Thursday, December 06, 2018 12:17:01 PM

Trump’s Trade War Dilemma And Gold

http://news.goldseek.com/GoldSeek/1544110020.php

-- Published: Thursday, 6 December 2018 | Print | Comment - New!

By Dave Kranzler

If the “risk on/risk off” stock market meme was absurd, its derivative – the “trade war on/trade war off” meme – is idiotic. Over the last several weeks, the stock market has gyrated around media sound bytes, typically dropped by Trump, Larry Kudlow or China, which are suggestive of the degree to which Trump and China are willing to negotiate a trade war settlement.

Please do not make the mistake of believing that the fate the of the stock market hinges on whether or not Trump and China reach some type of trade deal. The “trade war” is a “symptom” of an insanely overvalued stock market resting on a foundation of collapsing economic and financial fundamentals. The trade war is the stock market’s “assassination of Archduke Franz Ferdinand.”

Trump’s Dilemma – The dollar index has been rising since Trump began his war on trade. But right now it’s at the same 97 index level as when Trump was elected. Recall that Trump’s administration pushed down the dollar from 97 to 88 to stimulate exports. After Trump was elected, gold was pushed down to $1160. It then ran to as high as $1360 – a key technical breakout level – by late April. In the meantime, since Trump’s trade war began, the U.S. trade deficit has soared to a record level.

If Trump wants to “win” the trade war, he needs to push the dollar a lot lower. This in turn will send the price of gold soaring. This means that the western Central Banks/BIS will have to live with a rising price gold, something I’m not sure they’re prepared accept – especially considering the massive paper derivative short position in gold held by the large bullion banks. This could set up an interesting behind-the-scenes clash between Trump and the western banking elitists.

I’ve labeled this, “Trump’s Dilemma.” As anyone who has ever taken a basic college level economics course knows, the Law of Economics imposes trade-offs on the decision-making process (remember the “guns and butter” example?). The dilemma here is either a rising trade deficit for the foreseeable future or a much higher price of gold. Ultimately, the U.S. debt problem will unavoidably pull the plug on the dollar. Ray Dalio believes it’s a “within 2 years” issue. I believe it’s a “within 12 months” issue.

Irrespective of the trade war, the dollar index level, interest rates and the price of gold, the stock market is headed much lower. This is because, notwithstanding the incessant propaganda which purports a “booming economy,” the economy is starting to collapse. The housing stocks foreshadow this, just like they did in 2005-2006:

The symmetry in the homebuilder stocks between mid-2005 to mid-2006 and now is stunning as is the symmetry in the nature of the underlying systemic economic and financial problems percolating – only this time it’s worse…

**********

The commentary above is a “derivative” of the type of analysis that

precedes the presentation of investment and trade ideas in

the Mining Stock and Short Seller’s Journals.

To find out more about these newsletters, follow these links:

Short Seller’s Journal information and more about the Mining Stock Journal here:

Mining Stock Journal information.

http://news.goldseek.com/GoldSeek/1544110020.php

ex....

Gold Is “Coiled” and Looks Set To Surge Like Natural Gas — Bloomberg Intelligence

-- Published: Wednesday, 5 December 2018 | Print | Comment - New!

– Gold’s “setup” is “similar to natural gas before its big rally”

– Gold is gaining favour over stocks, bitcoin and cryptos

– Metals may be primary beneficiaries of imminent greenback peak

– Silver “appears ready for a potential longer-term recovery”

– GoldCore editors note: Natural gas is 56% higher year to date

by Bloomberg Intelligence (appeared first on the Bloomberg Terminal)

http://news.goldseek.com/GoldSeek/1544011200.php

Gold To Reassert Itself As Money | Alasdair MacLeod

8,512 views

FinanceAndLiberty.com

Published on Nov 23, 2018

ex...

https://www.youtube.com/watch?v=DPK26vJnH1A

Gran Colombia Gold's TTM Adjusted EBITDA Surpasses $100 Million

Nov. 26, 2018 11:12 AM ET |

About: Gran Colombia Gold Corp. (TPRFF)

Summary

TTM adjusted EBITDA reached $105.4 million at the end of September 2018.

The company has restructured its debt, and it no longer has convertible

debentures, which could’ve been highly dilutive.

Reserves and resources could rise significantly as

Gran Colombia has embarked on a 30,000-meter drilling campaign

at Segovia.

The latter currently has 27 known veins and only three are mined.

Looking for a community to discuss ideas with?

