Wednesday, August 16, 2017 12:26:18 AM

By filing NT Q-10, co required additional time to FULLY audit all shares transactions in connection with the most recent conversions, from unregistered sales of securities to fully registered and Part of the OS, based on all tape records, dollar transactions and shares numbers, execution prices and all DATA per the clearing house in regards with current outstanding shares and shareholders on record: ALL need to be disclosed and accounted for!!!... just simple requirements to be in compliance with all conditions set forth by SEC

https://www.sec.gov/fast-answers/answersregis33htm.html

Registration Under the Securities Act of 1933

Often referred to as the "truth in securities" law, the Securities Act of 1933 has two basic objectives:

•To require that investors receive financial and other significant information concerning securities being offered for public sale; and

•To prohibit deceit, misrepresentations, and other fraud in the sale of securities.

http://www.thefullwiki.org/Form_144

Not like this ones that don't fallow any rules...

no shorts ehh???

http://securities-law-blog.com/2014/10/14/depositing-penny-stocks-with-brokers-creates-obstacles-sec-charges-etrade-with-section-5-violation-1/

The SEC press release on the matter quoted Andrew J. Ceresney, Director of the SEC’s Division of Enforcement, as saying, “Broker-dealers serve an important gatekeeping function that helps prevent microcap fraud by taking measures to ensure that unregistered shares don’t reach the market if the registration rules aren’t being followed. Many billions of unregistered shares passed through gates that E*TRADE should have closed, and we will hold firms accountable when improper trading occurs on their watch.”

http://www.reuters.com/article/etrade-sec-idINN0530515020090305

SEC charges E*Trade, 5 others, for front running; E*TRADE Financial Corporation that failed in their gatekeeper roles and improperly engaged in unregistered sales of microcap stocks on behalf of their customers.

more: https://www.sec.gov/news/press-release/2014-225

SEC Charges Current and Former E*TRADE Subsidiaries With Improperly Selling Penny Stocks Through Unregistered Offerings

https://www.ft.com/content/9ac78462-5e60-11dd-b354-000077b07658

Subscribe to read: Financial Times

Etrade to pay $1m in SEC civil charges

if the CIA is not here yet.. maybe the SEC should ..

We all know, need to file complaints with SEC against it!!!

ERTF is asking for another 42 millions in fines.. fine with me!!

https://en.wikipedia.org/wiki/Front_running

Front running, also known as tailgating, is the prohibited practice of entering into an equity (stock) trade, option, futures contract, derivative, or security-based swap to capitalize on advance, nonpublic knowledge of a large pending transaction that will influence the price of the underlying security.[1] Front running is considered a form of market manipulation in many markets.[2]

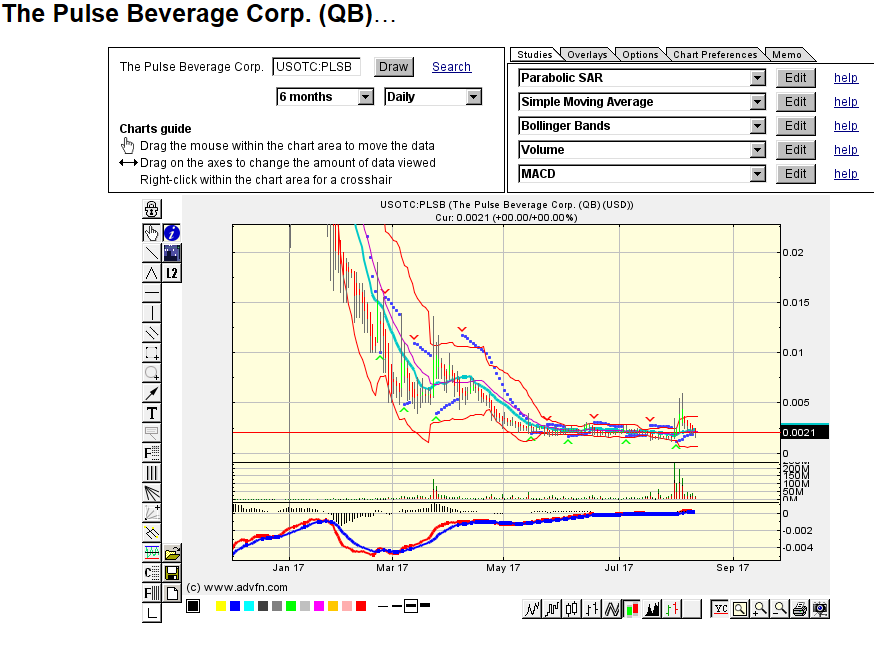

Where the co PPS sits today is close to criminal, for a fully compliant and SEC reporting company with more the 3mil average sales reported annually and CPA certified books

on a OS of 500 mils!!!

Solid Co = proven sales = proven distribution.. (any questions there??)

Share structure: per recent IR about 500 mils OS (as fully diluted assumptions = 2x since MAY = investors have had to ACCUMULATEd all extra shares, )

Who are the extra shares???... [color=red][/color]ok so

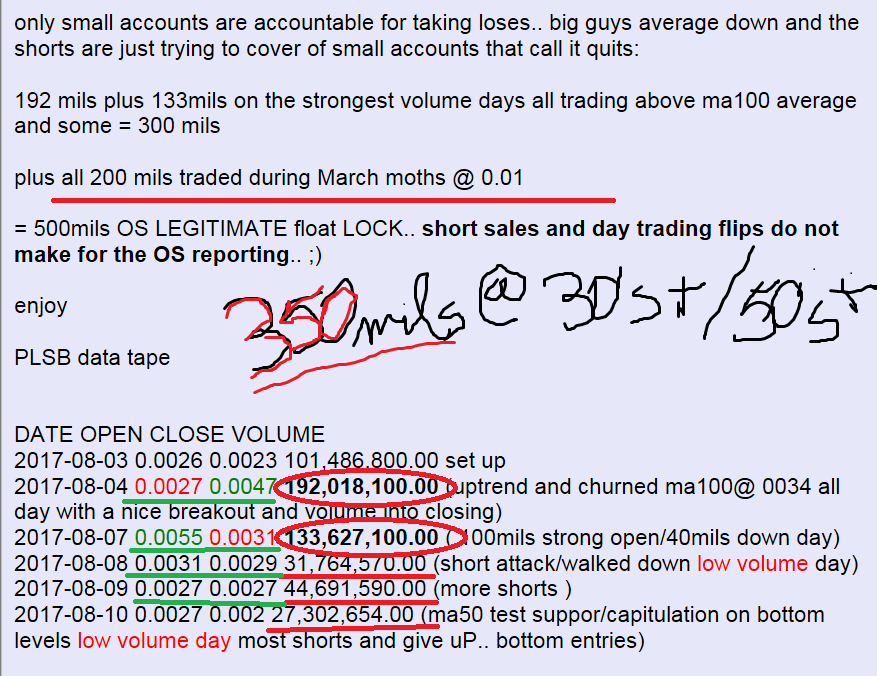

250mils traded before May and already assimilated by markets, and hold by long pos most likely in the 0.01 level

250 millions fully diluted recent extras from the co debt payment notes,

>>> 500 mils OS fully diluted and in the investors hands already :) all LEGIT ones to say the least.. lol

all long shares are sitting way above ma100 average.. all counted and accounted for... see trading tapes:

Just HIGHLIGHTED the info to HELP imagine how many outstanding and in NEED to cover SHORTS we deal with here in PLSB'land

per Finra Raised FLAGS in JUNE, and JULY.. and most likely both DEFAULT.. considering the low volume and some flipping positions that are adding to the vol pattern as well = lots on miles to cover..;)

To reduce the duration for which fails to deliver are permitted to sit open, the regulation requires broker-dealers to close out open fail-to-deliver positions in threshold securities that have persisted for 13 consecutive settlement days.[28] The SEC, in describing Regulation SHO, stated that failures to deliver shares that persist for an extended period of time "may result in large delivery obligations where stock settlement occurs."[28]

Regulation SHO also created the "Threshold Security List", which reported any stock where more than 0.5% of a company's total outstanding shares failed delivery for five consecutive days.

https://en.wikipedia.org/wiki/Naked_short_selling

For EXTRA proof on short that already FAILed to DELIVER please see attached or to to finra reg sho http://otce.finra.org/RegSHO , or http://www.otcmarkets.com/stock/PLSB/short-sales

or http://shortvolume.com/

How much down Pressure by shorts and manipulation.. ??

U go figure as the GapUP chart doesn't fit my screen!! lol

as I am sure the company left out a few accounts of its distributions due to same reason.. not enough space on the screen:

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.