Thursday, October 11, 2018 6:02:15 PM

Markets Shattering Golds Starts Walking On Broken Glass

Hello everyone and Welcome

Gold Green Lights Today YeeHaw

The Music:

M&MTGYS

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

The Metals:

Gold held near unchanged for most of the day in Asia, but it then began a steady advance in London, accelerated higher in New York, and ended near its late session high of $1226.10 with a gain of 2.48%. Silver surged to as high as $14.621 and ended with a gain of 1.75%.

Euro gold rose above €1054, platinum lost $2 to $820, and copper climbed 2 cents to about $2.77.

Gold and silver equities rose throughout the day and ended roughly 7% higher.

The Economy:

Trump says the Federal Reserve caused the stock market correction, but he won't fire Chair Powell CNBC

White House adviser Kudlow says Fed remains independent: CNBC Reuters

Trump calls 'loco' Federal Reserve 'too aggressive': Fox interview Reuters

U.S. inflation slows in September, weekly jobless claims rise Reuters

Tomorrow brings Import prices and Consumer sentiment.

The Markets:

Oil lost 3%, the U.S. dollar index dropped, and treasuries rose while the Dow, Nasdaq, and S&P fell markedly at times on an acceleration of yesterday’s risk-off trade.

Among the big names making news in the market today were Square, Bayer, Walgreens, and Tesla.

GATA Posts:

Signs suggest China may tolerate yuan's weakening past 7 per dollar

The Miners:

B2Gold’s BTG third quarter production, Barrick’s ABX third quarter production, Fortuna’s FSM third quarter production and rainfall event, and Endeavour Silver’s EXK third quarter production were among the big stories in the gold and silver mining industry making headlines today.

WINNERS

1. Harmony

HMY +15.91% $2.04

2. Sibanye

SBGL +13.67% $3.16

3. AngloGold

AU +9.75% $9.68

LOSER

1. Fortuna

FSM -2.58% $4.15

Winners & Losers tracks NYSE listed gold and silver mining stocks that trade over $1.

- Chris Mullen, Gold Seeker Report

Thank You Chris

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

The Charts:

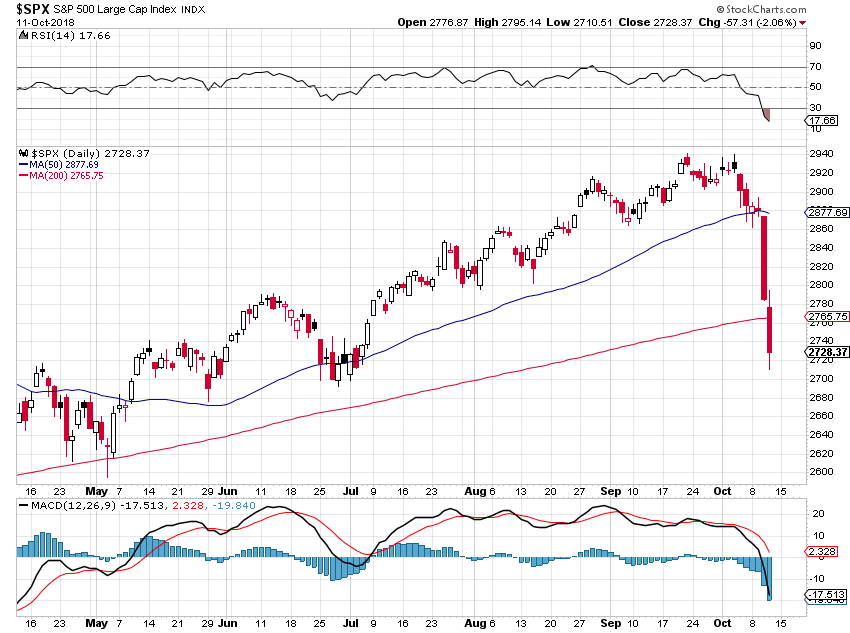

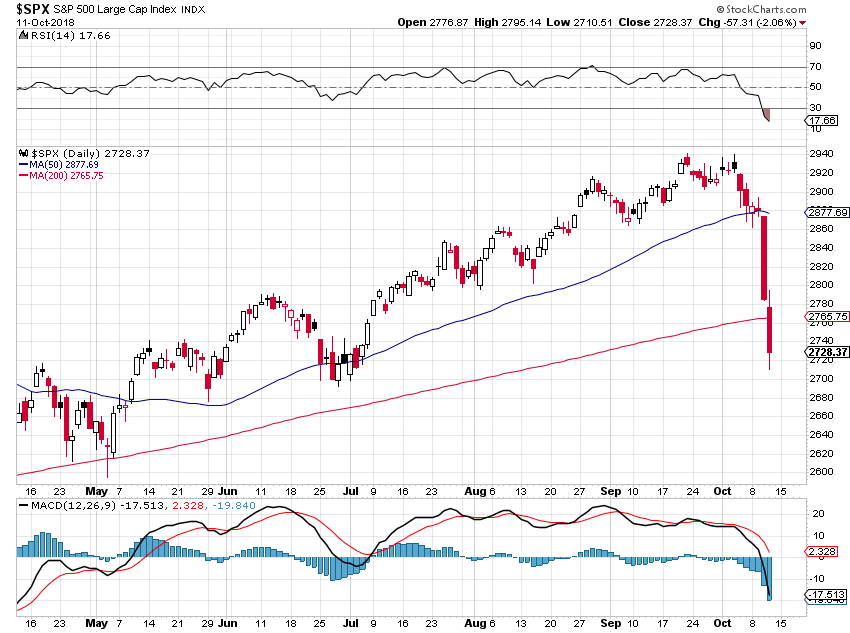

Shocktober Day 2: Stock Rout Accelerates As Bonds, Bullion Surge

China was ugly overnight with about 1000 companies halted 10% limit-down...

AsiaPac was a bloodbath... (down 10 days in a row and 27% from the highs)

Europe plunged (led by Italy)...

US Futures show the chaos and hopeful rebounds that just kept failing today...

Nasdaq flip-flopped desperately around unchanged for much of the day before margin calls hit...

Since October began, Trannies, Nasdaq, and Small Caps are down 9%!.

... and below its 200DMA (first close below since April)...)

The Dow was down almost 700 points at its worst and then a headline about a Trump-Xi meeting sparked panic-buying...back above its 200DMA...

The Dow ended down 545 points today - Double Top much? The Dow is down 1950 points from its highs last week

Nasdaq remains below its 200DMA...

Nasdaq 100 on track for its worst month since November 2008...

“There is a tipping point where higher rates start to have potentially a negative impact on growth and on equity valuations,” said Toby Gibb, client portfolio manager at Fidelity International in London. “People have started to get concerned that we may be approaching that level.”

Small Caps are well below their 200DMA and went red for 2018 today...

YTD gains are evaporating...

And Healthcare Sector is now best YTD -outperforming Tech...

S&P Tech closed below the 200DMA - first time since Brexit...

Only 1.5% of S&P Tech stocks are above their 50DMA...

VIX reached almost 29 intraday...

With the term structure now massively inverted...

As Stocks were slammed, bonds and bullion saw safe haven bids...

Bonds were bid as stocks skidded...

The yield curve flattened notably on the day...

The Dollar Index continued to slide to one-week lows...

Yuan soared today - interestingly following Mnuchin's face-to-face with the PBOC...biggest spike since August - WTF did Mnuchin say?

Cryptos were dumped too as Asia markets opened...

WTI Crude tumbled to a $70 handle on inventories and OPEC demand downgrades, but PMs were the big winner...

WTI had its worst 2-day drop since March 2017...

Gold futures spiked to $1230 today, highest since July (jumping by the most since Brexit), breaking above its 50DMA and the $1200 Maginot Line...

Since The Fed hiked rates in September, there's only one asset class in the green...

Finally, we ask, are US markets about to start the Great Rotation back into sync with the rest of the world...

ZeroHedge

10/11/18

Thank You Tyler

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Most Economists and Market Pundits In De-nile - Walk Like an Egyptian

"No regulatory penalties, no criminal indictments for fraud, no clawbacks, no prohibitions of bonuses at least during early phase of financial market recovery, all of this sticks in my mind as unjustifiable— and imprudent, as it taught a lasting lesson that bankers had immunity."

Dr. Harald Malmgren

"At the recent market peak, the most reliable measures of U.S. equity market valuation (those best correlated w/actual subsequent long-term returns) were about 200% above (3 times) historical norms. No market cycle, not even 2002, 2009, has ended at valuations even half that level."

John Hussman

Yesterday I said:

"The 2770 level on the SP 500 Futures chart looks like an important support level. Below that the bulls will need to start taking Xanax if they break 2740 and stick a close below that."

The continuous contract SP 500 futures, which is what I watch and chart, failed to hold that support at 2770, and closed at 2747, after an intraday low at 2712, which is the diagonal support line from the previous correction lows.

As for big cap tech, after a plunge to test 6905 they managed to come off the lows and actually finish in the green around 7040

So at least for today the market stabilization crew can claim 'mission accomplished.'

The Dollar took a bit of a dive today, as the safe haven buying flocked to the bonds, sending yields lower, and to gold and silver which had the kinds of bounces we have not seen in some time.

Gold finished near the upper band of its recent short term trading range.

Let's see how the wiseguys manage the markets yesterday, going into the weekend.

As previously noted, a decent attempt to get the stocks back higher, after some possible doodling around down here near support is certainly possible.

I have not bothered to calculate the percent declines and Fibonacci retracement levels yet, as the current correction is still rather 'young.'

We are on the brink of earnings season once again, and those firms coming out and warning are being beaten rather soundly.

If stock buybacks are the main thing that the stock bulls can look forward to, then they are just delaying the inevitable.

Have a pleasant evening.

Jesse's Cafe

Thank You Jesse

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Your Viewing Mining & Metals The Graveyard Shift on Investors Hub

Wishing Y'All a Good evening

and Thanks

J:D

Lake Street Dive - "Walking on Broken Glass" - WXPN Performance Studio

https://www.youtube.com/watch?v=j1y_PHS0x4U

.jpg)

Hello everyone and Welcome

Gold Green Lights Today YeeHaw

The Music:

M&MTGYS

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

The Metals:

Gold held near unchanged for most of the day in Asia, but it then began a steady advance in London, accelerated higher in New York, and ended near its late session high of $1226.10 with a gain of 2.48%. Silver surged to as high as $14.621 and ended with a gain of 1.75%.

Euro gold rose above €1054, platinum lost $2 to $820, and copper climbed 2 cents to about $2.77.

Gold and silver equities rose throughout the day and ended roughly 7% higher.

The Economy:

Trump says the Federal Reserve caused the stock market correction, but he won't fire Chair Powell CNBC

White House adviser Kudlow says Fed remains independent: CNBC Reuters

Trump calls 'loco' Federal Reserve 'too aggressive': Fox interview Reuters

U.S. inflation slows in September, weekly jobless claims rise Reuters

Tomorrow brings Import prices and Consumer sentiment.

The Markets:

Oil lost 3%, the U.S. dollar index dropped, and treasuries rose while the Dow, Nasdaq, and S&P fell markedly at times on an acceleration of yesterday’s risk-off trade.

Among the big names making news in the market today were Square, Bayer, Walgreens, and Tesla.

GATA Posts:

Signs suggest China may tolerate yuan's weakening past 7 per dollar

The Miners:

B2Gold’s BTG third quarter production, Barrick’s ABX third quarter production, Fortuna’s FSM third quarter production and rainfall event, and Endeavour Silver’s EXK third quarter production were among the big stories in the gold and silver mining industry making headlines today.

WINNERS

1. Harmony

HMY +15.91% $2.04

2. Sibanye

SBGL +13.67% $3.16

3. AngloGold

AU +9.75% $9.68

LOSER

1. Fortuna

FSM -2.58% $4.15

Winners & Losers tracks NYSE listed gold and silver mining stocks that trade over $1.

- Chris Mullen, Gold Seeker Report

Thank You Chris

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

The Charts:

Shocktober Day 2: Stock Rout Accelerates As Bonds, Bullion Surge

China was ugly overnight with about 1000 companies halted 10% limit-down...

AsiaPac was a bloodbath... (down 10 days in a row and 27% from the highs)

Europe plunged (led by Italy)...

US Futures show the chaos and hopeful rebounds that just kept failing today...

Nasdaq flip-flopped desperately around unchanged for much of the day before margin calls hit...

Since October began, Trannies, Nasdaq, and Small Caps are down 9%!.

The Dow was down almost 700 points at its worst and then a headline about a Trump-Xi meeting sparked panic-buying...back above its 200DMA...

The Dow ended down 545 points today - Double Top much? The Dow is down 1950 points from its highs last week

Nasdaq remains below its 200DMA...

Nasdaq 100 on track for its worst month since November 2008...

“There is a tipping point where higher rates start to have potentially a negative impact on growth and on equity valuations,” said Toby Gibb, client portfolio manager at Fidelity International in London. “People have started to get concerned that we may be approaching that level.”

Small Caps are well below their 200DMA and went red for 2018 today...

YTD gains are evaporating...

And Healthcare Sector is now best YTD -outperforming Tech...

S&P Tech closed below the 200DMA - first time since Brexit...

Only 1.5% of S&P Tech stocks are above their 50DMA...

VIX reached almost 29 intraday...

With the term structure now massively inverted...

As Stocks were slammed, bonds and bullion saw safe haven bids...

Bonds were bid as stocks skidded...

The yield curve flattened notably on the day...

The Dollar Index continued to slide to one-week lows...

Yuan soared today - interestingly following Mnuchin's face-to-face with the PBOC...biggest spike since August - WTF did Mnuchin say?

Cryptos were dumped too as Asia markets opened...

WTI Crude tumbled to a $70 handle on inventories and OPEC demand downgrades, but PMs were the big winner...

WTI had its worst 2-day drop since March 2017...

Gold futures spiked to $1230 today, highest since July (jumping by the most since Brexit), breaking above its 50DMA and the $1200 Maginot Line...

Since The Fed hiked rates in September, there's only one asset class in the green...

Finally, we ask, are US markets about to start the Great Rotation back into sync with the rest of the world...

ZeroHedge

10/11/18

Thank You Tyler

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Most Economists and Market Pundits In De-nile - Walk Like an Egyptian

"No regulatory penalties, no criminal indictments for fraud, no clawbacks, no prohibitions of bonuses at least during early phase of financial market recovery, all of this sticks in my mind as unjustifiable— and imprudent, as it taught a lasting lesson that bankers had immunity."

Dr. Harald Malmgren

"At the recent market peak, the most reliable measures of U.S. equity market valuation (those best correlated w/actual subsequent long-term returns) were about 200% above (3 times) historical norms. No market cycle, not even 2002, 2009, has ended at valuations even half that level."

John Hussman

Yesterday I said:

"The 2770 level on the SP 500 Futures chart looks like an important support level. Below that the bulls will need to start taking Xanax if they break 2740 and stick a close below that."

The continuous contract SP 500 futures, which is what I watch and chart, failed to hold that support at 2770, and closed at 2747, after an intraday low at 2712, which is the diagonal support line from the previous correction lows.

As for big cap tech, after a plunge to test 6905 they managed to come off the lows and actually finish in the green around 7040

So at least for today the market stabilization crew can claim 'mission accomplished.'

The Dollar took a bit of a dive today, as the safe haven buying flocked to the bonds, sending yields lower, and to gold and silver which had the kinds of bounces we have not seen in some time.

Gold finished near the upper band of its recent short term trading range.

Let's see how the wiseguys manage the markets yesterday, going into the weekend.

As previously noted, a decent attempt to get the stocks back higher, after some possible doodling around down here near support is certainly possible.

I have not bothered to calculate the percent declines and Fibonacci retracement levels yet, as the current correction is still rather 'young.'

We are on the brink of earnings season once again, and those firms coming out and warning are being beaten rather soundly.

If stock buybacks are the main thing that the stock bulls can look forward to, then they are just delaying the inevitable.

Have a pleasant evening.

Jesse's Cafe

Thank You Jesse

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Your Viewing Mining & Metals The Graveyard Shift on Investors Hub

Wishing Y'All a Good evening

and Thanks

J:D

Lake Street Dive - "Walking on Broken Glass" - WXPN Performance Studio

https://www.youtube.com/watch?v=j1y_PHS0x4U

.jpg)

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.