| Followers | 104 |

| Posts | 2500 |

| Boards Moderated | 0 |

| Alias Born | 12/02/2016 |

Tuesday, December 26, 2017 3:56:50 PM

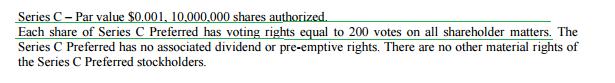

First off, Steve Berman's Series C Preferred stock does not have convertible rights. Read carefully, while the Series A, B, & D Preferred Stock classes can convert into common stock, the Series C cannot.

Secondly, Berman's preferred stock cannot possibly represent 30% of the already issued Preferred stock outstanding.

Pay attention to the fact that the Series A represent 20% of the postconversion issued and outstanding shares of common stock and the Series D represent another 75%, so doesn't rudimentary mathematics bring us to 95% between these two classes??? So then how do you go on to speculate that Berman owns 30%??? Your math does not add up, and frankly your DD doesn't either.

https://www.otcmarkets.com/financialReportViewer?symbol=TXTM&id=183107

As a class, the Series A Preferred can convert into that number of common shares equal to 20% of the postconversion issued and outstanding shares of common stock. Individual shares of Series A Preferred may convert into that pro-rata number of common shares equal to 1/100,000 of the total shares issuable to the entire class. The Series A Preferred has rights voting rights equal to that number of common shares into which the class is convertible on all shareholder matters. The Series A Preferred has no associated dividend or pre-emptive rights. There are no other material rights of the Series A Preferred stockholders.

Series D – Par value $0.001, 100,000 shares authorized.

As a class, the Series D Preferred can convert into that number of common shares equal to 75% of the postconversion issued and outstanding shares of common stock. Individual shares of Series D Preferred may convert into that pro-rata number of common shares equal to 1/100,000 of the total shares issuable to the entire class. The Series D Preferred has rights voting rights equal to that number of common shares into which the class is convertible on all shareholder matters. The Series D Preferred has no associated dividend or pre-emptive rights. There are no other material rights of the Series D Preferred stockholders.

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM