Monday, October 29, 2018 9:27:10 PM

Border Worries Solved

TGYS

Hot new American beverage guaranteed to cure Fear and other anxiety border issues.

and if your traveling to Mexico

Make sure and stop in at one of our many tennis shoes stores

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Ok Let's Go.....

Now back to reality

TGYS

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

The Metals:

Gold dropped $6.30 to $1227.70 in London and spiked down to $1224.50 in early afternoon New York trade, but it then rallied back higher into the close and ended with a loss of just 0.4%. Silver slipped to as low as $14.417 before it also bounced higher, but it still ended with a loss of 1.7%.

Euro gold fell to about €1080, platinum gained $11.50 to $834.50, and copper dropped 3 cents to about $2.72.

Gold and silver equities waffled near unchanged and ended slightly lower.

The Economy:

US reportedly planning tariffs on remaining $257 billion in Chinese goods if Trump-Xi talks fail CNBC

Bar Is High for Fed to Help Investors, Morgan Stanley Says Bloomberg

U.S. consumer spending rises; income gain smallest in 15 months Reuters

Wage increases are the highest on record, business economists say MarketWatch

Tomorrow brings the Case-Shiller home price index, Consumer confidence, and Home ownership.

The Markets:

Oil fell almost 1% on demand concerns.

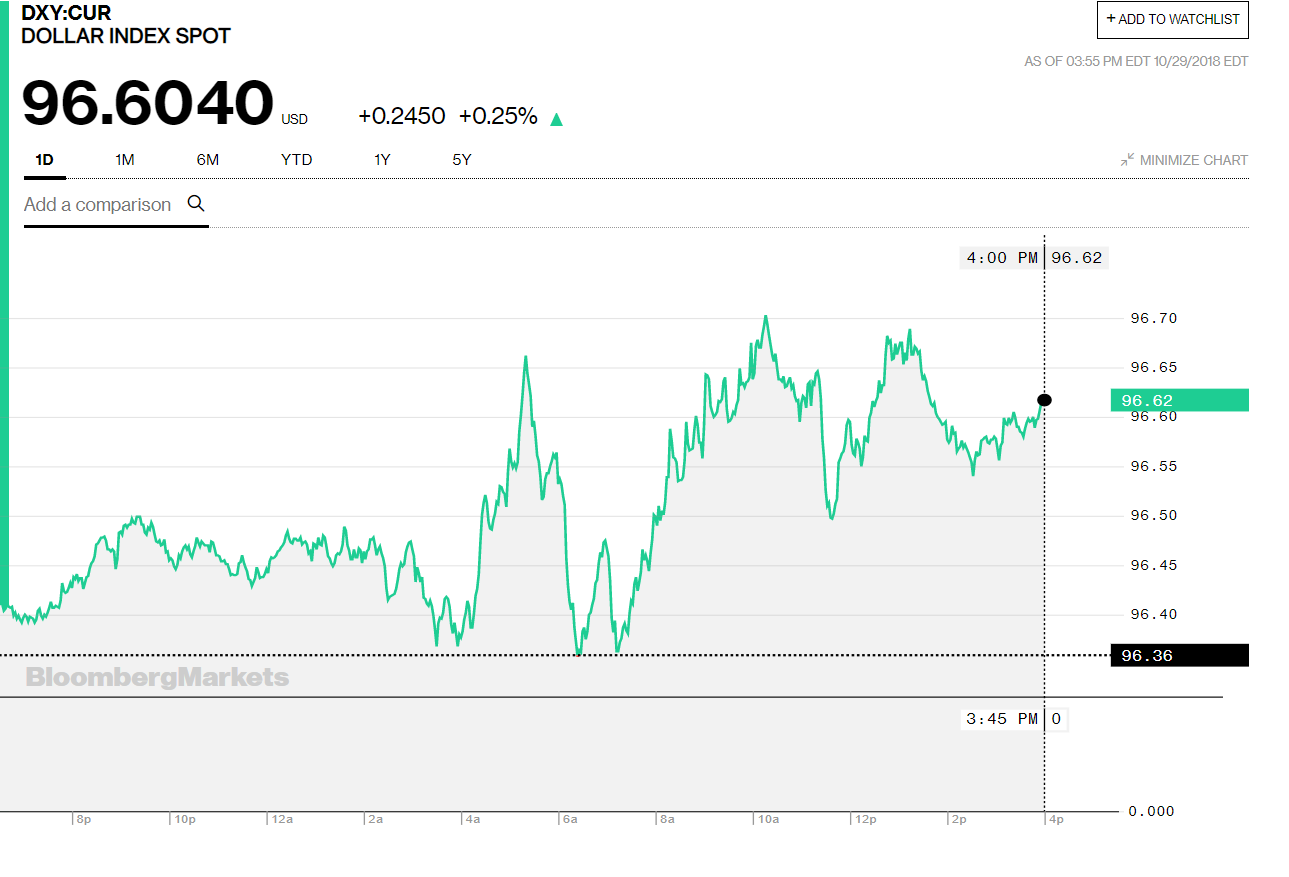

The U.S. dollar index rose as the euro fell “after German Chancellor Angela Merkel announced she would step down as party leader and not run for political office again after her term ends in 2021.”

Treasuries ended slightly lower in mixed trade while the Dow, Nasdaq, and S&P erased notable early gains and ended roughly 1% lower on renewed concerns about a US-China trade war.

Among the big names making news in the market today were GM, Hain Celestial, and IBM/Red Hat.

GATA Posts:

LBMA to reveal size of London's gold market on Nov. 20

A Bundesbank economist has a radical plan to halve Italy's debt

The Miners:

Goldcorp’s GG grant, Golden Star’s GSS share consolidation, and Goldcorp’s GG Normal Course Issuer Bid were among the big stories in the gold and silver mining industry making headlines today.

WINNERS

1. NovaGold

NG +3.78% $4.12

2. Newmont

NEM +2.53% $30.76

3. EMX Royalty

EMX +2.40% $1.28

LOSERS

1. Paramount

PZG -7.14% $1.04

2. Gold Standard

GSV -5.13% $1.48

3. Alamos

AGI -4.37% $4.16

Winners & Losers tracks NYSE listed gold and silver mining stocks that trade over $1.

- Chris Mullen,

Gold seeker

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Wax on Wax off

Neutron bombs kill broad swaths of human being without inflicting serious collateral explosive damage on physical infrastructure and systems. Fed monetary policy and GOP fiscal policy are like economic neutron bombs.

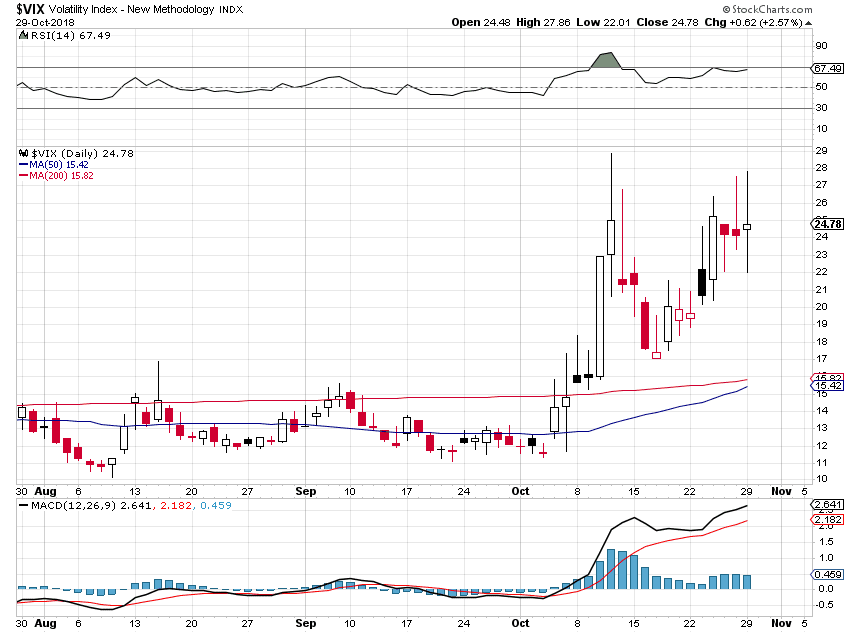

The early 'risk on' trade and big acquisition by IBM of Red Hat had the bulls and their spokesmodels all giddy this morning.

Alas, it was not meant to be— again.

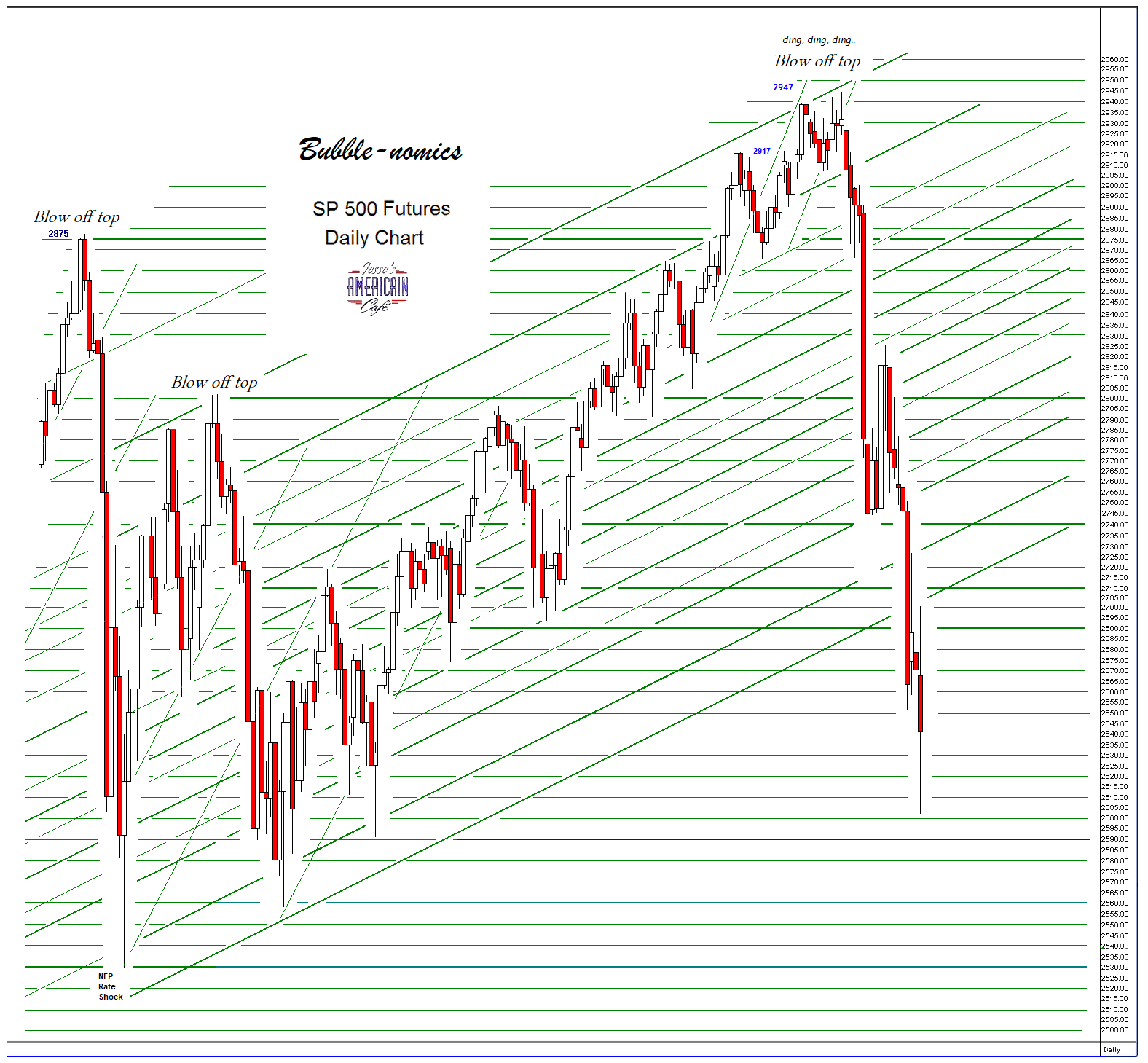

Stocks gave up all their morning gains, and sold off hard, although they did come off the lows of the day as the financial TV carnies pointed out so hopefully.

'What will turn this market around?' they plaintively whined. 'The puppies aren't eating the puppy food.'

Let's see, besides hot money and bullshit, what has been the backbone and mainstay of this 'Trump rally' for a very long time.

US equities will soon be coming out of the 'blackout period' for buybacks of their own stocks, which has been a major and sustaining force of stock price gains in this latest financial asset bubble. Before they were financing these buybacks, designed to hollow out the company's value while enhancing executive option gains, with corporate debt.

Now they also have a huge grant from the US government in the form of tax cuts in addition to the tax subsidies for executive compensation. The wealth transfers will continue until they can no longer be sustained— because it pays so well for the decisionmakers.

It's a big club— and you aren't in it. No matter what political party of economic school to which you proudly pledge your loyalty and proclaim your faithfulness. You are not counted by them as among the winners. You are cannon fodder, food for predators, a foolish chunk of meat.

The dollar was up again today, to the higher levels of its recent trading range. Gold and silver were lower as a consequence, although gold came back a bit on a the big stock sell off.

Before the internet changed everything, people who love books used to go to actual bookstores and search the stacks for those little gems that they would read and add to their collections.

As a long time collector and reader I used to frequent the antiquarian book stores in the Pittsburgh area, where I went to graduate business school, including a couple located in the very quaint residential Squirrel Hill section to the east of the city.

This is the site of the vicious attack on a group of worshipers in the Tree of Life Synagogue. It must have been jarring to have this happen in such a quiet and friendly residential neighborhood. They are all in my thoughts and prayers.

Have a pleasant evening.

https://jessescrossroadscafe.blogspot.com/

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Neil Diamond's America

https://www.youtube.com/watch?v=wTSLRbm8L9E

.jpg)

TGYS

Hot new American beverage guaranteed to cure Fear and other anxiety border issues.

and if your traveling to Mexico

Make sure and stop in at one of our many tennis shoes stores

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Ok Let's Go.....

Now back to reality

TGYS

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

The Metals:

Gold dropped $6.30 to $1227.70 in London and spiked down to $1224.50 in early afternoon New York trade, but it then rallied back higher into the close and ended with a loss of just 0.4%. Silver slipped to as low as $14.417 before it also bounced higher, but it still ended with a loss of 1.7%.

Euro gold fell to about €1080, platinum gained $11.50 to $834.50, and copper dropped 3 cents to about $2.72.

Gold and silver equities waffled near unchanged and ended slightly lower.

The Economy:

US reportedly planning tariffs on remaining $257 billion in Chinese goods if Trump-Xi talks fail CNBC

Bar Is High for Fed to Help Investors, Morgan Stanley Says Bloomberg

U.S. consumer spending rises; income gain smallest in 15 months Reuters

Wage increases are the highest on record, business economists say MarketWatch

Tomorrow brings the Case-Shiller home price index, Consumer confidence, and Home ownership.

The Markets:

Oil fell almost 1% on demand concerns.

The U.S. dollar index rose as the euro fell “after German Chancellor Angela Merkel announced she would step down as party leader and not run for political office again after her term ends in 2021.”

Treasuries ended slightly lower in mixed trade while the Dow, Nasdaq, and S&P erased notable early gains and ended roughly 1% lower on renewed concerns about a US-China trade war.

Among the big names making news in the market today were GM, Hain Celestial, and IBM/Red Hat.

GATA Posts:

LBMA to reveal size of London's gold market on Nov. 20

A Bundesbank economist has a radical plan to halve Italy's debt

The Miners:

Goldcorp’s GG grant, Golden Star’s GSS share consolidation, and Goldcorp’s GG Normal Course Issuer Bid were among the big stories in the gold and silver mining industry making headlines today.

WINNERS

1. NovaGold

NG +3.78% $4.12

2. Newmont

NEM +2.53% $30.76

3. EMX Royalty

EMX +2.40% $1.28

LOSERS

1. Paramount

PZG -7.14% $1.04

2. Gold Standard

GSV -5.13% $1.48

3. Alamos

AGI -4.37% $4.16

Winners & Losers tracks NYSE listed gold and silver mining stocks that trade over $1.

- Chris Mullen,

Gold seeker

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Wax on Wax off

Neutron bombs kill broad swaths of human being without inflicting serious collateral explosive damage on physical infrastructure and systems. Fed monetary policy and GOP fiscal policy are like economic neutron bombs.

The early 'risk on' trade and big acquisition by IBM of Red Hat had the bulls and their spokesmodels all giddy this morning.

Alas, it was not meant to be— again.

Stocks gave up all their morning gains, and sold off hard, although they did come off the lows of the day as the financial TV carnies pointed out so hopefully.

'What will turn this market around?' they plaintively whined. 'The puppies aren't eating the puppy food.'

Let's see, besides hot money and bullshit, what has been the backbone and mainstay of this 'Trump rally' for a very long time.

US equities will soon be coming out of the 'blackout period' for buybacks of their own stocks, which has been a major and sustaining force of stock price gains in this latest financial asset bubble. Before they were financing these buybacks, designed to hollow out the company's value while enhancing executive option gains, with corporate debt.

Now they also have a huge grant from the US government in the form of tax cuts in addition to the tax subsidies for executive compensation. The wealth transfers will continue until they can no longer be sustained— because it pays so well for the decisionmakers.

It's a big club— and you aren't in it. No matter what political party of economic school to which you proudly pledge your loyalty and proclaim your faithfulness. You are not counted by them as among the winners. You are cannon fodder, food for predators, a foolish chunk of meat.

The dollar was up again today, to the higher levels of its recent trading range. Gold and silver were lower as a consequence, although gold came back a bit on a the big stock sell off.

Before the internet changed everything, people who love books used to go to actual bookstores and search the stacks for those little gems that they would read and add to their collections.

As a long time collector and reader I used to frequent the antiquarian book stores in the Pittsburgh area, where I went to graduate business school, including a couple located in the very quaint residential Squirrel Hill section to the east of the city.

This is the site of the vicious attack on a group of worshipers in the Tree of Life Synagogue. It must have been jarring to have this happen in such a quiet and friendly residential neighborhood. They are all in my thoughts and prayers.

Have a pleasant evening.

https://jessescrossroadscafe.blogspot.com/

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Neil Diamond's America

https://www.youtube.com/watch?v=wTSLRbm8L9E

.jpg)

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.