Wednesday, May 23, 2018 2:12:48 PM

Back in April 2015, the first PR said: "With an audit on its way, near future up list, strong market cap and the apparent room for a great deal of growth, I would say there is a tremendous upside to being a shareholder in our company, especially given the recent upswing in volume and share price..."

In the three years since, the audit was periodically said to be "on the way" or "near completion" or something along those lines every couple PRs (March 2017: "The company has been diligently working to get all financial documentation in order for the anticipated audit so the company can move forward into a fully reporting status from voluntary reporting....", February 2017: "close to completion", December 2016: "a top priority", May 2016: "in the final stages", April 2015: "on the way", etc.)

With regard to uplisting specifically, 18 months ago, in February 2017, the company said this:

the company's main focus is to become fully reporting and qualify for the OTCQB platform, which calls for a .01 closing price for 30 consecutive days and audited financials, which the company is close to completing. The company will not plan to reverse its stock in hopes the market continues to support the efforts to grow ISBG.

https://www.otcmarkets.com/stock/ISBG/news/ISBG-aims-for-up-list-to-OTCQB-New-Website-to-Come?id=151030

Shortly thereafter, the stock price dropped from the .0011-0020 range down to no bid as billions of shares were sold, and die-hard shareholders continued to tell themselves that there would be no reverse split, that it was just shorts and bashers driving the price down to load up on cheap shares, and that the run to pennyland and uplisting was coming any day. The "close to completion" audit was not filed for a year and a half, until about three weeks ago. Also, in the meantime, and about 7 months after the above statement, the company did a 1:255 reverse split wiping out the last of its "loyal shareholders" who used to cheerlead on here. (For example, if you bought $1000 of ISBG at the lowest price on Feb 13, 2017, the day of the above PR, you would have spent the next few months watching that dwindle down to $100, then become unsellable at no bid, then your million shares would magically have become 3,922 shares overnight in September, then those would have dropped again to be worth about $20 through the end of last year, and now, blessedly, your $1000 investment has climbed back up to a whopping $117 at a PPS of .03)

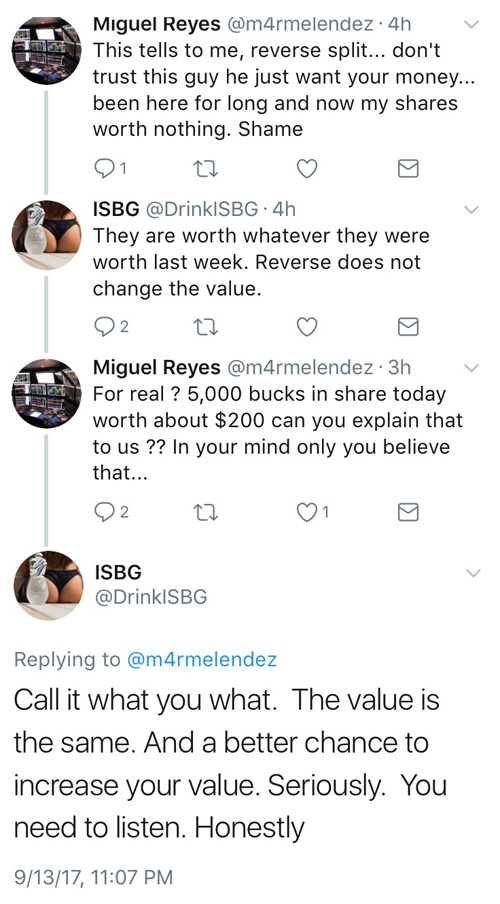

Generally speaking, putting out years of misleading press releases full of unfulfilled promises, telling your shareholders you have no plans to reverse split, dumping billions of shares into the market and then reverse splitting the stock so their $1000 buy becomes worth $20 is the kind of thing that *really* pisses people off. I think a lot of people wrote ISBG off for good as a result. It didn't help that the company was kind of a dick about it on twitter.

See here:

And here:

And here, even months before the R/S:

All that being said, *since* the R/S the stock has been on a fairly steady uptrend from a pre-split price of .00003 or so back to the equivalent of .00015-ish. The last few weeks have seen a lot of heavy buying volume and little dumping, and only a couple million shares issued (if you don't count the 50MM Pierce gave himself). The company filed audited-ish financials and appears to have several new board of directors members with surprisingly legit-sounding bios to be associated with a company that has this one's track record. So, maybe Pierce is turning it all around after all, and this thing has some more upside to it in the coming months/quarters. They are, after all, actually qualified to uplist to OTCQB for the first time ever, those sloppy quarterly financials from yesterday notwithstanding.

Put my in the I'll believe it when I see it camp ;)

Avant Technologies Equipping AI-Managed Data Center with High Performance Computing Systems • AVAI • May 10, 2024 8:00 AM

VAYK Discloses Strategic Conversation on Potential Acquisition of $4 Million Home Service Business • VAYK • May 9, 2024 9:00 AM

Bantec's Howco Awarded $4.19 Million Dollar U.S. Department of Defense Contract • BANT • May 8, 2024 10:00 AM

Element79 Gold Corp Successfully Closes Maverick Springs Option Agreement • ELEM • May 8, 2024 9:05 AM

Kona Gold Beverages, Inc. Achieves April Revenues Exceeding $586,000 • KGKG • May 8, 2024 8:30 AM

Epazz plans to spin off Galaxy Batteries Inc. • EPAZ • May 8, 2024 7:05 AM