| Followers | 368 |

| Posts | 5333 |

| Boards Moderated | 1 |

| Alias Born | 05/09/2013 |

Monday, April 24, 2017 12:02:56 PM

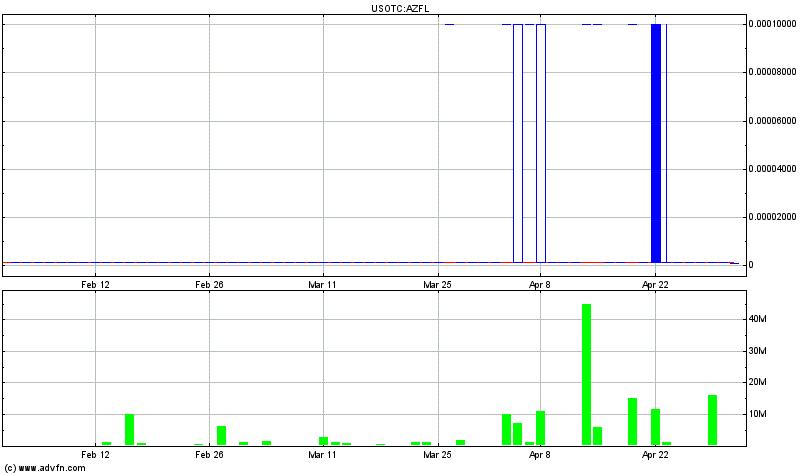

ENTERED $AZFL for an initial starter position @ .001.

Below is a copy of my private e-mail Alert.

E-Mail subscribers get my trade info first (as a priority)

------------------------------------------------------------------------------------

From: THREE-DAY-TRADER

Sent: Friday, April 21, 2017 2:50 PM

Subject: ***$AZFL = New Buy Alert {OTC~Subpenny Trade}***

------------------------------------------------------------------------------------

Hello!

My latest new trade is $AZFL today. Scroll down below for more details & for entry suggestions.

$AZFL is trading @ .0009/.001 at time of this alert is being sent out and earlier had an intra-day low of .0007 today.

In my speculative opinion, this one has excellent potential for % upside, just as good as or better than our past successful trades of $SCIE & $FLSR (back in February-March) covered here on e-mail Alerts.

I know this trade came out very late within only a few minutes to spare on this Friday afternoon before market close, but this trade happened to be a late decision in this instance. Anyhow, it likely will still represent buying opportunity on Monday & beyond yet before we see any major anticipated upside.

Also be aware that I'll Alert when making any updates or if coming out with another new trade in addition to this one.

I intend to be active going forward, so be ready for my upcoming trades periodically.

***THERE IS A GOOD CHANCE THAT I MAY COME OUT WITH A 2ND TRADE (OR MORE) BY NEXT WEEK.

***Please excuse the extended Spring Break I took over the past 6+ weeks in March & part of April.

My break was not intended to be this long, but various issues affected me during that period causing me to be dormant a few weeks.

Also continue to keep in mind that I'm only in these types of plays for short term trade flips.

Applying low range Limit entry orders is a crucial part of these trades, & when it comes to an exit strategy you should also be vigilant & responsible for your own stock position when ever it would gap up higher as a profit (not just depending on Sell Alerts).

Carefully scaling-out of your position (2-3 parts at a time) is a strategy you may want to independently consider later on whenever your trade becomes profitable.

Intended Goal here is to alert Buys & Sells on a timely basis, but a trader should always be mindful & ready to apply a good strategy in the event that a stock could make a surprising move (up or down).

Kind Regards & Happy Trading!!

3-D-T

-------------------------------------------------------------------------------------

Alerted Trading @ .0009/.001 on 4/21/2017 (Late Afternoon with intra-day low of .0007)

AZFL:

Suggestion is to initially set limit orders of .001 or less based on latest trading.

.001 or less seems to be a most prudent target for initial entry attempt.

****A reasonably decent chance this could achieve higher to .0015-.0025+, or possibly much more in the near future.

(Keep in mind .0015+ for a 'Minimum Upside Speculation Target')

****Keep in mind, that with OTC subpenny stocks it is always best to apply a proper risk/reward strategy. In other words, risk low amounts of $$$ per trade while seeking goal of a high % yield result.

$300-$2,000 is typical range for each subpenny stock trade for most people; All depending on % of your portfolio & risk tolerance.

****Also keep in mind that these types of plays are intended for Short Term Trade Flips based upon anticipation of 'Oversold Technical Reversals'.

Stocks like this can be very volatile and move for any reason, but the standard goal is to take short term profits on these technically oversold opportunities (typically caused by share dilution) & to thereby exit in the short term once the upside has shown technical resistance.

****Intended Goal here is to alert Buys & Sells on a timely basis, but a trader should always be mindful & ready to apply a good strategy in the event that a stock could make a surprising move (up or down).

>>>Entry Strategy:

Applying low range Limit entry orders is a crucial part of these trades.

>>>Exit Strategy:

When it comes to an exit strategy you should also be vigilant & responsible for your own stock position when ever it would gap up higher as a profit (not just depending on Sell Alerts).

Carefully scaling-out of your position (2-3 parts at a time) is a strategy you may want to independently consider later on whenever your trade becomes profitable.

-------------------------------------------------------------------------------------

Below is a copy of my private e-mail Alert.

E-Mail subscribers get my trade info first (as a priority)

------------------------------------------------------------------------------------

From: THREE-DAY-TRADER

Sent: Friday, April 21, 2017 2:50 PM

Subject: ***$AZFL = New Buy Alert {OTC~Subpenny Trade}***

------------------------------------------------------------------------------------

Hello!

My latest new trade is $AZFL today. Scroll down below for more details & for entry suggestions.

$AZFL is trading @ .0009/.001 at time of this alert is being sent out and earlier had an intra-day low of .0007 today.

In my speculative opinion, this one has excellent potential for % upside, just as good as or better than our past successful trades of $SCIE & $FLSR (back in February-March) covered here on e-mail Alerts.

I know this trade came out very late within only a few minutes to spare on this Friday afternoon before market close, but this trade happened to be a late decision in this instance. Anyhow, it likely will still represent buying opportunity on Monday & beyond yet before we see any major anticipated upside.

Also be aware that I'll Alert when making any updates or if coming out with another new trade in addition to this one.

I intend to be active going forward, so be ready for my upcoming trades periodically.

***THERE IS A GOOD CHANCE THAT I MAY COME OUT WITH A 2ND TRADE (OR MORE) BY NEXT WEEK.

***Please excuse the extended Spring Break I took over the past 6+ weeks in March & part of April.

My break was not intended to be this long, but various issues affected me during that period causing me to be dormant a few weeks.

Also continue to keep in mind that I'm only in these types of plays for short term trade flips.

Applying low range Limit entry orders is a crucial part of these trades, & when it comes to an exit strategy you should also be vigilant & responsible for your own stock position when ever it would gap up higher as a profit (not just depending on Sell Alerts).

Carefully scaling-out of your position (2-3 parts at a time) is a strategy you may want to independently consider later on whenever your trade becomes profitable.

Intended Goal here is to alert Buys & Sells on a timely basis, but a trader should always be mindful & ready to apply a good strategy in the event that a stock could make a surprising move (up or down).

Kind Regards & Happy Trading!!

3-D-T

-------------------------------------------------------------------------------------

Alerted Trading @ .0009/.001 on 4/21/2017 (Late Afternoon with intra-day low of .0007)

AZFL:

Suggestion is to initially set limit orders of .001 or less based on latest trading.

.001 or less seems to be a most prudent target for initial entry attempt.

****A reasonably decent chance this could achieve higher to .0015-.0025+, or possibly much more in the near future.

(Keep in mind .0015+ for a 'Minimum Upside Speculation Target')

****Keep in mind, that with OTC subpenny stocks it is always best to apply a proper risk/reward strategy. In other words, risk low amounts of $$$ per trade while seeking goal of a high % yield result.

$300-$2,000 is typical range for each subpenny stock trade for most people; All depending on % of your portfolio & risk tolerance.

****Also keep in mind that these types of plays are intended for Short Term Trade Flips based upon anticipation of 'Oversold Technical Reversals'.

Stocks like this can be very volatile and move for any reason, but the standard goal is to take short term profits on these technically oversold opportunities (typically caused by share dilution) & to thereby exit in the short term once the upside has shown technical resistance.

****Intended Goal here is to alert Buys & Sells on a timely basis, but a trader should always be mindful & ready to apply a good strategy in the event that a stock could make a surprising move (up or down).

>>>Entry Strategy:

Applying low range Limit entry orders is a crucial part of these trades.

>>>Exit Strategy:

When it comes to an exit strategy you should also be vigilant & responsible for your own stock position when ever it would gap up higher as a profit (not just depending on Sell Alerts).

Carefully scaling-out of your position (2-3 parts at a time) is a strategy you may want to independently consider later on whenever your trade becomes profitable.

-------------------------------------------------------------------------------------

***Go to my 'Profile' for more information on following me***

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.