Tuesday, December 11, 2018 2:48:26 AM

S&P 500 - Symmetrical Triangle BREAKOUT

for Tuesday, December 11, 2018

_________________________________________________________________

The Kick-Off Months in the OTC - Jan/Feb - Jun/Jul

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=137701925

_________________________________________________________________

The market continues to generally track

as expected.

After a five wave bull market,

with a subdividing third wave,

from SPX 1810 to SPX 2941,

the market reversed and appears to be

in a potentially short-lived bear market.

Our long term SPX count remains the same.

Five Intermediate waves up,

with a subdividing third wave,

from early-2016 to late-2018

to complete a Major wave 1 bull market

(1810-2941).

After that high

the market entered what we suspect

will be a short-lived Major wave 2 bear market,

with a possible loss of 15% to 20%.

The first decline of this bear market

bottomed in October at SPX 2604.

After the expected

Major wave 2 Bear Market ends,

the Primary III Secular Bull Market will resume.

https://caldaro.wordpress.com/2018/11/24/weekend-update-679/

https://caldaro.wordpress.com/2018/11/17/weekend-update-678/

https://caldaro.wordpress.com/2018/11/10/weekend-update-677/

https://caldaro.wordpress.com/

________________________________________________________________

Since we are expecting a three wave bear market

we are labeling the first decline

as Intermediate wave A,

and the current rally as Intermediate wave B.

Intermediate wave C should naturally follow

once this rally/uptrend concludes.

During the C

we are expecting the SPX

to break through the recent lows

with a maximum downside target

around SPX 2400 (green line).

After that

the next bull market should begin.

Keep in mind

we are in a Secular generational bull market,

and we are not expecting it to top

until the early 2030’s.

MEDIUM TERM: downtrend continues

This bear market started off simple enough:

a zigzag down to SPX 2604,

then an a-b-c rally to SPX 2815.

After that it has been a mess to count:

-200, +200, -200, +100, -100.

But Friday appears to have cleared it all up.

What it looks like we are dealing with

is an Intermediate wave A

taking the form of a double zigzag.

First

a Minor A zigzag SPX 2941-2603,

then

Minor B to SPX 2815,

now a

Minor C zigzag to SPX 2622 thus far.

It’s been quite choppy and volatile

just like a bear market.

Since Minor A dropped 337 points,

Minor C

should have some Fibonacci relationship to A

before it ends.

We see four possibilities:

SPX 2607 (0.618),

SPX 2577 (0.707),

SPX 2550 (0.786)

and

SPX 2478 (equal).

Two of these four fall within OEW pivots:

2577 and 2478

Too early to tell which is likely to work out.

But with all the political problems out there,

(US, China, Italy, France, and the UK),

any of these levels are possible.

SHORT TERM:

Trying to track this market

with short term waves

has been a near impossible task.

At times this market just seems to bounce

between OEW pivots

with no identifiable pattern.

Minute wave C,

of Minor C,

had

7 waves down to SPX 2622,

7 waves up to SPX 2709,

and now

5 waves down to SPX 2631,

(2643-2665-2623-2650-2631).

Another 7 wave pattern in the making ?

Hopefully

we will see the end of this downtrend soon.

Then we could get a good counter rally uptrend

for a while.

It will be interesting to see

how it all unfolds.

Best to your trading!

Trade what’s in front of you!

_______________________________________________________________

________________________________________________________________

________________________________________________________________

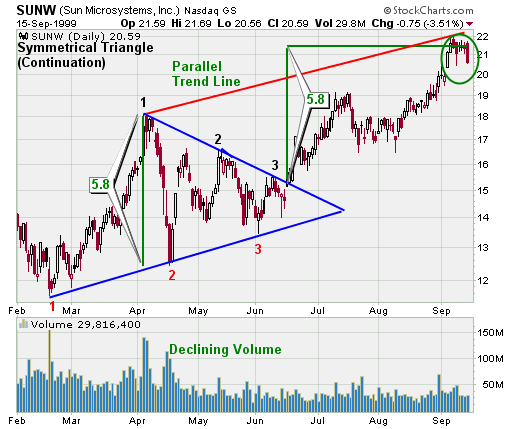

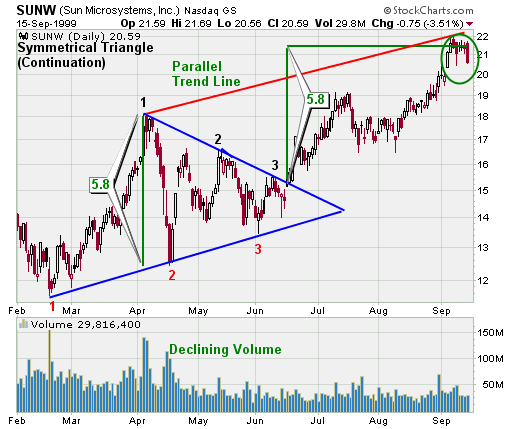

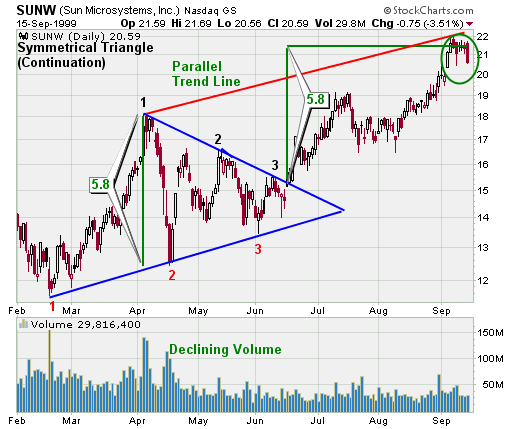

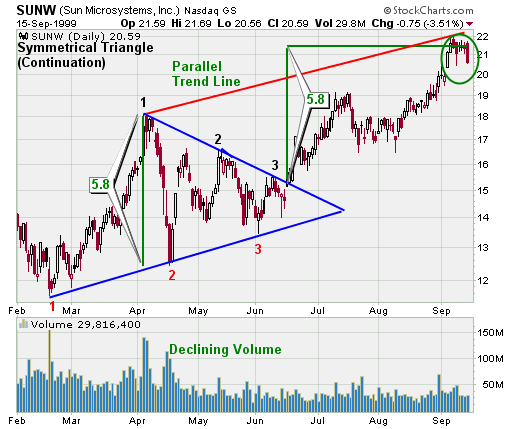

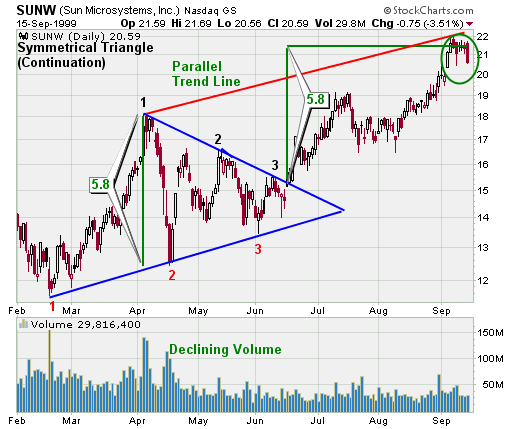

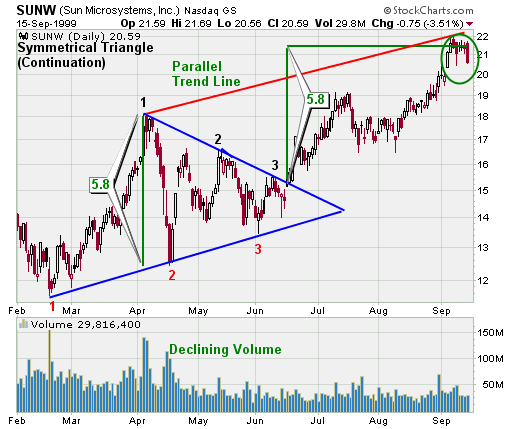

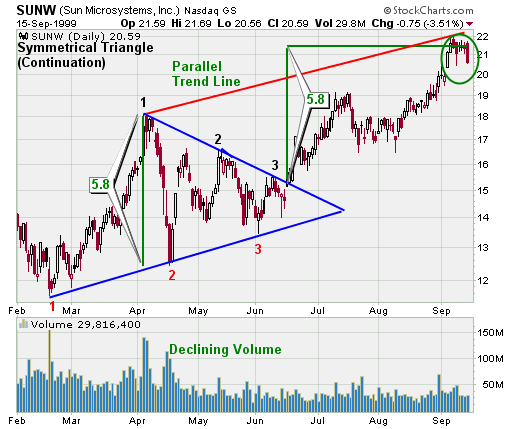

Symmetrical triangles

are usually continuation patterns

with converging trend lines.

