Tuesday, November 14, 2017 11:50:11 PM

Weathering Data

MMgys

Always Nice To Be The first To Wish You A Good Morning !

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

program note: The gys show is experiencing a server 2 hour lag on some of the pics and charts due to embedded too hot handle material resulting in server burn out.Please proceed with caution.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Nov 14/GOLD IS UP $4.00 DESPITE BANKER ATTEMPTS TO QUASH THE METAL/SILVER ALSO REBOUNDS/SILVER AND FINISHES UP 3 CENTS/LONG TERM BOND YIELDS FALTER/CHINESE MARKETS FALL/THE ONLY POSITIVE TODAY WAS GOLD/SILVER/THE USA IS STILL HAVING DIFFICULTY PASSING THE TAX REFORM BILL

November 14, 2017 · by harveyorgan · in Uncat

GOLD: $1282.85 UP $4.00

Silver: $17.08 UP 3 cents

Closing access prices:

Gold $1280.50

silver: $17.02

SHANGHAI GOLD FIX: FIRST FIX 10 15 PM EST (2:15 SHANGHAI LOCAL TIME)

SECOND FIX: 2:15 AM EST (6:15 SHANGHAI LOCAL TIME)

SHANGHAI FIRST GOLD FIX: $1285.54 DOLLARS PER OZ

NY PRICE OF GOLD AT EXACT SAME TIME: $1276.15

PREMIUM FIRST FIX: $9.39

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

SECOND SHANGHAI GOLD FIX: $1286.85

NY GOLD PRICE AT THE EXACT SAME TIME: $1277.10

Premium of Shanghai 2nd fix/NY:$9.75

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

LONDON FIRST GOLD FIX: 5:30 am est $1273.50

NY PRICING AT THE EXACT SAME TIME: $1273.20

LONDON SECOND GOLD FIX 10 AM: $1274.60

NY PRICING AT THE EXACT SAME TIME. 1273.86

For comex gold:

NOVEMBER/

NOTICES FILINGS TODAY FOR OCT CONTRACT MONTH: 0 NOTICE(S) FOR nil OZ.

TOTAL NOTICES SO FAR: 991 FOR 99,100 OZ (3.082TONNES)

For silver:

NOVEMBER

2 NOTICE(S) FILED TODAY FOR

10,000 OZ/

Total number of notices filed so far this month: 874 for 4,370,000 oz

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Bitcoin: BID $6545 OFFER /$6570 up $26.00 (MORNING)

BITCOIN CLOSING; BID $6609 OFFER: $6637 // UP $91.00

end

Quote of the day:

*Dennis Gartman…

“We have not been of the school of thought over the years that gold is and has been manipulated by powerful forces intent upon keeping gold weak, but we shall admit that things do indeed look very, very strange in recent weeks and the “conspiratorialists” are sounding more and more plausible with each passing day.”

Just one question: what planet is he on?

h

Let us have a look at the data for today

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

In silver, the total open interest FELL BY A SMALL 236 contracts from 199,358 DOWN TO 199,122 DESPITE YESTERDAY’S TRADING IN WHICH SILVER ROSE NICELY BY 16 CENTS. AS I WAS PREPARING FOR TODAY’S REPORT I WROTE THE FOLLOWING: “JUDGING FROM THE MASSIVE VOLUME, IT LOOKS LIKE WE DID NOT GET ANY LONG LIQUIDATION BUT AGAIN IT LOOKS LIKE WE GOT A FEW MORE COMEX LONGS TRANSFERRING THEIR CONTRACTS TO LONDON THROUGH THE EFP ROUTE.” I WAS EXACTLY CORRECT AS WE HAD A HUGE 702 DECEMBER EFP’S ISSUED ALONG WITH 84 EFP’S FOR MARCH FOR A TOTAL ISSUANCE OF 786 CONTRACTS. THE ISSUANCE FOR MARCH BOTHERS ME A LOT AS THIS IS SUPPOSE TO BE FOR EMERGENCY IN THE UPCOMING DELIVERY MONTH. I GUESS WHAT THE CME IS STATING IS THAT THERE IS NO SILVER TO BE DELIVERED UPON AT THE COMEX AND THEY MUST EXPORT THEIR OBLIGATION TO LONDON.

RESULT: A SMALL SIZED DROP IN OI COMEX WITH THE 16 CENT PRICE RISE. COMEX LONGS EXITED OUT OF THE COMEX AND FROM THE CME DATA 786 EFP’S WERE ISSUED FOR A DELIVERABLE CONTRACT OVER IN LONDON WITH A FIAT BONUS WHICH DEFINITELY EXPLAINS THE FALL IN OI. IN ESSENCE WE DID NOT GET A FALL IN DEMAND IN OPEN INTEREST ONLY A TRANSFER TO OTHER JURISDICTIONS.

In ounces, the OI is still represented by just OVER 1 BILLION oz i.e. 0.995 BILLION TO BE EXACT or 142% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT OCT MONTH/ THEY FILED: 2 NOTICE(S) FOR 10,000 OZ OF SILVER

In gold, the open interest ROSE BY A SMALLER THAN EXPECTED 1,996 CONTRACTS DESPITE THE GOOD RISE IN PRICE OF GOLD ($4.85) WITH YESTERDAY’S TRADING . YESTERDAY’S TRADING SAW NO GOLD LEAVES FALL FROM THE GOLD TREE. THE TOTAL NUMBER OF GOLD EFP’S ISSUED YESTERDAY TOTAL: 6577 CONTRACTS WHICH IS HUGE. THE MONTH OF DECEMBER SAW 5077 CONTRACTS AND FEB SAW THE ISSUANCE OF 1500 CONTRACTS. The new OI for the gold complex rests at 532,781.

Result: A SMALLER SIZED INCREASE IN OI DESPITE THE RISE IN PRICE IN GOLD ON YESTERDAY ($4.85). WE HAD A HUGE NUMBER OF COMEX LONG TRANSFERS TO LONDON THROUGH THE EFP ROUTE AS (6577 EFP’S). THERE DOES NOT SEEM TO BE MUCH PHYSICAL AT THE COMEX AND WE ARE APPROACHING THE HUGE DELIVERY MONTH OF DECEMBER. WE ALSO HAD NO GOLD COMEX OI LEAVE THE COMEX GOLD ARENA.

we had: 0 notice(s) filed upon for NIL oz of gold.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

With respect to our two criminal funds, the GLD and the SLV:

GLD:

A small change in gold inventory at the GLD/ a deposit of .300 tonnes

Inventory rests tonight: 843.39 tonnes.

SLV

TODAY WE HAD NO CHANGE IN SILVER INVENTORY AT THE SLV

INVENTORY RESTS AT 318.074 MILLION OZ

end

.

First, here is an outline of what will be discussed tonight:

1. Today, we had the open interest in silver FELL BY 236 contracts from 199,358 DOWN TO 199,122 (AND now A LITTLE FURTHER FROM THE NEW COMEX RECORD SET ON FRIDAY/APRIL 21/2017 AT 234,787) DESPITE THE RISE IN SILVER PRICE (A GAIN OF 16 CENTS). OUR BANKERS USED THEIR EMERGENCY PROCEDURE TO ISSUE 702 PRIVATE EFP’S FOR DECEMBER(WE DO NOT GET A LOOK AT THESE CONTRACTS) AND 84 EFP’S FOR MARCH, WHICH GIVES OUR COMEX LONGS A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. THIS IS QUITE EARLY FOR THESE EFP ISSUANCE..USUALLY WE WITNESS THIS ONE WEEK PRIOR TO FIRST DAY NOTICE AND THIS CONTINUES RIGHT UP UNTIL FDN. WE ALSO HAD MINIMAL SILVER COMEX LIQUIDATION. TOTAL EFP’S ISSUED YESTERDAY BY THE CME IN SILVER TOTAL 786 CONTRACTS.

RESULT: A SMALL SIZED DECREASE IN SILVER OI AT THE COMEX DESPITE THE 16 CENT RISE IN PRICE (WITH RESPECT TO YESTERDAY’S TRADING). WE HAD ANOTHER 786 EFP’S ISSUED TRANSFERRING OUR COMEX LONGS OVER TO LONDON TOGETHER WITH NO SILVER COMEX LIQUIDATION.

(report Harvey)

.

2.a) The Shanghai and London gold fix report

(Harvey)

2 b) Gold/silver trading overnight Europe, Goldcore

(Mark O’Byrne/zerohedge

and in NY: Bloomberg

3. ASIAN AFFAIRS

)Late MONDAY night/TUESDAY morning: Shanghai closed DOWN 18.29 points or .53% /Hang Sang CLOSED DOWN 30.06 pts or 0.10% / The Nikkei closed UP 0.98 POINTS OR 0.00%/Australia’s all ordinaires CLOSED DOWN 0.80%/Chinese yuan (ONSHORE) closed UP at 6.6378/Oil DOWN to 56.52 dollars per barrel for WTI and 62.85 for Brent. Stocks in Europe OPENED RED EXCEPT LONDON . ONSHORE YUAN CLOSED UP AGAINST THE DOLLAR AT 6.6378. OFFSHORE YUAN CLOSED WEAKER TO THE ONSHORE YUAN AT 6.6431 //ONSHORE YUAN STRONGER AGAINST THE DOLLAR/OFF SHORE STRONGER TO THE DOLLAR/. THE DOLLAR (INDEX) IS WEAKER AGAINST ALL MAJOR CURRENCIES. CHINA IS VERY HAPPY TODAY

i

3a)THAILAND/SOUTH KOREA/NORTH KOREA

i)North Korea//South Korea

b) REPORT ON JAPAN

c) REPORT ON CHINA

4. EUROPEAN AFFAIRS

i)GERMANY

The lower value of the Euro is a catalyst to Germany for growth as this exporting behemoth is certainly taking advantage due to weaker partners in the Euro zone. Its GDP rose at a 0.8% quarter over quarter. Yearly growth is reported at 2.3% and underlying growth at 2.8%,.

( zerohedge)

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

i)YEMEN

Very sad: the blockade in Yemen is having a devastating effect on citizens and their economy.

( Mike Krieger/Liberty BlitzkriegBlog)

Saudi Arabia

Pat Buchanan discusses the huge ramifications to Saudi Arabia for the antics of the MBS

( Pat Buchanan/Buchanan.org)

6 .GLOBAL ISSUES

Zimbabwe

There is a military coup in Zimbabwe as it looks like 93 yr old Mugabe is out:

( zerohedge)

7. OIL ISSUES

i)The IEA throws cold water on OPEC optimism for global demand for crude oil. They state that global oil demand is shrinking and this is after huge stockpiling by China.

( zerohedge)

ii)We have been bringing you terrific articles on the rapid demise of the welfare state of Saudi Arabia

(David Stockman and R Meijer). Now Charles Hugh Smith comments also on how these guys are in serious trouble.

( Charles Hugh Smith/TwoMinds Blog)

iii)Huge crude build at the end of the day sends oil southbound

( zerohedge)

8. EMERGING MARKET

9. PHYSICAL MARKETS

i)Gold trading today:

the crooks try and break the 200 day average for gold and fail: this caused gold to rise to 1280

( zerohedge)

ii)Interesting: Gartman hardly acknowledges GATA and yet he discloses in his latest letter the BIS involvement of gold swaps which is critical to the manipulation of gold

( GATA/Chris Powell./Gartman)

iii)Lawrie Williams found religion. We now have another gold writer who is now compelled to admit that the gold market is rigged

( GATA/Chris Powell/Lawrie Williams)

iv)Seems that Turkish citizens are not too enthralled with Erdogan and his economic and governing policies. They have bought the most gold ever as the Lira tumbles. So far in this 2017 year citizens have thought 47 tonnes. Also the Turkish government has also increased its reserves dramatically as in the 3rd quarter they bought over 30 tonnes of gold.

( zerohedge)

v)Koos Jansen provides a great commentary on the 777 tonnes of gold supplied to the citizens of China for the previous 3 quarters. Annualized it looks like China will import over 1,036 tonnes. This gold is not official gold whereby China always buys with USA dollars. All gold produced in China becomes official gold and at last look they mined 430 tonnes of gold.

( Koos Jansen/Bullionstar)

10. USA stories which will influence the price of gold/silver

i)Trading today: The long end of the yield curve crashes especially the 10 and 30 yr. The 10 yr is now at yearly lows. The flatter the yield curve, the more indication of a recession will be forthcoming

( zerohedge)

ii)This will not be good for the markets as CALPERS, California’s largest pension fund has just dumped 50 billion dollars worth of stocks as they have just called the top

( zerohedge)

iii)My goodness! what kept him so long: Sessions is now considering appointing a special council to investigate the Clintons

( zerohedge)

iv)Trump will make a major statement when he gets back onto USA soil

( zerohedge)

v a)The House tax reform bill will likely pass this Thursday, but the Senate version is now being marked up. To mee it seems hopeless that we will get a tax reform bill passed.

( zerohedge)

v b)As promised to you on several occasions, the SALT DEDUCTIONS will stay in the House bill and will never be removed

( zerohedge)

v c)Now the senate is proposing to strip the individual mandate from Health care in order to pass the tax bill. It would free up 300 to 400 billion Moderate Republicans will have difficulty in supporting this. No Democrat would vote for this.

( zerohedge)

vi)The IRS is perplexed? Out of 500,000 exchange Coinbase users only 900 reported gains or losses??

( zerohedge)

vii) October’s PPI is just as hot as September. This is a forerunner to real inflation coming down to meet us

( zerohedge)

Let us head over to the comex:

The total gold comex open interest SURPRISINGLY ROSE BY ONLY 1996 CONTRACTS UP to an OI level of 532,400 DESPITE THE FAIR SIZED RISE IN THE PRICE OF GOLD ($4.85 RISE WITH RESPECT TO YESTERDAY’S TRADING). OBVIOUSLY WE DID NOT HAVE ANY GOLD COMEX LIQUIDATION. WE HAD 6577 COMEX LONGS EXIT THE COMEX ARENA THROUGH THE EFP ROUTE AS THEY RECEIVE A DELIVERABLE LONDON FORWARD TOGETHER WITH A FIAT BONUS. THE CME REPORTS THAT 5077 EFPS WERE ISSUED FOR DECEMBER AND 1500 WERE ISSUED FOR MARCH. THE OBLIGATION STILL RESTS WITH THE BANKERS ON THESE TRANSFERS.

Result: a SURPRISE SMALL INCREASE IN OPEN INTEREST DESPITE THE FAIR SIZED RISE IN THE PRICE OF GOLD ($4.85.)

.

We have now entered the NON active contract month of NOVEMBER.HERE WE HAD A LOSS OF 0 CONTRACT(S) REMAINING AT 71. We had 2 notices filed YESTERDAY so GAINED 2 contracts or 200 additional oz will stand for delivery in this non active month of November. TO SEE BOTH GOLD AND SILVER RISE IN AMOUNT STANDING (QUEUE JUMPING) IS A GOOD INDICATOR OF PHYSICAL SHORTNESS FOR BOTH OF OUR PRECIOUS METALS.

The very big active December contract month saw it’s OI LOSE 9,219 contracts DOWN to 291,870 (OF WHICH 5077 WERE EFP TRANSFERS). January saw its open interest rise by 60 contracts up to 864. FEBRUARY saw a gain of 10,239 contacts up to 167,245.

.

We had 0 notice(s) filed upon today for NIL oz

VOLUME FOR TODAY : 176,626 (PRELIMINARY)

CONFIRMED VOLUME YESTERDAY: 248,933

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for the wild silver comex results.

Total silver OI SURPRISINGLY FELL BY 236 CONTRACTS FROM 199,358 DOWN TO 199,122 DESPITE YESTERDAY’S 16 CENT GAIN IN PRICE . WE HAD 702 PRIVATE EFP’S ISSUED FOR DECEMBER AND 84 EFP’S FOR MARCH BY OUR BANKERS TO COMEX LONGS WHO RECEIVED A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. THIS IS QUITE EARLY FOR THE ISSUANCE. USUALLY WE WITNESS THIS EVENT ONE WEEK PRIOR TO FIRST DAY NOTICE AND IT CONTINUES RIGHT UP TO FDN. WE HAD NO LONG SILVER COMEX LIQUIDATION. THUS THE TOTAL EFP’S ISSUED YESTERDAY TO OUR COMEX LONGS TOTAL 786 AND THUS DEMAND FOR SILVER OPEN INTEREST CONTINUES TO RISE TAKING INTO ACCOUNT THE INCREASE EFP’S ISSUED.

The new front month of November saw its OI FALL by 0 contract(s) and thus it stands at 3. We had 1 notice(s) served YESTERDAY so we gained 1 contracts or an additional 5,000 oz will stand in this non active month of November. After November we have the big active delivery month of December and here the OI FALL by 4,284 contracts DOWN to 110,412. January saw A GAIN OF 21 contracts RISING TO 1052.

We had 2 notice(s) filed for 10,000 oz for the OCT. 2017 contract

INITIAL standings for NOVEMBER

Nov 14/2017.

Gold Ounces

Withdrawals from Dealers Inventory in oz nil oz

Withdrawals from Customer Inventory in oz

21,364.844

oz

Scotia

144 kilobars

&

JPMorgan

Deposits to the Dealer Inventory in oz nil oz

Deposits to the Customer Inventory, in oz

nil oz

No of oz served (contracts) today

0 notice(s)

NIL OZ

No of oz to be served (notices)

71 contracts

(7100 oz)

Total monthly oz gold served (contracts) so far this month

991 notices

99,100 oz

3.082 tonnes

Total accumulative withdrawals of gold from the Dealers inventory this month NIL oz

Total accumulative withdrawal of gold from the Customer inventory this month xxx oz

Today we HAD 1 kilobar trans

WE HAD nil DEALER DEPOSIT:

total dealer deposits: nil oz

We had nil dealer withdrawals:

total dealer withdrawals: nil oz

we had 0 customer deposit(s):

total customer deposits nil oz

We had 2 customer withdrawal(s)

i) out of Scotia: 4,629.600 OZ (144 kilobars)

ii) Out of JPMorgan: 16,735.244

total customer withdrawals; 21,364.844 oz

we had 0 adjustment(s)

For NOVEMBER:

Today, 0 notice(s) were issued from JPMorgan dealer account and 0 notices were issued from their client or customer account. The total of all issuance by all participants equates to 0 contract(s) of which 0 notices were stopped (received) by j.P. Morgan dealer and 0 notice(s) was (were) stopped/ Received) by j.P.Morgan customer account.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

To calculate the INITIAL total number of gold ounces standing for the NOVEMBER. contract month, we take the total number of notices filed so far for the month (991) x 100 oz or 99100 oz, to which we add the difference between the open interest for the front month of NOV. (71 contracts) minus the number of notices served upon today (0 x 100 oz per contract equals 106,100 oz, the number of ounces standing in this NON active month of NOV

Thus the INITIAL standings for gold for the NOVEMBER contract month:

No of notices served (991) x 100 oz or ounces + {(71)OI for the front month minus the number of notices served upon today (0) x 100 oz which equals 106,200 oz standing in this active delivery month of NOVEMBER (3.303 tonnes)

WE GAINED 1 ADDITIONAL CONTRACTS OR 100 OZ OF ADDITIONAL GOLD STANDING FOR METAL AT THE COMEX

THIS IS THE FIRST TIME EVER THAT WE HAVE WITNESSED CONSIDERABLE QUEUE JUMPING IN GOLD AT THE COMEX. SILVER’S QUEUE JUMPING STARTED IN MAY 2017 AND HAS NOT LET UP ONCE COMMENCED.

.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Total dealer inventory 527,069.052 or 16.394 tonnes (dealer gold continues to disappear)

Total gold inventory (dealer and customer) = 8,676,238.163 or 269,74 tonnes

I have a sneaky feeling that these withdrawals of gold in kilobars are being used in the hypothecating process and are being used in the raiding of gold!

The gold comex is an absolute fraud. The use of kilobars and exact weights makes the data totally absurd and fraudulent! To me, the only thing that makes sense is the fact that “kilobars: are entries of hypothecated gold sent to other jurisdictions so that they will not be short with their underwritten derivatives in that jurisdiction. This would be similar to the rehypothecated gold used by Jon Corzine at MF Global.

IN THE LAST 14 MONTHS 85 NET TONNES HAS LEFT THE COMEX.

end

And now for silver

AND NOW THE NOVEMBER DELIVERY MONTH

NOVEMBER INITIAL standings

AND NOW THE NOVEMBER DELIVERY MONTH

NOVEMBER INITIAL standings

Nov 14/ 2017

Silver Ounces

Withdrawals from Dealers Inventory nil

Withdrawals from Customer Inventory

585,448.02 oz

SCOTIA

Brinks

Delaware

Deposits to the Dealer Inventory

nil oz

Deposits to the Customer Inventory

900,930.966

oz

CNT

Delaware

No of oz served today (contracts)

2 CONTRACT(S)

(10,000,OZ)

No of oz to be served (notices)

1 contract

(5,000 oz)

Total monthly oz silver served (contracts) 874 contracts(4,370,000 oz)

Total accumulative withdrawal of silver from the Dealers inventory this month NIL oz

Total accumulative withdrawal of silver from the Customer inventory this month

Nov 13/ 2017

today, we had 0 deposit(s) into the dealer account:

total dealer deposit: nil oz

we had nil dealer withdrawals:

total dealer withdrawals: nil oz

we had 3 customer withdrawal(s):

i) Out of SCOTIA: 563,275.100 oz

ii) Out of Delaware: 927.300 oz

iii) Out of Scotia: 563,275.100 oz

TOTAL CUSTOMER WITHDRAWAL 585,448.02 oz

We had 2 Customer deposit(s):

i) Into Delaware: 301,653.366 oz

ii) Into CNT: 599,277.600 oz

***deposits into JPMorgan have stopped again

In the month of March and February, JPMorgan stopped (received) almost all of the comex silver contracts.

why is JPMorgan bringing in so much silver??? why is this not criminal in that they are also the massive short in silver

total customer deposits: 900,930.966 oz

we had 0 adjustment(s)

The total number of notices filed today for the NOVEMBER. contract month is represented by 2 contracts FOR 10,000 oz. To calculate the number of silver ounces that will stand for delivery in NOVEMBER., we take the total number of notices filed for the month so far at 874 x 5,000 oz = 4,370,0000 oz to which we add the difference between the open interest for the front month of NOV. (3) and the number of notices served upon today (2 x 5000 oz) equals the number of ounces standing.

.

Thus the INITIAL standings for silver for the NOVEMBER contract month: 874 (notices served so far)x 5000 oz + OI for front month of NOVEMBER(3) -number of notices served upon today (2)x 5000 oz equals 4,375,000 oz of silver standing for the NOVEMBER contract month. This is EXCELLENT for this NON active delivery month of November.

We gained 1 contract(s) or an additional 5,000 oz will stand for metal in the non active delivery month of November.

AS I MENTIONED ABOVE, WE HAVE BEEN WITNESSING QUEUE JUMPING IN SILVER FROM MAY 1 2017 ONWARD. IT IS NOW COMFORTING TO SEE CONSIDERABLE QUEUE JUMPING OCCURRING CONTINUALLY IN GOLD FOR THE FIRST TIME SINCE RECORDED TIME AT THE GOLD COMEX!!(1974). QUEUE JUMPING CAN ONLY OCCUR ON PHYSICAL METAL SHORTAGE.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

ESTIMATED VOLUME FOR TODAY: 32,820

CONFIRMED VOLUME FOR YESTERDAY: 86,794 CONTRACTS

YESTERDAY’S CONFIRMED VOLUME OF 86,794 CONTRACTS EQUATES TO 443 MILLION OZ OR 63.4% OF ANNUAL GLOBAL PRODUCTION OF SILVER

Total dealer silver: 43.218 million

Total number of dealer and customer silver: 230.473 million oz

The record level of silver open interest is 234,787 contracts set on April 21./2017 with the price at that day at $18.42

The previous record was 224,540 contracts with the price at that time of $20.44

end

NPV for Sprott and Central Fund of Canada

1. Central Fund of Canada: traded at Negative 1.8 percent to NAV usa funds and Negative 1,5% to NAV for Cdn funds!!!!

Percentage of fund in gold 62.3%

Percentage of fund in silver:37.4%

cash .+.3%( Nov 14/2017)

2. Sprott silver fund (PSLV): STOCK RISES TO -0.77% (Nov 14 /2017)

3. Sprott gold fund (PHYS): premium to NAV RISES TO -0.70% to NAV (Nov 14/2017 )

Note: Sprott silver trust back into NEGATIVE territory at -0.77%-/Sprott physical gold trust is back into NEGATIVE/ territory at -0.70%/Central fund of Canada’s is still in jail but being rescued by Sprott.

Sprott WINS hostile 3.1 billion bid to take over Central Fund of Canada

(courtesy Sprott/GATA)

END

And now the Gold inventory at the GLD

NOV 14/a small deposit of .300 tonnes into the GLD inventory/Inventory rests at 843.39 tonnes

Nov 13/NO CHANGE IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 843.09 TONNES

Nov 10/no change in gold inventory at the GLD/Inventory rests at 843.09 tonnes

Nov 9/no changes in inventory at the GLD/Inventory rests at 843.09 tonnes

NOV 8/ANOTHER HUGE WITHDRAWAL OF 1.18 TONNES OF GOLD FROM THE GLD DESPITE GOLD’S RISE TODAY. INVENTORY RESTS AT 843.09

Nov 7/a huge withdrawal of 1.48 tonnes of gold from the GLD/Inventory rests at 844.27 tonnes

NOV 6/ a tiny withdrawal of .29 tonnes to pay for fees etc/inventory rests at 845.75 tonnes

Nov 3/no change in gold inventory at the GLD/Inventory rests at 846.04 tonnes

NOV 2/STRANGE!!! WE HAD ANOTHER WITHDRAWAL OF 3.55 TONNES FROM THE GLD DESPITE GOLD’S RISE OF $6.60 YESTERDAY AND $1.55 TODAY/INVENTORY RESTS AT 846.04 TONNES

Nov 1/a withdrawal of 1.18 tonnes of gold from the GLD/Inventory rests at 849.59 tonnes

OCT 31/no change in gold inventory at the GLD/Inventory rests at 850.77 tonnes

Oct 30/STRANGE WITH GOLD UP THESE PAST TWO TRADING DAYS, THE GLD HAS A WITHDRAWAL OF 1.18 TONNES FROM ITS INVENTORY/INVENTORY RESTS AT 850.77 TONES

Oct 27/NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 851.95 TONNES

Oct 26./A WITHDRAWAL OF 1.18 TONNES OF GOLD FROM THE GLD/INVENTORY RESTS AT 851.95 TONNES

Oct 25/NO CHANGE (SO FAR) IN GOLD INVENTORY/INVENTORY RESTS AT 853.13 TONNES

Oct 24./no change in gold inventory at the GLD/inventory rests at 853.13 tonnes

OCT 23./NO CHANGE IN GOLD INVENTORY AT THE GLD/INVENTORY REMAINS AT 853.13 TONNES

OCT 20/NO CHANGE IN GOLD INVENTORY AT THE GLD/ INVENTORY REMAINS AT 853.13 TONNES

oCT 19/NO CHANGE/853.13 TONNES

Oct 18 /no change in gold inventory at the GLD/ inventory rests at 853.13 tonnes

Oct 17./no change in gold inventory at the GLD/inventory rests at 853.13 tonnes

Oct 16/A HUGE WITHDRAWAL OF 5.32 TONNES FROM THE GLD/INVENTORY RESTS AT 853.13 TONNES

0CT 13/ NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 858.45 TONNES

Oct 12/NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 858.45 TONNES

Oct 10/NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 858.45 TONNES

Oct 9/ANOTHER DEPOSIT OF 4.43 TONNES INTO GLD/INVENTORY RESTS AT 858.45 TONNES

Oct 6/A DEPOSIT OF 2.96 TONNES OF GOLD INVENTORY INTO THE GLD/TONIGHT IT RESTS AT 854.02 TONNES

Oct 5/A LOSS OF 3.24 TONNES OF GOLD INVENTORY FROM THE GLD/INVENTORY RESTS AT 851.06 TONNES

Oct 4/NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 854.30 TONNES

oCT 3/ A HUGE WITHDRAWAL OF 10.35 TONNES FROM THE GLD/INVENTORY RESTS AT 854.30 TONNES

Oct 2/STRANGE/WITH GOLD’S CONTINUAL WHACKING WE GOT A BIG FAT ZERO OZ LEAVING THE GLD/INVENTORY RESTS AT 864.65 TONNES

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Nov 14/2017/ Inventory rests tonight at 843.39 tonnes

*IN LAST 271 TRADING DAYS: 97.56 NET TONNES HAVE BEEN REMOVED FROM THE GLD

*LAST 206 TRADING DAYS: A NET 59,72 TONNES HAVE NOW BEEN ADDED INTO GLD INVENTORY.

*FROM FEB 1/2017: A NET 28.61 TONNES HAVE BEEN ADDED.

end

Now the SLV Inventory

NOV 14/no change in silver inventory at the SLV/Inventory rests at 318.074 tonnes

Nov 13/NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 318.074 MILLION OZ

Nov 10/no change in silver inventory at the SLV/Inventory rests at 318.074 million oz/

Nov 9/no change in silver inventory at the SLV/inventory rests at 318.074 million oz.

NOV 8/NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 318.074 MILLION OZ

Nov 7/a huge withdrawal of 944,000 oz from the SLV/inventory rests at 318.074 million oz/

NOV 6/no change in silver inventory at the SLV/Inventory rests at 319.018 million oz/

Nov 3/NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS TONIGHT AT 319.018 MILLION OZ.

NOV 2/A TINY LOSS OF 137,000 OZ BUT THAT WAS TO PAY FOR FEES LIKE INSURANCE AND STORAGE/INVENTORY RESTS AT 319.018 MILLION OZ/

Nov 1/STRANGE! WITH SILVER’S HUGE 48 CENT GAIN WE HAD NO GAIN IN INVENTORY AT THE SLV/INVENTORY RESTS AT 319.155 MILLION OZ/

Oct 31/no change in silver inventory at the SLV/Inventory rests at 319.155 million oz

Oct 30/STRANGE!WITH SILVER UP THESE PAST TWO TRADING DAYS, WE HAD A HUGE WITHDRAWAL OF 1.133 MILLION OZ FROM THE SLV/INVENTORY RESTS AT 319.155 MILLION OZ/

Oct 27/NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 320.288 MILLION OZ

Oct 26/NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 320.288 MILLION OZ/

Oct 25/NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 320.288 MILLION OZ

Oct 24/no change in inventory at the SLV/inventory rests at 320.288 million oz/

oCT 23./STRANGE!!WITH SILVER RISING TODAY WE HAD A HUGE WITHDRAWAL OF 1.039 MILLION OZ/inventory rests at 320.288 million oz/

OCT 20NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 321.327 MILLION OZ

oCT 19/INVENTORY LOWERS TO 321.327 MILLION OZ

Oct 18 no change in silver inventory at the SLV/inventory rest at 322.271 million oz

Oct 17/ A MONSTROUS WITHDRAWAL OF 3.494 MILLION OZ FROM THE SLV/INVENTORY RESTS AT 322.271 MILLION OZ

Oct 16/ NO CHANGES IN SILVER INVENTORY AT THE SLV.INVENTORY RESTS AT 325.765 MILLION OZ

oCT 13/ NO CHANGES IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 325.765 MILLION OZ

Oct 12/THE LAST TWO DAYS WE LOST 1.113 MILLION OZ FROM THE SLV/INVENTORY RESTS AT 325.765 MILLION OZ

Oct 10/NO CHANGE IN INVENTORY AT THE SLV/INVENTORY RESTS AT 326.898 MILLION OZ/

Oct 9/A HUGE DEPOSIT OF 1.227 MILLION OZ INTO THE INVENTORY OF THE SLV/INVENTORY RESTS AT 326.898 MILLION OZ

Oct 6/NO CHANGE IN SILVER INVENTORY/ INVENTORY RESTS AT 325.671 MILLON OZ

Oct 5/ANOTHER WITHDRAWAL OF 944,000 OZ FROM THE SLV/INVENTORY RESTS AT 325.671 MILLION OZ

OCT 4/NO CHANGE IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 326.615 MILLION Z

Oct 3/A TINY WITHDRAWAL OF 143,000 FROM THE SLV FOR FEES/INVENTORY RESTS AT 326.615 MILLION OZ

Oct 2/NO CHANGES IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 326,757 MILLION OZ

Nov 14/2017:

Inventory 318.074 million oz

end

6 Month MM GOFO

Indicative gold forward offer rate for a 6 month duration

+ 1.50%

12 Month MM GOFO

+ 1.73%

30 day trend

end

Major gold/silver trading/commentaries for TUESDAY

GOLDCORE/BLOG/MARK O’BYRNE.

GOLD/SILVER

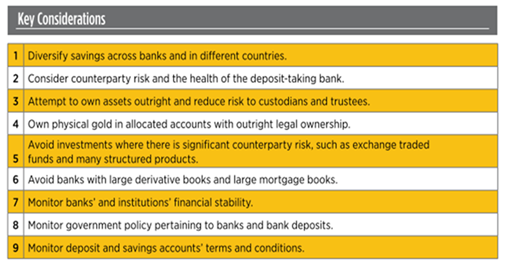

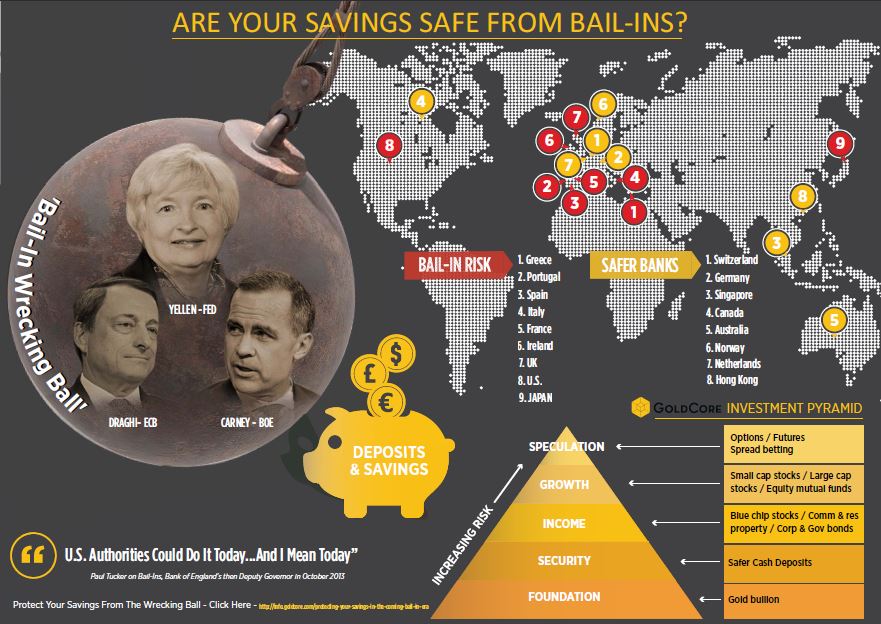

Preemptive Strike on Euro Savings. Protect Your Savings With Gold: ECB Propose End To Deposit Protection

by GoldCore

Nov 14, 2017 7:52 AM

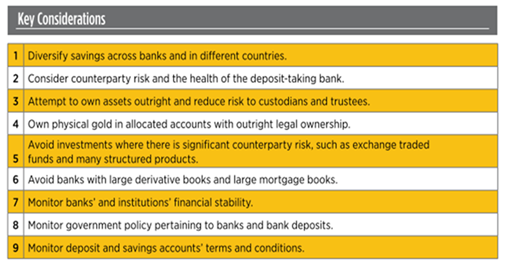

Protect Your Savings With Gold: ECB Propose End To Deposit Protection

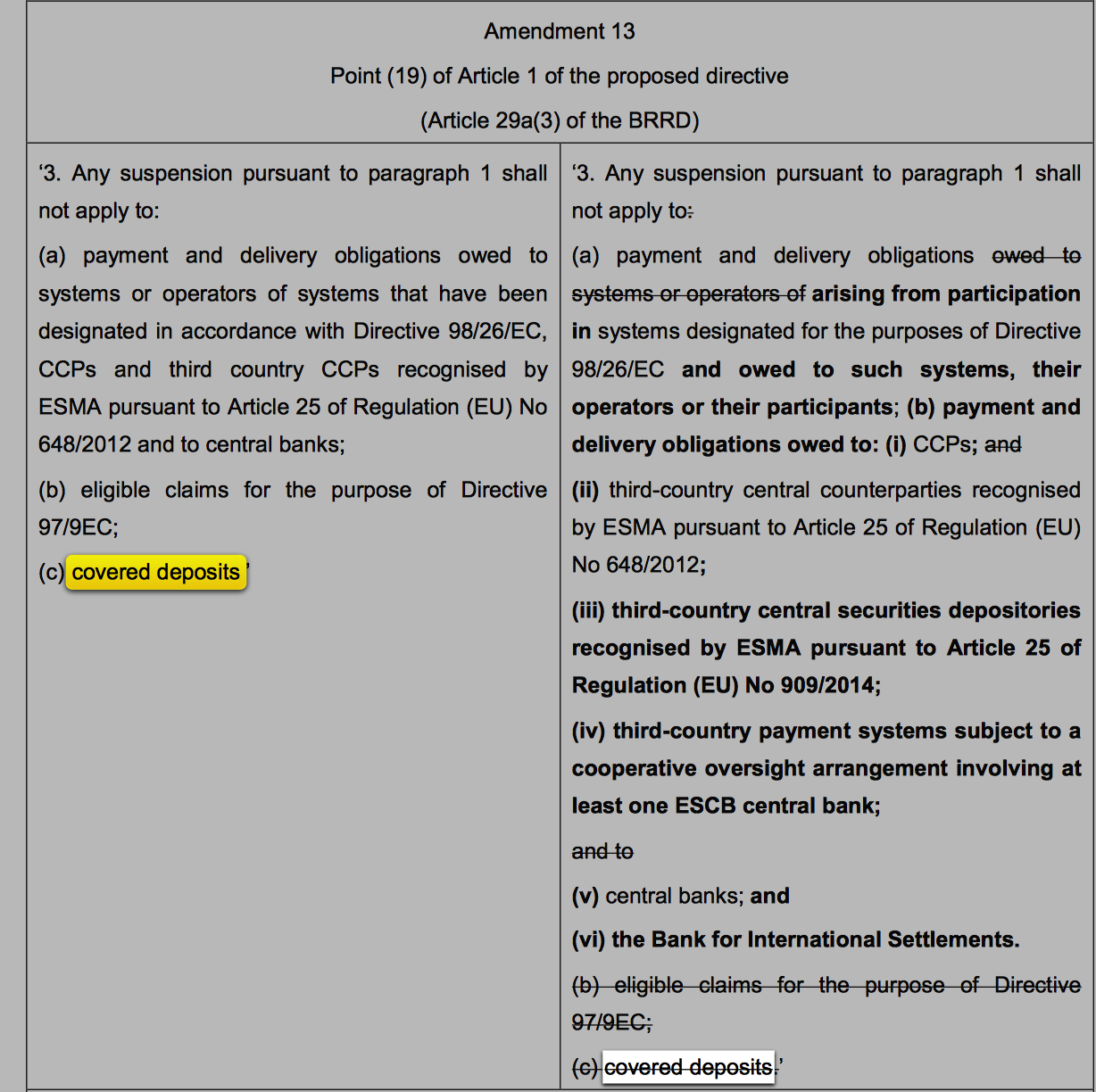

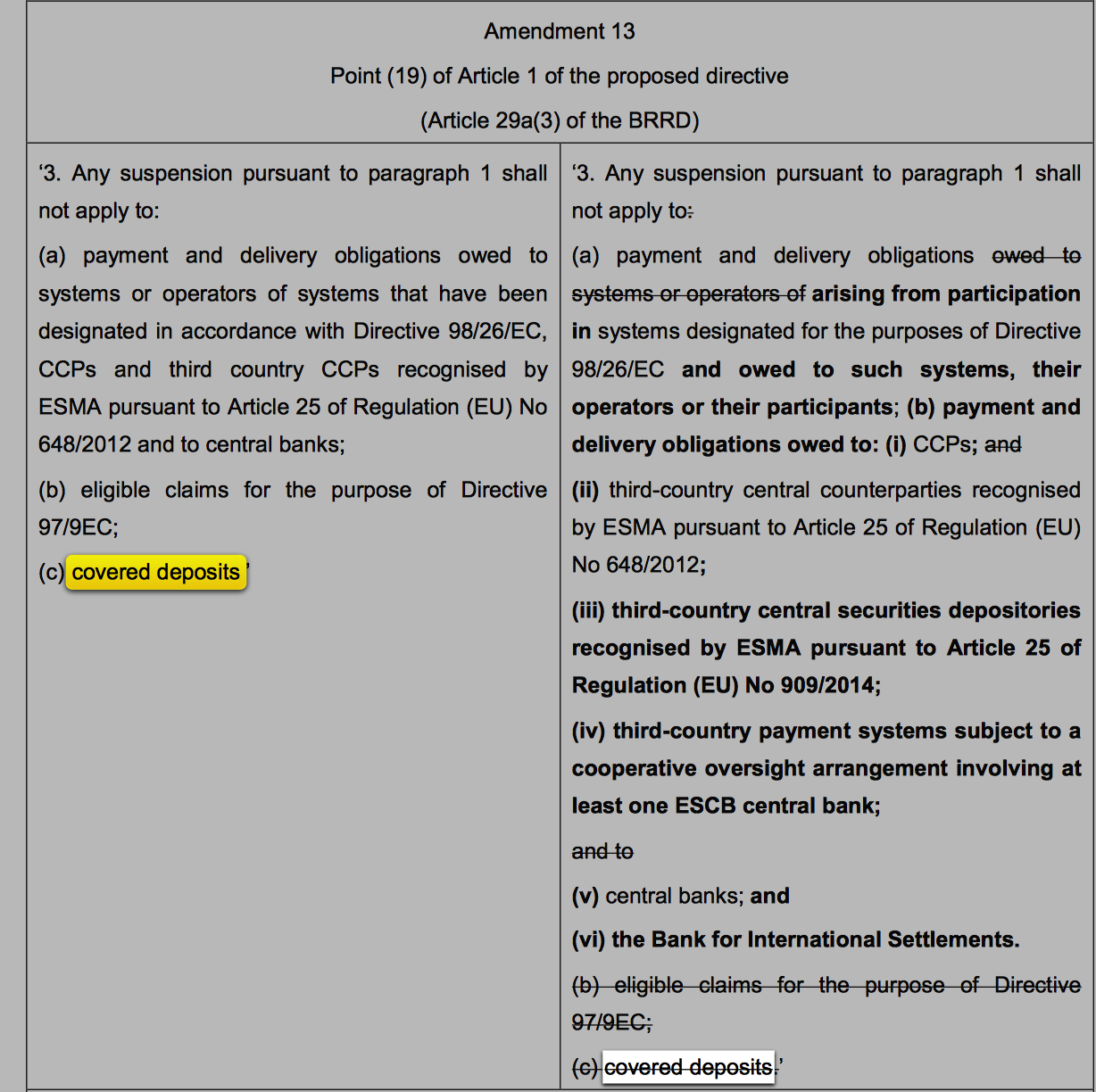

– New ECB paper proposes ‘covered deposits’ should be replaced to allow for more flexibility

– Fear covered deposits may lead to a run on the banks

– Savers should be reminded that a bank’s word is never its bond and to reduce counterparty exposure

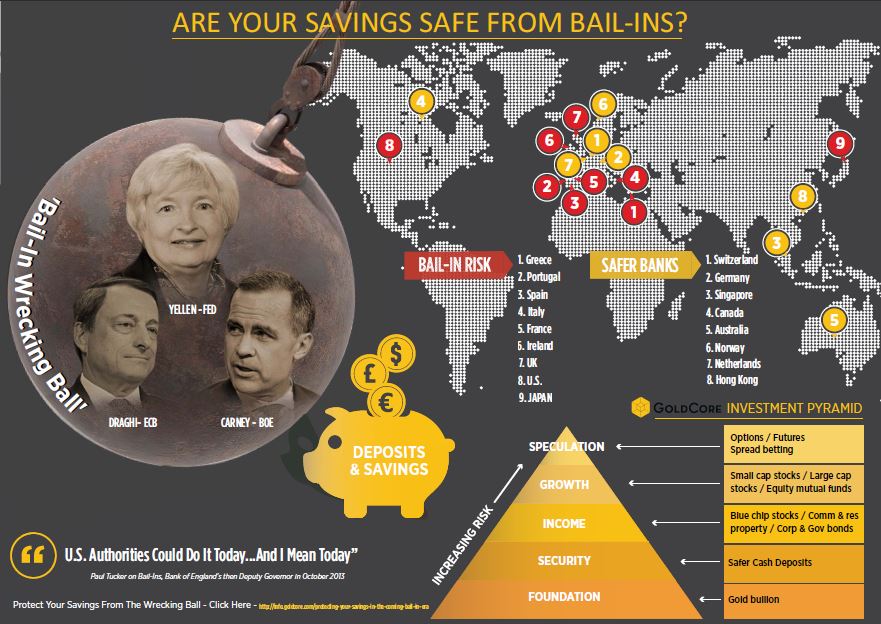

– Physical gold enable savers to stay out of banking system and reduce exposure to bail-ins

It is the ‘opinion of the European Central Bank’ that the deposit protection scheme is no longer necessary:

‘covered deposits and claims under investor compensation schemes should be replaced by limited discretionary exemptions to be granted by the competent authority in order to retain a degree of flexibility.’

To translate the legalese jargon of the ECB bureaucrats this could mean that the current €100,000 (£85,000) deposit level currently protected in the event of a bail-in may soon be no more.

But worry not fellow savers as the ECB is fully aware of the uproar this may cause so they have been kind enough to propose that:

“…during a transitional period, depositors should have access to an appropriate amount of their covered deposits to cover the cost of living within five working days of a request.”

So that’s a relief, you’ll only need to wait five days for some ‘competent authority’ to deem what is an ‘appropriate amount’ of your own money for you to have access to in order eat, pay bills and get to work.

The above has been taken from an ECB paper published on 8 November 2017 entitled ‘on revisions to the Union crisis management framework’.

It’s 58 pages long, the majority of which are proposed amendments to the Union crisis management framework and the current text of the Capital Requirements Directive (CRD).

It’s pretty boring reading but there are some key snippets which should be raising a few alarms. It is evidence that once again a central bank can keep manipulating situations well beyond the likes of monetary policy. It is also a lesson for savers to diversify their assets in order to reduce their exposure to counterparty risks.

Bail-ins, who are they for?

According to the May 2016 Financial Stability Review, the EU bail-in tool is ‘welcome’ as it:

…contributes to reducing the burden on taxpayers when resolving large, systemic financial institutions and mitigates some of the moral hazard incentives associated with too-big-to-fail institutions.

As we have discussed in the past, we’re confused by the apparent separation between ‘taxpayer’ and those who have put their hard-earned cash into the bank. After all, are they not taxpayers?

This doesn’t matter, believes Matthew C.Klein in the FT who recently argued:

Bail-ins are theoretically preferable because they preserve market discipline without causing undue harm to innocent people.

Ultimately bail-ins are so central banks can keep their merry game of easy money and irresponsibility going. They have been sanctioned because rather than fix and learn from the mess of the bailouts nearly a decade ago, they have just decided to find an even bigger band-aid to patch up the system.

‘Bailouts, by contrast, are unfair and inefficient. Governments tend to do them, however, out of misplaced concern about “preserving the system”. This stokes (justified) resentment that elites care about protecting their friends more than they care about helping regular people.’ Matthew C. Klein

But what about the regular people who have placed their money in the bank, believing they’re safe from another financial crisis? Are they not ‘innocent’ and deserving of protection?

When Klein wrote his latest on bail-ins, it was just over a week before the release of this latest ECB paper. With fairness to Klein at the time of his writing depositors with less than €100,000 in the bank were protected under the terms of the ECB covered deposit rules.

This still seemed absurd to us who thought it questionable that anyone’s money in the bank could suddenly be sanctioned for use to prop up an ailing institution. We have regularly pointed out that just because there is currently a protected level at which deposits will not be pilfered, this could change at any minute.

The latest proposed amendments suggest this is about to happen.

Why change the bail-in rules?

The ECB’s 58-page amendment proposal is tough going but it is about halfway through when you come across the suggestion that ‘covered deposits’ no longer need to be protected. This is determined because the ECB is concerned about a run on the failing bank:

If the failure of a bank appears to be imminent, a substantial number of covered depositors might still withdraw their funds immediately in order to ensure uninterrupted access or because they have no faith in the guarantee scheme.

This could be particularly damning for big banks and cause a further crisis of confidence in the system:

Such a scenario is particularly likely for large banks, where the sheer amount of covered deposits might erode confidence in the capacity of the deposit guarantee scheme. In such a scenario, if the scope of the moratorium power does not include covered deposits, the moratorium might alert covered depositors of the strong possibility that the institution has a failing or likely to fail assessment.

Therefore, argue the ECB the current moratorium that protects deposits could be ‘counterproductive’. (For the banks, obviously, not for the people whose money it really is:

The moratorium would therefore be counterproductive, causing a bank run instead of preventing it. Such an outcome could be detrimental to the bank’s orderly resolution, which could ultimately cause severe harm to creditors and significantly strain the deposit guarantee scheme. In addition, such an exemption could lead to a worse treatment for depositor funded banks, as the exemption needs to be factored in when determining the seriousness of the liquidity situation of the bank. Finally, any potential technical impediments may require further assessment.

The ECB instead proposes that ‘certain safeguards’ be put in place to allow restricted access to deposits…for no more than five working days. But let’s see how long that lasts for.

Therefore, an exception for covered depositors from the application of the moratorium would cast serious doubts on the overall usefulness of the tool. Instead of mandating a general exemption, the BRRD should instead include certain safeguards to protect the rights of depositors, such as clear communication on when access will be regained and a restriction of the suspension to a maximum of five working days by avoiding a cumulative use by the competent authority and the resolution authority.

Even after a year of studying and reading bail-ins I am still horrified that something like this is deemed to be preferable and fairer to other solutions, namely fixing the banking system. The bureaucrats running the EU and ECB are still blind to the pain such proposals can cause and have caused.

Look to Italy for damage prevention

At the beginning of the month, we explained how the banking meltdown in Veneto Italy destroyed 200,000 savers and 40,000 businesses.

In that same article, we outlined how exposed Italians were to the banking system. Over €31 billion of sub-retail bonds have been sold to everyday savers, investors, and pensioners. It is these bonds that will be sucked into the sinkhole each time a bank goes under.

A 2015 IMF study found that the majority of Italy’s 15 largest banks a bank rescue would ‘imply bail-in of retail investors of subordinated debt’. Only two-thirds of potential bail-ins would affect senior bond-holders, i.e. those who are most likely to be institutional investors rather than pensioners with limited funds.

Why is this the case? As we have previously explained:

Bondholders are seen as creditors. The same type of creditor that EU rules state must take responsibility for a bank’s financial failure, rather than the taxpayer. This is a bail-in scenario.

In a bail-in scenario the type of junior bonds held by the retail investors in the street is the first to take the hit. When the world’s oldest bank Monte dei Paschi di Siena collapsed ordinary people (who also happen to be taxpayers) owned €5 billion ($5.5 billion) of subordinated debt. It vanished.

Despite the biggest bail-in in history occurring within the EU, few people have paid attention and protested against such measures. A bail-in is not unique to Italy, it is possible for all those living and banking within the EU.

Yet, so few protests. We’re not talking about protesting on the streets, we’re talking about protesting where it hurts – with your money.

Read well, protest loudly and trust what you know and not just what you are told.

As we have seen from the EU’s response to Brexit and Catalonia, officials could not give two hoots about the grievances of its citizens. So when it comes to banking there is little point in expressing disgust in the same way.

Instead, investors must take stock and assess the best way for them to protect their savings from the tyranny of central bank policy.

To refresh your memory, the ECB is proposing that in the event of a bail-in it will give you an allowance from your own savings. An allowance it will control:

“…during a transitional period, depositors should have access to an appropriate amount of their covered deposits to cover the cost of living within five working days of a request.”

Savers should be looking for means in which they can keep their money within instant reach and their reach only. At this point physical, allocated and segregated gold and silver comes to mind.

This gives you outright legal ownership. There are no counterparties who can claim it is legally theirs (unlike with cash in the bank) or legislation that rules they get first dibs on it.

Gold and silver are the financial insurance against bail-ins, political mismanagement, and overreaching government bodies. As each year goes by it becomes more pertinent than ever to protect yourself from such risks.

Related content

Invest In Gold To Defend Against Bail-ins

Precious Metals Are “Best Defence” Against Bail-ins In Economic Crisis

Bail-Ins Coming To Italy? World’s Oldest Bank “Survival Rests On Savers”

News and Commentary

Pound ‘pounded’ by political uncertainty, Gold steady (FX Street)

Gold prices steady as dollar holds up on higher U.S. bond yields (Reuters)

Dalio’s Bridgewater Boosts Gold Holdings in SPDR, iShares (Bloomberg)

Nothing to See Here as Gold Held in Tightest Range in Four Years (Bloomberg)

U.S. runs $63 billion budget deficit in October (Reuters)

Junk-bond investors are getting jittery – do they know something we don’t? (Moneyweek)

Global Gold Investment Demand To Overwhelm Supply During Next Market Crash (Gold Eagle)

“Banks Are Rigging All Markets” (US Watchdog)

Internet Crackdown Begins: Senator Al Franken Wants Google, Facebook, & Twitter Censor Political Speech (Zerohedge)

Here’s how to tell if property prices are crazy – or not (SCH)

Gold Prices (LBMA AM)

14 Nov: USD 1,273.70, GBP 972.47 & EUR 1,086.59 per ounce

13 Nov: USD 1,278.40, GBP 977.59 & EUR 1,097.89 per ounce

10 Nov: USD 1,284.45, GBP 976.44 & EUR 1,102.19 per ounce

09 Nov: USD 1,284.00, GBP 980.98 & EUR 1,106.29 per ounce

08 Nov: USD 1,282.25, GBP 976.82 & EUR 1,105.43 per ounce

07 Nov: USD 1,276.35, GBP 970.92 & EUR 1,103.28 per ounce

06 Nov: USD 1,271.60, GBP 969.72 & EUR 1,095.61 per ounce

Silver Prices (LBMA)

14 Nov: USD 16.94, GBP 12.92 & EUR 14.45 per ounce

13 Nov: USD 16.93, GBP 12.93 & EUR 14.53 per ounce

10 Nov: USD 17.00, GBP 12.92 & EUR 14.60 per ounce

09 Nov: USD 17.10, GBP 13.03 & EUR 14.69 per ounce

08 Nov: USD 17.00, GBP 12.96 & EUR 14.65 per ounce

07 Nov: USD 17.01, GBP 12.95 & EUR 14.70 per ounce

06 Nov: USD 16.92, GBP 12.90 & EUR 14.59 per ounce

Recent Market Updates

– Internet Shutdowns Show Physical Gold Is Ultimate Protection

– Gold Coins and Bars Saw Demand Rise 17% to 222T in Q3

– Prepare For Interest Rate Rises And Global Debt Bubble Collapse

– Platinum Bullion ‘May Be One Of The Only Cheap Assets Out There’

– World’s Largest Gold Producer China Sees Production Fall 10%

– German Investors Now World’s Largest Gold Buyers

– Gold Price Reacts as Central Banks Start Major Change

– Why Switzerland Could Save the World and Protect Your Gold

– Invest In Gold To Defend Against Bail-ins

– Stumbling UK Economy Shows Importance of Gold

– Wozniak and Thiel Fuel Bitcoin-Gold Debate: Gold Comes Out On Top

– Russia Buys 34 Tonnes Of Gold In September

– Gold Will Be Safe Haven Again In Looming EU Crisis

END

Gold trading today:

the crooks try and break the 200 day average for gold and fail: this caused gold to rise to 1280

(courtesy zerohedge)

Gold Bounces Off Key Technical Support On Massive Volume

The last 48 hours has been quite a chaotic one in precious metals markets with massive volumes of ‘paper’ gold flushed in and out of the futures markets. This morning – shortly after the US open failed to spark a panic-bid in stocks – gold futures bounced off their 200-day moving average on huge volume (around $4.5 billion notional) breaking above the 100DMA…

The last day or so has seen a plunge below the 100DMA (on 33,000 contracts – around $4.2 billion notional), then another flush to the 200DMA as Europe opened overnight (on 22,000 contracts – around $2.8 billion notional) and then shortly after the US equity open, a 35,000 contract ($4.5 billion notional) rip higher off the critical moving average…

Once again the moves in gold appear to mirror manipulation in USDJPY…

Silver is echoing Gold’s moves today but yesterday’s standalone move remains…

end

Intermission

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.GYS

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.Now back to the data

Interesting: Gartman hardly acknowledges GATA and yet he discloses in his latest letter the BIS involvement of gold swaps which is critical to the manipulation of gold

(courtesy GATA/Chris Powell./Gartman)

Gartman Letter relies on GATA’s disclosure of BIS’ latest intervention in gold

Submitted by cpowell on Mon, 2017-11-13 18:45. Section: Daily Dispatches

1:51p ET Monday, November 13, 2017

Dear Friend of GATA and Gold:

What is the world coming to when commodity market analyst and newsletter writer Dennis Gartman of The Gartman Letter (https://www.thegartmanletter.com/) starts relying on GATA for research?

From today’s edition:

“Turning to gold, Friday was again a disaster as Fridays have been for the gold market all too often in the course of the past several years. Indeed, the best that gold can do at this point is hold its lows forged very late on Friday. The Bank for International Settlements reports that its ‘swaps’ position has gone to its highest level in history and that may have been the reason for the assault upon gold on Friday.”

The disclosure about the BIS’ latest gold swaps was made Sunday by GATA consultant Robert Lambourne here:

http://www.gata.org/node/17790

Of course a little attribution to GATA would have been courteous, but if The Gartman Letter can acknowledge the surreptitious involvement in the gold market by the BIS and its likely suppressive influence on the price of the monetary metal, the word is probably getting around pretty well these days, even if no financial journalist dares yet question the BIS about what it’s doing and on whose behalf.

While this does not necessarily foretell a return to free markets, truth, justice, and the American way as it used to be, it does suggest at least that the totalitarians are slowly being dragged into the open, which is the first step. So Arthur Hugh Clough may have been right. At least Churchill thought so.

Say not the struggle nought availeth,

The labor and the wounds are vain,

The enemy faints not, nor faileth,

And as things have been they remain.

