CONTRACTS ON THE TWO EXCHANGES OF 6339 CONTRACTS: 2775 OI CONTRACTS DECREASED AT THE COMEX AND 9114 EFP OI CONTRACTS WHICH NAVIGATED OVER TO LONDON. THUS TOTAL OI GAIN OF 6339 CONTRACTS OR 633,900 OZ OR 19,716 TONNES. FRIDAY WE HAD A GAIN IN THE PRICE OF GOLD TO THE TUNE OF $9.35….AND WITH THAT RISE, WE HAD A STRONG GAIN IN TONNAGE OF 25.82 TONNES!!!!!!.??????????????????????????????????????????

AS YOU WILL SEE, THE CROOKS HAVE NOW SWITCHED TO GOLD AS THEY INCREASE THE OPEN INTEREST FOR THE SPREADERS. THE TOTAL COMEX GOLD OPEN INTEREST WILL RISE FROM NOW ON UNTIL ONE WEEK PRIOR TO FIRST DAY NOTICE AND THAT IS WHEN THEY START THEIR CRIMINAL LIQUIDATION.

HERE IS HOW THE CROOKS USED SPREADING AS WE ENTER A NON ACTIVE DELIVERY MONTH OF MAY HEADING TOWARDS THE VERY ACTIVE DELIVERY MONTH OF JUNE.

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES, HERE IS THE BANKERS MODUS OPERANDI:

“YOU WILL ALSO NOTICE THAT THE COMEX OPEN INTEREST IS STARTING TO RISE IN THIS NON ACTIVE MONTH OF MAY BUT SO IS THE OPEN INTEREST OF SPREADERS. THE OPEN INTEREST IN GOLD WILL CONTINUE TO RISE UNTIL ONE WEEK BEFORE FIRST DAY NOTICE OF AN UPCOMING ACTIVE DELIVERY MONTH (JUNE), AND THAT IS WHEN THE CROOKS SELL THEIR SPREAD POSITIONS BUT NOT AT THE SAME TIME OF THE DAY. THEY WILL USE THE SELL SIDE OF THE EQUATION TO CREATE THE CASCADE (ALONG WITH THEIR COLLUSIVE FRIENDS) AND THEN COVER ON THE BUY SIDE OF THE SPREAD SITUATION AT THE END OF THE DAY. THEY DO THIS TO AVOID POSITION LIMIT DETECTION. THE LIQUIDATION OF THE SPREADING FORMATION CONTINUES FOR EXACTLY ONE WEEK AND ENDS ON FIRST DAY NOTICE.”

ACCUMULATION OF EFP’S GOLD AT J.P. MORGAN’S HOUSE OF BRIBES: (EXCHANGE FOR PHYSICAL) FOR THE MONTH OF MAY : 27,375 CONTRACTS OR 2,727,500OR 85.15 TONNES (4 TRADING DAYS AND THUS AVERAGING: 6843 EFP CONTRACTS PER TRADING DAY

TO GIVE YOU AN IDEA AS TO THE STRONG SIZE OF THESE EFP TRANSFERS : THIS MONTH IN 4 TRADING DAYS IN TONNES: 85.15 TONNES

TOTAL ANNUAL GOLD PRODUCTION, 2018, THROUGHOUT THE WORLD EX CHINA EX RUSSIA: 3555 TONNES

THUS EFP TRANSFERS REPRESENTS 85.15/3550 x 100% TONNES =2.39% OF GLOBAL ANNUAL PRODUCTION SO FAR IN DECEMBER ALONE.***

ACCUMULATION OF GOLD EFP’S YEAR 2019 TO DATE: 1900.72 TONNES

JANUARY 2019 TOTAL EFP ISSUANCE; 531.20 TONNES

FEB 2019 TOTAL EFP ISSUANCE: 344.36 TONNES

MARCH 2019 TOTAL EFP ISSUANCE: 497.16 TONNES

APRIL 2019 TOTAL ISSUANCE: 456.10 TONNES

WHAT IS ALARMING TO ME, ACCORDING TO OUR LONDON EXPERT ANDREW MAGUIRE IS THAT THESE EFP’S ARE BEING TRANSFERRED TO WHAT ARE CALLEDRIAL FORWARD CONTRACT OBLIGATIONS AND THESE CONTRACTS ARE LESS THAN 14 DAYS. ANYTHING GREATER THAN 14 DAYS, THESE MUST BE RECORDED AND SENT TO THE COMPTROLLER, GREAT BRITAIN TO MONITOR RISK TO THE BANKING SYSTEM. IF THIS IS INDEED TRUE, THEN THIS IS A MASSIVE CONSPIRACY TO DEFRAUD AS WE NOW WITNESS A MONSTROUS TOTAL EFP’S ISSUANCE AS IT HEADS INTO THE STRATOSPHERE.

