| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Friday, May 03, 2019 4:22:33 PM

Banks Vs. REITs Provide Bullish Clue

By: Tom Bowley | May 2, 2019

Fed Chair Jerome Powell ruined the bull market party on Wednesday afternoon, effectively suggesting that the Fed would not be lowering rates in response to low inflation data of late. The bond market has been screaming for a rate cut, not a hike, but at least for now, the Fed is having none of it. Powell said the lower inflation data was "transitory", not permanent. We've already seen the Fed stick to its guns once, in late 2018 as they continued to discuss multiple rate hikes in 2019 as the 10 year treasury yield ($TNX) was diving. The bond market eventually won that battle when the Fed later recanted its earlier rate hike call. We need to keep an eye on the TNX in coming weeks to see if bond traders persist that deflation is the real problem, not inflation.

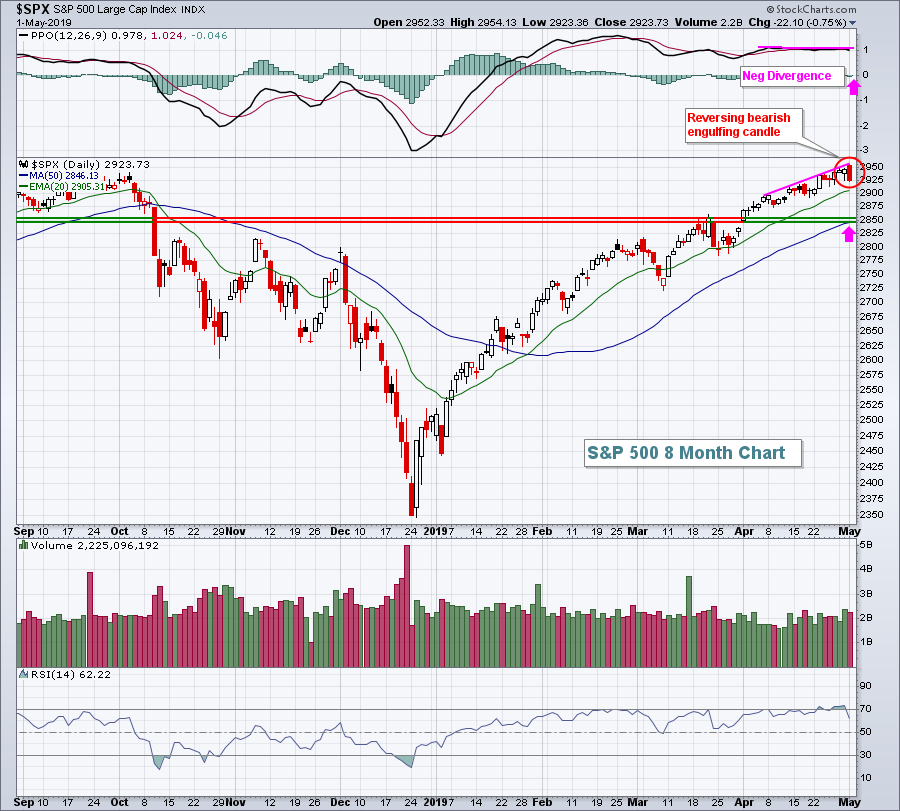

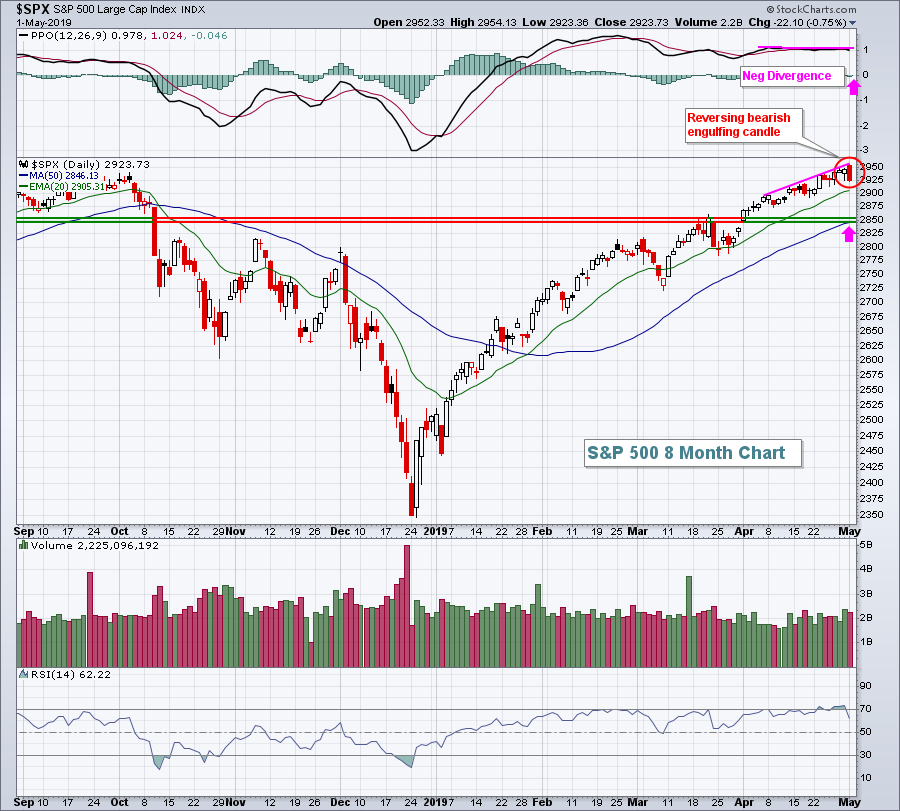

The S&P 500, after a quick move to the upside, sold off rather hard into the close and printed a reversing bearish engulfing candle:

I remain quite bullish, but the S&P 500 had reached an overbought level with its RSI moving above 70, there's a negative divergence in play, and yesterday we saw the big reversal after an earlier gap higher. All of this points to near-term consolidation, possibly even more selling. The two pink arrows above indicate that a 50 day SMA test and PPO centerline test are potential technical indications to look for.

None of the eleven sectors finished in positive territory yesterday. Energy (XLE, -2.00%) and materials (XLB, -1.81%) were the two hardest hit sectors as their relative performance continues to suffer badly. Consumer stocks also were hit as consumer staples (XLP, -1.23%) and consumer discretionary (XLY, -1.22%) dropped.

Most industry groups were lower as well, although computer hardware ($DJUSCR, +4.21%) performed quite well after Apple, Inc. (AAPL, +4.91%) soared on revenues and earnings that topped Wall Street's expectations. AAPL also provided a solid outlook.

Pre-Market Action

Dow Jones futures are lower by 27 points this morning, adding slightly to the losses encountered yesterday after the Fed's policy decision at 2pm EST. The 10 year treasury yield ($TNX) is relatively flat as bond traders are not exactly catering to the Fed's beliefs that lower than expected inflation is transitory. Gold ($GOLD) is down 1% this morning and crude oil ($WTIC) is lower by 1.80%.

Current Outlook

One key ratio to review periodically is the banks vs. the REITs ($DJUSBK:$DJR). When this ratio is moving higher, it signals that banks are outperforming REITs. The opposite holds true with the ratio is declining. A strong or strengthening economy typically benefits banks more than REITs. So if the stock market is betting on the banks on a relative basis, it tends to be a great environment for equity performance. Check this out:

When the DJUSBK:DJR is rising, we've seen explosive moves higher on the S&P 500. When it's declining, there have been many more hiccups in equities and the overall S&P 500 performance during those periods is much less robust for sure.

In the very near-term, as the S&P 500 breaks to an all-time high, the DJUSBK:DJR ratio has climbed off of a key relative price support level and has just moved back above its 20 day EMA. That's significant as a recent positive divergence printed, suggesting that the downward momentum in this ratio had diminished. We saw this exact divergence print in 2016, just prior to the explosive move higher in this ratio and the S&P 500. This doesn't guarantee us anything, but is definitely worth monitoring.

Sector/Industry Watch

The Dow Jones U.S. Specialized Consumer Services Index ($DJUSCS) reversed yesterday at a key price point. Many indices have cleared their 2018 highs, but the DJUSCS is just now testing its prior year high. A breakout would be bullish, but we want to see it first:

A few high SCTR stocks in this industry that would benefit from a breakout include MercadoLibre, Inc. (MELI), Autohome, Inc. (ATHM), Etsy, Inc. (ETSY), and Copart, Inc. (CPRT)...

Read Full Story »»»

• DiscoverGold

By: Tom Bowley | May 2, 2019

Fed Chair Jerome Powell ruined the bull market party on Wednesday afternoon, effectively suggesting that the Fed would not be lowering rates in response to low inflation data of late. The bond market has been screaming for a rate cut, not a hike, but at least for now, the Fed is having none of it. Powell said the lower inflation data was "transitory", not permanent. We've already seen the Fed stick to its guns once, in late 2018 as they continued to discuss multiple rate hikes in 2019 as the 10 year treasury yield ($TNX) was diving. The bond market eventually won that battle when the Fed later recanted its earlier rate hike call. We need to keep an eye on the TNX in coming weeks to see if bond traders persist that deflation is the real problem, not inflation.

The S&P 500, after a quick move to the upside, sold off rather hard into the close and printed a reversing bearish engulfing candle:

I remain quite bullish, but the S&P 500 had reached an overbought level with its RSI moving above 70, there's a negative divergence in play, and yesterday we saw the big reversal after an earlier gap higher. All of this points to near-term consolidation, possibly even more selling. The two pink arrows above indicate that a 50 day SMA test and PPO centerline test are potential technical indications to look for.

None of the eleven sectors finished in positive territory yesterday. Energy (XLE, -2.00%) and materials (XLB, -1.81%) were the two hardest hit sectors as their relative performance continues to suffer badly. Consumer stocks also were hit as consumer staples (XLP, -1.23%) and consumer discretionary (XLY, -1.22%) dropped.

Most industry groups were lower as well, although computer hardware ($DJUSCR, +4.21%) performed quite well after Apple, Inc. (AAPL, +4.91%) soared on revenues and earnings that topped Wall Street's expectations. AAPL also provided a solid outlook.

Pre-Market Action

Dow Jones futures are lower by 27 points this morning, adding slightly to the losses encountered yesterday after the Fed's policy decision at 2pm EST. The 10 year treasury yield ($TNX) is relatively flat as bond traders are not exactly catering to the Fed's beliefs that lower than expected inflation is transitory. Gold ($GOLD) is down 1% this morning and crude oil ($WTIC) is lower by 1.80%.

Current Outlook

One key ratio to review periodically is the banks vs. the REITs ($DJUSBK:$DJR). When this ratio is moving higher, it signals that banks are outperforming REITs. The opposite holds true with the ratio is declining. A strong or strengthening economy typically benefits banks more than REITs. So if the stock market is betting on the banks on a relative basis, it tends to be a great environment for equity performance. Check this out:

When the DJUSBK:DJR is rising, we've seen explosive moves higher on the S&P 500. When it's declining, there have been many more hiccups in equities and the overall S&P 500 performance during those periods is much less robust for sure.

In the very near-term, as the S&P 500 breaks to an all-time high, the DJUSBK:DJR ratio has climbed off of a key relative price support level and has just moved back above its 20 day EMA. That's significant as a recent positive divergence printed, suggesting that the downward momentum in this ratio had diminished. We saw this exact divergence print in 2016, just prior to the explosive move higher in this ratio and the S&P 500. This doesn't guarantee us anything, but is definitely worth monitoring.

Sector/Industry Watch

The Dow Jones U.S. Specialized Consumer Services Index ($DJUSCS) reversed yesterday at a key price point. Many indices have cleared their 2018 highs, but the DJUSCS is just now testing its prior year high. A breakout would be bullish, but we want to see it first:

A few high SCTR stocks in this industry that would benefit from a breakout include MercadoLibre, Inc. (MELI), Autohome, Inc. (ATHM), Etsy, Inc. (ETSY), and Copart, Inc. (CPRT)...

Read Full Story »»»

• DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.