If hopes were dupes, fears may be liars;

It may be, in yon smoke concealed,

Your comrades chase e’en now the fliers,

And, but for you, possess the field.

For while the tired waves, vainly breaking

Seem here no painful inch to gain,

Far back through creeks and inlets making,

Comes silent, flooding in, the main.

And not by eastern windows only,

When daylight comes, comes in the light.

In front the sun climbs slow, how slowly,

But westward, look, the land is bright.

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

END

Lawrie Williams found religion. We now have another gold writer who is now compelled to admit that the gold market is rigged

(courtesy GATA/Chris Powell/Lawrie Williams)

Another insider feels compelled to admit the gold market is rigged

Submitted by cpowell on Tue, 2017-11-14 00:54. Section: Daily Dispatches

8:02p ET Monday, November 13, 2017

Dear Friend of GATA and Gold:

Writing over the weekend for the Sharps Pixley bullion dealership in London, market analyst Lawrie Williams confided that he increasingly believes that the gold market is being rigged. Williams wrote that he has been pushed to such a conclusion by the growing number of smashes to the market out of the blue.

Williams wrote: “We have just seen yet another instance of a totally insane volume of notional gold hitting the futures markets, surely designed to stop any positive momentum for gold in its tracks. I say ‘insane’ because in a true fair market no one in their right minds would put so much on the market in such a short space of time even if it involves only paper gold rather than actual bullion.

These ‘flash crashes’ in the precious metals prices seem to be happening every time we start to see positive moves in the gold price. That cannot be coincidental. [GATA board member] Ed Steer, who publishes a daily newsletter to subscribers, called it ‘a picture-postcard waterfall decline’ — an apt description . …

“Ed places the latest ‘flash crash’ firmly at the hands of JP Morgan and the other bullion banks that hold large short positions in the precious metals — particularly in gold and silver — and thus have a vested interest in keeping the price suppressed. Ed’s views are well-known on market manipulation and are not seen as reality by some precious metals market mainstream observers, but these ‘coincidental’ flash crashes do seem increasingly to support his viewpoint as a counter-argument to what might be considered the mainstream financial establishment, which is very much in denial — probably because such manipulation appears to be an integral part of doing business in the sector.”

Bingo, Lawrie. Yes, the gold industry is the market-rigging industry, a giant real-life episode of “The Emperor’s New Clothes,” where everybody can see what is going on but no one dares say it except a few naive little kids who happened to pass by the parade, were not let in on the scheme, and only gradually deduced its evil and world-encompassing intent.

But things are changing if even some respected insiders like Williams and Dennis Gartman can question the scheme in public within a few hours of each other. Indeed, it has started to seem as if the central banks and governments masterminding the scheme are now in such stress that they can’t worry about being caught — that they know they have been caught and increasingly must resort to smashing the gold market in the open to try to warn off and intimidate investors, telling them in a crude way what Federal Reserve Chairman Alan Greenspan told them in testimony to Congress in 1998: “Central banks stand ready to lease gold in increasing quantities should the price rise”:

https://www.federalreserve.gov/boarddocs/testimony/1998/19980724.htm

But if they are not scared of being caught anymore, that doesn’t mean that central banks are not still scared — scared of losing control of what used to be markets.

Don’t believe us? Then try putting to central banks and anyone in the gold industry the four crucial and for the moment essentially prohibited questions about gold:

1) Are governments and central banks active in the monetary metals markets or not?

2) Are the documents compiled by GATA from government archives and other official sources asserting such activity genuine or forgeries?

3) If governments and central banks are active in the monetary metals markets, is it just for fun or is it for policy purposes?

4) If such activity by governments and central banks is for policy purposes, do those purposes involve the traditional objectives of defeating an independent world currency that competes with government currencies and interferes with government control of interest rates and, indeed, interferes with control of the entire economy and society itself?

If you get any answers, please forward them to your secretary/treasurer, whose e-mail address is below.

Williams might try putting these questions to Sharps Pixley’s own proprietor, Ross Norman, another gold market participant who has a respectable reputation to lose.

Williams’ commentary is headlined “Europe Pushes Gold higher — USA Slams It Down Yet Again!” and it’s posted at Sharps Pixley here:

http://tinyurl.com/ybl9eadp

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

END

Seems that Turkish citizens are not too enthralled with Erdogan and his economic and governing policies. They have bought the most gold ever as the Lira tumbles. So far in this 2017 year citizens have thought 47 tonnes. Also the Turkish government has also increased its reserves dramatically as in the 3rd quarter they bought over 30 tonnes of gold.

(courtesy zerohedge)

Turks Just Bought The Most Gold Ever As Lira Tumbles

Since President Recep Tayyip Erdogan installed himself as ‘Sultan for life’, the Turks appear to have had a dramatic change of heart towards the barbarous relic…

The Turks have never imported a greater value of gold than in the last 12 months…

Additionally, as Bloomberg reports, Bar and coin purchases, a measure of investment demand, were 47 metric tons so far in 2017, compared with 14.8 tons in the same period a year ago, according to a report from the World Gold Council published Thursday.

The weak lira and “President Erdogan’s pro-gold comments in November last year continued to lend support to the market,” the gold council said.

But it’s not just the average Turk who is buying gold, Turkey’s central bank is also buying gold, increasing purchases by 30.4 tons during the third quarter.

While the central bank has cited a good old-fashioned diversification policy, some analysts speculated that the country could be shoring up reserves amid rising tensions between Turkey and its traditional Western allies.

A year ago, President Recep Tayyip Erdogan urged Turks to prefer gold to the U.S. dollar as a savings vehicle, and asked the central bank to support that policy.

And gold is doing exactly what it should do as faith in fiat falters.

The question is – just like in India – how long before Erdogan ‘dictates’ an end to gold imports, imposes tariffs, or confiscates the precious metal?

end

Koos Jansen provides a great commentary on the 777 tonnes of gold supplied to the citizens of China for the previous 3 quarters. Annualized it looks like China will import over 1,036 tonnes. This gold is not official gold whereby China always buys with USA dollars. All gold produced in China becomes official gold and at last look they mined 430 tonnes of gold.

(courtesy Koos Jansen/Bullionstar)

Your early morning currency/gold and silver pricing/Asian and European bourse movements/ and interest rate settings TUESDAY morning 7:00 am

Euro/USA 1.1725 UP .0060/ REACTING TO SPAIN VS CATALONIA/REACTING TO +GERMAN ELECTION WHERE ALT RIGHT PARTY ENTERS THE BUNDESTAG/ huge Deutsche bank problems + USA election:/TRUMP HEALTH CARE DEFEAT//ITALIAN REFERENDUM DEFEAT/AND NOW ECB TAPERING BOND PURCHASES/ /USA FALLING INTEREST RATES AGAIN/HOUSTON FLOODING/EUROPE BOURSES RED EXCEPT LONDON

USA/JAPAN YEN 113.66 UP 0.060(Abe’s new negative interest rate (NIRP), a total DISASTER/SIGNALS U TURN WITH INCREASED NEGATIVITY IN NIRP/JAPAN OUT OF WEAPONS TO FIGHT ECONOMIC DISASTER/

GBP/USA 1.3107 DOWN .0013 (Brexit March 29/ 2017/ARTICLE 50 SIGNED

THERESA MAY FORMS A NEW GOVERNMENT/STARTS BREXIT TALKS/MAY IN TROUBLE WITH HER OWN PARTY/

USA/CAN 1.2724 DOWN .0011(CANADA WORRIED ABOUT TRADE WITH THE USA WITH TRUMP ELECTION/ITALIAN EXIT AND GREXIT FROM EU/(TRUMP INITIATES LUMBER TARIFFS ON CANADA)

Early THIS TUESDAY morning in Europe, the Euro ROSE by 60 basis points, trading now ABOVE the important 1.08 level RISING to 1.1725; / Last night the Shanghai composite CLOSED DOWN 18.29 POINTS OR .53% / Hang Sang CLOSED DOWN 30.06 POINTS OR 0.10% /AUSTRALIA CLOSED DOWN 0.80% / EUROPEAN BOURSES OPENED RED EXCEPT LONDON

The NIKKEI: this TUESDAY morning CLOSED UP 0.98 POINTS OR 0.00%

Trading from Europe and Asia:

1. Europe stocks OPENED RED EXCEPT LONDON

2/ CHINESE BOURSES / : Hang Sang CLOSED DOWN 30.06 POINTS OR 0.10% / SHANGHAI CLOSED DOWN 18.29 POINTS OR .53% /Australia BOURSE CLOSED DOWN 0.80% /Nikkei (Japan)CLOSED UP 0.98 POINTS OR 0.00%

INDIA’S SENSEX IN THE RED

Gold very early morning trading: 1273.25

silver:$16.93

Early TUESDAY morning USA 10 year bond yield: 2.395% !!! DOWN 1 IN POINTS from MONDAY night in basis points and it is trading JUST BELOW resistance at 2.27-2.32%. (POLICY FED ERROR)

The 30 yr bond yield 2.849 DOWN 2 IN BASIS POINTS from MONDAY night. (POLICY FED ERROR)

USA dollar index early TUESDAY morning: 94.24 DOWN 25 CENT(S) from YESTERDAY’s close.

This ends early morning numbers TUESDAY MORNING

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now your closing TUESDAY NUMBERS \1 PM

Portuguese 10 year bond yield:1.969% DOWN 3 in basis point(s) yield from MONDAY

JAPANESE BOND YIELD: +.050% UP 0 in basis point yield from MONDAY/JAPAN losing control of its yield curve/

SPANISH 10 YR BOND YIELD: 1.534% UP 1/4 IN basis point yield from MONDAY

ITALIAN 10 YR BOND YIELD: 1.829 DOWN 1/2 POINTS in basis point yield from MONDAY

the Italian 10 yr bond yield is trading 30 points HIGHER than Spain.

GERMAN 10 YR BOND YIELD: +.397% DOWN 2 IN BASIS POINTS ON THE DAY

END

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

IMPORTANT CURRENCY CLOSES FOR TUESDAY

Closing currency crosses for TUESDAY night/USA DOLLAR INDEX/USA 10 YR BOND YIELD/1:00 PM

Euro/USA 1.1769 UP .0105 (Euro UP 105 Basis points/ represents to DRAGHI A COMPLETE POLICY FAILURE/

USA/Japan: 113.52 DOWN 0.077(Yen UP 8 basis points/

Great Britain/USA 1.31510 UP 0.0030( POUND UP 30 BASIS POINTS)

USA/Canada 1.2737 UP.0001 Canadian dollar DOWN 1 Basis points AS OIL FELL TO $55.63

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

This afternoon, the Euro was UP 105 to trade at 1.16769

The Yen ROSE to 113.52 for a GAIN of 8 Basis points as NIRP is STILL a big failure for the Japanese central bank/HELICOPTER MONEY IS NOW DELAYED/BANK OF JAPAN NOW WORRIED AS AS THEY ARE RUNNING OUT OF BONDS TO BUY AS BOND YIELDS RISE

The POUND ROSE BY 30 basis points, trading at 1.3151/

The Canadian dollar FELL by 1 basis points to 1.2737 WITH WTI OIL FALLING TO : $55.63

The USA/Yuan closed AT 6.636

the 10 yr Japanese bond yield closed at +.05% UP 0 IN BASIS POINTS / yield/

Your closing 10 yr USA bond yield DOWN 1 IN basis points from MONDAY at 2.382% //trading well ABOVE the resistance level of 2.27-2.32%) very problematic USA 30 yr bond yield: 2.841 DOWN 2 in basis points on the day /

Your closing USA dollar index, 94.02 DOWN 77 CENT(S) ON THE DAY/1.00 PM/BREAKS RESISTANCE OF 92.00

Your closing bourses for Europe and the Dow along with the USA dollar index closing and interest rates for TUESDAY: 1:00 PM EST

London: CLOSED DOWN 0.76 POINTS OR 0.01%

German Dax :CLOSED DOWN 40.94 POINTS OR 0.31%

Paris Cac CLOSED DOWN 26.05 POINTS OR 0.49%

Spain IBEX CLOSED DOWN 59.50 POINTS OR 0.59%

Italian MIB: CLOSED DOWN 140.56 POINTS OR 0.53%

The Dow closed DOWN 30.23 POINTS OR .13%

NASDAQ WAS closed DOWN 19.22 Points OR 0.29% 4.00 PM EST

WTI Oil price; 55.33 1:00 pm;

Brent Oil: 61.74 1:00 EST

USA /RUSSIAN ROUBLE CROSS: 60.16 UP 77/100 ROUBLES/DOLLAR (ROUBLE LOWER BY 77 BASIS PTS)

TODAY THE GERMAN YIELD RISES TO +.397% FOR THE 10 YR BOND 1.00 PM EST EST

END

This ends the stock indices, oil price, currency crosses and interest rate closes for today 4:30 PM

Closing Price for Oil, 4:30 pm/and 10 year USA interest rate:

WTI CRUDE OIL PRICE 4:30 PM:$55.33

BRENT: $61.74

USA 10 YR BOND YIELD: 2.374% (ANYTHING HIGHER THAN 2.70% BLOWS UP THE GLOBE)

USA 30 YR BOND YIELD: 2.830%

EURO/USA DOLLAR CROSS: 1.1792 UP .01280

USA/JAPANESE YEN:113.44 DOWN 0.156

USA DOLLAR INDEX: 93.85 DOWN 64 cent(s)/

The British pound at 5 pm: Great Britain Pound/USA: 1.3166 : UP 46 POINTS FROM LAST NIGHT

Canadian dollar: 1.2733 UP 4 BASIS pts

German 10 yr bond yield at 5 pm: +0.397%

END

https://www.silverdoctors.com/tag/harvey-organ/

Always Nice To Wish You A Good Morning!

and

Thought Maybe You Might Like A Bite To Eat

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Now Serving "Breakfast" under the Gallows

Welcome to the Graveyard Gallows Cafe.

Please have a seat kick back and enJoy the pickings from the graveyard.

GYS_Dine

Thank You For Dining with Us Under The GYS Gallows Cafe

Ya'all come Back Now !

MMgys

Always Nice To Be The first To Wish You A Good Morning !

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

program note: The gys show is experiencing a server 2 hour lag on some of the pics and charts due to embedded too hot handle material resulting in server burn out.Please proceed with caution.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Nov 14/GOLD IS UP $4.00 DESPITE BANKER ATTEMPTS TO QUASH THE METAL/SILVER ALSO REBOUNDS/SILVER AND FINISHES UP 3 CENTS/LONG TERM BOND YIELDS FALTER/CHINESE MARKETS FALL/THE ONLY POSITIVE TODAY WAS GOLD/SILVER/THE USA IS STILL HAVING DIFFICULTY PASSING THE TAX REFORM BILL

November 14, 2017 · by harveyorgan · in Uncat

GOLD: $1282.85 UP $4.00

Silver: $17.08 UP 3 cents

Closing access prices:

Gold $1280.50

silver: $17.02

SHANGHAI GOLD FIX: FIRST FIX 10 15 PM EST (2:15 SHANGHAI LOCAL TIME)

SECOND FIX: 2:15 AM EST (6:15 SHANGHAI LOCAL TIME)

SHANGHAI FIRST GOLD FIX: $1285.54 DOLLARS PER OZ

NY PRICE OF GOLD AT EXACT SAME TIME: $1276.15

PREMIUM FIRST FIX: $9.39

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

SECOND SHANGHAI GOLD FIX: $1286.85

NY GOLD PRICE AT THE EXACT SAME TIME: $1277.10

Premium of Shanghai 2nd fix/NY:$9.75

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

LONDON FIRST GOLD FIX: 5:30 am est $1273.50

NY PRICING AT THE EXACT SAME TIME: $1273.20

LONDON SECOND GOLD FIX 10 AM: $1274.60

NY PRICING AT THE EXACT SAME TIME. 1273.86

For comex gold:

NOVEMBER/

NOTICES FILINGS TODAY FOR OCT CONTRACT MONTH: 0 NOTICE(S) FOR nil OZ.

TOTAL NOTICES SO FAR: 991 FOR 99,100 OZ (3.082TONNES)

For silver:

NOVEMBER

2 NOTICE(S) FILED TODAY FOR

10,000 OZ/

Total number of notices filed so far this month: 874 for 4,370,000 oz

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Bitcoin: BID $6545 OFFER /$6570 up $26.00 (MORNING)

BITCOIN CLOSING; BID $6609 OFFER: $6637 // UP $91.00

end

Quote of the day:

*Dennis Gartman…

“We have not been of the school of thought over the years that gold is and has been manipulated by powerful forces intent upon keeping gold weak, but we shall admit that things do indeed look very, very strange in recent weeks and the “conspiratorialists” are sounding more and more plausible with each passing day.”

Just one question: what planet is he on?

h

Let us have a look at the data for today

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

In silver, the total open interest FELL BY A SMALL 236 contracts from 199,358 DOWN TO 199,122 DESPITE YESTERDAY’S TRADING IN WHICH SILVER ROSE NICELY BY 16 CENTS. AS I WAS PREPARING FOR TODAY’S REPORT I WROTE THE FOLLOWING: “JUDGING FROM THE MASSIVE VOLUME, IT LOOKS LIKE WE DID NOT GET ANY LONG LIQUIDATION BUT AGAIN IT LOOKS LIKE WE GOT A FEW MORE COMEX LONGS TRANSFERRING THEIR CONTRACTS TO LONDON THROUGH THE EFP ROUTE.” I WAS EXACTLY CORRECT AS WE HAD A HUGE 702 DECEMBER EFP’S ISSUED ALONG WITH 84 EFP’S FOR MARCH FOR A TOTAL ISSUANCE OF 786 CONTRACTS. THE ISSUANCE FOR MARCH BOTHERS ME A LOT AS THIS IS SUPPOSE TO BE FOR EMERGENCY IN THE UPCOMING DELIVERY MONTH. I GUESS WHAT THE CME IS STATING IS THAT THERE IS NO SILVER TO BE DELIVERED UPON AT THE COMEX AND THEY MUST EXPORT THEIR OBLIGATION TO LONDON.

RESULT: A SMALL SIZED DROP IN OI COMEX WITH THE 16 CENT PRICE RISE. COMEX LONGS EXITED OUT OF THE COMEX AND FROM THE CME DATA 786 EFP’S WERE ISSUED FOR A DELIVERABLE CONTRACT OVER IN LONDON WITH A FIAT BONUS WHICH DEFINITELY EXPLAINS THE FALL IN OI. IN ESSENCE WE DID NOT GET A FALL IN DEMAND IN OPEN INTEREST ONLY A TRANSFER TO OTHER JURISDICTIONS.

In ounces, the OI is still represented by just OVER 1 BILLION oz i.e. 0.995 BILLION TO BE EXACT or 142% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT OCT MONTH/ THEY FILED: 2 NOTICE(S) FOR 10,000 OZ OF SILVER

In gold, the open interest ROSE BY A SMALLER THAN EXPECTED 1,996 CONTRACTS DESPITE THE GOOD RISE IN PRICE OF GOLD ($4.85) WITH YESTERDAY’S TRADING . YESTERDAY’S TRADING SAW NO GOLD LEAVES FALL FROM THE GOLD TREE. THE TOTAL NUMBER OF GOLD EFP’S ISSUED YESTERDAY TOTAL: 6577 CONTRACTS WHICH IS HUGE. THE MONTH OF DECEMBER SAW 5077 CONTRACTS AND FEB SAW THE ISSUANCE OF 1500 CONTRACTS. The new OI for the gold complex rests at 532,781.

Result: A SMALLER SIZED INCREASE IN OI DESPITE THE RISE IN PRICE IN GOLD ON YESTERDAY ($4.85). WE HAD A HUGE NUMBER OF COMEX LONG TRANSFERS TO LONDON THROUGH THE EFP ROUTE AS (6577 EFP’S). THERE DOES NOT SEEM TO BE MUCH PHYSICAL AT THE COMEX AND WE ARE APPROACHING THE HUGE DELIVERY MONTH OF DECEMBER. WE ALSO HAD NO GOLD COMEX OI LEAVE THE COMEX GOLD ARENA.

we had: 0 notice(s) filed upon for NIL oz of gold.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

With respect to our two criminal funds, the GLD and the SLV:

GLD:

A small change in gold inventory at the GLD/ a deposit of .300 tonnes

Inventory rests tonight: 843.39 tonnes.

SLV

TODAY WE HAD NO CHANGE IN SILVER INVENTORY AT THE SLV

INVENTORY RESTS AT 318.074 MILLION OZ

end

.

First, here is an outline of what will be discussed tonight:

1. Today, we had the open interest in silver FELL BY 236 contracts from 199,358 DOWN TO 199,122 (AND now A LITTLE FURTHER FROM THE NEW COMEX RECORD SET ON FRIDAY/APRIL 21/2017 AT 234,787) DESPITE THE RISE IN SILVER PRICE (A GAIN OF 16 CENTS). OUR BANKERS USED THEIR EMERGENCY PROCEDURE TO ISSUE 702 PRIVATE EFP’S FOR DECEMBER(WE DO NOT GET A LOOK AT THESE CONTRACTS) AND 84 EFP’S FOR MARCH, WHICH GIVES OUR COMEX LONGS A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. THIS IS QUITE EARLY FOR THESE EFP ISSUANCE..USUALLY WE WITNESS THIS ONE WEEK PRIOR TO FIRST DAY NOTICE AND THIS CONTINUES RIGHT UP UNTIL FDN. WE ALSO HAD MINIMAL SILVER COMEX LIQUIDATION. TOTAL EFP’S ISSUED YESTERDAY BY THE CME IN SILVER TOTAL 786 CONTRACTS.

RESULT: A SMALL SIZED DECREASE IN SILVER OI AT THE COMEX DESPITE THE 16 CENT RISE IN PRICE (WITH RESPECT TO YESTERDAY’S TRADING). WE HAD ANOTHER 786 EFP’S ISSUED TRANSFERRING OUR COMEX LONGS OVER TO LONDON TOGETHER WITH NO SILVER COMEX LIQUIDATION.

(report Harvey)

.

2.a) The Shanghai and London gold fix report

(Harvey)

2 b) Gold/silver trading overnight Europe, Goldcore

(Mark O’Byrne/zerohedge

and in NY: Bloomberg

3. ASIAN AFFAIRS

)Late MONDAY night/TUESDAY morning: Shanghai closed DOWN 18.29 points or .53% /Hang Sang CLOSED DOWN 30.06 pts or 0.10% / The Nikkei closed UP 0.98 POINTS OR 0.00%/Australia’s all ordinaires CLOSED DOWN 0.80%/Chinese yuan (ONSHORE) closed UP at 6.6378/Oil DOWN to 56.52 dollars per barrel for WTI and 62.85 for Brent. Stocks in Europe OPENED RED EXCEPT LONDON . ONSHORE YUAN CLOSED UP AGAINST THE DOLLAR AT 6.6378. OFFSHORE YUAN CLOSED WEAKER TO THE ONSHORE YUAN AT 6.6431 //ONSHORE YUAN STRONGER AGAINST THE DOLLAR/OFF SHORE STRONGER TO THE DOLLAR/. THE DOLLAR (INDEX) IS WEAKER AGAINST ALL MAJOR CURRENCIES. CHINA IS VERY HAPPY TODAY

i

3a)THAILAND/SOUTH KOREA/NORTH KOREA

i)North Korea//South Korea

b) REPORT ON JAPAN

c) REPORT ON CHINA

4. EUROPEAN AFFAIRS

i)GERMANY

The lower value of the Euro is a catalyst to Germany for growth as this exporting behemoth is certainly taking advantage due to weaker partners in the Euro zone. Its GDP rose at a 0.8% quarter over quarter. Yearly growth is reported at 2.3% and underlying growth at 2.8%,.

( zerohedge)

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

i)YEMEN

Very sad: the blockade in Yemen is having a devastating effect on citizens and their economy.

( Mike Krieger/Liberty BlitzkriegBlog)

Saudi Arabia

Pat Buchanan discusses the huge ramifications to Saudi Arabia for the antics of the MBS

( Pat Buchanan/Buchanan.org)

6 .GLOBAL ISSUES

Zimbabwe

There is a military coup in Zimbabwe as it looks like 93 yr old Mugabe is out:

( zerohedge)

7. OIL ISSUES

i)The IEA throws cold water on OPEC optimism for global demand for crude oil. They state that global oil demand is shrinking and this is after huge stockpiling by China.

( zerohedge)

ii)We have been bringing you terrific articles on the rapid demise of the welfare state of Saudi Arabia

(David Stockman and R Meijer). Now Charles Hugh Smith comments also on how these guys are in serious trouble.

( Charles Hugh Smith/TwoMinds Blog)

iii)Huge crude build at the end of the day sends oil southbound

( zerohedge)

8. EMERGING MARKET

9. PHYSICAL MARKETS

i)Gold trading today:

the crooks try and break the 200 day average for gold and fail: this caused gold to rise to 1280

( zerohedge)

ii)Interesting: Gartman hardly acknowledges GATA and yet he discloses in his latest letter the BIS involvement of gold swaps which is critical to the manipulation of gold

( GATA/Chris Powell./Gartman)

iii)Lawrie Williams found religion. We now have another gold writer who is now compelled to admit that the gold market is rigged

( GATA/Chris Powell/Lawrie Williams)

iv)Seems that Turkish citizens are not too enthralled with Erdogan and his economic and governing policies. They have bought the most gold ever as the Lira tumbles. So far in this 2017 year citizens have thought 47 tonnes. Also the Turkish government has also increased its reserves dramatically as in the 3rd quarter they bought over 30 tonnes of gold.

( zerohedge)

v)Koos Jansen provides a great commentary on the 777 tonnes of gold supplied to the citizens of China for the previous 3 quarters. Annualized it looks like China will import over 1,036 tonnes. This gold is not official gold whereby China always buys with USA dollars. All gold produced in China becomes official gold and at last look they mined 430 tonnes of gold.

( Koos Jansen/Bullionstar)

10. USA stories which will influence the price of gold/silver

i)Trading today: The long end of the yield curve crashes especially the 10 and 30 yr. The 10 yr is now at yearly lows. The flatter the yield curve, the more indication of a recession will be forthcoming

( zerohedge)

ii)This will not be good for the markets as CALPERS, California’s largest pension fund has just dumped 50 billion dollars worth of stocks as they have just called the top

( zerohedge)

iii)My goodness! what kept him so long: Sessions is now considering appointing a special council to investigate the Clintons

( zerohedge)

iv)Trump will make a major statement when he gets back onto USA soil

( zerohedge)

v a)The House tax reform bill will likely pass this Thursday, but the Senate version is now being marked up. To mee it seems hopeless that we will get a tax reform bill passed.

( zerohedge)

v b)As promised to you on several occasions, the SALT DEDUCTIONS will stay in the House bill and will never be removed

( zerohedge)

v c)Now the senate is proposing to strip the individual mandate from Health care in order to pass the tax bill. It would free up 300 to 400 billion Moderate Republicans will have difficulty in supporting this. No Democrat would vote for this.

( zerohedge)

vi)The IRS is perplexed? Out of 500,000 exchange Coinbase users only 900 reported gains or losses??

( zerohedge)

vii) October’s PPI is just as hot as September. This is a forerunner to real inflation coming down to meet us

( zerohedge)

Let us head over to the comex:

The total gold comex open interest SURPRISINGLY ROSE BY ONLY 1996 CONTRACTS UP to an OI level of 532,400 DESPITE THE FAIR SIZED RISE IN THE PRICE OF GOLD ($4.85 RISE WITH RESPECT TO YESTERDAY’S TRADING). OBVIOUSLY WE DID NOT HAVE ANY GOLD COMEX LIQUIDATION. WE HAD 6577 COMEX LONGS EXIT THE COMEX ARENA THROUGH THE EFP ROUTE AS THEY RECEIVE A DELIVERABLE LONDON FORWARD TOGETHER WITH A FIAT BONUS. THE CME REPORTS THAT 5077 EFPS WERE ISSUED FOR DECEMBER AND 1500 WERE ISSUED FOR MARCH. THE OBLIGATION STILL RESTS WITH THE BANKERS ON THESE TRANSFERS.

Result: a SURPRISE SMALL INCREASE IN OPEN INTEREST DESPITE THE FAIR SIZED RISE IN THE PRICE OF GOLD ($4.85.)

.

We have now entered the NON active contract month of NOVEMBER.HERE WE HAD A LOSS OF 0 CONTRACT(S) REMAINING AT 71. We had 2 notices filed YESTERDAY so GAINED 2 contracts or 200 additional oz will stand for delivery in this non active month of November. TO SEE BOTH GOLD AND SILVER RISE IN AMOUNT STANDING (QUEUE JUMPING) IS A GOOD INDICATOR OF PHYSICAL SHORTNESS FOR BOTH OF OUR PRECIOUS METALS.

The very big active December contract month saw it’s OI LOSE 9,219 contracts DOWN to 291,870 (OF WHICH 5077 WERE EFP TRANSFERS). January saw its open interest rise by 60 contracts up to 864. FEBRUARY saw a gain of 10,239 contacts up to 167,245.

.

We had 0 notice(s) filed upon today for NIL oz

VOLUME FOR TODAY : 176,626 (PRELIMINARY)

CONFIRMED VOLUME YESTERDAY: 248,933

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for the wild silver comex results.

Total silver OI SURPRISINGLY FELL BY 236 CONTRACTS FROM 199,358 DOWN TO 199,122 DESPITE YESTERDAY’S 16 CENT GAIN IN PRICE . WE HAD 702 PRIVATE EFP’S ISSUED FOR DECEMBER AND 84 EFP’S FOR MARCH BY OUR BANKERS TO COMEX LONGS WHO RECEIVED A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. THIS IS QUITE EARLY FOR THE ISSUANCE. USUALLY WE WITNESS THIS EVENT ONE WEEK PRIOR TO FIRST DAY NOTICE AND IT CONTINUES RIGHT UP TO FDN. WE HAD NO LONG SILVER COMEX LIQUIDATION. THUS THE TOTAL EFP’S ISSUED YESTERDAY TO OUR COMEX LONGS TOTAL 786 AND THUS DEMAND FOR SILVER OPEN INTEREST CONTINUES TO RISE TAKING INTO ACCOUNT THE INCREASE EFP’S ISSUED.

The new front month of November saw its OI FALL by 0 contract(s) and thus it stands at 3. We had 1 notice(s) served YESTERDAY so we gained 1 contracts or an additional 5,000 oz will stand in this non active month of November. After November we have the big active delivery month of December and here the OI FALL by 4,284 contracts DOWN to 110,412. January saw A GAIN OF 21 contracts RISING TO 1052.

We had 2 notice(s) filed for 10,000 oz for the OCT. 2017 contract

INITIAL standings for NOVEMBER

Nov 14/2017.

Gold Ounces

Withdrawals from Dealers Inventory in oz nil oz

Withdrawals from Customer Inventory in oz

21,364.844

oz

Scotia

144 kilobars

&

JPMorgan

Deposits to the Dealer Inventory in oz nil oz

Deposits to the Customer Inventory, in oz

nil oz

No of oz served (contracts) today

0 notice(s)

NIL OZ

No of oz to be served (notices)

71 contracts

(7100 oz)

Total monthly oz gold served (contracts) so far this month

991 notices

99,100 oz

3.082 tonnes

Total accumulative withdrawals of gold from the Dealers inventory this month NIL oz

Total accumulative withdrawal of gold from the Customer inventory this month xxx oz

Today we HAD 1 kilobar trans

WE HAD nil DEALER DEPOSIT:

total dealer deposits: nil oz

We had nil dealer withdrawals:

total dealer withdrawals: nil oz

we had 0 customer deposit(s):

total customer deposits nil oz

We had 2 customer withdrawal(s)

i) out of Scotia: 4,629.600 OZ (144 kilobars)

ii) Out of JPMorgan: 16,735.244

total customer withdrawals; 21,364.844 oz

we had 0 adjustment(s)

For NOVEMBER:

Today, 0 notice(s) were issued from JPMorgan dealer account and 0 notices were issued from their client or customer account. The total of all issuance by all participants equates to 0 contract(s) of which 0 notices were stopped (received) by j.P. Morgan dealer and 0 notice(s) was (were) stopped/ Received) by j.P.Morgan customer account.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

To calculate the INITIAL total number of gold ounces standing for the NOVEMBER. contract month, we take the total number of notices filed so far for the month (991) x 100 oz or 99100 oz, to which we add the difference between the open interest for the front month of NOV. (71 contracts) minus the number of notices served upon today (0 x 100 oz per contract equals 106,100 oz, the number of ounces standing in this NON active month of NOV

Thus the INITIAL standings for gold for the NOVEMBER contract month:

No of notices served (991) x 100 oz or ounces + {(71)OI for the front month minus the number of notices served upon today (0) x 100 oz which equals 106,200 oz standing in this active delivery month of NOVEMBER (3.303 tonnes)

WE GAINED 1 ADDITIONAL CONTRACTS OR 100 OZ OF ADDITIONAL GOLD STANDING FOR METAL AT THE COMEX

THIS IS THE FIRST TIME EVER THAT WE HAVE WITNESSED CONSIDERABLE QUEUE JUMPING IN GOLD AT THE COMEX. SILVER’S QUEUE JUMPING STARTED IN MAY 2017 AND HAS NOT LET UP ONCE COMMENCED.

.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Total dealer inventory 527,069.052 or 16.394 tonnes (dealer gold continues to disappear)

Total gold inventory (dealer and customer) = 8,676,238.163 or 269,74 tonnes

I have a sneaky feeling that these withdrawals of gold in kilobars are being used in the hypothecating process and are being used in the raiding of gold!

The gold comex is an absolute fraud. The use of kilobars and exact weights makes the data totally absurd and fraudulent! To me, the only thing that makes sense is the fact that “kilobars: are entries of hypothecated gold sent to other jurisdictions so that they will not be short with their underwritten derivatives in that jurisdiction. This would be similar to the rehypothecated gold used by Jon Corzine at MF Global.

IN THE LAST 14 MONTHS 85 NET TONNES HAS LEFT THE COMEX.

end

And now for silver

AND NOW THE NOVEMBER DELIVERY MONTH

NOVEMBER INITIAL standings

AND NOW THE NOVEMBER DELIVERY MONTH

NOVEMBER INITIAL standings

Nov 14/ 2017

Silver Ounces

Withdrawals from Dealers Inventory nil

Withdrawals from Customer Inventory

585,448.02 oz

SCOTIA

Brinks

Delaware

Deposits to the Dealer Inventory

nil oz

Deposits to the Customer Inventory

900,930.966

oz

CNT

Delaware

No of oz served today (contracts)

2 CONTRACT(S)

(10,000,OZ)

No of oz to be served (notices)

1 contract

(5,000 oz)

Total monthly oz silver served (contracts) 874 contracts(4,370,000 oz)

Total accumulative withdrawal of silver from the Dealers inventory this month NIL oz

Total accumulative withdrawal of silver from the Customer inventory this month

Nov 13/ 2017

today, we had 0 deposit(s) into the dealer account:

total dealer deposit: nil oz

we had nil dealer withdrawals:

total dealer withdrawals: nil oz

we had 3 customer withdrawal(s):

i) Out of SCOTIA: 563,275.100 oz

ii) Out of Delaware: 927.300 oz