Friday, October 13, 2006 12:27:30 PM

Franklin Mining - NEWS - FMNJ - REF -

www.FranklinMining.com

Franklin Mining, Inc. Integrates Quick Click Reference -

@ www.FranklinMining.com

LAS VEGAS, NV--(MARKET WIRE)--Oct 12, 2006 --

Franklin Mining, Inc.

(Other OTC:FMNJ.PK - News) is pleased to announce -

the addition of quick click reference to the website -

From the first gold mining of our properties in

the mid 1800's to mining for gold in Bolivia -

A golden history exists for this company -

and we hope a golden future -

With our change in direction in company philosphy -

we believe that a foundation for growth has been laid -

The Company is very excited about the future -

opportunties that await us -

http://www.franklinmining.com/Home/tabid/1215/Default.aspx

The quick click option has been integrated into the website

to allow visitors simplified and immediate access -

to company information.

Franklin Mining quick click reference now offers

significant information including project status,

financials, and company disclosure.

This development is another instrumental step in

Franklin Mining's developing program of improving

market information.

"Safe Harbor" statement under the Private Securities Litigation

Reform Act of 1995---- to time in Franklin Mining Inc.'s filings

with the Securities and Exchange Commission. These risks could

cause Franklin Mining Inc.'s actual results to differ materially

from those expressed in any forward-looking statements made by,

or on behalf of,

Franklin Mining Inc.

For Further Information check out our website - www.franklinmining.com

or contact:

Contact:

Contact:

Investor Relations

Mr. Andrew Austin

1-702-386-5379

Source: Franklin Mining, Inc. -

Welcome to Skype - 888 - The whole world can talk for free -

http://www.skype.com/products/skypeout/freecalls/

http://www.franklinmining.com/ContactUs/InvestorRelations/tabid/19853/Default.aspx

Zinc and Lead prices are breaking out -

and making new highs -

and I did not read one single news story -

on this event today from any source -

Shocking -

Seems everyone is alseep -

thinking we are still in a "correction" -

for commodities because oil -

the heavily manipulated commodities -

are still oversold to down -

Zinc broke out and hit $1.73/lb. -

and lead broke out and hit $.68/lb. -

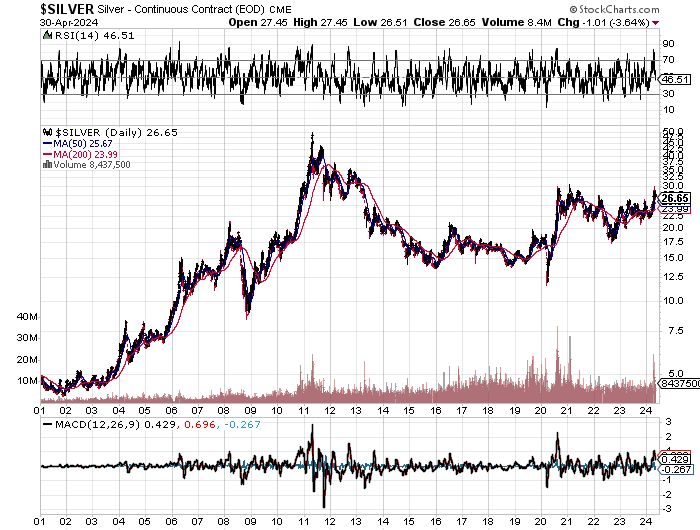

Silver Prices must go Up, and You can make a Fortune

in Silver -

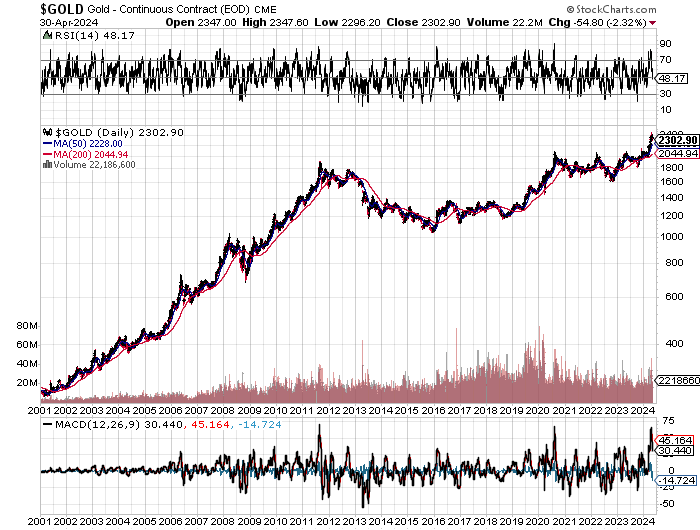

Paper money is now a total fraud, and has no Gold backing -

none whatsoever -

The U.S. gold has not been audited since the 1960's -

and may no longer even exist? -

If it does, the "official" U.S. Gold hoard of 261 million

ounces can back up the currency with one ounce of Gold

for every $40,000 dollars in the U.S. -

domestic banking system.

There has been less than 5 billion ounces of Gold mined -

in all of human history, worth about $3 trillion dollars -

But there is about $50 trillion of paper money in the world -

and about $50 trillion of debt -

So, Gold should go up in value at least 10-15 times -

or more -

Gold is money, because of its fundamental nature;

it is a great store of value;

it's liquid, portable, rare, a luxury item, lasting,

durable, divisible, recognizable, verifiable,

and can't be counterfeited -

Silver is like Gold, but better, because Silver is being -

used up by industry -

More Silver is used up by industry, jewelry and

photography than is mined every year -

Silver demand may not decrease with higher prices -

because Silver jewelry can become more fashionable -

as prices rise -

And in most industrial applications, Silver is a tiny

percentage cost of the overall product -

Further, as Silver prices rise, investment demand -

will increase, as it's hard to beat 30% gains every year -

as Silver has been doing since 2003 -

Silver can protect you from rises in gas prices! -

Oil is now about $60/barrel, but Silver is only

about $11/oz. -

In 1980, oil peaked at $43/barrel, and Silver peaked

at $50/oz.! -

And in 2000, oil bottomed at $10 barrel, and Silver

bottomed at $5/oz. -

Peak oil experts say that there is only about a 40-year

supply of oil left in the ground, but there is only

about 14 years supply of Silver reserves in the ground! -

Silver’s the better investment -

As Silver and oil prices return to historic ratios -

Silver prices will rise to about $30-$70/oz. -

up from $11/oz. today, and if oil moves even higher -

Silver will move higher with it! -

If Silver could be counterfeited, our copper clad coins

would look a lot more like Silver than they do -

Silver coins are easily recognized by anyone who has

ever held one, and felt the difference in weight -

Silver is so rare today that many of the best experts say -

that there is barely 300 million ounces of Silver -

in refined, deliverable form -

With 300 million people in the U.S., then if you have even

one single ounce of Silver, then you may have -

“more than your fair share”, and are either an evil,

greedy, capitalist pig, or a wise steward -

of your own wealth -

A day’s wage over 100 years ago used to be up to a

Silver dollar, or as little as a Silver dime -

You can buy those same Silver dollars today -

for much less - Get some FMNJ -

By Jason

Keep in mind -

Silver - LT Strong Bull Trend Started -

1st LT Bull wave - 1st correction -

4 more LT Bull waves to Go -

Gold - LT Strong Bull Trend Started -

1st LT Bull wave - 1st correction -

4 more LT Bull waves to Go -

(Elliott Wave 5-wave Elliott Pattern)

FMNJ - Cerro Rico -

The world largest and richest Silver Mine -

is also very rich in Zinc metal -

The world need Zinc - to Produce More Soon -

or Zinc - Prices to the Moon -

The use of Zinc is widespread, and its demand -

has increased significantly over the past 30 years -

A steady 4% annual increase in consumption has replaced -

the historic norm of 2% -

As countries -

like China and India continue to expand, creating huge

new demand for raw materials, the price of Zinc is

likely to continue climbing -

The 5 year price of Zinc showing the price to

have nearly doubled since January of 2003 -

Yet, even after this doubling -

it is still only 4 cents above the average Zinc price -

for the past 40 years -

a price which has moved as high as $1.70 -

a level which might soon be approached once

again -

40 year Zinc Chart -

Zinc's primary use is in the galvanizing process of steel -

The largest markets for galvanized steel -

are the housing and automobile industries -

As the commercial and residential construction sector -

continues to grow due to the modernization of peoples -

all over the world - the increasing demand -

for Zinc is a matter of fact -

Zinc is found in microwave and cellular towers -

steel beams, studs,

floor joints, trusses -

and galvanized electric circuits.

Die cast Zinc parts are found in automobiles -

computers, tools and all types of appliances -

As an alloy of lead, copper, tin, lead, aluminum -

or magnesium, zinc also plays a role in the electrical -

and consumer product industries -

But that's not all folks, Zinc is also used -

in manufacturing of batteries, rubber goods -

cosmetics, chemicals, and pharmaceuticals -

Furthermore, since Zinc is an essential nutrient -

for all living things, it is often -

used in vitamin supplements, animal feed -

and fertilizers -

But what would all this demand mean for the future -

of Franklin Mining if it weren't for the lack of supply? -

14 year Zinc Inventory Levels -

International demands -

has recently forecast that 2.5 million tons of new annual -

Zinc mine production must be attained -

by the year 2007 in order to fill in -

the supply/demand gap -

Because few of the large zinc mines are at this moment -

committed to production due to the low market price of Zinc -

it is highly unlikely that this demand will be met in time -

It takes 10-15 years for newly discovered Zinc deposits -

to reach the production stage -

and very few discoveries have been made -

in the past 10 years -

Of those few who have the possibility of becoming -

producers by 2010 -

higher Zinc prices are required to speed up the process -

since it will confirm the bull market -

satisfy feasibility requirements -

and allow for a much easier financing -

of the capital intensive mines -

Currently the LME Zinc inventory -

is about 540,000 tons -

down about 250,000 tons since its peak -

in April of 2004 -

If inventory levels continue to decline -

the price must increase -

to curb the excess demand -

The chart of LME warehouse levels for Zinc -

Do to this outstanding technical data -

it may happen that before Franklin Mining Company -

ever begins mining their mines -

or perhaps while in the midst of it -

that we will be sought out -

and bought out by a large mining company -

desiring to expand to it's own capacity -

In such a case -

it can only be speculated what the share price offered -

would be -

But based upon the earlier value calculations -

a conservative estimate would lie between $1 - 5 a share? -

I do not think it is likely FMNJ will sell all of

its properties rights -

A more likely outcome would be a Joint Venture -

in mining operations if it proves hard for FMNJ -

to raise the capital necessary for the start up of the

old richest mines -

If Zinc prices continue to rise -

I do not see this as any problem -

I believe that if the old Franklin -

desires to carry on the project themselves -

and that it is committed to do -

so as far as it is possible -

The *** Silver Bonus *** -

Some past production records however -

showed plenty of levels as high as 100s of ounces of Silver per tonne!

-

In the end, only time will tell whether in a few years -

FMNJ stock price will have ascended back up -

well beyond $5/share -

or have long since been bought out for a similar price -

Wisdom is indeed proved right by her children -

and the Franklin management team -

has done an outstanding job of putting things in order -

The right place at the right time -

Note - remember -

*** Opportunities always look bigger going than coming ***

Gold - Copper - Tin - Nickel -

rare strategic mineral bonuses etc. -

DD - -

http://www.investorshub.com/boards/board.asp?board_id=5406

FMNJ - Zinc - LME warehouse stocks have plummeted -

nearly 50% in six months yet prices have remained -

relatively flat since April -

Zinc is one of the the most undervalued metal -

on the market right now.

That means the metal's position today offers -

investors a great low-risk opportunity to take -

advantage of the continuing commodity bull

metal market - a FMNJ refresh -

Franklin Mine NEWS Cerro Rico Silver 33 Mil. Ounces -

Fourth Vein Shows Potential Silver Reserves -

Ag Over 11 Million Silver Ounces -

Repeat FMNJ N/R -

Franklin Mining Announces Cerro Rico Holds Over 33 Million -

Ounces of Silver, Fourth Vein Shows Potential Reserves -

of Over 11 Million -

Tuesday August 1, 7:30 am ET

LAS VEGAS, NV--(MARKET WIRE)--Aug 1, 2006 --

Franklin Mining, Inc. -

(Other OTC:FMNJ.PK - News) -

is pleased to announce today the significant value estimated -

by the COMIBOL reports on the Cerro Rico Mine reserves.

It is believed to hold over 33 million ounces of silver.

San Pedro Cerro Rico Mine -

(the fourth vein) reserves are projected to be over

11 million ounces of silver.

The results were provided by the combined reports from

COMIBOL (Bolivia's national mining company).

According to the COMIBOL prospective reserve reports -

San Pedro is believed to contain approximately -

11,937,569 tons of ore -

208,320 kilos of silver -

and 62,496 metric tons of zinc -

roughly 7,346,196 ounces of silver -

and 137,741,184 pounds of zinc.

This partnership encompasses the four veins of -

the famous Cerro Rico de Potosi Mine -

(San Miguel, San Pedro, Mesapata and Alkco Barreno).

The Cerro Rico Mine -

(located southeast of the city of Potosi, Bolivia) -

under COMIBOL's ownership, is considered -

the world's largest silver deposit -

and one of the most popular tourist attractions in Bolivia.

The four veins are projected to hold over

5.5 million metric tons of ore.

The combined estimated reserves are about -

938,130 kgs of Silver -

250,004 tons of zinc

and over 72,377 tons of tin -

yielding approximately 33,018,564 ounces of silver -

550,784,040 lbs of zinc -

and 159,518,908 lbs of tin.

"The Cerro Rico history's most fabulous silver strike -

changed Bolivia's social fabric 450 years ago.

Now, thanks to modern mining, it may do so again.

Legend has it that enough metal was extracted -

from the deposit to build a bridge of silver -

from South America to Europe.

'It is an impressive amount of mineral wealth,'

Roland Jordan Pozo, secretary general of Bolivia's

association of medium-sized miners, said.

'Industry officials say the deposit could vault -

Bolivia back into the vanguard of global silver production.'"

http://www.latinamericanstudies.org/bolivia/silver.htm

Metal prices today show silver at $ 11.38 USD per ounce -

tin at $3.78 USD per ounce -

and zinc at $ 1.52 per lb USD.

Franklin Mining, Bolivia S.A. -

(a Bolivian corporation)

is a subsidiary company of Franklin Mining, Inc.

COMIBOL is Bolivia's state-owned mining company.

For additional information on Franklin Mining, Inc,

please visit our web site,

http://www.franklinmining.com.

To receive Franklin Mining news by e-mail -

please send contact information to -

info@franklinmining.com.

"Safe Harbor" statement under the Private Securities

Litigation

Reform Act of 1995: This press release contains

forward-looking statements that are subject to risk and

uncertainties, incl. --- --in Franklin Mining, Inc.'s filings

with the Securities and Exchange Commission. These risks could

cause Franklin Mining Inc.'s actual results to differ

materially from those expressed in any forward-looking

statements made by, or on behalf of, Franklin Mining Inc.

Additional information on company operations is found at our

website -

http://www.franklinmining.com/.

Contact:

Franklin Mining, Inc.

Andrew Austin

702-386-5379

info@franklinmining.com

Source: Franklin Mining, Inc.

http://biz.yahoo.com/iw/060801/0149405.html

--

About Cerro Rico Mine:

The Cerro Rico Mine -

is considered by many to be the richest Silver Mine -

in the world.

Rich in Zinc and Silver -

it has been actively mined since the 1500's

and is in operation today -

Cerro Rico is owned by Bolivia's

national mining company, COMIBOL.

About COMIBOL:

COMIBOL is the government owned mining company -

in Bolivia.

COMIBOL owns the CERRO RICO Mines -

as well as many other properties -

and mineral rights in Bolivia.

"Safe Harbor" statement under the Private Securities Litigation

Reform Act of 1995: ----These risks could cause Franklin

Mining Inc.'s actual results to differ materially from those

expressed in any forward-looking statements made by, or on

behalf of, Franklin Mining Inc.

Contact:

Contact:

Franklin Mining, Inc.

Andrew Austin

1-702-386-5379

Source: Franklin Mining, Inc.

winifred, great move -

catch it before it fly away -

Silver will always be part of "The Real Gold & Silver Money" -

Some defend a fraud system with that, "its far too small

a market for large, modern economies" -

Well, its only to put a higher fair value on the Silver money -

it used to be worth $800/oz 500 years ago -

take the inflasion into the picture and Silver maybe worth -

a fair market value $80,000/oz sooner or later? -

Silver will do far better than any fiat fraud paper asset -

it will serve better as a "personal holding" and as

the major Real Money when its valued to its fair market value -

If it is of your way to balance wealth, then Silver will show

the LT Real value -

Metals have not shown their true worth for many years as

the world has done very well with manipulations of fiat fraud

paper money schemes -

This is very good some say - outside of ex. FMNJ Potosi -

But, all things do change! -

As it is our time and place to live this change -

our thoughts must view the future as it must be! -

Who can know the minds of men and countries -

as the 666 fiat paper burns? -

In our present system - all fiat currencies are

backed by the US$ -

as long as the US$ is on an "oil standard" of backing -

no other country can change -

the BIS would destroy their economy in a second of storm -

Many think that a country may sell or cut it's CB/US debt

backing at will! -

They cannot? - they will not! -

Oil will not accept another system? -

as long as the Oil/Gold bond works? -

the world currency system is somewhat in a counterfeited

owg order? -

If a crisis erupts and Gold breaks the bond with oil -

then a change must take place! -

We will no doubt see a mass run of CBs into Gold -

at ANY price! - this we know! - as for now -

each person must protect your worth -

as the nation/state is locked from change? -

You still may have a little bit of some time -

FMNJ - need an 'every day Update' on the -

Silver Companies > Market cap's (updated?) -

FMNJ - Franklin Mining, Inc. = $45 MILLION?

http://www.investorshub.com/boards/board.asp?board_id=2957

http://www.investorshub.com/boards/board.asp?board_id=5406

vs. compare to -

ECU - ECU Silver = $488 MILLION

http://www.investorshub.com/boards/quotes.asp?ticker=v.ecu

http://www.investorshub.com/boards/board.asp?board_id=6098

HL - Hecla Mining Co = $681.71 MILLION

http://www.investorshub.com/boards/quotes.asp?ticker=cde&qm_page=64251&qm_symbol=hl

http://www.investorshub.com/boards/board.asp?board_id=6097

SIL - Apex Silver Mines Ltd. = $905.33 MILLION

http://www.investorshub.com/boards/quotes.asp?ticker=v.ecu&qm_page=4079&qm_symbol=sil

http://www.investorshub.com/boards/board.asp?board_id=5810

SLW - Silver Wheatonfiltered= $2.06 BILLION

http://www.investorshub.com/boards/quotes.asp?ticker=v.ecu&qm_page=98063&qm_symbol=slw

http://www.investorshub.com/boards/board.asp?board_id=4338

SSRI - Silver Standard Resources Inc. = $1.16 BILLION

http://www.investorshub.com/boards/quotes.asp?ticker=v.ecu&qm_page=17190&qm_symbol=ssri

http://www.investorshub.com/boards/board.asp?board_id=6095

CDE - Coeur d'Alene Mines Corp = $1.47 BILLION

http://www.investorshub.com/boards/quotes.asp?ticker=v.ecu&qm_page=35188&qm_symbol=cde

http://www.investorshub.com/boards/board.asp?board_id=5237

PAAS - Pan American Silver Corp. = $1.59 BILLION

http://www.investorshub.com/boards/quotes.asp?ticker=v.ecu&qm_page=63958&qm_symbol=paas

http://www.investorshub.com/boards/board.asp?board_id=4490

UCOI (UNCN) - Unico Inc. = $1.8 MILLION -

(only $1.8 is very oversold - undervalued) -

http://www.investorshub.com/boards/quotes.asp?ticker=ucoi

http://www.investorshub.com/boards/board.asp?board_id=6582

Including - The Silver Bell Mine -

The Deer Trail Gold & Silver Mines -

The Bromide Gold Mines -

Note. if You have more updated info -

Silver comp. market cap. please, don't

hesitate to let us know -

tia.

SILVER Chart TA LT - Strong Bullrun Long Overdue -

http://www.investorshub.com/boards/board.asp?board_id=5406

SILVER used to be worth -

more than GOLD -

history often repeat itself -

Do not let any volatility shake You out -

the more volatility the higher it will go -

the new trend waves will often be -

Fibonacci - 162% of the previous correction -

when the weak hands exhaust themselves -

we'll see the next waves up -

U.S. NATIONAL DEBT CLOCK

The Outstanding Public Debt -

as of Aug. 2006:

http://www.alkalizeforhealth.net/Ldebtclock.htm

Unless the United States gets all of its economic

house in order ? -

Gold will become the basic real money again -

(which Gold has been for 1000's of years)

and national currencies will only be money -

if backed by - Gold.

With the exception only of the periods of -

- The Great Gold Standard -

practically all governments of history -

have used their exclusive power to issue fiat money -

to defraud with totalitarian bureaucratic powers -

rob, plunder and to make slaves -

of most the people -

http://www.goldrush21.com/

The Bolivian miners welcome FMNJ -

Mission Statement - with open arms -

To Make Money for the family -

for community programs to help with social situations -

such as health care and care for homeless children -

To Be Socially Responsible -

Thanks for your participations -

Brgds

Bob

God Bless

www.FranklinMining.com

Franklin Mining, Inc. Integrates Quick Click Reference -

@ www.FranklinMining.com

LAS VEGAS, NV--(MARKET WIRE)--Oct 12, 2006 --

Franklin Mining, Inc.

(Other OTC:FMNJ.PK - News) is pleased to announce -

the addition of quick click reference to the website -

From the first gold mining of our properties in

the mid 1800's to mining for gold in Bolivia -

A golden history exists for this company -

and we hope a golden future -

With our change in direction in company philosphy -

we believe that a foundation for growth has been laid -

The Company is very excited about the future -

opportunties that await us -

http://www.franklinmining.com/Home/tabid/1215/Default.aspx

The quick click option has been integrated into the website

to allow visitors simplified and immediate access -

to company information.

Franklin Mining quick click reference now offers

significant information including project status,

financials, and company disclosure.

This development is another instrumental step in

Franklin Mining's developing program of improving

market information.

"Safe Harbor" statement under the Private Securities Litigation

Reform Act of 1995---- to time in Franklin Mining Inc.'s filings

with the Securities and Exchange Commission. These risks could

cause Franklin Mining Inc.'s actual results to differ materially

from those expressed in any forward-looking statements made by,

or on behalf of,

Franklin Mining Inc.

For Further Information check out our website - www.franklinmining.com

or contact:

Contact:

Contact:

Investor Relations

Mr. Andrew Austin

1-702-386-5379

Source: Franklin Mining, Inc. -

Welcome to Skype - 888 - The whole world can talk for free -

http://www.skype.com/products/skypeout/freecalls/

http://www.franklinmining.com/ContactUs/InvestorRelations/tabid/19853/Default.aspx

Zinc and Lead prices are breaking out -

and making new highs -

and I did not read one single news story -

on this event today from any source -

Shocking -

Seems everyone is alseep -

thinking we are still in a "correction" -

for commodities because oil -

the heavily manipulated commodities -

are still oversold to down -

Zinc broke out and hit $1.73/lb. -

and lead broke out and hit $.68/lb. -

Silver Prices must go Up, and You can make a Fortune

in Silver -

Paper money is now a total fraud, and has no Gold backing -

none whatsoever -

The U.S. gold has not been audited since the 1960's -

and may no longer even exist? -

If it does, the "official" U.S. Gold hoard of 261 million

ounces can back up the currency with one ounce of Gold

for every $40,000 dollars in the U.S. -

domestic banking system.

There has been less than 5 billion ounces of Gold mined -

in all of human history, worth about $3 trillion dollars -

But there is about $50 trillion of paper money in the world -

and about $50 trillion of debt -

So, Gold should go up in value at least 10-15 times -

or more -

Gold is money, because of its fundamental nature;

it is a great store of value;

it's liquid, portable, rare, a luxury item, lasting,

durable, divisible, recognizable, verifiable,

and can't be counterfeited -

Silver is like Gold, but better, because Silver is being -

used up by industry -

More Silver is used up by industry, jewelry and

photography than is mined every year -

Silver demand may not decrease with higher prices -

because Silver jewelry can become more fashionable -

as prices rise -

And in most industrial applications, Silver is a tiny

percentage cost of the overall product -

Further, as Silver prices rise, investment demand -

will increase, as it's hard to beat 30% gains every year -

as Silver has been doing since 2003 -

Silver can protect you from rises in gas prices! -

Oil is now about $60/barrel, but Silver is only

about $11/oz. -

In 1980, oil peaked at $43/barrel, and Silver peaked

at $50/oz.! -

And in 2000, oil bottomed at $10 barrel, and Silver

bottomed at $5/oz. -

Peak oil experts say that there is only about a 40-year

supply of oil left in the ground, but there is only

about 14 years supply of Silver reserves in the ground! -

Silver’s the better investment -

As Silver and oil prices return to historic ratios -

Silver prices will rise to about $30-$70/oz. -

up from $11/oz. today, and if oil moves even higher -

Silver will move higher with it! -

If Silver could be counterfeited, our copper clad coins

would look a lot more like Silver than they do -

Silver coins are easily recognized by anyone who has

ever held one, and felt the difference in weight -

Silver is so rare today that many of the best experts say -

that there is barely 300 million ounces of Silver -

in refined, deliverable form -

With 300 million people in the U.S., then if you have even

one single ounce of Silver, then you may have -

“more than your fair share”, and are either an evil,

greedy, capitalist pig, or a wise steward -

of your own wealth -

A day’s wage over 100 years ago used to be up to a

Silver dollar, or as little as a Silver dime -

You can buy those same Silver dollars today -

for much less - Get some FMNJ -

By Jason

Keep in mind -

Silver - LT Strong Bull Trend Started -

1st LT Bull wave - 1st correction -

4 more LT Bull waves to Go -

Gold - LT Strong Bull Trend Started -

1st LT Bull wave - 1st correction -

4 more LT Bull waves to Go -

(Elliott Wave 5-wave Elliott Pattern)

FMNJ - Cerro Rico -

The world largest and richest Silver Mine -

is also very rich in Zinc metal -

The world need Zinc - to Produce More Soon -

or Zinc - Prices to the Moon -

The use of Zinc is widespread, and its demand -

has increased significantly over the past 30 years -

A steady 4% annual increase in consumption has replaced -

the historic norm of 2% -

As countries -

like China and India continue to expand, creating huge

new demand for raw materials, the price of Zinc is

likely to continue climbing -

The 5 year price of Zinc showing the price to

have nearly doubled since January of 2003 -

Yet, even after this doubling -

it is still only 4 cents above the average Zinc price -

for the past 40 years -

a price which has moved as high as $1.70 -

a level which might soon be approached once

again -

40 year Zinc Chart -

Zinc's primary use is in the galvanizing process of steel -

The largest markets for galvanized steel -

are the housing and automobile industries -

As the commercial and residential construction sector -

continues to grow due to the modernization of peoples -

all over the world - the increasing demand -

for Zinc is a matter of fact -

Zinc is found in microwave and cellular towers -

steel beams, studs,

floor joints, trusses -

and galvanized electric circuits.

Die cast Zinc parts are found in automobiles -

computers, tools and all types of appliances -

As an alloy of lead, copper, tin, lead, aluminum -

or magnesium, zinc also plays a role in the electrical -

and consumer product industries -

But that's not all folks, Zinc is also used -

in manufacturing of batteries, rubber goods -

cosmetics, chemicals, and pharmaceuticals -

Furthermore, since Zinc is an essential nutrient -

for all living things, it is often -

used in vitamin supplements, animal feed -

and fertilizers -

But what would all this demand mean for the future -

of Franklin Mining if it weren't for the lack of supply? -

14 year Zinc Inventory Levels -

International demands -

has recently forecast that 2.5 million tons of new annual -

Zinc mine production must be attained -

by the year 2007 in order to fill in -

the supply/demand gap -

Because few of the large zinc mines are at this moment -

committed to production due to the low market price of Zinc -

it is highly unlikely that this demand will be met in time -

It takes 10-15 years for newly discovered Zinc deposits -

to reach the production stage -

and very few discoveries have been made -

in the past 10 years -

Of those few who have the possibility of becoming -

producers by 2010 -

higher Zinc prices are required to speed up the process -

since it will confirm the bull market -

satisfy feasibility requirements -

and allow for a much easier financing -

of the capital intensive mines -

Currently the LME Zinc inventory -

is about 540,000 tons -

down about 250,000 tons since its peak -

in April of 2004 -

If inventory levels continue to decline -

the price must increase -

to curb the excess demand -

The chart of LME warehouse levels for Zinc -

Do to this outstanding technical data -

it may happen that before Franklin Mining Company -

ever begins mining their mines -

or perhaps while in the midst of it -

that we will be sought out -

and bought out by a large mining company -

desiring to expand to it's own capacity -

In such a case -

it can only be speculated what the share price offered -

would be -

But based upon the earlier value calculations -

a conservative estimate would lie between $1 - 5 a share? -

I do not think it is likely FMNJ will sell all of

its properties rights -

A more likely outcome would be a Joint Venture -

in mining operations if it proves hard for FMNJ -

to raise the capital necessary for the start up of the

old richest mines -

If Zinc prices continue to rise -

I do not see this as any problem -

I believe that if the old Franklin -

desires to carry on the project themselves -

and that it is committed to do -

so as far as it is possible -

The *** Silver Bonus *** -

Some past production records however -

showed plenty of levels as high as 100s of ounces of Silver per tonne!

-

In the end, only time will tell whether in a few years -

FMNJ stock price will have ascended back up -

well beyond $5/share -

or have long since been bought out for a similar price -

Wisdom is indeed proved right by her children -

and the Franklin management team -

has done an outstanding job of putting things in order -

The right place at the right time -

Note - remember -

*** Opportunities always look bigger going than coming ***

Gold - Copper - Tin - Nickel -

rare strategic mineral bonuses etc. -

DD - -

http://www.investorshub.com/boards/board.asp?board_id=5406

FMNJ - Zinc - LME warehouse stocks have plummeted -

nearly 50% in six months yet prices have remained -

relatively flat since April -

Zinc is one of the the most undervalued metal -

on the market right now.

That means the metal's position today offers -

investors a great low-risk opportunity to take -

advantage of the continuing commodity bull

metal market - a FMNJ refresh -

Franklin Mine NEWS Cerro Rico Silver 33 Mil. Ounces -

Fourth Vein Shows Potential Silver Reserves -

Ag Over 11 Million Silver Ounces -

Repeat FMNJ N/R -

Franklin Mining Announces Cerro Rico Holds Over 33 Million -

Ounces of Silver, Fourth Vein Shows Potential Reserves -

of Over 11 Million -

Tuesday August 1, 7:30 am ET

LAS VEGAS, NV--(MARKET WIRE)--Aug 1, 2006 --

Franklin Mining, Inc. -

(Other OTC:FMNJ.PK - News) -

is pleased to announce today the significant value estimated -

by the COMIBOL reports on the Cerro Rico Mine reserves.

It is believed to hold over 33 million ounces of silver.

San Pedro Cerro Rico Mine -

(the fourth vein) reserves are projected to be over

11 million ounces of silver.

The results were provided by the combined reports from

COMIBOL (Bolivia's national mining company).

According to the COMIBOL prospective reserve reports -

San Pedro is believed to contain approximately -

11,937,569 tons of ore -

208,320 kilos of silver -

and 62,496 metric tons of zinc -

roughly 7,346,196 ounces of silver -

and 137,741,184 pounds of zinc.

This partnership encompasses the four veins of -

the famous Cerro Rico de Potosi Mine -

(San Miguel, San Pedro, Mesapata and Alkco Barreno).

The Cerro Rico Mine -

(located southeast of the city of Potosi, Bolivia) -

under COMIBOL's ownership, is considered -

the world's largest silver deposit -

and one of the most popular tourist attractions in Bolivia.

The four veins are projected to hold over

5.5 million metric tons of ore.

The combined estimated reserves are about -

938,130 kgs of Silver -

250,004 tons of zinc

and over 72,377 tons of tin -

yielding approximately 33,018,564 ounces of silver -

550,784,040 lbs of zinc -

and 159,518,908 lbs of tin.

"The Cerro Rico history's most fabulous silver strike -

changed Bolivia's social fabric 450 years ago.

Now, thanks to modern mining, it may do so again.

Legend has it that enough metal was extracted -

from the deposit to build a bridge of silver -

from South America to Europe.

'It is an impressive amount of mineral wealth,'

Roland Jordan Pozo, secretary general of Bolivia's

association of medium-sized miners, said.

'Industry officials say the deposit could vault -

Bolivia back into the vanguard of global silver production.'"

http://www.latinamericanstudies.org/bolivia/silver.htm

Metal prices today show silver at $ 11.38 USD per ounce -

tin at $3.78 USD per ounce -

and zinc at $ 1.52 per lb USD.

Franklin Mining, Bolivia S.A. -

(a Bolivian corporation)

is a subsidiary company of Franklin Mining, Inc.

COMIBOL is Bolivia's state-owned mining company.

For additional information on Franklin Mining, Inc,

please visit our web site,

http://www.franklinmining.com.

To receive Franklin Mining news by e-mail -

please send contact information to -

info@franklinmining.com.

"Safe Harbor" statement under the Private Securities

Litigation

Reform Act of 1995: This press release contains

forward-looking statements that are subject to risk and

uncertainties, incl. --- --in Franklin Mining, Inc.'s filings

with the Securities and Exchange Commission. These risks could

cause Franklin Mining Inc.'s actual results to differ

materially from those expressed in any forward-looking

statements made by, or on behalf of, Franklin Mining Inc.

Additional information on company operations is found at our

website -

http://www.franklinmining.com/.

Contact:

Franklin Mining, Inc.

Andrew Austin

702-386-5379

info@franklinmining.com

Source: Franklin Mining, Inc.

http://biz.yahoo.com/iw/060801/0149405.html

--

About Cerro Rico Mine:

The Cerro Rico Mine -

is considered by many to be the richest Silver Mine -

in the world.

Rich in Zinc and Silver -

it has been actively mined since the 1500's

and is in operation today -

Cerro Rico is owned by Bolivia's

national mining company, COMIBOL.

About COMIBOL:

COMIBOL is the government owned mining company -

in Bolivia.

COMIBOL owns the CERRO RICO Mines -

as well as many other properties -

and mineral rights in Bolivia.

"Safe Harbor" statement under the Private Securities Litigation

Reform Act of 1995: ----These risks could cause Franklin

Mining Inc.'s actual results to differ materially from those

expressed in any forward-looking statements made by, or on

behalf of, Franklin Mining Inc.

Contact:

Contact:

Franklin Mining, Inc.

Andrew Austin

1-702-386-5379

Source: Franklin Mining, Inc.

winifred, great move -

catch it before it fly away -

Silver will always be part of "The Real Gold & Silver Money" -

Some defend a fraud system with that, "its far too small

a market for large, modern economies" -

Well, its only to put a higher fair value on the Silver money -

it used to be worth $800/oz 500 years ago -

take the inflasion into the picture and Silver maybe worth -

a fair market value $80,000/oz sooner or later? -

Silver will do far better than any fiat fraud paper asset -

it will serve better as a "personal holding" and as

the major Real Money when its valued to its fair market value -

If it is of your way to balance wealth, then Silver will show

the LT Real value -

Metals have not shown their true worth for many years as

the world has done very well with manipulations of fiat fraud

paper money schemes -

This is very good some say - outside of ex. FMNJ Potosi -

But, all things do change! -

As it is our time and place to live this change -

our thoughts must view the future as it must be! -

Who can know the minds of men and countries -

as the 666 fiat paper burns? -

In our present system - all fiat currencies are

backed by the US$ -

as long as the US$ is on an "oil standard" of backing -

no other country can change -

the BIS would destroy their economy in a second of storm -

Many think that a country may sell or cut it's CB/US debt

backing at will! -

They cannot? - they will not! -

Oil will not accept another system? -

as long as the Oil/Gold bond works? -

the world currency system is somewhat in a counterfeited

owg order? -

If a crisis erupts and Gold breaks the bond with oil -

then a change must take place! -

We will no doubt see a mass run of CBs into Gold -

at ANY price! - this we know! - as for now -

each person must protect your worth -

as the nation/state is locked from change? -

You still may have a little bit of some time -

FMNJ - need an 'every day Update' on the -

Silver Companies > Market cap's (updated?) -

FMNJ - Franklin Mining, Inc. = $45 MILLION?

http://www.investorshub.com/boards/board.asp?board_id=2957

http://www.investorshub.com/boards/board.asp?board_id=5406

vs. compare to -

ECU - ECU Silver = $488 MILLION

http://www.investorshub.com/boards/quotes.asp?ticker=v.ecu

http://www.investorshub.com/boards/board.asp?board_id=6098

HL - Hecla Mining Co = $681.71 MILLION

http://www.investorshub.com/boards/quotes.asp?ticker=cde&qm_page=64251&qm_symbol=hl

http://www.investorshub.com/boards/board.asp?board_id=6097

SIL - Apex Silver Mines Ltd. = $905.33 MILLION

http://www.investorshub.com/boards/quotes.asp?ticker=v.ecu&qm_page=4079&qm_symbol=sil

http://www.investorshub.com/boards/board.asp?board_id=5810

SLW - Silver Wheatonfiltered= $2.06 BILLION

http://www.investorshub.com/boards/quotes.asp?ticker=v.ecu&qm_page=98063&qm_symbol=slw

http://www.investorshub.com/boards/board.asp?board_id=4338

SSRI - Silver Standard Resources Inc. = $1.16 BILLION

http://www.investorshub.com/boards/quotes.asp?ticker=v.ecu&qm_page=17190&qm_symbol=ssri

http://www.investorshub.com/boards/board.asp?board_id=6095

CDE - Coeur d'Alene Mines Corp = $1.47 BILLION

http://www.investorshub.com/boards/quotes.asp?ticker=v.ecu&qm_page=35188&qm_symbol=cde

http://www.investorshub.com/boards/board.asp?board_id=5237

PAAS - Pan American Silver Corp. = $1.59 BILLION

http://www.investorshub.com/boards/quotes.asp?ticker=v.ecu&qm_page=63958&qm_symbol=paas

http://www.investorshub.com/boards/board.asp?board_id=4490

UCOI (UNCN) - Unico Inc. = $1.8 MILLION -

(only $1.8 is very oversold - undervalued) -

http://www.investorshub.com/boards/quotes.asp?ticker=ucoi

http://www.investorshub.com/boards/board.asp?board_id=6582

Including - The Silver Bell Mine -

The Deer Trail Gold & Silver Mines -

The Bromide Gold Mines -

Note. if You have more updated info -

Silver comp. market cap. please, don't

hesitate to let us know -

tia.

SILVER Chart TA LT - Strong Bullrun Long Overdue -

http://www.investorshub.com/boards/board.asp?board_id=5406

SILVER used to be worth -

more than GOLD -

history often repeat itself -

Do not let any volatility shake You out -

the more volatility the higher it will go -

the new trend waves will often be -

Fibonacci - 162% of the previous correction -

when the weak hands exhaust themselves -

we'll see the next waves up -

U.S. NATIONAL DEBT CLOCK

The Outstanding Public Debt -

as of Aug. 2006:

http://www.alkalizeforhealth.net/Ldebtclock.htm

Unless the United States gets all of its economic

house in order ? -

Gold will become the basic real money again -

(which Gold has been for 1000's of years)

and national currencies will only be money -

if backed by - Gold.

With the exception only of the periods of -

- The Great Gold Standard -

practically all governments of history -

have used their exclusive power to issue fiat money -

to defraud with totalitarian bureaucratic powers -

rob, plunder and to make slaves -

of most the people -

http://www.goldrush21.com/

The Bolivian miners welcome FMNJ -

Mission Statement - with open arms -

To Make Money for the family -

for community programs to help with social situations -

such as health care and care for homeless children -

To Be Socially Responsible -

Thanks for your participations -

Brgds

Bob

God Bless

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.