Saturday, November 03, 2018 12:59:48 PM

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=144504783

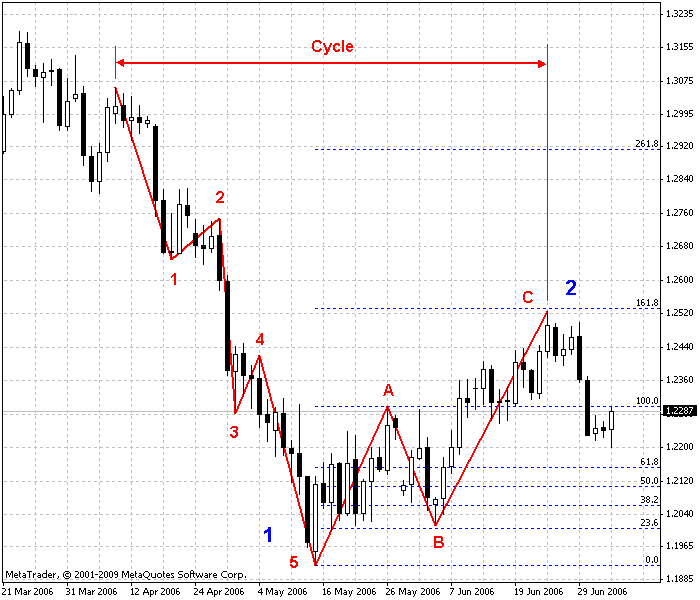

Buy after an Elliott Wave 5-Wave Decline

________________________________________________________________

Fibonacci Numbers and Retrace Targets: Explained

Fibonacci Numbers

http://www.stockta.com/cgi-bin/school.pl?page=fib

Fibonacci Retracements

* Golden 61.8% Retracements

* Moderate 38.2% Retracements

* Common 38.2% Retracements

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:fibonacci_retracemen

Fibonacci Retracements

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=77145842

________________________________________________________________

Fibonacci Numbers

are commonly used in Technical Analysis

with or without a knowledge of Elliot Wave Analysis

to determine potential support, resistance,

and price objectives.

The most popular Fibonacci Retracements are

61.8% and 38.2%

61.8% retracements

imply a new trend is establishing itself.

38.2% retracements

usually imply that the prior trend will continue

38.2% retracements

are considered natural retracements in a healthy trend.

Fibonacci Retracements

can be applied after a decline

to forecast the length of a counter-trend bounce.

________________________________________________________________

The 50% retracement is not based on a Fibonacci number.

Instead, this number stems from Dow Theory's assertion

that the Averages often retrace half their prior move.

50% retracement

implies indecision.

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

_________________________________________________________________

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • BLO • Apr 25, 2024 8:52 AM

Kona Gold Beverages, Inc. Announces Name Change to NuVibe, Inc. and Initiation of Ticker Symbol Application Process • KGKG • Apr 25, 2024 8:30 AM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM