Wednesday, January 10, 2018 11:16:12 PM

Soaring with the Condors Data

Good Morning Ladies and Gentlemen !

~Welcome To :

~*~Mining & Metals Du Jour~*~ Graveyard Shift~

Tonights Graveyard Shift is Sponsored By: S&H Green Stamps

MMgys

Thank You

(sorry the Chevrolet Corvette series is no longer available)

and now our feature presentation

EnJoy

Soaring with the Condors Data

MMgys

Lets Take Off !

and Thanks

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Jan 10/GOLD RISES $6.05 TO $1318.85/SILVER RISES 3 CENTS TO $17.01/ GOLD EFP’S RISE BY ANOTHER 9600 CONTRACTS/SILVER EFP TRANSFERS TO LONDON: 1436 CONTRACTS/THE BIG NEWS OF THE DAY: CHINA SET TO ABANDON PURCHASE OF USA BONDS/ALSO USA IS SET TO ABANDON NAFTA WHICH SENT THE MEXICAN PESO AND THE CANADIAN DOLLAR FALLING/

January 10, 2018 · by harveyorgan · in Uncategorized · Leave a comment

GOLD: $1318.85 UP $6.05

Silver: $17.01 UP 3 cents

Closing access prices:

Gold $1317.00

silver: $16.98

SHANGHAI GOLD FIX: FIRST FIX 10 15 PM EST (2:15 SHANGHAI LOCAL TIME)

SECOND FIX: 2:15 AM EST (6:15 SHANGHAI LOCAL TIME)

SHANGHAI FIRST GOLD FIX: $1319.28 DOLLARS PER OZ

NY PRICE OF GOLD AT EXACT SAME TIME: $1311.80

PREMIUM FIRST FIX: $7.48

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

SECOND SHANGHAI GOLD FIX: $1327.54

NY GOLD PRICE AT THE EXACT SAME TIME: $1311.00

Premium of Shanghai 2nd fix/NY:$16.54

SHANGHAI REJECTS NY /LONDON PRICING OF GOLD

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

LONDON FIRST GOLD FIX: 5:30 am est $1321.65

NY PRICING AT THE EXACT SAME TIME: $1315.80

LONDON SECOND GOLD FIX 10 AM: $1319.75

NY PRICING AT THE EXACT SAME TIME. $1318.10

For comex gold:

JANUARY/

NUMBER OF NOTICES FILED TODAY FOR JANUARY CONTRACT: 1 NOTICE(S) FOR 100 OZ.

TOTAL NOTICES SO FAR: 256 FOR 25600 OZ (0.7962 TONNES),

For silver:

jANUARY

30 NOTICE(S) FILED TODAY FOR

150,000 OZ/

Total number of notices filed so far this month: 537 for 2,685,000 oz

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Bitcoin: BID $14,030/OFFER $14,150 DOWN $345 (morning)

Bitcoin: BID 14,547/OFFER $14,667 up $170(CLOSING)

end

Let us have a look at the data for today

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

In silver, the total open interest ROSE BY A FAIR 795 contracts from 194,214 RISING TO 195,009 DESPITE YESTERDAY’S 14 CENT FALL IN SILVER PRICING. WE HAD NO COMEX LIQUIDATION BUT WITHOUT A DOUBT WE WITNESSED ANOTHER FAILED MAJOR BANK SHORT- COVERING OPERATION. NOT ONLY THAT , WE WERE AGAIN NOTIFIED THAT WE HAD ANOTHER GOOD SIZED NUMBER OF COMEX LONGS TRANSFERRING THEIR CONTRACTS TO LONDON THROUGH THE EFP ROUTE: A CONSIDERABLE 1436 EFP’S FOR MARCH (AND ZERO FOR OTHER MONTHS) AND THUS TOTAL ISSUANCE OF 1436 CONTRACTS. HOWEVER THE MOVEMENT ACROSS TO LONDON IS NOT AS SEVERE AS IN GOLD AS THERE SEEMS TO BE A MAJOR PLAYER TAKING ON THE BANKS AT THE COMEX. STILL, WITH THE TRANSFER OF 1436 CONTRACTS, WHAT THE CME IS STATING IS THAT THERE IS NO SILVER (OR GOLD) TO BE DELIVERED UPON AT THE COMEX AS THEY MUST EXPORT THEIR OBLIGATION TO LONDON. YESTERDAY WITNESSED EFP’S FOR SILVER ISSUED. ALSO KEEP IN MIND THAT THERE CAN BE A DELAY OF 24 HRS IN THE ISSUING OF EFP’S. I BELIEVE THAT WE MUST HAVE HAD SOME MAJOR BANKER SHORT COVERING AGAIN TODAY.

ACCUMULATION FOR EFP’S/SILVER/ STARTING FROM FIRST DAY NOTICE/FOR MONTH OF JANUARY:

20,707 CONTRACTS (FOR 8 TRADING DAYS TOTAL 20,707 CONTRACTS OR 103.500 MILLION OZ: AVERAGE PER DAY: 2588 CONTRACTS OR 12.940 MILLION OZ/DAY)

RESULT: A GOOD SIZED GAIN IN OI COMEX DESPITE THE 14 CENT FALL IN SILVER PRICE WHICH USUALLY INDICATES ANOTHER FAILED BANKER SHORT-COVERING. WE ALSO HAD A FAIR SIZED EFP ISSUANCE OF 1436 CONTRACTS WHICH EXITED OUT OF THE SILVER COMEX AND TRANSFERRED THEIR OI TO LONDON AS FORWARDS. FROM THE CME DATA 1436 EFP’S WERE ISSUED FOR TODAY (FOR MARCH EFP’S AND NONE FOR ALL OTHER MONTHS) FOR A DELIVERABLE FORWARD CONTRACT OVER IN LONDON WITH A FIAT BONUS. WE REALLY GAINED 2231 OI CONTRACTS i.e. 1436 open interest contracts headed for London (EFP’s) TOGETHER WITH A INCREASE OF 795 OI COMEX CONTRACTS. AND ALL OF THIS HAPPENED WITH THE FALL IN PRICE OF SILVER BY 14 CENTS AND A CLOSING PRICE OF $16.94 WITH RESPECT TO YESTERDAY’S TRADING. YET WE STILL HAVE A GOOD AMOUNT OF SILVER STANDING AT THE COMEX.

In ounces AT THE COMEX, the OI is still represented by just UNDER 1 BILLION oz i.e. 0.9775 BILLION TO BE EXACT or 140% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT JANUARY MONTH/ THEY FILED: 30 NOTICE(S) FOR 150,000 OZ OF SILVER

In gold, the open interest ROSE BY A FAIR SIZED 3383 CONTRACTS UP TO 555,455 DESPITE THE FALL IN PRICE OF GOLD WITH YESTERDAY’S TRADING ($6.30). IN ANOTHER HUGE DEVELOPMENT, WE RECEIVED THE TOTAL NUMBER OF GOLD EFP’S ISSUED YESTERDAY FOR TODAY AND IT TOTALED A GOOD SIZED 9593 CONTRACTS OF WHICH THE MONTH OF FEBRUARY SAW 9593 CONTRACTS AND APRIL SAW THE ISSUANCE OF 0 CONTRACTS. The new OI for the gold complex rests at 555,455. DEMAND FOR GOLD INTENSIFIES GREATLY AS WE CONTINUE TO WITNESS A HUGE NUMBER OF EFP TRANSFERS TOGETHER WITH THE MASSIVE INCREASE IN GOLD COMEX OI TOGETHER WITH THE TOTAL AMOUNT OF GOLD OUNCES STANDING FOR JANUARY. EVEN THOUGH THE BANKERS ISSUED THESE MONSTROUS EFPS, THE OBLIGATION STILL RESTS WITH THE BANKERS TO SUPPLY METAL BUT IT TRANSFERS THE RISK TO A LONDON BANKER OBLIGATION AND NOT A NEW YORK COMEX OBLIGATION. LONGS RECEIVE A FIAT BONUS TOGETHER WITH A LONG LONDON FORWARD. THUS, BY THESE ACTIONS, THE BANKERS AT THE COMEX HAVE JUST STATED THAT THEY HAVE NO APPRECIABLE METAL!! THIS IS A MASSIVE FRAUD: THEY CANNOT SUPPLY ANY METAL TO OUR COMEX LONGS BUT THEY ARE QUITE WILLING TO SUPPLY MASSIVE NON BACKED GOLD (AND SILVER) PAPER KNOWING THAT THEY HAVE NO METAL TO SATISFY OUR LONGS. LONDON IS NOW SEVERELY BACKWARD IN BOTH GOLD AND SILVER (BIG RISE IN BOTH GOFO AND SIFO) AND WE ARE WITNESSING DELAYS IN ACTUAL DELIVERIES. IN ESSENCE WE HAVE ANOTHER GOOD GAIN OF 12,976 OI CONTRACTS: 3383 OI CONTRACTS INCREASED AT THE COMEX AND A GOOD SIZED 9593 OI CONTRACTS WHICH NAVIGATED OVER TO LONDON.

YESTERDAY, WE HAD 5660 EFP’S ISSUED.

ACCUMULATION OF EFP’S/ GOLD(EXCHANGE FOR PHYSICAL) FOR THE MONTH OF JANUARY STARTING WITH FIRST DAY NOTICE: 72,858 CONTRACTS OR 7.286 MILLION OZ OR 226.26 TONNES (8 TRADING DAYS AND THUS AVERAGING: 9,107 EFP CONTRACTS PER TRADING DAY OR 910,700 OZ/DAY)

Result: A FAIR SIZED INCREASE IN OI DESPITE THE FALL IN PRICE IN GOLD TRADING ON YESTERDAY ($6.30). WE HAD ANOTHER FAIR SIZED NUMBER OF COMEX LONG TRANSFERRING TO LONDON THROUGH THE EFP ROUTE: 9593. THERE OBVIOUSLY DOES NOT SEEM TO BE MUCH PHYSICAL GOLD AT THE COMEX AND YET WE ALSO OBSERVED A HUGE DELIVERY MONTH FOR THE MONTH OF DECEMBER. I GUESS IT EXPLAINS THE HUGE ISSUANCE OF EFP’S…THERE IS HARDLY ANY GOLD PRESENT AT THE GOLD COMEX FOR DELIVERY PURPOSES. IF YOU TAKE INTO ACCOUNT THE 9593 EFP CONTRACTS ISSUED, WE HAD A NET GAIN IN OPEN INTEREST OF 12,976 contracts:

9593 CONTRACTS MOVE TO LONDON AND 3383 CONTRACTS INCREASED AT THE COMEX. (in tonnes, the gain in total oi equates to 40.36 TONNES)

we had: 1 notice(s) filed upon for 100 oz of gold.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

With respect to our two criminal funds, the GLD and the SLV:

With gold up again, we had another strange withdrawal today from the GLD: 2.95 tonnes

Inventory rests tonight: 831.91 tonnes.

SLV/

NO CHANGES IN SILVER INVENTORY AT THE SLV/

INVENTORY RESTS AT 318.423 MILLION OZ/

end

First, here is an outline of what will be discussed tonight:

1. Today, we had the open interest in silver ROSE BY A CONSIDERABLE 795 contracts from 194,214 UP TO 195,009 (AND now A LITTLE FURTHER FROM THE NEW COMEX RECORD SET ON FRIDAY/APRIL 21/2017 AT 234,787) WITH THE FALL IN PRICE OF SILVER TO THE TUNE OF 14 CENTS YESTERDAY. WE HAD WITHOUT A DOUBT ANOTHER MAJOR SHORT COVERING FROM OUR BANKERS AS THEY HAVE CAPITULATED. NOT ONLY THAT BUT OUR BANKERS USED THEIR EMERGENCY PROCEDURE TO ISSUE ANOTHER 1436 PRIVATE EFP’S FOR MARCH (WE DO NOT GET A LOOK AT THESE CONTRACTS AS IT IS PRIVATE BUT THE CFTC DOES AUDIT THEM). EFP’S GIVE OUR COMEX LONGS A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. WE HAD NO COMEX SILVER COMEX LIQUIDATION. BUT, IF WE TAKE THE GOOD OI GAIN AT THE COMEX OF 795 CONTRACTS TO THE 1436 OI TRANSFERRED TO LONDON THROUGH EFP’S WE OBTAIN A GAIN OF 2231 OPEN INTEREST CONTRACTS DESPITE THE MAJOR BANKER SHORT COVERING. WE STILL HAVE A GOOD AMOUNT OF SILVER OUNCES THAT ARE STANDING FOR METAL IN JANUARY (SEE BELOW). THE NET GAIN TODAY IN OZ: 11.15 MILLION OZ!!!

RESULT: A GOOD SIZED INCREASE IN SILVER OI AT THE COMEX WITH THE FALL OF 14 CENTS IN PRICE (WITH RESPECT TO YESTERDAY’S TRADING). BUT WE ALSO HAD ANOTHER 1436 EFP’S ISSUED TRANSFERRING COMEX LONGS OVER TO LONDON. TOGETHER WITH THE GOOD SIZED AMOUNT OF SILVER OUNCES STANDING FOR JANUARY, DEMAND FOR PHYSICAL SILVER INTENSIFIES AS WE WITNESS MAJOR BANK SHORT COVERING ACCOMPANIED BY INCREASES IN GOFO AND SIFO RATES INDICATING SCARCITY.

(report Harvey)

.

2.a) The Shanghai and London gold fix report

(Harvey)

2 b) Gold/silver trading overnight Europe, Goldcore

(Mark O’Byrne/zerohedge

and in NY: Bloomberg

3. ASIAN AFFAIRS

i)Late TUESDAY night/WEDNESDAY morning: Shanghai closed UP 7.93 points or 0.23% /Hang Sang CLOSED UP 62.31 pts or 0.20% / The Nikkei closed DOWN 61.79 POINTS OR 0.26%/Australia’s all ordinaires CLOSED DOWN 0.57%/Chinese yuan (ONSHORE) closed UP at 6.5040/Oil UP to 63.52 dollars per barrel for WTI and 69.16 for Brent. Stocks in Europe OPENED MOSTLY RED. ONSHORE YUAN CLOSED DOWN AGAINST THE DOLLAR AT 6.5040. OFFSHORE YUAN CLOSED DOWN AGAINST THE ONSHORE YUAN AT 6.5140 //ONSHORE YUAN STRONGER AGAINST THE DOLLAR/OFF SHORE STRONGER TO THE DOLLAR/. THE DOLLAR (INDEX) IS WEAKER AGAINST ALL MAJOR CURRENCIES. CHINA IS STILL HAPPY TODAY.(GOOD MARKETS AND STRONGER YUAN)

3a)THAILAND/SOUTH KOREA/NORTH KOREA

i)North Korea/South Korea

North Korea states: not so fast with our detente: “all our atomic bombs and ICBMS are aimed at the USA and not at South Korea, China or Russia

( zerohedge)

b) REPORT ON JAPAN

3 c CHINA

i)From Bloomberg, a big story where China is now set to slow or halt USA treasury purchases This sends the 10 yr USA treasury to 2.59% and the dollar plummeting

( zerohedge)

ii)Did China send a message to the uSA as to who is really in charge?

a must read..

( zerohedge)

4. EUROPEAN AFFAIRS

i)Orban: “We do not see them as refugees, we see them as Muslim invaders”

(interview of Orban/Bild/zerohedge)

ii)This European initiate is having quite an effect on independent stock research shops. Budgets for research in 2018 will be down 1/3

( zerohedge)

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

6 .GLOBAL ISSUES

Trial balloon? Canadian loonie and the Mexican Peso plunge on a report that the USA is going to pull out of NAFTA

( zerohedge)

7. OIL ISSUES

8. EMERGING MARKET

Venezuela crude output plummets to a 28 year low as this socialist nation is in shear chaos

( zerohedge)

9. PHYSICAL MARKETS

i)As we pointed out yesterday, China wants market forces to determine the value between the yuan vs the dollar

( GATA/Bloomberg)

ii)Buffet agrees with me in that cryptocurrencies have an intrinsic value of zero and thus he would buy a 5 year put on every single crypto

( zerohedge)

iii)Chris Marcus of Miles Franklin asks a good question. When our bankers decide to cover their silver shorts, to whom are they going to buy from?( Marcus/Miles Franklin)

10. USA stories which will influence the price of gold/silver

i)The following will be a good win for GDP in the 4th quarter as inventories rebound on top of good sales

(courtesy zerohedge)

ii)Heavy rains and a lack of some forests due to the fires, causes Southern California mudslides

( zerohedge)

iii)SWAMP STORIES

a)Once again a judge has blocked Trump’s immigration policy re DACA

( zerohedge)

b)Trump lawyer Michael Cohen is now suing Fusion GPS on the phony dossier and that should shed more light as to who financed this piece of work

( zerohedge)

iv)Firstly this morning we witness China abandoning purchase of USA Treasuries. This afternoon we see that Pakistan has suspended military and intelligence co-operation with the USA. Slowly but surely the uSA is losing its hegemony

( zerohedge)

v)The end may be near for Sears as Lampert considers all options if new financing fails

( zerohedge)

vi)

Moody’s warns Washington that its USA credit rating is at risk over the Trump tax cuts

(courtesy zerohedge)

Let us head over to the comex:

The total gold comex open interest ROSE BY FAIR SIZED 3383 CONTRACTS UP to an OI level of 555,455 DESPITE THE FALL IN THE PRICE OF GOLD ($6.30 LOSS WITH RESPECT TO YESTERDAY’S TRADING). OBVIOUSLY WE HAD ZERO COMEX GOLD LIQUIDATION WITH ANOTHER STRONG GAIN IN TOTAL OPEN INTEREST AS WE WITNESSED ANOTHER HUMONGOUS COMEX TRANSFER THROUGH THE EFP ROUTE. THESE LONGS RECEIVED A DELIVERABLE LONDON FORWARD TOGETHER WITH A FIAT BONUS. THE CME REPORTS THAT 9593 EFP’S WERE ISSUED FOR FEBRUARY AND 0 EFP’s FOR APRIL: TOTAL 9593 CONTRACTS. THE OBLIGATION STILL RESTS WITH THE BANKERS ON THESE TRANSFERS.

ON A NET BASIS IN OPEN INTEREST WE GAINED TODAY: 12,976 OI CONTRACTS IN THAT 9593 LONGS WERE TRANSFERRED AS FORWARDS TO LONDON AND WE GAINED 3383 COMEX CONTRACTS. NET GAIN: 12,976 contracts OR 1,297,600 OZ OR 40.34 TONNES

Result: A STRONG SIZED INCREASE IN COMEX OPEN INTEREST DESPITE THE SMALL FALL IN THE PRICE YESTERDAY’S GOLD TRADING ($6.30.) WE HAD NO GOLD LIQUIDATION ANYWHERE. TOTAL OPEN INTEREST GAIN ON THE TWO EXCHANGES: 1,297,600 OI CONTRACTS…

We have now entered the active contract month of JANUARY. The open interest for the front month of JANUARY saw it’s open interest FALL by 12 contracts DOWN to 181. We had 13 notices served on Friday so we GAINED 1 contract or 100 additional oz of gold will stand in this non active month AND QUEUE JUMPING RETURNS.

FEBRUARY saw a LOSS of 13,701 contacts DOWN to 344,176. March saw a gain of 53 contracts up to 472. April saw a GAIN of 14,037 contracts UP to 108,496.

We had 1 notice(s) filed upon today for 100 oz

PRELIMINARY VOLUME TODAY ESTIMATED; n/a

FINAL NUMBERS CONFIRMED FOR YESTERDAY: 400,689

comex gold volumes are RISING AGAIN

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for the wild silver comex results.

Total silver OI ROSE BY A CONSIDERABLE 795 CONTRACTS FROM 194,214 UP TO 195,009 DESPITE YESTERDAY’S 14 CENT FALL. AGAIN WE MUST HAVE HAD SOME BANKER SHORT COVERING. NOT ONLY THAT, WE HAD ANOTHER GOOD SIZED 1436 EMERGENCY EFP’S FOR MARCH ISSUED BY OUR BANKERS (ZERO FOR ALL OTHER MONTHS) TO COMEX LONGS WHO RECEIVED A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON: THE TOTAL EFP’S ISSUED: 1436. IT SURE LOOKS LIKE THE SILVER BOYS HAVE STARTED TO MIGRATE TO LONDON FROM THE START OF DELIVERY MONTH AND CONTINUING RIGHT THROUGH UNTIL FIRST DAY NOTICE JUST LIKE WE ARE WITNESSING TODAY. USUALLY WE NOTED THAT CONTRACTION IN OI OCCURRED ONLY DURING THE LAST WEEK OF AN UPCOMING ACTIVE DELIVERY MONTH. THIS PROCESS HAS JUST BEGUN IN EARNEST IN SILVER STARTING IN SEPTEMBER. HOWEVER, IN GOLD, WE HAVE BEEN WITNESSING THIS FOR THE PAST 2 YEARS. WE HAD NO LONG COMEX SILVER LIQUIDATION BUT A RISE IN TOTAL SILVER OI AS IT SEEMS THAT WE ARE WITNESSING SOME MAJOR FAILED BANKER SHORT-COVERING. WE ARE ALSO WITNESSING A FAIR AMOUNT OF SILVER OUNCES STANDING FOR COMEX METAL IN THIS NON ACTIVE JANUARY AS WELL AS THAT CONTINUAL MIGRATION OF EFPS OVER TO LONDON. ON A PERCENTAGE BASIS THERE ARE MORE EFP’S ISSUED FOR GOLD THAN SILVER AS IT SEEMS THAT A MAJOR PLAYER WISHES TO TAKE ON THE CROOKED COMEX SHORTS. ON A NET BASIS WE GAINED 2231 OPEN INTEREST CONTRACTS:

795 CONTRACT GAIN AT THE COMEX COMBINING WITH THE ADDITION OF 1436 OI CONTRACTS NAVIGATING OVER TO LONDON.

NET GAIN: 2231 CONTRACTS

We are now in the poor non active delivery month of January and here the OI GAIN by 9 contracts RISING TO 48. We had 0 notices served upon yesterday, so we GAINED 9 contracts or an additional 45,000 oz will stand for delivery AT THE COMEX

February saw a LOSS OF 1 OI contracts FALLING TO 182. The March contract LOST 758 contracts DOWN to 148,176.

We had 30 notice(s) filed for NIL 150,000 for the January 2018 contract for silver

INITIAL standings for JANUARY

Jan 10/2018.

