| Followers | 246 |

| Posts | 2992 |

| Boards Moderated | 1 |

| Alias Born | 06/16/2015 |

Wednesday, April 04, 2018 11:06:11 AM

I'm only posting this because I see quite a few WAGs at valuation, after some have reached out. I think it would do many folks a lot of good to check out the addendum at the bottom of this post.

There is no such thing as a precise and accurate valuation, but as a company gains a history of performance, eventually analysts come along and toss their hat in the ring and then investors eventually climb on board with the ultimate say in how the market values the stock. Eventually, after some oscillations, analysts and investors come together and there is a pseudo-equilibrium around a projected future value that is a whole lot like a behavioral science experiment turned into a self-fulfilling prophecy.

For now, as early investors in a start-up business, each individual has to be their own analyst - so it pays for each to perform their own DD (see the addendum).

Some might ask why the heck I spend so much time gathering info, analyzing and calculating. The answer should already be obvious, but maybe moreso if the following (below) is better understood. In short, there is a tremendous upside potential here, as with many micro-cap / penny stocks.

But there are very common methods for valuing a stock, and below I have given some insight into the general approach, including some useful links.

As I mentioned in a previous post, I have little care about an audit of the financials or Hexagon right now, including the name change and the shrinking float and domicile change... and all that those things entail. All good things, and great for adding even more value and, sure, some excitement from momo players and it'll surely result in significant trading volume and price movement and all that good stuff.

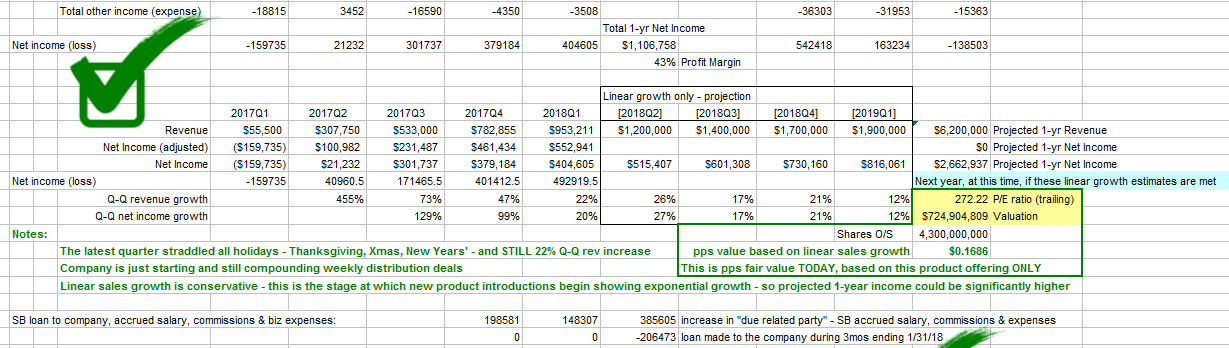

As I noted, valuation isn't super-precise, and it doesn't have to be. But this is all based on facts and standard methods. Note that one imprecise assumption is that the mobile safety product (line) IS the business - nothing else included here having to do with other possible business arms of Hexagon.

These resources are particularly helpful at this point:

http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/pedata.html

https://www.investopedia.com/ask/answers/050115/what-difference-between-forward-pe-and-trailing-pe.asp

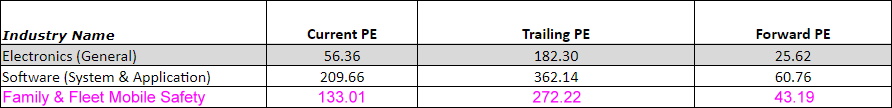

From NYU Stern School of Business:

The product is mostly software, but does include a hardware component in it's current form, as configured for aftermarket installation - though it could take another form as software only, should manufacturers integrate the hardware 100% in original manufacturing. So I chose the midpoint between the electronics and software PE ratios from NYU Stern School of Business (widely accepted industry ratios, recognized througout the financial community). It could easily be looked at with heavier weight on the software end, but this is a good conservative approach, IMO.

Finding this too good to be true? Just depends on whether we keep seeing sales increasing at least the same, "modest" ~20% Q-Q sales growth that we saw over the past 2 quarters. If growth is higher - which seems very likely, IMO - then it's even better than presented here.

Software/apps business is valuable, commanding high valuations due to high margins. Distracted Driving is an extremely hot issue with high demand for real solutions. Look at Microsoft and so many others. Look at Spotify's market cap from yesterday's IPO - $25B+

Here are snapshots of the valuation portion from my earlier-posted spreadsheet...

The original: (I just used a simple/generic PE for reference)

Here is the Value Today, using the Forward P/E ratio:

Here is the Value Today, using the Current P/E ratio:

Here is the Value Today, using the Trailing P/E ratio:

Here is the Value Next Year at this time - assuming we see the projected linear growth over the next 4 Q's - using the Current P/E ratio:

Here is the Value Next Year at this time - assuming we see the projected linear growth over the next 4 Q's - using the Trailing P/E ratio:

ADDENDUM

Here are a few questions that many traders ask themselves from time to time:

- Why do I sometimes find myself with a paltry position in a stock that I've been watching carefully, and then chasing it as it runs, only to sell far prematurely with a small fraction of the gains that I could have made?

- Why do I sometimes - maybe even frequently - find myself buying high and selling low?

- Why can I never get the confidence to accumulate a decent position in undervalued stocks?

- Why do I frequently/always sell a good performing stock way too soon (maybe for fear that I'll lose my profit on a 20%, 50% or 200% gain)? And yet, sometimes I don't sell those hyped-up momo plays fast enough.

99% of the answer, IMO, is that these traders do not do their own DD work, and have little understanding of the value of the stock they're "playing."

Now here comes the investor - who, by the way, is also a trader. Difference is, the investor, wanting to buy undervalued stocks, learns 2 things: 1) how to peruse the financials for the basics, understanding what simple things to look for and to use in combination with 2) how to value a stock.

That's all it takes, just those two things. And anyone who can put together a household budget - and balance it - knows enough to comprehend the basics of the income statement, balance sheet and statement of cash flows in the financial report of a public company.

Why does the investor want to buy undervalued stocks? Well, isn't that obvious? Of course it's so they can buy low and, eventually, sell high.

So... exactly how is it that many investor-wanabe traders expect they can buy low and sell high - and have any hope at all of achieving anywhere near the gain potential of their trade/investment - without knowing the value of their stock?

An undervalued stock is defined as a stock that is selling at a price significantly below what is assumed to be its intrinsic value. For example, if a stock is selling for $50, but it is worth $100 based on predictable future cash flows, then it is an undervalued stock.

Source: Wikipedia - Undervalued Stock, https://en.wikipedia.org/wiki/Undervalued_stock

Reconciling the Strategies

The secret to smart investing strategy is to understand the value of your investments. If asset prices are substantially above their historical norms, and investors are giddy with enthusiasm, be cautious — and vice-versa. Following trends is great if you know exactly when the trend will reverse course. If you don’t, then it’s best to understand market valuation and avoid paying too much for your financial assets.

Retire like Warren Buffett.

https://www.thebalance.com/how-to-apply-warren-buffet-investing-advice-4148097

Recent ONCI News

- Form SEC STAFF ACTION - SEC Staff Action: ORDER • Edgar (US Regulatory) • 10/17/2023 06:00:03 PM

FEATURED DaBaby and Stunna 4 Vegas's "NO DRIBBLE" Joins Music Licensing, Inc.'s Portfolio • Jun 7, 2024 10:15 AM

Mushrooms Inc. (OTC: MSRM) Announces Significant Share Buy Back by the Board Director and New Strategic Initiatives. • MSRM • Jun 5, 2024 1:32 PM

Hydromer Announces Launch of HydroThrombX Medical Device Coating Technology • HYDI • Jun 5, 2024 10:24 AM

Dr. Michael Dent Finances $1 Million to Drive HealthLynked's Healthcare Transformation • HLYK • Jun 5, 2024 8:00 AM

Avant Technologies Enters Binding LOI to Purchase Dozens of High-Performance, Immersible, AI-Powered Servers • AVAI • Jun 5, 2024 8:00 AM

IQST - iQSTEL Announces $290 Million 2024 Annual Revenue Forecast • IQST • Jun 4, 2024 1:43 PM