Ideally,

a stock breaks out from a symmetrical triangle

prior to reaching the apex of the triangle

with volume expansion.

Chart Patterns

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:chart_patterns

Symmetrical Triangle (Continuation)

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:chart_patterns:symmetrical_triangle_continuation

http://thestockbandit.com/symmetrical-triangle/

http://thepatternsite.com/st.html

_________________________________________________________________

Trend:

In order to qualify as a continuation pattern,

an established trend should exist.

The trend

should be at least a few months old

and the symmetrical triangle

marks a consolidation period

before continuing after the breakout.

________________________________________________________________

Price Target:

There are two methods

to estimate the extent of the move after the breakout.

First,

the widest distance of the symmetrical triangle

can be measured and applied to the breakout point.

Second,

a trend line can be drawn

parallel to the pattern's trend line

that slopes (up or down) in the direction of the break.

The extension of this line

will mark a potential breakout target.

_________________________________________________________________

Symmetrical triangles

are usually continuation patterns

with converging trend lines.

Ideally,

a stock breaks out from a symmetrical triangle

prior to reaching the apex of the triangle

with volume expansion.

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:chart_patterns:symmetrical_triangle_continuation

http://thestockbandit.com/symmetrical-triangle/

http://thepatternsite.com/st.html

_________________________________________________________________

http://stockcharts.com/h-sc/ui?s=%24SPX&p=W&yr=1&mn=5&dy=0&id=p84499328034

________________________________________________________________

for Tuesday, December 11, 2018

_________________________________________________________________

The Kick-Off Months in the OTC - Jan/Feb - Jun/Jul

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=137701925

_________________________________________________________________

The market continues to generally track

as expected.

After a five wave bull market,

with a subdividing third wave,

from SPX 1810 to SPX 2941,

the market reversed and appears to be

in a potentially short-lived bear market.

Our long term SPX count remains the same.

Five Intermediate waves up,

with a subdividing third wave,

from early-2016 to late-2018

to complete a Major wave 1 bull market

(1810-2941).

After that high

the market entered what we suspect

will be a short-lived Major wave 2 bear market,

with a possible loss of 15% to 20%.

The first decline of this bear market

bottomed in October at SPX 2604.

After the expected

Major wave 2 Bear Market ends,

the Primary III Secular Bull Market will resume.

https://caldaro.wordpress.com/2018/11/24/weekend-update-679/

https://caldaro.wordpress.com/2018/11/17/weekend-update-678/

https://caldaro.wordpress.com/2018/11/10/weekend-update-677/

https://caldaro.wordpress.com/

________________________________________________________________

Since we are expecting a three wave bear market

we are labeling the first decline

as Intermediate wave A,

and the current rally as Intermediate wave B.

Intermediate wave C should naturally follow

once this rally/uptrend concludes.

During the C

we are expecting the SPX

to break through the recent lows

with a maximum downside target

around SPX 2400 (green line).

After that

the next bull market should begin.

Keep in mind

we are in a Secular generational bull market,

and we are not expecting it to top

until the early 2030’s.

MEDIUM TERM: downtrend continues

This bear market started off simple enough:

a zigzag down to SPX 2604,

then an a-b-c rally to SPX 2815.

After that it has been a mess to count:

-200, +200, -200, +100, -100.

But Friday appears to have cleared it all up.

What it looks like we are dealing with

is an Intermediate wave A

taking the form of a double zigzag.

First

a Minor A zigzag SPX 2941-2603,

then

Minor B to SPX 2815,

now a

Minor C zigzag to SPX 2622 thus far.

It’s been quite choppy and volatile

just like a bear market.

Since Minor A dropped 337 points,

Minor C

should have some Fibonacci relationship to A

before it ends.

We see four possibilities:

SPX 2607 (0.618),

SPX 2577 (0.707),

SPX 2550 (0.786)

and

SPX 2478 (equal).

Two of these four fall within OEW pivots:

2577 and 2478

Too early to tell which is likely to work out.

But with all the political problems out there,

(US, China, Italy, France, and the UK),

any of these levels are possible.

SHORT TERM:

Trying to track this market

with short term waves

has been a near impossible task.

At times this market just seems to bounce

between OEW pivots

with no identifiable pattern.

Minute wave C,

of Minor C,

had

7 waves down to SPX 2622,

7 waves up to SPX 2709,

and now

5 waves down to SPX 2631,

(2643-2665-2623-2650-2631).

Another 7 wave pattern in the making ?

Hopefully

we will see the end of this downtrend soon.

Then we could get a good counter rally uptrend

for a while.

It will be interesting to see

how it all unfolds.

Best to your trading!

Trade what’s in front of you!

_______________________________________________________________

________________________________________________________________

________________________________________________________________

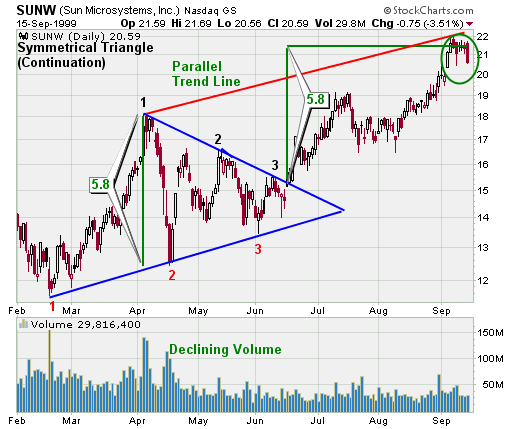

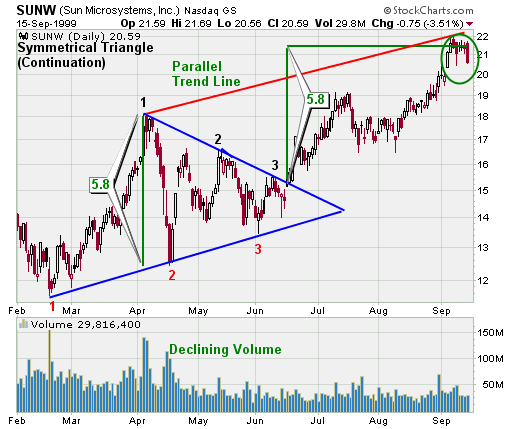

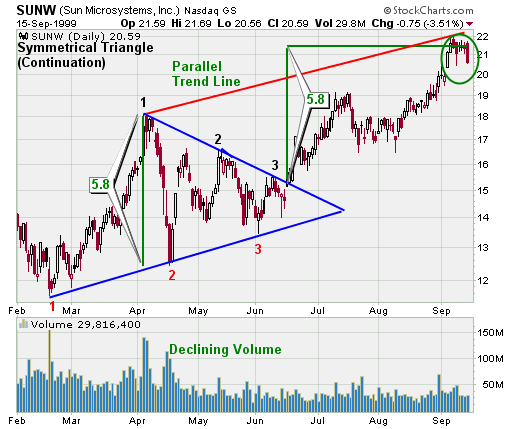

Symmetrical triangles

are usually continuation patterns

with converging trend lines.

Ideally,

a stock breaks out from a symmetrical triangle

prior to reaching the apex of the triangle

with volume expansion.

Chart Patterns

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:chart_patterns

Symmetrical Triangle (Continuation)

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:chart_patterns:symmetrical_triangle_continuation

http://thestockbandit.com/symmetrical-triangle/

http://thepatternsite.com/st.html

_________________________________________________________________

Trend:

In order to qualify as a continuation pattern,

an established trend should exist.

The trend

should be at least a few months old

and the symmetrical triangle

marks a consolidation period

before continuing after the breakout.

________________________________________________________________

Price Target:

There are two methods

to estimate the extent of the move after the breakout.

First,

the widest distance of the symmetrical triangle

can be measured and applied to the breakout point.

Second,

a trend line can be drawn

parallel to the pattern's trend line

that slopes (up or down) in the direction of the break.

The extension of this line

will mark a potential breakout target.

_________________________________________________________________

Symmetrical triangles

are usually continuation patterns

with converging trend lines.

Ideally,

a stock breaks out from a symmetrical triangle

prior to reaching the apex of the triangle

with volume expansion.

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:chart_patterns:symmetrical_triangle_continuation

http://thestockbandit.com/symmetrical-triangle/

http://thepatternsite.com/st.html

_________________________________________________________________

http://stockcharts.com/h-sc/ui?s=%24SPX&p=W&yr=1&mn=5&dy=0&id=p84499328034

________________________________________________________________

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.