Gold Ounces

Withdrawals from Dealers Inventory in oz nil oz

Withdrawals from Customer Inventory in oz

4369.916 oz

Scotia

Deposits to the Dealer Inventory in oz nil oz

Deposits to the Customer Inventory, in oz

nil oz

No of oz served (contracts) today

1 notice(s)

100 OZ

No of oz to be served (notices)

180 contracts

(18,000 oz)

Total monthly oz gold served (contracts) so far this month

256 notices

25600 oz

0.7962 tonnes

Total accumulative withdrawals of gold from the Dealers inventory this month NIL oz

Total accumulative withdrawal of gold from the Customer inventory this month xxx oz

we had zero kilobar transaction/

We had 0 inventory movement at the dealer accounts

total inventory movement at the dealer accounts: nil

we had one withdrawal into the customer account:

Out of Scotia: 4,369.916 oz

total withdrawal: 4,369.916 oz

we had 0 customer deposits

total deposits: zero

we had 0 adjustments

total registered or dealer gold: 568,449.373 oz or 17.681 tonnes

total registered and eligible (customer) gold; 9,205,743.76 oz 286.33 tones

For JANUARY:

Today, 0 notice(s) were issued from JPMorgan dealer account and 0 notices were issued from their client or customer account. The total of all issuance by all participants equates to 1 contract(s) of which 1 notices were stopped (received) by j.P. Morgan dealer and 0 notice(s) was (were) stopped/ Received) by j.P.Morgan customer account.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

To calculate the INITIAL total number of gold ounces standing for the JANUARY. contract month, we take the total number of notices filed so far for the month (256) x 100 oz or 25600 oz, to which we add the difference between the open interest for the front month of JAN. (181 contracts) minus the number of notices served upon today (1 x 100 oz per contract) equals 43,600 oz, the number of ounces standing in this active month of JANUARY

Thus the INITIAL standings for gold for the JANUARY contract month:

No of notices served (256 x 100 oz or ounces + {(181)OI for the front month minus the number of notices served upon today (1 x 100 oz which equals 43,600 oz standing in this active delivery month of JANUARY (1.356 tonnes). THERE IS 17.68 TONNES OF REGISTERED GOLD AVAILABLE FOR DELIVERY SO FAR.

WE GAINED 1 CONTRACTS OR AN ADDITIONAL 100 OZ WILL STAND IN THIS NON ACTIVE DELIVERY MONTH OF JANUARY

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

ON FIRST DAY NOTICE FOR JANUARY 2017, THE INITIAL GOLD STANDING: 3.904 TONNES STANDING

BY THE END OF THE MONTH: FINAL: 3.555 TONNES STOOD FOR COMEX DELIVERY AS THE REMAINDER HAD TRANSFERRED OVER TO LONDON FORWARDS.

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Total dealer inventory 568,449.373 oz or 17.681 tonnes (dealer gold continues to disappear)

Total gold inventory (dealer and customer) = 9,210,113.76 or 286.44 tonnes

I have a sneaky feeling that these withdrawals of gold in kilobars are being used in the hypothecating process and are being used in the raiding of gold!

The gold comex is an absolute fraud. The use of kilobars and exact weights makes the data totally absurd and fraudulent! To me, the only thing that makes sense is the fact that “kilobars: are entries of hypothecated gold sent to other jurisdictions so that they will not be short with their underwritten derivatives in that jurisdiction. This would be similar to the rehypothecated gold used by Jon Corzine at MF Global.

IN THE LAST 14 MONTHS 68 NET TONNES HAS LEFT THE COMEX.

end

And now for silver

AND NOW THE DECEMBER DELIVERY MONTH

DECEMBER FINAL standings

Jan 10 2018

Silver Ounces

Withdrawals from Dealers Inventory nil oz

Withdrawals from Customer Inventory

75,120.770 oz

CNT

Scotia

Deposits to the Dealer Inventory

nil

oz

Deposits to the Customer Inventory

1,197,997.140 oz

JPMorgan

CNT

No of oz served today (contracts)

30

CONTRACT(S)

(150,000 OZ)

No of oz to be served (notices)

18 contract

(90,000 oz)

Total monthly oz silver served (contracts) 537 contracts

(2,685,000 oz)

Total accumulative withdrawal of silver from the Dealers inventory this month NIL oz

Total accumulative withdrawal of silver from the Customer inventory this month

we had no inventory movement at the dealer side of things

total inventory movement dealer: nil oz

we had two inventory deposits into the customer account

i) Into JPMorgan (deposits of silver resume): 598,853,270 oz

ii) Into CNT: 599,138.870 oz

total inventory deposits: 1,197,997.140 oz

we had 2 withdrawals from the customer account;

i) out of CNT; 60,156.560 oz

ii) Out of Scotia; 14,970.210 oz

total withdrawals; 502,712.320 oz

we had 1 adjustments”

i) out of HSBC:

we had 5171.400 oz adjusted out of the dealer and into the customer account of HSBC

total dealer silver: 45.461 million

total dealer + customer silver: 245.595 million oz

The total number of notices filed today for the JANUARY. contract month is represented by 30 contract(s) FOR 150,000 oz. To calculate the number of silver ounces that will stand for delivery in JANUARY., we take the total number of notices filed for the month so far at 537 x 5,000 oz = 2,685,000 oz to which we add the difference between the open interest for the front month of JAN. (48) and the number of notices served upon today (30 x 5000 oz) equals the number of ounces standing.

.

Thus the INITIAL standings for silver for the JANUARY contract month: 537(notices served so far)x 5000 oz + OI for front month of JANUARY(48) -number of notices served upon today (30)x 5000 oz equals 2,775,000 oz of silver standing for the JANUARY contract month. This is VERY GOOD for this NONACTIVE delivery month of JANUARY. WE GAINED 9 CONTRACTS OR AN ADDITIONAL 45,000 OZ WILL STAND FOR DELIVERY IN THIS NON ACTIVE DELIVERY MONTH OF JANUARY.

ON FIRST DAY NOTICE FOR THE JANUARY 2017 CONTRACT WE HAD 3,790 MILLION OZ STAND.

THE FINAL STANDING: 3,730 MILLION OZ

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

ESTIMATED VOLUME FOR TODAY: 109,174

CONFIRMED VOLUME FOR FRIDAY: 98,941 CONTRACTS

YESTERDAY’S CONFIRMED VOLUME OF 98,941 CONTRACTS EQUATES TO 494 MILLION OZ OR 70.67% OF ANNUAL GLOBAL PRODUCTION OF SILVER

COMMODITY LAW SUGGESTS THAT OPEN INTEREST SHOULD NOT BE MORE THAN 3% OF ANNUAL GLOBAL PRODUCTION. THE CROOKS ARE SUPPLYING MASSIVE PAPER TRYING TO KEEP SILVER IN CHECK.

Total dealer silver: 59.182 million

Total number of dealer and customer silver: 240.232 million oz

The record level of silver open interest is 234,787 contracts set on April 21./2017 with the price at that day at $18.42

The previous record was 224,540 contracts with the price at that time of $20.44

end

NPV for Sprott and Central Fund of Canada

1. Central Fund of Canada: traded at Negative 3.1 percent to NAV usa funds and Negative 2.8% to NAV for Cdn funds!!!!

Percentage of fund in gold 62.9%

Percentage of fund in silver:36.9%

cash .+.2%( Jan 10/2018)

2. Sprott silver fund (PSLV): NAV RISES TO -0.97% (Jan 10/2018)??????????????????????????????

3. Sprott gold fund (PHYS): premium to NAV FALLS TO -0.49% to NAV (Jan 10/2018 )

Note: Sprott silver trust back into NEGATIVE territory at -0.97%-/Sprott physical gold trust is back into NEGATIVE/ territory at -0.49%/Central fund of Canada’s is still in jail but being rescued by Sprott.

Sprott WINS hostile 3.1 billion bid to take over Central Fund of Canada

(courtesy Sprott/GATA)

END

And now the Gold inventory at the GLD

Jan 10/with gold up today, a strange withdrawal of 2.95 tonnes/inventory rests at 831.91 tonnes

Jan 9/no changes in gold inventory at the GLD/Inventory rests at 834.88 tonnes

Jan 8/with gold falling by a tiny $1.40 and this being after 12 consecutive gains, today they announce another 1.44 tonnes of gold withdrawal from the GLD/

Jan 5/NO CHANGE IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 836.32 TONNES

Jan 4/2018/no change in gold inventory at the GLD/Inventory rests at 836.32 tonnes

Jan 3/a huge withdrawal of 1.18 tonnes of gold from the GLD/Inventory rests at 836.32 tonnes

Jan 2/2018/no changes in gold inventory at the GLD/inventory rests at 837.50 tonnes

Dec 29/NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 837.50 TONNES

Dec 28/NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 837.50 TONNES

Dec 27/NO CHANGES IN GOLD INVENTORY AT THE GLD/ INVENTORY RESTS AT 837.50 TONNES

Dec 26/no change in gold inventory at the GLD

Dec 22/ A DEPOSIT OF 1.48 TONNES OF GOLD INTO GLD INVENTORY/INVENTORY RESTS AT 837.50 TONNES

Dec 21' NO CHANGE IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 836.02 TONNES

Dec 20/DESPITE THE GOOD ADVANCE IN PRICE TODAY/THE CROOKS RAIDED THE COOKIE JAR TO THE TUNE OF 1.18 TONNES/INVENTORY RESTS AT 836.02 TONNES

Dec 19/NO CHANGE IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 837.20 TONNES

Dec 18 SHOCKINGLY AFTER TWO GOOD GOLD TRADING DAYS, THE CROOKS RAID THE COOKIE JAR BY THE SUM OF 7.09 TONNES/INVENTORY RESTS AT 837.20 TONNES

Dec 15/NO CHANGES IN GOLD INVENTORY/RESTS AT 844.29 TONNES.

Dec 14/a good sized gain of 1.48 tonnes of gold into the GLD/inventory rests at 844.29 tones

Dec 13/no changes in gold inventory at the GLD/inventory rests at 842.81 tonnes

Dec 12/SURPRISINGLY NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 842.81 TONNES

Dec 11/SURPRISINGLY NO CHANGES IN GOLD INVENTORY AT THE GLD DESPITE THE CONSTANT RAIDS ON GOLD/INVENTORY RESTS AT 842.81 TONNES

Dec 8/NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 842.81 TONNES

Dec 7/A BIG WITHDRAWAL OF 2.66 TONNES FROM THE GLD/INVENTORY RESTS AT 842.81 TONNES

Dec 6/No changes in GOLD inventory at the GLD/Inventory rests at 845.47 tonnes

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Jan 10/2018/ Inventory rests tonight at 831.91 tonnes

*IN LAST 307 TRADING DAYS: 109.04 NET TONNES HAVE BEEN REMOVED FROM THE GLD

*LAST 242 TRADING DAYS: A NET 48.27 TONNES HAVE NOW BEEN ADDED INTO GLD INVENTORY.

end

Now the SLV Inventory

Jan 10/with silver up again, we had a huge withdrawal of 1.227 million oz from the SLV/inventory rests at 316.348 million oz

Jan 9/a withdrawal of 848,000 oz from the SLV/Inventory rests at 317.575 million oz/

jan 8/no change in silver inventory at the SLV/Inventory rests at 318.423 million oz/

Jan 5/DESPITE NO CHANGE IN SILVER PRICING, WE HAD A HUGE WITHDRAWAL OF 2.026 MILLION OZ/INVENTORY RESTS AT 318.423 MILLION OZ.

Jan 4.2018/a slight withdrawal of 180,000 oz and this would be to pay for fees/inventory rests at 320.449 million oz/

Jan 3/NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 320.629 MILLION OZ.

Jan 2/WITH SILVER UP DRAMATICALLY THESE PAST 4 TRADING DAYS, THE FOLLOWING MAKES NO SENSE: WE HAD A WITHDRAWAL OF 2.83 MILLION OZ FROM THE SLV

INVENTORY RESTS AT 320.629 MILLION OZ/

Dec 29/no changes in silver inventory at the SLV/inventory rests at 323.459 million oz/

Dec 28/DESPITE THE RISE IN SILVER AGAIN BY 13 CENTS, WE LOST ANOTHER 1,251,000 OZ OF SILVER FROM THE SILVER.

Dec 27/WITH SILVER UP AGAIN BY 17 CENTS, WE LOST ANOTHER 802,000 OZ OF SILVER INVENTORY/WHAT CROOKS/INVENTORY RESTS AT 324.780 MILLION OZ/

Dec 26/no change in silver inventory at the SLV./Inventory rests at 325.582

Dec 21/NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 326.227 MILLION OZ/

Dec 20/INVENTORY REMAINS CONSTANT AT 326.337 MILLION OZ (COMPARE WITH GLD)

Dec 19/SILVER INVENTORY REMAINS CONSTANT AT 326.337 MILLION OZ

Dec 18.2017//SILVER INVENTORY CONTINUES TO REMAIN PAT./INVENTORY REMAINS AT 326.337 MILLION OZ/

INVENTORY RESTS AT 326.337 TONNES

Dec 15/NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 326.337 MILLION OZ/

Dec 14/a small withdrawal of 377,000 oz and that usually means to pay for fees./inventory rests at 326.337 million oz/

Dec 13/no change in silver inventory at the SLV/Inventory rests at 326.714 million oz/

Dec 12/WOW!ANOTHER STRANGE ONE: SILVER HAS BEEN DOWN FOR 10 CONSECUTIVE DAYS, YET THE SLV ADDS ANOTHER 1.415 MILLION OZ TO ITS INVENTORY. IN THAT 10 DAY PERIOD, SLV ADDS 9.584 MILLION OZ/

INVENTORY RESTS AT 326.714 MILLION OZ

Dec 11/WOW!! ANOTHER STRANGE ONE: SILVER DESPITE BEING DOWN FOR 9 CONSECUTIVE TRADING DAYS ADDS ANOTHER 944,000 OZ TO ITS INVENTORY. FROM NOV 30 UNTIL TODAY SILVER HAS BEEN DOWN EVERY DAY. HOWEVER THE INVENTORY OF SILVER HAS RISEN 8.169 MILLION OZ.

Dec 8/A HUGE DEPOSIT OF 2.642 MILLION OZ/INVENTORY RESTS AT 324.355 MILLION OZ/

Dec 7/strange!! with the continual whacking of silver, no change in silver inventory at the SLV/Inventory rests at 321.713

Dec 6/no change in silver inventory at the SLV/Inventory remains at 21.713 million oz.

Jan 10/2017:

Inventory 316.348 million oz

end

6 Month MM GOFO

Indicative gold forward offer rate for a 6 month duration

+ 1.73%

12 Month MM GOFO

+ 1.98%

30 day trend

end

Major gold/silver trading /commentaries for WEDNESDAY

GOLDCORE/BLOG/MARK O’BYRNE.

GOLD/SILVER

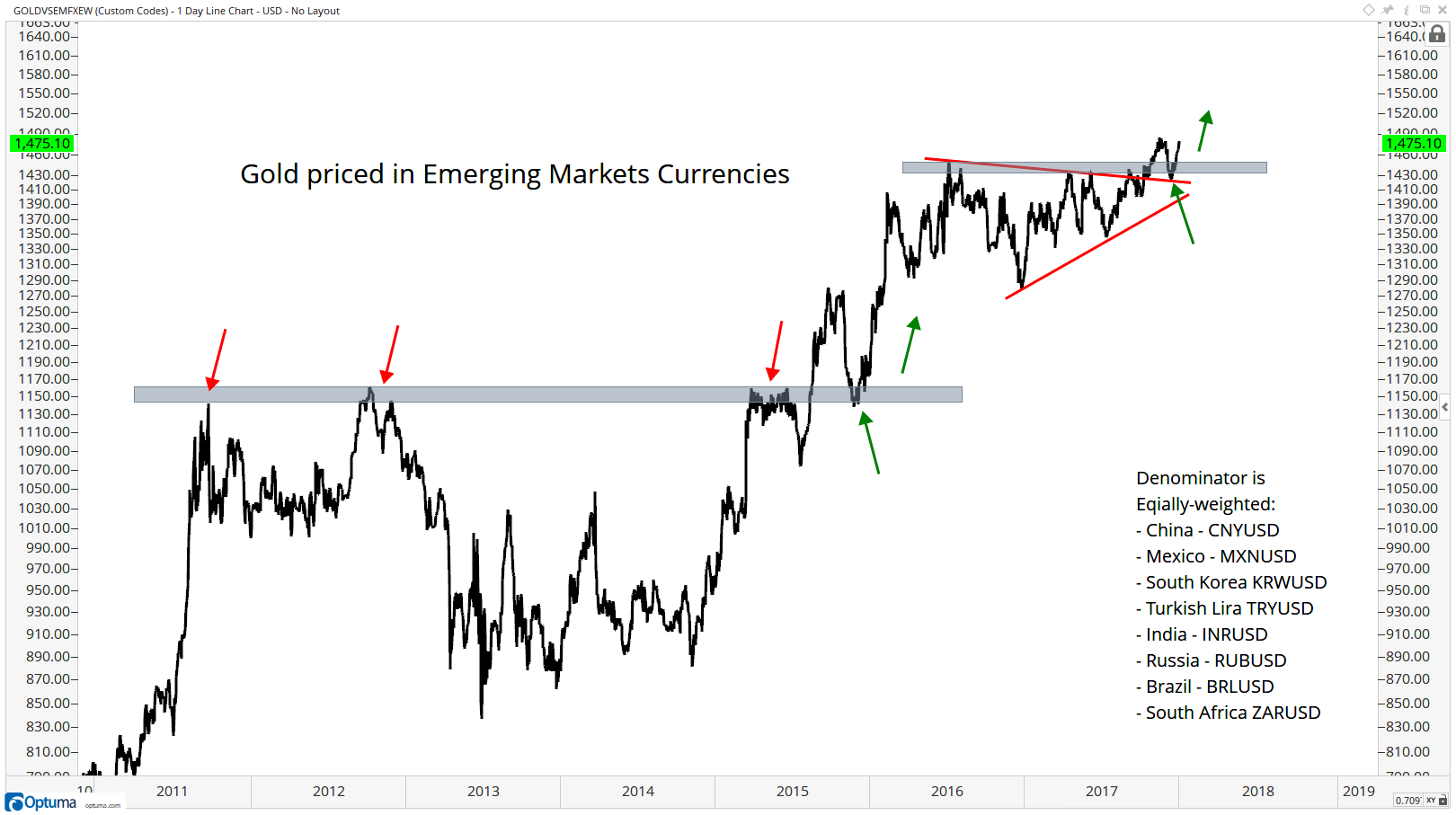

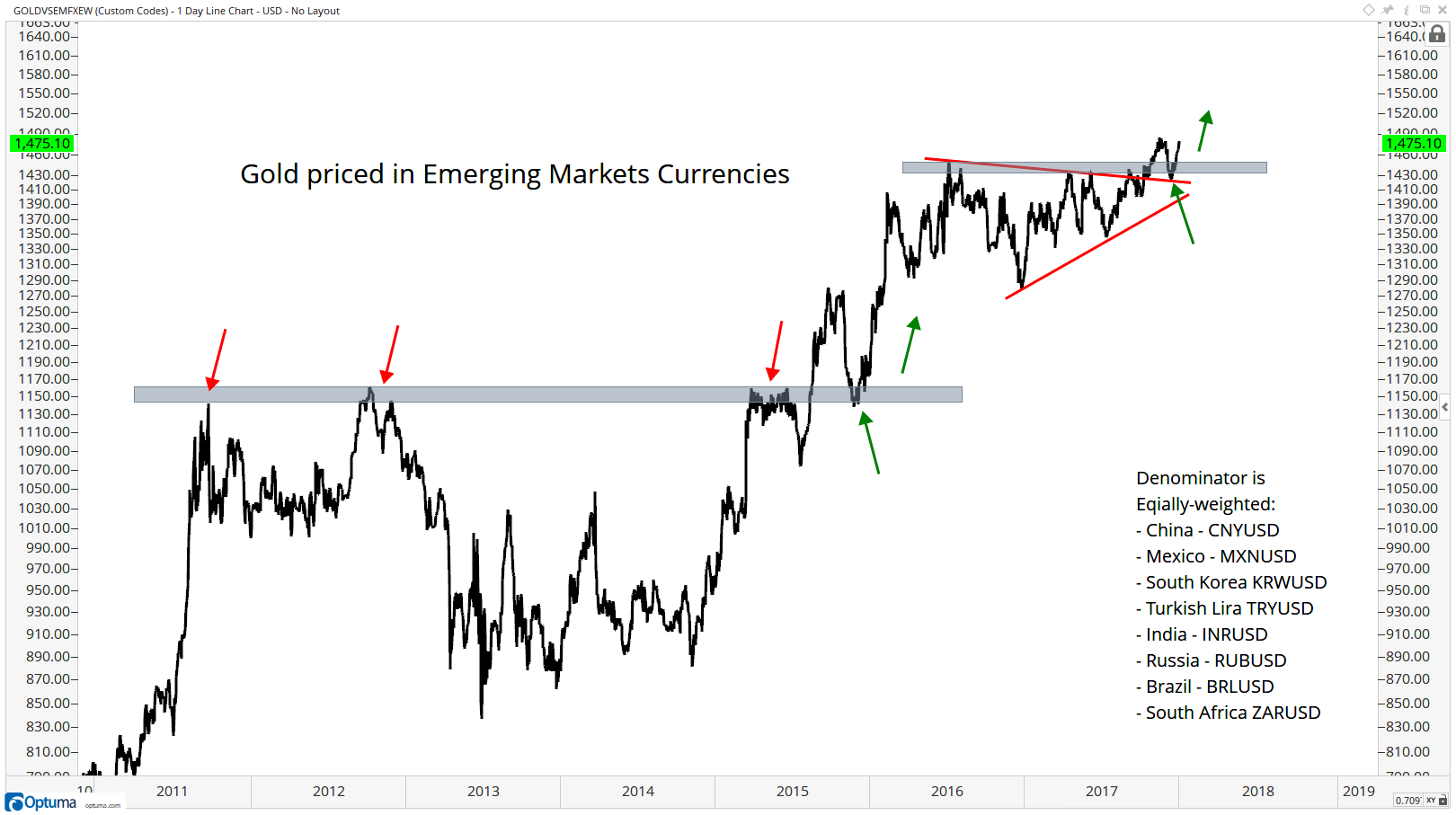

Gold Hits All-Time Highs Priced In Emerging Market Currencies

10, January

Gold Hits All-Time Highs Priced In Emerging Market Currencies

– Gold at all time in eight major emerging market currencies

– A stronger performance than seen when priced in USD, EUR or GBP

– As world steps away from US dollar hegemony expect new gold highs in $, € and £

– Gold is a hedge against currency debasement and depreciation of fiat currencies

Editor: Mark O’Byrne

Source: allstarcharts.com h/t @DominicFrisby

When we talk about the gold price we all too often focus on it priced in US dollars, with some frequent glances to Sterling and Euro as well. This is understandable, after all these are the currencies the majority of readers buy and sell in. The US dollar price is also the one which is most universally quoted.

However this approach ends up giving us a very skewed perspective of the gold market and price behaviour.It is arguably an old fashioned approach in a very globalised world. The relationship between gold and the US dollar is one which is rooted in the Bretton Woods agreement, something which was scrapped in 1971.

Today the gold price and the gold market is international, with far more interest in physical gold being paid by the emerging markets. One just has to look at the gold buying policies of Russia and China to see this.

In the long term, gold has performed very well in dollar, sterling, euro and all fiat currencies with gains of between 7% and 12% per annum over a 15 year period. Gains in emerging market currencies have been even greater.

Very often a change in the price of gold is a reflection in the change of the value of the currency in which you are choosing the quote the price. This has certainly be the case in the last year or so when it comes to gold bullion priced in the US dollar.

In 2017, gold’s dollar price was far more reflective of the dominant world currency’s perceived value than it was of other global events such as inflation, the threat of nuclear war etc.

So when the price of gold changes it is how it is perceived in relation to that currency and (more importantly) how that currency is behaving against other currencies.

Gold is a currency and clearly one of the most important safe havens and alternatives to the greenback. We see this with other currencies such as the Yen and the euro. So whilst gold might be a bet against the value of the US dollar it is also a safe haven against global risks and a hedge against currency devaluation.

This is of particular interest when we consider the above chart. Eight emerging market currencies and currently experiencing all time high gold prices. This gives a perspective of the gold market through a lens that we don’t usually see from a Western perspective. This perspective shows a totally different gold market – one which is at all time highs.

Is this a gold market that is perhaps reflecting the true risk in the global system?

The above chart was created by allstarcharts.com and was accompanied by this analysis:

What I see is a massive base from the 2011 to late 2015. After breaking out, the retest of that former resistance sparked the early 2016 rally in all precious metals. Look how they all rallied into that summer of 2016. Since then we have gone sideways. The nasty mess that gold has been, as mentioned above, can be seen in this chart very clearly. Look at this 18 months of nothing, perfectly describing the price action in Gold investments in general.

So what now? Well we’re breaking out of an 18-month base to new all-time highs. And we have successfully retested that breakout level. So things become very simple here. We want to be long Precious metals if we’re above those 2016 highs in this ratio. It’s about 1400 by my work.

The above chart and table show us what the bigger picture is telling us. rather than the gold price in just one currency. Gold has had an excellent twelve months when priced in the dollar and it has protected those with dollar assets from the further depreciation of the dollar seen in 2017.

However, gold’s hedging benefits were more clearly seen in emerging market currencies which continued to lose value in 2017.

That picture is perhaps suggesting that emerging markets and those interested in their currencies do not see a world which is in an American led so called recovery.

The emerging market gold chart shows a picture of a world which is far more diverse and takes gold’s role as both a currency and safe haven more seriously and gold is acting as a hedge against currency devaluation again.

Western investors and savers would be prudent to follow the diversification lead of Indian housewives and the People’s Bank of China and own physical gold. The charade of US dollar hegemony is not going to continue for much longer and all currencies including the euro and the pound are vulnerable to further debasement and depreciation in the coming months and years.

Recommended Reading

Gold Has Best Year Since 2010 With Near 14% Gain In 2017

Gold Gains In All Currencies In 2016 – 9% In USD, 13% In EUR and Surges 31.5% In GBP

Turkey, ‘Axis of Gold’ and the End of US Dollar Hegemony

News and Commentary

Gold inches down on higher U.S. Treasury yields (Reuters.com)

Asia Stock Rally Fades as Yen Gains for Second Day (Bloomberg.com)

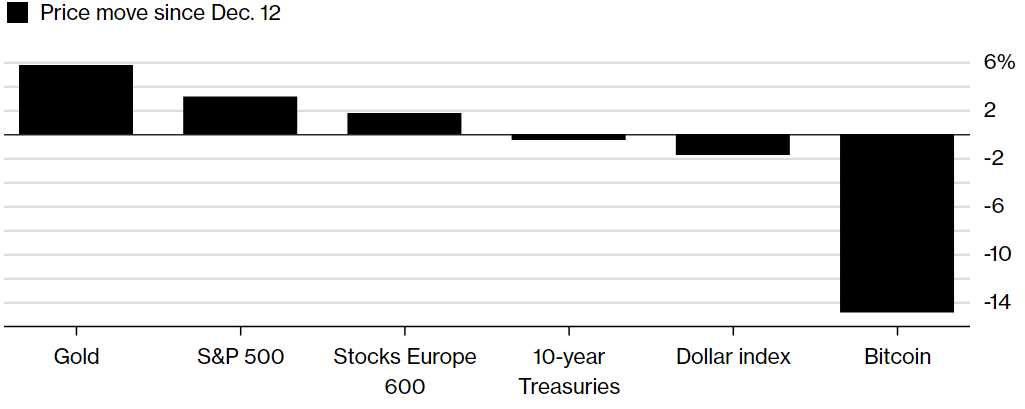

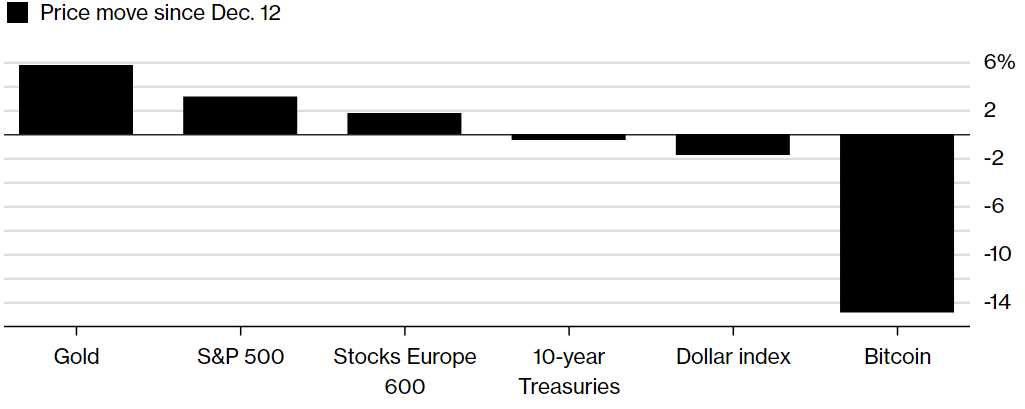

Gold Is Beating Everything Since the Fed Raised Rates (Bloomberg.com)

Dow industrials see 100-point climb as banks, health-care stocks rally (MarketWatch.com)

U.S. Stocks Pad Records, 10-Year Yield Tops 2.5% (Bloomberg.com)

Gold Is Beating Everything Since the Fed Raised Rates

EU Risks Global Bank Crisis If It Blocks Brexit Deal, U.K. Warns (Bloomberg.com)

Asian central banks push back, sending dollar bears a warning (Gata.org)

It’s Time For The Fear Trade To Move Gold Prices (Forbes.com)

World Bank issues warnings on interest rates and inflation (TheGuardian.com)

Morgan Stanley: “People Have A Hard Time Even Imagining How The Market Could Decline” (ZeroHedge.com)

Gold Prices (LBMA AM)

10 Jan: USD 1,321.65, GBP 976.96 & EUR 1,103.31 per ounce

08 Jan: USD 1,314.95, GBP 972.01 & EUR 1,102.19 per ounce

08 Jan: USD 1,318.80, GBP 974.33 & EUR 1,099.09 per ounce

05 Jan: USD 1,317.90, GBP 973.40 & EUR 1,094.25 per ounce

04 Jan: USD 1,313.70, GBP 969.77 & EUR 1,090.24 per ounce

03 Jan: USD 1,314.60, GBP 968.20 & EUR 1,092.96 per ounce

02 Jan: USD 1,312.80, GBP 968.85 & EUR 1,087.52 per ounce

Silver Prices (LBMA)

10 Jan: USD 17.13, GBP 12.64 & EUR 14.27 per ounce

09 Jan: USD 17.05, GBP 12.60 & EUR 14.30 per ounce

08 Jan: USD 17.17, GBP 12.68 & EUR 14.33 per ounce

05 Jan: USD 17.15, GBP 12.66 & EUR 14.24 per ounce

04 Jan: USD 17.13, GBP 12.64 & EUR 14.20 per ounce

03 Jan: USD 17.12, GBP 12.63 & EUR 14.25 per ounce

02 Jan: USD 17.06, GBP 12.59 & EUR 14.15 per ounce

Recent Market Updates

– World is $233 Trillion In Debt: UK Personal Debt At New Record

– 10 Reasons Why You Should Add To Your Gold Holdings

– Spectre, Meltdown Highlight Online Banking and Digital Gold Risks

– Palladium Prices Surge To New Record High Over $1,100 On Supply Crunch Concerns

– Gold Has Best Year Since 2010 With Near 14% Gain In 2017

– Happy 2nd Birthday Bail-in Tool! We Suggest Gold As The Perfect Gift

– 98,750,067,000,000 Reasons to Buy Gold in 2018

– Gold, Bitcoin and the Blockchain Replaces the Banks – Realists Guide To The Future

– It’s A Wonderful Life Is A Wonderful Lesson To Hold Gold Outside of The Banking System

– Goldnomics Podcast – Gold, Stocks, Bitcoin in 2018. Everything Bubble Bursts?

– What Peak Gold, Interest Rates And Current Geopolitical Tensions Mean For Gold in 2018

– New Rules For Cross-Border Cash and Gold Bullion Movements

– ‘Gold Strengthens Public Confidence In The Central Bank’ – Bundesbank

– WGC: 2018 Set To Be A Positive Year For Price of Gold and Investors

END

As we pointed out yesterday, China wants market forces to determine the value between the yuan vs the dollar

(courtesy GATA/Bloomberg)

Asian central banks push back, sending dollar bears a warning

Submitted by cpowell on Wed, 2018-01-10 00:28. Section: Daily Dispatches

By Katherine Greifeld, Robert Fullem, and Liz McCormick

Bloomberg News

Tuesday, January 9, 2018

Dollar bears take heed: Asian central banks may be putting the brakes on the greenback’s slide.

After working for three years to staunch the yuan’s slump, China is now moving to combat the opposite problem. The People’s Bank of China has stopped using a component of its daily fixing formula that had been widely interpreted as a tool to support the currency, people familiar with the matter said today. The yuan sank on the news.

Meanwhile, South Korea’s government has started to warn about the ascent in the won, Asia’s best-performing currency in 2017. And Taiwan’s central bank also sought to curb gains in its dollar. …

… For the remainder of the report:

https://www.bloomberg.com/news/articles/2018-01-09/dollar-bears-

END

Buffet agrees with me in that cryptocurrencies have an instrinsic value of zero and thus he would buy a 5 year put on every single cyrpto

(courtesy zerohedg

Buffett: “I Would Buy A Five-Year Put On Every Cryptocurrency”

Warren Buffett doubled down on his criticism of bitcoin Wednesday during an interview with CNBC, where he said he’s almost certain the cryptocurrency craze “will end badly” and that the current runup in value will be fleeting.

But paradoxically, he also admitted that he “doesn’t know anything” about digital currencies after saying he would eagerly buy five-year puts on “every one of the cryptocurrencies.”

“In terms of cryptocurrencies, generally, I can say with almost certainty that they will come to a bad ending,” said Buffett, the chairman and CEO of Berkshire Hathaway.

“When it happens or how or anything else I don’t know,” he added in an interview on CNBC’s “Squawk Box” from Omaha, Nebraska.

“But I know this: If I could buy a five year put on every one of the cryptocurrencies, I’d be glad to do it but I would never short a dime’s worth.”

While explaining why he wouldn’t take a short position, he said he “gets into enough trouble with things I know something about…”

“I get into enough trouble with things I think I know something about,” Buffett said. “Why in the world should I take a long or short position in something I don’t know anything about.”

