| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Saturday, January 20, 2018 9:57:41 AM

:::: DP Weekly Wrap: Almost A Top ::::

By Carl Swenlin | January 19, 2018

Friday was the last trading day before options expiration, so higher than normal volume should be attributed to that, not to other interpretations of volume versus price movement. We began the trading week with another breakout to new, all-time highs, but that turned into an intraday reversal. But not to worry, the decline only brought price back to the January rising trend line, which held for the rest of the week. In the process, price was squeezed into a short-term rising wedge. Typically, these formations resolve downward, but, let me guess, this wedge will probably resolve to the upside. It's still not too late for a price top, but I'm not holding my breath.

STOCKS

IT Trend Model: BUY as of 11/15/2016

LT Trend Model: BUY as of 4/1/2016

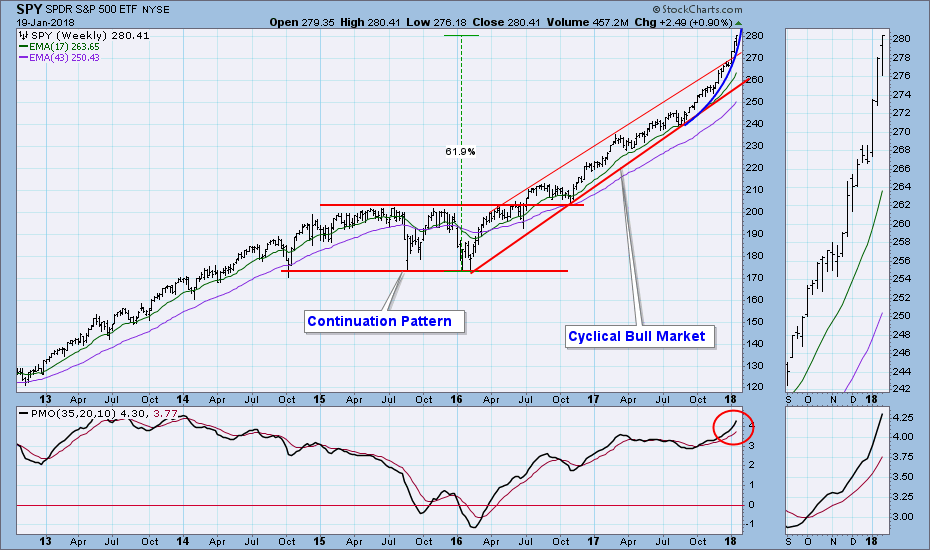

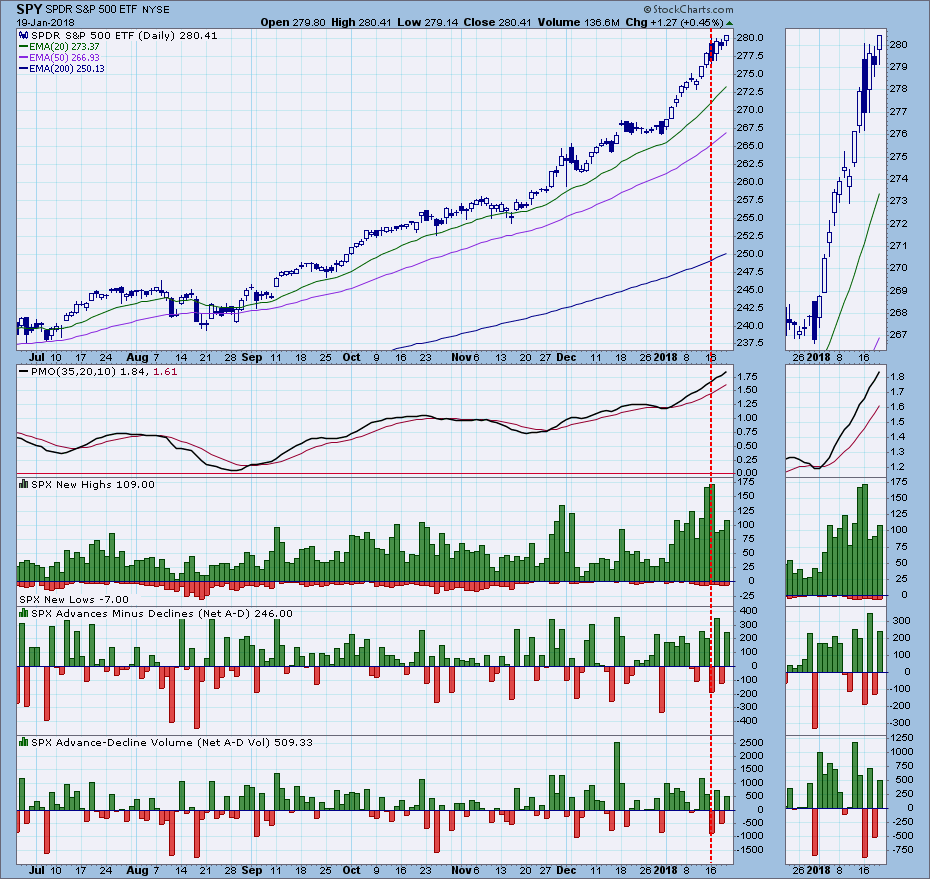

Daily Chart: The problem visible on this chart is the ever-increasing angle of ascent of the price index. The steeper it gets the less likely it is to continue, but it is still impossible to predict when it will end. There was some sideways churn this week, but it didn't do any technical damage. Another issue is that the EMAs are really spread apart, so, in the event of a serious decline, it will take a lot of time before we get EMA downside crossovers to generate signal changes.

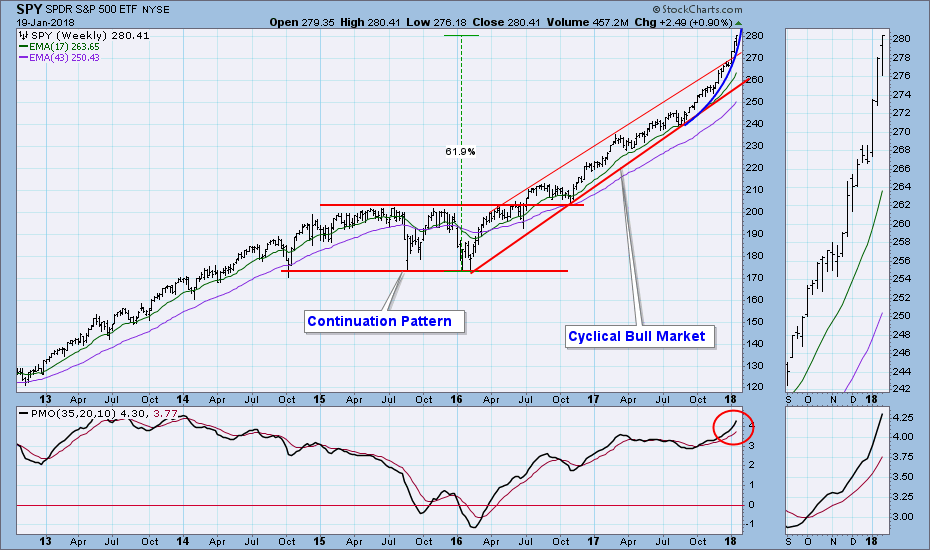

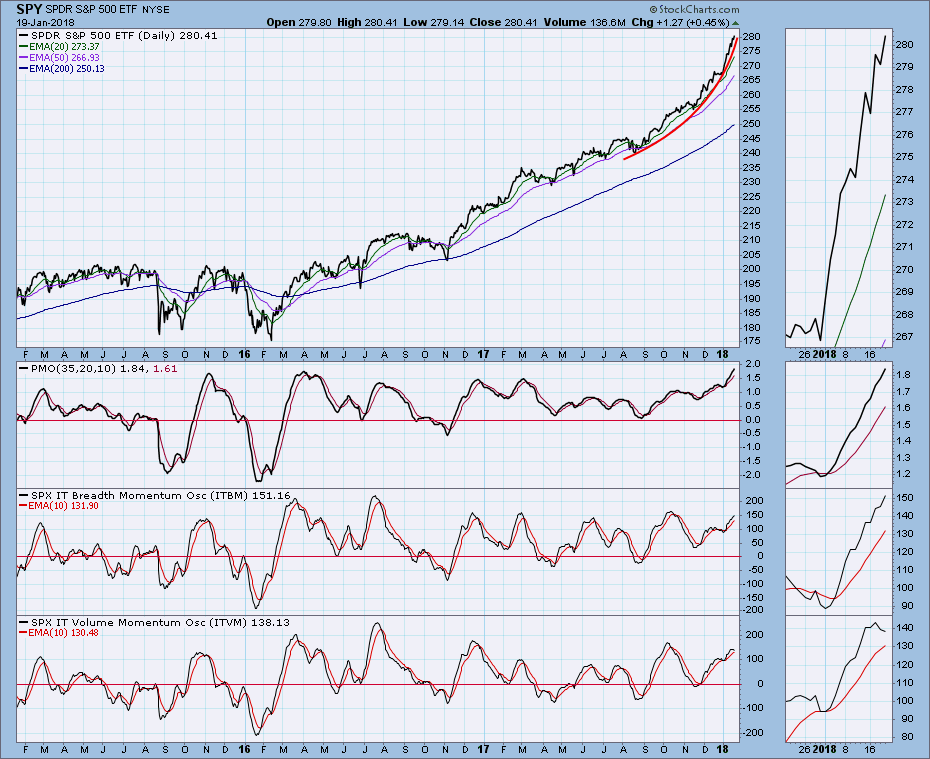

Weekly Chart: SPY has moved out of the cyclical bull market rising trend channel in a parabolic arc. This near-vertical path is unsustainable, and the normal trend channel beckons. A decline back to the rising trend line would require a decline of about -7%, which would do a lot to relieve the current excesses without killing the golden goose.

