Friday, July 07, 2017 8:50:38 AM

All I can do is post some numbers from my analysis.

Your timeline asks about two dates: (1) End of 3Q and (2) end of 2017.

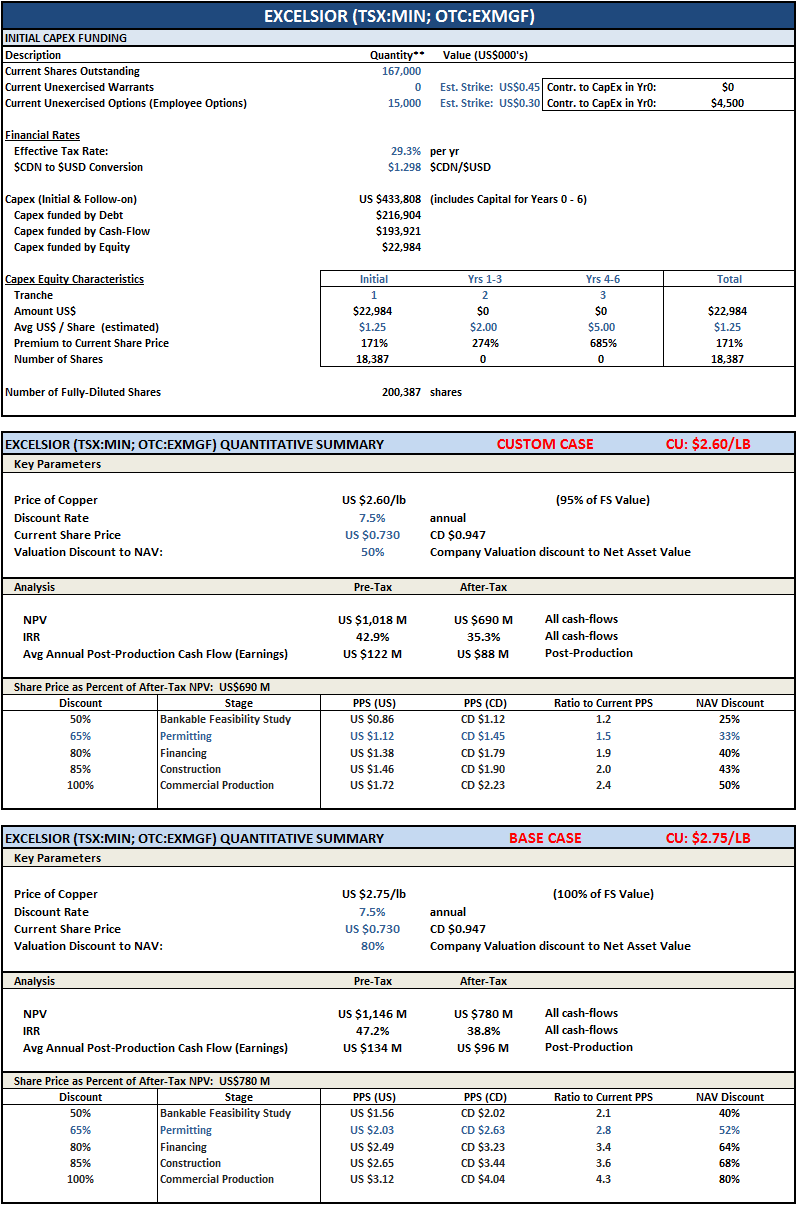

In the analysis, I used a lower bound of Cu price = $2.60/lb with a NPV discount of 50% [CUSTOM CASE] and an upper bound of Cu price = $2.75/lb and a NPV discount of 80% [BASE CASE].

End of 3Q: MIN should have both the ADEQ and EPA permits granted by the end of 3Q. I am quite confident this will be the case. This correlates to the Stage Derisking line titled "Permitting" in the analysis below.

- PPS Range (3Q): US$1.12 (CD$1.45) to US$2.03 (CD$2.63)

End of 2017: MIN should have secured all the financing required and be in the process of completing the construction of the mine. This correlates to the Stage Derisking line titled "Financing" in the analysis below.

- PPS Range (EOY): US$1.38 (CD$1.79) to US2.49 (CD$3.23)

Note: I'm using John Kaiser's Rational Speculation Model to guesstimate valuations for the various stages of completion.

Numbers are certainly up for debate, but - according to established models and a healthy discount for being an ISR project - should be in the ballpark.

Hope this helps.

PG

FEATURED NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM