| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Sunday, January 07, 2018 8:43:56 AM

By: Greg Schnell | January 6, 2018

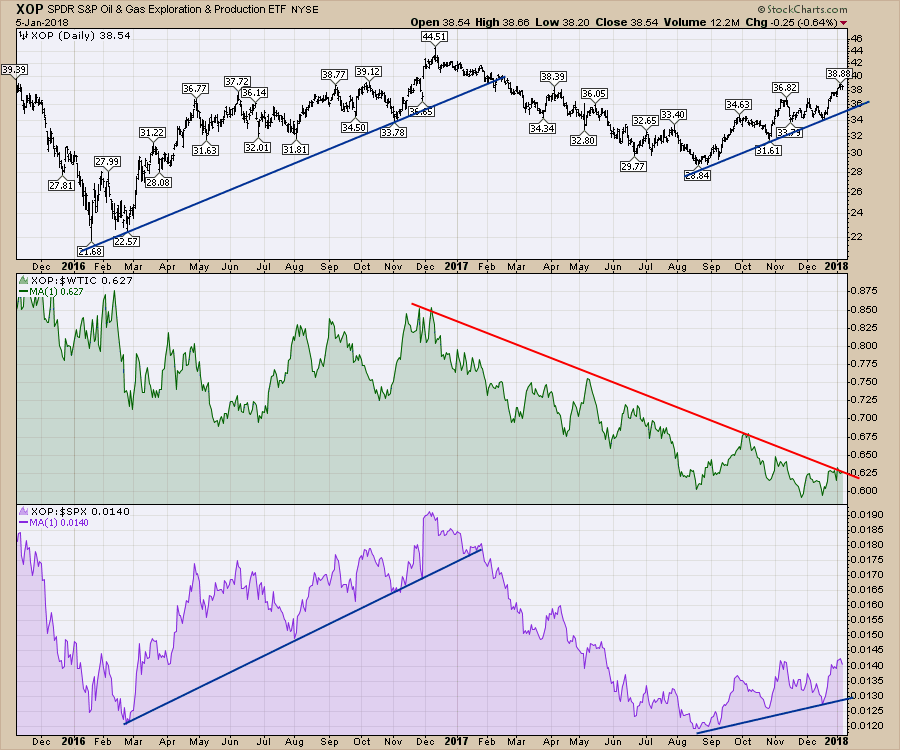

Oil trades have had a big beautiful run from June into early January. The commodity related stocks have also run since August. But there are some relative strength relationships we need to see break out to launch the next phase of stock runs.

Within the energy space, the recent flare-up in Natural Gas prices appeared as NYMEX traders felt the cold come in. Oil has been a persistent bull and just keeps adding a new high every week. But the energy exploration stocks and the oil service stocks had not broken out of their big down trends in relative strength (RS) during 2017. Perhaps that can change in 2018.

In the first chart, the Exploration and Production ETF XOP chart compared to oil and the S&P 500 shown in purple denote the problem. While the XOP does not have to outperform oil, it needs to at least keep up with oil to change the trend. As long as XOP is outperforming the $SPX, everyone seems happy with the rising trend. The $SPX relative strength surged to new 7-month highs this week. The big signal will come when XOP can start to outperform on both.

The oil services ETF XES is in a similar place. But there is a spark of enthusiasm. In 2018, XES started to break out in relative strength to the price of oil. It also started to make new 8-month highs in relative strength compared to the $SPX as we enter 2018. When RS is accelerating on both relative strength indicators, it can be very bullish.

While I have been steadfast in my bullish bias for higher oil and higher oil stock prices, it has been a grind. We are starting to see the signs that may rapidly attract more money. That sign we are watching for is relative outperformance. You can click on these charts to get an update at any time in the future.

Good trading,

Greg Schnell, CMT, MFTA.

http://stockcharts.com/articles/chartwatchers/2018/01/awaiting-some-relative-strength-clues-in-energy-related-stocks.html

• DiscoverGold

Click on "In reply to", for Authors past commentaries

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM