| Followers | 690 |

| Posts | 144135 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Sunday, July 01, 2018 7:12:13 PM

Unfunded Promises

By: John Mauldin | June 29, 2018

In describing the global debt train wreck these last few weeks, I’ve discovered a common problem. Many of us define “debt” way too narrowly.

A debt occurs when you receive something now in exchange for a promise to give something back later. It doesn’t have to be cash. If you borrow your neighbor’s lawn mower and promise to return it next Tuesday, that’s a kind of debt. You receive something (use of the lawn mower) and agree to repayment terms – in this case, your promise to return it on time and in working order.

One reason you try to get that lawnmower back on time and in the proper condition is that you might want to borrow it again in the future. In the same way that not paying your bank debt will make it difficult to get a bank loan in the future, not returning that lawnmower may make your neighbor a tad bit reluctant to lend it again.

Debt can be less specific, too. Maybe, while taking your family on a beach vacation, you notice a wedding taking place. Your 12-year-old daughter goes crazy about how romantic it is. In a moment of whimsy, you tell her you will pay for her tropical island beach wedding when she finds the right guy. That “debt,” made as a loving father to delight your daughter, gets seared into her brain. A decade later, she does find Mr. Right, and reminds you of your offer. Is it a legally enforceable debt? Probably not, but it’s at least a (now) moral obligation. You’ll either pay up or face unpleasant consequences. What is that, if not a debt?

These are small examples of “unfunded liabilities.” They’re non-specific and the other party may never demand payment… but they might. And if you haven’t prepared for that possibility, you may be in the same kind of trouble the US government will face in a few years.

Uncle Sam has made too many promises to too many people, with little regard for its future ability to fulfill them. These are debt. Worse, some of them are additional debt on top of the obligations we already see on the national balance sheet.

Even worse, entire generations have planned their retirement lives around the government fulfilling those promises. If those promises aren’t met, their lifestyles will indeed become a potential train wreck.

Assumptions Everywhere

Let’s start with what we know. The official, on-the-books federal debt is currently about $21.2 trillion, according to the US National Debt Clock. I say “about” cautiously because decimal points really matter when the numbers are this large. The difference between $21.1T and $21.2T is $100 billion. That used to be a lot. Now it’s a rounding error.

Anyway, $21.2T is the face amount of all outstanding Treasury paper, including so-called “internal” debt. This is about 105% of GDP and it’s only the federal government. If you add in state and local debt, that adds another $3.1 trillion to bring total government debt in the US to $24.3 trillion or more than 120% of GDP. Then there’s corporate debt, home mortgages, credit cards, student loans, and more. Add it all together and total debt is about 330% of GDP, according to the IIF data I cited in Debt Clock Ticking. We are in hock up to our ears.

But it’s actually worse than that, due to the kind of promises I mentioned above. Prime among them are Social Security and Medicare. Strictly speaking, these aren’t “unfunded” because they have dedicated revenue streams: payroll taxes. Most Medicare recipients also pay premiums. To date, these revenue sources have covered current expenditures and more, allowing the programs to build up reserves. But that’s about to change.

As of this year, both programs are in negative cash flow, meaning Congress must provide additional cash to pay the promised benefits. It will get worse, too. The so-called “trust funds” are going to run dry sooner or later, and it may be sooner. This month’s annual trustee report estimated Social Security will run out of reserves in 2034, and the hospitalization part of Medicare will go dry in 2026.

Just for the record, those “trust funds” don’t exist except as an accounting fiction. It is like you saving $100,000 for your child’s education and then borrowing all the money from your children’s education fund. You can pretend in your mind that you have set aside $100,000 for your child’s future education, but when it comes time to make those payments, you’ll have to pull it out of current income or liquidate other assets.

The US government has borrowed (or used or whatever euphemism you want to apply) all the money in those trust funds. So, talking about running out of reserves in 2034 or 2026 is rather meaningless. We’ve already run out of reserves. I was talking with Scott Burns about this and other facts over the unfunded liability (he wrote a book on it with Professor Larry Kotlikoff) and he gave me the great line, “The only truly bipartisan cooperation in Congress is that both sides lie.” Any time a politician talks about putting a “lock box” around Social Security or Medicare trust funds, he or she is either staggeringly ignorant or lying.

But, going with their terminology, these estimates of when the trust funds run out depend on a slew of assumptions. To estimate revenue, they must know how many workers the US has, their wages, and at what rates those wages will be taxed. To estimate expenses, they must know how many retirees will be drawing benefits, the amount of those benefits, and how long the retirees will live to receive them. They also have to assume an inflation rate on which the cost-of-living adjustment is based. A small deviation in any of those can have huge long-term consequences.

For what it’s worth, then, Social Security says it has a $13.2 trillion unfunded liability over the next 75 years. That’s the benefits they expect to pay minus the revenue they expect to receive.

Medicare projections require even more assumptions: what kind of treatments the program will cover, how much treatment senior citizens will need, and what those treatments will cost. All these could vary wildly but the “official” assumptions put Medicare’s 75-year unfunded liability at $37 trillion. It could be vastly more or, if we all get healthier and healthcare costs drop, could be less.

This being the government, I think the safe course is to assume their numbers are the best case, resembling reality only if everything goes exactly right. And of course, it won’t.

My friend Professor Larry Kotlikoff estimates the unfunded liabilities to be closer to $210 trillion. (Click on that sentence for a link to his Forbes column.) That’s a far cry from the $50 trillion official estimate.

So, at a minimum, we can probably assume Social Security and Medicare are at least another $50 trillion in debt on top of the $21.2 trillion (and growing) on-budget federal debt. And then you come to the scary part. This doesn’t include civil service or military retirement obligations, or federal backing for some private pensions via the Pension Benefit Guaranty Corporation, or open-ended guarantees like FDIC, Fannie Mae, and on and on.

Negative Cash Flow

Think back to my example of promising your daughter the beach wedding. That is sort of what is happening with Social Security, if you had accompanied the promise by asking your daughter to save a nickel a week toward paying for it. The resulting $28 after ten years would not begin to cover the cost, but your daughter will rightly argue she did her part. You will be on the hook for the rest, just as Congress will be on the hook with angry retirees who think they “paid” for their benefits.

That means benefits will continue once the trust funds run dry. Maybe they’ll make some minor cuts here and there, but voters won’t allow much, at least until enough Boomers leave the scene to let younger generations outnumber them. But as I continue to argue, Boomers are going to live a lot longer than the younger generations think. The deal each generation makes with previous generations is to die on schedule. The Boomer generation is going to break that deal. We will not go willingly into that good night.

But in reality, arguing over whether it’s $50 trillion or $200 trillion is pretty pointless. Long before we get to testing that hypothesis, we will have to cut spending or raise taxes or some combination of both.

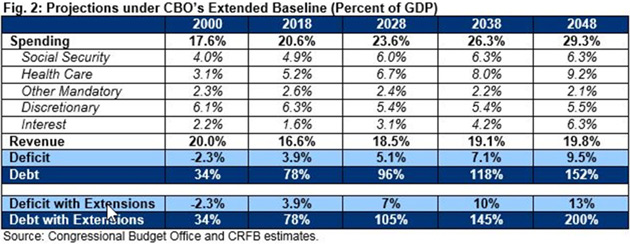

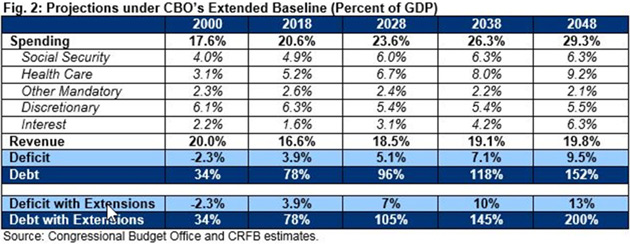

This week, the Congressional Budget Office released its 2018 Long-Term Budget Outlook. Like the Social Security and Medicare trustees, the CBO makes assumptions, so it’s fair to be skeptical of its estimates. In fact, we had all better hope they are too pessimistic because we’re in deep trouble otherwise.

