| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Friday, November 16, 2018 9:56:36 AM

History Supports Bullish Move But Earnings Last Night Could Dampen Bulls' Victory Thursday

By: Tom Bowley | November 16, 2018

If only for a day, technology stocks (XLK, +2.51%) resumed its leadership role. And it's likely to only be one day after two ugly quarterly earnings reports in the semiconductor space ($DJUSSC, +3.22%). This industry group will almost certainly be under intense selling pressure when the opening bell rings, but I'll be most interested in what happens after the bell rings. Any chartist would recognize that NVIDIA's (NVDA) and Applied Materials' (AMAT) earnings reports were not likely to be good. Both stocks have been spiraling lower for months - NVDA has lost 1/3 of its market cap since October 1st when it was trading at an all-time high and AMAT has been nearly cut in half since hitting $62 per share in March. Everyone should have predicted poor results, but will see an exhaustive selloff at today's open? Are these both cases of "sell on rumor, buy on news"? Today's candle will tell the story.

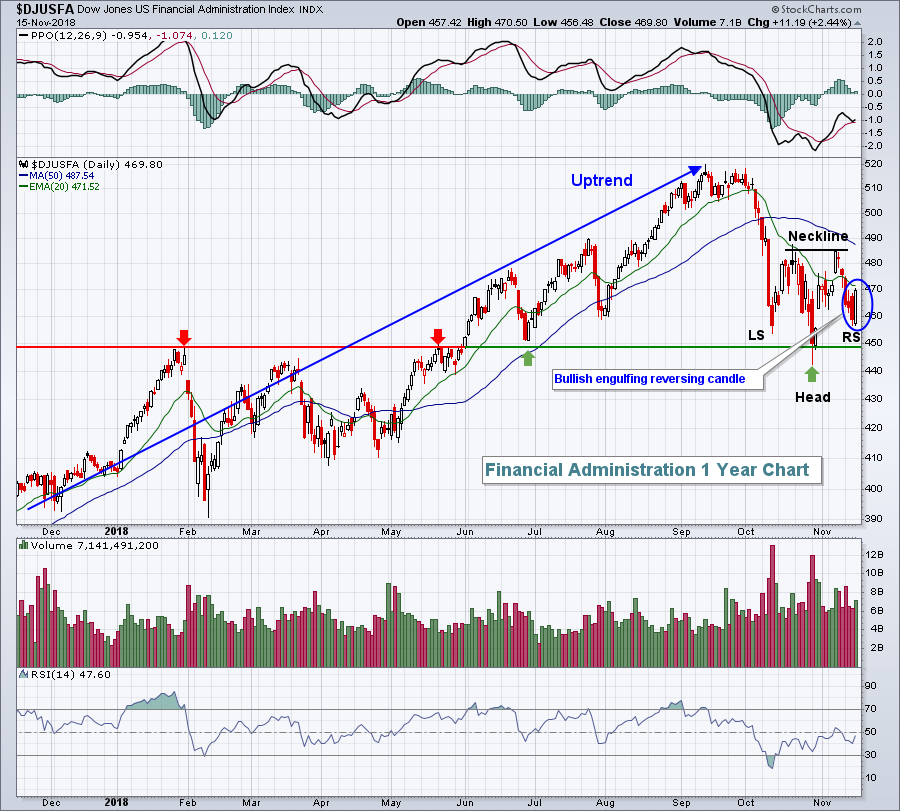

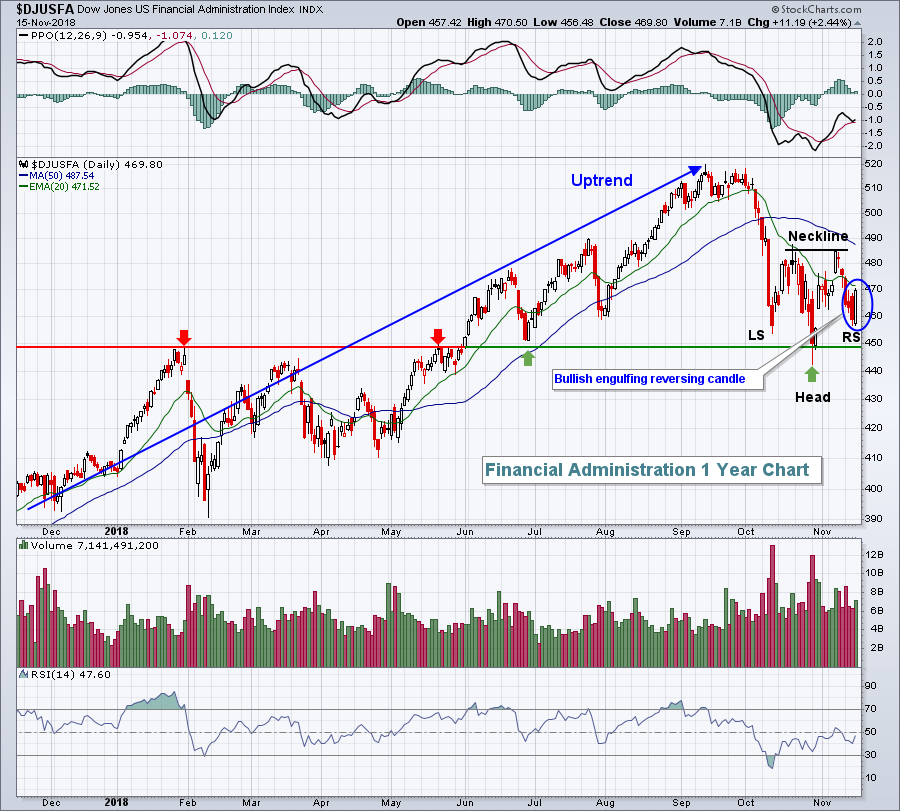

Financials (XLF, +1.48%), energy (XLE, +1.47%), materials (XLB, +1.37%) and industrials (XLI, +1.32%) all gained more than 1% on the session. Leading financials was the group that's led throughout much of the past couple years - financial administration ($DJUSFA, +2.44%) - as Square (SQ, +5.43%) and PayPal (PYPL, +3.20) both enjoyed solid days. The DJUSFA appears to have completed a bullish inverse head & shoulders continuation pattern with yesterday's bullish engulfing candle:

Remember one thing. A bullish pattern isn't a pattern until it's confirmed with a breakout to execute the pattern. That would require a close above 486 and heavy volume to accompany the breakout would add significance to the breakout and pattern.

Banks ($DJUSBK, +1.96%) also enjoyed a very strong session as the 10 year treasury yield ($TNX) reversed to close at 3.12% after touching 3.08% intraday.

Pre-Market Action

Crude oil ($WTIC) continues to find support and buyers as it attempts to reverse the huge slide that began six weeks ago from $77 per barrel. We saw a Tuesday low just beneath $55 per barrel. This morning, crude is up more than 2% to $57.66 at last check. That should help the energy ETF (XLE), which has easily been the worst performing sector over the past month and a half.

The Fed's Richard Clarida suggested that the Fed is moving closer to "neutral", suggesting that economic data ahead will determine whether the Fed's policy will be one of loosening or tightening. Those comments have money rotating towards treasuries this morning, with the 10 year treasury yield ($TNX) falling back to 3.09%, a drop of 3 basis points to challenge yesterday's low.

Asian markets were mixed overnight, while European markets are clearly lower. That European weakness, along with a couple not-so-great earnings reports last night, has U.S. futures on the defensive. Dow Jones futures are lower by 153 points with 30 minutes left to the opening bell. On a percentage basis, NASDAQ futures look to open even lower.