His comments notably come a day after JP Morgan Chase & Co. CEO Jamie Dimon said he “regrets calling bitcoin a fraud.” Dimon last fall famously compared bitcoin to the Dutch tulip mania and threatened to fire any JPM trader caught buying or trading digital currencies.

https://player.cnbc.com/p/gZWlPC/cnbc_global?playertype=synd&byGuid=3000685485&size=530_298

Buffett added that his remarks are purely hypothetical. “We’ll never own a position in them,” he said.

Still, Buffett admitting that he’d be a seller even though he “doesn’t know anything about” bitcoin – he even claimed he wouldn’t be able to explain bitcoin to a classroom of young students – should signal that readers should take his comments with a grain of salt.

After all, by his own admission, Buffett doesn’t know what he’s talking about

end

Chris Marcus of Miles Franklin asks a good question. When our bankers decide to cover their silver shorts, to whom are they going to buy from?

(courtesy Marcus/Miles Franklin)

Chris Marcus, Contributing Writer For Miles Franklin

If The Banks Try To Unwind Their Silver Short, Who Are They Going To Buy From?

While there’s a lot of commentary about the large paper short position that exists in the silver market, there’s an additional factor exacerbating the situation that few have mentioned. Specifically, given the mindset of the investors that actually own silver, if the banks and hedge funds have to cover their short position, who are they going to buy the metal from?

In a typical free market the price of an asset would be where there is an intersection of supply and demand. Yet consider the mindset of the average silver investor, which is far from your typical market participant.

Most of the people who own silver purchased their metal primarily in response to endless dollar printing. Often with a belief that the printing will continue, ultimately until the dollar is worth little or nothing.

This is different from the typical investor profile in many of the other standard investment markets. Usually in trading markets such as the stock market, people invest with the hope that a position goes their way, and then eventually convert to cash or another investment.

But those who own physical silver are generally coming at their investment from a different perspective. They bought silver because of concerns about the currency system, and are not necessarily looking to book a gain and convert back into dollars just because the price hit $20 or $30.

If someone has expenses or bills to pay, then sure, it’s possible they might sell some silver to access funds. But especially with silver so far below it’s 2011 $49 high, and with more money in the system than ever, at least the silver buyers I’ve spoken to over the past decade don’t seem like they’ll be in any rush to go out and sell.

So if the banks wanted to unwind their position, who are they going to buy all that silver from?

Part of the answer depends on the context in which a move occurs. If we just saw silver rise to $100 per ounce without any news or further significant dollar degradation, perhaps there would be more metal holders who might wonder if the price has hit a top and if it’s time to sell. But if silver hits $100 because the Fed just launched QE 5, 6, and 7, are silver investors going to be clamoring to convert back to dollars at the same time there are more of them in circulation than ever?

Speaking for myself, I first bought silver in 2010 primarily because I finally grasped the situation with the money supply. Based on the amount of money that had been printed and simple math, it always seemed to me that if silver were allowed to trade freely, the price would simply have to be a lot higher.

Yet as I learned more about the market and what Federal Reserve actually does, I started to realize that just like in other hyperinflation scenarios, eventually the dollar price just stops being relevant. At some point there would just be no reason to trade back into something that’s lost it’s value.

What all of this leads to is an environment where there could be incredible pressure on the shorts to cover their position at the same time it would be hard to find an offer. Which is why it always seemed that the longer the banks sold metal they don’t own, the more of a corner they backed themselves into.

Perhaps they’ll ultimately be successful in unloading a portion of their position onto the hedge funds that buy or sell based on the 50 and 200 day moving averages. But regardless of who holds that side of the trade, my guess is that the majority of silver owners are unlikely to let them off so easy.

I often read comments by frustrated metal owners that accept the markets are manipulated, and question why that would ever change. Which is reasonable enough. Although keep in mind that even the mighty J.P. Morgan has historical precedent for getting caught red-handed with a position that was too big. As was seen with their London Whale trade back in 2012.

So while that doesn’t mean the manipulation will end tomorrow, it does mean that market dynamics are in place that could facilitate some large gaps up in the price of silver.

~Chris Marcus

Your early TUESDAY morning currency, Asian stock market results, important USA/Asian currency crosses, gold/silver pricing overnight along with the price of oil Major stories overnight/9 AM EST

i) Chinese yuan vs USA dollar/CLOSED UP AT 6.5040 /shanghai bourse CLOSED UP AT 7.93 POINTS 0.23% / HANG SANG CLOSED UP 62/31 POINTS OR 0.20%

2. Nikkei closed DOWN 61.79 POINTS OR 0.26% /USA: YEN RISES TO 111.35

3. Europe stocks OPENED RED /USA dollar index FALLS TO 91.95/Euro RISES TO 1.2009

3b Japan 10 year bond yield: RISES TO . +.086/ GOVERNMENT INTERVENTION !!!!(Japan buying 100% of bond issuance)/Japanese yen vs usa cross now at 111.35/ THIS IS TROUBLESOME AS BANK OF JAPAN IS RUNNING OUT OF BONDS TO BUY./JAPAN 10 YR YIELD FINALLY IN THE POSITIVE/BANK OF JAPAN LOSING CONTROL OF THEIR YIELD CURVE AS THEY PURCHASE ALL BONDS TO GET TO ZERO RATE!!

3c Nikkei now JUST BELOW 17,000

3d USA/Yen rate now well below the important 120 barrier this morning

3e WTI:: 63.52 and Brent: 69.16

3f Gold UP/Yen UP

3g Japan is to buy the equivalent of 108 billion uSA dollars worth of bond per month or $1.3 trillion. Japan’s GDP equals 5 trillion usa./“HELICOPTER MONEY” OFF THE TABLE FOR NOW /REVERSE OPERATION TWIST ON THE BONDS: PURCHASE OF LONG BONDS AND SELLING THE SHORT END

Japan to buy 100% of all new Japanese debt and by 2018 they will have 25% of all Japanese debt. Fifty percent of Japanese budget financed with debt.

3h Oil UP for WTI and UP FOR Brent this morning

3i European bond buying continues to push yields lower on all fronts in the EMU. German 10yr bund RISES TO +.542%/Italian 10 yr bond yield UP to 2.032% /SPAIN 10 YR BOND YIELD UP TO 1.530%

3j Greek 10 year bond yield FALLS TO : 3.703?????????????????

3k Gold at $1323.30 silver at:17.14: 6 am est) SILVER NEXT RESISTANCE LEVEL AT $18.50

3l USA vs Russian rouble; (Russian rouble DOWN 11/100 in roubles/dollar) 56.98

3m oil into the 63 dollar handle for WTI and 69 handle for Brent/

3n Higher foreign deposits out of China sees huge risk of outflows and a currency depreciation. This can spell financial disaster for the rest of the world/China forced to do QE!! as it lowers its yuan value to the dollar/GOT A HUGE SIZED REVALUATION NORTHBOUND

JAPAN ON JAN 29.2016 INITIATES NIRP. THIS MORNING THEY SIGNAL THEY MAY END NIRP. TODAY THE USA/YEN TRADES TO 111.35 DESTROYING JAPANESE CITIZENS WITH HIGHER FOOD INFLATION

30 SNB (Swiss National Bank) still intervening again in the markets driving down the SF. It is not working: USA/SF this morning 0.9774 as the Swiss Franc is still rising against most currencies. Euro vs SF is 1.1742 well above the floor set by the Swiss Finance Minister. Thomas Jordan, chief of the Swiss National Bank continues to purchase euros trying to lower value of the Swiss Franc.

3p BRITAIN VOTES AFFIRMATIVE BREXIT/LOWER PARLIAMENT APPROVES BREXIT COMMENCEMENT/ARTICLE 50 COMMENCES MARCH 29/2017

3r the 10 Year German bund now POSITIVE territory with the 10 year RISING to +0.542%

The bank withdrawals were causing massive hardship to the Greek bank. the Greek referendum voted overwhelming “NO”. Next step for Greece will be the recapitalization of the banks and that will be difficult.

4. USA 10 year treasury bond at 2.588% early this morning. Thirty year rate at 2.937% /

5. Details Ransquawk, Bloomberg, Deutsche bank/Jim Reid.

(courtesy Jim Reid/Bloomberg/Deutsche bank/zero hedge)

Markets Turmoil On China Treasury Purchase Halt News

It was a relatively quiet session until a little after 5am ET when all early-morning market moves were superseded by aggressive cross-asset reaction (as Bloomberg puts it) – largely in the form of dumping anything US-linked – to a Bloomberg report that China is reconsidering its UST holdings. The dollar, US equity futures and US Treasurys all sold off on the report, while spot gold spiked higher.

E-minis tumbled immediately on the news, suffering their first sharp drop of the new year.

The dollar pared its weekly gains, and is back to a 92.00 level, as the UST curve steepens while the yen extends a rally on growing speculation the Bank of Japan may taper its unprecedented monetary easing, a process which was unveiled on Monday night.

Treasury yields spiked on news that Chinese officials reviewing foreign-exchange holdings are said to have recommended slowing or halting purchases of Treasuries, with the yield rising as high as 2.59%, just shy of Jeff Gundlach’s 2.63% red line.

Reduced asset purchases by the world’s top central banks, rising commodity prices and looming U.S. debt sales all support the case for higher bond yields, but until now they have proved resilient. The move in benchmark Treasuries on Tuesday – into what bond veteran Bill Gross declared a bear market – has left traders weighing where yields will go from here and what impact the change will have on other assets. And, as Jeff Gundlach discussed last night, once 10Y yields rise above 2.63%, all bets are off, even for the S&P.

Volumes in the euro and the pound remained low initially before jumping on speculation central banks might shift reserve allocation out of the dollar. Oil continued to rise while equities traded mixed.

In global markets, the Stoxx Europe 600 Index headed for its first down-day in six, following moves lower in a handful of Asian equity gauges. In commodities, WTI extended gains from the highest close in more than three years as U.S. industry data signaled crude stockpiles dropped for an eighth week.

In Asia, the yen climbed for a second day as traders unwound short positions in the wake of the Bank of Japan paring back purchases of ultra-long dated bonds. China’s central bank weakened its daily fixing on the yuan by the most since September, one day after a report showed it has adjusted its currency-fixing mechanism, a move interpreted as an embrace of greater fluctuation in the exchange rate.

While all overnight news are of secondary importance, in a tangential update, overnight China reported that its December headline CPI inflation inched up to 1.8% year-on-year from 1.7% yoy in November, slightly below consensus of 1.9% yoy. In month-on-month terms, headline CPI inflation picked up to 2.0% (seasonally adjusted annual rate), from 1.1% in November. For the full year in 2017, CPI inflation averaged at 1.6%, lower than 2.0% in 2016. PPI inflation decelerated further to 4.9% yoy from 5.8% yoy in November. This implies an annual rate of +2.7% (s.a.) in November, slightly up from an increase of 2.5% annualized in November

Commenting on the report, Goldman said that CPI inflation will likely be higher in Q1 this year, primarily on higher food prices, reflecting both a very low base (food prices declined significantly in Q1 of last year) and impacts of the record-breaking low temperature and snowstorm in some regions in the first half of January (though the China Meterological Administration expects the temperature will normalize to the historical average in the second half). Oil prices have increased notably recently, but there should be limited upwards pressure in the coming months suggested by our commodity team’s forecasts. As a reminder, a big reason behind the great inflationary scare of 2011 was surging – and transitory – Chinese food inflation, which also helped facilitate the Arab Spring revolutionary movement. 7 years later, are we about to get a repeat?

Meanwhile, in Brexit news, EU Brexit Negotiator Michel Barnier said that the risk of a disorderly Brexit has decreased and that the UK is ready to take responsibility for its choice. However, separate reports suggest that the EU is said to warn UK companies of being shut-out should a no-deal Brexit occur. Additionally, opposition from Germany reportedly risks derailing UK hopes for a bespoke post-Brexit trade deal. The reports suggest that Merkel considers the idea another ruse for Britain to “have its cake and eat it”.

Today’s data include MBA mortgage applications and wholesale inventories. Lennar, MSC Industrial and Aphria are among companies reporting earnings. Fed speakers include Evans, Kaplan, and Bullard.

Market Snapshot

• S&P 500 futures down 0.3% to 2,744.50

• STOXX Europe 600 down 0.07% to 399.82

• MSCI Asia Pacific up 0.06% to 180.67

• MSCI Asia Pacific ex Japan down 0.4% to 587.39

• Nikkei down 0.3% to 23,788.20

• Topix up 0.2% to 1,892.11

• Hang Seng Index up 0.2% to 31,073.72

• Shanghai Composite up 0.2% to 3,421.83

• Sensex down 0.04% to 34,428.35

• Australia S&P/ASX 200 down 0.6% to 6,096.68

• Kospi down 0.4% to 2,499.75

• Brent futures up 0.3% to $69.04/bbl

• US 10Y yield rose 3.9 bps to 2.59%

• German 10Y yield rose 6.9 bps to 0.535%

• Euro up 0.05% to $1.1943

• Italian 10Y yield rose 5.0 bps to 1.766%

• Spanish 10Y yield fell 0.8 bps to 1.507%

• Gold spot up 0.3% to $1,314.68

• U.S. Dollar Index down 0.2% to 92.37

Top overnight News from Bloomberg: China Sours On U.S. Debt Treasuries, Dollar Smacked by Review; Bond Bull Run Still Has Legs: Gundlach; Big U.S. Stockpile Drop Lifts Crude

• Officials reviewing China’s foreign-exchange holdings have recommended slowing or halting purchases of U.S. Treasuries; Chinese officials are said to see Treasuries as less attractive; they recommend slowing or halting in Treasury purchases

• Jeffrey Gundlach, the billionaire bond manager, says the S&P 500 Index will end the year with a negative return and is dubious of the long-term value of bitcoin

• The 10-year U.S. Treasury yield climbed to the highest level in about 10 months, leading Bill Gross at Janus Henderson Group to declare a bond bear market just as a deluge of debt sales began

• Investors won’t be as focused on the bottom line as Wall Street banks report 2017 results

• Deep-water driller Ocean Rig UDW Inc. is working with Credit Suisse Group AG to explore strategic options including a sale

Asia has failed to sustain the positive lead from Wall Street where all US majors resumed their record setting performance, with the regional bourses mostly lower as profit taking crept in. ASX 200 (-0.6%) was negative in which commodity names led the index’s pullback from decade highs, while Nikkei 225 (-0.3%) was subdued on continued JPY strength. Shanghai Comp. (+0.3%) and Hang Seng (+0.2%) were initially mixed with the mainland indecisive after the PBoC resumed open market operations for the 1st time in 13 sessions, although its efforts still amounted to a net neutral position after maturing operations were accounted for and as participants digested mixed CPI and PPI data. Finally, 10yr JGBs were lower in a continuation of yesterday’s post-Rinban pressure and in tandem of rising global yields, while a mixed 10yr auction result also failed to inspire demand. Chinese CPI YY (Dec) 1.8% vs. Exp. 1.9% (Prev. 1.7%). Chinese PPI YY (Dec) 4.9% vs. Exp. 4.8% (Prev. 5.8%) PBoC injected CNY 60bln via 7-day reverse repos and CNY 60bln via 14-day reverse repos. PBoC set CNY mid-point at 6.5207 (Prev. 6.4968)

Top Asia News

• Philippines Posts Record Trade Deficit as Machine Imports Rise

• Modi Eases Rules to Lure Foreign Investors as India Growth Slows

• CICC Cuts Its Forecasts for Mobile Phone Shipments in China

• HNA Group Has So Many Companies It’s Running Out of Names

• Sony Is Planning a Whole Range of Robots After Its Aibo Dog

• The $100 Million Game Turkish Officials Worry Is Pyramid Scheme

European equities initially kicked the session off with little in the way of firm direction as macro newsflow remained light from a European perspective. In terms of sector specifics, financial names outperform their peers in the wake of the continuing moves seen in global yields with RBS near the top of the FSTE 100 following a positive broker move at Morgan Stanley. Other notable movers include Sainsburys (+1.4%) who now see FY 17/18 underlying pretax profit to be moderately ahead of market consensus. Despite initially seeing muted trade, equities were dealt a blow in line with other global asset classes after news that Chinese officials are said to see Treasuries as less attractive.

Top European News

• ECB Hawks Take the Lead on QE Debate as Doves Stay Quiet for Now

• U.K. Factories in Best Growth Run Since 1997 Amid Global Upswing

• Norway’s $1 Trillion Fund Wants to Invest in Private Equity

• ‘Bad Brexit’ Would Hurt the U.K. Economy for More Than a Decade

• BlackRock-Backed Gold Miner May Join Rush of Russian IPOs

• EU Risks Financial Crisis If It Blocks Brexit Deal, U.K. Warns

In FX news, the JPY is extending gains and outperformance vs G10 and other peers via accelerated moves overnight. USD/JPY down through 112.00 stops to a circa 111.75 low. The move in USD/JPY was then exacerbated by mass-USD weakness after the aforementioned comments from Chinese officials suggesting they recommend slowing or halting in Treasury purchases; USDindex extending losses below 92.50, pushing EUR/USD briefly back above 1.2000. NOK and SEK both firmer vs the EUR, former in wake of stronger than expected Norwegian inflation data and latter on hawkish views revealed in the latest Riksbank policy meeting minutes (time to normalise policy nearer and scope to hike before the ECB. EUR/NOK down below 9.6000 and EUR/SEK sub-9.7600. NZD 2nd to the rampant JPY among G10 currencies and retesting 0.7200+ levels vs the USD, while its AUD antipodean counterpart back above 0.7850 vs the Greenback and the AUD/NZD cross under 1.0900, perhaps hampered by soft Chinese CPI data. GBP initially unfazed by latest stellar production figures after being offset by the widest trade deficit in 5 months, before eventually moving lower with GBP/USD now through key support at 1.3495

In commodities, energy prices remain near their highs in the wake of a significantly larger than expected draw down in headline API crude inventories (-11.19M vs. Exp. -3.90M). The move also came in the context of the EIA raising its forecast for 2018 world oil demand growth by 100k BPD, now forecasting a 1.72mln BPD Y/Y increase. In metals markets, gold prices have seen a modest recovery in European hours and continue to track fluctuations in the USD. Elsewhere, copper was rangebound during Asia-Pac trade amid an indecisive risk tone in the region while Chinese futures remain supported by the Chinese supply crackdown, however, analysts remain wary over the potential demand impact from adverse weather conditions.

US Event Calendar

• 7am: MBA Mortgage Applications, prior 0.7%

• 8:30am: Import Price Index MoM, est. 0.4%, prior 0.7%; YoY, est. 3.1%, prior 3.1%

• 8:30am: Export Price Index MoM, est. 0.3%, prior 0.5%; YoY, prior 3.1%

• 10am: Wholesale Inventories MoM, est. 0.7%, prior 0.7%; Wholesale Trade Sales MoM, est. 0.55%, prior 0.7%

Central Bank Speakers

• 9am: Fed’s Evans Discusses Economy and Policy Outlook

• 9:10am: Fed’s Kaplan Speaks in moderated Q&A in Dallas

• 10:15am: Fed’s Kaplan Speaks in moderated Q&A in Dallas

• 1:30pm: Fed’s Bullard Speaks on U.S. Economic Outlook in St. Louis

DB’s Jim Reid concludes the overnight wrap

Equities again saw blue skies yesterday but bond markets saw their own ‘bomb cyclone’ as yields soared across the globe. It was the Treasury market which stole the limelight however with 10y yields breaking up through 2.50% to close last night at 2.552% (+7.1bps). That is the highest closing yield since 14th of March last year when yields topped out at 2.601%, with Bill Gross calling yesterday the start of the ‘bond bear market’. In today’s PDF we replicate a chart that some are using to say we’ve broken the three decade plus down channel in 10 year US yields.

It was the long-end which weakened the most, with 30y yields closing up 8.4bps at 2.896% and the highest since 27th October while the spread between 2y and 30y yields steepened by the most (+7.3bps) since November 2016. Core yields in Europe were between 2.9bps and 4.6bps higher prior to this with 10yr Bunds +3.5bps to 0.464%.

There appeared to be a few reasons for justifying the price action. The ‘stealth taper’ of sorts by the BoJ certainly seemed to get the most airtime though after the BoJ cut long-end bond purchases. While it seemed to come as a surprise, it’s worth noting that the absolute purchase level was still within the BoJ target range of purchases, and with the BoJ also focused on controlling the yield curve the bigger test is perhaps the BoJ’s tolerance to let 10y JGBs move north of the 10bp ceiling should Treasuries sustainably move higher. For what it’s worth JGBs are up 1.3bp this morning but seem relatively calm while the Yen has strengthened c0.3%.

Also weighing on rates yesterday was primary issuance with a fairly decent pickup in sovereign and corporate issuance expected this week. Around $60bn of combined issuance is expected from sovereign deals from the US, Japan, Germany and the UK this week according to Bloomberg while €20bn of European corporate issuance is expected and US domestic IG issuance is also active with $14.7bn in total pricing.

Remember that in our outlook we showed that 2018 will likely be the first year in seven where QE doesn’t increase relative to net supply of government bonds (see figure 18 and page 16 of this doc). We think we’re at a turning point for the technicals in government bonds around now and perhaps as the technicals turns, sell-off can occur more easily than when we were at peak QE and peak technicals. Yesterday’s BoJ news was pretty minor so imagine the scenario if something major happened! However it will probably still take inflation beats to really turbo charge any bond sell off. We think there’s a decent chance we get closer to this after Q2 this year but before that Friday’s US CPI is an obvious focal point in which to test the bond market.

Elsewhere, it probably shouldn’t be overlooked too that Oil prices have moved sharply higher over the last 24 hours with WTI (+1.99%) in particular now above $63/bbl and to the highest since July 2015. 10y breakevens in the US were supported in part by that and are now at 10 month highs as a result at 2.041%. One other thing which caught our eye yesterday from our screens is the spread between Treasuries and the S&P 500 dividend yield. Yesterday the spread for the 10y and S&P widened to 70bps which now puts it at the highest since September 2014. That comes after the yield on 2y Treasuries last week overtook the S&P 500 dividend yield for the first time since 2008. It certainly feels like we’re hitting new extremes in more and more markets now.

Finally China also got in on the act yesterday after the announcement that the PBOC had made a small change to how it manages the Yuan fixing (by suspending a counter-cyclical factor) with the end result seemingly being that the PBOC has greater control over the currency. Afterwards the CNY weakened by the most (0.46%) since January yesterday, but is up c0.1% this morning.

Elsewhere this morning, China’s December CPI was slightly lower than expectations at 1.8% yoy (vs. 1.9%) and PPI slowed mom but was above market at 4.9% yoy (vs. 4.8% expected). Equities are trading mixed as type, with the Nikkei (-0.21%), Kospi (-0.41%) and China’s CSI 300 (-0.14%) slightly lower while the Hang Seng (+0.22%) is up. Elsewhere, UST 10y bond yields are up c0.5bp.

Moving on. Yesterday DB’s George Saravelos and his FX strategy team published their 2018 Blueprint titled ‘Don’t Stop me now’. The report notes that 2018 is likely to see a continuation of the global environment low volatility, a falling dollar, and continued EM performance. The combination of solid global growth, slow moving inflation and highly predictable central banks closely mirrors the 2004-06 pre-crisis period. Back then growth and financial conditions proved selfreinforcing, encouraging the build-up of leverage even in the face of tightening monetary policy. The team go on to note that as the world’s global funding currency the dollar weakened despite Fed hikes. It would be a clear oversight to forget what followed 2006. But the team’s assessment is that the current mood music can keep going for a while longer. Click on the following link to see the report.

Now recapping other markets performance from yesterday. US equities edged higher with the S&P up for the sixth consecutive day (+0.13%) – a record only matched at the start of the year in 1964 and 2010 (6 days) and beaten only in 1976 and 1987 (7 days). European markets were all higher, with the Stoxx 600 up 0.43% to the highest since August 2015 while the DAX was the relative laggard at +0.13%. Turning to currencies, the US dollar index strengthened 0.15% while the Euro and Sterling slipped 0.26% and 0.21% respectively. Elsewhere, precious metals weakened c1% (Gold -0.58%; Silver -0.95%) and other base metals also softened (Copper -0.09%; Zinc -0.50%; Aluminium -0.33%). The VIX rose 5.88% to above 10 for the first time in six days (10.08).

Away from the markets, the Fed’s Kashkari noted the stock market is pricing in this trend of lower interest rates “structurally over time” which partly explains the higher asset prices. Elsewhere, he advocates for “lower interest rates to get wages up and to get inflation back to our 2% target”. On tax, he is “skeptical” tax cuts will drive a material increase in investments, in part as these big companies already have large cash balances and can borrow at low rates, so if there are good investments to be made, “they would already be making those investments”.

Back onto Brexit, the EU Brexit negotiator Barnier has maintained his stance that UK based financial companies will lose their rights to operate freely across the EU post Brexit, but seem to have offered a glimmer of hope by noting that there may be cases where the EU could “consider certain UK rules as equivalent, based on a proportionate and risk based approach”. Elsewhere, the UK Brexit Secretary Davis called for an “imaginative and inventive” new relationship with the EU. Although, the Telegraph reported Germany’s Ms Merkel is strongly opposed to the UK’s plans for a bespoke trade deal with the EU post Brexit, as the UK should not “have its cake and eat it” too.

Finally, the World Bank has lifted its forecast for global GDP growth to 3.1% for 2018 (+0.2ppt), driven by increased investment and manufacturing activity as well as supportive monetary conditions. Growth is expected to slow to 3% in 2019 and 2.9% in 2020. Despite the improved forecasts, the IMF also warned that risks to the outlook remained skewed to the downside, which includes a sudden tightening of global financial conditions, rising geopolitical tensions and escalating trade restrictions.

Before we take a look at today’s calendar, we wrap up with other data releases from yesterday. In the US, the December NFIB small business confidence index was below market at 104.9 (vs. 108 expected) but still solid as it retreated from last month’s 34-year high. Elsewhere, the November JOLTS Job openings were below expectations at 5,879 (vs. 6,025), while the quits rate remain at a cyclical high of 2.2% for the third consecutive month.

In Europe, the November unemployment rate for the Eurozone and Italy both edged down 0.1ppt mom and were in line at 8.7% and 11% respectively, with the former at the lowest since early 2009. In Germany, the November IP was above market at 5.6% yoy (vs 3.9% expected) and the highest since 2011, while its trade surplus also beat at €23.7bln (vs. €21.3bln), with both exports and imports higher than expected. In France, the November trade deficit widened more than expected to -€5.7bn (vs. -€4.7bln), while the UK’s BRC same store sales rose to 0.6% yoy (vs. 0.3% expected) and total sales rose 1.4% yoy, both mainly driven by higher spending on food.

Looking at the day ahead, the November IP and manufacturing production for the UK and France are due, followed by the UK’s November trade balance. Over in the US, there is the November wholesale inventories along with December stats on exports and imports. Onto other events, the Fed’s Evans discusses the economy and policy outlook, while the Fed’s Kaplan speaks in a moderate panel. Elsewhere, the US Chamber of Commerce CEO Donohue will deliver his annual address and the South Korean President will host a New Year’s news conference

end

3. ASIAN AFFAIRS

i)Late TUESDAY night/WEDNESDAY morning: Shanghai closed UP 7.93 points or 0.23% /Hang Sang CLOSED UP 62.31 pts or 0.20% / The Nikkei closed DOWN 61.79 POINTS OR 0.26%/Australia’s all ordinaires CLOSED DOWN 0.57%/Chinese yuan (ONSHORE) closed UP at 6.5040/Oil UP to 63.52 dollars per barrel for WTI and 69.16 for Brent. Stocks in Europe OPENED MOSTLY RED. ONSHORE YUAN CLOSED DOWN AGAINST THE DOLLAR AT 6.5040. OFFSHORE YUAN CLOSED DOWN AGAINST THE ONSHORE YUAN AT 6.5140 //ONSHORE YUAN STRONGER AGAINST THE DOLLAR/OFF SHORE STRONGER TO THE DOLLAR/. THE DOLLAR (INDEX) IS WEAKER AGAINST ALL MAJOR CURRENCIES. CHINA IS STILL HAPPY TODAY.(GOOD MARKETS AND STRONGER YUAN)

3 a NORTH KOREA/USA

NORTH KOREA/SOUTH KOREA

North Korea states: not so fast with our detente: “all our atomic bombs and ICBMS are aimed at the USA and not at South Korea, China or Russia

3 b JAPAN AFFAIRS

end

c) REPORT ON CHINA

From Bloomberg, a big story where China is now set to slow or halt USA treasury purchases This sends the 10 yr USA treasury to 2.59% and the dollar plummeting

(courtesy zerohedge)

Treasurys Tumble, Futures Slide On Report China “To Slow Or Halt” Treasury Purchases

The treasuries complex has sold off aggressively across the curve after the following flashing red Bloomberg headline:

– CHINA OFFICIALS ARE SAID TO VIEW TREASURIES AS LESS ATTRACTIVE.

– CHINA OFFICIALS SAID TO RECOMMEND SLOWING OR HALTING TSY BUYING

As Bloomberg reports, “Officials reviewing China’s FX holdings have recommended slowing or halting purchases of US Treasuries, according to people familiar with the matter.”

The reasoning given is that the market for US government bonds is becoming less attractive relative to other assets, while trade tensions with the US may provide a reason to slow or stop buying American debt.

As Bloomberg further notes “The people didn’t specify why trade tensions would spur a cutback in Treasuries purchases, though foreign holdings of US securities have sometimes been a geopolitical football in the past.”

The news has been interpreted as Beijing wanting to send a signal to the US that it is willing to use financial means to respond to any shifts in US policy on issues such as trade.

Amusingly, with the GOP selling out, at least one deficit hawk remains: China.

The investment strategies discussed in China’s review don’t concern daily purchases and sales, said the people. The officials recommended that China closely watch factors such as the outlook for supply of U.S. government debt, along with political developments including trade disputes between the world’s two biggest economies, when deciding whether to cut some Treasury holdings, the people said.

While there is no official confirmation, this understandably has fixed income spooked. China is the single biggest foreign holder of Treasuries with $1.2 trillion in notional, so this report – if true – has massive implications.

As a consequence, US yields have more than retraced intraday losses, with the 30y trading to 2.92% and the 10y up 2bps. The rest of fixed income has followed through, with a similar spike in European yields.

The kneejerk reaction in fixed income was fast and furious, as over 35,000 10-year futures traded in the one-minute period after the news broke according to Bloomberg, sending 10Y yields as high as 2.59%, the highest since March 2017.

As a reminder, according to Jeff Gundlach once the 10Y hits 2.63%, not only is the selloff set to accelerate, it is also the level where the selling in TSYs finally hits equities too.

The news has also hit U.S. stock-index futures which have tumbled on the news, following declines in Europe.

• E-Mini futures on S&P down 0.4%

• E-Mini futures on Dow Jones down 0.4%

• E-Mini futures on Nasdaq 0.5% lower

• S&P 500 up 0.1% Tuesday, rising for 6th day to a fresh record

• VIX Index trading 1.8% higher

Meanwhile, the USD is selling off across the board following the sharp move lower in Treasuries, and FX markets are now responding. This has been perceived as a USD negative development, and as such the greenback is on sale. The Bloomberg Dollar index, BBDXY extends its drop and falls as much as 0.5% to 1,151.90.

As Bloomberg notes, the dollar initially pared losses on knee-jerk reaction to news that officials reviewing China’s foreign-exchange holdings have recommended slowing or halting purchases of U.S. Treasuries. However, it then quickly lost momentum and deepened its losses for the day even as 10-year U.S. Treasury yield rose to fresh high at 2.5917% after a report saying China may be looking to change its FX reserves strategy.

EUR/USD snaps a three-day decline, trades near 0.6% higher at 1.2011, jumping almost 70 pips while the CHF has rallied 40 pips, although as some desks note, volumes remain low; liquidity may be exacerbating extent of recent move.

USD/JPY remains offered, drops by as much as 1.2% to 111.30, the most since May 17 and at the lowest level since Nov. 28.

Of course, for the USD, the Fed’s normalization process will naturally be affected, as monetary conditions will tighten and as noted above, has seen the USD falling away against all of its counterparts, with the heavily trade weighted EUR/USD rate swiftly back to 1.2000, but contained here for now.

The only asset which has welcomed the news so far, is gold.

Some notes of caution on the news here from Citi’s trading desk, which notes that it is not surprising that the knee-jerk reaction has been lower in USD. However, it brings up the following three points:

1. Sourcing on the Bloomberg article is unclear, citing only ‘Officials reviewing China’s foreign-exchange holdings’. Comments to this effect in the past have sometimes come from officials outside the main policymaking circles. As a theme, this is not surprising, but given unclear sourcing, this may not signal imminent shifts in policy.

2. It is hard to shift holdings. Shifts in reserves portfolios are tectonic and this partly comes down to the fact that USD selling by sovereigns reinforces broad downward pressure on the dollar, which can run counter to bigger policy aims. It is clear that the long-term trend is towards reductions of overweight USD positions among sovereigns, but in practice shifts are by several percent over several years. Indeed, the only way to begin a very rapid shift in holdings might be to abandon previous exchange rate policy entirely, but this looks unlikely.

3. Foreigners (overall) have already been paring back on purchases of Treasuries relative to other securities for some time but this has not always been well correlated with USD moves.

USD could extend its losses simply on the basis of the tailwind for losses in the broader macro-environment, but we do not view these comments by Chinese authorities as a convincing catalyst in and of themselves. Indeed, if there is any lasting signal from the comments it is that tensions around trade and financial issues may be ratcheting up and we view this as risk negative. This means that currencies such as EUR may outperform risky currencies should market focus on this issue persist.

end

Bankruptcy Looms As Sears Warns “Will Consider All Options” If New Financing Process Fails

Sears Holdings, the one-time giant retailer that has been teetering on the edge of bankruptcy for years now, announced this morning that, following yet another disappointing holiday season (shocking), they’ve initiated new discussions with lenders aimed at renegotiating terms on some $1 billion of “non-first lien debt.”

According to a press release from the company, the debt concessions would be accompanied by another $200 million of cost cuts.