Result: A CONSIDERABLE SIZED DECREASE IN OI AT THE COMEX OF 2775 DESPITE THE RISE IN PRICING ($9.35) THAT GOLD UNDERTOOK YESTERDAY) //.WE ALSO HAD A STRONG SIZED NUMBER OF COMEX LONG TRANSFERRING TO LONDON THROUGH THE EFP ROUTE: 9114 CONTRACTS AS THESE HAVE ALREADY BEEN NEGOTIATED AND CONFIRMED. THERE OBVIOUSLY DOES NOT SEEM TO BE MUCH PHYSICAL GOLD AT THE COMEX. I GUESS IT EXPLAINS THE HUGE ISSUANCE OF EFP’S…THERE IS HARDLY ANY GOLD PRESENT AT THE GOLD COMEX FOR DELIVERY PURPOSES. IF YOU TAKE INTO ACCOUNT THE 9114 EFP CONTRACTS ISSUED, WE HAD AN GOOD GAIN OF 6339 CONTRACTS IN TOTAL OPEN INTEREST ON THE TWO EXCHANGES:

9114 CONTRACTS MOVE TO LONDON AND 2775 CONTRACTS DECREASED AT THE COMEX. (IN TONNES, THE GAIN IN TOTAL OI EQUATES TO 19.716 TONNES). ..AND THIS GOOD DEMAND OCCURRED WITH A RISE IN PRICE OF $9.35 IN YESTERDAY’S TRADING AT THE COMEX. HOWEVER A PERCENTAGE OF OI WAS DUE TO THE COMMENCEMENT OF THE SPREADING OPERATION AS I HAVE OUTLINED ABOVE.

we had: 76 notice(s) filed upon for 7600 oz of gold at the comex.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

With respect to our two criminal funds, the GLD and the SLV:

GLD...

WITH GOLD UP $2.35 TODAY

STRANGE!!

ANOTHER BIG CHANGE IN GOLD INVENTORY AT THE GLD

A HUGE WITHDRAWAL OF 5.88 TONNES

INVENTORY RESTS AT 739.64 TONNES

IT LOOKS LIKE WE HAVE REACHED THE BOTTOM OF THE BARREL FOR PHYSICAL GOLD BEING SUPPLIED TO THE CROOKS.

TO ALL INVESTORS THINKING OF BUYING GOLD THROUGH THE GLD ROUTE: YOU ARE MAKING A TERRIBLE MISTAKE AS THE CROOKS ARE USING WHATEVER GOLD COMES IN TO ATTACK BY SELLING THAT GOLD. IT SURE SEEMS TO ME THAT THE GOLD OBLIGATIONS AT THE GLD EXCEED THEIR INVENTORY

SLV/

WITH SILVER DOWN 3 CENTS TODAY:

A BIG CHANGE IN SILVER INVENTORY AT THE SLV/

A DEPOSIT OF 891,000

/INVENTORY RESTS AT 316.582 MILLION OZ.

end

First, here is an outline of what will be discussed tonight:

1. Today, we had the open interest in SILVER FELL BY A CONSIDERABLE SIZED 2193 CONTRACTS from 200,655 UP DOWN TO 200,109 AND FURTHER FROM THE NEW COMEX RECORD SET LAST IN AUG.2018 AT 244,196 WITH A SILVER PRICE OF $14.78/(AUGUST 22/2018)..THE PREVIOUS RECORD WAS SET ON APRIL 9/2018 AT 243,411 OPEN INTEREST CONTRACTS WITH THE SILVER PRICE AT THAT DAY: $16.53). AND PREVIOUS TO THAT, THE RECORD WAS ESTABLISHED AT: 234,787 CONTRACTS, SET ON APRIL 21.2017 OVER 1 1/3 YEARS AGO. THE PRICE OF SILVER ON THAT DAY: $17.89. AS YOU CAN SEE, WE HAVE RECORD HIGH OPEN INTERESTS IN SILVER ACCOMPANIED BY A CONTINUAL LOWER PRICE WHEN THAT RECORD WAS SET…..THE SPREADERS HAVE STOPPED THEIR LIQUIDATION IN SILVER BUT HAVE NOW MORPHED INTO GOLD..

EFP ISSUANCE:

OUR CUSTOMARY MIGRATION OF COMEX LONGS CONTINUE TO MORPH INTO LONDON FORWARDS AS OUR BANKERS USED THEIR EMERGENCY PROCEDURE TO ISSUE:

0 CONTRACTS FOR APRIL., 0 FOR MAY, FOR JUNE 0 CONTRACTS AND JULY: 698 CONTRACTS AND ALL OTHER MONTHS: ZERO. TOTAL EFP ISSUANCE: 698 CONTRACTS. EFP’S GIVE OUR COMEX LONGS A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. IF WE TAKE THE OI LOSS AT THE COMEX OF 2193 CONTRACTS TO THE 698 OI TRANSFERRED TO LONDON THROUGH EFP’S, WE OBTAIN A CONSIDERABLE LOSS OF 1495 OPEN INTEREST CONTRACTS. THUS IN OUNCES, THE LOSS ON THE TWO EXCHANGES: 4.7545 MILLION OZ!!! AND YET WE ALSO HAVE A STRONG DEMAND FOR PHYSICAL AS WE WITNESSED A FINAL STANDING OF GREATER THAN 30 MILLION OZ FOR JULY, A STRONG 7.475 MILLION OZ FOR AUGUST.. A HUGE 39.505 MILLION OZ STANDING FOR SILVER IN SEPTEMBER… OVER 2 million OZ STANDING FOR THE NON ACTIVE MONTH OF OCTOBER., 7.440 MILLION OZ FINALLY STANDING IN NOVEMBER. 21.925 MILLION OZ STANDING IN DECEMBER , 5.845 MILLION OZ STANDING IN JANUARY. 2.955 MILLION OZ STANDING IN FEBRUARY, 27.120 MILLION OZ FOR MARCH., 3.875 MILLION OZ FOR APRIL AND NOW 17.750 MILLION OZ FOR MAY