Wednesday, January 24, 2018 10:26:53 AM

Jan. 24, 2018

Grenadier

Summary

This is a follow-up on from my Blockchain ETFs Deep Dive.

In-depth analysis on BLCN's investment strategies, fund details and holdings.

A proper comparison with BLOK.

Last week I wrote about the two new ETF developments in “blockchain land” focusing on Amplify Transformational Data Sharing ETF (BLOK) and the Reality Shares Nasdaq Nexgen Economy ETF (BLCN). I have completed the analysis on BLOK in an article you can read here; but I was not able to complete the analysis on BLCN due to a lot of difficulties in getting the information from their website (for which I apologize). Now with reader help I have managed to resolve this, and it is only fair to give you an article on BLCN.

So let’s get started, shall we? All information in this article was sourced from Reality Shares website.

Basic Details:

Launch Date: January 17, 2018.

Expense Ratio: 0.68%.

Shares outstanding: 875,001.

Net assets: $21,306,739.

Number of Holdings: 59 at present up to a maximum of 100.

Daily Volume: 864,779.

Dividends: reinvested into the fund and not distributed.

Looking at the basic information gives me a few insights to share. First of all, like BLOK the fund is tiny which makes sense for a fund just starting out - however this might mean liquidity issues later on. Right now, 800K shares have changed hands on average over the past few days. This is pretty much equal to the entire float of shares, however this turnover volume is not as high as it was with BLOK. On the expense ratio side, the fees do look high compared to other technology ETFs but they are in line with those of BLOK (until 2019 when the fee on BLOK goes up). Due to the global nature of this fund and the need to develop an index I can see why the fee is high.

Prospectus / Investment Strategies:

According to the prospectus this is a passively managed ETF, yet they do create their own index to passively track in partnership with Nasdaq:

“The Index was developed through a partnership between Reality Shares, Inc. (“Reality Shares”), the parent company of Reality Shares Advisors, LLC (the “Adviser”), the Fund’s investment adviser, and Nasdaq, Inc.”

In composing the index, Reality Shares looks for the following (from the company's relevant SEC filing):

Companies committing material resources to developing, researching, supporting, innovating or utilizing blockchain technology for their proprietary use or for use by others (“Blockchain Companies”)

These blockchain companies are committing material resources to further the use and deployment of blockchain technology to, for example, streamline the distribution and verification of cross-border payments; more efficiently store and secure cloud-based digital data; facilitate trusted transactions based on data security and privacy; and mitigate risk in supply chain management, among other uses.

The index universe of “Blockchain Companies” is identified based on research and analysis conducted by the Index Providers. The Index universe is then narrowed to include only those Blockchain Companies with market capitalizations greater than $200 million, the shares of which are exchange-traded and have a six-month average daily trading volume greater than $1,000,000 as of the Index’s reconstitution date.

The remaining Blockchain Companies are then ranked to determine the leading Blockchain Companies as measured by their Blockchain Score™ which is a proprietary ranking system developed by the Index Providers designed to identify those Blockchain Companies expected to benefit most (e.g., from increased economic profit, operational efficiencies or transformational business practices) from the innovation, adoption, deployment and commercialization of blockchain technology.

The 50 to 100 leading Blockchain Companies with the highest Blockchain Scores™ are then selected as the Index constituents. Constituents are weighted in the Index based on their Blockchain Scores™, with Blockchain Companies having higher Blockchain Scores™ weighted more heavily. The Index is reconstituted semi annually in March and September

That last point is key as it notes that Reality Shares is actively creating the index which according to the prospectus is owned and published by them. Nasdaq is involved in calculating and administering the index but they are not involved in determining what is inside the index. I interpret this to mean that this is really an active fund. You have the same ETF provider creating the index and then tracking to it. This explains why the fee is higher compared to more “traditional” passive ETFs. The prospectus does not deliver detail on how this index is created and notes that it is “proprietary” and based on a "blockchain score". For that information I had to look at Reality Shares Advisors website for details.

The blockchain score is created via a five step process in order to determine what companies are included in the fund and to which level of weighting as well. I will summarize the steps here so you can see what is going on under the hood.

Step 1 is about determining the universe of stocks to be picked from based on publicly traded companies selected from across the globe based on multiple sources, including industry associations, journal posts, data searches, news articles, filings (including for patents) and the like. This universe is generated from third-party data vendors to ensure good standing, data transparency, and that all potential constituents are related to blockchain.

Step 2 is concerned with tradability criteria and matches found in the prospectus in that each company has to have a market cap of at least $200 million, have a greater average daily volume greater than $1 million and be listed on a regulated exchange.

Step 3 is concerned with calculating the blockchain score which is the key part of this five step process. Each potential firm from the universe calculated in step 1 is then subject to a 7 factor test:

Role in Blockchain Ecosystem: Scores are awarded commensurate with their level of active effort in the blockchain economy, categorized as one of the following: investor; adopter; advisor; supplier; and developer.

Blockchain Product Stage: Scores are assigned based on their stage of blockchain product development or utilization, categorized as one of the following: planning stage; testing stage; and growth stage.

Blockchain Economic Impact: Scores are awarded based on the expected economic impact of their blockchain utilization/involvement, categorized as one of the following: cost reduction; revenue maximization; and improved productivity.

Blockchain Institute Membership: Scores are assigned based on membership in blockchain institutes and consortiums (including Hyperledger, R3, and the Enterprise Ethereum Alliance).

Research & Development Expenditure: Scores are awarded based on the level of R&D expenditure as a percentage of total revenue.

Filings: Scores are awarded based on the number of public filings and announcements made in reference to blockchain technology.

Innovations: Scores are awarded based on their level of blockchain innovation, including the number of patent applications related to blockchain development.

The scores are summed up and based on other methodology rules not explained in the documentation and then we move on to step 4 where these scores are applied.

Step 4 is where the companies to be included in the index are those with a blockchain score equal to or greater than 50.

Step 5 involves calculating how much weight each company will have (not more than 15%) according to a set of formulas.

As with BLOK, I have covered the prospectus and investment methodology in quite some depth because I feel that since this area is so new and since this is really an actively managed ETF we investors need to know what we are buying into more so than with a traditional passive ETF.

Holdings:

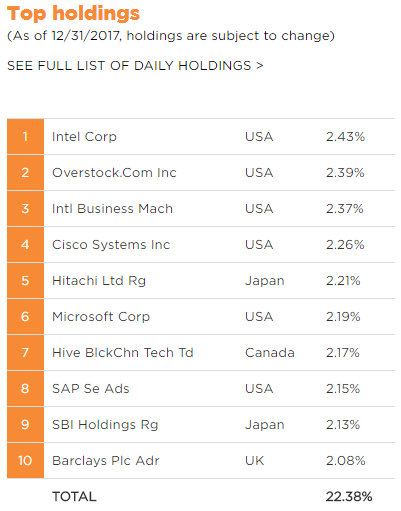

Now let’s look at what BLCN actually contains. At present there are 59 holdings in total. Now in terms of holdings there are two different top ten lists, the first is what other readers have found:

Source: Reality Shares

This appears to be an early “draft” set of holdings that they may have considered at one point in time. I have gone with the "daily holdings" as provided on their website which will form the basis of my analysis below.

The largest holding weighs in at 2.72% of the ETF and the smallest coming in at just over one percent. Less than a quarter of the fund is held within the top 10 compared to BLOK with 46% of the ETF held across the top 10 companies. BLCN has the lowest top 10 holding percentage I have seen as most ETFs have 35%+ in top ten.

Rank:

Holding:

Ticker:

Holding %:

1

Overstock.com Inc

OSTK

2.72%

2

International Business Machines

IBM

2.32%

3

Cisco Systems Inc

CSCO

2.28%

4

Hitachi Ltd

OTCPK:HTHIY

2.26%

5

Intel Corp

INTC

2.21%

6

SBI Holdings Inc/Japan

OTC:DLGEF

2.18%

7

Microsoft Corp

MSFT

2.14%

8

NVIDIA Corp

NVDA

2.08%

9

Advanced Micro Devices Inc

AMD

2.06%

10

Texas Instruments Inc

TXN

2.02%

Total Top 10:

22.26%

Source: Author

Looking at the top 10 in comparison to BLOK there is some overlap. In the top ten we have 4 companies that overlap most notably with Overstock which is the largest and second largest holding in both ETFs due to their work on a property registry based on blockchain. IBM is present in both ETFs probably due to IBM Blockchain platform offering amongst other things. Finally rounding out the top ten overlap are SBI Holdings in Japan which owns 10% of Ripple (the company, not the XRP token) - the one blockchain-related technology firm that has a lot of buy-in from the financial world with their xCurrent platform - and Nvidia (NVDA), which like with BLOK is a pure profit play on cryptocurrency mining.

There are three names in the top ten not present in BLOK at all; Cisco Systems with their IoT protocol initiative, Hitachi with their research into blockchain business models and Texas Instruments.

Looking at the next 20 holdings:

Rank:

Holding:

Ticker:

Holding %:

11

SAP SE

SAP

2.01%

12

Barclays PLC

BCS

1.99%

13

ZTE Corp

OTCPK:ZTCOF

1.98%

14

Hive Blockchain Technologies L

OTCPK:HVBTF

1.96%

15

GFT Technologies SE

ETR:GFT

1.90%

16

Deutsche Boerse AG

ETR:DB1

1.90%

17

Infosys Ltd

INFY

1.89%

18

Broadridge Financial Solutions

BR

1.88%

19

Oracle Corp

ORCL

1.87%

20

Thomson Reuters Corp

TRI

1.87%

Total Top 11-20:

19.25%

Within the next 10 there are some other overlaps between BLCN and BLOK with 6 overlapping holdings but of more interest are the 4 that do not appear in BLOK at all. There are Barclays PLC and ZTE Corp with their blockchain based credentials platform, and GFT Technologies and the Deutsche Boerse with their blockchain cash transfer concept that they are working on.

The top 20 BLCN holdings make up about 41.5% of the fund as opposed to 74% for BLOK, making BLOK far more concentrated.

In the remaining 39 holdings there are some major overlaps. These include financial institutions like Goldman Sachs (GS), Citigroup (C), State Street (STT), Broadridge Financial Solutions (BR) and Banco Santander (SAN). Payment services Visa (V) and Mastercard (MA) are also included. I have detailed what these companies are doing in the blockchain space in the article on BLOK. However there are 26 BLCM holdings that are not in BLOK, and these are the ones I want to focus on in order to give you some color. There is quite a strong set of Japanese firms, among them Fujitsu (OTCPK:FJTSY), NTT Data Corp (NTTY), NEC Corp (OTC:NIPNF) and Panasonic (OTCPK:PCRFY). NTT is notably involved in a trial blockchain for cross border trade with Mitsubishi UFJ Financial Group (MTU) and Fujitsu with their blockchain security technology. There is also a nice selection of Chinese names such as: Alibaba (BABA) with their efforts in creating better supply chains, BOC Hong Kong Holdings (HKG: 2388), NetEase (NTES) and Tencent Holdings (OTCPK:TCEHY) with the blockchain platform that they are building. BLCN is more global than BLOK, containing a lot of major global players in the space, including Siemens (SEI) with their investments in a blockchain based smart grid; Daimler AG (OTC:DDAIY), representing Europe; and the Toronto Dominion Bank (TD) from Canada with their involvement in a blockchain powered digital identity network developed by SecureKey in partnership with IBM. SecureKey is a private company and thus would not qualify for inclusion in this ETF.

As with BLOK I am pleased to see that there are no “junk” companies that simply added in “blockchain” to their name like RIOT Blockchain (RIOT) and Long Blockchain Corp (LBCC). Kodak (KODK) is “missing” in BLCN, which is good because as I noted in the article on BLOK, I did not think it worth including in an ETF.

All in all, now that I have been able to really dig into this ETF after a “trying effort” to get the information, I find that the holdings seem to match very well with the prospectus and the goals of the fund. You are getting a lot of exposure to global firms (more than half of the ETF is outside North America) involved in the blockchain and more of them than with BLOK, and at a slightly lower fee.

As with BLOK, this is not just a technology ETF (it is worth noting that retail focused firms like Tencent and Alibaba are classed as “information technology”) and has a strong financial component. This, again, represents the prevailing thought that the blockchain is supposed to change the very way we do business in the financial world.

In terms of blockchain investment vehicles, I have found BLCN to actually be a solid investment offering and yes, I might even have to admit that it is superior to BLOK (now that a proper analysis has been completed). With BLCN you have less concentration in the top 20 and more holdings, and thus more “bets” on potential winner. It is more globally diverse and is slightly cheaper.

As in my article on BLOK, I will caution readers that there will probably be more of these types of ETFs coming out soon as the space develops. I will be there to write more articles on these developments as well but as always, do your own diligence. Thank you for reading.

https://seekingalpha.com/article/4139686-blcn-etf-deep-dive?auth_param=f4h1u:1d6h70a:83d92bbfd20b6be8183cd9b65f50beed&uprof=54

UAV Corp. (UMAV) Reduces Authorized Shares by 1.2 Billion, Demonstrating Commitment to Shareholders; New Authorized Share Count Approved at 800 Million • UMAV • Dec 17, 2024 12:00 PM

Avant Technologies and Ainnova Secure Advanced AI Algorithms for Early Detection of Four Additional Diseases in the U.S. • AVAI • Dec 17, 2024 8:00 AM

North Bay Resources Announces MET Results of 97% Gold Recovery with Upgrade to 11.2 Ounces per Ton Concentrate, Fran Gold Project; Completes 120 Ton Winter Ore Shipment • NBRI • Dec 16, 2024 9:00 AM

Mass Megawatts Announces the Financial Reporting Status Being Current as of Today • MMMW • Dec 16, 2024 8:18 AM

VAYK Renewed JV to Renovate Historic Landmark into "Most Sought-after Airbnb Place" in Downtown Atlanta • VAYK • Dec 12, 2024 9:36 AM

Silexion Is Addressing the MOST COMMON Human Cancer Gene Mutation With RNAi; Recent M&As in the Field Were for Tens of Billions - $SLXN • SLXN • Dec 11, 2024 9:22 AM