| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Sunday, May 27, 2018 9:30:12 AM

Separating an Innocuous Correction From the Start of a Sinister Bear Market

By: Urban Carmel | May 25, 2018

Summary: It's true that equities fall before the start of most recessions. So why bother following the economy; why not just follow the price of equities?

"Market corrections" occur every 20 months, but less than a third of these actually becomes a bear market. Recessions almost always lead to bear markets, and bear markets outside of recessions are uncommon. For that reason, discerning whether a recession is imminent can help determine when an innocuous correction is probably the start of a sinister bear market. Volatile equity prices alone are not sufficient.

The future is inherently unknowable. We can never say with certainty what will happen in the month's ahead. But the odds suggest an imminent recession in the US is unlikely at present and, barring a rogue event like 1987, a bear market is not currently underway. That means equities are most likely on their way to new highs in the coming months.

* * *

Why bother following the economy? Why not just follow the price of equities?

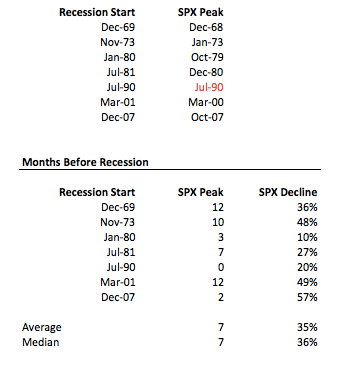

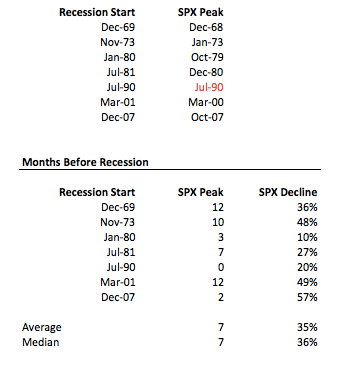

It's true that equities fall before the start of most recessions. Take the last 50 years as an example. There have been 7 recessions and the S&P has peaked and started to fall ahead of all except one (the S&P peaked with the start of the recession in 1990). On average, the S&P has provided a 7 month "heads up" that a recession is on the way. That's enough for even the slowest investor to get out of the way. Enlarge any chart by clicking on it.

But there's a basic problem with this approach. Only in hindsight do we know that an equity peak has signaled an oncoming recession. Most of the time, equity drops have signaled nothing.

Since 1950, there have been 35 "corrections", where the S&P has fallen at least 10%. Just 10 of these have gone on to become a bear market (defined as a fall of 20%, in red text in the table below; see note at bottom of this post; table from Yardeni, here).

Market corrections feel devastating in real-time, but the reality is they occur every 20 months on average (since 1980). Annual falls of greater than 10% are a basic feature of the stock market, but each one feels like the start of a bear market.

The eminent economist Paul Samuelson put his finger on the problem when he quipped that "the stock market has forecast nine of the last five recessions" (a 56% success rate). Actually, he was being polite: since 1950, the stock market has forecast 35 of the last 10 recessions (a 28% success rate).

Of the 10 recessions since 1950 (here), a bear market has materialized in 9 (1953-54 is the borderline exception). Because recessions almost always lead to bear markets, having a good guess at whether a recession is imminent is critical to understanding whether an innocuous correction will lead to a sinister bear market. Volatile equity prices alone are not sufficient (chart from Yardeni, here).

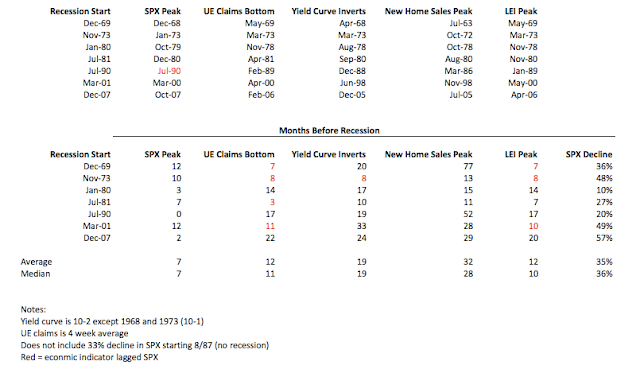

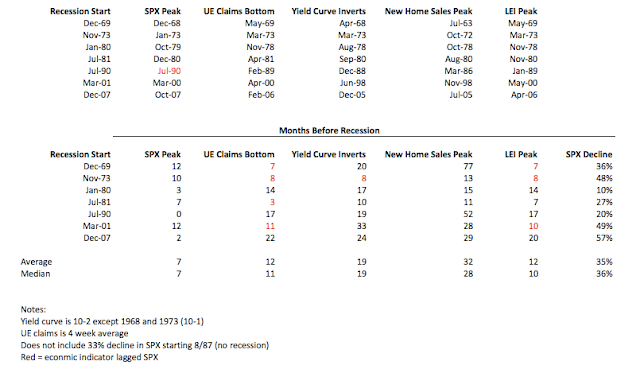

In the past 50 years, three economic indicators have warned of a recession: rising unemployment claims, an inverted yield curve and declining new home sales. On average, all of these signaled trouble ahead of a peak in the S&P. They lead price.

That means that if these economic indicators have signaled a rising probability of a recession, the next fall in equity prices is unlikely to be just a correction but a bear market.

The tables below show every recession in the past 50 years. In the top table, each recession date is shown together with the dates when the SPX peaked and the three economic indicators have signaled a warning. The bottom table calculates the months ahead of the recession for each of these.

>>> Read More

• DiscoverGold

Click on "In reply to", for Authors past commentaries

By: Urban Carmel | May 25, 2018

Summary: It's true that equities fall before the start of most recessions. So why bother following the economy; why not just follow the price of equities?

"Market corrections" occur every 20 months, but less than a third of these actually becomes a bear market. Recessions almost always lead to bear markets, and bear markets outside of recessions are uncommon. For that reason, discerning whether a recession is imminent can help determine when an innocuous correction is probably the start of a sinister bear market. Volatile equity prices alone are not sufficient.

The future is inherently unknowable. We can never say with certainty what will happen in the month's ahead. But the odds suggest an imminent recession in the US is unlikely at present and, barring a rogue event like 1987, a bear market is not currently underway. That means equities are most likely on their way to new highs in the coming months.

* * *

Why bother following the economy? Why not just follow the price of equities?

It's true that equities fall before the start of most recessions. Take the last 50 years as an example. There have been 7 recessions and the S&P has peaked and started to fall ahead of all except one (the S&P peaked with the start of the recession in 1990). On average, the S&P has provided a 7 month "heads up" that a recession is on the way. That's enough for even the slowest investor to get out of the way. Enlarge any chart by clicking on it.

But there's a basic problem with this approach. Only in hindsight do we know that an equity peak has signaled an oncoming recession. Most of the time, equity drops have signaled nothing.

Since 1950, there have been 35 "corrections", where the S&P has fallen at least 10%. Just 10 of these have gone on to become a bear market (defined as a fall of 20%, in red text in the table below; see note at bottom of this post; table from Yardeni, here).

Market corrections feel devastating in real-time, but the reality is they occur every 20 months on average (since 1980). Annual falls of greater than 10% are a basic feature of the stock market, but each one feels like the start of a bear market.

The eminent economist Paul Samuelson put his finger on the problem when he quipped that "the stock market has forecast nine of the last five recessions" (a 56% success rate). Actually, he was being polite: since 1950, the stock market has forecast 35 of the last 10 recessions (a 28% success rate).

Of the 10 recessions since 1950 (here), a bear market has materialized in 9 (1953-54 is the borderline exception). Because recessions almost always lead to bear markets, having a good guess at whether a recession is imminent is critical to understanding whether an innocuous correction will lead to a sinister bear market. Volatile equity prices alone are not sufficient (chart from Yardeni, here).

In the past 50 years, three economic indicators have warned of a recession: rising unemployment claims, an inverted yield curve and declining new home sales. On average, all of these signaled trouble ahead of a peak in the S&P. They lead price.

That means that if these economic indicators have signaled a rising probability of a recession, the next fall in equity prices is unlikely to be just a correction but a bear market.

The tables below show every recession in the past 50 years. In the top table, each recession date is shown together with the dates when the SPX peaked and the three economic indicators have signaled a warning. The bottom table calculates the months ahead of the recession for each of these.

>>> Read More

• DiscoverGold

Click on "In reply to", for Authors past commentaries

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.