Thursday, January 24, 2019 3:45:46 AM

A cannabis ETF is coming this year or next year. I have no doubt that CVSI will be part of the portfolio given their very healthy balance sheet and large growth potential.

No, they won’t due to CVSI’s poor record of fines, SEC Envforcement Acts, dealings with toxic death spiral financier John Millar Fife and his own SEC Enforcement Actions, Suspensions, Fines, clawback Of his death spiral financing and multiple lawsuits filed against him. Additionally CVSI’s CPA and Auditor Anton and Chia’s SEC Fine and Enforcement intheir fraud with CVSI all cited below:

They don’t care about being uplifted to NASDAQ. That was simply part and parcel of the pump and made for a tremendous PR release. However, after six months as of today and no off the list it’s clear is coming in the future. The timing was virtually perfect. Mona finally steps aside ostensibly to “clean up” the management and B.O.D’s handing the reins to Dowling. It doesn’t help the uplist request. They don’t want it to. Mona walks out filing a Form 4 for the first revealed million share dump. I’m sure there have been prior dumps by proxy. However this company never wanted NASDAQ, too costly, too many filings and far too much transparency required. What about Mona III staying on doing his fathers bidding? What about Dowling’s past. What about the fines and SEC Enforcement Actions against Anton and Chia their auditor. What about direct ties for 6 years to known toxic financier John Fife (“Iliad”). Have a look;

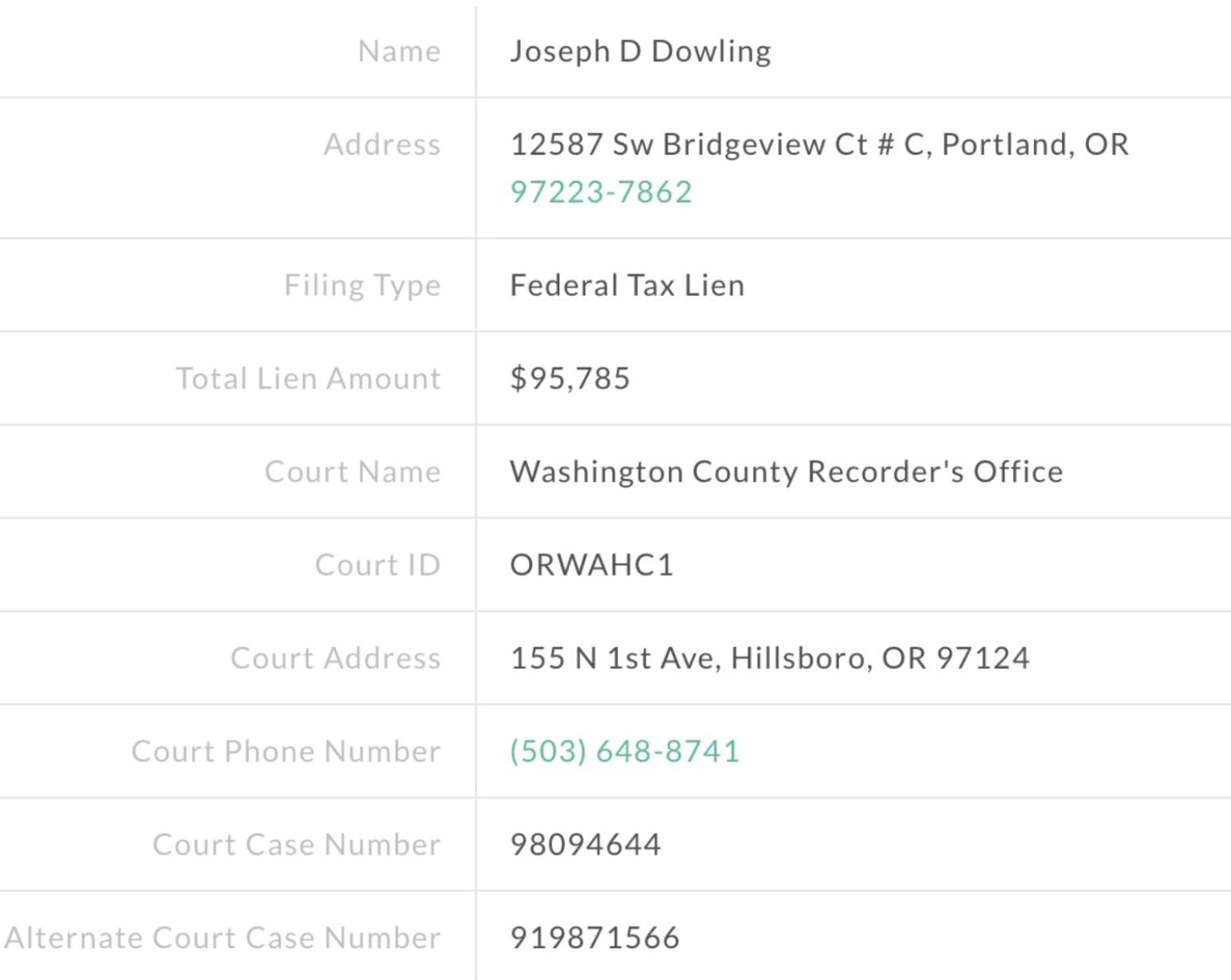

Mona Jr. leaves Joseph Dowling “formally” in charge of CVSI. I say “formally” as retired or not Mona Sr. is by far the largest shareholder, his son Mona III remains at the company as Mona Jr’s proxy to continue to do his bidding. Lastly, Mr. Dowling doesn't have what the SEC, FINRA or NASDAQ calls “clean hands.” He appears to have problems in his past paying his bills leaving in his wake liens, judgments and unpaid creditors. These include both State and Federal Tax Liens. The Federal lien being just under $100,000.00 pre interest and fines. Not exactly what NASDAQ looks for in its exchanges CEO’s. There are a myriad of other issues as well in the reason why no NASDAQ Uplist has yet occurred even after this six month wait. This is simple due diligence gleaned from public records into just whom is running this company, CVSI and their history.

A second State Tax Lien is listed in public records as well. You can tell these are two separate liens as they have different case numbers.

There are additional problems with any CVSI Uplist to NASDAQ due to their relationship with their former financier, John Fife (Iliad) a well known OTC toxic death spiral financier is yet another strike. Look at all the lawsuits and SEC regulatory fines and suspensions of Fife.

https://www.sec.gov/litigation/litreleases/2007/lr20250.htm

https://www.sec.gov/litigation/litreleases/2007/lr19972.htm

https://www.sec.gov/litigation/admin/2007/ia-2636.pdf

https://www.sec.gov/Archives/edgar/data/1379699/000114036115001204/doc1.htm

Sometimes Fife used his wife as his proxy until she was permanently barred from any position by the SEC in 2015;

https://brokercheck.finra.org/individual/summary/

Fife himself was suspended by the SEC in August of 2007 which included his having to pay a hefty fine. The suspension was for a minimum 18 months before he could apply for reinstatement.

https://www.sec.gov/litigation/litreleases/2007/lr20250.htm

Fife works under numerous corporate veils. In addition to the Iliad LLC he used to loan CVSI money you will also find him making toxic, death spiral convertible dilutive loans under the names; Tonaquint, Tangiers, Chicago Ventures, JVF Holdings, Inter Mountain Capital I Inc and Utah Resources.

Due to all this history along with the reasons I list below I don’t think an uplist is in CVSI’s near future.

