| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Friday, November 09, 2018 10:32:11 AM

S&P 500 Hesitates At Next Key Price Resistance

By: Tom Bowley | November 9, 2018

Well, another Fed day has come and gone. The FOMC ended its two day meeting and left rates unchanged, as expected. It promised, however, further gradual increases. If you recall, the spike in the 10 year treasury yield ($TNX) to 3.25%, a 7 year high, accompanied the October dive in equity prices. Many market pundits were blaming higher interest rates for the selling in equities. Yet, the latest rise in U.S. stocks has been accompanied with a similar rise in the TNX to 3.23%. Still, the Fed's discussion of further rate hikes will be pointed to by many as a problem for stocks. I'm not in that camp. Instead, I'm in the camp that's simply watching the price action and sector rotation. More on that in the Current Outlook section below.

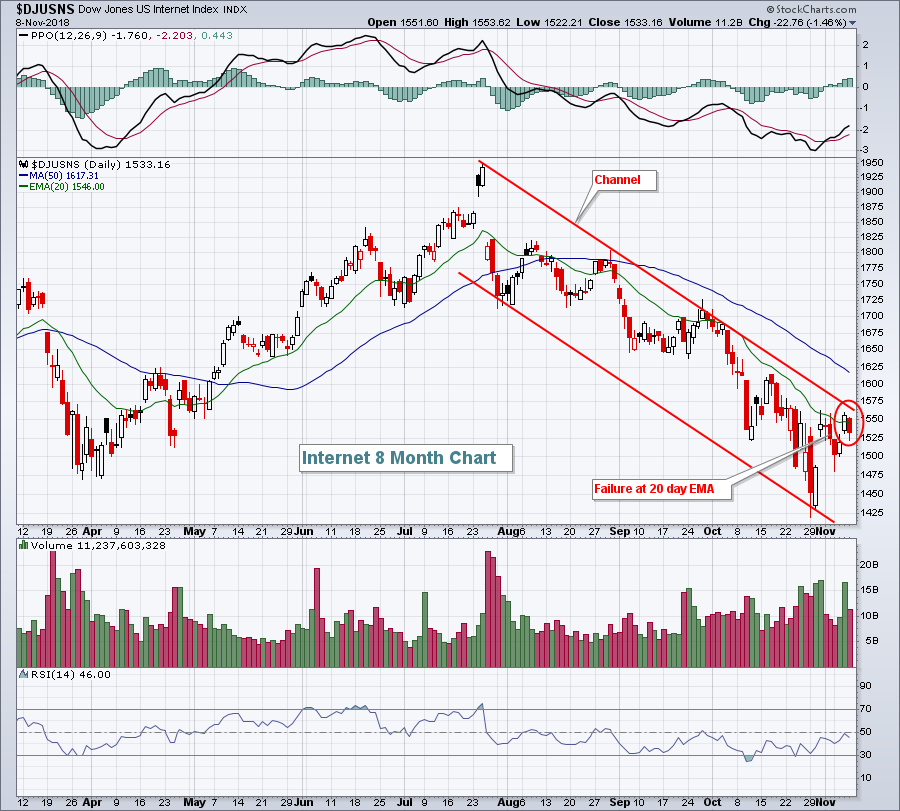

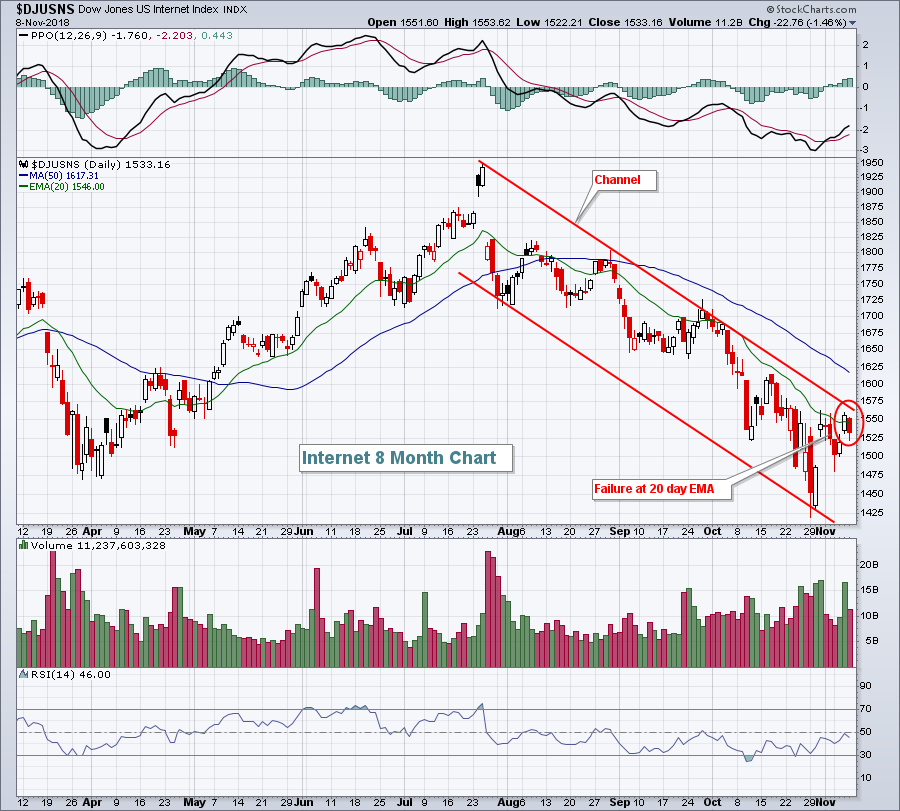

On Wednesday, U.S. indices ended in bifurcated fashion with the Dow Jones clinging to a small 11 point gain while the other major indices finished in negative territory. Sectors were evenly split between gains and losses, but the clear losers on the day were energy (XLE, -2.17%) and communication services (XLC, -0.94%). The latter was impacted by the continuing absolute and relative weakness in internet stocks ($DJUSNS, -1.46%). After closing above its declining 20 day EMA on Wednesday, the DJUSNS fell back beneath it on Thursday as Spotify (SPOT, -6.02%), Take-Two Interactive Software (TTWO, -5.30%), Netflix (NFLX, -2.93%) and Facebook (FB, -2.42%) all suffered significant losses. Here's the group's failure:

That's a well-defined downtrend channel where the failure yesterday took place. Internet stocks may in time right the ship, but currently it's a group I'd avoid.

Energy, meanwhile, has been ignoring the latest precipitous drop in crude oil prices ($WTIC). Check this out:

Watch to see if crude oil finds a bid near the $59 level. That's the February 2018 low. If that doesn't hold, the XLE could be in big trouble as we move forward.

Pre-Market Action

The U.S. Dollar Index ($USD) is on the rise again and nearing a 16 month high, which is putting additional pressure on commodities. Crude oil prices ($WTIC) are down another buck this morning to under $60 per barrel for the first time since the February 2018 low. The $59 support level is very important in my view. Look for another potentially rough day in the energy space given the tumbling crude prices.

Gold ($GOLD) is also having a tough morning, down $12 per ounce to $1213. The $1180-$1240 trading range remains in play. GOLD will have a difficult time breaking out to the upside if the USD continues rising.

Most Asian markets suffered losses of 1-2% overnight and European indices are lower as well. A surprisingly hot PPI and Core PPI report this morning may have traders on edge as well. Dow Jones futures are currently lower by 146 points with a little more than 30 minutes left to the opening bell.

Current Outlook

I mentioned during MarketWatchers LIVE yesterday that the bears were on the defensive as the S&P 500 had climbed to a very significant price resistance level and had done so just as short-term price relative breakdowns were occurring in a few key defensive areas. If the S&P 500 could clear the 2817 area with money rotating to aggressive areas of the market, in my opinion, a lot more technical buyers would appear. Fortunately for the bears, they provided resistance and won the short-term battle yesterday afternoon. Here's a 3 month 60 minute chart that's worth keeping an eye on:

The intraday price to watch on the S&P 500 is 2816.94 and the closing price is 2813.89. Keeping an eye on the above sector relative charts would be a good idea as well. If the S&P 500 pulls back further, but we don't really see much outperformance by defensive sectors, that could be a very important signal that the weakness won't last.

Read More »»»

• DiscoverGold

By: Tom Bowley | November 9, 2018

Well, another Fed day has come and gone. The FOMC ended its two day meeting and left rates unchanged, as expected. It promised, however, further gradual increases. If you recall, the spike in the 10 year treasury yield ($TNX) to 3.25%, a 7 year high, accompanied the October dive in equity prices. Many market pundits were blaming higher interest rates for the selling in equities. Yet, the latest rise in U.S. stocks has been accompanied with a similar rise in the TNX to 3.23%. Still, the Fed's discussion of further rate hikes will be pointed to by many as a problem for stocks. I'm not in that camp. Instead, I'm in the camp that's simply watching the price action and sector rotation. More on that in the Current Outlook section below.

On Wednesday, U.S. indices ended in bifurcated fashion with the Dow Jones clinging to a small 11 point gain while the other major indices finished in negative territory. Sectors were evenly split between gains and losses, but the clear losers on the day were energy (XLE, -2.17%) and communication services (XLC, -0.94%). The latter was impacted by the continuing absolute and relative weakness in internet stocks ($DJUSNS, -1.46%). After closing above its declining 20 day EMA on Wednesday, the DJUSNS fell back beneath it on Thursday as Spotify (SPOT, -6.02%), Take-Two Interactive Software (TTWO, -5.30%), Netflix (NFLX, -2.93%) and Facebook (FB, -2.42%) all suffered significant losses. Here's the group's failure:

That's a well-defined downtrend channel where the failure yesterday took place. Internet stocks may in time right the ship, but currently it's a group I'd avoid.

Energy, meanwhile, has been ignoring the latest precipitous drop in crude oil prices ($WTIC). Check this out:

Watch to see if crude oil finds a bid near the $59 level. That's the February 2018 low. If that doesn't hold, the XLE could be in big trouble as we move forward.

Pre-Market Action

The U.S. Dollar Index ($USD) is on the rise again and nearing a 16 month high, which is putting additional pressure on commodities. Crude oil prices ($WTIC) are down another buck this morning to under $60 per barrel for the first time since the February 2018 low. The $59 support level is very important in my view. Look for another potentially rough day in the energy space given the tumbling crude prices.

Gold ($GOLD) is also having a tough morning, down $12 per ounce to $1213. The $1180-$1240 trading range remains in play. GOLD will have a difficult time breaking out to the upside if the USD continues rising.

Most Asian markets suffered losses of 1-2% overnight and European indices are lower as well. A surprisingly hot PPI and Core PPI report this morning may have traders on edge as well. Dow Jones futures are currently lower by 146 points with a little more than 30 minutes left to the opening bell.

Current Outlook

I mentioned during MarketWatchers LIVE yesterday that the bears were on the defensive as the S&P 500 had climbed to a very significant price resistance level and had done so just as short-term price relative breakdowns were occurring in a few key defensive areas. If the S&P 500 could clear the 2817 area with money rotating to aggressive areas of the market, in my opinion, a lot more technical buyers would appear. Fortunately for the bears, they provided resistance and won the short-term battle yesterday afternoon. Here's a 3 month 60 minute chart that's worth keeping an eye on:

The intraday price to watch on the S&P 500 is 2816.94 and the closing price is 2813.89. Keeping an eye on the above sector relative charts would be a good idea as well. If the S&P 500 pulls back further, but we don't really see much outperformance by defensive sectors, that could be a very important signal that the weakness won't last.

Read More »»»

• DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.