Tuesday, October 02, 2018 5:03:22 PM

$RXMD = GREAT INVESTMENT, OVER 20 MILLION REVS

RXMD IS ON A COURSE FOR SUCCESS, ON OTCQB and NASDAQ

OUTLOOK FOR 2018: Completion of TWO REVENUE PRODUCING ACQUISTIONS (TouchPointRX Complete)

OUTLOOK FOR 2019: SEC Reporting Compliance, NASDAQ Uplist, and more ACQUISITIONS

ALL POINTS TO CONTINUED DEVELOPMENT AND GROWTH THROUGH EXPANSION ****INVEST WISELY****

WITH EXTREMELY LOW SHARE STRUCTURE

RXMD Security Details

Share Structure

Authorized Shares

500,000,000 08/31/2018

Outstanding Shares

431,221,376 on 08/31/2018 This balance also includes 5,590,432 common shares that were beneficially owned by Progressive Care through PharmCo, LLC and Progressive Training, Inc. and will be retired back to Treasury. So actual amount is 425,630,944 Outstanding on F/S

Previously 428,997,097 on 7/17/18

Restricted

82,224,982 08/31/2018

Unrestricted

348,996,394 08/31/2018

Float

334,506,590 03/31/2018

SHORT TERM PRICE TARGET $.35

https://finance.yahoo.com/news/seethruequity-issues-progressive-care-inc-131500911.html

http://www.seethruequity.com/wp-content/uploads/2018/03/RXMD-UPDATE-MAR-9-2018-FINAL.pdf

[/color]

***THE REAL DEAL***

TWO REAL BRICK AND MORTAR LOCATIONS SERVICING:

MIAMI DADE COUNTY, FLORIDA

MARTIN COUNTY, FLORIDA

PALM BEACH COUNTY, FLORIDA

BROWARD COUNTY, FLORIDA

ST. LUCIE COUNTY, FLORIDA

70 Employees

2 YEARS AUDITED FINANCIAL STATEMENTS

OTCQB with INDEPENDENT BOARD and AUDIT COMMITTEE MEMBERS

HERES SOME JUICY 2018 NUMBERS - W NEW LOCATION ACQUIRED 3/30/18, these revenues will start to be recognized July 1, 2018

Scripts: 187,877 a 8.7% increase compared to August 31, 2017

Net Revenue: $14.1 million, a $565,000+ increase compared to August 31, 2017

340B Sales: $3.8 million, a $2.2 million+ increase compared to August 31, 2017

Annualized, 2018 340B Sales are estimated at $6.1 Million, that's a 120% increase over 2017's $2.75 Million. PharmCoRX is obviously increasing the number of customers.

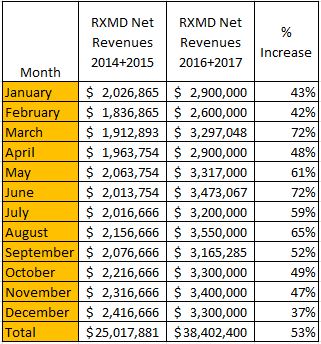

Then let’s observe increase in revenue last year. JUST KEEPS INCREASING YOY

Then check out increase in revenue from the last 2 years.

Overall

G - FY 2013 = $9.3 million

R - FY 2014 = $11.3 million

O - FY 2015 = $13.7 million

W - FY 2016 = $18.3 million (AUDITED)

T - FY 2017 = $20.1 million (AUDITED) does not include 340B revenues of $2.75 million

H - FY 2018 = $14.1 million (8 months) does not include 340B revenues of $3.8 million

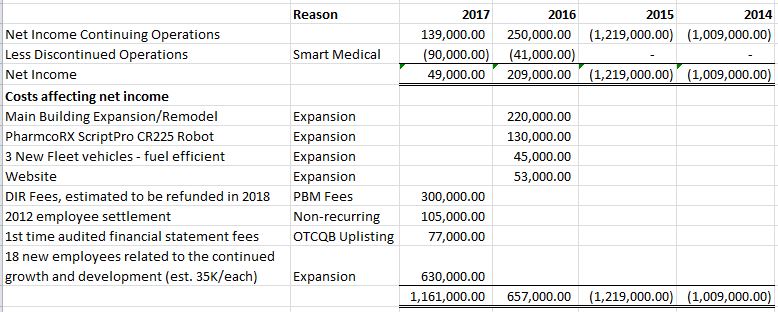

LET'S TALK ABOUT INCOME FROM PREVIOUS YEARS

Shall We . . .

FY 2017 = AUDITED Net Income, and w/o Discontinued Operations Net Income is $139,251

FY 2016 = AUDITED Net Income, and w/o Discontinued Operations Net Income is $259,319

Yes it did go down by $120,000, but quite explainable with information detailed below and still extraordinary when you consider the improvement from 2015 and 2014,

FY 2015 = $(1,219,000) Net Loss

FY 2014 = $(1,009,000) Net Loss

Expenses effecting additional net income has been applied to development, growth, and expansion initiatives. Growing, Growing, Growing. Everything says they are using money to GROW.