The Gold Commonwealth features a chat room of like-minded investors

sharing investing ideas and strategies. Start your free trial today »

Introduction and financials

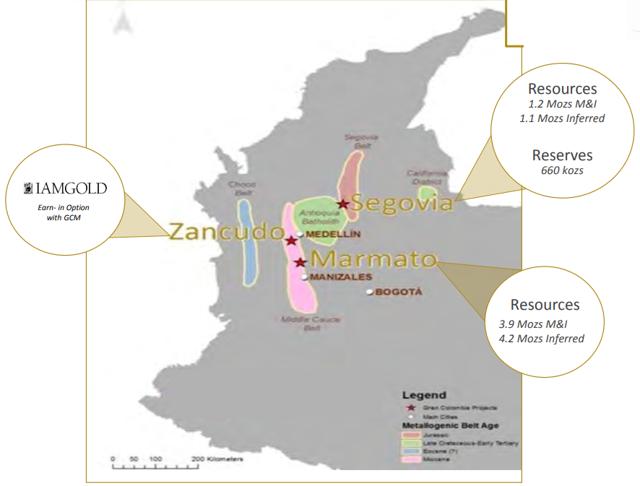

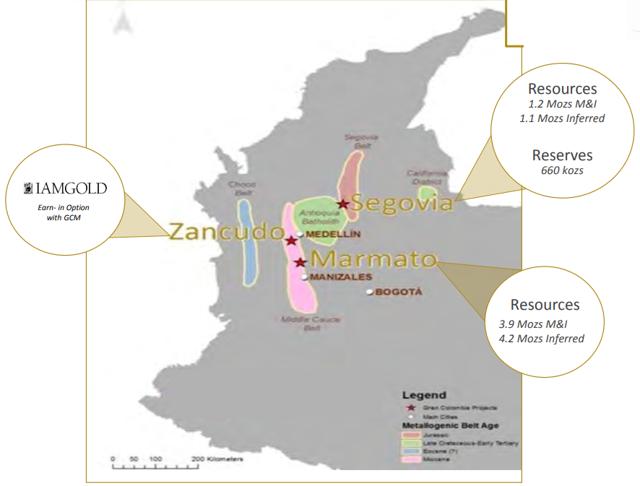

Gran Colombia Gold (OTCPK:TPRFF) is the largest underground gold and

silver producer in Colombia, and its main assets are the high-grade

Segovia Operations near the city of Medellin:

https://seekingalpha.com/article/4224489-gran-colombia-golds-ttm-adjusted-ebitda-surpasses-100-million?dr=1

Gran Colombia Gold Corp. (TPRFF / GCM:TSE) Gold is benefiting from growing risk-off sentiment in financial markets

as investors move out of falling equity markets and

into more defensive assets.

Economists said that the latest manufacturing data could add to

pessimism in the marketplace.

Bob babes, I think a spike is coming in gold.

I see gold going closer to 10k rather than 1k, like to see

Gran zoom 3x in coming months.

thank you, good info )

)

https://www.kitco.com/news/2018-11-21/Gold-Prices-Hit-Session-Highs-Following-4-4-Drop-In-U-S-Durable-Goods-Orders.html

Asia Gold: Weddings boost Indian demand; activity muted in other hubs

Rajendra Jadhav, Karen Rodrigues

MUMBAI/BENGALURU (Reuters) - Physical gold demand in India was robust

this week as consumers stepped up purchases during the traditional

wedding season after domestic rates slipped to a near six-week trough,

while gains in global prices weighed on bullion’s appeal in other Asian

hubs.

A salesman shows gold necklaces to a customer at a jewellery showroom during Dhanteras, a Hindu festival associated with Lakshmi, the goddess of wealth, in Kolkata, November 5, 2018. REUTERS/Rupak De Chowdhuri

Demand in India, the second biggest gold consumer after China, usually picks up towards the end of the year going into the wedding and festival season, when buying the metal is considered auspicious.

The current price level was attracting both jewellers and retail consumers, said Daman Prakash Rathod, a director at MNC Bullion, a wholesaler in Chennai.

Local gold prices were trading near their lowest since Oct. 1, as an appreciation in the rupee made buying overseas cheaper.

Dealers in India were charging a premium of up to $2 an ounce over official domestic prices this week, down from $3 last week. The domestic price includes a 10 percent import tax.

“Jewellers are now replenishing inventory as sales during Diwali were decent,” said a Mumbai-based dealer with a bullion importing bank.

SPONSORED

Indians celebrated the Dhanteras and Diwali festivals earlier this month.

Meanwhile, global benchmark spot gold prices were on track to post a second week of gains, having hit a two-week high of $1,230.07 an ounce on Wednesday.

In China, premiums of $4-$6 an ounce were charged over the benchmark, versus $4-$7 last week.

Demand in China is very quiet these days as prices are trading higher and people are hesitating to buy, said Peter Fung, head of dealing at Wing Fung Precious Metals in Hong Kong.

Premiums in Hong Kong also inched down slightly to $0.70-$1.50 an ounce from $0.80-$1.50 in the previous week.

In Singapore, premiums eased to $0.50-$0.80 an ounce from $0.60-$0.90 previously.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=144867546

TPRFF/GMC Possibility of a takeover -

Yes, crazy numbers here. total enterprise value with debt

under 250mm canadian.

A buyer can payoff debt, 100mm, and reap returns of

over 25-35% per year if purchased for $5.

This can happen in a flash.

Any thoughts?

by liquorc

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=145035997

Note the bottom lines;

Given Segovia's growth profile and low production cost, I believe

the stock is worth 15x forward earnings, or approximately $10/share,

representing close to 500% upside.

If the company continues to execute, then fair value should increase

over time.

Importantly, the company is now funding its growth from operating

cash flow; that eliminates the need for financing, which

is commonly a problem for junior miners.

The greatest risk to the thesis is the price of gold.

If gold were to fall to $1000/oz then I estimate that the company

would earn only around $0.10 of EPS;

at a 10x earnings multiple (reflecting thinner margins),

the stock would be worth $1/share, or ~40% downside.

Additionally, there remain operational tail risks, such as a

prolonged conflict with artisanal miners or gangs/guerrillas,

which could seriously impair the value of the company's assets.

Overall, I believe the very large upside potential more than

compensates investors for bearing these risks.

Disclosure: I am/we are long TPRFF.

The Largest Underground Gold And Silver Producer In Colombia - Gran Colombia Gold Corp.

Cambridge House International Inc.

Published on Nov 5, 2018

Watch as Mike Davies, CFO of Gran Colombia Gold Corp. (TSX: GCM),

discusses their new milestones for 2018.

https://www.youtube.com/watch?v=0fvFlrAOCKQ

Gran Colombia Gold: Extremely Deep-Value Gold Miner

https://seekingalpha.com/article/4216358-gran-colombia-gold-extremely-deep-value-gold-miner

Summary

•The stock trades at less than 3x forward earnings.

•Investors have ignored the company due to earlier financial trouble and no sell-side coverage.

•Dramatic valuation divergence from other gold miners, coupled with ongoing growth, creates a setup for huge returns.

Gold Market Update By: Clive Maund

Published: Monday, 5 November 2018 | Print | Comment - New!

The Precious Metals sector continues to be viewed with disdain and

skepticism by the vast majority of investors, which is exactly what you

want and expect to see at the earliest stages of a major bullmarket.

However, the charts continue to shape up well, as we will now see.

http://news.goldseek.com/CliveMaund/1541423160.php

Gran Colombia Gold Corp (TPRFF) CEO Lombardo Arenas on Q3 2018 Results - Earnings Call Transcript

Nov. 14, 2018 1:26 PM ET | About: Gran Colombia Gold Corp. (TPRFF)

https://seekingalpha.com/article/4222166-gran-colombia-gold-corp-tprff-ceo-lombardo-arenas-q3-2018-results-earnings-call-transcript?part=single

In GOD We Trust -

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

http://news.goldseek.com/GoldSeek/1544110020.php

-- Published: Thursday, 6 December 2018 | Print | Comment - New!

By Dave Kranzler

If the “risk on/risk off” stock market meme was absurd, its derivative – the “trade war on/trade war off” meme – is idiotic. Over the last several weeks, the stock market has gyrated around media sound bytes, typically dropped by Trump, Larry Kudlow or China, which are suggestive of the degree to which Trump and China are willing to negotiate a trade war settlement.

Please do not make the mistake of believing that the fate the of the stock market hinges on whether or not Trump and China reach some type of trade deal. The “trade war” is a “symptom” of an insanely overvalued stock market resting on a foundation of collapsing economic and financial fundamentals. The trade war is the stock market’s “assassination of Archduke Franz Ferdinand.”

Trump’s Dilemma – The dollar index has been rising since Trump began his war on trade. But right now it’s at the same 97 index level as when Trump was elected. Recall that Trump’s administration pushed down the dollar from 97 to 88 to stimulate exports. After Trump was elected, gold was pushed down to $1160. It then ran to as high as $1360 – a key technical breakout level – by late April. In the meantime, since Trump’s trade war began, the U.S. trade deficit has soared to a record level.

If Trump wants to “win” the trade war, he needs to push the dollar a lot lower. This in turn will send the price of gold soaring. This means that the western Central Banks/BIS will have to live with a rising price gold, something I’m not sure they’re prepared accept – especially considering the massive paper derivative short position in gold held by the large bullion banks. This could set up an interesting behind-the-scenes clash between Trump and the western banking elitists.

I’ve labeled this, “Trump’s Dilemma.” As anyone who has ever taken a basic college level economics course knows, the Law of Economics imposes trade-offs on the decision-making process (remember the “guns and butter” example?). The dilemma here is either a rising trade deficit for the foreseeable future or a much higher price of gold. Ultimately, the U.S. debt problem will unavoidably pull the plug on the dollar. Ray Dalio believes it’s a “within 2 years” issue. I believe it’s a “within 12 months” issue.

Irrespective of the trade war, the dollar index level, interest rates and the price of gold, the stock market is headed much lower. This is because, notwithstanding the incessant propaganda which purports a “booming economy,” the economy is starting to collapse. The housing stocks foreshadow this, just like they did in 2005-2006:

The symmetry in the homebuilder stocks between mid-2005 to mid-2006 and now is stunning as is the symmetry in the nature of the underlying systemic economic and financial problems percolating – only this time it’s worse…

**********

The commentary above is a “derivative” of the type of analysis that

precedes the presentation of investment and trade ideas in

the Mining Stock and Short Seller’s Journals.

To find out more about these newsletters, follow these links:

Short Seller’s Journal information and more about the Mining Stock Journal here:

Mining Stock Journal information.

http://news.goldseek.com/GoldSeek/1544110020.php

ex....

Gold Is “Coiled” and Looks Set To Surge Like Natural Gas — Bloomberg Intelligence

-- Published: Wednesday, 5 December 2018 | Print | Comment - New!

– Gold’s “setup” is “similar to natural gas before its big rally”

– Gold is gaining favour over stocks, bitcoin and cryptos

– Metals may be primary beneficiaries of imminent greenback peak

– Silver “appears ready for a potential longer-term recovery”

– GoldCore editors note: Natural gas is 56% higher year to date

by Bloomberg Intelligence (appeared first on the Bloomberg Terminal)

http://news.goldseek.com/GoldSeek/1544011200.php

Gold To Reassert Itself As Money | Alasdair MacLeod

8,512 views

FinanceAndLiberty.com

Published on Nov 23, 2018

ex...

https://www.youtube.com/watch?v=DPK26vJnH1A

Gran Colombia Gold's TTM Adjusted EBITDA Surpasses $100 Million

Nov. 26, 2018 11:12 AM ET |

About: Gran Colombia Gold Corp. (TPRFF)

Summary

TTM adjusted EBITDA reached $105.4 million at the end of September 2018.

The company has restructured its debt, and it no longer has convertible

debentures, which could’ve been highly dilutive.

Reserves and resources could rise significantly as

Gran Colombia has embarked on a 30,000-meter drilling campaign

at Segovia.

The latter currently has 27 known veins and only three are mined.

Looking for a community to discuss ideas with?

The Gold Commonwealth features a chat room of like-minded investors

sharing investing ideas and strategies. Start your free trial today »

Introduction and financials

Gran Colombia Gold (OTCPK:TPRFF) is the largest underground gold and

silver producer in Colombia, and its main assets are the high-grade

Segovia Operations near the city of Medellin:

https://seekingalpha.com/article/4224489-gran-colombia-golds-ttm-adjusted-ebitda-surpasses-100-million?dr=1

Gran Colombia Gold Corp. (TPRFF / GCM:TSE) Gold is benefiting from growing risk-off sentiment in financial markets

as investors move out of falling equity markets and

into more defensive assets.

Economists said that the latest manufacturing data could add to

pessimism in the marketplace.

Bob babes, I think a spike is coming in gold.

I see gold going closer to 10k rather than 1k, like to see

Gran zoom 3x in coming months.

thank you, good info

https://www.kitco.com/news/2018-11-21/Gold-Prices-Hit-Session-Highs-Following-4-4-Drop-In-U-S-Durable-Goods-Orders.html

Asia Gold: Weddings boost Indian demand; activity muted in other hubs

Rajendra Jadhav, Karen Rodrigues

MUMBAI/BENGALURU (Reuters) - Physical gold demand in India was robust

this week as consumers stepped up purchases during the traditional

wedding season after domestic rates slipped to a near six-week trough,

while gains in global prices weighed on bullion’s appeal in other Asian

hubs.

A salesman shows gold necklaces to a customer at a jewellery showroom during Dhanteras, a Hindu festival associated with Lakshmi, the goddess of wealth, in Kolkata, November 5, 2018. REUTERS/Rupak De Chowdhuri

Demand in India, the second biggest gold consumer after China, usually picks up towards the end of the year going into the wedding and festival season, when buying the metal is considered auspicious.

The current price level was attracting both jewellers and retail consumers, said Daman Prakash Rathod, a director at MNC Bullion, a wholesaler in Chennai.

Local gold prices were trading near their lowest since Oct. 1, as an appreciation in the rupee made buying overseas cheaper.

Dealers in India were charging a premium of up to $2 an ounce over official domestic prices this week, down from $3 last week. The domestic price includes a 10 percent import tax.

“Jewellers are now replenishing inventory as sales during Diwali were decent,” said a Mumbai-based dealer with a bullion importing bank.

SPONSORED

Indians celebrated the Dhanteras and Diwali festivals earlier this month.

Meanwhile, global benchmark spot gold prices were on track to post a second week of gains, having hit a two-week high of $1,230.07 an ounce on Wednesday.

In China, premiums of $4-$6 an ounce were charged over the benchmark, versus $4-$7 last week.

Demand in China is very quiet these days as prices are trading higher and people are hesitating to buy, said Peter Fung, head of dealing at Wing Fung Precious Metals in Hong Kong.

Premiums in Hong Kong also inched down slightly to $0.70-$1.50 an ounce from $0.80-$1.50 in the previous week.

In Singapore, premiums eased to $0.50-$0.80 an ounce from $0.60-$0.90 previously.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=144867546

TPRFF/GMC Possibility of a takeover -

Yes, crazy numbers here. total enterprise value with debt

under 250mm canadian.

A buyer can payoff debt, 100mm, and reap returns of

over 25-35% per year if purchased for $5.

This can happen in a flash.

Any thoughts?

by liquorc

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=145035997

Note the bottom lines;

Given Segovia's growth profile and low production cost, I believe

the stock is worth 15x forward earnings, or approximately $10/share,

representing close to 500% upside.

If the company continues to execute, then fair value should increase

over time.

Importantly, the company is now funding its growth from operating

cash flow; that eliminates the need for financing, which

is commonly a problem for junior miners.

The greatest risk to the thesis is the price of gold.

If gold were to fall to $1000/oz then I estimate that the company

would earn only around $0.10 of EPS;

at a 10x earnings multiple (reflecting thinner margins),

the stock would be worth $1/share, or ~40% downside.

Additionally, there remain operational tail risks, such as a

prolonged conflict with artisanal miners or gangs/guerrillas,

which could seriously impair the value of the company's assets.

Overall, I believe the very large upside potential more than

compensates investors for bearing these risks.

Disclosure: I am/we are long TPRFF.

The Largest Underground Gold And Silver Producer In Colombia - Gran Colombia Gold Corp.

Cambridge House International Inc.

Published on Nov 5, 2018

Watch as Mike Davies, CFO of Gran Colombia Gold Corp. (TSX: GCM),

discusses their new milestones for 2018.

https://www.youtube.com/watch?v=0fvFlrAOCKQ

Gran Colombia Gold: Extremely Deep-Value Gold Miner

https://seekingalpha.com/article/4216358-gran-colombia-gold-extremely-deep-value-gold-miner

Summary

•The stock trades at less than 3x forward earnings.

•Investors have ignored the company due to earlier financial trouble and no sell-side coverage.

•Dramatic valuation divergence from other gold miners, coupled with ongoing growth, creates a setup for huge returns.

Gold Market Update By: Clive Maund

Published: Monday, 5 November 2018 | Print | Comment - New!

The Precious Metals sector continues to be viewed with disdain and

skepticism by the vast majority of investors, which is exactly what you

want and expect to see at the earliest stages of a major bullmarket.

However, the charts continue to shape up well, as we will now see.

http://news.goldseek.com/CliveMaund/1541423160.php

Gran Colombia Gold Corp (TPRFF) CEO Lombardo Arenas on Q3 2018 Results - Earnings Call Transcript

Nov. 14, 2018 1:26 PM ET | About: Gran Colombia Gold Corp. (TPRFF)

https://seekingalpha.com/article/4222166-gran-colombia-gold-corp-tprff-ceo-lombardo-arenas-q3-2018-results-earnings-call-transcript?part=single

In GOD We Trust -

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.