| Followers | 368 |

| Posts | 9865 |

| Boards Moderated | 0 |

| Alias Born | 02/13/2014 |

Wednesday, January 09, 2019 7:36:06 AM

Current Share Structure. OS is MAXED & the company says no RS or AS increase is needed.

IR stating no AS increase && no RS

Interestingly enough, Verus did not have to file the usual 14C forms for a name/symbol change, because those forms are done in conjunction with a reverse split or increase in authorized shares. Because Verus did neither of those actions, they simply had to inform FINRA of the desired changes. So, investors will not see any filing.

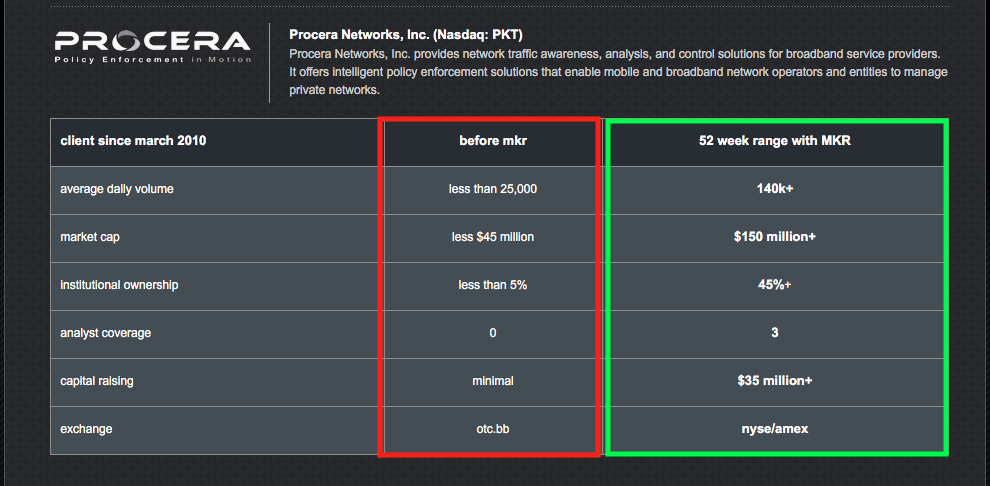

Some are quick to overlook the $VRUS IR firm, MKR Group. Take a look at what they've done for other OTC companies and the praise given to them by respected businessmen traded on major exchanges. This IR firm appears to know how to properly get a OTC company upflited.

$VRUS Up to $1 mil in revs per month added to our already impressive revs below. He is very clear this is not apart of our current backlog

In that regard, Verus is happy to announce that it has reached an agreement to supply a Dubai -based food seller with up to $1 million (USD)/month in multiple vegetable, fruit and meat categories. Initial products are expected to include mangos, onions, potatoes, eggs, mutton, beef and poultry sourced from suppliers in several countries. Financing is being finalized and will utilize a Letter of Credit (LC) and non-dilutive European and U.S. sources.

"Now that we are fully independent, we finally have the freedom to create our own identity and become more active in pursuing growth opportunities," explained Verus CEO Anshu Bhatnagar . "This contract represents new business (not in our current backlog) and is just the start of the kind of recurring orders that are available to us with the right financing. In this case, we can rely on the LC to minimize our need for funds, while still generating significant revenue."

One cannot argue the contracts we have with Disney or the $78 mil beef deal, it's all right there in the filings. Would the SEC allow a CT Order for an SEC filer if it wasn't all legitimate? I think not. In fact, I will begin to walk you through what's covered under the CT Order so investors can understand what was given the Confidential Treatment or CT Order. This is important because the Commission now releases orders relating to applications for confidential treatment of certain information otherwise required to be included in filed documents. The Divisions of Corporation Finance and Investment Management issue these orders pursuant to delegated authority. After showing the contracts are legit, I will prove they are also being fullfilled.

I took a screenshot of the beginning portion of exhibit 10.25 && 10.26 so investors can see what the exhibits are for. I encourage investors who haven't, go read the 10-k in its entirely. It may help you better understand the legitimacy of $VRUS and where it's headed in the near future.

https://www.sec.gov/edgar/searchedgar/ctorders.htm

SEC CT order for Exhibits 10.25 && 10.26

CT Order 10.25. Beef Contract

https://www.otcmarkets.com/stock/VRUS/news/RealBiz-Awarded-78-Million-Contract-To-Deliver-Beef-to-the-Middle-East?id=147791

CT Order 10.26. Disney Distribution

https://www.otcmarkets.com/stock/VRUS/news/RealBiz-Media-Group-Verus-Foods-Announces-Exclusive-Juice-Distribution-Agreement-with-The-Walt-Disney-Co-in-the-United-A?id=170497

Now that we can see the contracts are legit, lets see them being fulfilled, right investors?!?! Well here ya' go, contracts are indeed being fulfilled.

$VRUS Mangement

Anshu Bhatnagar – Chief Executive Officer and Chairman

Anshu Bhatnagar has served as our Chief Executive Officer and Chairman of the Board since January 2, 2017. In addition, Mr. Bhatnagar is a food distribution veteran and previously was the Chief Executive Officer of American Agro Group, an international trading and distribution company that specialized in exporting agricultural commodities and food products from 2012 to 2016. Mr. Bhatnagar was also a Managing Member of Blue Capital Group, a real estate oriented multi-family office focused on acquiring, developing, and managing commercial real estate as well as investing in operating businesses from 2008 to 2016. He has also owned, operated and sold other successful businesses in technology, construction and waste management. The Board believes Mr. Bhatnagar is qualified to serve as a member of the Board because of his extensive business experience.

Anshu Bhatnagar is a highly accomplished senior executive focused on private equity, real estate and running operating business across multiple industries.

Mr. Bhatnagar is a visionary, successful serial entrepreneur with numerous profitable, global businesses to his credit. Well-versed in all aspects of real estate acquisition and disposition, development, financing, leasing and operation and has broad experience across many sectors of real estate - hospitality, office, retail, multi-family, industrial and single family residential. He has a solid track record of developing and implementing strategic business plans that govern daily operations, position in the market, and ultimate disposition.

Mr. Bhatnagar has an exceptional career production – managed commercial real estate portfolios in excess of $1.0B, executed over 100 debt and equity transactions, sponsored a highly successful private real estate fund and a mezzanine debt fund.

Michael O’Gorman – Director

Michael O’Gorman has served as a member of our Board since August 11, 2017. Mr. O’Gorman has over 35 years of successful food brokerage, food manufacturing, project management, finance and legal experience in the international arena. Since 1982, Mr. O’Gorman has also served as Chairman and Chief Executive Officer of Crassus Group of companies, includes entities whose subsidiaries specialize in sourcing and marketing all natural, healthy food and consumer products. In addition, from 1976 to 1979 he served as Chief of Staff in both the House of Representatives and U.S. Senate. He has firsthand experience with agriculture since he has owned and operated a 252-acre farm where he raised both crops and Black Angus cattle. Mr. O’Gorman has spent a number of years working at major international law firms as well serving as a Member of the Corporate Law Department, Director of Litigation Support Group of Peabody International Corporation, Fortune 100 NYSE from 1979 to 1986. Mr. O’Gorman received his JD with a concentration in international law from the University of Connecticut, MBA in international finance from Fairleigh Dickinson University and BS in organic chemistry from St. Peters College. The Board believes Mr. O’Gorman is qualified to serve as a member of the Board because of his experience in agriculture and the food industry.

Thomas Butler Fore – Director

Thomas Butler Fore has served as a member of our Board since August 11, 2017. Mr. Fore is a multi-faceted entrepreneur and executive with experience in numerous categories of business, including real estate, media, personal care products and fashion. He has served as Chief Executive Officer of Sora Development, an award winning real estate development firm focused on large mixed-use projects with a specialty in public-private partnerships since 2007. In addition, from 2012 he served as Chief Executive Officer of Tiderock Media, a film production company and in 2014 he founded Digital2go Media Networks where he also served as a member of its board. Mr. Fore is also involved as an advisor and partner in numerous other enterprises in media, real estate and consumer products. Mr. Fore received his BA from Towson University. The Board believes Mr. Fore is qualified to serve as a member of the Board because of his background and experience in the industry.

Piyush Munot - CFO of Operations in Middle East, Africa && Asia

Piyush Munot has more than 18 years of total work experience including over a decade in the Corporate Finance & Advisory field. Prior to joining Al Masah Capital, Piyush worked at Al Dahra Holding, a food and agriculture dedicated sovereign wealth fund focusing on Fund Management & Investments. In addition, he also worked at KPMG for 7 years in their Business Valuations and M & A division. Piyush holds a Bachelors of Commerce from Narsee Monjee College in Mumbai, India, is a Certified Public Accountant from USA and an Executive MBA from the Indian Institute of Management.

CEO's words on CFO hiring; "In just the last few months, we have added an independent board, a very experienced CFO from a multibillion dollar public company.

Bringing in Piyush Munot as CFO to oversee our operations in the Middle East, Africa and Asia is a tremendous hire. We don't expect most investors to know some of the companies in the region, but Piyush was recently Group Finance Controller at a Division of Al Dahra Holdings, one of the leading sovereign wealth fund agri businesses in the UAE.

He has worked at major accounting firms such as KPMG and PWC, and is a US certified public accountant. He is also a great addition to our team and will help seamlessly integrate our overseas operations into our corporate accounting structure here in the US."

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM