Tuesday, January 30, 2018 9:34:31 AM

Question Posed: How Did Bob Corker Go from ‘Dead Broke’ to $69 Million Net Worth During 11 Years in U.S. Senate?

December 23, 2017 Admin

“How do you increase your net worth by 69 million dollars while you’re working full-time as a Senator?” That’s the question Rolling Stone reporter Matt Taibbi asked about Senator Bob Corker (R-TN) on Friday.

Neither Taibbi nor Rolling Stone are fans of Corker (or of President Trump, Republicans, or conservatism in general). And Rolling Stone has had problems of its own, recently, as has Taibbi.

Nonetheless, Taibbi puts a fine point on what many political watchers across the Volunteer State have been asking for years.

Federal campaign contributions and lobbying data tracker Open Secrets has perhaps the most jaw-dropping illustration of Corker’s rise to wealth.

As Rolling Stone’s Taibbi writes, “Corker didn’t just enter the Senate without any money. He entered it carrying, according to his own disclosure forms, a mountain range of huge loans.”

Setting the stage for his ‘promotion’ from Chattanooga Mayor to U.S. Senator, Taibbi writes of Tennessee’s junior senator:

Corker took office in January, 2007, during the last gasp of the Bush/Rove political juggernaut. The Iraq war had gone south and the Republicans had just been routed in midterms. The financial crisis was just around the corner. And nobody paid attention to the smooth-talking freshman Senator from Tennessee, who turned out to have some financial issues. . .

It wasn’t until Corker took office and filled out disclosure forms that his finances became public – sort of. Few in the media seem ever to have read the “liabilities” section of Corker’s first disclosure, where the former mayor and construction magnate listed a series of massive outstanding loans. At the low end, Corker appeared to owe a hair-raising $24.2 million. At the high end, $120.5 million.

He took office in debt to some of the nation’s biggest lenders – including somewhere between $12 million and $60 million in debt to GE Capital alone.

Corker had been a construction magnate in Tennessee before taking office, a sort of mini-Trump. Before he ran for office, he sold off his business to a local developer named Henry Luken.

Corker insists that the debts associated with the business were included in the transaction, however his financial disclosures seem to conflict with that assertion.

Sixteen paragraphs in to the article, Taibbi reveals this startling information about the first steps Corker took to accumulate his millions:

Corker tested the limits of the profiteering possibilities in the legislative branch, essentially becoming a full-time day-trader who did a little Senator-ing in his spare time.

In the first nine months of 2007, Corker made an incredible 1,200 trades, over four per day, including 332 over a two-day period.

Followed a few paragraphs later by:

By 2014, when Corker sat on the Senate Banking Committee, a position that gave him regular access to prime information about the future direction of the markets, the Tennessee Senator still had his foot on the gas. He made 930 stock trades that year.

The brazen trades – and their frequency – went generally unnoticed, but for the occasional ethics watchdogs who would cry foul from time to time. Anne Weismann is one such individual that Taibbi found, who, as the director of the Campaign for Accountability, filed a complaint in 2015.

“Senator Corker’s trades followed a consistent pattern,” Weissman said in the Campaign for Accountability’s statement about their filing. “He bought low and sold high. It beggars belief to suggest these trades – netting the senator and his family millions – were mere coincidences.”

The statement highlights some specific, lucrative activities, noting:

Many of Sen. Corker’s profitable trades were made in advance of his broker, UBS, issuing reports impacting CBL’s trading price.

Sen. Corker recently amended his filings to reveal a 2009 purchase of between $1 and $5 million of CBL stock, sold just five months later in 2010 at a 42% profit. Similarly, Sen. Corker made purchases worth between $3 and $15 million in 2010 and, just after his last trade, UBS said it was upgrading its outlook. The stock went up 18%. Shortly thereafter, Sen. Corker began selling; a week later, UBS downgraded the stock and the share price soon declined about 10%.

Corker spokesperson Micah Johnson is quoted by the Rolling Stone’s Taibbi about the complaint(s) saying: “they were ‘yet another baseless accusation by this political special interest group. These claims are categorically false and nothing more than a smear campaign. When amending the senator’s financial disclosure report, our office worked directly with the Senate Ethics Committee to ensure items were reported accurately and in line with Senate guidelines.”

The Rolling Stone article is not the only press report involving questions about Corker’s investments.

“A real-estate firm that has been a favored investment of Tennessee Republican Sen. Bob Corker is under investigation by federal law-enforcement officials for alleged accounting fraud, according to people familiar with the matter,” The Wall Street Journal reported in March 2016:

The Federal Bureau of Investigation and the Securities and Exchange Commission are focusing their examination of CBL & Associates Properties Inc. on whether officials at the Chattanooga, Tenn., company falsified information on financial statements to banks when applying for financing arrangements, the people said. Law-enforcement officials have talked to former CBL employees who allege the company inflated its rental income and its properties’ occupancy rates when reporting those figures to banks, the people said.

The FBI and SEC officials have also separately asked questions about the relationship between the company and Mr. Corker, who is close with senior executives at the firm and has made millions of dollars in profits trading the company’s stock in recent years. Authorities don’t believe that Mr. Corker was involved in the company’s potential accounting issues, but they are interested in learning more about the senator’s trading in CBL’s stock, the people said.

They have found no evidence to suggest that Mr. Corker has committed wrongdoing.

In another matter, The Tennessee Star reported earlier this year that concerns about ongoing investigations looking into an extremely profitable real estate transaction in a Mobile, Alabama retail center may have contributed to Corker’s decision to not seek re-election. The Star’s own Editor-in-Chief Michael Patrick Leahy wrote a series of investigative reports for Breitbart News that detailed the senator’s Alabama sweetheart deal.

You can read the full Rolling Stone article at: https://www.rollingstone.com/politics/features/taibbi-bob-corker-corrupt-what-a-surprise-w514493 (see below)

Bob Corker Facing Ethics Questions? What a Surprise

The Tennessee senator's financial success has been one of Washington's open questions for years

Tennessee Sen. Bob Corker speaks to reporters as he heads to a vote on Capitol Hill in Washington on December 19th, 2017. Tom Brenner/Redux

By Matt Taibbi

December 22, 2017

So Tennessee Senator Bob Corker is in trouble now, because he flip-flopped to vote for Donald Trump's tax bill after a provision was included that reportedly helps him personally.

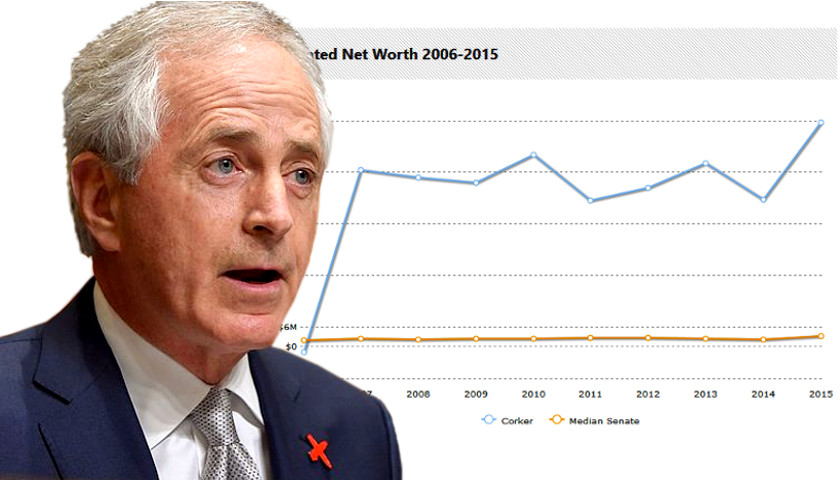

Color me not shocked. I spent most of this past summer investigating Corker, whose personal finances have been the subject of inquiry for years. Everything you need to know about the Senator can be discerned from this chart.

Click on that link and you’ll see what non-partisan research group Center for Responsive Politics has tracked: Corker's net worth has risen by millions since before being elected, to the point of being the fourth wealthiest man in the upper chamber, worth $69 million as of 2015.

How do you increase your net worth so significantly while you're working full-time as a Senator? That is not an easy story to explain.

According to his own disclosure forms, Corker in 2006 carried a series of huge loans.

Corker took office in January, 2007, during the last gasp of the Bush/Rove political juggernaut. The Iraq war had gone south and the Republicans had just been routed in midterms. The financial crisis was just around the corner. And nobody paid attention to the smooth-talking freshman Senator from Tennessee, who turned out to have some financial issues.

The former Chattanooga mayor's election was not without controversy. Corker was a country-club Republican who used an old Southern formula to get elected. He benefited from a lurid race-baiting RNC ad that showed a white woman winking and asking Corker's African-American opponent, Democrat Harold Ford, to "Call me!"

But no one knew about Corker's private peccadilloes.

It wasn't until Corker took office and filled out disclosure forms that his finances became public – sort of. Few in the media seem ever to have read the "liabilities" section of Corker's first disclosure, where the former mayor and construction magnate listed a series of massive outstanding loans. At the low end, Corker appeared to owe a hair-raising $24.2 million. At the high end, $120.5 million.

He had been in debt to some of the nation's biggest lenders – including somewhere between $12 million and $60 million in debt to GE Capital alone.

Corker had been a construction magnate in Tennessee before taking office, a sort of mini-Trump. Before he ran for office, he sold off his business to a local developer named Henry Luken.

Bob Corker in his campaign headquarters in downtown Chattanooga, Tennessee in 2006. Douglas Graham/Getty

It has always been Corker's contention that when he sold his business, his debts were also sold, meaning he was not technically in debt when he went to Washington. Still, he continued to list the loans as liabilities.

This is what Corker spokeswoman Micah Johnson told me this summer, about Corker's outstanding loans back then, and why they were listed on his Senate disclosure:

"On January 4, 2006, in preparation for his run for the Senate and to avoid conflicts, Senator Corker sold the majority of his commercial real estate portfolio. The loans… were transferred with the properties," Johnson wrote. "While the sale took place in January, 10 months before he was elected and one year before he took office, they still would have been listed on his 2007 financial disclosure since the sale took place in 2006."

Many of Corker's critics have disagreed with this interpretation of events. But even if the loans were discharged when he sold his company, it's what happened after Corker got elected that boggles the mind.

Ten years before reporters would swarm over Trump for (among other things) raising fees at his Mar-a-Lago resorts before making a series of taxpayer-funded visits, Corker tested the limits of the moonlighting possibilities in the legislative branch, essentially becoming a full-time day-trader who did a little Senator-ing in his spare time.

In the first nine months of 2007, Corker made an incredible 1,200 trades, over four per day, including 332 over a two-day period.

When I asked Johnson about this, and asked if Corker was making those trades himself or through a broker, Johnson gave a curious answer.

"Soon after taking office in January of 2007, rather than continuing to have a broker make discretionary transactions on his behalf throughout the day or week on a wide range of stocks in various companies, the senator felt it would be prudent to eliminate this arrangement," Johnson said. "The closing out of this arrangement would have added substantially to the number of trades normally made in the broker's discretionary account."

Johnson seems to be saying that Corker would have made substantially more trades if he had executed them through a broker. So, he didn't. I can offer no commentary shedding light on what this means, except to say that at the bottom of all of this is the still-incontrovertible fact that Corker made a truly awesome number of financial transactions while in office.

By 2014, when Corker sat on the Senate Banking Committee, a position that gave him regular access to prime information about the future direction of the markets, the Tennessee Senator still had his foot on the gas. He made 930 stock trades that year.

Senate Banking, Housing and Urban Affairs Committee members Sen. Richard Shelby (left) and Sen. Bob Corker joke before a hearing on Capitol Hill February 6, 2014 in Washington, D.C. Chip Somodevilla/Getty

Of his colleagues on the committee, Rhode Island's Jack Reed made 39 trades, Pennsylvania's Patrick Toomey 26, and nobody else made any – meaning Corker made 93.5% of all trades made by the legislators most plugged-in to the country's finances.

When I asked about that extraordinary volume of trading in 2014, when Corker sat on the Banking Committee, Johnson answered thusly: "In 2014, Senator Corker entered a separately managed account (SMA), which is a portfolio managed by a professional asset management firm. Since he had not previously been in a SMA, he asked the Senate Ethics Committee for a ruling on how they should be reported," she said.

She went on: "The Senate Ethics Committee studied the issue for several weeks, and out of an abundance of caution, advised us to report all underlying positions of the account, even though the senator was making no investment decisions."

A Separately Managed Account is not the same thing as a blind trust. That the Senate Ethics Committee advised Corker to continue reporting his positions even if the senator was making "no investment decisions" was noteworthy. And no matter what, it continued to be true that Corker was making a dizzying number of financial moves while sitting on the Senate Banking Committee.

Corker's activities didn't go completely unnoticed. A few ethics groups and reporters cried foul over the years. He had to amend his Senate disclosures after the Wall Street Journal in 2015 found unreported income from "quick" trades in a Chattanooga company called CBL enterprises. As Fortune noted at the time, Corker went back and made "dozens" of amendments to earlier disclosures, to reveal about $3.8 million in previously unreported income.

Meanwhile, Bethany McLean of Yahoo! News later reported that Corker had invested in a Tennessee hedge fund that made profitable short bets against the housing market with Goldman Sachs.

Anne Weismann, director of the Campaign for Accountability, which filed a complaint against Corker in 2015, described Corker's trading history in damning terms.

"Senator Corker's trades followed a consistent pattern," she said. "He bought low and sold high. It beggars belief to suggest these trades – netting the senator and his family millions – were mere coincidences."

One financial analyst I know said Corker's trading patterns looked more like the work of "an office of multiple analysts all grinding at least 60 hours a week" than like the work of "one guy moonlighting as a Senator."

Johnson's responded on behalf of Corker, stating that they were "yet another baseless accusation by this political special interest group. These claims are categorically false and nothing more than a smear campaign. When amending the senator's financial disclosure report, our office worked directly with the Senate Ethics Committee to ensure items were reported accurately and in line with Senate guidelines."

Corker's name sometimes comes up in stories about other members of Congress who trade auspiciously and often. There are conflicting views on the propriety of such activities, and Corker has never been formally censured.

Until this week, Corker's history has been scrutinized only occasionally, and most often because of the role he's played in an unrelated controversy known colloquially as #Fanniegate.

This monstrous dispute over the future of the "government sponsored entities" Fannie Mae and Freddie Mac, in which Corker played a loud and conspicuous part, made him enemies among investors who are embittered over the unilateral seizure of the two companies' profits six years ago, on August 17th, 2012. Corker supported that controversial and unprecedented move, known as the "revenue sweep."

But other than that affair, few paid attention to Corker over the years. There was some guffawing when it was reported last winter that Donald Trump may have passed over Corker for the Secretary of State job because of his height.

Six months or so later, Corker was seen playing golf with Trump and Peyton Manning. No hard feelings. This, too, is in keeping with Corker's bio. As much as any politician in America, he likes to keep his options open, politically and ideologically.

When Corker took on Trump this fall – saying the White House was "an adult day care center" and that Trump's behavior threatened "World War III" – he suddenly became a darling of sorts in the liberal media.

Now, to his critics, he's a bad guy again, for reportedly doing what he's always done, acting in his own financial interest while earning a paycheck as a U.S. Senator.

The Corker story to me is a classic example of why it's always dangerous to overlook a politician's failings because he happens to be on the right side of some partisan debate at a given moment in time. The reason is obvious: these types eventually revert to form, and soon enough, a politician's flaws will be working against you again, rather than for you.

EDITOR'S NOTE: Rolling Stone heard from Corker's after publication of this article. They objected to the characterization of Corker entering the Senate "without any money."

"Your own charts show that Senator Corker’s estimated net worth in 2007, the first year he was in office, was $54 million, but the writer claims he was worth nothing," they noted. "Since he has been in the Senate, your chart shows his worth has remained fairly flat despite your assertions to the contrary."

Corker "was wealthy then and remains wealthy now," they wrote, adding that, "Since taking office in 2007, the senator has donated his entire Senate salary [of $174,000] to the Community Foundation of Greater Chattanooga."

At issue is the year 2006, the year Corker was elected. Much like Open Secrets, which conducted the same analysis looking at the same disclosures, we found that Corker in 2006 listed matching ranges of assets and liabilities, including the multimillion-dollar loans referenced in the article whose status has remained controversial. Corker's office maintains the assets were worth much more than the liabilities.

The article has been updated to reflect that we were talking about Corker's status when elected, not when he entered the Senate.

Additional Editor's Note: We heard from Bob Corker's office again and they continue to dispute the characterization of the senator in the piece. We have made updates to the story and changed the headline out of respect for those concerns. To further the discussion, we invite Sen. Corker to talk to Matt Taibbi on the record about the issues raised in the article.

JANUARY 30, 2018

House Intel Committee votes to release secret FISA Court docs to the public in spite of DOJ warning against it. Now it's on to review and approval by president. McCabe "removed" from FBI Deputy Director post. More heads to roll.

HOUSE INTEL VOTES TO MAKE SECRET FISA MEMO PUBLIC

https://www.infowars.com/house-intel-votes-to-make-secret-fisa-memo-public/

EXECUTIVE BRANCH NOW HAS CUSTODY OF INTEL MEMO FOR REVIEW PRIOR TO RELEASE

https://www.infowars.com/executive-branch-now-has-custody-of-intel-memo-for-review-prior-to-release/

DEMS LEFT LITERALLY SHAKING OVER #RELEASETHEMEMO VOTE

https://www.infowars.com/dems-left-literally-shaking-over-releasethememo-vote/

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM