| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Monday, April 15, 2019 9:44:03 AM

By: Julius de Kempenaer | April 15, 2019

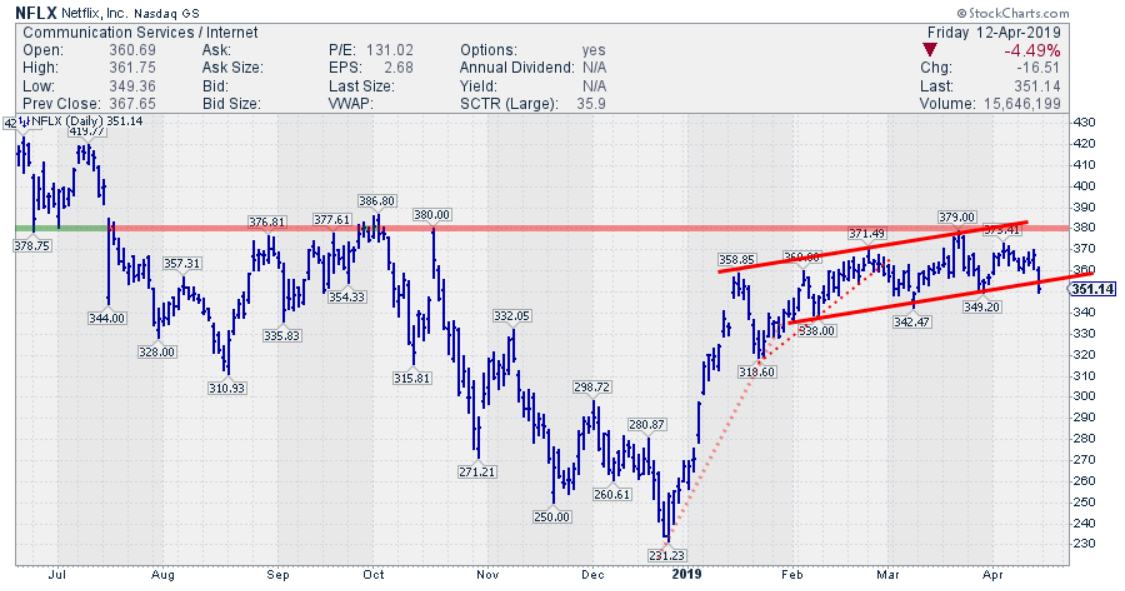

Since the start of the month, NFLX is lagging the S&P 500 index by more than 5%.

This is following the, relative, weakness that entered this stock after s strong start of 2019 where NFLX ran from $ 230 to $ 370 but then started to move sideways while facing heavy overhead resistance around $ 380.

From January to March the subsequent highs were still higher than their predecessors, albeit only marginally.

Failing To Push Through Resistance

The failure to push really higher was already an indication of weakness. This weakness was confirmed by the first high in April coming in lower than the peak at $ 379 in March. It was also the first time that NFLX failed to touch the upper boundary of the shallow rising channel that shows up from Jan/Feb onwards.

Looking at various trendlines that could have been drawn since the start of this year I see three potential support lines. In the chart above the first two are dotted red and the last one is solid red.

The initial trendline emerged out of the late December low and connects that one to the first low in January. Two touch trendlines are very dangerous and notoriously unreliable and this one gave way shortly after the low was in place.

The second trendline emerges out of that January low and has more touch points making it a bit more reliable but this one also lasted only shortly and was broken downward at the end of February.

The third trendline, the solid red support line, has three clearly marked touch points at the lows since February which makes it the most reliable one of all three.

At Friday's close, NFLX broke below this rising support and is now on its way to challenge/break near $ 349.

All in all the chart of NFLX is sending a lot of warning signals and the stock should be approached with caution. A break of the support levels clustered around $ 340 will very likely cause an acceleration of the decline.

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Research

Read Full Story »»»

• DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

Recent NFLX News

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 09/25/2024 07:33:18 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 09/25/2024 07:14:49 PM

- U.S. Stocks Close Higher Again; S&P Posts Fresh Record Closing High • IH Market News • 09/24/2024 08:43:00 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 09/24/2024 08:24:30 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 09/20/2024 09:49:02 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 09/19/2024 07:15:19 PM

- Intel Secures $3.5 Billion Subsidy, Stellantis Backs EU Emissions Targets, BP and Apollo Reach $1 Billion Deal • IH Market News • 09/16/2024 10:03:27 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 09/13/2024 08:49:42 PM

- Netflix to Announce Third Quarter 2024 Financial Results • PR Newswire (US) • 09/13/2024 04:00:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 09/05/2024 01:43:35 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 09/05/2024 01:43:27 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 09/05/2024 01:43:09 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 09/05/2024 01:43:01 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 09/05/2024 01:42:50 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 09/05/2024 01:42:07 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 09/05/2024 12:58:57 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 09/05/2024 12:10:38 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 09/04/2024 09:06:54 PM

- Stacks Prepares Nakamoto Upgrade, Record Bitcoin ETF Inflows, Semler Scientific Expands Bitcoin Reserves • IH Market News • 08/26/2024 10:35:56 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/21/2024 09:18:30 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/21/2024 09:14:49 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/21/2024 09:10:28 PM

- Walmart Sells JD.com Stake, Microchip Suffers Cyberattack, Union Pacific Warns of Strike in Canada, and Latest News • IH Market News • 08/21/2024 12:12:11 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 08/20/2024 05:45:24 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 08/20/2024 04:40:50 PM

North Bay Resources Commences Operations at Bishop Gold Mill, Inyo County, California; Engages Sabean Group Management Consulting • NBRI • Sep 25, 2024 9:15 AM

CEO David B. Dorwart Anticipates a Bright Future at Good Gaming Inc. Through His Most Recent Shareholder Update • GMER • Sep 25, 2024 8:30 AM

Cannabix Technologies and Omega Laboratories Inc. Advance Marijuana Breathalyzer Technology - Dr. Bruce Goldberger to Present at Society of Forensic Toxicologists Conference • BLOZF • Sep 24, 2024 8:50 AM

Integrated Ventures, Inc Announces Strategic Partnership For GLP-1 (Semaglutide) Procurement Through MedWell USA, LLC. • INTV • Sep 24, 2024 8:45 AM

Avant Technologies Accelerates Creation of AI-Powered Platform to Revolutionize Patient Care • AVAI • Sep 24, 2024 8:00 AM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM