| Followers | 246 |

| Posts | 2992 |

| Boards Moderated | 1 |

| Alias Born | 06/16/2015 |

Thursday, April 05, 2018 12:00:00 PM

Net income (earnings) comes right off the Income Statement, and the current O/S is estimated to be around 4.3B shares (my best guess at this point is a little bit higher, maybe around 4.4B...ish).

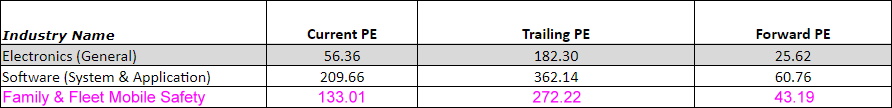

You need to use the "correct/accepted" P/E ratio for the industry which, in this case, is going to be closer to 362 (System & App Software) than it is to 182 (Electronics/General) - but I chose the mid-point value of 272 to be a little bit on the conservative side.

These numbers come from NYU Stern School of Business, which is a reliable go-to source for these numbers in the finance world:

And so here's the simple calculation, in black and white. Answer highlighted in yellow.

The really interesting part is that this is based on the PAST year. In just 2 months we are going to have another Q report, in which we expect to see significantly higher revenue and net income. And Q2 of 2017 - which had much lower income - drops off of the trailing 12-months.

So you might guess that the valuation could quickly approach $0.10 - and you'd be right! (Waldo knows this, he's done his DD homework)

If we see a 20% Q-Q growth in net income, it looks like this:

If we see a 20% Q-Q growth in net income, it looks like this:

Here's how to calculate earnings per share using information from a company's financial statements (Motley Fool)

One of the most useful metrics in assessing a company's profitability is earnings per share, and it can be calculated from information found on that company's balance sheet and income statement, two of the main financial statements. Here's the calculation method, and why it's useful to know.

https://www.fool.com/knowledge-center/how-to-calculate-earnings-per-share-on-a-balance-s.aspx

LINKS:

http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/pedata.html

https://www.investopedia.com/ask/answers/050115/what-difference-between-forward-pe-and-trailing-pe.asp

Recent ONCI News

- Form SEC STAFF ACTION - SEC Staff Action: ORDER • Edgar (US Regulatory) • 10/17/2023 06:00:03 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM

VAYK Exited Caribbean Investments for $320,000 Profit • VAYK • Jun 27, 2024 9:00 AM

North Bay Resources Announces Successful Flotation Cell Test at Bishop Gold Mill, Inyo County, California • NBRI • Jun 27, 2024 9:00 AM

Branded Legacy, Inc. and Hemp Emu Announce Strategic Partnership to Enhance CBD Product Manufacturing • BLEG • Jun 27, 2024 8:30 AM

POET Wins "Best Optical AI Solution" in 2024 AI Breakthrough Awards Program • POET • Jun 26, 2024 10:09 AM

HealthLynked Promotes Bill Crupi to Chief Operating Officer • HLYK • Jun 26, 2024 8:00 AM