Available Cash Is Building Up !!!

End Of 2017 = $419,000 2nd Qtr 2018 = $705,890

FY 2017 A/R = $1,270,114 2nd Qtr 2018 = $ 1,165,855

Cash and A/R Combined Cash Assets

December 31, 2017 = $1,689,000

June, 2018 = $1,871,745

[color=blue]EVERYTHING IS MOVING FORWARDS AND LOOKING GREAT !!!

Another Acquisition Scheduled for 2018

Another Acquisition, SEC Reporting Compliance, and NASDAQ Uplifting for early 2019

RXMD IS ON A COURSE FOR SUCCESS, ON OTCQB and NASDAQ

OUTLOOK FOR 2018: Completion of TWO REVENUE PRODUCING ACQUISTIONS (TouchPointRX Complete)

OUTLOOK FOR 2019: SEC Reporting Compliance, NASDAQ Uplist, and more ACQUISITIONS

ALL POINTS TO CONTINUED DEVELOPMENT AND GROWTH THROUGH EXPANSION ****INVEST WISELY****

WITH EXTREMELY LOW SHARE STRUCTURE

RXMD Security Details

Share Structure

Authorized Shares

500,000,000 08/31/2018

Outstanding Shares

431,221,376 on 08/31/2018 This balance also includes 5,590,432 common shares that were beneficially owned by Progressive Care through PharmCo, LLC and Progressive Training, Inc. and will be retired back to Treasury. So actual amount is 425,630,944 Outstanding on F/S

Previously 428,997,097 on 7/17/18

Restricted

82,224,982 08/31/2018

Unrestricted

348,996,394 08/31/2018

Float

334,506,590 03/31/2018

SHORT TERM PRICE TARGET $.35

https://finance.yahoo.com/news/seethruequity-issues-progressive-care-inc-131500911.html

http://www.seethruequity.com/wp-content/uploads/2018/03/RXMD-UPDATE-MAR-9-2018-FINAL.pdf

[/color]

***THE REAL DEAL***

TWO REAL BRICK AND MORTAR LOCATIONS SERVICING:

MIAMI DADE COUNTY, FLORIDA

MARTIN COUNTY, FLORIDA

PALM BEACH COUNTY, FLORIDA

BROWARD COUNTY, FLORIDA

ST. LUCIE COUNTY, FLORIDA

70 Employees

2 YEARS AUDITED FINANCIAL STATEMENTS

OTCQB with INDEPENDENT BOARD and AUDIT COMMITTEE MEMBERS

HERES SOME JUICY 2018 NUMBERS - W NEW LOCATION ACQUIRED 3/30/18, these revenues will start to be recognized July 1, 2018

Scripts: 187,877 a 8.7% increase compared to August 31, 2017

Net Revenue: $14.1 million, a $565,000+ increase compared to August 31, 2017

340B Sales: $3.8 million, a $2.2 million+ increase compared to August 31, 2017

Annualized, 2018 340B Sales are estimated at $6.1 Million, that's a 120% increase over 2017's $2.75 Million. PharmCoRX is obviously increasing the number of customers.

Then let’s observe increase in revenue last year. JUST KEEPS INCREASING YOY

Then check out increase in revenue from the last 2 years.

Overall

G - FY 2013 = $9.3 million

R - FY 2014 = $11.3 million

O - FY 2015 = $13.7 million

W - FY 2016 = $18.3 million (AUDITED)

T - FY 2017 = $20.1 million (AUDITED) does not include 340B revenues of $2.75 million

H - FY 2018 = $14.1 million (8 months) does not include 340B revenues of $3.8 million

LET'S TALK ABOUT INCOME FROM PREVIOUS YEARS

Shall We . . .

FY 2017 = AUDITED Net Income, and w/o Discontinued Operations Net Income is $139,251

FY 2016 = AUDITED Net Income, and w/o Discontinued Operations Net Income is $259,319

Yes it did go down by $120,000, but quite explainable with information detailed below and still extraordinary when you consider the improvement from 2015 and 2014,

FY 2015 = $(1,219,000) Net Loss

FY 2014 = $(1,009,000) Net Loss

Expenses effecting additional net income has been applied to development, growth, and expansion initiatives. Growing, Growing, Growing. Everything says they are using money to GROW.

Available Cash Is Building Up !!!

End Of 2017 = $419,000 2nd Qtr 2018 = $705,890

FY 2017 A/R = $1,270,114 2nd Qtr 2018 = $ 1,165,855

Cash and A/R Combined Cash Assets

December 31, 2017 = $1,689,000

June, 2018 = $1,871,745

[color=blue]EVERYTHING IS MOVING FORWARDS AND LOOKING GREAT !!!

Another Acquisition Scheduled for 2018

Another Acquisition, SEC Reporting Compliance, and NASDAQ Uplifting for early 2019

"To Give Anything Less Than Your Best, Is To Sacrifice the Gift." - Steve Prefontaine

Selling shares at $.019 prior to run to $.26 would have been my biggest failure. Glad it wasn't me!! ;-)

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.