Current Outlook

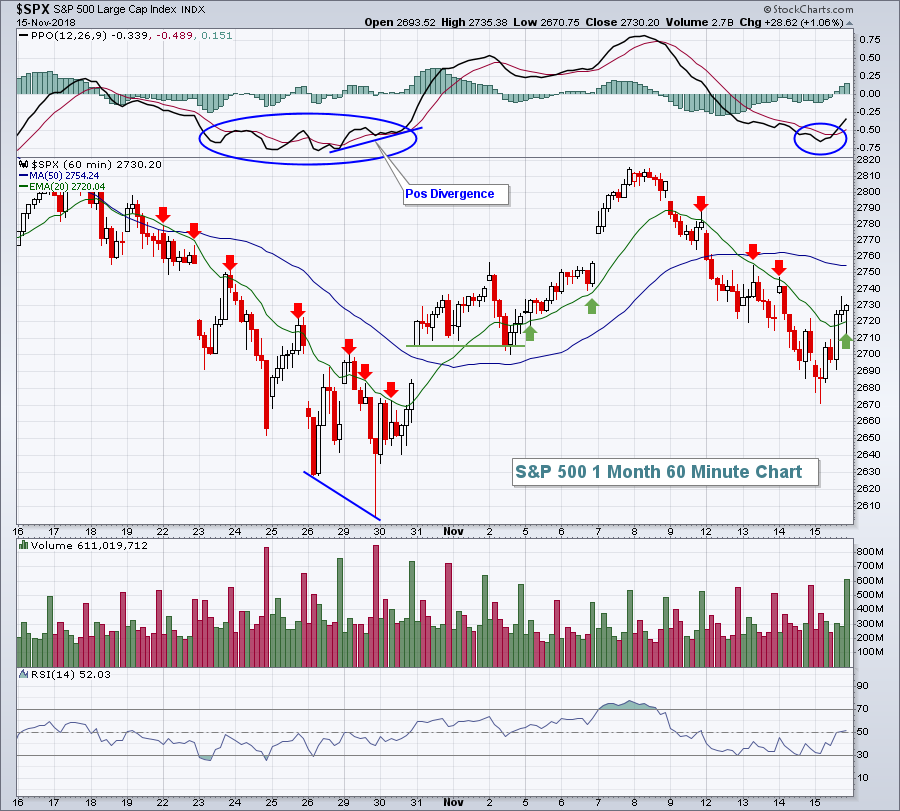

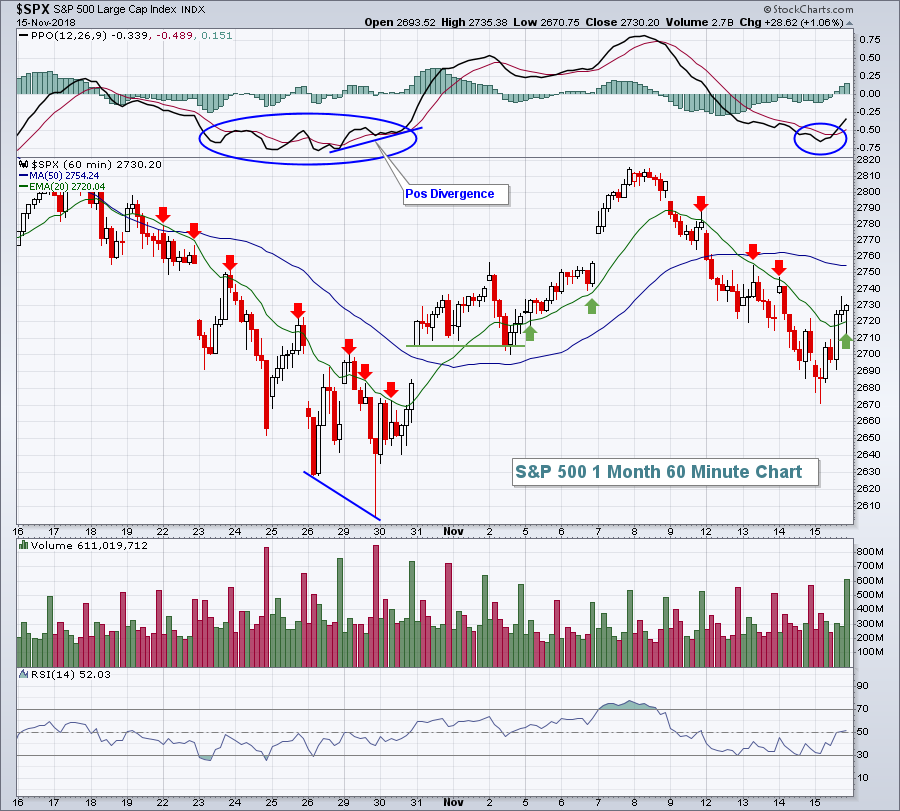

The near-term downtrend on the S&P 500 was ended yesterday during the afternoon buying spree, or was it? Recently, I've provided charts showing that the declining 20 hour EMA has provided overhead resistance on bounces. Well, that changed yesterday as price surged above both the 20 hour and 50 hour moving averages. Furthermore, when selling kicked in, the now-rising 20 hour EMA held as support:

But the October selloff ended with a much more predictable pattern as momentum slowed (positive divergence printed) as we neared a bottom. There was no such pattern yesterday. We filled gap support down to the October 30th close and then the buying began - all with the PPO accelerating lower. Is this just a blip to the upside within a bigger picture of selling? Today will likely provide us some clues. Futures are weak on the heels of several ugly quarterly earnings reports from high profile technology names like NVIDIA (NVDA) and Applied Materials (AMAT). Semiconductors ($DJUSSC) provided technology and the overall market a big lift on Thursday, but are likely to be under considerable pressure today given those two earnings reports.

Read More »»»

• DiscoverGold

By: Tom Bowley | November 16, 2018

If only for a day, technology stocks (XLK, +2.51%) resumed its leadership role. And it's likely to only be one day after two ugly quarterly earnings reports in the semiconductor space ($DJUSSC, +3.22%). This industry group will almost certainly be under intense selling pressure when the opening bell rings, but I'll be most interested in what happens after the bell rings. Any chartist would recognize that NVIDIA's (NVDA) and Applied Materials' (AMAT) earnings reports were not likely to be good. Both stocks have been spiraling lower for months - NVDA has lost 1/3 of its market cap since October 1st when it was trading at an all-time high and AMAT has been nearly cut in half since hitting $62 per share in March. Everyone should have predicted poor results, but will see an exhaustive selloff at today's open? Are these both cases of "sell on rumor, buy on news"? Today's candle will tell the story.

Financials (XLF, +1.48%), energy (XLE, +1.47%), materials (XLB, +1.37%) and industrials (XLI, +1.32%) all gained more than 1% on the session. Leading financials was the group that's led throughout much of the past couple years - financial administration ($DJUSFA, +2.44%) - as Square (SQ, +5.43%) and PayPal (PYPL, +3.20) both enjoyed solid days. The DJUSFA appears to have completed a bullish inverse head & shoulders continuation pattern with yesterday's bullish engulfing candle:

Remember one thing. A bullish pattern isn't a pattern until it's confirmed with a breakout to execute the pattern. That would require a close above 486 and heavy volume to accompany the breakout would add significance to the breakout and pattern.

Banks ($DJUSBK, +1.96%) also enjoyed a very strong session as the 10 year treasury yield ($TNX) reversed to close at 3.12% after touching 3.08% intraday.

Pre-Market Action

Crude oil ($WTIC) continues to find support and buyers as it attempts to reverse the huge slide that began six weeks ago from $77 per barrel. We saw a Tuesday low just beneath $55 per barrel. This morning, crude is up more than 2% to $57.66 at last check. That should help the energy ETF (XLE), which has easily been the worst performing sector over the past month and a half.

The Fed's Richard Clarida suggested that the Fed is moving closer to "neutral", suggesting that economic data ahead will determine whether the Fed's policy will be one of loosening or tightening. Those comments have money rotating towards treasuries this morning, with the 10 year treasury yield ($TNX) falling back to 3.09%, a drop of 3 basis points to challenge yesterday's low.

Asian markets were mixed overnight, while European markets are clearly lower. That European weakness, along with a couple not-so-great earnings reports last night, has U.S. futures on the defensive. Dow Jones futures are lower by 153 points with 30 minutes left to the opening bell. On a percentage basis, NASDAQ futures look to open even lower.

Current Outlook

The near-term downtrend on the S&P 500 was ended yesterday during the afternoon buying spree, or was it? Recently, I've provided charts showing that the declining 20 hour EMA has provided overhead resistance on bounces. Well, that changed yesterday as price surged above both the 20 hour and 50 hour moving averages. Furthermore, when selling kicked in, the now-rising 20 hour EMA held as support:

But the October selloff ended with a much more predictable pattern as momentum slowed (positive divergence printed) as we neared a bottom. There was no such pattern yesterday. We filled gap support down to the October 30th close and then the buying began - all with the PPO accelerating lower. Is this just a blip to the upside within a bigger picture of selling? Today will likely provide us some clues. Futures are weak on the heels of several ugly quarterly earnings reports from high profile technology names like NVIDIA (NVDA) and Applied Materials (AMAT). Semiconductors ($DJUSSC) provided technology and the overall market a big lift on Thursday, but are likely to be under considerable pressure today given those two earnings reports.

Read More »»»

• DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.