| Followers | 218 |

| Posts | 247348 |

| Boards Moderated | 2 |

| Alias Born | 04/06/2006 |

Saturday, April 28, 2018 8:13:53 AM

DashOfInsight<>Stock Exchange: Ominous Vomiting Camel Formation

April 27

The Stock Exchange is all about trading. Each week we do the following:

Discuss an important issue for traders;

highlight several technical trading methods, including current ideas;

feature advice from top traders and writers; and,

provide a few (minority) reactions from fundamental analysts.

We also have some fun. We welcome comments, links, and ideas to help us improve this resource for traders. If you have some ideas, please join in!

Review: How Do You Filter Noisy Trade Signals?

Our previous Stock Exchange asked the question: How Do You Filter Out Noisy Trade Signals? We considered the explosive growth in news and in data, and noted “information overload” is becoming an increasingly common complaint from traders. However, sticking to a disciplined trading process can help you do a better job of filtering out distractions and filtering in the data most important to your trades. A glance at your news feed will show that the key points remain relevant.

This Week: Ominous Vomiting Camel Formation

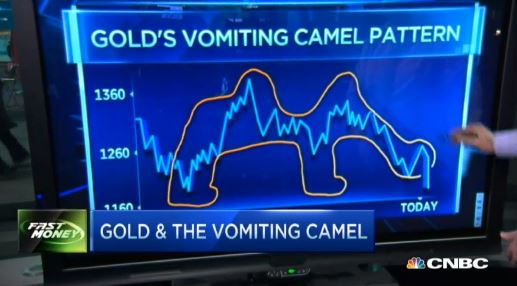

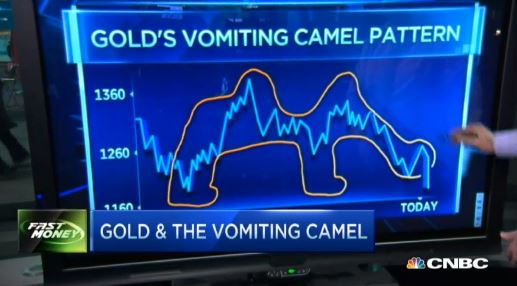

If you are not familiar, the Vomiting Camel formation is one of the most ominous signals a trader can receive. For example, this dangerous formation recently formed in both Bitcoin and Gold, and the subsequent market moves were devastating, as shown in the following charts.

Gold:

Bitcoin:

However, to be clear, the Vomiting Camel formation is a joke. It’s not a real thing. And we are using it to highlight the dangers of building trading programs that over fit the data. For example, some trading models over fit all of the data that is available to come up with meaningless patterns. Similarly, some humans draw absurd lines on charts, such as the vomiting camel. For more information on the origins of the Vomiting Camel, check out Katie Martin’s recent article:

The Vomiting Camel has escaped from Bitcoin zoo

Machine Learning and Over Fitting the Data:

We’ve written about the challenges of trading programs and machine learning/ artificial intelligence (“AI”) in the past, for example here:

What Can Traders Learn From Poker AI?

And this continues to be a challenge both inside and outside the world of trading as the prevalence of artificial intelligence grows. For example, Thomas T. Hills does an excellent job of highlighting some of the common mistakes of algorithmic learning, ranging from autonomous vehicles misreading stop signs to Google Flu dramatically over forecasting the intensity of influenza outbreaks, in this article:

Algorithms Can’t Tell When They’re Broken–And Neither Can We

And while our trading models are not as complex as autonomous driving algorithms, we do find that human “supervision” is an important element of the process. Specifically, we find it better to “lock in” our trading approach, and then allow the humans to do periodic testing and revisions.

Another important consideration is “trading teamwork.” Having people around to discuss, test ideas, and provide support is helpful. This excellent recent article by Brett Steenbarger lends itself to the question “Do you have trading teamwork?”

Creating Your Own Trading Culture

Overall, we find that having checks and balances between trading models and human beings can help reduce the risks of over fitting the data, and it can help prevent both the machines and the humans from arriving at inappropriate results.

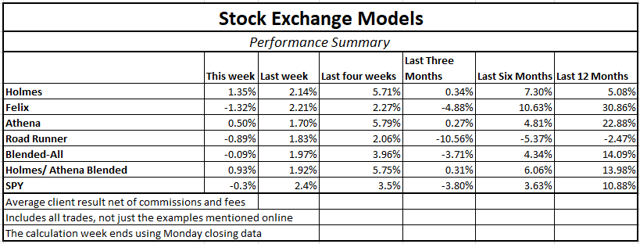

Model Performance:

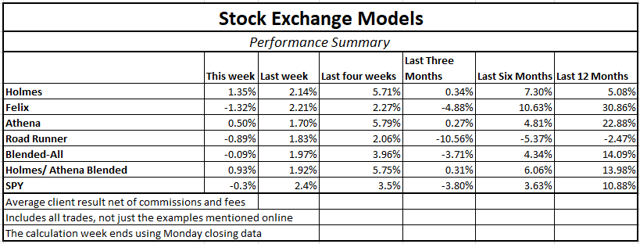

Per reader feedback, we’re continuing to share the performance of our trading models

We find that blending a trend-following / momentum model (Athena) with a mean reversion / dip-buying model (Holmes) provides two strategies, effective in their own right, that are not correlated with each other or with the overall market. By combining the two, we can get more diversity, lower risk, and a smoother string of returns.

And for these reasons, I am changing the “Trade with Jeff” offer at Seeking Alpha to include a 50-50 split between Holmes and Athena. Current participants have already agreed to this. Since our costs on Athena are lower, we have also lowered the fees for the combination.

If you have been thinking about giving it a try, click through at the bottom of this post for more information. Also, readers are invited to write to main at newarc dot com for our free, brief description of how we created the Stock Exchange models.

Expert Picks From The Models:

This week’s Stock Exchange is being edited by Blue Harbinger; (Blue Harbinger is a source for independent investment ideas).

Holmes: This week I purchased Petrobras (PBR). Are you familiar with this stock, Blue Harbinger?

lue Harbinger: Yes, Petrobras is the big Brazilian integrated oil and gas company. Why do you like it, Holmes?

Holmes: As you know, I am a “dip-buyer.” I purchased the shares on April 25th, and I believe they have upside over the next 6-weeks—which is my typical holding period.

Continue for more charts and data @ https://dashofinsight.com/stock-exchange-dangerous-vomiting-camel-formation/

April 27

The Stock Exchange is all about trading. Each week we do the following:

Discuss an important issue for traders;

highlight several technical trading methods, including current ideas;

feature advice from top traders and writers; and,

provide a few (minority) reactions from fundamental analysts.

We also have some fun. We welcome comments, links, and ideas to help us improve this resource for traders. If you have some ideas, please join in!

Review: How Do You Filter Noisy Trade Signals?

Our previous Stock Exchange asked the question: How Do You Filter Out Noisy Trade Signals? We considered the explosive growth in news and in data, and noted “information overload” is becoming an increasingly common complaint from traders. However, sticking to a disciplined trading process can help you do a better job of filtering out distractions and filtering in the data most important to your trades. A glance at your news feed will show that the key points remain relevant.

This Week: Ominous Vomiting Camel Formation

If you are not familiar, the Vomiting Camel formation is one of the most ominous signals a trader can receive. For example, this dangerous formation recently formed in both Bitcoin and Gold, and the subsequent market moves were devastating, as shown in the following charts.

Gold:

Bitcoin:

However, to be clear, the Vomiting Camel formation is a joke. It’s not a real thing. And we are using it to highlight the dangers of building trading programs that over fit the data. For example, some trading models over fit all of the data that is available to come up with meaningless patterns. Similarly, some humans draw absurd lines on charts, such as the vomiting camel. For more information on the origins of the Vomiting Camel, check out Katie Martin’s recent article:

The Vomiting Camel has escaped from Bitcoin zoo

Machine Learning and Over Fitting the Data:

We’ve written about the challenges of trading programs and machine learning/ artificial intelligence (“AI”) in the past, for example here:

What Can Traders Learn From Poker AI?

And this continues to be a challenge both inside and outside the world of trading as the prevalence of artificial intelligence grows. For example, Thomas T. Hills does an excellent job of highlighting some of the common mistakes of algorithmic learning, ranging from autonomous vehicles misreading stop signs to Google Flu dramatically over forecasting the intensity of influenza outbreaks, in this article:

Algorithms Can’t Tell When They’re Broken–And Neither Can We

And while our trading models are not as complex as autonomous driving algorithms, we do find that human “supervision” is an important element of the process. Specifically, we find it better to “lock in” our trading approach, and then allow the humans to do periodic testing and revisions.

Another important consideration is “trading teamwork.” Having people around to discuss, test ideas, and provide support is helpful. This excellent recent article by Brett Steenbarger lends itself to the question “Do you have trading teamwork?”

Creating Your Own Trading Culture

Overall, we find that having checks and balances between trading models and human beings can help reduce the risks of over fitting the data, and it can help prevent both the machines and the humans from arriving at inappropriate results.

Model Performance:

Per reader feedback, we’re continuing to share the performance of our trading models

We find that blending a trend-following / momentum model (Athena) with a mean reversion / dip-buying model (Holmes) provides two strategies, effective in their own right, that are not correlated with each other or with the overall market. By combining the two, we can get more diversity, lower risk, and a smoother string of returns.

And for these reasons, I am changing the “Trade with Jeff” offer at Seeking Alpha to include a 50-50 split between Holmes and Athena. Current participants have already agreed to this. Since our costs on Athena are lower, we have also lowered the fees for the combination.

If you have been thinking about giving it a try, click through at the bottom of this post for more information. Also, readers are invited to write to main at newarc dot com for our free, brief description of how we created the Stock Exchange models.

Expert Picks From The Models:

This week’s Stock Exchange is being edited by Blue Harbinger; (Blue Harbinger is a source for independent investment ideas).

Holmes: This week I purchased Petrobras (PBR). Are you familiar with this stock, Blue Harbinger?

lue Harbinger: Yes, Petrobras is the big Brazilian integrated oil and gas company. Why do you like it, Holmes?

Holmes: As you know, I am a “dip-buyer.” I purchased the shares on April 25th, and I believe they have upside over the next 6-weeks—which is my typical holding period.

Continue for more charts and data @ https://dashofinsight.com/stock-exchange-dangerous-vomiting-camel-formation/

Pray for A Pain Free Day!

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.