The reasons I’m positive there’ll be no CVSI uplist to NASDAQ are what I’ve stated above as well as the following;

(1) The farm bill is a complex matrix of provisions intended to help farmers already in the business of growing food and fiber for domestic consumption and export. It would also include certain restrictions on imports of food and fiber. These are mostly private enterprises running from small operations of a few acres up to multi billion dollar operations requiring annual financing to the tune of hundreds of millions. Farmers are also, by nature, conservative. They wouldn't, at first, fall all over themselves to commit large amounts of capital to hemp production just to supply some hemp by products to sell to the health and wellness businesses. Which means this is a tiny provision within the total package and not exactly something the politicians who must vote on the bill are deeply concerned with. The reefer nuts, however, pay no attention to what the politicians are debating about among themselves. Ultimately a bill must please the President, wacko that he is. He may veto it because he doesn't like the SNAP program. He has just threatened to close off the entire border with Mexico. CVSI “investors” are trying to simplify what is a very difficult piece of federal legislation with provisions that will have an impact on farming revenues for years to come.

(2) NASDAQ Rule 5101. Listing may be denied for association with individuals with a history of regulatory misconduct. Fully applicable.

(3) In a statement, FDA Commissioner Scott Gottlieb, M.D. says the passage of the U.S. farm bill, now called the Agriculture Improvement Act of 2018 since it is law, does not diminish the agency's regulatory oversight role related to cannabis-containing food and drink.

He says the FDA will be diligent in monitoring the hemp marketplace to ensure that makers of non-approved products are not making unsubstantiated medical claims.

Also, the Food, Drug and Cosmetics Act prohibits interstate commerce of food containing cannabidiol (CBD) or tetrahydrocannabinol (THC) since it is an active ingredient in an FDA-approved drugs.

IM-5101-1. Use of Discretionary Authority

To further Companies' understanding of Rule 5101, Nasdaq has adopted this Interpretive Material as a non-exclusive description of the circumstances in which the Rule is generally invoked.

Nasdaq may use its authority under Rule 5101 to deny initial or continued listing to a Company when an individual with a history of regulatory misconduct is associated with the Company. Such individuals are typically an officer, director, Substantial Shareholder (as defined in Rule 5635(e)(3)), or consultant to the Company. In making this determination, Nasdaq will consider a variety of factors, including:

• the nature and severity of the conduct, taken in conjunction with the length of time since the conduct occurred;

• whether the conduct involved fraud or dishonesty; In the cases of Anton and Chia this is even more clear. Have a look;

The SEC disciplining CVSI’s accountant and auditor Anton and Chia is stated below as clear fraud, manipulation and subsequent discipline

http://www.lexissecuritiesmosaic.com/gateway/sec/admin-proceeding/34-82206.pdf

See ya, We’ve gotta run to my courtside seats as

#14 Seed S. Tsitsipas vs

#2 Seed and buddies Rafa’s Semifinal match is about to begin

Good luck on that uplist, today made 6 months since the application and good luck being included in that new ETF.Personally as you can see I bought 116,000 shares of CVSI back in January of 2018 and banked $400,000.00+ pre tax profits soon thereafter;

Minds are like parachutes: they only function when they're open

Recent CVSI News

- Form 8-K - Current report • Edgar (US Regulatory) • 05/14/2024 01:10:34 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 12/12/2023 02:36:49 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 08/14/2023 08:21:25 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 08/14/2023 01:32:15 PM

Green Leaf Innovations, Inc. Expands International Presence with New Partnership in Dubai • GRLF • Jun 24, 2024 8:30 AM

Bemax Inc. Positions to Capitalize on Industry Growth with New Improved Quality of Mother's Touch® Disposable Diapers • BMXC • Jun 24, 2024 8:00 AM

Last Shot Hydration Drink Announced as Official Sponsor of Red River Athletic Conference • EQLB • Jun 20, 2024 2:38 PM

ATWEC Announces Major Acquisition and Lays Out Strategic Growth Plans • ATWT • Jun 20, 2024 7:09 AM

North Bay Resources Announces Composite Assays of 0.53 and 0.44 Troy Ounces per Ton Gold in Trenches B + C at Fran Gold, British Columbia • NBRI • Jun 18, 2024 9:18 AM

VAYK Assembling New Management Team for $64 Billion Domestic Market • VAYK • Jun 18, 2024 9:00 AM