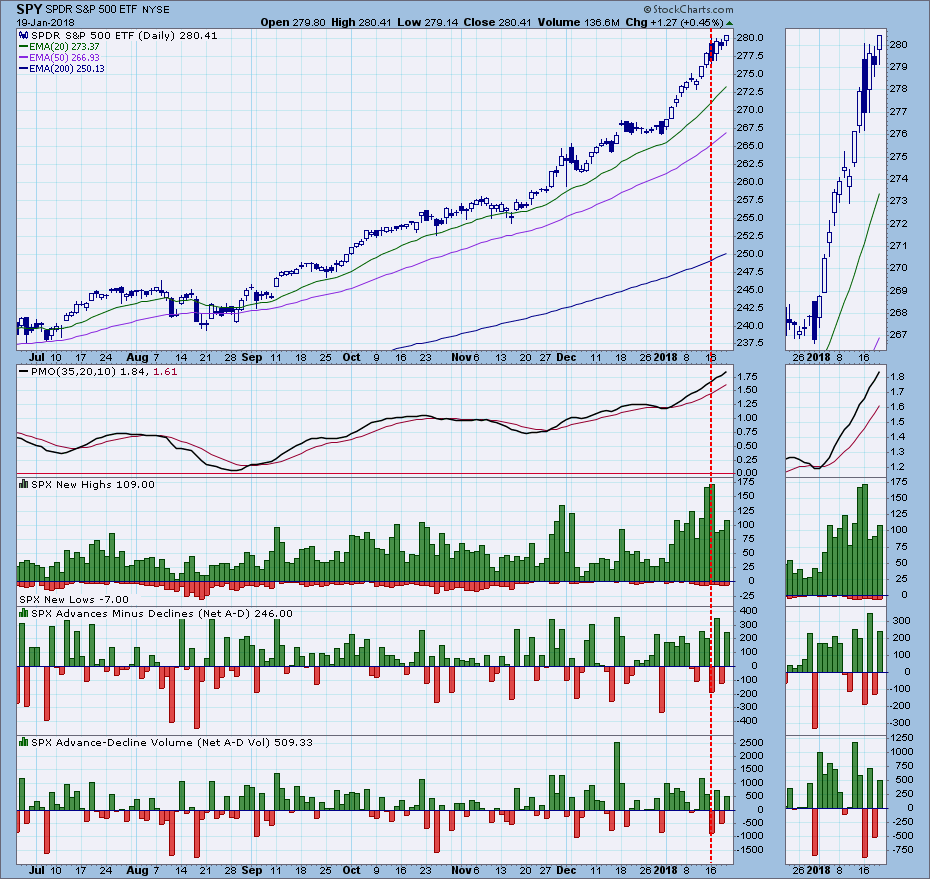

Climactic Market Indicators: There was a climax of New Highs on Tuesday, then a sharp contraction of New Highs the next day. There was a climax of Advances on Wednesday, then an absence of climaxes the rest of the week. This is the kind of activity that makes me look for a short, sharp pullback, but this market has too much upside bias to accommodate such expectations.

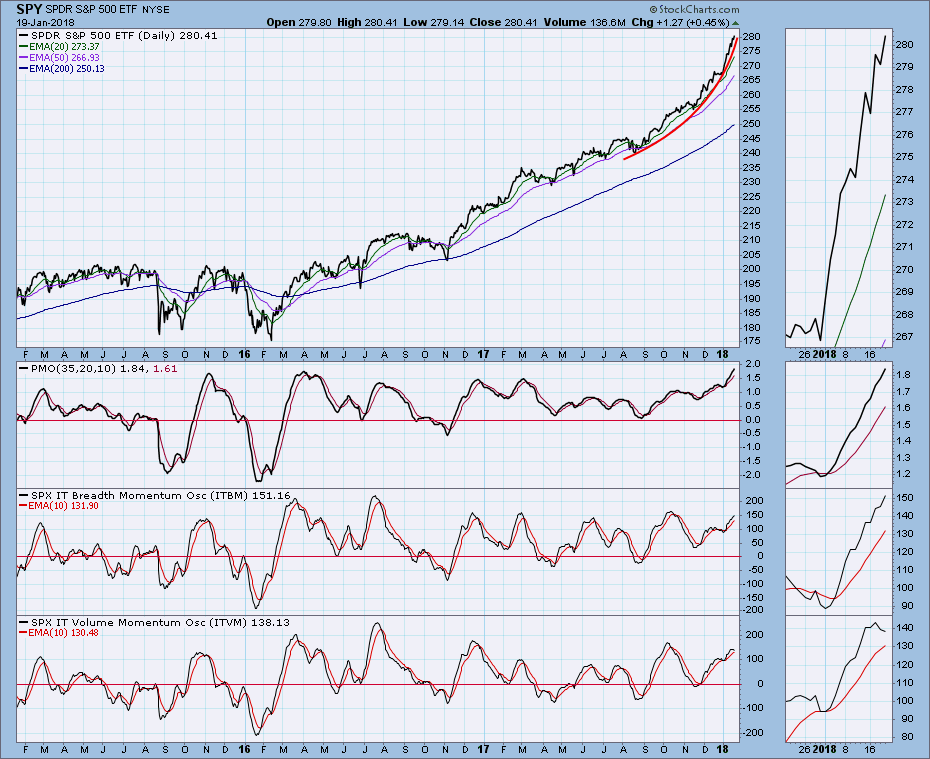

Short-Term Market Indicators: More neutral than helpful.

Intermediate-Term Market Indicators: These indicators are getting overbought, but March of last year was the last time that term had any meaning.

Conclusion: For weeks I have been expressing concern about the market's the near vertical price rise, and I am still concerned because it is worse than ever. Our intermediate-term indicators are overbought, and price is still parabolic. During the week I was thinking that there might be justification for being less concerned, but there's not. It was just me being momentarily worn down by the bull.

As for the parabolic nature of the advance, let's get a little perspective on that. One concept of how a parabolic resolves is that price breaks down dramatically and crashes down to unimaginable depths. I have seen this happen, but that is not our current situation. The parabolic began off the August lows, and that would be the lowest that I would expect price to correct. A more realistic target would be for price to decline about -7%, but even that may be too ambitious. Seriously, we will probably see some kind of pullback, but it will likely be far less than people like me will be satisfied with. . .

* * *

http://stockcharts.com/articles/decisionpoint/2018/01/dp-weekly-wrap-almost-a-top.html

• DiscoverGold

Click on "In reply to", for Authors past commentaries

By Carl Swenlin | January 19, 2018

Friday was the last trading day before options expiration, so higher than normal volume should be attributed to that, not to other interpretations of volume versus price movement. We began the trading week with another breakout to new, all-time highs, but that turned into an intraday reversal. But not to worry, the decline only brought price back to the January rising trend line, which held for the rest of the week. In the process, price was squeezed into a short-term rising wedge. Typically, these formations resolve downward, but, let me guess, this wedge will probably resolve to the upside. It's still not too late for a price top, but I'm not holding my breath.

STOCKS

IT Trend Model: BUY as of 11/15/2016

LT Trend Model: BUY as of 4/1/2016

Daily Chart: The problem visible on this chart is the ever-increasing angle of ascent of the price index. The steeper it gets the less likely it is to continue, but it is still impossible to predict when it will end. There was some sideways churn this week, but it didn't do any technical damage. Another issue is that the EMAs are really spread apart, so, in the event of a serious decline, it will take a lot of time before we get EMA downside crossovers to generate signal changes.

Weekly Chart: SPY has moved out of the cyclical bull market rising trend channel in a parabolic arc. This near-vertical path is unsustainable, and the normal trend channel beckons. A decline back to the rising trend line would require a decline of about -7%, which would do a lot to relieve the current excesses without killing the golden goose.

Climactic Market Indicators: There was a climax of New Highs on Tuesday, then a sharp contraction of New Highs the next day. There was a climax of Advances on Wednesday, then an absence of climaxes the rest of the week. This is the kind of activity that makes me look for a short, sharp pullback, but this market has too much upside bias to accommodate such expectations.

Short-Term Market Indicators: More neutral than helpful.

Intermediate-Term Market Indicators: These indicators are getting overbought, but March of last year was the last time that term had any meaning.

Conclusion: For weeks I have been expressing concern about the market's the near vertical price rise, and I am still concerned because it is worse than ever. Our intermediate-term indicators are overbought, and price is still parabolic. During the week I was thinking that there might be justification for being less concerned, but there's not. It was just me being momentarily worn down by the bull.

As for the parabolic nature of the advance, let's get a little perspective on that. One concept of how a parabolic resolves is that price breaks down dramatically and crashes down to unimaginable depths. I have seen this happen, but that is not our current situation. The parabolic began off the August lows, and that would be the lowest that I would expect price to correct. A more realistic target would be for price to decline about -7%, but even that may be too ambitious. Seriously, we will probably see some kind of pullback, but it will likely be far less than people like me will be satisfied with. . .

* * *

http://stockcharts.com/articles/decisionpoint/2018/01/dp-weekly-wrap-almost-a-top.html

• DiscoverGold

Click on "In reply to", for Authors past commentaries

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.