Because the CBO thinks federal spending will grow significantly faster than federal revenue, CBO foresees debt as a percentage of GDP will likely be 200% of GDP by 2048. But we will hit the wall long before then. Consider this table from the Committee for a Responsible Federal Budget.

>>> Read More…

• DiscoverGold

Click on "In reply to", for Authors past commentaries

By: John Mauldin | June 29, 2018

In describing the global debt train wreck these last few weeks, I’ve discovered a common problem. Many of us define “debt” way too narrowly.

A debt occurs when you receive something now in exchange for a promise to give something back later. It doesn’t have to be cash. If you borrow your neighbor’s lawn mower and promise to return it next Tuesday, that’s a kind of debt. You receive something (use of the lawn mower) and agree to repayment terms – in this case, your promise to return it on time and in working order.

One reason you try to get that lawnmower back on time and in the proper condition is that you might want to borrow it again in the future. In the same way that not paying your bank debt will make it difficult to get a bank loan in the future, not returning that lawnmower may make your neighbor a tad bit reluctant to lend it again.

Debt can be less specific, too. Maybe, while taking your family on a beach vacation, you notice a wedding taking place. Your 12-year-old daughter goes crazy about how romantic it is. In a moment of whimsy, you tell her you will pay for her tropical island beach wedding when she finds the right guy. That “debt,” made as a loving father to delight your daughter, gets seared into her brain. A decade later, she does find Mr. Right, and reminds you of your offer. Is it a legally enforceable debt? Probably not, but it’s at least a (now) moral obligation. You’ll either pay up or face unpleasant consequences. What is that, if not a debt?

These are small examples of “unfunded liabilities.” They’re non-specific and the other party may never demand payment… but they might. And if you haven’t prepared for that possibility, you may be in the same kind of trouble the US government will face in a few years.

Uncle Sam has made too many promises to too many people, with little regard for its future ability to fulfill them. These are debt. Worse, some of them are additional debt on top of the obligations we already see on the national balance sheet.

Even worse, entire generations have planned their retirement lives around the government fulfilling those promises. If those promises aren’t met, their lifestyles will indeed become a potential train wreck.

Assumptions Everywhere

Let’s start with what we know. The official, on-the-books federal debt is currently about $21.2 trillion, according to the US National Debt Clock. I say “about” cautiously because decimal points really matter when the numbers are this large. The difference between $21.1T and $21.2T is $100 billion. That used to be a lot. Now it’s a rounding error.

Anyway, $21.2T is the face amount of all outstanding Treasury paper, including so-called “internal” debt. This is about 105% of GDP and it’s only the federal government. If you add in state and local debt, that adds another $3.1 trillion to bring total government debt in the US to $24.3 trillion or more than 120% of GDP. Then there’s corporate debt, home mortgages, credit cards, student loans, and more. Add it all together and total debt is about 330% of GDP, according to the IIF data I cited in Debt Clock Ticking. We are in hock up to our ears.

But it’s actually worse than that, due to the kind of promises I mentioned above. Prime among them are Social Security and Medicare. Strictly speaking, these aren’t “unfunded” because they have dedicated revenue streams: payroll taxes. Most Medicare recipients also pay premiums. To date, these revenue sources have covered current expenditures and more, allowing the programs to build up reserves. But that’s about to change.

As of this year, both programs are in negative cash flow, meaning Congress must provide additional cash to pay the promised benefits. It will get worse, too. The so-called “trust funds” are going to run dry sooner or later, and it may be sooner. This month’s annual trustee report estimated Social Security will run out of reserves in 2034, and the hospitalization part of Medicare will go dry in 2026.

Just for the record, those “trust funds” don’t exist except as an accounting fiction. It is like you saving $100,000 for your child’s education and then borrowing all the money from your children’s education fund. You can pretend in your mind that you have set aside $100,000 for your child’s future education, but when it comes time to make those payments, you’ll have to pull it out of current income or liquidate other assets.

The US government has borrowed (or used or whatever euphemism you want to apply) all the money in those trust funds. So, talking about running out of reserves in 2034 or 2026 is rather meaningless. We’ve already run out of reserves. I was talking with Scott Burns about this and other facts over the unfunded liability (he wrote a book on it with Professor Larry Kotlikoff) and he gave me the great line, “The only truly bipartisan cooperation in Congress is that both sides lie.” Any time a politician talks about putting a “lock box” around Social Security or Medicare trust funds, he or she is either staggeringly ignorant or lying.

But, going with their terminology, these estimates of when the trust funds run out depend on a slew of assumptions. To estimate revenue, they must know how many workers the US has, their wages, and at what rates those wages will be taxed. To estimate expenses, they must know how many retirees will be drawing benefits, the amount of those benefits, and how long the retirees will live to receive them. They also have to assume an inflation rate on which the cost-of-living adjustment is based. A small deviation in any of those can have huge long-term consequences.

For what it’s worth, then, Social Security says it has a $13.2 trillion unfunded liability over the next 75 years. That’s the benefits they expect to pay minus the revenue they expect to receive.

Medicare projections require even more assumptions: what kind of treatments the program will cover, how much treatment senior citizens will need, and what those treatments will cost. All these could vary wildly but the “official” assumptions put Medicare’s 75-year unfunded liability at $37 trillion. It could be vastly more or, if we all get healthier and healthcare costs drop, could be less.

This being the government, I think the safe course is to assume their numbers are the best case, resembling reality only if everything goes exactly right. And of course, it won’t.

My friend Professor Larry Kotlikoff estimates the unfunded liabilities to be closer to $210 trillion. (Click on that sentence for a link to his Forbes column.) That’s a far cry from the $50 trillion official estimate.

So, at a minimum, we can probably assume Social Security and Medicare are at least another $50 trillion in debt on top of the $21.2 trillion (and growing) on-budget federal debt. And then you come to the scary part. This doesn’t include civil service or military retirement obligations, or federal backing for some private pensions via the Pension Benefit Guaranty Corporation, or open-ended guarantees like FDIC, Fannie Mae, and on and on.

Negative Cash Flow

Think back to my example of promising your daughter the beach wedding. That is sort of what is happening with Social Security, if you had accompanied the promise by asking your daughter to save a nickel a week toward paying for it. The resulting $28 after ten years would not begin to cover the cost, but your daughter will rightly argue she did her part. You will be on the hook for the rest, just as Congress will be on the hook with angry retirees who think they “paid” for their benefits.

That means benefits will continue once the trust funds run dry. Maybe they’ll make some minor cuts here and there, but voters won’t allow much, at least until enough Boomers leave the scene to let younger generations outnumber them. But as I continue to argue, Boomers are going to live a lot longer than the younger generations think. The deal each generation makes with previous generations is to die on schedule. The Boomer generation is going to break that deal. We will not go willingly into that good night.

But in reality, arguing over whether it’s $50 trillion or $200 trillion is pretty pointless. Long before we get to testing that hypothesis, we will have to cut spending or raise taxes or some combination of both.

This week, the Congressional Budget Office released its 2018 Long-Term Budget Outlook. Like the Social Security and Medicare trustees, the CBO makes assumptions, so it’s fair to be skeptical of its estimates. In fact, we had all better hope they are too pessimistic because we’re in deep trouble otherwise.

Because the CBO thinks federal spending will grow significantly faster than federal revenue, CBO foresees debt as a percentage of GDP will likely be 200% of GDP by 2048. But we will hit the wall long before then. Consider this table from the Committee for a Responsible Federal Budget.

>>> Read More…

• DiscoverGold

Click on "In reply to", for Authors past commentaries

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.