| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Saturday, February 11, 2017 9:54:56 AM

* February 11, 2017

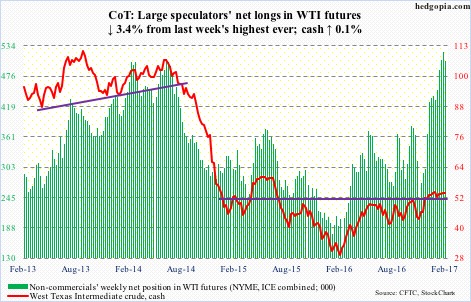

Following futures positions of non-commercials are as of February 7, 2017.

Crude oil: Same old, same old. Yet another week of oil bulls failing to take out $54-plus on spot West Texas Intermediate crude. Intraday Wednesday, it dropped below $52-plus but that support was reclaimed by close – an impressive reversal given the weekly EIA report out that day showed massive buildup in crude inventory.

For the week of February 3, crude stocks surged 13.8 million barrels to 508.6 million barrels – a 38-week high.

Distillate inventory inched up 29,000 barrels to 170.7 million barrels – the highest since October 2010.

Crude imports rose 1.1 million barrels per day to 9.4 mb/d – the highest since September 2012.

Refinery utilization inched down five-tenths of a point to 13-week low 87.7 percent.

And crude production increased 63,000 b/d to nine mb/d – a 44-week high. Production peaked at 9.61 mb/d in June 2015.

On the positive, gasoline stocks fell 869,000 barrels to 256.2 million barrels. The prior week was the highest since last February.

Near term, bulls have an opportunity to go after the afore-mentioned resistance, which in fact was tagged twice this week, including Friday. Medium term, the path of least resistance remains down.

Currently net long 505.2k, down 17.7k.

http://www.hedgopia.com/cot-peek-into-future-through-futures-82/

• DiscoverGold

Click on "In reply to", for Authors past commentaries

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM