| Followers | 130 |

| Posts | 18112 |

| Boards Moderated | 0 |

| Alias Born | 01/16/2007 |

Saturday, February 23, 2019 3:58:24 PM

Berlinale/EMF Festivals BLOG Key Points, Highlights Bullet Points

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=147057522

$$$***HHSE DUE DILIGENCE Updated-2/17****$$$ Form-10/S-1 SEC-Registrations, Uplist-OTC:QB, $0.10+

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=147053131

Monday, February 18, 2019

Happy President's Day! BLOG UPDATES / REVISED

Greetings HHSE Friends & Followers - Much to report on Berlinale' deals and general corporate activities...

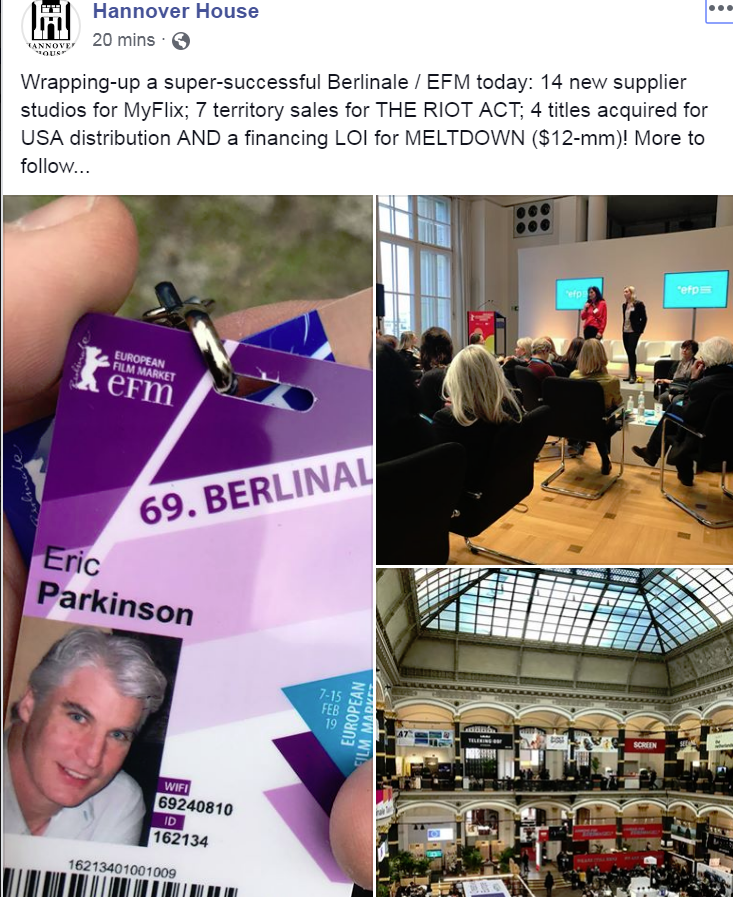

1). BERLIN / EFM MARKET

a). Sales Status for International Licenses; Meetings were held with buyers representing fourteen key territories, with a primary focus being on licenses for the recently completed feature, THE RIOT ACT. Sales have been consummated in three of these territories, with "offers" expected from six additional markets. There is an outreach campaign in motion to reach buyers from another 40+ territories for which Berlinale' meetings did not occur.

b). New Programming Acquisitions; The company did not plan to make any post-Berlin new title acquisition announcements at this time. However, the producer / licensors of TWO of the titles have already spoken to some media, thus our ability to discuss these two items. First up is an impressive Animated Feature called "THE PILGRIM'S PROGRESS" - based on the classic novel by John Bunyan. Revelation Media will release the film to theatres for this EASTER (April 18), with HHSE handling mainstream home video release in July.

PILGRIM'S PROGRESS: TEASER TRAILER:

https://assetsvideocpost-29b4.kxcdn.com/videos/812/360.mp4

PILGRIM'S PROGRESS - "BEHIND-THE-SCENES" CLIP:

https://www.youtube.com/watch?v=nG-pNvCH5bQ

"EASY LOVE" is a very unusual film from Germany that pioneers the genre' bending of narrative fiction and documentary into a category that Berlinale' referred to as "documental fiction." This impressive film tells the true story of seven young Germans as they seek emotional satisfaction through love, sex and drugs. With the emergence of documentary features performing especially well for Netflix and Amazon (evidenced by Netflix buying the Sundance documentary "Knock Down The House" for a $10-mm advance last month), HHSE feels that quality, specialized films of the nature of "EASY LOVE" are likely to connect with reviewers, sophisticated audiences and perform well on digital streaming platforms. HHSE will release the film to selected art-house cinemas with an English subtitled version (ala "Run, Lola Run"). The film contains graphic scenes of sexuality and drug use, so not even the official Berlinale' selection trailer (BELOW) is appropriate for all audiences (be forewarned!).

"EASY LOVE" - Berlinale Official Selection Trailer (without English Subtitles):

https://www.kino-zeit.de/film-kritiken-trailer/easy-love-2019#lg=1&slide=0

Other titles acquired at EFM will be announced as part of a coordinated publicity campaign, timed to best support the USA release of each picture.

c). Financing Partners ("Meltdown" and "Mother Goose"); It could jeopardize the current negotiations and documentation process to provide information on major film financing at this time. However, "deals" were made regarding the financing of "MELTDOWN" at USD $12-mm and "MOTHER GOOSE: JOURNEY TO UTOPIA" at USD $5-mm. Both of these films fulfill one of the key aspects of the HHSE "modified business model" - which calls for a modest number of LOCOMOTIVE level tent-pole features per year, and a modest number of "specialty cinema" features (but NO more "B-minus" indie horror type films) - and the focus on the launch of the MyFlix streaming site.

d). New MyFlix Supplier Studios; Fourteen (14) new supplier-studio partners have agreed to support the launch of MyFlix at EFM. These suppliers collectively represent an additional 800+ titles; as per the existing policy with MyFlix supplier partners, each will be announced individually and formally via a wire-services press announcement.

2). CORPORATE ENDEAVORS

a). Status of Year-End (2018), Audits & Form 10; authorized to publicly state that this important corporate filing is "on schedule."

b). Analysis of S-1 Venture and impact to HHSE; HHSE has been contacted by multiple venture capital partners, investors and funds expressing their support of buying significant positions into HHSE following the filing for the Form 10 and S-1. There is a total of USD $8-mm potentially available to the company under the S-1 offering, through block offerings of new issues at $.03, $.05 and $.08 per share. A modest "test" of HHSE pricing resistance occurred last July whebn a relatively modest amount of buying pressure about $120,000 (8-mm shares) was conducted last July by one major investor, which buying pressure caused the HHSE stock price to literally DOUBLE in only a few days... accordingly, there is a reasonable basis to anticipate that buying pressure of $1.5-mm initially (i.e., 50-mm S-1 shares at $.03 each) would likely result in a much higher PPS than $.03 / share if purchased on the open market. Therefore the S-1 block pricing - which is CURRENTLY a premium to today's market price of shares - is still a much better deal for these major purchasers than if the same dollar volume were run through the open market. Additionally, as is the structure of a S-1 Registration, the net sales proceeds go to the issuer (HHSE) for corporate uses and endeavors... whereas stocks traded on the open market benefit only the direct participants of a particular trade transaction. The second block of S-1 shares is 50-mm at $.05 each, and the third and final block of shares is another 50-mm at $.08 each. HHSE feels that the first block of shares is likely to sell very quickly based upon current inquiries... and that these proceeds will be very helpful in building momentum and consumer participation for the MyFlix venture, as well as for general operations and some payables management.

c). Update on Shareholder's Meeting (April 5, Chicago); It should be noted that the April 5 meeting at the Hyatt Regency Chicago will actually start at 3-pm Central Time. The prior announcement listed 2-pm Central Time, which could result in a trading advantage for attendees during regular market hours. Accordingly, by starting the meeting at 3-pm, any "news" of a previously non-public nature can be posted to all shareholders over the weekend, prior to the opening of the next market day of trading.

d). HHSE Stock Buy-Back / Return to Treasury. In a private and direct transaction, HHSE has just completed the purchase / buy-back of 500,000 common stock shares at $.013. These shares will be returned to treasury, and removed from the current issuance summaries.

3). LEGAL ISSUES & UPDATES

a). "Stay" Motions in foreign / sister state judgments; With Parkinson now back from the Berlin / EFM market, the filings to "stay" all actions in the cases of dubious foreign judgments will be promptly filed in the Washington County Courts in Arkansas. These include: LEWIN, JSJ and BEDROCK. There remains no collection efforts in Arkansas by ORIGIN (Texas) at this time, reducing the urgency to address this particular matter. REVISED (UPDATED 2-20-2019 at 5:45-pm Central). Shareholders have asked for updates / clarifications about two legal issues: The Crimson case (L.A. Superior Court) and a new Bedrock filing (Washington County, Arkansas). The Crimson case has been DISMISSED and there is no "status conference" tomorrow or trial next week; accordingly, we did not feel it merited mentioning in the blog today. With respect to BEDROCK, an unaffiliated third-party garnishee (Regal Entertainment) has filed a motion for dismissal of the Bedrock levy, on the basis of excusable neglect and non-affiliation. Again, because this was not a filing that impacted HHSE's position (and pending motion for dismissal), we did not feel it merited mentioning in this blog today.

b). General Response / Reaction to false narrative and chat board silliness; As has been proven in four prior court cases, Producers that "invent" false claims of monies due - despite clear accounting evidence to the contrary - have never once prevailed. It came to HHSE's attention that a representative of Royal Blue Pictures ("Gabrielle" and "Brutal Colors") has made false and disparaging comments on a stock chat board, which incorrectly state that HHSE owes them money. As per the terms of the contracts, this producer (and any other) are entitled to royalties on ACTUAL sales, not on the value of gross shipments before returns and costs. When a title like "BRUTAL COLORS" gets an order from Walmart for 20,000 units... that does NOT mean that $140,000 is now DUE to the producer, despite that figure being the value of the units multiplied by the average wholesale price. What it means is that this is a STARTING point... which will be reduced by virtue of UNSOLD / RETURNED units, manufacturing costs, freight, HHSE sales fee on "net" units sold and other marketing costs. In the case of "Brutal Colors" which had a greater than 75% "returns" rate for unsold shipments, the net monies are <negative> (meaning that the total costs to place the units exceeded the actual "net" purchase revenues of units by consumers). The corporate decision to STOP selling "micro-budgeted" horror films is borne by the dual realities that: 1). Such titles are NO LONGER commercially viable; and 2). The Producers of such titles tend to be inexperienced and often delusional. The new business model for HHSE - involving only higher-end features for production, and specialized "art" cinema fare for targeted release - circumvent both issues of sales viability and supplier sophistication. If the representative of Royal Blue Pictures persists in making false and damaging claims against HHSE on the stock chat-boards, we will pursue our rights and remedies for damages as well as judicial declaration for repayment of the funds that HHSE invested in the marketing of "Brutal Colors."

4). MYFLIX SPECIFIC NEWS

The right idea at the right time! If ever affirmation were needed as to the viability of the MyFlix venture, it was delivered quite enthusiastically at the Berlin / EFM market. Fourteen out of Fifteen supplier meetings resulted in a "yes, we want to participate" - with only ONE supplier saying, "no, we are keeping our titles available ONLY on our own streaming platform" (which, in that particular case, their streaming site has only 110 titles... which is hardly a solid motivation for a consumer to buy a monthly subscription - in HHSE's opinion!). What is CLEAR to those on the front lines is that DIGITAL STREAMING is the new medium for delivery of MOST entertainment... and is growing exponentially each year. "Physical" DVDs, BluRays and UltraHD discs are only working now for MAJOR THEATRICAL TITLES or SPECIALIZED RELEASES. The former "impulse" DVD business of a Walmart consumer (for instance) seeing an attractive DVD box and saying, "heck, $9.96 is a fair price!" are pretty much over... now that these same shoppers recognize that $10 bucks will get them a full MONTH of programming on Netflix, with over 1,200 titles... HHSE is adapting by doing what NO OTHER MEDIA COMPANY has done: consolidating almost EVERY indie supplier (and a few Major Studios) into a one-stop streaming site: MyFlix. We are quite confident that this is going to be the huge locomotive that pulls through everything else at HHSE!

HHSE CEO Eric Parkinson with Inspiration Films' Grant Bradley at the Ritz Carlton (Grant provided financing for "The Pilgrim's Progress" and additional faith-and-family films coming in 2019 / 2020 from Inspiration Films).

** ( FIFTEEN -15- PHOTOS Mostly Berlinale EMF Festivals ) **

http://hannoverhousemovies.blogspot.com/2019/02/happy-presidents-day.html

HHSE

Recent HHSE News

- Form 8-K - Current report • Edgar (US Regulatory) • 01/05/2024 07:17:02 PM

Cannabix Technologies and Omega Laboratories Inc. Provide Positive Developments on Marijuana Breathalyzer Testing • BLO • Jul 11, 2024 8:21 AM

ECGI Holdings Enhances Board with Artificial Intelligence (AI) Expert Ahead of Allon Apparel Launch • ECGI • Jul 10, 2024 8:30 AM

Avant Technologies to Meet Unmet Needs in AI Industry While Addressing Sustainability Concerns • AVAI • Jul 10, 2024 8:00 AM

Panther Minerals Inc. Launches Investor Connect AI Chatbot for Enhanced Investor Engagement and Lead Generation • PURR • Jul 9, 2024 9:00 AM

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM