Friday, September 21, 2018 9:20:24 PM

Closing Report

Good evening everybody

and Welcome Weekend

J:D

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

The Metals:

Gold gained $3.70 to $1211.00 in Asia before it crashed down to $1192.00 in early New York trade and then chopped back higher into the close, but it still ended with a loss of 0.69%. Silver slipped to as low as $14.155 and ended with a loss of just 0.07%.

Euro gold fell back under €1021, platinum lost $3.50 to $826, and copper jumped 8 cents to about $2.82.

Gold and silver equities fell over 1% at the open before they rallied back above unchanged by late morning, but they then drifted back lower into the close and ended not far from their opening lows.

The Economy:

US: Markit Manufacturing PMI improves to 55.6 in September vs 55 expected CNBC

Mortgage rates jump to four-month high as housing market hits a bump MarketWatch

Fed's Powell between a rock and hard place: Ignore the yield curve or tight job market? Reuters

PM May's statement on Brexit talks after EU rejects her proposals Reuters

The Markets:

Oil rose almost 1% after Reuters reported that “OPEC and other oil producers are discussing the possibility of raising output by 500,000 barrels per day (bpd) to counter falling supply from Iran because of U.S. sanctions.”

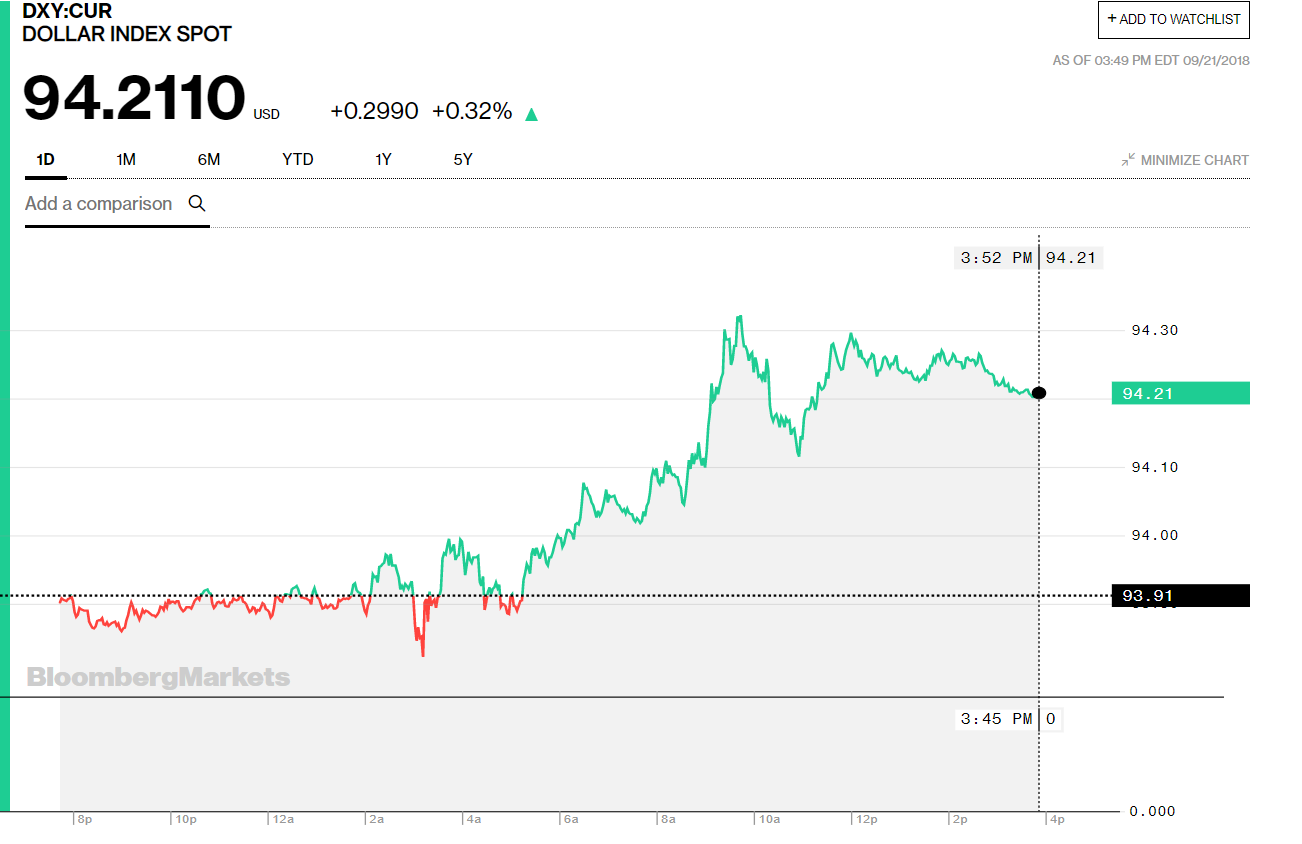

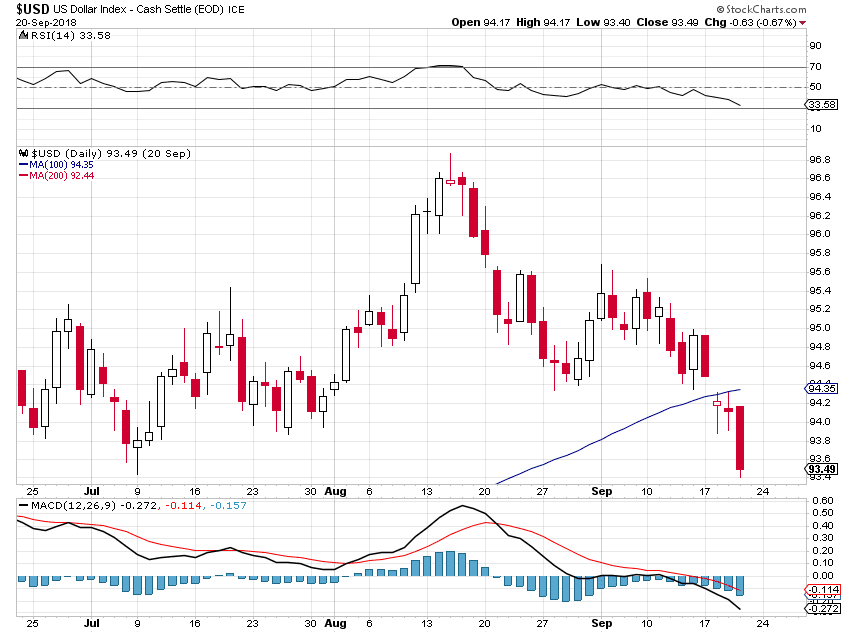

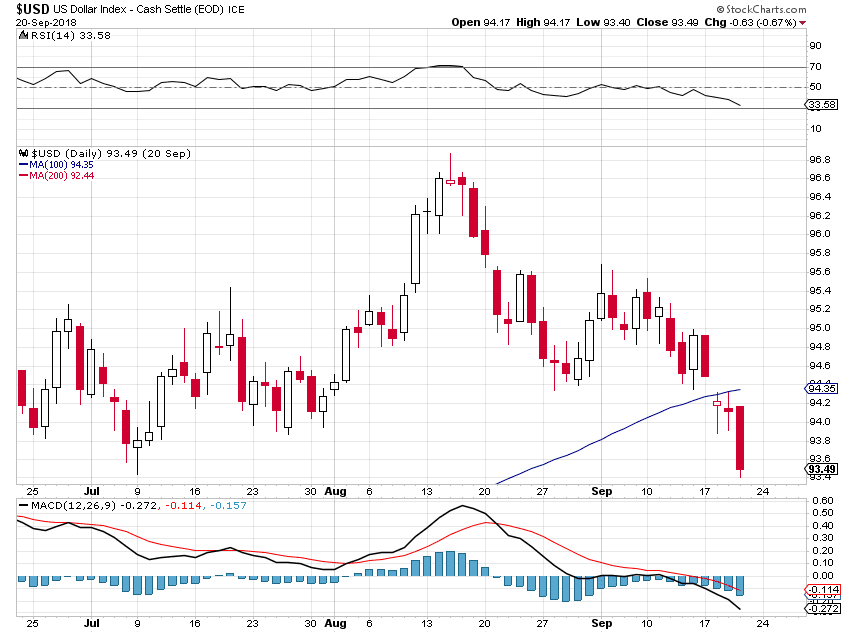

The U.S. dollar index rose as the pound and euro fell “after British Prime Minister Theresa May said the European Union must supply an alternative Brexit proposal.”

Treasuries held near unchanged as the Dow, Nasdaq, and S&P traded mixed on uncertainty about OPEC’s meeting this weekend.

Among the big names making news in the market Friday were Farfetch, Target, Caterpillar, Adobe, and Micron.

GATA Posts:

Ted Butler: A constructive suggestion

John Paulson is joined by 15 investors in council to oversee gold miners

Japan hit by another cryptocurrency heist, with $60 million stolen

GATA asks CFTC if market rigging by U.S. govt. is legal

Submitted by cpowell on Fri, 2018-09-21 16:50. Section: Daily Dispatches

12:56p ET Friday, September 21, 2018

Dear Friend of GATA and Gold:

The U.S. Commodity Futures Trading Commission this week announced it has imposed penalties on two futures traders for attempting to manipulate the gold market and other markets with "spoofing" trades:

https://www.cftc.gov/PressRoom/PressReleases/7797-18

https://www.cftc.gov/PressRoom/PressReleases/7796-18

In response, GATA is asking the commission whether its jurisdiction covers futures market manipulation by the U.S. government or brokers acting for the U.S. government, or whether such manipulation is authorized by law, like the Gold Reserve Act of 1934 as amended in the 1970s, which established the U.S. Treasury Department's Exchange Stabilization Fund:

https://www.treasury.gov/resource-center/international/ESF/Pages/esf-ind...

The letter containing GATA's inquiry to the CFTC is posted in PDF format here:

www.gata.org/files/GATALetterCFTC-09-21-2018.pdf

U.S. citizens can assist this endeavor by asking their members of Congress to urge the CFTC to reply promptly to GATA's inquiry.

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

GATA appeals to the new Shareholders Gold Council

Submitted by cpowell on Fri, 2018-09-21 16:33. Section: Daily Dispatches

12:37p ET Friday, September 21, 2018

Dear Friend of GATA and Gold:

Now that the Shareholders Gold Council has formally gotten started, according to the Bloomberg News report dispatched to you a little while ago --

http://www.gata.org/node/18509

-- GATA today is appealing to the council's founder, investment fund manager John Paulson, to allow GATA to make a presentation to the council about the longstanding policy of Western governments and central banks to intervene in the gold market surreptitiously to suppress the monetary metal's price.

The council represents a lot of influence in the monetary metals mining business and the financial markets and might do much to help expose and end the market manipulation.

Of course the World Gold Council ignores this issue and seems to exist mainly so that there might never be a world gold council. Maybe the Shareholders Gold Council can be more relevant both to investors in the monetary metals and to the cause of free markets and transparent and limited government.

GATA's appeal to the Shareholders Gold Council is posted in PDF format here:

http://www.gata.org/files/PaulsonLetter.pdf

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Ted Butler: A constructive suggestion

Submitted by cpowell on Fri, 2018-09-21 16:16. Section: Daily Dispatches

12:20p ET Friday, September 21, 2018

Dear Friend of GATA and Gold:

Responding today to your secretary/treasurer's request a few days ago that he consider the possibility that the U.S. government is the real party in interest behind the rigging of the monetary metals markets and that the investment bank JPMorganChase is just the government's broker --

http://www.gata.org/node/18501

-- silver market analyst and rigging exposer Ted Butler acknowledges the possibility but explains why he still thinks the bank is the main culprit.

Butler's commentary is headlined "A Constructive Suggestion" and it's posted at GoldSeek's companion site, SilverSeek, here --

http://silverseek.com/commentary/constructive-suggestion-17420

-- and at 24hGold here:

http://www.24hgold.com/english/news-gold-silver-a-constructive-suggestio...

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

The Miners:

Newmont’s NEM CEO profile and Avino’s ASM priced offering were among the big stories in the gold and silver mining industry making headlines Friday.

WINNERS

1. DRDGOLD

DRD +23.63% $2.25

2. Paramount

PZG +6.93% $1.08

3. EMX Royalty

EMX +6.19% $1.20

LOSERS

1. McEwen

MUX -4.59% $1.87

2. Tahoe Resources

TAHO -3.70% $2.86

3. Fortuna

FSM -3.10% $4.37

Winners & Losers tracks NYSE listed gold and silver mining stocks that trade over $1.

Gold seek

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

The Music:

Tedeschi Trucks Band - "Midnight in Harlem"

MMGYS

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Autumn - FOMC and Comex Option Expiration Next Week

There was a 'flash crash' in the precious metals futures this morning in honor of the quad witch option expiration.

This is the Dr. Evil strategy, as so named by the US traders who got nailed pulling this baloney in the European bond market some years ago.

It is a massive dumping of contracts into a dull market for the purpose of gaming the price to achieve some objective.

There is a rollback of financial reform and purposefully lax enforcement under the Republicans, who are servants to the moneyed interests. The corporate Democrats do not really care about financial reform either, except to pay it lip service. Like so many other donor-sensitive topics in our corrupt political system it interferes with their pandering to the big money interests with they favor.

The two parties hold up their boogeymen to distract the public. With the GOP it is politically correct, interfering SJWs and evil immigrants, and with the Democrats it is Trump/Russia all the time.

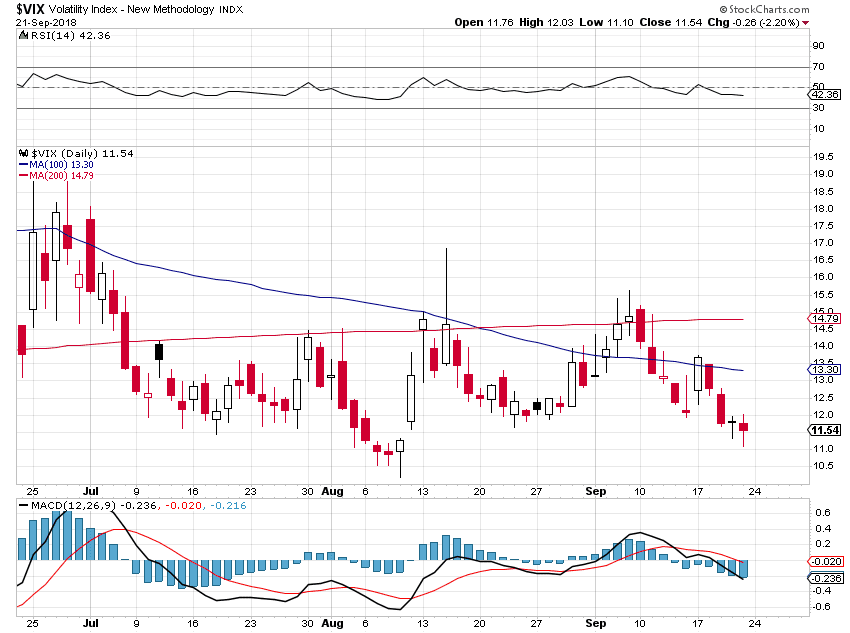

One of the spokesmodels called this a 'risk on' day. While the VIX declined a bit, stocks really not robust at all. It was a quad witch day in which fundamentals apply even less than normal.

Next week there will be an FOMC meeting, with 100% probability of a rate increase, and also an option expiration on the Comex, mostly involving gold. I have included the calendars below.

My mail order of Hula Daddy Kona coffee showed up today, just in time for the weekend. My son is into coffees. It's a treat for him.

Need little, want less, love more. For those who abide in love abide in God, and God in them.

Have a pleasant evening.

https://jessescrossroadscafe.blogspot.com/

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Latest Kitco at this hour

Record Close in The Dow Pressures Risk-On Asset Class

Gary Wagner Friday September 21, 2018 19:01

Gaining 82 points on the day resulted in the Dow Jones Industrial Average closing at a new record high of 26,743.50. This is the second consecutive day in which the Dow traded to a new all-time high. This strong risk-on market sentiment coupled with dollar strength put tremendous downside pressure on gold pricing today.

Gold futures basis the most active (December 2018) Comex contract closed down $7.90 and is currently fixed at $1,203.40 per ounce. Spot gold also traded under pressure resulting in an $8.10 decline and taking current pricing once again below 1,200. Spot gold is currently fixed at $1,198.80.

According to the KGX (Kitco Gold Index), today’s decline is almost an equal mix of selling pressure and dollar strength. A strengthening U.S. dollar accounts for $3.75 with the remaining $4.35 attributable to selling pressure.

With the exception of silver, all of the precious metals traded under selling pressure today resulting in lower pricing. However, the industrial component of silver put any selling pressure at bay, with silver futures closing up 1 ½ cents and is currently fixed at $14.32.

Waiting on the Fed

Next week the Federal Reserve will hold this month’s FOMC meeting (Federal Open Market Committee) beginning on Tuesday and concluding on Wednesday. It is widely expected that the Federal Reserve will announce and initiate an interest rate hike at the conclusion of next week’s meeting.

One primary question in the minds of investors and traders is in regards as to whether or not there will be a further interest rate hikes this year either in November or December.

According to the CME’s FedWatch tool, there is a 93.8% probability that the Fed will raise interest rates by 25 basis points (1/4%) and a 6.2% probability that the Fed will increase rates by 50 basis points (1/2%). This tool also predicts a 91.4% probability that there will be another rate hike in November of 25 basis points, with an 8.5% probability of a 50-basis point rate hike.

Currently, the Fed funds rate (the rate that depository institutions charge to lend reserve money to other banks) is at 175-200 basis points (1 ¾% to 2%). Although the highest probability results in this rate growing to 200-225 basis points, there is a remote possibility that this rate could go as high as 250 basis points by the end of the year.

We can expect the investment community at large to have a wait-and-see investment demeanor at least until Wednesday when the FOMC meeting concludes, and the Federal Reserve releases its monetary policy statement.

For those who would like more information, simply use this link.

Wishing you as always, good trading,

By Gary Wagner

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Have a Great Weekend everybody

and Thank You Mucho !

.jpg)

Good evening everybody

and Welcome Weekend

J:D

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

The Metals:

Gold gained $3.70 to $1211.00 in Asia before it crashed down to $1192.00 in early New York trade and then chopped back higher into the close, but it still ended with a loss of 0.69%. Silver slipped to as low as $14.155 and ended with a loss of just 0.07%.

Euro gold fell back under €1021, platinum lost $3.50 to $826, and copper jumped 8 cents to about $2.82.

Gold and silver equities fell over 1% at the open before they rallied back above unchanged by late morning, but they then drifted back lower into the close and ended not far from their opening lows.

The Economy:

US: Markit Manufacturing PMI improves to 55.6 in September vs 55 expected CNBC

Mortgage rates jump to four-month high as housing market hits a bump MarketWatch

Fed's Powell between a rock and hard place: Ignore the yield curve or tight job market? Reuters

PM May's statement on Brexit talks after EU rejects her proposals Reuters

The Markets:

Oil rose almost 1% after Reuters reported that “OPEC and other oil producers are discussing the possibility of raising output by 500,000 barrels per day (bpd) to counter falling supply from Iran because of U.S. sanctions.”

The U.S. dollar index rose as the pound and euro fell “after British Prime Minister Theresa May said the European Union must supply an alternative Brexit proposal.”

Treasuries held near unchanged as the Dow, Nasdaq, and S&P traded mixed on uncertainty about OPEC’s meeting this weekend.

Among the big names making news in the market Friday were Farfetch, Target, Caterpillar, Adobe, and Micron.

GATA Posts:

Ted Butler: A constructive suggestion

John Paulson is joined by 15 investors in council to oversee gold miners

Japan hit by another cryptocurrency heist, with $60 million stolen

GATA asks CFTC if market rigging by U.S. govt. is legal

Submitted by cpowell on Fri, 2018-09-21 16:50. Section: Daily Dispatches

12:56p ET Friday, September 21, 2018

Dear Friend of GATA and Gold:

The U.S. Commodity Futures Trading Commission this week announced it has imposed penalties on two futures traders for attempting to manipulate the gold market and other markets with "spoofing" trades:

https://www.cftc.gov/PressRoom/PressReleases/7797-18

https://www.cftc.gov/PressRoom/PressReleases/7796-18

In response, GATA is asking the commission whether its jurisdiction covers futures market manipulation by the U.S. government or brokers acting for the U.S. government, or whether such manipulation is authorized by law, like the Gold Reserve Act of 1934 as amended in the 1970s, which established the U.S. Treasury Department's Exchange Stabilization Fund:

https://www.treasury.gov/resource-center/international/ESF/Pages/esf-ind...

The letter containing GATA's inquiry to the CFTC is posted in PDF format here:

www.gata.org/files/GATALetterCFTC-09-21-2018.pdf

U.S. citizens can assist this endeavor by asking their members of Congress to urge the CFTC to reply promptly to GATA's inquiry.

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

GATA appeals to the new Shareholders Gold Council

Submitted by cpowell on Fri, 2018-09-21 16:33. Section: Daily Dispatches

12:37p ET Friday, September 21, 2018

Dear Friend of GATA and Gold:

Now that the Shareholders Gold Council has formally gotten started, according to the Bloomberg News report dispatched to you a little while ago --

http://www.gata.org/node/18509

-- GATA today is appealing to the council's founder, investment fund manager John Paulson, to allow GATA to make a presentation to the council about the longstanding policy of Western governments and central banks to intervene in the gold market surreptitiously to suppress the monetary metal's price.

The council represents a lot of influence in the monetary metals mining business and the financial markets and might do much to help expose and end the market manipulation.

Of course the World Gold Council ignores this issue and seems to exist mainly so that there might never be a world gold council. Maybe the Shareholders Gold Council can be more relevant both to investors in the monetary metals and to the cause of free markets and transparent and limited government.

GATA's appeal to the Shareholders Gold Council is posted in PDF format here:

http://www.gata.org/files/PaulsonLetter.pdf

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Ted Butler: A constructive suggestion

Submitted by cpowell on Fri, 2018-09-21 16:16. Section: Daily Dispatches

12:20p ET Friday, September 21, 2018

Dear Friend of GATA and Gold:

Responding today to your secretary/treasurer's request a few days ago that he consider the possibility that the U.S. government is the real party in interest behind the rigging of the monetary metals markets and that the investment bank JPMorganChase is just the government's broker --

http://www.gata.org/node/18501

-- silver market analyst and rigging exposer Ted Butler acknowledges the possibility but explains why he still thinks the bank is the main culprit.

Butler's commentary is headlined "A Constructive Suggestion" and it's posted at GoldSeek's companion site, SilverSeek, here --

http://silverseek.com/commentary/constructive-suggestion-17420

-- and at 24hGold here:

http://www.24hgold.com/english/news-gold-silver-a-constructive-suggestio...

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

The Miners:

Newmont’s NEM CEO profile and Avino’s ASM priced offering were among the big stories in the gold and silver mining industry making headlines Friday.

WINNERS

1. DRDGOLD

DRD +23.63% $2.25

2. Paramount

PZG +6.93% $1.08

3. EMX Royalty

EMX +6.19% $1.20

LOSERS

1. McEwen

MUX -4.59% $1.87

2. Tahoe Resources

TAHO -3.70% $2.86

3. Fortuna

FSM -3.10% $4.37

Winners & Losers tracks NYSE listed gold and silver mining stocks that trade over $1.

Gold seek

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

The Music:

Tedeschi Trucks Band - "Midnight in Harlem"

MMGYS

"Hello Autumn"

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Autumn - FOMC and Comex Option Expiration Next Week

There was a 'flash crash' in the precious metals futures this morning in honor of the quad witch option expiration.

This is the Dr. Evil strategy, as so named by the US traders who got nailed pulling this baloney in the European bond market some years ago.

It is a massive dumping of contracts into a dull market for the purpose of gaming the price to achieve some objective.

There is a rollback of financial reform and purposefully lax enforcement under the Republicans, who are servants to the moneyed interests. The corporate Democrats do not really care about financial reform either, except to pay it lip service. Like so many other donor-sensitive topics in our corrupt political system it interferes with their pandering to the big money interests with they favor.

The two parties hold up their boogeymen to distract the public. With the GOP it is politically correct, interfering SJWs and evil immigrants, and with the Democrats it is Trump/Russia all the time.

One of the spokesmodels called this a 'risk on' day. While the VIX declined a bit, stocks really not robust at all. It was a quad witch day in which fundamentals apply even less than normal.

Next week there will be an FOMC meeting, with 100% probability of a rate increase, and also an option expiration on the Comex, mostly involving gold. I have included the calendars below.

My mail order of Hula Daddy Kona coffee showed up today, just in time for the weekend. My son is into coffees. It's a treat for him.

Need little, want less, love more. For those who abide in love abide in God, and God in them.

Have a pleasant evening.

https://jessescrossroadscafe.blogspot.com/

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Latest Kitco at this hour

Record Close in The Dow Pressures Risk-On Asset Class

Gary Wagner Friday September 21, 2018 19:01

Gaining 82 points on the day resulted in the Dow Jones Industrial Average closing at a new record high of 26,743.50. This is the second consecutive day in which the Dow traded to a new all-time high. This strong risk-on market sentiment coupled with dollar strength put tremendous downside pressure on gold pricing today.

Gold futures basis the most active (December 2018) Comex contract closed down $7.90 and is currently fixed at $1,203.40 per ounce. Spot gold also traded under pressure resulting in an $8.10 decline and taking current pricing once again below 1,200. Spot gold is currently fixed at $1,198.80.

According to the KGX (Kitco Gold Index), today’s decline is almost an equal mix of selling pressure and dollar strength. A strengthening U.S. dollar accounts for $3.75 with the remaining $4.35 attributable to selling pressure.

With the exception of silver, all of the precious metals traded under selling pressure today resulting in lower pricing. However, the industrial component of silver put any selling pressure at bay, with silver futures closing up 1 ½ cents and is currently fixed at $14.32.

Waiting on the Fed

Next week the Federal Reserve will hold this month’s FOMC meeting (Federal Open Market Committee) beginning on Tuesday and concluding on Wednesday. It is widely expected that the Federal Reserve will announce and initiate an interest rate hike at the conclusion of next week’s meeting.

One primary question in the minds of investors and traders is in regards as to whether or not there will be a further interest rate hikes this year either in November or December.

According to the CME’s FedWatch tool, there is a 93.8% probability that the Fed will raise interest rates by 25 basis points (1/4%) and a 6.2% probability that the Fed will increase rates by 50 basis points (1/2%). This tool also predicts a 91.4% probability that there will be another rate hike in November of 25 basis points, with an 8.5% probability of a 50-basis point rate hike.

Currently, the Fed funds rate (the rate that depository institutions charge to lend reserve money to other banks) is at 175-200 basis points (1 ¾% to 2%). Although the highest probability results in this rate growing to 200-225 basis points, there is a remote possibility that this rate could go as high as 250 basis points by the end of the year.

We can expect the investment community at large to have a wait-and-see investment demeanor at least until Wednesday when the FOMC meeting concludes, and the Federal Reserve releases its monetary policy statement.

For those who would like more information, simply use this link.

Wishing you as always, good trading,

By Gary Wagner

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Have a Great Weekend everybody

and Thank You Mucho !

.jpg)

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.