Monday, May 06, 2019 9:15:58 AM

Q4 2018 Financial Highlights

(all comparisons are to Q4 2017 unless otherwise noted)

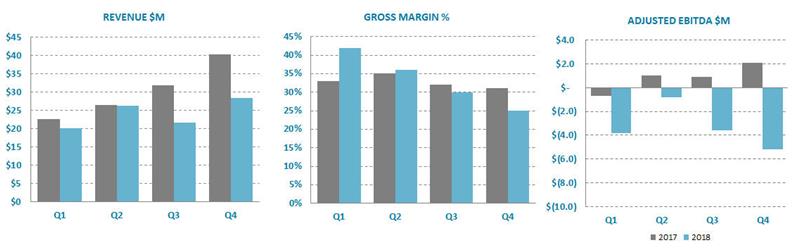

Total revenue was $28.5 million, a 29% decline.

Power Products revenue was $15.6 million, down 48% year-over-year and reflecting a decline in Heavy Duty Motive shipments to China compared to Q4 2017 as well as a decline in Portable Power/UAV product shipments given the divestiture of the Power Manager business, partially offset by increases in Material Handling and Backup Power.

Technology Solutions revenue was $12.9 million, a 27% increase due primarily to higher amounts earned from the HyMotion program with Audi.

Gross margin was 25%, down 6-points to $7.2 million, due to low sales of MEAs (Membrane Electrode Assemblies) in China and a limited volume of high margin Portable Power/UAV sales given the divestiture of the Power Manager business.

Cash operating costs2 were $11.2 million, essentially flat year-over-year.

Adjusted EBITDA2 declined 349% to ($5.2) million, due to the decrease in revenue and gross margin.

Net loss3 was ($11.5) million or ($0.06) per share, down 297% and 242%, respectively, driven primarily by the increase in Adjusted EBITDA loss.

Adjusted net loss2 was ($7.5) million or ($0.04) per share, down 731% and 613%, respectively.

Cash provided by operating activities was $0.2 million, an improvement of 126%, reflecting cash operating loss of ($4.4) million, offset by net working capital inflows of $4.6 million, driven primarily by higher deferred revenue of $8.5 million related primarily to the $9.0 million program pre-payment received from the joint venture with Weichai Power Co. Ltd. (“Weichai Power”) and lower inventory of $3.7 million.

Full Year 2018 Financial Highlights

(all comparisons are to full year 2017 unless otherwise noted)

Total revenue was $96.6 million, a 20% decline.

Power Products revenue was $57.0 million, down 27% reflecting a decline in Heavy Duty Motive product shipments to customers, principally in China.

Technology Solutions revenue was $39.6 million, down 9% due to a reduction in technology transfer revenue from China compared to 2017, partially offset by increased revenue from the HyMotion program with Audi and other programs.

Gross margin was 31%, down 3-points to $29.7 million primarily due to a shift in revenue mix away from higher margin Heavy Duty Motive and Technology Solutions.

Cash operating costs2 were $43.0 million, an increase of 10% due primarily to higher program development engineering expenses.

Adjusted EBITDA2 declined to ($13.5) million, due to lower revenue and gross margin.

Net loss3 increased to ($27.3) million or ($0.15) per share, down 239% and 222%, respectively. The increase in net loss was driven by the increase in Adjusted EBITDA loss.

Adjusted net loss2 was ($23.4) million or ($0.13) per share, down 351% and 326%, respectively.

Cash used in operating activities was ($31.7) million, a change of (224%) reflecting cash operating loss of ($14.4) million and net working capital outflows of ($17.3) million. This was due to a higher inventory balance of ($12.9) million, largely for expected Heavy Duty Motive shipments in 2019, and a higher accounts receivable balance of ($11.7) million, resulting from timing of revenues and related customer collections, partially offset by higher deferred revenue of $8.6 million.

Cash reserves were $192.2 million at December 31, $131.9 million higher than at the end of 2017, following close of strategic equity investments by Weichai Power and Broad Ocean.

http://ballard.com/about-ballard/newsroom/news-releases/2019/05/01/ballard-reports-q1-2019-results

Recent BLDP News

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 09/16/2024 04:50:35 PM

- Ballard announces restructuring to lower total operating expenses by more than 30% to align with delayed market adoption, while maintaining long-term competitiveness and balance sheet strength • PR Newswire (Canada) • 09/12/2024 09:30:00 PM

- Ballard announces restructuring to lower total operating expenses by more than 30% to align with delayed market adoption, while maintaining long-term competitiveness and balance sheet strength • PR Newswire (US) • 09/12/2024 09:30:00 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 08/13/2024 06:35:27 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 08/12/2024 12:51:08 PM

- Ballard Reports Q2 2024 Results • PR Newswire (US) • 08/12/2024 12:30:00 PM

- Ballard Reports Q2 2024 Results • PR Newswire (Canada) • 08/12/2024 12:30:00 PM

- U.S. Futures Steady as Markets Await Key Inflation Data, Oil Prices Climb • IH Market News • 08/12/2024 09:47:41 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 07/11/2024 12:41:49 PM

- Ballard Announces Q2 2024 Results Conference Call • PR Newswire (Canada) • 07/11/2024 12:30:00 PM

- Ballard Announces Q2 2024 Results Conference Call • PR Newswire (US) • 07/11/2024 12:30:00 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 06/18/2024 01:27:37 PM

- Ballard and Vertiv announce strategic technology partnership to support alternative energy usage for data centers • PR Newswire (US) • 06/18/2024 12:30:00 PM

- Ballard and Vertiv announce strategic technology partnership to support alternative energy usage for data centers • PR Newswire (Canada) • 06/18/2024 12:30:00 PM

- Ballard Publishes its 2023 ESG Report • PR Newswire (US) • 06/10/2024 09:30:00 PM

- Ballard Publishes its 2023 ESG Report • PR Newswire (Canada) • 06/10/2024 09:30:00 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 06/07/2024 10:51:25 AM

- Ballard Power announces results of Annual General Meeting 2024 • PR Newswire (US) • 06/07/2024 03:55:00 AM

- Ballard Power announces results of Annual General Meeting 2024 • PR Newswire (Canada) • 06/07/2024 03:55:00 AM

- Form SD - Specialized disclosure report • Edgar (US Regulatory) • 05/29/2024 06:50:08 PM

- Element 1 Corp. and Ballard Power Systems Collaborate on Revolutionary Hydrogen Power Solutions • Business Wire • 05/29/2024 11:00:00 AM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 05/28/2024 10:05:14 AM

- Ballard launches 9th generation high-performance fuel cell engine for heavy-duty vehicles at ACT Expo 2024 • PR Newswire (US) • 05/20/2024 12:30:00 PM

- Ballard launches 9th generation high-performance fuel cell engine for heavy-duty vehicles at ACT Expo 2024 • PR Newswire (Canada) • 05/20/2024 12:30:00 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 05/07/2024 01:16:22 PM

North Bay Resources Commences Operations at Bishop Gold Mill, Inyo County, California; Engages Sabean Group Management Consulting • NBRI • Sep 25, 2024 9:15 AM

CEO David B. Dorwart Anticipates a Bright Future at Good Gaming Inc. Through His Most Recent Shareholder Update • GMER • Sep 25, 2024 8:30 AM

Cannabix Technologies and Omega Laboratories Inc. Advance Marijuana Breathalyzer Technology - Dr. Bruce Goldberger to Present at Society of Forensic Toxicologists Conference • BLOZF • Sep 24, 2024 8:50 AM

Integrated Ventures, Inc Announces Strategic Partnership For GLP-1 (Semaglutide) Procurement Through MedWell USA, LLC. • INTV • Sep 24, 2024 8:45 AM

Avant Technologies Accelerates Creation of AI-Powered Platform to Revolutionize Patient Care • AVAI • Sep 24, 2024 8:00 AM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM